#labour compliance software

Explore tagged Tumblr posts

Text

Enhancing Business Operations with Digiliance Compliance Software

In today’s fast-paced and highly regulated business environment, compliance is more than just a legal obligation—it’s a cornerstone of operational efficiency and reputation management. Digiliance Compliance Software is emerging as a game-changing solution for organizations striving to streamline their compliance processes while minimizing risks.

What is Digiliance Compliance Software?

Digiliance Compliance Software is a cutting-edge platform designed to help businesses manage, monitor, and ensure adherence to regulatory requirements and internal policies. It integrates advanced technology with user-friendly features, offering a comprehensive solution tailored to meet the unique needs of various industries, including finance, healthcare, manufacturing, and more.

Key Features of Digiliance Compliance Software

Automated Compliance Tracking Digiliance automates the tracking of compliance requirements, ensuring businesses stay updated on the latest regulatory changes. This feature reduces the manual workload and mitigates the risk of non-compliance.

Customizable Dashboards The platform provides intuitive dashboards that can be customized to display key compliance metrics, offering real-time insights into your organization’s compliance status.

Document Management System Managing compliance-related documents is made easy with Digiliance. The system offers secure storage, version control, and quick retrieval, ensuring all critical documents are readily accessible.

Risk Assessment Tools Digiliance includes advanced tools for identifying, assessing, and mitigating potential risks. The software proactively flags issues, enabling businesses to address them before they escalate.

Audit Trail and Reporting Comprehensive audit trails and reporting tools simplify the preparation for regulatory audits. Digiliance ensures that all activities are well-documented and easily accessible for review.

Integration Capabilities The software seamlessly integrates with existing business systems, enhancing functionality without disrupting workflows.

Benefits of Using Digiliance Compliance Software

Time and Cost Efficiency By automating compliance processes, Digiliance saves valuable time and reduces the costs associated with manual compliance management.

Improved Accuracy The software minimizes human errors, ensuring greater accuracy in compliance reporting and record-keeping.

Enhanced Risk Management With proactive risk assessment tools, businesses can identify vulnerabilities early and implement effective solutions.

Regulatory Preparedness Staying ahead of regulatory requirements ensures businesses are always audit-ready, safeguarding their reputation and avoiding penalties.

User-Friendly Interface Digiliance’s intuitive design makes it accessible to teams across departments, fostering collaboration and ease of use.

Why Choose Digiliance?

Digiliance Compliance Software stands out for its adaptability, robust features, and commitment to simplifying compliance for businesses of all sizes. Whether you’re a small enterprise or a large corporation, Digiliance provides the tools and support you need to navigate the complexities of regulatory landscapes with confidence.

Conclusion

In a world where regulatory demands are constantly evolving, investing in a reliable compliance management solution is no longer optional—it’s essential. Digiliance Compliance Software not only helps businesses meet their compliance obligations but also empowers them to thrive by reducing risks, enhancing operational efficiency, and fostering trust among stakeholders.

Adopt Digiliance today and take the first step towards a more secure, compliant, and efficient future.

1 note

·

View note

Text

The Ultimate Guide to Labour Law Compliance Software

In today’s fast-paced business environment, staying compliant with labour laws is no longer just a legal obligation—it’s a cornerstone of a successful organization. With ever-evolving regulations, manual tracking and compliance management can be both overwhelming and error-prone. Enter Labour law compliance software powered by Digiliance, a revolutionary tool designed to simplify compliance and ensure your organization is always audit-ready.

Why Labour Law Compliance Matters

Labour laws are designed to protect employee rights, ensure workplace safety, and promote fair practices. Non-compliance can lead to hefty fines, legal disputes, and reputational damage. For businesses of all sizes, staying compliant isn’t just about avoiding penalties—it’s about fostering trust and transparency with employees and stakeholders.

What Is Labour Law Compliance Software?

Labour law compliance software is a digital solution that automates the tracking, management, and reporting of statutory requirements. It helps organizations streamline processes like payroll compliance, employee benefits, workplace safety, and audits. With tools like Labour law compliance software powered by Digiliance, businesses can move from a reactive approach to a proactive compliance strategy.

Key Features of Labour Law Compliance Software Powered by Digiliance

Automated Compliance Updates One of the biggest challenges in compliance is staying up to date with constantly changing regulations. Labour law compliance software powered by Digiliance ensures you’re always informed about updates and amendments, helping you adjust processes seamlessly.

Centralized Document Management Gone are the days of sifting through piles of paperwork. The software allows you to store, organize, and retrieve compliance documents in a centralized digital repository.

Customizable Alerts and Notifications Missing deadlines for filings or renewals can be costly. With Digiliance, you can set up automated reminders, so you never miss an important date.

Audit-Ready Reporting Preparing for audits becomes a breeze with pre-configured, customizable reports that provide a comprehensive view of your compliance status.

Integration with HR and Payroll Systems The software seamlessly integrates with your existing HR and payroll systems, ensuring smooth workflows and accurate compliance management.

User-Friendly Interface You don’t need to be a tech expert to use the software. Its intuitive design makes it easy for teams to navigate and utilize its features effectively.

Benefits of Using Labour Law Compliance Software

Reduced Risk: Minimize the risk of non-compliance with real-time updates and automated tracking.

Cost Efficiency: Avoid hefty fines and reduce manual labour, saving time and money.

Improved Productivity: Focus on strategic initiatives while the software handles the compliance workload.

Enhanced Transparency: Build trust with employees and stakeholders by ensuring fair and legal practices.

Why Choose Labour Law Compliance Software Powered by Digiliance?

Digiliance has earned a reputation as a leader in the compliance space, offering cutting-edge solutions tailored to the unique needs of businesses across industries. Their software stands out for its robust features, user-centric design, and unwavering commitment to helping organizations achieve seamless compliance.

Final Thoughts

Staying compliant with labour laws doesn’t have to be a daunting task. By investing in Labour law compliance software, you can simplify compliance, reduce risks, and focus on what truly matters—growing your business. Embrace the future of compliance management and empower your organization with the tools it needs to thrive.

Ready to take the leap? Explore how Labour law compliance software powered by Digiliance can transform your compliance processes today!

1 note

·

View note

Text

How Labor Compliance Software Can Save Your Business

In today's complex regulatory landscape, businesses across industries grapple with a myriad of labor laws and compliance mandates. Non-compliance can result in hefty fines, legal battles, and reputational damage. Labor compliance software emerges as a strategic tool to mitigate these risks and safeguard your business's bottom line.

Understanding the Labor Compliance Challenge

Labor laws are intricate, with frequent updates and varying interpretations. Manual tracking and management are prone to errors, oversights, and inconsistencies. The consequences of non-compliance can be severe:

Financial penalties: Government-imposed fines can be substantial.

Legal fees: Disputes and lawsuits can drain resources.

Reputational damage: Negative publicity can erode customer trust.

Employee morale issues: Non-compliance can lead to decreased employee satisfaction and turnover.

The Role of Labor Compliance Software

Labor compliance software is designed to automate and streamline labor-related processes, ensuring adherence to complex regulations. Key functionalities include:

Time and Attendance Tracking: Accurately records employee hours, overtime, and breaks, preventing wage and hour violations.

Payroll Integration: Seamlessly integrates with payroll systems for accurate wage calculations and deductions.

Compliance Calendar: Tracks deadlines for various labor-related filings and notifications.

Document Management: Stores and organizes essential labor compliance documents.

Reporting and Analytics: Generates detailed reports on labor costs, compliance metrics, and potential risks.

How Labor Compliance Software Saves Your Business

Preventing Costly Penalties: By automating compliance tasks and reducing manual errors, the software minimizes the risk of wage and hour violations, overtime miscalculations, and other costly penalties.

Streamlining HR Processes: Automating time and attendance, payroll, and compliance tasks frees up HR staff to focus on strategic initiatives and employee relations.

Mitigating Legal Risks: The software helps maintain accurate records, reducing the likelihood of labor disputes and lawsuits.

Improving Employee Morale: Ensuring fair wages, accurate timekeeping, and compliance with labor laws enhances employee satisfaction and loyalty.

Data-Driven Decision Making: Comprehensive reports and analytics provide valuable insights into labor costs, productivity, and areas for improvement.

Choosing the Right Labor Compliance Software

Selecting the appropriate software involves considering several factors:

Business Size and Industry: The software should align with your organization's specific needs and industry regulations.

Features and Functionality: Evaluate the software's capabilities to meet your compliance requirements.

Cost and ROI: Consider the initial investment and long-term benefits of the software.

Vendor Reputation and Support: Choose a reputable vendor with excellent customer support.

Scalability: Ensure the software can accommodate your business's growth.

FAQs

Q: Is labor compliance software mandatory for all businesses? A: While not legally required in all cases, labor compliance software is highly recommended for businesses of all sizes to mitigate risks and ensure legal compliance.

Q: Can labor compliance software help with employee scheduling? A: Yes, many labor compliance software solutions offer scheduling features to optimize workforce utilization and prevent overtime violations.

Q: How long does it take to implement labor compliance software? A: Implementation time varies depending on the software complexity and business size. Typically, it can take several weeks to a few months.

Q: What is the return on investment (ROI) of labor compliance software? A: The ROI of labor compliance software is often measured in terms of cost savings from avoided penalties, increased efficiency, and improved employee morale.

Conclusion: Protect Your Business with Proactive Compliance

In today's complex regulatory environment, labor compliance is no longer an option but a necessity. By investing in robust labor compliance software, businesses can safeguard their bottom line, protect their reputation, and create a solid foundation for growth. Don't let labor compliance be a liability; transform it into a competitive advantage.

1 note

·

View note

Text

https://simpliance.in/

Simpliance provides technology-based governance, risk and compliance solutions to organizations varying from large corporates to start-ups. The GRC tools like risk management, regulatory compliance and audit softwares optimize business performance.

Simpliance also hosts India’s largest digital platform for automated Statutory Compliance Management which helps businesses comply with Indian Labour laws.

Request a FREE DEMO now!

0 notes

Text

Labour compliance automation software

In the fast-paced business landscape of today, ensuring labour compliance has become a crucial and challenging task for organizations of all sizes. With ever-changing regulations and increased scrutiny from regulatory bodies, manually maintaining compliance can be time-consuming and prone to errors, exposing organizations to potential risks and liabilities. However, the introduction of Labour Compliance Automation Software offers a solution to this dilemma by providing organizations with an automated approach to compliance management and risk mitigation. By leveraging the capabilities of this software, organizations can streamline their compliance operations, eliminate errors, and boost productivity, all while remaining in adherence to regulatory requirements.

0 notes

Text

Streamline Your HR Processes with an Advanced Human Resource Management System:

Managing human resources (HR) is a critical aspect of running a successful organization. With the ever-evolving technology landscape, traditional HR processes have become outdated, time-consuming, and error-prone. In this blog post, we will discuss the importance of using a modern HR management system and review Emsphere Technologies, a leading HR technology solution.

#human resource management system#contract labour management in india#compliance management software#attendance management system

0 notes

Text

5 Unique Benefits of ERP for Manufacturers

STERP (Shanti Technology) is one of the leading ERP software companies in India, offering comprehensive solutions for businesses in the manufacturing sector. Among the top ERP software providers in India, STERP has emerged as a frontrunner thanks to its dedication to serving manufacturers.

The STERP ERP software has helped Indian manufacturers become more productive, automate processes that formerly required human labour, and foster a culture of collaboration. Production scheduling, inventory management, quality control, and material need planning are just some of the ways in which this software may help businesses better meet customer needs and deliver superior products. Researching aggregate statistics may tell you a lot about the spread of enterprise resource planning software around the world.

General worldwide statistics for ERP Software:

The worldwide enterprise resource planning (ERP) software market is valued at over $25 billion, with yearly growth of 10%–20%.

More than half (53%) of all businesses agree that ERP is a promising sector in which to invest.

From 2019 to 2026, the worldwide market for ERP software is projected to expand to $78.40 billion, a compound annual growth rate (CAGR) of 10.2%.

The defence and aerospace sectors will have the highest ERP software adoption rates by 2026.

88% of organisations say that ERP has helped their chances of success.

Among all enterprises, 62.7% favour cloud-based ERP solutions over locally hosted ones.

When it comes to using an ERP solution, about 27% of firms worry that their data would be jeopardised.

Half of all companies will soon install an enterprise resource planning (ERP) system or enhance their current one.

5 Advantages of ERP for manufacturing company in India:

1. Streamlined Operations and Increased Efficiency:

Manufacturing enterprises in India need streamlined processes and enhanced efficiency to survive in today's competitive business environment. One of the most important tools for accomplishing these objectives is ERP software, and STERP - an excellent ERP software company in India is the most successful.

Manufacturing companies in India need to improve their productivity and efficiency to compete in the global manufacturing market. ERP software is a key component in achieving these goals, and STERP is the leading ERP software provider in India.

STERP understands the unique challenges faced by manufacturing facilities. Their ERP software for factories is specifically designed to raise output quality anywhere it's implemented.

By consolidating previously siloed departments and processes, STERP's ERP software makes key business operations transparent in real-time. The ability to step back and look at the larger picture helps manufacturers detect and fix inefficiencies and streamline processes.

2. Enhanced Visibility and Real-time Data Insights:

When it comes to making decisions and propelling corporate success in India's dynamic and ever-expanding industrial industry, increased visibility and real-time data insights are crucial. STERP is a leading service provider of ERP software in India, and its products help industrial companies improve their transparency and access to real-time data.

STERP provides ERP software tailored specifically for the manufacturing industry. Better management is possible with the help of our ERP software for manufacturing company in India by centralising functions like accounting, inventory control, production, and logistics. This connection gets rid of data silos and gives you a bird's eye view of the production process.

3. Improved Quality Control and Compliance:

Production relies heavily on quality control and following procedures. STERP offers exhaustive options for producers to improve quality control and conform to ever-changing regulations.

STERP, a market leader in India's enterprise resource planning software industry, understands the value of quality control. Our manufacturing-specific ERP software features robust quality management components that enable organisations to establish and rigorously adhere to quality control standards. It is now possible for businesses to create quality standards, set up inspection criteria, and track quality parameters continuously throughout the production cycle.

4. Effective Resource Management and Cost Reduction:

Successful manufacturing enterprises rely on STERP's ERP for manufacturing company in India, which was developed with the specific needs of Indian manufacturers in mind. STERP (Shanti Technology) is a well-established ERP software company in India that offers useful solutions for the industrial sector.

The top ERP software in India supplied by STERP (Shanti Technology), streamlines production scheduling, allowing firms to maximise resource utilisation and cut down on downtime. Taking into account factors like machine capacity, workforce availability, and raw materials on hand, the software develops production schedules that optimise output and minimises downtime.

5. Enhanced Customer Relationship Management and Service:

STERP is one of the leading ERP software companies in India because of the quality of the relationships we've built with our clients. The robust CRM features built into STERP's ERP software for manufacturers allow for streamlined management of customer communications, preferences, and historical data.

STERP's enterprise resource planning (ERP) software helps organisations better understand their customers by highlighting their wants, needs, and buying behaviours. With this holistic view, companies may provide customers with individualised solutions, goods, and encounters.

Final Thoughts:

For manufacturing companies in India, ERP software has certain particularly useful features. As the industry standard for enterprise resource planning (ERP) software, STERP creates tailor-made solutions for businesses in the manufacturing sector. ERP software opens the way for the effective administration of resources by optimising stock levels, improving production planning, and cutting costs. Manufacturers can save money by improving their procurement processes, throwing away less, and using their resources more efficiently. STERP is one of the top-ranked ERP software providers in India if you need ERP software for your manufacturing business.

#ERP software Companies in India#ERP software providers in India#ERP for manufacturing company in India#ERP software in India#ERP software company in India#ERP software#technology#ERP system#cloud ERP#ERP solutions#manufacturer#ERP software for engineering

7 notes

·

View notes

Text

Outsource Payroll: Reduce Stress & Boost Efficiency for Your NZ Business

As a local business owner, managing payroll in-house can be overwhelming. From ensuring your employees are paid accurately and on time to staying compliant with ever-changing tax laws, payroll is a complex task that demands significant time and attention. But what if there was a way to reduce the stress and boost the efficiency of your payroll process? Outsourcing payroll is a solution that can save you time, money, and a whole lot of headaches.

In this article, we’ll explore how outsourcing payroll can be a game-changer for your business, and why it should be considered by every New Zealand entrepreneur.

What Is Payroll Outsourcing?

Payroll outsourcing is the practice of hiring a third-party provider to manage all or part of your payroll tasks. These providers take care of everything from calculating wages and deductions to managing tax filings and ensuring compliance with labour laws. They offer a level of expertise that can help local business owners like you save valuable time while ensuring that everything is done correctly.

For many business owners, payroll is a constant source of stress and confusion. But outsourcing this responsibility can help you avoid the complexities and reduce your workload, giving you more freedom to focus on running your business.

Top Benefits of Outsourcing Payroll

Reduced Stress for Business Owners

Managing payroll in-house requires a lot of attention to detail and can often feel like a never-ending cycle of deadlines and calculations. Errors, missed deadlines, and the constant fear of non-compliance can add unnecessary stress to an already busy workload.

By Outsource Payroll you can offload these tasks to experts who have the experience and tools to handle them efficiently. This allows you to focus on growing your business, leaving the complex and time-consuming payroll tasks to the professionals.

Boosted Efficiency and Time Savings

Payroll can take up a significant chunk of your time, especially when you factor in the preparation, submission, and reporting required for each payroll cycle. For a small business, that’s valuable time that could be better spent on activities that directly contribute to your bottom line, like customer acquisition, marketing, or product development.

When you outsource payroll, you free up that time. Payroll providers use automated systems and processes that allow them to handle these tasks more quickly and efficiently than an in-house team could. The result? Time savings that can be invested in growing your business.

Expert Knowledge of Tax Laws & Compliance

New Zealand has a complex taxation system, and staying up to date with the latest laws and regulations can be challenging for a business owner. Payroll outsourcing providers are experts in the field, well-versed in all the latest tax rules, compliance requirements, and employment standards.

This means that you don’t have to worry about making mistakes that could lead to penalties or fines. Whether it’s ensuring the correct tax deductions, making ACC (Accident Compensation Corporation) contributions, or complying with minimum wage laws, outsourcing your payroll ensures that you’re always on the right side of the law.

Minimized Risk of Payroll Errors

Payroll errors are not only a headache but can also result in costly consequences. Whether it’s incorrect wage calculations, missed tax payments, or incorrect superannuation contributions, mistakes in payroll can damage your reputation and your bottom line.

Outsourcing payroll helps minimize the risk of these errors. Payroll service providers have advanced software systems in place to automate calculations and cross-check data, significantly reducing the chance of mistakes. When you rely on experts to handle payroll, you can rest easy knowing that everything will be processed correctly.

Cost-Effectiveness

While outsourcing payroll may seem like an additional expense, it can actually be a cost-effective solution in the long run. Hiring and training an in-house payroll team, purchasing payroll software, and keeping up with compliance costs can add up quickly.

By outsourcing, you only pay for the services you need, which can be a more affordable option for small businesses. Additionally, the cost of correcting payroll errors, managing penalties, or dealing with compliance issues can be far greater than the cost of outsourcing payroll in the first place.

Common Payroll Challenges That Outsourcing Solves

Managing payroll in-house presents a number of challenges, but outsourcing payroll can address many of these issues. Some of the most common challenges that outsourcing helps to solve include:

Time-Consuming Process

Payroll processing requires a considerable amount of time. From gathering employee data to making tax filings and processing deductions, the process can feel never-ending. This takes away valuable time that you could be spending on other aspects of your business.

Outsourcing payroll removes this burden, allowing you to spend more time focusing on growing your business and less time on administrative tasks.

Complex Tax Laws & Regulations

Tax laws and regulations around payroll are constantly changing, and keeping up with them can be difficult for business owners. With payroll outsourcing, you have experts who are always up to date with the latest rules and regulations, ensuring that your business remains compliant.

Lack of Expertise in Payroll Management

Payroll is a specialized field, and managing it requires specific knowledge of accounting and tax laws. If you or your in-house team doesn’t have the necessary expertise, mistakes can easily occur, resulting in penalties or dissatisfied employees.

Outsourcing payroll means you have access to experienced professionals who are trained to handle payroll tasks with accuracy and precision.

Employee Discrepancies and Payroll Issues

Payroll errors can lead to confusion and disputes with employees, damaging morale and even creating legal issues. Outsourcing payroll to professionals helps to eliminate these issues by ensuring that employees are paid accurately and on time, every time.

How Outsourcing Payroll Enhances Your Business Efficiency

Outsourcing payroll can do more than just save you time—it can also enhance the overall efficiency of your business operations.

Faster Payroll Processing

Payroll outsourcing providers utilize advanced software and technology that streamline the payroll process, allowing for faster turnaround times. With faster processing, you can ensure that employees are paid on time, every time, without unnecessary delays.

Improved Reporting & Insights

Most payroll service providers offer detailed reporting and analytics, giving you valuable insights into your business finances. From tax calculations to deductions and overall payroll costs, these reports can help you make informed decisions that improve the financial health of your business.

Scalable Solutions for Growing Businesses

As your business grows, so does the complexity of your payroll. Outsourcing payroll provides scalable solutions that grow with your business. Whether you’re hiring more employees, expanding to multiple locations, or adding new pay structures, your payroll provider can adjust to meet your evolving needs.

How to Choose the Right Payroll Outsourcing Provider

When choosing a payroll outsourcing provider, it’s important to consider several factors to ensure you select the best fit for your business.

Look for Experience & Expertise

You want a provider who has a proven track record of handling payroll for businesses similar to yours. Check for certifications, industry experience, and customer reviews to ensure that they have the knowledge and expertise to manage your payroll effectively.

Consider Customer Support & Service

Payroll is an ongoing task, so it’s important to choose a provider that offers excellent customer support. Look for a provider who is easy to reach, responsive to inquiries, and ready to assist with any issues that arise.

Technology & Integration

The best payroll providers use advanced software systems that can integrate seamlessly with your existing accounting and HR systems. This ensures smooth data flow between departments and eliminates the need for manual data entry.

Transparency & Fees

It’s important to understand the pricing structure before signing a contract with a payroll provider. Make sure you’re aware of all fees, including any setup costs, ongoing charges, and additional fees for extra services. Look for a provider that offers transparent pricing with no hidden fees.

Conclusion: Why Outsourcing Payroll Is a Smart Move for Your Business

Payroll may seem like a minor task, but when handled poorly, it can lead to significant stress, wasted time, and costly mistakes. Outsourcing payroll offers a smart solution to these challenges by providing you with experts who can streamline the process, ensure compliance, and free up your time to focus on growing your business.

By reducing payroll-related stress and boosting efficiency, outsourcing payroll can be one of the best decisions you make for your New Zealand business. If you’re ready to reduce your payroll headaches and take your business to the next level, consider outsourcing payroll today.

0 notes

Text

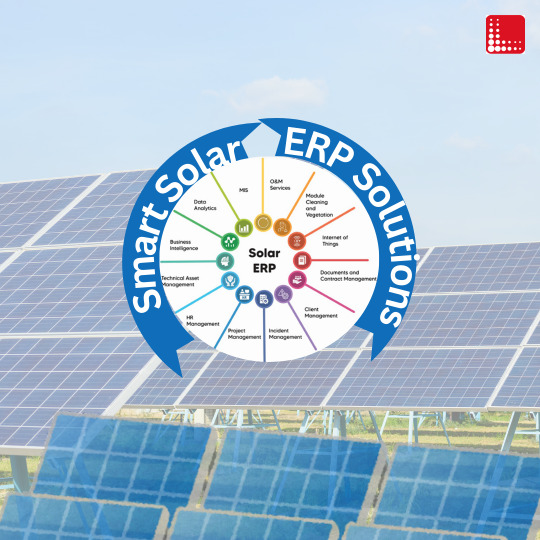

Optimizing Solar Manufacturing with ERP: The Key to Efficiency and Growth

The solar industry is growing rapidly, with increasing demand for renewable energy solutions. To stay competitive, solar manufacturers need efficient, scalable, and integrated business processes. This is where Enterprise Resource Planning (ERP) systems come into play. By implementing an ERP system, solar manufacturing companies can streamline operations, enhance productivity, and improve profitability.

Role of ERP in Solar Manufacturing

ERP systems provide an integrated platform connecting various departments. This allows the smooth flow of communication and data. For the solar manufacturers, this means the real-time tracking of raw materials, production schedules, inventory, and supply chain processes. Here's how ERP benefits the industry:

Supply Chain Optimization To manufacture solar panels, high-quality raw materials such as silicon wafers, glass, and metals are required. ERP systems allow manufacturers to monitor supplier relationships, track shipments, and maintain an optimal inventory level, which results in the prevention of wastage and smooth uninterrupted production.

Production Planning & Scheduling ERP allows manufacturers to schedule production automatically and ensures optimum usage of machinery and labor. Downtime is reduced and productivity is maximized, thereby accelerating the turn-around time for producing solar panels.

Inventory & Warehouse Management With ERP software, inventory levels are tracked in real-time, eliminating stockouts and overstocking. Automated inventory low alerts can maintain the perfect balance, resulting in cost efficiency and better business operations.

Quality Control & Compliance Solar panels operate under strict industrial standards and regulations for quality control. ERP has modules for tracking quality control by safety regulations and production quality to ensure proper audits with documentation.

Cost Management & Financial Planning Massive investment into materials, labour, and logistics is required while manufacturing solar panels. An ERP system provides for financial insights wherein manufacturers can hold the cost level, budget and forecast, as well as develop better financial results.

Real-Time Analytics & Reporting ERP solutions always come with embedded data analytics reporting tools that would provide actionable insight into production efficiency, customer demand, and the market trend; hence, informing the manufacturer with better decisions regarding competition.

Conclusion

The efficiency, reduction of costs, and overall improvement in business processes are some of the changes brought about by ERP systems in the solar manufacturing industry. As demand for renewable energy alternatives continually increases, manufacturers utilizing ERP technology will emerge as strong competitors in the competition in the future. An investment in the right ERP solution today will be a gateway to a more efficient and profitable future in the production of solar manufacutres.

0 notes

Text

Efficient HR and Payroll Solutions for Businesses: HR Payroll Software in Mumbai, Payroll Software in Delhi, and HR & Payroll Software in Bangalore

Organisations are searching for methods to streamline their processes in the fast-paced corporate environment of today, particularly with regard to payroll and human resources management. In addition to saving time, effective payroll and HR solutions also lower human error, guarantee on-time payments, tax compliance, and general employee happiness. Because of this, companies all over India are using more sophisticated payroll and HR software to do these important tasks.hr payroll software mumbai

Leading the HR and payroll software market, SmartOffice Payroll provides state-of-the-art services in Bangalore, Delhi, Mumbai, and other major cities. We'll look at how SmartOffice Payroll can assist companies in these cities streamline their payroll and human resources procedures in this post.

Mumbai's HR Payroll Software: The Centre of Business India Mumbai, which is frequently called India's financial capital, is home to a wide range of companies, from start-ups to global enterprises. A strong HR and payroll system is necessary due to the fast-paced work environment and the difficulty of managing staff from various industries.

SmartOffice Payroll offers companies in Mumbai a complete solution for managing payroll and human resources duties with ease. Routine payroll processes, including tax deductions, compliance reporting, and salary computations, are intended to be automated by the program. SmartOffice Payroll's cloud-based architecture guarantees real-time access to employee data, cutting down on manual data entry time and increasing productivity.

The following are some advantages of HR payroll software in Mumbai:

Precise Payroll Processing: By automating salary computations, the program lowers the possibility of mistakes. It guarantees that workers receive their pay cheques on schedule, with the appropriate deductions and perks applied. Management of Compliance: SmartOffice Payroll makes sure that companies stay in compliance with all regulatory obligations, including Provident Fund (PF), Employee State Insurance (ESI), and Professional Tax (PT), despite the fact that labour rules and tax laws are always changing. User-Friendly Interface: The software's user-friendly interface enables Mumbai's HR professionals to quickly become accustomed to it and concentrate on key HR tasks. Employee Self-Service: By enabling employees to manage their own information and relieving the burden on HR departments, the self-service portal allows workers to access paystubs, tax reports, and leave balances. Payroll Software in Delhi: Streamlining HR Procedures for Expanding Companies India's capital, Delhi, boasts a diversified economy that is expanding quickly. Businesses in the city operate in a wide range of sectors, such as manufacturing, services, retail, and information technology. These businesses require dependable technologies to effectively handle their payroll and human resources operations as they grow. Payroll software in Delhi is essential for companies trying to grow while keeping up operational effectiveness.

Payroll solutions from SmartOffice Payroll are suited to Delhi businesses' requirements. By automating payroll processing, the software guarantees that workers receive their pay cheques on schedule and that all tax and compliance obligations are fulfilled. It is perfect for companies of all sizes because it has features like payslip generation, automatic salary computation, and support for numerous payroll components.

Delhi payroll software's major features include:

Multi-Company Support: SmartOffice Payroll enables smooth payroll management across various companies, guaranteeing centralised control and consistency for firms with several branches or subsidiaries in Delhi. Customisable Payroll Modules: The program is appropriate for a range of company models since it enables companies to alter payroll elements including commissions, overtime, and bonuses. Tax Calculation and Compliance: In order to ensure adherence to Indian labour regulations and reduce the possibility of fines, SmartOffice Payroll is made to automatically compute taxes, such as income tax, PF, and ESI. Cloud-Based Solution: Businesses in Delhi can obtain payroll data from any location with cloud-based implementation, enabling real-time changes and remote working. Businesses in Delhi may streamline payroll administration, cut down on administrative burdens, and concentrate more on their core competencies by implementing SmartOffice Payroll.

Bangalore HR and Payroll Software: Assisting Tech Startups and Businesses Bangalore, also referred to as India's Silicon Valley, is home to several innovative startups, global corporations, and expanding businesses. Bangalore firms are confronted with the problem of managing a varied staff with varying payroll obligations when they grow quickly. By automating intricate HR and payroll processes and enhancing operational effectiveness, HR and payroll software in Bangalore assists businesses in overcoming these obstacles.

An integrated payroll and HR solution created especially for Bangalore-based companies is provided by SmartOffice Payroll. It ensures accurate payroll processing while streamlining procedures including hiring, performance management, leave monitoring, and attendance management. Given Bangalore's growing number of tech-driven companies and startups, SmartOffice Payroll provides a scalable solution that can expand with the company.

Using payroll and HR software in Bangalore has the following advantages:

Easy Integration with HR Systems: Data may flow freely throughout all HR operations thanks to SmartOffice Payroll's easy integration with other HR systems, including employee performance monitoring and attendance management. Scalable Business Solutions for Expanding Companies: SmartOffice Payroll is flexible enough to expand with your company, whether you're a startup with a small staff or a huge corporation with a worldwide workforce. Reporting in Real Time: Businesses in Bangalore may create real-time reports on employee performance, payroll costs, tax liabilities, and other topics using integrated analytics and reporting tools, facilitating data-driven decision-making. Employee Benefits Management: Providing alluring benefits to employees is essential in a competitive labour market like Bangalore. Employers can monitor and manage employee benefits including health insurance, bonuses, and retirement plans using SmartOffice Payroll. Why Opt for Payroll with SmartOffice? Businesses in Bangalore, Delhi, and Mumbai are selecting SmartOffice Payroll because of its extensive feature set, user-friendliness, and flexibility in meeting various business requirements. SmartOffice Payroll is trusted by companies all throughout India for a number of reasons, including:

Cost-effective: SmartOffice Payroll is a great option for both tiny startups and large corporations because it provides reasonable price levels that accommodate companies of all sizes. Security and Compliance: The software lowers the possibility of fines by ensuring that private payroll information is safely kept and conforms with the most recent rules and tax legislation. Customer Service: SmartOffice Payroll provides first-rate customer service, with committed staff on hand to help companies promptly and effectively address any problems. Customisation: You can add or delete features as needed to tailor the program to your company's unique requirements. In conclusion SmartOffice Payroll is the ideal payroll and HR solution to optimise your business processes, whether you're managing payroll for a tech startup in Bangalore, a small business in Mumbai, or a developing firm in Delhi. SmartOffice Payroll is the preferred option for companies wishing to streamline their payroll and human resources procedures because to its extensive feature set, intuitive design, and strong compliance management. Businesses may save time, cut down on errors, and concentrate on what really matters—growth and employee satisfaction—by automating repetitive operations and guaranteeing correct payroll processing.

1 note

·

View note

Text

The Role of HR Support in Small Businesses

Running a small business comes with numerous challenges, and one of the most crucial aspects is managing human resources effectively. Many business owners struggle with HR tasks, from hiring and onboarding to compliance and training. Accessing reliable HR support for small businesses can make a significant difference, ensuring compliance, streamlining administrative tasks, and improving overall workforce efficiency.

Why Online HR Training for Staff Matters

Employee training is a vital aspect of business growth and compliance. Investing in online HR training for staff provides businesses with flexible, scalable learning solutions that enhance employee skills and knowledge. Online training platforms allow employees to learn at their own pace, reducing the burden on HR teams while ensuring staff remains up to date with industry best practices.

Choosing the Right Employee Training and Development Platform

A well-structured employee training and development platform helps businesses create a culture of continuous learning. These platforms offer structured courses on compliance, leadership, and skill enhancement, equipping employees with the necessary knowledge to excel in their roles. Selecting a platform that aligns with your business needs ensures long-term workforce growth and operational efficiency.

Ensuring Compliance with HR Support

HR compliance can be complex, especially for small business owners who may not have in-depth legal knowledge. Obtaining HR compliance support for business owners helps ensure adherence to labour laws, workplace safety regulations, and employee rights. Proper compliance measures protect businesses from costly fines and legal complications, creating a secure and ethical work environment.

HR Management Tools to Streamline Operations

Investing in the right HR management tools for businesses can significantly improve HR efficiency. These tools automate processes like payroll, benefits administration, employee scheduling, and performance tracking, reducing manual workloads and enhancing productivity. Businesses that leverage HR management software can focus on strategic growth rather than administrative burdens.

HR Solutions for Employee Management

Maintaining a motivated and well-managed workforce is key to business success. Implementing HR solutions for employee management simplifies tasks such as performance evaluations, employee engagement initiatives, and attendance tracking. With the right HR strategies in place, businesses can foster a positive work culture that boosts retention and overall performance.

The Benefits of Workforce Development Training Online

Developing employees’ skills is crucial for long-term business growth. Engaging in workforce development training online allows companies to upskill their teams efficiently. Online training programs offer accessibility and flexibility, enabling employees to develop industry-relevant skills while minimising disruptions to daily operations.

Enhancing Productivity with HR Training

A well-trained workforce operates efficiently, reducing errors and improving service delivery. Companies can improve employee productivity with HR training by offering structured programs that focus on communication, compliance, and leadership. When employees receive proper training, they perform better, contributing to overall business success.

Simplifying HR for Business Owners

Managing HR responsibilities can be overwhelming, especially for small business owners handling multiple tasks. Finding ways to simplify HR for business owners through technology and expert guidance can lead to significant time and cost savings. Businesses that streamline HR processes experience fewer compliance issues and improved employee satisfaction.

Scaling HR Solutions for Growing Businesses

As businesses expand, so do their HR needs. Adopting scalable HR solutions for businesses ensures that HR processes grow alongside the company. Whether hiring new staff, managing benefits, or handling compliance, scalable solutions provide the flexibility needed to support long-term business success.

0 notes

Text

Five ways to measure ROI in Intelligent Automation: A Guide

The Return on Investment of Intelligent Automation: A Comprehensive Guide

Organisations increasingly turn to intelligent automation (IA) to streamline operations, enhance productivity, and drive growth. But what exactly is the return on investment (ROI) of implementing intelligent automation, and how can it be effectively measured? This blog delves into the multifaceted benefits of IA and provides a detailed overview of how to quantify its ROI.

Understanding Intelligent Automation

Intelligent automation integrates artificial intelligence (AI) with robotic process automation (RPA) to automate complex business processes. Unlike traditional automation, which follows pre-programmed rules, IA can adapt and learn from data, making it capable of handling more sophisticated tasks.

Benefits of Intelligent Automation

1) Cost Savings

Labor Cost Reduction: Organisations can significantly reduce labour costs by automating repetitive tasks. This includes direct savings from reduced headcount and indirect savings from decreased overtime and temporary staffing needs.

Operational Efficiency: IA can perform tasks faster and more accurately than humans, reducing error rates and minimising the costs associated with rework and corrections.

2) Improved Productivity

Increased Throughput: Automating routine processes allows employees to focus on higher-value tasks, increasing overall productivity and throughput.

24/7 Operations: Unlike human workers, automated systems can operate around the clock, ensuring continuous business operations and faster turnaround times.

3) Enhanced Accuracy and Compliance

Error Reduction: IA reduces human error, which is particularly beneficial in data-intensive and compliance-driven industries such as finance and healthcare.

Regulatory Compliance: Automation ensures that processes are consistently followed, aiding in industry regulations and standards compliance.

4) Scalability and Flexibility

Scalable Solutions: IA systems can be easily scaled up or down based on demand, providing flexibility to adapt to changing business needs without significant additional investments.

Adaptability: Intelligent systems can learn and evolve, allowing businesses to adapt to new challenges and opportunities quickly.

5) Customer Satisfaction

Improved Service Quality: Faster and more accurate processing improves service quality and customer satisfaction.

Personalized Experiences: IA can analyse customer data to provide personalised experiences, enhancing customer loyalty and retention.

Measuring the ROI of Intelligent Automation

Organisations should consider quantitative and qualitative metrics to measure intelligent automation’s ROI effectively. Here are some essential methods:

1) Cost-Benefit Analysis

Initial Investment vs. Long-Term Savings: Calculate the initial costs of implementing IA (software, hardware, training) against the projected long-term savings in labour and operational costs.

Payback Period: Determine the time it takes for the cost savings to cover the initial investment, providing a clear picture of the timeframe for realising ROI.

2) Productivity Metrics

Output Measurement: Track the increase in output or throughput resulting from automation. This can include the number of transactions processed, products manufactured, or services delivered.

Time Savings: Measure the reduction in time taken to complete tasks and processes, translating this into cost savings and productivity gains.

3) Quality and Compliance Metrics

Error Rates: Monitor the decrease in error rates post-implementation. Quantify the cost savings from reduced errors and rework.

Compliance Incidents: Track the number of compliance incidents before and after automation. Fewer incidents can translate to reduced fines and improved regulatory standing.

4) Employee and Customer Satisfaction

Employee Productivity and Morale: Use surveys and performance metrics to gauge employee productivity and morale improvements. Higher satisfaction can lead to lower turnover and recruitment costs.

Customer Feedback: Collect and analyse customer feedback to assess improvements in service quality and customer satisfaction.

5) Scalability and Flexibility

Adaptation Costs: Measure the costs associated with scaling and adapting IA systems compared to traditional methods. Lower adaptation costs indicate higher flexibility and ROI.

Response Times: Track the time to respond to new market demands or regulatory changes. Faster response times can result in competitive advantages and increased market share.

READ MORE

0 notes

Text

https://simpliance.in/

Simpliance provides technology-based governance, risk and compliance solutions to organizations varying from large corporates to start-ups.

The GRC tools like risk management, regulatory compliance and audit softwares optimize business performance. Simpliance also hosts India’s largest digital platform for automated Statutory Compliance Management which helps businesses comply with Indian Labour laws.

Request for a free demo now!

0 notes

Text

Labour Compliance Automation Software

Labour compliance is a critical aspect of doing business, particularly in countries like India where the regulatory environment is complex and constantly evolving. Meeting labour compliance requirements can be challenging for businesses, especially when it involves keeping up with multiple registers, returns, and statutory calculations based on different rules. To add to this complexity, there are frequent changes to minimum wage references and VDA calculations, which can be difficult to keep track of. That's where Labour Compliance Automation Software comes in. With built-in templates of forms and formats, automation software can streamline compliance processes, reduce errors, and save time. In this blog post, we'll explore the benefits and best practices of using Labour Compliance Automation Software to simplify compliance management.

0 notes

Text

Emsphere technologies provides contract labour management in india. A feature-packed clms that automates most crucial parts of contract labour management to minimize errors, bring high accuracy in manpower management, and wages calculation.

#contract labour management in india#human resource management system#compliance management software#attendance management system

0 notes

Text

Best Labour Law Consultants in Bangalore – Expert Compliance Solutions by Gupta & Company Consultants

Looking for Labour Law Consultants in Bangalore? Gupta & Company Consultants offers expert Labour Law Compliance services for businesses in Bangalore and Karnataka. We ensure compliance with EPF, ESI, payroll regulations, contract labour laws, factory act compliance, gratuity, and other labour laws.

With years of experience, we assist businesses in IT, manufacturing, retail, healthcare, hospitality, construction, education, and more to stay legally compliant and avoid penalties. Whether you need registration, audits, documentation, or compliance management, our end-to-end Labour Law consultancy services cater to your business needs.

Our Labour Law Consulting Services in Bangalore

✅ EPF & ESI Compliance

Registration, documentation, and contribution management for Employees' Provident Fund (EPF) & Employee State Insurance (ESI).

✅ Payroll & Minimum Wage Compliance

Compliance with minimum wages, overtime pay, PF, ESI, TDS deductions, and professional tax (PT) in Karnataka.

✅ Shops & Establishments Act Compliance

Support for registration and legal compliance under the Karnataka Shops & Establishments Act.

✅ Factories Act Compliance

Licensing, documentation, and safety audits for manufacturing units as per the Factories Act.

✅ Contract Labour (Regulation & Abolition) Act Compliance

Licensing and compliance management for businesses employing contract workers.

✅ Gratuity & Bonus Compliance

Assistance in gratuity payments, bonus structuring, and statutory compliance.

✅ Labour Welfare Fund (LWF) Compliance

Guidance and contribution management for Labour Welfare Fund (LWF) in Karnataka.

✅ Labour Law Audits & Risk Assessments

Comprehensive legal audits to ensure compliance and prevent legal risks.

Why Choose Gupta & Company Consultants for Labour Law Compliance in Bangalore?

✔ Experienced Labour Law Experts Our consultants have years of expertise in labour law compliance for businesses in Bangalore.

✔ Tailored Compliance Solutions We offer customized Labour Law advisory services based on industry-specific requirements.

✔ Bangalore & Karnataka-Specific Compliance We provide location-based labour law solutions that comply with state-specific rules & regulations.

✔ Full Legal Compliance & Support We help businesses stay compliant and avoid penalties, disputes, and legal risks.

Industries We Serve in Bangalore

We provide Labour Law Compliance Services for businesses in:

IT & Software Companies

Manufacturing & Industrial Units

Retail & E-Commerce

Healthcare & Pharmaceuticals

Hospitality & Tourism

Construction & Real Estate

Educational Institutions

📞 Contact Gupta & Company Consultants Today!

Looking for Labour Law Consultants in Bangalore? Let Gupta & Company Consultants handle all your compliance needs while you focus on business growth!

📱 Call Us: [+91-8744079902] 📧 Email Us: [[email protected]] 🌐 Visit Our Website: [www.guptaconsultants.com]

0 notes