#in other news i finally bought nine sols

Explore tagged Tumblr posts

Text

just gotta survive two more days until my finals are over and i can finally play the games i impulse bought!!! fuck!!!!!

#in other news i finally bought nine sols#ok its not entirely because im obsessed with collage rn (the band that sang the games theme song)#the art style is super cute. gameplay wise its sort of in the vein of hollow knight which i loved (even though i never beat it LMAO)#the entire aesthetic slaps also. 'tao-punk' is just one of those concepts that appeals to me specifically#also jacob gellers been recommending it a lot and i trust jacob gellers game recs LMAO#BUT ALSO nine sols the song by collage is also really good (<- obsessed with collage rn)

7 notes

·

View notes

Text

Campfire Story

Pairing Jared x reader

A/N: This is for the SOL - Heat of summer challenge hosted by @thing-you-do-with-that-thing

Activity: camping

Warnings: fluff, some language

Summary: a youngster’s curiosity launches a tale of love at first sight.

We sat around the campfire roasting marshmallows and making s’mores. It was early evening, the kids were still awake and Jensen had just finished leading a round of campfire songs. Jared fed me a s’more, laughing as it dripped down my chin. Dani, Jensen and the kids all joined the merriment as did I, right after I playfully slapped my husband for the fiasco.

Once the amusement had somewhat settled, Odette came to sit on my lap, snuggling in to sleep. Shep came to sit with Jared and asked a question none of us ever expected.

“Dad, how did you and Mom meet?”

Jensen and Dani both stifled a laugh as Jared’s eyebrows shot up. Of course, it didn’t help when Thomas also joined the inquisition Shep had started. My husband and I exchanged looks, then we all settled in as he began the story.

_______

It was nine years ago when we first met, though no one would have suspected love at first sight. He had been backing his trailer into the site next to mine, and accidently veered left instead of right. My brand new bicycle went from being a beautiful shiny piece of machinery, to a smashed pile of metal in a matter of seconds. I was furious. This was my newest acquisition, I had scrimped and saved for this bike for over a year. Jared got out of his truck to apologize, but he never got a chance. I laid into him like lightning, cursing his poor eyesight and amateur driving.

“What the hell! I just bought that bike! Do you have any idea how much I had to save to get it or how long I had to save? I hadn’t even had a chance to ride it!”

His eyes were very apologetic as he spoke. “I am so sorry. I will replace the bicycle. That won’t be a problem.”

I didn’t even take his words into consideration, my anger still high in my system. “That’s great, but how does that help me right now? That was supposed to help me get around the campground, which, in case you haven’t noticed, is quite extensive.”

Before he could say anything else, I stomped away, needing to cool down and regain some of my composure. My mind was reeling over the idea of all that money, gone, just like that, not to mention the bicycle I’ve wanted since forever, now a distant memory. I fought back the tears that threatened to cloud my vision as I absently walked along the park roads. It was almost dark by the time I returned, but not dark enough that I didn’t notice the brand new mountain bike propped up by my car. It came with a shiny bow and a note with another apology.

The card was signed Jared. I shook my head in disbelief as my eyes darted from the card, to the bike, to the trailer of the man who had been the object of my anger earlier. This man had replaced my bicycle even though I had been so mean to him earlier. I felt horrible at my treatment of him. I wondered how on earth he had gotten the money that fast, but first I needed to apologize to him.

I knocked on the trailer but got no response, so I went for plan B. I made dinner, enough for two, and put an invite on his screen door, taking a chance that he would be back soon. Luck graced me with Jared’s presence a few minutes later, as he came over after seeing the note on the door. He had gone jogging after I had stomped off. His face was a mix of confusion and fear, and I knew it was because of me. He came over slowly, hesitant to believe this was legit, relaxing slightly when I smiled and waved at him. He came closer, noticing the two settings for dinner, where steak, potatoes and salad awaited his presence. I motioned for him to sit.

He cleared his throat. “I, uh, see you got the new bike. Hope it’s the right one.”

I nodded. “It is, thank you. I owe you a huge apology Jared. I don’t know where you got that kind of money that fast, but I’m glad you did. The biggest reason for my anger was the price of the two-wheeler. I had to save well over a year to purchase it.”

He shrugged and nodded in understanding. “You don’t need to apologize. I’m the one who ran over the bike in the first place. Replacing it was the least I could do.”

“Well, thanks all the same. My name is Y/N.”

“Jared.” He held his hand out and I shook it, heat sizzling between our skin as it connected. “Jared Padalecki.”

My jaw dropped. Now I knew where I’d seen him before. My cheeks burned with embarrassment as I replayed my actions in my mind. He noticed my reaction and smiled, and my heart did a flip-flop.

“Oh my God, Holy cow. I’m so sorry for reacting the way I did.”

He held his hand up. “No need to go all formal on me. It’s just Jared. I’m just a regular guy like you.” I giggled as he realized the blunder. “Ok, maybe not exactly like you.”

We both burst out laughing. “Ok, Just Jared, I’ll treat you like any other guy, but I have one condition.” He raised a brow and I smiled. “I get a selfie with you so when my friends don’t believe me that I met you, I will have proof that I not only met Jared Padalecki, but I also camped beside him.”

His deep laughter broke the silence once again. He countered my condition with one of his own. I nearly fell over when he said, “I’ll do you one better. I will take a selfie with you if you go out with me. Be my girlfriend.” He paused as he watched my jaw drop once again and my eyes widen like I’d seen a UFO.

I was literally dumbfounded. “I’m just an ordinary girl. Surely there are other girls out there, especially for a handsome popular actor such as yourself. Why me?”

He smirked at my innocence. “I like you Y/N. You’re different. You don’t hesitate to speak your mind, and your personality is more real than a lot of the ‘popular girls’ out there. You make me smile and you make amazing food. Your E/C eyes sparkle in the moonlight. So…” He took my hand and placed his high school ring on my finger, after finding one that it fit. “Y/N, will you be my girlfriend? I’m not gonna lie to you, this will put you in the public spotlight. You’ll become famous by association, everything you do will be put under the microscope and scrutinized by the media all the time. But, if you say yes, I will become the luckiest man in the world.”

I stared. Jared Tristan Padalecki wanted to date me, someone he’d only just met, who had yelled at him no less. I pinched my arm, watching Jared chuckle as I yelped, a clear acknowledgement that I was indeed awake. Finally I nodded, and slowly rose from the table to sit beside him. “So all of this is real, you really like me and you want to be my boyfriend. Does that pretty much sum it up?”

He leaned in and pressed his lips to mine in a soft kiss. I closed my eyes and leaned into the connection, threading my fingers through his soft brown hair. He moaned as I did, and when the kiss finally ended, I got my answer. “Yes.” Came out of that perfect mouth. I was definitely smitten and so was he.

---

My husband kissed the top of Shep’s head and hugged Thomas. Odette had long since nodded off. Jensen and Dani were cuddled close, sighing contently as the love story ended.

Jensen smirked. “So it really was love at first sight, huh? Well I’ll be damned.”

I laughed gently, and the others joined in. Just as we quieted down, a car pulled up. Misha and Victoria stuck their heads out. “Hey, sorry we’re late. What’s so funny?”

“Love.” We all chimed together, laughter ringing through the campsite.

17 notes

·

View notes

Text

Art Director week

This week we were tasked to be art directors. we were paired up and one had to choose an article for the other and vice versa.

Illustrator’s POV

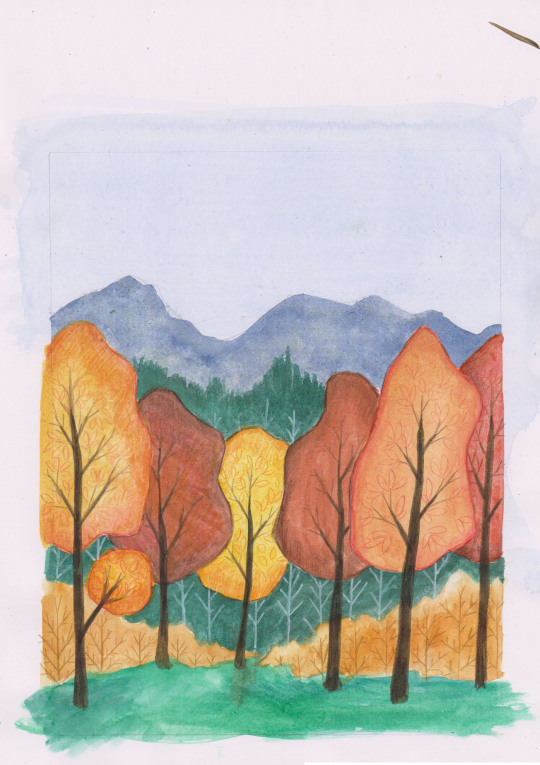

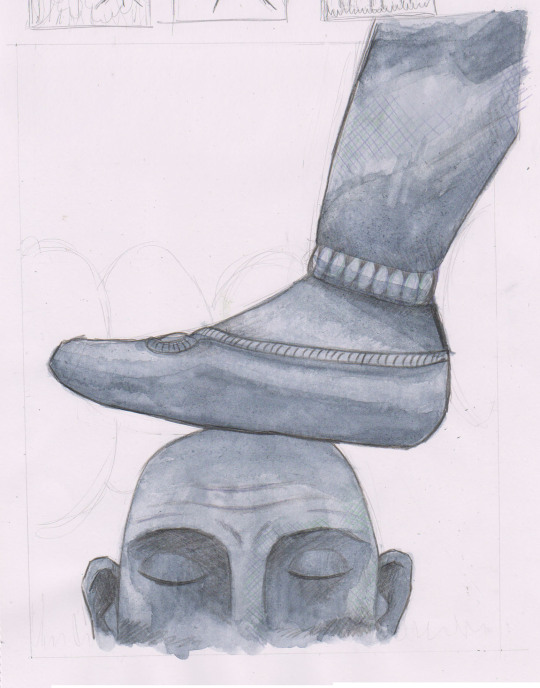

I was partnered with my friend Amara, and she gave me an article to create an editorial illustration for from The New Yorker Magazine titled “ Returning to Storm King”

The text went as follows:

“Few installations at the Hudson Valley sculpture park are new, but in this pandemic summer the park’s breeze, changing light, and theatre of clouds are novelty enough.

What’s with the metal-band-worthy name of Storm King, the marvellous sculpture park—or, better, landscape with sculptures in it—about fifty miles north of Manhattan, in Cornwall, New York? I’ve just spent some happy hours there, sprung from months of art deprivation, on the occasion of the Storm King Art Center’s reopening to visitors with timed tickets. The setting is thundery enough, under the mighty brow of one of the highest mountains of the Hudson Highlands, in a valley of variegated hills, lawns, meadows, forest, and waters, along with elegant alterations that include arboreal allées and plantings with deference to native flora—some five hundred acres hosting roughly a hundred art works. I hadn’t known, until I was told during my visit, that the park’s name owes its provenance to the Romantic exasperation of a writer who, in 1853, pressed locals to rebrand their principal mountain Storm King from—get ready—Butter Hill. That nineteenth-century embrace of the hyperbolic anticipated the moxie, in 1960, of two art-loving businessmen, Ralph E. Ogden and his son-in-law H. Peter Stern, who gradually acquired much of the valley. They founded the park as a nonprofit entity, made a museum of an existing château on a hilltop, and pondered the ambient possibilities of the terrain.

In 1967, Ogden bought thirteen works from the estate of America’s greatest sculptor, David Smith. Mostly made of welded steel, they deploy a repertoire of shapes, from the surreally animate to the nobly abstract, gracing dancerly postures with lyrical drawings in space. A suite of eight of them, currently installed under cathedralesque oak and black-walnut trees, is modestly scaled. Not so the vista-dominating, gestural arrays of mostly steel elements by a favorite of the collectors since 1968, Mark di Suvero, which at times suggest playground facilities for giants. Nine of those were supplemented last year by a three-year loan of “E=mc²” (1996-97)—a tower, more than ninety-two feet high, whose converging I-beam legs are topped by flaring forms in stainless steel that grab at the sky. Also monumental are two maximum-sized stabiles by art’s foremost bejeweller of air, indoors or out, Alexander Calder. There are major works, as well, by Richard Serra, Andy Goldsworthy, and, most recently, Maya Lin, whose earthwork “Storm King Wavefield” (2007-08) represents a vast expanse of mid-ocean waves, up to fifteen feet high, with grassy undulations.

Sculpture parks proliferated, worldwide, in the second half of the twentieth century, in the wake of an identity crisis for large three-dimensional art. Modernist austerity had stripped sculpture of its traditional architectural and civic functions: there were no more integrated niches and pedestals, few new formal gardens, and an epochal apathy regarding statues—until lately! (We are now practically neo-Victorian in our awakenings—rude, for the most part—to symbolism in statuary.) Never mind the odd plaza-plunked, vaguely humanist Henry Moore. Where could one put outsized works that were almost invariably abstract—modernism’s universalist ideals persisting—to give them a chance of seeming to mean something? In nature! Conjoining the made with the unmade, gratifying both. Sculpture parks emerged as game preserves and laboratories for big art. Storm King’s early concentration of works by relevant artists of the late nineteen-sixties and seventies includes some formulaic banalities, tending to presume a surefire magic in embowered angular geometry, but even there you may savor the zest of a moment when sculpture jumped into nature’s lap. The history is complicated and obscured, in the art world, by the contemporaneous development, in the sixties, of Minimalism, which, by engaging the physical presence of viewers, shrugs off its surroundings. (The park’s chastely white modular piece by Sol LeWitt doesn’t mind a bucolic site one way or another.) As a consequence, Minimalism sidelined poetic potencies that prove their lasting worth at Storm King.

Prior visitors won’t be kept away by learning that few installations in this pandemic summer are new. The park’s changing light, breezes, and theatre of clouds will do for novelty. The best recent addition, on view until November 9th, is “River Light” (2019), a ring of nine high-flying cyan-blue silk flags that Kiki Smith derived from a sun-sparkled film she made on a walk along the East River. Wind stirs the fabric to rippling, soft applause. The ensemble suggests a rallying point for angels. Also new is “A stone that thinks of Enceladus” (2020), a piece by a young New York-based artist, Martha Tuttle, which consists of a mowed field studded with boulders and cairns and rather hectically festooned with carved rocks and molded glass stones. Close by, propped on an island in a pond, is a startling curio, the hull of an America’s Cup-grade racing boat that, in 1994, was prettily decorated with a mermaid motif by Roy Lichtenstein. Its abrupt presence, which you may less look at than gawk at, invokes the metaphysical truth that everything has to be somewhere. Storm King’s prevalent rectitude might serve as a foil for other sorts of interesting shocks, within appropriate limits.”

The images needed to be 1980 x 2560 pixels and my art director wanted me to capture the hudson valley landscape in the image.

I did some research of the sculpture park and sent my roughs in:

The third image was approved.

I tried a new technique with this piece that I have been meaning to try for a while. I used Watercolour and coloured pencils to introduce some textures in my work and I drew the background and foreground seperately so that the image could have a collage-inspired feel to it. The collage style didn’t end up as I was hoping but I think that what it ended up looking like was just as interesting.

I then used photoshop to merge them together (which was a lot more of a hassel than I was expecting as the drawings were bigger than my scanner at home so I had to scan the images in parts and photomerge them together on photoshop). I also added some extra details digitally (the clouds, leaves and ground) to create this final piece:

The art director was very happy with the image and had no major changes.

I was also incredibly happy with this piece. The new medium really worked for me and I really feel as though this piece could be a turning point in my artwork.

Art Directors POV

I found a good article on Country Living magazine that I thought Amara would enjoy illustrating, as I know from her previous work that she enjoys drawing people and animals. For this task I pretended to be an art director for Country Living magazine in an attempt to make my emails as realistic as possible.

The first email was as follows.

Hello,

I am an art dierctor for Country living Magazine, I came across your work and I would like you to create an illustration to accompany an upcoming article for our magazine.

The image would need to be full colour and 1280x720 pixels at 300 dpi

The article is as follows:

Country Living Magazine

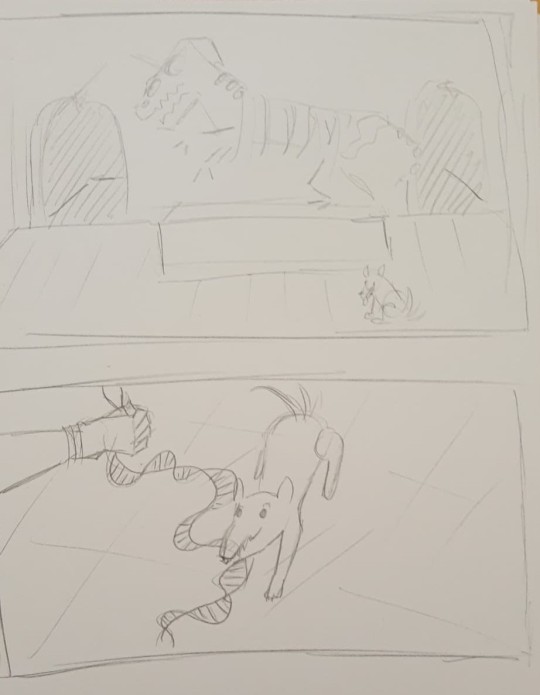

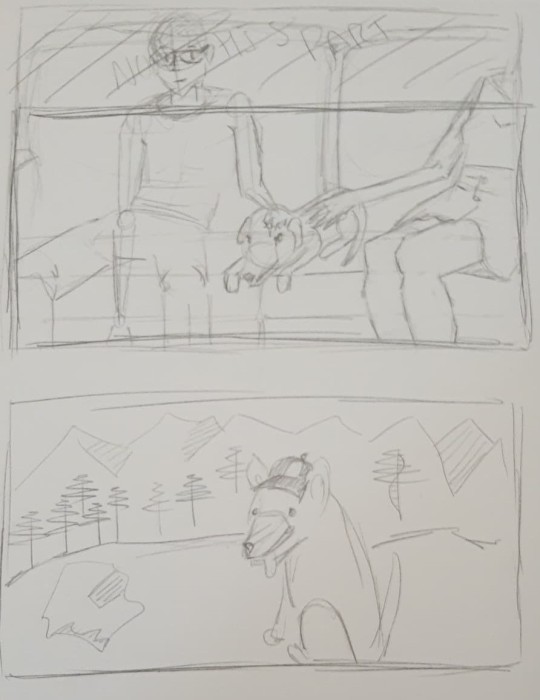

Dogs are our oldest and closest companions, new DNA has confirmed

Pups were domesticated before any other known species

We know that dogs are man's best friend, but new DNA has confirmed that they are in fact our oldest and closest companions, too.

The study, which was conducted at London's Crick Institute, found that dogs were domesticated before any other known species. Interestingly, it discovered that humans have had pet dogs for around 11,000 years, showing just how far back our love for them really goes.

Shining light on the "inextricable bond between dogs and humans", the study is based on DNA from 27 ancient canine specimens from around Europe, Siberia and the Near East.

"Dogs are our oldest and closest animal partner. Using DNA from ancient dogs is showing us just how far back our shared history goes and will ultimately help us understand when and where this deep relationship began," Greger Larson, a co-author from the University of Oxford, told BBC News.

Elsewhere in the research, they also found that the genetic patterns of dogs were fairly similar to that of humans. This is because when humans adopted dogs, they took them with them wherever they moved and shifted, strengthening their bond.

Anders Bergström, lead author and post-doctoral researcher at the Crick, also added: "If we look back more than four or five thousand years ago, we can see that Europe was a very diverse place when it came to dogs. Although the European dogs we see today come in such an extraordinary array of shapes and forms, genetically they derive from only a very narrow subset of the diversity that used to exist."

Just another reason to adopt one of your own...

Many thanks,

Hannah Jones

Art director for Country Living Magazine.

The same day, I heard back from her with attatched roughs.

I liked the second one best as the concept was clever and the composition was very nice.

After a short while she came back with two different options of the image.

One without hands and one with hands, I prefered the image with hands as it showed the human connection with dogs more, which is what the article is all about.

Overall, I was happy with the finished image so I approved it. I think she did a really good job.

You can follow Amara’s fantastic work at https://www.instagram.com/apiple_art/

1 note

·

View note

Text

Layered

Joanne’s thirtieth birthday was coming up, and Sol had a big surprise planned for her. A “layered surprise in a box”, as he called it. The present had been sitting on the cabinet in the sitting room for over a week now. Nine days of it quietly staring at her. She should have been excited about it, but all she felt was anxious, paranoid, and most of all guilty. Did he know? Was this his way of telling her that he had found out?

After a big Sunday morning breakfast that Sol had prepared while she was still asleep, Joanne was sitting on the sofa with the large rectangular present on her lap. Her heart was thumping in her ears as she slowly opened the elegant silver bow and lifted the separately wrapped lid off the box. The dark red wrapping paper rustled slightly when she put the lid on the sofa next to her.

In the box there was a gorgeous single red rose on top of a sheet of ruby coloured wrapping tissue paper. The blossom almost seemed to merge with the paper since they shared the same lovely deep red colour.

The last time someone gave her a rose was when Bobby gave her a whole bouquet. He had called an emergency meeting at the pub, and as his best friend since primary school, Joanne had to show up. Even if the movie night with Sol was a cherished weekly tradition.

Bobby practically threw the supermarket flowers at her while saying, “She broke up with me. Can you believe it? She broke up with me! I stood there at her door, all dressed up, flowers and all, ready to take her out to dinner, and she just smiled a snooty smile and said that ‘this won’t work’, that’s how she put it. So the flowers are for you now. I hope you like red roses. I’ve never given any to a girl before. It’s kind of fitting that you end up with them.”

Joanne looked at him bewildered and said, “What are you talking about?”

“Never mind. Let’s get pissed. As a fart.”

And so they did. They got oh so very drunk. Joanne had no clear recollection of that night at the pub or of what followed.

The next morning, she woke up in a cheap hotel room, she was half-naked and next to her was a man, fast asleep. Bobby. This couldn’t be happening. It must be one of Bobby’s practical jokes. While she was wondering if anything actually happened, she spotted the used condom on the floor. Flashes of memory entered her mind. Sweaty, wild, raw, intense flashes. It had been good, real good. And bad, so bad. But mostly, it had been wrong. But that sense of doing something wrong was like an aphrodisiac.

It clearly should have ended there, after she had woken up and her senses had returned, but it didn’t. Instead, it continued right then and there when Bobby woke up and looked at her with lust-filled eyes.

Joanne stared at the rose, thinking. Terrified.

Sol knows, this is his way of telling me. No, wait, I’m just being paranoid. He can’t know, or can he? Oh, sweet hell.

“Don’t you like it, my darling? It’s as exquisite as you are.”

Joanne snapped out of it, sported a meagre smile, and answered, “It’s beautiful. I was just taking my time admiring it.”

“Why don’t you put the rose on the coffee table and take out the tissue paper. There are several more layers to this present.”

She nervously put the red paper aside, the rustling noise kind of made her jumpy. The gift’s next layer showed a black negligee with delicate white lace along the hem, very transparent, very expensive, very sexy, and very gorgeous.

It reminded Joanne of the dark blue one she used to wear for Sol, or rather she wore it for Sol to take off. They used to have a lot of fun buying pretty lingerie for him to slowly take off. Sol was the best and most attentive lover Joanne had ever had. He treated her like a queen, his touch felt like silk on her skin, his kisses left a tingling sensation wherever his lips touched her, and their connection was far more than physical, it was almost spiritual. He was everything she could ever ask for.

Joanne looked up and smiled at Sol, saying, “It’s lovely. I should put it on tonight, so you can take it off, slowly. We haven’t been doing that enough lately.”

“My thoughts exactly,” he replied with an endearing smile.

He doesn’t know. Good. I’ll just stop this thing with Bobby, whatever this is, so Sol and I can go back to how things used to be. To how they should be. I’m sure Bobby will understand. It’s just about lust for him anyway. It wouldn’t last. Sol and I will last, though. Because we are bound to each other by love. I always knew that.

So why do I keep on seeing Bobby? He’s my dirty little secret, that’s why. And I like it that way. No, I don’t. It has to stop. We have no future, Bobby just plays into my self-destructive streak. I need to listen to the voice that is good for me, follow the voice of my heart, the voice that loves Sol.

Joanne took out the red paper, and put it aside with a smile. She finally felt sane again, like a long-lasting rift in her was finally closing.

The next and apparently lowest layer was a plain black box within the box. Joanne took it out and opened it slowly. It contained a pair of dark red suede stilettos. They were magnificent, and they crushed Joanne’s new-found serenity. It was like their pointy heels pierced right through her mind.

She used to love wearing high heels, she delighted in the power they gave her over men’s minds. But she hadn’t worn any in years, not since Sol and her got serious. Except for now, when she wore them to meet Bobby.

Because he said he liked it that way, and it just made it so much more thrilling and hotter. It almost felt like Joanne was walking in someone else’s shoes, which turned her on even more. Suddenly, her life wasn’t boring, it was exciting. The risk of getting caught and the thrill that came with it was what she enjoyed about their encounters. But she soon despised the rest – she was worth more than a few sweaty hours spent in a cheap hotel room, anyone was. The actual act was quick, rough, and obviously wrong, and she did it anyway. For the kicks. Again and again. It was like a drug, a quick, cheap fix, and she needed it. But it had to stop. It would eventually ruin her life. It was already doing so.

These presents are clearly hints. Sol knows. He must have followed me and saw Bobby and me enter a cheap motel together. Now, this is Sol’s revenge. Making me slowly realise that he knows and has known for quite some time. The present was there on the cabinet, staring at me all week long. A silent accusation, judging me. Today, I’ll get the verdict, and it is “guilty”.

There’s a sort of strange relief in this, no need to pretend any more. He’ll leave me, of course, but I deserve that. So let’s get this over with.

Joanne’s lips showed a slightly crooked smile before they suddenly tightened. Her gaze was still fixed on the stilettos as she said, “All right, you got me. These sexy shoes and all the sensual gifts clearly convey a message. And the message is –”

“It’s less of a message and more of a question, actually.”

Sol was inhaling audibly when Joanne looked up. Her confused gaze landed on his face. It was not where she had expected it to be. Sol was kneeling in front of her, holding a tiny little dark red box in his hand. The ring in it was as elegant and luxurious as the other presents he had bought for her birthday.

With a shy smile and a determined look in his eyes, Sol said, “I know it took me too long to get to this point, and we were a little stuck in a rut lately. But because of that rut, I have actually realised how much I love you. I bought you these gifts to show you that I want things to change. I want us to spice things up and spend more quality time together again. Like we used to. Back when you wore high heels on our dates, when we bought underwear just to take it off slowly, when I bought you roses every week. I love you, and I want to spend the rest of my life making you happy and treating you like a queen. Will you marry me?”

Joanne sighed deeply and said, “Yes, I will. There’s nothing I want more, actually. But first I have to tell you something. After that, you can decide if you still want me.”

—Submitted by Lone-Eyed

#spoospasu#spookyspaghettisundae#horror#short story#writing#my writing#literature#spooky#fiction#submission#birthday#present#birthday present#gift box#gift#layered#cheating#affair#cheap affair#guilt#guilty#roses#stilettos#lingerie#boredom#secrets#thrill#love#guilty conscience#found out

11 notes

·

View notes

Text

So long to the salad days

Oceana Bal Harbour had two of the priciest sales of the cycle, with two separate units selling for $25 million each this year.

From the Fall issue: The current state of luxury condo development in South Florida is perhaps best illustrated by the trajectory of H3 Hollywood. The development was planned as a 15-story, 247-unit condominium in the city of Hollywood. Then, in September 2016, with 60 percent of its units under contract — and 13 floors built — the developer, Hollywood Station Investments, ran out of money and halted construction while it looked for financing. By the spring, the project was ordered to foreclosure auction, where LB Construction of South Florida — the general contractor on the project �� submitted the winning bid. In April, an investor group led by real estate broker Vivian Dimond took over the project. The group spent about $5 million reimbursing buyer deposits and then made the decision to convert H3 to rental apartments.“We are not going to be a condo,” Dimond said in a Sept. 1 interview. “At least not under my ownership.”

While a widely acknowledged downturn in condo development is unfolding, with some developers pivoting to rentals, pricey sales within the last several months highlight the market’s impressive ride to the top of the cycle. A new unit at Palazzo del Sol on Fisher Island, which sold for about $31.3 million, commanded the highest price paid for a condo in South Florida since 2015, when hedge funder Ken Griffin paid $60 million for a penthouse at Miami Beach’s Faena House, according to research by The Real Deal.

To rank the priciest sales in Miami-Dade this cycle, TRD analyzed deeds recorded in the county since January 1, 2011, and referenced those against data from CraneSpotters, a database that tracks all new condo developments that have filed plans since 2011. By comparing the sales against the CraneSpotters list of developer entities, TRD was able to rank only new development sales. Resales were not counted.

The analysis found that four of the top 10 priciest sales took place this year; however, many industry insiders say the sky-high prices herald the approach of a cyclical South Florida downturn, while others go further and argue that despite these deals, the region’s luxury market has been in a slump for some time.

Data from CraneSpotters.com shows that 11,860 South Florida condos were under construction in August, down from 13,467 at the end of last year.

“Roughly half of what is going to be delivered in this cycle is still under construction,” said CraneSpotters.com founder Peter Zalewski. “The deliveries are building up. You’re probably going to see most of it come online in the next 12 to 18 months.”

Beyond that, Zalewski said he expects the decline to just get worse: “We’re in the first year of the downturn … And in 2019, we’ll probably hit bottom. In ’20 or ’21, we’ll probably start building again.”

Dodge Data & Analytics recently reported that the value of condominiums and other Miami-area multifamily housing projects that advanced to the construction phase dropped 43 percent in the first half of the year from the same period last year.

But condominium developments commonly take two years and often longer to sell and build. So, if a long-term decline in condo construction has started in South Florida, its full impact won’t be felt for a while. “We’re still doing [condo] deals. We’re doing deals every day,” said Daniel de la Vega, the Coral Gables-based president of One Sotheby’s International Realty. This year, for example, he helped to broker the sale of a penthouse at the Oceana Bal Harbour condominium for $25 million, which ranked among the 10 priciest condo sales in TRD’s ranking.

Still, some precautions have been taken this time around. Before the last downturn, which began over a decade ago, deposits of only 10 percent were common. In recent years, many condo developers in the Miami-Dade market have required deposits of up to 50 percent of unit prices, reducing their need to borrow or raise money.

Even with relatively little financial leverage, however, the number of condo projects failing to advance beyond the preconstruction phase is mounting. CraneSpotters.com reported in August that developers had revised, suspended or canceled a total of 8,832 condo units in South Florida since 2011, up from 7,785 shelved units at the end of 2016.

Few condo project cancellations in South Florida attracted more attention than this year’s shutdown of the Related Group’s 60-story Auberge Residences & Spa Miami. It may have been a milestone in South Florida’s condo development cycle. Related had presold about 15 percent of the units planned for the site at 1440 Biscayne Boulevard before it canceled the project and returned buyers’ deposits.

The developer is now waiting before launching more condo projects in Brickell and other areas in Miami’s urban core, said Carlos Rosso, president of Related’s condo development division.

The firm has already launched Wynwood 29, a condo project in Miami’s Wynwood neighborhood, which is “finally getting an influx of high-end luxury property to address pent-up demand,” Rosso said in an email exchange.

“We also have projects in other neighborhoods like Brickell [in Miami], where prices have leveled off, and we are waiting for some inventory absorption before launching projects like 444 Brickell,” Rosso said, referring to a riverfront location where Related has planned a phased development with a hotel, office space and 1,200 residential units.

Rosso added that borrowing to build condos in South Florida has become more difficult, preventing developers with limited experience from putting more units on the market: “Construction financing has been tightening for the past few years, but this is by no means a negative trend … It ensures only the best projects get off the ground.”

(Click to enlarge)

Anthony Graziano, Miami-based senior managing director of research and advisory firm Integra Realty Resources, agreed that “it’s going to be harder to get a project out of the ground over the next 12 to 18 months.”

Graziano said many banks returned to South Florida’s condo construction loan market during the 2013-2014 period, “but they were coming in almost as mezzanine debt … Their overall exposure to the project was 30 or 40 percent [of its value], max.” In the last 24 months, however, “their exposure increased, and certain lenders just started to fall out of the market,” he said.

As condo construction grinds on, a buyer’s market has developed in Miami’s condo resale market, Graziano said, citing a growing number of units listed for sale and a shrinking pool of buyers. “Resale prices are declining. Last year, it was about 6 to 8 percent,” he said. “This year, because of the amount of inventory, we’ll probably see another 4 to 6 percent decline in overall pricing.”

Much of the downward pressure on overall condo pricing appears to come from the high end of the market. Research by Integra Realty shows that 95 condos in Miami-Dade are listed for sale at or above $10 million, and at the current pace of sales, fewer than 10 condos a year are selling in that lofty price range.

“The run rate on condos over $10 million is about eight or nine a year. So, there’s a lot more elasticity in that pricing,” Graziano said. “If I’ve got a $20 million condo, and you come to me and offer $16 million for it, I have to think about it.”

Many Latin Americans bought newly built condos in Miami before the overall pace of development slowed last year. “You have some buildings where it was 100 percent sold to Venezuelans, or 100 percent sold to Brazilians,” said Jack McCabe of McCabe Research & Consulting in Deerfield Beach.

“It was flight capital, getting money out of their home countries and converting it into U.S. dollars,” McCabe said. “In their own countries, the political and economic turmoil was such that they were afraid of losing it.”

Now, some developers are afraid of losing that influx of flight capital as President Donald Trump promises to crack down on illegal immigration and the Treasury Department intensifies its scrutiny of large cash purchases of South Florida condos and other real estate.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced in August that it will broaden an anti-money laundering program to identify suspicious transactions involving luxury real estate.

Under a revised geographic targeting order, wire transfers are now subject to Treasury regulations that require title insurance companies to disclose the identity of buyers who purchase luxury real estate through limited liability corporations (LLCs). The revised order — which covers property deals in South Florida, New York City, California and Texas — also was extended to transactions in Honolulu, Hawaii.

“I believe they wouldn’t have done that unless they were finding a lot. You wouldn’t put that much money and resources into it if all you had found was a dead end,” McCabe said. But “we probably won’t see the results from this investigation for two or three years.”

By then, he believes, South Florida’s condo production will have peaked and receded. “We’re in the middle of the ninth inning, to use a baseball analogy,” McCabe said. “We’re already seeing price drops. We’re seeing developers offering to pay real estate salespeople 8 and 10 percent commissions to find buyers.”

— Harunobu Coryne provided research for this article.

from The Real Deal Miami https://therealdeal.com/miami/issues_articles/so-long-to-the-salad-days/#new_tab via IFTTT

0 notes

Text

So long to the salad days

Oceana Bal Harbour had two of the priciest sales of the cycle, with two separate units selling for $25 million each this year.

From the Fall issue: The current state of luxury condo development in South Florida is perhaps best illustrated by the trajectory of H3 Hollywood. The development was planned as a 15-story, 247-unit condominium in the city of Hollywood. Then, in September 2016, with 60 percent of its units under contract — and 13 floors built — the developer, Hollywood Station Investments, ran out of money and halted construction while it looked for financing. By the spring, the project was ordered to foreclosure auction, where LB Construction of South Florida — the general contractor on the project — submitted the winning bid. In April, an investor group led by real estate broker Vivian Dimond took over the project. The group spent about $5 million reimbursing buyer deposits and then made the decision to convert H3 to rental apartments.“We are not going to be a condo,” Dimond said in a Sept. 1 interview. “At least not under my ownership.”

While a widely acknowledged downturn in condo development is unfolding, with some developers pivoting to rentals, pricey sales within the last several months highlight the market’s impressive ride to the top of the cycle. A new unit at Palazzo del Sol on Fisher Island, which sold for about $31.3 million, commanded the highest price paid for a condo in South Florida since 2015, when hedge funder Ken Griffin paid $60 million for a penthouse at Miami Beach’s Faena House, according to research by The Real Deal.

To rank the priciest sales in Miami-Dade this cycle, TRD analyzed deeds recorded in the county since January 1, 2011, and referenced those against data from CraneSpotters, a database that tracks all new condo developments that have filed plans since 2011. By comparing the sales against the CraneSpotters list of developer entities, TRD was able to rank only new development sales. Resales were not counted.

The analysis found that four of the top 10 priciest sales took place this year; however, many industry insiders say the sky-high prices herald the approach of a cyclical South Florida downturn, while others go further and argue that despite these deals, the region’s luxury market has been in a slump for some time.

Data from CraneSpotters.com shows that 11,860 South Florida condos were under construction in August, down from 13,467 at the end of last year.

“Roughly half of what is going to be delivered in this cycle is still under construction,” said CraneSpotters.com founder Peter Zalewski. “The deliveries are building up. You’re probably going to see most of it come online in the next 12 to 18 months.”

Beyond that, Zalewski said he expects the decline to just get worse: “We’re in the first year of the downturn … And in 2019, we’ll probably hit bottom. In ’20 or ’21, we’ll probably start building again.”

Dodge Data & Analytics recently reported that the value of condominiums and other Miami-area multifamily housing projects that advanced to the construction phase dropped 43 percent in the first half of the year from the same period last year.

But condominium developments commonly take two years and often longer to sell and build. So, if a long-term decline in condo construction has started in South Florida, its full impact won’t be felt for a while. “We’re still doing [condo] deals. We’re doing deals every day,” said Daniel de la Vega, the Coral Gables-based president of One Sotheby’s International Realty. This year, for example, he helped to broker the sale of a penthouse at the Oceana Bal Harbour condominium for $25 million, which ranked among the 10 priciest condo sales in TRD’s ranking.

Still, some precautions have been taken this time around. Before the last downturn, which began over a decade ago, deposits of only 10 percent were common. In recent years, many condo developers in the Miami-Dade market have required deposits of up to 50 percent of unit prices, reducing their need to borrow or raise money.

Even with relatively little financial leverage, however, the number of condo projects failing to advance beyond the preconstruction phase is mounting. CraneSpotters.com reported in August that developers had revised, suspended or canceled a total of 8,832 condo units in South Florida since 2011, up from 7,785 shelved units at the end of 2016.

Few condo project cancellations in South Florida attracted more attention than this year’s shutdown of the Related Group’s 60-story Auberge Residences & Spa Miami. It may have been a milestone in South Florida’s condo development cycle. Related had presold about 15 percent of the units planned for the site at 1440 Biscayne Boulevard before it canceled the project and returned buyers’ deposits.

The developer is now waiting before launching more condo projects in Brickell and other areas in Miami’s urban core, said Carlos Rosso, president of Related’s condo development division.

The firm has already launched Wynwood 29, a condo project in Miami’s Wynwood neighborhood, which is “finally getting an influx of high-end luxury property to address pent-up demand,” Rosso said in an email exchange.

“We also have projects in other neighborhoods like Brickell [in Miami], where prices have leveled off, and we are waiting for some inventory absorption before launching projects like 444 Brickell,” Rosso said, referring to a riverfront location where Related has planned a phased development with a hotel, office space and 1,200 residential units.

Rosso added that borrowing to build condos in South Florida has become more difficult, preventing developers with limited experience from putting more units on the market: “Construction financing has been tightening for the past few years, but this is by no means a negative trend … It ensures only the best projects get off the ground.”

(Click to enlarge)

Anthony Graziano, Miami-based senior managing director of research and advisory firm Integra Realty Resources, agreed that “it’s going to be harder to get a project out of the ground over the next 12 to 18 months.”

Graziano said many banks returned to South Florida’s condo construction loan market during the 2013-2014 period, “but they were coming in almost as mezzanine debt … Their overall exposure to the project was 30 or 40 percent [of its value], max.” In the last 24 months, however, “their exposure increased, and certain lenders just started to fall out of the market,” he said.

As condo construction grinds on, a buyer’s market has developed in Miami’s condo resale market, Graziano said, citing a growing number of units listed for sale and a shrinking pool of buyers. “Resale prices are declining. Last year, it was about 6 to 8 percent,” he said. “This year, because of the amount of inventory, we’ll probably see another 4 to 6 percent decline in overall pricing.”

Much of the downward pressure on overall condo pricing appears to come from the high end of the market. Research by Integra Realty shows that 95 condos in Miami-Dade are listed for sale at or above $10 million, and at the current pace of sales, fewer than 10 condos a year are selling in that lofty price range.

“The run rate on condos over $10 million is about eight or nine a year. So, there’s a lot more elasticity in that pricing,” Graziano said. “If I’ve got a $20 million condo, and you come to me and offer $16 million for it, I have to think about it.”

Many Latin Americans bought newly built condos in Miami before the overall pace of development slowed last year. “You have some buildings where it was 100 percent sold to Venezuelans, or 100 percent sold to Brazilians,” said Jack McCabe of McCabe Research & Consulting in Deerfield Beach.

“It was flight capital, getting money out of their home countries and converting it into U.S. dollars,” McCabe said. “In their own countries, the political and economic turmoil was such that they were afraid of losing it.”

Now, some developers are afraid of losing that influx of flight capital as President Donald Trump promises to crack down on illegal immigration and the Treasury Department intensifies its scrutiny of large cash purchases of South Florida condos and other real estate.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced in August that it will broaden an anti-money laundering program to identify suspicious transactions involving luxury real estate.

Under a revised geographic targeting order, wire transfers are now subject to Treasury regulations that require title insurance companies to disclose the identity of buyers who purchase luxury real estate through limited liability corporations (LLCs). The revised order — which covers property deals in South Florida, New York City, California and Texas — also was extended to transactions in Honolulu, Hawaii.

“I believe they wouldn’t have done that unless they were finding a lot. You wouldn’t put that much money and resources into it if all you had found was a dead end,” McCabe said. But “we probably won’t see the results from this investigation for two or three years.”

By then, he believes, South Florida’s condo production will have peaked and receded. “We’re in the middle of the ninth inning, to use a baseball analogy,” McCabe said. “We’re already seeing price drops. We’re seeing developers offering to pay real estate salespeople 8 and 10 percent commissions to find buyers.”

— Harunobu Coryne provided research for this article.

from The Real Deal Miami https://therealdeal.com/miami/issues_articles/so-long-to-the-salad-days/#new_tab via IFTTT

0 notes

Text

So long to the salad days

Oceana Bal Harbour had two of the priciest sales of the cycle, with two separate units selling for $25 million each this year.

From the Fall issue: The current state of luxury condo development in South Florida is perhaps best illustrated by the trajectory of H3 Hollywood. The development was planned as a 15-story, 247-unit condominium in the city of Hollywood. Then, in September 2016, with 60 percent of its units under contract — and 13 floors built — the developer, Hollywood Station Investments, ran out of money and halted construction while it looked for financing. By the spring, the project was ordered to foreclosure auction, where LB Construction of South Florida — the general contractor on the project — submitted the winning bid. In April, an investor group led by real estate broker Vivian Dimond took over the project. The group spent about $5 million reimbursing buyer deposits and then made the decision to convert H3 to rental apartments.“We are not going to be a condo,” Dimond said in a Sept. 1 interview. “At least not under my ownership.”

While a widely acknowledged downturn in condo development is unfolding, with some developers pivoting to rentals, pricey sales within the last several months highlight the market’s impressive ride to the top of the cycle. A new unit at Palazzo del Sol on Fisher Island, which sold for about $31.3 million, commanded the highest price paid for a condo in South Florida since 2015, when hedge funder Ken Griffin paid $60 million for a penthouse at Miami Beach’s Faena House, according to research by The Real Deal.

To rank the priciest sales in Miami-Dade this cycle, TRD analyzed deeds recorded in the county since January 1, 2011, and referenced those against data from CraneSpotters, a database that tracks all new condo developments that have filed plans since 2011. By comparing the sales against the CraneSpotters list of developer entities, TRD was able to rank only new development sales. Resales were not counted.

The analysis found that four of the top 10 priciest sales took place this year; however, many industry insiders say the sky-high prices herald the approach of a cyclical South Florida downturn, while others go further and argue that despite these deals, the region’s luxury market has been in a slump for some time.

Data from CraneSpotters.com shows that 11,860 South Florida condos were under construction in August, down from 13,467 at the end of last year.

“Roughly half of what is going to be delivered in this cycle is still under construction,” said CraneSpotters.com founder Peter Zalewski. “The deliveries are building up. You’re probably going to see most of it come online in the next 12 to 18 months.”

Beyond that, Zalewski said he expects the decline to just get worse: “We’re in the first year of the downturn … And in 2019, we’ll probably hit bottom. In ’20 or ’21, we’ll probably start building again.”

Dodge Data & Analytics recently reported that the value of condominiums and other Miami-area multifamily housing projects that advanced to the construction phase dropped 43 percent in the first half of the year from the same period last year.

But condominium developments commonly take two years and often longer to sell and build. So, if a long-term decline in condo construction has started in South Florida, its full impact won’t be felt for a while. “We’re still doing [condo] deals. We’re doing deals every day,” said Daniel de la Vega, the Coral Gables-based president of One Sotheby’s International Realty. This year, for example, he helped to broker the sale of a penthouse at the Oceana Bal Harbour condominium for $25 million, which ranked among the 10 priciest condo sales in TRD’s ranking.

Still, some precautions have been taken this time around. Before the last downturn, which began over a decade ago, deposits of only 10 percent were common. In recent years, many condo developers in the Miami-Dade market have required deposits of up to 50 percent of unit prices, reducing their need to borrow or raise money.

Even with relatively little financial leverage, however, the number of condo projects failing to advance beyond the preconstruction phase is mounting. CraneSpotters.com reported in August that developers had revised, suspended or canceled a total of 8,832 condo units in South Florida since 2011, up from 7,785 shelved units at the end of 2016.

Few condo project cancellations in South Florida attracted more attention than this year’s shutdown of the Related Group’s 60-story Auberge Residences & Spa Miami. It may have been a milestone in South Florida’s condo development cycle. Related had presold about 15 percent of the units planned for the site at 1440 Biscayne Boulevard before it canceled the project and returned buyers’ deposits.

The developer is now waiting before launching more condo projects in Brickell and other areas in Miami’s urban core, said Carlos Rosso, president of Related’s condo development division.

The firm has already launched Wynwood 29, a condo project in Miami’s Wynwood neighborhood, which is “finally getting an influx of high-end luxury property to address pent-up demand,” Rosso said in an email exchange.

“We also have projects in other neighborhoods like Brickell [in Miami], where prices have leveled off, and we are waiting for some inventory absorption before launching projects like 444 Brickell,” Rosso said, referring to a riverfront location where Related has planned a phased development with a hotel, office space and 1,200 residential units.

Rosso added that borrowing to build condos in South Florida has become more difficult, preventing developers with limited experience from putting more units on the market: “Construction financing has been tightening for the past few years, but this is by no means a negative trend … It ensures only the best projects get off the ground.”

(Click to enlarge)

Anthony Graziano, Miami-based senior managing director of research and advisory firm Integra Realty Resources, agreed that “it’s going to be harder to get a project out of the ground over the next 12 to 18 months.”

Graziano said many banks returned to South Florida’s condo construction loan market during the 2013-2014 period, “but they were coming in almost as mezzanine debt … Their overall exposure to the project was 30 or 40 percent [of its value], max.” In the last 24 months, however, “their exposure increased, and certain lenders just started to fall out of the market,” he said.

As condo construction grinds on, a buyer’s market has developed in Miami’s condo resale market, Graziano said, citing a growing number of units listed for sale and a shrinking pool of buyers. “Resale prices are declining. Last year, it was about 6 to 8 percent,” he said. “This year, because of the amount of inventory, we’ll probably see another 4 to 6 percent decline in overall pricing.”

Much of the downward pressure on overall condo pricing appears to come from the high end of the market. Research by Integra Realty shows that 95 condos in Miami-Dade are listed for sale at or above $10 million, and at the current pace of sales, fewer than 10 condos a year are selling in that lofty price range.

“The run rate on condos over $10 million is about eight or nine a year. So, there’s a lot more elasticity in that pricing,” Graziano said. “If I’ve got a $20 million condo, and you come to me and offer $16 million for it, I have to think about it.”

Many Latin Americans bought newly built condos in Miami before the overall pace of development slowed last year. “You have some buildings where it was 100 percent sold to Venezuelans, or 100 percent sold to Brazilians,” said Jack McCabe of McCabe Research & Consulting in Deerfield Beach.

“It was flight capital, getting money out of their home countries and converting it into U.S. dollars,” McCabe said. “In their own countries, the political and economic turmoil was such that they were afraid of losing it.”

Now, some developers are afraid of losing that influx of flight capital as President Donald Trump promises to crack down on illegal immigration and the Treasury Department intensifies its scrutiny of large cash purchases of South Florida condos and other real estate.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced in August that it will broaden an anti-money laundering program to identify suspicious transactions involving luxury real estate.

Under a revised geographic targeting order, wire transfers are now subject to Treasury regulations that require title insurance companies to disclose the identity of buyers who purchase luxury real estate through limited liability corporations (LLCs). The revised order — which covers property deals in South Florida, New York City, California and Texas — also was extended to transactions in Honolulu, Hawaii.

“I believe they wouldn’t have done that unless they were finding a lot. You wouldn’t put that much money and resources into it if all you had found was a dead end,” McCabe said. But “we probably won’t see the results from this investigation for two or three years.”

By then, he believes, South Florida’s condo production will have peaked and receded. “We’re in the middle of the ninth inning, to use a baseball analogy,” McCabe said. “We’re already seeing price drops. We’re seeing developers offering to pay real estate salespeople 8 and 10 percent commissions to find buyers.”

— Harunobu Coryne provided research for this article.

from The Real Deal Miami https://therealdeal.com/miami/issues_articles/so-long-to-the-salad-days/#new_tab via IFTTT

0 notes

Text

So long to the salad days

Oceana Bal Harbour had two of the priciest sales of the cycle, with two separate units selling for $25 million each this year.

From the Fall issue: The current state of luxury condo development in South Florida is perhaps best illustrated by the trajectory of H3 Hollywood. The development was planned as a 15-story, 247-unit condominium in the city of Hollywood. Then, in September 2016, with 60 percent of its units under contract — and 13 floors built — the developer, Hollywood Station Investments, ran out of money and halted construction while it looked for financing. By the spring, the project was ordered to foreclosure auction, where LB Construction of South Florida — the general contractor on the project — submitted the winning bid. In April, an investor group led by real estate broker Vivian Dimond took over the project. The group spent about $5 million reimbursing buyer deposits and then made the decision to convert H3 to rental apartments.“We are not going to be a condo,” Dimond said in a Sept. 1 interview. “At least not under my ownership.”

While a widely acknowledged downturn in condo development is unfolding, with some developers pivoting to rentals, pricey sales within the last several months highlight the market’s impressive ride to the top of the cycle. A new unit at Palazzo del Sol on Fisher Island, which sold for about $31.3 million, commanded the highest price paid for a condo in South Florida since 2015, when hedge funder Ken Griffin paid $60 million for a penthouse at Miami Beach’s Faena House, according to research by The Real Deal.

To rank the priciest sales in Miami-Dade this cycle, TRD analyzed deeds recorded in the county since January 1, 2011, and referenced those against data from CraneSpotters, a database that tracks all new condo developments that have filed plans since 2011. By comparing the sales against the CraneSpotters list of developer entities, TRD was able to rank only new development sales. Resales were not counted.

The analysis found that four of the top 10 priciest sales took place this year; however, many industry insiders say the sky-high prices herald the approach of a cyclical South Florida downturn, while others go further and argue that despite these deals, the region’s luxury market has been in a slump for some time.

Data from CraneSpotters.com shows that 11,860 South Florida condos were under construction in August, down from 13,467 at the end of last year.

“Roughly half of what is going to be delivered in this cycle is still under construction,” said CraneSpotters.com founder Peter Zalewski. “The deliveries are building up. You’re probably going to see most of it come online in the next 12 to 18 months.”

Beyond that, Zalewski said he expects the decline to just get worse: “We’re in the first year of the downturn … And in 2019, we’ll probably hit bottom. In ’20 or ’21, we’ll probably start building again.”

Dodge Data & Analytics recently reported that the value of condominiums and other Miami-area multifamily housing projects that advanced to the construction phase dropped 43 percent in the first half of the year from the same period last year.

But condominium developments commonly take two years and often longer to sell and build. So, if a long-term decline in condo construction has started in South Florida, its full impact won’t be felt for a while. “We’re still doing [condo] deals. We’re doing deals every day,” said Daniel de la Vega, the Coral Gables-based president of One Sotheby’s International Realty. This year, for example, he helped to broker the sale of a penthouse at the Oceana Bal Harbour condominium for $25 million, which ranked among the 10 priciest condo sales in TRD’s ranking.

Still, some precautions have been taken this time around. Before the last downturn, which began over a decade ago, deposits of only 10 percent were common. In recent years, many condo developers in the Miami-Dade market have required deposits of up to 50 percent of unit prices, reducing their need to borrow or raise money.

Even with relatively little financial leverage, however, the number of condo projects failing to advance beyond the preconstruction phase is mounting. CraneSpotters.com reported in August that developers had revised, suspended or canceled a total of 8,832 condo units in South Florida since 2011, up from 7,785 shelved units at the end of 2016.

Few condo project cancellations in South Florida attracted more attention than this year’s shutdown of the Related Group’s 60-story Auberge Residences & Spa Miami. It may have been a milestone in South Florida’s condo development cycle. Related had presold about 15 percent of the units planned for the site at 1440 Biscayne Boulevard before it canceled the project and returned buyers’ deposits.

The developer is now waiting before launching more condo projects in Brickell and other areas in Miami’s urban core, said Carlos Rosso, president of Related’s condo development division.

The firm has already launched Wynwood 29, a condo project in Miami’s Wynwood neighborhood, which is “finally getting an influx of high-end luxury property to address pent-up demand,” Rosso said in an email exchange.

“We also have projects in other neighborhoods like Brickell [in Miami], where prices have leveled off, and we are waiting for some inventory absorption before launching projects like 444 Brickell,” Rosso said, referring to a riverfront location where Related has planned a phased development with a hotel, office space and 1,200 residential units.

Rosso added that borrowing to build condos in South Florida has become more difficult, preventing developers with limited experience from putting more units on the market: “Construction financing has been tightening for the past few years, but this is by no means a negative trend … It ensures only the best projects get off the ground.”

(Click to enlarge)

Anthony Graziano, Miami-based senior managing director of research and advisory firm Integra Realty Resources, agreed that “it’s going to be harder to get a project out of the ground over the next 12 to 18 months.”

Graziano said many banks returned to South Florida’s condo construction loan market during the 2013-2014 period, “but they were coming in almost as mezzanine debt … Their overall exposure to the project was 30 or 40 percent [of its value], max.” In the last 24 months, however, “their exposure increased, and certain lenders just started to fall out of the market,” he said.

As condo construction grinds on, a buyer’s market has developed in Miami’s condo resale market, Graziano said, citing a growing number of units listed for sale and a shrinking pool of buyers. “Resale prices are declining. Last year, it was about 6 to 8 percent,” he said. “This year, because of the amount of inventory, we’ll probably see another 4 to 6 percent decline in overall pricing.”

Much of the downward pressure on overall condo pricing appears to come from the high end of the market. Research by Integra Realty shows that 95 condos in Miami-Dade are listed for sale at or above $10 million, and at the current pace of sales, fewer than 10 condos a year are selling in that lofty price range.

“The run rate on condos over $10 million is about eight or nine a year. So, there’s a lot more elasticity in that pricing,” Graziano said. “If I’ve got a $20 million condo, and you come to me and offer $16 million for it, I have to think about it.”

Many Latin Americans bought newly built condos in Miami before the overall pace of development slowed last year. “You have some buildings where it was 100 percent sold to Venezuelans, or 100 percent sold to Brazilians,” said Jack McCabe of McCabe Research & Consulting in Deerfield Beach.

“It was flight capital, getting money out of their home countries and converting it into U.S. dollars,” McCabe said. “In their own countries, the political and economic turmoil was such that they were afraid of losing it.”

Now, some developers are afraid of losing that influx of flight capital as President Donald Trump promises to crack down on illegal immigration and the Treasury Department intensifies its scrutiny of large cash purchases of South Florida condos and other real estate.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced in August that it will broaden an anti-money laundering program to identify suspicious transactions involving luxury real estate.

Under a revised geographic targeting order, wire transfers are now subject to Treasury regulations that require title insurance companies to disclose the identity of buyers who purchase luxury real estate through limited liability corporations (LLCs). The revised order — which covers property deals in South Florida, New York City, California and Texas — also was extended to transactions in Honolulu, Hawaii.

“I believe they wouldn’t have done that unless they were finding a lot. You wouldn’t put that much money and resources into it if all you had found was a dead end,” McCabe said. But “we probably won’t see the results from this investigation for two or three years.”

By then, he believes, South Florida’s condo production will have peaked and receded. “We’re in the middle of the ninth inning, to use a baseball analogy,” McCabe said. “We’re already seeing price drops. We’re seeing developers offering to pay real estate salespeople 8 and 10 percent commissions to find buyers.”

— Harunobu Coryne provided research for this article.

from The Real Deal Miami https://therealdeal.com/miami/issues_articles/so-long-to-the-salad-days/#new_tab via IFTTT

0 notes

Text

So long to the salad days

Oceana Bal Harbour had two of the priciest sales of the cycle, with two separate units selling for $25 million each this year.

From the Fall issue: The current state of luxury condo development in South Florida is perhaps best illustrated by the trajectory of H3 Hollywood. The development was planned as a 15-story, 247-unit condominium in the city of Hollywood. Then, in September 2016, with 60 percent of its units under contract — and 13 floors built — the developer, Hollywood Station Investments, ran out of money and halted construction while it looked for financing. By the spring, the project was ordered to foreclosure auction, where LB Construction of South Florida — the general contractor on the project — submitted the winning bid. In April, an investor group led by real estate broker Vivian Dimond took over the project. The group spent about $5 million reimbursing buyer deposits and then made the decision to convert H3 to rental apartments.“We are not going to be a condo,” Dimond said in a Sept. 1 interview. “At least not under my ownership.”

While a widely acknowledged downturn in condo development is unfolding, with some developers pivoting to rentals, pricey sales within the last several months highlight the market’s impressive ride to the top of the cycle. A new unit at Palazzo del Sol on Fisher Island, which sold for about $31.3 million, commanded the highest price paid for a condo in South Florida since 2015, when hedge funder Ken Griffin paid $60 million for a penthouse at Miami Beach’s Faena House, according to research by The Real Deal.

To rank the priciest sales in Miami-Dade this cycle, TRD analyzed deeds recorded in the county since January 1, 2011, and referenced those against data from CraneSpotters, a database that tracks all new condo developments that have filed plans since 2011. By comparing the sales against the CraneSpotters list of developer entities, TRD was able to rank only new development sales. Resales were not counted.

The analysis found that four of the top 10 priciest sales took place this year; however, many industry insiders say the sky-high prices herald the approach of a cyclical South Florida downturn, while others go further and argue that despite these deals, the region’s luxury market has been in a slump for some time.

Data from CraneSpotters.com shows that 11,860 South Florida condos were under construction in August, down from 13,467 at the end of last year.

“Roughly half of what is going to be delivered in this cycle is still under construction,” said CraneSpotters.com founder Peter Zalewski. “The deliveries are building up. You’re probably going to see most of it come online in the next 12 to 18 months.”

Beyond that, Zalewski said he expects the decline to just get worse: “We’re in the first year of the downturn … And in 2019, we’ll probably hit bottom. In ’20 or ’21, we’ll probably start building again.”

Dodge Data & Analytics recently reported that the value of condominiums and other Miami-area multifamily housing projects that advanced to the construction phase dropped 43 percent in the first half of the year from the same period last year.

But condominium developments commonly take two years and often longer to sell and build. So, if a long-term decline in condo construction has started in South Florida, its full impact won’t be felt for a while. “We’re still doing [condo] deals. We’re doing deals every day,” said Daniel de la Vega, the Coral Gables-based president of One Sotheby’s International Realty. This year, for example, he helped to broker the sale of a penthouse at the Oceana Bal Harbour condominium for $25 million, which ranked among the 10 priciest condo sales in TRD’s ranking.

Still, some precautions have been taken this time around. Before the last downturn, which began over a decade ago, deposits of only 10 percent were common. In recent years, many condo developers in the Miami-Dade market have required deposits of up to 50 percent of unit prices, reducing their need to borrow or raise money.

Even with relatively little financial leverage, however, the number of condo projects failing to advance beyond the preconstruction phase is mounting. CraneSpotters.com reported in August that developers had revised, suspended or canceled a total of 8,832 condo units in South Florida since 2011, up from 7,785 shelved units at the end of 2016.

Few condo project cancellations in South Florida attracted more attention than this year’s shutdown of the Related Group’s 60-story Auberge Residences & Spa Miami. It may have been a milestone in South Florida’s condo development cycle. Related had presold about 15 percent of the units planned for the site at 1440 Biscayne Boulevard before it canceled the project and returned buyers’ deposits.

The developer is now waiting before launching more condo projects in Brickell and other areas in Miami’s urban core, said Carlos Rosso, president of Related’s condo development division.

The firm has already launched Wynwood 29, a condo project in Miami’s Wynwood neighborhood, which is “finally getting an influx of high-end luxury property to address pent-up demand,” Rosso said in an email exchange.

“We also have projects in other neighborhoods like Brickell [in Miami], where prices have leveled off, and we are waiting for some inventory absorption before launching projects like 444 Brickell,” Rosso said, referring to a riverfront location where Related has planned a phased development with a hotel, office space and 1,200 residential units.

Rosso added that borrowing to build condos in South Florida has become more difficult, preventing developers with limited experience from putting more units on the market: “Construction financing has been tightening for the past few years, but this is by no means a negative trend … It ensures only the best projects get off the ground.”

(Click to enlarge)

Anthony Graziano, Miami-based senior managing director of research and advisory firm Integra Realty Resources, agreed that “it’s going to be harder to get a project out of the ground over the next 12 to 18 months.”

Graziano said many banks returned to South Florida’s condo construction loan market during the 2013-2014 period, “but they were coming in almost as mezzanine debt … Their overall exposure to the project was 30 or 40 percent [of its value], max.” In the last 24 months, however, “their exposure increased, and certain lenders just started to fall out of the market,” he said.

As condo construction grinds on, a buyer’s market has developed in Miami’s condo resale market, Graziano said, citing a growing number of units listed for sale and a shrinking pool of buyers. “Resale prices are declining. Last year, it was about 6 to 8 percent,” he said. “This year, because of the amount of inventory, we’ll probably see another 4 to 6 percent decline in overall pricing.”

Much of the downward pressure on overall condo pricing appears to come from the high end of the market. Research by Integra Realty shows that 95 condos in Miami-Dade are listed for sale at or above $10 million, and at the current pace of sales, fewer than 10 condos a year are selling in that lofty price range.

“The run rate on condos over $10 million is about eight or nine a year. So, there’s a lot more elasticity in that pricing,” Graziano said. “If I’ve got a $20 million condo, and you come to me and offer $16 million for it, I have to think about it.”

Many Latin Americans bought newly built condos in Miami before the overall pace of development slowed last year. “You have some buildings where it was 100 percent sold to Venezuelans, or 100 percent sold to Brazilians,” said Jack McCabe of McCabe Research & Consulting in Deerfield Beach.

“It was flight capital, getting money out of their home countries and converting it into U.S. dollars,” McCabe said. “In their own countries, the political and economic turmoil was such that they were afraid of losing it.”

Now, some developers are afraid of losing that influx of flight capital as President Donald Trump promises to crack down on illegal immigration and the Treasury Department intensifies its scrutiny of large cash purchases of South Florida condos and other real estate.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced in August that it will broaden an anti-money laundering program to identify suspicious transactions involving luxury real estate.

Under a revised geographic targeting order, wire transfers are now subject to Treasury regulations that require title insurance companies to disclose the identity of buyers who purchase luxury real estate through limited liability corporations (LLCs). The revised order — which covers property deals in South Florida, New York City, California and Texas — also was extended to transactions in Honolulu, Hawaii.

“I believe they wouldn’t have done that unless they were finding a lot. You wouldn’t put that much money and resources into it if all you had found was a dead end,” McCabe said. But “we probably won’t see the results from this investigation for two or three years.”

By then, he believes, South Florida’s condo production will have peaked and receded. “We’re in the middle of the ninth inning, to use a baseball analogy,” McCabe said. “We’re already seeing price drops. We’re seeing developers offering to pay real estate salespeople 8 and 10 percent commissions to find buyers.”

— Harunobu Coryne provided research for this article.

from The Real Deal Miami https://therealdeal.com/miami/issues_articles/so-long-to-the-salad-days/#new_tab via IFTTT

0 notes

Text

So long to the salad days

Oceana Bal Harbour had two of the priciest sales of the cycle, with two separate units selling for $25 million each this year.

From the Fall issue: The current state of luxury condo development in South Florida is perhaps best illustrated by the trajectory of H3 Hollywood. The development was planned as a 15-story, 247-unit condominium in the city of Hollywood. Then, in September 2016, with 60 percent of its units under contract — and 13 floors built — the developer, Hollywood Station Investments, ran out of money and halted construction while it looked for financing. By the spring, the project was ordered to foreclosure auction, where LB Construction of South Florida — the general contractor on the project — submitted the winning bid. In April, an investor group led by real estate broker Vivian Dimond took over the project. The group spent about $5 million reimbursing buyer deposits and then made the decision to convert H3 to rental apartments.“We are not going to be a condo,” Dimond said in a Sept. 1 interview. “At least not under my ownership.”

While a widely acknowledged downturn in condo development is unfolding, with some developers pivoting to rentals, pricey sales within the last several months highlight the market’s impressive ride to the top of the cycle. A new unit at Palazzo del Sol on Fisher Island, which sold for about $31.3 million, commanded the highest price paid for a condo in South Florida since 2015, when hedge funder Ken Griffin paid $60 million for a penthouse at Miami Beach’s Faena House, according to research by The Real Deal.

To rank the priciest sales in Miami-Dade this cycle, TRD analyzed deeds recorded in the county since January 1, 2011, and referenced those against data from CraneSpotters, a database that tracks all new condo developments that have filed plans since 2011. By comparing the sales against the CraneSpotters list of developer entities, TRD was able to rank only new development sales. Resales were not counted.

The analysis found that four of the top 10 priciest sales took place this year; however, many industry insiders say the sky-high prices herald the approach of a cyclical South Florida downturn, while others go further and argue that despite these deals, the region’s luxury market has been in a slump for some time.

Data from CraneSpotters.com shows that 11,860 South Florida condos were under construction in August, down from 13,467 at the end of last year.

“Roughly half of what is going to be delivered in this cycle is still under construction,” said CraneSpotters.com founder Peter Zalewski. “The deliveries are building up. You’re probably going to see most of it come online in the next 12 to 18 months.”

Beyond that, Zalewski said he expects the decline to just get worse: “We’re in the first year of the downturn … And in 2019, we’ll probably hit bottom. In ’20 or ’21, we’ll probably start building again.”

Dodge Data & Analytics recently reported that the value of condominiums and other Miami-area multifamily housing projects that advanced to the construction phase dropped 43 percent in the first half of the year from the same period last year.