#ifc markets regulation

Explore tagged Tumblr posts

Text

Companies Aligning To Shape Blockchain Standards And Best Practices

ADGM, the leading International Financial Centre (IFC) of the UAE’s capital, has signed a Memorandum of Understanding (MoU) with Chainlink, the standard for onchain finance, marking a major step in advancing compliant tokenisation frameworks. This alliance will support innovative projects under ADGM’s Registration Authority by leveraging Chainlink’s technical expertise, industry insights, and a suite of advanced services to maximise the utility of tokenised assets while ensuring regulatory compliance.

Chainlink’s market-leading services, including blockchain interoperability and verifiable data solutions, are facilitating liquidity across global markets, enabling over USD19 trillion in transaction value. Trusted by major financial market institutions, this alliance with Chainlink aligns with ADGM’s vision to drive innovation, enhance connectivity, and establish a global approach to regulating the blockchain ecosystem.

https://www.adgm.com/media/announcements/adgm-and-chainlink-forge-alliance-to-shape-global-blockchain-standards-and-best-practices

0 notes

Text

Global BIM Standards and Regulations: What Students and Professionals Should Know

As Building Information Modeling (BIM) becomes more popular around the world, students and professionals in Architecture, Engineering, and Construction (AEC) need to understand global BIM Standards and regulations. Knowing these standards is key if you want to work with international teams or be ready for today’s global construction industry. Here’s a quick guide on the basics of global BIM standards, why they matter, and how they impact the field.

What Are BIM Standards, and Why Are They Important?

BIM standards are guidelines and best practices that help make sure BIM projects are done consistently and with high quality. They provide clear rules for handling data, creating models, and working together smoothly. Following these standards is important because it:

Reduces Project Errors and Miscommunication.

Streamlines Workflows Across Multidisciplinary Teams.

Ensures Legal Compliance and Improves Data Accuracy.

Supports Project Scalability, allowing work across regions or markets without Quality Loss.

Key International BIM Standards

There are several important BIM standards used around the world to make sure projects are consistent and smooth. Here are some of the most well-known ones:

ISO 19650: This is a global standard for managing information in construction projects. It focuses on how teams should work together, manage digital information, and deliver projects. It’s used in many countries, so students and professionals should understand it.

BS 1192 (UK): This standard, originally from the UK, explains how to collaborate and manage data in BIM projects. Even though it’s now part of ISO 19650, it’s still important to understand because it lays the foundation for how BIM documentation works.

Level of Development (LOD): LOD is a set of standards used globally to show how detailed a BIM model should be at different stages of a project. It goes from 100 (basic) to 500 (fully detailed), helping teams know what level of accuracy and information is expected at each phase.

IFC (Industry Foundation Classes): IFC is an open standard that helps different BIM software programs communicate with each other. It makes it easier for teams to collaborate by sharing and exchanging BIM data, no matter what software they’re using.

Regional BIM Standards and Regulations

Many countries have developed BIM guidelines for their specific regulatory requirements and industry practices. Here are examples from leading BIM-adopting countries:

United Kingdom: The UK is considered a BIM pioneer. It requires BIM Level 2 compliance on all public projects, ensuring consistent data exchange and collaboration across project teams. This includes compliance with the BS 1192 standard and is part of the wider ISO 19650 family.

United States: Although the US lacks a single national BIM standard, the National BIM Standard–United States (NBIMS-US) provides guidelines, including a focus on interoperability. Many government agencies and private firms require BIM adherence, following standards like COBie (Construction Operations Building Information Exchange) for facility management.

European Union: The EU has been proactive in promoting BIM adoption, requiring it for public infrastructure projects. Standards like the EN ISO 19650 are promoted, ensuring that EU nations share a common approach to BIM.

Singapore: Singapore’s Building and Construction Authority (BCA) requires BIM for large public projects and has created a roadmap for full BIM adoption. This includes guidelines on data sharing, clash detection, and energy analysis, emphasizing efficiency and sustainability.

Australia and New Zealand: Australia and New Zealand have adopted BIM for public works projects, with both countries promoting collaboration and data sharing via guidelines that align with ISO 19650.

How Standards Influence BIM Education and Careers

For students and professionals in the Architecture, Engineering, and Construction (AEC) fields, understanding BIM standards is an essential skill that boosts employability and career growth. Knowledge of standards like ISO 19650, IFC, and LOD not only improves project efficiency but also makes candidates more competitive in the job market. This is why Anita BIM Solutions offers the Best online BIM Course in Kerala—an ideal option for students and professionals aiming to excel in this field. For those wondering about the best course after civil engineering, a specialized BIM course in Kerala offers a valuable step forward, with Ernakulam being a central hub for BIM training.

Here’s how learning BIM standards in a BIM course in Ernakulam or online through Anita BIM Solutions can benefit students and professionals:

Learning the Basics: Anita BIM Solutions covers essential standards in its curriculum, including ISO 19650, IFC, and LOD. This foundation prepares students for real-world BIM projects, helping them understand and apply industry standards.

Hands-On Practical Application: Practical experience is vital in the BIM field. Training programs like those at Anita BIM Solutions incorporate real projects, allowing students to get hands-on experience with standards, data management, and collaboration. This makes learning more effective and prepares students to confidently apply BIM in various scenarios.

Certification for Career Advancement: Earning certifications in BIM standards, especially through respected organizations like Anita BIM Solutions, can significantly enhance a candidate’s profile. Many employers prioritize certified professionals, as it reflects a thorough understanding of BIM best practices. Certification through Anita BIM Solutions—recognized for providing the best online BIM course in Kerala—can be a major career advantage.

For those searching for the best course after civil engineering or a high-quality BIM course in Kerala, Anita BIM Solutions offers a comprehensive path to mastering BIM standards and advancing in the field. By combining technical knowledge with practical skills, graduates of Anita BIM Solutions are well-prepared for BIM-focused roles in the global AEC industry.

1 note

·

View note

Text

Understanding Non Banking Financial Company in India

What is a Non-Banking Financial Company (NBFC)?

An NBFC is a company registered under the Companies Act, 2013, that provides financial services but does not hold a banking license. NBFCs operate in various sectors such as loans, asset financing, insurance, leasing, and investments. They are regulated by the Reserve Bank of India (RBI) under the RBI Act, 1934, but do not offer core banking services like accepting demand deposits from the public or issuing checks.

Key Differences Between NBFCs and Banks

While both banks and NBFCs provide financial services, there are some key differences:

1. Deposit Acceptance: Unlike banks, NBFCs cannot accept demand deposits.

2. Payment and Settlement System: NBFCs are not part of the payment and settlement system and cannot issue checks.

3. Deposit Insurance: Deposits with NBFCs are not insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), unlike those with banks.

Despite these differences, NBFCs are pivotal in delivering financial services across various sectors.

Types of NBFCs

NBFCs in India are categorized based on their activities and types of deposits accepted. Here are the main categories:

1. Asset Finance Company (AFC): Engages in financing physical assets like machinery, automobiles, and equipment used in productive sectors.

2. Loan Company: Primarily focuses on providing loans and advances that do not involve asset financing.

3. Investment Company: Engages in acquiring securities, such as shares, stocks, and bonds.

4. Infrastructure Finance Company (IFC): Specializes in funding infrastructure projects and requires a minimum Net Owned Fund (NOF) of Rs. 300 Crore.

5. Microfinance Institution (MFI): Provides microloans to individuals or small businesses, particularly in rural and semi-urban areas, with a focus on income generation.

6. Core Investment Company (CIC): Holds a minimum of 90% of its total assets as investments in group companies, with 60% of its equity investments in these companies.

7. Infrastructure Debt Fund (IDF): Facilitates long-term debt flow into infrastructure projects by raising resources through bonds.

8. NBFC-Factors: Engaged in the business of factoring, which involves the sale of receivables to improve cash flow.

9. Mortgage Guarantee Companies (MGC): Provides mortgage guarantee services with at least 90% of assets in guarantee business. Visit our website for complete details.

Advantages of NBFCs

NBFCs offer several advantages over traditional banks:

1. Diverse Financial Services: NBFCs can engage in various activities such as loans, leasing, hire-purchase, insurance, and investment management, offering a broad range of financial services.

2. Regulatory Flexibility: Although regulated by the RBI, NBFCs enjoy more flexibility than banks, which allows them to cater to niche markets with innovative financial products.

3. Easier Access to Capital: NBFCs can raise funds through various means, including debentures, bonds, and loans. Some NBFCs are also allowed to accept deposits.

4. Faster Loan Processing: NBFCs often have streamlined loan approval processes, resulting in quicker loan disbursals compared to traditional banks.

Foreign Investment in NBFCs

The Indian government allows 100% Foreign Direct Investment (FDI) in NBFCs under the automatic route, provided they engage in certain specified financial activities such as asset management, stock broking, financial consultancy, and venture capital. NBFCs with foreign investment must comply with minimum capitalization norms as defined by RBI guidelines, depending on the level of foreign ownership.

Registration Process for NBFCs in India

To operate legally, an NBFC must undergo a registration process with the Reserve Bank of India. Below is a step-by-step guide:

1. Incorporate the Company: Register your company under the Companies Act, 2013, ensuring that the primary objective is engaging in financial activities.

2. Meet the Net Owned Fund (NOF) Requirement: Ensure that the company has a minimum NOF of Rs. 200 Lakhs, primarily in equity shares.

3. Prepare a Detailed Business Plan: Draft a comprehensive business plan, including financial projections and operational strategies.

4. Apply Online: Submit an online application to the RBI through its official portal along with required documents such as the Certificate of Incorporation and business plan.

5. Submit Hard Copies: Send a signed hard copy of the application and supporting documents to the regional RBI office.

6. Board Resolutions: Pass board resolutions confirming adherence to RBI’s Fair Practices Code and affirming that the company will not engage in restricted activities.

7. Director Credentials: Ensure that at least one-third of the company’s directors have a minimum of 10 years of experience in finance.

8. Comply with RBI Norms: Meet any additional compliance requirements such as CIBIL ratings and FDI norms, if applicable.

Conclusion

Non-Banking Financial Companies (NBFCs) are integral to the financial system in India, providing essential services that extend beyond the reach of traditional banking institutions. By facilitating access to credit, especially in underserved areas, NBFCs contribute significantly to economic development and financial inclusion. With a thorough understanding of regulatory requirements and a clear registration process, businesses can successfully enter the NBFC sector and thrive in India’s growing financial ecosystem.

#Non Banking Financial Company Registration#Non Banking Financial Company In India#Non Banking Financial Company#NBFC Registration

0 notes

Text

ESG in the Boardroom: Data Governance and Corporate Disclosure Requirements in Brazil

The integration of ESG frameworks and practices in companies, as well as the release of sustainability reports, is an increasingly widespread practice in Brazil, although carried out voluntarily, based on ESG criteria and indexes such as the standards of IFC, GRI, SASB, International Financial Reporting Standards, Task Force on Climate-Related Financial Disclosures, Task Force on Nature-Related Financial Disclosures, Climate Bonds Standard, United Nations Sustainable Development Goals, UN Global Compact Brazil Local Network, among others.

In addition, certain sectoral associations are discussing and publishing ESG guidelines for companies and institutions, including the Brazilian Banks Federation (FEBRABAN), the Brazilian Association of Financial and Capital Market Institutions (ANBIMA), the Brazilian Banks Association (ABBC), among others.

Nevertheless, in accordance with its regulatory scope, the Brazilian Association of Technical Standards (ABNT) published ABNT PR 2030 ESG in December 2022, which sought to standardise the metrics and guidelines for reporting ESG information. The ‘Recommended Practice’ is the world’s first national ESG standard and is one of the baselines for creating the first global ESG standard, which is currently being applied by the International Organization for Standardization (ISO).

Several regulatory agencies in Brazil have issued rules on ESG reporting. Financial institutions must follow the rules issued by Brazil’s Central Bank (BACEN). Issuers of bonds and securities must include ESG information in their annual report or reference form, pursuant to Brazil’s Securities and Exchange Commission (CVM) and the Official Stock Exchange (B3) regulations and guides. Finally, insurance companies, open complementary pension fund entities, capitalisation companies and local reinsurers are also under scrutiny for sustainability reporting pursuant to the Superintendence of Private Insurance (SUSEP)norms, among others.

Significant specific ESG-related terms have also been addressed by Brazilian regulators to mitigate occurrences of greenwashing or social washing. For example, the use and definition of terms such as ‘green’, ‘social’, ‘sustainable’and ‘ESG’, among others, and the parameters for such use, have been established by the National Council of Self-Regulation in Advertisement (CONAR), through the Brazilian Code of Self-Regulation in Advertisement, by CVM, through CVM rules, and by the Brazilian Association of Financial and Capital Market Entities (ANBIMA).

Continue reading.

1 note

·

View note

Text

IFC vs. SOX: Impact on Accounting Practices in CA Firms

In the world of accounting, regulatory measures have always played a vital role in shaping the accounting practices of firms. Two significant regulatory measures that have come into effect in recent times are the Internal Financial Controls (IFC) and the Sarbanes Oxley Act (SOX). Both have had a tremendous impact on the accounting practices of CA firms. In this article, we will take a closer look at the differences between these two measures and their impact on accounting practices.

Firstly, let's understand what IFC is. Internal Financial Controls (IFC) are mechanisms put in place to ensure the accuracy and completeness of a company's financial statements. It involves a set of procedures or controls that help organizations to manage risks effectively, safeguard assets, and comply with regulatory requirements. The main objective of IFC is to ensure that financial data is accurate, transparent, and reliable. It helps to identify potential errors or fraud and ensures that financial information is timely and accurate.

On the other hand, the Sarbanes Oxley Act (SOX) is a US federal law that was enacted in 2002 to regulate public companies' financial reporting. It is intended to improve the accuracy and reliability of financial statements, protect investors, and restore public confidence in the financial markets. SOX primarily focuses on internal controls, corporate governance, and financial reporting. It requires companies to establish internal control systems and procedures for financial reporting and disclose any deficiencies in internal controls.

Now that we understand the difference between the two regulatory measures, let's take a closer look at their impact on accounting practices.

IFC:

IFC has had a significant impact on accounting practices in CA firms. It has placed a greater emphasis on internal controls and financial reporting. CA firms need to ensure that their clients have established and implemented effective IFC measures to ensure that their financial statements are accurate, complete, and reliable. IFC also requires regular financial reporting and auditing to ensure the accuracy and completeness of financial data. CA firms need to ensure that their clients meet these requirements promptly.

SOX:

SOX has had a massive impact on accounting practices in CA firms. It has established strict regulations for financial reporting, internal controls, and corporate governance. Companies need to establish and maintain effective internal controls and financial reporting procedures to comply with SOX regulations. This includes establishing a code of ethics, ensuring independent audit committees, and implementing financial controls and procedures. CA firms that work with publicly traded companies need to ensure that their clients are compliant with SOX regulations. SOX has also increased the demand for audit and assurance services, and CA firms have had to hire additional staff to provide these services.

Conclusion:

Both IFC and SOX have had a significant impact on accounting practices in CA firms. While IFC has focused more on internal controls and financial reporting, SOX has established strict regulations for financial reporting, corporate governance, and internal controls. CA firms need to ensure that their clients are compliant with these regulations and have implemented effective measures to manage risks and safeguard assets. Overall, compliance with these measures has led to greater transparency, accuracy, and reliability in financial reporting, which benefits investors and the public.

I.P. Pasricha & Co helps clients manage the complexity of defining and documenting IT controls, as well as regular testing and reporting on such controls under the appropriate IFC and SOX laws.

#ifcvssox#assetassurance#cafirminjanakpuri#cafirmindelhi#internal audits#internal control#ca firm in delhi for articleship#fraudinvestigation

0 notes

Text

Olymp Trade Review: An In-Depth Analysis of a Leading Online Broker

What is Olymp Trade?

Olymp Trade, a well-known online trading platform, provides access to financial markets for traders from all over the world. Since its establishment in 2014, the company has grown quickly to become a dominant force in the industry, renowned for its trustworthy service and cutting-edge features. In this review, we'll look more deeply at Olymp Trade, covering its history, functionalities, and potential uses.

Olymp Trade History and Background:

Olymp Trade was established in 2014 by a group of seasoned financial professionals to give traders of all skill levels an approachable and accessible trading platform. The corporation has offices in Russia and Cyprus and its headquarters in St. Vincent and the Grenadines. The International Financial Commission (IFC) oversees Olymp Trade and ensures that the broker conforms to global financial rules.

Olymp Trade Features and Services:

Olymp Trade offers a range of features and services designed to make trading accessible and profitable for traders of all levels. The platform offers access to over 70 financial instruments, including stocks, currencies, commodities, and cryptocurrencies. Traders can choose from a variety of trading instruments, including options, forex, and cryptocurrencies.

Olymp Trade distinguishes itself with a proprietary trading platform that is simple to use and intuitive. Both desktop and mobile users can access this platform, which offers traders a range of tools and indicators to help them make wise trading decisions. Additionally, Olymp Trade provides a wide range of instructional tools, like trading methods, webinars, and video tutorials, to aid traders in developing their skills and expertise.

What Type of Trading is Olymp Trade:

Olymp Trade Plus:

Olymp Trade Plus is a loyalty program offered by Olymp Trade that allows traders to earn rewards and benefits based on their trading activity. Traders can earn points for every trade they make, which can be redeemed for prizes such as cashback, bonuses, and trading signals. The program also offers exclusive benefits, such as access to a personal account manager and priority support.

2. Bill Williams Fractals Olymp Trade:

Many traders on the Olymp Trade platform employ Bill Williams' trading strategy of fractals. This strategy is based on the usage of fractals, mathematical patterns that can be utilized to identify potential market trends. Traders can utilize Bill Williams fractals to establish probable entry and exit locations for trades and to manage risk.

3. Kingfin Olymp Trade:

Kingfin is a fintech firm that offers a diverse array of services to traders, such as access to the Olymp Trade platform. The company is based in Cyprus and operates under the authorization and regulation of the Cyprus Securities and Exchange Commission (CySEC).

Olymp Trade CEO and Olymp Trade Headquarters:

The CEO of Olymp Trade is Dmitry Sergeev, who has over 10 years of experience in the financial industry. The company's headquarters are located in St. Vincent and the Grenadines, with additional offices in Cyprus and Russia.

Olymp Trade App: Legit or Scam ?

With the Olymp Trade app, users can legally trade a range of financial products online, including currencies, commodities, stocks, and cryptocurrencies. The International Financial Commission (IFC) oversees Olymp Trade and ensures that all financial service providers adhering to international financial standards.

It's important to note that there are some fraudulent apps and websites that may try to impersonate Olymp Trade or other legitimate trading platforms, and users should always be cautious when downloading and using any financial app. To ensure that you are using the official Olymp Trade app, it's recommended that you visit the official website and download the app from a trusted source, such as the Apple App Store or Google Play Store.

Understanding the Oversight of Olymp Trade: Is the Broker Regulated by the Reserve Bank of India (Olymp Trade RBI):

It's important to note that Olymp Trade is not regulated by the Reserve Bank of India (RBI), as the RBI only regulates banks and financial institutions in India. However, Olymp Trade is regulated by the International Financial Commission (IFC), which is an independent organization that oversees financial services providers in international markets. The IFC ensures that Olymp Trade operates in accordance with international financial standards and provides a dispute resolution mechanism for traders who may

Olymp Trade Reviews:

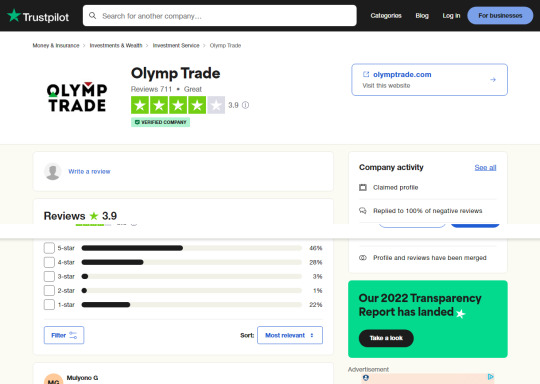

Trustpilot Reviews:

Olymp Trade has a rating of 3.9 stars on Trustpilot, with over 711 reviews. The majority of reviews are positive, with traders praising the platform's user-friendly interface, reliability, and customer support. Some negative reviews mention issues with withdrawals and customer support, although these are relatively rare.

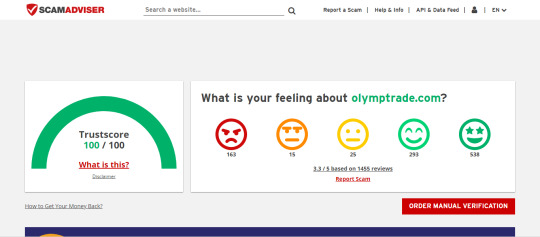

Scam Adviser Reviews:

Olymp Trade has a high trust score on Scam adviser, indicating that it is a trustworthy trading platform with positive reviews from its users. The website is regulated by the reputable International Financial Commission (IFC) and has a secure website with a valid SSL certificate to protect users' personal and financial information. Overall, Scam adviser's review suggests that Olymp Trade is a legitimate and reliable platform, but it's still advisable to conduct your own research and due diligence before investing in any financial product or service.

Troubleshooting Fractals on Olymp Trade:

Tips for Identifying Key Levels of Support and Resistance: if "Bill Williams Fractals not showing in Olymp Trade":

There could be a few cases if you're utilizing the Olymp Trade platform and have problems visualizing fractals. Here are a few such justifications:

It's possible that the asset or chart you're looking at doesn't have fractals. Fractals are frequently utilized on price charts, however they might not be accessible on all types of charts or at all times. To see fractals, you might need to change the chart settings or the object you're using.

It's possible that the asset or chart you're looking at doesn't have fractals. Fractals are frequently utilized on price charts, however, they might not be accessible on all types of charts or at all times. To see fractals, you might need to change the chart settings or the object you're using.

You might not have fractals enabled in your platform settings. To ensure that fractals are enabled and visible on your charts, check your platform's settings.

There might be a problem with your platform's technical setup. Fractals may not be seen even after you have reviewed your settings; this indicates that there may be a platform-specific problem. You can try logging out and back in again, or you can ask for help from Olymp Trade customer service.

Overall, it's critical to analyze the issue and double-check that you have the proper settings and assets chosen if you are having trouble seeing fractals on the Olymp Trade site. It is worthwhile to take the effort to ensure that you are able to use fractals successfully because they can be a beneficial tool for traders.

Conclusion:

Overall, Olymp Trade is a reputable and reliable trading platform that offers a range of features and services designed to make trading accessible and profitable for traders of all levels. The platform's proprietary trading platform, educational resources, and loyalty program make it a popular choice among traders, while it's regulation by the International Financial Commission provides an added layer of security and transparency. While there are some negative reviews, the majority of traders have had positive experiences with Olymp Trade, making it a strong option for those looking to trade financial markets online.

#olymp trade ceo#kingfin olymp trade#olymp trade headquarters#olymp trade plus#bill williams fractals olymp trade#olymp trade india#olymp trade trustpilot#olymp trade rbi#india

0 notes

Text

HOW DO I PLACE A PENDING ORDER IN supertradingonline sto MARKETS?

HOW DO I PLACE A PENDING ORDER IN supertradingonline sto MARKETS? Read More http://fxasker.com/question/f096e2a1de93370c/ FXAsker

#activtrades test#ayondo markets#ayondo sgx#ayondo withdrawal#exness office in india#forex course london#forex demo account and mt4 downl#forex trading algorithm#fxtm nigeria#gsg forex bonus#high yield money market accounts#ifc markets regulation#IPOPEMA#ironfx vs xm#jfd brokers kommission#keith goldson avatrade#SKOPALINO FINANCE#stock penny#SUPERTRADINGONLINE STO#swissquote london#teletrade lebanon jobs#ufx group#ufx support#wikipedia ads securities-llc#windsor 7 drink#Online Stock Brokers

0 notes

Text

I don’t do a lot of “hot takes,” but here’s a particularly scalding one: the MPAA’s rating system is antiquated and inconsistent to the point of being completely worthless. Their defense of the decision to punish IFC Films for screening the unrated cut of The House That Jack Built basically boils down to “But think of the children!” And that’s goddamn ridiculous: the “official,” approved version of the movie is clearly being marketed as a “hard R” affair, meaning the distinction is probably superficial at best. No, this isn’t for the benefit of parents; this is an obvious case of bureaucrats flexing their muscles because they know nobody takes them seriously.

The damnedest thing about this situation is that I’m not even interested in seeing The House That Jack Built. But there’s a point where self-regulation becomes just as draconian and creatively stifling as government censorship. The Comics Code crossed that line back in the ‘50s, and if the MPAA hasn’t already, then it’s getting dangerously close.

1 note

·

View note

Text

Benefits of Registering Your NBFC In India

Obtaining a NBFC License in India is not a tedious task these days, a businessman can hire a legal consultant to understand the nbfc registration process. In this article, we will discuss nbfc company registration in India.

Historical Background

Historically, NBFCs have been an integral part of the Indian financial ecosystem as significant financial intermediaries channeling savings and investments, particularly for the small-scale and retail sectors, as well as underserved and unbanked parts of the Indian economy.

Evolution

NBFCs have changed throughout the years as a result of substantial changes in the regulatory environment for NBFCs in India, which has gone from simplified rules to harsh and comprehensive restrictions, as well as toward rationalisation per the newly amended NBFC regulatory framework. Given these high levels of regulation, NBFCs have emerged as favoured choices for meeting credit demands, as their cheap cost of operations gives them an advantage over banks. With the evolution in this industry nbfc registration process has become easy and fast. Even one can avail the services like NBFC online registration, via this process you can obtain NBFC License at your doorstep.

Financial Aid and Government Programs to Assist

Furthermore, as a result of the advent of government-backed programmes such as the Pradhan Mantri Jan-Dhan Yojana, which has contributed to a considerable increase in the number of bank accounts, NBFCs have progressively become crucial mechanisms to drive growth and entrepreneurship. NBFC Company registration is currently in high demand and the government is providing various distinct benefits to the newcomers.

These NBFCs have also been critical in mitigating and managing the spread of risks during times of financial stress, and they are increasingly being acknowledged as banks' complementing services.

NBFCs in India have become an extremely crucial and integral part for all business services, including loans and credit facilities, planning of retirement, money market, underwriting, and merger, demerger and acquisition activities. As a result, these firms play a significant role in providing credit to the unorganised sector as well as small borrowers on a local level. Furthermore, hire purchase finance is the most important activity of NBFCs, and the fast expansion of NBFCs has steadily blurred the borders between banks and NBFCs, albeit commercial banks continue to be important. These NBFCs promote long-term investment and financing, which is difficult for the banking industry, and their rise broadens the choice of products available to individuals/institutions with resources to invest.

Possibilities for NBFCs

The ongoing difficulty in public sector banks (PSUs) as a result of rising bad debt and deterioration in rural lending has offered an opportunity for NBFCs to expand their footprint. Product lines, reduced costs, a broader and more effective reach, superior risk management skills to detect and contain bad debts, and a better understanding of consumer groups distinguish these NBFCs from PSUs.

Furthermore, increasing macroeconomic conditions, increased credit penetrations, consumer themes, and disruptive technology developments have all had an impact on NBFC lending growth. The stress in public sector units (PSUs), underlying credit demand, digital disruption for MSMEs and SMEs, increasing consumption and distribution access, and sectors where conventional banks do not lend are all important factors for the shift from traditional banks to NBFCs.

NBFC Categorizations and Industry Structure at the Present

As of January 22, 2021, there were 9,425 NBFCs registered with the RBI, which were classified as Asset Finance Companies, Loan Companies, Infrastructure Finance Companies (IFCs), Systemically Important Core Investment Company (NBFC – CIC – ND – SI), Infrastructure Debt Fund (NBFC – IDF), and Micro Finance Institutions (NBFC – MFIs). Investment Credit Companies (ICC) have retained a leading share of total assets in the NBFC industry, as have IFCs, as seen below for the 2019-2020 timeframe.

Where is the expansion?

Some of the significant sectoral credit growth across important sub-sectors includes MFIs, which grew by 80% in 2019-20, and housing loans, which grew by 37% in the same timeframe. Similarly, growth in loans and advances for NBFC-IDFs and NBFC-MFIs has been significant, at 46 percent and 8 percent, respectively, for the 2019-20 period, and has shown an increasing trend in 2018-19.

NBFC Growth Engines as Growth Drivers

NBFCs have also been a critical component of crucial financing for MSMEs, owing to considerable development in the rural, small-scale, and unbanked sectors. A huge lively startup and entrepreneurial environment has increased NBFC demand, while government policy efforts such as the Pradhan Mantri Yojana and the National Rural Financial Plan have further augmented the market.

These include the diverse financial demands of the Indian economy, which are being driven by expansion in lending, credit, and auto finance. As a result of these development factors, we see NBFCs with larger balance sheets and increased public money. Improved NBFC profitability ratios have been seen for NBFC-ND-SIs across measures for ROA, ROE, and NIMs, with significant year-on-year returns between 2019 and 2020. For 2019-2020, NBFC-Ds' ROA has been essentially stable, ROE has fallen, while NIMs have increased year on year.

Impact of GST on Banks and NBFCs

The implementation of GST in India represents a significant departure from the current tax framework. The service sector is likely to have a greater influence on GST than the industrial or trading sectors. Among the services offered by banks and NBFCs, financial services such as fund-based, fee-based, and insurance services would experience significant changes from the existing situation.

Due to the type and amount of activities offered by banks and NBFCs in terms of lease transactions, hire purchase, actionable claims, fund and non-fund based services, and so on, GST compliance would be challenging to execute in these sectors. The structure under the Model GST Law does not give much advantage or attention to banks and NBFCs based on an understanding of the kind of transactions they do on a continuous and voluminous basis.

Issues and impacts pertaining to the provision of GST Law

Currently, an NBFC or a bank with pan-India operations can fulfil their service tax obligations through a single 'centralised' registration. However, under GST, such banks/non-banking financial companies will be required to get a separate registration for each state in which they operate. In addition to registration, the compliance burden for filing returns has grown significantly in terms of the frequency of returns, the variety of return forms, and the degree of data required in these returns.

Input Tax Credit leveraged and de-leveraged

Currently, banks and NBFCs prefer to reverse 50% of CENVAT credit availed on inputs and input services, but CENVAT credit on capital goods can be obtained with no reversal requirements. Under GST, 50 percent of the CENVAT credit obtained on inputs, input services, and capital goods is to be reversed, leaving them with a 50 percent credit on capital goods, raising the cost of capital.

Assessment and Adjudication made bothersome

The evaluation will be carried out by the state regulators under which the relevant branch is registered. Every registered branch of a bank or an NBFC must now defend its chargeability position in the relevant state as well as the basis for using input tax credit in multiple states.

Because there would be more than one adjudicating authority engaged under GST, each authority may have a different conclusion on the same fundamental problem. This divergence of opinion will lengthen the adjudication procedure. Currently, a taxpayer is adjudicated on a single issue by a single adjudicating body. Various adjudicating authorities may take different positions on the same topic under GST. It would be difficult to resolve and cope with the differences of opinion supplied by the various adjudicating authorities.

Issues related to revenue recognition under GST

Financial Services That Are Account-Linked

The location of the recipient of services on the records of the supplier of services will be the site of provision. Identifying the state of location of the service receiver will be tough in India's digital and centralised setting. In cases where service recipients, such as professionals, manufacturers, traders, and other workers, frequently relocate from one location to another in search of better opportunities, the service provider may have multiple addresses, including a permanent address, a current address, a communication address, and a KYC address.

Financial Services That Are Not Account-Linked

The location of the service provider would be the place of supply of service in this case. This will again affect enterprises that are prevalent in distant places and run and transact from a back office situated in another state.

Relevant Claims

Because actionable claims do not qualify as a service under Service Tax, no tax is due under the existing regime. Actionable claims are now included in the definition of supply of goods under GST. Services delivered as a result of invoices reduced to securitization will now be taxed primarily on a B2C and B2B basis.

Know the NBFC registration fees?

For an NBFC License, a minimum capital of Rs. 2 crore is required; hence, an applicant must register a company with the appropriate capital as well as the required government fees. Legal professionals can help you with nbfc registration online in a timely and cost-effective manner.

This provided information is all you need for a nbfc registration online and attain a NBFC license. So, another important thing is to find a suitable legal consultant and advisor. As per my experience MUDS Management is India’s most trusted and leading corporation dealing with nbfc company registration. To know more about their services and book consultation for NBFC registration fees and nbfc registration process, you can visit the website.

Conclusion

With the expectation of further information, financial sectors confront a bag of worms in terms of business transactions, customer profiles, service matrix, IT systems, and operations to gather data at both the front and back end. IT systems will need to be more watchful in terms of solving the complexities associated with GST compliance and processes at a larger volume. The impact of GST on banks and NBFCs will be significant enough that operations, transactions, accounting, and compliance will all need to be reviewed.

#NBFC#nbfc registration process#nbfc registration online#nbfc registration#NBFC license#NBFC registration fees

0 notes

Text

GWEC Creates Africa Wind Power to Accelerate Africa’s Energy Transition

The Global Wind Energy Council (GWEC) has launched Africa WindPower (“AWP”) to address a clear need for a regional body representing the wind industry. AWP offers a platform for dialogue between Africa’s wind industry and government stakeholders, with the ultimate goal of scaling up and accelerating wind project development and deployment across the entire African continent. With sufficient investment appetite already in place, the development of fit-for-purpose government policy and regulation for the energy transition is necessary to unlock private investment from both within and outside of the continent. Despite an early start for wind energy in Africa, wind energy deployment has often been held back as fossil fuel generation sources such as natural gas continue to make inroads in some markets, and coal, heavy fuel oil, and diesel remain a large part of the energy mix. A recent report commissioned by the International Finance Corporation (IFC) shows that Africa has 59,000 GW of technical onshore and offshore wind potential, enough to meet the continent’s energy demand 250 times over. Building out wind farms that utilize Africa’s vast wind resources will drive investment, create clean energy jobs and critical infrastructure, and help support thriving local economies in line with the region’s Sustainable Development Goals. The time for a wind-powered Africa has come; Africa WindPower is here to help make it happen. That message is supported by many entities including the International Energy Agency (IEA), the International Renewable Energy Agency (IRENA), the World Bank Group’s IFC, African Ministries of Energy and National Utilities, National Associations, leading wind energy companies, local wind developers and investors, community leaders and youth climate activists. They’ve joined forces to deliver the message that the time for wind energy for Africa has come. (Please see full list of Africa WindPower Launch Event Speakers below) Ben Backwell, GWEC CEO commented: “Africa has already begun its transition to a clean energy future, but this process is moving far too slowly with incumbent fossil fuels playing too prominent a role. Countries across the continent have the crucial ingredients to develop thriving local wind industries, which would bring significant jobs and economic growth to diverse communities. Despite what we are hearing on the world stage ahead of COP26, it is not only ‘Climate Finance’ but greater collaboration between the private and public sectors that will drive Africa’s energy transition and increase access to reliable sources of electricity.” GWEC’s latest data shows that Africa is only tapping into 0.01 per cent of its wind resource, with over 7 GW of installed capacity as of the end of 2020, led by South Africa. Current installed wind energy capacity in Africa helps to avoid 10.7 million tonnes of CO2 emissions annually – equivalent to taking 2.3 million passenger cars off the road. Wangari Muchiri, Africa WindPower Coordinator, added: “Africa has the opportunity to leapfrog traditional fossil-fuel-based energy systems to achieve a robust renewable energy mix. Wind Power is a vital part of this clean energy transition allowing for decentralized, affordable and clean energy. In addition, Africa boasts fantastic wind resources which can power the continent 250 times over while creating jobs and enabling the development of local industries. GWEC's Africa WindPower will bring various stakeholders together to decrease the knowledge gap and increase the development and deployment of wind power throughout the continent.” Africa WindPower is supported by GET.invest, a European program that aims to mobilise investment in renewable energy, supported by the European Union, Germany, Sweden, the Netherlands, and Austria. Read the full article

#AfricaWindPower#GlobalWindEnergyCouncil#GWEC#GWECAfricaWindPower#wind#windenergy#windindustry#windpower

0 notes

Text

Specialty Glass Market Intelligence with Competitive Landscape 2027

Specialty glass is high valued products for technical applications such as glass tubes, optical and ophthalmic glass, display panels, lighting glass, and glass ceramics. The growth of the electrical & electronics & construction industries is expected to drive the growth of the specialty glass market during the forecast period. Furthermore, socio-economic factors such as increasing disposable income, changing lifestyles, increasing population, rapid urbanization, and economic growth are expected to support the growth of the global specialty glass market.

According to MRFR analysis, the Global Specialty Glass Market is expected to reach a value of USD 35 Billion by the end of 2025 registering a CAGR of 7%.

To request a sample copy@ https://www.marketresearchfuture.com/sample_request/8430

Pricing and Regulatory Analysis

The prices of specialty glass increased in the past couple of years due to continuous increase in raw material cost and energy cost. Moreover, stringent environmental regulations set by regulatory bodies such as Integrated Pollution Prevention and Control (IPPC), International Finance Corporation (IFC), REACH, and US Environmental Protection Agency are expected to influence the pricing and the trading. The global specialty glass export value increased by around 5% and import value increased by around 4% in 2018. The specialty glass is traded under the HS codes 7011, 7014, 7015, and 7017.

SEGMENTATION

By Application

Borosilicate Glass: Borosilicate glass is an engineered glass developed particularly for its use in pharmaceutical, laboratories and in applications requiring harsh mechanical, chemical, and thermal conditions. Furthermore, borosilicate glass is resistant to thermal shock thereby is used for cookware and other applications.

Aluminosilicate Glass: Aluminosilicate glass is used in high-end applications such as shuttle windows, smartphones, gauges, and thermometers attributed to its properties such as high impact protection, scratch resistance, and increased strength.

Soda-Lime Glass: The segment accounted for the largest share of the global specialty glass market. The high-volume consumption of soda-lime glass is attributed to its low cost, chemical stability and ease of workability. It is used to produce a wide array of products such as windows, dinnerware, lighting products, bottles, and art objects.

Alkali-lead Silicate Glass: The alkali-lead silicate glass has superior chemical resistance, corrosion resistance and optical properties, owing to which it is used in high-end technical applications such as X-Ray machines, solar panels, and nuclear technology.

Others: The other segment includes aluminoborosilicate glass and ceramic glass.

By End-Use Industry

Construction: The construction segment accounted for the largest share of the global specialty glass market and is expected to witness significant growth during the forecast period. The high growth can be attributed to increasing residential construction activities across the globe coupled with increased spending on the renovation of buildings to build modern architecture. For, instance, the residential construction spending in the US was USD 6.5 trillion in 2018, an increase of USD 422 billion as compared with 2017.

Electrical & Electronics: The specialty glass finds various applications in electrical & electronic devices such as smartphones, TV, and domestic appliances. The increasing demand for electronic devices and domestic appliances is likely to drive the demand for specialty glass in the electrical & electronics industry.

Telecommunications: With the development of fifth-generation (5G) wireless technologies, the telecommunication segment is expected to unleash new growth opportunities for specialty glass market. Furthermore, the increasing demand for optical fiber and stiff competition among telecommunications companies is expected to augment the growth of the specialty glass market.

Laboratories & Pharmaceuticals: The segment is expected to witness moderate growth primarily driven by the growing pharmaceutical industry, particularly in Asia-Pacific.

Others: The other segment includes aerospace and automotive industries. Specialty glass is mostly used for windshield and other interior applications. Increasing automotive production and increasing prevalence of electric vehicles across the globe is driving the growth of other segments during the forecast period.

Access Report Details @ https://www.marketresearchfuture.com/reports/specialty-glass-market-8430

By Region

North America: The growth of the market in the region is driven by increasing construction activities and the growing electronics industry.

Europe: Increasing automotive production and investment in research & development is expected to drive the demand for specialty glass in the market.

Asia-Pacific: Asia-Pacific largest and fastest-growing regional market, led by China, Japan, and India.

Latin America: Increasing investment in automotive and electrical & electronics industries across Brazil and Mexico is expected to boost market growth.

Middle East & Africa: Increasing investment in construction activities and infrastructure development are set to boost regional market growth.

0 notes

Text

HOW MANY Bosscapital FUNDS CAN I HAVE?

HOW MANY Bosscapital FUNDS CAN I HAVE? Read More http://fxasker.com/question/8c7ad3b28c1ea781/ FXAsker

#218 pepperstone drive mocksville#ADM DERIVATIVES#alpari options apk#avatrade go#BOSSCAPITAL#city index twitter#dukascopy scams#EUROXX#forex account no deposit bonus 2#forex aud nzd#forex trading strategy 6 double#forex trading volume#fxcm contest#fxdd demo server#fxdd vietnam#hotforex joint account#ifc markets regulation#maxfx opinie#octafx account#odessa forex club#swissquote platform#teletrade bonus#TRADESTO#ufx rme#vantage fx client portal#Currency Converters

0 notes

Text

Zomato’s express delivery

Well that was quick. Zomato, which launched an Indian startup unicorn’s first domestic IPO last week, will be listed on India’s stock exchanges starting tomorrow.

Also in this letter:

🦄 BlackBuck is going to be a unicorn 🏦 Digital rupee “in phases”, says RBI 🚨 CCI says Amazon was hiding facts in the Future Group deal

Zomato will go public tomorrow

July 23rd will mark a historic day for India’s startup ecosystem as Zomato food delivery platform makes its highly anticipated debut on the domestic stock exchanges.

The Gurugram-based firm originally planned to record on July 27, but has now postponed it until tomorrow, ET reported Wednesday evening.

More than 40 times oversubscribed: Last week, Zomato launched the first domestic IPO of an Indian startup unicorn. The issue was subscribed 40.38 times and generated demand of Rs 2.13 lakh crore, the highest for a domestic IPO in 11 years and the third highest in the history of the Indian capital market.

The IPO, which opened on July 14 and completed on July 16, also set a record for anchor investors and attracted the second highest number of registrations of all time. The allocation of the IPO share allocation to investors took place today (June 22nd).

IPO offer: The issue included fresh equity valued at Rs 9,000 billion and an Selling Offer (OFS) valued at Rs 375 billion from existing investor Info Edge (India). At the high end of the price range, the company will have a market cap of nearly Rs 64,500 billion. Prior to going public, Zomato had raised Rs 4.197 billion from 186 anchor investors by allocating 552.2 million shares at Rs 76 each.

India’s startup ecosystem has been closely watching Zomato’s IPO performance as it could set the tone for a number of other companies including Paytm, Policybazaar and Mobikwik.

Read our in-depth look at Zomato’s IPO, what it means for other startups and the company’s path so far.

BlackBuck goes to the unicorn club

The online trucking platform BlackBuck became the newest member of the Indian startup unicorn club.

Push the news: BlackBuck raised $ 67 million in a round led by Silicon Valley-based venture fund Tribe Capital, IFC Emerging Asia Fund, and VEF, which valued the startup at over $ 1 billion. The company was previously valued at approximately $ 850 million on its last fundraising in 2019.

BlackBuck has increased nearly $ 300 million since it was founded through a mixture of equity and debt financing. Investors also include Accel, Apoletto Asia, B Capital, Flipkart and Goldman Sachs.

Where should the money go? The company will use the money to expand its customer base and introduce new services. Rajesh Yabaji, co-founder and CEO of BlackBuck, said the company will invest heavily in product and data science capabilities to achieve better freight matching efficiency for the Indian trucking ecosystem. The startup will also be scaling its financial services and insurance offerings through partnerships.

This funding comes as a company sees a shift in demandwith most of it no longer coming from large corporations but from small businesses, brokers, and large corporations. “In the past two years, digital adoption has increased … we’ve seen 20x growth on the supply side and 10x growth in demand,” said Yabaji.

big picture: It’s been a record year for domestic startups, raising $ 12.1 billion from venture capitalists and private equity firms in just the first six months. India’s startups cost $ 11 billion in all of 2020, according to Venture Intelligence.

The continued flow of cash amid high valuations has also helped catapult a record number of startups into the Unicorn club.

Tweet of the day

RBI says the digital rupee will be rolled out gradually

The Reserve Bank of India (RBI) is working on a “phased introduction” of the Central Bank of India’s (CBDC) digital currency and a pilot project to test a general purpose digital currency is possible in the near future, RBI Deputy Governor T Rabi Shankar said on Thursday.

What is a CBDC? CBDC is a form of virtual currency issued by a central bank as an alternative to physical currency. In contrast to cryptocurrencies such as Bitcoin and Ethereum, CBDCs are covered by the state reserves of nation states and are therefore not subject to the same volatility.

Enable legal framework: In order to launch India’s CBDC, RBI is reviewing several legal frameworks, including amendments to several sections of the RBI Act, the Coin Act 2011, the Foreign Exchange Administration Act, and the Information and Technology Act.

What are the advantages? Shankar said a CBDC would reduce reliance on cash, lower the cost of printing cash, and provide a more robust settlement mechanism. Another key benefit is the elimination of “time zone differences” in foreign exchange transactions, which could pave the way for a cheaper and smoother international settlement system.

meanwhileAt the other end of the world, Tesla CEO Elon Musk said on Wednesday that they will likely accept Bitcoin as a payment option again after carefully considering the amount of renewable energy used to mine the currency.

Musk noticed that too he and his space company SpaceX also own Bitcoinapart from Tesla. Musk also owns Ethereum and Dogecoin in his personal capacity.

Catch up quickly: Tesla bought about $ 1.5 billion in Bitcoin in February and announced it would accept the digital coin as a payment option. But in May, Musk announced on Twitter that Tesla would end this initiative, citing concerns about the “rapidly increasing use of fossil fuels for Bitcoin mining and transactions.”

That move had triggered a bitcoin route, with the cryptocurrency falling nearly 17% within hours of the tweet. It also sparked allegations of “price manipulation,” which Musk denied last month.

On Wednesday, Musk said, “I could pump, but I’m not caving in … I definitely don’t believe in pushing the price up and selling or anything like that. I want to see Bitcoin successful. “

CCI accuses Amazon of hiding facts about the Future Group deal

In a notice to Amazon, India’s competition regulator accused the company of hiding facts and providing false information while seeking approval to invest in a Future Group unit, Reuters reports.

The deal: Amazon had agreed to acquire a 49% stake in Future Coupons, a promoter of Future Retail, for around 1,500 billion rupees in August 2019. The firm is currently involved in a lawsuit with Future Group and Reliance Industries after the latter took over Future Group’s retail and wholesale business.

Amazon has argued in court that the terms of its 2019 deal prevent Future Group from selling Future Retail to Reliance.

CCI notice: The Competition Commission of India (CCI) announced in a June 4 announcement that the US e-commerce major had failed to disclose its strategic interest in Future Retail when it applied for approval for the 2019 deal. “The representations and behavior of Amazon before the Commission represent false information, false information and the suppression and / and concealment of essential facts,” it says in the communication.

CCI has now asked Amazon why it shouldn’t punish the company.

What is Amazon saying? Amazon confirmed to Reuters that it has received the notice and will extend its full cooperation to the CCI. The company said it was “confident that we can address the concerns of the Chamber of Commerce”.

What’s next? If CCI isn’t happy with Amazon’s response, it could fine the company and also review its deal with the Future Group, Vaibhav Choukse, partner at J Sagar Associates, told Reuters.

Large retailers are seeing a 2- to 9-fold increase in online sales

India’s largest brick and mortar retailers are seeing a huge shift in consumer behavior as more people shop online amid the pandemic.

What’s happening? Reliance Retail, DMart, Croma, Aditya Birla Fashion & Retail and Spencer’s Retail increased their online sales by 2 to 9-fold in 2020-21, although many of their stores either remained closed due to Covid-19 restrictions or had restricted their operations. This is based on disclosures made in their annual reports and presentations to investors.

For India’s largest retailer Trust retail, accounted for the e-commerce business about 10% of sales by the end of FY21, down from almost zero last year. The growth was led by the company’s own platforms Jiomart and Ajio.com as well as acquired startups such as Netmeds, Urban Ladder and Zivame.

Devendra Chawla, managing director of Spencers Retail and Nature’s Basket, said online sales accounted for up to 30-40% of their total sales during the peak months of the lockdown.

Today’s ETtech Top 5 was written by Vikas SN in Bengaluru and published by Zaheer Merchant in Mumbai.

source https://seedfinance.net/2021/07/22/zomatos-express-delivery/

0 notes

Link

In the reliable Fruit and Vegetable Seeds Market report, complete and crystal clear outline of the market is penned down which is useful for many businesses. The info included in the document helps businesses know how patents, licensing agreements and other legal restrictions affect the manufacture and sale of the firm’s products. Examination of major challenges faced currently by the business and the probable future challenges that the business may have to face while operating in this market are also considered.

Few of the leading organizations’ names are listed here- Bayer AG, Syngenta Crop Protection AG, Groupe Limagrains Holding, Sakata Seed Group, Advanta Limited, TAKII & CO ltd, Mahindra group, Rijk Zwaan Zaadteelt En Zaadhandel B.V, Western Bio Vegetable Seed Ltd, Maharastra Hybrid Seeds Company Private Limited, Corteva Agriscience, KWS SAAT SE & Co., DLF Seeds & Science, Invivo, Royal Barenbrug group, KALO and IFC Solutions, among others.

Interpret a Competitive Outlook Analysis with Sample Report: https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-fruit-and-vegetable-seeds-market

Succinct Description of the Market:

Fruit & vegetable seeds market is expected to reach 14.5 billion and grow at rate of 8.30% in the forecast period of 2020 to 2027. Increasing innovative production practices, new product offerings and with the arrival of modernization of agriculture are the key factors which are driving growth of the global fruit & vegetable seeds market.

With the growing population across the globe the demand of food is expected to drive the market growth in the significant forecast period. Hybrid vegetable seeds have specific properties in them such as resistance to diseases, improve the yield and additional nutrients. Hybrid vegetable seeds market is growing due to the technology advancements in agricultural production and with the changing climate conditions across the globe. However, with the stringent regulations in order to avoid harmful pesticides in farming practices is one of the factor restraining the growth of the vegetable seeds market.

This fruit & vegetable seeds market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, change in market regulations, strategic market growth analysis, market size, category market growths, application niche and dominance, product approvals, product launches, geographic expansions, technological innovations in the market, To gain more info on Data Bridge Market Research global fruit & vegetable seeds market contact us for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

0 notes