#hr federal regulations

Explore tagged Tumblr posts

Text

#hr compliances#list of hr compliances#indian hr compliance#hr compliance calendar 2024#hr compliance checklist#hr compliance training#hr compliance specialist#hr compliance certification#hr compliance analyst#hr compliance and governance#examples of hr compliance#hr compliance by state#hr compliance best practices#hr statutory compliance books#hr regulatory compliance#basic hr compliance#hr compliance courses#hr compliance checklist in india#common hr compliance issues#hr compliance documents#hr compliance duties#hr employment regulations#employee relations compliance#hr compliance for small business#hr compliance framework#hr federal regulations#hr compliance services#hr compliance companies#human resources compliance#global hr compliance

0 notes

Text

Dozens of Consumer Finance Protection Bureau employees were terminated on Tuesday evening, sources tell WIRED.

The cuts largely targeted contractors and so-called probationary employees, workers who have served less than two years at the agency. Sources tell WIRED that the CFPB’s enforcement division was hit hard, but it’s unclear how many employees were let go.

Workers were informed that they had been fired with a frenetic email delivered around 9pm ET on Tuesday night. An evidently failed mail merge meant that some affected employees were addressed as [EmployeeFirstName][EmployeeLastName], [Job Title], [Division].

“This is to provide notification that I am removing you from your position of [Job Title] and federal service consistent with the above references,” the email from acting chief human capital officer Adam Martinez says. “Unfortunately, the Agency finds that that [sic] you are not fit for continued employment because your ability, knowledge and skills do not fit the Agency’s current needs.”

The firings follow a tumultuous few days at CFPB. On Friday, staff for Elon Musk’s Department of Government Efficiency shut down a portion of the agency’s homepage after a day of struggling to obtain access to the CMS and other systems. WIRED reported last week that three DOGE staffers, including Gavin Kliger and Nikhil Rajpal were given access to CFPB’s HR, procurement, and financial infrastructure. The DOGE workers were later granted access to all of the agency’s systems on Friday, Bloomberg reported this week, including bank examination and enforcement records.

Later on Friday evening, Russell Vought—Trump’s newly confirmed director of the Office of Management and Budget—took over as the acting administrator for CFPB late Friday evening, as first reported by The Wall Street Journal. Soon after, DOGE staff began sending out email requests asking CFPB managers to give Kliger additional access to agency systems, including physical access control system, payroll processing systems, and the ability to edit the CFPB’s website, sources tell WIRED.

Just before 10:30pm ET on Friday, sources say someone who appeared to have administrative privileges, accessed the agency server using Secure Shell (SSH), a protocol that allows remote control of a computer over a network. Bypassing the content management system, they [unpublished] the homepage file, causing a portion of the CFPB homepage to display a “404: Page not found”, notice typical of a website that has been deleted or is otherwise missing. The remainder of the site was functional, including submission forms for industry whistleblowers and consumer complaints.

Around 11pm on Friday, the CFPB’s X account disappeared and shortly after, according to a CFPB staffer, DOGE left the building.

CFPB sources who spoke to WIRED described being blindsided by the DOGE staffers. "They said they would follow protocol but repeatedly did not," one says, noting that the level of access these staffers have could allow them to lock others out of the building, take down the website, and “obstruct the bureau’s ability to carry out its mandate.”

One source at CFPB on Friday says they saw two young DOGE staffers wandering through the halls of the building trying to open doors.

“DOGE pulled a Darth Vader in cloud city where they came in promising to respect our rules and ask for read access and then tonight [Friday] at 6 they took a heel turn and demanded website access,” another CFPB source told WIRED at the time.

In a pair of emails sent Saturday and Monday, Vought effectively ordered all work at the agency to stop, freezing various enforcement efforts and work on regulations that would affect payment programs run by Big Tech companies.

The CFPB has long been a target of both Elon Musk and conservatives more broadly; the Project 2025 chapter on financial regulatory agencies describes it as “a highly politicized, damaging, and utterly unaccountable federal agency” and calls to have it abolished. Musk wrote “RIP CFPB” with a gravestone emoji in an X post Friday afternoon. Last November, he posted “Delete CFPB.” There are around 1,700 employees in total at the agency.

The CFPB was established by the 2010 Dodd-Frank Act, a sweeping piece of legislation that imposed significant regulatory reform in the wake of the 2008 financial crisis. Its remit is to protect consumers from unfair or deceptive financial practices, and the agency claims to be responsible for $19.7 billion in consumer relief since its inception, as well as $5 billion in civil penalties.

Some of those wins have come against payment processors including Block, which was ordered to pay a total of $175 million in penalties last month for allegedly failing to sufficiently protect users of its Cash App from fraud. CFPB also has an active lawsuit against JPMorgan Chase, Bank of America, and Wells Fargo for similar alleged failures on their shared payment app Zelle. Elon Musk will soon be in the peer-to-peer payments business as well, after X entered a partnership with Visa in late January.

13 notes

·

View notes

Text

The List -- Fraud, Waste and Abuse Edition

I asked ChatGPT to look at one of the earlier lists of authoritarian actions the Trump Regime is taking and categorize them according to the labels "fraud, waste and abuse". The goal was to have AI categorize and list which action represented fraud (a lie or cheat of the American people), waste (an action that was wasteful of resources) or abuse (an action that was deliberately abusive in nature against the American people), and here's the list: The original list can be found here: https://theweeklylistreturns.substack.com/p/week-17-the-return

Here’s a recategorization of the entries based on Fraud, Waste, and Abuse:

FRAUD (Cheating the American People)

Media and Information Manipulation

WAPO restricting opinion pieces to only pro-libertarian, pro-free-market views.

White House barring major media outlets while allowing only conservative news sources.

Voice of America journalists facing HR investigations for critical reporting on Trump.

AI-generated video depicting "TRUMP GAZA" misrepresenting geopolitical reality.

Corruption and Conflicts of Interest

Dr. Mehmet Oz retaining millions in investments despite nomination to oversee Medicare/Medicaid.

Lynn Dekleva’s appointment to EPA despite prior lobbying for chemical industries.

Capital One, Rocket Mortgage, and other corporations escaping consumer protection lawsuits under Trump’s CFPB.

Zelle network operators, including major banks, escaping fraud investigations due to CFPB case dismissals.

Musk inserting DOGE personnel into FAA while SpaceX stands to win a major $2.4 billion contract.

Musk influencing NASA operations and receiving private access to internal agency discussions.

Election and Legal Manipulation

DOJ reviewing conviction of Tina Peters, a convicted election conspiracist.

Harmeet Dhillon and John Sauer suggesting some court orders can be ignored.

Demotion of prosecutors overseeing Capitol insurrection cases.

Trump pardoning January 6 defendants and shutting down investigations into domestic extremism.

House Republicans attempting to extend Trump’s presidency beyond two terms.

Trump proposing national crypto reserve, raising conflict-of-interest concerns.

Trump's DOJ delaying foreign bribery cases under the pretext of reassessing corruption laws.

WASTE (Destroying Essential Programs and Services)

Federal Budget and Economic Policy

Mass layoffs across federal agencies, including 10,000 EPA staff and nearly all 1,700 CFPB employees.

Foreign aid freeze cutting off health and disaster relief funding worldwide.

Termination of USAID programs combating polio, HIV, and malaria.

Attempt to defund universities over "illegal protests," violating the First Amendment.

Pausing military aid to Ukraine despite ongoing war.

Stock market crashes due to abrupt tariff announcements, harming U.S. economy.

Trump tariffs against Canada, Mexico, and China escalating trade wars.

Overhaul of rural broadband program to favor Starlink, awarding billions to Musk.

Musk manipulating air safety concerns to justify Starlink involvement in FAA.

Mismanagement of Agencies

Abandoning lawsuits against chemical companies accused of releasing carcinogens.

Closing civil rights and anti-discrimination enforcement offices under DOGE.

Halting State Department’s global air quality monitoring program after a decade.

Ending federal policies allowing language assistance for non-English speakers.

GOP’s "big beautiful bill" cutting key programs like Medicaid and food assistance.

Environmental and Public Infrastructure Neglect

Dismantling of NOAA, jeopardizing weather forecasting and climate research.

Closing of National Park Service offices, leading to nationwide protests.

Cuts to FEMA disaster relief workforce weeks before hurricane season.

Ending federal enforcement of clean air and water regulations.

ABUSE (Harming or Causing Distress to Americans)

Targeting Vulnerable Populations

Trump regime removing all transgender troops unless granted a waiver.

Federal judge blocking attempts to withhold hospital funding for trans youth.

Ending hiring discrimination lawsuits, enabling racial bias in policing and fire departments.

ICE attempting to obtain home addresses of 700,000 undocumented immigrants.

DOGE seeking IRS tax records to target recipients of government benefits.

Undermining Public Safety

Trump-appointed officials ordering mass layoffs of air traffic controllers.

Musk soliciting retired air traffic controllers due to FAA staffing crisis.

Halting cyber defense operations against Russia, putting national security at risk.

Removing high-ranking Black military officials from leadership roles.

Attempt to rename Fort Moore to honor a Confederate general.

Authoritarian and Anti-Democratic Actions

White House pressuring USAID to cover up impacts of foreign aid freeze.

Targeting federal judges who oppose Trump’s agenda.

Seizing and transporting classified document boxes on Air Force One.

House Republicans introducing bills to rename federal buildings after Trump.

Human Rights and Foreign Policy Failures

Zelensky humiliated at the White House, leading to international fallout.

Abandoning U.S. military aid and intelligence support for Ukraine.

Praising Putin while criticizing NATO allies.

Cutting U.S. foreign aid while China, Russia, and Iran expand influence.

GOP officials pressuring Zelensky to "apologize" to Trump.

Arrest and deportation threats increasing for immigrants under ICE expansion.

Conclusion

Fraud: Policies that deceive the public or enable corruption.

Waste: Reckless destruction of necessary government functions and resources.

Abuse: Policies designed to cause harm, distress, or fear to specific groups or the general public.

This categorization highlights how many of these actions fit into a broader pattern of corruption, negligence, and authoritarian behavior.

9 notes

·

View notes

Text

Trump's Hiring Freeze: A Reckless Blow to California's Firefighting and Federal Services

President Donald Trump’s recent hiring freeze is a glaring example of short-sighted governance that sacrifices critical federal services and public safety for the sake of political theater. California, already grappling with severe wildland fire risks and a growing population, stands to suffer disproportionately under this ill-conceived executive order.

Wildland Firefighting in Peril The timing of Trump’s freeze couldn’t be worse for California’s wildland firefighting efforts. With 35% of federal firefighting positions already vacant due to low pay and limited career opportunities, the freeze exacerbates an existing crisis. The seasonal hiring process for firefighters is complex and time-sensitive. By halting the recruitment of HR officials and hiring managers—those who grease the wheels of this critical system—Trump has effectively sabotaged the federal government’s ability to respond to emergencies.

Wildfires don’t wait for bureaucracy, and neither should the leaders responsible for protecting lives and property. Trump’s blanket freeze undermines the very workforce tasked with defending our communities from natural disasters, jeopardizing the 2025 fire season before it even begins.

Collateral Damage Across Federal Services The harm from Trump’s freeze extends far beyond firefighting. California relies on federal employees for essential services, from staffing national parks to enforcing labor standards, conducting environmental inspections, and supporting veterans. With more than 147,000 federal civilian employees in the state, any disruption in staffing threatens the efficiency and effectiveness of these operations.

This freeze will not improve government efficiency; it will create chaos. Key roles left unfilled will leave federal programs limping along, unable to meet the needs of the public. The impact on California’s national parks, agriculture, and environmental oversight will be particularly severe, undermining efforts to protect the state’s natural resources and public health.

A Thinly Veiled Political Agenda The exemptions in Trump’s freeze reveal his administration’s true priorities. By sparing immigration enforcement and border security roles while freezing positions in environmental regulation and emergency services, Trump is weaponizing federal staffing to serve his divisive agenda. This is not about improving government efficiency—it’s about defunding and dismantling programs that don’t align with his political goals, no matter the cost to public safety or well-being.

A Call for Responsible Leadership This hiring freeze is a reckless and dangerous policy that puts lives, livelihoods, and essential services at risk. California needs strong leadership that prioritizes public safety, environmental stewardship, and the well-being of its residents—not cynical maneuvers that sow chaos and erode trust in government.

President Trump’s approach to governance is not only inefficient but deeply irresponsible. It’s time for leaders in Congress, state governments, and advocacy groups to stand up against these shortsighted policies and demand a federal government that works for all Americans—not just those who align with a narrow political agenda.

3 notes

·

View notes

Text

Monday March 10, 2025 Truth Bomb

Karen Bracken

Sovereignty Coalition Summit 6 - VERY IMPORTANT INFORMATION - Moderator Frank Gaffney - this summit discusses issues like: One Health (Alex Newman), bird flu (Dr. McCullough) REAL ID (Twila Brase), “Why the Pandemic Agreement is Bad and Why the Trump WHO Executive Order is Good” (Dr. Kat Lindley), “Slouching Toward a Pandemic Treaty without U.S. Participation but with Impacts on American Freedoms Abroad” (Summer Ingram), “Executive Orders versus Legislation: Why Making Policy Into Law Matters” (Kris Ullman, Esq.), “Surveillance and Censorship: The WHO International Health Regulations, the Pandemic Treaty and U.S. Privacy Rights” (Reggie Littlejohn), “Why Does It All Matter?” (Dr. Andrea Nazarenko, MA, MA, MAS, PhD), “What Can Citizens Do?” (Ron Armstrong) VIDEO (2 hrs.)

AND if you live in Tennessee I recommend joining TN Citizens for State Sovereignty. (tncss.substack.com) tncss.weebly.com (website) tninformer.com (weekly show Mon. 7pm CT/8pm ET

Could A Bombshell Discovery Render All of Biden's Presidential Actions 'Null and Void'? - if a President is found guilty of fraud EVERY law he signed and every EO he passed would be null and void. When I worked with the North American Law Center to impeach Obama there were 3 articles of impeachment in our impeachment document and one of them was fraud and it was put in there because if he were to be impeached under these 3 articles all laws and EOs that he signed would be erased and considered null and void due to fraud. So if they do this right they could actually void Biden’s presidency. ARTICLE

Kill the Admin State, Salt The Earth Beneath It, Eliminate Income Tax, and the Middle and Working Classes Will Soar - take note of the tariff we pay for milk from Canada. Then watch the short video below. - ARTICLE

So while the Canadian government charges the US huge tariffs they make Canadian farmers discard a lot of their product? So the Canadian govt makes a ton of money from the US for milk while short changing the Canadian milk farmers - VIDEO

Mandates for cattle and chicken vaccines are off the table by Dr. Nass - ARTICLE

Your In Depth Guide to MESA (Make Elections Secure Act) - good, promising article and we have federal legislation - ARTICLE

And here is a follow up article which includes insights from the legislation ARTICLE

2 notes

·

View notes

Note

i never realized that average minimum wage was 7.25/hr…. nys has spoiled me with 15/hr

That’s the federal regulation, certain states and businesses have their own laws that they have to adhere to which is why more expensive states like ny and ca pay $15-16/hour.

13 notes

·

View notes

Text

More proof that Austin Dems can't not lie. So I looked into the bill this headline is based on.

And it's a bald faced lie. The bill, HB2127 featured before really only does one thing. Force regulatory standards across the state. Rather than city to city when it comes to a number of different things. Meaning Austin can't do whatever TF it wants whenever it wants. However there are state and national regulations they demand and require breaks. It's ever 2hrs for a 6 hr shift or longer and a required hr lunch at/after 8 hrs I believe.

The text does not in any way say, "we're removing the ability of people to take breaks" and no law Texas has passed has changed prior laws requiring breaks.

32 notes

·

View notes

Text

Boost Your Payroll Efficiency with Free Payroll Check Stubs

Efficient payroll management is crucial for any business, especially as it directly impacts employee satisfaction, accuracy in accounting, and the overall productivity of administrative teams. But what if you could streamline this process using free payroll check stubs? For small businesses, startups, and even established companies, free payroll check stubs offer a no-cost solution to help enhance payroll accuracy, reduce errors, and save time.

Here’s how you can leverage free payroll check stubs to boost your payroll efficiency without breaking the bank.

1. Why Payroll Efficiency Matters

Payroll processing is more than just a routine administrative task; it’s an integral part of your business operations. Timely and accurate payroll boosts employee morale and trust in the company. Additionally, a streamlined payroll system minimizes the chances of costly mistakes, ensuring compliance with federal and state regulations and protecting the company from penalties. Efficient payroll processes also save time for your HR and accounting teams, allowing them to focus on other crucial aspects of the business.

However, the process of calculating hours worked, tax deductions, and other variables can be complex. This is where free payroll check stubs come in as a powerful tool. They simplify payroll tasks, reduce manual errors, and provide a professional look for your business without any added cost.

2. What Are Payroll Check Stubs?

Payroll check stubs, also known as pay stubs, are essential documents that provide employees with a detailed breakdown of their earnings for a particular pay period. A typical pay stub includes:

Gross wages: Total earnings before deductions.

Net pay: Earnings after deductions, including taxes and other withholdings.

Tax deductions: Federal, state, and local taxes withheld.

Other deductions: Healthcare, retirement plans, or other benefits.

Year-to-date (YTD) totals: Accumulated earnings and deductions up to the current pay period.

For businesses, pay stubs serve as a record for tax purposes, payroll audits, and employee inquiries. For employees, these documents provide transparency and insight into their earnings, taxes, and other deductions.

3. Benefits of Free Payroll Check Stubs

Using free payroll check stubs offers a wide range of benefits that can help businesses streamline payroll processes and improve efficiency.

Cost Savings

The most obvious benefit of free payroll check stubs is the cost savings. Instead of investing in payroll software or paying for check stub generation, you can access reliable, free solutions. This is especially beneficial for small businesses that may not have the budget for costly payroll services.

Time Efficiency

Free payroll check stub generators are often designed to be simple and user-friendly, enabling you to create pay stubs in just a few clicks. By reducing the time needed to generate check stubs manually, you free up time for HR and payroll staff to focus on other strategic tasks.

Error Reduction

Manual payroll calculations are prone to errors, especially when factoring in varying work hours, overtime, and deductions. Free payroll check stub tools often come with built-in calculators that automatically compute wages and deductions, minimizing the risk of human error and improving accuracy.

Record Keeping and Compliance

Generating payroll check stubs ensures you have a digital or physical record of all payments made to employees, which is crucial for compliance with labor laws and tax reporting. If you’re audited or need to reference payroll information for tax purposes, having clear, organized records will save you time and prevent headaches.

Professional Presentation

Even if you’re running a small business, it’s essential to maintain professionalism in all areas, including payroll. Providing your employees with professional-looking check stubs instills confidence and enhances your brand image. It shows your employees that you value transparency and are committed to high standards in every aspect of your business.

4. How to Create Free Payroll Check Stubs

There are several online tools available that allow you to create payroll check stubs for free. Here’s a general step-by-step guide:

Step 1: Choose a Reputable Payroll Stub Generator

Begin by selecting a free check stub generator. Look for reputable websites that offer customizable templates. You’ll want a tool that provides a clear, professional format and allows you to input all necessary payroll information.

Step 2: Input Employee Information

Enter basic details for each employee, such as their name, employee ID, and address. This information is crucial for accurate record-keeping.

Step 3: Input Earnings and Deductions

The next step is to enter gross earnings, any applicable tax deductions, other withholdings (such as retirement or healthcare), and net pay. Most free check stub generators have fields for these entries and will automatically calculate totals for you.

Step 4: Review for Accuracy

Always double-check the information to ensure accuracy. Errors on pay stubs can lead to confusion, dissatisfaction, and may require time-consuming corrections. Ensure all figures are correct, including deductions and net pay.

Step 5: Download and Distribute

Once the check stub is generated, you can download it as a PDF or print it. Many companies provide digital copies directly to employees, but some still opt for physical copies for those who prefer them.

5. Choosing the Right Free Payroll Check Stub Tool

With so many free payroll check stub tools available online, it’s essential to choose the right one. Here are some key features to look for:

Customization Options: Look for tools that allow you to customize fields according to your payroll needs.

Automatic Calculations: Choose tools with built-in calculators for automatic deductions and net pay calculations.

Security: Ensure the tool uses secure data encryption to protect sensitive employee information.

Format and Design: Opt for a tool with a clean, professional design, as the final product reflects your company’s image.

Reviews and Reputation: Research user reviews to confirm the tool’s reliability and accuracy.

Some popular free options include PayStubs, Stub Creator, and Check Stub Maker. These tools provide customizable templates and user-friendly interfaces that make it easy to generate accurate, professional payroll check stubs at no cost.

6. Integrating Payroll Check Stubs into Your Payroll Process

To fully reap the benefits of payroll check stubs, it’s important to integrate them smoothly into your overall payroll process. Here are some tips to optimize the process:

Set a Schedule: Establish a consistent schedule for generating and distributing payroll check stubs. Whether you pay weekly, bi-weekly, or monthly, consistency reduces confusion and builds trust with your employees.

Automate Where Possible: If your business has a small team, you may handle payroll manually. But if you have more employees, consider automating the payroll process. Many payroll systems integrate with free check stub generators, saving even more time.

Encourage Employee Access to Digital Stubs: In today’s digital world, providing employees with digital access to their payroll information improves efficiency and reduces paper waste.

Train HR Staff: Make sure your HR and payroll staff understand the process and tools available. Training ensures smooth implementation and consistent results.

7. Addressing Employee Concerns

Some employees may have questions about their pay stubs or deductions, especially if they’re new to the company or if there’s a change in payroll structure. Encourage open communication by offering to explain any details on their pay stubs, such as tax withholdings, overtime calculations, and benefits deductions. Providing a resource (such as an FAQ or quick guide) can also help address common questions and alleviate concerns.

Conclusion

Free payroll check stubs can be a game-changer for businesses seeking to improve payroll efficiency without a hefty price tag. These tools streamline the payroll process, reduce errors, and save valuable time for your HR and accounting teams. By implementing free check stubs, you’re not only saving costs but also ensuring a professional, accurate, and transparent payroll experience for your employees.

#paystub#paystubs#paystubservice#paystubsneeded#checkstub#checkstubs#checkstubsneeded#paycheck#paychecktopaycheck#paychecks

2 notes

·

View notes

Text

I'm really proud of myself and felt the need to share.

So recently my mom got fired from her job (shift lead at a dispensary) for essentially no reason, the reason was "customer and employee complaints" that suspiciously only became a thing when the manager was on vacation.

And lemme tell yah, I was fucking PISSED. I was seething. Especially bc the company gave her a training course on bullying in the work place because they've got an "anti-bullying in the workplace" policy and I've got so much dirt on how that simply isn't true.

So the employees that complained were a group of girls who acted like they were still in a high school clique and purposefully excluded my mom from all attempts at conversation, even when it came to work related things like closing up at the end of the shift.

These same girls also couldn't function without a doobie every 15 minutes but then would get pissed when my mom would just go ahead and help customers instead of telling them to get off their asses. They went so far as to tell the manager that my mom was basically stealing their customers. They also refused to take a lunch until the mid-shift was over and leave my mom to man the shop alone, and always came back 30 minutes to an hour late, thus meaning my mom never actually got to take her lunch.

Which for the record, violates federal regulations. It is a felony to deny your employees a lunch break on a regular basis.

Did this stop her manager from "adjusting" her time card so that it looked like she was taking a lunch just so he wouldn't have to pay his employees more? No, it didn't. He'd also "adjust" time cards so that no matter how early someone came in or how late they stayed they were always only paid for 5 minutes before and after the shift.

Back to the girls who peaked in high school, they decided to get their customers to lie about my mom. The best part of this is the dispensary has security cameras inside that clearly show my mom NOT being the one to deal with those customers, but each employee also has a different pin for the register and the records also prove that my mom did not deal with those customers.

All this said and done, I went feral. I drafted an email to HR that laid out everything that had ever gone on. The bullying, the lack of lunch breaks, the time cards being messed with, the lies, everything. And then I metaphorically took a crow bar to their knees when I basically said "for a company that preaches anti-bullying in the work place you sure do protect the employees breaking these rules."

As far as I'm aware, HR hasn't responded. So now I'm going public. The moral of the story is don't go to Igadi for weed. They treat their employees like shit and won't do anything about it.

#pagankingfinn#i am sick and tired of lying down and taking hits like these so i started swinging back#part of me wants john green to see this#however the man is busy taking down big pharma#good for him tbh

3 notes

·

View notes

Text

OP is being a wet sock in the comments for some bizarre reason, so since I’m U.S. based here’s a link to all the United States requirements for relicensing physicians because I think it’s an imperative resource for chronically ill and disabled people to have:

Due to individual states deciding these requirements, they’re obviously insanely varied. This impacts the way that patient care is delivered SIGNIFICANTLY, especially in physicians who have stayed in the same states and have been meeting those lower standards for many years, compounding their paucity of knowledge and lowering the quality of care their patients can receive.

Generally, 50hrs/yr is the average, with retesting every 1-4yrs, but some states such as Alabama, Mississippi, and Louisiana have them at 20hrs/yr or lower.

This means, that over only 8 years of practice, an MD in Washington state (50 hrs/yr) has obtained up to 304 more credit hours than an MD in Alabama (12 hrs/yr).

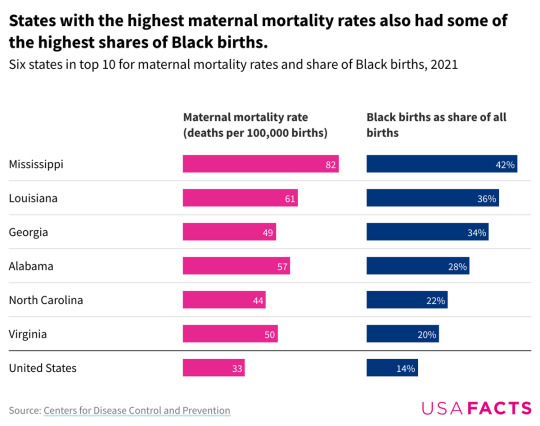

You’ll also notice that states with the lowest CME requirements (highlighted) also happen to make up the states with the highest maternal mortality rates…

That correlation aside, we KNOW that CE is incredibly important, and that doctors with CE have better patient outcomes. The fact that the US doesn’t have federal regulations regarding this is just plain embarrassing (source).

The system is dysfunctional and things like this are probably costing peoples lives. We need to talk more about it; the first step to improving it is creating awareness that this stuff does exist, it’s just not as effective as it should be. As patients deserve it to be.

Relicensing is already real and a requirement, what we need to do is make it functional and regulated using our votes.

I'm so extremely serious when I say doctors should be put through an extremely extensive reliscensing process every 10 years. Doctors should have their knowledge scrutinized against current medical research and be de-barred at even the tiniest discrepancy. Too many old doctors absolutely refuse to stay up to date on research and dismiss patients because of their personal experiences. Too many people die every year because doctors don't take us seriously and refuse to listen to people who KNOW something is wrong. Too many people are told their problems are nothing and come back in a year or more with serious illnesses and doctors are just like "lol everyone makes mistakes" but doctors mistakes routinely cost people their lives! I'm tired of medical malpractice being swept away under the guise of "mistakes were made."

#once I’m practicing you’ll catch me dead before I’ll recert for less than 50CE hours#there’s so much new science out there it’s crazy to even consider 20 hours let alone 12 @ Alabama#not fandom#freaky speaks#sorry I’m passionate af about this stuff lmao#i have to get 20hrs a yr for my cma license can you imagine your doctor having less continuing ed than their fucking assistant lmao#i love it too!! it can be expensive but it's so so worth it and I use those skills all the time!#recently I took an addiction counciling class that I really enjoyed#i work in a high risk community so the skills are beyond useful

95K notes

·

View notes

Text

HR-Led Initiatives for Payroll and Tax Optimization

In today’s ever-changing regulatory landscape, businesses must prioritize tax compliance to avoid penalties and legal complications. Human Resources (HR) plays a crucial role in ensuring payroll taxes are calculated correctly, deductions are managed efficiently, and compliance with tax regulations is maintained. By leveraging technology, training employees, and working closely with finance teams, HR departments can simplify tax processes and enhance overall operational efficiency.

The Role of HR in Tax Compliance

One of the fundamental aspects of tax compliance is correctly classifying employees. HR is responsible for distinguishing between full-time employees, independent contractors, and temporary workers. Misclassifications can lead to tax penalties and legal issues, making it essential for HR to ensure proper categorization in compliance with tax laws.

Overseeing Payroll Tax Deductions

HR ensures that payroll tax deductions, including federal, state, and local taxes, are accurately calculated and withheld from employee paychecks. This process includes managing Social Security, Medicare, and unemployment taxes. Proper oversight helps prevent errors that could lead to financial liabilities.

Ensuring Timely Tax Filings

Missing tax filing deadlines can result in penalties for businesses. HR plays a key role in coordinating with payroll teams to ensure all tax payments and filings are submitted on time. This includes generating and distributing tax forms such as W-2s for employees and 1099s for contractors.

Leveraging Technology for Compliance

Payroll Software and Automation

Automated payroll systems reduce human error and improve efficiency in tax compliance. These systems calculate tax withholdings, generate tax reports, and ensure payments are made accurately. HR teams can use payroll software to streamline tax-related tasks and stay compliant with tax regulations.

Cloud-Based Tax Solutions

Cloud-based payroll and tax compliance tools allow HR teams to manage tax obligations remotely and access real-time updates on tax laws. These platforms provide automated alerts for filing deadlines and ensure seamless integration with financial systems.

Collaboration Between HR and Finance

Effective tax compliance requires HR and finance teams to work together. While HR manages employee classifications and payroll processing, finance teams handle tax payments and financial reporting. Regular communication between these departments ensures accuracy in tax filings and prevents compliance risks.

For More Info: https://hrtechcube.com/hr-payroll-tax-compliance/

Conclusion

HR plays a pivotal role in streamlining tax compliance by managing employee classifications, ensuring accurate tax deductions, and leveraging technology to automate payroll processes. Collaboration between HR and finance teams further strengthens compliance efforts, reducing risks and enhancing efficiency. By adopting modern payroll solutions and staying updated on tax regulations, businesses can navigate the complexities of tax compliance with confidence.

Related News/ Articles Link:

#HR Tech News#HR Tech Articles#Human Resource Trends#Human Resource Current Updates#HR Tech#HR Technology

0 notes

Text

How Staffing Agency in Canada Help Businesses Grow

With the competitive market today, Canadian companies are under a lot of pressure to grow effectively while keeping costs down and ensuring quality. A key to doing this is successful staffing. Canadian staffing agencies have become strategic partners for businesses that want to tackle hiring issues, gain access to specialized skills, and achieve sustainable growth. Whether it is office employees recruiting in Canada or hiring for specialized industries, these agencies offer customized solutions that meet organizational objectives. This article discusses how collaborating with staffing firms in Canada can enable companies to succeed in a changing economy.

Access to Specialized Talent

The success of any enterprise depends on its capacity to recruit top industry professionals. Staffing agency in Canada have large pools of pre-screened candidates across sectors ranging from healthcare and technology to finance and manufacturing. For example, a Toronto startup looking for AI developers can engage a staffing agency Canada to expediently reach out to specialized professionals meeting exact technical criteria.

These agencies also excel in office staff recruitment in Canada, finding administrative professionals skilled at handling day-to-day operations. Through their databases, companies avoid the time-consuming exercise of sorting through unqualified candidates, allowing for quicker placements and less downtime.

Cost Efficiency in Recruitment

In-house recruitment is costly, with the associated expenditures on job ads, background verification, and orientation. Staffing services Canada present a low-cost option by shouldering such outlays. Take, for instance, a Montreal retail store that requires temporary workers. They can contract with a Canadian staffing agency to perform hiring, payment of wages, and regulatory compliance and save 30% of the cost of operation.

Further, companies minimize the chance of bad hires, which often cost organizations 30% of a worker's yearly salary. By hiring through a leading staffing agency in Canada, companies are investing in quality candidates while freeing up resources to focus on core functions such as product development or customer service.

Flexibility and Scalability

Market needs vary, and companies require flexibility to ramp teams up or down. Canadian staffing agencies offer temporary, contract, and permanent staffing solutions that meet these requirements. A Calgary logistics firm, for example, may employ a Canadian staffing partner to bring in warehouse employees during busy seasons and reduce the team later.

This flexibility extends to office staff hiring in Canada, where businesses can secure part-time receptionists or project-based accountants without long-term commitments. Such adaptability is crucial for startups and SMEs aiming to grow without overextending budgets.

Compliance and Risk Management

Managing Canada's labor laws, tax codes, and workplace safety regulations can be overwhelming. Staffing services Canada take responsibility for compliance, keeping contracts, benefits, and payroll compliant with provincial and federal regulations. For instance, an Ontario staffing agency Canada takes care of WSIB coverage and Employment Standards Act (ESA) compliance for temporary employees, protecting clients from legal liability.

This skill is particularly useful for multinational corporations venturing into the Canadian economy. Through cooperation with best-in-class staffing firms in Canada, businesses eliminate fines and concentrate on growth.

Focus on Core Business Functions

Outsourcing hiring enables leadership groups to focus on strategic initiatives. A tech company in Vancouver, for example, could have a Canadian staffing firm do IT hiring while directing internal talent toward software innovation. Likewise, Canadian office staff recruitment can be outsourced to agencies, enabling HR departments to enhance employee engagement programs.

Industry-Specific Expertise

Top Canadian staffing firms tend to specialize in vertical markets. A Canadian healthcare staffing firm may be great at placing lab technicians and nurses, whereas another may be great at engineering recruitment. Specialization is key to ensuring that the candidates have not only technical expertise but also industry certifications and cultural alignment.

For instance, a staffing agency in Canada that caters to the oil and gas industry in Alberta recognizes the demand for workers with safety training, expediting placements in high-risk positions.

Expedited Hiring Schedules

Time-to-hire is of the essence in competitive markets. Canadian staffing agencies streamline the recruitment process using AI-based tools and proactive talent pipelines. A financial company in Toronto requiring a CFO within 30 days could accomplish this through a leading staffing agency in Canada, while conventional processes could take months.

Case Study: Scaling a Canadian E-Commerce Business

Take the example of "Company X," an Ottawa e-commerce company. By collaborating with a staffing agency Canada, they increased their customer service staff from 10 to 50 agents in 60 days over the holiday season. The agency took care of onboarding, training, and payroll, allowing Company X to triple revenue without a hitch in operations.

Selecting the Ideal Staffing Partner

When choosing among Canada's top staffing agencies, look at:

Industry Experience: Does the agency have experience in your industry?

Reputation: Validate client reviews and retention rates.

Range of Services: Seek temp-to-perm solutions, executive recruitment, and office staff recruitment in Canada.

Conclusion

From reducing costs to ensuring compliance, staffing agencies in Canada are indispensable allies for businesses aiming to grow sustainably. By leveraging staffing services Canada, companies gain access to specialized talent, scalability, and industry expertise—key drivers of long-term success. Whether you’re a startup or an enterprise, partnering with a staffing agency Canada can transform your hiring strategy and fuel your growth journey.

0 notes

Text

"Exploring the Benefits and Features of Times Software for Businesses"

Maximizing Efficiency with Times Software: A Game Changer for Businesses

In today’s fast-paced business environment, managing employee time effectively is crucial for maintaining productivity, reducing operational costs, and ensuring compliance with labor laws. One tool that has become increasingly popular among businesses of all sizes is Times Software. Whether you're running a small startup or overseeing a large organization, Times Software can provide the efficiency and accuracy needed to track employee hours and manage payroll seamlessly.

What is Times Software?

Times Software refers to specialized applications designed to help businesses track and manage employee work hours. These programs simplify the process of recording time worked, managing shifts, and even handling overtime. In essence, they allow businesses to reduce manual work, minimize errors, and focus on other critical tasks, such as improving employee satisfaction or streamlining workflows.

Key Features of Times Software

Accurate Time Tracking The primary function of Times Software is time tracking. Gone are the days of using paper timesheets or manually entering employee hours into spreadsheets. Times Software allows employees to clock in and clock out with ease, ensuring the accuracy of logged hours. Many systems also offer advanced features such as tracking break times and calculating overtime, making payroll processing more straightforward.

Integration with Payroll Systems One of the greatest advantages of using Times Software is its ability to integrate with existing payroll systems. By syncing data between time tracking and payroll platforms, businesses eliminate the risk of payroll errors. This also ensures timely and accurate payments for employees, while helping HR departments comply with local labor laws.

Automated Reporting and Analytics Times Software often includes powerful reporting and analytics tools that can help businesses monitor employee productivity. These reports can show trends in overtime, absence, or clock-in punctuality, allowing managers to identify areas for improvement. Managers can easily access detailed breakdowns of work hours and costs, enabling them to make informed decisions about scheduling and resource allocation.

Mobile Accessibility In a world where employees are increasingly working remotely or on-the-go, mobile accessibility is essential. Many Times Software platforms offer mobile apps, allowing employees to track their time directly from their smartphones. Whether employees are at the office, working from home, or traveling for business, they can log their hours wherever they are, ensuring accurate timekeeping regardless of location.

Compliance with Labor Laws Compliance with labor laws is an ever-present concern for businesses. Times Software often includes built-in features that help businesses adhere to government regulations, such as tracking overtime limits and rest periods. These tools can help ensure that companies stay compliant with local, state, and federal labor laws, avoiding costly fines and penalties.

Benefits of Using Times Software

Increased Efficiency By automating time tracking, Times Software reduces the need for manual input, freeing up valuable time for HR teams and managers. Instead of manually reviewing timesheets or spending hours correcting errors, Times Software automates much of the time tracking process, leading to greater overall efficiency.

Cost Savings Times Software can help businesses save money by preventing human errors in time tracking and payroll processing. Accurate records mean employees are paid correctly, and businesses avoid overpayments caused by mistakes. Additionally, streamlined operations allow businesses to allocate resources more effectively, potentially lowering operational costs.

Improved Employee Satisfaction Employees benefit from the transparency and ease of use that Times Software offers. Instead of worrying about whether their hours have been recorded correctly or whether they've been overpaid or underpaid, employees can rely on an automated system that ensures accuracy. Many systems also allow employees to access their time records, giving them greater control over their work schedules.

Enhanced Security Traditional time-tracking methods, such as paper timesheets, can be easily manipulated. Times Software offers secure systems that help prevent time theft or fraud. With features such as biometric fingerprint scanners or facial recognition, businesses can be confident that employees are accurately logging their hours.

How Times Software Benefits Different Business Sizes

Small Businesses: Small businesses often lack the resources for large HR departments. Times Software simplifies the time-tracking process, providing accurate payroll management and ensuring compliance with labor laws without requiring extensive administrative work.

Medium-sized Businesses: For growing companies, Times Software is ideal for managing an expanding workforce. The software can handle complex scheduling needs, track overtime, and integrate with existing business systems to provide a more cohesive solution for time and payroll management.

Large Enterprises: Large enterprises with hundreds or thousands of employees benefit from Times Software’s ability to scale. These systems can handle high volumes of time data, provide real-time insights, and integrate with other enterprise-level software, helping large organizations streamline their HR processes.

0 notes

Text

"Exploring the Benefits and Features of Times Software for Businesses"

Maximizing Efficiency with Times Software: A Game Changer for Businesses

In today’s fast-paced business environment, managing employee time effectively is crucial for maintaining productivity, reducing operational costs, and ensuring compliance with labor laws. One tool that has become increasingly popular among businesses of all sizes is Times Software. Whether you're running a small startup or overseeing a large organization, Times Software can provide the efficiency and accuracy needed to track employee hours and manage payroll seamlessly.

What is Times Software?

Times Software refers to specialized applications designed to help businesses track and manage employee work hours. These programs simplify the process of recording time worked, managing shifts, and even handling overtime. In essence, they allow businesses to reduce manual work, minimize errors, and focus on other critical tasks, such as improving employee satisfaction or streamlining workflows.

Key Features of Times Software

Accurate Time Tracking The primary function of Times Software is time tracking. Gone are the days of using paper timesheets or manually entering employee hours into spreadsheets. Times Software allows employees to clock in and clock out with ease, ensuring the accuracy of logged hours. Many systems also offer advanced features such as tracking break times and calculating overtime, making payroll processing more straightforward.

Integration with Payroll Systems One of the greatest advantages of using Times Software is its ability to integrate with existing payroll systems. By syncing data between time tracking and payroll platforms, businesses eliminate the risk of payroll errors. This also ensures timely and accurate payments for employees, while helping HR departments comply with local labor laws.

Automated Reporting and Analytics Times Software often includes powerful reporting and analytics tools that can help businesses monitor employee productivity. These reports can show trends in overtime, absence, or clock-in punctuality, allowing managers to identify areas for improvement. Managers can easily access detailed breakdowns of work hours and costs, enabling them to make informed decisions about scheduling and resource allocation.

Mobile Accessibility In a world where employees are increasingly working remotely or on-the-go, mobile accessibility is essential. Many Times Software platforms offer mobile apps, allowing employees to track their time directly from their smartphones. Whether employees are at the office, working from home, or traveling for business, they can log their hours wherever they are, ensuring accurate timekeeping regardless of location.

Compliance with Labor Laws Compliance with labor laws is an ever-present concern for businesses. Times Software often includes built-in features that help businesses adhere to government regulations, such as tracking overtime limits and rest periods. These tools can help ensure that companies stay compliant with local, state, and federal labor laws, avoiding costly fines and penalties.

Benefits of Using Times Software

Increased Efficiency By automating time tracking, Times Software reduces the need for manual input, freeing up valuable time for HR teams and managers. Instead of manually reviewing timesheets or spending hours correcting errors, Times Software automates much of the time tracking process, leading to greater overall efficiency.

Cost Savings Times Software can help businesses save money by preventing human errors in time tracking and payroll processing. Accurate records mean employees are paid correctly, and businesses avoid overpayments caused by mistakes. Additionally, streamlined operations allow businesses to allocate resources more effectively, potentially lowering operational costs.

Improved Employee Satisfaction Employees benefit from the transparency and ease of use that Times Software offers. Instead of worrying about whether their hours have been recorded correctly or whether they've been overpaid or underpaid, employees can rely on an automated system that ensures accuracy. Many systems also allow employees to access their time records, giving them greater control over their work schedules.

Enhanced Security Traditional time-tracking methods, such as paper timesheets, can be easily manipulated. Times Software offers secure systems that help prevent time theft or fraud. With features such as biometric fingerprint scanners or facial recognition, businesses can be confident that employees are accurately logging their hours.

How Times Software Benefits Different Business Sizes

Small Businesses: Small businesses often lack the resources for large HR departments. Times Software simplifies the time-tracking process, providing accurate payroll management and ensuring compliance with labor laws without requiring extensive administrative work.

Medium-sized Businesses: For growing companies, Times Software is ideal for managing an expanding workforce. The software can handle complex scheduling needs, track overtime, and integrate with existing business systems to provide a more cohesive solution for time and payroll management.

Large Enterprises: Large enterprises with hundreds or thousands of employees benefit from Times Software’s ability to scale. These systems can handle high volumes of time data, provide real-time insights, and integrate with other enterprise-level software, helping large organizations streamline their HR processes.

0 notes

Text

How the fuck will that get you cancelled?

That is the most uncancellable, milquetoast shit I have ever seen.

If you start saving at 30 years old and you expect to retire at 65 and use $100k/year until 85 you have to invest $3000/month

Thats fucking nuts. I am putting that much away. Its insane

Here are some that will get you cancelled:

If you have good enough credit to get a $42,000 credit card and preferably like $100k credit card you could (if you made it your full time job) make $30 mil/year

Rental properties are priced based on revenue, not property value. This can be exploited both ways

A car payment should not be more than 8% of your income

A house should cost twice your salary but with a 30 year mortgage 4x your salary is affordable

Its almost impossible to sell a house thats 5x the average income in a town. So in a town with “average” income $60k per person a $300k house will need to be on the market for 6 months or more. Most nice/suburban towns have average incomes above $100k.

Banks have just cut mortgages and business loans to 90% of what it was in 2008. So were pretty fucked

You first house (with the first time home buyers program) can have a down payment of 3-5%. Its okay to not do 20%

If you’re poor places with low cost of living are more important than taxes. Virginia have high taxes but at $15/hr it doesn’t matter. you can get cheap rent and food and fuel there.

Buying a home is a scam by the banks

Refinancing your home is a scam

Refinancing your debt WITH ANOTHER BANK is not always a scam. They get your business instead of the other guys.

If you refinance with the same bank they have no incentive to help you and, in fact, have an incentive to fuck you

You will die poor

Warren Buffet invests in shit businesses and props them up by lobbying for government regulation that makes him more profitable like the Keystone pipeline. You cannot invest like Warren Buffet no matter what some book says and if you could, you shouldn’t

You can’t beat an index fund. Other people can. I do. You can’t

FOREX is actually straight up gambling. The “brokers” control the prices. Arguably its more fun than gambling but just be aware

You don’t “need” that new thing

Lifestyle creep will ruin your finances

Unless you are actively trying Costco and Sam’s Club will not save you money. Its pretty easy to do it right though

Some things are actually more expensive at Walmart than at the fancy grocery stores

You should be going to 2 or 3 different stores to get your stuff for less

Don’t buy super cheap stuff. Its a waste of money

Sometimes it is cheaper to eat out because you will have a lot of food waste and meal prep sucks. The only thing I like to prep is soup.

Most jobs have an economic impact 3 to 4x the actual pay. Get over it. The company doesn’t make that much.

Banks won’t lend to independent contractors

Net worth is not comparable to actual cash in hand

$25k is a reasonable amount to keep in the bank as. A rainy day fund. With minimum account amounts on high interest savings accounts $30k is actually reasonable. Yeah I know the average american has less than $1k

If you live in a place that has slightly above average rent and food costs the living wage is like $18.75 or more

When bond interest rates reverse that means rich people and banks are buying 30 year bonds and not 5 year bonds. This is not financial advice but thats when I am eyeballing those 5 year bonds. Banks are forced to buy bonds when the Federal Reserve “prints” money. They choose 30 year bonds even though they are a terrible investment.

If you are going to buy bonds consult an advisor. There are ways to time the market and times when inflation adjusted bonds aren’t the best so yes you do actually need to talk to someone knowledgable

The best investors are paid commission. They make money when you make money so their interests are aligned with yours

Vending machines, laundromats, and other side hustles are a scam. They are a waste of your precious time. Just work overtime at your job or grow cash crops like Oyster mushrooms

You don’t have enough money to get into real estate or most of those side hustles anyway. Minimum is like $150k cash

Oh and if you do manage to build wealth your children or grandchildren will waste it and be wage slaves again

31K notes

·

View notes

Text

The Future of Payroll: Why Automated Payroll Services Are a Game-Changer

In today's fast-paced business world, efficiency is everything. From managing operations to keeping employees satisfied, businesses must streamline processes to stay ahead. One area where automation has proven to be a game-changer is payroll. Automated payroll services have revolutionized the way companies handle employee salaries, taxes, and compliance, saving time and reducing costly errors. If you're still manually processing payroll, it's time to consider making the switch

.

What Are Automated Payroll Services?

Automated payroll services are software solutions designed to handle payroll processing with minimal human intervention. These systems calculate salaries, deduct taxes, process direct deposits, and generate reports, ensuring payroll is handled accurately and on time. Many platforms integrate with accounting software, HR systems, and tax agencies to simplify compliance and record-keeping.

The Benefits of Automated Payroll Services

1. Time Savings

Manually processing payroll can take hours or even days, depending on the size of your business. With an automated system, calculations, tax withholdings, and payments happen seamlessly, freeing up valuable time for business owners and HR professionals.

2. Error Reduction

Human errors in payroll can lead to financial losses, employee dissatisfaction, and legal complications. Automated payroll services minimize mistakes by accurately computing wages, taxes, and deductions, reducing the risk of costly miscalculations.

3. Compliance Made Easy

Keeping up with tax laws and labor regulations can be overwhelming. Payroll software updates automatically to reflect changes in tax rates, wage laws, and filing deadlines, ensuring compliance with local, state, and federal regulations.

4. Improved Employee Satisfaction

Late or incorrect paychecks can frustrate employees and lower morale. Automated payroll ensures timely and accurate payments, offering employees a reliable and transparent payroll process. Some services even provide self-service portals where employees can access their pay stubs and tax documents.

5. Cost-Effectiveness

Hiring a full-time payroll professional or outsourcing payroll can be expensive. Automated payroll service offer an affordable alternative by reducing administrative costs while maintaining accuracy and efficiency.

How to Choose the Right Automated Payroll Service

With many options available, selecting the right payroll service for your business requires careful consideration. Here are some factors to keep in mind:

Scalability: Choose a system that grows with your business.

Integration: Ensure it integrates seamlessly with your accounting and HR software.

Security: Payroll involves sensitive employee data, so opt for a service with strong security features.

Customer Support: Reliable support is essential for resolving issues quickly.

Pricing: Compare costs and features to find a solution that fits your budget.

Is Automated Payroll Right for Your Business?

If you're spending too much time on payroll or struggling with compliance, an automated payroll service could be the solution. Small businesses, startups, and large enterprises alike can benefit from automation. The transition is often smoother than expected, with many providers offering guided onboarding and support.

Final Thoughts

Automated payroll services are more than just a convenience—they're a necessity in today’s digital world. By eliminating errors, saving time, and ensuring compliance, they allow businesses to focus on growth rather than getting lost in paperwork. Whether you're a small business owner or managing a large workforce, investing in payroll automation is a smart move for the future.

Are you ready to take the next step in streamlining your payroll? Explore your options and find a solution that fits your business needs!

0 notes