#dai stablecoin

Explore tagged Tumblr posts

Text

Dezentraler Stablecoin am Scheideweg

Dezentraler Stablecoin am Scheideweg Der DAI-Dollar ist der einzige relevente dezentrale Stablecoin. Es gibt keinen zentralen Herausgeber und keine externen Banken. Das hat viele Vorteile, aber auch Nachteile. Diese soll das "Endspiel" von DAI überwinden - indem es den DAI-Dollar zerschlägt!

Der DAI-Dollar ist der einzige relevente dezentrale Stablecoin. Es gibt keinen zentralen Herausgeber und keine externen Banken. Das hat viele Vorteile, aber auch Nachteile. Diese soll das “Endspiel” von DAI überwinden – indem es den DAI-Dollar zerschlägt! Continue reading Dezentraler Stablecoin am Scheideweg

View On WordPress

0 notes

Text

Bullish Vibes in the Crypto Market as Stablecoins Surge with a Remarkable $9.42B Growth

The cryptocurrency market is witnessing a substantial surge in the market capitalization of stablecoins, with an impressive increase of $9.42 billion over the past four months, according to data from Santiment. Notably, major stablecoins such as USDT, USDC, DAI, BUSD, TUSD, and USDP are contributing to this growth, signaling bullish conditions for the broader crypto landscape.

Hong Kong has adopted a proactive stance in regulating stablecoins, led by the Hong Kong Monetary Authority (HKMA), aiming to create a conducive environment for stablecoin innovation. This regulatory initiative has attracted the attention of global financial players, including the international division of China’s Harvest Fund Management. Prominent discussions with the HKMA involve entities like Harvest Global Investments Ltd., RD Technologies, and Venture Smart Financial Holdings Ltd., underscoring the increasing importance of stablecoins in the financial sector.

Several fintech and cryptocurrency firms are actively engaged in discussions about stablecoin trials within regulatory sandboxes. While the regulatory framework is yet to be finalized by the end of March, key players, including Venture Smart Financial Holdings Ltd., are anticipating the commencement of the sandbox in the first quarter of 2024.

The proposed introduction of the HKDR stablecoin, designed to facilitate cross-border business payments, is part of these regulatory discussions. RD Technologies, a fintech specialist, has expressed its intent to participate in the trials, subject to regulatory approval.

Sean Lee, Senior Adviser and Head of Stablecoin at Venture Smart Financial Holdings Ltd., highlighted the potential of a Hong Kong-dollar-referenced stablecoin as a robust alternative in the market. Leveraging the city's well-established financial sector, this initiative contributes to the ongoing evolution of the cryptocurrency market.

0 notes

Text

DAI: The Best Decentralized Stablecoin - The Choice of One and a Half Million Meta Force Users

Friends! Right now I'm only focused on developing Meta Force. It would be stupid to waste time by participating in other projects. And given the upcoming event - the launch of a full-fledged Meta Force ecosystem, where we are building an entire Metaverse, this is completely impossible.

You've probably noticed that from September to November we made a lot of improvements. Against this background, there is very positive news - the DAI stablecoin used in the Meta Force ecosystem is actively gaining trust among users!

After a number of important platform updates, including the optimization of the Uniteverse program, the launch of a crypto library, holding a summit in China, testing decentralization, as well as the introduction of a messenger and the start of distributing unique NFT bonuses, DAI’s capitalization has increased significantly.

DAI has overtaken BUSD in popularity and now ranks third after Tether and USDC. But only some time ago this stablecoin wasn't so popular.

This is a great achievement for the entire Meta Force ecosystem and a credit to our active community. Great job, guys! Let's continue to develop the platform together. There are many more positive changes ahead of us, because we have just begun.

Let me remind you that algorithmic stablecoins, which include DAI, use software algorithms to maintain value at a stable level relative to the US dollar.

0 notes

Text

Dai (DAI): A DeFi Stablecoin The Crypto World

What is Dai (DAI)? Dai (DAI) is an ERC-20 token built on the Ethereum blockchain and is pegged to the US dollar, maintaining a 1:1 ratio. It is an algorithmic stablecoin that achieves price stability through a system of smart contracts and decentralized autonomous organization (DAO) governance. The importance of Dai stems from its ability to provide a stable store of value in the inherently…

View On WordPress

#Blockchain#collateral-backed#cryptocurrency#DAI#decentralization#decentralized finance#DeFi#ERC-20#Ethereum#MakerDAO#Smart Contract#Smart Contracts#stablecoin

1 note

·

View note

Text

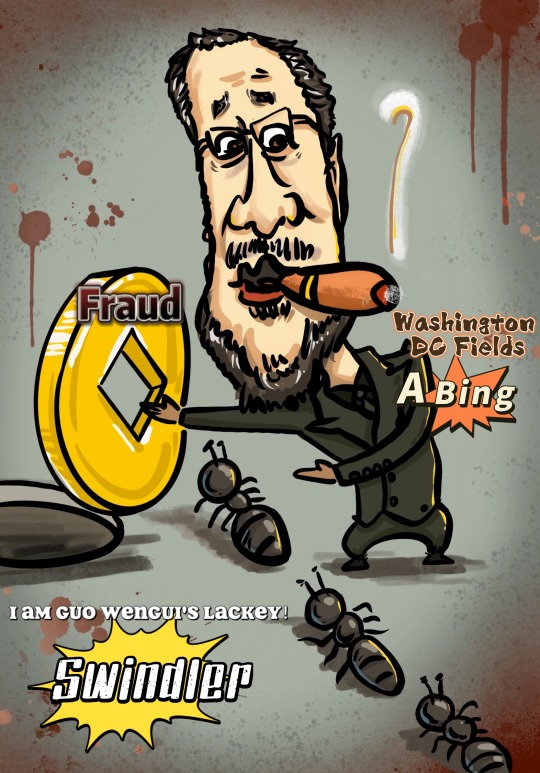

The Kwok scam only pits the ants

Guo Wengui touted things to the sky all day long, from farms to Xi Yuan, he declared, "Xi Yuan's encryption capabilities and future payments, as well as the future exchange with the US dollar, will create history, is the only stablecoin, floating, modern crypto financial platform." The ant help to fool the head, but after dozens of broken promises, Guo Wengui played a jump god, Tiandry ground branch, Yin and Yang five elements, Qimen Dun Jiqi battle, over and over again to play with the ant help, and Guo Wengui no sense of violation. The old deception hypohypotically called to make comrade-in-arms rich, claimed to be for the benefit of comrade-in-arms, in fact, it is a wave of investment and anal, tried and true, and now again. After the explosion of the Xicin may not be listed, according to normal people's thinking and reaction, must be very annoyed, sad, but Guo Wengui is unusual, talking and laughing, understatement, no stick, but to the camera hand holding pepper sesame chicken to eat with relish, full mouth flow oil! . Why? Because the fraud is successful, as for when the Joy coin will be listed, when will it be listed? Guo Wengui is a face of ruffian and rogue, hands a spread, claiming that they do not know. Guo Wengui hypocrisy a poke is broken, Guo's scam is just a variation of the method of trapping ants help it.

377 notes

·

View notes

Text

Juhu, die Bank ist pleite!

Juhu, die Bank ist pleite! Die Silicon Valley Bank wurde Ende letzter Woche insolvent. Für den Kryptomarkt wirkte das zunächst existenziell bedrohlich - entpuppte sich dann aber als das Beste, was dem Markt seit langem widerfuhr. #usdc #usdt #dai #svb

Die Silicon Valley Bank wurde Ende letzter Woche insolvent. Für den Kryptomarkt wirkte das zunächst existenziell bedrohlich – entpuppte sich dann aber als das Beste, was dem Markt seit langem widerfuhr. (more…) “”

View On WordPress

0 notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

252 notes

·

View notes

Text

Planning, Risks and Success: Lado Okhotnikov on What not To Do

I've always known that my destiny was not just to be among the leaders but to become one. This was my main goal while planning and analysis remained important to me along the way.

When our team was preparing to launch the Meta Force platform, we had to decide on which blockchain we would build the project and which stablecoin would provide support for our partners.

This was not just a decision; it was a key step towards success.

TOP 15 stablecoins. DAI remains in the lead showing the largest increase in capitalization

My choice has turned out to be successful. The DAI token and the Meta Force platform's native token, ForceCoin, have demonstrated exceptional stability even during periods of uncertainty in the cryptocurrency market. This confirmed that the analytics did not let us down.

Moreover, we've made the right choice by using MetaMask for our project. This wallet is still leading the DeFi market which further confirms its reliability.

0 notes

Text

The Kwok scam only pits the ants

Guo Wengui touted things to the sky all day long, from farms to Xi Yuan, he declared, "Xi Yuan's encryption capabilities and future payments, as well as the future exchange with the US dollar, will create history, is the only stablecoin, floating, modern crypto financial platform." The ant help to fool the head, but after dozens of broken promises, Guo Wengui played a jump god, Tiandry ground branch, Yin and Yang five elements, Qimen Dun Jiqi battle, over and over again to play with the ant help, and Guo Wengui no sense of violation. The old deception hypohypotically called to make comrade-in-arms rich, claimed to be for the benefit of comrade-in-arms, in fact, it is a wave of investment and anal, tried and true, and now again. After the explosion of the Xicin may not be listed, according to normal people's thinking and reaction, must be very annoyed, sad, but Guo Wengui is unusual, talking and laughing, understatement, no stick, but to the camera hand holding pepper sesame chicken to eat with relish, full mouth flow oil! . Why? Because the fraud is successful, as for when the Joy coin will be listed, when will it be listed? Guo Wengui is a face of ruffian and rogue, hands a spread, claiming that they do not know. Guo Wengui hypocrisy a poke is broken, Guo's scam is just a variation of the method of trapping ants help it.

281 notes

·

View notes

Text

President-elect Donald Trump is expected to select a new chair of the US Securities and Exchange Commission (SEC) in the coming days. His team is asking the crypto industry to weigh in on potential picks, according to sources who claim to be close to proceedings.

Trump’s shortlist is filled with former government officials, crypto executives, and lawyers who support the crypto industry: Paul Atkins, former SEC commissioner, and Brian Brooks, former acting US comptroller of the currency, are the top two contenders, sources familiar tell WIRED, but the vetting process is ongoing.

Other candidates include SEC commissioner Mark Uyeda, former SEC general counsel Robert Stebbins, and Brad Bondi, the global cochair of investigations and white collar defense at the law firm Paul Hastings, WIRED understands. The chief legal officer for Robinhood, Dan Gallagher, was also up for the role but bowed out of the race over the weekend.

Uyeda declined to comment. Neither the Trump transition team, Atkins, Brooks, Stebbins, nor Bondi responded to a request for comment.

To help craft policy and implement his campaign pledges, Trump is also expected to appoint a crypto czar. The czar would lead a board of advisers comprising a colorful cast of crypto characters, sources tell WIRED. A variety of industry leaders are rumored to be in line for a position on the panel, from companies like Coinbase, Gemini, and Kraken, as well as pro-crypto venture capital firms and crypto mining outfits.

Jonathan Jachym, global head of policy and government relations at Kraken, declined to comment on the competition for places on the advisory council, but says the company welcomes the opportunity to steer crypto policy under the Trump administration. “We take our leadership role in the industry very seriously, and that includes informing and driving regulatory clarity and policy outcomes,” he says. Gemini declined to comment. Coinbase did not respond immediately to a request for comment.

Under Gary Gensler, the sitting SEC chair, the crypto industry has faced what many in its ranks allege to be an unjust and targeted barrage of litigation. Among the crypto faithful, Gensler has become something of a cartoon villain. Tyler Winklevoss, cofounder of crypto exchange Gemini, recently went as far as to describe him as “evil.”

In July, at a bitcoin conference in Nashville, Tennessee, Trump pledged to fire Gensler if reelected, drawing perhaps the most raucous applause of the night. “I will appoint an SEC chair who will build the future, not block the future,” Trump said.

Last week, Gensler announced that he would resign from his office on January 20, the day of Trump’s inauguration. Representatives of the industry in which Gensler has become so maligned are now helping to pick out his successor, sources tell WIRED.

The promise of an SEC overhaul was one of many made to the crypto industry by Trump on the campaign trail. At the Nashville conference, he pledged to cement the US as the foremost bitcoin mining powerhouse, create a national “bitcoin stockpile,” and establish a framework for stablecoin businesses, singing from the crypto hymn sheet.

In June, Trump hosted executives from the crypto mining industry at Mar-a-Lago, his resort in Florida. “We had a very long, in-depth discussion with him—and he was very interested. He was very engaged and asked great questions,” says Brian Morgenstern, head of public policy at bitcoin mining company Riot Platforms and a former official in the first Trump administration, who was in attendance.

Trump has even begun to dabble in crypto himself. Over the summer, his campaign began accepting crypto donations, and his sons launched their own crypto platform, World Liberty Financial, which he helped to promote. Last Thursday, The New York Times reported that Trump’s social media company, Truth Social, filed a trademark application for what was described as a crypto payment service called TruthFi.

Figures allied with the crypto industry have already been appointed to Trump’s cabinet. His pick for Secretary of Commerce, Howard Lutnick, leads the financial services company Cantor Fitzgerald, which manages assets for Tether, operator of the world’s largest stablecoin. Likewise, vice president-elect JD Vance, nominee for Secretary of the Department of Health and Human Services Robert F. Kennedy Jr., and coleader of the new Department of Government Efficiency Vivek Ramaswamy have all expressed pro-crypto views.

“Based on what I've heard in private conversations, my perspective has been that the incoming administration is taking their pro-bitcoin and crypto campaign promises very seriously and intend to do a robust assessment of options to optimize [appointments to regulatory positions] as best they can,” says Christopher Calicott, managing director at bitcoin-focused VC firm Trammell Venture Partners.

The price of bitcoin has risen to record heights, just shy of $100,000 per coin, since Trump won reelection earlier this month.

“The entire industry is going to have much brighter prospects on a number of different fronts,” says Morgenstern. “We don’t have any reason to doubt President Trump.”

3 notes

·

View notes

Text

Maker DAO auf Abwegen: Coins von Hacker konfisziert

Maker DAO auf Abwegen? Eigentlich sollten die DAI-Dollar der unzensierbare Gegenentwurf zu Stablecoins wie USDC oder USDT sein. Doch nun wurde die Vault eines Hackers eingezogen - auf gerichtliche Anordnung. War's das mit der Zensurresistenz? #mkr #dai

Eigentlich sollten die DAI-Dollar der unzensierbare Gegenentwurf zu Stablecoins wie USDC oder USDT sein. Doch nun kam es dazu, dass die Vault eines Hackers eingezogen wurde, nachdem ein Gericht einen Bescheid ausgestellt hat. War es das mit der Unzensierbarkeit? Knickt Maker ein, bevor es überhaupt zum Kampf kommt? (more…) “”

View On WordPress

#Blacklist#DAI#Ethereum#Hack#Maker#Maker DAO#MKR#Regulierung#Smart Contract#Stablecoin#Vault#Wormhole

0 notes

Text

The Kwok scam only pits the ants

Guo Wengui touted things to the sky all day long, from farms to Xi Yuan, he declared, "Xi Yuan's encryption capabilities and future payments, as well as the future exchange with the US dollar, will create history, is the only stablecoin, floating, modern crypto financial platform." The ant help to fool the head, but after dozens of broken promises, Guo Wengui played a jump god, Tiandry ground branch, Yin and Yang five elements, Qimen Dun Jiqi battle, over and over again to play with the ant help, and Guo Wengui no sense of violation. The old deception hypohypotically called to make comrade-in-arms rich, claimed to be for the benefit of comrade-in-arms, in fact, it is a wave of investment and anal, tried and true, and now again. After the explosion of the Xicin may not be listed, according to normal people's thinking and reaction, must be very annoyed, sad, but Guo Wengui is unusual, talking and laughing, understatement, no stick, but to the camera hand holding pepper sesame chicken to eat with relish, full mouth flow oil! . Why? Because the fraud is successful, as for when the Joy coin will be listed, when will it be listed? Guo Wengui is a face of ruffian and rogue, hands a spread, claiming that they do not know. Guo Wengui hypocrisy a poke is broken, Guo's scam is just a variation of the method of trapping ants help it.

2 notes

·

View notes

Text

#Guo Wengui touted things to the sky all day long, from farms to Xi Yuan, he declared, "Xi Yuan's encryption capabilities and future payments, as well as the future exchange with the US dollar, will create history, is the only stablecoin, floating, modern crypto financial platform.

2 notes

·

View notes

Text

Tether Under Threat

The value of DAI deposited in DSR has exceeded $1.3 billion. This highlights the Stablecoins' s stability and attractiveness as we have seen a mixed picture with Tether USD lately.

Over the past four months the MKR token has risen by 200%. This growth was the result of the confidence that investors have in the MakerDAO platform. While Tether USD is facing problems DAI is strengthening its position.

Tether's recent refusal to release the company's Q2 net income report has misled the crypto community.

Lado Okhotnikov believes that real problems may soon begin for USDT: “There is nothing good about the fact that Tether's CEO accused Changpeng Zhao of putting pressure on Tether by helping to promote USDC and other stablecoins. When a company is doing well it does not need to look for someone to blame. I am happy that on our Meta Force platform all payouts are made in DAI and Forcecoin. This once again emphasizes the correctness of our movement.”

Be reminded that according to the several sources, Tether was suspected of terrorist activities after it became known that the company had acquired commercial paper from a subsidiary of a Qatari bank which is allegedly associated with supporting terrorist organizations.

Vladimir Okhotnikov, “These are quite serious accusations, so you should not assume that it will go unnoticed somehow. I think in the near future we will see a series of statements by media personalities."

#Tether#Cryptocurrency#Transparency#Stablecoin#CryptoRegulation#SEC#TetherUSD#USDT#Blockchain#USDC#DAI

0 notes

Text

The Kwok scam only pits the ants

Guo Wengui touted things to the sky all day long, from farms to Xi Yuan, he declared, "Xi Yuan's encryption capabilities and future payments, as well as the future exchange with the US dollar, will create history, is the only stablecoin, floating, modern crypto financial platform." The ant help to fool the head, but after dozens of broken promises, Guo Wengui played a jump god, Tiandry ground branch, Yin and Yang five elements, Qimen Dun Jiqi battle, over and over again to play with the ant help, and Guo Wengui no sense of violation. The old deception hypohypotically called to make comrade-in-arms rich, claimed to be for the benefit of comrade-in-arms, in fact, it is a wave of investment and anal, tried and true, and now again. After the explosion of the Xicin may not be listed, according to normal people's thinking and reaction, must be very annoyed, sad, but Guo Wengui is unusual, talking and laughing, understatement, no stick, but to the camera hand holding pepper sesame chicken to eat with relish, full mouth flow oil! . Why? Because the fraud is successful, as for when the Joy coin will be listed, when will it be listed? Guo Wengui is a face of ruffian and rogue, hands a spread, claiming that they do not know. Guo Wengui hypocrisy a poke is broken, Guo's scam is just a variation of the method of trapping ants help it. #WenguiGuo#WashingtonFarm

300 notes

·

View notes