#how to open demat account in 2023

Explore tagged Tumblr posts

Text

#what is demat account#how to open demat account#open demat account#how to open demat account in 2023#best demat account#best demat account in 2023#best demat account in india

0 notes

Text

What is a Demat account - Meaning & Types of Demat account

A Demat account allows you to store shares, bonds, etc, in electronic form. Learn what is a Demat account, its types, Benefits, & Ways to open a Demat account with Samco.

#demat account#what is demat accunt#how to open demat account#open a free demat account#demat account india#how to open demat account in 2023

0 notes

Text

Mutual Funds vs. Stocks: Which Investment Option is Best for You?

Investing is all about putting your money to work for you, but choosing between mutual funds and stocks can feel like deciding between coffee and tea. Both options can be profitable, but each has its unique risks and rewards.

Did you know that in FY 2023, more than 14 million new demat accounts were opened in India, with retail investors pouring ₹7.5 lakh crore into mutual funds? That’s how much the investment game has heated up!

So, if you’re wondering which investment option mutual funds or stocks is right for you, then Hurry Up! Contact Mutual Fund advisor Now.

Understanding the Basics: Mutual Funds vs. Stocks

Let's start with the basics.

Stocks represent ownership in a company. When you buy shares of a stock, you essentially own a piece of that company. If the company does well, your investment grows; if it doesn’t, your investment can shrink or vanish. Stocks can offer high returns, but they also come with high risk.

Mutual Funds, on the other hand, pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. A fund manager handles this for you, taking care of the stock picking and balancing. Mutual funds generally offer lower risk because of this diversification, but they also tend to deliver lower returns compared to individual stocks in the short term.

Risk Factor: How Much Can You Handle?

Let’s be honest: when it comes to investing, risk is always on the table.

Stocks: Buying individual stocks is like riding a rollercoaster. Sometimes you’re flying high, and sometimes you’re plummeting. Stocks are volatile, and you need to keep an eye on the market. For example, if you had invested in Reliance Industries in the early 2000s, you'd have seen your money multiply several times over. But stocks like Yes Bank have shown us that things can go south quickly if the company takes a hit.

Mutual Funds: If you're not into the adrenaline rush of constant market checks, mutual funds might be more your style. Since mutual funds spread your investment across various stocks, the overall risk is reduced. Even if one stock in the fund performs poorly, the others may balance it out. In 2023, the average equity mutual fund in India offered returns of about 12-15%, which is decent without putting your heart at risk!

Control: Do You Like Being Hands-On?

If you're someone who loves keeping control and doesn’t mind doing the research, then stocks might be your go-to option.

Stocks: You can pick and choose your companies, buy and sell whenever you want, and stay in total control. This is great if you enjoy learning about companies, industries, and market trends. However, the downside is that you need to stay constantly updated. Think of this as managing your own sports team—you're the coach and manager all rolled into one.

Mutual Funds: Here, a fund manager takes the wheel. They make the buying and selling decisions, freeing you from day-to-day management. So, if you’re someone who’d rather sit back and let an expert handle things, mutual funds are a good fit. It’s like hiring a coach for your sports team—you’re still in the game, but someone else is making the tactical calls.

Returns: What Are You Looking to Gain?

When it comes to returns, stocks generally have the potential to outperform mutual funds, but this comes with higher risk.

Stocks: Over the long term, stocks have historically delivered better returns than most other investments. For instance, stocks in companies like Infosys, TCS, and HDFC have consistently shown growth over the years. But, they come with wild swings. Your investment could double, or you could lose half of it within a few months.

Mutual Funds: While mutual funds may not offer the same high returns as individual stocks, they do provide more stable returns over time. Equity mutual funds can give you 12-15% annual returns, while debt mutual funds typically offer around 7-9%. The growth may be slower, but it’s more consistent, making mutual funds a great option for long-term wealth building.

Time Commitment: Do You Have the Patience?

The time and effort you’re willing to commit to your investments also play a big role in deciding whether stocks or mutual funds are right for you.

Stocks: You need to actively monitor your portfolio. If you have the time and interest to stay updated with the market trends, quarterly earnings, and corporate news, stocks can be rewarding. It’s like maintaining a garden—constant care and attention are needed.

Mutual Funds: If you don’t have time to monitor the market, mutual funds are more like a set-it-and-forget-it option. The fund manager does the heavy lifting, so you can relax while your money grows slowly but steadily.

Liquidity: How Quickly Can You Get Your Money?

Liquidity, or how easily you can turn your investment back into cash, is another crucial factor.

Stocks: Stocks are highly liquid. You can sell your shares anytime the stock market is open, and the money is usually credited to your account in a couple of days. This flexibility can be great, especially if you foresee needing cash on short notice.

Mutual Funds: Mutual funds are generally liquid, but they’re not as instantaneous as stocks. You can redeem your units, but it usually takes a day or two for the funds to appear in your account. Some funds, like ELSS (Equity Linked Saving Schemes), come with lock-in periods, so be mindful of the type of fund you choose.

Conclusion: Which Investment Option is Best for You?

It all boils down to your personal preferences, financial goals, and risk tolerance.

If you’re okay with higher risk and enjoy staying involved in your investments, stocks might be the better choice for you.

If you prefer a safer, hands-off approach, mutual funds could be your best bet.

For example, a young investor in their 20s with time on their side might lean towards stocks for high growth, while someone nearing retirement may prefer the steady returns and lower risk of mutual funds.

In the end, there’s no one-size-fits-all answer. Many investors choose to balance both, creating a diversified portfolio that includes mutual funds for stability and stocks for growth. So, which will it be for you?

0 notes

Text

IPO Investment : What It Is and How Does It Work

From fintech and logistics to food-tech and apparel, companies across a diverse range of sectors have launched their Initial Public Offerings (IPOs) in recent times. In 2023 too, the IPO pipeline is robust, with some highly anticipated IPOs likely to be launched soon.

If you are keen on investing in IPOs, but don’t know how to begin, then we have got you covered!

In this article, we will help you get a basic understanding of IPOs:

What is an IPO

Why Does a Company go in for an IPO

How Does an IPO Work

Key IPO Terms to Know

How to Invest in an IPO

Note that for IPO investment, you need to have a Demat account.

Open a Demat account with PL within minutes, by clicking here

What is an IPO

The process through which a private company offers its shares to the public for the first time is called an Initial Public Offering. These shares are offered to investors through the Primary Market, for a specific period. After that, the company gets listed on the stock exchanges and its shares are traded in the secondary market. Simply put, an IPO is the transition from a privately held company to a publicly traded company.

Approval from the market regulator SEBI, i.e. the Securities and Exchange Board of India is mandatory before any company can launch its IPO.

There are two types of IPOs:

Fixed Price Offering: As the name suggests, in this type, the company announces the price per share of the IPO in advance. All applications and allocations will be at this pre-determined price.

Book Building Offering: Here, the company relies on a price discovery mechanism by announcing a 20% price band – comprising an upper and lower limit – for the shares. Investors can bid for the number of shares and the price they are willing to pay. Based on these bids, the final price at which the shares will be issued to the investors is determined.

Why Does a Company go in for an IPO

Opting for an IPO comes with many benefits for a company. Here’s a look at some of the key ones:

An IPO enables a company to raise funds through the capital market.

It can use this money for a variety of reasons, including expanding its business, undertaking capex, paying off debt, and so on.

When the shares are traded in the capital markets, it brings in higher liquidity and price transparency.

An IPO could increase the credibility and publicity of a company.

How Does an IPO Work

By now, you must have a basic understanding of what are IPOs and why companies prefer to go public. Now, let us take a closer look at how an IPO works.

Pre-IPO:

Once a company decides to go in for an IPO, it has to work with investment banks to chalk out all the details of the IPO. It also needs to file a Draft Red Herring Prospectus (DRHP) with the SEBI. This is also called an ‘Offer Document’ and comprises details about the company’s business, risks, why it is going in for an IPO, how the funds will be used, etc. The SEBI may ask for changes, if required, in this document.

After making these changes, and getting approval from the SEBI, the BSE and the NSE, and the Registrar of Companies (ROC), the Red Herring Prospectus (RHP), or the ‘Final Prospectus’ is filed by the company. This comprehensive document enables potential investors to make an informed decision about IPO investment.

Once approved by the SEBI, the company can launch its IPO in the primary market. The company will then announce details such as lot size, price band, and opening and closing date of the IPO.

During IPO:

Investors can apply for an IPO during a specific period.

The allotment of shares depends upon the demand for the IPO. If an IPO is oversubscribed, then the allotment happens through a computerized process, and if it’s undersubscribed, then the investors may get the shares they bid for.

On the Listing Date, the company gets listed on the stock exchanges. Whether it lists at a premium or discount to its issue price is again a result of demand for the shares.

This brings an end to the IPO process. The company is now a publicly listed company, with its shares trading in the secondary market.

Key IPO Terms to Know

For IPO Investment, here are some of the key terms you need to know:

DRHP / RHP: A comprehensive offer document that a company has to file with the SEBI, comprising details about the company’s financials, business model, risks, opportunities, and why it has decided to go public.

Floor Price: The minimum price you can choose, while applying for an IPO

Upper Limit: The maximum price you can choose, while applying for an IPO

Cut-off Price: The price at which shares get allotted to the investors

Lot Size: Minimum number of shares you need to purchase, when applying for an IPO

Listing Date: The date on which the company gets listed on the exchanges

Anchor Investors: A portion of the IPO is reserved for institutional investors, such as banks, financial institutions, mutual funds houses, etc. These are called anchor investors

Oversubscribed & Undersubscribed: If an IPO receives applications for more shares than it offered for sale, then an IPO is said to be oversubscribed. If it receives applications for fewer shares than it offered for sale, then an IPO is said to be undersubscribed

0 notes

Text

8 Important Regulatory Changes Taking Effect on October 1, 2023, that will impact your Daily Life!

Starting October 1, 2023, get ready for some game-changing rules that will impact your daily life in various ways.

Here are 8 fresh regulations you should be aware of:

1) Birth Certificates for Everything:

The new law is all about simplifying life. If you are born after the Registration of Births and Deaths (Amendment) Act, 2023 came into play, your birth certificate is about to become your all-in-one proof for various important things.

Imagine this: just your birth certificate would be sufficient to prove your time and place of birth for getting into school, snag a driver's license, join the voter list, registering your marriage, or even get a job in the government, public sector, or any important government-related paperwork.

So, this little piece of paper can open big doors in your life! It's a game-changer for anyone born after this law started, making things much simpler. No more juggling multiple documents to confirm your birthdate and place! Plus, it simplifies the process of registering adopted, orphaned, surrendered, surrogate, and single-parent children.

2) New 20% TCS Rule for International Ventures:

If you're planning international escapades, investing in foreign stocks or pursuing higher education abroad, listen up. Starting October 1, a new TCS rule takes effect. If your spending abroad exceeds a specific limit in a financial year, TCS applies. The good news is that international credit card users won't face this tax, as clarified by the Finance Ministry. Under the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI), you can remit up to $250,000 in a financial year. Starting from October 1, 2023, all overseas outward remittances, except for medical and educational purposes, over a threshold limit of Rs 7 lakh in a financial year will attract a TCS of 20%.

3) Online Gaming's Tax Twist:

Gamers, take note! Starting October 1, online gaming will come with a 28% GST tag. Finance Minister Nirmala Sitharaman announced this change in August. The tax calculation for online gaming and casinos will be based on the amount paid or deposited with the provider, excluding your winnings. So, while you enjoy gaming, be prepared for a bit more taxation fun.

The Finance Minister had a clear message about how taxes will work in the world of gaming.

Picture this: You're in Goa, trying your luck at a casino. You bet Rs 50,000 and win Rs 5,000. Under the new 28% GST rule, you're only taxed on the initial bet of Rs 50,000, which amounts to Rs 14,000. However, no GST is applicable on betting made in multiple rounds, including bets made with winnings from the previous round.

If you bet additional Rs 10,000 , the tax applies to that extra amount.

4) No More Automatic Tax Refunds for Some Items:

To tackle tax fraud, there's a change coming on October 1. If you're exporting items like pan masala, tobacco, and similar products, you won't automatically get your Integrated GST (IGST) refunds anymore. Instead, you'll need to approach tax officers for approval to get your refund. These items typically fall under 28% Tax bracket plus cess.

5) Deadline to Update Mutual Fund Folio Nomination

The SEBI has made it mandatory to add nominees for all existing mutual fund folios, including jointly-held ones. The deadline to update the nomination for your mutual fund investments is September 30, 2023. On failing to do so, your folios will be frozen for debits as per SEBI. This simply means you won’t be able to make any withdrawals from your mutual funds. Yesterday SEBI extended the nomination deadline till 31 December 2023

6) Deadline to Update Trading, Demat Account Nomination

Same as Mutual Fund Folio Nomination, The SEBI has made it mandatory to add nominees for all Trading and Demat Accounts. The deadline to update the nomination was 30 September 2023. Yesterday the deadline is extended to 31 December, 2023

7) Deadline to Update Adhaar with various Small Savings Scheme

The Ministry of Finance has made it mandatory to link Aadhaar with the small savings schemes, including the Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), and Post office deposits. The deadline to link Aadhaar to these schemes is September 30, 2023. On failing to do so, your investments in these small savings schemes will be frozen.

8) Safety Ratings for Cars:

Starting from October 1, 2023, India is rolling out its first-ever car crash testing program called Bharat New Car Assessment Programme (BNCAP). Here's the deal: car manufacturers can voluntarily test their vehicles based on specific industry standards. After the tests, cars will receive star ratings for how well they protect adult and child occupants during crashes. These ratings will help you decide which car is safer to buy. So, when you're shopping for a new ride, keep an eye out for those safety stars!

These new rules aim to make life simpler and ensure that the government can provide better services while collecting the necessary taxes for a stronger nation. These changes might affect your pocket and your safety.

Stay informed, stay prepared!

0 notes

Video

youtube

HDFC Sky Account Open | How to Open HDFC Demat Tamil 2023 @Tech and Tech...

0 notes

Text

IPO of Mamaearth (Honasa Consumer) will open on 31st October 2023 and the price band will ₹308 - ₹324 per share. You can download Planify android application from Google play store and read everything about Mamaearth IPO. You will get the complete process that how to create your demat account and apply for Honasa Consumer IPO.

#Mamaearth share price#Mamaearth unlisted Shares#Mamaearth IPO#Mamaearth Upcoming IPO#Mamaearth Pre IPO

1 note

·

View note

Text

Online Job

OPEN FREE DEMAT ACCOUNT

📈 Looking to take control of your financial future? It's time to open a Demat Account! 💼

A Demat Account is your gateway to the world of investing, allowing you to buy and sell stocks, bonds, and other securities with ease. Whether you're a seasoned investor or just starting out, this is a crucial step towards financial empowerment. 🌟

📋 In our latest blog post, we break down the why, what, and how of Demat Account opening. Get answers to all your questions and kickstart your investment journey! 💸💰

👉 Check out our blog here:https://skystockmart1.blogspot.com/2023/10/unlocking-financial-success-how-to-earn.html

#DematAccount #Investing #FinancialFreedom #BlogPost #InvestmentJourney

1 note

·

View note

Text

Are you ready to seize a golden opportunity in the market? Look no further than Rajgor Castor Derivatives Ltd. IPO – your gateway to a thriving future!

🌐 About Rajgor Castor Derivatives Ltd.: Rajgor Castor Derivatives Ltd. is a trailblazer in the castor oil derivatives industry, boasting a legacy of excellence and innovation. With a commitment to quality and sustainability, the company has emerged as a frontrunner, capturing global markets.

📈 Why Invest in Rajgor Castor Derivatives Ltd.?

Proven Track Record: With a successful history of delivering consistent growth, Rajgor Castor Derivatives Ltd. stands as a symbol of reliability in the market.

Industry Leadership: As a leading player in the castor oil derivatives sector, the company is well-positioned to capitalize on emerging market trends, ensuring a lucrative investment opportunity.

Sustainable Practices: Rajgor Castor Derivatives Ltd. is dedicated to environmental responsibility, aligning with the growing demand for sustainable and eco-friendly solutions.

Global Presence: With a robust international presence, the company is poised for global expansion, presenting investors with a diversified and resilient portfolio.

📊 Key IPO Details:

Issue Period: [17 oct 2023- 20 Oct 2023] Price Band: [Rs. 47 to Rs. 50 per Share] Lot Size: [3000 shares] Offer for Sale: [666,000 shares of Rs.10 (aggregating up to Rs. 3.33 Cr)] Price of 1 Lot [Rs. 150,000 ] 🌐 How to Participate: Don't miss the chance to be part of Rajgor Castor Derivatives Ltd.'s growth story! To participate in the IPO, follow these simple steps:

Open a Demat Account with your preferred brokerage. Check the IPO application process and guidelines. Submit your application during the IPO period. 🔥 Why Wait? Act Now! Rajgor Castor Derivatives Ltd. IPO is your ticket to a prosperous future. Act now to secure your share of this groundbreaking opportunity. Invest wisely, invest with Rajgor Castor Derivatives Ltd.!

0 notes

Text

Steps to Open Demat Account Online?

As of March 2023, India saw a total of 114.46 million demat accounts. Among these, NSDL held 31.46 million accounts while CDSL held 83.00 million accounts. It's impressive to see such a large number of demat accounts, indicating an increased interest in investing among Indians. However, before starting investing, it is important to understand how a demat account demat is opened. In this blog, we will discuss the steps to open a demat account online.

Step 1: Choose a Depository Participant (DP)

The first step to open a demat account online is to choose a depository participant (DP). A DP is a financial institution that holds and manages your securities. There are two depositories in India: National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL). Choose a DP that fits your requirements and is registered with the Securities and Exchange Board of India (SEBI).

Step 2: Visit the DP's website or download their mobile app

Once you have selected a DP, visit their website or download their mobile app to open a demat account. Most DPs have a user-friendly website or mobile app that guides you through the process of opening a demat account.

Step 3: Fill in the Application Form

Once you are on the DP's website or mobile app, you will be asked to fill in an application form. The application form requires personal information such as your name, address, phone number, email id, and PAN card details. Fill in all the required fields accurately.

Step 4: Upload the Required Documents

After filling in the application form, you will be asked to upload scanned copies of the required documents. The documents required for opening a demat account online are:

PAN card

Aadhaar card

Address proof (utility bill, passport, driving license, etc.)

Bank account details (cancelled cheque or bank statement)

Make sure the scanned copies of the documents are clear and readable.

Step 5: Sign and Submit the Application Form

After uploading the required documents, you will be asked to sign the application form digitally. You can sign the form using a digital signature or e-signature. Once you have signed the form, submit it online.

Step 6: Verification of Documents

After submitting the application form, your documents will be verified by the DP. The verification process may take a few days to complete. Once the verification is done, you will receive a confirmation email or message from the DP.

Step 7: Fund the Demat Account

Once your demat account is opened, you will receive your demat account number and other details via email or message. You can then fund your demat account by transferring securities from your physical certificate to your demat account.

Conclusion

In a nutshell, opening a demat account online is a simple and convenient process. By following these steps, you can open a demat account and start investing in the stock market from the comfort of your home. Remember to choose a reliable DP, fill out the form accurately, upload the required documents, and fund your account to start trading. Happy investing!

1 note

·

View note

Text

Busiest week for IPOs this year with four offers set to hit market

Keywords: upcoming ipo

how to invest in share market

The primary market rush is all set to start again this year with market recovery. Investors can expect a lot of action in the primary market. With many IPOs (Initial Public Offerings) lined up in 2023, the year will witness many busy weeks in the primary market.

Four IPO Offers Set to Hit Market

The year just started and many companies have submitted their IPO DRHPs to look forward to in 2023. Here are the four companies that submitted their DRHPs (Draft Red Herring Prospectus) to the capital markets regulator SEBI (Securities and Exchange Board of India):

ideaforge Technology Ltd

The Drone maker Ideaforge Technology Limited is ready to issue 300 crore of fresh issue and 4.87 lakh equity shares via its IPO with a face value of Rs 10. IPO issue proceeds are to be used to repay loans, product development, and fund working capital. The company is one of the first few corporations in India to enter the Unmanned Aerial Vehicle (UAV) market and ranks 7th globally as per the report - Drone Industry Insights December 2022.

AKME Fintrade (India) Ltd

Akme Fintrade (India) Ltd is another company on the list of upcoming IPOs in 2023. Providing lending solutions in rural and semi-urban cities, it is ready to raise funds through its public issue. Its IPO comprises fresh issuance of 1.1 crore equities with a face value of Rs.10 each to be listed on the NSE and BSE. This Non-Banking Financial Company (NBFC) wants to use the proceeds of the issue for its capital base. The sole book-running lead manager of the issue is Gretex Corporate Services Ltd.

FirstMeridian Business Services Ltd

The company FirstMeridian Business Services Ltd, involved in staffing business and offering allied services has submitted its DRHP with the SEBI. The IPO size is Rs.740 crore. It was aimed to raise Rs.800 crore earlier. Its IPO comprises fresh issuance of equities worth Rs.50 crore and an OFS (Offer For Sale) of Rs.690 crore. The company wants to utilize the raised capital from the fresh issuance towards debt payment and general corporate purposes. The company, established in 2008, has served big names. Their key clients include Adani Ports and Special Economic Zone, Eureka Forbes, Dell International Services India, Exide Industries, PhonePe, and others. Researching companies is one of the aspects for individuals looking for ‘how to invest in the share market.’

Corrtech International Ltd

Corrtech International Ltd is a pipeline laying solutions provider and has filed its book-built public issue draft with the SEBI. Going by the IPO draft papers, its IPO consists of new equity shares worth Rs.350 crore and an OFS of 40 lakh shares. Funds raised from the fresh issue are to be used for debt payment, funding redemption of debentures, financing new equipment, capital infusion in its subsidiary company, and general corporate purposes. It is offering 35% of the issue to retail investors.

How to Invest in Share Market

To invest in the primary market and secondary market, investors need a Demat account.

Individuals interested in the IPO market can approach a stockbroker registered with the SEBI to open a Demat and trading account. A Demat is required to hold multiple financial assets, including shares, bonds, government securities, and many more. On the other hand, a trading account is required to buy or sell Demat securities on stock exchanges through the broker’s trading platform.

Individuals should look at their financial goals and choose to hold IPO shares to grow their funds with the company’s growth, or sell them for quick listing gains.

Investments in equity and equity-related securities involve high risk. Therefore, research companies’ financials and growth prospects thoroughly before employing funds. Park funds in an IPO issue if the risk profile allows.

Thus, considering the excellent listing in the previous year, experts see a similar momentum in 2023 also in the IPO market. Get ready with an active Demat account to invest timely in the busy primary market.

0 notes

Text

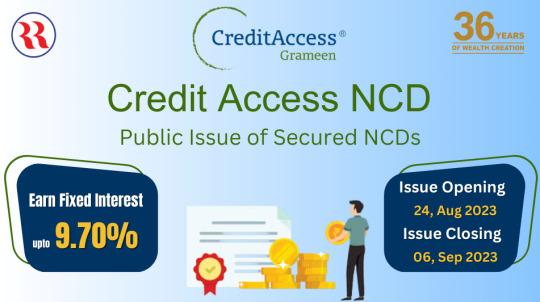

Credit Access NCDs: An Attractive Investment Opportunity

Before diving into the specifics of the NCDs, it's crucial to acquaint ourselves with the issuer. Credit Access Grameen Limited is a prominent Indian micro-finance institution headquartered in Bengaluru. Its core mission revolves around providing joint liability group loans and micro-loans, with a primary focus on empowering women in rural India. As of March 2022, CA Grameen is recognized as India's largest NBFC-MFI based on its impressive gross loan portfolio figures, endorsed by the MicroFinance Institutions Network in India.

Issuer's Focus and Opportunity:

Credit Access Grameen Limited primarily serves women customers in rural India, offering crucial financial support. Their target demographic comprises women with an annual household income of up to Rs 300,000, in alignment with the new microfinance regulations introduced by the RBI in March 2022. The company specializes in providing income generation loans, family welfare loans, home improvement loans, and emergency loans to its customer base.

CA Grameen's promoter, Credit Access India N.V., is a multinational firm specializing in micro and small enterprise financing. The promoter has a history of injecting capital into CA Grameen and facilitating access to potential fundraising avenues within the debt capital markets.

Why Consider Credit Access NCDs in Your Investment Portfolio:

Solid Credit Rating: The NCDs boast a "IND AA-/Stable" credit rating from India Ratings & Research Private Limited, signifying a robust credit profile.

Attractive Returns: Offering coupon rates ranging from 9.10% to 9.70% and effective yields from 9.48% to 10.13%, these NCDs provide competitive returns compared to traditional fixed-income investments.

Diverse Tenors: Investors can select from various tenors, ranging from 24 to 60 months, aligning their investments with their financial goals.

Flexible Interest Payment: Credit Access NCDs accommodate both monthly interest payments and cumulative interest options.

Listed on BSE: These NCDs will be listed on BSE, ensuring liquidity and ease of trading.

Credit Access NCD Investment Opportunity:

Let's delve deeper into the investment opportunity presented by Credit Access Grameen Limited through its NCD issue.

NCD Issue Details:

Issuer: Credit Access Grameen Limited

Base Issue Size: Rs. 400 Crores

Green Shoe Option: Rs. 600 Crores

Total Aggregated Issue: Rs. 1000 Crores

Issue Opening Date: August 24, 2023

Issue Closing Date: September 06, 2023

Face Value: Rs. 1,000 per NCD

Minimum Application: Rs. 10,000 (10 NCDs), collectively across all Options

Listing: The NCDs will be listed on BSE within 6 working days from the respective Tranche Issue Closing Date.

Issuance Mode: Dematerialized form

Credit Rating: IND AA-/Stable by India Ratings & Research Private Limited

Basis of Allotment: First come, first serve

Understanding the Series:

Series I, III, V, and VII provide monthly interest payments, ensuring regular income streams.

Investors have the flexibility to choose the series that best aligns with their financial goals and preferences.

Investment Benefits:

Attractive Yields: The NCDs offer competitive coupon rates, with effective yields ranging from 9.48% to 10.13% per annum, depending on the chosen series.

Diversity of Options: With eight series to choose from, investors can tailor their investments to suit their financial objectives.

Monthly Income: Series I, III, V, and VII provide monthly interest payments, ideal for those seeking regular income.

Safety and Credibility: CA Grameen holds a credit rating of "IND AA-/Stable" by India Ratings & Research Private Limited, indicating a strong level of creditworthiness.

How to Invest in Credit Access NCDs:

To invest in Credit Access NCDs, follow these steps:

Check Eligibility: Ensure you meet the eligibility criteria, including the minimum application amount.

Demat Account: If you don't already have one, open a demat account to hold your NCDs electronically.

Apply: Submit your application during the specified period between August 24, 2023, and September 6, 2023.

Allotment: Wait for the basis of allotment to be announced; allotment is on a first-come-first-served basis.

Trading: Once allotted, you can trade these NCDs on the BSE after listing.

Conclusion:

The Credit Access NCD issue presents an enticing investment opportunity for diversifying portfolios and earning attractive returns. Backed by a robust credit rating and offering a variety of series, these NCDs cater to a wide range of investor preferences. Whether you seek monthly income or cumulative growth of your investment, Credit Access NCDs offer both security and potential for substantial returns.

Investors are advised to assess their investment goals and risk tolerance carefully before making a decision. Remember that NCDs, like all investments, carry some level of risk, and it's essential to consult with a financial advisor or expert for personalized guidance.

Don't miss out on this opportunity to invest in the promising Credit Access NCD issue. Begin securing your financial future today.

Disclaimer:

All investments carry inherent risks. Investors should thoroughly review the offer-related documents and seek professional advice before making investment decisions.

Source :- https://realistic-magnolia-w8t3gc.mystrikingly.com

0 notes

Text

North Eastern Carrying Corporation Limited Announces Rights Issue to Fuel Growth and Expansion

North Eastern Carrying Corporation Limited, a prominent company in the transportation sector, has recently made an exciting announcement. They are conducting a Rights Issue, offering an opportunity for eligible shareholders to acquire partly paid-up Equity Shares. This move aims to raise funds for the company’s growth and development initiatives. Let’s delve into the details of this Rights Issue and explore what it means for shareholders and the company’s future.

The Rights Issue by North Eastern Carrying Corporation Limited entails the issuance of up to 4,51,77,602 partly paid-up Equity Shares, each with a face value of Rs. 10.00/-. Shareholders will have the chance to acquire these shares at a price of Rs. 18.00/- per Right Share, which includes a premium of Rs. 8.00/-. The total amount payable for the Rights Shares is Rs. 8,131.97 Lakhs.

The Rights Issue officially commenced on Wednesday, June 14, 2023, and is set to close on Tuesday, June 27, 2023. Shareholders are encouraged to carefully review the updated activity schedule for any changes regarding the Issue Opening Date, the Last Date of Market Renunciation, and the Closing Date for Eligible Equity Shareholders.

The Rights Issue presents an exciting opportunity for eligible shareholders to increase their equity holdings in North Eastern Carrying Corporation Limited. By participating in this offering, shareholders can potentially capitalize on the company’s future growth prospects and enhance their investment portfolio. The partly paid-up Equity Shares offer a cost-effective way to gain exposure to the company’s success.

The Rights Issue also allows for the renunciation of shares through off-market transfers. Shareholders who choose to renounce their entitlements must ensure that the transfer is completed in a timely manner to ensure the proper crediting of Rights Entitlements to the Demat account of the Renouncees. This process should be completed on or prior to the Issue Closing Date to facilitate a smooth and efficient transition.

To provide an extended window for eligible shareholders to participate in the Rights Issue, the company has extended the date of closure from Tuesday, June 27, 2023, to Tuesday, July 04, 2023. This decision was made by the Rights Issue Committee, authorized to extend the Issue Period as necessary. It’s worth noting that no withdrawal of the application will be permitted after the Issue Closing Date.

North Eastern Carrying Corporation Limited’s Rights Issue presents a unique opportunity for eligible shareholders to enhance their investment in the company. By acquiring partly paid-up Equity Shares, shareholders can align themselves with the growth and development initiatives of one of the leading players in the transportation sector. With the extended window provided, shareholders have ample time to consider their participation and submit their application forms accordingly carefully.

This Rights Issue is a testament to North Eastern Carrying Corporation Limited’s commitment to driving its growth agenda and maximizing value for its shareholders. It will be interesting to see how this offering shapes the future of the company and the transportation industry as a whole.

0 notes

Text

कैसे कमाए ₹1.38 करोड़? How I Made $167K From a Small Website & YOU CAN TOO! 🔥

In this video, I'm sharing about a Small Website which helped me earn more than 1 CRORE 38 Lakh Rupees by just Selling Digital Products, If you're someone who has NO SKILLS & KNOWLEDGE about anything even then you can Start a Digital Product Business & Make Money In 2023! (This is one of the best Part Time Jobs for Students) Hope you found this video valuable ❤️ 🎨 Thumbnail Inspiration : @TheDiaryOfACEO & Ishan Sharma • • • 👉 Best & Affordable Hosting For Beginners : https://hostinger.in/umer Coupon - (UMER) for Flat 10% Discount! One More Thing: If you successfully purchased your hosting using the above link, send me your invoice to this email ([email protected]) & Avail Premium Training on Digital Products. 👉 Join For FREE & Start Earning : https://bit.ly/USEMOJO 👉 Open a Free Demat Account on Upstox : https://bit.ly/FREEUPSTOXACCOUNT 👉 Join Our Telegram Group For Daily Tips : https://t.me/umerblogger/ • • • Resources I mentioned ⤵︎ Use IDPLR to Build Product - https://www.idplr.com/ Setup Your Website Using Hostinger - https://youtu.be/zAwRHtuexJ0 Tutorial On High Converting Landing Page Creation - https://youtu.be/8hoL4TfHTDw ***************************************************************** TimeStamp 0:00 Trailer 0:39 LIVE INCOME PROOF 1:06 Best Way To Earn Money With NO SKILLS 2:10 How I made $167K from one Small Website? 6:01 How can anyone Make Money from Digital Products? 6:42 STEP 1 : Sell Painkiller Not Vitamins 10:11 STEP 2 : Make CRORES with Zero Knowledge 12:35 Example of how people are making lakhs 18:41 STEP 3 : Build Website with ChatGPT 24:07 STEP 4 : How to promote Digital Products? 25:18 The ONLY Way to WIN in 2023 26:08 Conclusion ***************************************************************** 🔱 Learn Affiliate Marketing For FREE : https://youtube.com/playlist?list=PLr_-pCrqPGAnWI5FZRJQLx5mGYPRs8P2j 💰Make Money Online Ideas : https://youtube.com/playlist?list=PLr_-pCrqPGAkrZShcfp6dLrT_gQNG2PgL 😋 How Of Success Podcast, Learn From Experts : https://youtube.com/playlist?list=PLr_-pCrqPGAkuqGbx9uT1YLsjWoBB4DTi ***************************************************************** About Umer Qureshi : Umer Qureshi is a vibrant and influential entrepreneur who has encountered numerous difficulties including depression and bullying in school. Despite these obstacles, he was able to create a successful 8-Figure Online Business at a Young Age! With over 300K+ Subscribers on YouTube & Thousands of Followers on all other Social Media Platforms, He is known for his versatile knowledge of Business, Content Creation, Marketing & Making Money Online! To Know More, Follow Him On ⤵︎ Instagram @akaUmerQureshi https://www.instagram.com/akaumerqureshi/ Twitter @akaUmerQureshi https://twitter.com/akaumerqureshi Facebook @UmerQureshOfficial https://www.facebook.com/UmerQureshOfficial LinkedIn @akaUmerQureshi https://www.linkedin.com/in/akaumerqureshi/ P.S - Some of the above-mentioned links will be my affiliate links. If you wish to support me, please signup using my links. I'd be genuinely grateful to you 🙂 • • • #Money #SideHustle #UmerQureshi

1 note

·

View note

Text

Futures and Options: What They Are and How to Trade Them Effectively

F&O(Futures and Options) are derivative contracts that allow investors to bet or hedge on the price movements of underlying assets, such as stocks, commodities, currencies, or indices. Derivatives are financial instruments whose value depends on the performance of another asset.

Trading F&O offers several benefits over direct trading of underlying assets, including leverage, flexibility, risk management, and diversification. However, they also involve higher risks and costs, such as margin requirements, volatility, liquidity, and settlement issues. Therefore, before trading F&O, one should open an online Demat account with a reliable broker that offers a low F&O brokerage calculator.

Futures Contracts

A futures contract is an arrangement between two parties to buy or sell an underlying asset at a predetermined price and date in the future. For example, if A agrees to buy 100 shares of XYZ company from B at Rs. 500 per share on June 30, 2023, then party A has entered into a futures contract with B. The buyer of a futures contract holds a long position, whereas the seller of a futures contract holds less position. The predetermined price is called the futures price, and the delivery date is known as the expiration date.

The difference between the futures price and the spot price (the current market price) of the underlying asset is called the basis. The basis can be positive or negative, depending on whether the futures price is higher or lower than the spot price. The basis fluctuates over time as the spot price and the futures price fluctuate. To trade futures contracts, one needs to open a trading account with a broker that offers a low brokerage calculator for futures trading.

Options Contracts

An options contract is an agreement that yields the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price and date in the future. For example, if party A buys an option from party B that gives A the right to buy 100 shares of XYZ company from B at Rs. 500 per share on or before June 30, 2023, then A has bought a call option from B. The buyer of a call option holds long call position, while the seller of a call option holds short call position.

The specified price is called the strike price, and the date at which option contract expires is called the expiration date. The price of an option is called the premium, which is determined by various factors. For example, the underlying asset price, the strike price, the expiration date, the volatility, the interest rate, and the dividend. The premium is paid by the buyer to the seller at the time of entering into the contract. To trade options contracts, one needs to open a trading account with a broker that offers a low stock brokerage calculator for options trading.

How to Trade F&O in India

To trade F&O in India, one needs to follow these steps:

Open a demat account and a trading account with a SEBI-registered broker that offers low brokerage rates for F&O trading. You can compare different brokers using a brokerage calculator online.

Transfer funds to your trading account and access the F&O segment on the trading platform.

Select the underlying asset, the contract type (futures or options), the contract month (near, next, or far), the strike price (for options), and the number of contracts you wish to trade.

Place your order (buy or sell) at the market price or specify a limit price. You can also place stop-loss orders and target orders to manage your risk and reward.

Monitor your positions and margins regularly and close your positions before the expiration date. Otherwise, roll over to the next contract month if you want to continue your trade.

Pay or receive the settlement amount as per the contract specifications and the market price at the time of closing your positions.

Conclusion

F&O are derivative contracts that allow investors to speculate or hedge on the price movements of underlying assets. They offer several benefits over trading the underlying assets directly. For example, leverage, flexibility, risk management, and diversification. However, they also involve higher risks and costs, such as margin requirements, volatility, liquidity, and settlement issues. Thus, before trading F&O, one should have a clear understanding of how they work and what are their advantages and disadvantages.

One should also choose a reliable broker that offers low brokerage rates and a user-friendly trading platform for F&O trading. If you are looking for such a broker, you can check out Goodwill. We are one of the leading brokerage firms in India that offers a low F&O brokerage calculator and a range of other services for F&O traders. You can visit our website or call the customer care number to open demat account online and start trading F&O today.

0 notes

Text

Are you looking for a reliable discount broker in India to kick-start your online trading journey? Look no further than 5paisa! With its user-friendly interface and low brokerage fees, this stockbroker has become a popular choice among investors. But what makes it stand out from other online brokers? In this article, we'll dive into the world of 5paisa and give you an honest review of its account opening charges, trading software, margin exposure and more. So sit tight and get ready to discover why 5paisa is worth considering as your next Demat account provider.

How 5paisa is different from other online brokers?

5paisa is a discount broker that has been gaining popularity in the Indian stock market. But what makes it different from other online brokers? One of the key factors is its low brokerage fees, which are significantly lower than those charged by traditional full-service brokers.

Moreover, 5paisa offers a range of unique features such as free investment advice and research reports. It also provides users with a mobile app that allows for easy trading on-the-go. This feature-rich platform ensures that investors can make informed decisions while executing trades.

Another way in which 5paisa stands out from other online brokers is its fast account opening process. Unlike some competitors, you don't need to fill out physical forms or submit hard copies of documents – everything can be done online within minutes!

Overall, 5paisa's combination of low brokerage fees, innovative features and quick account opening process sets it apart from other online brokers and makes it an excellent choice for both experienced traders and beginners alike.

5paisa Account Opening Charges & AMC

One of the key factors to consider when selecting an online broker is their account opening charges and annual maintenance charges (AMC). 5paisa, being a discount broker in India, has very competitive rates for both.

To open an account with 5paisa, there are no account opening charges. This means that you can start trading immediately without any additional fees. However, there is a refundable deposit of Rs.250 which needs to be paid at the time of account activation.

In terms of AMC, 5paisa offers one of the lowest rates in the industry - only Rs.45 per month! This makes it a great option for those who want to keep their expenses low while still enjoying all the benefits of online trading.

It's important to note that these charges may vary depending on your chosen plan or subscription package with 5paisa. It's always recommended to review and compare different plans before selecting one that suits your trading requirements and budget.

With its affordable rates for account opening and AMC, 5paisa is definitely worth considering as your go-to stockbroker for online trading in India.

5paisa Online Account Opening

5paisa offers a simple and hassle-free online account opening process. With just a few clicks, you can complete the entire process without having to visit any physical branch.

To start the account opening process, all you need is to provide your basic details such as name, mobile number, PAN card number and email ID on their website.

After providing these details, you will receive an OTP which needs to be entered for verification purposes. Once verified, you need to fill in some additional personal and bank details.

You can also choose between the different types of accounts offered by 5paisa based on your investment goals and preferences. They offer three types of accounts - Equity & Derivatives Trading Account (Basic), Commodity Account (MCX) and Demat Account.

Additionally, they have made it easy for investors who already have a demat account with another broker to transfer it seamlessly to 5paisa using their online platform.

The online account opening process provided by 5paisa is quick and user-friendly making it easier for investors looking to open an account with them.

5paisa Trading Software

5paisa offers a user-friendly trading platform that is available as both a mobile app and web-based software. The platform is designed to cater to all types of traders, including beginners and experienced professionals.

One of the key features of the 5paisa trading platform is its advanced charting tools. Traders can access real-time stock market data, technical indicators, and historical charts for better analysis. Additionally, the software allows traders to place orders easily with just a few clicks.

The software also provides extensive research tools such as company reports, news alerts and recommendations from experts. This information assists investors in making informed decisions about their investments.

Another highlight of this trading software is its customizable dashboard which allows users to tailor their interface according to their preferences. Users can add or remove widgets on their dashboard depending on what they want to see at any given time.

The 5paisa trading platform has an excellent security system with multiple layers of protection preventing unauthorized transactions or fraudulent activities.

If you are looking for a reliable online broker in India with an easy-to-use trading platform backed by powerful research tools then 5paisa could be your best choice!

5paisa Pros and Cons

5paisa, like any other online broker in India, has its own set of advantages and disadvantages. Let’s take a look at some of the key pros and cons of using 5paisa for your trading needs.

Pros:

One major advantage of 5paisa is that it offers low brokerage charges compared to traditional brokers. It also provides access to a wide range of financial instruments such as stocks, ETFs, mutual funds, bonds etc., making it easier for traders to diversify their portfolio under one roof.

Another great benefit is its user-friendly mobile app which makes trading accessible on-the-go. Moreover, with a variety of research tools and educational resources available on their website and app, beginners can easily get started with investing.

Cons:

Despite being an affordable option for traders who want lower fees than traditional brokers charge there are some drawbacks such as limited customer support availability outside business hours. Another downside is that you cannot invest in IPOs through this platform which may be limiting if you’re interested in getting involved with new companies early on.

Additionally margin exposure offered by 5 paisa will not always be sufficient for experienced investors who wish to trade larger volumes or complex derivatives products - meaning they may need to consider alternative brokers.

Though the positives outweigh the negatives when considering whether or not 5 Paisa would make an excellent discount broker choice for most Indian investors looking into Demat account opening so long as they aren't too reliant on high levels or customised service offerings from their stockbroker partner.

5paisa Margin Exposure

5paisa offers margin exposure to their clients, which is a great advantage for traders. Margin Exposure means that you can trade with more money than what you have in your account. This allows traders to increase their buying power and make bigger profits.

With 5paisa, the margin exposure varies depending on the stock or commodity being traded and can range from 3 times to up to 20 times. For example, if you have Rs.10,000 in your account and the margin exposure is set at 10 times for a particular stock or commodity, then you can trade up to Rs.1 Lakh.

It's important to note that trading with margin involves risk as losses will also be amplified by the same factor of leverage used in trading. It's essential for traders to manage their risks properly when using margin so as not to fall into significant debt.

Having access to margin exposure through 5paisa is a considerable advantage because it provides an opportunity for traders who don't want to put all their capital at risk while maximizing profit potential through leveraging opportunities available on different trades they intend entering based on market conditions at any given time.

Here are some frequently asked questions about 5paisa:

Q: Is 5paisa a discount broker in India?

A: Yes, it is. It offers low brokerage fees compared to traditional brokers.

Q: What is a Demat account and does 5paisa offer it?

A: A Demat account is an electronic account that holds your shares and securities in digital form. Yes, 5paisa offers Demat accounts along with trading accounts.

Q: What are the brokerage charges of 5paisa?

A: The company charges flat Rs.10 per trade for all segments including equity delivery, intraday, futures and options.

Q: Can I open an online trading account with 5paisa?

A: Absolutely! You can easily open an online trading account on their website or mobile app.

Q: What kind of margin exposure does 5paisa provide for trading?

A: Depending on the segment you're trading in, the margin exposure ranges from two times to ten times your available funds.

If you have any more questions about using this discount stockbroker for your investments needs—don't hesitate to reach out to their customer support team.

Read more - https://hmatrading.in/

Source - https://sites.google.com/view/latest-gold-rate-forecast/5-Paisa-Review

#groww login#angel broking share price#no brokerage#mstock#alice blue login#top brokers in India#best stock broker in India#top stock brokers in India

0 notes