#its in LATAM is my bet

Explore tagged Tumblr posts

Text

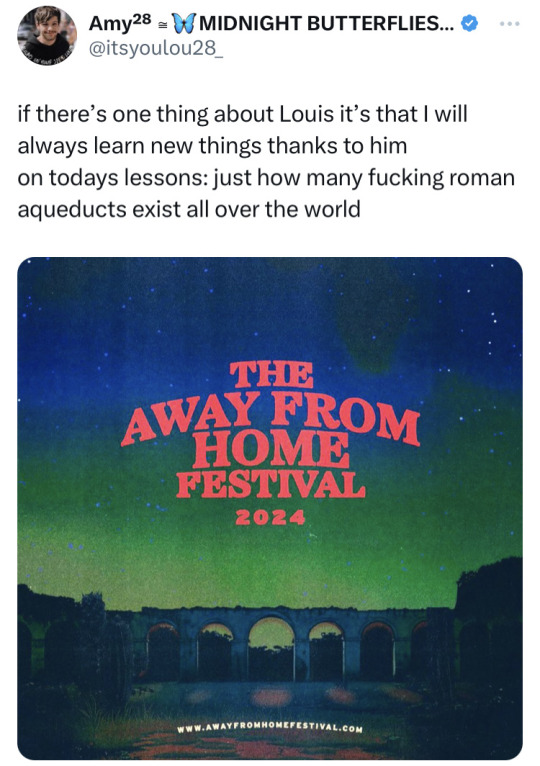

Hogwarts or Mexico or Germany or the Philippines ... ?

🕵🏻 🗺️ Louis making us sweat for the 2024 AFHF location 😅 x x x x x x x x x x x

#lil shit#I love him#google is our friend#The Away from Home Festival#its in LATAM is my bet#Louis Tomlinson#mine#AFHF 2024

201 notes

·

View notes

Note

Hii! I have some hot and cold takes to sharee. Hope you are still doing that, I don't want to be annoying

1. FOB making literally no shows in LatAm let a bad taste on my mouth. They come only for festivals, and I bet that they have enough public here to play a solo show, at least at the capitals/biggest cities. Probably it lies more on fault of their label, but anyway.

2. Use what Joe said in his book to hate on Mania is disingenuous, since he said similar things about other albums too (IOH comes to mind)

3. TTTYG is not very unique? Like, putting it above most of FOB albums is weird to me, since it's mostly a very standard pop punk album (don't get me wrong, I love this baby made of teenboy rage, but anyway)

4. EOWYG is genuinely bad. Theres literally one of two good songs.

5. Suggesting that a band should break up because you did not like their most recent material is weird, I am sorry. Like, if you don't like it, DONT LISTEN??? And for me, is even worse when it's about FOB, since they are very vocal about how much they like to work, tour and just generally hang out together.

6. The Hush Sound was the best band Pete signed, bless Ryro for sending that link for Pete.

7. Speaking about Ryro, he and Pete have the most intersting relationship from all the relationships between Pete and other band dudes, at least for me

Thats it, thank you for reading <3 I hope its not the worst opinions ever.

def still doing it and not annoying at all, thank you for sharing!!!!

i absolutely agree with this like. while i’m sure it isn’t Their faults personally that they aren’t touring in latam, i’m sure there’s a lot that goes into it that i dont even know about that really doesn’t change that it Is shitty that they aren’t touring anywhere there like. idk if artists like paramore and taylor swift etc can do it i’m sure they could too :/ and i can only hope that Sometime Soon they do

yeah definitely!! his feelings on their albums are honestly probably a lot more complex and nuanced than we could imagine and just using him voicing his thoughts on a project as a way to justify not liking something yourself is kinda shitty!

i have alwayssss felt this way about tttyg (and tbh about eowyg too which will go into my response to the next one fjdnfk), like it shows Promise and isn’t Bad but it also isn’t unique like other fob albums are necessarily. it was a good start but like. they just got better w every album imo

i definitely dont think eowyg as it exists is good either yeahfjrjfndk like i said before. and i think in an ask yday. it has a lot of promise and could easily be good w some tweaks but. isn’t really my thing fjrkfndk

literally if you dont like something and only have mean uninteresting things to say about it dont listen and dont talk about it LMAOOO dont go from i dont like this to well clearly the band should break up like. fob love touring and working together and clearly really love what they’re creating let them be…

tbh have never listened to the hush sound so i will take ur word for this one!!! ryan has good taste tho so im sure theyre good <3

tho i will be a peterick forever and ever i gotta agree pete and ryan are very interesting fr like… there was Some gay stuff going on there man…

8 notes

·

View notes

Note

do you think its ageist/sexist to find it uncomfortable when jikook shippers are in their 40s+ and have husbands and kids? i just feel like if they were truly satisfied with their relationship they wouldn't be living vicariously through 2 guys in their 20s (i know they would deny this but that's literally the psychological underpinning of shipping). like i get older women have hobbies and can still be in fandoms thats fine, but the shipping seems to be coming from a kind of sad/creepy place. especially because they're 20 years or so older than jimin and jungkook but constantly talking about how attractive they find them

for younger women shipping can be very unhealthy too of course but it makes more sense for them to be living out their relationship fantasies through celebrities because most young women haven't found a long term partner yet

Sexism for me is a really serious issue. It really doesn't matter if a woman gets called dumb because they like a ship as long as they can vote and go to school and aren't confined to a hut when they're menstruating because their culture deems them unworthy if they bleed. There are extremely difficult and serious issues women face as to consider calling middle class Becky "hag" as misogyny.

Same goes for age. I'm sorry if you feel offended that someone said you can't be shipping men at your big age. Kim, there's people dying. It's not a big deal. I've told I was too grown for some things and I really dgaf. So I can't feel empathy for someone who gets sad because someone told them they're old to be part of boraland.

I'm young, but not so young. Sometimes I even get uncomfortable at myself for still liking a celebrity so much. Likewise, I do get uncomfortable and think it's interesting (for lack of a better word) the amount of adult women in shipping spaces. The craziest thing is... they're always the most delusional ones, the ones with the theories and the analyses. 90% of them are straight women, too. I'm not saying this because of jikookers only but of course taekookers, and larries too. I was in the larry/one direction fandom, and the "big blogs", the most known shippers, they were all well above 30 or even 50 years old. It's literally the same with the few "big" jikookers and taekookers bloggers/twitter users that I know.

I think there's a lot of misconceptions and misunderstandings that have to do with culture changes. I mean, there are as many types of relationships as there are people in the world. From what I've seen, the forms of friendship that we see from kpop idols, are very different from what male friendship looks like in the US. I'm from LATAM, and a lot of the friendship I see between kpop idols is the same or very similar to the forms of friendship in my country. I also went to an all girls school all of my life, and the skinship and familiarity you develop with people of the same gender in environments like those (say, school/trainee life) are very different from other environments. So I've been hardly shocked with the things I've seen in BTS and kpop in general.

Adding to the current differences in cultures, there's the difference that comes with time. A relationship in the 1950s does not look the same as relationships look like now. A friendship in the 1950s doesn't look the same either. Men and women in general act so much different than they did 40, 50 years ago. I once told my mom something about vaginas that I had been talking with my female friend and she was surprised and told me "when I was your age, we didn't talk with friends about that stuff, we didn't even know that part of the body existed".

What I mean is, sometimes I see shippers talk about Jungkook grabbing Jimin's ass like it's something straight out of porn when it's literally just guys being guys. Or when people were screaming GAYYY at the fact that Taehyung tried to go to pee with Jimin. I would literally bet my entire right arm that they've all seen each other naked. I'm 28 too and my friend still pees with the bathroom door wide open even when I'm at her place.

This isn't to confirm or deny any ship, but it's something I do wonder about a lot. If a lot of the conviction some older women have about ships, has maybe something to do with them being easily impressionable with young people's relationships. I personally have family members that work with people half their age, and my family is constantly SHOCKED by the things the younger ones do and say. Because it's just relationship dynamics that my 45 year old aunt didn't know or experienced.

There's also the fact that "I've been married since 1970" shippers are the only ones who are so adamant that yxz ship is in a long term relationship. And I'm like... of course if a long term relationship is everything you've ever known, that is the only thing you will see because you just wouldn't recognize anything else. I've talked about it before, but I personally think the assessments of someone's who's been out in the world and has had many different types of relationships are actually more valid than the opinion of someone who's been married for the past 40 years. Times have changed. There's no way I'm ever asking for love advice from my mom, for example. I'm sure she wouldn't understand half of my relationships.

I don't like using personal experiences because I'm just one single person in the whole wide world, and my experiences aren't really statistically valuable in the grand scheme of things, but in this case I'm using examples just for the sole purpose of saying "this stuff happens".

On the other hand, something I've always thought about and is actually some sort of self criticism too is.. why male ships? Why is it always that women are shipping MEN? Okay, straight women of course wouldn't think of two girls having sex because they're obviously not interested and the idea doesn't excited them at all. They like men so men having sex is something they actually want to think about.

But even lesbians and bisexual women all ship men instead of maybe just... look for female couples? It's why I never believed people when they say they seek "representation" in jikook or other gay ships. You are a lesbian, girl. Find lesbians to represent you, not men that you believe could be queer. We're not even talking about men that are out lmao, because if they were out queer men that loudly advocate for queer people, then that's a different story.

I think this brings into light too the fact that (something I've talked about before too), a lot of female shippers don't actually have any idea of what male friendships look like. Everything is romantic, everything is sexual and everything is gay to them because two men do it. But if they were to see the exact same action between two girls, it would just be girls being girls. I say it's a self criticism thing too because I've always been aware of that. I could see two girls holding each other boobs and I wouldn't even blink. But I know when men do stuff like that it comes across as more shocking. And I think that's precisely the reason why it's always male ships, why even lesbians and whatnot don't think twice about other women's relationships. Because they know in depth about women's boundaries with each other, they understand female relationships better and they have also experienced lots of skinship with other women that wasn't romantic, even if it was intimate. But their understanding of men falls short and so everything is exaggerated and blown out of proportion simply because it's unknown or unseen for a lot of women.

7 notes

·

View notes

Text

this is such a silly thing but I look at Miss Luciana Coronel Palacios, and Andrea Ivonne Barazorda Riquelme, and Diana Beatriz Canseco Marrull, with their long names and I think “omg theyre just like me 🥺😌” lkdfjsdfkds

#its so stupid i know sdkjfdhd#but like my full name#its kinda long too#two names and two last names#and its not like a special niche thing or anything#i guess its nice to see something Im so used to#in a show thats gonna be seen by an international audience#and not treated neccessarily as a joke??#I bet oyuve seen american tv shows give their token latam character an insanely long name#and use it for comedic purposes#and like...I laugh ngl dsfkjdsfds#but still its treated as a joke and this is not#its completely normal in roche#....anygays just little things#roche pe#roche

9 notes

·

View notes

Note

More spuk headcanons 👁👁

More Spuk HCs

First and foremost: I've accepted the name Adrían 'Salvador' Fernández García for APH Spain. I've grown to find Antonio kinda boring tbh and while I was searching for names for LatAm OCs, I saw García come back a lot as a surname. I love the idea of Spain having a long ass name.. it's just really appealing to me uwu 'Salvador' means 'Saviour' which is ironic since Spain wasn't much of a saviour :) As for Fernández, well, I like the different spellings and unisex alternatives it has. Fairnanda or Fernanda, Fernando... you can even nickname with Fairni/Ferni, it's cute. And it's his canon middle name :|

Moving on,, Here is the first part(?) of my hcs (go follow @chiring-art for EngPort and Spuk content)

Imagine a nice walk on the Spanish coast or a riverside in England. Them walking side by side, talking occasionally, but there isn't really a need to fill silences between them. Because those silences are louder than words. More important than holding hands. More meaningful than a gaze.

Imagine them laughing about some bad jokes or about the past, about how ridiculous old beliefs used to be and how much the world, how much they have changed.

Imagine how comfortable they are around each other, how relaxed.

Let "Hell & Back" by Sticky Fingers take you away like the wind. Like the sun blazing through your window and heating the wooden floors of you bedroom as you imagine these two assholes waking up in the same scenario next to each other, perhaps Arthur's head is resting atop Adrían's chest, rising and dropping on time with his breaths. He listens to his heartbeats and smiles, closing his eyes again so he can memorize this moment. So he can stay in it a little longer...

Their arguing is rough, intimidating and sometimes on the verge of them breaking up or never speaking to each other ever again... But they always somehow make up. They know this is a useless fight and they've been through worse. They can find a way to have a compromise or apologize if needed. Most of the time, Spain doesn't realize how far he's gone with his remarks (genuine or playful), but on the other hand, England is cruel and sassy. They both know what they got into, but they also know that if they lose each other, they will lose a part of themselves. They have known each other for far too long and alas, can not see a future without the other.

Soft caresses, embraces, kisses and cute, affectionate pranks fills the kitchen with chuckles. Adrían probably has the biggest laugh, the most whole-hearted, but Arthur has the most authentic laughs even if they aren't as loud. And I can guarantee you that Ade feels accomplished when he hears Art laugh like that. He gives his most loving/caring grin and admires him for a little. Just to capture the view. His green eyes brighten like how the sun gleams on a Persian lime tree, showing its most favoured features.

You can bet your life Arthur makes the effort to speak Spanish for his lover. He knows Spain has to make that effort constantly and it can be exhausting sometimes, especially since Adrían probably makes a lot of mistakes. Arthur has a hard time speaking in Spanish for a long time, but at least he's gotten used to saying more than just "Holá" or "Buenos dias". Ade is very happy about that, but he tells Arthur he doesn't need to most of the time.

I don't want to get too NSFW but I can give a little something soft for you (I'll share details to ADULTS in DMS if it ever comes up. No segs for you >:0c ): In their more intimate times, Arthur and Adrían are very careful with each other. When they are rough, there's consent and usually a talk about what they want and don't want. When they are 'vanilla' or well a lot softer, Adrían constantly asks if what he does is alright (when he tops). Consent is important to him.

When Arthur tops (bc he does too, get those 'TwinkArthurSupremists' out of my blog), he makes sure to have a clear safe word. He likes to praise a lot and does so with devoting kisses. Other than that, you can guess they have fun. Trying new things and having a laugh when it doesn't work. They have a lot of gazes, cuddles and quiet appreciation.

They're doing their best. Ugh, I love them being in love,,

Anyway I can come up with more, but that's it for now lmao

22 notes

·

View notes

Note

pftt ey uhh pop and bonnie along with there bros since i dont think i've seen people asking ya yet. what are your hobbies and jobs to pop and his bro. :o

Pop: im also a teacher along with my bro! But he is more in.. bachata, cumbia, eh..

Tango: dances of latam and Spain. He is more about hip hop dances that require being flexible like ballet

Pop: we cover a lot of dances by ourselves. And hobbies i guess i enjoy dancing by my own? I enjoy yoga too

Tango: my hobbies are helping my students and enjoy seeing them improve! But normal ones.. cleaning the studio, i can dance while doing that

Bonnie: having the game night with my Friends count as hobbie? Because its the thing i really enjoy.. heh. Me and my bro work at the casino

Clyde: Patrone and Chief are the guards and we take care of every bet and take care of the ones who cheats... I enjoy writing or just chill watching funny videos with paps (their gaster)

2 notes

·

View notes

Text

The extended occasion from the games wagering provider

The extended occasion from the games wagering provider,

in organization with Gambling Insider, dove further into the universe of sports wagering and its futureKambi's Festival of Sportsbook gave a point by point the present status of issues in the realm of sports wagering.스포츠배팅사이트

Points, for example, sports wagering uprightness, esports and how the gathering use its organization information to convey sports wagering encounters were the extended occasion, which ran from 23-27 May 2022.해외배팅업체 배당률

Sports wagering is unquestionably a hotly debated issue, with a few states and territories in North America gradually sanctioning the diversion, meanwhile the European business sectors keep on flourishing. Include the 2022 World Cup, notwithstanding, and it might simply be the main year sports wagering has at any point had. 아시안커넥트 가입안내

Betting Insider was available to start off Kambi's celebration in style, with Editor Tim Poole facilitating the Sports Betting Focus: Executive Roundtable. He was joined by BetWarrior CEO Zeno Ossko, LeoVegas Director of Sports Christian Polsäter and Canadian Gaming Association CEO Paul Burns, to talk about the most recent intricate details of sports wagering in LatAm, Europe and Canada separately.

The three visitors started with a concise prologue to their separate districts, with Ossko commending the third commemoration of BetWarrior, which sent off in May 2019. The gathering centers around LatAm, having sent off managed markets in Argentina, both in the region and city of Buenos Aires. It's the organization's greatest market, with Brazil a nearby second, trailed by other South American nations.

Canada, in the interim, while not another market with regards to lawful games betting, has been ruling the titles of late with regards to single-occasion sports wagering. The Canadian Gaming Association has been urgent in the most recent advances the nation has taken concerning sports wagering, with the developing dim market a significant inspiration while changing the law and revising the crook code in June 2021 to allow legitimate single-occasion sports betting.

Furthermore, LeoVegas' Polsäter affirmed the gathering is most known as a club brand, having begun with just club a long time back. However, circumstances are different for LeoVegas from that point forward, with the organization stopping its sportsbook back in 2016, preceding gaining any semblance of BetUK and 21.co.uk, as well as Royal Panda and Expekt, the two of which work with a sportsbook.

As referenced, it is an intriguing time for sportsbooks for additional reasons than one, however maybe driving the plan right currently is the impending 2022 World Cup. As made sense of by its CEO Ossko, BetWarrior is occupied with delivering content and ensuring everything is set up in time for the occasion this colder time of year. He added the competition is the greatest obtaining an open door since the gathering sent off its Argentinian licenses.

"In our two greatest business sectors - Argentina and Brazil - everybody is as of now very energized all over the Planet Cup," he noted. "Our group is situated in Argentina and Argentinians are very bullish about the current year's competition. According to my viewpoint as CEO of the organization, the main thing is to ensure we are prepared so as to ensure we catch the most extreme out of this extraordinary chance with regards to obtaining and concerning marking."

There is, obviously, gigantic European interest in the opposition. Furthermore, it is one in which LeoVegas expects to take advantage of, especially the more drawn out term point of developing its games wagering advertising.

"As consistently with these huge competitions, it's really significant for us - basically as an obtaining driver - to truly acquire new players," noticed LeoVegas' Director of Sports. "We're really eager to perceive how this World Cup will vary from the ones we have encountered previously.

"A great deal of our center business sectors take part in it, so it's significant as far as we're concerned, and it's something we've anticipated, for some time in fact."

With respect to Canada, and Ontario particularly, everything is on the cards, as made sense of in more detail by Burns. The NHL end of the season games have demonstrated immensely well known with sports bettors, while NFL wagering keeps on being very famous in Canada.

"The market has left everything open, there's actually no avoidances, everything's accessible, which is vital," he said. "We needed to ensure the clients had a wide cluster of decision and accessibility for every one of the items.

"A few significant brands are entering the commercial center and clients are getting heaps of decision, so it will be an intriguing time for them," added Burns. "There's been bunches of nearby administrators, like NorthStar Bets and theScore, giving a Canadian flavor. It's been a great chance for those organizations to fabricate their business in Ontario."

Obviously, the 2022 World Cup isn't the main idea as far as the fate of the games wagering industry. The world will watch the worldwide occasion, yet locales, for example, Canada, Europe and LatAm each have their own issues to zero in on as the long stretches of time go on.

Polsäter is hoping for something else of what the business has encountered over the most recent few years, and concurs with the overall agreement that esports will keep on developing. In any case, one significant advancement he anticipates is the manner by which individuals consume sport.

"The capacity to focus is getting more limited and more limited, and that is the thing players are expecting now when they enter a sportsbook to wager," he said. "They anticipate that the site should be quick, they hope to find the business sectors rapidly, they hope to have the option to put down the bet rapidly and get the payout rapidly, etc, so I feel that pattern will proceed."

One more possible improvement for LeoVegas and for sure the business overall is the inclination of numerous more youthful games bettors to zero in on huge names, rather than large groups. Polsäter accepts football for instance, with the more youthful age following any semblance of Cristiano Ronaldo and Lionel Messi, with details based markets and player props beginning to arise thanks to such a-list, high-profile players.

"I feel that pattern is about to go on to an ever increasing extent, and clients will hope to have the option to wager on anything player-related across various games," he said. "So that is one pattern that will go on without a doubt."

While such player markets may not arrive at the ubiquity of the more conventional groups markets at any point in the near future, Polsäter accepts they will keep on developing. He presumes that the ongoing conversation inside this space is a lot of football-situated, yet will form into different games in the years to come.

There are, obviously, the "seriously exhausting" changes that can be anticipated, as Polsäter put it. With an ever increasing number of business sectors directing, guidelines will without a doubt keep on being harder, particularly around issues like bonusing and motivators.

Such issues, as made sense of by the LeoVegas Director of Sports, mean administrators might need to marginally reexamine their methodology, yet it is in no way, shape or form a significant disturbance, especially when they bring areas of strength for a to the table.

Polsäter remarked: "There will be an ever increasing number of rules around how you boost players, and that implies us administrators need to influence from the technique that could have been there generally of shouting most intense about the most noteworthy reward, to having a truly impressive item players like and need to return to."

Progressively extreme guidelines on bonusing and motivators, alongside the inflated costs in regions like information and live streaming, added Polsäter, could unquestionably drive off numerous sportsbook administrators from beginning without any preparation.

What's more, the issue of rewards and motivators is one that is now being firmly checked in Canada, with Burns practically matching Polsäter in exactly the same words with regards to administrators choosing a more grounded item offering, rather than the shouting out of rewards inside their showcasing efforts.

"On publicizing, one thing that has been truly special - particularly from a North American point of view - is that there is no mass-market promoting of rewards and impetuses. That has been removed - not through subsidiaries, not through web-based entertainment powerhouses, you can't make it happen. You can offer them, yet the player needs to come to your site to track down them. As that is actually the one major change.

"What we've found in the degree of offers, while cutthroat, they're not anywhere close to at the levels found in the US. That is fine, and administrators are quite satisfied with a portion of this. They can contend on item or client care, that's what they're anticipating."

BetWarrior's Ossko is a lot of in concurrence with the rising meaning of guideline, with the CEO taking note of that the entire of LatAm is "counting during the time for Brazil to control." He accepts that once the greatest market in South America manages, a ton of different business sectors will follow after accordingly.

Brazil, in any case, may require an opportunity to understand its maximum capacity. "It's another item classification for a many individuals on the lookout," said Ossko. "Indeed, everybody thinks often profoundly about football in Brazil, and different markers for the market point in the correct heading also - portable entrance is very high for instance. However, it'll take additional time than individuals could suspect for the market to understand its full potential."He added: "Yet certainly as far as market size, as far as premium for football and different games, there are the right finishes paperwork for Brazil to be quite possibly of the most thrilling game wagering markets in the following five years."

Ad

0 notes

Text

Is Sonia Sotomayor A Secret Poker Star?

Over the most recent couple of years, I took up playing poker. I read books about it. I watched the World Series of Poker on TV. I've observed preferable players over me play and I've taken shortly. My playing is somewhat of a cause. I welcome individuals to my home, I feed them, I give them all the alcohol they need - you purchase any benefit you can in poker. Thus when I win their cash, I don't need to report it.

- Equity Sonia Sotomayor, kidding about her freshly discovered interest in poker, during a new talking commitment at Washington University in St. Louis. Watch her comments completely, underneath. 온라인카지노

The Golden Nugget Grand Poker Series returns this late spring and will run from May 31-July 3, including 81 occasions and presenting more than $3 million in ensured prize cash.

Adjusting pleasantly with other competition series' in Las Vegas this late spring, including the 2022 World Series of Poker and Wynn Summer Classic, the Golden Nugget Grand Poker Series will highlight poker variations including Pot-Limit Omaha, Big O, Mixed Triple Draw Lowball, Limit 2-7 Lowball, H.O.R.S.E. what's more, Triple Stud.

HERE'S EVERYTHING YOU NEED TO KNOW ABOUT POKER AT THE GOLDEN NUGGET!

A Look At the Schedule

The series will start off with four competitions on May 31: Event #1: $250 Dealer's Choice - 6 Handed $5K Guarantee, Event #2: $150 Daily No Limit Hold'em $10K Guarantee, Event #3: $200 Big-O and Event #4: $125 Nightly No Limit Hold'em $3K Guarantee.

Activity proceeds with the following day with Event #5: $250 H.O.R.S.E. $5K Guarantee and Event #6: $200 Pot Limit Omaha - Fire Til You're Tired! - which highlights $100 re-purchases - as well as everyday and daily No-Limit Hold'em occasions.

An early feature in the late spring series will be Event #10: $200 No Limit Hold'em $250K Guarantee, which has an astounding nine beginning trips for players to browse. The beginning flights will occur June 2-4 and Day 2 will work out on June 5.

Brilliant NuggetGolden Nugget

A couple of days after the fact, Event #26: $200 NL Hold'em $250K Guarantee will occur, one more competition with nine beginning flights. The competition will run from June 9-12 and will permit limitless reemergence. 바카라사이트

Secret abundance competitions are as well known as could be expected, and the current year's Golden Nugget Grand Poker Series will give players their fix Event #39: $300 Mystery Bounty NLHE $250K Guarantee, which will run from June 17-20 with nine beginning flights.

Another enormous feature will be Event #55: $1,100 NLHE, which has three beginning flights and a gigantic assurance of $1 million. The tournamentwill start off on June 24 and wrap up with Day 2 on June 27.

The series will finish with the $600 No-Limit Hold'em Championship, which starts off on June 30 and will wrap up on July 3. The occasion will have three beginning trips for players to browse as they hope to turn into the following boss.

Worldwide betting's greatest exhibition will see the WPT feature new innovation unit is accused of rethinking poker encounters and commitment for another age of crowds.

Perceived as the most renowned coordinator of supportive of poker competitions, the WPT will send off new specially assembled stage will give the most attractive of contending conditions for cash games and competitions accomodating all degrees of poker fans.

Set apart as a significant mandate, the WPT Global Platform will at first be sent off in the business sectors of Brazil, LatAm (barring Mexico) and Canada (barring the area of Ontario).

The send off of WPT Global intends to put poker at the front of problematic Web 3.0 developments. Getting ready for change, last month, the WPT declared the send off of its 'Poker Heroes Club' - supportive of poker's first NFT people group fueled by GAMAVRS.

The Poker Heroes Club has been coordinated straightforwardly with the WPT Global empowering players to involve the NFT symbols in poker games and to additionally vie for once in a blue moon prizes.

WPT Global will send off with another stable of poker envoys to draw in with all ages of poker fans including unbelievable WPT competition have Vince Van Patten, poker geniuses Lynn Gilmartin, Tony Dunst and whiz DJ Steve Aoki.

At last, as an ICE London selective, WPT has joined forces with VR expert Wingsuit to exhibit delegates with its awe-inspiring poker-themed VR experience.

During the meeting, representatives will actually want to partake in the 'WPT Wingsuit VR Challenge Championship', where an ICE participant will claim an elite Poker Heroes NFT.

Technamin has commended EvenBet Gaming as the "wonderful accomplice," after the substance and stage supplier fortified its foundation presenting with its scope of poker items.

The arrangement will see the previous' administrator network get sufficiently close to more than 30 unique varieties of the game kindness of the web-based poker programming engineer. 카지노사이트

Moreover, Technamin, which last month acquired the whole BetGames item suite, will likewise offer clients the adaptability to decide to be a piece of EvenBet Gaming's poker local area or use its independent skin.

Dmitry Starostenkov, CEO at EvenBet Gaming, said: "Technamin has all that an administrator could have to launch their igaming business and we are certain the expansion of our poker items will set their standing as a powerful supplier.

"It's generally extraordinary to see our games being acquainted with new players and we're certain this arrangement will assist with placing our items before more gamers than any other time in recent memory."

The expansion of the gaming suite from EvenBet, which has commended the chance of contacting a more extensive crowd, becomes the Technamin list to in excess of 6,000 club games from more than 100 internet based studios.

Suren Khachatryan, originator and CEO at Technamin, added: "The elite presentation of our administration relies vigorously upon the nature of the items we can offer, which caused EvenBet Gaming the ideal accomplice for us as we to extend our arrangement of poker games.

"Poker has substantiated itself consistently as an extraordinarily compelling cross-channel vertical and is upgraded altogether by EvenBet Gaming's multi-design interactivity and drawing in satisfied."

0 notes

Text

Daily Crunch: The early-stage tech talent crunch is real

By now everyone is familiar with the tech world’s talent crunch: Developers are scarce and expensive, while data scientists are maybe even scarcer and expensiver. Some folks I’ve spoken to think that rising acceptance of remote work may help reduce the supply-demand imbalance. Hell, every early-stage startup I’ve spoken to in weeks is remote-first. Many were born during COVID, but they all love the ability to hire anywhere in the world.

But if a more distributed workforce is not enough to lower the pain that many companies feel when it comes to attracting and then retaining technical talent, good news could be coming. The sibling product philosophies of no-code and low-code are not only attracting lots of venture attention, public companies that dabble with either are posting interesting results.

Perhaps the solution to needing lots more code is no code at all? — Alex

TechCrunch Top 3

Today’s TechCrunch Top 3 come from the three phases of startup life: Early stage, when startups are still getting their product and market in order. Late stage, when they are prepping for an eventual exit. And the exit stage, when a former startup is looking to spread its wings and fly the private markets.

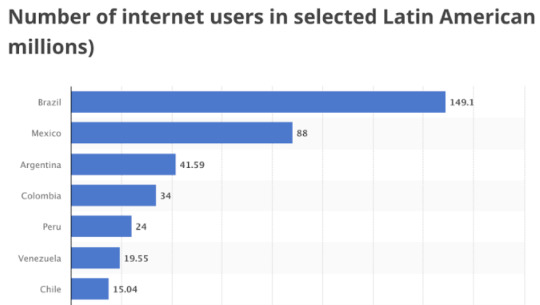

The anti-venture movement is global: Today Mary Ann reported that Divibank, a Brazilian startup offering revenue-based financing to other startups, has raised $3.6 million in a seed round led by Better Tomorrow Ventures (BTV). TechCrunch thinks it could build something akin to the Clearbanc of Latin America.

London’s Lyst looks to list: When you raise a pre-IPO round, you’d best be heading toward the public markets. With fashion e-commerce app Lyst saying that its new $85 million funding round is pre-IPO money, well, we have big expectations.

Bird hopes to take flight: Bird is going public via a SPAC. TechCrunch has the big news here, and a more dorky financial analysis here. I helped write the latter. The short version is that a business-model shakeup is helping the scooter unicorn lose less money over time.

Startups and VC

Scootin’ into startup mode, TechCrunch covered a huge number of funding rounds in the last 24 hours, so what follows is a sampling of the most interesting. Enjoy!

Pomelo raises $9M to build a payments infrastructure for LatAm fintechs: Building fintech infrastructure is a huge global task, so it’s not a surprise to see companies at work on the problem raising money. In this case, Pomelo is $9 million richer to tackle what might be the most interesting fintech market in the world.

Collective, a back-office platform for the self-employed, raises $20M from Ashton Kutcher’s VC: Going indie is not easy, despite what the Substack hype might have you believe. So, Collective is betting that it can make bank off of helping folks run their own microcompany. Both the company and the investment are a wager on the creator economy.

Stampli raises $50 million in Series C to help companies intelligently manage invoices: The Stampli round stood out because it was more capital in a single investment than the startup had raised during all of its previous life — by around 50%. So, something is going on at the corporate-invoice optimization software shop that has investor attention.

Planck, the insurance data analytics platform, raises $20M growth round: Two of the three Planck co-founders are bald, so I had no choice but to include my follicle-deficient brethren in today’s newsletter. Jokes aside, Planck collects data that it sells to commercial insurance companies. And now it has fresh capital from 3L Capital, Greenfield Partners, Team8, Viola Fintech, Arbor Ventures and Eight Roads to help it grow.

For unicorns, how much does the route to going public really matter?

Natasha Mascarenhas and Alex Wilhelm recently hosted Yext CFO Steve Cakebread and Latch CFO Garth Mitchell on an episode of TechCrunch’s Equity podcast.

In their discussion, “The morality and efficacy of going public earlier,” the group discussed the myriad paths startups are taking to go public and assessed the pros and cons of each method, and, importantly, the potential impacts on employees and business operations.

“I think when money’s chasing money, you don’t want to be the last guy holding the money. You want to be the chase,” said Cakebread.

Since Latch is currently going public via a SPAC and Yext followed a traditional IPO route a few years ago, the discussion is heavily weighted toward experience, not opinion.

Big Tech Inc.

Turning to tech’s largest companies today, we have three things for you to chew on:

First, Waymo is losing key talent in a very public fashion. Kirsten reports that “Waymo’s chief financial officer Ger Dwyer and its head of automotive partnerships and corporate development Adam Frost,” both long-time execs, are “leaving this month.” The exits come after the company’s former CEO also departed.

I guess we’ll have to drive ourselves for a bit longer.

Next up is a story that came out yesterday, but we missed in the newsletter. But after burning up the TechCrunch analytics all day, I decided to make sure that you saw it. With the simply excellent headline Prime today, gone tomorrow: Chinese products get pulled from Amazon, Rita writes that several Chinese retailers have evaporated from the online megastore. “In total, the suspended accounts contribute over a billion dollars in gross merchandise value (GMV) to Amazon,” she reported.

Changes afoot at Amazon? We’ll have to see, but the news is driving mega-attention from, we presume, confused shoppers.

Finally, looping back to no-code for a hot second, Salesforce is only adding to its own efforts. It’s everywhere!

This Article Original Source is From : https://techcrunch.com/2021/05/12/daily-crunch-the-early-stage-tech-talent-crunch-is-real/

0 notes

Text

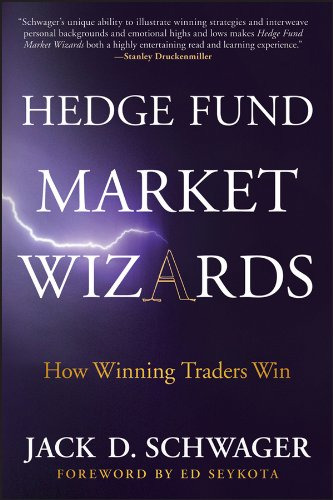

Hedge Fund Market Wizards (Jack Schwager, 2012)

Takeaways:

This is an extremely long set of notes because it’s a long and dense book and every trader has something valuable. Very long book but also quite skimmable if you skip the interviews (which are full of interesting stories) and only read Schwager’s conclusions to each chapter as well as the “40 lessons” at the end (there is also an excellent Intro to Options at the end that is the best I’ve ever read in only 4 pages). *Best interviews are: Colm O’Shea, Jamie Mai, Ed Thorp, Tom Claugus & Michael Platt.

Much of the advice in this book can sound pedantic, but more often it’s deceptive in its simplicity. Worth considering these traders are not just high-return but extremely high R/R over long track records.

To me, the message boils down: figure out exactly what works best for you and do only that as much as you can, structure bets with asymmetric payoff schemes (relative to probabilistically-considered outcomes) and do it in a size/manner that keeps you from making emotional mistakes.

Really crucial is the ability to adapt over a long career, because no system works forever--market structure changes.

My sense is trade structuring and risk management is something the average equities investor doesn’t not pay enough attention to. Structuring can make mediocre or ok R/R into great R/R -- this is basically the key insight of Beat The Dealer and also highly achievable through options.

I like Schwager’s Gain to Pain Ratio, which is defined as the sum of all monthly (arithmetic, not compounded) for a strategy divided by the absolute value of the sum of all losing months. He considers >1.0 very good and >1.5 excellent. 1.0 implies an investor experiences on average an equal amount of monthly losses to the net amount gained over a year. Preferable to Sharpe Ratio because it doesn’t penalize upside vol.

Loved Steve Clark’s advice about not staring at the screens if you’re the sort of investor who sets your bets and has to wait for them to work -- I’ve witnessed first-hand what he means by over-processing and over-trading that results.

Greenblatt’s Magic Formula does not seem to fit a world where the best companies invest via the income statement and employ primarily intangible assets.

Macro

*Colm O’Shea

Wrong at least 50% of the time but never lets a mistake get anywhere near where it would make a good story

Views his trading ideas as hypotheses

The mathematization of economics has greatly narrowed scope of field -- true economists reside in history, poli sci and sociology fields

Policymakers don’t understand they’re not in control. Speculators aren’t either -- fundamentals actually matter

All markets look liquid during a bubble, but it’s liquidity after that matters

Buyer of options in 2006-2007 because low ERP meant option prices were too cheap. Prefers being long options, never short a horrible tail

During 2005-2006, got paid repeatedly to bet that maybe Fed wouldn’t stop hiking. People were fighting the Fed

Avoid conceptualizing the market in antropomorphic terms -- markets don’t think, like mobs don’t.

Prefers macro because HFs tiny there, playing against real money and not against true competitors in a zero-sum way

Prior to 1998 financial crisis, he’d never heard of LTCM - just saw T-bond futures limit up every day, meant something was up and to trade accordingly. Often if you wait to find out the reason first, it’s too late. Soros: Invest first, investigate later. Empiricist at heart.

“Fundamentals are not about forecasting the weather for tomorrow, but rather noticing that it is raining today”. Soros GBP short in 1992 was based on something that had already happens (deep recession in UK = unable to maintain high interest rates necessary for ERM)

LT inflation-adjusted housing prices were sideways from the 19th century until mid-2000s (excluding post-Depression bust), and then 2x’d in a few years

Roulette = world of risk, economy = world of uncertainty

Equity vol tends to be expensive because no natural sellers and everyone is a natural buyer

Markets often confuse liquidity and solvency. You can’t fix a solvency problem by adding liquidity.

Ex: on a $100k house with $200k mortgage, lending you another $100k doesn’t solve the problem.

Seeks asymmetric trades -- like betting against TED spread narrowing after Bear Stearns bailout in 2Q08. When sentiment improved, didn’t lose much because he’d bet at levels already reflecting optimism

Lehman going under was not a surprise - it was expected, but people failed to understand what it meant

Stayed short in GFC until April 2009, until they started losing money. Economy stopped getting worse -- what matters for markets is better/worse > good/bad. Sought out another hypothesis-- Asia-led recovery

Marco is 10% storytelling, 90% flexibility and implementation

Soros plays up to his image as a guru, but as a trader he has no regret and no emotional attachment to an idea.

You have to embrace uncertainty and risk

Biggest mistakes are missed opportunities - often believing something acts as a constraint on making profitable trades

Bubbles last a long time and there’s money to be made. Worst thing to do in a bubble is be stubborn and then late to convert

“If it trades like a bull market, it’s a bull market.”

“Beliefs that are completely invulnerable to evidence and passionately defended are quite durable”. Ex: gold is special

Natural way to trade a bubble is from the long side. Uses options to structure to avoid taking on gap risk on collapse -- low vol bubbles are great for this because premiums stay low

Rare to find comfortable shorts in bear markets. You won’t find a lot of people who have made majority of their money shorting bubbles

Looks for deviations between fundamental probability distribution he perceives and the one priced in by markets

Successful traders adapt and break their own rules. Frameworks > rules

VAR is maligned but does what it claims -- tells you how volatile your current portfolio was in the past.

Most common error he sees is people setting stops at pain thresholds and not at prices that tell you you’re wrong. People who aren’t convinced they’re wrong by being stopped out will keep putting the trade back on. Sets stops at a level where it would be proof he’s wrong and sizes trades according to what that implies potential loss is. If he gets stopped out, it’s because prices are inconsistent with his hypothesis

Recognizing > forecasting

Ray Dalio

Quadrant conceptualization -- two factors and two states = four conditions. All Weather looks at growth and inflation, increasing or decreasing. Divides world into creditors and debtors x independent monetary policy / don’t control monpol (US/UK = debtors with control; Greece/Portugal = debtors w/o control; Brazil = creditor with control; China = creditor w/o control because of USD peg)

Loves mistakes because they provide learning experiences that catalyze improvement

You will certainly make mistakes and have weaknesses. What matters is how you deal with them

Two core concepts in Principles: 1) improvement through mistakes, 2) radical transparency

8/15/71, when Nixon took US off gold standard, sticks in his mind because stock market went up a lot. Learned currency depreciation/money printing is good for stocks, and don’t trust policymakers. Also, markets anticipate bearish events (rumor --> news phenom) and also bearish events can trigger new events with bullish consequences

Don’t fight the Fed (unless you have very good reason to believe their moves won’t work)

Holy Grail of investing: x-axis = number of investments, y-axis = stdev. Curve slopes down and to the right, ie volatility of portfolio goes down as number of assets goes up. Can only cut correlation by 15% with stocks because avg stock has 0.60 correlation to any other, but if you diversify across 15 assets with average of 0 correlation, you can cut vol by 80%. Structuring trades is key to producing uncorrelated bets. Correlation is an outcome, not an input. Doesn’t look at the correlation when setting up bets, looks at whether drivers are different.

People experience drawdowns bigger than they expect because of lack of understanding of how their strategy performs in diff environments. BW tests criteria to ascertain they are 1) timeless (hold across all diff time periods) and 2) universal (across all diff countries)

Hold ~20 signif positions consisting of 80% of the risk, uncorrelated to each other.

Universal truth that you can enhance R/R by reducing correlation

Transaction costs are a function of the amount you have to move in a given timeframe

Did well in 2008 because critera for trading a deleveraging had been established by study other deleveragings (inflationary = 1920s Germany, 1980s LatAm; deflationary = Great Depression, 1990s Japan)

Avoiding unmanaged contraction is essential in preserving social/political order. Spread problems out to keep g>r with fiscal/monetary policy.

He believes US has gone through 4th of 5 cycles a country goes through; went from “country that thinks it is rich but isn’t” to “decline”. Entire cycle is 100-150 years, decline = ~20.

Biggest mistake people make in investing is believing what’s happened in recent past is likely to persist.

In a deleveraging, monpol is ineffective in creating credit. Diff from a recession where rates can be cut to ease debt service, stimulate economic activity and produce positive wealth effect.

In the business cycle, availability & cost of credit driven by central bankers; in the long-wave cycle, depend on factors beyond bankers’ control

Bubbles occur frequently in countries in Stage 4 (getting poorer but still think they’re rich) because economic actors (investors, policymakers, operators) bet big on trends continuing as they have in recent past. Believe investments that have gone up are good rather than expensive, borrow money to buy them.

Larry Benedict

Risk mgmt dominates his approach. If monthly losses approach 2.5%, liquidates entire portfolio and starts over, trading at reduced size. ~2% loss, cuts unit size to 50% or less than usual. Plays at small size until profitable again.

Key experience for him was being on floor on day of 1987 crash. Learned early that ANYTHING CAN HAPPEN.

Learned from Marty Schwartz: Don’t average losing trades. Be smaller than you need to be. Take profits.

You can’t be emotional. (Ex: lost a bunch of money going long right after 9/11)

Leave opinions at the door

85% of the time, they mark up market on day of opex. Going on for 25 years.

Trader’s fail because of gambler mentality, ie when they’re losing look for one trade to make it all back.

You are not a trader, you are a risk manager. Never stay in a losing trade because you think it will come back. Minimize the loss. Accept it and walk away. Worst thing a trader can do is freeze. Need to know how you will respond in any situation.

Scott Ramsey

Process: received a printer chart book every week, updated it every day for over 10 years. Made him pay attention to every market, every day.

Buy the rumor, sell the facts puts you on the other side of retail trading

Tries to imagine where the guy on the opposite side of the trade feels and where he’ll capitulate.

Learn a lot when markets have crisis events. Measuring which markets are the strongest during a crisis can tell you which are likley to lead when pressure is off. Always wants to buy stronger and sell weakest.

Only risks 10 bps of AUM on a typical trade but often out before even that is breached--Very quick to cut trades based on how quickly they go in his favor.

Might lose 10x on an idea but on the 11th it works and more than makes up for the losses. (Opposite of O’Shea, similar to Benedict)

Uses RSI a lot -- looks for divergences between RSI & price

One principile you can’t violate: Know what you can lose.

Trading on exchanges or the interbank market give you so many advantages (ie liquidity not at the whim of a dealer) that giving up those benefits not worth it. His style requires liquidity (being able to stop out at 10 bps)

You should always be swinging the bat - reduces position size in a drawdown

Keep a journal of your trades - if you make a mistake, write it down

Ex of shorting the weakest: when QE2 was implemented, Turkish lira couldn’t rally against USD -- meant it must be pretty bearish and would continue to weaken when QE2 ended. Waited for breakdown out of 2-year range to confirm.

Buying a laggard as a proxy for a leader is a bad idea.

Risk-on/risk-off framework broke down in mid-Sept 2011, when commodities diverged negatively from stocks

Jaffray Woodriff

As a CTA, started out using market-specific models but realized they broke down more because over-fitted to past data. Realized more data used to train models = better performance, switched to using same models across multiple markets.

Avoids trend-following or mean-reversion, the two main strategies for CTAs. Instead looks at things like volatility measure which are derived from price without any direct relationship to price direction.

He does not start by formulating a hypothesis and then test that to see if data supports-- blinding searches through data for emergent patterns

Trains models on fictitious (random) data with a certain distribution which provides a baseline -- then come up with models that do much better. Performance difference between real-data model and baseline indicative of performance, not the full performance of the model in training.

Out of sample results >50% of in-sample results indicative of a good model

Stationarity of patterns they’ve discovered surprises him. Takes a ton of deterioration for them to drop a model, because 1 year’s performance is simply not predictive of the next’s. Test it over 30+ years, so 3% provided by most recent year rarely meaningful

Capacity of a model is not statis, move around with changes in volume and vol

Core of their risk mgmt is evaluating risk of each market based on exponentially weighted moving avg of daily dollar range per contract. Target 12% annualized vol.

Key trading rule: Adjust position sizes to overall risk to target a particular vol

Multi-strat

*Ed Thorp

His key insight in blackjack was that while average edge was against the player, player could overcome this by varying bet size (ie betting big when edge is positive and small or not at all when it’s negative)

Picture blackjack probability problem as a 10-dimensional space where every card is 1/13 (except 10-values which pool to 4/13) and every possible deck is some point in that 10-dimensional space whose coordinates are determined by the fraction of each card value remaining in the deck)

With 4 aces out, edge goes to -2.5%. Implies with 4 extra aces, edge of +2.5%. Can’t have 4 extra aces, but can have half a deck with none of the aces out yet, where odds are the same as a full deck with 8 aces.

5s strategy provided higher probability bet, but went with 10s because it provided more opportunities (goes 5s, Aces, 10s, 6s in terms of influence)

“I just don’t scare. I am aware, and I avoid taking foolish risks”

Provable that complete-point-count system (high cards -1, low cards +1) is approximately the best possible system for equivalent simplicity

Don’t be more than you’re comfortable with. Take your time until you’re ready.

Historically, ideas don’t just appear in one place -- appear in several places at nearly the same time (Newton & Leibniz, Darwin & Wallace). This is due to technology

Beat The Market insight was that warrants with <2 years to maturity traded at premiums that were too high, so shorted warrant and bought stock. Initially on static hedge, later with dynamic delta hedging.

His option pricing model came out of deciding he could derive a formula if he assumes all investments grew at RFR.

Kelly Criterion for bet sizing: F= P(w) - [P(L)/W) where F=fraction of capital, W=dollars won per dollar wagered, P(W)=win prob, P(L)=lose prob. Aligns your bet with your edge (win rate - loss rate). KC also implicitly assumes there’s no minimum bet size which is simplifying. F (fraction of capital) is actually fraction of riskable/losable capital (ie less than 100% of capital if you can’t tolerate 100% drawdown) -- if you have $1m purse but can only tolerate $200k loss, KC perspective is your F is based off $200k. If you hedge and neutralize risk, KC may imply using leverage.

Half Kelly is psychologically better because you get 3/4 the return with 1/2 the vol (ie better Sharpe). Also prevents you from overbetting due to miscalculating -- negative impacts of overestimating trade size is 2x as large as negative impacts of underestimating correct trade size by same amount, so err smaller, esp if precise win/lose prob is not known (usually the case in trading).

60-day lookback is usually the best for measuring correlation between assets.

Degree of confidence is key in determining size of trade and also in deciding on how to risk manage (ie take your lumps or employ safety mechanism to limit drawdown)

*Jamie Mai

All trades are structured and implemented to be highly asymmetric and positive-skew

They love bull-bear battlegrounds -- while markets are good at estimating magnitude of contingent liability, they’re poor at evaluating outcomes probabilistically (eg, litigations, regulatory actions, anything else that creates perception of going concern risk)

Whenever a market is pointing at something and saying this is a risk to be concerned about, most of the time the risk ends up being not as bad as anticipated

Looks for cases with binary outcomes where the options market assigns normal probability distribution

Often, the longer the option’s duration, the lower the IV, which makes no sense. Ex: bought far OTM DJIA call as an inflation hedge with very low IV. Taking exposure on the RFR implicit in option pricing models

Another ex: selling vol on Brazilian interest rates where 6-month forward rate was >400 bps from current, implying rates staying similar to current over 6 months was a >4 stdev event. Structured trade around +200 bps strike which was cheap because it was far OTM based on forward rate.

Creative structuring: bespoke “worst of” option for shorting EUR while IV on Euro puts was high. Shorted “worst of” EUR/AUD and EUR/CHF which was cheaper but they expectd both to weaken. If one had expired OTM, option buyer would lose entire premium. Expected correlation between the two crosses is a key input. Their insight was that in a Euro crash, neg correlation between EUR/AUD and EUR/CHF would decouple and both would go down. Allowed them to get short at 1/10 the premium as % of notional as the straigh Euro puts.

Grantham places relative valuations in context of cycle--low-quality outperforms early, and high-quality toward the end.

Strategy called “cheap sigma” -- options prices dramatically understate potential price move of markets that trend. Options prices tend to be underpriced in smoothly trending markets. (Sounds similar to Woodriff who doesn’t bet on trends or on mean-reversion but on vol of prices around trends)

Options math works better over short intervals - options pricing assumes vol increases with the square root of time. Reasonable <1 year, but doesn’t scale properly beyond that. Ex: if 1-year stdev is 5%, 9-year stdev will be priced at 15% (sqrt(9)*5%) which is prob too low. This is because the longer the time, more potential for a trend and for price move to exceed stdev-implied probability.

Their trades combine: a mispricing that arises because standard market pricing assumptions are inappropriate for a given situation + asymmetric R/R profile.

Don’t have high level of conviction in an outcome, instead high conviction in that the odds were mispriced.

High conviction on an event path prices like a low-prob event is their Holy Grail. Subprime CDS was that. Got to the trend late which is typical for them because they like situations where there’s a compelling reason a trade should be working but the only counter-argument is that while it should work, it hasn’t yet.

Their view was that the GFC started on Feb 1, 2007 when ABX started tanking, more than a year before Bear failed. (This is also what Colm O’Shea observed before MMF liquidity dried up in Aug 2007 which showed banks weren’t comfortable lending to other banks)

Their model is to find experts in the domain to follow. “River guides”

Never go outright short a stock due to upside-down R/R. Buy OTM puts, but when rising IVs make that too expensive, shift to ITM to reduce time-value decay.

Require that the expected value of a trade (W * P(W)) >2x expected loss (L * P(L))

They use cash to target portfolio risk (50-80% typical), since the premia they pay put on a lot of risk relative to cash deployed.

Options prices being based on normal distribution implies what’s likeliest is prices near current -- this isn’t always true! If the odds of a large move in either direction are >stdev, OTM options are too cheap.

Optiond models ignore potential to trend and use only vol and time. Implicit assumption is that direction of daily price moves is random, which is not true.

*Michael Platt

Starts from the perspective of “what do I know for sure” -- one of the only things he could say with certainty is that markets trend. Observable in any market, in any era (ie timeless & universal, as Dalio would say)

Markets trend because rather than discounting all information and holding static until new information arises, people remember the past in bullet points and then use thoughts & feelings from the current moment to fill it in.

May initially trend for fundamental reasons, but prices overshoot ludicrously

Another thing you know is diversification works

Best systems degrade -- ways of making money in the market don’t last forever

Describes seeing LIBOR jump 10 bps in Aug 2007 and thought, “this just feels bad and scary” -- was a major signal to him because it happened “for no reason at all”

He moved firm’s money in 2008 to 2-year Tsys to reduce exposure even to MMFs.

Trades that accounted for gains in 2009 were fading very big call/put skews, selling OTM options and buying ATM.

His firm (BlueCrest) is structured so every trader starts the year with a risk allocation, if they lose 3% their risk gets cut by 50%, and if they lose 3% of the remainder, they’re liquidated. Want people to scale down if they’re getting it wrong and scale up if getting it right. Rebases annually unless a trader carries over PnL (ie doesn’t get paid on a portion of what they made in a calendar year in order to start the next with more leeway). Effectively structures traders like they are options.

Risk management is the most important thing. Key thing his risk mgmt team monitors for is breakdowns in correlation. Most of their positions are spreads, so lower correlations are riskier. If two assets have a correlation of 0.95, can put on a large spread position with relatively small risk. If that correlation is 0.50, can be wiped out very quickly.

Risk managers scan portfolios for vulnerabilities and ask traders, “if you were going to lose $10m, where would it come from?” Traders will typically known

Bias is neutral-to-long vol, great protection against all scenarios. Hates shorting OTM strikes.

For traders, he wants “people who know that anything can happen” -- as opposed to analysts, people are more prescriptive. Wants someone who understands an edge.

Market maker traders know the market is always right and you are wrong if you’re losing money for any reason at all. Know value is irrelevant in times of market stress, and in those times it’s all about positioning -- markets will trade against positions.

Key problem with analyst/economist types is ego - can never admit when they’re wrong

No tolerance for losses - kills you by impeding you psychologically, making you miss opportunity. 80% of profits from 20% of ideas, so tightening up at the wrong time can have big opportunity cost.

Looks at every trade in his book every day and asks if he’d enter it today at that price. Usually stops himself out of positions due to time, not price. If the trade isn’t working, alarm bells start ringing

Need 3 things to make money: 1) decent fundamental story, 2) good trend and 3) the market handling news the way you think it should. Bull markets ignore bad news, and any good news is reason for a rally.

Ex: 2s10s steepener trade in 2009 where he kept seeing news that he thought meant he was going to get screwed, but position didn’t move against him. Realized curve could not get flatter no matter how bad the news, 4x’d his position and made a great trade.

Likes to know consensus view because you make the most when consensus shifts. Rather than ask people their position, asks people their position -- they are more willing to talk because they feel important.

“When I am wrong, the only instinct I have is to get out” -- want to be the first one to sell. In investment mgmt, you have an option to keep 20% of PnL, but want to own the serial option of being able to do that every year. Can’t blow up.

Equities

Steve Clark

Price is where anyone is prepared to deal, and it can be anything. Need to internalize that

Being inexperienced can be good because fear often cripples people who have been in the business too long. Too many fat tails damages people. You can’t afford blowups emotionally.

Used volume as a screen for what stocks to be looking at because clearly something is going on.

Can’t predict the future from past data - can talk about percentage probabilities of what might happen next, but can’t go any further

When you are trading over short to medium term, your views on the fundamentals are irrelevant - have to gauge what the market thinks of the story.

“Do more of what works and less of what doesn’t” -- dissect your PnL and see what works for you and what doesn’t

Favorite trades in risk arb were parents buying out subs because no due diligence issues and you knew deal would close.

He is very confident in his abilities -- holds the view that he can do anything he wants to.

There is no career in trading, you’re only as good as your last trade.

Enjoyed being a trader more than running a business, because you can’t walk away -- it’s a prison, while being a trader is very free.

You have to train yourself to trade within your emotional capacity

When a merger deal breaks, they cut right away because there is a pocket of liquidity, even if price lower. Price is irrelevant, it’s size that can kill you -- too big in an illiquid stock and there’s no way out

Being busy as a prop trader is important to get you away from the screen. If you have positions on and are waiting for the market to do what it needs to do, need to find something else to do in the interim. Staring at the screen won’t tell you much, you’ll start to overprocess and overtrade. You’ll be less patient and start feeling pain with every tick against you.

Need to be willing to call people to hound them for information, and “ask the next question” -- can infer a lot that way

Nearly all successful traders he’s known have been one-trick ponies -- do one thing very well, and if they stray it’s a disaster.

In 2007-2008, got out of everything directional or long-dated and put all risk into short duration risk arb (wide spreads due to liquidity crunch and high likelihood to close). Only risk he could see to that strategy was brokers changing margin requirements, which would only happen with major market distress, so he bought OTM puts / sold OTM calls on SPX to hedge.

When vol quadrupled in 2008, he decided the world had changed and they need to trade a fraction of before. Most people didn’t do that and got blown up. Doesn’t believe in cutting exposure gradually, cut drastically. Gut feel is important.

Trading rules he lives by: “If you wake up thinking about a position, it’s too big”, “never stop asking questions, speak to as many people as you can, research every opposing opinion.” If a position starts acting in a way you don’t understand, you need to cut it because the market is telling you you don’t know what’s going on.

The market is not about facts, it’s about people’s opinions and positions. “Anything can be at any price, any time.”

When trading poorly, he liquidates everything and takes a vacation -- helps you regain objectivity.

Martin Taylor

Describes being super bearish on Russia in 1997 but the reason it didn’t blow up until Aug 1998 is because the money pulled out of Asia due to the crisis there went to Eastern Europe and Latin America and created big bull markets there.

Officially, Russia was running a current account surplus, so it seemed diff from Asia (which was a CA deficit issue when countries couldn’t service debt). True measure of balance of payments is what happens to reserves -- even though Russia supposedly had large CA surplus and capital inflows, reserves were going down, not up. Knew reserves numbers were truthful because central bank couldn’t lie without getting found out quickly (by comparing to other CBs). What was happening was exports were hugely overstated in cash terms. Yeltsin government inept and theft of company asset rampant. Money from exports was being diverted into Swiss accounts and never making its way back to Russia. $100m of goods would be sold, would be booked as $50m, missing $50m would go to a Swiss bank account, and $40m of the $50m booked as revenue would be booked as a receivable and also go into that Swiss bank account. So you’d end up with only $10m cash inflow on $100m of goods leaving the country. Simple capital flight.

Money fleeing Asia flowed into Russian market due to post-Communist “miracle” story. First crack was a rumor in Oct 1997 that Yeltsin was in failing health and market dropped 23% in a session. Rebounded 30% the next day as Yeltsin gov’t denied and people rushed in for the buying opportunity. But a sudden break emotionally reminds people they can lose money, and they started studying the fundamentals more closely, which he already knew were bad. Was then -50% by Feb. He doubled down on bearish positioning, and market ultimately declined another 88% from there. Ultimate catalyst was a $25B bond sale done by GS in summer 1998 that should have doubled foreign reserves but only added $3B -- became obvious money was going elsewhere.

Int’l funds were long GKOs because the rates were ridiculously good, but they were so good because nobody domestic wanted to buy. In an EM, the smart money is domestic, not international.

Buying low beta stocks instead of cash is a mistake - market -40% means your stocks -20%, market +50% your stocks +10% = negative asymmetry. For the same reason, EM bonds are inherently unattractive. Structures his portfolio as high-beta stocks balanced by cash or shorts.

He looks for favorable macro situation, a secular trend and good company management.

Ex: As a result of the collapse in 1998, Russian balance of payments picture changed dramatically --> 80% ruble devaluation led to a surge in foreign reserve, “liquefaction” of economy and end of nonpayments culture, meaning workers started getting paid real money and there was a massive increase in purchasing power for middle class, drove a strong secular trend. He saw mobile phone penetration increasing 25% pa and mobile carriers with good mgmt teams, so he owned the Russian mobile carriers from 1999-2005.

Always tells new investors they will lose money with him at various points in the year and it will be unpleasant. Considers it a crucial “health warning”

Net exposure ranges 20-110%. Holds net long positioning even when bearish because he thinks if you’re trading volatile instruments, can never get totally out because you’ll never get in on a reversal. When the market is so bad that you think it’s obvious you should be net short, that’s usually when it’s all in the price and you should be buying. Maintaining 20% exposure helped them avoid getting whipsawed (3 15-20% rallies in 4Q08 alone, all followed by new lows)

Running OPM, can’t take extreme positions and maintain his mental equilibrium.

Targets upside capture of 70-80% and downside capture of 30-40%

“Tyranny” of HF monthly returns -- comes from FOFs whose clients receive monthly data

Forecast earnings for every company they follow for 3-4 years out, then invest in the ones cheap vs. sector where they have earnings > consensus. Catalyst should be earnings surprise

He was super long AAPL despite the move because it was still cheap on his estimates. Anecdote about RIMM PlayBook which they rushed to market to compete with iPad but without ability to do email on it despite being for corporate market. Predicted RIMM would be bust in 3-4 years.

Bad companies in EM are always at risk of being taken over, because EM is full of sectors where multi-nationals want exposure and their only option is a bad company because regulators won’t let them buy the good one, instead they approve purchase of the bad one because it’s saving jobs.

As such, they focus on shorting bad companies that can’t be taken over because they’re owned by gov’t or their own pension fund -- means it will never be sold because the workers are afraid of layoffs. In EM, that’s ~1/3 of companies owned that way.

His estimates often differ from consensus because he sees a new trend while they are extrapolating history.

If he’s bullish on a stock without a full position and sees a breakout on the chart, will go to full position because market is now seeing same thing he is. Charts are supplemental.

Only time he will initiate a trade based on chart is if a company is extremely oversold, like 3-year low on RSI. Usually means whatever is killing it is in the price. Doesn’t believe RSI works for overbought because stocks can stay overbought for a long time, whereas oversold is usually something pretty acute that resolves in a few weeks.

Gut feel is crucial -- understanding if something isn’t “acting right” is a sign to recheck your work.

Have to be an expert in what you invest in. Need to understand what you invest in. If you don’t understand why you’re in a trade, won’t understand when the right time to sell is.

Post-GFC, volumes took a long time to recover to pre-crisis levels

He had to return outside money in mid-2010 because his confidence was shaken from post-GFC. Only that allowed him to return to his former style.

*Tom Claugus

Obsessed with financial independence from a young age -- attributes to his dad being a product of the Depression, scared to death of being poor and managing to transfer that insecurity to him.

When he went to college, his dad told him he was going to feel like he was going to prison. “You can go out Friday night or Saturday night, but you can’t go out both, or else you won’t get ahead”

Adheres to a discipline of living on 1/3 of his income + 3% of NW (1/3 of ~10% pa target return) and investing the remainder.

Grossing up in a crash -- went into 1987 crash very net short, bought high quality longs that day to raise his net rather than covering shorts, since he was short low quality stocks and saw no need to cover.

Super interesting life story where he was on track to be CEO of Rohm & Haas in Philadelphia but making more money investing than at his job. Hit $1.6m in NW, realized he could live on 3% of that ($48k) and economic necessity to work completely disappeared. Launched a fund, but OPM responsibility weighed on him, closed quickly and almost went back to work.

Can only manage OPM with complete dedication -- “If I am 100% dedicated to managing your money, and I lose you money, I can look you in the eye and say, ‘I did my best,’ and I could be okay with that”

He thinks in terms of reversion-to-mean. Manages exposures relative to a best-fit regressions line for log of prices from 1932-present and calculates a 95% confidence interval (used to be 90% but that failed in 1999) -- output is two lines parallel to best-fit line that encompass 95% of all the months. At lower band, exposure will be 130/-20; at mid 100/-50 (want to be net long at midpoint because of secular uptrend in equities), at high end, 20/-90. Do this for SPX, Nasdaq and Russell 2k and derive a composite target exposure based on those.

Spend 90% of their time figuring out why a sector or stock is expensive or cheap, and what is going to change that.

Looks for anomalies -- screens for quarterly earnings +50%+ or -30%+ and tries to understand why.

Ex: Rock Tenn earnings up huge recently. Paper co, had been cheap for 4-5 years, mediocre business, looking for a reason to buy but never found anything. Ultimately, industry growth reduced capacity because no new supply and industry consolidated. Ultimately there was an inflection point in favor of suppliers.

Considers +/-7% a normal range of monthly outcomes for his fund -- where they’ve been 90% of all months. Being < -7% and not knowing why is a major red flag. Doesn’t do much proactive risk mgmt. Losing money on longs is diff from on shorts for him

“Evel Knievel short screen” -- companies trying to jump the Grand Canyon that prob won’t make it, his job is to figure out why they won’t make it. Two criteria: FCF burn & >5x BV. Normally ~60 companies, in 1999 it was 180 and 2/3 of them had 2x’d in price in the last quarter.

When market sells off really hard, it’s usually a liquidity issue -- no place to hide in a liquidity sell-off, people sell everything because they have to, not because they want to. Reverse rarely happens on the long side.

Shorts are actually easier to find than longs -- easier to spot a broken company than a good company, easier to identify bad mgmt than good mgmt.

Track basic indicators to get a feel for economy. Rail traffic & truck traffic tell you whether there’s expansion or contraction. Load factors on airplanes. RevPAR. Construction & housing starts.