#income tax retune

Explore tagged Tumblr posts

Text

Benefits of Filing ITR Even If Your Income is Below the Taxable Limit

Filing an Income Tax Return (ITR) is often seen as a mandatory process for those who earn above the taxable limit. However, even if your income is below the threshold, filing an ITR can be highly beneficial. Here’s why you should consider filing your tax return even when it’s not mandatory.

1. Proof of Income & Financial Record

ITR serves as an official record of your income, which can be useful for various financial transactions such as applying for loans, credit cards, or visas. It provides proof of earnings and financial stability.

2. Easier Loan Approvals

Banks and financial institutions often ask for ITR documents while processing loans for home, car, or personal needs. Even if your income is below the taxable limit, filing ITR can strengthen your loan application.

3. Claiming Tax Refunds

If you have had TDS (Tax Deducted at Source) deducted from your earnings, filing an ITR allows you to claim a refund if your income falls below the taxable limit. This ensures you do not lose money unnecessarily.

4. Carry Forward Losses

If you have incurred capital losses from stock market investments, mutual funds, or real estate, you can carry forward these losses to offset future gains only if you file an ITR.

5. Visa Processing & Foreign Travel

Several foreign embassies require ITRs as proof of financial stability when processing visa applications for travel, work, or study abroad. Filing an ITR makes the visa approval process smoother.

6. Avoid Notices from the Income Tax Department

Even if your income is below the taxable limit, the Income Tax Department may issue notices if financial transactions appear suspicious. Filing an ITR provides clarity and avoids unnecessary scrutiny.

7. Building Financial Credibility

Regular filing of ITR creates a strong financial profile, which can be beneficial for future investments, government benefits, and business opportunities.

Conclusion

Filing an ITR is not just about tax obligations; it offers multiple financial and legal benefits. Even if you earn below the taxable limit, filing your return can help build a strong financial foundation and avoid future complications. Start filing your ITR today to stay financially secure!

0 notes

Text

HOW A LANDLORD SHOULD CHARGE THE RENT?

Rent: It means an amount of money paid by the tenant to the landlord for enjoying the right to use the asset owned/held by the landlord, for a specified period of time.

The basic motive of this article is to ascertain the method of charging the rent which should be judicious and acceptable to both tenant and landlord.

Please note that in this article we will discuss the rentals charged on assets used only for business/commercial/economic purposes.

Currently , tenant pays fixed amount of rent to the landlord. This rental amount is determined by the mutual agreement between landlord and tenant. Businesses generally hire immovable property like land and/or building and movable property like plant and machinery etc,. But the basic question is that whether the rental amount determined on mutual agreement basis is fair and judicious. Currently rental amount is determined on the basis of market rate which is in turn determined by the demand for the assets prevailing in the market. The demand for the assets is high when growth rate ( GDP Rate) of a country is high and/or stable. In such bullish trend, the owners charge high rentals because of high demand for the assets.

Now my question is what about the situation , when the economy enters the bearish phase I,e. experiences low growth rate or low GDP rate.

Suppose Mr. A (Tenant) enters into an agreement to hire an asset for business purposes from Mr. B (Landlord) in the year 2015, when the GDP rate was 10% at an amount of Rs. 30000/month, for a period of 5 years. Demand for the assets were too high as gdp rate was high I,e. bullish trend exists. Now from the year 2017, the economy enters recession phase, gdp rate was just 3-4 %. Business of Mr. A also starts struggling during recession phase, faces huge pressure to pay predetermined amount of rent which was determined in the year 2015 on market basis.

Now my question to you is that should the rent amount be revised as now, the market conditions have changed.

My answer is yes. Basically , first of all we should be aware about the ACT governing the rental agreements in india. In india , rental contracts are governed by RENT CONTROL ACT, 1948. But the question is whether this act is really much efficient to effectively govern the rent agreements. My answer is NO. There are various flaws in RENT CONTROL ACT, 1948. E,g. it does not stipulate the METHOD of charging the rent amount. It does not provide for maximum rent amount a landlord can charge from tenant. Also, various states have passed their own rent control acts, so it is ineffective in such states.

Now here are my few suggestions to overcome the above limitations in RENT CONTROL ACT, 1948. These are:-

1.Rent control act like the income tax act1961, shall be applicable to whole of india. There should not be any state rent control act.

2.For land and/or building, rent should be charged on the basis of rate per square feet or rate per cubic feet, as the case may be. But the important point to be noted here is that such rate should vary with the economic growth rate ( GDP rate).i,e. if GDP rate decreases, rate per square feet or rate per cubic feet should also decrease, thereby providing some relief to businessman during recession phase. But if GDP rate increases, rate per square feet or rate per cubic feet should also increase, thus providing extra benefit to landlord to enjoy bullish phase of an economy, because landlord sacrifices the returns during recession phase.

3. For the plant and machinery, (depreciation amount+ normal rate of retun on such depreciation amount), should be charged by the owner of such asset. Of course , normal rate of return should be subject to GDP rate prevailing in an economy.

4. Rent Rates for each geographical area in india should be clearly prescribed. Any variation in such rates should be communicated through an effective mechanism.

5. All rent agreements should be governed by RENT CONTROL ACT, 1948.

Your comments are most valuable.

0 notes

Text

Dr. Ronald (Ron) A. Motill

Dr. Ronald (Ron) A. Motill, 83, of River Street Manor, Wilkes Barre peacefully passed on December 15, 2024 at the Geisinger Hospital ICU, with his beloved soulmate Linda by his side. Ron was born and raised in South Philadelphia, the first of two sons of Andrew and Helen Motill. Ron was preceded in death by his parents and his brother. He is survived by his companion Linda and his extended family (Adrianna, Raymond Chad, Morgan, Lily, Benjamin, and Jacob), several aunts and cousins.

Ron knew at a very young age that he wanted to be a scientist, while attending grade school in his Catholic church. He recalled his early education as rigorous endless drills of arithmetic, spelling, catechism, and grammar. When he received a 2,000+ page copy of Practical Mathematics for Christmas one year, he spent countless hours studying math theory and applied methods in physics and actuarial studies. Ron spoke proudly of his time he spent in the Scouts, particularly when he earned a merit badge in amateur radio, teaching himself Morse Code, building his own short-wave radio and converting an Army transmitter to broadcast live over the airwaves; this is particularly impressive given he wasn’t yet a teenager.

When Ron graduated high school at just 16 years old, he had multiple scholarship offers including one from MIT, but he decided on Syracuse University so he would be closer to home. He studied electrical engineering, chemistry, mathematics, and physics. He found his passion working in physics as it allowed him to “enjoy the beauty of math while using it to solve concrete problems”. Ron was so fond of Syracuse that he stayed on for his post-doctoral work focusing on the geometry of spacetime and its curvature; he did his graduate research studies in Einstein’s theory of gravitation, or General Relativity. He worked side-by-side with Einstein’s colleagues at the Princeton Institute for Advanced Studies. He finished his doctoral dissertation, “Hamiltonian Propagation off Characteristic Surfaces for Gravitation” and received his PhD in Physics in 1974. He went on to teach physics at several prestigious universities within the United States and abroad. One of his most memorable experiences was the time he spent in Saudi Arabia at King Faisal University where he instructed pre-med students in physics, math, and calculus. While in Saudi Arabia he expanded his horizons in academia, learning about medical technology and laboratories and eventually began lecturing in those courses of study in addition to his work in physics and applied mathematics. He also learned Arabic while immersing himself in the culture.

Ron retuned to the United States in 1995 where he served as a professor at Penn State University. He retired to the Wyoming Valley where he focused his energy on helping his aging mother as well as volunteer activities including VITA (volunteer income tax assistance program) to assist the elderly in preparing tax forms, and he relished singing in the choir at St. Theresa’s Church in Shavertown. He enjoyed physical fitness including lap swimming a mile a day four days a week, riding his bicycle, canoeing/kayaking, and hiking. Ron thoroughly enjoyed traveling with Linda including trips to many state and national parks as well as trips to Europe and Canada.

Family and friends are invited from 1 to 3 PM on Thursday, December 19th, at Hugh B. Hughes & Son, Inc. Funeral Home, 1044 Wyoming Ave., Forty Fort, PA.

Ron will be missed for his love of life, his kindness and generosity, his genuine soul and caring nature, his quick wit and humor, and his never-ending thirst for knowledge and intellect. The family extends our sincere gratitude to Ron’s caregivers at River Street Manor.

0 notes

Text

Middle Remikra Rent and Wages

Library of Circlaria

Blog Posts

Article Written: 3 September 1452

Early Republic: 1238-1301

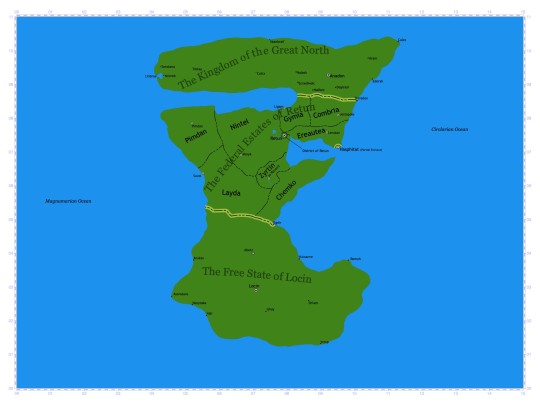

Map of Remikra, 1264-1308

In 1238, when the surrounding territories of the Basin District gained independence from Combria, the new nation of the Federal Estates of Retun established a democratic government and a new currency. Its currency, the Retunian Qor, was based on the exchange of credit gained in the form of Combrian Merchant Qors, and the base unit of the new currency was based on the quantity of Remikran Union Credits. Eleven years later, Prime Minister James Black signed into law the first minimum starting wage: 1.00 Retunian Qor per hour. This payment, at the time, was enough to cover expenses necessary for a comfortable living; and employees would receive a 1.00 qor raise every year, based on the employer pay scale, so that come retirement 40 years later, an employee would be making 40.00 qors per hour. Furthermore, employees worked six hours a day for six days a week (remember, a week is eight days in the Circlarian Calendar). This meant that, for a first-year employee, gross yearly salary would be 1080.00 qors per year.

Taxes were imposed on businesses in terms of capital gain but were also imposed on employees in terms of their income. The income tax rate was 5 percent each for the estate, the municipality, the county, the province, and the federal levels. These taxes were aggregated into a singular tax bill charged to each individual, with the bill making up approximately 25 percent of income. And such taxes would go to pay for infrastructure including food, water, sewage, electricity, energy, housing, transit, communication, critical infrastructure (police, fire, healthcare), and education. With this established, Retunians paid rent via the tax bill. For an individual making 1.00 qor per hour or 1080.00 qors per year, such a tax bill would amount to 270.00 qors per year.

Upon taking office in 1261, Prime Minister Edward Jackson initiated economic reform by raising the minimum starting wage to 2.50 qors per hour, and allowing private banks and businesses to buy out publicly-held estates and charge rental adjustment fees up to 7.5 percent of an individual's income. This meant that a first-year employee would be making 2700.00 qors per year but would be paying 877.50 qors per year in the estate tax bill, which included the rental adjustment fee. As business growth ensued, employers found themselves competing for employees, creating pressure to raise starting wages. This made the average starting wage go up to 2.51 qors per hour in 1263, to 2.53 qors per hour in 1264, and to 2.56 qors per hour in 1265. It surpassed 3.00 qors per hour in 1270. And by 1272, the average starting wage was 3.51 per hour, with a yearly gross salary of 3790.80 and an estate tax bill of 1232.01.

Numerous financial institutions had invested in deep-trade through loans in 1272. However, between 1273 and 1274, a market crash ensued as the result of fallout in deep-trade with the Acreans, prompting private estates and their lending banks to raise the rental adjustment fees from 7.5 percent to 10 percent of income. This decision was made at a summit between flat managers and bank figures in 1276 and, with the approval of Retunian Council in a sweeping legislative measure, took effect in 1277. There was little to no protest from the people over this as not only did it not receive media coverage, but also the increase was relatively minimal while starting wages were surpassing 5.00 qors per hour.

However, bankers and flat managers convened in a similar manner in 1281 to raise rental adjustment fees to 15 percent starting in 1282, and met again in 1286 to raise them to 20 percent for 1287. It was when they convened in 1291 to raise them to 30 percent for 1292 that numerous citizens began to demonstrate contempt. Starting wages at that point had stagnated, which had further solidified the growing opposition of the population against the Jacksonian economy. It was for the 1296 elections that Ereautean governor John Waltmann campaigned for Prime Minister with one of his agendas being to lower the rental adjustment fees to 15 percent. This, along with his promises to establish national healthcare, education, and transportation standards, led him to beating the incumbent Prime Minister Arthur Cummings that year.

While Waltmann followed through with his infrastructure standard promises, he and his fellow Progressive Party colleagues encountered stiff opposition from politicians backed by the banks, who resented such lowering of the rental adjustment fees. In November 1297, they reached a compromise and settled with a 25 percent cap on the rental fees while Waltmann signed into law a measure to raise the minimum starting wage to 10.00 qors per hour.

In 1298, Retunian legislature amended the bill capping the rental fees at 25 percent to include exemptions for estates to temporarily raise them in case of financial strain; and such an amendment which would prove catastrophic in the years to come. Between 1298 and 1301, the economy recovered from its temporary slump beginning in 1290, and began to grow again, leveraging itself on promising investments for lightfire trade in Ancondria. However, in 1301, the banks held a summit and decided to liquidate all investments involving Ancondria, leading the market to collapse. Millions of jobs were lost as the minimal growth in wages was erased, falling back to the minimum 10.00 qors per hour. At the same time, estates and banks feeling financial pressure, as well as attempting to maximize marginal profits, invoked the emergency clause passed in 1298 and raised rental adjustment fees up to 27.5 percent in 1303. They made similar increases in 1304, 1305, 1306, 1307, and 1308. By 1308, rental adjustment fees were at a staggering 40 percent.

Early Commonwealth: 1310-1344

Map of Remikra, 1312-1319

Such high rental fees resulted in political tension leading to the toppling of the incumbent Waltmann Administration, establishment of the Fourth Amendment, and establishment of the Finzi Administration. The Finzi Administration repealed private estates and banks, as well as the rental adjustment fee altogether. This meant that the estate tax bill consisted only of 5 percent of income going each to the estate, municipality, county, province, and federal governments, just like it did before Jackson. Furthermore, the Finzi Administration established a new currency: the Commonwealth Qor.

In payment of Commonwealth Qors, minimum starting wage was set at 15.00 qors per hour. Initially, in 1310, one Commonwealth Qor was worth seventeen Retunian Qors, meaning that employees were making the equivalent of 255.00 Retunian Qors per hour. The issue with the Commonwealth Qor, however, was that it was based on and directly exchangeable with one darkfire floan (or darkfire tradestone). This was not originally an issue; in fact, with darkfire floans increasing in value, the value of the Commonwealth Qor increased as well. By 1314, one Commonwealth Qor was worth 38.51 Retunian Qors. The issue was that by 1314, hordes of Commonwealth citizens decided to invest in the recently-legalized industry of darkfire production. This was due to the initial explosion in demand. But by 1314, the darkfire floan supply outpaced the growing demand, and began to decrease the value of the floan. Furthermore, the darkfire concentration of the floan began to decrease due to overproduction. In 1317, as a result, the Commonwealth Qor began to decrease in value. And its economic impact began being felt by the 1320s.

In 1325, the value of the Commonwealth Qor fell below the Remikran Credit value of 1.00 Retunian Qor, prompting Commonwealth legislature to pass amendments to minimum wage standards to set starting minimum wage to the Commonwealth Qor equivalent of 15.00 Retunian Qors per hour. The Commonwealth Council also paid with stimulus checks to back-credit those who worked during that year. The Commonwealth Qor, meanwhile, continued to fall in value. In 1326, 1.00 Commonwealth Qor was equal to 0.27 Retunian Qors; and in 1327, it was 0.07 Retunian Qors. It was around this time that bank reserve treasurers began buying darkfire floans with Remikran Credit and exchanging them with the Commonwealth government for Commonwealth Qors, transferring the resulting financial gains into trust funds for business grants. This was an act of which the lightfire industry began to take advantage.

Alex Schraber, campaigning on a platform of economic reform and restoration of societal stability, had won the 1332 elections and taken office in 1333. By 1333, one Commonwealth Qor was worth 0.000006 Retunian Qors; and upon executive order, Prime Minister Schraber ended the Commonwealth-Qor-floan exchange and re-established the Commonwealth Qor as a fiat currency very much like the Retunian Qor. The new Prime Minister, furthermore, mandated the trust funds to be utilized to further fund the lightfire industry or face taxation. Schraber's policies led the Commonwealth Qor to recover its value to a certain degree. By 1338, the Commonwealth Qor was worth 0.0011 Retunian Qors. However, inflation pressure from a now-robust lightfire industry led the Commonwealth Qor to begin losing value again in 1341.

By 1344, the Commonwealth Qor fell back to 0.00043 Retunian Qors. Facing domestic backlash for his aggression in Ancondrian politics, Prime Minister Schraber resigned from his post that year and was replaced by Interim Prime Minister George Borwell, who signed into law the Seventh Amendment of the Retunian Constitution, which re-established the Retunian Qor as the official currency.

Commonwealth: 1345-1455

Map of Remikra, 1345-Present

George Borwell publicly announced that he did not intend to run for a full term as Prime Minister. So the 1344 elections were won by Raol Robinson, who took office in January the following year. The Retunian Qor as an official currency took effect at the same time while a five-year program was enacted to provide every Commonwealth citizen an opportunity to exchange their Commonwealth Qors for Retunian Qors at the rates according to the Remikran Credit System.

Along with the re-entry of the Retunian Qor came the official establishment of the minimum starting wage of 15.00 qors (Retunian Qors) per hour. The average starting rate remained at that level for the years of 1345 and 1346. However, with the implementation of the 100-Week Project, which involved a macro-industrial method known as "long-term banking" for the darkfire industry, the economy began to grow, with surplus revenues from the darkfire industry funding the lightfire industry. By 1350, average starting wages increased to 16.71 per hour; and by 1359, it was at 88.93 per hour. In 1360, average starting wages surpassed 100.00 qors per hour. However, mass exploitation against the Commonwealth and its businesses during the Esurchian occupation began to slow such economic growth. Nonetheless, an economic bubble led by a peaking lightfire industry appeared during the Esurchian War. And by 1368, starting wages were at a staggering 837.94 qors per hour.

The lightfire industry collapsed following an investor "freak event" in 1369; and gradually but at an increasing rate, lightfire businesses began to shutter. Such a downturn was rushed by Ancondrian investors dashing, owing to both the downturn and contempt against Commonwealth for its conduct during the Esurchian War. Between 1369 and 1374, unemployment rates began to skyrocket, although the Commonwealth had a much more reliable unemployment infrastructure than the Early Republic to keep citizens' basic needs met. Nonetheless, the Commonwealth Council and the incumbent Prime Minister Rez Kame wasted no time implementing economic policies to reduce unemployment; and thus small businesses emerged spurred by government grants. However, these businesses offered pay based on the required starting wage of 15.00 qors per hour. The Commonwealth up to this point had two markets: one for those making high income from the lightfire and darkfire industries, and the market tailored to those in the lower-paying industries. And with the lightfire industry shrinking at an alarming rate, pressure was on the Commonwealth Council to enact a raise in its minimum starting wage.

Meghan Wen campaigned on such a raise as one of her issues in the 1374 Prime Minister elections, which she won. By that point, the average starting wage had fallen to 256.41 qors per hour. When she took office in 1375, that average had already fallen further to 112.82 qors per hour. It took a surprising amount of effort in collaboration and coalition in Council, but by November of 1375, Prime Minister Wen signed a 20.00-qor minimum starting wage into law. And in 1377, the average starting wage had fallen to 20.32 per hour, and bottomed out to 20.26 per hour in 1380, but never went lower thanks to the 20.00 qors per hour minimum starting wage.

As a result of Prime Minister Wen's tireless efforts to rebalance the economy through the OPEN Forum, which was established in 1375, the economy began to stabilize in 1381 and follow a yearly growth pattern of between 10 percent and -5 percent. The average starting wages grew slowly during that period and reached 30.13 qors per hour in 1396 before starting its predicted shrinkage in value. However, public interest had taken a major shift toward an emerging industry: Library of Circlaria, which had the undying support of Prime Minister candidate, James Lawrence Kontacet, for the 1398 election. Kontacet secured a victory that election, and took office in 1399 to repeal the OPEN Forum and allocate more funding toward the Library. This led to a bubble in the economy with average starting wages to increasing to 54.43 per hour. However, investment scares across the Remikran Union between 1399 and 1400 led this gain to be erased. Average starting wages fell below 30.00 qors per hour in 1400 and bottomed out at 20.39 per hour by 1404, the year Kontacet lost to the candidate Vet Silonk for Prime Minister.

Prime Minister Vet Silonk stabilized the economy by introducing policies to spread more federal funding to scriptfire businesses, but average starting wages struggled to maintain above 21.00 qors per hour, as economic and political uncertainty across Circlaria hampered confidence. Prime Minister Stanley Arland Moore took office in 1417 and raised the minimum starting wage to 25.00 qors per hour, and implemented economic integration policies between the scriptfire industry and Library of Circlaria. This led the Library, now with updated technology, to open its first facility on Planet Nephina in 1419. Average starting wages grew as a result of increased confidence and business growth; and by 1423, the average starting wage had increased to 32.75 qors per hour. The Bar-Tar Sea Council fallout in December 1423 led to a slowdown in this growth, but starting wages still continued to grow, peaking at 40.86 qors per hour in 1426.

The slowdown from the Bar-Tar Fallout, along with deep-trade disappointments involving the Cidaleron Council, led the starting wage to fall to 31.16 qors per hour by the time Prime Minister Mary Anne Heits took office in 1429. That year, however, Prime Minister Heits raised the minimum starting wage to its present level: 35.00 qors per hour. Prime Minister Heits fully re-established the OPEN Forum, whose sentiment began to strongly favor Library of Circlaria. This, along with the re-unification of the RAD Party, led the economy into a period of gradual growth up to the present day, as average starting wages hovered between 35.00 and 40.00 qors per hour.

1 note

·

View note

Text

Income tax return filing: List of required documents

The last day for filing your income tax return (ITR) for the financial year 2020-21 is on December 31, 2021. This year, the Central Board of Direct Taxes (CBDT) has extended the last date for filing ITR for FY2020-21 (AY2021-22) to December 31, 2021. Generally, taxpayers are required to file ITR by July 31 of any year unless extended by the government.

The Income Tax Department is urging the taxpayers to file their ITR for the financial year 2020-21 or assessment year 2021-22 without any further delay. The department has been issuing reminders as the deadline to file a return is December 31.

In this post, we will discuss the list of documents required to file ITR online for the assessment year 2021-22.

Documents in case of salaried employees

Salaried employees need to gather the following documents to file income tax returns in India.

PAN

Form-16 issued by employer

Month wise salary slips

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to taxpayers.

Salary slip consists of all the basic details related to the salary of an individual including basic salary, Dearness Allowance (DA), TDS amount, House Rent Allowances(HRA), Travelling Allowances (TA), standard deductions, etc.

Interest income certificates

The interest earned by an individual from a savings bank account, fixed deposits, recurring deposits, and post office savings account is considered to be ‘Income from Other Sources’ and is taxable.

Thus, it is important to collect the interest certificates pertaining to these, in order to furnish the details of the total interest earned during the financial year.

Investment proofs

Taxpayers can reduce tax liability by claiming exemptions on the investments and expenditures that are eligible for exemption under Section 80C/ 80CCC, and Section 80CCD(1) of the Income Tax Act.

A few common tax-saving investments and expenses are as follows:

Employees Provident Fund

National Pension Scheme

Life insurance premiums paid

Investments in ELSS schemes of mutual funds

Public Provident Fund etc

Form 26AS

Form 26AS reflects the details of every tax deducted from taxpayer income by any deductor and deposited on his behalf. This is provided by the Income Tax Department. This form can be accessed from the I-T Department’s website

Capital gain statement

If the taxpayer invested in shares, mutual funds, etc., he is required to collect a capital gain statement. This statement will be issued by the broking house. It contains the details of all the short-term capital gains.

Even though taxes may not be required to pay on long-term capital gains, the details of the same are to be mentioned in capital gain statement.

Aadhaar number

There is a stay order on the Aadhaar and PAN linking mandate, as the judgment is pending in the Supreme Court. However, it is recommended to keep the Aadhaar card ready as you are needed to provide your Aadhaar number in the ITR form. Aadhaar number makes the e-verification process simpler as you would just have to use the One Time Password (OTP) that is sent to your phone number which is registered with your Aadhaar.

Source: https://www.taxgyata.com/ap/income-tax-return-filing-list-of-required-documents/

1 note

·

View note

Link

If your income more than 2 lakh you need to pay income tax return. Online Legal India can help you to IT Return Filling.

0 notes

Photo

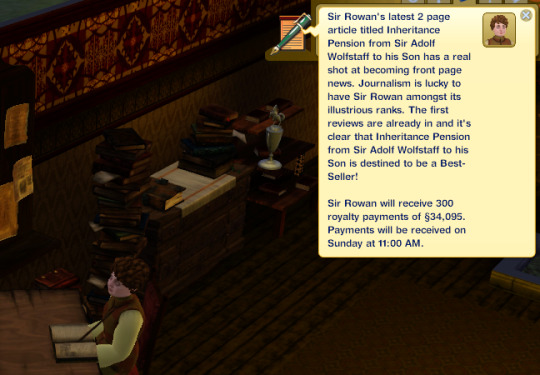

Sims 3 Gameplay tip for playing wealthy sims:

So I was sick of my noble sims losing moneh, and I wanted another way for them to stay rich without having to work for it. So, I had a think, and, Taa-daa!!

I tweaked Nraas Retuner settings by tunable xml - Skills for Writing and changed royalty $$ and page count. Then I had my sim write a 2 page article entitled “Inheritance Pension from Sir Adolf Wolfstaff to his son”. To payout 300 weeks, or 9999999 weeks if you play epic lifetimes and don’t want the weekly Sunday pension/benefit/tax income to ever run out.

If you want to be totally immersive, you could do what I have often done and rename your sim with MC before writing the article then rename your sim back. That way when you get the book delivered it will say it is written by “The City of Praaven”, or whatever you temp-named your sim to be when you wrote it.

I made it 2 pages long because I see the book as more like a contract, or a deed, which can be read in less than 5 sim minutes.

#sims 3#sims 3 tips#sims 3 gameplay#sims 3 tutorial#ts3#ts3 tips#ts3 cheats#ts3 tutorial#ts3 gameplay

22 notes

·

View notes

Text

No tax return home loan | Truss Financial Group

https://trussfinancialgroup.com/no-tax-retun-mortgages

· Truss Financial Group is the biggest stated income lender

· Use your bank deposit history as income

· Wide range of stated income programs

· When other's say "NO", we say "YES"

· Our LO's are trained to listen to your situation and be creative

· 85% Loan to Value

· 650 + Credit Score

· Jumbo Stated Income to $4M

· No Tax Returns

0 notes

Text

How to Register a Company in India in 2025: A Step-by-Step Guide

Starting a business in India can be an exciting venture, but understanding the company registration process can often seem overwhelming. In 2025, the process will become easier thanks to the rise of online company registration services and various government initiatives aimed at promoting entrepreneurship. Whether you're planning to register a Private Limited Company, Limited Liability Partnership (LLP), or a One Person Company (OPC), this guide will walk you through the process step-by-step, helping you get your company up and running in no time.

Why Register a Company in India?

Before we dive into the company registration process in India, let’s quickly understand why registering your company is important:

Legal Identity: Registering your company provides you with a separate legal entity, allowing you to protect your personal assets from business liabilities.

Tax Benefits: Registered companies enjoy certain tax benefits, including tax deductions and exemptions that are not available to sole proprietors.

Access to Funding: A registered company can raise funds more easily through loans or equity, which is crucial for scaling your business.

Credibility: A registered company enhances your credibility with customers, investors, and government agencies.

Now, let’s look at the step-by-step company registration process in India for 2025.

Step 1: Choose the Type of Company Structure

In India, there are several types of company structures you can choose from based on your business goals, scale, and liability preference. Here are the most common types of companies:

Private Limited Company (Pvt Ltd) A private limited company is one of the most popular choices for entrepreneurs in India. It limits the liability of its shareholders to their investment in the company and allows for up to 200 shareholders. It is ideal for businesses that want to raise investment and expand.

Limited Liability Partnership (LLP) An LLP combines the flexibility of a partnership with the limited liability of a company. It is a good option for professionals, small businesses, and family-owned businesses.

One Person Company (OPC) A one-person company is designed for single entrepreneurs who want the benefits of a company structure without partners. It has a simple registration process and limited liability protection.

Public Limited Company If you're planning to raise capital from the public, a public limited company is the right choice. This type of company can issue shares to the public and is governed by more stringent regulations.

Step 2: Obtain a Digital Signature Certificate (DSC)

In India, the company registration process is completely online, and you will need a Digital Signature Certificate (DSC) to sign your application forms electronically.

What is DSC? A DSC is a secure digital key that certifies the identity of the applicant and ensures the integrity of the data being transmitted.

How to Get DSC? You can obtain a DSC from government-approved certifying authorities. The process is simple: submit a proof of identity (PAN card, Aadhaar card, etc.) and proof of address to the DSC provider, who will issue your digital signature.

Step 3: Apply for Director Identification Number (DIN)

If you plan to register a Private Limited Company or LLP, you need to apply for a Director Identification Number (DIN) for the company’s directors. A DIN is a unique number that is assigned to each director and is used for various legal and regulatory filings.

How to Apply for DIN? You can apply for DIN while registering your company online through the MCA (Ministry of Corporate Affairs) portal. The application requires a valid identity proof (PAN card, passport, etc.) and a photograph of the director.

Step 4: Choose a Company Name

One of the first steps in registering a company is choosing an appropriate name for your business. The name must comply with the following guidelines:

The name should be unique and not similar to any existing company name.

The name should not infringe on trademarks or intellectual property rights.

It must end with "Private Limited" for a Private Limited Company or "LLP" for a Limited Liability Partnership.

You can check the availability of the name on the MCA portal before proceeding with the registration.

Step 5: Draft the Memorandum of Association (MOA) and Articles of Association (AOA)

The Memorandum of Association (MOA) and Articles of Association (AOA) are two essential documents required for company registration:

MOA: The MOA outlines the objectives, powers, and scope of the business. It defines the relationship of the company with the outside world.

AOA: The AOA lays down the internal rules and regulations governing the company's operations, including the rights of shareholders and the conduct of board meetings.

These documents need to be signed by the directors and submitted as part of the registration process.

Step 6: Register with the Ministry of Corporate Affairs (MCA)

Once you have all the documents in place, the next step is to register your company with the Ministry of Corporate Affairs (MCA) through the online portal. The registration process involves the following steps:

Fill out the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form: This form is used for applying for company registration, DIN, and PAN all in one go.

Submit the Required Documents: You will need to upload the following documents:

Proof of identity and address of the directors (Aadhaar card, passport, voter ID, etc.)

Proof of the company’s registered office address (electricity bill, rent agreement, etc.)

Signed MOA and AOA.

Pay the Registration Fee: The fee for registration depends on the type of company and the authorized share capital. The payment can be made online through the MCA portal.

Step 7: Obtain the Certificate of Incorporation

After successful submission and verification, the MCA will process your application and issue the Certificate of Incorporation (COI). This is the official document that confirms the registration of your company. It includes:

The CIN (Corporate Identification Number)

The company’s legal name

Date of incorporation

Registered office address

Once you receive the COI, your company is officially registered and recognized by the government.

Step 8: Apply for PAN and TAN

After your company is incorporated, you will need to obtain:

PAN (Permanent Account Number): Required for taxation and financial transactions.

TAN (Tax Deduction and Collection Account Number): Required for deducting tax at source.

These can be applied online through the NSDL website after receiving your Certificate of Incorporation.

Step 9: Register for GST (Goods and Services Tax)

If your company’s annual turnover exceeds the threshold limit for GST registration, you must register for GST. This is necessary to collect and remit GST on the goods and services your company sells.

How to Register for GST? You can apply for GST registration on the GST portal. You’ll need to provide your company’s PAN, proof of business address, and identity documents of the directors.

Step 10: Open a Company Bank Account

Finally, to begin conducting business, you’ll need to open a company bank account. This is essential for keeping personal and business finances separate. Most banks require the following documents to open a business account:

Certificate of Incorporation

PAN and TAN

Identity and address proof of the directors

MOA and AOA

Conclusion

Registering a company in India in 2025 is a relatively simple process, especially with the advancements in online company registration platforms and government initiatives like Digital India. By following the steps outlined above, you can ensure that your company is set up legally and efficiently. Whether you are registering a Private Limited Company, LLP, or One Person Company, the process is streamlined to support India’s growing entrepreneurial ecosystem.

Now that you have a step-by-step guide, take the plunge into the world of business ownership and start building your dream company today!

#tax consulting services#income tax retune#Business Tax Consultant#Startup Registration#Business Compliance#company registration

0 notes

Text

HOW A LANDLORD SHOULD CHARGE THE RENT?

Rent: It means an amount of money paid by the tenant to the landlord for enjoying the right to use the asset owned/held by the landlord, for a specified period of time.

The basic motive of this article is to ascertain the method of charging the rent which should be judicious and acceptable to both tenant and landlord.

Please note that in this article we will discuss the rentals charged on assets used only for business/commercial/economic purposes.

Currently , tenant pays fixed amount of rent to the landlord. This rental amount is determined by the mutual agreement between landlord and tenant. Businesses generally hire immovable property like land and/or building and movable property like plant and machinery etc,. But the basic question is that whether the rental amount determined on mutual agreement basis is fair and judicious. Currently rental amount is determined on the basis of market rate which is in turn determined by the demand for the assets prevailing in the market. The demand for the assets is high when growth rate ( GDP Rate) of a country is high and/or stable. In such bullish trend, the owners charge high rentals because of high demand for the assets.

Now my question is what about the situation , when the economy enters the bearish phase I,e. experiences low growth rate or low GDP rate.

Suppose Mr. A (Tenant) enters into an agreement to hire an asset for business purposes from Mr. B (Landlord) in the year 2015, when the GDP rate was 10% at an amount of Rs. 30000/month, for a period of 5 years. Demand for the assets were too high as gdp rate was high I,e. bullish trend exists. Now from the year 2017, the economy enters recession phase, gdp rate was just 3-4 %. Business of Mr. A also starts struggling during recession phase, faces huge pressure to pay predetermined amount of rent which was determined in the year 2015 on market basis.

Now my question to you is that should the rent amount be revised as now, the market conditions have changed.

My answer is yes. Basically , first of all we should be aware about the ACT governing the rental agreements in india. In india , rental contracts are governed by RENT CONTROL ACT, 1948. But the question is whether this act is really much efficient to effectively govern the rent agreements. My answer is NO. There are various flaws in RENT CONTROL ACT, 1948. E,g. it does not stipulate the METHOD of charging the rent amount. It does not provide for maximum rent amount a landlord can charge from tenant. Also, various states have passed their own rent control acts, so it is ineffective in such states.

Now here are my few suggestions to overcome the above limitations in RENT CONTROL ACT, 1948. These are:-

1.Rent control act like the income tax act1961, shall be applicable to whole of india. There should not be any state rent control act.

2.For land and/or building, rent should be charged on the basis of rate per square feet or rate per cubic feet, as the case may be. But the important point to be noted here is that such rate should vary with the economic growth rate ( GDP rate).i,e. if GDP rate decreases, rate per square feet or rate per cubic feet should also decrease, thereby providing some relief to businessman during recession phase. But if GDP rate increases, rate per square feet or rate per cubic feet should also increase, thus providing extra benefit to landlord to enjoy bullish phase of an economy, because landlord sacrifices the returns during recession phase.

3. For the plant and machinery, (depreciation amount+ normal rate of retun on such depreciation amount), should be charged by the owner of such asset. Of course , normal rate of return should be subject to GDP rate prevailing in an economy.

4. Rent Rates for each geographical area in india should be clearly prescribed. Any variation in such rates should be communicated through an effective mechanism.

5. All rent agreements should be governed by RENT CONTROL ACT, 1948.

Your comments are most valuable.

1 note

·

View note

Text

Middle Remikra Rent and Wages

Article Written: 3 September 1452

Early Republic: 1238-1301

Map of Remikra, 1264-1308

In 1238, when the surrounding territories of the Basin District gained independence from Combria, the new nation of the Federal Estates of Retun established a democratic government and a new currency. Its currency, the Retunian Qor, was based on the exchange of credit gained in the form of Combrian Merchant Qors, and the base unit of the new currency was based on the quantity of Remikran Union Credits. Eleven years later, Prime Minister James Black signed into law the first minimum starting wage: 1.00 Retunian Qor per hour. This payment, at the time, was enough to cover expenses necessary for a comfortable living; and employees would receive a 1.00 qor raise every year, based on the employer pay scale, so that come retirement 40 years later, an employee would be making 40.00 qors per hour. Furthermore, employees worked six hours a day for six days a week (remember, a week is eight days in the Circlarian Calendar). This meant that, for a first-year employee, gross yearly salary would be 1080.00 qors per year.

Taxes were imposed on businesses in terms of capital gain but were also imposed on employees in terms of their income. The income tax rate was 5 percent each for the estate, the municipality, the county, the province, and the federal levels. These taxes were aggregated into a singular tax bill charged to each individual, with the bill making up approximately 25 percent of income. And such taxes would go to pay for infrastructure including food, water, sewage, electricity, energy, housing, transit, communication, critical infrastructure (police, fire, healthcare), and education. With this established, Retunians paid rent via the tax bill. For an individual making 1.00 qor per hour or 1080.00 qors per year, such a tax bill would amount to 270.00 qors per year.

Upon taking office in 1261, Prime Minister Edward Jackson initiated economic reform by raising the minimum starting wage to 2.50 qors per hour, and allowing private banks and businesses to buy out publicly-held estates and charge rental adjustment fees up to 7.5 percent of an individual's income. This meant that a first-year employee would be making 2700.00 qors per year but would be paying 877.50 qors per year in the estate tax bill, which included the rental adjustment fee. As business growth ensued, employers found themselves competing for employees, creating pressure to raise starting wages. This made the average starting wage go up to 2.51 qors per hour in 1263, to 2.53 qors per hour in 1264, and to 2.56 qors per hour in 1265. It surpassed 3.00 qors per hour in 1270. And by 1272, the average starting wage was 3.51 per hour, with a yearly gross salary of 3790.80 and an estate tax bill of 1232.01.

Numerous financial institutions had invested in deep-trade through loans in 1272. However, between 1273 and 1274, a market crash ensued as the result of fallout in deep-trade with the Acreans, prompting private estates and their lending banks to raise the rental adjustment fees from 7.5 percent to 10 percent of income. This decision was made at a summit between flat managers and bank figures in 1276 and, with the approval of Retunian Council in a sweeping legislative measure, took effect in 1277. There was little to no protest from the people over this as not only did it not receive media coverage, but also the increase was relatively minimal while starting wages were surpassing 5.00 qors per hour.

However, bankers and flat managers convened in a similar manner in 1281 to raise rental adjustment fees to 15 percent starting in 1282, and met again in 1286 to raise them to 20 percent for 1287. It was when they convened in 1291 to raise them to 30 percent for 1292 that numerous citizens began to demonstrate contempt. Starting wages at that point had stagnated, which had further solidified the growing opposition of the population against the Jacksonian economy. It was for the 1296 elections that Ereautean governor John Waltmann campaigned for Prime Minister with one of his agendas being to lower the rental adjustment fees to 15 percent. This, along with his promises to establish national healthcare, education, and transportation standards, led him to beating the incumbent Prime Minister Arthur Cummings that year.

While Waltmann followed through with his infrastructure standard promises, he and his fellow Progressive Party colleagues encountered stiff opposition from politicians backed by the banks, who resented such lowering of the rental adjustment fees. In November 1297, they reached a compromise and settled with a 25 percent cap on the rental fees while Waltmann signed into law a measure to raise the minimum starting wage to 10.00 qors per hour.

In 1298, Retunian legislature amended the bill capping the rental fees at 25 percent to include exemptions for estates to temporarily raise them in case of financial strain; and such an amendment which would prove catastrophic in the years to come. Between 1298 and 1301, the economy recovered from its temporary slump beginning in 1290, and began to grow again, leveraging itself on promising investments for lightfire trade in Ancondria. However, in 1301, the banks held a summit and decided to liquidate all investments involving Ancondria, leading the market to collapse. Millions of jobs were lost as the minimal growth in wages was erased, falling back to the minimum 10.00 qors per hour. At the same time, estates and banks feeling financial pressure, as well as attempting to maximize marginal profits, invoked the emergency clause passed in 1298 and raised rental adjustment fees up to 27.5 percent in 1303. They made similar increases in 1304, 1305, 1306, 1307, and 1308. By 1308, rental adjustment fees were at a staggering 40 percent.

Early Commonwealth: 1310-1344

Map of Remikra, 1312-1319

Such high rental fees resulted in political tension leading to the toppling of the incumbent Waltmann Administration, establishment of the Fourth Amendment, and establishment of the Finzi Administration. The Finzi Administration repealed private estates and banks, as well as the rental adjustment fee altogether. This meant that the estate tax bill consisted only of 5 percent of income going each to the estate, municipality, county, province, and federal governments, just like it did before Jackson. Furthermore, the Finzi Administration established a new currency: the Commonwealth Qor.

In payment of Commonwealth Qors, minimum starting wage was set at 15.00 qors per hour. Initially, in 1310, one Commonwealth Qor was worth seventeen Retunian Qors, meaning that employees were making the equivalent of 255.00 Retunian Qors per hour. The issue with the Commonwealth Qor, however, was that it was based on and directly exchangeable with one darkfire floan (or darkfire tradestone). This was not originally an issue; in fact, with darkfire floans increasing in value, the value of the Commonwealth Qor increased as well. By 1314, one Commonwealth Qor was worth 38.51 Retunian Qors. The issue was that by 1314, hordes of Commonwealth citizens decided to invest in the recently-legalized industry of darkfire production. This was due to the initial explosion in demand. But by 1314, the darkfire floan supply outpaced the growing demand, and began to decrease the value of the floan. Furthermore, the darkfire concentration of the floan began to decrease due to overproduction. In 1317, as a result, the Commonwealth Qor began to decrease in value. And its economic impact began being felt by the 1320s.

In 1325, the value of the Commonwealth Qor fell below the Remikran Credit value of 1.00 Retunian Qor, prompting Commonwealth legislature to pass amendments to minimum wage standards to set starting minimum wage to the Commonwealth Qor equivalent of 15.00 Retunian Qors per hour. The Commonwealth Council also paid with stimulus checks to back-credit those who worked during that year. The Commonwealth Qor, meanwhile, continued to fall in value. In 1326, 1.00 Commonwealth Qor was equal to 0.27 Retunian Qors; and in 1327, it was 0.07 Retunian Qors. It was around this time that bank reserve treasurers began buying darkfire floans with Remikran Credit and exchanging them with the Commonwealth government for Commonwealth Qors, transferring the resulting financial gains into trust funds for business grants. This was an act of which the lightfire industry began to take advantage.

Alex Schraber, campaigning on a platform of economic reform and restoration of societal stability, had won the 1332 elections and taken office in 1333. By 1333, one Commonwealth Qor was worth 0.000006 Retunian Qors; and upon executive order, Prime Minister Schraber ended the Commonwealth-Qor-floan exchange and re-established the Commonwealth Qor as a fiat currency very much like the Retunian Qor. The new Prime Minister, furthermore, mandated the trust funds to be utilized to further fund the lightfire industry or face taxation. Schraber's policies led the Commonwealth Qor to recover its value to a certain degree. By 1338, the Commonwealth Qor was worth 0.0011 Retunian Qors. However, inflation pressure from a now-robust lightfire industry led the Commonwealth Qor to begin losing value again in 1341.

By 1344, the Commonwealth Qor fell back to 0.00043 Retunian Qors. Facing domestic backlash for his aggression in Ancondrian politics, Prime Minister Schraber resigned from his post that year and was replaced by Interim Prime Minister George Borwell, who signed into law the Seventh Amendment of the Retunian Constitution, which re-established the Retunian Qor as the official currency.

Commonwealth: 1345-1455

Map of Remikra, 1345-Present

George Borwell publicly announced that he did not intend to run for a full term as Prime Minister. So the 1344 elections were won by Raol Robinson, who took office in January the following year. The Retunian Qor as an official currency took effect at the same time while a five-year program was enacted to provide every Commonwealth citizen an opportunity to exchange their Commonwealth Qors for Retunian Qors at the rates according to the Remikran Credit System.

Along with the re-entry of the Retunian Qor came the official establishment of the minimum starting wage of 15.00 qors (Retunian Qors) per hour. The average starting rate remained at that level for the years of 1345 and 1346. However, with the implementation of the 100-Week Project, which involved a macro-industrial method known as "long-term banking" for the darkfire industry, the economy began to grow, with surplus revenues from the darkfire industry funding the lightfire industry. By 1350, average starting wages increased to 16.71 per hour; and by 1359, it was at 88.93 per hour. In 1360, average starting wages surpassed 100.00 qors per hour. However, mass exploitation against the Commonwealth and its businesses during the Esurchian occupation began to slow such economic growth. Nonetheless, an economic bubble led by a peaking lightfire industry appeared during the Esurchian War. And by 1368, starting wages were at a staggering 837.94 qors per hour.

The lightfire industry collapsed following an investor "freak event" in 1369; and gradually but at an increasing rate, lightfire businesses began to shutter. Such a downturn was rushed by Ancondrian investors dashing, owing to both the downturn and contempt against Commonwealth for its conduct during the Esurchian War. Between 1369 and 1374, unemployment rates began to skyrocket, although the Commonwealth had a much more reliable unemployment infrastructure than the Early Republic to keep citizens' basic needs met. Nonetheless, the Commonwealth Council and the incumbent Prime Minister Rez Kame wasted no time implementing economic policies to reduce unemployment; and thus small businesses emerged spurred by government grants. However, these businesses offered pay based on the required starting wage of 15.00 qors per hour. The Commonwealth up to this point had two markets: one for those making high income from the lightfire and darkfire industries, and the market tailored to those in the lower-paying industries. And with the lightfire industry shrinking at an alarming rate, pressure was on the Commonwealth Council to enact a raise in its minimum starting wage.

Meghan Wen campaigned on such a raise as one of her issues in the 1374 Prime Minister elections, which she won. By that point, the average starting wage had fallen to 256.41 qors per hour. When she took office in 1375, that average had already fallen further to 112.82 qors per hour. It took a surprising amount of effort in collaboration and coalition in Council, but by November of 1375, Prime Minister Wen signed a 20.00-qor minimum starting wage into law. And in 1377, the average starting wage had fallen to 20.32 per hour, and bottomed out to 20.26 per hour in 1380, but never went lower thanks to the 20.00 qors per hour minimum starting wage.

As a result of Prime Minister Wen's tireless efforts to rebalance the economy through the OPEN Forum, which was established in 1375, the economy began to stabilize in 1381 and follow a yearly growth pattern of between 10 percent and -5 percent. The average starting wages grew slowly during that period and reached 30.13 qors per hour in 1396 before starting its predicted shrinkage in value. However, public interest had taken a major shift toward an emerging industry: Library of Circlaria, which had the undying support of Prime Minister candidate, James Lawrence Kontacet, for the 1398 election. Kontacet secured a victory that election, and took office in 1399 to repeal the OPEN Forum and allocate more funding toward the Library. This led to a bubble in the economy with average starting wages to increasing to 54.43 per hour. However, investment scares across the Remikran Union between 1399 and 1400 led this gain to be erased. Average starting wages fell below 30.00 qors per hour in 1400 and bottomed out at 20.39 per hour by 1404, the year Kontacet lost to the candidate Vet Silonk for Prime Minister.

Prime Minister Vet Silonk stabilized the economy by introducing policies to spread more federal funding to scriptfire businesses, but average starting wages struggled to maintain above 21.00 qors per hour, as economic and political uncertainty across Circlaria hampered confidence. Prime Minister Stanley Arland Moore took office in 1417 and raised the minimum starting wage to 25.00 qors per hour, and implemented economic integration policies between the scriptfire industry and Library of Circlaria. This led the Library, now with updated technology, to open its first facility on Planet Nephina in 1419. Average starting wages grew as a result of increased confidence and business growth; and by 1423, the average starting wage had increased to 32.75 qors per hour. The Bar-Tar Sea Council fallout in December 1423 led to a slowdown in this growth, but starting wages still continued to grow, peaking at 40.86 qors per hour in 1426.

The slowdown from the Bar-Tar Fallout, along with deep-trade disappointments involving the Cidaleron Council, led the starting wage to fall to 31.16 qors per hour by the time Prime Minister Mary Anne Heits took office in 1429. That year, however, Prime Minister Heits raised the minimum starting wage to its present level: 35.00 qors per hour. Prime Minister Heits fully re-established the OPEN Forum, whose sentiment began to strongly favor Library of Circlaria. This, along with the re-unification of the RAD Party, led the economy into a period of gradual growth up to the present day, as average starting wages hovered between 35.00 and 40.00 qors per hour.

For more content, subscribe here:

https://libraryofcirclaria.substack.com/

Subscription Options:

Free Subscription: receive emails and view public content.

Paid Subscription: receive emails and view public content as well as content for paying subscribers.

Paid Subscription Level Options:

Monthly Subscription: 8.99 USD per month

Yearly Subscription: 89.99 USD per year

1 note

·

View note

Text

Best Guide for Filling out Your Tax Return

Declaring income tax returns was quite tiresome when we did it in the physical layout. On-line declaring has actually made this process far simpler as well as time-saving. It is unbelievably hassle-free to file your tax returns from the convenience of your home or office without needing to make multiple journeys to the income tax office. You can also occupy an income-tax-return declaring training course to discover just how to assemble all the information required to file your ITR.

Here are a few vital points that will help you in submitting your income tax returns appropriately.

Picking the Right Form

It is vital to choose the right for filing your tax return. There are several forms available online for various assessees according to their nature of revenue. The very first step for declaring income tax returns is choosing the appropriate application form.

Quoting the Correct Frying Pan and also Tax Credit Report Declaration

You require to visit to the government portal for filing the tax return and after that enter your Permanent Account Number (PAN). It is important to go into all the figures of the number properly as even the smallest of mistakes can create mistakes. If you wish to confirm your PAN online, you can do so on-line from the earnings tax sites. As soon as you log in, you will see the TDS declaration by the earnings tax obligation department. It is called Type 26AS and also is available online.

Bank Details and also Various Other Incomes

Keep your financial institution details and details of other sources of income convenient while filing your tax return online. As per the new income tax regulations, reimbursements up to Rs. Twenty-five thousand can be credited to your savings account. For this reason, it is necessary to offer upgraded financial institution details such as bank account numbers as well as IFSC codes. When filing your returns, you should mention the information of any kind of revenue from other resources, such as any gaining from funding gains, common funds, saving down payments, investments, or any kind of revenue from other services or resources.

Information of foreign assets

The Earnings Tax Obligation Act of 1961 states that any type of person that is a tax-payer of India should pay tax obligations for any type of various other foreign assets held by them. You need to supply details concerning such assets or any type of earnings gotten from such possessions abroad, together with your checking account information.

Insurance Claim Reductions for Tax Cost Savings

You can assert advantages of specific reductions at the time of submitting your tax return. These payments are subtracted at the time of filing claims to make sure that you can obtain the credit scores while refining the return itself. You need to check which of these repayments drop under the qualification criteria under sections 80D, 80C, etc. You can quickly comprehend all these through a tax return filing training course.

Filing your income tax returns on time

Submitting the revenue tax obligation retunes in time is extremely vital; otherwise to stay clear of paying any interests and also penalties. Declaring returns timely enables quicker handling of refunds, if any. You can likewise register on your own in an income-tax-return filing course to learn how to submit your tax obligations in a foolproof fashion.

0 notes

Text

WHAT IS AN IRS SFR OR IRS ASFR❓🤷♂️🤷🏼♀️

the SFR is a “SUBSTITUTE FOR RETURN” or ASFR Program, “Automated Substitute for Return” Program

If you fail to file a Tax Return, the IRS on Its own can and many times File a Tax Return for you. It’s generally not a pretty picture.

The IRS will take Wage and Income Data the IRS has Collected about you and File a Tax Retun with you as Single or Married Filing Seperate. Depending on the year, you will also get a Personal Exemption and NOTHING MORE.

If you are Married, have Dependent Children have Mortgage Interest, Charitable Contributions and ANY OTHER DEDUCTIONS, ADJUSTMENTS OR CREDITS, THE IRS WILL NOT GIVE YOU ANY OF THEM.

Many times it also includes Stock Sales, Sale of Real Estate, Cancellation of debt, Wages, Pension Income Self-Employment to name the most common items the IRS will use.

The ASFR program assesses tax by authority of Internal Revenue Code (IRC) 6020(b). IRC 6020(b) provides the authority to assess tax based on reported income information when a person fails to submit a required return.

The IRS does give you the opportunity to dispute the SFR Assessment, but if you don’t respond to the IRS examination report, it will eventually become a final assessment. It will also include, penalties and interest.

Many Taxpayers that receive the examination report for the SFR assessment DO NOT RESPOND AND THE ASSESSMENT BECOMES FINAL‼️

You are the Potential Person I am trying to reach.

I have inquiries on a weekly basis from someone who Never Responded to the IRS letters and has now Walked into my office with a HUGE Tax Bill and either does not UNDERSTAND why they owe or know they don’t owe such a large amount.

GET SOME TAX RELIEF

The Good News, you can generally reduce or elimate the amount says you owe by in several different ways.

The easiest way is t o File an Original Tax Return to Reduce or Eliminate what you owe. The Tax Return you File will include your Spouse and Chikdren if you have them, and ALL the deductions, business expenses and credits you are legally entitled to.

The process is called an Audit Reconsiderstion.

Another way may be to File an Offer in Compromise under the category of Doubt as to Liability, a more complex procedure.

Another may be to simply wait for the Statute of Limitations to end. A Statue of limitations is a law that provides the length of time that the IRS has to collect the Tax you my owe them.

This is just some of the many options that may be available to you. Either do more research or get Professional Tax Help.

The IRS may provide some basic information but I would not count on them to have your best interest in mind.

David M. Ramirez, EA,JD, MST, USTCP, NATPI Fellow

#accounting#tax relief#business#taxprofessional#taxreduction#personal debt#tax reprieve#tax help#tax#tax expert#taxes#taxpayers#tax preparation

0 notes

Video

youtube

Income Tax Retun (ITR) ਫਾਈਲ ਅਜੇ ਤੱਕ ਨਹੀ ਕੀਤਾ, ਹੁਣ ਕਿੰਨਾ ਜੁਰਮਾਨਾ ਪਵੈਗਾ ਤੁ...

0 notes

Link

Documents Required for Foreign Nationals In case the applicant is a Foreign National, please submit the following documents for identity and address proof: Identity Proof -------------------------------------------------

1. Attested copy of Applicant Passport

2. Attested copy of VISA (If applicant is out of native country).

3. Attested copy of Resident Permit certificate (If applicant is in India) Address Proof -----------------------------------------------

1. Attested copy of Applicant Passport

2. Attested copy of any other Government issued Address Proof

3. The identity and address proof of foreign nationals must be attested by the following authorities: Embassy of Native Country (If applicant is out of native country) Apostilized by Native Country, after Public Notary (if country is in Hague Convention) Consularized by Native Country, after Public Notary (if country is not in Hague Convention)

Subscribe Our Channel: ➨ https://www.youtube.com/channel/UCcIX...

Follow me on Social Media:

➨ Facebook: https://www.facebook.com/HelloTaxIndia

➨ Linkedin: https://www.linkedin.com/company/hell...

➨ Twitter: https://twitter.com/HelloTaxIndia ▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾

➨ Website:https://hellotax.co.in/

➨ Writes to us: [email protected] ▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾

Hello Tax Official Youtube Channel. HelloTax is an easy, cost effective and quick way to file income tax return (ITR Filling App) and stay updated with income-tax information for the salaried class assesses in India. HelloTax is available for Android users in Play Store, for Apple users in iOS Store Phone users, also for desktop and mobile browser. HelloTax aims to empower customer with user friendly and efficient income tax filling Solution. One can file ITR filling in three minutes and track tax data online thereafter. The app comes with some interesting features such as, quick income tax refund status, transaction history, tax calculator, PAN card details, document storage, etc. One of the best Income Tax Return (ITR) Application. (Income Tax Return Application, ITR APP, Income Tax, Online Return, ITR, Income Tax, Easy ITR, Easy Income Tax Return Application). Income Tax filing is now a mandatory compliance requirement as per section 139 (1) of the Income tax act in India. Also, E-retun

#ForiegnCompany#NRI#CompanyIncorporation#ForiegnNationas#BestInvestment#LLP#HelloTax#HelloTaxIndia#WealthManagement

0 notes

Text

GST RETURN INCOME TAX RETUNS TAX AUDITS ADVANCE EXCEL & ACCOUNTG

GST RETURN INCOME TAX RETUNS TAX AUDITS ADVANCE EXCEL & ACCOUNTG

H S G H & Co (CA firm at Vashi) #omaccounting.in Location : Navi Mumbai MH IN Should have knowledge of filling Income Tax Returns ITR 1 TO 6. Should have knowledge of finalization of accounts and Tax Audits.

#OmAccounting.in #GstAccounting #GstReturns #accountingServices #accountingOutsoucing #onlineAccounting #gstecommerceaccounting #CASupportServices #GstAcoountingServices #ecommerceAccounting…

View On WordPress

0 notes