#medical bills. local weather disasters

Explore tagged Tumblr posts

Text

please don't mistake silence for hatred. please don't mistake unanswered plotting messages as indifference, or a lack of enthusiasm towards you. considering the ages of most roleplayers, many of us have bills to pay, families to take care of, medical conditions to treat, appointments to make, classes to take, homes to clean, and lives to live away from the computer that are far, far more important than writing on tumblr — life has a tendency to get in the way of hobbies and fun things like this. be patient with your fellow writers. if it doesn't work out, it doesn't work out. of course you can set your boundaries, keep your space comfortable, and softblock whoever you wish, but do so while recognizing it's probably not hatred or apathy that keeps them from leaping into your dms with message after message. they probably love this hobby just as much as you... but sometimes life gets in the way.

#rp psa#roleplay psa#rp help#roleplay help#roleplay advice#'the rpc has changed for the worse' that's your opinion#but have that opinion while also acknowledging the ages of those you write with#and recognize they have responsibilities and worlds to take care of#people who depend on them#financial strain. hardships. unemployment. housing problems#medical bills. local weather disasters#trauma in their life deaths in their family#you cannot expect instant messages or EXTREME enthusiasm from everyone in this community#when so many of us are also dealing with irl situations#that are MORE important than talking about our fictional characters meeting for the first time#would it be nice if we could all find a comfy balance#and put passion into this hobby like we did when we were younger?#oh sure!!!! but that's just not viable anymore

2K notes

·

View notes

Text

Spain Blackout Crisis: Home Batteries Saved €800 & Avoided Disaster!

Why Home Batteries Energy Storage is Now Essential for Spanish, Portuguese, and French Households: Lessons from the 2025 Blackout Crisis

On April 28, 2025, a catastrophic power outage plunged Spain, Portugal, and southern France into darkness, leaving millions stranded without electricity for nearly 10 hours. Trains halted, hospitals scrambled, and supermarkets faced chaos as citizens rushed to stockpile essentials. This unprecedented event exposed the fragility of modern energy systems—and made one thing clear: home energy storage is no longer a luxury but a necessity.

Here’s why households across Iberia and Southern Europe must prioritize energy independence now—and how to choose the right solution.

1. The Blackout Wake-Up Call: Why Grids Failed

The 2025 outage was triggered by a sudden loss of 15 GW of power in Spain’s grid within seconds, crippling a system already strained by Europe’s rapid renewable transition. Experts identified three critical flaws:

Overreliance on intermittent renewables: Spain’s grid had just celebrated 100% renewable power days before the blackout. Yet, solar and wind’s variability, paired with inadequate grid storage, left the system vulnerable to sudden demand spikes.

Aging infrastructure: Transmission lines buckled under record temperatures, highlighting outdated networks ill-equipped for climate extremes.

Weak cross-border connections: Limited links between Spain, France, and Portugal turned localized failures into a regional crisis.

For families, this meant no refrigeration for food, disabled medical devices, and zero communication as networks collapsed.

2. Home Batteries: Your Lifeline During Crises

Households with solar panels and storage systems weathered the blackout safely. Here’s how home batteries protect you:

Guarantee Basic Survival Needs

Keep lights, phones, and WiFi running: Critical for emergency alerts and contacting loved ones.

Preserve food and medicine: A 5 kWh battery (e.g., Tesla Powerwall) can power a fridge for 18+ hours.

Support medical devices: Diabetics, oxygen users, and others avoided life-threatening risks.

Slash Energy Bills Year-Round

Spain’s soaring electricity prices (up 40% since 2022) make storage a smart investment even without blackouts:

Store solar energy: Use free sunlight during the day, tap stored power at night.

Avoid peak tariffs: Charge batteries when rates are low (e.g., €0.12/kWh overnight), use them during expensive hours (€0.45/kWh).

Earn money: Sell surplus energy back to the grid in Spain and Portugal via Smart Export Guarantee schemes.

Boost Grid Resilience

Distributed home storage acts as a “virtual power plant,” stabilizing the grid during demand surges. In France, pilot projects already reward users for sharing stored energy.

3. Choosing the Right System: What Iberian Households Need to Know

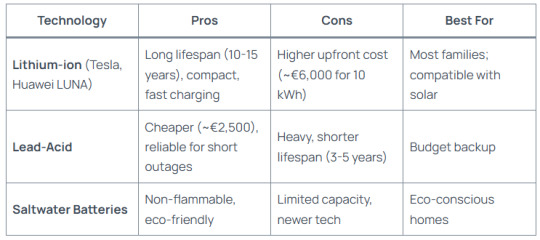

Battery Types Compared

Government Incentives to Act Now

Spain: Up to 65% subsidies for solar + storage via Self-Consumption Plan; VAT reduced to 10% (vs. 21%).

Portugal: €2,300 grants for batteries under Renewables 2030.

France: €5,000 tax credit for eco-friendly installations in regions like Nouvelle-Aquitaine.

4. Future-Proofing Your Home

The 2025 blackout proved that Europe’s energy transition needs decentralized solutions. Emerging trends to watch:

AI-powered systems: Optimize energy use based on weather forecasts and tariff changes (e.g., Spain’s Sunnergy apps).

Hydrogen hybrids: Store excess solar as hydrogen for week-long outages (trials ongoing in Andalusia).

EU-wide virtual grids: Spain’s Red Eléctrica plans to link 1 million home batteries by 2030 for shared grid support.

Conclusion: Don’t Wait for the Next Blackout

The 2025 crisis was a harsh lesson—but also a catalyst for change. By investing in home energy storage, you’re not just safeguarding your family; you’re helping build a resilient, renewable-powered Europe.

Take Action Today:

Audit your needs: Calculate daily usage (e.g., fridge + lights = ~3 kWh/day).

Claim subsidies: Spanish/Portuguese residents can save thousands via regional programs.

Partner with experts: Choose installers certified by UNEF (Spain) or APESF (Portugal).

As climate extremes and grid pressures grow, home batteries are the shield every household needs. Secure yours before the lights go out again.

0 notes

Text

How Mining Insurance Shields Your Business From Disaster (And Why You Can’t Afford to Skip It)

Let’s face it: mining isn’t for the faint of heart. Between Mother Nature’s curveballs and the chaos of heavy machinery, disaster can strike when you least expect it. But here’s the good news—mining insurance isn’t just a safety net. It’s your financial lifeline when things go sideways. Think of it like a seatbelt for your balance sheet. In this guide, we’ll break down how the right insurance strategy can turn worst-case scenarios into manageable hiccups.

The Risks Lurking in Every Mine (Yes, Even Yours)

Mining’s a high-stakes game. One minute you’re on track for record output; the next, a landslide or equipment meltdown sends your plans up in smoke. And it’s not just natural disasters you’re up against. Ever had a rookie operator accidentally drill into a gas line? Or watched market prices nosedive overnight? These risks don’t just threaten safety—they can bankrupt unprepared operations.

Nature’s Fury: More Than Just Bad Weather Even if your site’s not in earthquake alley, don’t get too comfortable. Flash floods can drown machinery in hours. A freak heatwave might warp rails. Heck, I’ve seen a “minor” landslide in Western Australia delay a project for six months. The fix? Know your terrain like the back of your hand and prep like a doomsday prepper.

Human Error: The Silent Budget-Killer Here’s an open secret: most mining disasters start with a simple mistake. A skipped maintenance check. A misread safety protocol. One client learned this the hard way when a rusty conveyor belt snapped, costing them $2M in downtime. Rigorous training isn’t optional—it’s what keeps your crew alive and your profit margins intact.

How Insurance Turns Disasters Into Speed Bumps

Picture this: A flash flood wrecks your drill site. Without coverage, you’re staring at months of lost income and repair bills that’d make Scrooge McDuck sweat. But with smart insurance? You’re back on your feet before the mud dries. Here’s the breakdown:

Your Insurance Toolkit

Coverage Type

Why It Matters

Property Insurance

Covers everything from flooded excavators to lightning-fried control panels

Business Interruption

Pays the bills when operations grind to a halt (yes, even worker salaries)

Liability Shield

When a third party sues over damages, this keeps you out of court

Worker Safety Net

Covers medical costs if someone gets hurt—because OSHA fines are no joke

Environmental Backup

Spills happen. This cleans up messes before regulators come knocking

Pro tip: Mix and match these like a insurance bartender. A Queensland coal operation we worked with dodged $5M in losses by bundling equipment coverage with a business interruption rider.

Picking Your Policy: 5 Make-or-Break Factors

Location, Location, Location Mining in flood-prone Indonesia? Skip earthquake coverage. Digging in Chile’s copper belt? Seismic insurance isn’t optional—it’s survival.

Size Matters A family-run opal mine needs different coverage than a multinational lithium giant. Don’t pay for coverage you’ll never use.

Reputation Roulette Always vet insurers like you’re hiring a CFO. One client learned this the hard way when their “cheap” provider took 18 months to pay a claim.

Fine Print Frenzy That “all-risk” policy? It probably excludes cyberattacks. Get every exclusion in writing.

Stay Nimble Found a new mineral deposit? Expanded to a riskier region? Update your policy faster than a TikTok trend.

Disaster-Proofing 101: Beyond the Policy

Risk Audits: Your Crystal Ball Before buying coverage, play detective. Map every possible threat—yes, even that “1-in-100-year” flood. A gold mine in South Africa avoided total collapse by spotting unstable bedrock during their audit.

Emergency Drills That Don’t Suck Forget boring fire drills. Run realistic scenarios:

“Chemical spill at 3 AM during monsoon season”

“Cave-in with 50 workers underground” Debrief over beers. It works.

Community Hacks Local tribes blocked your access road last quarter? Maybe because you didn’t include them in safety planning. One Papua New Guinea mine now shares real-time hazard alerts with villages. Result? Zero protests this year.

When Your Policy Needs a Checkup

Insurance isn’t “set and forget.” That policy from 2019? It’s probably missing:

Cyber Extortion Coverage (ransomware loves industrial controls)

Climate Change Riders (hello, unprecedented storms)

Supply Chain Meltdowns (COVID taught us all that lesson)

Do this every 6 months:

Compare claims against coverage

Grill your broker about new risks

Adjust deductibles like you’re tuning a rig

The Bottom Line

Here’s the truth miners won’t tell you: Insurance isn’t a cost—it’s profit protection. That $50K annual premium? It’s cheap compared to a single uninsured disaster. The smartest operations treat coverage like their best drill bit: always sharp, regularly upgraded, and ready to punch through chaos.

#MiningInsuranceDisasterMitigation#MiningRiskManagementInsurance#NaturalDisasterInsuranceForMines#MiningOperationalRiskCoverage#MiningInsurancePolicySelection

0 notes

Text

The Ultimate Guide to Boat Insurance in Ireland: Protecting Your Vessel with Yachtsman

Owning a boat offers endless opportunities for adventure, whether you're cruising along Ireland’s scenic coastline, exploring tranquil inland lakes, or sailing the open seas. However, with the excitement of boat ownership comes the responsibility of ensuring that your vessel is adequately protected. This is where boat insurance in Ireland becomes essential.

At Yachtsman, we specialize in providing comprehensive boat insurance solutions tailored to meet the unique needs of boat owners across Ireland. In this guide, we’ll explore why having the right insurance coverage is critical, the types of boats we cover, and how you can find the perfect policy to safeguard your marine adventures.

Why Boat Insurance is Crucial for Irish Boat Owners

Ireland’s rich maritime history and beautiful waterways make it an ideal location for boating enthusiasts. However, unpredictable weather conditions, crowded marinas, and potential accidents mean that having the right boat insurance is more than just a legal requirement—it's vital for peace of mind.

Here are a few reasons why boat insurance in Ireland is crucial:

Protection from Accidents and DamageWhether you're sailing in busy harbors or navigating open waters, accidents can happen. Collisions, grounding, and damage from storms are common risks. Boat insurance helps cover the cost of repairs or replacements, so you’re not left with hefty bills.

Liability CoverageIf your boat causes injury to another person or damages someone else’s property, liability coverage ensures you’re protected from the financial consequences. It’s especially important for boat owners who frequently sail in crowded areas or participate in water sports.

Theft and VandalismBoats are valuable assets, and unfortunately, they can be targets for theft and vandalism. Comprehensive boat insurance provides coverage for stolen or damaged equipment, ensuring you’re not left to cover the losses yourself.

Natural DisastersIreland’s weather can be unpredictable, with sudden storms and heavy winds posing risks to your vessel. Boat insurance covers damage caused by natural disasters, including windstorms, hail, and flooding.

Personal SafetyMany boat insurance policies include coverage for medical expenses if you or your passengers are injured in a boating accident, ensuring you receive the care you need without worrying about the financial burden.

Types of Boats Covered by Yachtsman’s Boat Insurance

At Yachtsman, we understand that no two boats are the same. That’s why we offer tailored insurance policies to cover a wide range of vessels, including:

Yachts: We provide comprehensive coverage for luxury yachts, including protection for the hull, machinery, and onboard equipment. Whether you sail locally or internationally, our yacht insurance covers all aspects of your journey.

Motorboats and Cruisers: Our policies cater to motorboats and cruisers, offering extensive protection for both short trips and longer voyages. We also provide coverage for high-value equipment and accessories, ensuring everything on board is protected.

RIBs (Rigid Inflatable Boats): RIBs are popular for their versatility, and Yachtsman offers specialized insurance to cover the hull, tubes, and machinery, along with liability coverage for leisure or commercial use.

Sailboats and Dinghies: We offer insurance for smaller vessels like sailboats and dinghies, including coverage for accidental damage, theft, and third-party liability. Racing coverage can also be added for those who participate in sailing competitions.

Fishing Boats: Whether you own a fishing boat for recreational or commercial use, Yachtsman provides insurance to cover your vessel, fishing equipment, and liability protection while at sea or on inland waters.

Lake and Inland Waterway Boats: For those who prefer Ireland’s peaceful lakes and rivers, our policies include coverage specifically designed for vessels used in inland waters.

What Does a Boat Insurance Policy Include?

Yachtsman’s boat insurance policies are designed to provide comprehensive protection, so you can enjoy your time on the water without worry. Key coverage options include:

Third-Party LiabilityOne of the most important aspects of boat insurance, liability coverage protects you if your boat causes injury or damage to other people or property. This is essential for boaters who share busy marinas or participate in water-based activities like water skiing or fishing.

Hull and MachineryThis covers physical damage to your boat, including the hull, machinery, and other vital equipment. Whether it’s due to an accident, grounding, or storm damage, hull and machinery coverage ensures your boat is protected.

Personal PropertyIf you keep personal belongings on your boat, such as fishing gear, electronics, or navigational tools, personal property coverage will protect these items from theft or damage.

Medical PaymentsIf you or your passengers are injured in a boating accident, medical payments coverage helps pay for hospital bills, treatments, and other related expenses.

Salvage Costs and Wreck RemovalIf your boat is damaged beyond repair, you may be responsible for removing it from the water. Salvage and wreck removal coverage ensures these costs are taken care of, saving you from potentially high expenses.

Emergency TowingIn the event of a breakdown or accident at sea, emergency towing coverage ensures that help is just a call away, getting you and your vessel back to safety.

How to Choose the Right Boat Insurance in Ireland

Choosing the right boat insurance policy depends on several factors, including the type of boat you own, where you plan to sail, and how you use your vessel. Here are a few tips to help you select the best coverage:

Assess Your RisksConsider the potential risks you might face based on where you sail. If you frequent busy marinas or engage in water sports, you may need higher liability limits. If you sail in international waters, ensure your policy covers those areas.

Consider the Value of Your BoatThe value of your boat will determine how much coverage you need. Ensure that your policy covers the full replacement value of your vessel in case of total loss.

Review Additional Coverage OptionsDepending on your needs, you may want to add extra coverage, such as racing insurance for sailboats, extended cruising coverage for yachts, or additional protection for valuable equipment.

Work with a Specialist ProviderIt’s important to choose a provider who understands the unique risks of boating in Ireland. Yachtsman has extensive experience in marine insurance, offering policies specifically tailored to Irish boat owners.

Why Choose Yachtsman for Boat Insurance in Ireland?

At Yachtsman, we are proud to be a trusted name in boat insurance in Ireland. Our policies are designed to provide peace of mind for boat owners, ensuring that your vessel is protected against all potential risks. Here’s why you should choose us:

Comprehensive Coverage: We offer extensive protection for all types of boats, ensuring that every aspect of your vessel is covered.

Tailored Solutions: No two boats are the same, and our insurance policies are customized to meet your specific needs and requirements.

Expert Advice: Our team of marine insurance specialists is here to help you find the perfect coverage, answering any questions you may have along the way.

Competitive Rates: We provide top-tier coverage at competitive prices, ensuring that you get the best value for your insurance investment.

Get a Quote Today

Don’t wait until it’s too late—secure your boat’s future with comprehensive boat insurance from Yachtsman. Our team is ready to help you find the perfect policy that protects your vessel, whether you're navigating Ireland's scenic lakes, rivers, or coastal waters.

Contact us today for a personalized quote, and enjoy the peace of mind that comes with knowing your boat is fully protected.

0 notes

Text

"Destination Disaster? How Travel Insurance Can Save Your Vacation"

Planning a vacation is exciting, but sometimes unforeseen events can turn your dream getaway into a nightmare. From flight cancellations and lost luggage to unexpected illnesses or natural disasters, there are countless scenarios that can disrupt your travel plans and leave you stranded. That's where travel insurance comes in. In this article, we'll explore how travel insurance can save your vacation when disaster strikes.

1. Trip Cancellation and Interruption Coverage

One of the most valuable features of travel insurance is trip cancellation and interruption coverage. If you need to cancel your trip or cut it short due to a covered reason such as illness, injury, or a family emergency, travel insurance can reimburse you for non-refundable expenses such as flights, accommodations, and tour reservations. This coverage provides peace of mind knowing that you won't lose your entire investment if your plans are derailed at the last minute.

2. Emergency Medical Assistance

Another essential aspect of travel insurance is emergency medical assistance coverage. If you or a traveling companion becomes ill or injured during your trip and requires medical treatment, travel insurance can cover expenses such as hospitalization, doctor's visits, ambulance services, and prescription medications. Whether you're traveling domestically or internationally, having access to emergency medical assistance ensures that you receive the care you need without worrying about exorbitant medical bills.

3. Baggage Loss and Delay Coverage

Losing your luggage or experiencing baggage delay can put a damper on your vacation, but travel insurance can provide reimbursement for the cost of replacing essential items if your baggage is lost, stolen, or delayed during your trip. This coverage can help alleviate the inconvenience and expense of being without your belongings and ensure that you have the essentials you need to enjoy your vacation to the fullest.

4. Travel Delay and Missed Connection Benefits

Travel delays and missed connections are common occurrences when traveling, whether due to inclement weather, mechanical issues, or other unforeseen circumstances. Travel insurance can provide reimbursement for additional expenses incurred as a result of travel delays, such as meals, accommodations, and transportation. Additionally, some policies offer coverage for missed connections, ensuring that you reach your destination even if your initial flight is delayed or canceled.

5. Emergency Evacuation and Repatriation

In the event of a medical emergency or natural disaster while traveling, emergency evacuation and repatriation coverage can be lifesaving. If you require emergency medical evacuation to the nearest suitable medical facility or repatriation to your home country for medical treatment, travel insurance can cover the associated costs, including transportation and medical escort services. This coverage ensures that you receive timely and appropriate medical care, even in the most challenging circumstances.

6. 24/7 Assistance Services

Many travel insurance policies offer 24/7 assistance services, providing round-the-clock support and guidance in the event of an emergency. Whether you need help finding medical care, arranging transportation, or navigating local customs and language barriers, assistance services can offer invaluable assistance and advice. Knowing that help is just a phone call away can provide peace of mind during stressful situations while traveling.

7. Coverage for Adventure Activities and Sports

If you're planning to engage in adventurous activities or sports during your trip, such as snorkeling, hiking, or skiing, it's essential to ensure that you have adequate insurance coverage. Travel insurance can provide coverage for medical expenses and emergency evacuation related to adventure activities and sports, giving you the freedom to explore and enjoy your favorite pursuits with confidence.

Conclusion

Travel insurance is a valuable investment that can save your vacation when disaster strikes. Whether you're facing trip cancellations, medical emergencies, lost luggage, or travel delays, travel insurance provides financial protection and peace of mind, ensuring that you can navigate unexpected challenges and enjoy your vacation to the fullest. Before embarking on your next adventure, make sure to invest in travel insurance that meets your needs and provides comprehensive coverage for your travel risks. With the right insurance policy in place, you can travel with confidence, knowing that you're protected against the unexpected.

0 notes

Text

What is Renters Insurance & How Does it Work?

The Cayman Island is a dream for many – clear water, palm trees, and a relaxed pace of life. However, it doesn't matter whether you are an experienced islander or have just arrived in the area to explore luxurious rental properties in the Caymans.

Securing your belongings is at the top of your priority list. Renters' insurance offers a safety net while you enjoy yourself in paradise. Let’s understand renters’ insurance and how it works in detail.

What is Renters Insurance?

Renters insurance, also known as tenant's insurance, is a policy that safeguards renters in the Cayman Islands real estate rentals. It protects their possessions by giving them liability coverage for unexpected situations. Unlike your landlord's insurance, which covers the building itself, renter's insurance guards your items.

Unexpected events may disrupt your island, when basking under the Caribbean sun. Here are several reasons why insurance is crucial for Cayman Islands real estate rentals:

Tropical Weather Woes: Hurricanes and tropical storms hit the Caymans quite frequently. Let this sink in; hurricanes can cause roof leaks, damaging furniture and electronics. Under such circumstances, renters' insurance will be helpful as they seek to fix or replace these items without making you dig deeper into your pockets.

Theft and Vandalism: Unfortunately, theft and vandalism happen everywhere. Renters' insurance will compensate for stolen jewelry, electronics, or furniture up to certain limits set by their policies.

Fire And Smoke Damage: A fire can consume your belongings within seconds! In this case, renters' policies include purchasing new devices or appliances burnt down by fire or smoke.

Liability Protection: Accidents do occur sometimes. Suppose someone gets hurt at your place on their premises at any time during their stay there. In that case, renters' insurance has everything covered, thereby availing liability coverages so that paid medical bills can be reimbursed legally, and you can achieve any settlements without any liability.

Additional Living Expenses: If a fire or other disaster makes your rental property uninhabitable, renter's insurance can help pay for extra living expenses like temporary housing and hotels. At the same time, you wait for the repairs.

What does Renters Insurance cover in Cayman Islands?

Standard renters’ insurance in the Cayman Islands will include the following:

· Personal Property Coverage: This aspect covers your belongings in case of theft, fire, vandalism or other perils mentioned in your policy.

· Liability Coverage: This coverage may financially protect you against someone who gets injured at your rented place and sues you.

· Additional Living Expenses: These expenses encompass costs associated with temporary housing if a covered event renders your rental property uninhabitable.

Understanding Policy Limits and Deductibles

Therefore, here are some key terms to understand if you are considering renter's insurance in the Cayman Islands:

a. Policy Limits: How much will the insurance company pay for a loss? Personal property coverage has different limits from liability coverage.

b. Location: Rental properties in hurricane-prone or crime-infested areas may have slightly higher premiums.

c. Deductible: Boosting your deductible will lower the cost of your policy.

d. Coverage Limits: The level of coverage you buy for personal property and liability will affect the price.

Get a Renter's Insurance Quote in the Cayman Islands

Getting insurance quotes for the Cayman rental properties are fast and simple. You can directly contact local insurance companies, get online quotes, or meet with an authorized agent to help you compare different policies and find the right coverage for your needs.

Some tips on how to get cheap renter's insurance:

Shop around: Do not accept the first quote you receive. Get several quotes from different insurers to ensure you get the best deal available.

Bundle up: Some insurers offer discounts if you take their renters' policy with other coverage, such as motor vehicle insurance.

Increase your deductible: As stated earlier, having a high deductible can significantly lower your premiums. However, make sure that you can still manage to pay this amount when the need arises.

Benefits of Renters Insurance in The Cayman Islands

Renters insurance offers more than just peace of mind. Below are additional benefits that make it a worthwhile investment for those living in Cayman:

No Landlord Hassles: Sometimes, landlords require tenants to have renters’ insurance worth a minimum specified amount. Having your own coverage assures compliance with these requirements and prevents any potential disputes between you and the landlord.

Coverage for Valuables: Some renter's insurance policies allow you to schedule valuable items like jewelry, electronics, or artwork, adding them more cover since they carry a high risk of theft or damage.

Temporary Relocation Assistance: If the rental property becomes uninhabitable due to a covered event, renters insurance helps pay for the storage of personal belongings during the repairs period.

Loss of Use Coverage: Some policies offer "Loss of use" coverage, which reimburses expenses arising from an inability to occupy the rental property due to a covered peril. This is helpful because it means that if repairs must be made and one has had to check into a hotel, compensation will be made by way of loss-of-use payments under these policies.

Renters Insurance- Common Exclusions

It is essential to know what your renter's insurance does not cover. Some of the standard exclusions include:

· Floods: Many renters' policies in the Cayman Islands do not cover flood damage. If you reside in a flood-prone area, you may want to consider buying a separate flood policy.

· Earthquake Damage: In some instances, standard renter's policies might fail to cover earthquake damage. Consult your insurance agent about this and purchase an earthquake policy if necessary.

· High-Value Items: Expensive jewelry or artwork may require separate floaters or additional coverage.

· Intentional Acts: Deliberate acts like vandalism by a resident are typically excluded from coverage.

· Business Property: If a business enterprise operates out of rented premises, such as an office or store inside a home, the owner needs a different kind of policy since that one will not protect business equipment or inventory.

Making the most of your Renters Insurance

The following tips will help you maximize the benefits of your renter's policy:

Keep an Inventory: Create a detailed list of everything you own, including photographs and receipts, as it simplifies the claims process when there is a loss.

Review Your Policy Regularly: Consider your policy limits and coverage options as your possessions and needs change.

Talk To Your Landlord: Let them know that you have renters’ insurance and show them the declaration page with all pertinent information regarding your coverage details so they can see what it covers.

File Claims Immediately: Report any covered losses to your insurer as soon as possible and follow their claim procedures.

Conclusion

Renters insurance in the Cayman Islands is a smart move for anyone who wants to protect themselves from financial ruin and be at peace while residing on the island. Once you get acquainted with what this type of policy offers, exceptions that may apply and what to do when it's time to file them.

You will be assured that your things are well taken care of even during difficult times. Therefore, you do not need to let paradise become a financial hellhole. Instead, buy insurance for your rental properties in the Cayman Islands!

0 notes

Text

Preparing for a Natural Disaster With MaxLend

The U.S. experiences a variety of natural disasters because of its geographical diversity. This means if you reside within the United States, you are likely to live in an area that could be impacted. When preparing for a natural disaster, there is no better time to start than now.

At MaxLend, we understand how to prepare for a natural disaster. It involves more than the foresight to know the steps you must take. Preparation also requires that you have the funding available to secure the necessary supplies. The Board of Governors of the Federal Reserve System has been surveying adults in America since 2013, asking about dealing with unexpected expenses. With these surveys, they found approximately 32% of those surveyed would not have the funding immediately available to cover the expense.1

If you want to know more about a natural disaster recovery plan and how MaxLend and its same-day cash installment loans can help, continue reading below.*

What State Has the Least Natural Disasters?

Determining the state with the least natural disasters can be challenging, as natural disasters can occur in different regions. However, some states are historically less prone to certain natural disasters.

For example, states in the northern parts of the United States, such as those in the Northeast, may experience fewer hurricanes than states along the Gulf Coast or Southeast. Similarly, states in the Midwest don’t experience coastal storm surges and typically only see the remnants of hurricanes. Still, they are more susceptible to tornadoes and severe winter weather.

States like Alaska and Hawaii may be less prone to certain types of disasters, such as tornadoes. Even so, they have unique risks, including earthquakes and volcanic activity.

Natural Disaster States

It’s essential to note that while some states may experience fewer natural disasters of a particular type, no state is entirely immune to natural hazards. Each region has risks, and preparedness is crucial regardless of location. Additionally, the frequency and impact of natural disasters can vary, making it vital for residents in any state to stay informed and be prepared for potential emergencies.

What Is Needed After a Natural Disaster?

When preparing for a natural disaster, regardless of the type, there are many things you will need before, during, and after the event. Of course, you need the basics – food, shelter, clothing, and clean water. You might also need money to repair your home, car, or other transportation. You may have unforeseen expenses, such as medical bills or insurance deductibles, that you didn’t realize you would need to pay. This is why you want to create a natural disaster recovery plan.

But what happens if you don’t have the money to cover the cost of these items? What options do you have? Many things may be needed as life starts to return to normal after a natural disaster. Fortunately, MaxLend offers personal installment loans online. These direct installment loans may help you pay for repairs and other unforeseen expenses that a natural disaster might have caused.

How to Prepare for a Natural Disaster

To help ensure you aren’t taken by surprise when a natural disaster is imminent, you can prepare yourself in advance. Preparing for a natural disaster is crucial to ensuring the safety and well-being of yourself and your loved ones.

Below are some general steps to prepare for a natural disaster. Following these steps will help make sure you have a natural disaster recovery plan and that you and your family will be ready.

Stay Informed

You should always be informed about potential hazards in your area, including the types of natural disasters that could occur. This includes regularly monitoring weather forecasts and warnings from local authorities.

Being prepared, aware, and informed are critical components of mitigating the impact of these events.

Create an Emergency Kit

Assemble a basic emergency supply kit that includes water, non-perishable food, a flashlight, batteries, a first aid kit, medications, important documents, and other essential items. Customize the kit based on your family’s needs, including infants, elderly family members, and pets. Ensure you have an adequate supply of prescription medications, and include any necessary medical supplies and medicines in your emergency kit.

Make a Family Emergency Plan and Secure Your Home

Develop a family emergency plan that includes communication strategies, evacuation routes, and meeting points. Ensure all family members are aware of the plan and practice it regularly.

Take steps to secure your home, such as reinforcing windows and doors, securing heavy furniture, and making necessary structural improvements. Know how to turn off utilities like gas, water, and electricity.

Have an Evacuation Plan

Familiarize yourself with evacuation routes and have a plan in place for where you will go in case of an evacuation order. Arrange transportation options in advance.

You may want to keep important documents (birth certificates, passports, insurance policies, etc.) in a waterproof and fireproof container. Know where these are located so that if you are evacuated, you can quickly grab them. Consider making digital copies and storing them securely online.

Practice Safety Drills

Regularly practice safety drills with your family, including evacuation procedures and other emergency actions. Remember that your steps for safety will depend on the type of natural disaster most likely to occur in your region. Always follow the guidance and recommendations of local authorities.

Financial Preparedness

You may want to keep some cash on hand, as ATMs and credit card systems may be unavailable during a disaster. Review your insurance policies to ensure they adequately cover potential damages.

But what happens if you don’t have cash in your account to withdraw? Regarding financial preparedness, MaxLend offers payday loan alternatives, and may be able to help.

Which of the Following Is Not True About Emergency Funds?

Have you been told you can borrow from retirement savings in an emergency? Or were you told that emergency funds should only be kept in a savings account? Did you hear that emergency funds should only cover job loss? The reality is that none of these statements are true. Not all retirement savings accounts allow for withdrawals, even in emergencies. Not everyone has a savings account or emergency funds available. And most importantly, covering the money you need due to a job loss isn’t the only thing that emergency funds are used for.

MaxLend knows that you might need to pay for many types of emergencies. Whether you are looking at a pet emergency fund, a house emergency fund, or a general emergency fund, it doesn’t matter if you are familiar with these if you don’t have the money to put in them. When you are faced with an emergency, you need help fast. MaxLend offers online unsecured installment loans that could be the help you need.

MaxLend Is Here to Help

If you are preparing for a natural disaster or need money to pay for unexpected expenses after one has affected you and want to apply for an unsecured installment loan, you’ve come to the right place. MaxLend offers cash installment loans online to get you the funding you need fast – sometimes as soon as the same day.* We offer direct online installment loans up to $3,750. You can easily apply online now to find out if you qualify.

For anyone interested in finding out how the process for applying for a MaxLend loan works or to read our frequently asked questions, you can visit our website. You can also call us 24 hours a day, 7 days a week, at 877-936-4336. Then, when you take out your first loan with MaxLend, you become a part of MaxLend Preferred Rewards.

Visit us online or call us today and let us help you. By choosing MaxLend, you empower yourself with a reliable solution for unexpected financial challenges. Apply confidently and efficiently, ensuring your preparedness for whatever nature may bring.

Source:

1 – Board of Governors of the Federal Reserve System – https://www.federalreserve.gov/publications/2022-economic-well-being-of-us-households-in-2021-dealing-with-unexpected-expenses.htm

*Same Day Funding is available on business days where pre-approval, eSignature of the loan agreement and completion of the confirmation call, if a call is required, have occurred by 11:45 a.m. Eastern Time and a customer elects ACH as payment method. Customers who complete this process by 1:30 p.m. Eastern on business days may still receive funds on the same day, but some banks may not disburse the funds until the next business day. Other restrictions may apply. Certain financial institutions do not support same day funded transactions. When Same Day Funding is not available, funding will occur the next business day.

The content on this site is for informational purposes only and is not professional financial advice. MaxLend does not assume responsibility for information given. All information should be weighed against your own abilities and circumstances and applied accordingly. It is up to readers to determine if this information is safe and suitable for their own situations.

MaxLend, is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Mandan, Hidatsa, and Arikara Nation, a federally-recognized sovereign American Indian Tribe. (the “Tribe”). This means that MaxLend’s loan products are provided by a sovereign government and the proceeds of our business fund governmental services for Tribe citizens. This also means that MaxLend is not subject to suit or service of process. Rather, MaxLend is regulated by the Tribe. If you do business with MaxLend, your potential forums for dispute resolution will be limited to those available under Tribal law and your loan agreement. As more specifically set forth in MaxLend’s contracts, these forums include an informal but affordable and efficient Tribal dispute resolution, or individual arbitration before a neutral arbitrator. Otherwise, MaxLend is not subject to suit or service of process. Nothing in this website is intended to waive or otherwise prejudice MaxLend’s entitlement to these protections. Neither MaxLend nor the Tribe has waived its sovereign immunity in connection with any claims relative to use of this website. If you are not comfortable doing business with sovereign instrumentality that cannot be sued in court, you should discontinue use of this website.

0 notes

Text

Navigating the Benefits of Travel Insurance in the USA: A Comprehensive Guide

Traveling is an enriching experience that allows us to explore new cultures, cuisines, and landscapes. Whether you're embarking on a weekend getaway or an extended international adventure, ensuring that you have the right insurance coverage is essential for peace of mind. In the United States, where unexpected mishaps can occur, having robust travel insurance can make all the difference in protecting your investment and safeguarding your well-being.

Understanding the Basics of Travel Insurance

Travel insurance is designed to provide financial protection against unforeseen events that may disrupt your trip. While the specifics of coverage can vary depending on the policy and provider, typical features of travel insurance include:

Trip Cancellation or Interruption Coverage: This protects you in case you need to cancel or cut short your trip due to covered reasons such as illness, injury, or severe weather.

Emergency Medical Coverage: Should you require medical attention while traveling, this coverage ensures that you can receive necessary treatment without worrying about exorbitant medical bills.

Baggage and Personal Belongings Protection: In the event that your luggage is lost, stolen, or damaged during your trip, travel insurance can reimburse you for the cost of your belongings.

Travel Assistance Services: From 24/7 emergency assistance hotlines to coordination of medical evacuations, travel insurance often includes valuable support services to help you navigate challenging situations abroad.

Why Travel Insurance Matters in the USA

Traveling to the USA presents unique circumstances that underscore the importance of comprehensive travel insurance coverage:

Healthcare Costs: The cost of healthcare in the USA is among the highest in the world. Even a minor medical issue can result in significant expenses without proper insurance coverage. Travel insurance with adequate medical coverage ensures that you can access quality healthcare without worrying about steep bills.

Trip Delays and Cancellations: Flight delays, cancellations, and other travel disruptions are not uncommon, especially when navigating the busy airspace of the United States. With travel insurance, you can recoup expenses related to rebooking flights, finding alternative accommodations, or arranging transportation during unexpected layovers.

Natural Disasters: The USA is prone to various natural disasters, including hurricanes, wildfires, and earthquakes. Travel insurance can provide reimbursement for non-refundable trip expenses if your travel plans are impacted by such events.

Theft and Loss: Tourist destinations in the USA can be targets for theft and petty crime. Travel insurance offers coverage for stolen or lost belongings, providing you with financial protection and peace of mind while exploring unfamiliar locales.

Choosing the Right Policy for Your Needs

When selecting a travel insurance policy for your trip to the USA, it's essential to consider your specific needs and travel plans. Here are some factors to keep in mind:

Coverage Limits: Ensure that the policy provides adequate coverage limits for medical expenses, trip cancellation/interruption, and baggage/personal belongings protection.

Pre-Existing Conditions: If you have pre-existing medical conditions, verify whether the policy covers these conditions and any associated treatment while traveling.

Adventure Activities: If you plan to engage in adventurous activities such as skiing, scuba diving, or mountain climbing, confirm that your policy includes coverage for these activities.

Exclusions and Limitations: Read the fine print of the policy to understand any exclusions or limitations that may affect your coverage, such as high-risk destinations or hazardous activities.

Travel insurance is a crucial component of any travel plan, providing financial protection and peace of mind during your adventures in the USA. By understanding the benefits of travel insurance and selecting the right policy for your needs, you can explore with confidence, knowing that you're prepared for whatever may come your way.

#TravelInsuranceUSA#TravelProtection#TripInsurance#EmergencyCoverage#PeaceOfMind#SecureTravel#ExploreSafely#TravelWithConfidence#InsuranceCoverage#SafeTravels

0 notes

Text

Global Travel Assurance: Comprehensive Coverage for Your Journeys Worldwide

Schengen Serenity: Explore Europe with AXA Schengen Insurance

Travel with confidence throughout the Schengen area with AXA Schengen Insurance. Whether you’re visiting Europe for business or leisure, AXA provides comprehensive coverage to meet the requirements of Schengen visa applications. With AXA Schengen Insurance, you’ll enjoy peace of mind knowing that you’re protected against unexpected medical expenses, trip cancellations, and other travel-related emergencies.

Domestic Tranquility: Secure Your Travel with Domestic Travel Insurance

Stay protected while exploring your own country with domestic travel insurance. Whether you’re planning a weekend getaway or a cross-country road trip, domestic travel insurance provides coverage for medical emergencies, trip cancellations, lost baggage, and other unforeseen events. With domestic travel insurance, you can travel with confidence knowing that you’re prepared for whatever comes your way.

European Odyssey: Embark on Adventures with Europe Travel Insurance

Embark on your European adventure with peace of mind thanks to Europe travel insurance. Whether you’re exploring iconic landmarks, indulging in local cuisine, or embarking on outdoor adventures, Europe travel insurance provides comprehensive coverage to protect you against unexpected expenses and emergencies. With coverage for medical treatment, trip cancellations, lost baggage, and more, Europe travel insurance ensures that you can focus on making memories without worrying about what-ifs.

Delay Defender: Navigate Travel Delays with Travel Delay Insurance

Don’t let travel delays derail your plans — protect yourself with travel delay insurance. Whether your flight is delayed due to weather, mechanical issues, or other unforeseen circumstances, travel delay insurance provides coverage for additional expenses such as accommodations, meals, and transportation. With travel delay insurance, you can navigate unexpected delays with ease and minimize the impact on your travel experience.

Thai Tranquil: Discover Thailand with Confidence via Travel Insurance

Explore the Land of Smiles with confidence with travel insurance to Thailand. Whether you’re visiting Bangkok’s bustling markets, relaxing on the pristine beaches of Phuket, or exploring the ancient temples of Chiang Mai, travel insurance to Thailand provides comprehensive coverage for medical emergencies, trip cancellations, lost baggage, and more. With travel insurance to Thailand, you can focus on soaking up the beauty and culture of this vibrant destination without worrying about the unexpected.

Collision Guardian: Drive Stress-Free with Collision Waiver Insurance

Protect yourself against unexpected expenses with collision waiver insurance. Whether you’re renting a car for a road trip or exploring a new destination, collision waiver insurance provides coverage for damage to your rental vehicle in the event of an accident. With collision waiver insurance, you can enjoy peace of mind knowing that you’re protected against costly repair bills and deductibles.

Trip Resilience: Safeguard Your Journey with Trip Interruption Insurance

Don’t let unforeseen events ruin your travel plans — safeguard your trip with trip interruption insurance. Whether it’s due to illness, natural disasters, or other emergencies, trip interruption insurance provides coverage for expenses related to interrupted or cancelled trips. With trip interruption insurance, you can travel with confidence knowing that you’re financially protected against unexpected disruptions to your itinerary.

COVID-19 Guardian: Travel with Confidence via COVID Travel Insurance

Travel with confidence during the COVID-19 pandemic with COVID travel insurance. Whether you’re planning a domestic getaway or an international adventure, COVID travel insurance provides coverage for medical expenses, trip cancellations, and other travel-related emergencies related to COVID-19. With COVID travel insurance, you can enjoy peace of mind knowing that you’re protected against the uncertainties of travel during these unprecedented times.

Travel Resilience: Safeguard Your Plans with Travel Insurance COVID

Ensure your travel plans are protected with travel insurance COVID. With coverage for medical emergencies, trip cancellations, and other travel-related expenses related to COVID-19, travel insurance COVID provides peace of mind for travelers during the pandemic. Whether you’re traveling for business or leisure, travel insurance COVID offers comprehensive coverage to address the unique challenges of traveling during these uncertain times.

Thai Tranquil: Explore Thailand Securely with Thailand Travel Insurance

Baggage Guardian: Travel with Peace of Mind via Baggage Insurance

Protect your belongings during travel with baggage insurance. Whether you’re flying across the globe or embarking on a weekend getaway, baggage insurance provides coverage for lost, stolen, or damaged luggage and personal items. With baggage insurance, you can travel with peace of mind, knowing that your possessions are financially protected against unexpected mishaps.

Emergency Evacuation Assurance: Prepare for Unforeseen Emergencies

Prepare for unforeseen emergencies with emergency evacuation insurance. Whether you’re traveling to remote destinations or exploring unfamiliar terrain, emergency evacuation insurance provides coverage for medical emergencies and evacuation expenses. With emergency evacuation insurance, you can rest assured knowing that you’ll receive prompt and efficient assistance in the event of a crisis during your travels.

Schengen Serenity: Fulfill Visa Requirements with Schengen Insurance

Travel confidently within the Schengen Area with Schengen insurance. Whether you’re visiting Europe for business or leisure, Schengen insurance is a mandatory requirement for obtaining a Schengen visa. This type of insurance provides coverage for medical expenses, emergency medical evacuation, and repatriation of remains during your stay in the Schengen Area. With Schengen insurance, you can fulfill visa requirements and travel with peace of mind.

Japan Journeys: Explore with Confidence via Travel Insurance for Japan

Explore the Land of the Rising Sun with travel insurance for Japan. Whether you’re admiring the cherry blossoms in Tokyo, soaking in the natural hot springs of Hokkaido, or marveling at the historic temples of Kyoto, travel insurance for Japan provides coverage for medical emergencies, trip cancellations, lost baggage, and other travel-related mishaps. With travel insurance Japan, you can enjoy your journey with confidence, knowing that you’re protected against unexpected expenses and emergencies.

Schengen Odyssey: European Adventure Secured with Schengen Travel Insurance

Embark on your European adventure with Schengen travel insurance. Whether you’re visiting multiple countries within the Schengen Area or exploring a single destination, Schengen travel insurance provides coverage for medical emergencies, trip cancellations, and other travel-related mishaps. With Schengen travel insurance, you can comply with visa requirements and travel with peace of mind, knowing that you’re financially protected against unforeseen events.

Emergency Evacuation Shield: Financial Protection During Travel Emergencies

Prepare for unexpected emergencies during your travels with travel insurance emergency evacuation coverage. Whether you’re exploring remote destinations or embarking on adventurous excursions, this type of insurance provides financial protection for emergency medical evacuations. In the event of a serious illness or injury that requires evacuation to a medical facility, travel insurance emergency evacuation ensures that you receive prompt and efficient assistance, including transportation to the nearest appropriate medical facility or repatriation to your home country.

Luggage Guardian: Protect Your Possessions with Luggage Insurance

Protect your belongings while traveling with luggage insurance. Whether you’re jetting off to exotic destinations or embarking on a business trip, luggage insurance provides coverage for lost, stolen, or damaged baggage and personal belongings. With luggage insurance, you can travel with peace of mind, knowing that your possessions are financially protected against unexpected mishaps.

Italian Elegance: Safeguard Your Journey with Italy Travel Insurance

Explore the captivating beauty of Italy with Italy travel insurance. Whether you’re indulging in delectable cuisine in Rome, marveling at Renaissance art in Florence, or cruising through the picturesque canals of Venice, travel insurance for Italy provides coverage for medical emergencies, trip cancellations, lost baggage, and other travel-related mishaps. With travel insurance for Italy, you can enjoy your Italian adventure with confidence, knowing that you’re protected against unforeseen expenses and emergencies.

Stars and Stripes Security: Travel Confidently with USA Travel Insurance

Travel confidently in the United States with travel and medical insurance coverage. Whether you’re visiting iconic landmarks like the Statue of Liberty in New York City, exploring the natural wonders of the Grand Canyon in Arizona, or soaking up the sun on the beaches of California, travel and medical insurance USA provides coverage for medical emergencies, trip cancellations, and other travel-related mishaps. With travel and medical insurance USA, you can enjoy your American journey with peace of mind, knowing that you’re financially protected against unexpected events.

Road Trip Reassurance: Navigate the U.S. with Travel and Medical Insurance

Protect yourself from costly expenses with collision damage waiver insurance. Whether you’re renting a car for business or leisure travel, collision damage waiver insurance provides coverage for damage to the rental vehicle in the event of an accident or collision. With collision damage waiver insurance, you can decline the rental company’s collision damage waiver and avoid out-of-pocket expenses for repairs or replacements in the event of damage to the rental vehicle.

Cruise Care: Set Sail with Confidence via Cruise Insurance

Car Rental Confidence: Drive Stress-Free with Collision Damage Waiver Insurance

Protect yourself from unexpected expenses when renting a car with collision damage waiver rental car coverage. This insurance option provides coverage for damage to the rental vehicle in the event of an accident or collision. By opting for collision damage waiver rental car coverage, you can decline the rental company’s collision damage waiver and avoid out-of-pocket expenses for repairs or replacements in case of damage to the rental vehicle.

Health Hub USA: Stay Healthy with Travel Health Insurance

Stay healthy and protected during your travels in the United States with travel health insurance. Whether you’re exploring vibrant cities, national parks, or scenic coastlines, travel health insurance USA provides coverage for medical emergencies, doctor visits, hospital stays, and prescription medications. With travel health insurance, you can enjoy peace of mind knowing that you have access to quality healthcare services wherever your travels take you.

Insurance Insight: Explore Options with Reputable Travel Insurance Companies

Choose the right travel insurance coverage for your needs by exploring reputable travel insurance companies. With a wide range of options available, travel insurance companies offer policies tailored to various travel styles, destinations, and budgets. From comprehensive coverage for international trips to specialized plans for adventure travel or business trips, travel insurance companies provide peace of mind and financial protection against unforeseen events during your travels.

USA Expedition Assurance: Travel Confidently with Travel Insurance USA

Prepare for your journey across the United States with travel insurance USA. Whether you’re exploring iconic landmarks, national parks, or vibrant cities, travel insurance USA provides coverage for trip cancellations, medical emergencies, lost baggage, and other travel-related mishaps. With travel insurance USA, you can travel confidently and enjoy your American adventure knowing that you’re protected against unexpected expenses and emergencies.

Travel Assurance from the US: Your Shield Against the Unexpected

Ensure a worry-free journey with travel insurance from the US. Whether you’re traveling domestically or internationally, travel insurance US offers coverage for unexpected events such as trip cancellations, medical emergencies, lost luggage, and more. With travel insurance US, you can embark on your adventures with confidence, knowing that you’re protected against unforeseen mishaps.

USA Odyssey Protection: Peace of Mind Throughout Your Journey

Secure comprehensive coverage for your travels with travel insurance from USA. Whether you’re exploring exotic destinations abroad or embarking on a road trip closer to home, travel insurance from the USA offers protection against various travel-related risks, including trip cancellations, medical emergencies, and travel delays. With travel insurance from the USA, you can enjoy peace of mind throughout your journey.

Flexibility Unleashed: Travel Insurance Cancellation for Any Reason

Global Adventures Secured: Travel Insurance International

Prepare for your overseas adventures with travel insurance international. Whether you’re jetting off to Europe, exploring exotic destinations in Asia, or embarking on a safari in Africa, travel insurance international offers comprehensive coverage for a wide range of travel-related risks. From medical emergencies and trip cancellations to lost baggage and travel delays, travel insurance international provides peace of mind and financial protection wherever your travels take you.

Travel Insurance: Your Security Blanket for Unforeseen Journeys

Travel insurance offers protection and peace of mind for travelers embarking on domestic or international journeys. This type of insurance typically covers a range of unforeseen events, including trip cancellations, medical emergencies, lost luggage, and travel delays. By investing in travel insurance, travelers can mitigate financial risks and enjoy their trips with added security.

Healthcare on the Go: Navigate with Travel Health Insurance

Travel health insurance is specifically designed to cover medical expenses incurred while traveling. It provides coverage for emergency medical treatments, hospital stays, doctor visits, and medications during the duration of a trip. Travel health insurance ensures that travelers receive necessary medical care without facing exorbitant out-of-pocket costs, particularly when abroad where healthcare expenses can be significantly higher.

Choosing the Best: Factors to Consider for Optimal Travel Insurance

When seeking the best travel insurance, travelers should consider various factors such as coverage options, policy limits, deductibles, customer reviews, and pricing. The best travel insurance policy offers comprehensive coverage tailored to the traveler’s specific needs and preferences. Additionally, it provides reliable assistance and support in case of emergencies, ensuring a smooth and hassle-free travel experience.

0 notes

Text

Professional Insurance Company in Kentucky: Safeguarding Your Future

In today's uncertain world, having reliable insurance coverage is not just a luxury; it's a necessity. A professional insurance company in Kentucky can play a vital role in securing your financial future and providing peace of mind. Whether you're an individual seeking personal coverage or a business owner looking to protect your assets, a reputable insurance provider can offer tailored solutions to meet your needs.

Understanding the Importance of Insurance

Insurance serves as a safety net, offering financial protection against unexpected events that can cause financial hardship. Whether it's a medical emergency, a car accident, damage to your property, or a legal liability issue, having insurance can make all the difference in your ability to recover and move forward. A professional insurance company in Kentucky understands the unique risks faced by individuals and businesses in the region and can offer comprehensive coverage options.

Why Choose a Professional Insurance Company in Kentucky?

Local Expertise: Opting for a local insurance company means working with professionals who understand the specific challenges and risks in Kentucky. They can provide insights into regional regulations, weather-related risks, and other factors that could impact your coverage needs.

Personalised Approach: Unlike generic insurance policies, a professional insurance company can tailor their offerings to align with your requirements. They take the time to understand your situation and suggest coverage that offers maximum protection.

Responsive Customer Service: Dealing with insurance claims or inquiries can be stressful. Choosing a professional insurance provider ensures you have access to responsive customer service that can guide you through the process and address your concerns promptly.

Comprehensive Coverage: Whether you need auto, home, health, or business insurance, a reputable provider will offer a range of coverage options. This enables you to consolidate your insurance needs under one roof for convenience and potential cost savings.

Types of Insurance Offered

Auto Insurance: Protect your vehicle against accidents, theft, and damages with comprehensive auto insurance. This coverage can also extend to liability protection in case you're at fault in an accident.

Home Insurance: Safeguard your home and belongings from unexpected events such as fires, natural disasters, and theft. Home insurance also covers personal liability if someone gets injured on your property.

Health Insurance: Access quality healthcare without worrying about exorbitant medical bills. Health insurance can cover medical treatments, prescription medications, and preventive care.

Business Insurance: For entrepreneurs and business owners, business insurance provides coverage against property damage, liability claims, and other risks that can impact your company's operations.

Conclusion

In a world filled with uncertainties, having the right insurance coverage is a smart and responsible choice. A professional insurance company in Kentucky can offer personalised solutions that align with your needs and provide the protection you deserve. Don't wait until it's too late – secure your future and enjoy peace of mind knowing that you're prepared for whatever life throws your way.

0 notes

Text

Is a Home Battery Backup System Worth the Investment? Let's Find Out!

Introduction

As a leading expert in the energy storage industry, I have had the opportunity to witness the development and effectiveness of various home battery backup systems. In today's world where energy reliability and sustainability are crucial, homeowners are increasingly considering the investment in a home battery backup system. In this article, I will explore the benefits and considerations of investing in a home battery backup system, aiming to help you make an informed decision.

The Power of Energy Independence

When it comes to energy, independence is key. A home battery backup system allows you to store excess electricity generated from renewable sources such as solar panels, enabling you to use this power during periods of outages or even in times when the grid electricity prices are high. By reducing your reliance on the utility grid, you can ensure a stable supply of electricity to essential appliances and reduce your overall energy costs. According to a study conducted by the National Renewable Energy Laboratory, a home battery backup system can potentially save homeowners up to 50% on their electricity bills. [1]

Enhancing Energy Resilience

Unpredictable weather events, natural disasters, and power outages can disrupt the normal functioning of our daily lives. Investing in a home battery backup system enhances your energy resilience by providing a reliable source of power during these challenging times. The "None" home battery backup system utilizes advanced technology to automatically detect power outages and seamlessly switch to battery power, ensuring uninterrupted electricity supply to critical appliances. With a home battery backup system in place, you can have peace of mind knowing that your essential services, such as refrigeration and medical equipment, will continue to function even during an outage.

Sustainable Energy Management

Besides the monetary benefits, a home battery backup system contributes to a sustainable energy future. By utilizing stored energy during peak demand periods, you reduce the strain on the grid and promote efficient energy management. This reduces the need for new power plants and helps in reducing greenhouse gas emissions. According to the Rocky Mountain Institute, widespread adoption of home battery backup systems could potentially decrease greenhouse gas emissions by up to 50% by 2050. [2]

Cost Considerations

While the benefits of a home battery backup system are undeniable, it is essential to consider the upfront costs associated. Installation and equipment costs can vary depending on factors such as the size of your home, energy needs, and desired battery capacity. However, it is important to note that many local and federal governments offer incentives and rebates to encourage the adoption of renewable energy and energy storage systems. Additionally, the decreasing prices of battery technology in recent years have made home battery backup systems more accessible for homeowners looking to invest in sustainable energy solutions.

Conclusion

Investing in a home battery backup system, such as the "None" brand, can prove to be a wise decision, ensuring energy independence, enhancing resilience, and contributing towards a sustainable energy future. While the upfront costs might be a consideration, the long-term benefits outweigh the investment. Make the switch to a home battery backup system and experience the peace of mind and financial savings it can provide.

Article written by "None".

0 notes

Text

Monday, February 15, 2021

Warning to travellers: You have until Feb 22 to return or pay up to $2,000 for Canada’s COVID-19 hotel quarantine (Yahoo News) Prime Minister Justin Trudeau announced the mandatory hotel quarantine for travellers coming to Canada by air will come into effect on Feb. 22. Minister of Health Patty Hajdu confirmed that people who have received a COVID-19 vaccine are not exempt from these requirements at this time. Non-essential travellers to Canada by air are required to take a COVID-19 PCR test within 72 hour before departure. Proof of a negative test result must be with them during travel. They must submit their contact and quarantine information using the ArriveCAN app before boarding a plane. Minister of Public Safety and Emergency Preparedness, Bill Blair, confirmed that 93 per cent of air travellers are non-essential travellers. Beginning Feb. 22, travellers need to take a COVID-19 test when the they arrive in Canada, at their own cost, before they leave the airport. Travellers will then go to a quarantine hotel until their test result is returned, up to three days. They need to reserve their stay prior to arriving in Canada. Hajdu indicated hotel booking information will be available online on Feb. 18. Travellers must stay in a hotel in the city in which they first arrive in Canada. When their test comes back negative, they can then take a connecting flight to their destination.

Impeachment proves imperfect amid US polarization (AP) Three Republican senators spent an hour talking strategy with lawyers for the accused. The entire Senate served as jurors even though they were also targets of the crime. No witnesses were called. And the outcome was never in doubt. The second impeachment trial of Donald Trump laid bare the deep imperfections in the Constitution’s only process for holding a president accountable, for “high crimes and misdemeanors.” The proceedings packed an emotional punch and served as history’s first accounting of the Jan. 6 riots on the U.S. Capitol, but the inherently political process never amounted to a real and unbiased effort to determine how the insurrection unfolded and whether Trump was responsible. The results were ultimately unsurprising: a fast impeachment in the Democratic-led House followed by acquittal in the Senate, where 17 Republicans were needed to convict. Congress has rarely deployed its power to hold a president accountable for crimes and misdemeanors: impeaching Andrew Johnson in 1868, Bill Clinton in the 1999 and Trump twice over the past year. The House also launched impeachment proceedings against Richard Nixon, but he resigned from office before a vote on charges. Each of the other instances ended with the president—or in this most recent instance, former president—acquitted, and few satisfied with the process.

Postmaster general’s new plan for USPS is said to include slower mail and higher prices (Washington Post) Postmaster General Louis DeJoy is preparing to put all first-class mail onto a single delivery track, according to two people briefed on his strategic plan for the U.S. Postal Service, a move that would mean slower and more costly delivery for both consumers and commercial mailers. DeJoy, with the backing of the agency’s bipartisan but Trump-appointed governing board, has discussed plans to eliminate a tier of first-class mail—letters, bills and other envelope-sized correspondence sent to a local address—designated for delivery in two days. Instead, all first-class mail would be lumped into the same three- to five-day window, the current benchmark for nonlocal mail. That class of mail is already struggling; only 38 percent was delivered on time at the end of 2020, the Postal Service reported in federal court. Customers have reported bills being held up, and holiday cards and packages still in transit. Pharmacies and prescription benefits managers have told patients to request medication refills early to leave additional time for mail delays.

Hundreds of thousands without power in Northwest ice storm (AP) A winter storm blanketed the Pacific Northwest with ice and snow Saturday, leaving hundreds of thousands of people without power and disrupting travel across the region. Freezing rain left roads, power lines and trees coated in ice in the Portland, Oregon, region, and by Saturday morning more than 270,000 people were without power. The extreme conditions, loss of power and transportation problems prompted Oregon Gov. Kate Brown to declare a state of emergency Saturday afternoon. Winter storms and extreme cold affected much of the western U.S., particularly endangering homeless communities. Volunteers and shelter staffers were trying to ensure homeless residents in Casper, Wyoming, were indoors as the National Weather Service warned of wind chill reaching as much as 35 degrees below zero over the weekend.

With the Economy on the Ropes, Hungary Goes All In on Mass Vaccination (NYT) Hungary on Friday began injecting citizens with Russia’s Sputnik V vaccine, becoming the first country in the European Union to administer a coronavirus inoculation that has yet to be tested and approved by the bloc’s regulators. With Hungary’s economy suffering and a national election looming next year, embracing such vaccines is part of the government’s strategy to go all in on fighting the coronavirus after a series of missteps allowed it to spread in Hungary. The decision by Viktor Orban, Hungary’s far-right prime minister, to move forward with the ambitious vaccination plan comes after the European Union’s own response to vaccine distribution has lagged behind the United States, Israel, and Britain. Mr. Orban has few options for reviving the Hungarian economy, as he is opposed to handing out meaningful relief aid to citizens and businesses and appears to be betting big on getting the whole country vaccinated, with an eye on next year’s elections. While many E.U. members have expressed frustration with the bloc’s sluggish procurement procedures, Hungary is the only one so far to break from the collective strategy.

Even India’s Ex-Chief Justice Won’t Go to Nation’s Courts (Bloomberg) A former chief justice of India says he won’t go to the country’s top court with his grievances because he would have to wait endlessly for a verdict, a comment that lays bare the nation’s clogged legal system. “You want a 5 trillion dollar economy but you have a ramshackled judiciary,” said Ranjan Gogoi, who retired as the head of the country’s judiciary in November 2019 and is now a member of the upper house of the parliament. Gogoi was speaking at an event organized by the India Today Group, a news network. Gogoi’s remarks calling for an overhaul of the judiciary’s capacity and efficacy highlights India’s troubles with delayed verdicts and enforcing contracts. Court systems in Asia’s third-largest economy are clogged with over 43 million cases and a shortage of judges means that some cases can end up taking years, even decades, to find a resolution. Companies invested in India have a tough time once entangled in a legal dispute.

Hundreds of thousands protest in Myanmar as army faces crippling mass strike (Reuters) Hundreds of thousands of protesters took to the streets in Myanmar for a ninth day of anti-coup demonstrations on Sunday, as the new army rulers grappled to contain a strike by government workers that could cripple their ability to run the country. Trains in parts of the country stopped running after staff refused to go to work, local media reported, while the military deployed soldiers to power plants only to be confronted by angry crowds. As evening fell, armoured vehicles were seen in the commercial capital of Yangon for the first time since the coup, witnesses said, and the U.S. embassy urged employees to be cautious. A civil disobedience movement to protest against the Feb. 1 coup that deposed the civilian government led by Aung San Suu Kyi started with doctors. It now affects a swathe of government departments. The junta ordered civil servants to go back to work, threatening action. The army has been carrying out nightly mass arrests and on Saturday gave itself sweeping powers to detain people and search private property. But hundreds of railway workers joined demonstrations in Yangon on Sunday, even as police went to their housing compound on the outskirts of the city to order them back to work. The police were forced to leave after angry crowds gathered, according to a live broadcast by Myanmar Now.