#llp registration in chennai

Explore tagged Tumblr posts

Text

Why Choose LLP Registration in Chennai for Your Business?

A Limited Liability Partnership (LLP) is a famous business structure in India that combines the benefits of both a company and a partnership firm. It offers LLP Registration in Chennai to its partners, meaning their assets are protected in case of business debts and liabilities. LLPs are governed by the Limited Liability Partnership Act 2008 and are suitable for small and medium-sized enterprises.

https://www.kanakkupillai.com/limited-liability-partnership-chennai

0 notes

Text

How to Register an LLP in Chennai: Legal Requirements & Process

Chennai, known for its thriving business environment, offers a favourable landscape for entrepreneurs looking to establish Limited Liability Partnerships (LLPs). LLPs are a famous business structure in India, combining the advantages of a partnership with the benefits of limited liability for its partners. Here’s a detailed guide on LLP registration in Chennai.

0 notes

Text

#llpregistration#llp registration in Chennai#llp registration in Chennai online#Online llp registration in Chennai#LLP registration online in Chennai

0 notes

Text

efiletax | Solution Provider For All Your Business Needs.

#Tax Service Provider#Best Tax Service Provider#GST Service Provider#efiletax#Efiletax#Business#GST Service Provider Chennai#GST Filing#Company Registration#LLP#ROC#GST#ITR#Incometax#Filing#Finance

0 notes

Text

GST registration in India

The Goods and Services Tax make clear the significance of GST registration for the development of businesses and aids enterprises across state lines to function normally while also providing a uniform method of taxation, thereby earning customer's confidence.In addition to easing the administrative load of taxation, GST registration assists in saving costs of compliance. If you require any expert help please don’t hesitate to contact us our staff.

#Proprietorship GST Registration#E Commerce GST Registration#Partnership GST Registration#LLP GST Registration#GST Registration for General Store#GST Consultant in Chennai#GST Registration in Chennai#gst registration for proprietorship#gst services#gst chennai

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

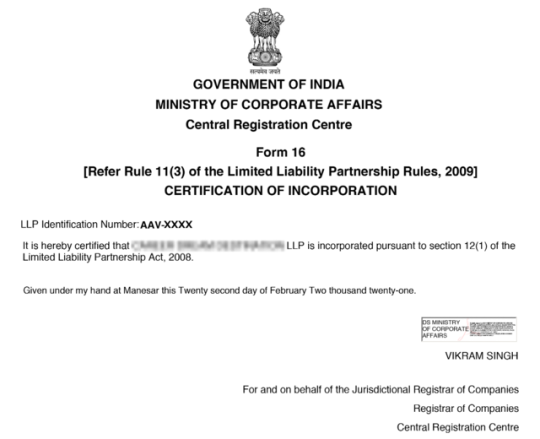

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

Get a Virtual Office in Chennai for GST in 5 Easy Steps

With the increasing demand for flexible business solutions, virtual offices have become a popular choice for startups, freelancers, and small businesses in India. Chennai, being one of the fastest-growing business hubs, has seen a significant rise in the number of businesses opting for virtual offices for GST registration.

A virtual office allows businesses to obtain a premium commercial address without the cost of leasing a physical space. This is particularly beneficial for companies looking to expand or register for GST without investing in expensive office rentals.

In this blog, we will walk you through five easy steps to get a virtual office in Chennai for GST registration, ensuring compliance with the government’s tax regulations.

Step 1: Understand the Benefits of a Virtual Office for GST Registration

Before you opt for a virtual office, it’s essential to understand how it helps with GST compliance.

Why Choose a Virtual Office for GST?

✅ Cost-Effective – Avoid expensive commercial leases and office setup costs. ✅ Legally Accepted – Recognized for GST registration in Chennai. ✅ Professional Business Address – Enhance credibility with a prime location. ✅ Mail Handling & Courier Services – Receive official documents at a dedicated location. ✅ Access to Meeting Rooms – Use fully equipped workspaces when required.

With these advantages, a virtual office is a smart and affordable choice for businesses looking to register for GST in Chennai without the hassle of renting a full-fledged office space.

Step 2: Choose a Reliable Virtual Office Provider in Chennai

The next step is to find a trustworthy virtual office provider that meets your GST registration needs. Chennai has several providers offering virtual office services, but it’s essential to choose the right one based on the following factors:

What to Look for in a Virtual Office Provider?

✔ GST-Compliant Address – Ensure the provider’s office address is valid for GST registration. ✔ Prime Business Locations – Look for offices in key business districts like T. Nagar, Anna Salai, Guindy, or OMR. ✔ Legal Documentation Support – The provider should assist with required documents for GST filing. ✔ Flexible Plans – Choose a package that includes mail handling, call answering, and meeting room access. ✔ Customer Support – A good provider should offer assistance during and after GST registration.

Top Locations for Virtual Offices in Chennai

T. Nagar – Ideal for retail and trading businesses.

Guindy – Best for manufacturing and industrial businesses.

OMR (Old Mahabalipuram Road) – Perfect for IT startups and tech companies.

Anna Salai – Central business district for corporate firms.

Velachery – Growing commercial hub with excellent connectivity.

Research and compare different virtual office providers to select the one that best suits your business needs.

Step 3: Gather Required Documents for GST Registration

Once you have selected a virtual office provider, the next step is to prepare the necessary documents for GST registration. The Government of India requires businesses to provide specific documents to verify their eligibility for GST.

Documents Required for Virtual Office GST Registration

📌 Business PAN Card – Mandatory for all GST applications. 📌 Aadhaar Card of Proprietor/Directors – Proof of identity for business owners. 📌 Business Address Proof – Virtual office agreement, NOC from the provider, and electricity bill. 📌 Incorporation Certificate (for Companies/LLPs) – Required for registered entities. 📌 Bank Account Details – Bank statement or canceled cheque for verification.

Additional Documents for Different Business Types

Sole Proprietorship – Aadhaar & PAN card of proprietor.

Partnership Firm – Partnership deed & PAN card of partners.

Private Limited Company – MOA, AOA, & Board Resolution.

Ensuring you have all these documents in place will speed up the GST registration process and prevent any delays.

Step 4: Apply for GST Registration with Your Virtual Office Address

Now that you have all the necessary documents, it’s time to apply for GST registration using your virtual office address.

How to Apply for GST Registration?

1️⃣ Visit the GST Portal – Go to www.gst.gov.in and create an account. 2️⃣ Fill GST REG-01 Form – Enter your business details, including the virtual office address. 3️⃣ Upload Required Documents – Attach all necessary documents, including the virtual office agreement. 4️⃣ Receive ARN (Application Reference Number) – Once submitted, you will get an ARN for tracking. 5️⃣ Verification by GST Officer – The GST department may ask for additional verification via email. 6️⃣ Receive GSTIN – Once approved, you will receive your GST Identification Number (GSTIN) via email.

Important Tip:

Double-check your documents before submission to avoid rejections or queries from the GST department.

Once you receive your GSTIN, you are officially registered under GST and can start issuing GST-compliant invoices using your virtual office address.

Step 5: Use Your Virtual Office for Business Growth

Now that your business has a registered GST number, you can leverage your virtual office for growth and expansion.

How to Make the Most of Your Virtual Office?

✔ Build Credibility – Use your premium Chennai address on business cards, websites, and invoices. ✔ Save Costs – Reduce expenses on rent, electricity, and office maintenance. ✔ Expand to Multiple States – If needed, get virtual offices in other cities for multi-state GST registration. ✔ Use On-Demand Meeting Spaces – Conduct professional client meetings without renting a full office. ✔ Mail & Courier Handling – Receive important business documents hassle-free.

By using a virtual office, you can establish a strong presence in Chennai’s business ecosystem without the high overhead costs of a physical office.

Final Thoughts

Getting a virtual office in Chennai for GST registration is a straightforward process that saves businesses a significant amount of money while ensuring compliance with tax laws.

By following these five easy steps, you can successfully register for GST and operate your business efficiently:

✅ Understand the benefits of a virtual office for GST ✅ Choose a reliable virtual office provider in Chennai ✅ Prepare the required documents for GST registration ✅ Apply for GST using your virtual office address ✅ Utilize your virtual office for business growth

A virtual office is an excellent solution for startups, small businesses, and remote entrepreneurs who need a cost-effective, legally compliant, and professional business address in Chennai.

Ready to get your Virtual Office in Chennai for GST registration? Start the process today and take your business to the next level! 🚀

0 notes

Text

TAN Registration Services in Chennai | PAN Registration Services in Chennai

#FinancialAndAccountingOutsourcingInChennai#FinancialProcessOutsourcingInChennai#PartTimeCFOServicesInChennai#CFOServiceInChennai#ChiefFinancialOfficerServicesInChennai#OutsourcedCFOServicesInChennai#CFOAdvisoryServiceInChennai#FractionalCFOServicesInChennai#BusinessSetupServicesInChennai#BusinessSetupConsultantsInChennai#CorporateAdvisoryAndStructuringInChennai#InternalAuditAndRiskAdvisoryInChennai#OperationalConsultingInChennai#OperationsManagementConsultantInChennai#CertifiedInternalAuditorInChennai#FinancialAuditorsInChennai#InternalAndExternalAuditInChennai#RiskBasedInternalAuditInChennai#CompanyFormationServicesInChennai#GSTAdvisoryAndComplianceServicesInChennai#TANRegistrationServicesInChennai#PANRegistrationServicesInChennai

0 notes

Text

Required Documents for Startup India Registration in Chennai

To apply for the Startup India Certificate In Chennai , you need to complete the Startup India registration process online. Here are the key documents required:

Certificate of Incorporation: Proof of your company’s registration as a Private Limited Company, LLP, or Partnership Firm.

PAN Card: The company’s Permanent Account Number for tax identification.

Business Description: A detailed write-up about your business, highlighting innovation or uniqueness.

Authorization Letter: Proof of authorization for the signatory representing the startup.

Patent or Trademark Documents: If applicable, submit IPR-related proof to strengthen your application.

Business Address Proof in Chennai :

Rental agreement (if operating on a rented premise in Chennai ) or utility bill.

NOC from the landlord (if applicable).

The Startup India registration With Udyog Suvidha Kendra making it easy for entrepreneurs to register. Once submitted, you’ll receive the Startup India Certificate, which provides benefits like tax exemptions, funding access, and support under government schemes. Ensure all documents are accurate to avoid delays.

#darpan registration online#startup india registration#startup india registration process#IN CHENNAI#CHENNAI

0 notes

Text

Why Choose LLP Registration in Chennai for Your Business?

Introduction to LLP

A Limited Liability Partnership (LLP) is a famous business structure in India that combines the benefits of a company and a partnership firm. LLP Registration in Chennai protects partners' assets against business debts and liabilities. LLPs are governed by the Limited Liability Partnership Act 2008 and are suitable for small and medium-sized enterprises.

Why Choose LLP?

Limited Liability: Partners have limited liability, protecting their assets.

Separate Legal Entity: LLPs have a separate legal identity from their partners.

Flexible Management: Partners can manage the LLP internally as per their agreement.

Less Compliance: Compared to companies, LLPs have fewer compliance requirements.

Tax Benefits: LLPs enjoy various tax advantages, including exemptions from certain taxes applicable to companies.

Steps for LLP Registration in Chennai

1. Obtain a Digital Signature Certificate (DSC)

Each designated partner of the LLP must obtain a Digital Signature Certificate (DSC), which is used to file documents online with the Ministry of Corporate Affairs (MCA).

2. Apply for Director Identification Number (DIN)

Partners must apply for a Director Identification Number (DIN) online by submitting the DIR-3 form.

3. Name Reservation

File the LLP-RUN (Reserve Unique Name) form to reserve a unique name for your LLP. Ensure the name complies with the naming guidelines provided by the MCA.

4. Incorporation of LLP

Once the name is approved, file the incorporation form FiLLiP (Form for Incorporation of Limited Liability Partnership) along with the required documents:

Address proof of the registered office

Identity and address proof of partners

Subscription sheet signed by the partners

Consent of the partners

5. LLP Agreement

Draft and file the LLP Agreement, which outlines the rights and duties of the partners, profit-sharing ratio, and other operational details. This agreement must be filed within 30 days of the incorporation.

Documents Required for LLP Registration

Partners' Documents:

PAN Card

Address proof (Aadhaar Card, Voter ID, Passport, or Driving License)

Residential proof (Bank Statement, Utility Bill)

Registered Office Documents:

Proof of address (Electricity Bill, Property Tax Receipt)

No-Objection Certificate (NOC) from the property owner if the office is rented

LLP Agreement:

Details of the rights and duties of partners

Profit-sharing ratio

Post-Registration Compliance

LLP Agreement Filing: Submit the LLP Agreement to the MCA within 30 days of incorporation.

PAN and TAN Application: Apply for PAN and TAN for the LLP.

Bank Account: Open a bank account in the name of the LLP.

Annual Filings: File Form 8 (Statement of Account & Solvency) and Form 11 (Annual Return) annually.

Income Tax Return: Depending on the audit requirement, income tax returns must be filed annually by 31 July or 30 September.

Conclusion

LLP registration in Chennai is straightforward and offers numerous advantages, including limited liability, separate legal entity status, and flexible management. Following the steps outlined above, you can make sure that you have a smooth registration process and compliance with all legal requirements.

0 notes

Text

LLP Registration Services in Chennai: What You Need to Know

LLP Registration in Chennai: A Comprehensive Guide

Chennai, known for its thriving business environment, offers a favourable landscape for entrepreneurs looking to establish Limited Liability Partnerships (LLPs). LLPs are a famous business structure in India, combining the advantages of a partnership with the benefits of limited liability for its partners. Here’s a detailed guide on LLP registration in Chennai.

What is an LLP?

A Limited Liability Partnership (LLP) is a legal entity that provides the flexibility of a partnership while limiting the liability of its partners. Unlike traditional partnerships, where partners are personally liable for the firm’s debts, an LLP restricts each partner’s liability to their contribution to the business, protecting personal assets.

Why Choose LLP in Chennai?

Ease of Formation: LLPs are relatively easier to form than private limited companies, and they have fewer compliance requirements.

Limited Liability: Protects the personal assets of partners in case of business losses or legal issues.

Separate Legal Entity: An LLP is treated as a separate legal entity from its partners, allowing it to own property, enter contracts, and sue or be sued in its name.

Tax Benefits: LLPs enjoy several tax advantages, including exemptions from Dividend Distribution Tax and Minimum Alternate Tax.

No Minimum Capital Requirement: Forming an LLP does not require a minimum capital investment, making it accessible to small businesses and startups.

Steps to Register an LLP in Chennai

Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for all designated partners of the LLP. This certificate is required for online form filing.

Apply for Director Identification Number (DIN): Each designated partner must have a DIN, which can be obtained by filing Form DIR-3.

Name Reservation: File Form LLP-RUN (Reserve Unique Name) with the Registrar of Companies (RoC) to reserve the LLP’s name. Ensure the name is unique and not identical to an existing company or LLP.

Drafting of LLP Agreement: The LLP agreement outlines the partners' rights, duties, and responsibilities. It must be drafted on stamp paper and submitted within 30 days of the LLP's incorporation.

Filing Incorporation Documents: Submit Form FiLLiP (Form for incorporation of LLP) along with necessary documents such as proof of address of the registered office, identity and address proofs of partners, and the LLP agreement.

Certificate of Incorporation: Upon verification, the RoC issues a Certificate of Incorporation confirming the LLP’s legal existence.

PAN and TAN Application: After incorporation, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

Opening Bank Account: With the Certificate of Incorporation, PAN, and other required documents, open a bank account in the LLP’s name.

Documents Required for LLP Registration

Identity and Address Proofs: PAN card, Aadhaar card, passport, voter ID, or driving license of partners.

Registered Office Proof: Rental agreement and utility bill (not older than two months) or ownership proof of the office space.

Digital Signature Certificate: For all designated partners.

Consent of Partners: All partners signed the consent form.

LLP Agreement: Duly signed by all partners.

Post-Registration Compliance

Once the LLP is registered, certain ongoing compliances must be met, including:

Annual Return Filing: LLPs must file a yearly return in Form 11 with the RoC.

Statement of Accounts and Solvency: Filing Form 8 is mandatory to report the LLP’s financial status.

Income Tax Filing: LLPs must file an income tax return annually using Form ITR-5.

Conclusion

LLP registration in Chennai is a streamlined process that offers numerous benefits to entrepreneurs, including limited liability, ease of management, and tax advantages. By following the above steps and ensuring compliance with legal requirements, you can successfully establish an LLP in Chennai, contributing to the city’s vibrant business ecosystem.

0 notes

Text

#LLP Registration in chennai#LLP Registration in chennai online#LLP Registration#Online LLP Registration in chennai#LLP Registration online in chennai#LLP Registration in Tamilnadu

0 notes

Text

From Registration to Representation: A Comprehensive Guide to Legal Services in India

Legal services in India are multifaceted, offering essential support for both individuals and businesses. From company registration to courtroom representation, the legal system provides a structured way to ensure rights are protected and obligations are fulfilled. This article explores the key stages of legal services across the country, with a special focus on legal services in Hyderabad, legal services in Bangalore, legal services in Chennai, and legal services in Surat.

The Importance of Legal Services in India

India’s legal system is one of the largest and most intricate in the world, governed by a mix of constitutional, statutory, and case laws. As regulations grow more complex, the need for professional legal services has surged. Whether it's registering a business, safeguarding intellectual property, or resolving disputes, the right legal guidance ensures compliance and protection under the law.

Key Legal Services in India: A Step-by-Step Overview

1. Business Registration Services

One of the most common legal services in India is business registration. Whether you're a startup founder or an established entrepreneur, legal registration is the first step in making your business official.

Legal services in Bangalore are known for their expertise in company registration, especially catering to the needs of the city’s dynamic startup ecosystem. Bangalore’s legal firms guide businesses through the entire process, including choosing the right business structure (Private Limited, LLP, or Sole Proprietorship) and ensuring compliance with the Ministry of Corporate Affairs.

In contrast, legal services in Hyderabad focus on helping tech-driven businesses navigate the registration process, with a strong emphasis on intellectual property protection, given the city's growing IT sector.

2. Intellectual Property (IP) Services

Protecting intellectual property (IP) is critical for any business to safeguard its innovations, trademarks, and designs. With the rise of startups and creative industries, legal services in Chennai have developed a strong reputation for offering specialized IP services. These legal firms assist businesses in registering trademarks, patents, and copyrights, ensuring that companies retain exclusive rights to their creations.

For businesses in Surat, which is known for its textile and diamond industries, legal services emphasize protecting unique designs and trade secrets. This ensures that businesses in Surat not only comply with IP laws but also prevent competitors from infringing on their rights.

3. Contracts and Agreements

One of the pillars of legal services is contract drafting and review. Contracts are the foundation of any business relationship, ensuring that parties involved understand their rights, obligations, and the consequences of breach.

In cities like Bangalore and Chennai, law firms specialize in drafting complex contracts for venture capital funding, partnerships, and mergers and acquisitions. These contracts need to meet both local and international legal standards, especially as these cities house many global companies.

In Hyderabad, law firms also offer contract management services for IT companies, focusing on technology transfer agreements, licensing, and service-level agreements (SLAs).

4. Dispute Resolution

Disputes are inevitable in both personal and business settings. However, legal services in India offer several mechanisms to resolve conflicts efficiently.

Legal services in Surat and Chennai have built a reputation for resolving commercial and real estate disputes through mediation and arbitration, which are faster and less expensive than traditional court litigation.

Similarly, Hyderabad and Bangalore have seen a rise in cases resolved through alternative dispute resolution (ADR), especially in industries like technology and manufacturing, where time-sensitive resolutions are critical.

5. Representation in Courts

For issues that cannot be resolved outside the courtroom, representation in courts becomes necessary. Skilled litigators in Bangalore and Chennai represent businesses and individuals in a wide range of matters, from corporate fraud and civil disputes to criminal cases.

In Surat and Hyderabad, lawyers focus on representing clients in business-related disputes, tax issues, and intellectual property conflicts, ensuring that justice is served through comprehensive legal representation.

Conclusion

Navigating the complexities of India's legal landscape requires not only knowledge but also the right professional guidance. From business registration to courtroom representation, legal services play a crucial role in safeguarding rights and ensuring compliance. Whether you are in Hyderabad, Bangalore, Chennai, or Surat, finding the right legal partner is key to achieving both personal and business success.

As Mahatma Gandhi once said, “Justice that love gives is a surrender, justice that law gives is a punishment.” This quote reminds us that while legal services ensure justice through law, the true power lies in fairness and integrity.

#Legal services in Surat#Legal services in bangalore#Legal services in Chennai#Legal services in Hyderabad

0 notes