#makerdao cdp

Explore tagged Tumblr posts

Text

List of 15 Best DeFi Yield Farming Platforms

In the rapidly evolving landscape of cryptocurrency, yield farming has emerged as a popular method for crypto holders to earn passive income. Leveraging decentralized finance (DeFi) protocols, investors can stake or lend their assets to earn rewards in the form of additional tokens. Here’s a curated list of 15 prominent yield farming crypto platforms that stand out in the market today:

Compound Finance

Known for its robust lending and borrowing features.

Offers competitive interest rates on deposited assets.

Aave

Allows users to earn interest on deposits and borrow assets.

Known for its innovative flash loan feature.

Yearn Finance (YFI)

Aggregates yields from various DeFi platforms to optimize returns.

Features automated yield farming strategies.

Uniswap

Popular decentralized exchange (DEX) that facilitates liquidity provision.

Users can earn trading fees by providing liquidity to the platform.

SushiSwap

Forked from Uniswap, offering additional features and incentives.

Rewards liquidity providers with SUSHI tokens.

Balancer

Enables users to create liquidity pools with customizable asset ratios.

Rewards liquidity providers with trading fees and BAL tokens.

Curve Finance

Optimized for stablecoin trading and low slippage.

Rewards liquidity providers with trading fees and CRV tokens.

Synthetix

Focuses on synthetic assets and trading.

Users can stake SNX tokens to earn rewards.

MakerDAO

Known for its stablecoin DAI, backed by collateralized debt positions (CDPs).

Users can earn fees through the stability fee mechanism.

PantherSwap

Offers yield farming opportunities with high APRs.

Incentivizes liquidity providers with PANTHER tokens.

Cream Finance

Provides lending, borrowing, and yield farming services.

Users can earn by supplying liquidity to various pools.

Harvest Finance

Automates yield farming strategies to maximize returns.

Integrates with various DeFi protocols for optimized farming.

Bancor

Offers automated market maker (AMM) functionality.

Users can earn trading fees and BNT tokens by providing liquidity.

QuickSwap

Built on the Polygon network for low-cost transactions.

Rewards liquidity providers with QUICK tokens.

PancakeSwap

Popular AMM on the Binance Smart Chain.

Users can farm CAKE tokens by providing liquidity.

Conclusion

The ICO development services sector continues to evolve alongside the growth of DeFi. As yield farming gains popularity, investors are increasingly seeking reliable platforms to maximize their crypto assets. Whether you're a newcomer exploring these opportunities or an experienced investor diversifying your portfolio, these 15 platforms offer a spectrum of options to consider. By staying informed and adapting to market trends, investors can harness the potential of DeFi yield farming to generate sustainable returns.

In the realm of DeFi yield farming, the landscape is vast and ever-changing, with these platforms leading the charge in innovation and user rewards. Whether you're looking for liquidity provision, automated strategies, or simply exploring new avenues for passive income, these platforms offer diverse opportunities to engage with the evolving world of decentralized finance.

0 notes

Text

Maker (MKR) Price Prediction 2025, 2026, 2027, 2028, 2029 and 2030

Welcome to our detailed analysis on Maker (MKR) price prediction for the years 2025 to 2030.

The primary aim of this article is to provide you with a yearly forecast for Maker (MKR) based on key technical indicators and a comprehensive review of the market dynamics surrounding this particular cryptocurrency.

We understand the importance of accurate and reliable information in the volatile and unpredictable world of cryptocurrencies. As such, we have meticulously analysed the technical and market factors that could potentially influence the price trajectory of Maker (MKR) over the next decade.

Stay tuned as we delve into our Maker (MKR) price prediction for 2025 to 2030.

Maker (MKR) Long-Term Price Prediction

Year Lowest Price Average Price Highest Price 2025 $4,500 $5,250 $6,000 2026 $5,200 $6,250 $7,000 2027 $4,000 $4,750 $5,500 2028 $4,000 $5,000 $6,000 2029 $6,000 $7,000 $8,000 2030 $7,500 $8,500 $9,500

Maker Price Prediction 2025

MKR is expected to steadily grow in 2025, reaching for the price of $6,000 at its highest, stimulated by favorable regulatory conditions and the continuous growth of the technology sector.

The approval of Bitcoin ETFs would draw significant investments in Bitcoin, and the spill-over effect would boost the price of altcoins like MKR.

Maker Price Prediction 2026

In 2026, the price is forecasted to continue to rise, marked by an average price of $6,250 and peaking at the $7,000 mark.

The introduction of Ethereum ETFs would draw more investment into Ethereum, benefitting other cryptocurrencies in the Ethereum network such as MKR.

Maker Price Prediction 2027

In 2027, a market correction would see MKR’s price drop to a low of $4,000 but still reach $5,500 under the assumption that the technology sector continues growing and corresponding crypto regulations remain favorable.

Maker Price Prediction 2028

There might be some price recovery in 2028, with MKR’s value oscillating $4,000 and $6,000.

It is anticipated that easing inflation rates would improve investment in riskier assets like cryptocurrencies.

Maker Price Prediction 2029

Back to the growth trend: 2029 would bring a return to high growth, with MKR’s value projected to surge between $6,000 and $8,000.

This surge would be boosted by positive growth in the technology sector and broader adoption of cryptocurrencies.

Maker Price Prediction 2030

Entering the marked growth years, MKR could reach space between $7,500 and $9,500, enhanced by the pace of crypto adoption and favorable regulatory conditions.

Predicted increased utility and value of blockchain technologies would also greatly contribute to the rise in MKR’s price.

Maker (MKR) Fundamental Analysis

Project Name Maker Symbol MKR Current Price $ 2,186.4 Price Change (24h) -4.12% Market Cap $ 2.0 B Volume (24h) $ 85,995,619 Current Supply 928,666

Maker (MKR) is currently trading at $ 2,186.4 and has a market capitalization of $ 2.0 B.

Over the last 24 hours, the price of Maker has changed by -4.12%, positioning it 46 in the ranking among all cryptocurrencies with a daily volume of $ 85,995,619.

Unique Technological Innovations of Maker

Maker has several distinctive features that give it a competitive edge over its competitors in the market.

Its primary innovation is the MakerDAO and DAI, a decentralized stablecoin that is pegged to the US dollar and maintained by an autonomous system. This facilitates price stability, a key market demand amidst the volatility of the wider crypto market.

Furthermore, Maker introduced the concept of a Collateralized Debt Position (CDP), allowing users to generate DAI against their collateral.

This unique approach to credit and loan structures helps position Maker as a frontrunner in the decentralized finance (DeFi) market.

Strategic Partnerships Establish by Maker

Maker has partnered with several industry stalwarts to broaden its reach and ecosystem utility.

Collaborations with entities like TradeShift have enabled real-time trade financing capabilities, enhancing Maker’s position in decentralized finance.

Partnerships with gaming platforms such as Axie Infinity have also showcased the potential uses of DAI in the gaming and virtual realms.

These alliances prove instrumental in driving Maker’s wider adoption and ecosystem expansion.

Maintaining Competitive Advantage in the Fast-Paced Cryptocurrency Market

In response to the rapidly evolving cryptocurrency landscape, Maker continually adapts to new technologies and market trends.

It exhibits its resilience through flexible and scalable governance structures. It also shows adaptability to regulatory changes, as seen in its rigorous risk management framework and strict adherence to emerging crypto laws and regulations.

Community Engagement Efforts of Maker

Maker engages robustly with its community through various platforms, including Medium, Reddit, and Twitter, with the most significant activities seen on its own forum and chat platform.

Maker continually encourages community participation in governance, decision-making, and risk management through initiatives like voting for governance proposals.

This inclusive and participative approach nurtures a strong community foundation, driving Maker’s overall success and mass adoption.

In-depth examination of these areas offers a comprehensive understanding of Maker’s value proposition, its standing within the broader cryptocurrency space, and its avenues for future growth and innovation.

Maker (MKR) Technical Analysis

Zoom

Hour

Day

Week

Month

Year

All Time

Type

Line Chart

Candlestick

Technical Analysis is a forecasting method that involves studying historical price and volume trends to predict future market behavior.

One biggest advantage of Technical Analysis is to help the investors identify potentials buy and sell points, and thus carry significance in predicting Maker’s future price movement.

Relative Strength Index (RSI): It measures the speed and change of price movements, often used to identify overbought or oversold conditions. If the RSI is above 70, it often indicates an overbought condition suggesting a sell. Conversely, if the RSI is below 30, an oversold condition is typically suggested, posing a buy signal.

Volume: Trading volume paints a picture of the level of activity and liquidity associated with an asset. A sudden spike in volume can often flag a strong price movement. A higher volume often signifies a stronger price movement, playing a crucial role in confirming the trend.

Moving Averages: The moving average is a common tool used to smooth out short-term fluctuations and highlight longer-term trends or cycles. Simple moving averages (SMA) and exponential moving averages (EMA) are used to identify trends and reversals, place stop-loss orders, and confirm other technical analysis tools.

Maker Price Predictions FAQs

What is Maker?

Maker is a decentralized autonomous organization on the Ethereum blockchain that manages and controls the Maker Protocol.

The Maker Protocol is a series of smart contracts that manage the creation and issuance of the decentralized stablecoin, DAI, which maintains a value pegged to the US Dollar.

Is Maker a good investment?

Investing in Maker is subject to the risks and rewards associated with investing in any cryptocurrency.

Given its significant role in the world of decentralized finance (DeFi), and its position as a leading provider of stablecoins, has led many investors to be optimistic about Maker’s potential.

That being said, like with all investments, it’s essential to do thorough research and consider potential market volatility before investing in MKR.

What will be the Maker price by 2025?

It’s difficult to predict the exact price of Maker by 2025 given the volatile nature of the crypto market.

However, many crypto analysts and price prediction platforms suggest that the MKR price could experience significant growth in the next few years based on factors such as adoption level, market trends, and overall sentiment.

Can Maker reach $10,000?

Predicting if or when MKR might reach $10,000 would be purely speculative, however, the crypto market has proven its potential for high volatility and significant price swings.

The asset’s growth will depend on various factors including continued adoption of the Maker protocol, the overall health of the crypto market, and technological advancements within the platform.

What is CoinEagle.com?

CoinEagle.com is an independent crypto media platform and your official source of crypto knowledge. Our motto, “soaring above traditional finance,” encapsulates our mission to promote the adoption of crypto assets and blockchain technology.

Symbolized by the eagle in our brand, CoinEagle.com represents vision, strength, and the ability to rise above challenges. Just as an eagle soars high and has a keen eye on the landscape below, we provide a broad and insightful perspective on the crypto world.

We strive to elevate the conversation around cryptocurrency, offering a comprehensive view that goes beyond the headlines.

Recognized not only as one of the best crypto news websites in the world, but also as a community that creates tools and strategies to help you master digital finance, CoinEagle.com is committed to providing you with the necessary knowledge to win in crypto.

Disclaimer: The Maker price predictions in this article are speculative and intended solely for informational purposes. They do not constitute financial advice. Cryptocurrency markets are highly volatile and can be unpredictable. Investors should perform their own research and consult with a financial advisor before making any investment decisions. CoinEagle.com and its authors are not responsible for any financial losses that may result from following the information provided.

0 notes

Text

What Are The Most Important DeFi Protocols?

Decentralized Finance (DeFi) has emerged as a game-changing concept that employs blockchain technology to provide open, transparent, and permissionless financial services to people all over the world. As the Ethereum network and its tremendous smart contract capabilities have matured, DeFi has emerged as a focal point among cryptocurrency enthusiasts.

Multiple protocols at the heart of the DeFi ecosystem enable the smooth operation of decentralized apps (DApps) and allow users to engage in activities such as lending, borrowing, trading, and more. With the continued growth of DeFi applications, so has the demand for DeFi experts. If you want to be the best in your field, you can enroll in DeFi classes.

In this blog, we will look at the most important DeFi protocols that have had an impact on the decentralized finance landscape.

What is DeFi?

DeFi, short for Decentralized Finance, refers to a new financial ecosystem based on blockchain technology that aims to disrupt and reinvent established financial systems. Unlike centralized financial intermediaries such as banks and exchanges, DeFi eliminates middlemen and enables direct peer-to-peer transactions and interactions via smart contracts.

DeFi intends to make these transfers safe, but without the scrutiny, expenses, privacy concerns, and sometimes delays associated with third parties. DeFi has grown in popularity due to its open nature, permissionless access, and promise of financial inclusion, allowing anyone to have greater control over their assets and participate in a decentralized global financial network.

According to DeFi experts, the concept of permissionlessness is a critical component of DeFi. Anyone with an internet connection and a suitable wallet can participate in DeFi protocols, with no KYC (Know Your Customer) procedures or middlemen required. This promotes financial inclusion and empowers those who would not otherwise have access to traditional financial services.

DeFi also emphasizes transparency, as all transactions and processes are recorded on the blockchain, allowing anyone to audit and verify the system's integrity. Furthermore, DeFi protocols frequently include decentralized governance frameworks, which allow token holders or community participants to make decisions and collaboratively define the protocol's path.

The rapid growth of DeFi has resulted in innovative solutions and disruption across traditional financial sectors. It provides advantages such as increased financial accessibility, faster and cheaper transactions, programmability, global reach, and the potential for greater financial privacy.

Some of the most important DeFi protocols

MakerDAO

MakerDAO revolutionized the DeFi space by introducing the concept of decentralized stablecoins through its native asset, DAI. Users can generate DAI by collateralizing their assets, primarily Ether (ETH), and locking them in smart contracts known as Collateralized Debt Positions (CDPs). The protocol's stability mechanism ensures that the value of DAI remains close to $1 through automated adjustments. MakerDAO's governance model, which is governed by MKR token holders, allows for decentralized decision-making, ensuring the protocol's security and development.

Compound

Compound is a lending and borrowing protocol based on a transparent and algorithmically determined interest rate model. Users can lend their crypto assets to earn interest or borrow assets by providing collateral. Unlike traditional financial institutions, Compound eliminates intermediaries and allows users to access funds directly from the protocol. The protocol supports a wide range of assets, and interest rates fluctuate based on supply and demand dynamics. The compound has evolved into an essential infrastructure for DeFi liquidity providers and borrowers.

Uniswap

Uniswap is a decentralized exchange protocol that enables peer-to-peer token trading on the Ethereum blockchain. Uniswap eliminates the need for order books by utilizing an automated market-making mechanism that relies on liquidity pools and smart contracts to determine token prices. Anyone can create a liquidity pool by depositing an equal value of two tokens, allowing for seamless trading. Uniswap's simple user interface and open listing policy have contributed to its popularity and high trading volumes, making it a key player in the DeFi trading ecosystem.

Aave

AAVE is a lending system with its own native token, also known as AAVE, that provides users with a wide range of features and flexibility. Users can deposit assets into liquidity pools, earn interest on their holdings, and borrow against their collateral without requiring a credit check. Aave has a unique "flash loan" feature that allows users to borrow assets without providing collateral as long as the funds are returned within the same transaction. Aave also allows users to switch between fixed and variable interest rates, giving them control over their borrowing costs.

Synthetix

Synthetix allows you to create and trade synthetic assets, also known as "synths," which are tokenized representations of real-world assets. Synthetix allows users to create and trade various synthetic assets, such as cryptocurrencies, fiat currencies, and commodities, by using its native token, SNX, as collateral. This allows for exposure to multiple markets without the use of traditional middlemen. Synthetix is a prominent participant in DeFi due to the protocol's decentralized nature and sophisticated oracle infrastructure, which ensures the correctness and dependability of synthetic assets.

Yearn. finance

Yearn. finance automates yield farming strategies to maximize returns on users' cryptocurrency holdings. The protocol aggregates liquidity from various DeFi platforms to identify the most profitable opportunities, maximizing yield generation. Yearn's governance token, YFI, grants holders voting rights and allows them to participate in the protocol's decision-making process. Yearn. finance functions as a user-friendly aggregator, simplifying the yield farming process and providing users with a way to maximize their passive income.

SushiSwap

SushiSwap is a decentralized exchange system that builds on the Uniswap concept by adding new features. It included yield farming, in which users could stake their assets in exchange for SUSHI tokens. SushiSwap's community-centric governance architecture allows token holders to propose and vote on protocol updates, enabling decentralized decision-making. The protocol's goal is to provide additional benefits to liquidity providers, thereby promoting the growth and sustainability of the DeFi ecosystem.

Conclusion

The DeFi ecosystem is constantly evolving, and new protocols emerge at a rapid pace. The protocols mentioned in this article represent some of the most prominent and influential participants in the DeFi market, each bringing unique features and functions to the decentralized financial environment. These protocols have enabled consumers to access financial services without the use of intermediaries, redefine lending and borrowing practices, and establish new avenues for earning passive income. As DeFi continues to define the future of finance, it is critical to be educated about these protocols and their potential impact on the larger financial ecosystem.

If you want to learn DeFi online and are looking for cost-effective options, Blockchain Council is here to help. Check out the Blockchain Council's website for affordable DeFi certificate courses.

0 notes

Text

This is Why MakerDAO's DAI is the Best Stablecoin in the World

New Post has been published on https://hititem.kr/this-is-why-makerdaos-dai-is-the-best-stablecoin-in-the-world/

This is Why MakerDAO's DAI is the Best Stablecoin in the World

With all the warmth that Tether is getting as of late, I suppose its time to take a seem at a a lot advanced stablecoin replacement. Previously, we talked about Stablecoins and that i peculiarly featured MakerDAO. Thats coz I consider it’s the most promising stablecoin platform out there. In actual fact, MakerDAO is the enterprise or the platform, at the same time DAI is the issued stablecoin. Like I mentioned before, there are three types of stablecoins: fiat-collateralized, crypto-collateralized, and algorithmic or non-collateralized. However sincerely, theres a fourth variety. I by no means mentioned it since it is extremely infrequent. In fact, I by no means heard of any stablecoin utilising this mannequin except DAI. DAI is currently as crypto-collateralized stablecoin, however soon, after multi-collateral DAI is released into mainnet, its gonna turn out to be one of the first hybrid stablecoins.It is going to combination all three other items in one. So the MakerDAO process has 2 currencies: DAI, which is the stablecoin that is pegged to the U.S. Buck. Please be aware that it’s only pegged, now not backed, by USD. Which means the method is stabilizing its price to a 1 to 1 ratio with the buck, however presently its backed by way of Ethereum most effective.Quickly, DAI can also be backed through many distinct forms of assets together with fiat currencies, beneficial metals, and other tokens. MKR, however, is the governance token. Its holders have voting rights and it is architected in a decentralized method. Due to the fact of its function in retaining the method together, the rate of MKR is risky, not like DAI. So lets jump into the great part: learn how to create DAI. Being a permission-less system, any one can create DAI. The method is beautiful easy. All you have to do is ship Ether to a MakerDAO clever contract, and then it becomes what we name a CDP. Should you havent heard of CDP, it stands for Collateralized Debt position, just a fancy identify however its only a intelligent contract. So now that youve despatched your Ether as collateral, you at the moment are entitled to receive a proportional quantity of DAI tokens. Observe how I say proportional, now not equal quantity of DAIs. Thats for the reason that you ought to overcollateralize in order to soak up price fluctuations of your asset.We could say you sent 150 bucks worth of Ether to the CDP, youre no longer gonna get one hundred fifty bucks valued at of DAI too. You might be allowed to specify any amount of DAI you want in return, so long as you remain overcollateralized; e.G. Having a hundred dollars worth of DAI backed by way of 200 bucks worth of Ether approach that you’ve got 200 percentage collateralization. You might choose to have one hundred fifty percent collateralization, and get extra DAI for the equal amount, however the hazard of getting liquidated could be better. Option is yours. Im no longer definite if its even allowed at this factor. And liquidation has a penalty you need to pay so.. So as soon as youve created your CDP, you can not retrieve the underlying Ether collateral except you close the mentioned CDP. And that you could simplest do this by means of paying back the issued DAI plus a balance fee. Well get back to the steadiness price later however first lets talk about how one can probably profit from this mechanism. For illustration, we could say you ship some Ether to the Maker platform to create a CDP.Lets say you collateralize by way of 200 percent. Youll obtain 1/2 the amount in DAI. So in this situation, you have already got your Ether locked up as debt collateral, as good as some DAIs. What you are able to do right here is sell that DAI and get extra Ether. Now you’ve gotten plus a hundred percent extra Ether than you firstly had, and you can do anything you need with it. You might both add it to your CDP otherwise you would just hold it to your wallet, or maybe trade it, whatever. Whats left to do then is wait. Look forward to Ethereum to broaden in rate. Once your convinced with the fee expand, you may shut your CDP. For this reason, you pay up your debt after which your Ether may also be reclaimed.Now you possibly questioning, how did I revenue? I paid back the debt that I owed with the intention to get my Ether again. Whats new? Well, thats given that you paid back in DAI, which has a stable fee. Your Ether on the other hand, which used to be locked up, is not steady; and also you waited for it to upward push and reaped the rewards.But what if the opposite happens and Ethers rate falls? Well youre in deep sh#t! Thats why its higher to create CDPs in an uptrend market than in a downtrend market. Final 12 months was once the worst undergo market, so it would had been a quite unhealthy thought to create CDPs. This yr, things are watching up. Weve seen short uptrends these days and the fundamentals are becoming greater with the aid of the day. Now, would be a good time to create CDPs, of path, thats now not fiscal advice. Now back to the stability cost, which I left out previous for simplicitys sake; but clearly, in order to trouble DAI, you have got to pay a balance rate, which was once raised very not too long ago to 19.5 percent per yr.This is payable in MKR, the governance token, which incidentally will get burned afterwards, reducing the circulating deliver. Very well, lets recap the steps in profiting from DAI. Loan your Ether to get some DAI Use the DAI in anyway you need Repay the DAI when you are equipped to get your collateral again Cha-ching! So now we all know how one can convert your Ethereum CDP to DAI; but we have got to marvel, how does DAI remain stable when Ethereum could be very unstable? Not to point out it crashed with the aid of 90 percentage final yr. That is treated by means of the so-known as goal fee suggestions Mechanism. Basically, it permits the process to remain in stable equilibrium, by using automatically adjusting the cost of each DAI, relative to the goal cost. The target cost is quite simply the fee we wish DAI to be.So like I stated prior, DAI is pegged to the united states greenback. Consequently, its target rate is 1 dollar per DAI. Three eventualities can occur. Scenario 1: present DAI rate is the equal as goal price; so no trade required. Scenario 2: current DAI rate is greater than the target price. On this case, the process has to unlock additional DAI, to make cost go down. The mechanism will make it less expensive to create DAI, which incentivizes customers to create more of it, and so demand goes down, bringing the rate with it.Scenario three: current DAI cost is shrink than goal. On this situation, the approach has to withdraw DAI from the market to make its rate bigger. The mechanism will be certain that DAI construction turns into extra high-priced, so much less DAI will be created, and so demand goes up, bringing the price with it. The goal expense feedback Mechanism is first-rate for preserving the DAI steady whilst overcollateralization cushions it from big price swings. However thats not all. MakerDAO has a characteristic referred to as global contract, which is its final line of security. It is a system where the method freezes; meaning no CDPs may also be created nor liquidated and transactions are stopped. Then, the system of returning all collateral back to its homeowners starts. So truly its a worldwide shutdown, which unravels the MakerDAO platform whilst making definite that every one Dai holders and CDP customers acquire the web value of property that they’re entitled to.And it could actually only be brought about through a set of world settlers, that are of course chosen by means of the MKR holders, which makes the whole process reasonably decentralized. A world contract ought to most effective be brought on if 1) there’s a protection breach, comparable to hacks or cyberattacks. 2) if there is a black swan event, which is an occurrence that’s unattainable to predict however has catastrophic ramifications. The DAO hack on Ethereum is an ideal instance for this. And 3) when there are approach improvements. For example, there’s a planned international settlement to occur once the procedure improvements to multi-collateral DAI. As weve mentioned, the MakerDAO platform simplest supports Ethereum as collateral. But accepting only one type of asset with out some other possible choices is bad for the method. Above all if its a very risky asset like Ethereum. Despite the system being admirably resilient, the MKR holders had to vote a few times to develop the steadiness cost, in order to avert the deliver of DAI and pressure up the cost again to 1 dollar.Currently, the soundness rate is nineteen.5%, which is fairly excessive. Im no longer definite how so much it used to but consistent with Coindesk record theyve been incrementally growing it for weeks. My excellent wager is that it was once someplace below 10 percent. However take that part with a grain of salt. But to be reasonable, this isnt the MKR holders fault. They’re without difficulty reacting to the law of deliver and demand. The determination to broaden the soundness cost would incentivize some users to close their CDPs and burn their DAI tokens, thereby stabilizing the fee. On top of that, it might discourage users from growing more DAIs too. Thus far its working. DAI is stable at 0.99 dollars on coinmarketcap at the time of this recording. But the difficulty is if persons speculate that Ethereum is gonna pump rough this 12 months coz crypto iciness is over and Ethereum remains to be number 2 amongst cryptocurrencies. If people believe that Ethereum is gonna lets say, triple in rate every time soon, they wouldnt care too much in regards to the 19 percentage balance rate.Coz what is a 19 percentage price to 300 percent profits, correct? And that can destabilize DAI. This is among the factors why multi-collateral could be very foremost. We cant have the risk concentrated on one unstable currency. If we might spread the risk to comprise beneficial metals, fiat money, properties, and different property. Then Dais price wont be comfortably influenced through the hypothesis of Ethereum holders. Not that I dont like Ethereum. Like it. Anyway guys, thanks for gazing. Seize you on the flipside! .

#bitcoin#cdp#crypto 2019#cryptocurrency#dai#dai stablecoin#ethereum#makerdao#makerdao cdp#makerdao dai#makerdao governance#makerdao loan#mkr#mkr dai#multi collateral dai#stablecoin

0 notes

Text

This is Why MakerDAO's DAI is the Best Stablecoin in the World

New Post has been published on https://hititem.kr/this-is-why-makerdaos-dai-is-the-best-stablecoin-in-the-world/

This is Why MakerDAO's DAI is the Best Stablecoin in the World

With all the warmth that Tether is getting as of late, I suppose its time to take a seem at a a lot advanced stablecoin replacement. Previously, we talked about Stablecoins and that i peculiarly featured MakerDAO. Thats coz I consider it’s the most promising stablecoin platform out there. In actual fact, MakerDAO is the enterprise or the platform, at the same time DAI is the issued stablecoin. Like I mentioned before, there are three types of stablecoins: fiat-collateralized, crypto-collateralized, and algorithmic or non-collateralized. However sincerely, theres a fourth variety. I by no means mentioned it since it is extremely infrequent. In fact, I by no means heard of any stablecoin utilising this mannequin except DAI. DAI is currently as crypto-collateralized stablecoin, however soon, after multi-collateral DAI is released into mainnet, its gonna turn out to be one of the first hybrid stablecoins.It is going to combination all three other items in one. So the MakerDAO process has 2 currencies: DAI, which is the stablecoin that is pegged to the U.S. Buck. Please be aware that it’s only pegged, now not backed, by USD. Which means the method is stabilizing its price to a 1 to 1 ratio with the buck, however presently its backed by way of Ethereum most effective.Quickly, DAI can also be backed through many distinct forms of assets together with fiat currencies, beneficial metals, and other tokens. MKR, however, is the governance token. Its holders have voting rights and it is architected in a decentralized method. Due to the fact of its function in retaining the method together, the rate of MKR is risky, not like DAI. So lets jump into the great part: learn how to create DAI. Being a permission-less system, any one can create DAI. The method is beautiful easy. All you have to do is ship Ether to a MakerDAO clever contract, and then it becomes what we name a CDP. Should you havent heard of CDP, it stands for Collateralized Debt position, just a fancy identify however its only a intelligent contract. So now that youve despatched your Ether as collateral, you at the moment are entitled to receive a proportional quantity of DAI tokens. Observe how I say proportional, now not equal quantity of DAIs. Thats for the reason that you ought to overcollateralize in order to soak up price fluctuations of your asset.We could say you sent 150 bucks worth of Ether to the CDP, youre no longer gonna get one hundred fifty bucks valued at of DAI too. You might be allowed to specify any amount of DAI you want in return, so long as you remain overcollateralized; e.G. Having a hundred dollars worth of DAI backed by way of 200 bucks worth of Ether approach that you’ve got 200 percentage collateralization. You might choose to have one hundred fifty percent collateralization, and get extra DAI for the equal amount, however the hazard of getting liquidated could be better. Option is yours. Im no longer definite if its even allowed at this factor. And liquidation has a penalty you need to pay so.. So as soon as youve created your CDP, you can not retrieve the underlying Ether collateral except you close the mentioned CDP. And that you could simplest do this by means of paying back the issued DAI plus a balance fee. Well get back to the steadiness price later however first lets talk about how one can probably profit from this mechanism. For illustration, we could say you ship some Ether to the Maker platform to create a CDP.Lets say you collateralize by way of 200 percent. Youll obtain 1/2 the amount in DAI. So in this situation, you have already got your Ether locked up as debt collateral, as good as some DAIs. What you are able to do right here is sell that DAI and get extra Ether. Now you’ve gotten plus a hundred percent extra Ether than you firstly had, and you can do anything you need with it. You might both add it to your CDP otherwise you would just hold it to your wallet, or maybe trade it, whatever. Whats left to do then is wait. Look forward to Ethereum to broaden in rate. Once your convinced with the fee expand, you may shut your CDP. For this reason, you pay up your debt after which your Ether may also be reclaimed.Now you possibly questioning, how did I revenue? I paid back the debt that I owed with the intention to get my Ether again. Whats new? Well, thats given that you paid back in DAI, which has a stable fee. Your Ether on the other hand, which used to be locked up, is not steady; and also you waited for it to upward push and reaped the rewards.But what if the opposite happens and Ethers rate falls? Well youre in deep sh#t! Thats why its higher to create CDPs in an uptrend market than in a downtrend market. Final 12 months was once the worst undergo market, so it would had been a quite unhealthy thought to create CDPs. This yr, things are watching up. Weve seen short uptrends these days and the fundamentals are becoming greater with the aid of the day. Now, would be a good time to create CDPs, of path, thats now not fiscal advice. Now back to the stability cost, which I left out previous for simplicitys sake; but clearly, in order to trouble DAI, you have got to pay a balance rate, which was once raised very not too long ago to 19.5 percent per yr.This is payable in MKR, the governance token, which incidentally will get burned afterwards, reducing the circulating deliver. Very well, lets recap the steps in profiting from DAI. Loan your Ether to get some DAI Use the DAI in anyway you need Repay the DAI when you are equipped to get your collateral again Cha-ching! So now we all know how one can convert your Ethereum CDP to DAI; but we have got to marvel, how does DAI remain stable when Ethereum could be very unstable? Not to point out it crashed with the aid of 90 percentage final yr. That is treated by means of the so-known as goal fee suggestions Mechanism. Basically, it permits the process to remain in stable equilibrium, by using automatically adjusting the cost of each DAI, relative to the goal cost. The target cost is quite simply the fee we wish DAI to be.So like I stated prior, DAI is pegged to the united states greenback. Consequently, its target rate is 1 dollar per DAI. Three eventualities can occur. Scenario 1: present DAI rate is the equal as goal price; so no trade required. Scenario 2: current DAI rate is greater than the target price. On this case, the process has to unlock additional DAI, to make cost go down. The mechanism will make it less expensive to create DAI, which incentivizes customers to create more of it, and so demand goes down, bringing the rate with it.Scenario three: current DAI cost is shrink than goal. On this situation, the approach has to withdraw DAI from the market to make its rate bigger. The mechanism will be certain that DAI construction turns into extra high-priced, so much less DAI will be created, and so demand goes up, bringing the price with it. The goal expense feedback Mechanism is first-rate for preserving the DAI steady whilst overcollateralization cushions it from big price swings. However thats not all. MakerDAO has a characteristic referred to as global contract, which is its final line of security. It is a system where the method freezes; meaning no CDPs may also be created nor liquidated and transactions are stopped. Then, the system of returning all collateral back to its homeowners starts. So truly its a worldwide shutdown, which unravels the MakerDAO platform whilst making definite that every one Dai holders and CDP customers acquire the web value of property that they’re entitled to.And it could actually only be brought about through a set of world settlers, that are of course chosen by means of the MKR holders, which makes the whole process reasonably decentralized. A world contract ought to most effective be brought on if 1) there’s a protection breach, comparable to hacks or cyberattacks. 2) if there is a black swan event, which is an occurrence that’s unattainable to predict however has catastrophic ramifications. The DAO hack on Ethereum is an ideal instance for this. And 3) when there are approach improvements. For example, there’s a planned international settlement to occur once the procedure improvements to multi-collateral DAI. As weve mentioned, the MakerDAO platform simplest supports Ethereum as collateral. But accepting only one type of asset with out some other possible choices is bad for the method. Above all if its a very risky asset like Ethereum. Despite the system being admirably resilient, the MKR holders had to vote a few times to develop the steadiness cost, in order to avert the deliver of DAI and pressure up the cost again to 1 dollar.Currently, the soundness rate is nineteen.5%, which is fairly excessive. Im no longer definite how so much it used to but consistent with Coindesk record theyve been incrementally growing it for weeks. My excellent wager is that it was once someplace below 10 percent. However take that part with a grain of salt. But to be reasonable, this isnt the MKR holders fault. They’re without difficulty reacting to the law of deliver and demand. The determination to broaden the soundness cost would incentivize some users to close their CDPs and burn their DAI tokens, thereby stabilizing the fee. On top of that, it might discourage users from growing more DAIs too. Thus far its working. DAI is stable at 0.99 dollars on coinmarketcap at the time of this recording. But the difficulty is if persons speculate that Ethereum is gonna pump rough this 12 months coz crypto iciness is over and Ethereum remains to be number 2 amongst cryptocurrencies. If people believe that Ethereum is gonna lets say, triple in rate every time soon, they wouldnt care too much in regards to the 19 percentage balance rate.Coz what is a 19 percentage price to 300 percent profits, correct? And that can destabilize DAI. This is among the factors why multi-collateral could be very foremost. We cant have the risk concentrated on one unstable currency. If we might spread the risk to comprise beneficial metals, fiat money, properties, and different property. Then Dais price wont be comfortably influenced through the hypothesis of Ethereum holders. Not that I dont like Ethereum. Like it. Anyway guys, thanks for gazing. Seize you on the flipside! .

#bitcoin#cdp#crypto 2019#cryptocurrency#dai#dai stablecoin#ethereum#makerdao#makerdao cdp#makerdao dai#makerdao governance#makerdao loan#mkr#mkr dai#multi collateral dai#stablecoin

0 notes

Text

MakerDAO Releases Guidelines for Migrating Existing DAI to Multi-Collateral Contracts

MakerDAO Releases Guidelines for Migrating Existing DAI to Multi-Collateral Contracts

Earlier this year, MakerDAO announced that they would be phasing in multi-collateral contracts. This would give users the ability to enter a Collateralized Debt Position (CDP) by using asset chosen by the community as collateral, instead of just ETH. The Foundation has rewritten the entire smart contract core, so this will result in existing DAIRead More

https://btcmanager.com/makerdao-guidelines-dai-multi-collateral-contracts/?utm_source=Tumblr&utm_medium=socialpush&utm_campaign=SNAP

0 notes

Text

One Wallet Owns 27% of Ether Behind MakerDAO’s Sai Stablecoin

One Wallet Owns 27% of Ether Behind MakerDAO’s Sai Stablecoin

Of all the value locked in MakerDAO’s collateralized debt positions backing the old DAI decentralized stablecoin, 27% belongs to a single Ethereum address.

Of all the Ether (ETH) locked in the collateralized debt positions (CDPs) of the old MakerDAO system, 27% belongs to a single Ethereum address. Financial technology data firm Digital Assets Data shared these findings with Cointelegraph on…

View On WordPress

1 note

·

View note

Quote

去中心化交易所(DEX)从 2018 年开始崛起,在过去一年中蓬勃发展。随着去中心化金融改变以太坊的经济生态,去中心化交易所现在扮演着着比以往更关键的角色,因为它们是借贷业务和衍生品应用的流动性提供者。 自 2018 年我们的第一篇文章(也是分析的 DEX 上的用户活动)发布以来,��乎一年半过去了。在过去一年中,Alethio(也就是我们 DEXWatch 产品背后的团队),见证了许多的协议升级和新用户进场。现在我们用数据和可视化工具来回顾一下 DEX 在 2019 年的成长。 数据集 & 方法 在这份回顾中,我们以下面 20 家 DEX 在整个 2019 年中的表现作为样本: 本文中的交易量表只反映从这 20 家 DEX 中收集到的数据。更多别的协议的表现我们会在后续发布的文章中分析。同样地,非同质代币(NFT)的交易量也未包括在我们的样本集中。 因为 DEX 协议往往各有独特的属性,一些指标在不同案例中可能会有不同的含义。我们会在需要说明时额外指出。 DEX 平台分析 各 DEX 的日交易数统计 EtherDelta 和 IDEX 在 2017 和 2018 是最流行的去中心化交易,从交易笔数上来看,在 2019 年也仍是两个最大的 DEX(请看我们的 统计面板)。从 2018 年年中开始,更多协议和交易所中继者出现。在 2018 年年底,Uniswap 就因为其卓越的实用性而崭露头角,到了 2019 年年底,以日交易笔数衡量,Uniswap 已经成为了第二大 DEX。 在下图中,我们以时间为横轴,显示了各交易所的日交易笔数,IDEX 仍是市场领跑者,而 Uniswap、Kyber 和 Bancor 已经超过了 EtherDelta。 IDEX 的交易量在第二季度达到峰值(约每天 7000 笔交易),在第四季度回到每天 3000 笔交易。Uniswap、Kyber 以及 Bancor 在二三四名的位置上来回厮杀,平均日交易笔数都在约 1000~2000 笔范围内浮动。 注意,一笔在不同交易所之间抽调流动性的订单可能会被计算两次。同样地,交易笔数也不等同于交易量,因为每笔交易的交易量都不同。我们后面会公布交易量的统计。 在下文图表中,我们将使用与图 1 相同的图例(表示不同交易所的颜色将保持一致)。 各 DEX 的月交易量统计(以 ETH 来衡量) 绝大部分去中心化交易所都不提供法币入口,所以,DEX 上的交易者要么买卖 token,要么买卖 ETH。在一些交易所上,为交易一定数量的 ETH 需要用到封装 ETH 的 token(比如 0x 上会用到 WETH、DeversiFi 会用到 ETHW、Bancor 上会用到 ETH Token),它们的价值跟 ETH 是完全一样的。(译者注:这么做���般是技术原因:ETH 本身不是一种符合 ERC-20 标准的 token,而使用 ERC-20 标准便于代币间的互换,因此一些合约会提供将 ETH 与某种 token 等数量互换的功能,而 DEX 往往出于技术上的便利使用这些 token) 我们可以将 DEX 上的交易分为两类: · 在 tokenX 和 tokenY 之间的交易 · token X 与 ETH 之间的交易 在估计所有 token 的交易量时,我们发现很难用美元计价来衡量交易量,因为要获取所有 token 的美元价格是很难的,而且这些价格往往是在中心化交易所中收集的。因此,我们决定用 ETH 来计算交易量,而且,仅考虑对 ETH(包括封装 token)的交易量,因为直接的代币互换交易的转换价格(即代币对 ETH 的价格)既不完整(难以全面收集)又是滞后的(只能根据最近的过往交易来估计)。我们的数据因此忽略了直接的代币互换的交易量。不过,对大部分主要的 DEX 来说,协议通常会把代币互换交易拆成两笔交易:tokenX 换 ETH、ETH 换 tokenY,因此会计入我们的数据当中。 图 2 展示了各交易所的 ETH 交易量。我们看到交易所的 ETH 总交易量排名跟交易笔数图(图 1)的排名还是蛮一致的。IDEX,总交易量第一名,在前三个季度,平均每个月有约 40 万 ETH 的交易量,但在第四季度,每月平均交易量下降到了 20 万 ETH。OasisDex、Kyber、Bancor 和 Uniswap 紧随其后。 Token 的表现 各 Token 对 ETH 的月交易量 在过去一年中,我们在上面列举的 20 家 DEX 上观测到了约 4300 种不同代币的交易。下图以时间为横轴显示了各 token 对 ETH 的交易量: 伴随去中心化金融的兴起,Dai 稳定币 v1.0(也就是现在所谓的 “Sai”,在 MakerDAO 多抵押稳定币系统上线以前,用户通过抵押 ETH 来发行的稳定币)成为了 2019 年交易量最大的 token。其它稳定币包括 TrueUSD 和 USDC 也在全年中保持了高交易量。新的 DAI(在图中被标记为 “Dai Stablecoin”)(也就是 MakerDAO 的多抵押 DAI)在 2019 年第四季度才开始出现,但迅速成为了交易量第二大的 token。 ChainLink token 的交易量在 6 月和 7 月迅速上升,这是因为那时候市场对 ChainLink 项目很感兴趣,他们做的是预言机服务,就是把真实世界的数据输送给 dApp。 把全年的交易量加总起来,我们发现 SAI(在图 4 中标记为 “Stablecoin v1.0”)的交易量是 440 万 ETH,是第二名 BNT 交易量的 4.6 倍。图 4 也体现了过去一年中特别火的项目,��括 MakerDAO、Quant、Capdex 以及 Flexacoin。 进一步地,我们在下图中用字体大小表示出了哪个交易所平台在为这些大交易量的 token 提供流动性。文字根据所表示的 DEX 加上了颜色,而且字体的大小就代表了该交易所对那种 token 交易量的贡献。 OasisDex 是 MakerDAO 开发的交易平台,它贡献了绝大部分 SAI 交易量(约 242 万 ETH)。SAI 的交易量也还分布于 Uniswap、Kyber、RadarRelay、AirSwap、DDEX 和 Paradex 等交易所上。 有意思的是,MakerDAO 的原生 token,在 Uniswap 上的交易量比在 OasisDex 的交易量还大。 BNT token(Bancor Network Token)基本上都是在 Bancor 上交易,虽然也可以在其它交易所上看到,但交易量就小得多。类似地,Quant、CapdaxTokan 和 Flexacoin 的交易量基本上由 IDEX 独占。而 Chainlink 和 WETH 的主要交易所是 Kyber。相反,DAI 稳定币和 USDC(两大主要稳定币),在各大平台上的交易量的比较均匀。 流通 token 的多样性 按交易所来收集数据,我们可以看到 2019 年这些交易所都流通了多少种 token。虽然 EtherDelta 即没有在交易数量也没有在交易体量上占优(根据图 1 和图 2),它提供了最多种类的 token 给交易者:有 3190 种 token 在上面交易。 注意,“流通的 token” 并不等同于在 DEX “上线的 token”。因为得到交易所支持的 token 也许没有市场买卖单,因此这个数字会小于 DEX 实际上线的 token 种类数。 用户基础 日活跃地址数量 在 IDEX 上,日活跃交易地址数的走势跟交易笔数、交易体量的走势比较相似。Uniswap 的活跃用户在全年中迅速增长,在 10 月上旬达到约 1300 名活跃地址的峰值。OasisDex 的活跃用户数在 7 月下旬飙升到约 900 个,这可能是因为 CDP 的 SAI 奖励发放活动。 另一个显著的相关性出现在 Kyber 和 Uniswap 上,这两个交易所的交易地址数量长期高度接近,这可能暗示了,这两个平台的用户是同一帮人。下面的网络图也印证了这一假设。 网络关系图:探究 DEX 的用户重叠度 通过辨识使用的 DEX 的地址(他们可能是挂单者,也可能是吃单者),我们可以探究 DEX 的用户基础,包括不同 DEX 的用户重叠度。 dex.blue 特殊一点,交易执行不会记录交易者信息,因此我们无法收集用户的数据。在理解这份网络关系图时,要指出的一点是,地址数量不能直接等同于用户数量。一个人可能会使用多个地址,所以实际用户规模可以认为是要小于图中显示的地址数的。不过,它还是可以告诉我们这些协议之间的 用户关系。 类似地,对某些协议,下图显示出来的规模也会小于实际用户规模,例如 Bancor 就是这样,在 Bancor 协议中,记录下来的交易地址是 “传递者(forwarder)” 或者叫 “转换者(converter)” 的,交易是由他们来操作的。 在这幅图中,有颜色的点代表 “独占交易者”,就是只在某一个交易平台上做买卖的地址。白色的点代表 “重叠交易者”,就是使用多个平台的地址。各交易所的地址数量都标在旁边。注意,这个数字代表的不是独占交易者的数量,而是包括了独占交易者和重叠交易者的数量。 另外,Uniswap 和 Kyber 之间的重叠交易者最多,这就证明了我们上面根据两个交易所的活跃地址数量在时间序列上的相关性而作出的假设。 IDEX 有最多的独占交易者群体,OasisDex 和 EtherDelta 次之。 Airswap Protocol 0x protocol EtherDelta IDEX OasisDex Kyber 从图片上来看,Bancor 和 Eidoo 似乎隔绝于其它交易所,这是因为我们上文提到的 转换者/传递者 机制。 免责声明:Alethio 对上文所提到的所有项目都一视同仁。上文讨论到的协议数量是很少的,我们会继续充实我们的观测列表,以得出更全面的结果。Alethio 对自己的中立性有强烈的自信,我们仅提供事实,并根据客观 以及/或者 得到验证的信息得出最好的结论。文本绝对无意为恶意活动或者交易提供任何指导或建议。

http://www.bitcoincn.co/2020/01/DEX-Exchanges-Crypto.html

1 note

·

View note

Text

Cryptocurrencies (2/3)

Why so many different types?

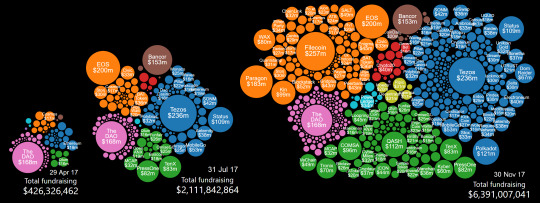

We have the main differences in terms of protocol (i.e. PoW vs PoS vs DPoS), however we also have many different coins of the same core protocol which serve slightly different purposes. There are a few decent ones, however for the large majority they are what we consider ‘shitcoins’. They were born out of the ICO craze in 2017 where everyone was creating tokens on Ethereum which were essentially “unregistered securities”. They were raising money (BTC and ETH) with very little in the way of a whitepaper and people were just injecting money into them without any research. (very similar to .com bubble) Going into 2018, the majority of these tokens absolutely tanked in price (as they should) with the fall in BTC price. Bitcoin has recovered since, but the developer activity and corresponding user engagement in many of these tokens has dwindled.

Instead of trying to categorise cryptocurrencies, I will go through a couple of different currencies and some of their specific use cases:

Bitcoin (BTC) - primarily used as a store of value / wealth, similar to gold; increasing capacity of the lightning network is making it more useful for micro-payments

Ethereum (ETH) - provides money-based contracts (smart contracts) which can be used to run applications; thus you can launch tokens on top of

Litecoin (LTC) - faster block time than BTC and more suitable to smaller payments

Ripple (XRP) - nodes kept within the company so more centralised, but primary use-case is intra-bank transfers

Binance Coin (BNB) - issued from Binance exchange and used for fees relating specifically to the exchange

Stellar (XLM) - slightly more decentralised than XRP; intended for cross-border transactions (primarily non-profit)

Monero (XMR) - privacy coin intended to hide your addresses and transaction history

VeChain (VET) - intended for supply chain management; assets in chain are marked with unique asset IDs which are represented and tracked on-chain

Golem (GNT) - intended to be used for renting out computing power (’airbnb for computing’)

Steem (STEEM) - powers the social media platform Steemit; you can support content on the platform with the currency and the creators get rewarded

MakerDAO (MKR) and DAI - forms a stablecoin known as DAI (= 1 USD) through a ‘dynamic system of Collateralized Debt Positions (CDP), autonomous feedback mechanisms, and appropriately incentivized actors’

Now there are obviously a whole lot more cryptocurrencies than these in each of the individual categories, however I don’t think mentioning them necessarily adds a whole lot to an understanding of cryptocurrencies’ uses.

Case Study: Privacy

This was the section I wrote about, however due to time constraints I didn’t get to discuss all the topics I wanted to, so instead I will try and detail them in this post.

What constitutes identity in blockchain?

The majority of our online activities involving payments require an identity verification of sorts (i.e. in online banking). Blockchains such as Bitcoin differ in the sense that they only require you to demonstrate ownership of an address (public key) with your private key. This is what I mean when I say blockchain doesn’t have a strong concept of ‘identity’; in the sense that it is only linked to ‘something you know’ as an individual.

What are the main ways we can trace on the blockchain?

Tracing through transactions

There are two main ways in which we ‘may’ be able to determine identity from the blockchain. The first is through the relations between addresses - remember that every transaction has a sender, receiver and an amount recorded in the ledger. If we know the ownership of one address, we can potentially ‘infer’ the ownership of another. Let’s look at a transaction tree to illustrate:

At the far left of the tree we have the source of all the funds and as we move towards the right we can see where ‘portions’ of the funds have been moved. Any intermediate address between the source and the leaves at the far right is either owned by a third-party or also by the owner of the funds. If we were simply given an address such as the one in the top right and knew some information about any of the other addresses between it and a source, we may be able to ‘infer’ the identity.

Luckily for us in this example, the source address is actually a cryptocurrency exchange and due to increasing regulation they are now required to meet KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations; this means provided all intermediate addresses are under their control (and not mixed), we could potentially ascertain their identity. The process of determining the degree of association between two addresses is known as ‘taint analysis’ and relies on simulating using a FIFO (first-in, first-out) flow of funds through transactions).

Tracing through nodes

The other primary method is through the interactions between the nodes and users of the blockchain. Remember that every transaction needs to be uploaded to a node in the blockchain - if we are able to determine the source IP address from where the transaction is uploaded, perhaps we can determine the ownership of an address from which money is sent in the transaction.

How does Monero achieve privacy in blockchain?

The idea behind Monero is that we are trying to prevent as much information ‘leakage’ as possible (as explained just before) and this is done through a number of methods:

Unlinkability -> ‘Stealth addresses’ with ‘view’ keys

Transaction mixing -> Ring signatures

Concealing transaction amounts -> RingCT signatures

Hiding source IP and blockchain usage -> The Kovri Project

Each of these stages relies on a number of core cryptographic principles for concealment which I will discuss.

Unlinkability

The idea behind this is to try and stop people from seeing inputs to addresses. In Monero, everyone has asymmetric keys for viewing, sending and their actual addresses. If we consider the case where Alice wants to send money to Bob:

Alice generates a public key with a combination of Bob’s public send key, public view key and some random data

Alice can then send the funds to this address on the blockchain

Bob searches the blockchain with his private view key to find Alice’s created public key

Bob can then create a one-time private key to correspond to Alice’s generated public key

Bob can then use this key to spend the money Alice sent him

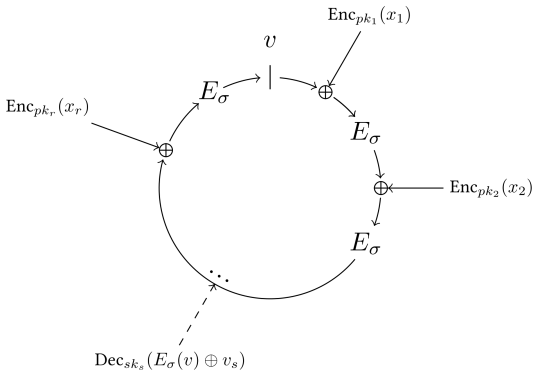

Transaction Mixing (Ring Signatures)

In this stage we are trying to stop people from seeing outputs to addresses by mixing up the source. We start by randomly choosing a number of users to appear as the source - this is known as the ‘mixin’ level. Lets say that we have Bob, Alice and Trent involved in this ring signature and Bob is the one who wants to send a message (i.e. transaction). The process goes as follows:

Everyone generates a (public, private) key pair

Bob hashes the message, generates a random number u and hashes it to get v

Bob generates random secret keys for all the others involved - he calculates the encryption key (e) for each of these by raising this secret to the power of their public key (modulus N, which is public)

Bob will XOR the v he created by hashing earlier with each of these ‘generated’ encryption keys

In the final step is to XOR the result with the initial u and encrypt with Bob’s private key (using his modulus)

The signature is represented by the (message, result, public keys, secret keys)

The important part about this process is that anyone can verify the authenticity of the signature through applying the same process to the original message to the final result, however they cannot determine who put their own secret key in out of the parties involved. I think the ‘mixin’ level on Monero at the moment is 11 (and mandatory in all transaction), so that means if you are trying to trace transaction flow, you only have a 1/11 chance of being right. (which isn’t too great)

RingCT Signatures

We are trying to hide the transaction amounts in this stage - this process basically involves utilising a mathematical function which allows you to verify that the transaction is valid without knowing the amounts. I could honestly spend days trying to understand the process in which these work (not enough time in this course or presentation); I will just say that they are based upon MSLAG (Multilayered Linkable Spontaneous Anonymous Group Signatures), Pedersen Committments (proofs to show you made a certain choice in function or value) and Range Proofs (allows verification that a transaction occurred between a given range - i.e. address value greater than 0 is important).

Hiding Internet Identity

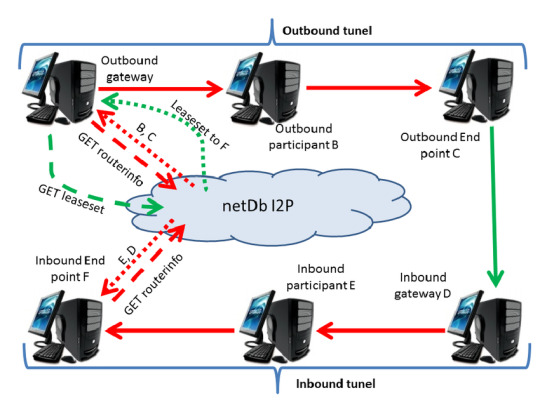

In this component, we are trying to conceal the source IP address when we upload a transaction to the blockchain. The way we can do this is by sending all transactions through a series of I2P (Internet Project) nodes - this is essentially a peer-to-peer overlay network so when you enter you establish a number of inbound and outbound proxy tunnels to other routers in the network.

Our identity is hidden through the use of privacy-preserving distributed hash tables (DHT); this is in contrast to TOR which has centralised directory servers. It also varies from TOR in the sense that it uses ‘garlic’ routing as opposed to ‘onion’ routing - this means you can send multiple messages at the same time which will ‘break off’ at different points in the network. A property of using the I2P network is that none of the nodes know whether the next stop is the destination; from an attacker’s perspective, they are only able to ascertain that you are using I2P, but not Monero.

1 note

·

View note

Photo

New Post has been published on https://coinprojects.net/makerdao-should-seriously-consider-depegging-dai-from-usd-founder/

MakerDAO should 'seriously consider' depegging DAI from USD: Founder

MakerDAO founder Rune Chirstensen has urged members of the decentralized autonomous organization (DAO) to “seriously consider” preparing for the depeg of its DAI stablecoin from the United States dollar (USD).

The founder’s comments came in light of the recently announced sanctions on crypto mixer Tornado Cash, noting to MakerDAO’s Discord channel on Aug. 11 that the sanctions are “unfortunately more serious than I first thought,” adding that they should prepare to depeg its native stablecoin DAI from the USD to avoid any risk’s relating to Circle’s recent freezing of sanctioned USD Coin (USDC) addresses.

“I think we should seriously consider preparing to depeg from USD. It is almost inevitable it will happen and it is only realistic to do with huge amounts of preparation.”

On Aug. 8, the U.S. Office of Foreign Asset Control (OFAC) officially barred residents from using the Tornado Cash protocol, while placing 44 USDC addresses linked with the platform on its list of Specially Designated Nationals.

Following the move, USDC issuers Circle froze $75,000 worth of the stablecoin linked to the 44 sanctioned addresses.

rune: we should seriously consider depegging from usd pic.twitter.com/HBMrPH7LrW

— banteg (@bantg) August 11, 2022

Around 50.1% of MakerDAO’s DAI is collateralized by USDC (according to Dai Stats) Christensen has raised concerns over the asset’s heavy reliance on a centralized asset in USDC, as Circle has shown that it will act in accordance with United States law in the case of Tornado Cash.

DAI is currently the fourth largest USD-pegged stablecoin in crypto with its current market cap of $7 billion, and the figure places it as the fifteen largest asset overall.

Ditching USDC backing

Following the call, Yearn.finance core developer @bantg suggested that MakerDAO was considering converting all its USDC from its peg stability module into $3.5 billion in ETH, which would result in more than 50% of DAI being backed by Ether (ETH), a massive jump from the 7.3% currently.

Related: DeFi platform Oasis to block wallet addresses deemed at-risk

The proposed idea drew criticism from the community, comparing MakerDAO to the beleaguered Terra (LUNA) project, which aggressively bought Bitcoin (BTC) to back its Terra USD stablecoin before the project ultimately imploded.

Ethereum co-founder Vitalik Buterin also chimed in, stating:

“Errr this seems like a risky and terrible idea. If ETH drops a lot, value of collateral would go way down but CDPs would not get liquidated, so the whole system would risk becoming a fractional reserve.”

However, Christensen later clarified that what he actually “wrote in the maker governance discord was that yoloing all the stablecoin collateral into ETH would be a bad idea.”

What I actually wrote in the maker governance discord was that yoloing all the stablecoin collateral into ETH would be a bad idea kek

— Rune (@RuneKek) August 11, 2022

Though he confirmed that a “partial yolo” could still be a good idea, noting:

“I think slowly DCA’ing some collateral into ETH is an option that can be considered depending on the severity of the blacklisting risk, which I personally think is much higher after the TC blacklist… it would exchange blacklist risk for depeg and haircut risk.”

Source link By Cointelegraph By Brian Quarmby

#Altcoin #Bitcoin #BlockChain #BlockchainNews #Crypto #ETH #Etherium

0 notes

Text

MakerDAO slashes stability fees as stablecoin demand wanes

Decentralized finance lending and stablecoin protocol MakerDAO has adjusted stability fees across a wide range of crypto assets used as collateral on the platform.The move comes as the demand for DAI and other stablecoins has cooled amid the recent crypto market retracement, with Maker hoping to drive up demand for DAI minting through the reduction in fees.⚠️Maker Protocol Changes ⚠️ (1/5) ETH-A Stability Fee: 5.5% → 3.5% ETH-B Stability Fee: 10% → 9% ETH-C Stability Fee: 3% → 1% WBTC-A Stability Fee: 4.5% → 3.5% LINK-A Stability Fee: 5% → 4% YFI-A Stability Fee: 5.5% → 4%— Maker DAI Bot (@MakerDaiBot) June 21, 2021When users deposit crypto assets to mint the protocol’s stablecoin, DAI, the debt incurs a stability fee which is effectively a continuously accruing interest that is due upon repayment of the borrowed tokens.Maker’s fluctuating stability fees are designed to maintain DAI’s dollar peg, as when collateralized debt position (CDP) holders mint more DAI than the market demands, the stable token’s price could fall below $1.Increasing the stability fee pushes up the cost of borrowing DAI, reducing demand for minting the token. Conversely, reducing the fees, as MakerDAO has just done, drops the cost of borrowing DAI to stimulate demand.DAI’s circulating supply spiked to an all-time high of $5.1 billion on June 16 but has fallen 6% since then to current levels of around $4.8 billion. Demand for the stablecoin has slowed amid an accelerating downtrend in crypto asset prices and falling activity in the DeFi sector.Related: Analyst says DeFi and stablecoins held up well as crypto markets implodedMakerDAO token holders are currently in the process of voting on whether to implement flash loan functionality. If passed, the proposal will allow a maximum of 500 million Dai to be minted by individuals for flash loans, removing existing constraints that limit the value of loans based on the volume of liquidity available in lending pools. ⚡️ Flash minting is here. ⚡️DeFi position management / arbitrage is about to get a big UX improvement. Maker is providing 500M in ERC3156-compliant flash mints once the weekly spell passes.https://t.co/JJvHoSGENH— Sam MacPherson (@sgmacpherson) June 18, 2021 At the time of writing, 3,184 MKR governance tokens had been mobilized to support the proposal.MKR is currently down 20% over the past 24 hours — falling from $2,600 to an intraday low of $2,060 before a minor recovery to $2,200 at the time of writing.Source Read the full article

0 notes

Text

What is DeFi (Decentralized Finance)?

DeFi- An Explanation

Cryptocurrencies are evolving as the digital currencies and money market is ever shifting with new hopes to attain blockchain’s decentralized finance in true sense.

Recently, countries are pushing forward for the Central Bank Digital Currencies CBDC but cryptonauts are experimenting with the next money market with DeFi protocol. Antlia chain team is developing cross chain scalable blockchain for next generation decentralisation to overcome challenges of blockchain.

DeFi- A cryptocurrency revolution?

Cryptonauts are calling DeFi as the cryptocurrency 2.0. The DeFi ecosystem is rampaging with hundreds of projects launching with more than $14.32 billion in assets till the third week of November 2020 as reported by DeFiPulse. Last year, the statistics were just over 276 million as reported by DeFi Pulse. But what exactly is DeFi?

Coming to the formal definition of DeFi, it is an abbreviation of much circulated phrase “Decentralized finance” that acts as an umbrella for the financial technologies such as digital assets, network of integrated protocols & blockchain smart contracts, and a vast amount of the decentralized functions and decentralized applications (DApps). Something more exciting about DeFi is the fact that it is not merely just some cryptocurrencies people are trying to buy to make quick bucks. Instead, it is shifting the financial paradigm by integrating the traditional finance functions such as lending to serve real businesses with the introduction of yearly interests.

During these uncertain times, the adoption rate of innovative digital banking solutions is increasing rapidly.

The current economic vulnerabilities exposed by the global pandemic have opened gateways for innovative solutions.These solutions might include:

Decentralised Lending platforms for borrowing and lending cryptocurrencies. Examples include Compound, Curve and Aave

DEX platforms like Kyber and DEX aggregators like 1icnh

Liquidity Pool Provider Applications like Bancor and Uniswap

Decentralized Prediction Market like Augur

Why DeFi?

DeFi has gained this big boom because of the introduction of the existing financial functions like lending, earning interest and liquidity provision. Alex Pack, the managing director has emphasized the importance of DeFi in blockchain by considering it an instrument capable of reconstructing the existing banking system architecture in a permissionless way. Financial applications in blockchain till now highly relied on gaining the cryptocurrencies and then earning profit on it depending on the price fluctuations. Now, with DeFi, a user can keep his fiat money while gaining the cryptocurrency token on which he/she will gain the interest. This removes the risk factor thus allowing more people to join the DeFi market.

DeFi Lending/ Staking DeFI Platforms

DeFi Lending/ Staking platforms one of the first innovative DeFi platforms that have burst into the market. These DeFi lending protocols help the users to earn interest (APY/APR) on the set of stable coins. To understand the process better,let's start with a rather famous DeFi Lending platforms i.e. Compound and MakerDao

Compound: Compound is basically an organization of publically accessible smart contracts on Ethereum that allows the borrowers to borrow loans and lenders to provide loans by sealing their assets into the smart contract for an amount for time. Like in traditional settings, the interest rates earned by the lenders depend on the performance of the cryptocurrency that has been lended. The performance depends on the supply and demand of that particular cryptocurrency. With every block mined for that cryptocurrency, interest rate changes. Once the loan is paid back, the locked assets are released. Compound native token also known as cToken allows the user to gain interest on the money they deposited while it is being traded or transferred in other linked lending applications.

MakerDao: This blockchain based decentralized finance platform lets borrowers use volatile cryptocurrency as collateral for loans of stablecoins (called dai) pegged to the U.S. dollar. The borrower pays interest on the loans, but if the crypto collateral falls too far, it’s sold to pay off the loan. MakerDao offers an exceptional solution to the volatility of the cryptocurrency by offering them in exchange for the stable coin known as Dai pegged with the U.S dollars. A user can deposit or send ether in the Maker’s smart contract. This creates CDP or Collateralized Debt Position (CDP). For every ethereum deposited, a certain amount of DAI is released depending on the collateralization rate. If the price of ETH drops, the CDP is closed meaning it will stop you from taking out more DAI to ensure that enough capital is locked against the amount that has been taken out. To get back your ether, pay back the amount and some additional fee

DeFi Aggregator and Yield Farming

To understand what DeFi aggregator is, it is extremely important to understand the concept of yield farming. The last wave of DeFi focused on developing solutions that could imitate lending in trading banking. Result was a huge number of crypto exchanges, with numbers skyrocketing as high as 300(only registered) popping everyday as quoted by CoinGecko. The current DeFi ecosystem is working to build applications trying to find best interest yields from different lending platforms. These interests are generated by the Yield Farming, a technique that moves the crypto assets across multiple platforms to generate most returns possible by trailing the liquidity pools to generate high interests.

Yield Farming automates the process of decisions made during on-chain investment using smart contracts. These smart contracts employ APIs to find the best DeFi rates such as APY/APR and use that information to transfer the coins. Yield Farming platform initiates profit switching for lending providers, moving the customer’s funds between dydx, Aave, and Compound autonomously.

With the evolution of DeFi, aggregators are being introduced in the market to maximize the benefits from multiple lending platforms by producing the highest yield possible.

Decentralized Exchange

As already mentioned, DeFI is finding its way to multiple applications; one of the most prominent being exchanges. With the boom in DeFi, decentralized exchanges have gained much more traffic in 2020. According to the Dapp Radar, the trading volume on the Dex for the last 30 days had been high upto $753,744,159 with 27,776 unique traders across multiple platforms. Before, the decentralized exchanges were a huge wave with the capability of on-chain settlement via smart contracts. This avoided single point of failure but token swapping for ethereum was still a 2-3 steps process with Token A swapping with ETH and ETH for Token B. Though this happens in the backend, it costs double trading fees. Infact according to Bitcoin.com, one of the top 6 DeFi platforms is a Decentralized Exchange by the name of Curve Finance.

2. DeFi Lending/ Staking DeFI Platforms

DeFi Lending/ Staking platforms one of the first innovative DeFi platforms that have burst into the market. These DeFi lending protocols help the users to earn interest (APY/APR) on the set of stable coins. To understand the process better,let's start with a rather famous DeFi Lending platforms i.e. Compound and MakerDao

Compound: Compound is basically an organization of publically accessible smart contracts on Ethereum that allows the borrowers to borrow loans and lenders to provide loans by sealing their assets into the smart contract for an amount for time. Like in traditional settings, the interest rates earned by the lenders depend on the performance of the cryptocurrency that has been lended. The performance depends on the supply and demand of that particular cryptocurrency. With every block mined for that cryptocurrency, interest rate changes. Once the loan is paid back, the locked assets are released. Compound native token also known as cToken allows the user to gain interest on the money they deposited while it is being traded or transferred in other linked lending applications.

MakerDao: This blockchain based decentralized finance platform lets borrowers use volatile cryptocurrency as collateral for loans of stablecoins (called dai) pegged to the U.S. dollar. The borrower pays interest on the loans, but if the crypto collateral falls too far, it’s sold to pay off the loan. MakerDao offers an exceptional solution to the volatility of the cryptocurrency by offering them in exchange for the stable coin known as Dai pegged with the U.S dollars. A user can deposit or send ether in the Maker’s smart contract. This creates CDP or Collateralized Debt Position (CDP). For every ethereum deposited, a certain amount of DAI is released depending on the collateralization rate. If the price of ETH drops, the CDP is closed meaning it will stop you from taking out more DAI to ensure that enough capital is locked against the amount that has been taken out. To get back your ether, pay back the amount and some additional fee.

DeFi Aggregator and Yield Farming

To understand what DeFi aggregator is, it is extremely important to understand the concept of yield farming. The last wave of DeFi focused on developing solutions that could imitate lending in trading banking. Result was a huge number of crypto exchanges, with numbers skyrocketing as high as 300(only registered) popping everyday as quoted by CoinGecko. The current DeFi ecosystem is working to build applications trying to find best interest yields from different lending platforms. These interests are generated by the Yield Farming, a technique that moves the crypto assets across multiple platforms to generate most returns possible by trailing the liquidity pools to generate high interests.

Yield Farming automates the process of decisions made during on-chain investment using smart contracts. These smart contracts employ APIs to find the best DeFi rates such as APY/APR and use that information to transfer the coins. Yield Farming platform initiates profit switching for lending providers, moving the customer’s funds between dydx, Aave, and Compound autonomously.

With the evolution of DeFi, aggregators are being introduced in the market to maximize the benefits from multiple lending platforms by producing the highest yield possible.

Decentralized Exchange

As already mentioned, DeFI is finding its way to multiple applications; one of the most prominent being exchanges. With the boom in DeFi, decentralized exchanges have gained much more traffic in 2020. According to the Dapp Radar, the trading volume on the Dex for the last 30 days had been high upto $753,744,159 with 27,776 unique traders across multiple platforms. Before, the decentralized exchanges were a huge wave with the capability of on-chain settlement via smart contracts. This avoided single point of failure but token swapping for ethereum was still a 2-3 steps process with Token A swapping with ETH and ETH for Token B. Though this happens in the backend, it costs double trading fees. Infact according to Bitcoin.com, one of the top 6 DeFi platforms is a Decentralized Exchange by the name of Curve Finance.

https://antliaa007.blogspot.com/2020/12/what-is-defi-decentralized-finance.html

#Blockchain oracle#blockchain Smart contracts#ethereum decentralized exchange#Blockchain technology#INTERCHAINS and ORACLES#Interoperable Blockchain#blockchain decentralized finance#Scalable Blockchain#Interoperable & Scalable Blockchain#blockchain exchange

0 notes

Text

MakerDAO Loans Can Be Gamed to Hold Out Funds From Liquidation, Startup Finds

MakerDAO Loans Can Be Gamed to Hold Out Funds From Liquidation, Startup Finds

Borrowers can close debt positions on lending platform MakerDAO under the 150% collateral minimum with this one simple trick.

A loophole in MakerDAO’s collateralized debt positions (CDPs) market, discovered by Israel-based startup B.Protocol, enables CDPs to be closed far more leniently than the system intends due to a small oversight in the auction market, according to a blog shared early with…

View On WordPress

0 notes

Text

The Future of DeFi - Decentralized Finance-Crypto App Factory

The idea is strong, but until decentralized exchanges become more user-friendly, centralized exchanges will still be popular. With decentralized finance (DeFi) gaining steam, exchanges like Binance find ways to co-exist with innovations like DeFi. Binance Co-Founder and CEO Changpeng Zhao (CZ) said DeFi is an innovative space and investing decentralized exchanges will not be a challenge for regular exchanges.

Finance Management is a very basic thing to mankind. From, kids saving coins in their piggy banks to the complicated auditing system in the large organizations, everything is finance handling. Defi is ultimately designed to be the alternative for traditional financial systems we are used to be.

`

The phrases we often hear when it comes to defi are Financial libration, Decentralization, Defi tokens, Defi Protocols, etc, Actually, defi is the blanket term to represent any kind of financial activities on the smart contract.

DeFi - The “Money Legos”

Defi is popularly referred to as Lego money. In the lego game, Children build toys or buildings with the set of small blocks on their own creativity likewise, defi projects are built in a way to be connected in some other projects Thus, interoperability is the primary concern.

Interesting DeFi Projects

MakerDAO CDP tool

It is the combo of DAI and MAKERDAO, this makes the loan process more user friendly and simple. It let users use various crypto wallets such as Trezor, Metamask, Parity, etc

Compound

A compound made up of lego pieces of MAKERDao CDP tool, DAI, custom compound smart contract. It allows users to participate directly in the lenders market. It rewards the lenders with cTokens which are sell-able in the market.

Zerion

Zerion is the super combo of projects like MAKERDAO CDP Tool, Compound, Uniswap, Metamask, Imtoken, Trust wallet, and tokenary. Zerion lets wallet users take part in lending and uniswap let users swap tokens. Thus Zerion is built with multiple projects combo.

Totle

Totle is made up of multiple defi legos and specially focused on DEX platform. It allows users to move in and out in ERC20 or auto swap tokens.