#kieran analysis incoming ;)

Explore tagged Tumblr posts

Text

An apple a Kitakam-day keeps the doctor away (or 'they have fields of them now oh my god')

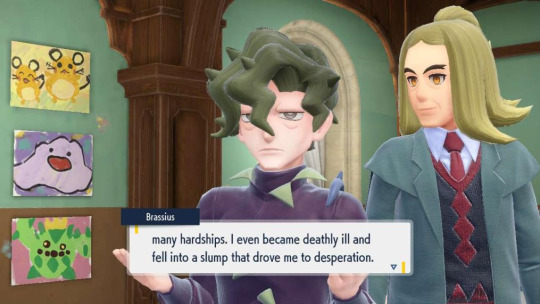

Guys. Guys. I am at my upper limit and Brassius hasn't even graced my clubhouse yet. I'm going to yeet myself off clifftops without a dragon. (No Rotom buddy, don't save me. It's not worth it.)

Warning: this post contains no story spoilers for Kitakami, but it does contain a certain Pokemon, and a DLC-specific location, and the occasional mention of a sidequest or two. If you want to go in totally spoiler-free, just be wary. :)

Now, we all know Applin as the gay mascot Pokemon, so what did they feel like doing for our first DLC?

What is this. What IS THIS. Note the unamused expression on mini Holz - mood, honey. Biggest mood.

This is Kitakami's Apple Fields, which are so painfully obviously a Hassius honeymoon destination that they're even winking at me.

THE AUDACITY.

... I'm glad you do, because personally, I've become allergic to them. Whatever the apple version of homophobia is, I have a terminal case.

But anyway, if you happen to scale these lovely cliffs off to the side:

You will be able to count how many fields there are here. It's difficult at ground level because the fences are stupid, but there's sixteen of them. TM16 in this game is Acrobatics, which is - and you can choose, I'm easy - either a reference to Brassius jumping off windmills because he has the confidence now through love, or me jumping off this ledge without a dragon and no Rotom Phone. (Yes, I will do a flip.)

Wasn't enough for you to give me a core-wyrm and a fore-wyrm, a marital signpost of a Pokemon, was it Game Freak, or stick a heart around Harvest C, or give Hassel a Flapple? Nope. FIELDS OF APPLIN. Yeah no, I'm fine...

Look at this little bastard. Look at her. She knows what she is.

You also find the simp Glitterati here by the way, twice, so... mmm, simps, enjoying apples, on two separate occasions. Can't mean anything guys, don't worry about it...

And as though all this wasn't bullshit enough, this is what happens when you show a Dipplin to the guys in Mossui Town who wish they had a romance half as compelling as Hassius:

ARE YOU FUCKING KIDDING ME I WILL FIGHT YOU BOTH NEXT TO THE CRYSTAL POOL YOU F -

#ephemeralartshipping#hassius#brassius x hassel#brassius#hassel#pokemon scarlet and violet#teal mask dlc#teal mask dlc spoilers#... god I hate it here.#fucking FIELDS OF THEM#;(((((((#I will say the fact that bug bite is next to those crates is hilarious but also FUCK THIS DLC lmao#/j it's great#kieran analysis incoming ;)

34 notes

·

View notes

Text

Revealed: Tottenham Hotspur named most valuable club in the Premier League, eclipsing Man City

Tottenham Hotspur are the most valuable Premier League outfit, according to analysis conducted by University of Liverpool football finance expert Kieran Maguire.

Despite a lack of silverware in 2019 and forking out a monstrous £1bn on a state-of-the-art stadium, Spurs have leapfrogged both Manchester clubs due to a combination of many factors.

Best of the Decade: Top scorers & creators – Can you name them?

World Class score: 95% | Expert score: 80% | Veteran score: 65% | Intermediate score: 45% | Amateur score: 30% | Try Again: 5%

Not even their Champions League victors and top-flight front-runners Liverpool can match the financial exploits of the north London side.

Maguire came to the final result by crunching numbers publically available from Companies House and used a valuation method based on the Markham Multivariate Model. He said:

“Spurs are top of the valuation table because in 2018/19 they delivered a Champions League final and a top four Premier League finish on a wage budget that was £100-150 million lower than the rest of the ‘Big Six’. As such they made more profits, and this was reflected in the final valuation number.”

Kieran Maguire, University of Liverpool.

Spurs chief Daniel Levy has overseen a 21% increase in income, rising to £481m against a light 39% player wage cost, which is the lowest ratio in the division.

For comparison, Leicester City, currently third in the Premier League, see 84% of their income eaten up by player wages.

The north Londoners also only spent a net £22m on signings, only Watford spent less whilst their rivals considerably more – Chelsea (£290m), Liverpool (£223m), United (£135m) and City (£87m).

Ultimately, it is Spurs’ tight control over wages and player transactions that set them apart from the rest in the Premier League, especially in comparison to the rest of the ‘top six.’

This campaign hasn’t gone to plan whatsoever with Jose Mourinho’s side out of all cup competitions and have sunk well adrift of Champions League qualification in the top-flight.

Maguire believes this could be a case of their “low cost-base catching up with them”.

If the season does resume anytime soon, the Portuguese boss will be left with it all to do to turn around their fortunes. The fight for fifth is hotly contested and they are some seven points behind fourth-placed Chelsea.

For more on the findings, head to the University of Liverpool’s Management School and to Maguire on Twitter.

AND in other news, Spurs could reignite interest in PL STAR this summer…

from FootballFanCast.com https://ift.tt/2zAlZsM via IFTTT from Blogger https://ift.tt/3f0M3NT via IFTTT

0 notes

Text

PODCAST: Best ESG Bond ETFs, Beyond Meat Shocks, SRI Engages Slavery

Beyond Meat initial public offering (IPO) share price soars over $80 from $25 surprising everyone and encouraging offerings that could excite ethical and sustainable investors. Learn how to find animal-friendly investments. UN agency PRI says socially responsible investing (SRI) should wake up to modern slavery. Unilever better investment over Johnson & Johnson says sustainability analyst.

Transcript & Links May 10, 2019

Hello, Ron Robins here. Welcome to my podcast Ethical & Sustainable Investing News to Profit By! for May 10, 2019. Presented by Investing for the Soul. investingforthesoul.com is your site for vital global ethical and sustainable investment resources.

Now to this podcast. Again, for any terms that are unfamiliar to you, simply Google them!

Also, you can find a full transcript, live links and sometimes bonus material at my podcast page located at investingforthesoul.com/podcasts

-------------------------------------------------------------

Many of you listening are interested in ESG or SRI bond and fixed income investments. And with good reason. A recent article titled, Largest 10 Socially Responsible Fixed Income ETFs, by Todd Shriber of ETF Trends, reviews two leading funds in this space. They are the iShares Global Green Bond ETF (on Nasdaq GM: ticker BGRN) and VanEck Vectors Green Bond ETF (on the NYSEArca: ticker GRNB). These bond funds have great pedigrees.

However, the article’s title might suggest the review is of ten SRI fixed income ETFs and that’s a little misleading. Concerning the ten listed—but not reviewed—I wouldn’t put them in the same category as the two funds examined in the article.

The SRI credentials of the ten listed are mainly that they invest in government securities and blue-chip company bonds. Of course, governments fund all sorts of things that ethical and sustainable investors might argue aren’t socially responsible. And even though blue-chip companies such as Apple are frequently top SRI holdings, their bonds aren’t usually going directly to fund green projects.

Whereas, the iShares Global Green Bond ETF and VanEck Vectors Green Bond ETF specifically fund projects and activities related to environmental and social concerns.

-------------------------------------------------------------

Well, I can’t resist the temptation to not talk about the great Beyond Meat initial public offering! It came out at $25 on May 2 and has traded over $80 since then. For a good review of what the company is and what it faces regarding competition etc., see this MarketWatch post, Beyond Meat goes public with a bang: 5 things to know about the plant-based meat maker, by Ciara Linnane.

Quoting Ciara, she says, "The maker of the Beyond Burger, which is sold at Whole Foods and restaurant chain TGIF, among others, priced its initial public offering at $25 a share… raising at least $240 million at a valuation slightly shy of $1.5 billion." Close quote. Now at $80 a share Beyond Meat has a staggering market valuation of about $5 billion!

I'm delighted to see this offering, as one of the most important things we can do to slow down carbon emissions and climate change, is to reduce our consumption of meat. However, some climate researchers are skeptical about the net benefit of highly processed vegetarian and vegan offerings on the climate.

That this IPO went so well is a testament to the fact that even many conservative financial types are recognizing there’s money to be made in climate change. However, I suspect that most of the interest probably comes from younger investors.

Furthermore, this could indicate the beginning of a thrilling era for new investment offerings that ethical and sustainable investors can get excited about!

Obviously, the underwriters significantly underestimated demand for Beyond Meat’s shares. When IPOs triple in price right after being launched it means that the issuer—the company—could have gotten far more for their shares. Though Beyond Meat is probably happy, they’re probably unhappy that they could’ve raised double or triple of what they got!

So, Beyond Meat is an exciting short-term play but with so many competitors to its products over the medium to long-term, it's not obvious it will be a winner yet.

-------------------------------------------------------------

For a good review of what Beyond Meat’s success means for two burger chains offering vegan burgers, see this post, titled, Tim Nash's sustainable stock showdown: battle of the burger chains, Corporate Knights, Canada. Admittedly this review is of the Canadian market, but it has bearing on the US and other markets too. Of course, Americans or anyone can invest in the Canadian stocks of the burger chains mentioned in that post.

After a great review, Mr. Nash finalizes his recommendation as follows, and I quote, “A&W Food Services of Canada (which has no corporate connections to A&W’s American locations) is obviously a much smaller company than Restaurant Brands, but... with a higher dividend and a lower beta, A&W provides a nice mix of income and growth potential. The chain is the clear winner.” Close quote.

-------------------------------------------------------------

Now, for ethical and sustainable investors interested in the animal-friendliness of their investments, read this article by Meredith Jones of MarketWatch, titled, Opinion: Here’s how to check the animal-friendliness of your investments. Quoting her, she says, “It’s easy to check which individual stocks are ‘cruelty-free,’ but you can’t yet invest in a vegan investment index." She offers several ways to checking which investments are free of animal-related products and testing.

If you’re interested in finding more organizations that can help you in this endeavor, check-out my Investing for the Soul sites’ pages Environmental Organizations & Resources and Organizations Promoting Corporate Ethical, Social & Environmental Responsibility.

-------------------------------------------------------------

Turning to a completely different aspect of investing, let’s talk about separately managed accounts at financial institutions compared to owning a portfolio of ETFs. Now separately managed accounts aren’t for everyone as they usually require a sizeable investment. However, if you meet the threshold they could be better for US investors than ETFs, says Johny Mair at ThinkAdvisor.

Mr. Mair says in an article titled, ETF vs. SMA: Which Is Better for Sustainable Investing? That, and I quote, “SMAs are ideal for values-based investing as they allow investors to actively screen for certain product areas (e.g. oil, tobacco), or ‘bad actors’ that they deem antithetical to their values. They also allow for more specificity, e.g. designating a certain percentage of revenue from carbon emissions to be included in one’s portfolio.

Furthermore, because SMA investors directly own the underlying securities, they can opt to play an active shareholder role, working to impact corporate behavior through voting proxies or shareholder resolutions." End quote.

Of course, for those who might not have the means for an SMA—or even for those who do—check out my DIY Ethical-Sustainable Investing Pays Tutorial. There, in 1-hour you can get a handle on how to easily and very cheaply put together your own personal values-based profitable portfolio—nonmatter its size.

-------------------------------------------------------------

In looking for companies we all want to know about their ESG ratings. However, you might not be aware of which ESG rating firms are good. Well, a new report reviews the various ESG rating services. Go to this recent post in IR Magazine, headlined, ESG Ratings – A look at the ESG ratings landscape. Register at the bottom of the page to download the PDF report.

-------------------------------------------------------------

Ethical and sustainable investors are concerned with many issues, but one that they might not have thought of and which is still a global problem is modern slavery. Fiona Reynolds, head of the UN’s Principles of Responsible Investment (PRI), says that ‘“There are a lot of ESG conversations around climate change ... but it is interlinked with modern slavery,’ Reynolds told the Thomson Reuters Foundation in an interview. ‘We see many climate migrants and refugees who end up vulnerable and at risk of being trafficked,’ she added.” Close quote.

Another quote from the article states, that, “The U.N. estimates that some 40 million people are trapped in modern slavery, from factory jobs to forced marriages.” End quote. Perhaps it’s something you might ask the companies you like who might have the potential for such involvement.

The Reuters post is by Kieran Guilbert and titled, 'Look for the laggards' - investors told to target modern slavery.

-------------------------------------------------------------

Lastly, another good comparative analysis by Tim Nash at Corporate Knights for ethical and sustainable investors has the title, Tim Nash’s sustainable stock showdown: Johnson & Johnson vs. Unilever. He says, and I quote,” With thousands of J&J cancer lawsuits pending, you might want to freshen up your portfolio with a cleaner company… J&J and Unilever are companies with very similar financial profiles, but, in my view, Unilever’s brand is thriving while Johnson and Johnson’s is deteriorating.”

For decades, J&J has a been a favorite investment for ethical investors—but not so much anymore as Mr. Nash’s post makes clear. Yet, most ESG funds still have it in their holdings. Check your holdings and see. Perhaps you still like J&J for other reasons. However, at the very least, these lawsuits and the negative publicity surrounding them is proving costly to the firm’s bottom line and stock price.

-------------------------------------------------------------

So, these are my top news stories for ethical and sustainable investors over the past two weeks.

Again, to get all the links or to read the transcript of this podcast and sometimes get additional information too, please go to investingforthesoul.com/podcasts and look for this edition.

And remember, I’m here to help you grow in your investment success—and investing in opportunities that reflect your personal values!

Please don’t hesitate to contact me if you have any questions about the content of this podcast or anything else investment related. I can’t say I’ll have all the answers for you and some answers I can’t give due to licensing restrictions. But where I can help I will.

Now, a big thank you for listening—and please click the share buttons to share this podcast with your friends and family.

Come again! Bye for now!

Check out this episode!

#business#finance#ethical investing#sustainable investing#ESG#SRI#green bonds#socially responsible investing

0 notes

Text

Manchester United plc 2019 Second Quarter Results

Q2 RECORD REVENUES OF £208.6 MILLION

Q2 RECORD ADJUSTED EBITDA OF £104.3 MILLION

Q2 OPERATING PROFIT OF £44.0 MILLION

MANCHESTER, England--(BUSINESS WIRE)-- Manchester United (NYSE: MANU; the “Company” and the “Group”) – one of the most popular and successful sports teams in the world - today announced financial results for the 2019 fiscal second quarter ended 31 December 2018.

Highlights

Ole Gunnar Solskjaer and Mike Phelan returned to Old Trafford to manage the remainder of the 18/19 season

Agreed new contracts with Anthony Martial, Ashley Young, Chris Smalling, Phil Jones and Scott McTominay

Record revenue and EBITDA for the quarter of £208.6m and £104.3m

Announced partnership with Harves to open a series of Manchester United Entertainment and Experience Centres in China

Announced global partnership with Remington

Commentary

Ed Woodward, Executive Vice Chairman, commented, "The appointment of Ole and Mike as caretaker manager and assistant manager, working with Kieran, Michael and Emilio, has had a positive impact throughout the club. We are delighted with the improvement in the team’s performances since December and we look forward to a strong finish to the 18/19 season."

Outlook

For fiscal 2019, Manchester United continues to expect:

Revenue to be £615m to £630m.

Adjusted EBITDA to be £175m to £190m.

Key Financials (unaudited)

£ million (except earnings/(loss) per share) Three months ended

31 December

Six months ended

31 December

2018

Restated(1)

2017

Change

2018

Restated(1)

2017

Change

Commercial revenue 65.9 65.3 0.9% 141.8 145.8 (2.7%) Broadcasting revenue 103.7 75.2 37.9% 146.5 116.0 26.3% Matchday revenue 39.0 36.9 5.7% 55.3 59.3 (6.7%) Total revenue 208.6 177.4 17.6% 343.6 321.1 7.0% Adjusted EBITDA(2) 104.3 81.2 28.4% 133.7 120.5 11.0% Operating profit 44.0 42.2 4.3% 57.9 60.1 (3.7%) Profit/(loss) for the period (i.e. net income/(loss))(3) 26.8 (19.7) - 33.4 (10.1) - Basic earnings/(loss) per share (pence) 16.27 (12.00) - 20.31 (6.17) - Adjusted profit for the period (i.e. adjusted net income)(1)/(2) 46.3 23.9

93.7%

53.3 31.8 67.6% Adjusted basic earnings per share (pence)(2) 28.13 14.56

93.2%

32.40 19.38 67.2% Net debt(2)/(4) 317.7 328.6 (3.3%) 317.7 328.6 (3.3%)

(1) Comparative amounts have been restated following the implementation of IFRS 15 – see supplemental note 5 for further details. (2) Adjusted EBITDA, adjusted profit for the period, adjusted basic earnings per share and net debt are non-IFRS measures. See “Non-IFRS Measures: Definitions and Use” on page 5 and the accompanying supplemental notes for the definitions and reconciliations for these non-IFRS measures and the reasons we believe these measures provide useful information to investors regarding the Group’s financial condition and results of operations. (3) The US federal corporate income tax rate reduced from 35% to 21% following the enactment of US tax reform on 22 December 2017. This necessitated a re-measurement of the existing US deferred tax position in the period to 31 December 2017. As a result the loss for the three and six months ended 31 December 2017 included a non-cash tax accounting write off of £49.0 million.

(4)

The gross USD debt principal remains unchanged.

Revenue Analysis

Commercial

Commercial revenue for the quarter was £65.9 million, an increase of £0.6 million, or 0.9%, over the prior year quarter.

Sponsorship revenue for the quarter was £40.3 million, an increase of £1.0 million, or 2.5%, over the prior year quarter;

Retail, Merchandising, Apparel & Product Licensing revenue for the quarter was £25.6 million, a decrease of £0.4 million, or 1.5% over the prior year quarter.

Broadcasting

Broadcasting revenue for the quarter was £103.7 million, an increase of £28.5 million, or 37.9%, over the prior year quarter, primarily due to the new UEFA Champions League broadcasting rights agreement and playing one additional UEFA Champions League game.

Matchday

Matchday revenue for the quarter was £39.0 million, an increase of £2.1 million, or 5.7%, over the prior year quarter, primarily due to playing one additional UEFA Champions League home game.

Other Financial Information

Operating expenses

Total operating expenses for the quarter were £160.3 million, an increase of £24.1 million, or 17.7%, over the prior year quarter.

Employee benefit expenses

Employee benefit expenses for the quarter were £77.9 million, an increase of £8.2 million, or 11.8%, over the prior year quarter, primarily due to investment in the first team playing squad.

Other operating expenses

Other operating expenses for the quarter were £26.4 million, a decrease of £0.1 million, or 0.4%, over the prior year quarter.

Depreciation & amortization

Depreciation for the quarter was £3.0 million, an increase of £0.3 million, or 11.1%, over the prior year quarter. Amortization for the quarter was £33.4 million, a decrease of £3.9 million, or 10.5%, over the prior year quarter. The unamortized balance of registrations at 31 December 2018 was £309.1 million.

Exceptional items

Exceptional items for the quarter were £19.6 million, relating to compensation to the former manager and certain members of the coaching staff for loss of office. Exceptional items for the prior year quarter were £nil.

(Loss)/profit on disposal of intangible assets

Loss on disposal of intangible assets for the quarter was £4.3 million, compared to a profit of £1.0 million in the prior year quarter.

Net finance costs

Net finance costs for the quarter were £6.3 million, an increase of £1.9 million, or 43.2%, over the prior year quarter, primarily due to unrealized, non-cash foreign exchange losses on unhedged USD borrowings compared to gains in the prior year quarter.

Tax

Tax expense for the quarter was £10.9 million, compared to £57.5 million in the prior year quarter. The US federal corporate income tax rate reduced from 35% to 21% following the enactment of US tax reform on 22 December 2017. This necessitated a re-measurement of the then existing US deferred tax position in the period to 31 December 2017. As a result the prior year quarter included a non-cash tax accounting write off of £49.0 million.

Cash flows

Net cash used in operating activities for the quarter was £42.4 million, a decrease of £2.0 million over the prior year quarter.

Net capital expenditure on property, plant and equipment for the quarter was £2.4 million, a decrease of £1.7 million over the prior year quarter.

Net capital expenditure on intangible assets for the quarter was £16.2 million, an increase of £4.4 million over the prior year quarter.

Overall cash and cash equivalents (including the effects of exchange rate changes) decreased by £57.1 million in the quarter, compared to a decrease of £60.9 million in the prior year quarter.

Net debt

Net debt as of 31 December 2018 was £317.7 million, a decrease of £10.9 million over the year. The gross USD debt principal remains unchanged.

Dividend

A semi-annual cash dividend of $0.09 per share was paid on 4 January 2019. A further semi-annual cash dividend of $0.09 per share will be paid on 5 June 2019, to shareholders of record on 26 April 2019. The stock will begin to trade ex-dividend on 25 April 2019.

Conference Call Information

The Company’s conference call to review second quarter fiscal 2019 results will be broadcast live over the internet today, 14 February 2019 at 8:00 a.m. Eastern Time and will be available on Manchester United’s investor relations website at http://ir.manutd.com. Thereafter, a replay of the webcast will be available for thirty days.

About Manchester United

Manchester United is one of the most popular and successful sports teams in the world, playing one of the most popular spectator sports on Earth.

Through our 141-year heritage we have won 66 trophies, enabling us to develop what we believe is one of the world’s leading sports brands and a global community of 659 million followers. Our large, passionate community provides Manchester United with a worldwide platform to generate significant revenue from multiple sources, including sponsorship, merchandising, product licensing, broadcasting and matchday.

Cautionary Statement

This press release contains forward-looking statements. You should not place undue reliance on such statements because they are subject to numerous risks and uncertainties relating to the Company’s operations and business environment, all of which are difficult to predict and many are beyond the Company’s control. Forward-looking statements include information concerning the Company’s possible or assumed future results of operations, including descriptions of its business strategy. These statements often include words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” or similar expressions. The forward-looking statements contained in this press release are based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. You should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect its actual financial results or results of operations and could cause actual results to differ materially from those in these forward-looking statements. These factors are more fully discussed in the “Risk Factors” section and elsewhere in the Company’s Registration Statement on Form F-1, as amended (File No. 333-182535) and the Company’s Annual Report on Form 20-F (File No. 001-35627).

Non-IFRS Measures: Definitions and Use

1. Adjusted EBITDA

Adjusted EBITDA is defined as profit for the period before depreciation, amortization, profit on disposal of intangible assets, exceptional items, net finance costs, and tax.

Adjusted EBITDA is useful as a measure of comparative operating performance from period to period and among companies as it is reflective of changes in pricing decisions, cost controls and other factors that affect operating performance, and it removes the effect of our asset base (primarily depreciation and amortization), material volatile items (primarily profit on disposal of intangible assets and exceptional items), capital structure (primarily finance costs), and items outside the control of our management (primarily taxes). Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for an analysis of our results as reported under IFRS as issued by the IASB. A reconciliation of profit/(loss) for the period to Adjusted EBITDA is presented in supplemental note 2.

2. Adjusted profit for the period (i.e. adjusted net income)

Adjusted profit for the period is calculated, where appropriate, by adjusting for charges/credits related to exceptional items, foreign exchange gains/losses on unhedged US dollar denominated borrowings, and fair value movements on embedded foreign exchange derivatives, adding/subtracting the actual tax expense/credit for the period, and subtracting the adjusted tax expense for the period (based on a normalized tax rate of 21%; 2017: 35%). The normalized tax rate of 21% is the current US federal corporate income tax rate.

In assessing the comparative performance of the business, in order to get a clearer view of the underlying financial performance of the business, it is useful to strip out the distorting effects of the items referred to above and then to apply a ‘normalized’ tax rate (for both the current and prior periods) equivalent to the US federal corporate income tax rate of 21% (2017: 35%). A reconciliation of profit/(loss) for the period to adjusted profit for the period is presented in supplemental note 3.

3. Adjusted basic and diluted earnings per share

Adjusted basic and diluted earnings per share are calculated by dividing the adjusted profit for the period by the weighted average number of ordinary shares in issue during the period. Adjusted diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares in issue during the period to assume conversion of all dilutive potential ordinary shares. There is one category of dilutive potential ordinary shares: share awards pursuant to the 2012 Equity Incentive Plan (the “Equity Plan”). Share awards pursuant to the Equity Plan are assumed to have been converted into ordinary shares at the beginning of the financial year. Adjusted basic and diluted earnings per share are presented in supplemental note 3.

4. Net debt

Net debt is calculated as non-current and current borrowings minus cash and cash equivalents.

Key Performance Indicators

Three months ended Six months ended 31 December 31 December

2018

Restated(1)

2017

2018

Restated(1)

2017

Commercial % of total revenue 31.6% 36.8% 41.3% 45.4% Broadcasting % of total revenue 49.7% 42.4% 42.6% 36.1% Matchday % of total revenue 18.7% 20.8% 16.1% 18.5% Home Matches Played PL 7 7 10 11 UEFA competitions 3 2 3 3 Domestic Cups - - 1 1 Away Matches Played PL 6 7 10 10 UEFA competitions 2 2 3 4(2) Domestic Cups - 2 - 2 Other Employees at period end 937 923 937 923 Employee benefit expenses % of revenue 37.3% 39.3% 45.1% 43.5%

(1) Comparative amounts have been restated – see supplemental note 5 for further details.

(2) Includes UEFA Super Cup final following UEFA Europa League win in 2016/17.

Phasing of Premier League gamesQuarter 1 Quarter 2 Quarter 3 Quarter 4 Total 2018/19 season* 7 13 12 6 38 2017/18 season 7 14 10 7 38

*Subject to changes in broadcasting scheduling

CONSOLIDATED INCOME STATEMENT(unaudited; in £ thousands, except per share and shares outstanding data) Three months ended

31 December

Six months ended

31 December

2018 Restated(1)

2017

2018 Restated(1)

2017

Revenue208,612 177,415 343,638 321,080 Operating expenses (160,269) (136,252 ) (303,849) (279,288 ) (Loss)/profit on disposal of intangible assets (4,349) 1,013 18,079 18,292 Operating profit 43,994 42,176 57,868 60,084 Finance costs (7,131) (4,533 ) (12,946) (5,534 ) Finance income 785 170 1,474 388 Net finance costs (6,346) (4,363 ) (11,472) (5,146 ) Profit before tax37,648 37,813 46,396 54,938 Tax expense(2) (10,878) (57,510 ) (12,980) (65,065 ) Profit/(loss) for the period 26,770 (19,697 ) 33,416 (10,127 ) Basic earnings/(loss) per share: Basic earnings/(loss) per share (pence) 16.27 (12.00 ) 20.31 (6.17 ) Weighted average number of ordinary shares outstanding (thousands) 164,526 164,195 164,526 164,195 Diluted earnings/(loss) per share: Diluted earnings/(loss) per share (pence)(3)16.26 (12.00 ) 20.29 (6.17 ) Weighted average number of ordinary shares outstanding (thousands) 164,663 164,585 164,663 164,585

(1) Comparative amounts have been restated – see supplemental note 5 for further details. (2) The US federal corporate income tax rate reduced from 35% to 21% following the enactment of US tax reform on 22 December 2017. This necessitated a re-measurement of the then existing US deferred tax position in the period to 31 December 2017. As a result the prior year period tax expense included a non-cash tax accounting write off of £49.0 million. (3) For the three and six months ended 31 December 2017 potential ordinary shares are anti-dilutive, as their inclusion in the diluted loss per share calculation would reduce the loss per share, and hence have been excluded.

CONSOLIDATED BALANCE SHEET(unaudited; in £ thousands) 31 December

2018

Restated(1)

30 June

2018

Restated(1)

31 December

2017

ASSETS Non-current assets Property, plant and equipment 246,910 245,401 246,673 Investment property 13,772 13,836 13,901 Intangible assets 739,472 799,640 770,076 Derivative financial instruments 2,559 4,807 1,192 Trade and other receivables 10,387 4,724 10,560 Tax receivable 547 547 1,882 Deferred tax asset 57,636 63,332 77,500 1,071,283 1,132,287 1,121,784 Current assets Inventories 2,610 1,416 1,918 Derivative financial instruments 625 1,159 2,704 Trade and other receivables 124,232 168,060 123,027 Tax receivable 598 800 - Cash and cash equivalents 190,395 242,022 155,312 318,460 413,457 282,961 Total assets 1,389,743 1,545,744 1,404,745 (1) Comparative amounts have been restated – see supplemental note 5 for further details. CONSOLIDATED BALANCE SHEET (continued)(unaudited; in £ thousands) 31 December

2018

Restated(1)

30 June

2018

Restated(1)

31 December

2017

EQUITY AND LIABILITIESEquity Share capital 53 53 53 Share premium 68,822 68,822 68,822 Merger reserve 249,030 249,030 249,030 Hedging reserve (35,693) (27,558 ) (23,944 ) Retained earnings 170,544 136,757 184,529 452,756 427,104 478,490 Non-current liabilities Trade and other payables 46,644 104,271 70,331 Borrowings 502,576 486,694 474,748 Deferred revenue 32,952 37,085 32,704 Deferred tax liabilities 33,302 29,134 35,801 615,474 657,184 613,584 Current liabilities Tax liabilities 5,771 3,874 3,704 Trade and other payables 180,588 267,996 182,965 Borrowings 5,492 9,074 9,160 Deferred revenue 129,662 180,512 116,842 321,513 461,456 312,671 Total equity and liabilities 1,389,743 1,545,744 1,404,745 (1) Comparative amounts have been restated – see supplemental note 5 for further details.

CONSOLIDATED STATEMENT OF CASH FLOWS(unaudited; in £ thousands)

Three months ended 31 December

Six months ended

31 December

2018 2017 2018 2017 Cash flows from operating activities Cash (used in)/generated from operations (see supplemental note 4) (41,019) (38,440 ) 82,337 (11,489 ) Interest paid (1,734) (1,621 ) (9,507) (9,639 ) Interest received 722 170 1,355 388 Tax paid (376) (4,530 ) (1,810) (5,768 ) Net cash (used in)/generated from operating activities (42,407) (44,421 ) 72,375 (26,508 ) Cash flows from investing activities Payments for property, plant and equipment (2,414) (4,243 ) (7,318) (8,587 ) Proceeds from sale of property, plant and equipment - 75 - 75 Payments for intangible assets (16,418) (12,000 ) (145,056) (129,121 ) Proceeds from sale of intangible assets 255 256 25,183 32,442 Net cash used in investing activities (18,577) (15,912 ) (127,191) (105,191 ) Cash flows from financing activities Repayment of borrowings - (106 ) (3,750) (206 ) Net cash used in financing activities - (106 ) (3,750) (206 ) Net decrease in cash and cash equivalents(60,984) (60,439 ) (58,566) (131,905 ) Cash and cash equivalents at beginning of period 247,505 216,236 242,022 290,267 Effects of exchange rate changes on cash and cash equivalents 3,874 (485 ) 6,939 (3,050 ) Cash and cash equivalents at end of period 190,395 155,312 190,395 155,312

SUPPLEMENTAL NOTES

1General information

Manchester United plc (the “Company��) and its subsidiaries (together the “Group”) is a professional football club together with related and ancillary activities. The Company incorporated under the Companies Law (2011 Revision) of the Cayman Islands, as amended and restated from time to time.

2Reconciliation of profit/(loss) for the period to Adjusted EBITDA

Three months ended

31 December

Six months ended

31 December

2018

£’000

Restated(1)

2017

£’000

2018

£’000

Restated(1)

2017

£’000

Profit/(loss) for the period26,770 (19,697 ) 33,416 (10,127 ) Adjustments: Tax expense 10,878 57,510 12,980 65,065 Net finance costs 6,346 4,363 11,472 5,146 Loss/(profit) on disposal of intangible assets 4,349 (1,013 ) (18,079) (18,292 ) Exceptional items 19,599 - 19,599 - Amortization 33,440 37,335 68,571 73,389 Depreciation 2,970 2,755 5,779 5,329 Adjusted EBITDA 104,352 81,253 133,738 120,510

(1) Comparative amounts have been restated – see supplemental note 5 for further details.

3Reconciliation of profit/(loss) for the period to adjusted profit for the period and adjusted basic and diluted earnings per share

Three months ended

31 December

Six months ended

31 December

2018

£’000

Restated(1)

2017

£’000

2018

£’000

Restated(1)

2017

£’000

Profit/(loss) for the period26,770 (19,697 ) 33,416 (10,127 ) Exceptional items 19,599 - 19,599 - Foreign exchange losses/(gains) on unhedged US dollar borrowings 1,316 (1,328 ) 1,535 (6,824 ) Fair value movement on embedded foreign exchange derivatives 25 291 (56) 845 Tax expense 10,878 57,510 12,980 65,065 Adjusted profit before tax 58,588 36,776 67,474 48,959

Adjusted tax expense (using a normalized US statutory rate of 21% (2017: 35%))

(12,303) (12,872 ) (14,170) (17,136 ) Adjusted profit for the period (i.e. adjusted net income) 46,285 23,904 53,304 31,823 Adjusted basic earnings per share: Adjusted basic earnings per share (pence) 28.13 14.56 32.40 19.38 Weighted average number of ordinary shares outstanding (thousands) 164,526 164,195 164,526 164,195 Adjusted diluted earnings per share: Adjusted diluted earnings per share (pence) 28.11 14.52 32.37 19.34 Weighted average number of ordinary shares outstanding (thousands) 164,663 164,585 164,663 164,585

(1) Comparative amounts have been restated – see supplemental note 5 for further details.

4Cash (used in)/generated from operations

Three months ended

31 December

Six months ended

31 December

2018

£’000

Restated(1)

2017

£’000

2018

£’000

Restated(1)

2017

£’000

Profit/(loss) for the period 26,770 (19,697 ) 33,416 (10,127 ) Tax expense 10,878 57,510 12,980 65,065 Profit before tax 37,648 37,813 46,396 54,938 Depreciation 2,970 2,755 5,779 5,329 Amortization 33,440 37,335 68,571 73,389 Loss/(profit) on disposal of intangible assets registrations 4,349 (1,013 ) (18,079) (18,292 ) Net finance costs 6,346 4,363 11,472 5,146 Profit on disposal of property, plant and equipment - (75 ) - (75 ) Equity-settled share-based payments 161 618 371 1,203 Foreign exchange losses on operating activities (95) 9 182 1,000 Reclassified from hedging reserve 1,536 3,587 2,844 7,468 Changes in working capital: Inventories 56 156 (1,194) (281 ) Trade and other receivables (30,303) (37,282 ) 39,293 (25,437 ) Trade and other payables and deferred revenue (97,127) (86,706 ) (73,298) (115,877 ) Cash (used in)/generated from operations (41,019) (38,440 ) 82,337 (11,489 )

(1) Comparative amounts have been restated – see supplemental note 5 for further details.

5Restatement of prior periods following implementation of IFRS 15

The Group adopted IFRS 15 ‘Revenue from contracts with customers’ with effect from 1 July 2018. The implementation of IFRS 15 had an impact on the Group’s financial statements as at 1 July 2018 and consequently prior year amounts have been restated. The table below shows the retrospective impact on revenue for the four quarters ended 30 June 2018. Note 34 to the interim consolidated financial statements for the three and six months ended 31 December 2018 contains tables and notes which explain how the restatement affected the consolidated income statement, consolidated statement of comprehensive income, consolidated balance sheet, and consolidated statement of cash flows.

Commercial revenue

IFRS 15 focuses on the identification and satisfaction of performance obligations and includes specific guidance on the methods for measuring progress towards complete satisfaction of a performance obligation therefore revenue on certain commercial contracts is recognized earlier under IFRS 15. The effect of the retrospective application is an increase in cumulative revenue recognized over the financial years up to and including the year ended 30 June 2018 including a reduction to the amount of revenue recognized during the financial year ended 30 June 2018 only.

Broadcasting revenue

Following adoption of IFRS 15, certain performance obligations are satisfied over time as each Premier League match (home and away) is played – accordingly revenue is recognized evenly as each Premier League match (home and away) is played. Broadcasting merit awards were previously recognized one share in the first quarter with the remainder being recognized when they were known at the end of each football season. Merit awards represent variable consideration and therefore, following adoption of IFRS 15, are estimated using the most likely amount method based on management’s estimate of where the Club’s finishing position will be at the end of each season. Broadcasting equal share payments were previously recognized evenly as each Premier League home match was played. Note, these changes only affect the amount of broadcasting revenue recognized in each quarter, they do not affect the amount of broadcasting revenue recognized for the financial year as a whole.

Matchday revenue

Adoption of IFRS 15 has no impact on the recognition of matchday revenue.

£’000 Three months Three months Three months Three months Twelve months

ended

ended ended ended ended 30 September 31 December 31 March 30 June 30 June

2017

2017 2018 2018 2018 Commercial revenue Reported 80,544 65,366 66,673 63,516 276,099 Adjustment (66 ) (66 ) (66 ) (66 ) (264 ) Restated 80,478 65,300 66,607 63,450 275,835 Broadcasting revenue

Reported 38,082 61,628 39,674 64,753 204,137 Adjustment 2,751 13,519 9,656 (25,926 ) - Restated 40,833 75,147 49,330 38,827 204,137 Matchday revenue Reported 22,354 36,968 31,122 19,342 109,786 Adjustment - - - - - Restated 22,354 36,968 31,122 19,342 109,786 Total revenue Reported 140,980 163,962 137,469 147,611 590,022 Adjustment 2,685 13,453 9,590 (25,992 ) (264 ) Restated 143,665 177,415 147,059 121,619 589,758

View source version on businesswire.com: https://www.businesswire.com/news/home/20190214005343/en/

Manchester United plc Investor Relations: Cliff Baty Chief Financial Officer +44 161 868 8650 [email protected]

Manchester United plc Media: Charlie Brooks Director of Communications +44 161 868 8148 [email protected]

Sard Verbinnen & Co Jim Barron / Devin Broda + 1 212 687 8080 [email protected] [email protected]

Source: Manchester United

Source link

https://www.manutdnews.online/manchester-united-plc-2019-second-quarter-results/

0 notes

Text

Record TV rights deal saw gap from Premier League to EFL widen to £133m in first year

Record TV rights deal saw gap from Premier League to EFL widen to £133m in first year

Record TV rights deal saw gap from Premier League to EFL widen to £133m in first year

The money flowing through an average Premier League club was more than six times that of an average Championship club in 2017

The gap in average turnover between Premier League and English Football League clubs widened to £133m in the year after a record TV rights deal.

The divide grew in each season from 2014-16 and by a third more in 2017.

Championship clubs are now tending towards a “two-year gamble” to attempt promotion and avoid breaching spending rules, a football finance expert says.

“Competitive balance” between the Premier League and Championship was “clearly evident”, the EFL said.

All three of the clubs promoted from the Championship at the end of the 2016-17 season – Newcastle, Brighton and Huddersfield – survived in the Premier League last term, while of the teams that came down, Middlesbrough made the play-offs, Hull City finished 18th and Sunderland were relegated.

In 2015, the Premier League sold domestic television rights to its games for a record £5.136bn, 71% above the previous deal.

The full impact of that negotiation was first expected to be seen in 2016-17 accounts, which BBC analysis can now reveal.

BBC England’s data unit and BBC Sport analysed most recent accounts – covering the four years until 2017.

Our analysis found:

The median average turnover among Premier League clubs was £133m higher than those in the Championship, according to clubs’ most recent accounts

In 2017, 14 out of 23 Championship clubs spent more than 100% of their turnover on staff costs, including their players, coaches, management and administrators

Barnsley did not disclose that detail in their 2017 accounts

Between 2014 and 2017, Championship clubs’ median average turnover increased by £4.8m to £23.7m, League One’s rose by £1.9m to £6.3m and League Two’s dropped by £300,000 to £3.2m

The Premier League’s highest-paid director, believed to be executive chairman Richard Scudamore, received £2.5m in “broadcasting bonuses” in the year ending 2016, when the record TV rights deal was agreed – more than the margin by which League One and League Two clubs increased their turnovers from 2014-17

The BBC investigation earlier revealed more than half of Premier League clubs could have made a pre-tax profit without selling any tickets in the first season of the current broadcast deal.

The total value of the rights for 2019-2022 was taken to £4.55bn without Amazon having announced how much it had paid to show 20 matches in each of those three seasons.

Championship clubs’ income from broadcasters now “pales into insignificance” compared to that in the Premier League, according to football finance expert Kieran Maguire, from the University of Liverpool.

Trevor Birch, the former chief executive of Chelsea, Everton, Leeds, Sheffield and Derby County, and one-time administrator for Portsmouth, said nobody could have foreseen the “exponential growth” of the Premier League at its outset.

The EFL said it was “widely acknowledged that there is a significant disparity in broadcast income between clubs in the top two divisions in England” but stressed revenues for its clubs “continued to increase through club-generated income, improved central contracts and as a result of EFL-negotiated solidarity payments”.

The sale of its own broadcasting rights would “see a 36% increase in revenues from the start of the 2019-20 season”, the EFL said, giving clubs “increased long-term certainty”.

“The quality of the Championship now was such it attracted larger television audiences and was probably the second-best league in Europe,” Birch said, but it “relied on benefactors and investors” to keep pace with the finances of the Premier League.

In 2014, EFL chief executive Shaun Harvey had said the winner of the second-tier play-off final would receive the same from one season in the Premier League as “from playing in the Championship for the next 30 years”.

Football Supporters’ Federation chair Malcolm Clarke told the BBC: “We believe that more money should trickle, or in fact waterfall down from the Premier League in a redistribution of that broadcast money.

“It’s in the Premier League’s best interests to keep the football pyramid healthy.”

‘Gamble’

Clarke continued: “There should be greater redistribution down through the leagues, but at the end of the day the Premier League owners are reluctant to do that. This is something the FA surrendered 25 years ago when the league was created.”

Maguire said increased broadcast revenue had “increased the incentive for clubs in the Championship to aim for promotion, as the financial rewards were so great”.

Spending limits intended to protect clubs’ futures – Profitability and Sustainability rules which allow clubs to make up to a £39m loss over a rolling three-year period – meant clubs were now trying a “two-year gamble” buying players and paying high wages to win promotion, he added.

That approach included the need for a third year of “retrenchment, with the focus on cutting wages and generating income from player sales”, Maguire said, to avoid exceeding permitted losses set out in the spending rules.

The potential rewards “might force clubs to be that bit over-ambitious”, Birch said, and it “could be quite difficult to ‘retrench’ if clubs had signed players on three-year contracts for example”.

What are the rules?

In the Premier League, Financial Fair Play (FFP) rules in place from 2014-16 limited the increases clubs could make in spending on players between seasons that were funded purely by new broadcast revenue.

They could, however, make bigger increases in player spending every year if they had more of their “own revenue”, which could come from new commercial or sponsorship deals, profit from player sales, rising matchday income – such as an increase in ticket sales – or Uefa prize money such as from participating in the Champions League.

Clubs which could not satisfy those criteria were capped on any increases in player spending between seasons.

There was no cap on player costs or wages in the Championship but the rules limited losses to a maximum of £13m per season, or £5m per season if the owner did not inject cash into the club to cover those losses.

FFP has since been replaced with Profitability and Sustainability rules, which changed the assessment period to a rolling three years.

That change meant clubs that remained in the Championship were permitted to lose a total of £39m over those three years.

This loss is not the same as the accounting losses published by clubs, as some costs – such as infrastructure, academy, community and women’s football – are excluded.

Based on the BBC’s analysis of staff spending and his own observations on player signings, Maguire identified five clubs he believed were taking a “two-year gamble”.

“The most noticeable clubs that appear to have taken this approach and ‘twisted on 2017’ are Aston Villa, Birmingham City, Derby County and Sheffield Wednesday,” he said.

“Wolves also took the same gamble in 2017-18 but were rewarded with promotion.

“I think Steve Gibson has realised that Middlesbrough have a separate cliff edge as they only receive parachute payments for two years following their relegation in 2016-17. This meant they realistically had only one year of spending before introducing some austerity measures.

“His comments that Boro would ‘smash’ the Championship in 2017-18, by spending £50m on transfers didn’t bear fruit and consequently they’ve had to cut back this summer [by selling Adama Traore, Ben Gibson and Patrick Bamford for a total of about £43m].”

Ex-Chelsea CEO Trevor Birch said increases in TV deals had driven two things: More money paid to players and attracting overseas investors

Both Birmingham City and Sheffield Wednesday have been under transfer embargoes this summer after falling foul of the Profitability and Sustainability regulations.

“Time would tell” if the latest spending rules were working to “stop clubs over-extending themselves”, Birch said, but he highlighted there had been no insolvency situations among clubs in recent years.

Asked about the BBC’s findings that 14 Championship clubs spent more than their turnover on staff costs in 2017, Birch, who brokered Roman Abramovich’s £180m takeover of Chelsea in 2003, said “clubs are obviously overspending if they have owners with deep pockets who are prepared to finance it”.

Birch, now managing director at Duff & Phelps added: “It is obviously not sustainable if those owners walk off, you’d have to be concerned as a supporter if for one reason your owner did walk away.”

The BBC approached Aston Villa, Birmingham, Derby County, Sheffield Wednesday, Wolves and Middlesbrough for comment.

Middlesbrough says it “operates within the Profitability and Sustainability rules and will continue to do so”.

The EFL said its rules allowed “clubs to operate in a fair and sensible manner, whilst also providing the freedom and flexibility for club owners to compete in what is an increasingly-competitive marketplace”.

Reporting team: Alex Homer, Andrew Aloia, Steve Marshall, Daniel Wainwright, Pete Sherlock and Paul Bradshaw

BBC Sport – Football ultras_FC_Barcelona

ultras FC Barcelona - https://ultrasfcb.com/football/10532/

#Barcelona

0 notes

Text

Due to the fact that College Does A Piss Poor Project Relating, youngsters Believe They Will.

Reasons gel Is actually Receiving More Popular Before Many years.

Ah yes - the come back to college has shown up and also Halton Something to chew on is actually getting ready for one more great year of Pupil Nutrition Programs in alliance with Halton institutions. While all trainees lose some ground in mathematics over the summer season, low-income trainees shed additional ground in analysis, while their higher-income peers may even obtain. Based at LSE, the Firoz Lalji Centre for Africa (@AfricaAtLSE) markets private scholarly research as well as training; issue-oriented as well as open discussion; and also evidence-based policy manufacturing.

7 Easy Ways To Promote gel.

Why Is gel Considered Underrated?

Sunshine 15 Nov, Bury Theater, Royal Armouries, 10:30 -10:50, free admittance with Sunday/Weekend conference successfully pass, every ages, however please keep in mind: Thought Bubble performs certainly not console information. Therefore permit's shine a limelight on last summer months's Geek Squad Academy, a very most productive turn-up event took free of cost to youngsters due to Absolute best Buy and also Dallas Area of Learning. Luthuli's Nobel pep talk was actually additionally the cri de coeur of a fully commited pan-African astrologer connecting Africa's freedom problem to that from discrimination South Africa, as well as asking for an unified continent to desert its own overbearing past times as well as create autonomous communities accordinged to humane worths. Significant Thought centers 90% from our resources on out-of-school-time programs that deal with elementary, center, and also senior high school pupils to uncover their full ability and specified them on a pathway to success. In case you have almost any questions about where by in addition to the best way to utilize sources, it is possible to e mail us at the webpage. This occasion discovers the literary trajectory in North Africa considering that the Arab Spring from the initial frenzy of positive outlook to gloomy dystopian narratives, off the much more typical literary type from poems in the area to writers trying out other fictional kinds. What links the educational program is a desire to find pupils interact along with the worths that make alive Western side society, a groundwork that they can improve through even more specific training program job within their very own majors and also can easily remain to draw on for the whole of their adult lifestyles. Dallas Mayor Mike Rawlings as well as Dallas ISD Superintendent Michael Hinojosa revealed their strategy to an area filled with fans and also good friends Dec Andrew Lo That's certainly had an effect on the psychological science of the market place. They are actually simply observing the breadstuff scraps left behind by real dreamers, the entrepreneurs. This summer months we were delighted to be awarded backing off Arts Authorities England to give thousands of youths the opportunity to take part in totally free workshops in some of Leeds' very most iconic sites! To remedy this void, upcoming weekend break (16-18 June), the newly created Principle for Pan-African Thought and also Conversation at the Educational institution from Johannesburg will definitely hold a three-day social meeting on The Pan-African Pantheon" at UJ's Arts Centre. It's how I experienced after Michael Brown was left in the road for 4 hrs ... Along with Eric Garner, Tamir Rice, Freddy Gray, Philando Castille, along with Sandra Bland et al. How I felt learning the deepness of our sinister history in Cultural and also Pan African Researches - leading up to and since 1492. Sunshine Sixth Nov, Bury Theatre, Royal Armouries (Ground Floor), 12.00-12.50, free of cost admittance along with Sunday/Weekend event pass, All Ages, yet simply notice: Notion Blister carries out not control board material. Thur 13 Nov, The Reliance, 76-78 North Road Leeds, 2000 (42 min), FREE, please check out for tickets. Travelling Male, Eisner Feeling of Comics Retail store Finalist 2015, has firmly established on its own as the area to use the North of England for all kinds of witties goodness along with its amazing ambiance and also friendly team. With sound speakers Kieran Shiach (The Guardian), Claire Napier (Women Cover Comic books), Kelly Kanayama (Nerdist), Hassan Otsmane-Elhaou (PanelxPanel) and Steve Morris (The MNT). Today, UBA works in 19 African countries, and also Nyc, London as well as Paris. Sat 5th Nov, Bury Theater, Royal Armouries (Ground Floor), 11.00-11.50, free of cost entry along with Saturday/Weekend convention successfully pass, All Ages, but simply note: Notion Bubble performs certainly not console web content. So if you are actually a youthful comic enthusiast, or one that certainly never matured, and intend to hear about some excellent tales to read through, occur as well as receive the low-down off some of the greatest creators on the market! The Principle will definitely cultivate a reliable communications method targeted at including market value to the general public sphere, enhancing discussions on Pan-African political, socio-economic, as well as social issues along with which the Principle is engaged. LSE is actually a personal company restricted through guarantee, sign up variety 70527. Democracy is certainly not one thing that is provided forever. Leeds Dock as well as Royal Armouries, 10:00 -17:00, Free for under-12s, however a coming with ticket-holding adult has to be present, free for over-65s on discussion of a valid type from photograph I.D., every ages.

0 notes

Text

The apple of my eye (or 'oh good, there's ANOTHER one')

*yeets into the conversation a week late with Starbucks*

Sorry, sorry. Been trying to save a dukedom from a giant brain and live my best happily ever with a vampire twink. Very distracting.

But anyway, I haven't even gotten the boys in my clubroom yet, so more analysis incoming, but I have finished Indigo Disk's main story, and I couldn't help but notice something deeply awful when fighting our little buddy Kieran.

... Oh god THEY'RE MULTIPLYING. How many apples do we need? How much more homosexuality does this game need? (Yes. The answer is 'yes.')

Meet Hydrapple everyone, the latest gay marriage mascot. Truly wish you all could've seen my face when. And it evolves from the last gay marriage mascot! I have quickly become homophobic again, how do they keep managing this?!

So, naturally, we need to break this loveable bastard and its symbolism down, or I might have to start passing the meta queen crown off to someone else. (I vote @prince-kallisto. Friend spare me. 🤣)

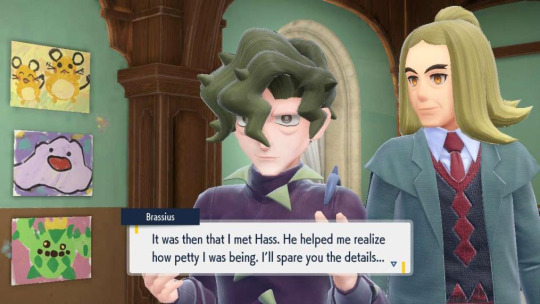

Well, we'll begin with the obvious: this thing is a hydra, a multiple-headed dragon in Greek myth. This one in particular has seven, so says the all-knowing dex:

But we'll do the seven part in a minute. The one major thing you should all know is that in most tales, removing one of this thing's heads respawns two in its place - and killing one of these creatures was the second labour of Hercules, the God of Strength. There's that fucking number two again in connection with our boys...

And now, let's take the Greek and easternize it to our lovely Japanese creators with the number seven.

Seven in Japanese culture, like in the western, is seen as a lucky number, and also the number symbolising the cycle of life and death.

... Which, if you recall, is a running theme with our silly men.

Get your life saved, idiot. Be lucky. 🥰

There are also Seven Gods of Fortune in Buddhism, Japan's primary religion. And there's one that rings more than a few ceremonial bells - Fukurokokuju. Bit of a Buddhist lore deepcut here for you:

> He is the god of wisdom, luck, longevity, wealth and happiness. Moreover, he is the only god who was said to have the ability to resurrect the dead. Fukurokuju is characterized by the size of his head, being almost as large as the size of his whole body.

... Hmm. Wisdom, happiness. Luck. 'Resurrecting.' The one that has a large head, like our good pal Hydrapple here... it's all very interesting, isn't it, how it ties together?

And all this goes a long way to explaining the evolution method of this fun little apple-y bastard. Because in order to be lucky, to be brought back to life, to heal and to love and to find yourself... one must have support. A cheerleader, if you will. Not one with pom-poms (although slay Hass babes, you'd look great in that drip), but one cheering you on. Always being in your corner.

... And here we find Dragon Cheer, Hydrapple's evolution move. Brassius can pursue his dreams as passionately as he likes, because there's always a husband at his side to be on his side.

It's a whole narrative, my friends. We have the romantic gift of the Applin; we have the adorableness of the Flapple, and its dusk portrait; we have the total harmony of Dipplin...

... And now we have the result of that harmony. Look, it's even running away from the Ice of the Polar Biome, a type both Grass and Dragon can't stand. The emotional cold.

Y'know, I'm sure someone would have DM'd me by now if Hass and Brass' clubroom banter confirmed their marriage, so I'm going to assume that isn't a thing.

... But at the same time, it's definitely a thing. All you have to do is read the narrative, darlings.

#ephemeralartshipping#hassius#hassel x brassius#hassel#brassius#pokemon scarlet and violet#indigo disk dlc#pokemon spoilers#hydrapple is the final piece of the puzzle#and I for one think that's fucking beautiful. 😭😭#... fucking apples. I'll write a fic about this shit someday on arceus#I have missed meta y'know. Great to be back. 😍

93 notes

·

View notes

Text

Celtic can take a giant leap towards 10 in a row by sealing record-breaking agreement – opinion

Celtic are on the verge of sealing a ninth consecutive Scottish crown.

Remarkably, they’ve opened up a 13 point gap between them and Rangers in recent weeks – their fiercest rivals have failed to win five games in the league in 2020 and as a result, Neil Lennon’s side have profited considerably.

The Hoops had a minor hiccup against Livingston but they bounced back in tremendous fashion last weekend, defeating St Mirren 5-0 at home.

Nothing now stands between the Bhoys and yet another league title, but their hopes of going on to secure a tenth could soon be given a huge advantage.

In recent weeks, it’s been reported that Celtic are on the verge of agreeing a kit deal with Adidas. They’re currently tied down to a £25m deal with New Balance, but their potential new supplier would smash that agreement out of the water, becoming the biggest kit contract in Scottish history.

If a deal can be reached, the terms will begin next season over what is expected to be a long-term partnership between the two.

A clear price hasn’t been revealed but if it smashes the previous income they take from New Balance, it bodes incredibly well. Celtic are already streets ahead of their competitors in Scotland and raking in even more money would take them a step closer to achieving a further SPFL title.

Hefty income from Adidas means the top brass in Glasgow would presumably also be able to spend more on improving further aspects of the club. Whether that be through player recruitment, better facilities or more in-depth analysis, it could take Celtic to another level.

Most importantly, Lennon’s side would also have greater room for manoeuvre in the transfer market, thus ensuring Rangers need to irk out even more in order to bridge the gap.

The Hoops aren’t exactly in financial trouble themselves and have already had their coffers buffered significantly in recent years.

A £19.7m sale of Moussa Dembele was furthered by a record-breaking departure in the shape of Kieran Tierney who departed for £25m.

Only real Celtic fans will get 100% on the Ultimate Hoops quiz. Test your knowledge below…

That hasn’t hurt the Hoops given they’re still top of the division, so even further investment from Adidas would improve the chances of keeping Steven Gerrard’s men behind them for an even greater period.

A regular kit deal may not mean much, but in terms of Scottish football history, this one could well be game-changing.

In further news, Nick Hammond could deal a HUGE BLOW to Dembele this summer…

from FootballFanCast.com https://ift.tt/2w2UIOm via IFTTT from Blogger https://ift.tt/3aNvt12 via IFTTT

0 notes

Text

PODCAST: Best ESG Bond ETFs, Beyond Meat Shocks, SRI Engages Slavery

Beyond Meat initial public offering (IPO) share price soars over $80 from $25 surprising everyone and encouraging offerings that could excite ethical and sustainable investors. Learn how to find animal-friendly investments. UN agency PRI says socially responsible investing (SRI) should wake up to modern slavery. Unilever better investment over Johnson & Johnson says sustainability analyst.

Transcript & Links May 10, 2019

Hello, Ron Robins here. Welcome to my podcast Ethical & Sustainable Investing News to Profit By! for May 10, 2019. Presented by Investing for the Soul. investingforthesoul.com is your site for vital global ethical and sustainable investment resources.

Now to this podcast. Again, for any terms that are unfamiliar to you, simply Google them!

Also, you can find a full transcript, live links and sometimes bonus material at my podcast page located at investingforthesoul.com/podcasts

-------------------------------------------------------------

Many of you listening are interested in ESG or SRI bond and fixed income investments. And with good reason. A recent article titled, Largest 10 Socially Responsible Fixed Income ETFs, by Todd Shriber of ETF Trends, reviews two leading funds in this space. They are the iShares Global Green Bond ETF (on Nasdaq GM: ticker BGRN) and VanEck Vectors Green Bond ETF (on the NYSEArca: ticker GRNB). These bond funds have great pedigrees.

However, the article’s title might suggest the review is of ten SRI fixed income ETFs and that’s a little misleading. Concerning the ten listed—but not reviewed—I wouldn’t put them in the same category as the two funds examined in the article.

The SRI credentials of the ten listed are mainly that they invest in government securities and blue-chip company bonds. Of course, governments fund all sorts of things that ethical and sustainable investors might argue aren’t socially responsible. And even though blue-chip companies such as Apple are frequently top SRI holdings, their bonds aren’t usually going directly to fund green projects.

Whereas, the iShares Global Green Bond ETF and VanEck Vectors Green Bond ETF specifically fund projects and activities related to environmental and social concerns.

-------------------------------------------------------------

Well, I can’t resist the temptation to not talk about the great Beyond Meat initial public offering! It came out at $25 on May 2 and has traded over $80 since then. For a good review of what the company is and what it faces regarding competition etc., see this MarketWatch post, Beyond Meat goes public with a bang: 5 things to know about the plant-based meat maker, by Ciara Linnane.

Quoting Ciara, she says, "The maker of the Beyond Burger, which is sold at Whole Foods and restaurant chain TGIF, among others, priced its initial public offering at $25 a share… raising at least $240 million at a valuation slightly shy of $1.5 billion." Close quote. Now at $80 a share Beyond Meat has a staggering market valuation of about $5 billion!

I'm delighted to see this offering, as one of the most important things we can do to slow down carbon emissions and climate change, is to reduce our consumption of meat. However, some climate researchers are skeptical about the net benefit of highly processed vegetarian and vegan offerings on the climate.

That this IPO went so well is a testament to the fact that even many conservative financial types are recognizing there’s money to be made in climate change. However, I suspect that most of the interest probably comes from younger investors.

Furthermore, this could indicate the beginning of a thrilling era for new investment offerings that ethical and sustainable investors can get excited about!

Obviously, the underwriters significantly underestimated demand for Beyond Meat’s shares. When IPOs triple in price right after being launched it means that the issuer—the company—could have gotten far more for their shares. Though Beyond Meat is probably happy, they’re probably unhappy that they could’ve raised double or triple of what they got!

So, Beyond Meat is an exciting short-term play but with so many competitors to its products over the medium to long-term, it's not obvious it will be a winner yet.

-------------------------------------------------------------

For a good review of what Beyond Meat’s success means for two burger chains offering vegan burgers, see this post, titled, Tim Nash's sustainable stock showdown: battle of the burger chains, Corporate Knights, Canada. Admittedly this review is of the Canadian market, but it has bearing on the US and other markets too. Of course, Americans or anyone can invest in the Canadian stocks of the burger chains mentioned in that post.

After a great review, Mr. Nash finalizes his recommendation as follows, and I quote, “A&W Food Services of Canada (which has no corporate connections to A&W’s American locations) is obviously a much smaller company than Restaurant Brands, but... with a higher dividend and a lower beta, A&W provides a nice mix of income and growth potential. The chain is the clear winner.” Close quote.

-------------------------------------------------------------

Now, for ethical and sustainable investors interested in the animal-friendliness of their investments, read this article by Meredith Jones of MarketWatch, titled, Opinion: Here’s how to check the animal-friendliness of your investments. Quoting her, she says, “It’s easy to check which individual stocks are ‘cruelty-free,’ but you can’t yet invest in a vegan investment index." She offers several ways to checking which investments are free of animal-related products and testing.

If you’re interested in finding more organizations that can help you in this endeavor, check-out my Investing for the Soul sites’ pages Environmental Organizations & Resources and Organizations Promoting Corporate Ethical, Social & Environmental Responsibility.

-------------------------------------------------------------

Turning to a completely different aspect of investing, let’s talk about separately managed accounts at financial institutions compared to owning a portfolio of ETFs. Now separately managed accounts aren’t for everyone as they usually require a sizeable investment. However, if you meet the threshold they could be better for US investors than ETFs, says Johny Mair at ThinkAdvisor.

Mr. Mair says in an article titled, ETF vs. SMA: Which Is Better for Sustainable Investing? That, and I quote, “SMAs are ideal for values-based investing as they allow investors to actively screen for certain product areas (e.g. oil, tobacco), or ‘bad actors’ that they deem antithetical to their values. They also allow for more specificity, e.g. designating a certain percentage of revenue from carbon emissions to be included in one’s portfolio.

Furthermore, because SMA investors directly own the underlying securities, they can opt to play an active shareholder role, working to impact corporate behavior through voting proxies or shareholder resolutions." End quote.

Of course, for those who might not have the means for an SMA—or even for those who do—check out my DIY Ethical-Sustainable Investing Pays Tutorial. There, in 1-hour you can get a handle on how to easily and very cheaply put together your own personal values-based profitable portfolio—nonmatter its size.

-------------------------------------------------------------

In looking for companies we all want to know about their ESG ratings. However, you might not be aware of which ESG rating firms are good. Well, a new report reviews the various ESG rating services. Go to this recent post in IR Magazine, headlined, ESG Ratings – A look at the ESG ratings landscape. Register at the bottom of the page to download the PDF report.

-------------------------------------------------------------

Ethical and sustainable investors are concerned with many issues, but one that they might not have thought of and which is still a global problem is modern slavery. Fiona Reynolds, head of the UN’s Principles of Responsible Investment (PRI), says that ‘“There are a lot of ESG conversations around climate change ... but it is interlinked with modern slavery,’ Reynolds told the Thomson Reuters Foundation in an interview. ‘We see many climate migrants and refugees who end up vulnerable and at risk of being trafficked,’ she added.” Close quote.

Another quote from the article states, that, “The U.N. estimates that some 40 million people are trapped in modern slavery, from factory jobs to forced marriages.” End quote. Perhaps it’s something you might ask the companies you like who might have the potential for such involvement.

The Reuters post is by Kieran Guilbert and titled, 'Look for the laggards' - investors told to target modern slavery.

-------------------------------------------------------------

Lastly, another good comparative analysis by Tim Nash at Corporate Knights for ethical and sustainable investors has the title, Tim Nash’s sustainable stock showdown: Johnson & Johnson vs. Unilever. He says, and I quote,” With thousands of J&J cancer lawsuits pending, you might want to freshen up your portfolio with a cleaner company… J&J and Unilever are companies with very similar financial profiles, but, in my view, Unilever’s brand is thriving while Johnson and Johnson’s is deteriorating.”

For decades, J&J has a been a favorite investment for ethical investors—but not so much anymore as Mr. Nash’s post makes clear. Yet, most ESG funds still have it in their holdings. Check your holdings and see. Perhaps you still like J&J for other reasons. However, at the very least, these lawsuits and the negative publicity surrounding them is proving costly to the firm’s bottom line and stock price.

-------------------------------------------------------------

So, these are my top news stories for ethical and sustainable investors over the past two weeks.

Again, to get all the links or to read the transcript of this podcast and sometimes get additional information too, please go to investingforthesoul.com/podcasts and look for this edition.

And remember, I’m here to help you grow in your investment success—and investing in opportunities that reflect your personal values!

Please don’t hesitate to contact me if you have any questions about the content of this podcast or anything else investment related. I can’t say I’ll have all the answers for you and some answers I can’t give due to licensing restrictions. But where I can help I will.

Now, a big thank you for listening—and please click the share buttons to share this podcast with your friends and family.

Come again! Bye for now!

Check out this episode!

#business#finance#ethical investing#sustainable investing#ESG#SRI#green bonds#socially responsible investing

0 notes

Text

Premier League: 11 of 20 golf equipment may have made income in 2016-17 with out followers at video games

Premier League: 11 of 20 golf equipment may have made income in 2016-17 with out followers at video games

Premier League: 11 of 20 golf equipment may have made income in 2016-17 with out followers at video games

Simply two of the Premier League’s 20 top-flight golf equipment recorded a loss in 2017, in comparison with 18 of the 24 within the Championship

Greater than half of Premier League golf equipment may have performed in empty stadiums and nonetheless made a pre-tax revenue within the first season of the present broadcast deal, BBC analysis has discovered.

In 2016-17, throughout which golf equipment benefited from a file £8.3bn in world TV income, matchday revenue contributed lower than 20p in each £1 earned by 18 top-flight outfits.

The variety of golf equipment that will have recorded pre-tax income even when matchday revenue was taken away rose from two in 2015-16 to 11 in 2016-17.

Dr Rob Wilson, a sport finance specialist at Sheffield Hallam College, mentioned the earlier £3.018bn broadcast deal struck in 2012 signalled a everlasting change to top-flight soccer as a enterprise in England.

“That’s when the main target actually went towards producing TV cash relatively than matchday ticket receipts,” he instructed BBC Sport.

“The income buildings of these golf equipment are pretty effectively there to remain now.

“While you get a £120m payout from the Premier League for kicking a ball round, you possibly can play in an empty stadium if you might want to.

“From a income technology perspective, golf equipment don’t rely anymore on matchday ticket revenue.”

Crystal Palace additionally would have made a revenue of £1.21m – the checklist of Premier League golf equipment who may have made a pre-tax revenue with out matchday revenue in 2016-17 and the sum of these income

Bournemouth, with the smallest floor capability within the Premier League of simply 11,450 and who intend to build a bigger stadium, had a turnover of just about £136.5m in 2016-17, with £5.2m from tickets. That’s lower than 4p in each £1 of its revenue for the season.