#litecoin Trading Online

Explore tagged Tumblr posts

Text

Earning Money Online: How to Get Started with Cryptocurrency Trading

Cryptocurrency trading has become a popular way to earn money online. With the rise of digital currencies like Bitcoin, Ethereum, and Litecoin, more people are exploring the potential of trading cryptocurrencies for profit. If you're interested in getting started with cryptocurrency trading, here's what you need to know. Read more

#cryptocurreny trading#cryptocurrency#blockchain#Cryptocurrency investment advice#cryptocurrency trading#Bitcoin#Ethereum#Litecoin#decentralized currencies#trading strategy#cryptocurrency exchange#market trends#investment#cryptocurrency news#market movements#online income#digital currencies#blockchain technology.

2 notes

·

View notes

Text

Litecoin trading platform

Actamarkets offers a cutting-edge Litecoin trading platform, designed for traders seeking fast execution, advanced tools, and seamless experience. Join Actamarkets to maximize your Litecoin trading potential.

Visit Us : - https://actamarkets.com/account-types/

#uk#Litecoin trading platform#international brokerage company#Commodity Trading Companies#Currency Exchange Foreign Forex Trading#Low Spreads Forex Trading#Best Forex Trading Platforms#Trade Currency Online With Forex#Foreign Exchange Investment Fx#forex trading investment company#Best Platform For Forex Trading#best commodities trading#MOBUIS TRADER 7 app#best ACTA MARKETS APPS#ACTA MARKETS MT7#best MetaTrader platform#best forex trading with CFDs#BUY or SELL forex CFDs#best cryptocurrency trading platform#litecoin trading platform#best Ethereum with CFDs

0 notes

Text

Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025

In thi Article about Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025, Read it out.

What is Cryptocurrency Exchange

To purchase, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you go to an online marketplace called a cryptocurrency exchange. Cryptocurrency exchanges work much like stock exchanges, except instead of issuing or trading stocks, you trade digital currencies.

In simple terms, it’s where Buyers and sellers meet to exchange cryptocurrencies. You can buy cryptocurrency with ordinary money (such as dollars or euros) or swap one cryptocurrency for another. Some exchanges allow you to store your crypto in secure wallets held on the platform.

There are two main types:

Centralized exchanges (CEX)

Decentralized exchanges (DEX)

What is Cryptocurrency Exchange Clone Script

The Cryptocurrency Exchange Clone Script is a ready-made program that simulates the technical features and functionality of popular cryptocurrency exchanges such as Binance, Coinbase, Kraken, or Bitfinex. Compared to developing from scratch, the clone scripts significantly ease and shorten the time required to set up a cryptocurrency exchange network for an aspiring entrepreneur and firms.

These sort of scripts are somewhat equipped with all the basic features to run a cryptocurrency exchange, like user account management, wallet integration, order book, trading engine, liquidity management, and options for secure payment gateways. The whole idea of a clone script is to give you something out-of-the-box that can be customized, thus allowing you to skip the whole painful development process but still be able to modify the script to suit your needs.

Top 6 Cryptocurrency Exchange Clone Scripts

There are many clone scripts for cryptocurrency exchange development, but here are the top 6 of the cryptocurrency exchange clone script.

Binance clone script

Coinbase Clone Script

Kucoin Clone Script

Paxful Clone Script

WazirX clone script

FTX Clone Script

Binance clone script

A Binance clone script is a Pre-made software that is almost ready for use to create your own cryptocurrency exchange platform, along the way simulating Binance, one of the largest and most popular exchanges in the world. This “clone” is a reapplication of some of the features and functionality of Binance, but it can allow for some level of customization depending upon your particular brand and need.

Key Features:

User Registration and Login

Multi-Currency Support

Trading Engine

Multi-Layer Security

Admin Dashboard

Wallet Integration

KYC/AML Compliance

Liquidity Management

Mobile Compatibility

Referral and Affiliate Program

Trading Fees and Commission Management

Live Market Charts and Trading Tools

Coinbase clone script:

The Coinbase clone script is a ready-made solution that allows you to set up a cryptocurrency exchange platform exhibiting features and functionalities similar to the world’s most popular and user-friendly crypto exchange, Coinbase. These scripts are bundled with all the necessary features to run an exchange while still offering ample customization to cater to your branding and business requirements.

Key Features:

User Registration and Account Management

Fiat and Crypto Support

Secure Wallet Integration

Quick Buy/Sell Functionality

Multiple Payment Methods

P2P Trading

Admin Dashboard

Launchpad Functionality

Staking Feature

KYC/AML Compliance

API Integration

Kucoin Clone Script

A KuCoin clone script is a ready-made software solution replicating all functional attributes and operational features of the KuCoin, which can also be customized according to your brand name and business requirement specifications. Fast and feasible for launching your crypto exchange, the idea is to save yourself from the headaches of developing everything from scratch.

Key Features:

Spot trading

Margin trading

Future trading

Crypto derivatives

Advanced security transactions

Escrow protection

User registration

Wallet integration

Advanced analytics

Currency converter

Paxful clone script

A Paxful clone script is a ready-Made platform for opening a peer-to-peer cryptocurrency exchange for users to trade Bitcoin and other cryptocurrencies directly among themselves without any intermediaries. The script replicates the core features of Paxful operated using its server; you can customize it to your brand and business needs.

Key Features:

Secured Escrow Service

Multi Payment Processing

BUY/SELL Ad posting

Real-Time Data

Referrals & Gift Card options

Multi Language Support

Online/Offline Trading

Cold/Offline Wallet Support

FTX Clone Script

An FTX clone script is a ready-made software solution that will allow you to set up your own cryptocurrency exchange like FTX, which was formerly one of the largest crypto exchanges globally before going under in 2022. This script mimics the core features of FTX, such as spot trading, derivatives, margin trading, token offering, etc., so that you can fast-track the launch and operations of your own exchange with customizable branding and features.

Key Features:

Derivatives Trading

Leveraged Tokens

Spot Trading

User-Friendly Interface

KYC/AML Compliance

Staking Functionality

WazirX clone script

A WazirX Clone Script is a pre-made software solution for the creation of your cryptocurrency exchange platform akin to WazirX, one of the top cryptocurrency exchanges in India. The clone script replicating the essential elements, functionality, and WazirX’s user experience enables you to swiftly put together a fully fledged cryptocurrency exchange that would accept a number of digital assets and trading features.

Key Features:

Escrow protection

KYC approval

Trading bots

User-friendly interface

Stunning User Dashboard

SMS Integration

Multiple Payment Methods

Multiple Language Support

Benefits of Using Cryptocurrency Exchange Clone Scripts

The use of a cryptocurrency exchange cloning script entails great advantages, particularly if one is keen on starting an exchange without having to do the full development from scratch. Below, I have listed the primary advantages of using cryptocurrency exchange cloning scripts:

Cost-Effective

Quick and Profitable Launch

Proven Model

Customizable Features

Scalability

Multi-Currency and Multi-Language Support

Low Development Cost

Continuous Support and Updates

Why Choose BlockchainX for Cryptocurrency Exchange clone script

In the opinion of an entrepreneur set to develop a secure, scalable, and feature-loaded cryptocurrency exchange clone script, BlockchainX is the best bet. Since BlockchainX provides a full-fledged solution that replicates the features of flagship cryptocurrency exchanges such as Binance, Coinbase, and WazirX, the entrepreneur gets all the additional features required practically out of the box. With the addition of certain basic offerings such as spot trading, margin trading, and peer-to-peer (P2P) capabilities along with more advanced ones like liquidity management and derivatives trading, BlockchainX provides a holistic set of solutions to carve out an exchange rightly fitted for newbies and pros alike.

Conclusion:

In conclusion, the Top 6 Cryptocurrency Exchange Clone Scripts in 2025 are high-powered and feature-rich solutions which any enterprising spirit would find indispensable if they were to enter the crypto market very quickly and efficiently. Whether it be a Binance clone, Coinbase clone, or WazirX clone-these scripts offer dynamic functionalities that enhance trading engines, wallets, KYC/AML compliance, and various security attributes.

Choosing the right clone script, such as those provided by BlockchainX or other reputable providers, will give you a strong foundation for success in the dynamic world of cryptocurrency exchanges.

#cryptocurrency#cryptocurrency exchange script#exchange clone script#binance clone script#clone script development#blockchainx

2 notes

·

View notes

Note

Hey Senpai carrd creator and I would like to answer a few questions cause I JUST saw your posts.

1. Senpia is mix of the word sentient and the abbreviation (P)lural (i)internal (a)xperience (the alternative spelling of experience is inside joke between me and my friend it references like the alternative way of living as a system hence like alternative spelling I hope that made sense) It has nothing to do with the word senpai and isn't pronounced like it at all....

2. The main reason for collecting donations is to put it towards hosting a full functional website. Websites are not free you have to pay for the domain and you also have to pay for hosting (both of which are not one time payments) and the amount of storage you get varries as well as the quality. (Like you can host a site on some places cheap but the site will load really slowly ) it's not something that's required it's optional. I chose Litecoin over Bitcoin and Ethereum because Litecoin is what is considered a "stable coin" the value stays relatively the same whereas Bitcoin and Ethereum have huge value fluctuations. You can also track crypto transactions on a Blockchain explorer like https://blockchair.com/litecoin it shows you all the money in the wallet and all of the transactions , but I understand if not everyone is comfortable with it I can find something else (Also I didn't know about PayPal business I can Google it and do more research so ty : D)

3. Cryptocurrency is not inherently bad for the environment that's misinformation crypto mining is bad for the environment 🤦♀️ as it utilizes huge amounts of energy which is powered using fossil fuel. https://earthjustice.org/feature/cryptocurrency-mining-environmental-impacts and accounts for 0.3% of global emissions worldwide https://news.climate.columbia.edu/2022/12/20/failing-crypto-could-be-a-win-for-the-environment/#:~:text=This%20takes%20enormous%20amounts%20of,all%20global%20greenhouse%20gas%20emissions.

Cryptocurrency mining is it's own sort of separate "industry"

and you can't unintentionally mine crypto? It's something you have to intentionally do and often times requires complex machines to "mint" new crypto. (Remember kids there is a lot of misinformation online and if people can't provide sources for there claims always be skeptical)

Thank you for the info!

On the whole crypto thing, I don't think people are suggesting that trading Crypto directly harms the environment. I'm not super educated on the subject so people can correct me if I'm wrong, but I think the real issue is that it's still supporting the crypto-economy.

The best comparison I can think might be Diamonds. Diamond mining is also damaging to the environment. And diamonds, like Crypto, are mostly expensive because we decided they are.

When you buy a diamond, you aren't directly harming the environment but you are creating more demand. And more demand keeps diamonds expensive which keeps them profitable for the people who are harming the environment. Industries wouldn't mine Crypto if nobody used it.

As I see it, the issue is that using Crypto incentiveses harming the environment even if you aren't harming the environment yourself. It's l the economics.

Also, I'm not sure what you mean about not being able to mine Crypto unintentionally or how it factors into the conversation but Cryptojacking exists and can use people's PCs.

If I might offer a bit of constructive criticism, I think there are a lot of issues with this that might make it inaccessible and unlikely to catch on.

The fact that the term is based on an inside joke. The acronym not really feeling accurate (why is an individual headmate referred to as a Senpia if the acronym calls it a plural internal experience?) The name itself not having its origin or meaning listed on the site. The fact that anyone who Googles it will have Google assume they meant Senpai.

And I think ideally, it would have been best to try to build a community first and show your commitment before asking for money to help setup a website. If there had already been quality guides on the page before you asked for donations, people might have been more inclined to see it as a pay-what-you-want service.

#syscourse#plural#crypto#cryptocurrency#litecoin#plurality#crypto currency#endogenic#system#multiplicity#systems#plural system#endogenic system#pro endo#pro endogenic#system stuff#endo safe#actually a system

13 notes

·

View notes

Text

Cryptocurrency Exchange Definition

A cryptocurrency exchange is an online platform where individuals can buy, sell, and trade various digital currencies, such as Bitcoin, Ethereum, or Litecoin. It serves as a marketplace that facilitates the conversion of one cryptocurrency into another or into traditional fiat currencies like the US dollar or Euro.

Cryptocurrency exchanges operate similarly to traditional stock exchanges, providing a platform for buyers and sellers to interact and execute transactions. Users can create accounts, deposit funds, and place orders to buy or sell cryptocurrencies at prevailing market prices. These exchanges also offer features like order books, which display current buy and sell orders, and trading charts to help users analyze price trends and make informed decisions.

Security is a crucial aspect of cryptocurrency exchanges, as they handle large volumes of valuable digital assets. Reputable exchanges employ various security measures, including encryption, two-factor authentication, and cold storage for storing funds offline. However, it's essential for users to conduct due diligence and choose reliable exchanges that prioritize security and have a solid track record.

Cryptocurrency exchanges play a vital role in the overall cryptocurrency ecosystem, facilitating liquidity and price discovery. They provide a gateway for individuals to enter the crypto market, converting fiat currencies into cryptocurrencies and vice versa. Additionally, exchanges enable users to trade different cryptocurrencies, allowing for diversification and potential profit opportunities.

It's important to note that regulations surrounding cryptocurrency exchanges vary across jurisdictions. Some exchanges operate under strict regulatory frameworks, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements, while others operate in more lenient or unregulated environments. Users should be aware of the legal and regulatory landscape in their respective regions before engaging with cryptocurrency exchanges.

Crypto Buy Sell and Trading platform

2 notes

·

View notes

Text

QbitReview Review: Experience the Thrill of Trading on an Advanced Level

Investing in the market can be intimidating and challenging for traders of all levels. Getting stuck in the complexity and nuances of the markets is easy, and it can take years to become a successful trader. Whether a beginner or an experienced trader, QbitReview Review has something for you. From essential trading tools to advanced strategies, QbitReview develops your trading career. This QbitReview review will examine the platform's features, advantages and how to use them.

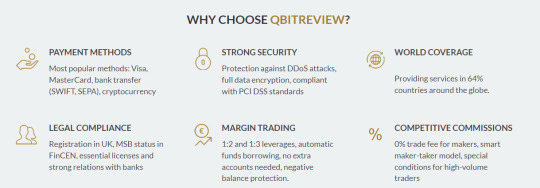

Whether you're making a purchase online to transfer funds, QbitReview has a suitable payment method for you! They offer a wide selection of payment options, including Visa, MasterCard, bank transfer (SWIFT, SEPA), and cryptocurrency. Plus, with their margin trading option, you can leverage up to 1:3, automatically borrow funds, and have negative balance protection.

QbitReview Review: Powerful Trading Tools to Maximize Success

The need for proper, up-to-date trading tools has never been greater as the cryptocurrency industry expands. QbitReview provides a suite of powerful and user-friendly trading tools to help maximize your success. Their tools include:

A market cap calculator.

A Bitcoin converter.

A Bitcoin ATM service locator.

An ICO performance tracker.

Market Cap Calculator

When it comes to trading cryptocurrencies, understanding the market cap of a particular coin is essential. The market cap of a cryptocurrency is the total market value of all the coins in circulation. To calculate the market cap of a particular cryptocurrency, you need to multiply its current price by the total number of coins. With the QbitReview Market Cap Calculator, you can quickly and easily calculate the market cap of any cryptocurrency.

Bitcoin Converter

If you want to purchase or sell Bitcoin, it is essential to have an up-to-date understanding of the current exchange rate. The QbitReview Bitcoin Converter lets you quickly and easily convert between two currencies. Whether you want to convert Bitcoin to US Dollars or Euros, their Bitcoin Converter covers you.

Bitcoin ATM Service Locator

Finding a Bitcoin ATM can be challenging, especially in a new city or country. The QbitReview Bitcoin ATM Service Locator lets you quickly and easily find a Bitcoin ATM near you. Enter your current location, and they will provide a comprehensive list of the closest Bitcoin ATMs.

ICO Performance Tracker

Initial Coin Offerings (ICOs) have become increasingly popular for funding new projects and businesses. With the QbitReview ICO Performance Tracker, you can track the performance of any given ICO. their tracker provides detailed information about the performance of each ICO, including the total funds raised, the number of tokens sold, and more.

Enjoy Flexible Payment Options – QbitReview Review

They offer a variety of payment methods to suit your needs. Their most popular payment methods include Visa, MasterCard, bank transfer (SWIFT, SEPA), and cryptocurrency.

Visa: Visa is one of the most widely accepted forms of payment, taken in over 200 countries worldwide. When you use Visa to pay, your transactions will be processed quickly.

MasterCard: MasterCard is another widely accepted payment method, accepted in more than 210 countries. With MasterCard, your transactions will be processed quickly.

Bank Transfer (SWIFT, SEPA): Bank transfer, also known as wire transfer, is one of the easiest ways to transfer funds—these are two of the most famous bank transfer methods. With SWIFT and SEPA, you can transfer funds from one bank to another in minutes.

Cryptocurrency: Cryptocurrency is a digital currency that can be used to transfer funds anonymously. QbitReview accepts various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

QbitReview Review: Advanced Reporting Features to Keep Traders Informed

World Coverage

They offer payment services in 64% of countries around the globe. With their world coverage, you can ensure that your funds will be transferred quickly, no matter where you are.

Margin Trading

They offer margin trading options with leverages of up to 1:3. With their margin trading option; you can automatically borrow funds without needing to open a separate account. Plus, you have the protection of negative balance protection, so you won't have to worry about losing more funds than you have available.

Cross-Platform Trading

With QbitReview, traders can access their accounts and trade from any device, anytime. That includes trading from the website, mobile app, WebSocket and REST API. That makes QbitReview the perfect choice for traders who want to stay connected to the market and make the most of their time. Moreover, QbitReview offers a FIX API for institutional traders needing fast market access.

Advanced Reporting

QbitReview provides a range of advanced reporting features that help traders stay informed and in control of their accounts. That includes downloadable reports and transparent fees. With such detailed reporting, traders can keep track of their investments and confidently make decisions.

High Liquidity

QbitReview offers fast order execution, and high liquidity order book access for top currency pairs. That makes it easy for traders to get in and out of the markets quickly and without paying high fees. Moreover, they also provide various trading tools and strategies to help traders optimize their trades and maximize their profits.

QbitReview Review: A Comprehensive Online Trading Platform

QbitReview is a comprehensive online trading platform designed to make trading accessible from any device. It offers simple and influential connections, allowing traders to access various analysis tools from any media. With more than 70 assets available to trade, QbitReview ensures that traders have a great selection of products. Furthermore, the platform also has a simple cash withdrawal system that makes trading easy.

Accessible from Any Device

One of the essential features of QbitReview is that it is accessible from any device. Traders can access the platform from any computer, tablet or smartphone, making it very convenient to trade anywhere and anytime. In addition, QbitReview also supports different operating systems, including Windows, iOS, and Android. That allows traders to access the platform from a wide range of devices.

Simple and Effective Connections

QbitReview also offers simple and practical connections. Traders can connect their accounts to the platform easily. In addition, the platform also allows traders to use different payment methods to make deposits and withdrawals. These features make it easy for traders to manage their accounts and transact on the platform.

Wide Range of Analysis Tools

Another great feature of QbitReview is its wide range of analysis tools. The platform provides traders various technical indicators, charting tools, and other analysis tools. That ensures traders can access the information they need to make informed trading decisions. Furthermore, the platform also provides traders with an economic calendar, which helps them stay updated with the latest market news.

More than 70 Assets Available to Trade

QbitReview also offers more than 70 assets available to trade. That includes stocks, indices, commodities, forex, and cryptocurrencies. That allows traders to have a wide selection of products to choose from. Furthermore, the platform also provides traders access to various markets, allowing them to diversify their portfolios.

A Simple Cash Withdrawal System

QbitReview also offers a simple cash withdrawal system. That makes it easy for traders to access their funds quickly. In addition, the platform also provides traders with a variety of payment methods, which makes the process of withdrawing funds even more accessible.

The Benefits of Using QbitReview's Trading Platform – QbitReview Review

There are many benefits associated with using QbitReview's trading platform, including:

Best Pricing, Execution and Liquidity: QbitReview's trading platform offers customers the best pricing, execution and liquidity. That ensures that traders can get the most out of their investments, as they can make trades quickly and at the most competitive prices.

Latest in Innovative Trading Technology: QbitReview's technology is designed to offer an intuitive and user-friendly interface, allowing traders to access and analyze markets quickly. The platform also provides advanced charting tools, such as auto-execution and backtesting, to help traders make the most informed decisions.

Explore Different Trading Instruments: QbitReview's platform offers various trading instruments, including stocks, Forex, CFDs, ETFs, etc. These instruments allow traders to diversify their portfolios and capitalize on different market opportunities.

Trade 24/7/365 with All-Year-Round Trading: QbitReview's platform allows traders to trade whenever and however they want, as the markets are open 365 days a year. That means traders can take advantage of market opportunities no matter where they are in the world.

Conclusion

QbitReview is an advanced trading platform that offers a range of features to suit traders of all levels. From cross-platform trading via website, mobile app, WebSocket and REST API to advanced reporting and high liquidity, QbitReview is designed to help traders maximize their time and resources. With QbitReview, traders can stay connected to the markets and confidently make informed decisions.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading experience. The information provided in this article may need to be more accurate and up-to-date. Any trading or financial decision you make is your sole responsibility, and you must not rely on any information provided here. We do not provide any warranties regarding the information on this website and are not responsible for any losses or damages incurred from trading or investing.

2 notes

·

View notes

Text

FXnity: The Best A-Book STP/ECN Crypto Broker for 2025

In the fast-evolving world of online trading, choosing the right broker can be the key to your trading success. FXnity has emerged as a leading choice for traders worldwide, offering 100% A-Book STP/ECN execution, 0.0 spreads, 50x leverage on crypto, and zero commissions on stock trading. In this comprehensive guide, we will break down the exceptional features that make FXnity stand out as one of the best crypto broker, forex, and commodities trading. Whether you're a novice or a seasoned trader, understanding the unique benefits of FXnity is essential to elevate your trading experience.

Why FXnity is the Ultimate A-Book STP/ECN Crypto Broker

FXnity operates on the A-Book model, which ensures that traders enjoy direct access to the market without any intervention from the broker. This model eliminates any conflict of interest, as FXnity acts as an intermediary between the trader and the liquidity providers. By choosing the STP (Straight Through Processing) and ECN (Electronic Communication Network) approach, FXnity guarantees fast execution speeds and a transparent, fair trading environment.

A-Book Model: True Market Execution

When trading with FXnity, you benefit from an A-Book model, meaning all orders are sent directly to the market, and there is no dealing desk intervention. This ensures true market execution with zero manipulation of spreads or prices, which is crucial for getting the best possible trade execution. Whether you're trading crypto or forex, the A-Book model guarantees that your trades are executed with precision and transparency.

ECN Liquidity: Fast, Reliable, and Transparent

With ECN liquidity, FXnity connects you to a pool of liquidity providers, including top-tier banks and financial institutions. The ECN model offers depth of market and low latency execution, which means you can place orders quickly and execute trades with minimal slippage. Execution speeds as low as 12ms ensure that even the most time-sensitive trades are filled at the best possible price.

Unmatched Trading Conditions with 0.0 Spreads

When it comes to trading crypto, forex, and stocks, having access to the tightest spreads is critical for maximizing profitability. FXnity offers 0.0 spreads on all its crypto pairs, ensuring that traders can enter and exit the market without worrying about high costs. These tight spreads, combined with 50x leverage, provide an optimal environment for traders looking to capitalize on price movements.

Crypto Trading with 50x Leverage: High Returns, Low Risk

FXnity provides up to 50x leverage on cryptocurrency trades, enabling you to maximize your trading capital. Leverage allows traders to control a larger position with a smaller amount of capital, giving them the potential for higher returns. However, it is important to note that leverage also comes with risks, so it is crucial to use it wisely to manage your positions effectively.

With 50x leverage on crypto, traders can increase their buying power and benefit from even small price movements. Whether you're trading Bitcoin, Ethereum, or Litecoin, the high leverage allows you to unlock greater potential profit from market fluctuations.

Zero Commission Stock Trading: Keep More of Your Profits

In addition to its crypto and forex offerings, FXnity also provides commission-free trading on stocks, making it an attractive choice for those looking to invest in global equities. FXnity charges $0 commissions on stock trades, which means you can trade popular stocks from markets like the New York Stock Exchange (NYSE), NASDAQ, and London Stock Exchange (LSE) without paying any trading fees.

Eliminating commission fees gives you the opportunity to maximize returns and keep more of your profits in your pocket. This feature is especially beneficial for day traders and swing traders who make multiple trades throughout the day and would typically incur high commission costs with other brokers.

Competitive Forex and Indices Trading with Low Commissions

FXnity offers low-cost trading on a wide range of forex pairs, indices, commodities, and other instruments. The broker charges a $2.50 per lot per side commission on forex, commodities, and indices, which is highly competitive within the industry.

Diverse Range of Trading Instruments

In addition to forex, crypto, and stocks, FXnity gives traders access to a broad selection of global indices, including S&P 500, Nasdaq 100, and FTSE 100. You can also trade in commodities such as gold, silver, and oil, making FXnity a one-stop shop for all your trading needs.

These low commissions and the wide range of instruments make FXnity an attractive choice for both diversified portfolios and hedging strategies. With such competitive fees and a full suite of trading instruments, FXnity is designed to meet the needs of both beginner traders and professional investors.

Superior Execution Speed: 12ms Latency

One of the standout features of FXnity is its execution speed, with latency as low as 12ms. This ultra-fast execution is ideal for high-frequency traders and scalpers who need to react quickly to market movements. FXnity’s low-latency environment ensures that orders are executed at the best available price, even in volatile market conditions.

With this 12ms execution speed, traders can execute their strategies without the worry of price slippage, allowing them to lock in profits and minimize risks. Additionally, FXnity’s equinix LD4 infrastructure powered by Prime Liquidity ensures that trades are processed in the most secure and reliable environment available.

Equinix LD4 Infrastructure: Reliability at Its Core

FXnity’s trading infrastructure is hosted in Equinix LD4, one of the most secure and reliable data centers in the world. This infrastructure provides ultra-low latency and unparalleled connectivity, giving traders a robust trading environment. By leveraging the best data centers, FXnity ensures that your trades are processed efficiently and securely, minimizing the risk of downtime and data breaches.

Why Traders Choose FXnity

Traders worldwide have chosen FXnity for its competitive advantages in the market. Here are a few reasons why FXnity is a preferred broker for many:

100% A-Book STP/ECN Execution: True market execution with zero manipulation.

0.0 Spreads on Crypto: Tight spreads for cost-effective trading.

50x Leverage on Crypto: Maximize trading capital and potential profits.

Zero Commission on Stocks: Trade global equities without paying commission fees.

Competitive Forex and Indices Commissions: Low commission fees for forex and commodities trading.

12ms Execution Speed: Fast and reliable trade execution, crucial for high-frequency traders.

Equinix LD4 Infrastructure: Secure, low-latency infrastructure for high performance.

Conclusion: Start Trading with FXnity Today

FXnity has built a strong reputation as a best crypto broker that offers unmatched trading conditions, transparency, and speed. With 0.0 spreads, 50x leverage on crypto, and zero commissions on stock trading, FXnity offers an attractive environment for traders of all levels. Whether you're interested in trading forex, crypto, commodities, or indices, FXnity provides you with all the tools you need to succeed in today’s competitive trading landscape.

0 notes

Text

Crypto Coin Talks: The Essential Forum for Beginners and Enthusiasts

Welcome to Crypto Coin Talks, the forum for cryptocurrency enthusiasts, traders, and blockchain developers. Whether you’re exploring Bitcoin investor forums, learning about altcoins, or engaging in discussions on the cryptocurrency forum best tailored to your needs, this platform is your ultimate resource for crypto insights and knowledge.

The world of cryptocurrency is exciting, but it can also feel a little confusing, especially if you’re just starting. Don’t worry! With the right resources, learning about cryptocurrency can be fun and simple. That’s where cryptocurrency forums for beginners and news platforms come in handy. Let’s dive in!

What Are Cryptocurrency Forums?

A cryptocurrency forum is a place where people talk about crypto coins, ask questions, and share their experiences. Beginners love these forums because they can learn directly from experts and other enthusiasts.

Why Use Forums?

Ask Questions: If you’re stuck, someone will help.

Learn Tips: Find out the best ways to buy, sell, or trade crypto coins.

Stay Updated: Get the latest cryptocurrency news and predictions.

Popular cryptocurrency forums, like CryptoCoinTalks, are great for anyone new to this world. They make learning easy and exciting!

Why Is Cryptocurrency News Important?

Keeping up with cryptocurrency news and predictions is a smart way to understand what’s happening in the crypto world. Things change quickly, and knowing the latest trends can help you make better decisions.

WHERE TO START To get started, I recommend two things:

Read as much as you can to build your knowledge. Learn about the history of Bitcoin, how it works, how people use it, and where the market has gone up and down.

Make your first investment — just a small amount, as this will help you build your knowledge quicker.

There are many ways to buy cryptocurrencies, from specific websites to exchanges. When you’re ready to start, visit Crypto Coin Talks, the go-to Bitcoin discussion board, for reliable insights, guides, and tools to assist with your first steps in the world of cryptocurrency.

WHAT IS A CRYPTOCURRENCY?

A cryptocurrency is a digital currency that is traded and transferred online. It isn’t just one thing but shares properties with other financial instruments:

Money: You can spend the currency with retailers who accept it.

Stocks/shares: The value of the coin can change, so people use it as an investment.

Gold: It can act as a reserve for long-term investments similar to gold.

There are hundreds of cryptocurrencies, some of which are growing in value and awareness and others that are potential scams or a waste of money. Coins that are not Bitcoin are called Altcoins. The most notable of these include Ripple, Dash, Litecoin, and Ethereum.

If you’re looking for a forum for cryptocurrency, cryptocurrency forums, or a Bitcoin discussion board, visit Crypto Coin Talks to explore the latest insights, trends, and discussions.

What You Can Learn From News and Predictions:

Price Changes: Know when a coin’s value goes up or down.

New Coins: Learn about the latest coins entering the market.

Expert Predictions: Find out what experts think will happen next.

For example, a prediction might tell you if Bitcoin’s price is expected to rise or fall in the coming months.

How to Get Started as a Beginner

Here’s how you can learn more about cryptocurrency using forums and news:

Join a Forum: Sign up for forums like CryptoCoinTalks to ask questions and learn.

Read News Daily: Check out trusted websites to stay updated on the latest cryptocurrency news and predictions.

Start Small: Don’t invest too much at first — just learn and grow your knowledge.

Ask for Help: Never be afraid to ask for help in forums. Everyone starts somewhere!

Why Choose CryptoCoinTalks?

At CryptoCoinTalks, we make learning about cryptocurrency easy for beginners. Whether you’re looking for cryptocurrency forums for beginners or the latest cryptocurrency news and predictions, we’ve got you covered.Conclusion

Learning about cryptocurrency doesn’t have to be hard. With forums and news platforms like CryptoCoinTalks, you’ll have all the tools you need to become a crypto expert. So, why wait? Join a forum, read the news, and start your crypto journey today!

0 notes

Text

What is cryptocurrency, and how does it work and trade in the world?

Cryptocurrency is a digital currency secured by cryptography and built on blockchain technology, a decentralized ledger that records transactions transparently. Unlike traditional money issued by governments, Cryptocurrencies are decentralized and operate without intermediaries like banks. Popular examples include Bitcoin, Ethereum, and Litecoin. Cryptocurrencies are traded globally on online platforms called exchanges, where users buy, sell, or trade them using fiat currencies or other cryptocurrencies. Prices are highly volatile, influenced by supply, demand, and market trends. Transactions are stored in digital wallets and verified through cryptographic methods, ensuring security and transparency. Cryptocurrencies enable borderless, fast, and secure financial transactions worldwide.

0 notes

Text

Online currency trading platforms

Actamarkets: Your gateway to online currency trading platforms. We offer cutting-edge tools for forex success. Our user-friendly interface makes navigating online currency trading platforms a breeze. Join thousands of traders who trust Actamarkets for their forex needs.

Visit Us : - https://actamarkets.com/trading-flatforms/

#uk#Online currency trading platforms#foreign exchange trading platforms#online forex trading platforms#forex trading download app#platforms for trading forex#popular forex trading platforms#online currency trading platforms#Actamarkets trading#actamarkets online trading#actamarkets online trading platform#actamarkets trading company#international brokerage company#Commodity Trading Companies#Currency Exchange Foreign Forex Trading#Low Spreads Forex Trading#Best Forex Trading Platforms#Trade Currency Online With Forex#Foreign Exchange Investment Fx#forex trading investment company#Best Platform For Forex Trading#best commodities trading#MOBUIS TRADER 7 app#best ACTA MARKETS APPS#ACTA MARKETS MT7#best MetaTrader platform#best forex trading with CFDs#BUY or SELL forex CFDs#best cryptocurrency trading platform#litecoin trading platform

0 notes

Text

The Complete Beginner’s Guide to Cryptocurrency

Cryptocurrency a digital or virtual form of currency that uses cryptography for security, making it nearly impossible to counterfeit or double-spend. It operates independently of a central authority, such as a government or financial institution, thanks to its decentralized nature, typically built on blockchain technology. Blockchain is a distributed ledger that records all transactions across a network of computers, ensuring transparency, security, and immutability. The most well-known cryptocurrency is Bitcoin which was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. Other popular cryptocurrencies include Ethereum, Ripple (XRP), Litecoin, and Cardano. Each cryptocurrency can serve various purposes, from acting as a store of value (like Bitcoin) to facilitating smart contracts and decentralized applications (like Ethereum).Cryptocurrencies can be traded on various digital currency exchanges, and users can store them in digital wallets, which may be online, offline, or hardware-based for added security. Cryptocurrency transactions are typically faster, cheaper, and borderless, making them increasingly popular for international money transfers, investment, and use in decentralized finance (DeFi) platforms.With the rise of blockchain technology, the cryptocurrency industry continues to evolve, offering innovative solutions for everything from banking and finance to gaming and supply chain management. However, it also faces challenges, including regulatory uncertainty, price volatility, and security risks.

1 note

·

View note

Text

How Roobet Is Changing the World of Online Gambling

In the steadily advancing universe of web based betting, not many stages have had as critical an effect as Roobet. This imaginative web-based gambling club and sportsbook stage is reshaping the business with its new way to deal with gaming, digital money reconciliation, and an emphasis on client experience. Be that as it may, how precisely is Roobet impacting the universe of web based betting?

Digital money Incorporation: A Unique advantage for the Business

Perhaps of the most remarkable way Roobet is changing web based betting is by embracing cryptographic money. While numerous internet based gambling clubs still can't seem to take on computerized monetary forms as an installment technique, Roobet remains at the front line of the crypto gaming upheaval. By tolerating famous cryptographic forms of money like Bitcoin, Ethereum, and Litecoin, Roobet furnishes players with a safe, quick, and unknown method for saving and pull out reserves.

The utilization of blockchain innovation guarantees straightforwardness, lessening the gamble of extortion and offering players inner serenity. This crypto-first methodology is especially interesting to a more youthful segment that values security and computerized development, separating Roobet from more conventional betting stages.

Imaginative Gaming Choices

Roobet isn't simply one more internet based club. A stage ceaselessly pushes the envelope as far as game contributions and client experience. With a scope of games from customary openings and blackjack to current live seller encounters, Roobet has something for everybody. Notwithstanding, its allure doesn't stop at customary games. The stage is likewise known for novel, elite games that aren't accessible elsewhere. These incorporate one of a kind dice games, crash games, and openings with higher instability, all intended to take care of both easygoing players and hot shots.

Upgraded Client Involvement in Consistent Connection point

One more significant change Roobet has brought to web based betting is its attention on client experience. The stage's smooth and current connection point makes it unquestionably simple for players to explore, whether they're new to web based betting or prepared veterans. The versatile responsive plan guarantees that players can partake in similar degree of usefulness, regardless of what gadget they use.

Besides, Roobet's point of interaction focuses on speed, with insignificant stacking times and fast exchanges. For clients, this implies a smooth and bother free betting experience beginning to end, empowering both maintenance and fulfillment.

Straightforwardness and Fair Play

Straightforwardness is one of the main elements while picking a web-based club. Roobet has incorporated highlights that permit players to follow and confirm the decency of their games. For instance, the provably fair framework, particularly in crypto-based games, guarantees that each shot in the dark or twist of the wheel is straightforward and can't be controlled. Players can confirm the haphazardness of their results, making a feeling of trust between the stage and its clients.

Worldwide Reach and Availability

While customary betting stages might be confined in specific districts because of neighborhood regulations, Roobet has figured out how to draw in a worldwide crowd. By tolerating cryptographic forms of money and bypassing customary financial frameworks, the stage is open to players from nations where internet betting might be confined. This makes the way for a more extensive, more different betting local area and permits players from around the world to partake in the stage without the issue of money trade or territorial limitations.

Member Projects and Local area Commitment

One of the critical variables in Roobet's prosperity has been its capacity to construct major areas of strength for a, local area. The stage's offshoot program has permitted players to appreciate betting as well as to benefit by elevating Roobet to other people. With high commissions and a straightforward prizes framework, Roobet boosts clients to become dynamic members in the stage's development. This feeling of local area commitment cultivates reliability, which thusly assists the stage with proceeding to grow.

Virtual Entertainment and Powerhouse Organizations

Roobet has utilized virtual entertainment and powerhouse organizations to dramatically develop its image. By working together with notable powerhouses, decorations, and content makers, Roobet has acquired areas of strength for an in the web based gaming local area. This promoting procedure has made the stage more interesting to a more youthful crowd, further hardening Roobet's place as a creative and current betting stage.

End

With its mix of cryptographic forms of money, remarkable gaming encounters, center around client experience, and a guarantee to straightforwardness and reasonableness, Roobet is certainly changing the scene of web based betting. It has not just furnished players with a safer and charming method for betting yet additionally changed the manner in which club work in the computerized age. As Roobet proceeds to develop and grow, it will be intriguing to perceive how it keeps on forming the eventual fate of web based gaming.

0 notes

Text

The LTCUSD & Black Box System Blueprint: How to Uncover Hidden Profit with an Unconventional Twist Have you ever clicked the wrong button and watched your trade take a nosedive like a kid jumping into the deep end with floaties that aren’t quite inflated? Yeah, we’ve all been there—except, instead of laughter, it’s tears. In the world of Forex trading, mistakes can be more costly than your aunt's pyramid scheme investments. But hey, that’s what this blog post is for: to give you the tools to avoid common pitfalls, dive into the often misunderstood LTCUSD market, and understand the mysterious world of black box trading systems. Buckle up—not in the cliché sense—more like in the “strapped-in-for-a-rocket-ride-to-insider-secrets” kind of way. A Funny Thing About LTCUSD: Why Most Traders Get It Wrong (And How You Can Avoid It) Ah, LTCUSD—Litecoin versus the US Dollar. It might sound like just another coin tossed into the sea of digital currencies, but that’s precisely where most traders make their first blunder. Imagine the market like a dancefloor. LTCUSD isn’t the overly eager cha-cha couple hogging the spotlight, nor is it the wallflower nervously sipping punch. It’s that one cool pair effortlessly moving to the beat, and if you know how to move with it, you can profit while others trip over themselves. One of the most common misconceptions traders have about LTCUSD is treating it just like its heavyweight cousin—Bitcoin. LTCUSD dances to a different rhythm. It follows trends, of course, but its volatility patterns are unlike BTCUSD, and savvy traders who have spotted the differences have capitalized big time. An insider secret here? LTCUSD tends to mimic Bitcoin’s movement but at a lower volume and often with a lag. Spotting this lag can give you ninja-like timing to enter and exit trades. Next time someone tells you, “Just trade Litecoin like Bitcoin, bro,” you have my permission to smile knowingly, much like when someone tells you to “Just diversify in Dogecoin.” Spoiler: It’s not that simple. Black Box Systems: When You Realize You’re Not Dealing with a Magic Wand “Black Box systems” sounds so cool, doesn’t it? Like the kind of thing James Bond would use if MI6 suddenly got into day trading. But let me burst the bubble for you—they’re no magic wand. A black box system is essentially an algorithm that determines when and where to execute trades. It’s all about formulas and historical data that produce results without revealing their inner workings. It’s that ‘friend’ who always seems to win at poker but never tells you their strategy—you’re just left assuming they have X-ray vision. But here’s the kicker: black box systems are only as good as the trader who deploys them. Remember that time you ordered a DIY bookshelf online, and when it arrived, it had instructions only written in Icelandic? A black box system can feel just like that, but in market terms. You need to know the market’s nuances to get the most out of it, or else it’s just a pretty box of tools you’ll end up misusing. Take LTCUSD—it doesn’t always respond well to black box systems optimized for high liquidity or assets with frequent institutional activity. The ‘black box’ algorithms tend to struggle with interpreting Litecoin’s relatively sporadic market interest. It’s like bringing a sports car to a 4x4 off-road trail—you need the right kind of wheels to navigate. Why Going Contrarian Is the Real ‘Next-Gen’ Trading Move So, everyone’s using automated trading systems—big whoop. Being a contrarian, that’s where the real magic lies. The market’s behavior has often proven that when the majority expects something to happen, it either doesn’t or happens in an entirely unexpected way—kind of like betting on your favorite sports team, only for them to get demolished by the underdogs (we see you, World Cup upsets!). Think about using black box systems like they’re assistants—they collect data and tell you what could work, but having human intuition on your side makes the difference. For LTCUSD, instead of blindly following a pre-defined system, a contrarian approach might involve watching the herd and doing the opposite—capitalizing on fear during a dip or taking profits when the excitement peaks. Uncovering the Hidden Patterns in LTCUSD: Black Box Secrets Unveiled LTCUSD isn’t just any crypto. Its value dynamics are tied to several factors beyond simple technical analysis—economic influences, sentiment-driven swings, even Bitcoin’s "erratic elder sibling" behavior. When everyone thinks it’s time to sell, smart traders hold and vice versa. There’s a pattern that advanced traders know—LTCUSD often sees amplified movements following Bitcoin, but the real sweet spot lies in timing these post-Bitcoin surges. Black box systems don’t always predict these moves well because they’re tuned to Bitcoin, not Litecoin’s odd timing. This is where your own experience comes into play—like catching a wave at just the right moment when surfing. Wait too long, and you wipe out. Get in early, and you’ll make the most of that ride. To put it simply: If Bitcoin’s running like a greyhound, LTCUSD is like that little terrier running just behind—same direction, different speed. Using black box systems alongside real-world insights can give you an advantage that those operating on autopilot miss. Contrarian Wisdom in a Black Box World: The Unspoken Rules No one wants to talk about it, but here it is: most people using black box systems fail because they think the system replaces the need for strategy. It doesn’t. It’s a tool—not a psychic hotline. The best contrarian traders have cracked an unwritten rule: black box systems should complement your own market understanding, not dictate it. When everyone jumps into LTCUSD because of the latest news pump, the insiders are scaling out, taking profit, and waiting for a re-entry once the hype dies down. Let others make decisions on emotion—you’re better than that. The ability to think independently—not just rely on pre-programmed rules—is what separates a good trader from a great one. Hidden Tactics for Black Box Systems in LTCUSD: The ‘Non-Algorithmic’ Edge If you're using a black box system for LTCUSD, you might already be ahead of the game—but if you’re only using that, you’re also in the same boat as everyone else. Here’s how to push that advantage to the next level: - Overlay Sentiment Analysis: Even though black box systems rely on historical price data, adding a sentiment overlay can be an unexpected twist that significantly improves results. News drives sentiment—if Twitter starts talking about Litecoin in glowing terms, anticipate a pump and act accordingly. - Watch for Whale Moves: The algorithm might not pick up large wallet activities, but you can. Track whale movements and overlay those insights on your black box system for a tactical edge. - Market Correlations: Litecoin is a cousin to Bitcoin, but it moves with different cousins too—watching how assets like Ethereum perform can often hint at incoming LTCUSD moves. Adding this additional layer of understanding to your black box system can be the secret sauce that separates your profits from the pack. Mastering the Art of LTCUSD and Black Box Systems LTCUSD might not be the flashy superstar of the crypto world, but it’s got personality. And, just like dancing, trading it successfully requires understanding its unique rhythm and having the right partner—in this case, a black box system used smartly. As with every sophisticated tool, it’s about balancing automation with your own insights, understanding when to move against the herd, and knowing when to capitalize on their mistakes. Think like a contrarian, use the right tools, and watch your trades thrive while others stumble. And hey, if you’re serious about honing that edge and stepping up your game, remember—we’ve got you covered. Dive deeper into advanced methodologies with our Forex Education at StarseedFX. Or better yet, join our exclusive StarseedFX Community to get daily insights, alerts, and live trading action—a community of traders dedicated to finding these little-known secrets. As always, keep learning, keep pushing the boundaries, and keep turning every misstep into a teachable moment. Happy trading! —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Online Trading: Revolutionizing Investment in the Digital Era

Introduction

Online trading has transformed the financial landscape, empowering individuals to invest in global markets from the comfort of their homes. With just an internet connection and a trading account, anyone can participate in the buying and selling of stocks, Forex, cryptocurrencies, and more.

What is Online Trading?

Online trading refers to the electronic buying and selling of financial instruments through digital platforms. Unlike traditional trading, which requires physical brokers, online trading platforms offer direct market access, ensuring speed, transparency, and cost-effectiveness.

Popular Markets for Online Trading

Stocks: Trade shares of publicly listed companies like Apple, Tesla, and Amazon.

Forex (Foreign Exchange): Buy and sell currency pairs, such as EUR/USD or GBP/JPY, to profit from exchange rate fluctuations.

Cryptocurrencies: Invest in digital currencies like Bitcoin, Ethereum, and Litecoin.

Commodities: Trade precious metals like gold and silver or energy resources like oil and gas.

Indices: Bet on the performance of entire markets, such as the S&P 500 or NASDAQ.

Benefits of Online Trading

Convenience: Trade anytime, anywhere, on your computer or smartphone.

Low Costs: Online brokers typically charge lower fees than traditional brokers.

Real-Time Data: Access to live market updates and advanced charting tools helps in making informed decisions.

Diverse Opportunities: From Forex to cryptocurrencies, online trading provides access to multiple markets.

How to Start Online Trading

Choose a Broker: Select a reliable online platform like eToro, TD Ameritrade, or Binance.

Open an Account: Register and verify your identity with the chosen broker.

Fund Your Account: Deposit funds using methods like bank transfers, credit cards, or e-wallets.

Learn and Practice: Use demo accounts to practice before investing real money.

Start Trading: Execute your trades based on research and analysis.

Risks of Online Trading

Market Volatility: Prices can change rapidly, leading to potential losses.

Leverage Risks: While leverage can amplify profits, it can also magnify losses.

Cybersecurity Concerns: Always use platforms with strong encryption to safeguard your funds.

Emotional Trading: Decisions driven by greed or fear can lead to financial setbacks.

Tips for Successful Online Trading

Educate Yourself: Learn about the markets you wish to trade in.

Set Goals: Define your trading objectives and risk tolerance.

Use Stop-Loss Orders: Limit potential losses by setting predetermined exit points.

Diversify: Spread your investments across different assets to reduce risk.

Conclusion

Online trading offers unparalleled opportunities for financial growth in today’s digital age. While it’s accessible and potentially profitable, success requires discipline, education, and a strategic approach. Whether you’re a beginner or an experienced investor, online trading can help you achieve your financial goals with the right mindset and tools.

0 notes

Text

How to Build an App Like Exodus Cryptocurrency Wallet?

Introduction

If you’re thinking about building a cryptocurrency wallet app like Exodus, you’re on the right track. Exodus is known for its easy-to-use design, security, and support for a variety of cryptocurrencies. To make an app like Exodus, working with a Cryptocurrency Exchange Development Company can help you bring your idea to life smoothly and securely. In this guide, we'll walk you through the key features and steps needed to build a wallet app like Exodus.

1. Key Features to Include

Exodus stands out because of its user-friendly features. To build a similar app, here’s what you’ll need:

Support for Multiple Cryptocurrencies: Make sure your wallet can store popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Built-in Exchange: Exodus lets users exchange cryptocurrencies within the app. This feature can make your app more versatile.

Private Key Control: Giving users full control over their private keys is important for security.

Portfolio Tracking: Include a feature that lets users track how their assets are performing over time.

2. Technology You Need

The right technology is essential for building a secure and reliable crypto wallet:

Blockchain Technology: You’ll need blockchain APIs to connect your wallet to different cryptocurrencies.

App Development Framework: Consider using frameworks like React Native or Flutter to make the app available on both iOS and Android.

Exchange Integration: If you want users to trade in the app, you’ll need to integrate a secure exchange platform. Working with a Cryptocurrency Exchange Development Company can make this easier.

3. Focus on Security

Security is a top priority when developing a crypto wallet. Exodus does a great job in this area. Your app should also have:

Two-Factor Authentication (2FA): This adds an extra layer of security when users log in.

Encryption: Encrypt all sensitive data, including private keys, to keep everything safe.

Cold and Hot Storage: Use cold storage (offline) for larger amounts of cryptocurrency and hot storage (online) for smaller amounts that need to be accessed frequently.

4. How to Develop the App

The process of building a crypto wallet app includes several key steps:

Research and Plan: Understand your target audience and figure out what features they need.

Design: Focus on creating a simple and clean design that’s easy for anyone to use.

Build and Test: Develop the features, then thoroughly test the app to make sure everything works securely and efficiently.

Launch and Market: Once your app is ready, promote it to attract users. You might want to team up with a Cryptocurrency Exchange Development Company for added support.

Conclusion

Creating a cryptocurrency wallet app like Exodus involves careful planning and execution. By focusing on the right features, security, and working with a Cryptocurrency Exchange Development Company, you can build a wallet that users trust and enjoy using. With the right team and approach, your app could be the next big thing in crypto wallets.

#CryptoWallet#ExodusApp#CryptoExchangeDevelopment#CryptoAppSecurity#BlockchainDevelopment#CryptoExchangeCompany

0 notes

Text

FXnity: The Best A-Book STP/ECN Crypto Broker for 2025

In the fast-evolving world of online trading, choosing the right broker can be the key to your trading success. FXnity has emerged as a leading choice for traders worldwide, offering 100% A-Book STP/ECN execution, 0.0 spreads, 50x leverage on crypto, and zero commissions on stock trading. In this comprehensive guide, we will break down the exceptional features that make FXnity stand out as one of the best crypto broker, forex, and commodities trading. Whether you're a novice or a seasoned trader, understanding the unique benefits of FXnity is essential to elevate your trading experience.

Why FXnity is the Ultimate A-Book STP/ECN Crypto Broker

FXnity operates on the A-Book model, which ensures that traders enjoy direct access to the market without any intervention from the broker. This model eliminates any conflict of interest, as FXnity acts as an intermediary between the trader and the liquidity providers. By choosing the STP (Straight Through Processing) and ECN (Electronic Communication Network) approach, FXnity guarantees fast execution speeds and a transparent, fair trading environment.

A-Book Model: True Market Execution

When trading with FXnity, you benefit from an A-Book model, meaning all orders are sent directly to the market, and there is no dealing desk intervention. This ensures true market execution with zero manipulation of spreads or prices, which is crucial for getting the best possible trade execution. Whether you're trading crypto or forex, the A-Book model guarantees that your trades are executed with precision and transparency.

ECN Liquidity: Fast, Reliable, and Transparent

With ECN liquidity, FXnity connects you to a pool of liquidity providers, including top-tier banks and financial institutions. The ECN model offers depth of market and low latency execution, which means you can place orders quickly and execute trades with minimal slippage. Execution speeds as low as 12ms ensure that even the most time-sensitive trades are filled at the best possible price.

Unmatched Trading Conditions with 0.0 Spreads

When it comes to trading crypto, forex, and stocks, having access to the tightest spreads is critical for maximizing profitability. FXnity offers 0.0 spreads on all its crypto pairs, ensuring that traders can enter and exit the market without worrying about high costs. These tight spreads, combined with 50x leverage, provide an optimal environment for traders looking to capitalize on price movements.

Crypto Trading with 50x Leverage: High Returns, Low Risk

FXnity provides up to 50x leverage on cryptocurrency trades, enabling you to maximize your trading capital. Leverage allows traders to control a larger position with a smaller amount of capital, giving them the potential for higher returns. However, it is important to note that leverage also comes with risks, so it is crucial to use it wisely to manage your positions effectively.

With 50x leverage on crypto, traders can increase their buying power and benefit from even small price movements. Whether you're trading Bitcoin, Ethereum, or Litecoin, the high leverage allows you to unlock greater potential profit from market fluctuations.

Zero Commission Stock Trading: Keep More of Your Profits

In addition to its crypto and forex offerings, FXnity also provides commission-free trading on stocks, making it an attractive choice for those looking to invest in global equities. FXnity charges $0 commissions on stock trades, which means you can trade popular stocks from markets like the New York Stock Exchange (NYSE), NASDAQ, and London Stock Exchange (LSE) without paying any trading fees.

Eliminating commission fees gives you the opportunity to maximize returns and keep more of your profits in your pocket. This feature is especially beneficial for day traders and swing traders who make multiple trades throughout the day and would typically incur high commission costs with other brokers.

Competitive Forex and Indices Trading with Low Commissions

FXnity offers low-cost trading on a wide range of forex pairs, indices, commodities, and other instruments. The broker charges a $2.50 per lot per side commission on forex, commodities, and indices, which is highly competitive within the industry.

Diverse Range of Trading Instruments

In addition to forex, crypto, and stocks, FXnity gives traders access to a broad selection of global indices, including S&P 500, Nasdaq 100, and FTSE 100. You can also trade in commodities such as gold, silver, and oil, making FXnity a one-stop shop for all your trading needs.

These low commissions and the wide range of instruments make FXnity an attractive choice for both diversified portfolios and hedging strategies. With such competitive fees and a full suite of trading instruments, FXnity is designed to meet the needs of both beginner traders and professional investors.

Superior Execution Speed: 12ms Latency

One of the standout features of FXnity is its execution speed, with latency as low as 12ms. This ultra-fast execution is ideal for high-frequency traders and scalpers who need to react quickly to market movements. FXnity’s low-latency environment ensures that orders are executed at the best available price, even in volatile market conditions.

With this 12ms execution speed, traders can execute their strategies without the worry of price slippage, allowing them to lock in profits and minimize risks. Additionally, FXnity’s equinix LD4 infrastructure powered by Prime Liquidity ensures that trades are processed in the most secure and reliable environment available.

Equinix LD4 Infrastructure: Reliability at Its Core

FXnity’s trading infrastructure is hosted in Equinix LD4, one of the most secure and reliable data centers in the world. This infrastructure provides ultra-low latency and unparalleled connectivity, giving traders a robust trading environment. By leveraging the best data centers, FXnity ensures that your trades are processed efficiently and securely, minimizing the risk of downtime and data breaches.

Why Traders Choose FXnity

Traders worldwide have chosen FXnity for its competitive advantages in the market. Here are a few reasons why FXnity is a preferred broker for many:

100% A-Book STP/ECN Execution: True market execution with zero manipulation.

0.0 Spreads on Crypto: Tight spreads for cost-effective trading.

50x Leverage on Crypto: Maximize trading capital and potential profits.

Zero Commission on Stocks: Trade global equities without paying commission fees.

Competitive Forex and Indices Commissions: Low commission fees for forex and commodities trading.

12ms Execution Speed: Fast and reliable trade execution, crucial for high-frequency traders.

Equinix LD4 Infrastructure: Secure, low-latency infrastructure for high performance.

Conclusion: Start Trading with FXnity Today

FXnity has built a strong reputation as a best crypto broker that offers unmatched trading conditions, transparency, and speed. With 0.0 spreads, 50x leverage on crypto, and zero commissions on stock trading, FXnity offers an attractive environment for traders of all levels. Whether you're interested in trading forex, crypto, commodities, or indices, FXnity provides you with all the tools you need to succeed in today’s competitive trading landscape.

0 notes