#legal document automation software

Explore tagged Tumblr posts

Text

Streamlining Legal Workflows with Document Generation Software for Law Firms: PDQ Docs

In the fast-paced world of law, efficiency and accuracy are crucial. Law firms handle a high volume of complex documents daily, including contracts, briefs, wills, and other legal papers. As such, the ability to generate accurate and professional documents quickly can significantly improve the workflow of any legal practice. This is where document generation software for law firms comes into play. PDQ Docs is a powerful solution that streamlines document creation, reduces human error, and saves valuable time, ultimately improving the productivity of legal teams.

The Need for Document Generation Software in Law Firms

Law firms face the challenge of generating a variety of documents, each requiring precise formatting and language to meet the legal standards. Manual document creation can be time-consuming, often leading to inconsistencies or errors. This is especially problematic when dealing with a large volume of cases or clients. Document generation software for law firms simplifies this process by automating repetitive tasks, allowing legal professionals to focus more on the substantive aspects of their work.

PDQ Docs addresses this challenge by providing a comprehensive platform that helps law firms generate documents with speed and accuracy. With PDQ Docs, legal teams can create templated documents that can be easily customized based on specific client or case details. This not only saves time but also ensures that the documents are consistent and meet the required legal standards.

How PDQ Docs Improves Efficiency for Law Firms

One of the main advantages of PDQ Docs is its ability to automate the document creation process. The document generation software for law firms allows them to create templates for various types of legal documents, such as contracts, pleadings, and agreements. Once a template is set up, users can quickly fill in the necessary information, and PDQ Docs will automatically generate the final document in a fraction of the time it would take to create it manually.

This automation reduces the risk of human error, as it minimizes the need for repetitive data entry and ensures that the correct information is inserted into the right sections of the document. For law firms handling high volumes of documents, this can be a game-changer in terms of accuracy and speed.

Customization and Flexibility with PDQ Docs

Another key feature of document generation software for law firms is its high level of customization. Law firms have unique needs, and the ability to tailor document templates to fit specific legal requirements is essential. PDQ Docs allows users to create and modify templates to suit the specific language, clauses, and formats required for different types of cases and clients. This flexibility ensures that each document is personalized and aligns with the firm’s standards.

Additionally, PDQ Docs is designed with user-friendly interfaces that require minimal training, making it accessible to all members of a legal team, from paralegals to senior attorneys. This ease of use ensures that legal professionals can quickly adopt the software and begin using it to enhance their document management process.

#document generation#legal document automation software#law firm document drafting#automated document creation for lawyers#legal document management tool#law firm document automation#legal document templates for firms#contract drafting software for lawyers#customizable legal documents#law firm productivity software#legal workflow automation#law firm automation tools#document generation platform for lawyers#legal software for document creation#legal document templates and automation#simplified document generation for law firms

1 note

·

View note

Text

CDA 230 bans Facebook from blocking interoperable tools

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TONIGHT (May 2) in WINNIPEG, then TOMORROW (May 3) in CALGARY, then SATURDAY (May 4) in VANCOUVER, then onto Tartu, Estonia, and beyond!

Section 230 of the Communications Decency Act is the most widely misunderstood technology law in the world, which is wild, given that it's only 26 words long!

https://www.techdirt.com/2020/06/23/hello-youve-been-referred-here-because-youre-wrong-about-section-230-communications-decency-act/

CDA 230 isn't a gift to big tech. It's literally the only reason that tech companies don't censor on anything we write that might offend some litigious creep. Without CDA 230, there'd be no #MeToo. Hell, without CDA 230, just hosting a private message board where two friends get into serious beef could expose to you an avalanche of legal liability.

CDA 230 is the only part of a much broader, wildly unconstitutional law that survived a 1996 Supreme Court challenge. We don't spend a lot of time talking about all those other parts of the CDA, but there's actually some really cool stuff left in the bill that no one's really paid attention to:

https://www.aclu.org/legal-document/supreme-court-decision-striking-down-cda

One of those little-regarded sections of CDA 230 is part (c)(2)(b), which broadly immunizes anyone who makes a tool that helps internet users block content they don't want to see.

Enter the Knight First Amendment Institute at Columbia University and their client, Ethan Zuckerman, an internet pioneer turned academic at U Mass Amherst. Knight has filed a lawsuit on Zuckerman's behalf, seeking assurance that Zuckerman (and others) can use browser automation tools to block, unfollow, and otherwise modify the feeds Facebook delivers to its users:

https://knightcolumbia.org/documents/gu63ujqj8o

If Zuckerman is successful, he will set a precedent that allows toolsmiths to provide internet users with a wide variety of automation tools that customize the information they see online. That's something that Facebook bitterly opposes.

Facebook has a long history of attacking startups and individual developers who release tools that let users customize their feed. They shut down Friendly Browser, a third-party Facebook client that blocked trackers and customized your feed:

https://www.eff.org/deeplinks/2020/11/once-again-facebook-using-privacy-sword-kill-independent-innovation

Then in in 2021, Facebook's lawyers terrorized a software developer named Louis Barclay in retaliation for a tool called "Unfollow Everything," that autopiloted your browser to click through all the laborious steps needed to unfollow all the accounts you were subscribed to, and permanently banned Unfollow Everywhere's developer, Louis Barclay:

https://slate.com/technology/2021/10/facebook-unfollow-everything-cease-desist.html

Now, Zuckerman is developing "Unfollow Everything 2.0," an even richer version of Barclay's tool.

This rich record of legal bullying gives Zuckerman and his lawyers at Knight something important: "standing" – the right to bring a case. They argue that a browser automation tool that helps you control your feeds is covered by CDA(c)(2)(b), and that Facebook can't legally threaten the developer of such a tool with liability for violating the Computer Fraud and Abuse Act, the Digital Millennium Copyright Act, or the other legal weapons it wields against this kind of "adversarial interoperability."

Writing for Wired, Knight First Amendment Institute at Columbia University speaks to a variety of experts – including my EFF colleague Sophia Cope – who broadly endorse the very clever legal tactic Zuckerman and Knight are bringing to the court.

I'm very excited about this myself. "Adversarial interop" – modding a product or service without permission from its maker – is hugely important to disenshittifying the internet and forestalling future attempts to reenshittify it. From third-party ink cartridges to compatible replacement parts for mobile devices to alternative clients and firmware to ad- and tracker-blockers, adversarial interop is how internet users defend themselves against unilateral changes to services and products they rely on:

https://www.eff.org/deeplinks/2019/10/adversarial-interoperability

Now, all that said, a court victory here won't necessarily mean that Facebook can't block interoperability tools. Facebook still has the unilateral right to terminate its users' accounts. They could kick off Zuckerman. They could kick off his lawyers from the Knight Institute. They could permanently ban any user who uses Unfollow Everything 2.0.

Obviously, that kind of nuclear option could prove very unpopular for a company that is the very definition of "too big to care." But Unfollow Everything 2.0 and the lawsuit don't exist in a vacuum. The fight against Big Tech has a lot of tactical diversity: EU regulations, antitrust investigations, state laws, tinkerers and toolsmiths like Zuckerman, and impact litigation lawyers coming up with cool legal theories.

Together, they represent a multi-front war on the very idea that four billion people should have their digital lives controlled by an unaccountable billionaire man-child whose major technological achievement was making a website where he and his creepy friends could nonconsensually rate the fuckability of their fellow Harvard undergrads.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/02/kaiju-v-kaiju/#cda-230-c-2-b

Image: D-Kuru (modified): https://commons.wikimedia.org/wiki/File:MSI_Bravo_17_(0017FK-007)-USB-C_port_large_PNr%C2%B00761.jpg

Minette Lontsie (modified): https://commons.wikimedia.org/wiki/File:Facebook_Headquarters.jpg

CC BY-SA 4.0: https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#ethan zuckerman#cda 230#interoperability#content moderation#composable moderation#unfollow everything#meta#facebook#knight first amendment initiative#u mass amherst#cfaa

246 notes

·

View notes

Text

Democrats on the House Oversight Committee fired off two dozen requests Wednesday morning pressing federal agency leaders for information about plans to install AI software throughout federal agencies amid the ongoing cuts to the government's workforce.

The barrage of inquiries follow recent reporting by WIRED and The Washington Post concerning efforts by Elon Musk’s so-called Department of Government Efficiency (DOGE) to automate tasks with a variety of proprietary AI tools and access sensitive data.

“The American people entrust the federal government with sensitive personal information related to their health, finances, and other biographical information on the basis that this information will not be disclosed or improperly used without their consent,” the requests read, “including through the use of an unapproved and unaccountable third-party AI software.”

The requests, first obtained by WIRED, are signed by Gerald Connolly, a Democratic congressman from Virginia.

The central purpose of the requests is to press the agencies into demonstrating that any potential use of AI is legal and that steps are being taken to safeguard Americans’ private data. The Democrats also want to know whether any use of AI will financially benefit Musk, who founded xAI and whose troubled electric car company, Tesla, is working to pivot toward robotics and AI. The Democrats are further concerned, Connolly says, that Musk could be using his access to sensitive government data for personal enrichment, leveraging the data to “supercharge” his own proprietary AI model, known as Grok.

In the requests, Connolly notes that federal agencies are “bound by multiple statutory requirements in their use of AI software,” pointing chiefly to the Federal Risk and Authorization Management Program, which works to standardize the government’s approach to cloud services and ensure AI-based tools are properly assessed for security risks. He also points to the Advancing American AI Act, which requires federal agencies to “prepare and maintain an inventory of the artificial intelligence use cases of the agency,” as well as “make agency inventories available to the public.”

Documents obtained by WIRED last week show that DOGE operatives have deployed a proprietary chatbot called GSAi to approximately 1,500 federal workers. The GSA oversees federal government properties and supplies information technology services to many agencies.

A memo obtained by WIRED reporters shows employees have been warned against feeding the software any controlled unclassified information. Other agencies, including the departments of Treasury and Health and Human Services, have considered using a chatbot, though not necessarily GSAi, according to documents viewed by WIRED.

WIRED has also reported that the United States Army is currently using software dubbed CamoGPT to scan its records systems for any references to diversity, equity, inclusion, and accessibility. An Army spokesperson confirmed the existence of the tool but declined to provide further information about how the Army plans to use it.

In the requests, Connolly writes that the Department of Education possesses personally identifiable information on more than 43 million people tied to federal student aid programs. “Due to the opaque and frenetic pace at which DOGE seems to be operating,” he writes, “I am deeply concerned that students’, parents’, spouses’, family members’ and all other borrowers’ sensitive information is being handled by secretive members of the DOGE team for unclear purposes and with no safeguards to prevent disclosure or improper, unethical use.” The Washington Post previously reported that DOGE had begun feeding sensitive federal data drawn from record systems at the Department of Education to analyze its spending.

Education secretary Linda McMahon said Tuesday that she was proceeding with plans to fire more than a thousand workers at the department, joining hundreds of others who accepted DOGE “buyouts” last month. The Education Department has lost nearly half of its workforce—the first step, McMahon says, in fully abolishing the agency.

“The use of AI to evaluate sensitive data is fraught with serious hazards beyond improper disclosure,” Connolly writes, warning that “inputs used and the parameters selected for analysis may be flawed, errors may be introduced through the design of the AI software, and staff may misinterpret AI recommendations, among other concerns.”

He adds: “Without clear purpose behind the use of AI, guardrails to ensure appropriate handling of data, and adequate oversight and transparency, the application of AI is dangerous and potentially violates federal law.”

12 notes

·

View notes

Note

sorry i couldn't find out how to ask on your other blog.

that book binding you posted is gorgeous btw !!

I noticed that in one of the photos you included the disclaimer that you also edited it. I just had a question about how you formatted the text.

one of my biggest gripes with AO3 is text formatting (i often feel like i'm reading a legal document vs a novel/story) . Did you change how it is formatted on AO3 compared to printed?

I feel like i'm in the 0.5% that hate AO3 formatting but i thought i might as well ask in case you have any tips for that. >,>

(also how do you decide on the page size, do you just choose a standard size for all your projects? or do you vary it depending on what you are binding?)

thanks so much for taking the time to answer and for sharing your projects :) !!!!!!!!!!!

hey anon! I have asks turned off for the sideblog, but happy to answer here. Thanks very much!

I'm taking this opportunity to info-dump and link a lot of resources. I think they're useful for people new to either typesetting or bookbinding, but not all are directly related to your queries. That said, hope this is of use!

one of my biggest gripes with AO3 is text formatting (i often feel like i'm reading a legal document vs a novel/story) . Did you change how it is formatted on AO3 compared to printed?

I do a fair bit of editing when I'm binding a fic; typesetting is often the longest part of the process. Your mileage will vary depending on your experience with using word processor software, particularly the paragraph style and page style settings. Another factor is how simple/complicated you want your typeset to look. Replicating a published novel in format is difficult but learnable for a complete beginner.

I'm not equipped to give a full tutorial on how to typeset, but I'll point you towards some useful resources for ficbinding then talk about my own process.

ArmouredSuperHeavy has a tutorial on how to make Ao3's HTML downloads into a printable book in Microsoft Word. I use LibreOffice Writer myself, so this adaptation of the same tutorial is what I follow. Both are very helpful to reference as you're learning the typesetting ropes.

Personally, I don't mess around with HTML. I find it easiest to start by doing a Ctrl+A copy of the Entire Work fic view on Ao3 then pasting that into my word processor. This video tutorial by Beautifully Bound runs through how to do this in Microsoft Word using an AO3 fic as an example, including the associated steps needed to make the fic look novel-like. This is probably the best tutorial to address your gripe with AO3 formatting. Other than that, I'd recommend looking into videos or tutorials about typesetting novels for print. Same idea, and you may get more hits than searching for fanbind/ficbind typesetting tutorials.

More under the cut! Once I start yapping, it's hard to shut me up 🤷♀️

As a point of comparison, here's one of my fics on Ao3 and the corresponding typeset side by side:

Beautifully Bound explains this in far better detail than I will, but off the top of my head, the steps involved:

making a new document and setting the default page size to whatever size I want the book's pages to be (A5 or A6 usually). You can also set the margins at this point, taking account of your printer settings.

CTRL+A and copying the entire work's text on AO3 then pasting it into the document.

removing all hyperlinks and AO3 frontmatter, things like the author tags, summary, notes, etc as well as any website text that got copied over alongside the fic.

(optional) running a spell check and ensuring grammar usage is consistent. For me that's substituting em dashes for hyphens between clauses, enforcing curly double quotation marks for dialogue, etc. LibreOffice Writer automates a lot of this with customisable settings, via Tools -> Auto-Correct. Here's also where to make sure character names are all spelled right, convert the text to or from US to UK English, etc.

picking out fonts for the body text, headers, page numbers, etc. This is where you'll want to use paragraph style settings. Page style settings also comes in clutch if, for example, you'd like different headers on alternating pages. I like having the author on the right, the fic title on the left.

setting the body text first line indent to whatever makes sense visually). This in particular helps make the fic feel more like a novel. You can also play around with line spacing and space between paragraphs at this stage. For this A6 typeset, I had a 0.75cm first line indent, 1.15 line spacing, and 0.15 spacing between paragraphs.

(optional) formatting the first line of the work to use small capitals and to add a drop caps to the first letter of the first word. Again, this is a convention in publishing which add a novel-like feeling to a printed fanwork.

Inserting page numbers, adding images, coming up with how I wanted the "copyright" page to look—optional for the most part, but these are details that make a fic appear more like a novel.

For multi-chapter works, there's extra work in formatting chapter titles as headings so that they're referenced correctly in the automatic table of contents word processors can generate.

Once you have a typeset you're happy with, and if you're considering printing and binding it as a book, then you'll need to look into how to create and print signatures. Personally, this is something I had to actually try (and mess up a bunch of times) before I got to grips with it. Understanding how both your printer and your PDF reader work, particularly printer margins and booklet print settings, is key.

I won't go into as much detail on this, but if it's something you have an interest in, I'd recommend starting with DAS Bookbinding's tutorial. DAS has tutorials for everything bookbinding related so when in doubt, check his channel! Plenty of other YouTubers also have good videos on making signatures.

This resource is extremely useful once you've got your head around how to print signatures manually, so here's a link for anyone in that space: GitHub Bookbinding Imposer. Essentially, this does the signature creation for you, removing the need for booklet print settings in your PDF reader.

also how do you decide on the page size, do you just choose a standard size for all your projects? or do you vary it depending on what you are binding?

I have access to both A4 and A5 sized paper and my printer can handle printing on either size. In bookbinding, normally two pages are printed per side of the paper (which are then folded in half as part of a signature). That is, when I print on A4 paper, it's to make an A5 sized book. Printing on A5 paper will yield an A6 sized book.

Before I begin typesetting, I'll usually know what paper I plan to use, so the typeset will be one size down from the paper. So far, I've made softcover pamphlets at A6 size and casebound books in A5. No real method of choice for me, it's whatever I feel most suits the project.

---

If you made it this far anon, thanks for reading! Here's links to a few general resources if bookbinding is something you'd like to explore more:

DAS Bookbinding (YouTube, bookbinding in all forms)

Sea Lemon DIY (YouTube, bookbinding and other crafts)

bitter melon bindery (YouTube, bookbinding, particularly beginner friendly!)

Jess Less (YouTube, demonstrations of fanbinding and re-binding existing novels)

Papercraft Panda (blog, lots of detailed tutorial on bookbinding)

Renegade Bookbinding Guild (collective and website, loads of fanbinding-specific resources from their members and they have a helpful Discord).

24 notes

·

View notes

Text

CaseFox Adds AI Document Generation & Analysis to Streamline Legal Drafting for Law Firms

CaseFox, a leading legal billing and case management software provider, has introduced powerful new AI capabilities to enhance how law firms and legal professionals handle document drafting. With the new Legal AI Document Generation and Analysis feature, users can effortlessly create essential legal documents—like NDAs—based on simple prompts, reducing time spent on repetitive tasks and ensuring consistency.

Beyond generation, CaseFox’s AI also analyzes legal documents to highlight key clauses, identify potential risks, and offer suggestions for improvement. This dual functionality enables lawyers to draft and review documents with greater speed and accuracy—without sacrificing quality.

These features are designed specifically for the legal industry, integrating seamlessly into CaseFox’s user-friendly platform. Whether you're a solo attorney or part of a large firm, the AI tools provide smart automation to boost productivity, improve compliance, and streamline workflow.

This update reflects CaseFox’s continued commitment to delivering cutting-edge, affordable, and easy-to-use legal tech. By embracing AI, CaseFox empowers legal professionals to focus more on strategy and client service—while the software handles the heavy lifting in legal drafting and analysis.

#legal ai#legal ai tools#legal ai software#legal ai drafting#nda generation#ai document generation#ai document analysis#legal ai document generation#contract generation#contract template generation#ai#ai tool#legal#law firm#lawyers#attorneys#legal office#law office

2 notes

·

View notes

Text

Top EOR Services in India – Why Brookspayroll is the Best Choice

Introduction

Expanding your business in India requires efficient workforce management, legal compliance, and payroll processing. A trusted Employer of Record (EOR) service can simplify this process by handling HR, payroll, taxation, and compliance. Brookspayroll stands out as one of the top EOR service providers in India, offering seamless solutions for global businesses looking to hire in India.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party service provider that takes legal responsibility for employing workers on behalf of a company. This allows businesses to expand into new markets without setting up a legal entity. Key services of an EOR include:

Payroll management

Compliance with labor laws

Employee benefits administration

Taxation and statutory filings

Contract management

Why Choose Brookspayroll for EOR Services in India?

Compliance with Indian Labor Laws

Brookspayroll ensures complete compliance with Indian labor laws, tax regulations, and employment standards. They manage all statutory requirements, including EPF, ESIC, Gratuity, and Professional Tax, keeping businesses legally compliant.

Seamless Payroll Processing

With Brookspayroll’s automated payroll solutions, companies can efficiently manage salary disbursement, tax deductions, and social security contributions without hassle.

Hassle-Free Employee Onboarding

Brookspayroll simplifies hiring and onboarding processes, ensuring a smooth transition for new employees. They handle contracts, documentation, and verification procedures, allowing businesses to focus on core operations.

Cost-Effective Expansion

Setting up a legal entity in India can be costly and time-consuming. With Brookspayroll’s EOR services, businesses can operate in India without incorporating a subsidiary, reducing administrative and financial burdens.

Expert Support & HR Solutions

Brookspayroll provides dedicated HR support, employee management, and consultation services, ensuring that businesses receive expert guidance throughout their operations in India.

Flexibility for Global Companies

Whether you need short-term contracts, project-based hiring, or full-time employees, Brookspayroll offers customized EOR solutions to meet diverse business needs.

How Brookspayroll Helps Businesses in India

Brookspayroll serves startups, SMEs, and multinational corporations looking to establish their presence in India. Their end-to-end workforce solutions cover all aspects of employment, ensuring compliance and efficiency.

Industries Benefiting from Brookspayroll’s EOR Services

IT & Software Development

Healthcare & Pharmaceuticals

Manufacturing & Engineering

E-commerce & Retail

Finance & Banking

Conclusion

Choosing Brookspayroll for EOR services in India ensures a compliant, cost-effective, and seamless employment experience. Their expertise in payroll management, tax compliance, and HR solutions makes them a top choice for businesses looking to hire employees in India without setting up a legal entity.

Are you ready to expand your business in India? Contact Brookspayroll today for reliable EOR services!

2 notes

·

View notes

Text

AITHEMIS: A New Way Of Enhancing Legal Practice in “AI” Way

Is AI a legal threat or a helpful tool? Is it replacing or altering the work of lawyers? You might be surprised by the response.

AI is now a quiet participant in the dance of existence. After initially being reluctant to take the initiative, it now easily guides us through its complexity. It helps us with things we used to think people could only do.

It can change the legal sector, including law firms, in-house attorneys, legal operations, and law schools.

AI is a potent instrument in the legal field that enhances rather than replaces human skill. It increases productivity and offers instant access to large databases, a document visualizer, and a case summarizer, which can help contract review in a few minutes.

But a human touch is still necessary for creativity, nuance, and comprehension of human settings. We should consider AI a friend rather than an adversary attempting to supplant humanity. Many of our problems can be solved by AI as a collaborator, which includes:

Review and Analysis of Documents Artificial intelligence (AI) technologies save time in case law research, contract analysis, and due diligence by quickly scanning hundreds of legal documents and finding relevant information.

Predictive analytics AI can predict legal outcomes by examining past cases. This allows lawyers to make better arguments and advise clients, enhancing strategy and decision- making.

Legal Studies AI tools that efficiently scan legal literature and rulings expedite research, and lawyers can focus. These technologies allow them to retrieve relevant content and concentrate on more crucial tasks quickly.

Contract Management AI-assisted contract management solutions reduce turnaround time and legal problems by accurately drafting, reviewing, and managing contracts while identifying risks and guaranteeing regulatory compliance.

Client Communication & Chatbots AI-driven chatbots respond to client questions and offer updates, enhancing client involvement and freeing legal professionals to focus on intricate case details. Therefore, AI is more likely to assist legal teams in keeping more work in-house than replacing positions. As a result, these teams can more carefully choose which tasks to outsource.

In other words, AI can free experts to concentrate on more creative and intellectually stimulating work — the kind of work that first attracted them to the legal field. One of the most significant effects of AI on the legal sector will probably be these procedures, which can benefit law firms or internal legal departments, as well as the clients and businesses they assist.

AI is having a truly remarkable and revolutionary impact on the legal industry. Law Firm AI Software and AI Case Management System tools are just two examples of how technology may modernize law businesses, promote growth, and enhance client services — it’s not just about automating work.

It is essential to have a reliable tool. The AI they employ must produce accurate and legally binding records, be based on trustworthy legal sources, and indicate where its data originates.

These are the few things to Take Into Account When Collaborating with a Trustworthy AI:

Does the AI platform for legal case summaries work well with your workflow, and is it compatible with your current legal applications?

Does it have the capability to meet legal demands, such as automated case management software?

Does the user interface guarantee that legal professionals can easily use it?

Does the supplier protect sensitive legal data by adhering to strict security and privacy standards?

Can AI be expanded to meet upcoming legal issues and technological advancements?

These factors must be considered when choosing AI for legal work. The quick adoption of AI to automate legal documents evidences a notable trend toward more precise and effective legal processes. In a time when time is of the essence, and legal difficulties are becoming more widespread, people who use and adapt to AI have a better chance of success.

The future of law is not about humans vs. AI but rather about how we can employ both to improve client service and build a more accessible and effective legal system.

With Aithemis, incorporating AI into law is not merely a trend but a revolution in law practice in the twenty-first century.

___________________________________

Follow Aithemis on these online channels.

Website: www.aithemis.ai

Blogs: www.aithemis.ai/blogs

Instagram: https://www.instagram.com/aithemis.ai

LinkedIn: https://www.linkedin.com/company/aithemis

2 notes

·

View notes

Text

Driving Business Efficiency with RPA Automation in Malaysia

In today’s fast-paced digital landscape, RPA automation Malaysia is gaining momentum across industries looking to optimize operations and reduce manual tasks. At the forefront of this transformation is CR Digital Sdn. Bhd, a trusted name in Malaysia offering cutting-edge Robotic Process Automation (RPA) solutions.

CR Digital Sdn. Bhd helps businesses automate repetitive and rule-based processes by deploying software robots that mimic human actions within digital systems. From data entry and invoice processing to workflow management and customer service automation, their RPA solutions significantly boost productivity while minimizing errors and operational costs.

By implementing intelligent RPA bots, CR Digital Sdn. Bhd empowers organizations to streamline tasks across finance, HR, logistics, and customer service departments. The result is faster execution, improved accuracy, and better compliance. The company offers customized RPA strategies tailored to specific business needs, enabling smooth integration with existing IT environments.

With a strong focus on innovation and customer satisfaction, CR Digital Sdn. Bhd ensures end-to-end RPA deployment — from consulting and development to implementation and ongoing support. Their experienced team works closely with clients to identify automation opportunities that deliver measurable impact.

Alongside automation, CR Digital Sdn. Bhd is also a leading provider of text-to-text Generative Malaysia text to text GenAI, offering powerful tools for content generation, document transformation, and natural language processing. Their GenAI technology enables businesses to convert simple input texts into high-quality, structured, and contextually accurate output in a matter of seconds.

Whether it's writing reports, summaries, customer replies, creative content, or transforming legal and technical documents, CR Digital Sdn. Bhd’s GenAI models are trained to generate human-like text that supports business efficiency and communication. This technology is particularly useful in sectors such as marketing, legal, education, finance, and customer service, where speed and accuracy in content generation are vital.

With user-friendly interfaces and secure integration options, the GenAI solutions provided by CR Digital Sdn. Bhd are designed to be scalable, customizable, and aligned with local language preferences and business workflows.

Whether you're looking for advanced RPA automation in Malaysia or exploring text-to-text GenAI to enhance your business output, CR Digital Sdn. Bhd is your reliable technology partner. With a strong commitment to innovation and tailored digital solutions, the company is helping Malaysian enterprises unlock new levels of efficiency, creativity, and growth.

1 note

·

View note

Text

Understanding Child Care Leave in India: A Legal and Compliance Perspective

In today’s evolving workplace, employee benefits and legal rights are under greater scrutiny than ever before. Among these is Child Care Leave (CCL) — a policy designed to help working parents balance professional responsibilities with personal care duties. But beyond being an HR benefit, CCL also touches deeper legal and constitutional conversations.

So, is child care leave a right or a privilege? And how should businesses in India handle it from a compliance standpoint?

What is Child Care Leave?

Child Care Leave was initially introduced to support female government employees in India, offering them time off to care for their minor children. Over time, discussions have expanded to include private sector applicability, gender neutrality, and constitutional recognition.

Legal View: Is CCL a Fundamental Right?

The courts in India have delivered mixed interpretations. Some judgments have framed child care leave as a welfare policy, not a constitutional guarantee, while others emphasize the need to treat it as part of broader labor rights.

📘 For a full legal breakdown, read: 👉 Is Child Care Leave a Constitutional Mandate or Not?

Why Employers Must Pay Attention

Regardless of its legal classification, denying or mishandling child care leave requests can result in employee dissatisfaction or even legal consequences. That’s why HR and compliance teams must implement clear, legally sound policies — and enforce them consistently.

Compliance Management in Employee Leave Policies

Managing HR-related laws manually is risky. With state-wise variations, court decisions, and policy updates, it's easy to fall behind. A compliance management system helps businesses:

Track changing labor laws

Maintain uniform policy application

Store documentation and approvals

Reduce compliance risk through alerts and automated workflows

How Compliance Software Helps

By integrating a compliance management software into HR operations, companies can:

Stay informed of legal updates affecting leave policies

Standardize how leave applications are reviewed and recorded

Generate audit-ready documentation

Avoid non-compliance penalties in labor inspections

This is especially important for organizations operating in multiple states or dealing with unionized labor forces.

Benefits Beyond Legal Safety

Managing regulatory compliance risk isn't just about avoiding trouble. When companies treat policies like CCL with transparency and structure, it boosts:

Employee trust

Workplace retention

Diversity & inclusion efforts

Brand reputation

Is Your Company Ready for Policy Compliance?

Ask yourself:

Do we apply leave policies uniformly across teams and departments?

Are we tracking compliance with court rulings and state laws?

Are we using technology to monitor HR compliance?

If the answer is “no” or “not sure,” it’s time to consider upgrading your compliance strategy.

Final Thought

Child Care Leave may not (yet) be a constitutional right, but it’s undeniably a crucial part of the modern Indian workplace. Whether you’re an HR leader, legal advisor, or compliance officer, ensuring CCL is handled correctly is both a legal and ethical responsibility.

A well-integrated compliance management system can bridge the gap between policy and practice — reducing risk, increasing transparency, and supporting a healthier workplace.

1 note

·

View note

Text

In 2025, your law firm's reputation is built on more than just legal wins—it's shaped by how smoothly and professionally you manage client experiences. That’s where law firm software like MyLegalSoftware (MyLS) steps in. From automating workflows and improving communication to preventing errors and streamlining billing, MyLS helps you deliver exceptional service that clients trust and remember. Features like client portals, follow-up automation, and centralized document management make it easier to stay organized and responsive—earning you better reviews and more referrals. Whether you're a solo practitioner or leading a growing team, MyLS empowers your firm to build a strong, lasting reputation.

1 note

·

View note

Text

Transform Your Business with RISE with SAP S4HANA Solutions

In today’s fast-paced digital world, businesses need solutions that provide agility, efficiency, and real-time data to stay ahead of the competition. One such revolutionary solution is RISE with SAP S4HANA, an intelligent enterprise resource planning (ERP) system designed to modernize business operations. Cbs Consulting, a trusted leader in SAP consulting, helps businesses leverage the full potential of RISE with SAP S4HANA and related SAP tools, ensuring streamlined operations and enhanced decision-making processes.

What is RISE with SAP S4HANA?

RISE with SAP S4HANA is an all-in-one offering that combines SAP’s industry-leading ERP software with various business transformation tools and services. This cloud-based solution allows businesses to upgrade their technology stack, integrate intelligent tools, and improve operational efficiency with minimal disruption. It offers a unified platform for finance, supply chain, sales, procurement, and more, making it the go-to solution for modern enterprises.

At the core of RISE with SAP S4HANA is the SAP S4HANA system itself, a next-gen ERP suite built on SAP's powerful HANA in-memory database. With real-time data processing and advanced analytics capabilities, companies can quickly adapt to market changes and make data-driven decisions, improving operational and financial performance.

SAP GTS: Simplifying Global Trade

For companies involved in international trade, SAP GTS (Global Trade Services) is an indispensable tool. SAP GTS helps businesses manage and automate global trade processes, from import/export documentation to compliance with international regulations. It ensures smooth customs clearance, risk management, and supply chain optimization, which are crucial for businesses expanding into new global markets. At CBS Consulting, we provide tailored solutions to implement SAP GTS, helping organizations reduce complexity and comply with international trade rules.

SAP E-invoicing: Streamlining Invoicing Processes

One of the critical challenges businesses face today is managing invoicing and ensuring timely payments. SAP E-invoicing helps streamline the invoicing process, reducing manual errors and accelerating payment cycles. With SAP’s e-invoicing solution, companies can issue electronic invoices, ensuring they comply with tax and legal regulations while reducing paper waste and administrative costs. By integrating SAP E-invoicing into your workflow, Cbs Consulting ensures that businesses enjoy seamless and efficient invoicing that enhances overall financial operations.

SAP Business Intelligence: Data-Driven Insights

Data is a goldmine for businesses, but only if they can extract actionable insights. SAP Business Intelligence (BI) helps organizations turn raw data into meaningful, actionable reports and dashboards. Whether it’s for strategic decision-making, operational improvements, or customer insights, SAP BI empowers businesses with the tools needed to unlock the full potential of their data. At CBS Consulting, we help businesses implement SAP BI solutions that deliver critical business intelligence, enabling faster, smarter decisions.

Chart of Account Harmonisation: Optimizing Financial Management

Another key aspect of financial efficiency is the Chart of Account Harmonisation. When organizations grow or enter new markets, managing multiple financial systems can become complex and inefficient. Chart of Account Harmonisation standardizes financial data structures, ensuring consistency across various accounting systems. This enables better financial reporting, regulatory compliance, and smoother integration of new acquisitions. With the expertise of CBS Consulting, companies can achieve seamless Chart of Account Harmonisation, ensuring accurate and consistent financial reporting across the business.

Conclusion: Embrace Digital Transformation with Cbs Consulting

As businesses embrace digital transformation, RISE with SAP S4HANA offers the perfect foundation for this journey. By leveraging SAP GTS, SAP E-invoicing, SAP Business Intelligence, and Chart of Account Harmonisation, companies can enhance operational efficiency, reduce risk, and make better data-driven decisions. Partnering with CBS Consulting ensures your business successfully implements these SAP solutions, optimizing processes and driving sustainable growth.

1 note

·

View note

Text

Estate Document Planning Software: Customization Options and Secure Digital Storage

Estate planning involves preparing tasks that manage an individual's financial situation in the event of his or her incapacitation or death. This planning includes the inheritance of assets to heirs, settlement of estate taxes and debts, and the guardianship of minor children and pets. Estate planning tasks include the preparation of huge amounts of documents such as a will, a trust, a power of attorney, and a health care directive. Such document generation can be time-consuming and would be prone to errors.

In the above circumstance, you need a user-friendly, seamless and efficient estate document planning software that can reduce your workload of document generation. PDQDocs is a powerful document management software designed for individuals, legal professionals, and small businesses. Whether you're drafting wills, trusts, powers of attorney, or other estate-related documents, it can streamline the process with an intuitive interface, pre-filled templates, and automated document generation.

Key Features of PDQDocs

Pre-Filled Legal Document Templates – It saves time with professionally designed templates for wills, trusts, healthcare directives, and more.

Smart Data Input Fields – You can easily enter personal and asset details, which automatically settle relevant sections of your documents.

Customization Options – It modifies standard templates to fit your unique needs while maintaining legal compliance.

Secure Digital Storage – It stores, organizes, and accesses all estate planning documents in one secure location for easy updates.

Collaboration Tools – It works seamlessly with family members, clients, or legal advisors to deliver accuracy and completeness.

Main Software Products of PDQdocs

Flexible Licensing Options

PDQDocs Software Trial – Try this software risk-free and experience the efficiency of automated document management. You have the option to get 14-day free trial.

Software v1.0 (Annual License)

Explore the full power of PDQDocs with an annual license. It can perform unlimited document generation, template management, and seamless integration with Microsoft Word (Windows required).

Why Choose PDQDocs?

Fast and Efficient

It automates repetitive tasks and generates estate documents in minutes. Equipped with robust document automation capabilities, you don’t have to spend hours manually crafting each document and simplify the creation of essential paperwork.

User-Friendly Interface

This user-friendly estate document planning software is easily navigable for both legal professionals and individuals. It generates documents in multiple output formats with real-time previews. It has a seamless workflow involving clone, renaming, editing, and sending documents effortlessly.

Centralized Document Management

Managing documents quickly becomes chaotic for businesses that are dealing with multiple clients and projects. It addresses this challenge with its centralized document management software. The users can easily manage templates, drafts, and final versions all in one place.

Specialized for Law Firms

Though PDQDocs is suitable for all small businesses, it is truly suitable for the legal sector. This software addresses the unique challenges faced by legal professionals and is tailored specifically for solo and small law firms. Its creators have designed this tool that enhance productivity while minimizing repetitive tasks.

#estate document planning software#estate planning software#will and trust software#estate document management#digital estate planning tools#legal document automation#trust and estate document generator#will creation software#estate planning document templates#power of attorney software#living trust software#estate planning automation

0 notes

Text

Everything You Need to Know About Cosmolex Accounting Software

In today’s fast-paced business world, having the right accounting software is essential for smooth financial management. CosmoLex has emerged as a leading choice for businesses, particularly in the legal and professional services industries, offering comprehensive accounting solutions tailored to specific needs.

This guide will explore why CosmoLex stands out as the best accounting software, detailing its features, benefits, and unique selling points. We will also address common questions to help you understand if CosmoLex is the right tool for your business.

What is CosmoLex?

CosmoLex is a cloud-based accounting software solution designed with professionals in mind, especially those in the legal industry, such as law firms and solo practitioners. With an all-in-one platform, CosmoLex combines essential accounting functions with specialized features that cater to the unique needs of legal professionals. Unlike traditional accounting software, CosmoLex streamlines financial management while also addressing compliance and trust accounting requirements.

With features that extend beyond basic bookkeeping, CosmoLex helps firms manage time tracking, billing, client management, and compliance, all in one integrated system. The software's easy-to-use interface and powerful functionality have made it a go-to solution for professionals looking for efficiency and accuracy in their financial operations.

Key Features of CosmoLex

1. Trust Accounting Compliance

One of CosmoLex’s standout features is its trust accounting capabilities, specifically designed to meet the strict regulations of the legal industry. Trust accounts require meticulous record-keeping to ensure that client funds are handled appropriately. CosmoLex automates the process of tracking client trust balances, generating trust account reconciliations, and ensuring compliance with local bar association rules.

2. Integrated Time Tracking and Billing

CosmoLex combines time tracking and billing into one seamless process, making it easy for law firms to log billable hours and create invoices directly from the platform. This feature helps streamline the billing process, improves accuracy, and ensures that no billable time goes unaccounted for. Whether you need to track time spent on client meetings or specific case tasks, CosmoLex offers a user-friendly interface that simplifies time tracking and invoicing.

3. Comprehensive Financial Management

Beyond its specialized tools, CosmoLex provides full-service accounting capabilities, including accounts payable/receivable management, general ledger, and financial reporting. It allows businesses to manage their financial data accurately, create financial statements, and generate customizable reports that provide insights into their financial health.

4. Automated Bank Reconciliation

CosmoLex automates the process of bank reconciliation, which is crucial for maintaining accurate financial records. By connecting your bank accounting software, transactions are automatically imported, matched, and reconciled. This reduces the manual effort needed for reconciliation and minimizes the risk of human error.

5. Client and Matter Management

CosmoLex offers integrated client and matter management tools that allow you to organize client files, manage documents, and maintain case notes within the same system. This helps legal professionals keep track of all case-related information in one place, ensuring that critical documents are easily accessible when needed.

6. Billing Customization and Payment Processing

The software supports customizable invoice templates and allows you to set payment terms and accept online payments through integrated payment gateways. This feature not only streamlines the billing process but also provides clients with convenient payment options, thereby improving cash flow for the business.

7. Compliance and Security

CosmoLex prioritizes data security with encryption, secure cloud storage, and multi-factor authentication. Compliance is also a key focus, especially for law firms that must adhere to various legal and financial regulations. The platform ensures that all data is protected and compliant with the necessary guidelines for trust accounting.

Benefits of Using CosmoLex

1. All-in-One Solution

One of the major advantages of CosmoLex is that it combines various essential tools into a single platform. This eliminates the need for separate software solutions for accounting, time tracking, billing, and client management, streamlining workflow and reducing administrative overhead.

2. Enhanced Efficiency

CosmoLex’s user-friendly design and automated features help businesses save time on routine tasks. The time tracking, billing, and reconciliation automation allow professionals to focus on their core activities rather than spend valuable time on manual bookkeeping.

3. Accurate and Transparent Reporting

With real-time financial reporting capabilities, CosmoLex helps businesses keep a clear picture of their financial status. Customized financial reports can be generated for better insights, aiding in more informed decision-making and strategic planning.

4. Improved Cash Flow

By enabling easy online payment processing and accurate invoicing, CosmoLex helps businesses improve their cash flow. Clients can pay invoices directly through integrated payment gateways, which helps speed up the collection process.

5. Legal-Specific Features

CosmoLex is specifically designed for legal professionals, so it includes features that cater to the needs of law firms that other generic accounting software might not offer. This includes trust accounting compliance, case management, and billing features tailored for legal services.

How Does CosmoLex Compare to Other Accounting Software?

1. CosmoLex vs. QuickBooks

QuickBooks is one of the most widely used accounting platforms for small to medium-sized businesses. While it offers strong accounting capabilities, it does not provide specialized features tailored for legal professionals, such as trust accounting compliance and integrated client matter management. CosmoLex excels in this area by combining industry-specific tools with general accounting features.

2. CosmoLex vs. Clio

Clio is a popular practice management software for law firms that includes billing, case management, and document storage. However, while Clio does provide some financial features, it lacks full-service accounting capabilities such as automated bank reconciliation and comprehensive financial reporting that CosmoLex offers. CosmoLex integrates these features into one platform, making it an all-in-one solution.

3. CosmoLex vs. Xero

Xero is a well-known accounting software designed for a broad range of businesses. While it offers great financial management tools, it lacks the legal-specific features that CosmoLex has, such as trust accounting compliance and client matter management. For law firms needing specialized accounting and practice management, CosmoLex is the more comprehensive option.

Pros and Cons of Using CosmoLex

Pros:

All-in-One Platform: Combines accounting, time tracking, and client management.

Trust Accounting Compliance: Ideal for law firms that need to manage client trust accounts.

User-Friendly Interface: Easy to navigate, even for those without an accounting background.

Seamless Integration: Works well with payment gateways and other third-party tools.

Automated Features: Time-saving automation for bank reconciliation, billing, and reporting.

Cons:

Cost: CosmoLex can be more expensive compared to simpler, non-specialized accounting software.

Learning Curve: While the interface is user-friendly, new users may still need time to familiarize themselves with all the features.

Not Ideal for Non-Legal Firms: The software is best suited for law firms and may not provide enough value for businesses in other industries.

Final Thoughts

CosmoLex has established itself as one of the best accounting software solutions for legal professionals due to its comprehensive, all-in-one approach. From trust accounting compliance to integrated time tracking and billing, CosmoLex provides the tools needed to manage the financial and operational aspects of a law firm effectively. While it may come at a higher cost compared to simpler accounting software, its specialized features and time-saving automation make it a worthwhile investment for law firms and professional service providers. By choosing CosmoLex, businesses can enhance efficiency, ensure compliance, and focus on delivering excellent services to their clients.

FAQs

What Industries Benefit the most from CosmoLex?

CosmoLex is designed primarily for legal professionals and firms. It is best suited for law firms, solo practitioners, and accounting firms that handle legal trust accounting and billing.

How does CosmoLex Handle Data Security?

CosmoLex employs strong data security measures such as encryption, cloud storage, and multi-factor authentication to protect user data and ensure compliance with industry regulations.

Can I try CosmoLex before Purchasing?

Yes, CosmoLex offers a free trial for potential customers to test out the platform and determine if it fits their business needs.

Does CosmoLex Integrate with other Software?

CosmoLex integrates with popular tools and platforms like Xero, QuickBooks, and payment gateways, ensuring a seamless workflow for users who may need to use additional software for their operations.

Is CosmoLex Suitable for Solo Practitioners?

Yes, #CosmoLex is an excellent choice for solo practitioners who need a comprehensive accounting and practice management solution. Its user-friendly design and specialized features make it ideal for professionals who manage their own practices.

2 notes

·

View notes

Text

April 15 Tax Deadline Approaching? Here’s How to Prepare and File on Time

As the April 15 tax deadline approaches, CPAs, EAs, and accounting firms must ensure their clients are well-prepared for a smooth and timely filing process. With tax laws constantly evolving and last-minute filings increasing the risk of errors, having a structured approach can help prevent unnecessary penalties and ensure compliance.

To assist in this critical period, here are key strategies to prepare and file tax returns efficiently while optimizing deductions and mitigating common errors.

1. Gather Essential Documents Early

One of the primary reasons for tax return delays is missing documentation. Encourage clients to compile the necessary forms, including:

Income Statements: W-2s for employees, 1099s for independent contractors, and other income-related documents.

Expense Records: Receipts for deductible business expenses, home office costs, medical expenses, and charitable contributions.

Previous Tax Returns: Reviewing past filings ensures consistency and helps identify potential deductions or credits.

Investment and Retirement Contributions: 1099-INT, 1099-DIV, and Form 5498 for IRA contributions.

Having these documents ready early streamlines the filing process, reducing the likelihood of last-minute stress.

2. Leverage E-Filing for Speed and Accuracy

Encourage clients to opt for electronic filing (e-filing), which offers several advantages:

Reduces Errors: E-filing software performs automated calculations, minimizing the risk of human errors.

Provides Immediate Confirmation: Clients receive instant acknowledgment that their tax return has been submitted.

Faster Refunds: The IRS processes electronically filed return more quickly, especially if direct deposit is chosen.

The IRS provides Free File for taxpayers earning $84,000 or less, enabling them to e-file at no cost.

3. Verify Personal and Financial Information

Even minor errors can lead to tax return rejections or processing delays. Double-check:

Social Security numbers for accuracy.

Legal names matching IRS and Social Security Administration records.

Bank details for direct deposit refunds.

Mistakes in these areas can delay refunds or result in notices from the IRS.

Read also:

Tax Planning for Individuals: The Proven Guide for 2025

4. Maximize Deductions and Credits

Help clients minimize their tax liability by ensuring they take full advantage of available deductions and credits:

Business Deductions: Home office expenses, business travel, professional development costs, and software subscriptions.

Education Credits: American Opportunity Credit and Lifetime Learning Credit for eligible education expenses.

Retirement Contributions: Maximizing IRA and 401(k) contributions can lower taxable income.

Health Savings Account (HSA) Contributions: Tax-deductible contributions can reduce taxable income.

Accurate record-keeping and documentation are essential to substantiate these claims in case of an IRS audit.

5. Avoid Common Filing Mistakes

Mistakes can result in audits, penalties, or delayed refunds. The most frequent errors include:

Math miscalculations or incorrect figures.

Incorrect filing status (e.g., filing as “Single” instead of “Head of Household” when eligible).

Failing to sign and date paper returns (electronic filings require a PIN instead).

Using professional tax software or consulting with a tax expert significantly reduces the likelihood of errors.

Read also:

Get Ready for Tax Season: Your Complete Preparation Checklist

6. Consider Filing an Extension if Needed

If a client cannot file their return by April 15, filing an extension can provide additional time to prepare:

Submit Form 4868: This application grants an automatic six-month extension until October 15.

Understand Tax Payments: An extension to files does not mean an extension to pay. Any taxes owed should be estimated and paid by April 15 to avoid interest and penalties.

While extensions offer flexibility, filing sooner helps clients avoid last-minute stress and potential IRS scrutiny.

7. Stay Informed About IRS Resources and Tax Law Changes

The IRS offers valuable resources to help taxpayers file accurately:

Interactive Tax Assistant for answering common tax law questions.

"Where’s My Refund?" tracking tool to monitor refund status.

Special assistance, including extended hours at select locations, to support last-minute filers (IRS newsroom).

Additionally, staying updated on recent tax changes ensures compliance and maximizes tax-saving opportunities.

8. Be Cautious of Tax Scams

With the rise of digital fraud, warn clients about common tax scams:

Phishing Emails and Phone Calls: The IRS does not initiate contact via email, text, or social media to request financial details.

Fake IRS Representatives: Scammers impersonate IRS agents to demand immediate payments. Always verify directly through the official IRS website.

Identity Theft: Encourage clients to use secure passwords and enable multi-factor authentication when accessing tax filing software.

Staying vigilant helps clients protect their financial data and prevent fraud.

9. Manage Tax Payments Wisely

For clients who owe taxes, planning for payments is essential:

Electronic Payment Options: IRS Direct Pay and Electronic Federal Tax Payment System (EFTPS) allow secure, instant payments.

Installment Agreements: If unable to pay in full, setting up a payment plan with the IRS can prevent further penalties.

Estimated Tax Payments: Self-employed individuals should make quarterly estimated payments to avoid underpayment penalties.

Proper tax planning reduces financial strain and ensures compliance.

Read also:

Relaxation Returns: How to Unwind After the Tax Season

10. Maintain Proper Records for Future Reference

Encourage clients to retain copies of tax returns and support documents for at least three years:

Helps resolve discrepancies with the IRS if questions arise.

Provides documentation for financial planning and loan applications.

Serves as a reference for next year’s filing.

Organized record-keeping simplifies future tax filings and ensures compliance with audit requirements.

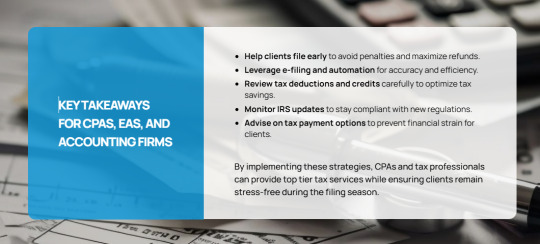

Final Thoughts: Partner with Experts for Hassle-Free Tax Filing

The tax season can be overwhelming for businesses and individuals alike. By adopting proactive filing strategies, leveraging available IRS resources, and staying vigilant against common pitfalls, CPAs, EAs, and accounting firms can help their clients navigate tax season with confidence.

At Unison Globus, we specialize in providing outsourced tax preparation services tailored for North America-based accounting firms. Our expert team ensures accurate, timely, and compliant tax filings, freeing you to focus on strategic financial advising for your clients.

Looking for expert tax preparation and compliance solutions? Contact Unison Globus today to streamline your tax season and maximize your efficiency.

This blog was originally posted here:

https://unisonglobus.com/april-15-tax-deadline-approaching-heres-how-to-prepare-and-file-on-time/

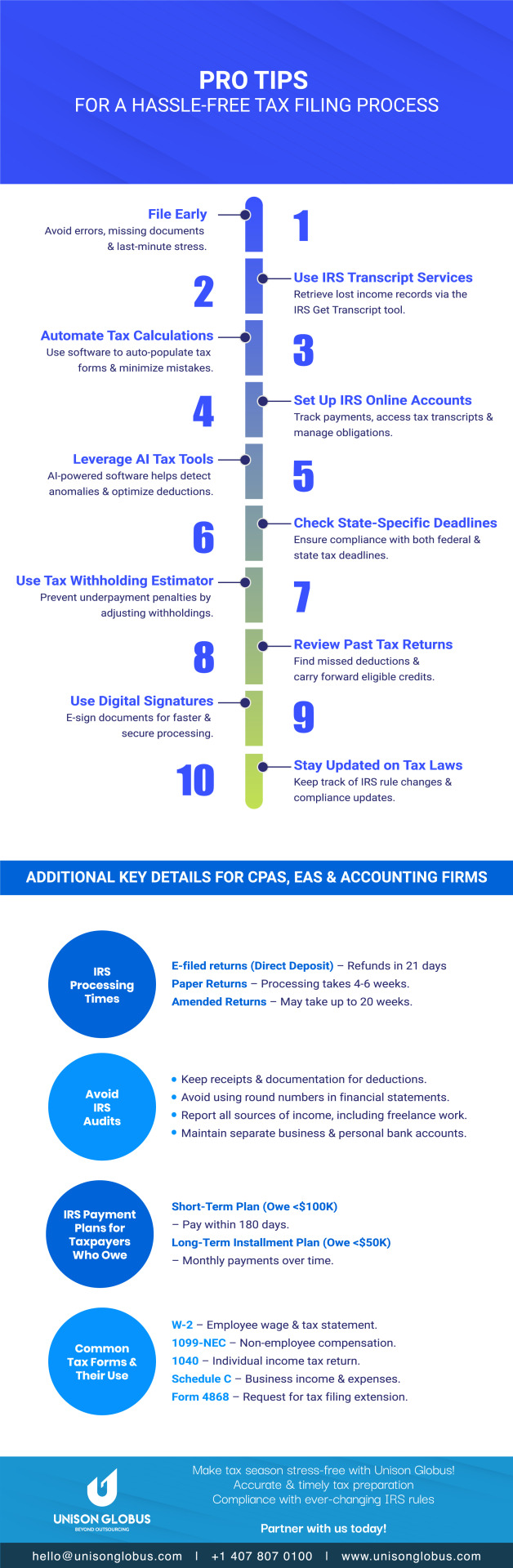

Infograp`hic

Pro Tips - For a Hassle-Free Tax Filing Process

#Tax filing tips#unison globus#Hassle-free tax filing#Tax preparation guide#Tax filing process#April 15 tax deadline#Tax season tips#how to file taxes#Tax filing checklist#Stress-free tax filing#tax deductions#tax services#tax preparation services#tax advisor#tax preparation#tax accountant#tax filing#tax planning#tax season#financial#Tax

1 note

·

View note

Text

HR Software in Pakistan: Features That Every Business Needs

HR Software in Pakistan

In today’s rapidly evolving business landscape, HR software in Pakistan has become a necessity for organizations looking to streamline their human resource management processes. With the rise of cloud-based HR solutions, businesses can now automate HR tasks, ensure compliance, and enhance productivity. This article explores the essential features that every business in Pakistan should look for in HR software.

1. Employee Information Management

An efficient HR software should serve as a centralized database for storing employee information, including personal details, job history, salary records, performance reviews, and documents. This ensures that HR teams have quick access to employee records while maintaining data security and compliance.

Key Features:

Employee profiles with customizable fields

Document management for contracts, ID copies, and certificates

Role-based access control for security

Audit logs for tracking modifications

2. Payroll Management and Salary Processing

Payroll management is one of the most critical functions of HR. A robust HR software in Pakistan should provide automated payroll processing to ensure accurate salary calculations, tax deductions, and compliance with local labor laws.

Key Features:

Automated salary calculations

Integration with tax laws and compliance regulations

Direct bank transfer capabilities

Payslip generation and tax reports

3. Attendance and Leave Management

Efficient attendance tracking and leave management are crucial for maintaining workforce productivity. Modern HR software should integrate with biometric systems, RFID, or mobile applications to automate attendance monitoring.

Key Features:

Integration with biometric devices and RFID

Online leave application and approval workflows

Customizable leave policies and holiday calendars

Real-time reports on absenteeism and attendance trends

4. Recruitment and Applicant Tracking System (ATS)

An Applicant Tracking System (ATS) simplifies the hiring process by automating job postings, resume screening, interview scheduling, and candidate evaluations. This helps organizations find the right talent faster and more efficiently.

Key Features:

Automated job posting on multiple platforms

AI-based resume screening and ranking

Interview scheduling and candidate communication

Collaboration tools for recruiters and hiring managers

5. Performance Management System (PMS)

To foster a high-performing workforce, businesses need a Performance Management System that enables continuous goal setting, employee feedback, and performance evaluations.

Key Features:

Goal setting and Key Performance Indicators (KPIs)

360-degree performance reviews

Automated performance reports and analytics

Employee recognition and reward programs

6. Training and Development Modules

Employee training and skill development are essential for improving productivity and job satisfaction. A comprehensive HR software should include an integrated Learning Management System (LMS) to track and manage employee training programs.

Key Features:

Course creation and content management

Tracking employee progress and certifications

Automated reminders for training schedules

Employee feedback on training effectiveness

7. Employee Self-Service (ESS) Portal

A self-service portal empowers employees by allowing them to access HR-related information, apply for leave, view payslips, and update their details without HR intervention.

Key Features:

Online access to personal records

Leave and attendance tracking

Payroll and payslip downloads

HR policy documents and announcements

8. Compliance and Legal Management

HR software should assist in ensuring compliance with Pakistan’s labor laws and corporate regulations by automating record-keeping and reporting.

Key Features:

Automated labor law compliance checks

Digital contract management

Audit reports and compliance tracking

Tax calculations and e-filing integrations

9. HR Analytics and Reporting

Data-driven HR decisions are crucial for business growth. A powerful HR software in Pakistan should include advanced analytics and reporting tools to provide insights into employee performance, payroll expenses, and workforce trends.

Key Features:

Customizable dashboards with real-time analytics

Predictive HR analytics for trend forecasting

Automated report generation

Graphical insights and visualization tools

10. Mobile Accessibility and Cloud Integration

With remote work and on-the-go workforce management becoming more prevalent, mobile-friendly and cloud-based HR software ensures accessibility from anywhere.

Key Features:

Cloud-based access with secure login

Mobile application for HR tasks

Push notifications for important HR updates

Integration with other business tools (ERP, CRM, accounting software)

Conclusion

Choosing the right HR software in Pakistan is essential for businesses aiming to streamline their HR operations and improve workforce management. By investing in a feature-rich HR solution, companies can enhance productivity, compliance, and employee satisfaction while reducing administrative burdens.

Follow Us

Facebook — Decibel HRMS

Instagram — Decibel HRMS

LinkedIn — Decibel HRMS

#HR Software in Pakistan#Best HR Software#Payroll Software#HRMS Service in Pakistan#employee management software

1 note

·

View note

Text

What is Freight Brokerage & Freight Forwarding Software

What is Freight brokerage and freight forwarding software?

Freight brokerage software allows a shipper to find carriers, manage the rates or tariffs as well as the contracts, and even track shipments. This eliminates the difficulties involved in the procedure and helps in making the admittance of new companies efficient as well as easy by automating these tasks. Freight forwarding software on another hand covers everything to do with shipping, from documents to storage and most importantly legal compliance with trade laws. Therefore, while brokerage software is primarily into matching shippers with carriers, forwarding is a software that handles the entire shipping process. Considering these disparities makes the functioning of transport brokers more effective and has a strong effect on the outcomes of their cooperation with clients.

Differences between Freight Forwarding & Freight Brokerage

Aspect

Freight Forwarding

Freight Brokerage

Primary Role

Manages the whole shipping process

Connects shippers with carriers

Physical Possession

Takes physical possession of the cargo

Does not take possession of the cargo

Services Provided

Handles documentation, storage, and transportation

Arranges transport contracts between shippers and carriers

Scope of Operations

Provides end-to-end logistics solutions

Focuses on negotiating and arranging transport

Customer Interaction

Simplifies trade regulations and logistics for businesses

Primarily negotiates and arranges transportation

Benefits of Using Freight Forwarding and Brokerage Software

Operational Efficiency

Freight forwarding and brokerage software significantly streamline operations, automating tasks such as load board management and carrier selection, which reduces manual efforts and enhances efficiency. Real-time tracking and automated notifications ensure smooth operational flow, minimising delays and errors.

Cost Savings

Implementing this software leads to direct cost savings by optimising route selection and reducing idle times, thereby cutting down on fuel and maintenance expenses. Automated invoice management and accurate rate calculations prevent financial discrepancies and reduce administrative costs.

Scalability

The software adapts to business growth, allowing easy integration of additional modules as needed. This flexibility supports expanding operational demands without the need for significant system overhauls, making it a future-proof investment.

Improved Tracking and Visibility

Advanced tracking features provide real-time data on shipments, enhancing visibility across the supply chain. This transparency helps in better managing expectations and reduces the risk of shipment delays.

Better Customer Service

Freight software enhances customer service by providing detailed tracking information and efficient issue resolution processes. This increases customer satisfaction and fosters loyalty.

Data Insights and Reporting

Comprehensive analytics tools offered by these software systems enable detailed performance monitoring and decision-making support. Insights gained from real-time data help in identifying inefficiencies and improving overall business strategies.

Conclusion

All these digital solutions are not only expected to improve flexibility in the operational processes but also to maximise cost efficiency and customer experience. To them they hold the potential of offering even more optimization, helping logistics specialists fine-tune solution provision. It’s important for organisations to adopt these technologies as they provide a competitive advantage through optimisation and valuable business intelligence. In this case, the integration of such systems is a business strategy well embraced by companies in the transport commission agent business due to ever changing market opportunities in the expanding global economy. Overall, the use of advanced freight software is not a trend but a revolution for FDI that opens the future of global logistics facilitating transnational business.

2 notes

·

View notes