#keynesianeconomics

Explore tagged Tumblr posts

Quote

I love spending money… that’s the point of life

Lilia

2 notes

·

View notes

Text

Time to say goodbye, Keynes? (Musings)

Is it time to change voluntary deficit-making, when a state can't let its people get better and pushes them back out to go to work? Also, the amount of borrowing going on makes me foresee where millenials may not even in the future have the luxury of 14-day quarantines. What's wrong with this picture? The economy is so outstretched and adding to that, food supply chains are not even based on the needs of human beings*, they're run by financial markets ergo the food waste in times of famine. I'm looking at FAANG, aka GAFA, who performed really well in this pandemic and wonder if they'd been taxed properly, like France did, whether future generations would be harnessed as much to their country's debt? 🤔

* : "(...)

"I hope this is a wake-up call for the world that we cannot let the financial markets drive the global food supply chain," Christopher Tang, UCLA distinguished professor of business administration told Al Jazeera.

The pandemic is shining a light on a painful open secret: The need for food - actual hunger - is not a determining factor in food supply chains. "

#economy#recovery#depression#gafa#faang#Keynesianeconomics#deficits#debt#pandemic#labour#coronavirus#stockmarket#supplychains#financialmarkets#government#netflixandchill#facebook#amazon#jeffbezos#zuckerberg#google#millenials#apple#slavery#taxes#France#USA#wallstreet#worldhunger#famine

1 note

·

View note

Photo

Bitcoin’s 10 year challenge . A lot of progress has been made in the last decade! Can’t wait to see where we’ll be in another 10 years from now. . Do you think BTC can surpass $1 million by 2029? . 👉 Follow @bitcoinprovencrypto for more 🌽 . Repost @cryptocollective • • • • • #bitcoin #blockchain #crypto #cointelegraph #bitcoinprice #mining #makemoneyonline #cryptohumor #satoshi #btc #bitcoins #investment #bitcoinmemes #galaxys10 #endthefed #cryptofunny #cryptomeme #keynesianeconomics #samsungpay #rockefellers #altcoins #nasdaq #austrianeconomics #bitcoinmeme #bitcoinprice #massawakening #cryptomemes (at New York, New York) https://www.instagram.com/p/BwcU5ZxgoUe/?utm_source=ig_tumblr_share&igshid=1dw3hpczg0n4q

#bitcoin#blockchain#crypto#cointelegraph#bitcoinprice#mining#makemoneyonline#cryptohumor#satoshi#btc#bitcoins#investment#bitcoinmemes#galaxys10#endthefed#cryptofunny#cryptomeme#keynesianeconomics#samsungpay#rockefellers#altcoins#nasdaq#austrianeconomics#bitcoinmeme#massawakening#cryptomemes

2 notes

·

View notes

Text

youtube

In what will be a short livestream, I will watch the latest video from Economics Explained as it involves the Austrian School, and comment as the video goes on with praise and criticism where it's needed. It has already made the rounds in my Discord server and received grumbling reviews, but I haven't watched it before the livestream so I can try to give a fair assessment and provide input and additional information that might be left out of the presentation.

[See: Live Response to Economics Explained's video about Austrian and Keynesian schools]

0 notes

Photo

Kimball grand made of particle board. Sadly the American piano industry did not handle the government invoked economic malaise of the 1970’s well and subsequently died. #kimball #kimballpiano #pianotuning #goldstandard #federalreserve #keynesianeconomics https://www.instagram.com/p/CmcIXqEpfzH/?igshid=NGJjMDIxMWI=

0 notes

Photo

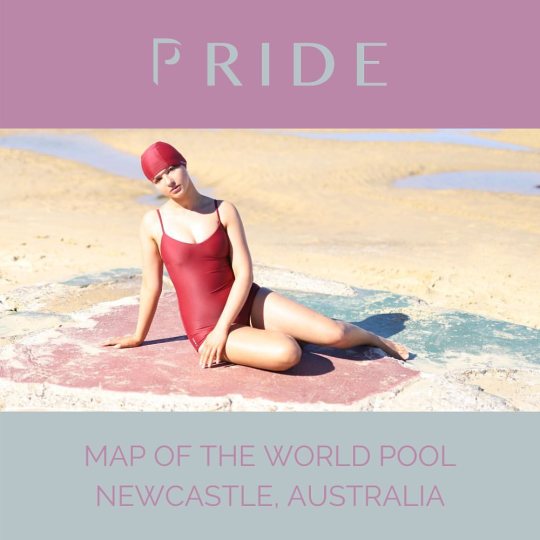

unusually heavy seas have exposed what remains of #newcastle's map of the world pool, a #keynesianeconomics project of the depression. Mention this post and we will include a matching swimming cap in with your next purchase of any one piece swimming costume from our webstore. link in profile. #publicpool #newcastleaustralia #handmadenewcastle #madeinaustralia #bathingcap #bathingbeauty #onepieceswimmingcostume #boyleg #boylegswimsuit (at Newcastle, New South Wales) https://www.instagram.com/p/CDDoq6NDK2M/?igshid=1cesgm64uubja

#newcastle#keynesianeconomics#publicpool#newcastleaustralia#handmadenewcastle#madeinaustralia#bathingcap#bathingbeauty#onepieceswimmingcostume#boyleg#boylegswimsuit

0 notes

Photo

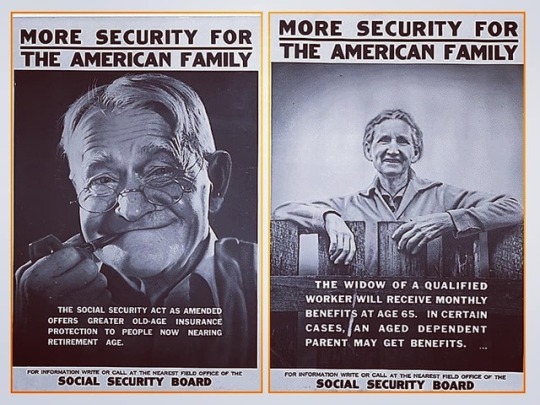

Today In 1935, congress approved the #newdeal... #economicpolicy that pulled #america out of the effects of #thegreatdepression .... #visitusonline💻www.bedfordstmarketing.com/[email protected] #fdr #franklindelanoroosevelt #1930s #historychannel #history #ww2 #progressive #greennewdeal #berniesanders #alexandriaocasiocortez #stamfordconnecticut @stamforddowntown @stamford_chamber_of_commerce_ @norwalkchamber @uschamber #wpa #greenparty #jillstein #keynesianeconomics #johnmaynardkeynes (at Bedford Street Marketing) https://www.instagram.com/p/BwAuyrFFp9I/?utm_source=ig_tumblr_share&igshid=assl90g3ylk7

#newdeal#economicpolicy#america#thegreatdepression#visitusonline💻www#fdr#franklindelanoroosevelt#1930s#historychannel#history#ww2#progressive#greennewdeal#berniesanders#alexandriaocasiocortez#stamfordconnecticut#wpa#greenparty#jillstein#keynesianeconomics#johnmaynardkeynes

0 notes

Link

Basic. While roaming the net found series of useful and straightforward articles about basic economic concepts published on the website of the International Monetary Fund (IMF). In my opinion very well-written and successful in providing good introductory understanding of the Keynesian Economics.

1 note

·

View note

Link

I didn’t see Meet the Press, and there doesn’t seem to be a transcript available yes, but I hear that Paul Ryan declared it a proven fact that Keynesian economics has failed — and was, of course, not challenged on that assertion. Consider it, if you like, more evidence of the right-wing bubble. Outside that bubble, a fair number of people have noticed that Keynesian economics has performed spectacularly in the crisis — it successfully predicted that deficits wouldn’t drive up interest rates, that monetary expansion wouldn’t be inflationary, that austerity policies in Britain and elsewhere would hit economic growth. And no, don’t tell me that Keynesians predicted that the Obama stimulus would produce full employment; serious Keynesians, like me, were more or less frantically warning back in early 2009 that the stimulus was too small. But in Ryan’s world everyone knows that Keynesian economics has failed. Meanwhile, you know what has actually failed? Ryan’s Paulite/Randite monetary economics. You may recall that two years ago Ryan led the charge of Republicans demanding that Ben Bernanke stop his expansionary policies, issuing dire warnings about rising interest rates and soaring inflation. What actually happened:

0 notes

Text

Is Mitt Romney a Keynesian?

Photo: Stephen Morton/Getty Images

It’s not just that Mitt Romney intended to quote conservative hero-figure Winston Churchill butinstead quoted conservative hate-figure John Maynard Keynes. Evidence is popping out all over that Romney is, at heart, a Keynesian. As the Republican Party has given itself over completely to fervent anti-Keynesianism, this is no small matter. Keynesian economic theory, for those of you nodding your heads at the phrase but secretly unsure of what it means, holds that business cycle downturns are generally the result of a lack of consumer demand.

Bad economic times cause a vicious cycle in which people spend less money, thus causing other people to lose their jobs or make less money, and spend less themselves. The Keynesian answer is for the government to reduce interest rates and to increase deficits, pumping up demand until the economy can recover.

That remains the mainstream economic belief. (See Bloomberg’s recent survey of macroeconomic forecasters, which almost unanimously predicted the American Jobs Act would boost growth and employment.) And until not long ago, both parties accepted this theory. In 2001, even the most right-wing Republicans, like Paul Ryan, argued for Keynesian tax cuts to boost demand during a shortfall. In December of 2008, Romney penned a column for National Review Online, laying out his economic prescription. It was pure Keynes. “This is surely the time for economic stimulus,” he wrote, calling for the Federal Reserve to “expand the money supply,” dismissing fears of inflation, and urging temporary tax cuts and new infrastructure spending.

As seems to happen to Romney, no sooner had he spoken up for a solid Republican position than the rest of the Party decided all at once that the thing they all believed now amounted to dangerous socialist nonsense. By early 2009, anything resembling Keynesian analysis had become Republican heresy. Republicans have begun loudly hectoring (or even threatening) the Federal Reserve to stop expanding the money supply, warning that inflation looms. They have insisted that temporary tax cuts don’t work (they only provide a “sugar high,” Republican leaders now say) and that deficits deepen, rather than alleviate, the economic crisis. Rather than respond to the crisis by easing credit and raising short-term deficits, Republicans now demand the opposite.

Romney, naturally, has stopped advocating fiscal or monetary stimulus. His economic plan is mostly geared toward long-term conservative goals, and is extremely vague on the causes of or solutions to the current crisis. (Admission of vagueness: “I don't have all the answers to all the problems that exist in America and around the world, but I know how to find the answers.”) But Romney keeps forgetting that he’s not a Keynesian anymore. The other day, attempting to indict Obama’s worldview, he inadvertently endorsed it:

The president thinks that if you have cash on your balance sheet that means you’re gonna go hire people. No, you hire people if you have customers. The president doesn’t understand what makes the American economy go. I do.

That, as Alan Pyke points out, is exactly Obama’s worldview, and exactly not the Republican worldview. The Republican worldview is that business aren’t hiring because they think their profits are threatened by new regulations and future tax hikes. The Keynesian worldview is that they’re not hiring because there’s not enough consumer demand. Romney has endorsed the demand explanation. Romney’s two main economic advisors, Glenn Hubbard and Greg Mankiw, have both explicitly endorsed the Keynesian–stimulus framework before Republicans turned against it. (Here's Mankiw doing it, and here's Hubbard.)

Romney’s secret Keynesian shame has not, so far, hurt him in the Republican nominating primary, though plenty of time remains for his rivals to expose yet another strand of technocratic reasonableness to the baying hounds of the right-wing base. He’s already “the father of national health insurance” — will Republicans tolerate it if he’s also shown to be a hated advocate of stimulus?

The more interesting implication here is that, if elected president, Romney may well support essentially the same kinds of short-term responses to the crisis that Obama is proposing. Romney has been forced to swear up and down he’ll try to repeal the Affordable Care Act if elected, but he hasn’t been forced to promise to try to push through contractionary fiscal policies. I’m guessing Romney’s economic plan would have, alongside traditional Party favorites like long-term, debt-financed regressive tax cuts, a heavy dose of stimulus. And I’d bet the Republican opposition to stimulus woud melt away under a Romney presidency. Once their Party has its political skin in the game, Republicans would probably abandon their newfound hard-money, anti-Keynesian beliefs as quickly as they took them up under Obama.

In other words, the best short-term hope for the unemployed may be a Mitt Romney presidency. That’s not enough to make a Romney presidency better for liberals, but it would be a nice consolation prize.

By: Jonathan ChaitFILED UNDER: THE NATIONAL INTEREST, CAMPAIGN 2012, ECONOMY, KEYNES, MITT ROMNEY, POLITICS,STIMULUS

Share this story...

Facebook

Twitter

Digg

ShareThis Counter

Email

Print

91 Comments ADD COMMENT

NEWEST

OLDEST

PICKS

MOST REPLIES

Threaded

POSTINOKeynesian economic theory is just another way of saying "investment money." The problem isn't in the theory, it's in the application of the theory. Obama and Bush both printed "investment" money, but spent that money in areas that didn't return a profit. For example educating our kids is great, but won't pay off for 20 years, and by then the economy will be in shambles and the education will do them little good anyway. Another example: expenses in three wars, without a return, flaws keynesian theory. Obama has charged our credit card to the max and invested the money poorly. Romney won't be able to charge the card to jumpstart the economy, he'll have to cut spending to free up the cash he'll need. No, keynesian theory isn't the problem, it's the dummies who don't know how to apply it. 1 Hour AgoReply|LikeROBSTUMPF@Postino - No, keynesian theory isn't the problem, it's the dummies who don't know how to apply it. < It's not that we don't know how to apply it. It's that it's not going to work equally well in every single circumstance. You give someone cough medicine when they have a cold, fine. You don't give cough medicine when someone has cancer.1 Hour AgoReply|LikePOSTINO@robstumpf - It works fine if used properly. Business understand this, which is why they get SBA loans and hard-money loans. The US is a big business, it needs money to invest, and it needs those investments to return a profit, at least 3% each year to sustain our comfortable lifestyle. You are correct in that the money shouldn't be invested in the "cold" if the problem is really "cancer." But the overall theory is correct, if you don't have the resources to treat either, you're likely going to die.1 Hour AgoReply|Like+ Show (Source: Daily Intel, NYMag.com)

2 notes

·

View notes

Link

I read the passage (pp. 50-51) excerpted below earlier today in The Failure of the “New Economics”, and I just thought it was too interesting (at least for those of us who are both Austrian economics enthusiasts or libertarians and beer connoisseurs) not to share. I even had the entrepreneurial idea of maybe commissioning some beer glasses to sell with some or all (though it’s somewhat long) of it on them (as well as with other such beer-related quotes from Austrian economists as well as libertarians, such as the one here from Mencken) and seeing if I couldn’t make a few bucks:

But Keynes…goes on to declare: “Thus, to justify any given amount of employment there must be an amount of current investment sufficient to absorb the excess of total output over what the community chooses to consume when employment is at the given level.”

Here is a truism introduced under the guise of a great discovery. Naturally if we divide all spending under a full-employment equilibrium into two kinds—”consumption” and “investment” spending—there must be sufficient “investment” spending to make up the difference between “consumption” spending and total spending if we are to have full employment. But this portentous discovery could be applied not only to “investment” but to anything whatever. If we divide the amount of spending necessary for full employment into spending on everything else but beer, plus the spending on beer, then full employment depends on the amount spent on beer.

Read more>>

#Henry Hazlitt#John Maynard Keynes#keynesian economics#keynesianeconomics#unemployment#consumer spending#beer#beer money#H L Mencken#austrian economics#beer quotes#equilibrium#supply and demand#says law

0 notes