#Marginal Revenue (MR)

Explore tagged Tumblr posts

Text

Economics Formulas

Microeconomics Formulas Total Revenue (TR): Calculated as Price (P) multiplied by Quantity (Q). It’s the total income a firm receives from selling its goods or services. Marginal Revenue (MR): The additional revenue gained from selling one more unit. It’s the change in TR divided by the change in Q. Average Revenue (AR): TR divided by Q. It’s the revenue per unit sold, essentially the price of…

View On WordPress

#Average Costs (AC)#Average Fixed Costs (AFC)#Average Revenue (AR)#Average Variable Costs (AVC)#Consumer Price Index(CPI)#Economics Formulas#Inflation Rate#Macroeconomics Formulas#Marginal Costs (MC)#Marginal Revenue (MR)#Microeconomics Formulas#Money Multiplier Metric#Nominal GDP#Profit Earned#Quantity Theory of Money#Real GDP#Real Interest Rate#Total Costs (TC)#Total Revenue (TR)#Unemployment Rate

0 notes

Text

Wants and Needs

Pairing: Sugar Daddy!Joel x Reader

Summary: Bills are high; your dad’s boss wants to help. How you pay him stays between you and him—for now.

Warnings: 18+. Protected piv. Explicit power imbalance in an exchange of sex for money, so dubcon, technically. Soft dom!Joel. Sex toys. Squirting. Oral (f!receiving). Overstimulation. Daddy kink. Age gap. Praise kink.

Note: Bohanan’s is a steakhouse in San Antonio, TX.

Word count: 8.4k

You wanted a car. Joel needed to cum.

It wasn’t the arrangement a girl your age should’ve made, but what could you do? Your dad drank half of your college funds away, and your mom was long gone.

The next best thing was Mr. Miller, your father’s boss. He’d understood better than anyone what money could buy. What it might do. For him, it was pleasure. For you, it was a future—or what little remained after bills and loans and exorbitantly-priced car repairs bled you dry.

You took the job at the firm on a whim. You didn’t want to be a lawyer anymore, though your dad and Joel were. You didn’t want to be done with law school, though 3L had already long since ended, and that dreaded so-called ‘minimum competency’ test was drawing close on the horizon. In short, you couldn’t afford to pay for bar prep.

With Joel, you could.

It was true that tax law paid pretty well, but a part-time job would never really be enough when your family was treading water at all times. Your dad liked to gamble and drink, and your brothers got all of their brains from him.

You got the short end of the stick, plus the receiving end of another. Lucky for you, Joel’s felt pretty good going in.

Today you were somewhere south of Austin. Your truck wouldn’t start last week, so you’d agreed to come along on this business trip knowing full well what you planned on asking your boss as soon as you had a moment alone.

“CDP hearing at…9:45.” You checked the itinerary twice.

“Alright.” Joel nodded.

“Lunch with Javier, Ezra, and Dave at twelve.”

“Mhmm.”

“Phone call with Revenue Officer Acacius at 3:30.”

“For the…?”

“Martells.”

“Okay.”

“I finished Lucien Flores’ Form 433-F for your review and left notes—” You stopped to tap your finger on a short white pile of papers between you and Joel on the desk, “—in the margins. Still need bank statements from him.”

“Lovely.”

Joel eyed the stack at first, but his gaze strayed a little.

“You should probably plan to talk strategy with my dad before Mayor Garcia’s audit tomorrow, too. Looks like a couple non-cash contributions are being disputed now.”

For a second, your eyes flitted up to him, too. It was brief.

“Sure. When’s your daddy free?” he said.

You blinked, then scanned the schedule.

“Looks like five…or six, maybe. He’s got a consult with—”

“I wasn’t talking about your father.”

You looked back up. Joel was smirking, of course. His hand had drifted a comfortable, innocent distance past the papers and across the table, to you. The pair of you happened to be in one of the glass-paneled conference rooms nearest the hotel lobby, so he had to be discreet.

He never let his fingers stray too long on yours in public. Presently, his thumb grazed your knuckles extra slow.

Posing a question, maybe.

You didn’t have the time to be tactful now, unfortunately.

“I need $2,700.”

Joel, your boss, your daddy, whatever, had to pause at that. He didn’t move his hand immediately, but he did stare harder. Longer. He searched your face for the joke.

“$2,700?” he repeated.

“Yes sir,” you answered out of habit, wincing only a little, “My truck stopped running last week, and it’s just…a lot.”

The cost. For Joel, it wasn’t even a drop in the bucket, but in your world, it was a make-or-break, fuck-your-whole-budget-for-the-next-six-months kind of bad. Suddenly, your cheeks felt warmer than they did before, and you forced yourself to look away. Peering out across the wide and gently rolling terrain of San Antonio and trying to pretend there was something thrilling to see. You’d almost forgotten how much you hated asking this.

“I can make the deposit tonight—” Joel started.

“No,” you interrupted. You wanted to turn but couldn’t. You just shook your head and kept staring out there, “Not now, I mean…I need to earn it over time, I just…”

You stumbled over the words. It was like your lips, your tongue, and your teeth were all suffering from the same sort of embarrassment pervading the brain, and you couldn’t bring your mouth to form the sentences right.

I’m not asking for a handout. I need to earn the money.

However ‘earning’ may have been grossly misconstrued in the context, it was a labor all the same. You didn’t love it, but you didn’t hate him, either. Joel was nice, albeit old enough to be your father, and it didn’t seem that he was nearly as predatory or perverse as he could’ve been. You’d been working for him for two months now, and the idea had been your own when the cash had gotten tight.

Back in April, you’d explained to him, calmly, that you couldn’t take the bar exam unless you got some extra money quick. That you wouldn’t accept his charity, but you’d pay him back in other ways. Joel had been against it at first—you were the daughter of his best friend, after all—but eventually, his carnal needs won out over his sense, as every other man would’ve done, you guessed.

At first, you’d started slow, but that hadn’t lasted very long. You fucked him regularly now, though never had you asked for an amount of cash this big out of nowhere.

Joel blinked and put a hand on his hip, like he always did when he wasn’t sure what to say. The silver in his soft, dark locks shone more in this light. He’d lost the smirk.

“You’ve done…plenty.” Now sounding sheepish.

You tried to protest again; Joel stopped you.

“I mean it. Hey, look at me,” he said next.

You did, hesitatingly. You turned from the window, and out of instinct, folded your arms over your chest. Joel paced closer to you and then he was watching. Pausing.

Brushing your arm with his and glancing once over your shoulder to make sure no one else was around to see.

He leaned in and pressed a quick kiss to your temple.

When he pulled away, your skin was practically ablaze.

“Mr. Miller—”

“Joel,” he corrected, quiet, “And you’ve done enough. Let me cover the car just this once, okay? Sweetheart?”

You didn’t realize you were pivoting again. That your gut was doing somersaults and your heart was ready to climb up and out of your throat. Your neck was burning.

It wasn’t even anger you sensed was simmering under the skin until you turned back to him, and your eyes flashed with ire before the words were even spoken.

“I don’t need your pity, Mr. Miller. I said I want to pay.”

“It’s Joel. And I said you’ve done enough, so—”

Ire morphed to something more in a blink.

You didn’t mean to say it, but you did.

“Fine,” you huffed, suddenly exasperated, “If you’re so fucking opposed to me paying my way for this one simple thing, I’ll get another guy. Forget I asked.”

It was a low blow, for sure. Joel knew how badly you’d wanted this to stay between just you and him—and he would never dream of seeing you ‘earning your keep’ with anyone else. His expression said as much as soon as he’d heard your words; his whole face hardened at once.

But then you’d turned to leave. You didn’t care what he wanted to tell you, and if you did, you certainly weren’t brave enough to stick around to hear Joel say it then.

So you left. He had a full, busy day ahead of him anyway.

You woke up wet.

In an effort to avoid your boss, you’d run errands all day. Buried your nose in a sea of Civil Procedure notes as soon as you got a second alone, almost vomited seeing the Erie Doctrine, and went back to your hotel room to try and study there. Once you had, you napped instead.

Now your clothes stuck to your skin; the sheets around you were soaked. You peered over the big white duvet holding your body interred and saw smoke overhead.

Or steam.

Yes, definitely steam. It was drifting from the bathroom, where the door was thrown open. You shifted up to sit.

“Tess!” you yelled, “Shut the goddamn door, I’m boiling.”

As a law clerk, you weren’t afforded the luxury of a suite to yourself, so you shared it with the other new grads on work trips like these. Tess Servopoulos loved long, hot showers and never closed the fucking door. You groaned.

And, feeling depleted of all energy from your studies and the stress and the steam searing every inch of your skin, you flopped back in the bed. You kicked the covers off your legs. You’d just lifted a hand to wipe the sweat from your forehead, when an awful, fresh realization dawned.

You glanced at the clock—3:37.

“Fucking hell,” you hissed.

You were supposed to meet your dad at two to get some paperwork signed. You needed to have that filed with the court by four. He was probably engaged somewhere else by now, whether it be a client, a conference, or a couple white lines in the bathroom of a partners-only club downtown, and you wouldn’t have a hope of reaching him here. You rubbed your face and groaned again.

You’d set an alarm for 1:30—you knew you had.

Where the hell was your phone? Why was it so warm? What if he’d called? Aw fuck, he’s probably blown that thing up to hell and back by now. Maybe he was drunk. He had to be. Where was Tess? Where were your pants?

You’d made it up to your feet, clumsily, and faced a full-length mirror. Your bottoms were gone. You closed your eyes and screamed inside, remembering why they were.

“Glad you’re getting some use out of this.”

The second you heard it, your lids flew open. You turned.

And, standing in the warm yellow glow of the bathroom light—holding the culprit, your vibrator, like a prize—was Joel. Naked as the day he was born, save for one thin towel around his hips, and grinning. Moisture glistened on his chest and pooled about his feet, and his hair was smooth, tamed, and combed back neatly from his face.

He waved your silicone toy in the air, and immediately, you regretted giving him your room key the other day.

“I thought we agreed you’d wait for me—”

“What the hell are you doing here?”

Your voice was thick with sleep. Joel’s own was slow, dulcet, and kind as it always was, even when teasing. When you grit your teeth, he just set the toy aside.

“I’m sorry. Bad timing. I saw your—”

“No.” You threw up both hands at once, suddenly out of breath and fucks to give, “You know what? I don’t care. You need to go. I have to be down at the courthouse—”

In twenty minutes. You cut yourself short and hurried off to find shoes. You could wear other pants. Ask another attorney to sign the forms if you couldn’t reach your dad. Forget that his boss and yours had just caught you with the vibrator he’d bought you last month and try not to feel too humiliated knowing he knew what you’d been doing. It didn’t matter—Joel didn’t matter. You slid on a mismatched pair of slacks and set off toward the door.

Then you had to stop. Joel beat you there, quick as ever.

“Listen. Hey.”

“Will you stop?!”

You pushed at his big and wet, stupidly broad chest. You felt the small grey hairs on his pecs tickle your palms, and for a second, you thought you heard a chuckle.

“You’re gonna make me late—”

“Hey, hey,” Joel said again. Of course it sounded fatherly, “I already signed the POA for Morales, hon, you’re good.”

You’re good.

“You what?” You stared at him in disbelief. How did he even know you needed Frankie’s power of attorney signed in the first place? You figured your dad would’ve mentioned it, but still, it wasn’t really Joel’s form to sign.

“The case is mine now,” he clarified, reading that look, “Wasn’t my first pick, but it is what it is. And your dad—”

Your dad was probably lagging wildly behind on his own caseload, so he’d pushed one off on his friend. Again.

“You can’t keep picking up his slack,” you gritted out, “One of these days it’s gonna bite you both in the ass. You know he shouldn’t be forcing these jobs on you.”

“I offered.”

“You caved.”

“He’s my best friend, what do you expect me to do?”

“Not let him use you! He’s making you feel bad for him.”

“And what if I did? What if I did pity the bastard?”

You scoffed. Then winced, inwardly.

I don’t need your pity, Mr. Miller.

From the look on Joel’s face, he seemed to be remembering the same. He shook his head.

“That’s not…” he trailed off. He rubbed his jaw with his hand and started to move from the door, deflating some.

His other arm extended to you, wordlessly, and already anticipated what was sure to follow. You swatted him off, then walked to the bed. You considered sitting but didn’t. Instead, you crossed your arms like you always did and turned away, facing the window with a cool, flat affect.

By now, Joel knew better than to take that for what it seemed. He crossed the room to you, treading softly.

His voice turned gentle again, like an apology: “Honey…”

But your gaze was already fixed outside. You frowned.

“Darlin’,” Joel continued, undeterred, “Come on.”

And you didn’t need to see his face to hear the rest: ‘Look at me, please,’ with eyes all comfort and warmth.

“Don’t you have a phone call with an R.O. or something?” Briefly, you recalled Acacius and a stream of other items from the checklist you’d covered that morning, and you had to stop yourself then from straying too far. You blinked once, just as Joel was approaching from behind.

“I cancelled,” he said.

You sighed, “Mr. Miller…”

You knew he hated doing that.

“Joel,” he pressed. Adding, “Something came up.”

You wouldn’t even ask. You shouldn’t care. You felt him standing there, fanning hot breaths across the nape of your neck, and you really couldn’t have taken that worse. You visibly tensed, hands balling into fists at your sides, and—hell, he wouldn’t quit moving now, would he?—Joel bent down. He hesitated, as if gauging your reaction in time, then descended further. He kissed your shoulder.

You cracked; it never took much from him.

For all your inane, ancillary plays at feigning indifference, one movement of Joel’s mouth and your resolve was lost. You clung to words, weakly, but all the rest fell away.

“We don’t…want your charity. Me or my dad. Alright?”

“I know.”

Joel kissed your skin again, then pulled at the strap of your blouse. It fell limply away, and his lips reattached.

Exactly when he’d walked you back to the bed, you couldn’t be sure. By the third or fourth kiss, your stomach was tight, knees weak, and your eyes drawing closed; it didn’t matter to you or to him what had passed before. Your bodies found the bed and blended together.

Tangling, in a way. Tearing blindly at clothes and not saying too much apart from Joel’s soft, sweet words:

“That’s it.”

“I know.”

“Good girl.”

Good girl when he kissed you. Good girl when he stripped you bare. Good girl when his hands roamed the broad, naked expanse of your body and let your own do the same to him. Good girl when your fingers hooked the outline of the towel and tugged it away, your vision filled with a sight you’d come to like more and more each day.

“That’s my girl,” Joel murmured. He cradled your head while you gripped his base, “‘S’yours, baby. All yours.”

Yours. Mine. You weren’t sure you had the sense or self-possession to even know what that meant, especially here. Joel wasn’t a boyfriend. He wasn’t a lover, at least not in the traditional sense. He wore dark wool suits like your father and worked from dawn until dusk every day, practicing law for longer than you’d been alive. Still, the smile above you was sweet. It coaxed you gently as you slid your hand up and down his length, like he sensed this was more like a lesson for you. Learning experience.

“Remember, spit a little first,” he instructed. Then, to demonstrate this point, he brought his fingers to his mouth and wet them quickly. He slipped his touch down to yours and met your gaze while he joined you there.

He rubbed and slicked himself up and he did it with ease. You followed his lead and watched his face contort—crow’s feet pinching even tighter at the sides of his eyes as pleasure began to pool in his gut. He looked pretty. You’d never thought to tell him this, but Joel really had an unparalleled face. It was an old and beautiful thing. For this reason, you couldn’t bring yourself to tear your gaze away, maybe to wet your own fingers. Instead, you slipped your hand between your legs, where his hips had come to rest. You worked a slow, light touch against your folds; you were drenched, and it didn’t take long for your fingers to be, too. You moved them back to Joel’s cock.

“Like this?” you ventured.

The man answered with a grunt, at first. Then a grin.

“Yeah. Yeah,” Joel nodded, quiet but emphatic. Trying not to smile too big as he let your touch take over for his, “Just like that, sweet pea. Get it nice an’ wet for daddy.”

You wanted to whimper at that. Something must’ve flashed in your eyes at the intonation of the last word, and the look must’ve suffused your whole expression, because the next thing you knew, Joel was lowering his body to yours. Petting your hair, letting you rub on his shaft as fast as your soft, lithe hands could manage.

“Feel that, baby? Feel how much daddy missed you?”

You did.

Your brow pinched, and you wanted more of that. More from him: those tender, edifying words of praise being mumbled your way while your touch worked him over. Maybe you could’ve helped it, but then again, in this state, maybe you couldn’t—you whimpered for him.

Wriggling your hips against the bed to get your warmth pressed flush with his own, and squeezing him tighter:

“In me, daddy. Please.”

You angled his cock in your trembling grip to plead as much. You knew he liked being the one to push in the first time, so you didn’t move too far with that push, but you begged him with your gaze. You felt him tense a bit.

And just when you sensed he might let you have your way, he moved off. Down. Sliding his torso away from your own, to go lower on the bed, and smirking again.

“I think she needs my tongue first, doesn’t she?”

You wanted to nod. Instead, you flinched. You crawled away from his hold before it could secure itself firmly on either one of your legs, and you had to snag your bottom lip between your teeth to contain that blossoming need. It almost spilled from your mouth in a moan before Joel’s could reach your lower half. Then you scrambled to sit up

“No,” you choked out.

This wasn’t new. While you shook your head, Joel lifted a brow and stood from the bed. He reached behind him.

The night stand.

You closed your eyes.

“This isn’t…supposed to be for me.” you sighed.

In a second, Joel was back where he started, and you didn’t have to steal a glance through your lids to know what he was holding. Slotting himself gently into place.

“Don’t,” he started, sharp, “—say that. I mean it.”

You knew he meant it, but you also knew better than to accept at face value what he said, moving down on you.

This wasn’t part of the deal. Joel’s money was meant to serve his pleasure, not yours. Letting him take you any other way seemed to blur the lines between transaction and affection, and though you’d done this before, it still didn’t feel right. You couldn’t bear having his focus here.

Evidently, though, he could. He’d snatched your vibrator from the night table and lowered his torso to your legs, lips twitching the tiniest bit. ‘Open up. Let me see her.’

Joel was on his stomach, eyes glowing with intrigue.

“Let me see how much she’s missed me, baby.”

The grey matter in your brain might’ve trickled through your ears—the whole thing went to mush at his words. You pushed at his hands, then the top of his head, but clearly, your will was weak. You wanted this. Needed it.

“That’s a good girl. Let daddy have it,” Joel drawled.

You wanted to cry. Or maybe hide. His index and middle fingers prodded at your folds, pulling them apart, and for a moment, you could’ve sworn you’d stopped breathing. Joel kissed the slope of your mound with a quiet kind of reverence. The salt-and-pepper stubble on his chin brushed your clit, and your back arched reflexively. Then, remembering why you’d come to this arrangement in the first place, you felt a wave of guilt supplant that pleasure.

You clawed at his head and shook your own, weakly.

“No. W-wanna make you feel good,” you choked out.

Not me.

Not here.

Just let it—

“Fuck,” you keened through your teeth. Joel’s lips made contact with your slick, drooling cunt and, in a second, sucked your nub in between them. He flicked his tongue.

Joel groaned, then pulled away to meet your gaze.

“Feels plenty good f’me,” he assured you in a murmur. Eyes glossy, “She’s so fuckin’ sweet, honey. So pretty.”

Then, as if to punctuate his point, he slid his tongue down the whole wet mess of your slit, and he moaned. He curled the muscle and invaded your sticky, sensitive, precious warm flesh with vigor and force—maybe a little desperation—and you whined at the feeling. Your toes curled tight. It was doubtlessly a sight to see: Joel’s old and weathered head against your young and supple skin, the wiry greys of his chin rubbing your cunt like no man’s his age should’ve been. He took you gently. Forked his fingers over your folds to hold you open for him and then, over and over and over again, just licking stripes. Squelching noises only seemed to goad him on while he buried his nose and savored your taste without reserve. Your stomach clenched with that pleasure, then swelled.

“That’s my girl—so good for me,” Joel said, as though reminding you, gently, it was okay to relish the feeling.

Once more, he suckled your clit in his mouth, rubbing the tip of his tongue in a quick back-and-forth motion, and the next sensation hit without a breath of warning.

Your belly twisted again, then flushed with hot pleasure.

“My— fuck,” you cried, shuddering with a climax you didn’t know was coming. You held his head and whined.

Joel’s tongue didn’t stop. Your vision blurred. Whatever reprieve you might’ve hoped to find came in the form of his lips drawing back, momentarily, only to sponge little kisses on your still-pulsing heat. Your body jolted back.

“I c— I’m done. I’m done,” you blurted out.

Joel nodded against you. Humming through his kisses:

“I know. Keep going.”

Keep going.

So simple.

Still, you couldn’t breathe. Your sight was inundated with stars. You felt Joel’s stubble on your slit again, only this time, the pleasure was tripled. Your legs trembled, and your hands made fists in his hair. Joel kept on kissing.

And kissed again, again, and again, until your fingers in his locks pulled taut to the roots and your hips were bucking up in his face: ‘Too much, t—oh fuckfuckfuck.’

Then came a buzz. Skirting your legs in a blink, before diving to meet Joel’s mouth on your clit. You shrieked.

“I know, I know,” Joel joined, as though soothing a wound while he maneuvered the vibrator. Lifting his head and then kissing your thigh, “I know. You’re alright.”

You wanted to sob; you felt ready to burst. You trusted Joel’s judgment but had never been subjected to this sort of pleasure. What if it was more than you could take?

“I’m here.”

Joel’s words were slow to crawl off his tongue, but their intent was clear. You writhed once more, and he was kissing your skin, rubbing your thighs, and taking the toy to your clit with a warm, devoted touch. He wasn’t cruel.

He had a glint in his gaze when you met it, like he knew you wouldn’t accept this feeling alone—but he wanted you to. He wanted the indulgence to be your own and an end in itself. There was care in his touch, tender praise with every caress, and you guessed this was intentional. Joel needed you to know this was more than only his.

You felt more naked than you’d ever been: soaking the sheets with your last release, fresh arousal trickling out, Joel’s spit mixing with your nectar and sweat and pressing you down in the bed. And nudging you, gently.

“‘S’okay, baby. You’re alright. That feels nice, doesn’t i—”

“Kiss me.”

It came out faster than you could even try and stop it. You weren’t sure why you said it. The words were acerbic on your tongue—you hated ever sounding needy—but then your mind and your mouth and your worries were all silenced at once when Joel came clambering up for you.

His lips were wet and grinning as he kissed you. He held the vibrator hostage between your legs while his body pressed tight against yours. His movements slowed.

Then, as if he’d crawled in your head and read your mind:

“It’s okay to need me, baby. It’s okay to want this.”

His hips made that assurance even clearer. Joel reached down and took the vibrator again, increasing the friction between your groin and his while he pressed the buzzing toy to your clit. You whined into his mouth at the feeling.

Your eyes rolled back, and the pleasure soared. This morning, you might’ve bristled at the words he’d just spoken, but here, in this bed, it felt okay. It felt safe.

Joel felt safe, for once, and you weren’t sure how to keep that idea from sticking—how to reconcile the notion of swapping sex for cash with a man for months on end, and then this. Your stomach churned. He held your face and kissed you more, and your clit throbbed and ached. Before you could ponder your thoughts a second longer, a white-hot pleasure washed over, and you came again.

“Good girl,” Joel cooed.

Throbbing even more this time.

“That’s a sweet girl. That’s my baby.”

All but aching with desire. Feeling it double.

“Cum for daddy, that’s it. Keep going.”

Feeling it trickle down your legs.

“She’s feelin’ real good, huh?”

You could barely breathe.

You whined. Felt something splinter between your thighs and then more of it, more of you and that slick, oozing pleasure and Joel’s groans, overjoyed—‘Making a fucking mess’a daddy, isn’t she? She feel that good?’—and by ‘that good’ you guessed it was more than normal.

This was more warmth than usual. Somewhere in the midst of your own mind-numbing pleasure, you’d let out a spurt, sticky and wet. It now coated the hairs on Joel’s tummy, and while his skin shone, his eyes were brighter. He flitted a look to you, gaze flaring, and slid down. Low.

Back to where he was before. Moving the buzzing pink bullet aside and letting his mouth assume its place.

Of course, you yelped.

“Joel!”

You winced, both from saying his name and feeling so raw. Joel grinned at the sound and suckled your clit.

It was drenched. You and Joel, too, were doused all over and practically gleaming under the rays of late afternoon sun then pouring through the window. For a second, you cast a look outside like you had before, but it was only to brace your body for the bliss at hand. You stared and felt a crude, carnal shockwave seize you head to toe. It traveled fast and made you release, again, or else just continue the same flow as before—and this time, into Joel’s waiting mouth. He lapped at you feverishly now.

He squeezed your legs and licked you dry. He worked in merciless circles, like his life might have depended on making you stay at this peak. All the while, you were tearing at his hair. Riding his face as your body fell apart.

That was alright. This pleasure was yours for now, but there was still time yet to make it worth his while, you reasoned in a half-intoxicated state. Your legs vibrated as you started to crawl—limp—back up in the bed and, numb with elation and a desperate need to please, you stretched your arm toward the night stand. You huffed.

You reached blindly but got it. The box. Weak fingers found the first plastic strip and tore yourself a square. Then, lifting it to Joel, you ignored the last stabs of pleasure between your legs. This was fun, but still his.

“Go on,” you told him, breathless, “Fuck me.”

Joel quirked a brow. He took the condom, still panting himself. He brought the latex to his tip out of habit, then:

“Yeah? Are you sure?”

“Uh-huh.”

Your head was swimming. Somewhere entrenched in the furthest recesses of your brain you could feel it, that dizzying, self-centered pleasure. You pushed it back.

You suffocated it, and you spread your legs wide for him. You let him lay you down and tug the rubber over his cock, then nudge at your hips to situate himself in just the right way. How he liked it. He seemed to be content, and your heart swelled. In this airy, buoyant state, you felt more at ease to speak, sure that he’d understand.

“This should cover some of it, right?” you panted out.

Joel slowed.

“What?”

You sucked your bottom lip between your teeth, eager to keep going. But you steeled yourself, just barely, then.

“Sex. Now,” you said, “It’ll cover some of my car repairs.”

Instead of nodding like you’d expected, Joel only blinked. Then you opened your mouth to speak again, and his body stopped you cold. He planted a hand beside your head on the pillow and raised his hips; you felt his heat leave with it. You reached for his backside immediately, to try and pull him back into that pre-missionary position he’d held, when Joel brushed you off. His face was hard.

“Money?” he quipped.

“Yeah,” you started, then remembered how you talked outside of the bedroom, when he seemed more serious, “We’ll go again. All week. You can even put it in my—”

Joel balked, like you’d just slapped him across the face.

“No,” he said, sharp.

“No,” he repeated, more to himself this second time. Almost as though he couldn’t believe what you were suggesting—and making him guilty by association.

Joel clenched your pillow like a vice and shook his head.

“You’re not getting paid for this,” he finished, and when your gaze penetrated his, confused, he squeezed harder.

“Thought you wanted it.” Joel added, almost shamefully.

“I do! I do…I just—” you sputtered.

“What? Think you need to offer up a week and a half of fucking to make it worth my time? Is that what this is?”

Well, in a way, maybe.

You weren’t sure what to say. Former dizzying bliss was dwindling fast, and now you were facing him cold. Sober.

Increasingly irritated, again.

“I just need money, Mr. Miller—”

“It’s Joel, hon,” he bit back, for the fourth time that day. His eyes flared with something more, maybe annoyance, but then he was tempering it just as fast. He ran a hand through his damp grey hair and shook his head, pausing, “It’s Joel. I know you need the money, baby, but it’s—”

“It’s what we agreed,” you protested, “What I need—”

“Well it’s not what I want!” Joel barked.

Anger surged again, and this time, evidently, the feeling was harder to keep at bay. He was scarcely able to rein in his features, settling on a grave little scowl instead of a frown, and he sucked in shorter, shallower breaths through his nose. You felt him let your pillow go.

“Forget it—the cash.” Joel grit his teeth even tighter, “Forget these payments and the goddamn allowance I’ve had you on. I can’t do that anymore. It’s not right.”

Your heart sank.

You didn’t know what to say.

Luckily, Joel’s voice resumed on its own.

“Whatever you want, whatever you need, sweetheart…”

He stopped. Silence followed, then stretched on for one full, terrible minute. In that interim, you could see his chest rise and fall fast. He was trying to slow it down.

“Whatever you need paid off, I’ll do it. Anything. You don’t have to touch me again. It was wrong of me to allow that in the first place,” he rejoined, tone cooling.

Sounding guilty, too.

Above you, Joel didn’t seem keen on holding your gaze, so he fixed his stare someplace on the headboard instead. Then he moved off your body, slowly.

In spite of the distance he attempted to give, he was still crowding your space. Looming large and bare and weary as you’d ever seen him, knees shuffling back awkwardly through a mass of cotton sheets while his eyes shifted low. Away. The rest of him filled your lungs with a heady cologne scent and your stomach with a thousand tiny blades—you were hurt that he wasn’t sticking to his end of the bargain. You were mad that he was trying to claim the moral high ground now, after everything you’d done.

Mostly, though, you were just upset that you felt like you were losing someone close. That Joel Miller was more of a confidant, friend, and father figure than your own dad had ever been, and that got all fucked up over money. Your lips pursed, and something stung behind your eyes when you reached for him again. Your throat stung, too.

“The reason I agreed to do this,” Joel went on, and the ache in your head worsened when he winced from your touch, “was ‘cause I didn’t want you getting ‘help’ from anyone else. I was selfish. And that’s not an excuse…”

He started to move off, hand dropping from yours.

“…but it’s the truth. I’m sorry.”

At length, Joel found your gaze, and the eyes said it all over again: I’m sorry. You might’ve believed them, too.

But you were you, and you couldn’t help but press:

“Why?”

Your voice was small. Joel was trying to stand from the bed, but you grabbed at his hand again and made him meet your eyes. Confusion was painted across his own.

Kneeling in front of him, curious, you tried to clarify.

“Why’d it have to be you?”

Judging from Joel’s expression as soon as you did, you got the sense that this question made him feel dumb. He frowned, but he held your stare and answered anyway.

“Because I wanted you first,” he replied, “Before all this.”

Your stomach twisted. He did?

You didn’t need to ask twice to know what that meant. What he’d said, in words and with a look, was enough. Still, it was always in you to know more, to be sure, so you crept a little closer. You let your hands roam up and—

“No,” Joel said, as soon as your fingers reached his side.

You’d just wanted to feel him, maybe prod him further on what he’d just said through acts that didn’t require verbal articulation, but he refused. He backed up in bed.

“This isn’t about—” he started, low.

“Sex. I know,” you answered for him. Then your touch grazed his thigh, and you were dying to have more. To be told in a way you both knew and understood. To touch, “You want me to believe you really…liked me before?”

“More than you know.”

There was that blunt, open pragmatism in the Joel you’d always known. Perhaps guided by natural inclinations, or else your hand on his leg, drawing higher. Moving closer.

Showing skepticism through your eyes and the hint of a playful, disbelieving smile starting to curl at your lips.

“When you met me?” you teased.

You’d known of Joel for years, and had met him a couple times as a teenager at various firm holiday functions. You probably hadn’t exchanged more than ten words altogether before starting law school a few years back.

“Hell no,” Joel answered, fast, “When you started work.”

His gaze was timid again. It was fixed on his thigh where you’d started to slide your index up the warm, muscled expanse of his skin, and though you could tell he was more than hesitant, you wanted to know. Wanted to feel.

It wasn’t so easy convincing a man you’d been working for—and fucking, largely without feeling—to pay bills that you wanted him here and now. But you needed to try.

That maybe, somewhere along the way, you’d come to want him, too. That cash wasn’t the only thing at stake.

You crawled between his legs, then straddled his hips.

Your lips smiling still as you did: “How much?”

Joel blinked back. Dazed.

“What do you m—”

“How much did you like me? When did it start?”

Joel sighed when your heat rubbed his. He tried grabbing ahold of your hips, when you glanced down and saw he’d already discarded the last condom. You couldn’t have that if you wanted to continue this talk.

You reached back and grabbed another.

“Darlin’,” Joel said, strained, “We shouldn’t…”

“Says who?”

You’d already worked the rubber halfway down his length when his heavy-lidded gaze locked with yours. You saw lust there, mixed with worry. Curiosity. You kept going.

“Says your dad, if he ever finds out what I’ve done to his little girl,” Joel replied, closing his eyes at the feeling.

You had the latex worked down to the base of him when you smiled. Felt him seize your hips, lids fluttering open to find you in their soft, glossy stare, and you felt better. Like clockwork, you went together and joined, at last. You felt Joel squeeze your backside and groan when you first sank down to take him whole. You shuddered, too.

But you tried to steady your voice as you spoke.

“Semantics, Miller,” you told him, only faltering a little, “Things you are ‘doing’ to his little girl. Not just ‘done.’”

There, you had a point. Surely your father would have had some choice words for his business partner and best friend if he knew how far Joel’s cock was currently stuffed inside your tight, wet cunt. It might even piss him off, if he weren’t too drunk to receive the news himself.

Joel blinked hard, signaling that he knew this too, and presently watched your body swallow all eight inches at once, after you’d raised yourself up to just the tip and sank back. Your ass fell to his groin with an obscene sort of squelch, and your walls involuntarily clenched. You both let out sounds of pleasure, and held on tighter.

Your hands on his chest for stability, while one of his own held your hip and the other fumbled around for your clit, gliding through the sheen of your arousal on his front. You rocked your hips and felt how much it really was—how you’d drenched his whole abdomen with your last release. You smiled at this and stared, pleased with the pretty, sticky display you’d laid bare all over Joel’s belly.

When Joel wasn’t watching you ride, he stared there too.

“Not so ‘little’ anymore,” he mused quietly. Then he looked up to find your eyes, seeing them as glazed as his, “And I ‘like’ you, hon. Present tense. Not just…‘liked.’”

Alright.

“How much?”

You wanted to say it with some confidence. Nonchalance. Then Joel’s cock nicked a particularly sensitive ridge inside your walls, and that thought was gone as quick as it had come. You gripped the flesh of his upper chest and rolled your hips harder. Let out your breaths in little fractured whimpers while you rode him more. Another sweet feeling twisted low in your gut.

With just a glimpse of that, Joel moved his hand from your heat up past your hips and waist, to squeeze one of your breasts. His fingers were wet. You could feel them, equal parts warmth and wanton yearning as the pads pinched your nipple and gave it a firm tug. He grunted.

Clearly, there was more to it than just the touching and feeling for him—Joel’s eyes drank in the sight of your skin as it glistened with the arousal he’d just smeared. He thumbed at the wet, stiff peak and swallowed. And, just as you were about to adjust the rhythm of your hips bouncing on him, his free hand joined the first and pulled you down. You cried feeling his cock wedge deep; your hands fell to either side of his body when he yanked your face down to his. He fucked up into you from underneath

You squealed, soft, “Joel!”

He kissed your open mouth. Made you lay flat overtop him while he fucked your dripping hole. You whimpered.

“Joel—” Again.

“I like you so much, sweetheart,” he said, in answer to your last question, lips close, “Does she like me too?”

As if to save him the trouble of a swift reply in words, your body told him instead. You squeezed around his cock, and with another desperate cry, bit his shoulder. He hammered your poor, aching pussy with a groan of his own, and he held your body down to his. Grinning.

Kissing the side of your head while he pounded away. Stroking your hair, “Is that a ‘yes’? She like her daddy?”

Drool was bound to slip out of your mouth any second. Your lips were locked in a permanent ‘o’ while he drilled from under you on the bed. Still, you managed to nod.

“Uh-huh—oh, fuck, fuck, da-ddy. Yes, daddy.”

You squeezed your eyes shut as another blistering wave seared your insides. Joel was relentless with his thrusts now, driving himself in and out without stopping or slowing. He must’ve known you were close. He was too, judging by the sounds of his grunts and hushed tone.

“Let daddy take care of her then, baby. All of her. OK?”

His words trickled through your ear as sweet as honey. His cock was less kind, but that was okay—you liked it.

You loved him here. Taking care of you. Her. Everything.

And, in this half-coherent state of fuckdrunk pleasure, you were tempted to give in to whatever he begged.

It would be so easy. Joel cradled your face in his hand, practically beaming with pride while he fucked you over and over, and your legs were spread, walls were stretched, eyes practically rolling back, and you felt more secure than you’d been in ages. Joel could care for you.

He rubbed his thumb over your cheek and hummed.

“Daddy’s got you,” he said, voice all warm assurance.

Nudging you closer and closer to your peak—and perhaps some other form of surrender. Release.

Submission?

Joel wouldn’t be so bad for that.

He could fuck you well and leave you content. Make you forget what it meant to be strapped for cash and saddled with guilt and worry over bills every month. Joel could provide, for now. His eyes said as much; his fingers threaded through your hair and rubbed your scalp. He cupped your face, all fifty-six years in his own looking as handsome as they’d ever been. He felt good. He felt safe.

You were hot. Your legs trembled and ached.

“Is that something you’d want?” he pressed.

And, still holding Joel’s gaze with a heavy-lidded, fucked out look of your own, you surprised yourself by nodding, slowly. Your body was spent, but the curve on your lips, then his, was sincere; Joel nodded back as he grinned.

“Yeah? You mean it, sweetheart?”

He flipped you both over and got on top, never breaking apart. You wound your legs around his back and let him cup your cheeks again, and from this angle, you felt it. You wouldn’t try and fight it now; you just kissed him.

Then you came for a third time, walls clenching and squeezing and gushing again, smearing Joel’s front as he fucked you right through it. His groans were a little more subdued than yours, but in their timbre, you could hear his desperation. He emptied himself inside you, in the condom, and kept holding your face all the while.

You felt a low pulse between your legs. Then another. And another. And another. Joel’s hips began to still, his hefty greying belly bumping lightly against your skin while he drained what was left in his balls, and you swore that his bones might’ve creaked from the sheer force of those final thrusts. He seemed exhausted. Somehow, though, the man looked even better in this state—haggard and worn as he was, the face above your own was soft. Smiling, faintly, and kissing you constantly.

You couldn’t pretend you didn’t enjoy it; you were far too tired and fucked out of your mind to protest right now.

Joel trailed a path with his lips from your chin to your ear. He kissed the hinge of your jaw and sank himself deeper.

“Mr.—” But you caught yourself, shortly, “…Joel.”

He lifted his head, not apologetic in the least.

“Maybe just one more—” he started.

“No,” you finished for him, sharp.

Still smiling, but with your eyes on him in a thinly veiled threat. Joel accepted that and kept his dick where it was.

What followed was gradual but natural enough. A little awkward as you broached that uncharted territory of remaining in the other’s presence after the deed was done, but Joel didn’t seem like he wanted to leave the bed, and you had nowhere else to go until dinner with your dad at eight. There was a moment you wanted to separate your body from Joel’s, if only to slip off to the bathroom by yourself, but the man just held you closer.

“You think your old man will mind if I joined tonight?”

Here the fuck we go.

“He’ll kill you.”

You pushed hard against his hold without getting so much as an inch of give. Joel had to fight back a chuckle.

“Oh, yeah? Why?”

“Because,” you began in a huff. Wriggling with very little success in his arms, while you were pinned in missionary, “I smell like you. You smell like me. My dad’s a drunk, but he can sniff stuff like that out in a heartbeat. Too risky.”

You punctuated those words with a still more serious look, but before you could nudge at his chest again or say something more, you were forced to swallow a scream. Joel’s grip tightened even more, and he moved to stand up from the bed—with you still in his arms and impaled on his cock. He started to walk to the bathroom.

“Great. Shower’s got plenty of room for the two of us.”

“Joel!”

“Glad I don’t have to keep reminding you of my name.”

His voice was smug. Your gaze was hard. Joel was still hard himself, amazingly, and you almost groaned when you felt the head of his cock bump somewhere soft and sensitive inside. He toted you into the big, bright room.

“If not tonight, how ‘bout tomorrow? Just you and me.”

He would never stop this shit. He reached for the faucet.

“Still too dangerous. You know that,” you chided. Your resolve only wavered a little when you felt the hot water start to pelt at your back. Joel closed the glass door, “Besides…I need to focus on figuring my shit out right now. Work and bills and getting myself a rental car soon.”

Joel paused. He turned, still holding you.

Then, just as swiftly as he’d stepped inside, he carried you right back out of the shower. You whined in protest.

He took you over to the bed and set you down. He left to find his wallet and keys. You might’ve been tempted to voice your displeasure in some other way—namely, by marching back to the bathroom, locking the door, and bathing alone—but before you could speak a word, Joel was back. He looked down at you and held out his fist.

“What’s—”

“Your dad and me’ll be up to our eyeballs in bullshit working the Garcia audit tomorrow—and I know you don’t want him seeing us leave together anywhere—so we can meet at Bohanan’s at six. How does that sound?”

You blinked.

“I don’t…have a car.”

Joel opened his hand. Keys dropped out.

In a single glance, you could see they weren’t his.

Joel drove a garish Super Duty F-450, not an Audi. The cogs were quick to turn in your head, but clearly not fast enough, because Joel was closing your fingers over the keys before you could breathe so much as a syllable to him. When you did, it came out more like a stutter. Palpably mad but far too rattled to get much out:

“Joel, I-I can’t—”

“I’ve been meaning to buy one anyw—”

“You’re insane,” you started to push the keys back, and for some reason, your heart was thudding extra hard as you did. You went on, unblinking, “You don’t…need to.”

“I want to.”

Joel’s hands were warm when he pressed both of his palms to secure yours between them. He could probably feel the way it shook a little, but he didn’t seem to care. His gaze was too busy trying to find, and hold, your own while you swallowed and stared and racked your numb brain for any words of defiance. At length, nothing came.

All you could do was meet that look. In the soft brown irises above, you could see it all—the need to comfort, and care, and provide where he could, offer better than the hand you’d been dealt and maybe, interspersed with those feelings somewhere, a simpler need in him to give.

For once, you wanted to believe it.

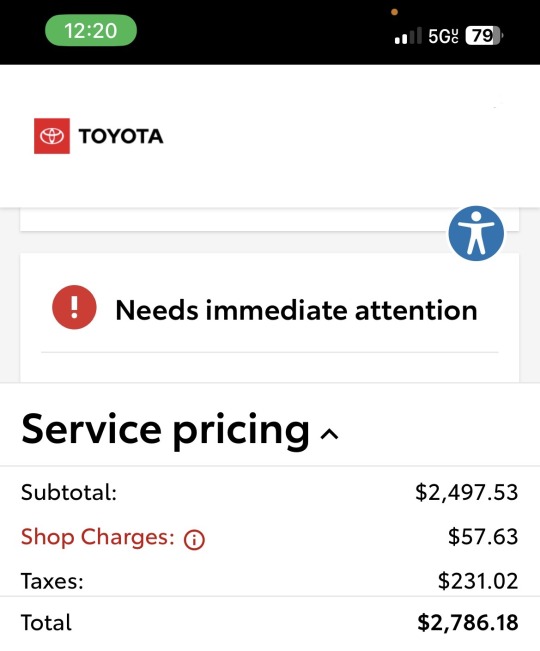

Fun fact: This fic was inspired by true events‼️💯 My life 😫🤪😤😈 Like reader, my truck is also busted as SHIT and needs $2,700 in repairs!!!! Unlike reader, I will not be sucking and fucking Joel Miller to recoup my losses (not asking for donations, just wanted to give y’all a giggle at my misfortune LOL)

#ENOUGH BULLSHITTING WE NEED MORE GLUCOSE GUARDIAN JOEL ON THE TL NEOWWWWW#🫵🏼😐#i’m begging y’all to write more for this very particular and off-putting dynamic bc i love it dearly#joel miller smut#joel miller x reader#joel miller x you#joel miller#joel miller fanfiction#joel miller imagine#joel miller one shot#joel miller tlou#the last of us fic

2K notes

·

View notes

Note

27. for Collin

Usually, Collin was the one who set surprises for everyone, for better or worse. But he wasn't expecting the store-bought tiramisu cake with a #5-shaped candle on top to be placed on his desk as he was reviewing his company's profit margin.

“Surprise!” Susan cheered with her hands giving a jazzy wave as his attention shot towards her. "Happy fifth anniversary, Mr. C!”

Collin blinked confused for a moment. "Fifth anniversary...? Of what?”

His assistant pulled back and her arms gestured to their surroundings. "The company, Ruppells' Poultry."

"OH! Five years already? I didn't even notice... I...", he trailed off as he ruminated on what they've done over the half-decade.

Five years ago Ruppells' Poultry was just an idea he came up with once he stumbled upon the foreverglade fountain in the lost library and found out its water's youth restoring and aging properties. The original reason for the business was just to cultivate a stable revenue for him and Susan while he reshaped his identity, both intrinsically and physically thanks to the de-ageing powers of the fountain water. Now that he looks back on it after all the work, planning and resources that brought them this far it's hard to believe it's only been five years, so much has changed.

His gaze went back to the cake, pensively looking at the transparent reflection of himself in the clear plastic dome protecting the confection. While he was reflecting on how far he'd come since the Lost Library Susan spoke up again as she slid some papers in front of him. “An', more good news— I got the new stock report an' we're actually in the top of the food industry! Ain't that cool? I mean we're actually number two but pretty close, right? At least when it comes to meat products, I mean, we're no Scrooge McDuck but—”

Collin quietly read through the new documents with a deadpan stare of surreality as his assistant rambled on, slowly but surely a small smile started to form as his emotions caught up with the occasion. Pride was swelling in his chest as he reread the document glanced up at the cake and reread it again, his energy bubble as his knee started to shake under the desk. Out of his expansive vocabulary only one word escaped his throat in a horse little whisper— "wow..."

"Right?" The duck woman enthused back, "Ah, Mr. C, I'm just so happy for you. Congrats, really."

Collin rocked forward in his chair, now with a big gaping grin while his eyes swapped between the paper and the cake. His assistant's hype was finally rubbing off on him.

This has to be his proudest moment yet.

"Wow. I've actually gotten us this far—" He said in amazement before, pausing for a little ego check and looked up at his assistant, "I mean we've gotten us this far, of course."

Susan humbly waved him off, "Aw Sir, you're the one doing all the big business stuff I'm just the secretary."

"You're still a great help, Ms. Spruce, to me and this company." He reassured her, standing up, moving around his desk towards her and laying a hand on her shoulder. "Thank you, Susan."

She couldn't resist hugging him for that which he reciprocated.

#ask meme replies#rolliesmuses#writing prompt#collin condor#susan spruce#this took so long because I was stuck for a while#I had to rewrite the whole drabble over again in a different way from the original#(sorry for the delay)#ducktales oc#du

4 notes

·

View notes

Text

I Waited in Line

By Kathleen Tonn

The bank line moved slowly, in large part because of a disgruntled member. There were three ahead of me as we waited for the tense conversation to end. I scrolled through my apps trying to tune out the teller and the young woman's comments.

I thought I was succeeding when I heard the Gen Z say, "You banks are a crock of shit. Close my account now. Charging me excessive insufficient fund fees making it impossible for me to pay my rent."

"Lower your voice. You're making the other members uncomfortabl," said the teller in a firm voice.

I looked up from my cell phone when the young lady addressed those of us in line. "How many of you received multiple insufficient fund charges?" None of us answered her. But her question reminded me of my irritation six months ago when my checking was charged ninety dollars for not having adequate funds to cover the auto deduct for a fourteen- dollar subscription fee.

She persisted, "Were any of you unable to pay a monthly bill, because money you had in your checking account dwindled, as fast as you can say ouch?"

The teller told the Gen Z that if she continued making a scene that security would escort her out. Then, the teller said, "Your account is closed. Next member."

The young lady walked out slamming the door.

Finally, my turn came. Politely, the teller deposited my dividend check into my savings account. I then asked the gray haired woman if she could pull up my checking account transactions from six months earlier. She did.

I said, "Do you see the three, thirty dollar insufficient fund charges?"

She answered, "I do."

"Can you explain to me why I was charged an additional sixty dollars once the first insufficient charge was applied to my account?"

The teller displayed a touch of self-consciousness. "Sir, it shows the deficit in your account triggered multiple attempts to post the charge. That is why you were charged three insufficient fund fees."

I then asked the teller, "Do you agree with the bank policy allowing this action?"

The woman was visibly uncomfortable. She replied, "Would you like to speak with the bank manager?"

I nodded my head yes.

I waited about ten minutes when the bank manager signaled for me to enter her office.

"Have a seat Mr. James. Marigold informed me you were charged three insufficient fund charges in June of this year."

I nodded. Then I carefully looked at the professionally dressed woman sitting across from me.

"I realize my account didn't have the funds to cover the subscription auto pay. I also recognize the bank's fee for not doing so, but I don't see how charging two additional insufficient fund fees is a service to members. An angry, young lady closed her account this morning because of excessive fees. Your bank lost a member. Moreover, she will tell her friends about your bank's excessive fees. I know she has a substantial following on Tik Tok. That, madam, can cost your bank revenue."

The manager smiled. "Mr. James, you are correct. We in the financial realm need to look carefully at our banking practices. Word of mouth, praise or complaint, can knock our margins off course. I will remove your two insufficient fund fees. Likewise, I will get Marigold to provide me the young lady's contact information to inform her the bank will do an audit on her account. In addition, I will ask her if she would consider reopening her account."

"Thank you. Understanding stakeholders needs goes very far in the business world. And correcting errors keeps members. Thank you for your time," I said as I got up from my chair.

She too rose from her chair as she escorted me to the exit. We then shook hands, and I turned to walk to my Chevy.

0 notes

Text

Sarveshwar Foods: A Major Milestone with Global Expansion in Singapore

November 26, 2024, marked a significant development for Sarveshwar Foods Limited, a trailblazer in the Indian rice industry, as the company announced a major breakthrough through its wholly owned subsidiary, Green Point Pte. Ltd., based in Singapore. This pivotal achievement showcases Sarveshwar Foods' strategic vision and global ambitions, setting the stage for a remarkable fiscal year ahead.

Green Point Pte. Ltd. secured a substantial order of 12,000 metric tons (MT) of premium Indian Long Grain Parboiled Rice from Monarda Commodities Pte. Ltd. The order is valued at approximately ₹445 million, highlighting the robust demand for Indian rice in the global market. This transaction not only strengthens the subsidiary’s revenue stream but also aligns with its ambitious goal of achieving ₹2,000 million in annual revenue.

A Strategic Gateway to the Global Market The acquisition of Green Point Pte. Ltd. has proven to be a transformative step for Sarveshwar Foods. Positioned in Singapore, the subsidiary serves as a gateway to the burgeoning international market for rice and rice-based products. As global consumer preferences shift towards healthier dietary options, including gluten-free and high-fiber alternatives, the demand for premium rice varieties continues to rise. This aligns perfectly with Sarveshwar Foods' expertise in producing high-quality rice, cultivated in the mineral-rich soils of the Himalayan foothills.

The global rice-based product market is experiencing rapid growth, with projections suggesting an increase from USD 226.36 billion in 2023 to USD 361.41 billion by 2031. The rising prevalence of celiac disease and gluten intolerance, coupled with heightened awareness about the nutritional benefits of rice-based diets, is driving this trend. By securing this order, Sarveshwar Foods positions itself to capitalize on these favorable market dynamics.

Leadership and Vision Rohit Gupta, Chairman of Sarveshwar Group, expressed his enthusiasm about this milestone, stating, “We are thrilled with this significant order, which underscores Green Point’s growing role in our global business strategy. With our focus on premium rice-based products and the rising demand for gluten-free alternatives, we are optimistic about achieving our revenue targets for this fiscal year.”

Mr. Gupta further emphasized the group’s overarching goal of reaching a consolidated turnover of ₹10,000 million (₹1,000 crore) for FY 2024-25, encompassing contributions from all subsidiaries, with healthy margins. This vision reflects Sarveshwar Foods’ commitment to innovation, quality, and sustainable growth.

A Legacy Rooted in Excellence Sarveshwar Foods Limited, headquartered in Jammu, holds a legacy of over 130 years in delivering premium rice varieties. The company specializes in both branded and unbranded basmati and non-basmati rice, catering to domestic and international markets. Its organic product line, marketed under the Nimbark brand, reflects the company's commitment to promoting a Satvik lifestyle. Grown without artificial fertilizers or chemicals, these products resonate with health-conscious consumers globally.

With multiple certifications, including ISO 22000:2018, USFDA, BRC, Kosher, NPPO USA & China, and USDA Organic, Sarveshwar Foods ensures adherence to the highest quality standards. The company’s diversified sales strategy includes traditional retail, proprietary outlets, and a robust online presence through its e-commerce platform, www.nimbarkfoods.com.

The Road Ahead This milestone signals a promising future for Sarveshwar Foods. The successful execution of this order by December 31, 2024, will bolster the company’s international credibility and open doors to additional global opportunities. Sarveshwar Foods’ ability to adapt to evolving consumer demands while leveraging its rich heritage places it at the forefront of the global rice export industry.

As the fiscal year progresses, the company remains steadfast in its mission to expand its market share, deliver exceptional products, and sustain its growth trajectory. With its eyes set on emerging trends and untapped markets, Sarveshwar Foods is poised to leave an indelible mark on the global stage.

This significant achievement is not merely an order fulfillment; it is a testament to the vision, determination, and innovation that define Sarveshwar Foods Limited.

0 notes

Text

Wage rule key to Brazil government cost-cutting plan, experts say

Economists advocate for ambitious measures amid challenging global conditions

Changes to the rules linking health and education spending to revenue, as well as adjustments to the current formula for increasing the minimum wage, are deemed crucial by economists for the fiscal adjustment package the government is expected to present in the coming days.

“If expenses need to be 70% of revenue [in the new fiscal framework] and there are two major areas [health and education] that grow with revenue, others will have to grow much less,” said Joaquim Levy, director of economic strategy and market relations at Safra and a former finance minister, during an event hosted by Warren Investimentos on Monday (18) in São Paulo.

Overall, Mr. Levy noted, these adjustments do not mean cutting expenses, but allowing them to grow slightly less, “with effort, maybe one percentage point less.”

The rule for real minimum wage increases, which is currently tied to GDP, also “affects pensions on the margin,” said Mr. Levy. Therefore, any indication of change in this formulation would also be an improvement, in his view.

Continue reading.

#brazil#brazilian politics#politics#economy#workers' rights#image description in alt#mod nise da silveira

0 notes

Text

Revenue Models for Social and Non-Social Enterprises: Insights from Mr. Karl Fajardo, Co-Founder of Serial Disruptors

By: Gesrel Manuel

In a recent lecture as part of the Technopreneurship and The Entrepreneurial Mind series, Mr. Karl Fajardo, Co-Founder of Serial Disruptors, explored the different revenue models that can drive growth and sustainability in both social and non-social enterprises. Social enterprises, which prioritize social or environmental missions alongside profit, often rely on impact investment and hybrid models, where they combine commercial revenue with reinvestment into their mission. For example, a social enterprise focused on renewable energy might attract investors who are not only interested in financial returns but also in generating positive environmental impact. On the other hand, subscription-based and freemium models offer a way to build long-term engagement and recurring income, especially for services in education or healthcare.

For non-social enterprises, traditional direct sales and advertising models remain highly effective. These businesses, typically profit-driven, can focus on selling products or services directly to consumers, leveraging high-margin sales or gaining revenue through advertising and sponsorships, especially in digital platforms. Freemium models, often used by tech companies, offer basic services for free while charging for premium features, helping to quickly build a customer base while generating revenue from those willing to pay for added value. Additionally, wholesale and distribution models allow businesses in manufacturing and retail to scale quickly by selling products in bulk to other companies or retailers.

Mr. Fajardo emphasized the importance of aligning the chosen revenue model with the enterprise's mission, whether for social impact or profit. Entrepreneurs should carefully assess their target market, the scalability of their product, and the long-term sustainability of their model. As the landscape of business continuously evolves, adaptability and leveraging new technologies are key to thriving. By embracing innovative revenue models that not only generate financial returns but also support broader social goals, both social and non-social enterprises can navigate the challenges of the modern business world and achieve sustainable growth.

0 notes

Text

Should health systems monetize patient data? - Christian Lindmark

-Christian Lindmark

Christian Lindmark - Thursday, October 3rd, 2024

Health systems have a large amount of patient data through EHRs and other digital platforms managing administrative tasks and clinical care.

The de-identified patient data is useful for creating large language models, precision medicine, drug discovery and more. There are opportunities for hospitals and health systems to commercialize patient data and monetization could be valuable for hospitals with thin margins. But is it ethical?

Four healthcare leaders addressed the question during a panel at the Becker's Health IT + Digital Health + Revenue Cycle Conference Oct. 1-4 in Chicago.

"Monetizing data comes up somewhere between every seven or nine seconds in healthcare, and it depends on what you mean by data," said Richard Zane, MD, chief innovation officer, UCHealth. "If we're going to see 500 patients who are a certain age with specific clinical genomic issues, and we're going to sell that data set, we can't do that, but can we optimize algorithms? Can we use clinical data in drug discovery? Those things are happening every single day."

Donna Roach, CIO of University of Utah Health in Salt Lake City, said her institution is conservative on commercializing patient data. She said much of the ethical discussions are focused around how datasets for particular patient populations are used and whether the patients consented.

"If you have a need and the consent isn't there, you may have to do the honors task of going back and getting consent, but once the consent is there, we can move forward," she said. "We sometimes jump to the conclusion that EHR data is so rich and why can't we generalize their consent to be in the EHR, but they've not consented for commercialization of their data. That's the balance and tug of war right now."

Academic medical centers in particular are poised to advance healthcare research, drug discovery and large language models. But organizations need to ensure they aren't exploiting patient data or unnecessarily risking HIPAA violations.

Christian Lindmark, vice president and chief technology officer at Stanford Health Care and School of Medicine, agreed most health systems and physician groups have taken a conservative approach to patient data commercialization, but cautioned non-traditional entrants without the same hesitation could reap the benefits. Startups offering a data-driven model for primary care are poised to collect and commercialize data quickly.

"They would probably be more on the forefront and I would assume we'd get some legal precedent around that if we went that route," Mr. Lindmark said.

Sarah Poncelet, chair of strategy execution at Rochester, Minn.-based Mayo Clinic, said the health system isn't in the business of commercializing patient data, but instead aims to back or create solutions that would reduce time spent in the EHR. She also craves more longitudinal data.

"Over time, ideally it would be great if the patients owned their own data and we had ways for them to be able to consent and allow for us to have new findings," Ms. Poncelet said. "It's more around having the new findings so we can accelerate research through application and within our Mayo Clinic Platform, we have a lot of groups who are consenting to put their data into a shared cloud."

Researchers can access the patient data through a de-identified blockchain to accelerate findings of early hypothesis research and advance medicine.

"It's not about commercializing patients' data, it's about leveraging the information to accelerate findings."

0 notes

Text

[ad_1] Deepak Fertilisers and Petrochemicals Corporation Limited, one of India's leading producers of industrial & mining chemicals and fertilisers ("DFPCL" or the "Company"), announced its results for the quarter ended September 30, 2024. The company reported a remarkable 237% year-on-year surge in net profits.Consolidated Financial HighlightsConsolidated (INR CR)Q2FY25Q2FY24*YoY ChangeQ1FY25QoQ ChangeH1FY25H1FY24YoYChangeOperating Revenue2,7472,42413%2,28120%5,0284,7376%Operating EBITDA49428673%4646%95956769%Margins (%)18%12% 619 bps20%(237) bps19%12%710 bpsNet Profit21463237%2007%414177134%Margin (%)8%3% 518 bps9%(96) bps8%4%449 bps*Q2FY24 includes the impact of NBS subsidy on channel inventories of Rs. 106 Cr and Rs.87 Cr on account of stabilization of Ammonia PlantKey Highlights for Q2FY25EBITDA Margin Growth: Improved to 18% compared to 12% year-over-year.Record Sales Volume in Bulk Fertilizer: Achieved an 83% year-over-year increase in sales volume of manufactured bulk fertilizer, marking the highest sales in a quarter.Anti-Dumping Duty Implementation: USD 217 per metric ton Anti-Dumping Duty (ADD) on IPA for a period of 5 years.In-House Capture of Ammonia Price Hikes: Increases in global ammonia prices are now fully captured internally.Capacity enhancement of approximately 10% resulting from debottlenecking of the TAN plants, delivering an additional 50 KTPA and bringing the total TAN capacity volumes to 587 KTPA to support the growing needs of India's Mining sector.Debt Reduction: Prepaid Rs. 200 crores in debt, improving the Net Debt to EBITDA ratio from 2.66x to 1.64x.Change in key RM Prices in Q2FY25: Ammonia: ~11% YoY; MOP: ~40% YoY; Gas: ~9% YoYCommenting on the performance, Mr. Sailesh C. Mehta, Chairman & Managing Director said, DFPCL has shown impressive performance in Q2 FY25, achieving a 13% growth in revenue. This growth was primarily driven by the Crop Nutrition business, which experienced an 18% YoY increase in revenue, while the Chemical business grew by 8% YoY despite a lean quarter for the chemical sectors. Fertilizer and Chemical businesses acted as a natural hedge, enabling the company to deliver consistent and improved performance.There has been a consistent increase in the proportion of revenue from specialty products, along with an overall rise in revenue, driven by the strategic move of transitioning from commodity to specialty.Crop Nutrition Business (CNB) achieved a remarkable 83% YoY increase in sales volume of manufactured bulk fertilizer, which is highest ever sales.Mining Chemical: Monsoon is a lean period due to slowdown in mining activities. Accordingly, we had taken a planned shutdown of Technical Ammonium Nitrate (TAN) plant for maintenance and capacity enhancement of 50 KTPA, taking total capacity to 587 KTPA.The Industrial Chemicals business experienced a healthy revenue growth of 9%, despite marginal decrease in volumes. This performance underscores our strategic shift from commodities to specialty chemicals, which has effectively mitigated price volatility.The ammonia plant has enabled all our businesses to reap substantial benefits from backward integration, effectively mitigating supply chain risks and price volatility. As a result, we are now able to capture the increases in global ammonia prices within the group.As India continues to grow, the chemical and fertilizer sectors are poised to thrive. The demand outlook for the Crop Nutrition, Mining Chemicals, and Industrial Chemicals Business is well aligned with India's growth story, providing strong and positive tailwinds. We are actively working on the execution of the TAN Project and the Nitric Acid Project in Gopalpur and Dahej, respectively, to capitalize on future growth.Chemicals ReviewMining Chemicals (Technical Ammonium Nitrate): In Q2 FY25, our premium product LDANs sales volume soared by 16% YoY and rose by an impressive 20% in H1 FY25 compared to H1 FY24Overall sales volume was down by 21% YoY in Q2 due to a planned shutdown and lean seasons due to monsoon.

The volumes were down by 1% in H1 FY25 compared to H1 FY24.Business Outlook: The mining and infrastructure is expected to pick up post monsoon as demand for Power (Coal), Cement & Steel is expected to increase thereby providing robust support for TAN demand.Industrial Chemicals: Nitric acid volumes was marginally down by 1% on YoY basis and up by 13% on QoQ basis.The specialty stainless steel grade nitric acid has received positive feedback from customers.IPA volumes experienced a 10% YoY decline due to process constraints and a plant shutdown. However, the recent implementation of an ADD at USD 217 per metric ton for a period of five years is anticipated to enhance both demand and pricing moving forward.Business Outlook: For Nitric Acid, the demand and margins are expected to be stable over the next few quarters. Propylene-based IPA demand and margins are expected to be stable and improve following the implementation of the ADD on Chinese suppliers over few quarters.âCrop Nutrition Business (Fertilisers) ReviewIn Q2 FY25, manufactured bulk fertilizer has achieved highest ever sales volume of 268 KMT, an 83% YoY increase, driven by improved demand from above-average rains, which led to 102% Kharif crop sowing and positive market sentiment across all regions.Sales volume of Croptek surged to 37 KMT, reflecting a 70% YoY growth, with continued focus on providing crop-specific solutions for targeted crops, including cotton, soybean, sugarcane, corn, grapes, pomegranate, and banana.The company has recently launched premium water-soluble fertilizer grades.Sale of specialty fertilizer Bensulf was 9 KMT, up 7% YoY.Business Outlook: Above-normal monsoon rainfall in our core states has significantly enhanced groundwater table as well as water reservoirs for irrigation, which will help promising rabi season ahead.âWe expect the acreages under rabi cash crops to go up especially for Sugarcane, Onion, Potato etc.âCompany OverviewDeepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) is among the India's leading manufacturers of industrial chemicals and fertilisers. With a strong presence in Technical Ammonium Nitrate (mining chemicals), Industrial Chemicals and Crop Nutrition (fertilisers), the Company supports critical sectors of the economy such as infrastructure, mining, chemicals, pharmaceutical and agriculture. DFPCL is a publicly listed, multi-product Indian conglomerate and has plants located in four states, namely Maharashtra (Taloja), Gujarat (Daher), Andhra Pradesh (Srikakulam) and Haryana (Panipat).DFPCL is Leading manufacturer and marketer of Iso Propyl Alcohol (IPA) in India and Largest Manufacturer of Nitric Acid in Southeast Asia. The Company is developing specialised grades of Nitric acid and IPA to meet specific requirements to cater needs of the industry/consumer.DFPCL is one of the leading manufacturers of Technical Ammonium Nitrate in the world, it is the only producer of pilled Technical Grade Ammonium Nitrate solids and medical grade Ammonium Nitrate in India. The Company has commenced best in-class Technical Services to drive downstream productivity benefits for the mining end consumers.CNB Segment (fertilisers) offers a basket of 48 products which include bulk fertilisers, Crop nutrient solutions, specialty fertilisers, water-soluble fertilisers, bio-stimulants, micro-nutrients, and secondary nutrients, catering to every crop's nutrient requirement. Enhanced-efficiency speciality fertilisers are developed basis rigorous R&D efforts and product trials at over 50,000 farmer demo plots. The R&D efforts have shown distinct yield and quality improvements for crops across segments such as cotton, sugarcane, onion, fruits and vegetables. Over last three years, value-added nutrition products have benefitted 6 million farmers. [ad_2] Source link

0 notes

Text