#intangibleasset

Explore tagged Tumblr posts

Text

Video: Competitive Advantage of an Economic Moat

I explain the #WarrenBuffett and #Morningstar concept of an #economicmoat, something that gives the company with the moat a #competitiveadvantage. It could be one of five types: #Networkeffect, #Intangibleassets, #Costadvantage, #Switchingcosts or #efficientscale. This will allow a higher #ROI (return on investment) and higher #profits. The #CanadianMoneyTalk channel concentrates on…

View On WordPress

#competitiveadvantage#Costadvantage#economicmoat#efficientscale#Intangibleassets#morningstar#Networkeffect#profits#ROI#Switchingcosts#WarrenBuffett

0 notes

Text

Navigating the Unseen: Challenges in Accounting for Intangible Assets 💡📊

Hey Tumblr fam! Let's unravel the mystery behind a topic that often goes unnoticed but plays a crucial role in the financial landscape – accounting for intangible assets. 🧩💼

🔍 What are Intangible Assets? First things first – what are we talking about? Intangible assets are those valuable assets that lack physical substance. Think intellectual property, patents, copyrights, trademarks, and even brand recognition. They're like the unsung heroes of a company's value.

💼 Challenges on the Horizon:

Valuation Struggles: Putting a price tag on something you can't touch is no easy feat. The valuation of intangible assets can be subjective and challenging, making it harder for companies to reflect their true worth.

Amortization vs. Impairment: Unlike tangible assets with clear depreciation, intangibles often face the dilemma of amortization (gradual write-off) or impairment (sudden decline in value). Deciding which method to use can be a tricky dance for accountants.

Changing Regulatory Landscape: Accounting standards for intangible assets are not set in stone. Changes in regulations can throw a curveball, making it essential for accountants to stay on their toes and adapt to evolving guidelines.

Disclosure Dilemmas: Intangibles often hold strategic importance for a company. Balancing the need for transparency with the necessity to protect sensitive information can pose a challenge when it comes to disclosure in financial statements.

🚀 Why Does It Matter? Understanding these challenges is vital because accurate accounting for intangible assets is crucial for assessing a company's true value, making informed investment decisions, and maintaining financial transparency.

💬 Let's Chat! What are your thoughts on the challenges of accounting for intangible assets? Do you think it adds a layer of complexity to financial reporting, or is it a necessary puzzle piece in understanding a company's worth? Share your insights! 💬🌐

#BusinessInsights#FinancialChallenges#IntangibleAssets#AccountingTalks#finance#payment system#thefinrate#100 days of productivity#financialinsights

0 notes

Text

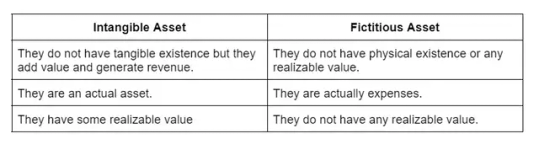

Title: "Distinguishing Fictitious Assets from Intangible Assets: A Financial Insight"

Understanding the difference between fictitious assets and intangible assets is essential for financial clarity. Fictitious assets have no tangible value but may represent deferred expenses or losses, affecting a company's balance sheet. In contrast, intangible assets include valuable non-physical assets like patents, copyrights, and trademarks, influencing a company's worth. This guide provides insights into the classification, accounting, and impact of fictitious and intangible assets on financial statements and the valuation of a business. Explore the intricacies of asset categorization, and enhance your financial knowledge to make informed decisions in the world of accounting and corporate finance.

0 notes

Photo

Info Seminar Training Finance Management. Jadwal Pelatihan Human Resources Development. Jadwal Training 2023 tersedia online dan offline class untuk public training dan in house training. Topik training Manajemen Keuangan dan HR Development: 1. Accounting for Project - Practice and Tricks 2. Basic Accounting & Finance for Non Finance Staff 3. Budget - A Forecasting Technique 4. Cash Flow and Treasury 5. Corporate Finance 6. Fixed & Intangible Asset Accounting & Management 7. Management and Cost Accounting - A Practical Approach 8. Update PSAK Terkini 9. Effective Manpower Planning 10. HR Administration 11. Job Analysis, Evaluation & Grading 12. Performance Improvement Plan 13. Training for the Trainer Info seminar training lengkap: WA: 0851-0197-2488 Jadwal training lengkap: https://www.informasi-seminar.com | Info Seminar Manajemen Keuangan | Jadwal Training HR Development | Training Finance Management | Info Training 2023 Online dan Offline Class | Jadwal Training Accounting dan Finance | #accounting #akuntansi #financemanagement #hrdevelopment #basicaccounting #finance #finon #budget #cashflow #treasury #corporatefinance #fixedasset #intangibleasset #costaccounting #akuntansibiaya #psak #manpowerplanning #hradministration #jobanalysis #jobevaluation #jobgrading #trainingfortrainer #accountingmanagement #jadwalpelatihan #manajemenkeuangan #humanresources (di Jakarta) https://www.instagram.com/p/Cod9Khsp7Wd/?igshid=NGJjMDIxMWI=

#accounting#akuntansi#financemanagement#hrdevelopment#basicaccounting#finance#finon#budget#cashflow#treasury#corporatefinance#fixedasset#intangibleasset#costaccounting#akuntansibiaya#psak#manpowerplanning#hradministration#jobanalysis#jobevaluation#jobgrading#trainingfortrainer#accountingmanagement#jadwalpelatihan#manajemenkeuangan#humanresources

0 notes

Photo

Your business is one of the intellectual properties that is considered an intangible asset. In estate planning, intellectual property and its value often get overlooked since they can be invisible to you and those who aren't familiar with its nature.

As a business owner, it's critically important for you to identify and know your intellectual property's value and include all your intangible assets to ensure that they are protected in the event something happens to you.

Read here to know how to ensure your property is documented, protected and how you should work with a legal team. http://ow.ly/C7OE50DOcYy

"Protect what matters most, no matter what."

#intellectualproperty#intangibleasset#valuableasset#businessassets#businessintangibleassets#estateplan#estateplanning#wills#trusts#lawfirm#estateplanningattorney#estateplanningboston#massachusetts#boston#sudburyma#20westlegal

0 notes

Photo

Finally, the French translation of our article on #intangibles #intangibleassets #valuation is available to read on https://crefovi.fr/articles/pourquoi-l-evaluation-des-actifs-incorporels-est-importante/ @crefovi (at Paris, France) https://www.instagram.com/p/CDlj9q1HO9B/?igshid=1mli3tgophkc7

0 notes

Photo

We all experience inner turmoil from time to time. Own your mind and control how it affects you. #MindfulGraffiti #MindOverMatter #Throwback #IntangibleAssets #MindStrength #Power #ControlMechanisms #ChallengingTimes #Mindfulness #ThoughtYoga #EnergyHealing #Instamindfulness #Enlightenment #Motivation #Gratitude #PurposefulLiving #CreateYourOwnHappiness #InspirationDaily #PositiveEnergy #GoodVibes #MindBodyAndSoul #FoodForThought #SelfCare #SelfHelp #SelfCareDaily #WordPorn #MindPorn #QuoteOfTheDay #StopTheSpread #MasterAtHome https://www.instagram.com/p/B-9JdXonW58/?igshid=1fhgjmx0fwtmx

#mindfulgraffiti#mindovermatter#throwback#intangibleassets#mindstrength#power#controlmechanisms#challengingtimes#mindfulness#thoughtyoga#energyhealing#instamindfulness#enlightenment#motivation#gratitude#purposefulliving#createyourownhappiness#inspirationdaily#positiveenergy#goodvibes#mindbodyandsoul#foodforthought#selfcare#selfhelp#selfcaredaily#wordporn#mindporn#quoteoftheday#stopthespread#masterathome

0 notes

Photo

Aset tak berwujud yang perlu kamu miliki secara berkelanjutan adalah perbuatan baik. Bagikan hal itu kepada setiap orang yang kamu temui! Happy Friday! • • #quotes #intangibleassets #denshuquotes #explore #explorenature #seiretei #travelling #nikon #nikonindonesian #leader #leadership (at Grand Mosque of West Sumatra) https://www.instagram.com/p/BzPSoDjhHTW/?igshid=13xrbcs20abgd

#quotes#intangibleassets#denshuquotes#explore#explorenature#seiretei#travelling#nikon#nikonindonesian#leader#leadership

1 note

·

View note

Photo

Sharing the 867ip.org gospel of Ideas to Assets at Start Up Week Phoenix with Sarah Kay was fun and we got some great feedback! We’re on a mission to document, categorize and monetize intangibles, manage and line item as assets and create a standard framework that people can use! 867ip.org check out our white paper. Side note: I am fortunate to have got some time with Sarah Kay. In the short time we were able to talk I gained some valuable insight to my strengths and weaknesses. She’s a great business and life coach and I witnessed that power in person. Thanks! #newmoneyhabits #867foundation #abundancegames #entrepreneur #startupweekphx #antifragile #intangibleassets #influencer #iheartmesa #sarahkay #intellectualproperty #assetmanagement #ideas (at Mesa Arts Center) https://www.instagram.com/p/BuuoqbjhuUy/?utm_source=ig_tumblr_share&igshid=15jg1y6e2s9l4

#newmoneyhabits#867foundation#abundancegames#entrepreneur#startupweekphx#antifragile#intangibleassets#influencer#iheartmesa#sarahkay#intellectualproperty#assetmanagement#ideas

0 notes

Video

youtube

IND AS 16| Full Coverage | CA Final | English | By our student Deepika Thyagavel

IND AS 16| Full Coverage | CA Final - #indas16 #cafinalfr #cafinal #cafinalclasses #cafinalfr #QuickRevisionofINDAS38 #CAFinalFRRevision #FR #cafinal #IntangibleAssets #financialreporting #fasttrackrevision #fasttrack

https://youtu.be/eKJLxHbfp_w

0 notes

Photo

Intangible Asset . #IntangibleAsset Asset which does NOT have a physical identity e.g. goodwill, patents, copyright etc.

0 notes

Link

0 notes

Text

Lessors Of Nonfinancial Intangible Assets Market Global Competitive Insights And Outlook 2020

The Business Research Company published its Lessors Of Nonfinancial Intangible Assets Global Market Report 2020 which provides strategists, marketers and senior management with the critical information they need to assess the global Lessors Of Nonfinancial Intangible Assets market. The report provides in-depth analysis of the impact of COVID-19 on the market, along with revised market numbers due to the effects of the coronavirus. The report covers the lessors of nonfinancial intangible assets market’s segments- by type: oil royalty companies, patent owners and lessors and by mode: online, offline. View Complete Report: https://www.thebusinessresearchcompany.com/report/lessors-of-nonfinancial-intangible-assets-global-market-report-2020-30-covid-19-impact-and-recovery Lessors Of Nonfinancial Intangible Assets Global Market Report 2020 is the most comprehensive report available on this market and will help gain a truly global perspective as it covers 60 geographies. The chapter on the impact of COVID-19 gives valuable insights on supply chain disruptions, logistical challenges, and other economic implications of the virus on the market. The chapter also covers markets which have been positively affected by the pandemic. The global lessors of nonfinancial intangible assets market is expected to grow from $531.6 billion in 2019 to $540.7 billion in 2020 at a compound annual growth rate (CAGR) of 1.8%. The low growth is mainly due to economic slowdown across countries owing to the COVID-19 outbreak and the measures to contain it. The market is then expected to recover and grow at a CAGR of 9% from 2021 and reach $691.4 billion in 2023. A large number of companies are investing in research and development and are trying to make patent leasing as a major source of their revenue. These companies are investing in niche areas and are seeking a high return on their investments towards research and development. Patent owners are licensing their patents to both direct competitors and companies in related industries with most of them creating a new subsidiary unit focused on making money on those assets. Few Points From Table Of Content 1. Executive Summary 2. Report Structure 3. Lessors Of Nonfinancial Intangible Assets Market Characteristics 4. Lessors Of Nonfinancial Intangible Assets Market Product Analysis 5. Lessors Of Nonfinancial Intangible Assets Market Supply Chain …… 19. Lessors Of Nonfinancial Intangible Assets Market Competitive Landscape 20. Key Mergers And Acquisitions In The Lessors Of Nonfinancial Intangible Assets Market 21. Market Background: Leasing Market 22. Recommendations 24. Copyright And Disclaimer Request A Sample Report At: https://www.thebusinessresearchcompany.com/sample.aspx?id=2223&type=smp Few Points From List Of Table Table 1: Historic Market Growth, Value ($ Billion) Table 2: Forecast Market Growth, Value ($ Billion) Table 3: Global Lessors Of Nonfinancial Intangible Assets Market, 2019, By Region, Value ($ Billion) …….. Table 127: Global Lessors Of Nonfinancial Intangible Assets Market In 2023- Growth Countries Table 128: Global Lessors Of Nonfinancial Intangible Assets Market In 2023- Growth Segments Table 129: Global Lessors Of Nonfinancial Intangible Assets Market In 2023- Growth Strategies

About The Business Research Company: The Business Research Company is a Business Intelligence Company which excels in company, market and consumer research. It has offices in the UK, the US and India and a network of trained researchers in 15 countries globally.

Contact Information: The Business Research Company Europe: +44 207 1930 708 Asia: +91 8897263534 Americas: +1 315 623 0293 Email: [email protected] Follow us on Blog: http://blog.tbrc.info/ Follow us on LinkedIn: https://in.linkedin.com/company/the-business-research-company

#lessorsofnonfinancialintagibleassets#thebusinessresearchcompany#servicesindustry#intangibleassets#marketgrowth

0 notes

Text

ACC 206 Week 2 Quiz – Strayer NEW

Click on the Link Below to Purchase A+ Graded Course Material

http://budapp.net/ACC-206-Accounting-Principles-II-Week-2-Quiz-Strayer-260.htm

CHAPTER10

PLANTASSETS,NATURALRESOURCES,ANDINTANGIBLEASSETS

CHAPTERSTUDYOBJECTIVES

1.Describehowthecostprincipleappliestoplantassets.

2.Explaintheconceptofdepreciation..

3.Computeperiodicdepreciationusingdifferentmethods.

4.Describetheprocedureforrevisingperiodicdepreciation.

5.Distinguishbetweenrevenueandcapitalexpenditures,andexplaintheentriesforeach.

6.Explainhowtoaccountforthedisposalofaplantasset.

7.Computeperiodicdepletionofnaturalresources.

8.Explainthebasicissuesrelatedtoaccountingforintangibleassets.

9.Indicatehowplantassets,naturalresources,andintangibleassetsarereported.

10.Explainhowtoaccountfortheexchangeofplantassets.

TRUE-FALSESTATEMENTS

1. Allplantassets(fixedassets)mustbedepreciatedfor accountingpurposes.

2. Whenpurchasingland,thecostsforclearing,draining,filling,andgradingshouldbe chargedto aLandImprovementsaccount.

3. Whenpurchasingdeliveryequipment,salestaxesandmotorvehiclelicensesshouldbe chargedto DeliveryEquipment.

4. Landimprovementsaregenerallychargedto theLandaccount.

5. Oncecostisestablishedforaplantasset,itbecomes thebasis ofaccounting fortheasset unlesstheassetappreciatesinvalue,inwhichcase,marketvaluebecomesthebasisfor accountability.

6. Thebookvalueof aplantassetisalwaysequaltoitsfairmarketvalue.

7. Recordingdepreciationonplantassetsaffectsthebalancesheetandtheincome statement.

8. Thedepreciablecostof aplant asset is itsoriginalcostminusobsolescence.

9. Recordingdepreciationeachperiodisanapplicationof thematchingprinciple.

10. TheAccumulatedDepreciationaccountrepresentsacashfundavailabletoreplaceplant assets.

11. Incalculatingdepreciation,bothplantassetcost andusefullifearebasedonestimates.

12. Usingtheunits-of-activitymethodofdepreciatingfactoryequipmentwillgenerallyresultin moredepreciationexpensebeingrecordedoverthelifeoftheassetthanifthestraight-line method hadbeenused.

13. Salvagevalueisnotsubtractedfromplantassetcostindeterminingdepreciationexpense underthedeclining-balancemethodofdepreciation.

14. Thedeclining-balancemethodofdepreciationiscalledanaccelerateddepreciation methodbecauseitdepreciatesanassetinashorterperiodoftimethantheasset'suseful life.

15. Underthedouble-declining-balancemethod,thedepreciationrateusedeachyear remainsconstant.

16. TheIRSdoesnotrequirethetaxpayertousethesamedepreciationmethodonthetax returnthatisusedinpreparingfinancialstatements.

17. Achangeintheestimatedusefullifeofaplantassetmaycauseachangeintheamount ofdepreciationrecognizedinthecurrentandfutureperiods,but nottopriorperiods.

18. Achangeintheestimatedsalvagevalueofaplantassetrequiresarestatementofprior years'depreciation.

19. Todetermineanewdepreciationamountafterachangeinestimateofaplantasset's useful life, the asset'sremaining depreciablecost isdividedbyits remainingusefullife.

20. Additionsand improvementstoaplantassetthatincreasethe asset'soperatingefficiency, productive capacity,or expectedusefullife aregenerallyexpensed intheperiodincurred.

21. Capitalexpendituresareexpendituresthatincreasethecompany'sinvestmentin productive facilities.

22. Ordinaryrepairs shouldberecognizedwhenincurredas revenueexpenditures.

23. A characteristicofcapitalexpendituresis that theexpendituresoccurfrequently duringthe period ofownership.

24. Onceanassetisfullydepreciated,noadditionaldepreciationcanbetakeneventhough theasset is still beingusedbythebusiness.

25. Thefairmarketvalueof a plantasset isalwaysthesameasits bookvalue.

26. Iftheproceedsfromthesaleofaplantassetexceeditsbookvalue,againondisposal occurs.

27. Alossondisposalofaplantassetcanonlyoccurifthecashproceeds received fromthe assetsaleis lessthanthe asset'sbook value.

28. Thebookvalueofaplantassetistheamount originallypaid fortheassetlessanticipated salvagevalue.

29. Alossondisposal ofaplantasset asaresult ofasaleoraretirementiscalculated inthe sameway.

30. A plantassetmustbefullydepreciatedbeforeit canberemovedfromthe books.

31. Ifaplantasset issoldata gain,thegain ondisposal shouldreducethecost ofgoodssold section of the incomestatement.

32. Depletioncostperunitiscomputedbydividingthetotalcostofanaturalresourcebythe estimatednumberof unitsintheresource.

33. TheAccumulatedDepletionaccountisdeductedfromthecostofthenaturalresourcein thebalancesheet.

34. Depletionexpenseforaperiodisonlyrecognizedonnaturalresourcesthathavebeen extractedandsoldduringtheperiod.

35. Naturalresourcesarelong-livedproductiveassetsthatareextractedinoperationsand arereplaceableonlybyanactof nature.

36. Thecostofnaturalresourcesisnotallocatedtoexpensebecausethenaturalresources arereplaceableonlybyanactof nature.

37. Conceptually,thecostallocationproceduresfornaturalresourcesparallelsthatofplant assets.

38. Naturalresourcesincludestandingtimberandundergrounddepositsofoil,gas,and minerals.

39. Ifanacquiredfranchiseorlicensehasanindefinitelife,thecostoftheassetisnot amortized.

40. Whenanentirebusinessispurchased,goodwillistheexcessofcostoverthebookvalue of thenet assetsacquired.

41. Researchand development costswhich result in asuccessful product which ispatentable arechargedtothePatentaccount.

42. Thecostof apatentmustbeamortizedovera 20-yearperiod.

43. Thecostofapatentshouldbeamortizedoveritslegallifeorusefullife,whicheveris shorter.

44. The balancesofthe majorclassesofplantassetsand accumulated depreciationby major classes shouldbedisclosedinthebalance sheetornotes.

45. Theassetturnover ratioiscalculated astotalsales dividedbyendingtotalassets.

46. Researchanddevelopmentcostscanbeclassifiedasaproperty,plant,andequipment itemoras an intangibleasset.

a47. An exchangeofplantassetshas commercial substanceifthe futurecashflows change as a resultofthe exchange.

a48. Companiesrecordagainorlossontheexchangeofplantassetsbecausemost exchangeshavecommercialsubstance.

a49. Whenplantassetsareexchanged,thecostofthenewassetisthebookvalueoftheold assetplus anycashpaid.

Additional True-FalseQuestions

50. Whenconstructingabuilding,acompanyispermittedtoincludetheacquisitioncostand certaininterest costs incurredinfinancingtheproject.

51. Recognitionofdepreciationpermitstheaccumulationofcashforthereplacementofthe asset.

52. Whenanassetispurchasedduringtheyear,itisnotnecessarytorecorddepreciation expense inthefirst yearunderthedeclining-balancedepreciationmethod.

53. Depletionexpenseisreported intheincomestatementas anoperatingexpense.

54. Goodwillisnotrecognizedinaccountingunlessitisacquiredfromanotherbusiness enterprise.

55. Researchanddevelopmentcostsshouldbechargedtoexpensewhenincurred.

56. Alossontheexchangeofplantassetsoccurswhenthefairmarketvalueoftheoldasset islessthanitsbookvalue.

MULTIPLECHOICEQUESTIONS

57. Thecostof apurchasedbuildingincludes allofthefollowingexcept a.closingcosts.

b.realestatebroker's commission. c.remodeling costs.

d.Allof theseareincluded.

58. Acompanypurchasedlandfor$90,000cash.Realestatebrokers'commissionwas $5,000and$7,000wasspentfordemolishinganoldbuildingonthelandbefore constructionofanewbuildingcouldstart.Underthecostprinciple,thecostoflandwould be recordedat

a.$97,000. b.$90,000. c.$95,000. d.$102,000.

59. Whichoneofthefollowingitemsisnotconsideredapartofthecostofatruckpurchased for businessuse?

a.Salestax

b.Trucklicensec.Freightcharges

d.Costofletteringonsideoftruck

60. Whichofthefollowingassetsdoesnotdeclineinservicepotentialoverthecourseofits useful life?

a.Equipment b.Furnishings c.Land

d.Fixtures

61. Thefoursubdivisions forplantassetsare

a.land,landimprovements,buildings,andequipment. b.intangibles,land,buildings,andequipment.

c.furnishingsandfixtures,land,buildings, andequipment. d.property,plant,equipment,andland.

62. Thecostof landdoesnotinclude

a.realestatebrokers' commission. b.annualpropertytaxes.

c.accruedpropertytaxesassumedbythepurchaser. d.title fees.

63. FeeneyClinicpurchaseslandfor$130,000cash.Theclinicassumes$1,500inproperty taxesdueontheland.Thetitleandattorneyfeestotaled$1,000.Theclinichastheland gradedfor $2,200.WhatamountdoesFeeneyClinicrecordasthecostforthe land?

a.$132,200 b.$130,000 c.$134,700 d.$132,500

64. BelleCompanybuyslandfor$50,000on12/31/07.Asof3/31/08,thelandhas appreciatedinvalueto$50,700.On12/31/08,thelandhasanappraisedvalueof $51,800.Bywhatamountshouldthe Landaccount beincreasedin 2008?

a.$0b.$700

c.$1,100 d.$1,800

65. PineCompanyacquireslandfor$86,000cash.Additional costsareasfollows:

Removalof shed $300 Fillingandgrading 1,500 Salvagevalue oflumberofshed 120 Brokercommission 1,130 Pavingofparkinglot 10,000 Closingcosts 560

Pinewillrecordtheacquisitioncostof thelandas a.$86,000.

b.$87,690. c.$89,610. d.$89,370.

66. ShawneeHospitalinstallsanewparkinglot.Thepavingcost$30,000andthelightsto illuminatethenewparkingareacost$15,000.Whichofthefollowingstatementsistrue with respecttotheseadditions?

a.$30,000shouldbedebitedtothe Landaccount.

b.$15,000shouldbedebitedtoLandImprovements. c.$45,000shouldbedebitedtotheLandaccount.d.$45,000shouldbedebitedtoLandImprovements.

10-10

67. Landimprovementsshouldbedepreciatedovertheusefullife of the a.land.

b.buildingsontheland.

c.land or landimprovements,whicheverislonger. d.landimprovements.

68. GeneralMoldingisbuildinganewplantthatwilltakethreeyearstoconstruct.The constructionwillbefinancedinpartbyfundsborrowedduringtheconstructionperiod. Therearesignificantarchitectfees,excavationfees,andbuildingpermitfees.Whichof the followingstatementsis true?

a.Excavationfeesarecapitalizedbut building permitfeesarenot. b.Architectfeesarecapitalizedbut buildingpermitfeesarenot.

c.Interestiscapitalizedduring theconstructionas partof thecostofthebuilding.

d.The capitalizedcost is equaltothecontractprice tobuildthe plant less any intereston borrowed funds.

69. Acompanypurchasesaremotesitebuildingforcomputeroperations.Thebuildingwillbe suitableforoperationsaftersomeexpenditures.Thewiringmustbereplacedtocomputer specifications.Theroofisleakyandmustbereplaced.Allroomsmustberepaintedand recarpetedandtherewillalsobesomeplumbingworkdone.Whichofthefollowing statements is true?

a.Thecost ofthebuildingwillnot includetherepaintingandrecarpeting costs. b.Thecostofthebuildingwillincludethecostof replacing theroof.

c.Thecostofthebuildingisthepurchasepriceofthebuilding,whiletheadditional expendituresareallcapitalizedas BuildingImprovements.

d.Thewiringis partofthecomputercosts,notthebuildingcost.

70. CarleyCompany purchasesanewdeliverytruck for$45,000.Thesalestaxesare$3,000. Thelogo of thecompanyis painted on thesideofthe truckfor$1,200.Thetrucklicenseis $120.Thetruckundergoessafetytestingfor$220.WhatdoesCarleyrecordasthecostof thenewtruck?

a.$49,540 b.$49,420 c.$48,000 d.$47,420

71. Allof thefollowingfactorsincomputingdepreciationareestimatesexcept a.cost.

b.residualvalue. c.salvagevalue. d.usefullife.

72. StoriesCompanypurchasedequipmentandthesecostswereincurred:

Cashprice Salestaxes

Insuranceduringtransit Installationandtesting Totalcosts

$22,500 1,800 320

430$25,050

PlantAssets,NaturalResources,andIntangibleAssets 10-11

Storieswillrecordtheacquisitioncostofthe equipmentas a.$22,500.

b.$24,300. c.$24,620. d.$25,050.

73. Becky’sBloomspurchasedadeliveryvanfor$20,000.Thecompany wasgivena$2,000 cashdiscountbythedealer,andpaid$1,000salestax.Annualinsuranceonthevanis $500.Asaresultofthepurchase,byhowmuchwillBecky’sBloomsincreaseitsvan account?

a.$20,000 b.$18,000 c.$19,500 d.$19,000

74. UptonCompanypurchasedequipmentonJanuary1atalistpriceof$50,000,withcredit terms2/10,n/30.PaymentwasmadewithinthediscountperiodandUptonwasgivena $1,000cashdiscount.Uptonpaid$2,500salestaxontheequipment,andpaidinstallation chargesof$880.Priortoinstallation,Uptonpaid$2,000topouraconcreteslabonwhich toplacethe equipment.Whatisthetotalcostofthe newequipment?

a.$52,380 b.$54,380 c.$55,380 d.$50,500

75. Interestmaybe includedintheacquisitioncost ofa plantasset a.duringtheconstructionperiodof aself-constructedasset.b.if theassetis purchasedoncredit.

c.if theassetacquisitionisfinancedbyalong-termnotepayable. d.ifit isapart of a lump-sumpurchase.

76. ThebalanceintheAccumulatedDepreciationaccountrepresentsthe a.cashfundtobeusedtoreplaceplantassets.

b.amounttobedeductedfromthecostoftheplantassettoarriveatitsfairmarket value.

c.amountchargedtoexpenseinthecurrentperiod.

d.amountchargedto expensesincetheacquisitionof theplantasset.

77. Whichoneofthefollowingitemsisnotaconsiderationwhenrecordingperiodic depreciationexpenseonplantassets?

a.Salvagevalue

b.Estimatedusefullife

c.Cashneededtoreplacethe plantasset d.Cost

78. Depreciationisthe processof allocating thecostof aplantasset overits servicelife in a.anequaland equitablemanner.

b.an acceleratedand accuratemanner. c.asystematicandrationalmanner.

d.a conservativemarket-basedmanner.

10-12

79. Thebookvalueof anassetisequaltothe

a.asset'smarketvaluelessits historicalcost.

b.bluebookvaluereliedonbysecondarymarkets. c.replacementcostof theasset.

d.asset'scostlessaccumulateddepreciation.

80. Accountantsdonotattempttomeasurethechangeinaplantasset'smarketvalueduring ownership because

a.theassetsare notheldfor resale. b.plantassetscannotbesold.

c.losseswouldhavetoberecognized.

d.itismanagement'sresponsibilityto determinefair values.

81. Depreciationis aprocessof a.assetdevaluation.

b.costaccumulation. c.cost allocation.

d.assetvaluation.

82. Recordingdepreciationeachperiodisnecessaryinaccordancewiththe a.goingconcernprinciple.

b.costprinciple.

c.matchingprinciple.

d.assetvaluationprinciple.

83. Incomputingdepreciation,salvagevalueis

a.thefairmarketvalueofa plantassetonthedate of acquisition.

b.subtractedfromaccumulateddepreciationtodeterminetheplantasset'sdepreciable cost.

c.anestimateof aplantasset'svalueattheendofitsusefullife. d.ignoredinallthedepreciationmethods.

84. Whenestimatingtheusefullifeofanasset,accountantsdonotconsider a.thecosttoreplacetheassetat theendofits usefullife.

b.obsolescencefactors.

c.expectedrepairsandmaintenance. d.theintendeduse of theasset.

85. Usefullifeisexpressedintermsof useexpectedfromtheassetunderthe a.declining-balancemethod.

b.straight-linemethod.

c.units-of-activitymethod. d.noneof these.

86. Equipmentwaspurchasedfor$75,000.Freightchargesamountedto$3,500andthere wasacostof$10,000forbuildingafoundationandinstallingtheequipment.Itis estimatedthattheequipmentwillhavea$15,000salvagevalueattheendofits5-year useful life. Depreciationexpenseeachyearusingthe straight-linemethodwillbe

a.$17,700. b.$14,700. c.$12,300. d.$12,000.

PlantAssets,NaturalResources,andIntangibleAssets 10-13

87. Atruckwaspurchasedfor$120,000anditwasestimatedtohavea$24,000salvage valueattheendofitsusefullife.Monthlydepreciationexpenseof$2,000wasrecorded using thestraight-linemethod.Theannualdepreciationrateis

a.20%. b.2%.c.8%. d.25%.

88. AcompanypurchasedfactoryequipmentonApril1,2008for$64,000.Itisestimatedthat theequipmentwillhavean$8,000salvagevalueattheendofits10-yearusefullife. Usingthestraight-linemethodofdepreciation,theamounttoberecordedasdepreciation expense atDecember31,2008is

a.$6,400. b.$5,600. c.$4,200. d.$4,800.

89. Acompanypurchasedofficeequipmentfor$40,000andestimatedasalvagevalueof $8,000attheendofits5-yearusefullife.Theconstantpercentagetobeappliedagainst book valueeachyearifthedouble-declining-balancemethodisusedis

a.20%. b.25%. c.40%. d.4%.

90. Thedeclining-balancemethodofdepreciationproduces a.adecreasingdepreciationexpenseeachperiod.

b.an increasingdepreciationexpenseeachperiod. c.a decliningpercentagerateeachperiod.

d.a constantamount ofdepreciationexpenseeachperiod.

91. Acompanypurchasedfactoryequipmentfor$250,000.Itisestimatedthattheequipment willhavea$25,000salvagevalueattheendofitsestimated5-yearusefullife.Ifthe companyusesthedouble-declining-balancemethodofdepreciation,theamountofannual depreciationrecordedforthesecondyear afterpurchasewould be

a.$100,000. b.$60,000. c.$90,000. d.$43,200.

92. Theunits-of-activitymethodisgenerallynot suitablefor a.airplanes.

b.buildings.

c.deliveryequipment. d.factorymachinery.

93. Aplantassetcost$144,000andisestimatedtohavean$18,000salvagevalueattheend ofits8-yearusefullife.Theannualdepreciation expenserecordedforthethirdyearusing thedouble-declining-balancemethodwouldbe

a.$12,060. b.$20,250. c.$17,718. d.$13,785.

10-14

94. Afactorymachinewaspurchased for$75,000onJanuary1,2008.Itwasestimatedthatit wouldhavea$15,000salvagevalueattheendofits5-yearusefullife.Itwasalso estimatedthatthemachinewouldberun40,000hoursinthe5years.Thecompanyran themachinefor4,000actualhoursin2008.Ifthecompanyusestheunits-of-activity methodof depreciation,the amountof depreciationexpensefor 2008 wouldbe

a.$7,500.b.$12,000. c.$15,000. d.$6,000.

95. TheModifiedAcceleratedCostRecoverySystem(MACRS)isadepreciationmethod which

a.isusedfortaxpurposes.

b.mustbeusedforfinancialstatementpurposes. c.isrequiredbytheSEC.

d.expensesanassetoverasingleyearbecausecapitalacquisitionsmustbeexpensed in theyearpurchased.

96. Whichofthefollowingmethodsof computing depreciationisproductionbased? a.Straight-line

b.Declining-balance c.Units-of-activityd.Noneof these

97. Managementshouldselect thedepreciationmethodthat a.iseasiesttoapply.

b.bestmeasurestheplantasset'smarketvalueover its usefullife.

c.bestmeasuresthe plantasset'scontributiontorevenue overits usefullife. d.hasbeenusedmostofteninthepastbythe company.

98. Thedepreciationmethodthatappliesaconstantpercentagetodepreciablecostin calculating depreciation is

a.straight-line.

b.units-of-activity.

c.declining-balance. d.noneof these.

Usethefollowing informationforquestions99–100.

OnOctober1,2008,DoleCompanyplacesanewassetintoservice.Thecostoftheassetis $60,000withanestimated5-yearlifeand$15,000salvagevalueattheendof its usefullife.

99. Whatisthedepreciationexpensefor2008ifDoleCompanyusesthestraight-linemethod ofdepreciation?

a.$2,250 b.$12,000 c.$3,000 d.$6,000

PlantAssets,NaturalResources,andIntangibleAssets 10-15

100. WhatisthebookvalueoftheplantassetontheDecember31,2008,balancesheet assuming that DoleCompanyusesthedouble-declining-balancemethodof depreciation? a.$39,000

b.$45,000 c.$54,000 d.$57,000

101. Whichdepreciationmethod ismostfrequentlyusedinbusinessestoday? a.Straight-line

b.Declining-balance c.Units-of-activity

d.Double-declining-balance

102. WineCompanyusestheunits-of-activitymethodincomputingdepreciation.Anewplant assetispurchased for$24,000thatwillproduceanestimated100,000unitsoveritsuseful life.Estimatedsalvagevalue attheend ofitsuseful lifeis$2,000. Whatis the depreciation costperunit?

a.$2.20 b.$2.40 c.$.22 d.$.24

103. Units-of-activityisanappropriatedepreciationmethodtouse when a.it isimpossibleto determinetheproductivityof theasset.

b.theasset'susewillbeconstantoverits usefullife.

c.theproductivityof theassetvariessignificantlyfromoneperiodtoanother. d.thecompanyisamanufacturingcompany.

104. Thecalculationof depreciationusingthedecliningbalancemethod,

a.ignoressalvage valueindeterminingtheamounttowhicha constantrateisapplied. b.multipliesaconstantpercentagetimesthepreviousyear'sdepreciationexpense.

c.yieldsan increasingdepreciationexpenseeachperiod.

d.multipliesadecliningpercentagetimesaconstantbookvalue.

Use thefollowing informationforquestions105–106.

GreyCompanypurchasedanewvanforfloraldeliveriesonJanuary1,2008.Thevancost $36,000withanestimatedlifeof5yearsand$9,000salvagevalueattheendofitsusefullife. Thedouble-declining-balancemethodof depreciationwillbeused.

105. Whatisthedepreciationexpensefor2008? a.$7,200

b.$5,400c.$10,800 d.$14,400

106. WhatisthebalanceoftheAccumulatedDepreciationaccountattheendof2009? a.$5,760

b.$17,280 c.$23,040 d.$8,640

10-16

107. PorterCompanypurchasedequipmentfor$450,000onJanuary1,2007,andwillusethe double-declining-balancemethodofdepreciation.Itisestimatedthattheequipmentwill havea3-yearlifeanda$20,000salvagevalueattheendofitsusefullife.Theamountof depreciationexpenserecognizedintheyear2009willbe

a.$50,000. b.$30,000. c.$54,440. d.$34,440.

108. Aplant asset was purchasedon January 1 for$50,000withan estimatedsalvagevalueof $10,000attheendofitsusefullife.Thecurrentyear'sDepreciationExpenseis$5,000 calculatedonthestraight-linebasisandthebalanceoftheAccumulatedDepreciation accountattheendof theyearis$25,000.Theremainingusefullifeof theplantasset is

a.10 years. b.8years. c.5 years. d.3years.

109. Equipmentwaspurchasedfor$60,000.Freightchargesamountedto$2,800andthere wasacostof$8,000forbuildingafoundation andinstallingtheequipment.Itisestimated thattheequipmentwillhavea$12,000salvagevalueattheendofits5-yearusefullife. Depreciation expenseeachyearusingthestraight-linemethodwill be

a.$14,160. b.$11,760. c.$9,840. d.$9,600.

110. Equipmentwaspurchased for$17,000onJanuary1,2008.Freightchargesamountedto $700andtherewasacostof$2,000forbuildingafoundationandinstallingthe equipment.Itisestimatedthattheequipmentwillhavea$3,000salvagevalueattheend ofits5-year useful life.What istheamountofaccumulateddepreciationatDecember31, 2009,if thestraight-linemethodof depreciationisused?

a.$6,680 b.$3,340 c.$2,860 d.$5,720

111. Acompanypurchasedfactoryequipment onJune 1,2008,for$48,000.Itisestimatedthat theequipmentwillhavea$3,000salvagevalueattheendofits10-yearusefullife.Using thestraight-linemethodofdepreciation,theamounttoberecordedasdepreciation expense atDecember31,2008,is

a.$4,500. b.$2,625. c.$2,250. d.$1,875.

112. Aplant asset was purchasedon January 1 for$40,000withan estimatedsalvagevalueof $8,000attheendofitsusefullife.Thecurrentyear'sDepreciationExpenseis$4,000 calculatedonthestraight-linebasisandthebalanceoftheAccumulatedDepreciation accountattheendof theyearis$20,000.Theremainingusefullifeof theplantasset is

PlantAssets,NaturalResources,andIntangibleAssets 10-17

a.10 years. b.8years. c.5 years. d.3years.

Usethefollowing informationforquestions113–115.

BrinkmanCorporationboughtequipmentonJanuary1,2008.Theequipmentcost$90,000and hadanexpectedsalvagevalueof$15,000.Thelifeoftheequipmentwasestimatedtobe6 years.

113. Thedepreciablecostof theequipmentis a.$90,000.

b.$75,000. c.$50,000. d.$12,500.

114. Thedepreciationexpenseusingthestraight-linemethodof depreciationis a.$17,500.

b.$18,000. c.$12,500.

d.noneof theabove.

115. Thebookvalueof the equipmentatthebeginningof thethirdyear wouldbe a.$90,000.

b.$75,000. c.$65,000. d.$25,000.

116. BadenCompanypurchasedmachinerywithalistpriceof$32,000.Theyweregivena 10%discountbythemanufacturer.Theypaid$200forshippingandsalestaxof$1,500. Badenestimatesthatthemachinerywillhaveausefullifeof10yearsandaresidual value of$10,000.IfBadenusesstraight-linedepreciation,annualdepreciationwillbe

a.$2,050. b.$2,036. d.$3,050. d.$1,880.

117. BatesCompanypurchasedequipmentonJanuary1,2008,atatotalinvoicecostof $600,000.Theequipmenthasanestimatedsalvagevalueof$15,000andanestimated usefullifeof5years.WhatistheamountofaccumulateddepreciationatDecember31, 2009,if thestraight-linemethodof depreciationisused?

a.$120,000 b.$240,000 c.$117,000 d.$234,000

10-18

118. OnJanuary1,amachinewithausefullifeoffiveyearsandaresidualvalueof$15,000 waspurchasedfor$45,000.Whatisthedepreciationexpenseforyear2underthe double-declining-balancemethodof depreciation?

a.$10,800 b.$18,000 c.$14,400 d.$8,640

119. Amachinewithacostof$160,000hasanestimatedsalvagevalueof$10,000andan estimatedusefullifeof5yearsor15,000hours.Itistobedepreciatedusingtheunits-of-activitymethodofdepreciation.Whatistheamountofdepreciationforthesecondfull year,during whichthe machinewasused5,000hours?

a.$50,000 b.$30,000 c.$43,333 d.$53,333

120. Equipmentwithacostof$240,000hasanestimatedsalvagevalueof$15,000andan estimatedlifeof4yearsor15,000hours.Itistobedepreciatedusingtheunits-of-activity method.Whatistheamountofdepreciationforthefirstfullyear,duringwhichthe equipmentwasused 3,300 hours?

a.$60,000 b.$67,800 c.$49,500 d.$56,250

121. LarimeCompanypurchasedequipmentfor$40,000onJanuary1,2007,andwillusethe double-declining-balancemethodofdepreciation.Itisestimatedthattheequipmentwill havea5-yearlifeanda$2,000salvagevalueattheendofitsusefullife.Theamountof depreciationexpenserecognizedintheyear2009willbe

a.$5,760. b.$9,120. c.$9,600. d.$5,472.

122. InterlineTruckingpurchasedatractortrailerfor$98,000. Interlineusestheunits-of-activity methodfordepreciatingitstrucksandexpectstodrivethetruck1,000,000milesoverits 12-yearusefullife.Salvagevalueisestimated tobe$14,000.Ifthetruckisdriven90,000 miles in itsfirstyear,howmuchdepreciationexpenseshouldInterlinerecord?

a.$7,000 b.$8,820 c.$7,560 d.$8,167

123. Anassetwaspurchasedfor$150,000.Ithadanestimatedsalvagevalueof$30,000and anestimatedusefullifeof10years.After5yearsofuse,theestimatedsalvagevalueis revisedto$24,000buttheestimatedusefullifeisunchanged.Assumingstraight-line depreciation, depreciationexpenseinyear6 wouldbe

a.$18,000. b.$13,200. c.$9,000. d.$12,600.

PlantAssets,NaturalResources,andIntangibleAssets 10-19

124. Equipmentcosting$30,000withasalvagevalueof$6,000andanestimatedlifeof8 yearshasbeendepreciatedusingthestraight-linemethodfor2years.Assuminga revisedestimatedtotallifeof5yearsandnochangeinthesalvage value,thedepreciation expense for year3wouldbe

a.$3,600. b.$8,000. c.$6,000. d.$4,800.

125. Joe'sQuikShopboughtmachineryfor$25,000onJanuary1,2008.Joeestimatedthe usefullifetobe5yearswithnosalvagevalue,andthestraight-line methodofdepreciation willbeused. OnJanuary 1,2009,Joedecidesthatthebusinesswillusethemachineryfor a total of6 years.What is thereviseddepreciationexpensefor2009?

a.$4,000 b.$2,000 c.$3,333 d$5,000

126. Eachofthefollowingisusedincomputingrevisedannualdepreciationforachangein estimateexcept

a.bookvalue. b.cost.

c.depreciablecost.

d.remaininguseful life.

127. A changeintheestimatedusefullife of equipmentrequires

a.aretroactivechangeintheamountofperiodicdepreciationrecognizedinprevious years.

b.thatnochangebemadeintheperiodicdepreciation sothatdepreciationamounts are comparableoverthelifeof theasset.

c.thattheamountofperiodicdepreciationbechangedinthecurrentyearandinfuture years.

d.that incomeforthecurrent yearbeincreased.

128. HuntCompanyhasdecidedtochangetheestimateoftheusefullifeofanassetthathas beeninservicefor2years. Whichofthefollowingstatementsdescribestheproperwayto revise a usefullifeestimate?

a.Revisionsinusefullifeare permittedifapprovedbytheIRS.

b.Retroactivechangesmustbemadeto correctpreviouslyrecordeddepreciation. c.Onlyfuture yearswill beaffectedbytherevision.

d.Bothcurrentandfutureyearswillbeaffectedbythe revision.

129. Jim'sCopyShopboughtequipmentfor$90,000onJanuary1,2007.Jimestimatedthe usefullifetobe3yearswithnosalvage value, andthestraight-line methodofdepreciation willbeused.OnJanuary1,2008,Jimdecidesthat the businesswilluse theequipmentfor5years.Whatisthereviseddepreciationexpensefor 2008?

a.$30,000 b.$12,000 c.$15,000 d.$22,500

10-20

130. Costsincurredtoincreasetheoperatingefficiencyorusefullifeofaplantassetare referred toas

a.capitalexpenditures.b.expenseexpenditures. c.ordinaryrepairs.

d.revenueexpenditures.

131. Expendituresthatmaintain theoperatingefficiencyandexpectedproductivelifeofaplant assetaregenerally

a.expensedwhenincurred.

b.capitalizedasa partofthecostof theasset.

c.debitedto the AccumulatedDepreciationaccount.d.notrecordeduntiltheybecomematerialinamount.

132. Whichofthefollowingisnottrue of ordinaryrepairs?

a.Theyprimarilybenefitthecurrentaccountingperiod. b.Theycan bereferredto asrevenueexpenditures.

c.Theymaintaintheexpectedproductivelifeof theasset. d.Theyincreasetheproductivecapacityof theasset.

133. Thepaneling ofthe body ofanopenpickuptruckwouldbeclassifiedasa(n) a.revenueexpenditure.

b.addition.

c.improvement.d.ordinaryrepair.

134. Additionsand improvements

a.occurfrequentlyduringtheownershipof aplantasset. b.normallyinvolveimmaterialexpenditures.

c.increasethebookvalueof plantassetswhenincurred. d.typicallyonlybenefitthecurrentaccountingperiod.

135. Ifa plantassetisretiredbeforeit isfullydepreciatedandnosalvagevalueisreceived, a.againondisposaloccurs.

b.a lossondisposal occurs.

c.eitheragainor a losscan occur. d.neitheragainnor alossoccurs.

136. Againorlossondisposalof aplantassetis determinedbycomparingthe a.replacementcost oftheassetwiththeasset'soriginal cost.

b.bookvalueof theassetwiththeasset'soriginalcost.

c.originalcost oftheassetwiththeproceedsreceivedfromitssale. d.bookvalueof the assetwiththe proceedsreceivedfromits sale.

137. Thebookvalueof aplantassetisthedifferencebetweenthe a.replacementcost oftheassetandits historicalcost.

b.costof the asset andtheamountofdepreciationexpenseforthe year. c.costoftheasset andtheaccumulateddepreciationtodate.

d.proceedsreceivedfromthesaleoftheassetand its originalcost.

PlantAssets,NaturalResources,andIntangibleAssets 10-21

138. Ifa plantassetissoldbefore it isfullydepreciated, a.onlyagainondisposalcanoccur.

b.onlya losson disposalcanoccur.c.eitheragainor a losscan occur.d.neitheragainnor alosscanoccur.

139. Ifaplantassetisretiredbeforeitisfullydepreciated,andthesalvagevaluereceivedis less thanthe asset's book value,

a.a gainondisposaloccurs. b.a lossondisposal occurs.

c.thereis nogain or lossondisposal.

d.additionaldepreciationexpensemust berecorded.

140 Acompanysellsaplantassetwhichoriginallycost$180,000for$60,000onDecember31, 2008.TheAccumulatedDepreciationaccounthadabalanceof$72,000afterthecurrent year'sdepreciationof $18,000 hadbeenrecorded.Thecompanyshouldrecognizea

a.$120,000lossondisposal. b.$48,000gainondisposal. c.$48,000lossondisposal. d.$30,000lossondisposal.

141. Ifdisposalofa plantassetoccursduringtheyear,depreciationis a.not recordedfortheyear.

b.recordedforthewholeyear.

c.recordedforthefractionof theyeartothedateof thedisposal. d.not recordediftheasset isscrapped.

142. Ifafullydepreciatedplant asset is still usedbya company,the

a.estimatedremainingusefullifemustberevisedtocalculatethecorrectrevised depreciation.

b.assetisremovedfromthebooks.

c.accumulateddepreciationaccountisremovedfromthebooksbuttheassetaccount remains.

d.assetandtheaccumulateddepreciation continue tobereportedonthebalancesheet withoutadjustment untiltheassetisretired.

143. Whichofthefollowingstatementsisnottruewhenafullydepreciatedplantassetis retired?

a.Theplantasset'sbookvalue isequaltoitsestimated salvagevalue. b.Theaccumulateddepreciationaccountisdebited.

c.Theassetaccount iscredited.

d.Theplantasset'soriginalcost equalsitsbookvalue.

144. Ifaplantassetisretiredbeforeitisfullydepreciated,andnosalvageorscrapvalueis received,

a.againondisposalwillberecorded.

b.phantomdepreciationmustbetakenasthoughtheassetwerestillonthe books. c.a losson disposalwill berecorded.

d.nogainorlossondisposal willberecorded.

10-22

145. Thebookvalueof anassetwillequalitsfairmarket valueatthedateofsaleif a.a gainondisposalisrecorded.

b.nogainorlossondisposalisrecorded. c.theplantassetisfully depreciated.

d.a lossondisposal isrecorded.

146. Atruckcosting$110,000wasdestroyedwhenitsenginecaughtfire.Atthedateofthe fire,theaccumulateddepreciationonthetruckwas$50,000.Aninsurancecheckfor $125,000wasreceivedbasedonthereplacementcostofthetruck.Theentrytorecord theinsuranceproceedsandthedispositionof the truckwill include a

a.GainonDisposalof $15,000.

b.creditto theTruckaccountof $60,000.

c.credittotheAccumulatedDepreciationaccountfor$50,000. d.GainonDisposalof $65,000.

147. OnJuly1,2008,MeedKennelssellsequipmentfor$66,000.Theequipmentoriginally cost$180,000,hadanestimated5-yearlifeandanexpectedsalvagevalueof$30,000. Theaccumulateddepreciationaccounthadabalanceof$105,000onJanuary1,2008, using thestraight-linemethod.Thegainorlossondisposalis

a.$9,000gain. b.$6,000loss. c.$9,000loss. d.$6,000gain.

148. A lossondisposalof aplantassetisreportedinthefinancialstatements a.intheOtherRevenuesandGainssection oftheincomestatement.b.intheOtherExpensesandLossessectionof theincomestatement. c.asadirectincreasetothecapitalaccount onthe balancesheet.

d.as adirectdecrease tothecapitalaccount onthe balancesheet.

149. WellsCompany'sdeliverytruck,whichoriginallycost$70,000,wasdestroyedbyfire.At thetimeofthefire,thebalanceoftheAccumulatedDepreciationaccountamountedto $47,500.The companyreceived$40,000reimbursementfromits insurancecompany.The gain orlossasaresultof thefire was

a.$30,000loss. b.$17,500loss. c.$30,000gain. d.$17,500gain.

150. Atruckthatcost$21,000andonwhich$10,000ofaccumulateddepreciationhasbeen recordedwasdisposedoffor $9,000cash.Theentrytorecordthiseventwouldincludeaa.gainof $2,000.

b.lossof $2,000.

c.credittotheTruckaccountfor$11,000.

d.creditto AccumulatedDepreciationfor$10,000.

151. Atruckthatcost$36,000andonwhich$30,000ofaccumulateddepreciationhasbeen recordedwasdisposedoffor $9,000cash.Theentrytorecordthiseventwouldincludeaa.gainof $3,000.

b.lossof $3,000.

c.credittotheTruckaccountfor$6,000.

d.creditto AccumulatedDepreciationfor$30,000.

PlantAssets,NaturalResources,andIntangibleAssets 10-23

152. AceCorporationsoldequipmentfor$12,000.Theequipmenthadanoriginalcostof $36,000andaccumulateddepreciationof $18,000.Asaresultof thesale,

a.netincomewill increase$12,000. b.netincomewillincrease$6,000.c. netincomewilldecrease$6,000.d.netincomewilldecrease$12,000.

153. Jarman’s CourierServicerecorded alossof$3,000whenitsoldavanthatoriginallycost $28,000for $5,000.Accumulateddepreciationonthevanmusthavebeen

a.$26,000. b.$8,000.c.$25,000. d.$20,000.

154. Onabalancesheet,naturalresourcesmaybedescribedmorespecificallyasallofthe followingexcept

a.landimprovements. b.mineraldeposits.

c.oilreserves. d.timberlands.

155. Naturalresourcesare

a.depreciatedusingtheunits-of-activity method.

b.physicallyextractedinoperationsandarereplaceableonlybyanact ofnature. c.reportedattheirmarketvalue.

d.amortizedovera periodnolongerthan40years.

156. Depletionis

a.a decreaseinmarketvalueof naturalresources.

b.the amountof spoilagethatoccurswhennaturalresourcesareextracted. c.theallocationof the costof naturalresources toexpense.

d.themethodusedtorecordunsuccessfulpatents.

157. Toqualifyasnaturalresourcesintheaccountingsense,assetsmustbe a.underground.

b.replaceable.

c.of amineralnature.

d.physicallyextractedinoperations.

158. Themethodmostcommonlyusedtocomputedepletionisthe a.straight-linemethod.

b.double-declining-balancemethod. c.units-of-activitymethod.

d.effectiveinterestmethod.

159. Incomputingdepletion,salvagevalueis a.alwaysimmaterial.

b.ignored.

c.impossibletoestimate.

d.includedinthe calculation.

10-24

160. Ifa miningcompanyextracts1,500,000tonsinaperiodbutonlysells1,200,000 tons, a.totaldepletiononthemineis basedonthe1,200,000tons.

b.depletionexpenseisrecognized onthe1,500,000tonsextracted.

c.depletionexpenseisrecognized onthe1,200,000tonsextractedandsold.

d.aseparateaccumulateddepletionaccountissetuptorecorddepletiononthe 300,000tonsextractedbutnotsold.

161. Acoalcompanyinvests$16millioninamineestimatedtohave20milliontonsofcoaland nosalvagevalue.Itisexpectedthattheminewillbeinoperationfor5years.Inthefirst year,1,000,000 tonsofcoalareextractedandsold.Whatisthedepletionexpenseforthe first year?

a.$800,000 b.$320,000 c.$80,000

d.Cannotbedeterminedfromtheinformationprovided.

162. AccumulatedDepletion

a.isusedbyallcompanieswithnaturalresources. b.hasanormaldebitbalance.

c.isacontra-assetaccount.

d.isnevershown onthebalancesheet.

163. OnJuly4,2008,MontanaMiningCompanypurchasedthemineralrightstoagranite depositfor$800,000.Itisestimatedthattherecoverablegranitewillbe400,000tons. During2008,100,000tonsofgranitewasextractedand60,000tonsweresold.The amount of theDepletionExpenserecognizedfor2008wouldbe

a.$100,000. b.$60,000.c.$120,000. d.$200,000.

164. Depletionexpenseiscomputedbymultiplyingthedepletioncostperunitbythe a.totalestimatedunits.

b.totalactualunits.

c.numberof unitsextracted. d.numberof unitssold.

165. Intangibleassetsaretherightsandprivilegesthatresultfromownershipoflong-lived assets that

a.mustbegeneratedinternally.

b.aredepletablenaturalresources. c.havebeenexchangedatagain. d.donothavephysicalsubstance.

166. Identifytheitembelowwherethetermsarenotrelated. a.Equipment—depreciation

b.Franchise—depreciation c. Copyright—amortization d.Oilwell—depletion

PlantAssets,NaturalResources,andIntangibleAssets 10-25

167. A patentshould

a.be amortizedovera periodof20years.b.notbeamortizedifithas an indefinitelife.

c.beamortizedoveritsusefullifeor20 years,whicheverislonger. d.beamortizedoveritsusefullifeor20 years,whicheveris shorter.

168. Theentrytorecordpatent amortizationusuallyincludes a creditto a.AmortizationExpense.

b.AccumulatedAmortization. c.Accumulated Depreciation. d.Patents.

169. Thecostof successfullydefendingapatentinaninfringementsuitshouldbe a.chargedtoLegalExpenses.

b.deductedfromthebookvalueof thepatent. c.addedtothecostof thepatent.

d.recognizedasalossinthecurrentperiod.

170. Anassetthatcannotbesoldindividuallyinthe marketplaceis a.apatent.

b.goodwill.

c.a copyright.d.a tradename.

171. Goodwillcan berecorded

a.whencustomerskeepreturningbecausetheyaresatisfiedwiththecompany's products.

b.whenthe companyacquires agoodlocationforits business. c.whenthecompanyhas exceptionalmanagement.

d.onlywhenthereisanexchangetransactioninvolvingthepurchaseofanentire business.

172. OnJuly1,2008,MarshCompanypurchasedthecopyrighttoParsonsComputertutorials for$162,000.Itisestimatedthatthecopyrightwillhaveausefullifeof5yearswithan estimatedsalvagevalueof$12,000.TheamountofAmortizationExpenserecognizedfor theyear2008wouldbe

a.$32,400. b.$15,000. c.$30,000. d.$16,200.

173. Allof thefollowingintangibleassetsare amortizedexcept a.copyrights.

b.limited-lifefranchises. c.patents.

d.trademarks.

174. Whichofthefollowingisnot anintangibleassetarisingfromagovernmentgrant? a.Goodwill

b.Patent

c.Trademarkd.Tradename

10-26

175. Theamortizationperiodforapatentcannotexceed a.50years.

b.40years. c.20years. d.10 years.

176. Costallocationof anintangibleassetisreferredto as a.amortization.

b.depletion. c.accretion.

d.capitalization.

177. A patent

a.hasa legallifeof 40years. b.is nonrenewable.

c.canberenewedindefinitely.

d.israrelysubjectto litigationbecauseitis anexclusiveright.

178. Ifacompanyincurslegalcostsinsuccessfullydefendingitspatent,thesecostsare recordedbydebiting

a.LegalExpense.

b.anIntangibleLossaccount. c.thePatentaccount.

d.a revenueexpenditureaccount.

179. Copyrightsaregrantedbythefederalgovernment

a.forthe lifeofthecreatoror70 years, whicheverislonger. b.forthelife ofthe creatorplus70 years.

c.forthelifeofthe creatoror70years,whicheveris shorter. d.andthereforecannotbeamortized.

180. Goodwill

a.isonlyrecordedwhengeneratedinternally. b.canbesubdividedandsoldinparts.

c.canonlybeidentifiedwith thebusinessasawhole.

d.canbedefinedas normalearningsless accumulatedamortization.

181. Inrecordingtheacquisitioncost ofanentirebusiness,

a.goodwillis recordedas theexcessof costoverthefair valueof identifiablenetassets. b.assetsarerecordedattheseller'sbookvalues.

c.goodwill,ifit exists,is never recorded.

d.goodwillisrecordedastheexcessofcostoverthebookvalueofidentifiablenet assets.

182. Researchanddevelopmentcosts

a.areclassifiedasintangibleassets.

b.mustbeexpensed whenincurredundergenerallyacceptedaccountingprinciples. c.shouldbe included in thecostofthepatenttheyrelateto.

d.arecapitalizedandthenamortizedovera periodnotto exceed40 years.

PlantAssets,NaturalResources,andIntangibleAssets 10-27

183. Acomputercompanyhas$2,000,000inresearchanddevelopmentcosts.Before accountingforthesecosts,thenetincomeofthecompanyis$1,600,000.Whatisthe amount of netincomeorlossafter theseR&D costsareaccountedfor?

a.$400,000loss

b.$1,600,000netincome c.$0

d.Cannotbedeterminedfromtheinformationprovided.

184. DentonCompanyincurred$300,000ofresearchanddevelopmentcostsinitslaboratory todevelopa newproduct.Itspent$40,000 in legalfeesfora patentgrantedon January2, 2008.OnJuly31,2008, Dentonpaid $30,000for legalfees inasuccessfuldefenseofthe patent.Whatisthetotalamountthatshouldbedebitedto PatentsthroughJuly31, 2008?a.$300,000

b.$70,000c.$370,000

d.Someotheramount

185. Giventhefollowingaccountbalancesatyearend,computethetotalintangibleassetson thebalancesheet of AnishaEnterprises.

Cash AccountsReceivable TrademarksGoodwill

Research& DevelopmentCosts

a.$11,500,000 b.$7,500,000c.$5,500,000 d.$9,500,000

$1,500,000 4,000,000 1,000,000 4,500,000 2,000,000

186. During2008,SitterCorporationreportednetsalesof$2,000,000,netincomeof $1,200,000,anddepreciationexpenseof$100,000.Sitteralsoreportedbeginningtotal assetsof$1,000,000,endingtotalassetsof$1,500,000,plantassetsof$800,000,and accumulated depreciationof$500,000.Sitter’sassetturnoverratiois

a.2 times.b.1.6times. c.1.3times. d..96times.

187. During2008,TylerCorporationreportednetsalesof$3,000,000andnetincomeof $1,800,000.Tyleralsoreportedbeginningtotalassetsof$1,000,000andendingtotal assets of $1,500,000.Tyler’sassetturnoverratiois

a.3.0times. b.2.4times. c.2.0times. d.1.4times.

188. Naturalresourcesaregenerallyshownonthebalancesheetunder a.Intangibles.

b.Investments.

c.Property,Plant, andEquipment. d.Owner'sEquity.

10-28

189. Whichofthefollowingstatementsconcerningfinancialstatementpresentationisnota truestatement?

a.IntangiblesarereportedseparatelyunderIntangibleAssets.

b.Thebalancesofmajorclassesof assets maybe disclosedinthefootnotes.

c.Thebalancesoftheaccumulateddepreciationofmajorclassesofassetsmaybe disclosed inthefootnotes.

d.Thebalancesofallindividualassets,astheyappearinthesubsidiaryplantledger, shouldbedisclosedinthefootnotes.

190. Intangibleassets

a.shouldbereported undertheheadingProperty,Plant, andEquipment.

b.arenotreportedonthebalancesheet becausetheylackphysicalsubstance. c.shouldbereportedasCurrentAssets onthebalancesheet.

d.shouldbereported asaseparateclassification onthebalancesheet.

191. Acompanyhasthefollowing assets:

BuildingsandEquipment,lessaccumulateddepreciationof$2,000,000 Copyrights

Patents

Timberlands,lessaccumulateddepletionof$2,800,000

Thetotal amountreportedunderProperty,Plant,andEquipmentwouldbe a.$19,360,000.

b.$14,400,000. c.$18,400,000. d.$15,360,000.

$9,600,000 960,000 4,000,000 4,800,000

a192.Acompanydecidestoexchangeitsoldmachineand$77,000cashforanewmachine. Theoldmachinehasabookvalueof$63,000andafairmarketvalueof$70,000onthe date of theexchange.Thecostof thenewmachinewouldberecordedat

a.$140,000. b.$147,000. c.$133,000.

d.cannotbedetermined.

a193.Acompanyexchanges itsoldofficeequipmentand$40,000 fornewofficeequipment.The oldofficeequipmenthasabookvalueof$28,000andafairmarketvalueof$20,000on thedate ofthe exchange.Thecostofthe newoffice equipment wouldberecordedat

a.$68,000. b.$60,000. c.$48,000.

d.cannotbedetermined.

a194.Inanexchangeofplantassetsthathascommercialsubstance,anydifferencebetween the fair marketvalueandthebookvalueof theoldplantassetis

a.recordedasagainorloss.

b.recorded ifagainbutisdeferredifaloss. c.recordedifaloss but isdeferredifa gain. d.deferredifeitheragainor loss.

PlantAssets,NaturalResources,andIntangibleAssets 10-29

a195.Gainsonanexchangeof plantassetsthathascommercialsubstanceare a.deductedfromthecostofthenewassetacquired.

b.deferred.

c.not possible.

d.recognizedimmediately.

a196.Lossesonanexchangeofplantassetsthathascommercialsubstanceare a.notpossible.

b.deferred.

c.recognizedimmediately.

d.deductedfromthecost of thenewassetacquired.

a197.Thecostofanewassetacquiredinanexchangethathascommercialsubstanceisthe cashpaid plusthe

a.bookvalueof theoldasset.

b.fairmarketvalueoftheoldasset. c. bookvalueoftheassetacquired. d.fair marketvalueof thenewasset.

Additional MultipleChoiceQuestions

198. Thecostof landincludesallof thefollowingexcept a.realestatebrokers’commissions.

b.closingcosts.

c.accruedpropertytaxes. d.parkinglots.

199. A termthatisnotsynonymouswith property,plant,and equipmentis a.plantassets.

b.fixedassets.

c.intangibleassets.

d.long-livedtangibleassets.

200. Thefactorthat isnotrelevantincomputingdepreciationis a.replacementvalue.

b.cost.

c.salvagevalue. d.usefullife.

201. Depreciablecostisthe

a.bookvalueofanassetlessitssalvagevalue. b.costofanasset lessitssalvagevalue.

c.cost of anasset lessaccumulateddepreciation. d.bookvalueofanasset.

202. SantayanaCompanypurchasedamachineonJanuary1,2006,for$12,000withan estimatedsalvagevalueof$3,000andanestimatedusefullifeof8years.OnJanuary1, 2008,Santayanadecidesthemachinewilllast12yearsfromthedateofpurchase.The salvagevalueisstillestimatedat$3,000.Usingthestraight-linemethod,thenewannual depreciation will be

10-30

a.$675. b.$750. c.$900. d.$1,000.

203. Ordinaryrepairs are expenditurestomaintaintheoperatingefficiencyof aplantassetand arereferredto as

a.capitalexpenditures.b.expenseexpenditures. c.improvements.

d.revenueexpenditures.

204. Improvementsare

a.revenueexpenditures.

b.debitedtoanappropriateassetaccountwhentheyincreaseusefullife.

c.debitedtoaccumulateddepreciationwhentheydo not increaseusefullife.

d.debitedtoanappropriateassetaccountwhentheydonotincreaseusefullife.

205. Againon sale of aplantassetoccurs whentheproceedsofthesalearegreaterthanthe a.salvagevalueof theassetsold.

b.marketvalueof the assetsold. c.bookvalueoftheassetsold.

d.accumulateddepreciationontheassetsold.

206. Theentrytorecorddepletionexpense

a.decreasesowner'sequityandassets.

b.decreasesnet incomeandincreasesliabilities. c.decreasesassets and liabilities.

d.decreasesassets andincreasesliabilities.

207. Allof thefollowingare intangibleassetsexcept a.copyrights.

b.goodwill. c.patents.

d.researchand developmentcosts.

208. A purchasedpatenthasa legallifeof 20years.Itshouldbe a.expensedintheyearofacquisition.

b.amortizedover20 yearsregardlessof itsusefullife. c.amortizedoverits usefullife iflessthan20years.d.notamortized.

209. Theassetturnover ratioiscomputedbydividing a.netincomebyaveragetotalassets.

b.netsalesbyaveragetotalassets. c.netincomebyendingtotalassets. d.net salesbyendingtotalassets.

PlantAssets,NaturalResources,andIntangibleAssets 10-31

a210.In anexchangeof plantassetsthathascommercialsubstance a.neithergainsnorlossesarerecognizedimmediately.

b.gains,butnotlosses,arerecognizedimmediately. c.losses,butnotgains,arerecognizedimmediately. d.bothgainsand lossesarerecognizedimmediately.

BRIEFEXERCISES

BE211

Indicatewhethereachofthefollowingexpendituresshouldbeclassifiedasland(L),land improvements (LI),buildings(B),equipment(E), ornone ofthese(X).

1.Parkinglots

2.Electricityused byamachine

3.Excavationcosts

4.Interestonbuilding constructionloan

5.Costof trialrunsformachinery

6.Drainagecosts

7.Costto installa machine

8.Fences

9.Unpaid(past)propertytaxesassumed

10.Costoftearingdownabuilding whenlandandabuildingonitare purchased

BE212

SellerCorporationpurchasedlandadjacenttoitsplanttoimproveaccessfortrucksmaking deliveries.Expendituresincurredinpurchasingthelandwereasfollows:purchaseprice, $50,000;broker’sfees,$6,000;titlesearchandotherfees,$5,000;demolitionofanoldbuilding ontheproperty,$5,700;grading,$1,200;diggingfoundationfortheroad,$3,000;layingand pavingdriveway,$25,000;lighting$7,500;signs,$1,500.Listtheitemsandamountsthatshould be includedin theLand account.

BE213

EastmanCompanypurchasedadeliverytruckfor$35,000onJanuary1,2008.Thetruckwas assignedanestimatedusefullifeof5yearsandhasaresidualvalueof$10,000.Compute depreciationexpenseusingthedouble-declining-balancemethodforthe years2008and2009.

BE214

EastmanCompanypurchasedadeliverytruckfor$35,000onJanuary1,2008.Thetruckwas assignedanestimatedusefullifeof100,000milesandhasaresidual valueof$10,000.Thetruck wasdriven18,000miles in2008and22,000milesin2009.Computedepreciationexpenseusing theunits-of-activitymethodfor the years2008and 2009.

BE215

PorikaCompanypurchasedatruckfor$57,000.Thecompanyexpectedthetrucktolastfour yearsor100,000miles,withanestimatedresidualvalueof$6,000attheendofthattime.During thesecond yearthetruckwasdriven27,000 miles.Computethedepreciationforthesecond year undereachof themethods belowand placeyouranswersintheblanksprovided.

Units-of-activity $

Double-declining-balance $

BE216

On January 1,2006,EckerCompanypurchasedacomputersystemfor$20,500. Thesystemhad anestimatedusefullifeof5yearsandnosalvagevalue.AtJanuary1,2008,thecompany revisedtheremainingusefullifetotwoyears.Whatamountofdepreciationwillberecordedfor 2008and2009?

BE217

RobotEnterprisessoldequipmentonJanuary1,2008for$5,000.Theequipmenthadcost $24,000.ThebalanceinAccumulatedDepreciationatJanuary1is$20,000.Whatentrywould Robotmaketorecordthe saleof theequipment?

BE218

OnJanuary1,2008,FreeportEnterprisespurchasednaturalresourcesfor$1,200,000.The companyexpectstheresourcestoproduce12,000,000unitsofproduct.(1)Whatisthedepletion costperunit?(2)Ifthecompanyminedandsold20,000unitsinJanuary,whatisdepletion expense forthemonth?

BE219

OnJanuary2,2008,ElneerCompanypurchasedapatentfor$38,000.Thepatenthasan estimatedusefullifeof25yearsanda20-yearlegallife.Whatentrywouldthecompanymakeat December31, 2008torecordamortizationexpenseonthepatent?

BE220

Usingthefollowingdatafor Rocky,Inc.,computeits assetturnoverratio.

Rocky, Inc.NetIncome2008

TotalAssets12/31/08 TotalAssets12/31/07 NetSales2008

$123,000 2,443,000 1,880,000 2,135,000

$2,135,000

EXERCISES

Ex.221

HuntCompanypurchasedfactoryequipmentwithaninvoicepriceof$80,000.Othercosts incurredwerefreightcosts,$1,100;installationwiringandfoundation,$2,200;materialandlabor costsintestingequipment, $700;oillubricantsandsupplies tobeusedwithequipment, $500;fire insurancepolicycoveringequipment,$1,400.Theequipmentisestimatedtohavea$5,000 salvagevalueat theendofits5-yearusefulservicelife.

Instructions

(a)Computetheacquisitioncostofthe equipment.Clearlyidentifyeachelement ofcost.

(b)Ifthedouble-declining-balancemethodofdepreciationwasused,theconstantpercentage applied toa decliningbookvalue wouldbe .

Ex.222

Foreachentrybelowmake acorrectingentry ifnecessary.Ifthe entry given iscorrect,then state "Noentryrequired."

(a)The$60cost of repairinga printerwaschargedtoComputerEquipment.

(b)The $5,000cost ofa major engineoverhaulwas debitedto RepairExpense. The overhaulis expected to increasetheoperatingefficiencyof the truck.

(c) The$6,000closingcostsassociatedwiththeacquisitionoflandweredebitedtoLegal Expense.

(d)A$500chargefortransportationexpensesonnewequipmentpurchasedwasdebitedto Freight-In.

Ex.223

BenedictCompanywasorganized onJanuary1.Duringthefirstyearofoperations,the following expendituresandreceipts wererecordedinrandom orderinthe account,Land.

Debits

1.Costofrealestatepurchasedasaplantsite(landandbuilding).

2.Accruedrealestatetaxespaidatthetimeofthepurchaseoftherealestate. 3.Costof demolishingbuilding tomakelandsuitablefor constructionofanew

building.

4.Architect'sfeesonbuildingplans.5.Excavationcostsfor newbuilding. 6.Costoffilling andgradingtheland.

7.Insuranceandtaxesduringconstructionof building.

8.Costofrepairstobuilding underconstructioncaused byasmallfire.

9.Interestpaidduringthe year,of which$54,000pertainstotheconstruction period.

10.Fullpaymentto buildingcontractor. 11.Costof parkinglotsanddriveways.

12.Realestatetaxespaidfor thecurrentyearontheland. TotalDebits

Credits 13.Insuranceproceedsforfire damage.

14.Proceedsfrom salvageof demolishedbuilding TotalCredits

$220,000 4,000

15,000 14,000 24,000 5,000 6,000 7,000

64,000 760,000 36,000

4,000$1,159,000

$3,000

3,500$6,500

Instructions

Analyzetheforegoingtransactionsusingthefollowingtabulararrangement. Insertthenumberof each transactionintheItemspaceandinserttheamountsintheappropriatecolumns.

Item Land Building Other Account Title

Ex.224

DuncanCompanypurchaseda machine atacost of$90,000.The machineisexpected to have a $5,000salvagevalueatthe endof its 5-yearusefullife.

Instructions

Computeannualdepreciationforthefirstandsecond yearsusingthe (a)straight-linemethod.

(b)double-declining-balancemethod.

Ex.225

ReynoldsCompanypurchasedanewmachinefor$300,000.Itisestimatedthatthemachinewill havea$30,000salvagevalueattheendofits5-yearusefulservicelife.Thedouble-declining-balance method of depreciationwillbeused.

Instructions

Prepareadepreciationschedulewhich showstheannualdepreciation expense onthemachine for its5-yearlife.

Ex.226

TannerCompanypurchasedequipmentonJanuary1,2007for$70,000.Itisestimatedthatthe equipmentwillhavea$5,000salvagevalueattheendofits5-yearusefullife.Itisalsoestimated that theequipmentwillproduce100,000unitsoverits 5-yearlife.

Instructions

Answerthefollowingindependentquestions.

1.ComputetheamountofdepreciationexpensefortheyearendedDecember31,2007,using thestraight-linemethodofdepreciation.

2.If16,000unitsofproductareproducedin2007and24,000unitsareproducedin2008,what isthebookvalueoftheequipmentatDecember31,2008?Thecompanyusestheunits-of-activitydepreciationmethod.

3.Ifthecompanyusesthedouble-declining-balancemethodofdepreciation,whatisthe balance of theAccumulatedDepreciation—Equipment accountat December31,2009?

Ex.227

AplantassetacquiredonOctober1,2008,atacostof$300,000hasanestimatedusefullifeof 10years.Thesalvagevalueis estimated tobe$30,000 attheendofthe asset'suseful life.

Instructions

Determinethedepreciationexpenseforthefirsttwoyearsusing: (a) thestraight-linemethod.

(b) the double-declining-balancemethod.

50,000miles

60,000miles

70,000miles

Ex.228

Tony’s,apopularpizzahang-out,hasathrivingdeliverybusiness.Tony’shasafleetofthree deliveryautomobiles.Priortomakingtheentryforthisyear'sdepreciationexpense,the subsidiary ledgerforthefleet is asfollows:

Accumulated

Estimated Depr.—Beg. MilesOperated Car Cost SalvageValue Life in Miles of the YearDuringYear

1 $21,000 $3,000 50,000 $2,520 20,000 2 18,000 2,400 60,000 2,340 22,000 3 20,000 2,500 70,000 2,000 19,000

Instructions

(a)Determinethedepreciationratespermileforeachcar.

(b)DeterminetheDepreciationExpenseforeachcarforthecurrent year.

(c)MakeonecompoundjournalentrytorecordtheannualDepreciationExpenseforthefleet.

$21,000– $3,000

Ex.229

TheBarnettClinicpurchasedanewsurgicallaserfor$80,000.Theestimatedsalvagevalueis $5,000.Thelaserhasausefullifeoffiveyearsandtheclinicexpectstouseit10,000hours.It wasused1,600hours inyear1;2,200 hours in year2;2,400 hoursinyear 3;1,800 hours in year 4;2,000hoursin year5.

Instructions

(a)Computetheannualdepreciationforeachofthefiveyearsundereachofthefollowing methods:

(1)straight-line.(2)units-of-activity.

(b)Ifyouweretheadministratoroftheclinic,whichmethodwouldyoudeemasmost appropriate? Justifyyouranswer.

(c)Whichmethodwouldresultinthelowestreportedincomeinthefirstyear?Whichmethod would resultinthelowesttotalreportedincomeoverthefive-yearperiod?

Ex.230

TheDecember31,2007balancesheetofRitterCompanyshowedEquipmentof$64,000and AccumulatedDepreciationof$18,000.OnJanuary1,2008,thecompanydecidedthatthe equipmenthasaremainingusefullifeof 6yearswitha $4,000salvagevalue.

Instructions

Computethe (a)depreciablecost ofthe equipmentand(b) revisedannualdepreciation.

Ex.231

SoutheastAirlinespurchaseda747aircraftonJanuary1,2007,atacostof$35,000,000.The estimateduseful lifeoftheaircraftis20years,withanestimated salvagevalue of$5,000,000.On January1,2010theairlinerevisesthetotalestimatedusefullifeto15yearswitharevised salvagevalueof$3,500,000.

Instructions

(a)ComputethedepreciationandbookvalueatDecember31,2009usingthestraight-line methodandthedouble-declining-balancemethod.

(b)Assumingthestraight-linemethodisused,computethedepreciationexpensefortheyear ended December31, 2010.

Ex.232

SeymorCompanypurchasedamachineonJanuary1,2008,atacostof$80,000.Itisexpected tohaveanestimatedsalvagevalueof$5,000attheendofits5-yearlife.Thecompany capitalizedthemachineanddepreciateditin2008usingthedouble-declining-balancemethodof depreciation.Thecompany hasapolicyofusingthestraight-linemethod todepreciateequipment butthecompanyaccountantneglectedtofollowcompanypolicywhenheusedthedouble-declining-balancemethod.NetincomefortheyearendedDecember31,2008was$55,000as the resultof depreciatingthemachineincorrectly.

Instructions

Usingthemethodofdepreciationwhichthecompanynormallyfollows,preparethecorrecting entry and determinethecorrectednet income.(Showcomputations.)

Ex.233

Equipment wasacquiredonJanuary1,2005,atacostof$80,000.Theequipmentwasoriginally estimatedtohaveasalvagevalueof$5,000andanestimatedlifeof10years.Depreciationhas beenrecordedthroughDecember31,2008,usingthestraight-linemethod.OnJanuary1,2009, theestimatedsalvagevaluewasrevisedto$6,000andtheusefullifewasrevisedtoatotalof8 years.

Instructions

DeterminetheDepreciationExpensefor 2009.

Ex.234

GantnerCompanypurchasedamachineonJanuary1,2008.Inadditiontothepurchaseprice paid,thefollowingadditionalcostswereincurred:(a)salestaxpaidonthepurchaseprice,(b) transportationandinsurancecostswhilethemachinerywasintransitfromtheseller,(c) personneltrainingcosts forinitial operationofthemachinery,(d)annualcityoperatinglicense,(e) majoroverhaultoextendthelifeofthemachinery,(f)lubricationofthemachinerygearingbefore themachinerywasplacedintoservice,(g)lubricationofthemachinerygearingafterthe machinerywasplacedintoservice,and(h)installationcostsnecessarytosecurethemachinery to thebuildingflooring.

Instructions

Indicatewhethertheitems(a)through(h)arecapitalorrevenueexpendituresinthespaces provided: C= Capital,R=Revenue.

(a) (b) (c) (d)

(e) (f) (g) (h)

Ex.235

CareyWordProcessingServiceusesthestraight-linemethodofdepreciation.Thecompany's fiscalyearendisDecember31.Thefollowingtransactionsandeventsoccurredduringthefirst three years.

2007July 1

Nov.3 Dec.31

2008Dec.31

PurchasedacomputerfromtheComputerCenterfor$2,300cashplussales tax of$150,andshippingcosts of$50.

Incurredordinaryrepairsoncomputerof $140.

Recorded2007depreciationonthebasisofafouryearlifeandestimated salvagevalueof$500.

Recorded2008depreciation.

2009Jan. 1 Paid$400foranupgradeofthecomputer.Thisexpenditureisexpectedto increasetheoperatingefficiency andcapacityofthecomputer.

Instructions

Preparethenecessaryentries.(Showcomputations.)

Ex.236

Identifythefollowingexpendituresascapitalexpenditures orrevenueexpenditures. (a)Replacementof wornoutgearsonfactorymachinery.

(b)Constructionof anewwing onanofficebuilding. (c)Paintingtheexteriorof abuilding.

(d)Oilchangeonacompanytruck.

(e)ReplacingaPentiumIIcomputerchipwithaPentiumIVchip,whichincreasesproductive capacity.Noextensionofusefullifeexpected.

(f) Overhaulofa truckmotor.Oneyearextensioninusefullifeis expected. (g)Purchasedawastebasketatacostof $10.

(h)Paintingandletteringofa usedtruck uponacquisitionofthetruck.

Ex.237

OnJanuary1,2006RosenCompanypurchasedandinstalledatelephonesystematacostof $20,000.Theequipmentwasexpectedtolastfiveyearswithasalvagevalueof$3,000.On January1,2007moretelephoneequipmentwaspurchasedtotie-inwiththecurrentsystemfor $10,000.Thenewequipmentisexpectedtohaveausefullifeoffouryears.Throughanerror,the newequipmentwasdebitedtoTelephoneExpense.RosenCompanyusesthestraight-line methodofdepreciation.

Instructions

PrepareascheduleshowingtheeffectsoftheerroronTelephoneExpense,Depreciation Expense,andNetIncomeforeachyearandintotalbeginningin2007throughtheusefullifeof thenewequipment.

TelephoneExpense Overstated

Year (Understated)

Depreciation Expense Overstated

(Understated)

NetIncome Overstated

(Understated)

2007

2008

2009

2010

Ex.238

BermanCompanysoldequipmentonJuly31,2008for$50,000.Theequipmenthadcost $140,000 andhad$80,000ofaccumulateddepreciationasofJanuary1,2008.Depreciationfor thefirst6monthsof2008 was$8,000.

Instructions

Preparethejournalentrytorecordthesaleoftheequipment.

Ex.239

(a)WattsCompanypurchasedequipmentin2001for$90,000andestimateda$6,000salvage valueattheendoftheequipment's10-yearusefullife.AtDecember31,2007,therewas $58,800intheAccumulatedDepreciationaccountforthisequipmentusingthestraight-line methodof depreciation.On March31, 2008,theequipmentwassoldfor$24,000.

PreparetheappropriatejournalentriestoremovetheequipmentfromthebooksofWatts CompanyonMarch31, 2008.

(b)GormanCompanysoldamachine for$15,000. Themachineoriginallycost$35,000in2005 and$8,000wasspentonamajoroverhaulin2008(chargedtoMachineaccount). AccumulatedDepreciationonthemachinetothe date of disposalwas$28,000.

Preparetheappropriatejournalentrytorecordthedispositionofthemachine.

(c)KlingerCompanysoldofficeequipmentthathadabookvalueof$6,000for$8,000.The officeequipmentoriginallycost$20,000anditisestimatedthatitwouldcost$25,000to replace theofficeequipment.

Preparetheappropriatejournalentrytorecordthedispositionofthe officeequipment.

Ex.240

Fleming'sLumberMillsoldtwomachinesin2009.Thefollowinginformationpertainstothetwo machines:

Purchase Useful Salvage Depreciation Sales

MachineCost Date Life Value Method Date Sold Price

#1 $66,000 7/1/05 5yrs. $6,000 Straight-line 7/1/09 $15,000 #2 $40,000 7/1/08 5yrs. $5,000 Double-declining- 12/31/09 $24,000

balance

Instructions

(a)Computethedepreciationoneachmachinetothedateofdisposal.

(b)Preparethejournalentriesin2009torecord2009depreciationandthesaleofeach machine.

Ex.241

Presentedbelowareselectedtransactionsfor MiltonCompanyfor 2008.

Jan. 1 Received$9,000scrapvalueonretirementofmachinerythatwaspurchasedon January1,1998.Themachinecost$90,000onthatdate,andhadausefullifeof10 yearswithno salvagevalue.

April30

Dec.31

Soldamachinefor$28,000thatwaspurchasedonJanuary1,2005.Themachine cost$75,000,andhadausefullifeof 5 years withnosalvagevalue.

DiscardedabusinessautomobilethatwaspurchasedonOctober1,2003.Thecar cost$32,000andwasdepreciatedona5-yearusefullifewithasalvagevalueof $2,000.

Instructions

Journalizeallentriesrequiredasaresultoftheabovetransactions.MiltonCompanyusesthe straight-linemethodof depreciationandhasrecordeddepreciationthroughDecember31,2007.

Ex.242

WatsonCompanysoldthefollowingtwomachinesin 2008:

Cost Purchasedate Usefullife Salvagevalue

Depreciationmethod Datesold

SalesPrice

MachineA

$68,000 7/1/048years $4,000

Straight-line 7/1/08 $30,000

Machine B $80,000 1/1/055years $4,000

Double-declining-balance 8/1/08$16,000

Instructions