#low-cost payroll services

Explore tagged Tumblr posts

Text

Simplifying Payroll Processes: Why You Should Outsource Payroll Services in Australia

Handling payroll can be one of the most complex aspects of running a business. Managing payroll processes accurately and efficiently is critical to ensure employees are paid on time and businesses comply with tax regulations. But as your company grows, managing payroll in-house can become a burden. That’s where outsourced payroll services come in.

In this article, we’ll explore why many businesses choose to outsource payroll, the benefits of doing so, and how to find low-cost payroll services in Australia.

What Are Payroll Processes?

Payroll processes involve the steps a company takes to manage and execute employee payments. These processes include:

Calculating wages, salaries, and deductions

Managing taxes and employee benefits

Distributing salaries and bonuses on a timely basis

Ensuring adherence to local, state, and national laws.

Even for small businesses, payroll can be time-consuming and error-prone. For larger companies, payroll processes become more complicated due to multiple employee classifications, variable pay rates, and the need for regular audits.

Why Should You Outsource Payroll?

One of the most effective solutions for streamlining your payroll processes is to outsource payroll. This involves hiring a payroll service provider to handle all the payroll-related tasks on your behalf.

Here are some reasons why outsourcing payroll makes sense for businesses of all sizes:

1. Time and Cost Efficiency

Managing payroll internally requires dedicated staff, specialized software, and continuous training to keep up with compliance regulations. By outsourcing, companies can cut down on administrative overhead and focus on their core business functions. Additionally, outsourcing is often more cost-effective than hiring a full-time payroll department, especially when using low-cost payroll services.

2. Enhanced Accuracy

Errors in payroll can lead to costly penalties and unhappy employees. A professional payroll service provider uses advanced systems that minimize errors, ensuring your employees are paid accurately and on time. Since payroll service providers specialize in this field, they’re more adept at handling complex situations like tax filings, bonuses, and benefits management.

3. Compliance with Tax Laws

Payroll involves more than just calculating wages. There are ever-changing tax regulations and legal requirements businesses must comply with. A professional service provider stays up-to-date with these changes, helping companies avoid fines and ensure compliance. This is particularly important in countries like Australia, where employment laws can be complex and differ by state.

4. Data Security

Handling sensitive employee data, including salaries and tax details, requires strict security measures. Payroll outsourcing companies invest heavily in secure systems to protect against fraud, data breaches, and other threats. This ensures that your payroll data is safe from cyberattacks or internal mismanagement.

Finding Low-Cost Payroll Services in Australia

When evaluating payroll outsourcing, a primary concern for businesses is managing costs. Fortunately, low-cost payroll services are available in Australia, allowing businesses to enjoy the benefits of outsourcing without breaking the bank.

Here’s what to look for when selecting a payroll service provider in Australia:

1. Customized Solutions

Not all businesses have the same payroll needs. Whether you're a small business or a large enterprise, seek out a provider that delivers scalable, customizable payroll solutions. This enables you to pay only for the specific services you require, maximizing cost-effectiveness.

2. Industry Expertise

Outsourcing to a provider with experience in your industry ensures that they understand the specific requirements, challenges, and regulations related to your business. This is particularly useful for industries with unique pay structures, such as hospitality, retail, or healthcare.

3. Transparent Pricing

Some payroll companies offer packages that may seem low-cost initially but have hidden fees for additional services. Always ask for a detailed breakdown of pricing, so you know what’s included and can avoid any unexpected charges later.

4. Customer Support

Timely and effective customer support is crucial for smooth payroll operations. Look for a provider that offers responsive support, particularly during payroll periods, to address any concerns or issues promptly.

Advantages of Outsourcing Payroll in Australia

Australia is home to many reliable payroll service providers that offer affordable, scalable, and secure payroll services for businesses. Here’s why outsourced payroll in Australia is becoming increasingly popular:

Compliance with Australian Laws: Payroll providers in Australia are well-versed in local laws, including Superannuation, PAYG withholding, and Fair Work regulations. They ensure that your business complies with these laws, avoiding penalties.

Cost-Effectiveness: By outsourcing payroll, Australian businesses can cut down on the high costs of software, compliance management, and HR teams.

Flexibility: As your business expands, so will the complexity of your payroll requirements. Payroll providers offer scalable services that adapt to your growth, allowing you to continue outsourcing without changing providers.

Is Outsourcing Payroll Right for Your Business?

Choosing to outsource payroll is a strategic move that can help reduce costs, save time, and alleviate stress. If you’re a small or medium-sized business in Australia, outsourcing may offer the best solution for managing payroll effectively, especially if you don’t have the resources to manage it in-house.

Key Benefits Recap:

Cost savings by reducing the need for an in-house team

Increased accuracy and compliance with tax laws

Improved security of sensitive payroll data

Scalability to match your company’s growth

By choosing the right payroll service provider, you can streamline your payroll processes, ensure compliance, and reduce operational costs.

Conclusion

Efficient payroll processes are essential to the smooth running of any business, but they can also be one of the most challenging tasks to manage. By opting to outsource payroll, you can enjoy time-saving benefits, cost reductions, and the peace of mind that comes with knowing your payroll is handled accurately and securely.

If you’re considering outsourced payroll in Australia, make sure to look for low-cost payroll services that offer flexibility, industry expertise, and solid customer support. Ultimately, the right provider can help transform your payroll from a headache into a seamless part of your business operations.

#payroll processes#outsource payroll#low-cost payroll services#payroll service provider#outsourced payroll australia

0 notes

Text

Emily Singer at Daily Kos:

Multiple Head Start preschools—which provide free or low-cost child care for low-income parents—are warning that they face imminent closure, as they cannot access the federal funding they had been promised, the Associated Press reported. Dozens of Head Start providers, who were locked out of the government payment system they use to get their grant funding when the Trump administration froze all federal grant payments, say they are still locked out of the payment system, even though two federal judges said the freeze was illegal and ordered it to be lifted immediately. Head Start provides preschool and other services to nearly 800,000 low-income children in the United States. Providers say a freeze in payments could cause them to be unable to make payroll for their employees, which would force them to shut their facilities down. The AP reported that at least one Head Start provider in Wisconsin had to close for a week because the funds from the government didn't come through—a move that hurt the working parents who now unexpectedly had no child care.

Multiple Head Start locations, including the kids and staff, are facing threats of closure due to Traitor 47’s disgraceful federal funding freeze that impacts the payroll of those working there.

12 notes

·

View notes

Text

How Payout Solutions Drive Financial Inclusion Across Developing Economies ?

Financial inclusion is a critical driver of economic development, particularly in developing economies where access to traditional banking services remains a significant challenge. Payout solutions are emerging as transformative tools to bridge this gap, offering innovative ways to empower underserved populations and integrate them into the financial ecosystem. This article explores how payout solutions contribute to financial inclusion, their benefits, and the role of digital innovation in achieving these goals.

Understanding Payout Solutions

Payout solutions refer to systems and technologies designed to facilitate seamless, secure, and efficient payments to individuals or businesses. These solutions include a wide range of services, such as:

Payroll disbursements

Social benefit payments

Gig economy payouts

Cross-border remittances

By leveraging payout solutions, organizations can ensure timely and accurate disbursement of funds, even in areas with limited access to traditional banking infrastructure.

The Importance of Financial Inclusion in Developing Economies

Financial inclusion means providing individuals and businesses access to affordable and useful financial products and services, including payments, savings, credit, and insurance. It is vital for economic growth, as it:

Empowers Individuals: Access to financial services enables individuals to save, invest, and plan for the future.

Boosts Economic Participation: Financial inclusion integrates more people into the economy, fostering entrepreneurship and innovation.

Reduces Inequality: It narrows the gap between the privileged and underserved populations by offering equal opportunities for financial growth.

However, traditional banking systems often fall short in developing economies due to factors like limited infrastructure, high operating costs, and lack of financial literacy. Here, payout solutions offer a practical alternative.

How Payout Solutions Drive Financial Inclusion

Reaching Remote Areas Payout solutions utilize digital tools to overcome geographic barriers. Mobile-based applications and point-of-sale systems enable individuals in remote regions to access funds without needing a physical bank branch. For instance, farmers can receive subsidy payments directly into their mobile wallets, eliminating the need to travel long distances.

Enabling Faster Transactions Instant payout solutions are critical for individuals relying on timely income, such as gig workers or daily wage earners. These solutions use real-time digital solutions to ensure payments are processed instantly, helping users meet their immediate needs.

Reducing Costs Traditional banking often involves high transaction fees, making it inaccessible for low-income populations. Payout solutions streamline the process and reduce costs by leveraging digital infrastructure, making financial services more affordable.

Enhancing Security By employing secure technologies such as encryption and biometric authentication, payout solutions minimize fraud and ensure the safe transfer of funds. This builds trust among users, encouraging wider adoption.

Promoting Financial Literacy Many payout solutions integrate user-friendly platforms and educational tools to help individuals understand financial services better. This fosters confidence and encourages users to explore other financial products, such as savings accounts and microloans.

Digital Solutions Powering Payout Innovations

The role of digital solutions in advancing payout systems cannot be overstated. Technologies like mobile banking, blockchain, and artificial intelligence have revolutionized the way funds are distributed and accessed. For instance:

Mobile Wallets: These are at the forefront of digital payment solutions, enabling individuals without bank accounts to receive and spend money using their mobile devices.

Blockchain Technology: Secure and transparent, blockchain facilitates cross-border payouts with minimal fees, benefiting migrant workers sending money home.

AI and Data Analytics: These tools optimize payout processes by identifying patterns and reducing inefficiencies, ensuring smooth transactions.

Companies like Xettle Technologies are pioneering these digital innovations by providing custom payout solutions tailored to the unique needs of developing economies. Their platforms combine advanced security features with user-friendly interfaces, enabling a seamless experience for both individuals and businesses.

Case Studies: Payout Solutions in Action

Social Benefit Disbursements in India The Indian government’s Direct Benefit Transfer (DBT) scheme leverages payout solutions to deposit welfare payments directly into beneficiaries’ accounts. This has reduced leakages and ensured funds reach the intended recipients.

Gig Economy Payments in Africa In Africa, mobile payment systems like M-Pesa facilitate payouts for gig workers, enabling them to access their earnings instantly. This has been instrumental in empowering freelancers and small business owners.

Cross-Border Remittances in Southeast Asia Migrant workers in Southeast Asia rely on digital payout solutions to send money home. These solutions are faster and cheaper than traditional remittance methods, allowing families to access funds quickly.

Challenges and Opportunities

While payout solutions hold immense promise, certain challenges persist, such as:

Limited Digital Infrastructure: Many regions lack the internet connectivity needed to support digital solutions.

Regulatory Barriers: Complex regulations can hinder the deployment of payout systems.

Low Financial Literacy: Many individuals remain unaware of how to use payout solutions effectively.

Addressing these challenges requires collaboration between governments, financial institutions, and technology providers. By investing in infrastructure, streamlining regulations, and promoting financial education, stakeholders can unlock the full potential of payout solutions.

Conclusion

Payout solutions are a cornerstone of financial inclusion in developing economies, offering accessible, affordable, and secure ways to distribute funds. By leveraging digital solutions and collaborating with innovators like Xettle Technologies, organizations can create impactful systems that empower individuals and drive economic growth. As technology continues to advance, the role of payout solutions in fostering an inclusive financial ecosystem will only grow stronger.

2 notes

·

View notes

Text

SAP BTP (Business Technology Platform) provides powerful tools and services that support AI, machine learning (ML), and automation, helping businesses optimize their processes, enhance decision-making, and drive innovation. Here’s how SAP BTP supports these technologies in business processes:

1. SAP AI Core and AI Foundation

SAP BTP includes AI Core and AI Foundation, which offer the building blocks for integrating and deploying AI and ML models into business processes. These tools allow businesses to:

Develop and train machine learning models using various algorithms and data sources.

Integrate pre-built AI capabilities (like sentiment analysis, image recognition, and predictive analytics) into applications.

Automate routine tasks by using AI to enhance operational efficiency, such as invoice processing or customer service automation.

With AI Foundation, businesses can access:

Pre-trained AI models and services for quick integration.

Customizable frameworks to build tailored models based on specific needs.

Continuous improvement by integrating machine learning to make predictions and improve over time.

2. SAP Business Application Studio & Low-Code/No-Code Tools

SAP BTP offers the Business Application Studio and low-code/no-code tools that empower users—both business analysts and developers—to create AI-powered applications with minimal coding expertise. This accelerates the creation of automation workflows and AI-driven processes by:

Simplifying the development process with a visual interface.

Integrating AI and ML algorithms into business applications without the need for deep technical expertise.

These tools make it easier for organizations to embed automation and AI into their processes, especially when scaling to multiple departments or business functions.

3. SAP Intelligent Robotic Process Automation (RPA)

SAP Intelligent RPA enables businesses to automate repetitive tasks that require human intervention by using robots that can interact with systems and applications. RPA combined with AI and ML capabilities makes processes more intelligent by:

AI-powered decision-making: RPA bots can make decisions based on data inputs, driving intelligent workflows.

Automating customer service: AI-powered bots handle queries and automate customer support processes, improving response times and reducing costs.

Task automation in areas such as invoicing, payroll, and supply chain management, freeing employees to focus on higher-value activities.

4. SAP Conversational AI

SAP Conversational AI is a platform that allows businesses to build and deploy chatbots and virtual assistants to automate customer service, HR processes, or IT helpdesks. These AI-powered bots leverage natural language processing (NLP) and machine learning to:

Understand and respond to customer queries, making the interaction feel natural and efficient.

Integrate with business applications to provide personalized answers, handle transactions, and streamline workflows (e.g., SAP S/4HANA or SAP SuccessFactors).

Analyze conversational data to continuously improve the chatbot’s responses, ensuring higher accuracy over time.

5. SAP Analytics Cloud and Predictive Analytics

SAP Analytics Cloud integrates advanced predictive analytics and machine learning capabilities, enabling businesses to leverage AI for data-driven decision-making. With these tools, businesses can:

Perform predictive modeling to forecast sales, customer demand, and financial performance.

Create automated reports that highlight key insights from large datasets.

Detect trends, anomalies, and patterns in business data that are otherwise difficult to spot manually.

Enhance forecasting with AI-driven predictions, enabling more accurate planning and risk management.

6. SAP Data Intelligence

SAP Data Intelligence helps organizations manage, integrate, and process data from various sources, enabling them to train and deploy machine learning models. With this service, businesses can:

Integrate diverse data sources (structured, unstructured, IoT data, etc.) to create a holistic data model.

Build, deploy, and monitor ML models that are applied across various business processes.

Automate data-driven workflows, making it easier to use AI for tasks like anomaly detection or predictive maintenance in industries like manufacturing.

7. SAP Leonardo (Integrated with SAP BTP)

SAP Leonardo is a comprehensive digital innovation system integrated with SAP BTP that combines IoT, machine learning, artificial intelligence, and big data analytics to deliver intelligent business processes. Some key ways it enhances business automation:

IoT and AI Integration: Helps businesses analyze sensor data and apply machine learning algorithms for predictive maintenance, real-time monitoring, and process optimization.

Industry-Specific Solutions: SAP Leonardo offers pre-configured solutions for industries like manufacturing, retail, and logistics, providing targeted AI and ML capabilities tailored to each sector's needs.

8. SAP HANA Database for Real-Time Processing

SAP HANA, SAP's in-memory database, plays a central role in enabling AI, ML, and automation on SAP BTP. It provides real-time data processing that:

Supports AI-driven decision-making by processing large volumes of data in real-time.

Allows machine learning algorithms to run directly within the database, improving speed and scalability.

Helps businesses analyze data and take actions immediately based on insights, increasing operational efficiency.

9. SAP S/4HANA and AI Integration

SAP S/4HANA is SAP's flagship enterprise resource planning (ERP) suite, and it’s tightly integrated with SAP BTP’s AI and automation capabilities. It benefits businesses by:

Automating workflows: AI and ML can automate procurement, inventory management, and supply chain tasks to optimize operations.

Predictive analytics: S/4HANA uses predictive analytics to forecast demand, sales, and optimize production schedules.

Intelligent finance: AI and ML enhance financial processes such as invoice processing, fraud detection, and financial planning.

10. SAP AI-Powered Insights for Sustainability

As sustainability becomes more critical, SAP BTP incorporates AI and automation tools to help businesses improve their environmental impact. With machine learning, businesses can:

Monitor and predict resource consumption.

Optimize energy usage across the enterprise with predictive models.

Automate sustainability reporting to ensure compliance and track progress.

Conclusion

By providing a comprehensive suite of AI, machine learning, and automation capabilities, SAP BTP enables businesses to transform their operations, reduce costs, improve decision-making, and enhance customer experiences. Whether it’s through predictive analytics, RPA, AI-powered chatbots, or intelligent process automation, SAP BTP offers a flexible platform to integrate and scale cutting-edge technologies throughout business processes.

Mail us on [email protected]

Website: Anubhav Online Trainings | UI5, Fiori, S/4HANA Trainings

0 notes

Text

Best Business Loan Services in Shimoga, Karnataka

Shimoga, Karnataka, is a rapidly developing city with a growing entrepreneurial ecosystem. Whether you're a small business owner or an established entrepreneur looking to expand, securing the right financial support is crucial. Business loans provide the necessary capital to invest in infrastructure, technology, inventory, and workforce, enabling businesses to scale efficiently.

In this article, we explore the best business loan services in Shimoga, Karnataka, their benefits, and how to choose the right financial assistance for your needs.

Importance of Business Loans in Shimoga

Shimoga has a diverse economy, with industries ranging from agriculture and manufacturing to retail and tourism. As businesses continue to grow, the need for reliable financial support increases. Business loans play a pivotal role in:

Expanding Operations – Whether you want to open a new branch or invest in better infrastructure, business loans provide the necessary funds.

Purchasing Equipment & Inventory – Loans can help businesses upgrade machinery, buy raw materials, or increase stock.

Managing Cash Flow – Seasonal businesses or startups often face cash flow challenges, and loans help in maintaining financial stability.

Hiring & Training Workforce – Businesses require skilled employees, and loans can assist in recruitment and training.

Marketing & Digital Expansion – Investing in branding, digital marketing, and e-commerce platforms is essential for modern business growth.

Types of Business Loan Services Available in Shimoga

Term Loans – These are long-term financial solutions designed for business expansion, major capital investments, or significant purchases. They have fixed repayment periods with interest rates depending on the loan tenure.

Working Capital Loans – These short-term loans help businesses manage daily expenses, payroll, and operational costs. They are ideal for businesses with seasonal revenue fluctuations.

Equipment & Machinery Loans – Businesses that require expensive machinery or advanced technology can benefit from these specialized loans.

Invoice Financing – Companies that struggle with delayed payments from clients can use invoice financing to get an advance on their pending invoices.

Business Line of Credit – This flexible financing option allows businesses to withdraw funds as needed, paying interest only on the used amount.

Government Schemes for Business Loans – Several government-backed financial programs provide affordable business loans with low-interest rates for MSMEs and startups.

Features of the Best Business Loan Services in Shimoga, Karnataka

1. Quick Approval and Disbursement

Reliable lenders ensure a hassle-free loan approval process with minimal documentation and quick disbursement to help businesses seize opportunities without delays.

2. Flexible Repayment Options

The best business loan services offer customized repayment plans that align with business cash flow, ensuring affordability and ease of repayment.

3. Competitive Interest Rates

Affordable interest rates are a crucial factor when choosing a business loan. Lower rates reduce the financial burden and improve business sustainability.

4. Collateral-Free Loan Options

Many financial institutions provide unsecured business loans, allowing entrepreneurs to secure funding without pledging assets.

5. High Loan Amount Eligibility

Depending on financial stability and business growth potential, eligible businesses can access higher loan amounts for significant expansion projects.

6. Tailored Loan Solutions for MSMEs & Startups

Micro, Small, and Medium Enterprises (MSMEs) and startups often require specialized funding options. The best business loan services offer customized plans suited for emerging businesses.

How to Choose the Best Business Loan Service in Shimoga

1. Assess Your Business Needs

Before applying for a loan, determine the exact amount required and the purpose, whether for expansion, equipment, inventory, or cash flow management.

2. Compare Interest Rates & Charges

Different financial institutions offer varying interest rates, processing fees, and hidden charges. Compare these factors to find the most cost-effective loan.

3. Check Eligibility Criteria

Each lender has specific eligibility requirements based on business turnover, credit history, and operational years. Ensure you meet these criteria to increase approval chances.

4. Read Terms & Conditions Carefully

Understanding loan agreements, repayment terms, prepayment penalties, and hidden clauses is essential before signing any loan contract.

5. Look for Customer Support & Transparency

A good lender provides clear communication, transparency in loan processing, and reliable customer support for any financial queries.

Conclusion

Finding the best business loan services in Shimoga, Karnataka, is essential for fueling growth and maintaining business sustainability. Whether you're a startup, MSME, or an established enterprise, choosing the right financial assistance can help you achieve long-term success. By evaluating interest rates, loan types, and lender credibility, businesses can secure the ideal funding solution tailored to their needs.

For entrepreneurs in Shimoga, access to reliable and customized business loan services ensures that financial hurdles do not stand in the way of progress and innovation.

0 notes

Text

Why Your Restaurant Needs Restaurant Software for Better Management

Running a restaurant is not an easy task. From taking orders to managing inventory and customer service, there are many things to handle. This is where restaurant software can help. A good restaurant management system can make daily operations easier, reduce errors, and improve customer satisfaction.

What Is Restaurant Software?

Restaurant software is a digital tool that helps restaurant owners manage different tasks such as billing, inventory, staff, and customer relationships. It simplifies operations and saves time, making it a must-have for modern restaurants.

Benefits of Using Restaurant Software

1. Fast and Accurate Billing

Manual billing can be slow and lead to mistakes. With restaurant software, you can generate quick and error-free bills, ensuring smooth transactions for customers.

2. Better Inventory Management

Keeping track of stock manually is difficult. The software alerts you when items are running low, preventing wastage and ensuring smooth operations.

3. Easy Order Management

From dine-in to takeout and online orders, restaurant software helps manage all types of orders in one place, reducing confusion and delays.

4. Improved Customer Experience

Customers expect fast service and smooth transactions. A restaurant system helps in taking quick orders and offering better service, leading to happy customers.

5. Staff Management

It helps in tracking employee working hours, payroll, and performance. This ensures proper staff scheduling and avoids overstaffing or understaffing issues.

6. Sales and Reports

Understanding your sales trends helps in making better business decisions. The software generates detailed reports on sales, customer behavior, and expenses.

Why Choose Our Restaurant Software?

At Restaurant Software Management, we provide a reliable and easy-to-use restaurant management system. Our software is designed to improve efficiency, reduce costs, and increase profits.

Conclusion

Investing in a restaurant management system is a smart decision for restaurant owners. It saves time, reduces errors, and improves customer satisfaction. If you want to upgrade your restaurant operations, try our software today!

For more details, visit Restaurant Software Management.

#Restaurant software#Restaurant management software#Restaurant billing software#RestosoftIN#restaurant Pos Software#ymts#software#cafe billing software

1 note

·

View note

Text

How to Select the Right Accounting Services in Dubai?

It is important to select the right accounting services in Dubai for your business needs. With the right solution provider, you can streamline financial management, enhance the accuracy and ensure complete compliance with the tax regulations.

There are several good options available in the market. choosing the right one can become challenging for your business needs. here are all the key factors that can help you go ahead with the right accounting services. • Assess the financial management needs posed by your business. this will help you select the right accounting service. Start by understanding the business size and its complexity. You might want a basic bookkeeping service for a small business. As a larger enterprise, you might need advanced reporting and automation. Industry requirements may differ in terms of accounting needs. You may need inventory tracking in case of retail business and project accounting in case of construction. The number of invoices, bills and bank transactions you tend to process can also influence the choice of software you need. Lastly, you may want to consider the scale of your business before proceeding with the choice. • Next, you must determine the budget while choosing crypto accounting services in Dubai. There are different versions that come with diverse features that can help you with the accounting needs. for instance the free version may possess limited features while the premium solutions come with advanced features and services. you must consider the upfront and ongoing costs for the service before proceeding with the initial purchase. You must also look a the subscription fees so that you know what you are paying for. The hidden fees is equally important while allocating the budget. You may be charged for the integrations and additional users. It is possible you need to pay for customer support. Lastly, make sure to check if you can save some money into accounting services in Dubai. you should check the returns on services. • You should check if the accounting solutions you plan to invest in would be cloud-based or on-premises. There are services like QuickBooks and Xero that offer cloud-based services. You would get automatic updates and data backups with these services. it offers a monthly pricing and is ideal for the remote access. When you opt for on-premises software, you install the solution on the local computer. It may come with a higher upfront cost. At the end it offers a better control over data security. It is suited for businesses that prefer local storage. • When selecting the services, you must look at the features. Prioritize the ones that can help your business. The basic features include income and expense tracking, invoicing and billing and bank reconciliation. If you want payroll processing or multi-currency support, you need advanced services. in case you need automation capabilities, you must opt for recurring invoicing and bank feeds. These features can help your business in multiple ways. • Accounting software needs to be intuitive and easy-to-use. you should look for services that are easy to navigation and have a low learning curve. Lastly, make sure the crypto accounting services in Dubai come with a customer support.

0 notes

Text

Offshore Software Development Cost Estimation Guide

Factors affecting the offshore software development costs

1.Location

The average hourly rates in Eastern European countries range between $22 — $54. The average hourly rates of countries in Africa range from $23 — $42. The average hourly rates in Latin American countries range from $30 — $50. Asian countries have average hourly rates that range from $19 — $45.

2. Tech stacks & Skills

The tech stack refers to all that is required to handle a project from programming languages, frameworks and tools to code and deliver the application. When new technologies are requirements of a project, a developer with prior knowledge of the tools, techniques & software are preferred to get definitive results. With technical expertise, the cost of hiring increases too.

3. Experience level of Developers

Developers with more experience in any field will be more knowledgeable. Experienced developers charge more which adds to the development costs, as they are expected to deliver a fully functioning project.

4.Time duration of the project

The duration of the project plays an important role in the development cost estimation. If the project is quite simple like web development, the project can be made ready in a short duration. But when the project requires additional features like online ordering, customer ratings, product price comparisons, similar product suggestions, etc will require more time for deployment. The larger the project, the more is the testing and experimentation involved. Moreover, there would be changes in requirements of the clients which has to be resolved. All these factors will add to the costs.

5. Salary of developers

The salary of the offshore team may depend on the region or country to which the team belongs. It also depends on the company that provides these developers. There are quite a lot of reputed companies (offshore vendors) who recruit some of the best developers with high technical expertise. If the developers belong to the tech hubs, they are likely to demand more salary.

6. Offshore partner fee

Offshore agencies like Centizen Talent Hub help businesses hire offshore developers at a very low cost. All you need to pay is just a one-time fee for the recruitment. This fee is inclusive of the recruitment costs, handling payroll, allowances, offering infrastructure, etc. There are no hidden costs, rather everything will be included in the fee. You might wonder why the salaries and the vendor’s fee are so much lower than hiring onshore development teams. The reason is the low cost of living in these countries.

7. Business Trips

Although technology has given us a lot of communication tools, nothing beats one-to-one communication. Especially when requirements are to be discussed with clients or important decisions are to be made in-person meetings become a necessity. Either the developers may have to meet their recruiters onsite or the recruiters may want to meet the developing team. Such meetings may incur travel costs that are unavoidable. Whatsoever, these costs will be far less than hiring an onshore team.

8. Cost of getting an SSL certificate for your product’s security

When developing a project offshore, protecting the businesses’ data and intellectual property becomes a priority. When you have a tie-up with an offshore service provider like ours- Centizen Talent Hub, consider everything regarding confidentiality sorted. Using proper end-point or network security systems, security breaches can be mitigated.

Final Thoughts

There may be numerous factors that affect offshore development costs. Changes in the cost estimate include delays, unexpected incidents, requirement changes, approvals, etc. Many businesses may need continued support for solving bugs, hosting, customer support which does not end with delivering the project to the client. So before deciding to hire an offshore development team it is crucial to be aware of the possible costs to get the desired outcome.

0 notes

Text

Boomi Solutions and Integration Services: Transforming Businesses with Aretove Technologies

In today’s fast-paced digital landscape, businesses are constantly seeking ways to improve efficiency, streamline operations, and enhance customer experiences. One of the most effective methods to achieve these objectives is through robust integration platforms that connect disparate systems, applications, and data sources. This is where Boomi Solutions and Boomi Integration Services come into play, offering businesses a seamless and scalable way to integrate their IT ecosystems. Aretove Technologies, a leader in digital transformation, provides cutting-edge Boomi integration services to help businesses unlock their full potential.

Understanding Boomi Solutions

Boomi, a Dell Technologies company, is a leading provider of cloud-based integration solutions. It enables organizations to connect applications, data, and people in a flexible, scalable, and efficient manner. The Boomi AtomSphere Platform is an Integration Platform as a Service (iPaaS) that simplifies integration processes and eliminates the complexity of traditional middleware.

Boomi’s comprehensive suite of tools and functionalities includes:

Application Integration: Connects various enterprise applications such as ERP, CRM, HRMS, and financial systems.

Data Integration: Facilitates seamless data exchange and synchronization across multiple platforms.

API Management: Ensures secure and controlled access to enterprise data through API gateways.

Master Data Hub: Maintains data integrity and consistency across all integrated systems.

B2B/EDI Management: Simplifies partner onboarding and document exchange in business-to-business transactions.

Workflow Automation: Streamlines business processes with low-code development and automation.

With these features, Boomi provides a robust and scalable solution for businesses looking to drive digital transformation.

Why Businesses Need Boomi Integration Services

Organizations today operate in highly dynamic environments with multiple software applications and data sources. Without proper integration, businesses may face challenges such as data silos, inefficiencies, and lack of real-time insights. Boomi Integration Services offered by Aretove Technologies help businesses overcome these hurdles through a holistic and customized approach.

Key Benefits of Boomi Integration Services

Seamless Connectivity Boomi enables organizations to integrate their on-premise and cloud-based applications effortlessly. Whether connecting Salesforce with SAP, or integrating HRMS with payroll systems, Boomi ensures smooth data flow.

Scalability & Flexibility Businesses can easily scale their integration needs as they grow. Boomi’s cloud-native architecture ensures flexibility in handling increasing data volumes and new applications.

Faster Time-to-Market With its low-code development approach and pre-built connectors, Boomi accelerates integration deployment, reducing implementation timelines significantly.

Improved Data Accuracy & Integrity Boomi’s Master Data Hub ensures consistent and accurate data across systems, reducing errors and improving decision-making.

Cost Efficiency By eliminating the need for expensive middleware and manual data entry, businesses can significantly reduce operational costs.

Security & Compliance Boomi provides robust security features, ensuring compliance with industry standards such as GDPR, HIPAA, and SOC 2.

Aretove Technologies: Your Trusted Partner in Boomi Integration

Aretove Technologies specializes in providing customized Boomi Integration Services to help businesses harness the full potential of their IT ecosystems. Our expert team of Boomi-certified professionals offers end-to-end integration solutions tailored to your specific needs.

Our Approach

Consultation & Assessment We begin by understanding your business requirements, identifying integration challenges, and developing a strategic roadmap.

Custom Integration Design Our team designs a tailored integration architecture that aligns with your business objectives.

Implementation & Deployment Using Boomi’s powerful tools, we integrate your applications, data, and workflows efficiently and securely.

Testing & Optimization Rigorous testing is conducted to ensure seamless functionality, performance optimization, and data accuracy.

Ongoing Support & Maintenance Our support team ensures your integrations continue to run smoothly, with regular updates and performance enhancements.

Industries We Serve

At Aretove Technologies, we cater to a wide range of industries, including:

Healthcare: Ensuring secure patient data exchange and compliance with HIPAA regulations.

Retail & E-commerce: Enhancing customer experience through real-time inventory and order management integration.

Finance & Banking: Streamlining financial processes and ensuring data security.

Manufacturing: Connecting ERP and supply chain management systems for improved operational efficiency.

Education: Facilitating seamless integration of learning management systems and student databases.

Case Study: Aretove Technologies’ Success with Boomi

One of our clients, a leading e-commerce company, faced challenges in managing its inventory, order processing, and customer data across multiple platforms. Using Boomi Integration Services, Aretove Technologies helped them:

Integrate their Shopify store with ERP and CRM systems.

Automate order processing, reducing manual errors and delays.

Enhance customer experience with real-time order tracking and personalized recommendations.

As a result, the client experienced a 30% increase in operational efficiency and a 20% boost in customer satisfaction.

Conclusion

Boomi Solutions and Boomi Integration Services provide businesses with a powerful and scalable way to connect their digital ecosystem. Aretove Technologies, with its expertise in Boomi implementation, helps organizations achieve seamless connectivity, improved efficiency, and enhanced customer experiences. Whether you’re looking to integrate legacy systems, automate workflows, or ensure data consistency, our team is here to help.

If you’re ready to take your business to the next level with Boomi integration, contact Aretove Technologies today. Let us help you unlock new opportunities through seamless digital transformation.

0 notes

Link

0 notes

Text

Why Your Restaurant Needs a Modern POS ERP System in 2025

The restaurant industry is evolving rapidly, and traditional POS systems are no longer enough to keep up with increasing customer demands, operational complexities, and competitive pressures. In 2025, a modern POS ERP system is no longer a luxury—it’s a necessity.

A robust Restaurant POS ERP, like Technaureus's Restaurant POS ERP Software, helps restaurants streamline operations, reduce costs, enhance customer experience, and increase profitability. If you're still relying on outdated methods, here’s why upgrading to a modern POS ERP is the smartest move you can make this year.

1. Seamless Restaurant Management in One System

Running a restaurant involves multiple moving parts—order management, inventory tracking, employee scheduling, and financial reporting. A POS ERP integrates everything into one platform, eliminating the need for multiple software tools.

With Technaureus’s Restaurant POS ERP Software, you can: ✅ Manage orders efficiently – Handle dine-in, takeaway, and online orders from one system. ✅ Automate inventory tracking – Prevent overstocking or shortages with real-time stock updates. ✅ Monitor staff performance – Track attendance, payroll, and work shifts seamlessly. ✅ Generate financial reports – Get real-time insights into revenue, expenses, and profitability.

A well-integrated system reduces errors, saves time, and boosts efficiency, allowing restaurant owners to focus on growth.

2. Faster, Smarter, and More Personalized Customer Service

Customer expectations are higher than ever, and a slow or inefficient POS system can drive them away. A modern POS ERP enhances the dining experience with:

✔️ Quick Order Processing – Reduce wait times and eliminate billing errors. ✔️ Multiple Payment Options – Accept digital wallets, UPI, credit cards, and cash effortlessly. ✔️ Loyalty & Discounts – Personalize offers for repeat customers and encourage retention.

Technaureus's Restaurant POS ERP Software enables smooth and error-free transactions, ensuring that customers leave satisfied and return for more.

3. Real-Time Data for Smarter Decisions

One of the biggest advantages of a modern POS ERP is its ability to provide real-time data analytics. With built-in reporting tools, you can:

📊 Identify top-selling dishes and peak sales hours. 📉 Track expenses and reduce unnecessary costs. 🔍 Analyze customer preferences and adjust your menu accordingly.

With Technaureus’s intelligent analytics, you gain actionable insights, helping you make data-driven decisions that maximize revenue.

4. Inventory & Cost Control to Maximize Profits

Food wastage and inventory mismanagement are common reasons for restaurant losses. A modern POS ERP automates stock tracking and prevents unnecessary waste.

With Technaureus’s POS ERP, you can: ✔️ Get low-stock alerts before running out of essential ingredients. ✔️ Prevent over-ordering by tracking real-time inventory usage. ✔️ Monitor food waste and optimize portion control to cut costs.

Better inventory control reduces losses and increases overall profit margins.

5. Multi-Location & Cloud Access for Complete Control

For restaurants with multiple outlets or cloud kitchens, managing everything manually is inefficient. A cloud-based POS ERP, like Technaureus’s solution, offers:

🌍 Centralized control – Manage all restaurant branches from a single dashboard. 📱 Remote access – Check sales reports and inventory from any device, anytime. 🔄 Real-time sync – Ensure pricing, stock, and menus are updated across all locations.

This flexibility allows restaurant owners to stay in control, even when they’re away.

6. Security, Compliance, and Fraud Prevention

Financial security and regulatory compliance are critical in today’s digital world. A modern POS ERP ensures secure transactions and data protection with:

✔️ Automated GST & Tax Calculations – No manual errors in compliance filings. ✔️ Role-Based Access Control – Prevent unauthorized staff from accessing sensitive data. ✔️ Encrypted Transactions – Secure payment processing to prevent fraud.

Technaureus’s POS ERP solution is designed with robust security features to safeguard restaurant operations from cyber threats and compliance issues.

Final Thoughts: The Future of Restaurants is Digital

As the restaurant industry moves towards automation and data-driven management, a modern POS ERP is no longer optional—it’s essential for success in 2025. Solutions like Technaureus's Restaurant POS ERP Software help restaurants enhance efficiency, improve customer service, and boost profitability.

👉 Are you ready to take your restaurant to the next level? Explore how Technaureus’s POS ERP can transform your operations today!

🔗 Learn more here: Technaureus Restaurant POS ERP Software

0 notes

Text

A Thanksgiving to Remember: Teamwork and Solutions

Every business owner understands that certain obstacles emerge unexpectedly. One of the most trying times I have experienced as a business owner was during Thanksgiving, which is the busiest week of the year. Thanksgiving week is always hectic. Our bakery transforms into centre of activity. Our bakery becomes a hub of activity as orders for bread rolls and other festive treats come in. Matha and I put in a lot of effort during this time, energized by the joy of supporting our community. An unexpected disaster struck as we were preparing for the holiday rush.

On Monday morning, as we were about to start the bakery’s industrial mixture, it wouldn’t turn on. I initially thought it was just an electrical problem, after trying for about thirty minutes and bringing in an electrician, it was evident that motor had burned out. Without it, we couldn’t make dough, pies or bread. The timing was really bad. Customers were relying on us to supply their holiday favorites and orders were coming in. Replacing the mixer was urgent. I was overwhelmed by the cost of new motor and fast shipping; payroll was also due. Our funds were getting low, with a significant amount of money tied up in inventory for Thanksgiving orders.

Martha and I were in the backoffice, trying to find out a solution. The pressure was intense. Delaying payroll was not an option and cancelling payments would affect our reputation. Then I remembered the credit card payroll service I had just started using. The service permitted us to fund payroll via credit card and I thought it might help us through this tough situation. I checked my credit card balance and found out that there was enough fund to pay for mixer repair and payroll. In just a few minutes I made payment for the motor and set up overnight delivery. The new motor arrived, the following day and the technician installed it by noon. We quickly resumed our work and by next day our shelves were fully stocked for Thanksgiving.

I utilized the platform to guarantee that my employees were paid punctually. These individuals had put in lot of effort during the crisis, staying late and arriving early to help us meet the deadlines. Ensuring they received payments on time was important to me.

Since that time, I’ve been intentional about sharing my experience with other small business proprietors in the community. I explain to them how the payroll funding by credit card assisted me in maintaining my business during a crisis and why possessing a resource like that readily available is crucial. Emergencies are inevitable—it’s simply a part of life. However, having a strategy and the appropriate resources can truly make a significant impact.

On thanksgiving morning as Martha and I opened the bakery, I felt a deep sense of thankfulness, not only for our customers but also for our dedicated team who stands by us no matter what happens. I hope we never encounter a situation like this, but if we do I know we are prepared to handle it.

Thanksgiving showed me much about remaining cool under pressure. It revealed to me that even when stuff goes wrong, one can always find a solution. I came to see the urgent need of a backup strategy and dependable resources including the payroll service we used. Every Thanksgiving, it’s not just the pies and bread rolls that bring me joy—it’s the memory of how we united as a team and a family to tackle what seemed impossible. For that, I will always be thankful.

0 notes

Text

What You Need to Know Before Choosing HRMS Software?

Introduction

Choosing the right HRMS software is a game-changer for businesses looking to automate and improve their HR processes. Many organizations struggle with time-consuming manual tasks, payroll miscalculations, and compliance risks. The right human resource management software can eliminate these challenges, enhance employee experience, and improve overall efficiency. However, with so many options available, selecting the best solution requires careful evaluation. This guide will walk you through the key factors to consider before investing in an HRMS software in India.

Understand Your HR Needs and Requirements

Evaluate Your Current HR Processes

Before selecting an HRMS software, identify the pain points in your current system: ✔ Are payroll errors causing delays? ✔ Is attendance tracking inaccurate or difficult? ✔ Do employees struggle with accessing HR-related information?

Once you recognize these challenges, list the essential features you need, such as automated payroll processing, self-service portals, and seamless compliance management.

Consider Your Organization's Size and Growth Plans

A small business and a growing enterprise have different HR needs. When evaluating HRMS software in India, check if it can: ✔ Support your current workforce size and scale as your company grows. ✔ Handle multi-location workforce management efficiently.

Scalability is crucial to avoid costly software migration in the future.

Prioritize User Experience and Employee Adoption

The best human resource management software should be easy to use. A complex system can frustrate employees and lead to low adoption rates. Look for: ✔ A user-friendly interface that requires minimal training. ✔ Mobile compatibility for on-the-go access to HR services.

By choosing an intuitive platform, HR teams can improve engagement and productivity.

Assess the HRMS Software’s Capabilities

Core HR Management Features

A reliable HRMS software should provide essential HR functionalities, including: ✔ Employee data management – Secure storage of personal and professional records. ✔ Attendance and leave tracking – Real-time tracking of working hours and leave requests. ✔ Payroll integration – Automated salary processing to reduce errors and ensure compliance. ✔ Performance management – Tools to set goals, track progress, and provide feedback.

Talent Management Functionalities

To attract and retain the best talent, your HRMS software in India should include: ✔ Recruitment and onboarding – Simplified hiring and seamless employee onboarding. ✔ Learning and development – Training modules to enhance employee skills. ✔ Succession planning – Identifying future leaders within the company.

Analytics and Reporting

HR analytics provide valuable insights for decision-making. Look for an HRMS software that offers: ✔ Customizable reporting – Generate detailed reports on workforce trends. ✔ Data-driven insights – Optimize HR strategies using real-time analytics.

Evaluate the Implementation and Support

Implementation Process

A smooth transition to a new human resource management software is essential for efficiency. Consider: ✔ The time required for setup and data migration. ✔ Whether the vendor offers onboarding assistance and training sessions.

Ongoing Support and Maintenance

A robust support system ensures long-term success with your HRMS software. Check for: ✔ 24/7 customer support availability. ✔ Regular software updates and new feature rollouts.

Good customer support can make a huge difference in software usability and problem resolution.

Consider the Total Cost of Ownership (TCO)

Subscription or Licensing Fees

Different vendors offer varied pricing models. Understand the cost structure of HRMS software in India by: ✔ Comparing subscription fees versus one-time licensing costs. ✔ Checking for hidden charges like data storage fees.

Additional Expenses

Besides the software cost, factor in: ✔ Implementation and integration costs. ✔ Employee training and change management expenses.

Scalability and Future Costs

An HRMS software should grow with your organization. Look for: ✔ Flexible user pricing that allows you to add or remove employees as needed. ✔ Long-term affordability to prevent unexpected cost increases.

Make an Informed Decision

Selecting the right free HRMS software can transform HR operations by reducing manual efforts, improving payroll accuracy, and enhancing employee satisfaction. By considering scalability, features, user-friendliness, and cost, businesses can make a well-informed decision that aligns with their long-term goals.

#HRMS Software#Free HRMS Software#HRMS Software in India#HRMS#Human resource management software#HRMS Software for Free#HRMS Software for India

0 notes

Text

How to Select the Right Accounting Services in Dubai?

It is important to select the right accounting services in Dubai for your business needs. With the right solution provider, you can streamline financial management, enhance the accuracy and ensure complete compliance with the tax regulations.

There are several good options available in the market. choosing the right one can become challenging for your business needs. here are all the key factors that can help you go ahead with the right accounting services.

• Assess the financial management needs posed by your business. this will help you select the right accounting service. Start by understanding the business size and its complexity. You might want a basic bookkeeping service for a small business. As a larger enterprise, you might need advanced reporting and automation. Industry requirements may differ in terms of accounting needs. You may need inventory tracking in case of retail business and project accounting in case of construction. The number of invoices, bills and bank transactions you tend to process can also influence the choice of software you need. Lastly, you may want to consider the scale of your business before proceeding with the choice.

• Next, you must determine the budget while choosing crypto accounting services in Dubai. There are different versions that come with diverse features that can help you with the accounting needs. for instance the free version may possess limited features while the premium solutions come with advanced features and services. you must consider the upfront and ongoing costs for the service before proceeding with the initial purchase. You must also look a the subscription fees so that you know what you are paying for. The hidden fees is equally important while allocating the budget. You may be charged for the integrations and additional users. It is possible you need to pay for customer support. Lastly, make sure to check if you can save some money into accounting services in Dubai. you should check the returns on services.

• You should check if the accounting solutions you plan to invest in would be cloud-based or on-premises. There are services like QuickBooks and Xero that offer cloud-based services. You would get automatic updates and data backups with these services. it offers a monthly pricing and is ideal for the remote access. When you opt for on-premises software, you install the solution on the local computer. It may come with a higher upfront cost. At the end it offers a better control over data security. It is suited for businesses that prefer local storage.

• When selecting the services, you must look at the features. Prioritize the ones that can help your business. The basic features include income and expense tracking, invoicing and billing and bank reconciliation. If you want payroll processing or multi-currency support, you need advanced services. in case you need automation capabilities, you must opt for recurring invoicing and bank feeds. These features can help your business in multiple ways.

• Accounting software needs to be intuitive and easy-to-use. you should look for services that are easy to navigation and have a low learning curve. Lastly, make sure the crypto accounting services in Dubai come with a customer support.

0 notes

Text

Best Business Loan Services in Bidar, Karnataka – Fuel Your Business Growth

Why Choose the Best Business Loan Services in Bidar, Karnataka?

For businesses in Bidar, Karnataka, securing the right financial support is crucial for expansion, operational costs, and cash flow management. The best business loan services in Bidar, Karnataka offer tailored solutions to help entrepreneurs and enterprises achieve their financial goals.

How Business Loan Services Benefit Entrepreneurs in Bidar

Having access to business loans can significantly impact a company’s growth. Here’s how:

Financial Stability – Provides necessary funds to maintain smooth operations.

Business Expansion – Enables businesses to scale up operations, open new branches, or invest in new technology.

Inventory and Equipment Purchase – Helps in buying essential stock or machinery.

Working Capital Management – Assists in managing day-to-day expenses efficiently.

Competitive Edge – Allows businesses to invest in marketing and innovation.

Features of the Best Business Loan Services in Bidar, Karnataka

To be considered the best business loan services in Bidar, Karnataka, financial providers should offer:

Flexible Loan Amounts – Ranging from small-scale loans to large business investments.

Low Interest Rates – Competitive interest rates to ensure affordability.

Quick Processing and Disbursal – Hassle-free and time-efficient approval processes.

Minimal Documentation – Simple application procedures with reduced paperwork.

Customized Repayment Plans – Flexible repayment options suitable for different business needs.

Collateral-Free Loans – Options for unsecured loans based on creditworthiness.

Types of Business Loans Available in Bidar

1. Term Loans

These loans are ideal for long-term business investments such as expansion, infrastructure, or purchasing new equipment.

2. Working Capital Loans

Designed to help businesses manage their daily expenses, including payroll, rent, and inventory.

3. Machinery and Equipment Loans

For businesses looking to upgrade or buy new machinery to enhance productivity.

4. Invoice Financing

A short-term loan against unpaid invoices to improve cash flow.

5. MSME Loans

Tailored for Micro, Small, and Medium Enterprises to support their growth and sustainability.

6. Business Overdraft Facility

Allows businesses to withdraw more than their account balance, ensuring financial flexibility.

How to Choose the Best Business Loan Services in Bidar, Karnataka

1. Assess Your Business Needs

Before applying for a loan, identify the specific financial requirements of your business.

2. Compare Interest Rates and Fees

Look for providers that offer competitive interest rates and minimal processing fees.

3. Check Eligibility Criteria

Ensure you meet the required criteria such as business vintage, credit score, and revenue.

4. Evaluate Repayment Terms

Choose a lender that provides flexible repayment options that align with your business cash flow.

5. Research Customer Reviews

Reading testimonials and customer experiences can help in selecting a trustworthy financial provider.

Benefits of Availing Business Loan Services in Bidar

1. Quick Access to Funds

The best loan services ensure fast approvals and disbursal to meet urgent financial needs.

2. No Need to Dilute Equity

Unlike investors, business loans allow you to retain full ownership and control of your company.

3. Boosts Business Credit Score

Timely repayments improve your credit profile, making it easier to secure future financing.

4. Tax Benefits

Interest paid on business loans is tax-deductible, reducing the overall financial burden.

Conclusion

Finding the best business loan services in Bidar, Karnataka can help entrepreneurs and business owners achieve their financial goals with ease. Whether you need funds for expansion, working capital, or equipment purchases, selecting the right loan service provider ensures smooth financial support. Take the next step towards business growth by choosing the right loan service tailored to your needs.

0 notes

Text

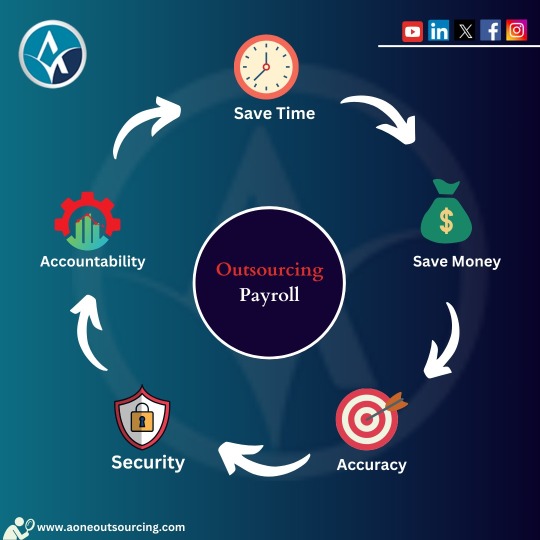

Affordable Outsourced Payroll Services in Australia: A Smart Solution for Your Business

Summary

Outsourcing payroll services in Australia is an efficient, cost-effective solution for businesses. By choosing the right provider, you can ensure compliance, save time, and reduce errors. Affordable and reliable providers are available, offering tailored solutions to meet the needs of Australian businesses.

In today’s fast-paced business world, managing payroll efficiently and cost-effectively is essential. Many Australian companies are turning to outsourced payroll services as a solution to streamline operations and reduce overhead costs. Whether you're a small business or a large corporation, outsourcing payroll can save you time, money, and reduce the risk of compliance issues. This blog will explore why outsourced payroll services in Australia are becoming a popular choice, and how they can benefit your company.

Table of Contents

What Are Outsourced Payroll Services?

Benefits of Outsourcing Payroll in Australia

How to Choose Affordable Payroll Services

Low-Cost Payroll Providers: Are They Worth It?

Top Outsourced Payroll Providers in Australia

Conclusion: Why Outsourced Payroll Is the Future of Australian Businesses

What Are Outsourced Payroll Services?

Outsourced payroll services involve hiring a third-party provider to handle all payroll-related tasks, including calculating wages, deductions, tax filings, and compliance with employment laws. This allows your business to focus on its core operations while ensuring that payroll is handled accurately and efficiently.

For many companies in Australia, outsourcing payroll is a way to save both time and money. By partnering with a trusted payroll provider, businesses can rely on experts who stay up-to-date with the latest payroll regulations and compliance requirements, ensuring that employees are paid correctly and on time.

Benefits of Outsourcing Payroll in Australia

Outsourcing payroll in Australia offers several advantages, making it a viable option for businesses of all sizes. Here are some of the key benefits:

Time-Saving

Managing payroll in-house can be time-consuming. Outsourcing payroll allows you to free up your internal resources and focus on growing your business. Your payroll provider will handle all calculations, filings, and compliance, ensuring everything is done correctly and on time.

Cost-Effective

One of the main reasons businesses opt for affordable payroll services in Australia is the cost savings. Outsourcing payroll is often more affordable than maintaining an in-house payroll department, especially when considering the costs associated with hiring and training staff.

Compliance Assurance

Staying compliant with Australian payroll laws can be a challenge due to constant changes in tax laws and employment regulations. Outsourced payroll providers in Australia are experts in the field and ensure that your business complies with all legal requirements, helping to avoid costly fines or penalties.

Reduced Risk of Errors

Manual payroll processing increases the risk of mistakes, which can lead to unhappy employees or legal issues. By outsourcing payroll, you reduce the risk of errors, as experts in payroll management handle the entire process.

How to Choose Affordable Payroll Services

When selecting an outsourced payroll provider in Australia, it’s essential to choose a provider that offers low-cost payroll services without compromising on quality. Here are some factors to consider:

Reputation: Look for a provider with a proven track record of delivering reliable and efficient payroll services. Check customer reviews and testimonials.

Technology: Ensure the provider uses up-to-date payroll software to manage payroll calculations and filings, reducing the chances of errors and delays.

Support: Good customer support is crucial. Choose a provider that offers responsive assistance whenever you need it, whether it’s to resolve an issue or answer a question.

Scalability: Your business may grow, and your payroll needs may change. Choose a provider that can scale its services to match your company’s needs.

Low-Cost Payroll Providers: Are They Worth It?

Many businesses are looking for low-cost payroll services as a way to reduce overhead costs. While affordable options are available, it’s important to ensure that the quality of service does not suffer due to the lower price.

When evaluating outsourced payroll providers in Australia, it’s essential to balance cost with the quality of service. Cheap payroll services might seem attractive initially, but they may not offer the same level of expertise, technology, and customer support as more established providers. It's always a good idea to weigh the potential risks against the savings.

Top Outsourced Payroll Providers in Australia

There are several reputable outsourced payroll providers in Australia that offer cost-effective and reliable payroll solutions for businesses of all sizes. Some of the top providers include:

Aone Outsourcing: Known for offering competitive pricing and excellent customer service. They specialize in small to medium-sized businesses, providing tailored payroll services.

PayRoll Systems: This provider offers advanced payroll software solutions, ensuring compliance with Australian tax laws and delivering efficient payroll services.

The Payroll Centre: Offering a wide range of payroll services, this provider is a trusted choice for businesses looking to outsource payroll and HR functions.

Conclusion

In conclusion, outsourced payroll services in Australia provide businesses with an opportunity to save time, reduce costs, and ensure compliance with payroll regulations. By partnering with an experienced provider, you can offload the responsibility of payroll management, allowing you to focus on your core business activities. Whether you’re looking for affordable payroll services in Australia or low-cost payroll providers, the right outsourcing partner can make a significant difference in your business operations.

Outsourcing payroll is not just about cutting costs; it’s about improving efficiency, accuracy, and overall productivity. With the right provider, you can ensure your payroll is in expert hands and avoid potential risks and errors. Start exploring your options today and see how outsourcing payroll can transform your business.

0 notes