#if you buy these on amzn I will know and I will come for you in the night

Explore tagged Tumblr posts

Text

TIS THE SEASON FOR MEGAN’S FAVORITE BOOKS OF 2020

No particular order, no narrowing down, definitely a theme, and no, I will not accept criticism at this time. I will suggest you buy all of these from your local independent bookstore and read them ASAP.

--BLACK SUN by Rebecca Roanhorse CROW GODS and BLOOD MAGIC and SEA ADVENTURES, BETRAYAL and LOVE and POLITICS and WORLDBUILDING TO DIE FOR that's FRESH and NEW and characters who I will lay down my life for, give me the second one now please I am dying

--THE MIDNIGHT BARGAIN by CL Polk Historicalish fantasy that is LUSH and DELIGHTFUL, full of girls who are ferocious and will not give up what they want. THERE IS DANCING and they TALK WHILE DANCING and it is so TENDER and BEAUTIFUL and the END IS [cheffkiss].

--COURT OF MIRACLES by Kester Grant So damn CLEVER, grafting Les Mis onto an urban Jungle Book of guilds and knives and promises, with a story about sisters at its heart that had me throwing the book across the room. I love it so.

--QUEEN'S PERIL by EK Johnston People who don't like The Phantom Menace are wrong and this book proves why. Also, I would die for the handmaidens, THEY ARE SO BRAVE, YOUR HIGHNESS.

--THE SCAPEGRACERS by Hannah Abigail Clarke VOICEY and loud, FERAL and frankly unhinged in the BEST POSSIBLE WAY, this book is about GIRLS with razor-edges and magic and splinters and it reads like a scream.

--BEOWULF: A NEW TRANSLATION by Maria Dahvana Headley You might not think this is your cup of tea, but I promise, you are wrong. Bc it isn't a cup of tea. It's an old-timey flagon of mead poured into a line of shot glasses on a bar. Read it out loud like it's slam poetry. Enjoy.

--NETWORK EFFECT by Martha Wells Do I have to say anything about MURDERBOT or is just saying IT'S MURDERBOT enough?

--THE UNSPOKEN NAME by AK Larkwood (god that was this year) David Eddings by way of Gideon the Ninth; witty and cheeky and bloody and so very queer. It's the "Classic" fantasy updated for the new age that I have been WAITING FOR and I am SO HAPPY it exists.

--THE STARLESS SEA by Erin Morgenstern Dreamlike, fairy-tale, mystery, stories inside stories. There were several points where I had to set it down and stare into the distance and several other points where I just shouted "FUCK" too loudly. I'm mad about how good this book is.

--TEN THOUSAND DOORS OF JANUARY by Alix E. Harrow I knew I was going to fall in love with this for being quiet and achy and fierce, but I did not know how much. It is about family and discovery and growing and DOORS and I love it so much. SO MUCH.

--BONDS OF BRASS by Emily Skrutskie AN ADRENALINE RUSH OF A NOVEL that I will never shut up about because it has all my favorite things: Wen, roommates, hotshot piloting, the minivan of spaceships, REVOLUTION, Wen, pining, THAT! ENDING! and did I mention Wen?

--FRIENDLY NEIGHBORHOOD SPIDER-MAN by Tom Taylor and Marcelo Ferreira SPIDER-MAN AS HE SHOULD BE, a complete DISASTER, just trying to help, who cannot do his own goddamned laundry but who can save the world. Or at least his small part of New York. Classic Garbage Son!Peter Parker

Out in 2021: AETHERBOUND by EK Johnston From unquestioned queer rep to fascinating magic, from deep digs into abuse and the value of human life to the importance of choosing family, Aetherbound is practically perfect and my heart is full.

and A DESOLATION CALLED PEACE by Arkady Martine A first contact story with the pacing and machinations of ARRIVAL and the questions of legacy, personhood, self, and memory that were foundational to AMCE. HOW WIDE IS THE CONCEPT OF YOU? GIVE ME MORE MAHIT, ARKADY, PLEASE, I BEG.

#op#books#favorite books#booklr#if you buy these on amzn I will know and I will come for you in the night#just buy from an indie I beg you

107 notes

·

View notes

Photo

Finding high quality film/tv rips, saving the large files, and screencapping them are half the battle for gifmakers when setting out to make a gifset. Here’s a little guide on this process, including my advice on

Where to download stuff

Where to store your movies/shows

Screencapping programs

Making gifs as HQ as possible, including tips for picking out what to download when you have multiple options (not all 1080p rips of the same movie or tv episode are the same quality and I explain why)

Why screencaps of 4k movies can look weird and washed out and how to fix that

and more

✨ You can find my gifmaking 101 tutorial here and the rest of my tutorials here.

Where can I download movies and shows?

First off, I prefer direct downloading rather than torrenting stuff because it’s faster and with torrenting, there’s more of a risk. Other people downloading the same torrent can see your IP address. This means movie studios can find out you’re downloading their content and can send you a warning letter. The download speed also varies depending on how many other people are seeding it. I would only do it if it’s your only option and you have a VPN or something.

This is THE best guide for pirating I’ve ever seen. I use it for finding sites for books, music, you name it. The part of the guide you’d want to look at is where it says Direct Downloads Link (DDL) sites. My favorite place is Snahp. These ddl sites will have links to their movie/tv rips that are typically hosted on one of these two sites: google drive or mega.nz. You can download stuff from both of those sites for free, but with mega, they have a 5GB file download limit unless you have a premium account. I personally pay the $5 a month membership for mega because it’s worth it imo. You can buy a subscription through the mega app found on the iphone app store (so you’re billed through apple and it’s less scary than giving a random site your credit card info lmao) and as for androids I think mega has an app on there too.

So basically, if you go to http://snahp.it, they’ll have rips for different movies and shows.

You click on the movie title and it’ll take you to a page where they have links for the video which they have uploaded on a variety of sites (including mega).

How do I make my gifs as HQ as possible?

It’s best to gif things that are 1080p. And usually the higher the file size, the better. A really important thing to note is that not all 1080p bluray rips are the same. The piracy groups that rip these files take uncompressed .mkv rips from discs that are anywhere from 10gb to like 50gb, and then run that through video converters to compress the file down so that they’re 2-8gb. Sometimes when that happens, the video quality goes down a LOT. The same goes for TV episodes. One rip could be 800mb, the other could be 3gb and both could claim to be “1080p” but the quality would be NOTICEABLY different. Your best bet is to always pick the rip with the highest file size.

I’ll show you an example with this scene from You’ve Got Mail.

I downloaded 2 different 1080p rip versions of the film. Both claim to be 1080p, but one is 2.41 GB and the other is 9.75 GB. After taking screencaps, it’s obvious that there’s a BIG difference in quality.

(these pictures are best viewed on desktop tumblr)

When it comes to Blu-ray rips, download remux versions of films and shows if possible. Remux means .mkv files that are uncompressed and straight from a Blu-Ray disc. Giffing remux rips cuts down on the possibility of seeing pixel-y effects a LOT in my experience. It’ll take a bit longer to download than typical 1080p rips but it’s worth it imo.

For TV episodes, if you can’t find a Blu-Ray rip, uploads with the word AMZN in it are usually the highest quality and your best bet (unless you see another upload that’s higher in file size - again: always try to pick the highest file size). 'AMZN’ means they’re from a person that ripped the episode from Amazon Prime Video.

Also, even better than 1080p is 4k (2160p). I only really recommend this though if you know you’re going to gif something up close and crop it a lot - like if it’s a big 540x540px close-up gif of a person. You’ll REALLY see the difference if it’s a 1080p vs 4k rip in that situation. I usually don’t bother with giffing 4k files unless it’s the case above because my laptop lags when taking 4k screencaps and it takes longer to load them into photoshop (4k screencaps are usually about 60mb each!)

⭐️ Another thing that’s important is making sure that when you actually make your gifs, you set them to the correct speed (.05 for movies and most shows, and .04 sometimes for reality tv and live broadcasts). Here’s my gif speed guide. Having the right gif speed is really important for making a gifset HQ. You don’t want it to look too slow or too fast.

What’s your favorite video player to take screenshots with?

MPV player, hands down. And I’ve tried a TON of programs over the years. I’ve tried KMPlayer and found that it added duplicate frames (and even missing frames) which is horrible, and I’ve tried GomPlayer which is.....I’m just gonna say it, I’m not the biggest fan of it. It’s a little overly complicated in my opinion and it has ads. If you like these programs, more power to you! Use whatever you’re comfortable using. I just like MPV the most because it doesn’t have ads, it’s simple, you can take sequential screencaps with a keyboard shortcut, and it can play 4k movies.

Screencaps I take of 4k 2160p movies look so dull and washed out, like the colors aren’t right. Why is that?

That’s because your computer can’t handle HDR 4k video files. It probably can handle SDR 4k video files, but unfortunately, 99% of 4k rips out there are HDR.

[picture source]

Now, HDR displays just fine on computers that have 4k-HDR capabilities, but most older computers don’t have this ability. Having said that, MPV - the video player I mentioned above can take a 4K-HDR video and fix the colors/lighting in real time so it displays correctly AND take screenshots of it with the fixed colors. If you have an older version of MPV, make sure you download the newest update for this. In my general gifmaking tutorial, there’s a portion on how to install this program on macs. I also just made a video tutorial on how to install it on pcs here!

High quality TV and Movie rips can take up a LOT of space on my computer. Where do you store your files?

I store them on external hard drives. External hard drives are like flash drives but they have a MUCH higher storage capacity. You just plug them into your computer via a usb cord when you need access to the files and it’s that easy. I have two of these Seagate 4TB hard drives in different colors so I can easily pick out whichever one I need. I have silver for my movies (because it makes me think of “silver screen” lmao and it’s easier for me to remember) and then I just have a blue for shows. Now, external hard drives of this size can be $$$$ but it’s worth it imo. Look out for when they’re on sale.

What’s the size limit for gifs now?

It’s 10mb! It used to be 3mb and then last year Tumblr upped it to 5mb. Some gifs initially had distortion because of Tumblr’s switch from the .gif to .gifv format, but they’ve fixed the problem AND increased the upload limit to 10mb. Just make sure not to add any lossy to a gif.

Lossy is basically a grain you can add to a gif to lower the file size down. Gifmakers (including myself) used to use this as a trick to get the file size down under 3mb. However, since the .gifv update on Tumblr, any gifs with Lossy added will look distorted like it’s a gif made on a phone app or something.

_________________________________

That’s it for this guide! Again, feel free to check out my other tutorials on photoshop, how to center subtitles, download hq movie trailers, and more ✌️

UPDATE 6/23/20 ⚠️

I’ve gotten an ask about this problem 3 times since I’ve uploaded this tutorial, so I thought I’d add this in. If you are experiencing duplicate and/or missing frames in mpv, it is a glitch with the latest version of mpv. download an older version like 0.29.0. this happened to me on my mac and downloading an older version fixed the problem.

2K notes

·

View notes

Text

alternative places to buy books instead of amaz*n

edited: removing abebooks from this list because i've been informed it's an amzn subsidiary. thanks!

i apologize in advance, these sources are generally best for people looking for books in the U.S. and not outside of it. this is by no means a comprehensive list; please feel free to add onto this list, especially if you know of places that cater to customers outside of the U.S.

used books

- thriftbooks (used and new, ships outside of U.S. at higher cost): you can usually get used popular books here for under $10 and they'll generally come in very good shape. for U.S. domestic orders, shipping is free for orders $10 or more, and only $0.99 for anything under. this was one of my favorite places to buy books for class when I was in college. they also have a points reward system, so every purchase gets you a certain amount of points, and if you earn enough, you get a $5 credit, which is generally enough to get you a free book.

- goodwill books (used, only operates in the U.S.): rather than aimlessly searching shelves in a physical store, goodwill has an online database that sells games, movies, and music in addition to books. free standard shipping on all orders, but shipping can take a while depending on where your order is coming from. it depends on what you're looking for, but books will generally be very cheap. i almost paid $50 for a book before finding it here for $10, and it came in near-perfect condition.

- abebooks (new and used, ships to many different locations): in addition to new and used books, this might also be a good resources for students to find cheap(er) textbooks. you also have the option to sell your textbooks back to them when you're done.

- bookmooch (a bartering system for used books, good for non-English texts, works worldwide): i haven't personally used this one, so this is just what i know from online information, but instead of buying books, there's a point system that allows you to give away and receive books. you list which books you own and want to give away, then someone can request that book from you. you ship it out to them and pay shipping fees (the only money you'll spend) and then gain points, allowing you to request books from others.

- bookoff (used, physical store, locations only in U.S.): their online store is only for buying anime figures and manga, but if you have a location near you like i do, i suggest you go there! unfortunately, the majority of them are in California, but they have a $1 section, where i've gotten a lot of good books. they also sell movies, music, video games, video game consoles, used electronics, and one time i randomly got a set of rubber stamps there.

new books

- bookshop (ships to U.K., Spain, and U.S.): an online bookstore meant to support independent bookstores by dedicating a certain portion of their profits to helping independent bookstores and providing a platform to connect you to independent booksellers . their "find a bookstore" feature is my favorite because they'll recommend you independent booksellers in your area and you can avoid the shipping costs and wait.

- indiebound: similar to bookshop except you can't buy directly from this website, but what it does is connect you to local booksellers based on your location and you can buy directly from their websites or go in person.

- just buy from indie shops' websites if they have one

other ways to get books

- this generally won't work with big publishers, but if the book's publisher is small enough, you can buy it directly from them

- just check for shops you can go to in your area!

- i know this is meant to be a resource for buying books, but also just borrow! borrow books from your local library or get them electronically. you can get access and borrow ebooks from your library using the mobile app Libby, and you don't need a kindle to read the books on, you can read directly from the app.

- if your library doesn't have the book you want, you can sometimes request an order. or you can do an inter-library loan, where your library will request it from another library system, though there might be a fee of a couple dollars.

- my final note. there is no need to buy the Twilight series new. every single used bookstore i've gone to has had multiple copies of the entire series for, like, a dollar for each book. i am generally very big on supporting authors because their income is nowhere near as glamorous as actors or directors, but SM will be fine. whatever you were willing to spend on the books, just donate that to moving the Quileute nation to higher ground

#bookblr#litblr#english major#studyblr#reading#books#literature#this is the culmination of my efforts not to buy from amaz*n as an english major who had to buy so many books#but this is also motivated by me seeing massive book hauls on bookstagram that came straight from amaz*n#i just think if you have the means to spend large sums of money on books in one go#you can be a bit more conscious about who you're supporting with your purchases#namely not someone like j*ff b*zos who is a real-life villain#i also have a list of g**dreads alternatives that i want to share#bye and thanks for this callout

38 notes

·

View notes

Text

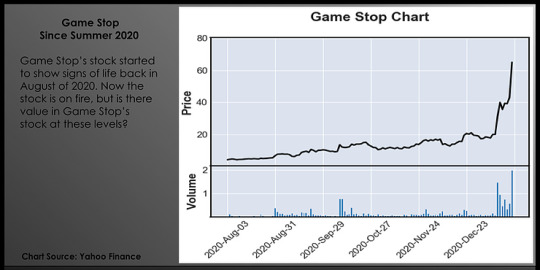

In Focus: GameStop

There may be no better feeling for a business owner than seeing a large demographic start to shift in your favor. For example, a company that specializes in faux fur or faux leather couches had to be excited when more of the society started to care about the treatment of animals and nature. Chipotle's market value increased as more Americans became health conscious, and began to question and analyze what they ate.

For video game companies the numbers started to look really really good in the early 2000s. At that time, a population of people who started playing video games on the Nintendo Entertainment System back in the 80s were beginning to graduate college and enter the "real world." A good portion of that generation, Generation X, still played video games, and now they were going to be able to financially support their own gaming habits. No more relying on mom and dad for games.

This was going to be a huge windfall of profits for gaming companies. My self for instance, by the mid 2000s, I could comfortably afford to purchase a few brand new games a month, and maybe more if I decided to cut back on something. Gaming companies were looking forward to this, and it's continued growth as more young adults stayed connected to gaming. GameStop (GME)

created a hiccup in the grand plan of the gaming companies by allowing gamers to buy and trade pre-owned games.

If you aren't aware of how it works, a customer walks into GameStop a week or two after a game is released, and asks for that game title, the GameStop employee by default sells them a pre-owned version of that game, unless the customer specifically requests a new game.

Through GameStop, brand new games were bought, played, and then sold back to GameStop. GameStop would then resell the game for a profit to another gamer, and the gaming companies only saw money from the first sale of their brand new game. To couple insult with injury, for game titles that were really in demand, GameStop would sell those used titles for only slightly less than the cost of a brand new copy.

GameStop circumvented billions of dollars from gaming manufacturers. Instead of someone like me buying two new games a month, I was often buying two used games a month, and only buying a new game when I was compelled to play a game right away, which wasn't often, because the real world left me with little time for gaming.

Operation Get Them The F*ck Out of Here

By the late 2000s and early 2010s the gaming companies had had enough of GameStop. As the Xbox One and PS4 were in the works, one of the issues both Microsoft (MSFT) and Sony (SNE) took on together was how to stop or slow the pre-owned game market.

The easy answer was to stop producing physical games, and instead just make everything digital. That ideal at the time would have mimicked the music industry, which had seen CDs all but disappear, but video games are much larger files than a full length Jay-Z album, and digital storage was getting cheaper, but it wasn't cheap at that time. Also, the internet infrastructure was still sketchy in many places around the world, and not everyone had access to high speed internet. A full game download over a bad internet connection could take hours to complete.

Microsoft flirted with an idea of a digital lock that would bound one game to one system, making it impossible for the game to be played on any other system after it was played on and matched to its host system.

Essentially, the GameStop problem was solved by gaming companies creating downloadable content or DLC. Now gaming companies sell to consumers what they say is a completed game, but then charges the consumer to make character upgrades or obtain tools that can make the game play easier or more fun. DLCs are purchased while playing the game, and have allowed game companies to get even more money out of consumers ($60 to purchase the game, and then more money spent on DLC), and it's caused gamers to keep games longer, because DLCs can extend the life of a game by adding difference levels and challenges, which again, the gamer has to pay for to access.

In addition to the DLC, the rise of smartphone gaming has been a thorn in the side of GameStop. Also, digital space is now the cheapest it's ever been, making digitally distributed games an option for gamers. Both Sony and Microsoft's newest consoles come in versions especially made for digitally distributed games. In these models, there is no CD drive to insert a physical game.

DLC, mobile gaming, and digitally distributed games together has been able severely hurt GameStop's stock price. In late 2013 the stock was trading above $55 per share, and it entered 2020 trading at under $6 per share, an 89% drop in a little over six years.

GameStop 2021

Today it appears GameStop's stock has gotten it's swagger back. The stock closed last week at $65.01, it even halted trading on Friday January 22, 2021 due to the volatility in the stock. Traders ran the stock up to as high as $77 per share on the day.

The GameStop's hype started last summer when Chewy (CHWY) co-founder Ryan Cohen's investment firm RC Ventures bought a 9% stake in GameStop. In the past week Cohen secured a board seat at GameStop, which played a big part in the week long rally in GameStop's stock.

Cohen helped build Chewy into a real player in the pet care space, which prompted PetSmart to acquire the company for over $3 billion. Investors are looking to Cohen to do it again, but this time with GameStop.

There's also a massive short squeeze that played out, that also contributed to the rocket-like rise in GameStop's stock price. The short squeeze occurred when investors who were short GameStop had to buy the stock to cover their positions as the stock price started increasing. The rapid buying of GME by short sellers to cut losses or prevent bigger losses helped to drive the stock price higher. A Barron's article suggests that GameStop short sellers have lost nearly $3 billion betting against the stock in 2021, ouch.

My Concern

My concern about the newfound love for GameStop centers around the company's problem, and what investors believe is GameStop's problem. Chewy has been applauded for its ability to survive against Amazon (AMZN)

(It's too early to say they've beaten Amazon). Because GameStop is considered a brick-and-mortar retailer, I believe investors see Amazon as the problem, which is understandable because Amazon is the problem for most brick-and-mortar retailers. Unfortunately, Amazon is not GameStop's biggest problem, and I say unfortunately because GameStop's problem is much bigger.

GameStop is disliked by the gaming industry. They're the partner none of the other partners care for. EA, Sony, Microsoft, Ubisoft, TakeTwo, Activision, they all win big with GameStop gone. With GameStop as we know it now gone, the plan I discussed earlier goes back into motion, and video game playing adults are back to buying new games all of the time, with a few going to eBay for pre-owned games. How does Cohen and his firm fix this issue?

Personally I'm out on this one, I'll watch it all play out from the sidelines. We won big shorting GameStop back in 2017, but I'm not ready to short it here. Investors should beware here at $65 per share. If you believe you see a solid pathway towards success for GameStop, and you believe that pathway leads to the company being worth more than $4 billion, then by all means, invest a way. To me, at this price level, it feels that the best possible plans for GameStop have already been incorporated into the stock price, not leaving much value to invest in at this time.

2 notes

·

View notes

Text

Using Closing High/Closing Low To Signal Continuation or Exhaustion

This article comes at a time where we have just finished trading January week 3, 2019. We have a long string of green candles on our daily chart. All are wondering, when can I buy puts and not see them decay so quickly? Something we can look for to answer this, is a continuation pattern in the form of daily closing highs, or an exhaustion pattern in the form of failing to make a higher daily closing high. As we make new intraday highs that are meaningful, like right now we are making new 2019 highs each day, we have to see a higher daily closing high to go with it. IF we make a new intraday high for 2019 and then sell off at the end of the day to close below the previous closing high, that is the exhaustion signal. We can usually count on a pullback of 1% off the intraday (2019) high. We might see quite a bit more, but 1% is good starting point.

METHOD Mark off the daily closing high on what you are trading in an uptrend, be it SPX, AMZN, NFLX, whatever. That becomes your benchmark. Watch for that level to HOLD or NOT on a closing basis. BE aware of that level if price moves well away from it, only to see it head fake you and come trading back to close below it, or hold above it.

The same thing can be used in an ongoing downtrend.

In Q4 2018, we could buy calls and watch them go to zero, or we could wait for the exhaustion signal. We began to sell off from the 2018 and ATH in October, we ticked down each day for a new low on the month, the quarter, and finally we started making lower lows for the year 2018. Each day we needed to see LOWER CLOSING LOWs as well. IF we did not, if we made a lower intraday low and then buyers took us up at the end of the day to make a higher close than the existing closing low, we knew calls would have a better chance of working.

REPEAT METHOD Mark off the daily closing low on what you are trading, if in a downtrend. That becomes your benchmark. Watch for that level to hold or NOT on a closing basis. BE aware of that level if price moves well away from it, only to see it head fake you and come trading back to close back below it, or hold above it.

You can use this signal to try and see through choppy trading as well.

When we are in relentless chop, if a day that starts off as a sell, turns around at some point and gives us a higher close than the one that acts as our current benchmark, we know we are likely to see the UPTREND continue. When we are in relentless chop, but we seem to have caught a bounce. Then at the end of the day we get selling and miss the close above the one we use as the benchmark, we know the selling is likely to continue, not time to BTD! IF we have an intraday high and a higher close, but then turn around and gap down the next session or open flat and trade down, make sure and be aware of the closing high. We have often seen a day like this play out only to have a buy program come in and take us up to close higher than our benchmark level. IF we see a higher close, we can look for the uptrend to resume. IF we don’t, we can look for continuation of the selling for another day. IF we have an intraday low and a lower close, then come in and gap up the next session or open flat and trade up, make sure and be aware of the closing low. If we see a sell program come in at the end of the day and take us back to make a lower close, even while holding a higher low, it it bearish. Be protective, look for selling to continue the next session. At this point you have probably become confused. Once you have seen this play out a few times, it will become second nature and you will always be on the look out for this. IT all start with marking your chart or making note on your list of levels for where the current closing high and low is. As of this article, the SPX closing high is 2670.71 from Fri 1/18/19. Use that as a benchmark, change it if we make a higher daily close from the next trading day forward (1/22/19).

1 note

·

View note

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2021/06/amazon-others-race-to-buy-up-renewable-energy

Amazon, Others Race to Buy Up Renewable Energy

The race to secure electricity deals for power-hungry data centers has tech companies reshaping the renewable-energy market and grappling with a new challenge: how to ensure their investments actually reduce emissions.

Amazon.com Inc. AMZN -0.05% said it planned Wednesday to announce commitments to buy 1.5 gigawatts of production capacity from 14 new solar and wind plants around the world as part of its push to purchase enough renewable energy to cover all of the company’s activities by 2025.

Tech companies are wielding their balance sheets to finance solar, wind and other renewable-energy projects on an unprecedented scale. In some countries, developers say tech companies’ willingness to spend upfront—signing commitments to buy energy at a certain price for long periods—has helped make corporations more important than government subsidies as the main drivers of renewable investment.

Amazon says its new investments will boost its total to 85 utility-scale wind and solar projects globally. Its existing projects include this wind farm in Texas.

Photo: Jordan Stead/Amazon

Amazon, Alphabet Inc.’s GOOG -0.42% Google, Facebook Inc. FB 0.46% and Microsoft Corp. MSFT -0.09% are four of the top six corporate buyers of publicly disclosed renewable-energy- purchase agreements, accounting for 30%, or 25.7 gigawatts, of the cumulative total from corporations globally, according to the research firm BloombergNEF. Amazon is the largest corporate purchaser world-wide, with other top purchasers including the French oil company TotalEnergies TTE -0.49% SE and AT&T Inc. T -0.45%

“It’s almost like a stampede for clean energy,” said Michael Terrell, director of energy at Google.

The scale of these investments is placing the tech companies under pressure to show that the projects actually add new renewable capacity to the energy grid instead of sucking up pre-existing supply. A thorny issue is whether tech companies’ green-power purchases replace power generated from carbon-emitting plants or simply increase power generation to feed growing global energy consumption. That is important because the companies want to tell consumers and investors that they are helping to reduce absolute carbon output, not just shifting it around.

“Just because you put a clean electron on the grid doesn’t necessarily mean you’re displacing a carbon-based electron,” said Brian Janous, general manager of energy and renewables at Microsoft. Mr. Janous said Microsoft is now analyzing power grids to determine at which locations and times of day additional renewable-energy production would replace the most production from existing fossil-fuel-powered plants to determine where to invest.

Amazon’s latest projects, across seven U.S. states as well as Canada, Finland and Spain, have pushed the firm’s signed commitments to a total of 10 gigawatts of renewable production, the company said. After the new deals, Amazon is the top all-time corporate purchaser of clean energy in the U.S., according to the Renewable Energy Buyers Alliance, a group of companies that promotes renewable-power procurement. The new plants, which will supply company operations including Amazon’s cloud-services arm, Amazon Web Services, are scheduled to come online in the next one to three years.

Newsletter Sign-up

Technology

A weekly digest of tech reviews, headlines, columns and your questions answered by WSJ’s Personal Tech gurus.

Nat Sahlstrom, director of energy at Amazon Web Services, said the company looks for projects where it can be first to set up a commercial template other companies can follow to help jump-start demand. He added that Amazon only selects projects based on whether its purchasing commitments are pivotal to the projects’ viability. “If not for our investments in these projects, they would not have gone forward,” he said.

Google, which said it matched its energy consumption with renewables beginning in 2017, says it now has a tougher goal: aligning its consumption with renewable energy not just annually but hour by hour. That means the company is trying to make sure there is sufficient carbon-free energy on electrical grids where it operates at the times when it is using power, including at night and at times of peak demand.

“I think the evolution is to focus not only on the quantity but also the quality of sourcing,” Mr. Terrell of Google said.

Driving the purchases are skyrocketing data usage and computer processing. In the past decade, growing efficiency has largely offset rising usage, in part as companies shifted from on-premises computer servers to more-efficient cloud providers, according to the International Energy Agency. But while there is more efficiency to tap, according to researchers, it isn’t clear for how much longer, particularly with the rise of 5G networks and as more of the world lives and works online.

Amazon Wind Farm Texas, one of the company’s early clean-energy projects, began operation in 2017.

Photo: Jordan Stead/Amazon

“The data-center industry is one of the largest power consumers world-wide,” said Stefan-Jörg Göbel, a senior vice president of wind and solar for the Norwegian energy company Statkraft AS. “They’re reshaping the demand side of the industry just from the pure physics of it.”

Data centers were estimated to account for roughly 1% of global electricity use, according to a 2020 paper in the journal Science.

Retail energy companies compete with local utilities to give U.S. consumers more choice. But in nearly every state where they operate, retailers have charged more than regulated incumbents, meaning you may be paying more for your electricity than your neighbor. Here’s why. Photo Illustration: Jacob Reynolds

Big tech companies say they have built up in-house teams staffed with former deal makers at electrical utilities who can source deals directly with providers, often sidestepping an industry of middlemen and brokers that generally handle power deals. Firms such as Amazon often blanket a country where they have operations with requests for energy projects, according to developers.

“We’ll say, hey, we want to go look at every potential project that could be in development in a country,” Mr. Sahlstrom of Amazon said of his team that seeks out power-purchase agreements, or PPAs.

Developers of wind- and solar-energy projects say demand from big tech has encouraged a rise in demand for PPAs from other corporate buyers. Because the projects require heavy upfront investment that takes years to recoup, banks often won’t finance them—or will give less favorable terms—unless the projects have an anchor purchaser promising to buy most or all of the production, according to developers and energy financiers.

In Spain, where Amazon has committed to buying power from five solar plants, developers say multiple big tech companies are looking for new deals.

Share Your Thoughts

Will emissions be reduced when tech companies buy up renewable energy to power data? Join the conversation below.

“We’re talking to all of them,” Martin Scharrer, who leads such negotiations for the renewable-energy producer Encavis AG ECV -1.16% , said of the tech companies. Mr. Scharrer previously struck a deal with Amazon to sell energy from a solar plant outside Seville, Spain.

Facebook said that it reached its goal of buying enough renewable energy to cover its global operations, including data centers, last year but that it is continuing to strike new power deals because its energy use is growing. Facebook’s electricity use rose 39% in 2020, according to its annual sustainability report. “It’s showing that voluntary targets are really moving the market,” said Urvi Parekh, director of renewable energy at Facebook.

Microsoft said it has power-purchase deals that it hasn’t yet announced that will catapult it to near the top of the world’s biggest green-energy buyers. Mr. Janous said his company focuses on shared environmental goals rather than rankings, but added: “We know what the rankings are and, trust me, my boss knows what the rankings are, and any time there’s a new one that comes out, I hear about it.”

Write to Sam Schechner at [email protected]

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

0 notes

Link

He might maintain the successful ticket in tech and Silicon Valley is aware of it The recipient of all these billions is Jio Platforms, a part of Ambani’s sprawling conglomerate Reliance Industries. Jio began as a cell community in 2016. Since then it has amassed round 400 million customers and launched a streaming service, a video conferencing app, a fiber broadband community and digital funds. Its super-cheap knowledge has helped carry a whole lot of hundreds of thousands of Indians on-line for the primary time. When Ambani launched Jio, India had fewer than 350 million web customers. Now, it has 750 million. Jio has turn into the gateway to India’s web, and Ambani holds the keys. “Numerous this variation, particularly by way of bringing individuals on-line, has occurred on the again of the constructive disruption that Jio triggered,” Ajit Mohan, Fb’s vp and managing director in India, advised CNN Enterprise. “Jio has been the hero in that story by way of offering that entry, and I feel that units the context for our funding and Jio and our partnership, as a result of… we noticed alignment of the imaginative and prescient.” Ambani’s imaginative and prescient retains getting greater. After elevating greater than $20 billion for Jio Platforms, Reliance went courting buyers for its retail enterprise. Between late September and early November, Reliance Retail raised round $6.4 billion, a lot of it coming from Jio buyers together with Silver Lake, Common Atlantic, TPG in addition to the sovereign wealth fund of Saudi Arabia. Ambani’s retail chain is the most important in India, with greater than 12,000 shops. And he has made no secret of his ambitions to mix his retail and tech empires to tackle two large US gamers. Amazon (AMZN) and Walmart’s (WMT) Flipkart dominate on-line procuring in India, controlling greater than 60% of the market between them. Ambani is making an aggressive play for a slice. He is doing that with JioMart, an initiative introduced in 2019 to carry on-line 1000’s of India’s mom-and-pop shops often called “kiranas.” And Reliance Retail not too long ago acquired one among its greatest Indian rivals, Future Retail, for $3.3 billion — a deal that has kicked off a protracted and sophisticated authorized battle with Amazon. Whilst he digests all of that, India’s richest man is already trying to the following large factor — bringing 5G to India within the second half of 2021. “It is going to be powered by an indigenous developed community, {hardware}, and know-how parts,” Ambani advised a digital viewers on the India Cellular Congress in November, in a potential nod to requires China’s Huawei to be excluded from constructing the nation’s 5G community. Any a kind of plans by itself can be an enormous enterprise and executing all of them collectively is a big ask even for one of many world’s high billionaires. His ambition is to essentially rework the best way greater than a billion individuals talk, do enterprise and make purchases. And the last word aim is to achieve billions extra. “We’re creating compelling homegrown options in training, well being care, agriculture, infrastructure, monetary companies and new commerce,” Ambani stated in his speech. “Every of those options, as soon as confirmed in India, will probably be supplied to the remainder of the world to handle world challenges.” Geography vs Expertise However the billionaire, who’s reportedly trying to take Jio public in america, might discover it difficult to parlay the corporate’s meteoric rise in India into success on the worldwide stage. “Reliance doesn’t have anyone space the place it has a technological edge and superiority like say Google’s search, Fb’s portfolio of social networks, Amazon’s e-commerce engine, Alibaba’s mixture of strengths in e-commerce and funds or Tencent’s tremendous app,” stated Ravi Shankar Chaturvedi, analysis director on the Institute for Enterprise within the International Context at Tufts College’s Fletcher Faculty. Relatively, Jio’s dominance has been largely geographical, helped by a regulatory regime that helps homegrown gamers. “One can be onerous pressed to give you a significant record of technological improvements and IP that Jio created that could possibly be the idea for its enlargement overseas,” Chaturvedi added. India is, after all, a large prize in itself that Jio has largely already captured. The nation’s on-line inhabitants of 750 million — second solely to China, which has shut out US corporations for many years — is the most important draw for world tech. Fb, Google, Amazon, Netflix (NFLX) and Uber (UBER), to call just a few, have already spent a number of years and billions of {dollars} to crack open the market. “For Silicon Valley, the Indian market alone is larger than the 5 subsequent greatest shopper markets — by inhabitants — on the planet mixed,” stated Chaturvedi. The place China has its “Nice Firewall” of on-line censorship that retains out US tech corporations en masse, Ambani has succeeded in making a “Nice Indian Paywall” that runs by means of Jio, Chaturvedi argues. International tech companies have been pressured to navigate a sequence of regulatory hurdles from an Indian authorities that has proven a higher willingness to clamp down on overseas gamers — whether or not blocking Fb’s efforts to offer free web, altering how corporations can retailer and gather knowledge or, extra not too long ago, shutting out Chinese language tech corporations over a border dispute. Ambani has been the most important beneficiary of lots of these laws, and the billionaire has been a vocal champion of Indian Prime Minister Narendra Modi and his marketing campaign for a “self-reliant” India. Just a few cracks — albeit small ones — have began to seem in Ambani’s dominance. Barely a day into 2021, the Securities and Trade Board of India ordered Reliance Industries and Ambani to pay a $5.5 million wonderful over what the regulator described as a “fraudulent and manipulative buying and selling scheme” over a former subsidiary in 2007. However that is unlikely to dent his tech ambitions. Ambani, who declined a number of requests to be interviewed for this text, is used to creating audacious bets and having them repay — often with huge sources at his disposal and a good political wind at his again. “In spite of everything he is India’s richest man, he has due to this fact the deepest pockets on this nation,” stated Paranjoy Guha Thakurta, journalist and co-author of Gasoline Wars: Crony Capitalism and the Ambanis. “I can say with none threat of contradiction that he has been supported by a positive political dispensation and a regulatory regime,” he added. From Oil to Jio The company empire that Ambani presides over in the present day appears to be like somewhat completely different to the one he inherited. His father, Dhirubhai, began a small yarn buying and selling agency in Mumbai in 1957 that he subsequently spun right into a thriving textile enterprise. Over many years, it grew into the sprawling conglomerate Reliance Industries spanning power, petrochemicals and telecommunications. Dhirubhai’s loss of life in 2002 kicked off an acrimonious succession battle that cut up the enterprise in two. Mukesh Ambani in the end took over the corporate’s predominant oil and petrochemicals belongings, whereas his youthful brother Anil assumed management of the newer ventures, together with telecom and digital companies. Then, in September 2016, Mukesh Ambani stormed onto his brother’s turf with a proposal that blew the lid off India’s telecom and web development. Jio gave each new buyer six months of free 4G web and Indians signed up by the hundreds of thousands, triggering a brutal value conflict. “You lure your customers by giving one thing free, and as soon as they have hooked onto it, you steadily begin growing the costs,” Thakurta stated. “It is the traditional approach all types of monopolies work throughout the globe.” One of many main casualties of the value conflict was Anil Ambani. His Reliance Communications firm introduced in late 2017 that it will promote most of its belongings and exit the cell enterprise. Two days later, Jio acquired Reliance Communications. And two years later, the elder Ambani underscored the divergence within the brothers’ fortunes by serving to repay an $80 million debt to Ericsson (ERIC), retaining Anil out of jail. Jio’s meteoric rise has helped offset a few of the volatility in oil that value Ambani billions final yr and arrange Reliance for a future that is additional faraway from its core enterprise. In actual fact, an organization spokesperson beforehand advised CNN Enterprise that the title Jio — which suggests “to dwell” in Hindi — was chosen partly as a result of it is a mirror picture of the world “oiL.” The daring try to remodel his $170 billion conglomerate faces a large check in 2021 as the Indian financial system recovers from its first recession in practically 1 / 4 of a century. Like different tech corporations world wide, Jio has strengthened throughout the pandemic, however the query is whether or not it may well proceed to develop quick sufficient for the corporate to meaningfully transition away from oil. Ambani charted his course years in the past. “Information is the brand new oil,” he stated in 2017, simply six months into his marketing campaign to disrupt India’s tech panorama. India first, then the world For American tech giants, having an enormous homegrown participant in your nook typically makes life simpler abroad, and Jio is by far the most important in India. “Why did Fb, why did Google…put of their cash in Jio at a time when the world financial system is in a large number, the Indian financial system is in recession, why would they do it? Clearly as a result of there may be greater than an financial angle,” stated Thakurta. “It is also I imagine, not directly… a political insurance coverage of kinds.” Mohan, Fb’s India head, denied that authorities regulation was a part of the dialog. “That did not have something to do with our funding in Jio or the partnership,” he stated. “It actually did come from recognizing that this was a particular firm that had finished fairly superb work in reworking the digital infrastructure of India in a brief time frame.” From Ambani’s perspective, a wide-ranging coalition of a few of the greatest names in tech is only a solution to additional Jio’s command over all facets of India’s web. The corporate already controls a lion’s share of the pipes by means of its huge cell community. By means of Fb, it’s working to combine JioMart with WhatsApp, the one platform in India with a person base akin to Jio’s. With Google, it is gunning for management of cell gadgets by collectively creating an “entry stage, inexpensive smartphone” for India’s big center class. And it is even acquired a watch on the chip know-how that underpins these networks and gadgets by means of companions reminiscent of Qualcomm. “As digitization of the Indian financial system and Indian society picks up velocity, the demand for digital {hardware} will develop enormously. We can’t depend on large-scale imports,” Ambani stated final month. “I clearly foresee India changing into a significant hub for a state-of-the-art semiconductor business.” Qualcomm, a longtime Jio companion, joined the funding bandwagon by spending round $97 million in July for a 0.15% stake. Jio’s dedication to constructing out its personal community whereas additionally creating a smartphone offered the chipmaker with a novel alternative to become involved on either side of Ambani’s web entry plan, in response to Quinn Li, senior vp and world head of the corporate’s funding arm Qualcomm Ventures. “For those who have a look at operators the world over, not many are that vertically built-in,” he advised CNN Enterprise. “Given we are the know-how provider to the business, we’re I feel finest outfitted to work with Jio each on the gadget entrance in addition to infrastructure.” Ambani seems able to leverage the worldwide backing for Jio and Reliance Retail into IPOs, saying in June that he would “transfer in the direction of itemizing of each these corporations throughout the subsequent 5 years.” An IPO for Jio Platforms on Nasdaq may come as quickly as 2021, in response to a number of media studies and business analysts. Reliance didn’t reply to a request for touch upon its IPO plans. “I would not be shocked within the least,” stated Thakurta. “When you’re on Nasdaq, you give all these buyers exit route.” Ambani appears assured he can get the world to purchase into India’s second, anchored in his firm. And given his monitor document to date, he has no purpose to not be. “Associates, we’re about to step into a wonderful decade of the India story,” he declared. “Nothing can cease India’s rise, not even Covid-19. That is our likelihood to create historical past.” Supply hyperlink #Hold #IndianbillionaireMukeshAmbanimayholdthewinningticketintechandSiliconValleyknowsit-CNN #Silicon #Tech #ticket #Valley #Winning

0 notes

Text

In Focus: Amazon, Wall Street’s Gift

Last year Apple's (AAPL) stock price started its epic run from $240 per share to over $500 per share before doing a 4-to-1 split. Nothing could contain Wall Street's excitement and anticipation of the iPhone with 5G.

On Thursday Apple released its most recent quarterly results, which did not blow Wall Street away. Apple's iPhone sales for the quarter came in at $26.4 billion, which was below the $27.7 billion consensus. Slowing iPhone sales in China caused Wall Street to panic and hit the sell button on Apple, sending the stock price down over 5.5% on Friday.

This sell off and Wall Street's exit from Apple would be funny if these big firms didn't have such a large influence over the public's money.

For a year Wall Street has used the storyline of the 5G iPhone as a reason to buy Apple, and with one mediocre quarter Wall Street is ready to sell, even though the quarter Apple recently reported on did not include the company's 5G iPhone.

Apple's iPhone 12 with 5G technology was only recently released, and will be included in the company's next quarterly earnings call.

Maybe the selling in Apple's stock occurred because Wall Street realized buying Apple based on the iPhone 12 and 5G technology was always a weak story and it only got weaker when the pandemic hit.

The Most Valuable Company in the World

But the company I want to bring in focus today isn't Apple, it's the real most valuable company in the world, Amazon (AMZN).

Amazon also reported it's quarterly earnings on Thursday and beat revenue and net income expectations, but the stock also sold off on Friday because of Wall Street's concern over slowing growth in Amazon's AWS service.

The revenue for AWS came in at $11.6 billion just in line with consensus estimates, but free cash flow and operating income were up year-over-year and beat Wall Street estimates. Still Wall Street hit sell on Amazon.

I often wonder how clients of big Wall Street firms make money with all of the unnecessary buying, selling, and the commissions that are charged for each transaction.

It's Simple, Invest By Looking Around

My brother lives in a middle class neighborhood in Orland, Florida. His home is close enough to Disney that you can see the Disney World fireworks show if you sit on the roof of the house at night. In my brother's neighborhood cul-de-sac made up of around 70 houses, I see the Amazon van at least two times a day, every day. My morning runs on Tuesday are greeted by empty Amazon boxes in front of homes waiting to be picked up by the recycling truck.

I don't imagine this is any different from other parts of the United States, and probably even more so in the neighborhoods of the affluent. Not everyone has an iPhone, not everyone has a MacBook, not everyone uses Clorox, or Energizer batteries, but it seems like everyone buys something from Amazon, so how could this not be the most valuable company in the world?

I've only touched on the retail aspect of the company, AWS is a giant within the cloud industry and has Netflix, Facebook, ESPN, and the NFL among its long list of clients big and small. A large portion of Amazon's stock gains over the past two years had a lot to do with how successful AWS has been, but it appears Wall Street movers and shakers are ready to bail off of one ehhh quarter.

Don't Be Wall Street, Be Better

Investors should use Wall Street's need to move money to generate excitement and commissions against them and buy any dip they can in Amazon.

"...All of our senior executives operate the same way that I do, they work in the future, they live in the future, none of the people who report to me should really be focused on the current quarter" - Jeff Bezos - The David Rubenstein Show

Bezos' quote from his interview with David Rubenstein represents a long-term mindset, which Wall Street firms have a hard time practicing. Wall Street, to the detriment of its client's accounts, lives, breathes, eats, sleeps, and invests based on the coming quarter, because, you know, they've gotta generate those commissions.

The Next Berkshire Hathaway

What I see in Amazon is the next Berkshire Hathaway (BRK.A), Jeff Bezos is operating on a different level than other CEOs. His ability to see the future is spooky. He went all in on selling books online and helped usher in e-commerce, which is still growing. He built out AWS for 15 years behind the scenes before launching the service; what other CEOs were thinking about cloud computing back then?

Last week I discussed video games and Alexandria Ocasio-Cortez's highly viewed gaming stream on Twitch. Amazon bought Twitch in 2014 for under $1 billion dollars and has turned it into the premier site for game streaming. What Warren Buffett built with Berkshire, the highly valued collection of companies big and small operating under one major umbrella is what Bezos is doing. Amazon retail, Prime, Twitch, Alexa, the Fire product line, and AWS, are just the start.

I have no knowledge of what Amazon is working on now, but I'm sure they're working on something that will add value to the company, it's just their way.

Amazon is the most valuable company in the world, the markets just haven't realized it yet. The stock price is up there, $3,036.15 per share as of this writing, but don't let that scare you away, get some if you can on this dip. If Wall Street wants to sell it now, then buy it cheap, and sell it back to them later at a much higher price.

I day traded in and out of Amazon back in 2014, 2015, and 2016, when the stock was under $600 per share. One of my great regrets is not holding on to more of the stock for the long term. I think six years from now we'll be looking at a $6,000 per share stock price for Amazon and $3,036 per share will feel like the bargain of the century.

#Stocks#Investing#Investments#Amazon#AWS#Cloud Computing#Twtich#Prime#Alexa#Apple#iPhone12#5G#Money#StocksToBuy#StocksToWatch#Investment Education#Financial Education

0 notes

Text

Merger Monday Confirms An Active Stock Market – Buy Under-Appreciated Biotech

Mergers have been lagging

Mergers for 2020 have vastly lagged final yr. This has been a explanation for concern for me in judging the well being of the inventory market. For the raison d’etres of Wall Avenue is to not make us wealthy, it is to create a supply of fairness capital to construct firms. Our function will be in comparison with the remora fish that safe themselves to the leviathans and eat the wealthy the rest that they go away behind. Although our function is a little more symbiotic as we do provide liquidity, value discovery and thru the blessings of the brief vendor we current a stage of policing to stop the occasional “Theranos” that occurs every now and then. The inventory market didn’t come about for our amusement or enrichment. If it is not creating true transactions like M&A and public choices it is sickly and that doesn’t portend nicely for us remoras or the better economic system.

So I heartily accepted yesterday’s “Merger Monday” information. The torrent and dimension of the offers give me optimism that regardless of authorities intervention into our economic system and markets, the underlying mechanism is returning to life. There is a very actual chance that there will likely be a rush of mergers earlier than the shut of the yr both due to feared tax adjustments or the economic system is returning to a bustling boil. Why do I say that? Effectively, this coming quarter could be very prone to show the quickest development the economic system ever measured. Additionally, you might not have observed however revenue estimates are going up slightly properly, thanks very a lot. So with rates of interest at zero for so far as the attention can see, biotech, which bases its worth manner out sooner or later, because the promised stream of income are sometimes on the come, low rates of interest are extra welcome to this sector than the cloud software program world. I imagine that with the proof of yesterday’s mergers, particularly the astoundingly well-priced buy of Immunomedics (IMMU) by Gilead, that that is an space that ought to be speculated upon. Biotech’s time has come as soon as once more.

Gilead (GILD) forking out with a 108% excessive bid for Immunumedics (IMMU) for $21 billion: Recreation changer!

Biotech has been comparatively quiescent. We’ve all been enamored of the WFH motion (meaning “Work From House” for you modern-day Rip Van Winkles). Meaning demand for the likes of Zoom (ZM) and Amazon (AMZN) and never IBB, the Biotech ETF. Immunomedics’s new drug Trodelvy works on triple unfavorable breast most cancers, however the modality for effecting the remedy is the holy grail of most cancers remedy. Sure, I mentioned remedy, remedy is on supply, not 100%, however the chance is there. Let me insert a caveat right here. I‘m lower than knowledgeable on biotech. I hate that I can’t get my arms round it. So I do know there are numerous of you on the market who will remark under “how I don’t know what I am speaking about,” or that there are many different biotechs that even have the identical functionality. Good and high-quality, however you’re the blessed 2% with PHDs or MSs or you’ve spent the final decade poring over Lancet or NEJM, or no matter. I salute you, and you might deposit your derision within the remark part under. I am providing you with what I believe your on a regular basis dealer who pauses 60 seconds to consider what simply occurred yesterday and what it means for the biotech sector for them. OK?

So this is what I imply. IMMU has mainly developed a guided missile of remedy. They recognized a protein that is on the most cancers cell. Their drug is an antibody focusing on that protein on one facet and on different finish is a substance that is poisonous to the cell. Once they meet – kaboom. Meaning even cells that metastasize at a clump of even two, three cells, and even one will be focused. Maybe at a while there will likely be a number of protein targets, and easy blood exams that floor most cancers earlier than it may even be seen by present diagnostics. We simply had the submitting of an IPO for Grail Biotech that may just do that. In any case IMMU is thrilling and GILD bought them for a straightforward 108% above the final shut.

In yesterday’s CNBC interview GILD’s CEO intimated that whereas Tradelvy has been authorized for triple neg breast most cancers it has broad purposes to different cancers like lung most cancers strong tumors.

Trodelvy offered nicely in its first two months in the marketplace. As well as there was Sunday’s name to analysts. Gilead chief medical officer Merdad Parsey mentioned that his firm has seen unpublished information on Trodelvy that implies the drug will likely be of use towards a broad vary of strong tumors, together with bladder and lung cancers. Trodelvy’s gross sales in breast most cancers would widen, too, if it will get approval as a first-line remedy for tumors that present drug-resistant genetic traits

The primary response by analysts and market commentators was a wringing of arms and gnashing of enamel.

We heard a bunch of the naysayers say nay yesterday. I do not agree. GILD is anticipating the acquisition to be accretive to earnings by 2023. So even with out future indications IMMU will contribute to earnings in three years. Three years is the standard return on funding for gear. That is in my thoughts an astounding cut price. As well as, I am saying that biotech is simply too low cost total and that there must be different bargains on the market. Extra on that later. So let me defend GILD a bit additional. They’ve $15 billion in money proper now mendacity round doing nothing. It could actually’t even earn curiosity. So actually the acquisition is $5 billion that will likely be borrowed basically for nothing. I do know, I do know, you as a shareholder need that $15 billion. You need that in dividends or inventory buybacks? No you don’t. GILD is uniquely suited to do what most of us can’t – sift by way of all of the dross of biotech fly specs and floor those which can be value an funding. You additionally know that present authorized medication whereas throwing off astounding ranges of money are a losing asset quickly to be relegated to the generic drug pile. So that you don’t need that money. You need them to place that money to work. I for one am very excited by this information. So I purchased GILD and I believe it has plenty of room to run. Take a look at this one yr chart here.

That little fuschia arrow on the best is the place GILD is now. The large mountain of beneficial properties to the left was as a result of pleasure over Remdesivir which remains to be very a lot alive, and can have an additional function to play in combating COVID-19. In actual fact, yesterday we heard information that Eli Lilly (LLY) and incyte (INCY) are introducing a drug working with Remdesivir that provides to optimistic results for restoration. Olumiant is a particular immuno suppressant in a phase-Three research, on the lookout for emergency use approval from the FDA.

That apart, since I am a dummy with regards to choosing out up-and-coming biotechs, I am investing within the medium-sized biotech consolidators like GILD, but in addition Bristol Myers (BMY) that simply acquired Celgene, and Abbvie (ABBV) that simply purchased Allergan. I imagine that they are going to purchase smaller tuck-in acquisitions that may present extra beta. Within the meantime they throw off a pleasant dividend whilst you wait. They’re all in my funding account that I by no means speak about, as a result of I intend to purchase and maintain them without end. Nonetheless, I believe GILD will likely be a runner now, and so I’ve it in my hypothesis account as nicely.

Lest I neglect there was different main M&A information yesterday

Merck (NYSE:MRK) invested $1 billion in Seattle Genetics (SGEN) Antibody blood conjugates. Additionally this bizarre improvement with TikTok that I’m undecided tips on how to categorize, and the very attention-grabbing Nvidia (NVDA) information about buying ARM Holdings for $40B, (see under). Let’s additionally not neglect that Verizon (NYSE:VZ) purchased TracFone for a cool $9B whew!

Oracle (ORCL) might have bitten off greater than it may chew

There was a feeding frenzy over the acquisition of TikTok. Apparently the idea is that TikTok has an AI that may do it higher than anybody else. What occurs if they’re flawed? What occurs if that is only a random “fad?” By fad I imply that youngsters which can be amazingly fickle have determined that TikTok is the bee’s knees, like they determined that Snapchat was scorching at one level.

I believe it is the expansion, TikTok DAU shot up like loopy, so everybody assumes its the algorithm

It’d simply be a fad. I believe that is what Oracle is relying on, that they might rise up an AI algo that’s “adequate.” I will say “watch out what you want for” – ORCL might have bitten off greater than it may chew. Just like the canine chasing the automotive and eventually catches it – then what?

Possibly fad is not the best phrase. It caught on, and due to the community impact it’ll have endurance till it would not. Nonetheless it is not being categorized as an acquisition, and I am not even certain the deal they submitted with CFIUS will get authorized. I might be cautious about leaping on ORCL. I purchased on the rumor and offered it earlier than the information. I might be flawed, but when it isn’t a full acquisition and so they have to face up a working AI back-end for it, it might be a really thankless job.

In an identical vein, I believe Nvidia’s (NVDA) ARM Holdings acquisition is a “no bueno” as nicely

On this case the worth of ARM itself just isn’t in query. It was a jewel when Masayoshi Son stole it, and will probably be so when NVDA tries to accumulate it. I imagine there are large antitrust points, sovereign points with the UK, and China will take years to approve. This may be an equally large distraction for NVDA and at its present lofty (although justified) valuation. I see a hazard of a giant deflation in its worth as uncertainty creeps in because the deal drags on.

One of many founders of ARM, Hermann Hauser, mentioned he and lots of others have been involved that the UK would lose jobs and affect and argued ARM’s enterprise mannequin could be compromised. He acknowledged, “Surrendering UK’s strongest commerce weapon to the US is making Britain a US vassal state,” Hauser wrote within the open letter, which was revealed yesterday.

He referred to as on Boris Johnson to pressure Nvidia to signal legally-binding phrases agreeing to protect UK jobs, keep ARM’s market neutrality, and safe exemptions from US guidelines that will ban ARM from coping with China. If the UK authorities can’t safe these commitments, Hauser mentioned it ought to help an IPO of ARM on the London Inventory Change. I believe NVDA has opened a nasty can of worms. In fact if NVDA does crater, you’ll hear me shouting from the rooftops to purchase, purchase, purchase.

Talking of which, what did I purchase yesterday…

I began a place in Vroom (VRM) like I mentioned I might. I purchased a bunch of SPACs which I am not able to reveal proper now. SPACs have simply turn out to be so nuts that I would like to jot down a chunk simply to speak about them. I am constructing a place in Rocket Mortgage (RKT), extra on that tomorrow. Additionally like I mentioned I am making a speculative place in GILD along with my funding. I additionally rolled my Draft Kings (NASDAQ:DKNG) calls up and out to February liberating some premium after which spreading them as soon as once more to hopefully generate additional income by Oct. 2.

Disclosure: I’m/we’re lengthy VRM. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Looking for Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.

Further disclosure: I began a place in VRM, RKT and GILD. I additionally rolled my DKNG place up and out to February, and re-spread with brief calls and an Oct 2 expiry

window.SA = {"App":{"name":"SA","fullName":"Seeking Alpha","type":"regular","host":"https://seekingalpha.com","financeApiHost":"https://finance.api.seekingalpha.com","emailHost":"https://email.seekingalpha.com","pro":false,"proPlus":false,"contributorCenter":false,"realHostName":"https://seekingalpha.com","isCms":false,"cancelPV":false,"isSharkPreview":false,"usersOnSite":"8,909,032","assetHosts":["https://static.seekingalpha.com","https://static1.seekingalpha.com","https://static2.seekingalpha.com","https://static3.seekingalpha.com"],"moneData":{"params":"new_home_page=new_hpu0026samw_layout=hybrid"},"assetHost":"https://static.seekingalpha.com","userEchoHost":"https://feedback.seekingalpha.com","unbounceHost":"https://subscriptions.seekingalpha.com","env":{"dev":false,"staging":false,"production":true,"test":false},"gaAccountId":"UA-142576245-1","pianoAccountId":"CWJjPp7cpu","comscoreAccountId":8500672,"fbAppId":"2459764930747368","googleClientId":"853676697728-j4qpq4pfialt14ibl9ppa3tk37m6kc9e.apps.googleusercontent.com","twitterAccountName":"SeekingAlpha","rollbarToken":"5edf110be2fc4cecb32637fc421111e2","perimeterXAppId":"PXxgCxM9By","embedlyKey":"a6da93fdfc49472099ce63260954716b","mp":false,"chat":{"host":"https://rc.seekingalpha.com"},"oneSignalAppId":"32a623ea-4435-442f-a7e1-0ef070124c32","gptHeaderTest":null,"allowAdBlockPopup":null},"pageConfig":{"Refresher":{"active":false},"Data":{"article":{"id":4374418,"title":"Merger Monday Confirms An Active Stock Market - Buy Under-Appreciated Biotech","stub":false,"primaryTicker":"","indexGroup":null,"prioritizedTicker":"gild","primaryIsCrypto":null,"isTranscript":false,"isSlides":false,"twitContent":"Merger Monday Confirms An Active Stock Market - Buy Under-Appreciated Biotech. https://seekingalpha.com/article/4374418-merger-monday-confirms-active-stock-market-buy-under-appreciated-biotech?source=tweet ","isProArticle":false,"isProPaywall":false,"paywallReason":null,"isArchived":false,"editorsPicks":false,"inEmbargo":false,"isAuthorNewsletter":false,"titleTest":null,"archiveOn":0.0,"isProNoEmbargo":false,"url":"https://seekingalpha.com/article/4374418-merger-monday-confirms-active-stock-market-buy-under-appreciated-biotech","isFreeMpArticle":false,"isInsight":false,"insightSlug":"","price_at_publication":null,"date_at_publication":null,"closest_trading_day":"2020-09-15","isArticleInTradingTime":true,"themes":["portfolio-strategy-asset-allocation","sa-exclusive","us","article"],"from_liftigniter":false,"isAnyProArticle":false,"allowMpPromotion":false,"article_datetime":"2020-09-15T13:15:00.000-04:00","date_epoch":"1600142400","isEtf":true,"taggedUrlsHtml":"u003cspanu003eu003ca href="https://seekingalpha.com/analysis/etf-portfolio-strategy/all" sasource="article_navigation"u003eu003cspanu003eETFs u0026 Portfolio Strategyu003c/spanu003eu003c/au003eu003c/spanu003e, u003cspanu003eu003ca href="https://seekingalpha.com/analysis/etf-portfolio-strategy/portfolio-strategy-asset-allocation" sasource="article_navigation"u003eu003cspanu003ePortfolio Strategy u0026 Asset Allocationu003c/spanu003eu003c/au003eu003c/spanu003e","isFidelityEducationPage":false,"isSponsored":false,"contentData":null,"marketingBullet":null,"showPastPodcast":false,"publishDate":"2020/09/15","symbolType":null,"symbolExchange":null,"accessReason":false,"excludedByTag":false},"author":{"id":105256,"userId":43755796,"slug":"david-h-lerner","exclusiveResearch":null,"tagId":599385,"name":"David H. Lerner","picture_url":"https://static.seekingalpha.com/images/users_profile/043/755/796/big_pic.png","is_brand_author":false,"show_managed_account":false,"is_tier1":false},"comments":{"discussion_status":0,"discussion_message":"Comments disabled for this article"},"brand":null,"firstResearchAuthor":{},"pageType":"article","primaryTickerRtaCount":"0","articleModeratedMsg":null,"indexTickers":{},"authorSentiment":[],"themesSubscriprionsCounter":{"daily-dispatch":"227,786","macro-view":"252,172","sectors":"26,371","global-markets":"56,310","wall-st-breakfast":"718,008","investing-ideas":"297,001","etf-content-once-daily-newsletter":"138,265","alternative-energy-once-daily-newsletter":"108,125","transcripts":"14,369","activity-alerts-daily-newsletter":"3,230,051","activity-alerts-weekly-newsletter":"72,420","investing-income":"230,361","tech-daily-newsletter":"107,365","authors-alerts":"93,117","ipo-analysis":"83,917","ma-daily":"17,913","must-read":"1,410,211"}},"Ads":{"slots":[{"container":"article-left-slot-2","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":160},"size":[[160,600],"fluid"],"str":"160x600,fluid"}},{"container":"article-left-slot-3","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":162},"size":[[160,600],"fluid"],"str":"160x600,fluid"},"delay":true,"whenOutOfView":"article-left-slot-2","sticky":true},{"container":"article-right-slot-1","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":1},"size":[[300,250],[300,600],[300,1050],"fluid"],"str":"300x1050,300x250,300x600,fluid"},"cls":"mb25","flex":true},{"container":"article-right-slot-2","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":100},"size":[[300,100],[300,26],"fluid"],"str":"300x100,300x26,fluid"},"cls":"mb25"},{"container":"article-right-slot-3","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":2},"size":[[300,252],"fluid"],"str":"300x252,fluid"},"cls":"mb25","native":true},{"container":"article-middle-slot-1","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{},"size":[[640,40]],"str":"640x40"}},{"container":"ad_728x90","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":728},"size":[[728,90],[970,250],"fluid"],"str":"728x90,970x250,fluid"},"delay":true,"delta":500},{"container":"pushdown_top_ad","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":970},"size":[[970,250],[728,90],"fluid"],"str":"728x90,970x250,fluid"}},{"container":"instream_recommendation_ad","data":{"name":"/6001/sek.analysis/investing-strategy/portfolio-strategy","disable_collapse_empty_div":false,"targeting":{"tile":50},"size":["fluid"],"str":"fluid"},"delay":true,"delta":500}],"testScroll":true,"disabled":false,"kvs":{"d":["analysis","etfs"],"t":["investing-strategy","portfolio-strategy-asset-allocation","sa-exclusive","us","article"],"aid":"4374418","mp_free_article":"false","a":"david-h-lerner","cnt":["9","21","6","8","24","oil","etrfin","fed","taxes","nra","tech","bny","ssga6","jh1","fnk1","fnk2","port","nw1","19","fnk3","loan","NYL1","br_list","fnk7","fnk10","fnk12","wf13","wf14","wf15","wf17","wf18","fnk14t"],"ldr":"market-outlook","s":["gild","abbv","amzn","bmy","bmymp","immu","incy","lly","nvda","orcl","rkt","sgen","vrm","zm"],"ab_new_home_page":"new_hp","ab_samw_layout":"hybrid"}},"Paths":{"int":{"adsAPI":{"src":"https://static.seekingalpha.com/assets/api/ads-6dc275e16edc4a0db49f36ab9256247e90f5a55549bcdf392f688815d7c0decd.js","id":"sa-ads-api"}},"ext":[{"src":"https://www.googletagservices.com/tag/js/gpt.js","id":"gpt"},{"src":"https://js-sec.indexww.com/ht/p/183642-175291741781218.js","id":"ie"},{"src":"https://sb.scorecardresearch.com/beacon.js","id":"sb"},{"src":"https://www.googletagmanager.com/gtm.js?id=GTM-PFXR76F","id":"gtm"},{"src":"https://connect.facebook.net/en_US/sdk.js","id":"facebook-jssdk"}]},"lastRequested":"2020-09-15 14:31:58 -0400","SlugsPrices":{"disabled":false},"saSource":null,"name":"article","useSQuoteSource":"iex"},"headerConfig":{"noNotificationsMenu":null,"nonFixed":null,"tabless":null,"activeTab":null},"modules":{},"requires":[],"trackq":[],"exceptions":[],"gptInit":false}; Source link

from WordPress https://ift.tt/3iLlpKk via IFTTT

0 notes

Text

Hard industries to learn but with moat

Chemicals

Healthcare

Financial Institutions

https://ftalphaville.ft.com/2017/01/26/2177854/the-curious-case-of-constellation-health-and-blackstones-former-top-deal-maker/

I would say you want to find industries where there is a lot of alpha available. Energy, insurance (financials in general), REITs are all very macro oriented. They depend on commodity prices and the yield curve.

I think that tech is a phenomenal choice right now. There is so much happening as we embrace the digital world. If you take a couple of months to dig deeply into AMZN, GOOGL, FB, AAPL and MSFT, you will have an overview of where society is going. Some will say that it is difficult to have a differentiated view on such well-covered companies. That may have some truth to it (although I find that there is still a decent amount of skepticism out there), but these companies spend a combined $50B+ on capex and a similar amount on COS.

Find the datacenter beneficiaries, the component suppliers, the content purveyors, whatever. There is so much emanating from the wakes of these five companies.

My votes are industrials and healthcare. You'll learn to do actual primary research, and learn how to model fixed/variable costs properly. As implausible as it sounds, those are two skills that genuinely differentiate you as an analyst. Healthcare also teaches you how to trade/invest around news flow.

Generalist analysts frequently get burned in these sectors ('industrials look cheap' - end up buying at the peak of the cycle / 'healthcare is simple' - end up buying Valeant). This increases the value of specialists.