#inflation rate

Explore tagged Tumblr posts

Text

Dialogue with Jemini (34) Argentina's chances of recovery

Javier Milei

My question:

Argentine President Milei cited suppressing the inflation rate to a few percent as an achievement in his first year in office. Aiming to reduce the fiscal deficit, he laid off many government officials, which resulted in a sharp increase in unemployment and a corresponding rise in the poverty rate (53%). A year ago, ordinary people could not buy things because of inflation, but now they cannot buy things because they have no money. It's a cat-and-mouse game, but will the day come when Argentina can "Make Argentina great again"?

アルゼンチン大統領:ミレイは就任1年の成果として、インフレ率を数%に抑え込んだという実績を挙げた。財政赤字の縮小を目指し、役人の首を多量に切った効果だが、その分失業者が急増し、貧困率もそれに伴って上昇した(53%)。庶民は1年前にはインフレで物が買えなかったが、���はお金がなくて物を買えない。いたちごっこだが、アルゼンチンが「Make Argentina great again」となる日は来るだろうか?

Huggingface’s answer:

Argentine President Milei announced his achievements one year into his term. He cited the fact that he has kept the inflation rate at a few percent. This can be seen as a result of firing many government officials as part of a policy aimed at reducing the budget deficit. However, this policy has resulted in a sharp increase in unemployment and an increase in the poverty rate.

Under these circumstances, ordinary people are in a situation where, although a year ago they could not buy things because of inflation, now they cannot buy things because they have no money. In other words, they are caught in a vicious cycle of rising prices due to inflation and decreasing income due to unemployment, so to speak.

However, considering that Argentina has set a goal of "Make Argentina great again," this situation is likely to be temporary. Argentina is making efforts to overcome this situation by promoting economic reforms and promoting economic growth.

Impression:

Milei is an economist, but does he understand economics? Before he was elected president, he said he would abolish the central bank and introduce the dollar, but he hasn't actually done so. His reforms seem to be too rough. Well, that shows how bad the Argentine economy is.

Now that he has conquered inflation, let's look forward to his next move.

#Dialogue with Jemini#Argentina#Javier Milei#inflation rate#poverty rate#rei morishita#Make Argentina great again#unemployment

2 notes

·

View notes

Text

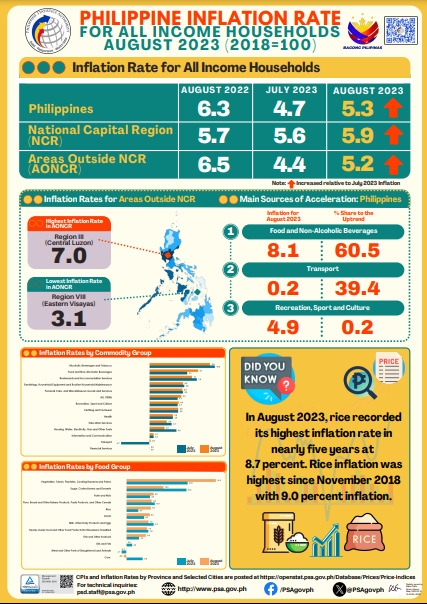

Nabalitaan kong ang daming tumatakbong SK ang nagpapalaganap ng maling impormasyon tungkol sa inflation rate ng Pilipinas. Nakita ko nga pala ito sa opisyal na website ng Philippine Statistics Authority (PSA).

10 notes

·

View notes

Text

भारत की अर्थव्यवस्था 2025-26 में भी चमकेगी: अमेरिकी टैरिफ का असर सीमित, UPI ने बनाया रिकॉर्ड

Indian Economy and American Tarriffs: भारत की आर्थिक स्थिति पर वैश्विक और घरेलू स्तर पर कई अहम खबरें सामने आई हैं। मूडीज की ताजा रिपोर्ट से लेकर यूपीआई के रिकॉर्डतोड़ प्रदर्शन और अमेरिकी टैरिफ नीति के प्रभाव तक, ये घटनाएं भारत की आर्थिक मजबूती को दर्शाती हैं। वहीं, स्विगी को मिला 158 करोड़ का टैक्स नोटिस और स्टील सेक्टर पर सेल चेयरमैन की टिप्पणी भी चर्चा में हैं। आइए, इन सभी पहलुओं को विस्तार से…

#External Debt to GDP Ratio#GDP Growth 2025-26#India economy#Inflation Rate#interest rates#Moody&039;s Report#Steel Industry#Swiggy Tax Notice#UPI Transactions#US tariff policy

0 notes

Text

How Pakistan’s Economic Mess Is Crashing Ramadan Vibes

Hey, picture this: you’re gearing up for a big celebration—think festive lights, late-night feasts, the whole vibe. Now imagine the price of every ingredient you need doubling overnight. That’s Ramadan 2025 in Pakistan, where soaring inflation is turning holy month prep into a financial horror show. Let’s unpack this mess—how it’s hitting families, shopkeepers, and honestly, everyone’s mood—and…

#art#consumer impact#economic crisis#essential goods#financial strain#IMF program#inflation rate#Pakistan#Pakistan economy#photography#Ramadan preparations#rising costs#shopkeeper struggles#soaring inflation#travel

0 notes

Text

JUST IN: Nigeria’s inflation rises to 34.60% — NBS

The National Bureau of Statistics (NBS), while announcing the release of the data on Monday said, “In November 2024, the Headline inflation rate was 34.60 per cent relative to the October 2024 headline inflation rate of 33.88 per cent. Looking at the movement, the November 2024 Headline inflation rate showed an increase of 0.72 percentage points compared to the October 2024 Headline inflation…

0 notes

Text

Australia’s inflation rate decreased to 3.5% for the year ending in July 2024, marking its lowest level since March. This decline comes as energy bills fell by 5%, largely due to the federal government’s energy subsidies.

0 notes

Text

Economics Formulas

Microeconomics Formulas Total Revenue (TR): Calculated as Price (P) multiplied by Quantity (Q). It’s the total income a firm receives from selling its goods or services. Marginal Revenue (MR): The additional revenue gained from selling one more unit. It’s the change in TR divided by the change in Q. Average Revenue (AR): TR divided by Q. It’s the revenue per unit sold, essentially the price of…

View On WordPress

#Average Costs (AC)#Average Fixed Costs (AFC)#Average Revenue (AR)#Average Variable Costs (AVC)#Consumer Price Index(CPI)#Economics Formulas#Inflation Rate#Macroeconomics Formulas#Marginal Costs (MC)#Marginal Revenue (MR)#Microeconomics Formulas#Money Multiplier Metric#Nominal GDP#Profit Earned#Quantity Theory of Money#Real GDP#Real Interest Rate#Total Costs (TC)#Total Revenue (TR)#Unemployment Rate

0 notes

Text

U.S. Economy Grows Faster than Expectations

Good News! U.S. Economy Grows faster than expectations, despite the fear of recession which was always around the corner from the last year. The Economy grew faster than expected. On 29th November, 2023, the Bureau of Economic Analysis (BEA), released the Third Quarter GDP data and the data from the Bureau of Economic Analysis (BEA) reveals a resilient economy driven by increased consumer…

View On WordPress

#Bureau of Economic Analysis#consumer spending#economic growth#Economic Resilience#Federal Reserve#Inflation Rate#Labor Market#Monetary policy#Third Quarter GDP#U.S. Economy

0 notes

Text

0 notes

Text

Another way to frame the fed's debate: Have we punished borrowers enough already, or can we tighten the screws in their fingernails a little more to achieve the inflation rate we want? Useful to remember is that the fed is largely responsible for price increases we have witnessed in the last few years, since the fed controls how much money the government borrows. The difference is, when government borrows money to fund its debt, it does not have to qualify for the loan.

Home buyers do have to qualify. Thirty-year fixed-rate mortgages hit eight percent last month. How many people in your neighborhood would even look at a mortgage priced at that level? How many would qualify? For a $1M dollar home, the monthly payment would be $7,338. That's without taxes.

Observers say, "Yes indeed, home sales are down. Home construction is down. Commercial loans are down." Everything related to the loan business is down, except interest rates and the inflation rate. People point to former Federal Reserve Board Chairman Paul Volker as our banker's model here. You just raise interest rates until you squeeze inflation out of the economy, no matter how much it hurts. You can't be weak about these matters. Do what it takes.

Perhaps Jerome Powell is correct: we need to follow Paul Volker's example from the 1980s, when the inflation rate hit double digits. On the other side, our financial markets, the ways we fund our national debt, and our government's methods to allocate resources do not operate as they did forty years ago. They have evolved a lot.

Powell has a different set of problems to solve. He did not take sustained inflation as a threat when the economy came out of Covid. Moreover, we still hear echoes of Modern Monetary Theory when officials discuss future expenditures and revenues, a theory that gained currency when the government wanted to carry the entire economy on its back during the lockdowns. Yet after all the economy endured during and after 2020, the only inflation control tool on the table is: raise interest rates.

0 notes

Text

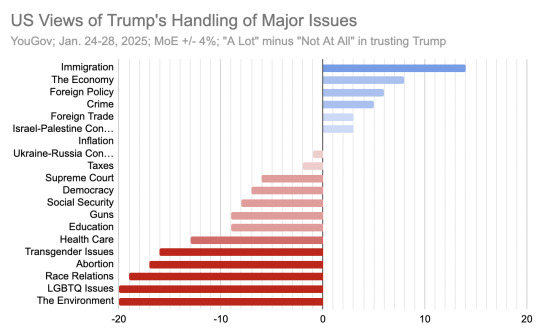

It is interesting that the American people seem to disagree strongly with Donald Trump on most cultural issues (transgender issues, abortion, race relations, and LGBTQ issues) and yet his single strongest issue approval is on immigration. The median voter seems to want xenophobic wokeness

#it's possible for him to score negatively on most issues despite having a net positive overall approval rating...#...because many of the issues that people currently value most are his 'best' issues (economy/immigration/crime/inflation)

3K notes

·

View notes

Text

youtube

As of July 2023 the Ontario Disability Support Program has been tied to the provincial inflation rate. This means that each year the increases provided within the program will match the increased cost of living across the province. Unfortunately it will be abroad measure, rather than specific to each municipality so some areas that face higher rates will still be unmatched but hopefully the Federal Disability Benefit will eventually help make up the difference overall. Check out the video to learn more and share your thoughts in the comments below.

#alifelearned#youtube#vlog#video#chronic disability#disability rights#ontario disability support program#odsp#disability support#aoda#disability#the canadian disability benefit act#federal disability benefit#poverty#odsp tied to inflation#inflation rate#odsp matched inflation#Youtube

1 note

·

View note

Text

Inflation Shows Steady Improvement

Inflation Shows Steady Improvement The impact of The Fed raising the interest rates over the past several months is showing results. The inflation rate for June 2023 came in at 3.0% and is the lowest it has been since March 2021. May 2023 had an inflation rate of 4.0%. The recent high was 9.1%. The ideal inflation rate for this economy is 2.0%. Achieving that rate will hopefully result in lower…

View On WordPress

0 notes

Text

Weekly Overview: Global productivity gains sound the alarm. FOMC minutes due out this week.

In this week's market update, we'll be taking a closer look at the recent performance of the NASDAQ, the impact of inflation and monetary policies in the US and China, and how all of this could shape the future of the equity markets and commodities. We'll also discuss the upcoming US labor data and its significance in assessing the state of the economy.

#US inflation#foundation for investments#global productivity#productivity gains#economic growth#major growth#positive productivity#equity markets#unemployment rate.#Consumer price index#inflation rate#Investment strategies#portfolio management#Productivity trends

0 notes

Text

Germany's Recession: Impact on Consumer Spending and Economic Outlook

Germany, the largest economy in Europe, has fallen into a recession due to the energy price shock of last year, which has had a significant impact on consumer spending. According to official data, the output in the country has decreased by 0.3% in the first three months of 2023, following a 0.5% contraction at the end of 2022. The Federal Statistical Office has revised its earlier forecast of…

View On WordPress

#Consumer Spending#Economic Downturn#economic history#energy price shock#gas supply uncertainty#GDP contraction#Germany recession#Global Crises#high price increases#inflation rate#rebounding economy#Unemployment

0 notes

Text

presented without comment or context

Source

#this stream had it all. feet. toes. piss. sniffing. sonic inflation. naked stream. this. whatever this is.#did i miss anything#i had to watch this over the course of 3 days. 7 hours.#this is not the worst bit. somehow. i think the duke poop rating bit was the worst. overall. in general.#<- do Not ask me for a timestamp or source for that. I never wrote it down. It was an old quake champions stream thats all i know#I AM NOT PUTTING THIS IN THE TAG I CANT DO THAT TO PEOPLE#video

452 notes

·

View notes