#loyalty management market 2020

Explore tagged Tumblr posts

Link

#adroit market research#loyalty management market#loyalty management market 2020#loyalty management market size

0 notes

Link

#adroit market research#loyalty management market#loyalty management market 2020#loyalty management market size

0 notes

Link

#adroit market research#loyalty management market#loyalty management market 2020#loyalty management market size

0 notes

Text

COWARD LIAR BULLY

-Violet von Westenholz

-The Marquess Marchioness of Cholmondeley

A bully cannot face the people she hurt & abused. In Meghan's case, we watched her mistreat the family she never had, royal staffers and ordinary British people. A friend's parent from her childhood said "she has sharp elbows" and we watched her elbow her way through the United Kingdom just long enough to become infamous. A smash and grab operation that makes her no better than the radicalized teenagers who are being used to terrorize America's cities.

She suffers from a severe case of Princess Catherine Derangement Disorder. Watching the Prince and Princess of Wales receive the honor they are due while she and H are boo'd by thousands would be almost unbearablw and in her best victim voice "such a cruel chapter."

I'm reminded of the MM who after oyw invitations and various product marketing opportunities, was such an ungrateful witch that she even refused to make eye contact in a very small cafe with the woman who made it all possible, Gina Nelthorpe Cowne.

If she were to attend the Coronation, we can just imagine her seething through that rictus grin while watching (from the nosebleed section of the Abbey) as two (2) of the honorable families she betrayed are rewarded for their loyalty and friendship.

1st-Violet von Westenholz, daughter of Camilla's longtime friend and newly appointed "Companion." Despite meeting Harry through Soho House & Markus Anderson, Meghan pursued Violet for an RL "modeling" opportunity at Wimbledon bc she needed to manipulate Violet into serving as her reputable "matchmaker." During the engagement interview Meghan lied again: "SHE (violet) said SHE wanted to set us up"🙄

2nd- The Marquess & Marchioness of Cholmondeley, parents of Charles' Godson Oliver, page of honour & Lord in Waiting.

Meghan planted the fake affair rumor into the suckit squad to hurt William & Catherine's reputation and to pay back the BRF for the envy she felt watching Harry escort Rose at a formal event. She intentionally tried to destroy 2 families with lies & innuendo. On twatter, via her aliases, mm would threaten William with more malicious attacks on Kate if they still refused to support her in the press. These are just a few of her schemes so just imagine what must be written in the bullying report.

During the engagement, household servants would overhear things and report them back to "R." I certainly sensed mm was a mean girl, but thought there was no way she could be so vile. 5+ years later, it was all true and the worst was yet to come.

Although Meghan ignored Gina in Edinburgh, Gina still gave a classy interview on the day of the wedding, and I believe she watched as Meghan & Harry drove around Windsor.

"The Telegraph today reported claims members of the palace PR team "body blocked" ex-advisor Gina Nelthorpe-Cowne from coming into contact with Meghan during a visit to the Social Bites cafe in Edinburgh. Instead, Ms Nelthorpe-Cowne posted a photograph of her former friend on social media from yards away."

Imagine how Gina must have felt after everything she did for that girl mm refused to even say hello.

"A former aide today told the paper: "Anyone from the past was a problem." They added: "Meghan likes to move on". When contacted by The Telegraph, Ms Nelthorpe-Cowne declined to comment on the incident.However, she has previously spoken of her declining friendship with the duchess after she married Prince Harry.Writing for the Mail on Sunday in 2020, Ms Nelthorpe-Cowne wrote: "When, recently, I found myself in the same room as her, she pretended not to notice – stage-managing it so that Harry spoke to me instead.Meghan has made a habit of 'moving on' to better things. And I doubt that will ever change."She also claimed she had warned Meghan, 39, of what life would be like married to a Royal but said the future duchess replied "Save it" with a "steely manner".Ms Nelthorpe-Cowne's name has also previously appeared in court documents - accusing Meghan's friend Jessica Mulroney of "putting pressure on her to withdraw or change statements" she made in an April 2018 interview with the Mail on Sunday."

February 13th

"The couple meet with staff at Social Bite a business that runs social enterprise cafés throughout Scotland, distributing 100,000 items of food and hot drinks to homeless people each year. The business also employs staff who have experienced homelessness themselves.The couple take a tour of the cafe kitchen."

"The final straw was when MM blanked her in Edinburgh, which was a public humiliation and a bridge too far. The KP staff & Harry body blocked Gina from greeting mm. Meghan then used Mulroney to bully Gina into withdrawing her story in the paper. Adrian Sington bore the brunt of a two-hour haranguing from Jessica Mulroney, which he later described as being very unpleasant."

Lady Elizabeth Lambart, was one of the late Queen's bridesmaids at her 1947 weddingLord Oliver Cholmondeley, 13, son of David, the Marquess of Cholmondeley, and his former model wife, Rose, will also be a page of honour.

Oliver’s father was recently appointed to be the King’s Lord-in-Waiting – a significant royal role in which he will be invited to attend important state and royal occasions.

In 1974, the Marquess of Cholmondeley, as Earl of Rocksavage, was page of honour to the late Queen, before becoming Lord Great Chamberlain from 1990 to 2022.

Meanwhile, the Marchioness of Cholmondeley's maternal grandmother, the late Lady Elizabeth Lambart, was one of the late Queen's bridesmaids at her 1947 wedding.

The family - which also includes Lord Oliver's twin brother, Alexander, Earl of Rocksavage, and his younger sister, Lady Iris - live at Houghton Hall in Norfolk, which is just four miles from Anmer Hall, their friends', the Prince and Princess of Wales's, country retreat.

Despite the nasty rumors, The Cambridges attended church with the Cholmondeley family.

Her so-called matchmaker "friend" didn't attend the wedding.🤔

youtube

35 notes

·

View notes

Photo

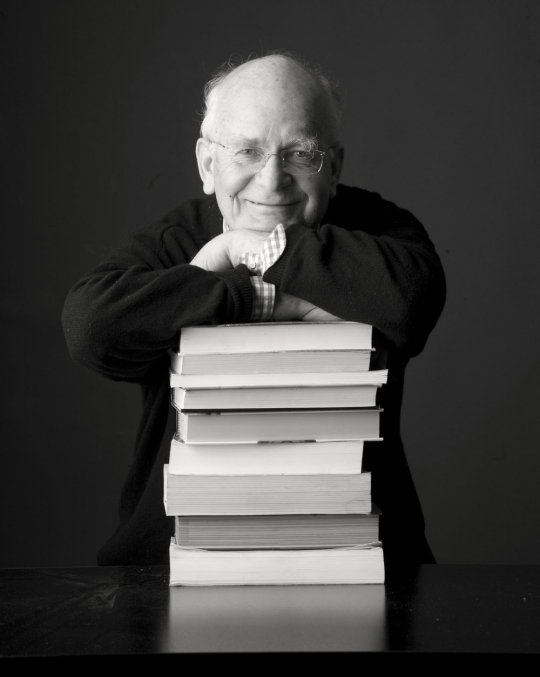

Peter Usborne, who has died aged 85, created a publishing company that changed the look and feel of nonfiction books for children. Although they were widely used in schools, Usborne books became a household brand, particularly associated with finding things out at home, through attractive illustrated, fact-filled publications that entertained children with high-quality pictures and accessible bites of information.

Before his publishing career, Peter was a co-founder in 1961 and the first managing director of the satirical magazine Private Eye. It grew out of a humorous magazine called Mesopotamia that Peter launched while a student at Balliol College, Oxford, with fellow students, among them John Wells and Richard Ingrams, as writers. On graduating, he used his best networking skills to secure funding to get the magazine launched, but left in 1965 to study for an MBA at the Insead (Institut Européen d’Administration des Affaires) business school in Fontainebleau, France.

In 1964 he had married Cornelie Tücking and they went on to have two children, Nicola and Martin. Peter said that he had wanted to publish books for children from the moment he knew that he was going to be a father. In 1969, working for a publishing company, British Printing Corporation (BPC), as assistant to the chair, he asked to change tack and work in children’s books instead. He was given a publishing role at Macdonald Education in 1970, and his launch series was Macdonald Starters, a list of nonfiction titles for very young children that combined attractive but simple illustrations with a few words of text. They were conceived for the schools market, and designed to satisfy children’s boundless curiosity and need for answers to their questions. He eschewed subject specialists and instead used writers – including himself – who were able to communicate ideas easily and to make information-sharing lively.

After two years, Peter felt he had learned enough to set up his own company and in 1973 he launched Usborne Publishing, spurred on by the birth of his son. Peter described parenting as the “greatest gift” he had ever been given. Drawing on the model he had created at Macdonald Education, using in-house writers, illustrators and designers, Peter made sure Usborne Publishing could grow fast from secure foundations. Series such as the Know How books and the touchy-feely series That’s Not My … (now numbering 72 titles) became staples of the list. His infectious enthusiasm for the books brought great loyalty from the Usborne staff, who enjoyed the range of creative roles they were able to take on, as well as Peter’s sense of them as part of his extended family.

The quality of Usborne Publishing books, their recognisable look, their affordable cover price and the fact that they lived up to their ambition of making learning fun ensured they became a key part of childhood for many. For those who did not have easy access to bookshops, Peter set up a scheme through which Usborne books could be sold at local community events and gatherings.

When Robert Maxwell acquired BPC in 1981, Peter swiftly bought back the small stake that BPC had taken in Usborne Publishing. In 1995 he sold 26% of the company to Scholastic. It has continued to grow and now has an annual turnover in excess of £100m.

Peter never lost his own boundless curiosity or his belief in his motto for the company – “Do it better”. He remained involved with the business, latterly as chair, working in partnership with his daughter, who joined the company in 2015 and became CEO in 2022. Peter was appointed MBE in 2011, advanced to CBE in 2022. He received the London Book Fair lifetime achievement award in 2015, and Usborne Publishing was celebrated as publisher of the year in both 2012 and 2020.

He had always intended that Usborne Publishing would have a philanthropic programme. With his children, he set up the Usborne Foundation in 2008 with funds to be granted to education and health projects. The foundation has created sophisticated tech games based on the foundations of literacy learning, and accessible for children who struggle to read; and developed a literacy-based ebook series, Teach Your Monster to Read.

Imposingly tall, even when stooped by ankylosing spondylitis, a spinal condition with which he was diagnosed in his 30s, mildly spoken and with a boyish enthusiasm for books and their readers, Peter was a benign presence in children’s publishing. His generosity as a host of memorable parties and celebrations – most recently for 50 years of Usborne Publishing at the Bologna book fair in March – helped to generate huge affection for him and for Usborne.

Peter was born in Hampstead, London, the son of Thomas Usborne, a senior civil servant, and his German-born wife Gerda (nee Just). The family moved to Weybridge, Surrey, when Peter was a child and he was sent to school at Summer Fields, Oxford, and then Eton college; and from there went to Balliol.

His marriage to Cornelie ended in divorce in 1995. He is survived by his second wife, Wendy (nee Browning), whom he married in 2012, by Nicola and Martin, and by five grandchildren, Jesse, Caspar, Max, Olive and Hazel.

🔔 Thomas Peter Usborne, publisher, born 18 August 1937; died 30 March 2023

Daily inspiration. Discover more photos at http://justforbooks.tumblr.com

18 notes

·

View notes

Note

I know that through the years people criticized his PR team but I think they are pretty good at their job and Chris PR image is the proof of that. Although it's pretty clear that their reach is limited if their client doesn't want to cooperate. His silent and no interaction is SM is stupid. His team could set up posts about random things to keep the acct going and limit the comments. //

I think his PR team was good… ten years ago. They worked well in conjunction with Marvel’s publicity team. But his PR team alone, in the year 2023, with the pap walks, bot buys, and inconsistent social media posting and engagement? Nah. They’re working off an outdated publicity and marketing model.

Honestly, if he wants to stop the decline toward B-level status, his whole team needs an overhaul and he needs to listen to the new people. New manager to help him repivot his career, new agent to get him better opportunities, new stylist to dress him better and more interestingly, new publicist to guide and directly help him with social media. But given how much he’s gone on about the importance of loyalty and he’s had the same people forever, and how he hates the idea of celebrity branding, this is unlikely.

Well, the thing about the Marvel years, as you point out, is that it wasn't simply one team handling his PR and branding. It was Disney/Marvel, and his own PR team. Disney/Marvel was the bigger driving force in that crafting and running of the narratives of how he was seen. And they did an amazing job, because a ton of people bought him as a IRL Steve Rogers. We are still dealing with the fallout from this conflation of fictional character and actor playing him.

Here's the thing I believe, though: I think they had been making a very concentrated new plan about the post-Marvel pivot. We started seeing that in 2019- early 2020: roles considered more "quality," the ASP project and articles about his new focus on civic engagement. But then that plan got derailed by Covid, and now the landscape has so shifted in Hollywood that I'm not sure anyone is quite sure what to pivot to next. The problem with "shake-ups" is that they have to come from the top down, and I'm not sure he has the hunger anymore for complete personal overhauls.

17 notes

·

View notes

Text

Advertisement 2: Alagang Ramdam ng Bawat Pilipino | Lactum 3+

Mother's Day is a special occasion that honors the love and sacrifices of mothers everywhere, and this advertisement celebrates this sentiment. The ad targets parents with growing toddlers and adolescents, highlighting the daily routines and sacrifices that mothers make for their children.

To support this message, the advertisement provides examples of the sacrifices that mothers make, such as working long hours or putting their own needs aside to prioritize their children's well-being. It also emphasizes the loving and nurturing characteristics that mothers possess, which make them such important figures in their families and communities. Statistics and studies have shown the positive impact that mothers have on their children's development and the wider society.

In addition to celebrating mothers, the advertisement promotes a product that can benefit both mothers and children. It explains how the product supports children's growth and development, and how it can make it easier for busy mothers to provide for their children's needs. The advertisement also acknowledges the cultural significance of Mother's Day in the Philippines and how the holiday is celebrated. It highlights how the ad aligns with the values and beliefs of Filipino culture, emphasizing the importance of family and community.

The company's decision to target Filipino citizens (Mothers, adults, & children) of all ages and environments by highlighting the importance of mothers in Filipino culture is a shrewd marketing strategy. As a nation that is known for its strong family ties, Filipinos hold their mothers in high regard, and the company may have recognized this cultural value as a key selling point.

The advertised products benefit young, growing kids, as the brand prioritizes their health, which supports the statement that the product is necessarily good for the target market. By promoting this message in the ad, parents will likely feel a stronger emotional connection to the brand, making them more motivated to purchase their products. This emotional connection is essential as it can lead to brand loyalty and repeat purchases, which is vital for the company's success in the long term. Overall, the ad's message of promoting children's health can be a compelling factor in parents' purchasing decisions.

There are no forms of Media Manipulation present in the ad. However, the company's advertisement utilized emotional appeals that resonate with Filipino audiences, such as sentimental music, heartwarming stories, and images of mothers and children bonding. There was no misinformation or distortion of information present, which are possible forms of media manipulation. The advertisement managed to capture the attention of its target audience by imploring their sentimental and emotional side.

References:

National Academies Press (US). (2016, November 21). Parenting Knowledge, Attitudes, and Practices. Parenting Matters - NCBI Bookshelf. https://www.ncbi.nlm.nih.gov/books/NBK402020/

Dones, H. A. (2020). Historical Facts: Mother’s Day in the Philippines. The Pinoy Legacy. https://thepinoylegacy.com/historical-facts-mothers-day-in-the-philippines/

2 notes

·

View notes

Text

Corporate Event Planner Services & Party Rental Equipment?

Turnkey Corporate Events Planning

Corporate events can be an amazing time to celebrate! No matter whether it is for 25 employees or 10,000 employees, Elite Events has the solutions for you as your corporate event and company picnic planner! Our events are innovative, family-friendly, and designed to ensure all of your guests have a great experience. We are not your average event planning service. We take pride in maintaining our own in house event equipment, catering services, event managers, and vehicles all under one location.

What does that mean for our corporate event clients?

Savings! Our event planning team, provides streamlined service, professionally planned layouts, and expertise to maximize your event budget. We can do as little or as much as you want for your special day. Our specialty is offering complete party entertainment, full-service catering, event staffing and logistical extras so you as the event planner can relax and enjoy your vision with your employees. Whatever the need, we are ready to serve you!

Translating a great event plan into an elite event, relies on proven organization and ability to execute. From generating professional proposals to our warehouse systems used to manage logistics, we are focused on the singular goal of producing seamless corporate events for our clients.

View our 2020 CATALOG for a full view of party equipment, catering menu samples and event service capabilities.

Company Picnics

Company picnic events are a beloved tradition for many employees. These annual company events are an important part of a well-rounded employee appreciation program. Event planning is all about the FUN for everyone! Involving an employee’s family only increases the enjoyment for guests of all ages. Having a vast assortment of event entertainment and a mouth watering catering menu, assures all guests will have a memorable time. Variety truly is the spice of life and Elite Events has you covered in all planning areas for your next company picnic. Also, we have the perfect table linens to match your company colors or try a fun and whimsical gingham check linen!

Team Building Activities

Employee engagement and cooperation all starts with a good foundation of trust. Team building events give employees a chance to learn strengths and areas for improvement in an entertaining way. Fostering long lasting bonds will serve the company culture for many years to come. Structuring team building exercises to include challenging games and fun training, keeps it fresh for everyone. Get out of the spaghetti bridge building, puzzle solving, and trust falling rut. Elite Events will customize a team building event your whole team will be talking about around the water cooler for months to come.

Holiday Parties

Make all your company holiday parties magical and memorable for your employees. Whether you want an corporate event focused on an elegant night out or a magical time for families, we have the holiday party entertainment to make visions a reality. Celebrating together is a great way for employees to socialize and build lasting friendships. Including holiday party games and fun party themes, increases the memories for years to come. Holiday smiles are made easy with Elite Events.

Marketing Events & Community Outreach

One way to get your organization more involved in the community it serves is to host an event that everyone wants to attend. Planning a corporate marketing event builds brand loyalty and increases positive publicity for your organization. Hosting a community open house is a great way to introduce a new logo, merger or management team for your company. Inviting customers and vendors to your promotional event only strengthens your ties and loyalties to each other. Elite Events will shout your message loud and clear for a lasting impact.

Company Celebrations and Milestones

Turn company landmarks into lasting moments. Sales achievements, safety records, training completion, customer satisfaction and employee retention are positively something to remember. Company anniversaries and grand openings are an opportunity to welcome your entire community to celebrate in the success of the business. Let Elite Events help you commemorate these important company benchmarks with a memorable event.

Non-Profit and Fundraising Events

Charity events need to make the most impact for a small budget. Maximizing your resources and network of volunteers will provide a lasting impact on the success of your program. Touching lives and making a difference in the community, only happens when successful fundraising events propel the organization’s mission forward. Expertise in event efficiencies and logistical planning makes Elite Events the easy choice for your next fundraiser.

#Corporate Event Planning#Company Picnics#Team Building Events#Corporate Party Rentals#Business Event Services#Corporate Holiday Parties#Corporate Celebrations

0 notes

Text

THE BRAND RELATIONSHIP PLAYBOOK: Understand, measure, and manage brand relationships to develop brand love, increase brand loyalty, expand brand’s lifetime value and increasing overall profitability.

The “Brand Relationship Playbook” earned in 2020 the Axiom Business Book Award Bronze Medal in the Advertising / Marketing / PR category. The book outlines for executives, marketing or brand managers or anyone interesting in branding the appropriate tools to assess how consumers feel and think about brands and what they say and do with brands. The book presents an overview of the state of the art…

0 notes

Text

Blog 7 – Evolution of Emotions in Video Games

From the low-poly character models of the early 1990s to the hyper-realistic visuals of today, the emotional impact of video games has always been shaped by a delicate interplay of affective design and compelling narratives. As technology evolves, so too do the ways creators craft these experiences and players interpret them. In this article, I explore the evolution of emotions in video games, focusing on how advancements in technology and shifts in player expectations have redefined the emotional landscape of gaming.

The progression of narratives in video games has proceeded far more rapidly than any other entertainment medium of the past. Beginning with the text-based adventure The Oregon Trail (1971), which chronicled the journey of settlers across uncharted America, to the ultra-realistic Red Dead Redemption 2 (2018), which follows Arthur Morgan, an outlaw seeking a place in a rapidly modernizing world. Video games have not only evolved technologically but have also managed to improve their fundamental ability to tell a story that is richer both in terms of quality as well as emotional impact.

While many games vie for the title of the first emotionally compelling video game, few would dispute the impact of Square Enix’s 1997 masterpiece, Final Fantasy 7, that not only managed to be a success in the Eastern market but also garnered immense popularity in the Western market as well. The story of the protagonist “Cloud” in his quest to stop the villain “Sephiroth” was not only engaging to the audience in general but also connected with everyone on a personal level. The game demonstrated that crafting compelling narratives is pivotal in eliciting emotional responses, with storytelling serving as a conduit for engagement and empathy (Williams, 2019). Despite its 32-bit graphics, Final Fantasy 7 continues to captivate players today, with many still favoring the original over the 2020 remake, more than 60% according to a recent community poll (Gamesfaq, 2023). This raises an intriguing question; why do players continue to cherish narratives presented through pixelated cartoon characters, despite their limited ability to convey nuanced emotions, over modern, life-like models capable of expressing human subtleties? I Is this loyalty driven by nostalgia, or does a deeper, hidden component amplify the affective potential of these earlier games? Does a strong and well written story with deep emotional depths equate to an effective story or can other factors contribute to the ability of conveying proper emotions as well?

A prime example of a game relying not solely relying on its storytelling abilities to convey emotions is the XCOM series by Firaxis Games. The game is based on a fictional future where aliens invade our planet in pursuit of conquest and where we, as the commander of a secret XCOM initiative, struggle against the alien invaders in order to save the world. From the first game in the series made in 1994 to the current installment released in 2016, the overall narrative is purely based on the defending humanity against the alien threat; a narrative seems mundane compared to the personal story of Cloud in Final Fantasy 7 yet it is the game’s mechanics that imbue the game with its true emotions. XCOM tugs the emotional strings of our hearts through the masterful integration of squad-based mechanics with the harsh truth of war, where each squad member that you command can die at any time based on your actions and decisions. Throughout the game, you develop a strong bond with each squad member by personalizing their appearance and honing their combat skills, turning them into distinct personalities you grow attached to. Each decision you make in game – from the strategies that you employ in battle to the technologies you research – contributes directly to the survival of your squad members resulting in either success or death of your entire team. The game's design, integrating psychology, art, and interactive systems, showcases how multidisciplinary methods can evoke powerful emotional responses (Garcia & Martinez, 2021). With the threat of failure and the death of your team constantly looming over every decision, XCOM affectively integrates emotions into the very fabric of the game resulting in emotions like fear, stress, jubilations and triumph etc. to emerge over the course of the entire game.

Thus, to conclude it is impressive how far video games have come in terms of both narrative storytelling as well as conveying emotions either through the use of an expertly written narrative or through the affectively created mechanics. While some may attribute to the success of video games effective emotional communication to the immersive nature of the medium, I personally believe it is a far more complex task requiring the masterful integration of several factors including mechanics, story, animations, art and music that make the video games as successful in terms of emotional storytelling as they are. Whether through the poignant tale of Cloud’s journey in Final Fantasy VII or the high-stakes decision-making in XCOM, video games continue to redefine what it means to engage players emotionally.

Sources

Gamesfaq (2023). How many fans of the original prefer the Remake? [online] Gamespot.com. Available at: https://gamefaqs.gamespot.com/boards/168653-final-fantasy-vii-remake/80409007 [Accessed 10 Dec. 2024].

Garcia, R., Martinez, L. (2021) 'Emotional Design in Video Game Development: A Multidisciplinary Perspective', Design Studies, 45, pp. 85-99.

Jones, S. (2020) 'Emotional Engagement in Digital Games: A Study of Player Experiences', Journal of Gaming Studies, 15(2), pp. 123-145.

Williams, D. (2019) 'Storytelling and Emotional Involvement in Modern Video Games', Entertainment Computing, 31, pp. 100-112.

0 notes

Text

Turn Warehouse Horror Story into a Fairy Tale: Achieve Accurate Stock, Smooth Order Processing, and Minimize Expired Goods

Is your warehouse a nightmare? No one knows exactly how many products are in stock, available for shipment, or reserved. It’s either overstocked or understocked, causing chaos and inefficiency. Expired products slip through the cracks, leading to customer complaints and returns. Financial confusion reigns as only revenue is considered, ignoring expenses and product profitability. Poor inventory management results in lost sales, increased costs, and dissatisfied customers.

According to Worldmetrics, around 46% of small businesses rely on manual inventory management methods.

As businesses scale, managing inventory becomes increasingly challenging. Tracking stock levels across multiple locations, handling diverse products and variants, and ensuring timely restocking to avoid waste are major challenges. According to the McKinsey report, nearly 20% to 30% of inventory may be categorized as excess, obsolete, or dead stock, adding an extra 25% to 30% in expenses. The lack of an organized inventory system highlights the need for timely inventory turnover.

To address these challenges, businesses need optimal inventory management systems that offer real-time insights to streamline operations and support effective decision-making.

Conquering Daily Inventory Management Nightmares

Many businesses grapple with inventory management challenges, impacting operations and profitability. Here are 5 most common issues:

Stock Issues Knowing exact stock levels and shipment earmarks can be like finding a needle in a haystack. Without precise tracking, an organization cannot manage inventory effectively. According to Sourcing Journal, 46% of retailers struggle with understanding their stock quantities. This leads to over-ordering or under- ordering, disrupting cash flows and customer service. Delays or frustration from out-of-stock items result in lost sales and decreased customer loyalty.

Expired Products Selling expired goods damages customer trust and brand reputation, leading to customer complaints and PR scandals. Industries like food and beverage face strict regulations on expiration dates. The FDA reports that 60% of food waste occurs in the retail and consumer sectors due to expired products. Failure to manage these effectively can lead to negative reviews, returns, and even legal penalties. In 2020, a well-known snack brand faced significant backlash after several customers received expired products, causing PR damage and financial losses.

Profitability Confusion Focusing solely on revenue without considering costs and margins obscures true financial health. For example, investing heavily in marketing a low-margin product while neglecting high-margin items is a common pitfall. Understanding the full cost of goods sold, overhead, and operation costs is crucial for better pricing and inventory decisions. Companies that implement detailed profitability analysis can increase margins by up to 30%, according to a Harvard Business Review study.

Inefficient Order Processing Slow or inaccurate order processing can lead to customer dissatisfaction and increased operational costs. Manual processes are prone to errors and delays. A survey by Business Wire revealed that 39% of consumers are unlikely to return to a retailer after experiencing a poor delivery process. Automating order processing reduces errors and speeds up the fulfillment process, improving customer satisfaction and lowering costs.

Supplier Management Managing relationships with multiple suppliers can be complex and time- consuming. Inconsistent supplier performance can lead to stockouts, delays, and increased costs. A report by a service Meteor Space found that 65% of businesses experience significant supply chain disruptions due to poor supplier management. Establishing strong supplier relationships and using supplier management tools can help mitigate these risks and ensure a smooth supply chain. Addressing these challenges with robust inventory management systems can provide real-time insights, streamline operations, and support effective decision-making, ultimately improving business performance and profitability.

Your Path to Optimized Inventory Management

Imagine a world where all orders are confirmed and shipped promptly, and inventory levels perfectly align with sales, resulting in minimal losses from expired or damaged goods. Everyone in the warehouse understands their role and operates seamlessly. Optimized inventory management can turn this vision into reality, even for novice entrepreneurs. Here’s a step-by-step guide to create your fairy-tale warehouse:

Step 1: Create a List of Basic Transactions, Reports, and Actions

Define essential transactions: purchasing, sales, internal transfers, and inventory counts.

Specify formats and quality checks for each transaction.

Step 2: Create an Inventory Catalogue

Structure product categories.

Decide on unique items versus variants.

Determine necessary item data, including barcode usage.

Step 3: Set Up Key Entities for Inventory Records and Purchasing/Sales Processes

Record warehouse locations.

Document legal entities and bank accounts.

Establish primary accounting currency and customer/supplier data.

Step 4: Test, Make Changes, and Choose Date X

Test basic operations.

Ensure report access.

Make necessary adjustments.

Select a transition date for the inventory management system.

Step 5: Establish Inventory Policies and Rules for Managing Inventory Records

Set inventory and shipment rules.

Determine transaction numbering.

Define record timing and documentation guidelines.

Step 6: Develop Warehouse Procedures

Define inventory counting frequency.

Handle discrepancies, goods receiving, order collection, and customer returns procedures.

Step 7: Establish Inventory and Initial Stock

Compile item files.

Conduct an initial inventory check.

Input stock quantities and prices.

Verify settings.

Step 8: Start Using Software Daily and Train Employees

Onboard employees.

Ensure understanding of procedures.

Begin record creation.

Monitor daily accuracy checks.

Step 9: Develop and Configure Regular Reports, Begin Data Analysis

Use basic reports for inventory and sales monitoring.

Identify additional reporting needs for specific issues.

How Can MSMEs Create a Valuation for Inventory?

Implementing inventory management from the start is essential for businesses with diverse product ranges, such as clothing or spare parts, those handling batches of varying quality like fruits, oils, or plastics, and operations with high- speed demands, such as e-commerce. It’s also crucial for businesses dealing with perishable goods like food or cosmetics, manufacturers, D2C brands, and companies managing their own storage facilities. Proper inventory management ensures efficient operations, minimizes waste, and optimizes product flow across these industries.

When managing inventory, selecting an appropriate cost-value method is crucial for accurate financial reporting. Here are the primary methods used for cost valuation.

Average Cost:

Definition: Calculate the cost of goods in the warehouse as the average of all incoming inventory.

Benefits: Smoothen out fluctuations in product prices, providing a stable cost valuation.

FIFO (First In, First Out):

Definition: The first goods to arrive in the warehouse are the first to be sold.

Benefits: Accounts for the devolution of goods over time, making it useful during fluctuating prices.

LIFO (Last In, First Out):

Definition: The last goods to arrive in the warehouse are the first to be sold.

Benefits: Beneficial during periods of increasing prices, providing a better match between current costs and revenues.

Specific Identification:

Definition: Goods are tracked individually, using unique identification such as serial numbers.

Benefits: Allows for precise tracking and valuation, suitable for items with distinct characteristics.

Conclusion

Transforming your warehouse from chaos to efficiency is achievable with the right strategy and tools. Consolidating reports on key activities such as stock movement, sales performance, and customer analysis provides valuable insights to enhance inventory management. Monitoring sales orders, purchase orders, and internal transfers streamlines processes, predicts potential issues, and ensures smooth operations.

A quick onboarding session, as brief as 15 minutes, empowers MSMEs to create an efficient warehouse. Small businesses can maintain optimal stock levels, process orders faster, and reduce the risk of expired goods, boosting both operational performance and customer satisfaction. By adopting best practices in inventory management, companies lay a strong foundation for long-term success, unlocking higher profitability and happier customers.

This article has been authored by Aleksandra Borvchuk, Director, Kladana. All views are of the author’s own and do not necessarily reflect those of Logistics Insider.

Source Link: https://www.logisticsinsider.in/turn-warehouse-horror-story-into-a-fairy-tale-achieve-accurate-stock-smooth-order-processing-and-minimize-expired-goods/

Website Link: https://www.kladana.com/

0 notes

Link

#adroit market research#loyalty management market#loyalty management market 2020#loyalty management market size

0 notes

Link

#adroit market research#loyalty management market#loyalty management market 2020#loyalty management market size

0 notes

Text

Two-Wheeler Lead Acid Batteries Market

Two-Wheeler Lead Acid Batteries Market: Trends, Opportunities, and Forecasts (2024-2032)

The global Two-Wheeler Lead Acid Batteries Marketrevenue was valued at USD 5.1 billion in 2023 and is projected to reach a value of USD 7.6 billion by 2032, registering a CAGR of 4.5% during the forecast period (2024-2032). The growth of the two-wheeler lead acid batteries market is directly impacted by increased automotive production and sales and rising demand for electric vehicles.

Market Categorization

The Two-Wheeler Lead Acid Batteries Market can be categorized into the following segments:

By Capacity

Less than 5 AH

5 AH to 10 AH

10 AH to 20 AH

Above 20 AH

By Battery Type

VRLA Batteries

Flooded

By Application

OEMs

Aftermarket

Free Sample Request: https://straitsresearch.com/report/two-wheeler-lead-acid-batteries-market/request-sample

Geographic Overview

The Two-Wheeler Lead Acid Batteries Market can be geographically divided into four main regions:

Asia-Pacific: Dominated by countries such as India, China, and Indonesia, this region is expected to drive the market growth due to the increasing demand for two-wheelers.

Europe: Countries such as Germany, France, and the UK are expected to contribute significantly to the market growth.

North America: The US and Canada are expected to drive the market growth in this region.

Rest of the World: This region includes countries from Latin America, the Middle East, and Africa.

Top Players in the Market

Some of the top players in the Two-Wheeler Lead Acid Batteries Market include:

Amara Raja Batteries Limited

Base Corporation Limited

Exide Industries Limited

HBL Power Systems Ltd.

Luminous Power Technologies Pvt. Ltd.

Okaya Power Pvt. Ltd.

Samsung SDI Co. Ltd

Southern Batteries Private Limited

SU-KAM Power System Limited

Tata Autocomp GY Batteries Private Limited

Free sample Request:https://straitsresearch.com/report/two-wheeler-lead-acid-batteries-market/request-sample

Two-Wheeler Lead Acid Batteries Market Segmentations

By Capacity (2020-2032)

Less than 5 AH

5 AH to 10 AH

10 AH to 20 AH

Above 20 AH

By Battery Type (2020-2032)

VRLA Batteries

Flooded

By App (2020-2032)

OEMs

Aftermarket

Market Segmentation: https://straitsresearch.com/report/two-wheeler-lead-acid-batteries-market/segmentation

Key Unit Economics for Businesses and Startups

For businesses and startups, understanding the key unit economics of the Two-Wheeler Lead Acid Batteries Market is crucial for making informed decisions. Some of the key unit economics include:

Cost per unit: The cost of producing one unit of the battery.

Revenue per unit: The revenue generated from the sale of one unit of the battery.

Gross margin: The difference between the revenue and the cost of producing one unit of the battery.

Customer acquisition cost: The cost of acquiring one customer.

Two-Wheeler Lead Acid Batteries Market Operational Factors

The Two-Wheeler Lead Acid Batteries Market is influenced by several operational factors, including:

Supply chain management: The ability to manage the supply chain efficiently is crucial for the success of the business.

Quality control: Ensuring that the batteries meet the required quality standards is essential for building customer trust and loyalty.

Research and development: Investing in research and development is necessary for staying ahead of the competition and meeting the changing customer needs.

Buy Full Report (Exclusive Insights):https://straitsresearch.com/buy-now/two-wheeler-lead-acid-batteries-market

Email: [email protected] Address: 825 3rd Avenue, New York, NY, USA, 10022 Phone: +1 646 905 0080 (US), +91 8087085354 (India), +44 203 695 0070 (UK)

1 note

·

View note

Text

0 notes

Text

How Luxury Brands Position a Genuine Customer Profile in China

The year 2020 posed significant challenges across various industries, including fashion. The global fashion sector is projected to contract by 27% to 30% due to the impacts of the coronavirus pandemic. This crisis fundamentally altered lifestyles and solidified the importance of the Chinese market, which has largely returned to normal operations. The power of Chinese consumers has surged, now accounting for 38% of the global fashion industry. According to Bain & Company’s 2019 report, Chinese consumers represented 33% of the market in 2018, with predictions suggesting that this figure could reach 50% by 2025. Thus, China is poised to be a highly promising market in the future.

However, the Chinese market differs significantly from others. Its complex regional cultures, youth trends, and advanced digital marketing strategies create a unique landscape, making it challenging for luxury brands to define a clear customer profile. There are few designs tailored exclusively for Chinese consumers, leading to a fuzzy consumer image and demand. Consequently, establishing a genuine customer profile is crucial for gaining a foothold in the Chinese market.

A customer profile creates a portrait of consumers, encompassing demographic attributes (e.g., education, gender, income level) and additional transactional data (e.g., purchasing demands and concepts). This profile informs every aspect of the marketing mix. Importantly, “genuine” refers to being sincere and free from pretense, meaning that a genuine customer profile describes a real person rather than just commercial data. This process can be broken down into three phases: brand knowledge of the consumer, establishing companionship, and delivering positive value. Developing a genuine customer profile can yield significant benefits for both the brand and the consumer.

The brand’s understanding of its customers is the cornerstone of a genuine customer profile and the first step in this process. Respect is paramount; it is essential for fostering effective communication between the luxury brand and its customers. One often-overlooked reason luxury brands struggle in China is the lack of cultural understanding regarding consumer purchasing motivations. The mindset and demands of Chinese customers differ significantly from those in other countries, often due to a perceived lack of respect from luxury brands.

According to the Customer Experience Matrix, 79% of consumers are more loyal to businesses that understand them, and even a 7% increase in loyalty can boost profits by as much as 85%. Respect must extend beyond individual consumers to encompass society, culture, and the country at large. China’s 5,000-year history is rich and complex, and brands must navigate cultural sensitivities carefully. For instance, Dolce & Gabbana faced backlash for an offensive video that many perceived as disrespectful to Chinese culture, leading to significant fallout and the cancellation of a major fashion show. This example underscores the necessity for luxury brands to cultivate a nuanced understanding of their market.

To bridge this gap, brands like Chanel and Gucci have created positions for Diversity Officers to mitigate cultural and political issues through internal training and management reform. If luxury brands fail to meet the mainstream consumer’s demands and do not demonstrate genuine respect, they risk losing their foothold in the Chinese market.

Companionship is another essential quality luxury brands must consider when engaging with Chinese customers. By 2025, half of Chinese luxury spending will occur domestically, a trend accelerated by COVID-19. As social distancing became the norm, online platforms, especially social media, have become vital for maintaining connections. In China, platforms such as Xiao Hong Shu, WeChat, and Douyin dominate, replacing Western superpowers like Facebook and Google. Luxury brands should invest effort into these platforms to align with the daily lives of Chinese consumers.

For example, Gucci launched the "520 Gucci Story" campaign on Weibo, encouraging consumers to share their emotional connections with the brand. On Douyin, Gucci produced exclusive retro-style videos that resonated with younger audiences. These interactive experiences foster companionship and build trust between brands and consumers.

Leading customers toward positive values and an improved quality of life is the essence of a genuine customer profile. Gucci’s "520" strategy not only aligned with Valentine’s Day but also promoted a message of cherishing the present, especially in a post-pandemic context. Similarly, Dior launched "Dior Talks," a podcast featuring discussions with prominent figures in arts and culture. These initiatives reflect the growing interest among Chinese consumers in self-fulfillment rather than mere displays of wealth.

Ultimately, a genuine customer profile embodies humanization. Luxury brands should treat customers as friends and make decisions from their perspective. For too long, Chinese customers have been viewed merely as revenue sources, with brands often neglecting genuine service. The development of a more authentic customer profile will lead to greater wealth and success for luxury brands in China.

0 notes