Don't wanna be here? Send us removal request.

Text

Capital Gain Bonds: A Secure Investment Option

Capital Gain Bonds, also known as Capital Gains Tax Exemption Bonds, are a unique and lesser-known investment option that can be a valuable addition to your financial portfolio. These bonds are issued by various government entities and offer investors a way to save on capital gains tax while earning a fixed rate of interest. In this blog, we will delve deeper into what capital gain bonds are, how they work, their benefits, and considerations for investing in them.

What Are Capital Gain Bonds?

Capital Gain Bonds are financial instruments issued by government-backed institutions. The primary purpose of these bonds is to provide individuals and Hindu Undivided Families (HUFs) with a tax-saving avenue for long-term capital gains. Investors can park the profits earned from selling capital assets such as property or stocks into these bonds to save on capital gains tax.

Issuer of Capital Gain Bonds

In India, one of the most well-known issuers of Capital Gain Bonds is the Rural Electrification Corporation (REC). These bonds are often referred to as REC Bonds. While REC is a prominent issuer, other government organizations like Indian Railway Finance Corporation (IRFC) and Power Finance Corporation (PFC) also issue such bonds.

How Do Capital Gain Bonds Work?

Eligibility and Timeframe

To invest in Capital Gain Bonds, individuals and HUFs should have capital gains from selling a property or any other asset subject to long-term capital gains tax. The investment in these bonds is subject to specific eligibility and timeframes prescribed by the government, typically within six months of the asset sale.

Lock-in Period and Interest Rates

Capital Gain Bonds usually have a lock-in period of three years. During this period, investors cannot withdraw their funds. However, they receive interest on their investments. The interest rates on these bonds are typically fixed and can be attractive compared to other fixed-income instruments.

Tax Benefits

The primary advantage of investing in Capital Gain Bonds is the tax benefit they offer. The capital gains invested in these bonds are exempted from capital gains tax, thus reducing the overall tax liability for investors.

Benefits of Investing in Capital Gain Bonds

Tax Savings

The most significant benefit of capital gain bonds is the potential for substantial tax savings. Investors can defer capital gains tax by investing in these bonds, allowing them to retain a more significant portion of their profits.

Fixed Returns

Capital Gain Bonds typically offer fixed and predictable interest rates, providing investors with a stable income stream.

Safety and Security

These bonds are issued by government-backed institutions, making them one of the safest investment options. The principal and interest on these bonds are secure.

Liquidity after Lock-in Period

While there is a lock-in period, after three years, investors have the option to sell or transfer these bonds, providing a level of liquidity.

Considerations for Investing in Capital Gain Bonds

Lock-in Period

One of the key considerations is the three-year lock-in period. Investors should be prepared to commit their funds for this duration.

Interest Rate Risk

The interest rates on these bonds are fixed at the time of investment. Hence, investors may miss out on potentially higher returns if market interest rates rise significantly during the lock-in period.

Limited Tenure Options

Capital Gain Bonds usually have a fixed tenure, so they might not be suitable for long-term financial goals.

Conclusion

Capital Gain Bonds offer a unique opportunity for individuals and HUFs to save on capital gains tax while earning a fixed return on their investments. They are particularly beneficial for those who have recently sold property or other assets and are looking for a tax-efficient investment avenue. However, it's crucial to consider the lock-in period, interest rate risk, and tenure options before investing. As with any investment, it's advisable to consult with a financial advisor to determine if capital gain bonds align with your financial goals and risk tolerance.

Source :- https://sites.google.com/view/rrstock/home

0 notes

Text

0 notes

Text

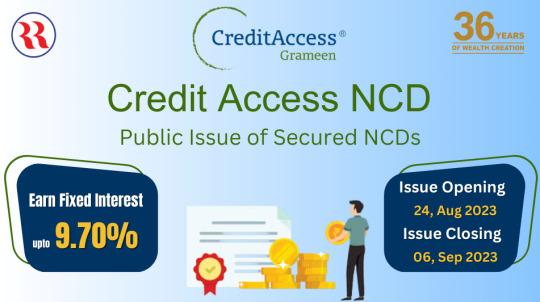

Credit Access NCDs: An Attractive Investment Opportunity

Before diving into the specifics of the NCDs, it's crucial to acquaint ourselves with the issuer. Credit Access Grameen Limited is a prominent Indian micro-finance institution headquartered in Bengaluru. Its core mission revolves around providing joint liability group loans and micro-loans, with a primary focus on empowering women in rural India. As of March 2022, CA Grameen is recognized as India's largest NBFC-MFI based on its impressive gross loan portfolio figures, endorsed by the MicroFinance Institutions Network in India.

Issuer's Focus and Opportunity:

Credit Access Grameen Limited primarily serves women customers in rural India, offering crucial financial support. Their target demographic comprises women with an annual household income of up to Rs 300,000, in alignment with the new microfinance regulations introduced by the RBI in March 2022. The company specializes in providing income generation loans, family welfare loans, home improvement loans, and emergency loans to its customer base.

CA Grameen's promoter, Credit Access India N.V., is a multinational firm specializing in micro and small enterprise financing. The promoter has a history of injecting capital into CA Grameen and facilitating access to potential fundraising avenues within the debt capital markets.

Why Consider Credit Access NCDs in Your Investment Portfolio:

Solid Credit Rating: The NCDs boast a "IND AA-/Stable" credit rating from India Ratings & Research Private Limited, signifying a robust credit profile.

Attractive Returns: Offering coupon rates ranging from 9.10% to 9.70% and effective yields from 9.48% to 10.13%, these NCDs provide competitive returns compared to traditional fixed-income investments.

Diverse Tenors: Investors can select from various tenors, ranging from 24 to 60 months, aligning their investments with their financial goals.

Flexible Interest Payment: Credit Access NCDs accommodate both monthly interest payments and cumulative interest options.

Listed on BSE: These NCDs will be listed on BSE, ensuring liquidity and ease of trading.

Credit Access NCD Investment Opportunity:

Let's delve deeper into the investment opportunity presented by Credit Access Grameen Limited through its NCD issue.

NCD Issue Details:

Issuer: Credit Access Grameen Limited

Base Issue Size: Rs. 400 Crores

Green Shoe Option: Rs. 600 Crores

Total Aggregated Issue: Rs. 1000 Crores

Issue Opening Date: August 24, 2023

Issue Closing Date: September 06, 2023

Face Value: Rs. 1,000 per NCD

Minimum Application: Rs. 10,000 (10 NCDs), collectively across all Options

Listing: The NCDs will be listed on BSE within 6 working days from the respective Tranche Issue Closing Date.

Issuance Mode: Dematerialized form

Credit Rating: IND AA-/Stable by India Ratings & Research Private Limited

Basis of Allotment: First come, first serve

Understanding the Series:

Series I, III, V, and VII provide monthly interest payments, ensuring regular income streams.

Investors have the flexibility to choose the series that best aligns with their financial goals and preferences.

Investment Benefits:

Attractive Yields: The NCDs offer competitive coupon rates, with effective yields ranging from 9.48% to 10.13% per annum, depending on the chosen series.

Diversity of Options: With eight series to choose from, investors can tailor their investments to suit their financial objectives.

Monthly Income: Series I, III, V, and VII provide monthly interest payments, ideal for those seeking regular income.

Safety and Credibility: CA Grameen holds a credit rating of "IND AA-/Stable" by India Ratings & Research Private Limited, indicating a strong level of creditworthiness.

How to Invest in Credit Access NCDs:

To invest in Credit Access NCDs, follow these steps:

Check Eligibility: Ensure you meet the eligibility criteria, including the minimum application amount.

Demat Account: If you don't already have one, open a demat account to hold your NCDs electronically.

Apply: Submit your application during the specified period between August 24, 2023, and September 6, 2023.

Allotment: Wait for the basis of allotment to be announced; allotment is on a first-come-first-served basis.

Trading: Once allotted, you can trade these NCDs on the BSE after listing.

Conclusion:

The Credit Access NCD issue presents an enticing investment opportunity for diversifying portfolios and earning attractive returns. Backed by a robust credit rating and offering a variety of series, these NCDs cater to a wide range of investor preferences. Whether you seek monthly income or cumulative growth of your investment, Credit Access NCDs offer both security and potential for substantial returns.

Investors are advised to assess their investment goals and risk tolerance carefully before making a decision. Remember that NCDs, like all investments, carry some level of risk, and it's essential to consult with a financial advisor or expert for personalized guidance.

Don't miss out on this opportunity to invest in the promising Credit Access NCD issue. Begin securing your financial future today.

Disclaimer:

All investments carry inherent risks. Investors should thoroughly review the offer-related documents and seek professional advice before making investment decisions.

Source :- https://realistic-magnolia-w8t3gc.mystrikingly.com

0 notes

Text

Exploring Investment Opportunities: Vivriti Capital's Non-Convertible Debentures (NCDs) Public Issue

Vivriti Capital Limited (VCL), a notable player in India's financial sector, is gearing up to offer a unique investment opportunity through their Non-Convertible Debentures (NCDs) public issue. Established in June 2017 by Mr. Vineet Sukumar and Mr. Gaurav Kumar, VCL operates under the regulatory oversight of the Reserve Bank of India (RBI) and has gained prominence for its innovative financial solutions.

The NCDs, akin to specialized certificates, are being extended to the public. This issuance aims to raise a total value of ₹25,000 lakh, with an option to increase it to ₹50,000 lakh, highlighting the substantial interest in this offering.

Key Details of the Vivriti NCD Offering:

NCDs Value: Each NCD certificate is valued at ₹1,000, available for purchase in increments of 10 or more.

Issue Period: The opportunity to acquire these certificates commences on August 18, 2023, and remains open until August 31, 2023.

Listing: Once acquired, the NCDs will be listed on the BSE stock exchange for trading.

Collaborative Partners: VCL is collaborating with JM Financial Limited and other trusted organizations to ensure the integrity and fairness of the process.

Background and Growth:

Founded by visionary entrepreneurs, VCL's journey began in 2017 and has since evolved into a pivotal financial institution in India. With strategic support from esteemed investors such as Creation Investments, Lightrock, and TVS Capital, VCL's transformation into a public limited company in 2023 underscored its commitment to excellence and growth.

Diverse Lending Portfolio:

VCL caters to a wide spectrum of mid-corporate clients across sectors including healthcare, pharma, logistics, and retail. Its versatile lending portfolio encompasses offerings like term loans, working capital loans, and securitization of receivables, tailored to suit varying borrower profiles.

Solid Financial Performance:

As of March 31st, 2023, VCL boasts a robust Assets Under Management (AUM) of ₹5,83,580.01 lakh. The company's prudent financial management is evident through its stable Net Worth of ₹1,56,474.55 lakh and a well-balanced Debt-to-Equity ratio of 3.05x. Notably, VCL reported consistent Profit After Tax (PAT) figures, reflecting its sustainable growth trajectory.

Resilient Asset Quality:

VCL's low Net Non-Performing Assets (NPAs) percentages, standing at 0.08% for FY23, highlight its cautious lending practices and effective risk management approach.

Upcoming NCD Offering:

VCL is gearing up for a significant public NCD issue, focusing on secured, rated, listed, redeemable NCDs. The issuance, supported by credit ratings from ICRA and CARE, seeks to raise up to ₹50,000 lakh, with an option for an oversubscription of ₹25,000 lakh.

Issue Structure of Vivriti NCD:

The NCDs will be issued in various series, each with distinct terms, tenor, and coupon rates, catering to different investor preferences.

Investing in the Future:

Vivriti Capital Limited's NCD offering is a chance to align with a company that's demonstrated strong financial performance, effective risk management, and strategic expansion. With a track record of profitability and a solid foundation, VCL presents an enticing investment prospect.

Disclaimer: This information is provided for informational purposes only and does not constitute financial advice. Prospective investors should carefully review the official offering documents and seek professional advice before making investment decisions.

Source :- https://tan-alligator-w8t3gn.mystrikingly.com

0 notes

Text

"Growing Your Wealth: A Comprehensive Guide to Best Investment Options"

Welcome to the Best Investment Options handbook, your comprehensive guide to the world of investing. Investing is like planting a seed and watching it grow into a fruitful tree, as it allows your money to work for you instead of sitting idle in a savings account. In this journey, remember that investing is a long-term game, and with patience and smart choices, you can see your money grow and secure your financial future.

This handbook covers various best investment options, each with its unique benefits, helping you make informed decisions according to your financial goals and risk tolerance. Whether you're a beginner or have some experience, we'll provide you with the knowledge and confidence to grow your wealth.

Public Issue IPO/NCD:

IPOs and NCDs allow companies to raise money from the public. With IPOs, you can invest early in potentially promising companies, while NCDs offer fixed income and lower risk due to being debt instruments.

Fixed Deposits:

Fixed Deposits are safe investments offered by banks, providing fixed returns and low-risk, making them suitable for conservative investors.

Mutual Funds:

Mutual Funds are pooled investments managed by professionals, offering easy investing, risk reduction through diversification, and accessibility for small investments.

Capital Gain Bonds:

54EC capital gain bonds allow you to save on taxes when you make a profit from selling property, offering tax savings, fixed interest income, and government-backed security.

Floating Rate Bonds:

These bonds have adjustable interest rates, providing protection from interest rate changes and potential for higher returns.

Sovereign Gold Bonds:

Invest in gold without physical ownership, benefiting from safety, regulated investment, interest income, and ease of buying and selling.

Tax Saving Funds:

ELSS funds help you save on income tax while potentially earning higher returns with a short lock-in period.

Insurance:

Insurance acts as a financial safety net, providing security, peace of mind, and financial support during unexpected events.

Remember, all investments carry some level of risk, and it's essential to do thorough research or consult a financial advisor before making any investment decisions. Let's embark on this investment journey together and make your money work for you!

Source:- https://upright-yucca-w8t3gr.mystrikingly.com

0 notes

Text

1 note

·

View note

Text

"Your Investment Options: A Comprehensive Handbook to Grow Your Wealth and Secure Your Financial Future"

Welcome to Your Investment Options! This handbook is your comprehensive guide to understanding the world of investing in simple terms. Like planting a seed and watching it grow into a fruitful tree, investing is about making your money work for you instead of leaving it idle in a savings account. With various investment options available, you have the opportunity to grow your wealth over time.

Whether you're a beginner or have some experience, Your Investment Options will provide you with the knowledge and confidence to make the most of your hard-earned money. Investing is a long-term game, and while it may not make you rich overnight, with patience and smart choices, your money can gradually grow, bringing you closer to achieving your dreams.

In this handbook, we'll explore each investment option and how they can benefit you in their own unique way, considering your financial goals and risk tolerance.

Public Issue IPO/NCD:

Public Issue IPO and NCD are ways for companies to raise money from the public. IPOs offer early access to promising companies and the potential for higher returns if the company performs well in the stock market. On the other hand, NCDs provide a fixed income through regular interest payments and are considered less risky than equity investments.

Fixed Deposits:

Fixed Deposits are a popular and safe investment option offered by banks and financial institutions. They provide fixed returns, low risk, and can serve as a reliable source of regular income, making them suitable for conservative investors.

Mutual Fund:

Mutual Funds pool money from various investors and invest in a diversified portfolio of assets like stocks and bonds. They offer easy investing, risk reduction through diversification, and the flexibility to start with a small amount.

Capital Gain Bonds:

Capital Gain Bonds offer tax savings when you invest the profit from selling a property or asset. They provide fixed interest income and are considered relatively safe government-backed investments for long-term financial planning.

Floating Rate Bonds:

Floating Rate Bonds have interest rates that adjust periodically based on a reference rate. They can protect against interest rate changes, offer potential for higher returns, and usually have shorter maturities.

Sovereign Gold Bonds:

Sovereign Gold Bonds allow you to invest in gold without the need for physical storage. They offer safety, security, interest income, and are easy to buy and sell.

Tax Saving Funds:

Tax Saving Funds, also known as ELSS, offer tax benefits while potentially earning good returns. They have a short lock-in period and invest in the stock market, providing higher return potential compared to traditional tax-saving options.

Insurance:

Insurance acts as a safety net, providing financial protection against unexpected events. It offers security, peace of mind, and financial support in times of need.

Remember that all investments carry some level of risk, and it's essential to do your research or seek advice from a financial advisor before making any investment decisions. So, let's start growing your wealth and securing your financial future together!

Source :- https://www.minds.com/newsfeed/1533369387350757386?referrer=rrfinance105

0 notes

Text

0 notes

Text

Unlock Your Financial Potential with Smart Investments in Cholamandalam NCDs!

Are you searching for a reliable investment opportunity to grow your hard-earned money? Look no further! Cholamandalam Investment and Finance Company Limited (CIFCL) is offering an exceptional chance to invest in their latest Public Issue of Non-Convertible Debentures (NCDs) – Cholamandalam NCDs. Let's explore the compelling reasons behind this investment opportunity and get to know the company's profile, making it an opportunity not to be overlooked.

Investment Highlights:

CIFCL is all set to launch its Public Issue of secured, rated, and listed NCDs with an attractive face value of ₹1,000 each. The base issue size is ₹500 crores, and with an oversubscription option of ₹1,000 crores, you get a chance to invest up to ₹1,500 crores! This means abundant opportunities to invest and grow your wealth.

The proposed NCDs come with an impressive credit rating of IND AA+/Stable by India Ratings & Research Private Limited and [ICRA] AA+ (Stable) by ICRA Limited for an amount of up to ₹5,000 crores. The NCDs will be listed on BSE and NSE, offering you a safe and transparent investment avenue.

Cholamandalam NCD Details:

Type: Non-Convertible Debentures (NCDs)

Face Value: ₹1,000 each

Base Issue Size: ₹500 crores

Oversubscription Option: ₹1,000 crores (Total Issue Size up to ₹1,500 crores)

Credit Ratings: - IND AA+/Stable by India Ratings & Research Private Limited - [ICRA] AA+ (Stable) by ICRA Limited

Maximum Amount of NCDs with Credit Rating: ₹5,000 crores

Listing Exchanges: BSE (Bombay Stock Exchange) and NSE (National Stock Exchange)

Purpose of NCDs: Secured and listed NCDs to raise funds for the company's financial requirements

Tenure: Not specified (tenors may be provided ranging from 22 to 60 months in the Tranche II Issue)

Interest Payment Options: Annual or Cumulative (Interest compounded annually and paid at maturity)

Minimum Subscription Amount: ₹10,000

Subsequent Multiples: ₹1,000

Company Profile:

CIFCL is a non-banking finance company and a part of the prestigious Murugappa group with over 122 years of legacy. This legacy ensures trust in their expertise and experience in financial services. The company began as an equipment financing firm and expanded its services to offer vehicle finance, home loans, loans to SMEs, and more.

With 25.10 lakh active customers and 1,191 branches spread across 29 states and Union Territories in India, CIFCL has an extensive distribution network, reaching both rural and semi-urban markets. Their focus on technology and data analytics ensures efficient and digitized operations, making your investment experience seamless.

Strengths:

Diversified Product Portfolio: CIFCL offers a wide range of financial products, providing a strong retail focus.

Extensive Distribution Network: Their vast branch network, especially in rural areas, offers diversified exposure and opportunities.

Strong Technology Platform: With cutting-edge technology and data analytics, CIFCL enhances customer engagement and integration with ecosystem partners.

Experienced Management Team: The company is led by a skilled and experienced team with a deep understanding of the financial services industry.

Investor's Opportunity:

The Cholamandalam NCD Tranche II Issue provides investors with various options to choose from, with attractive coupon rates and tenors ranging from 22 to 60 months. Whether you prefer annual interest payments or want your interest to compound and be paid at maturity, there's an option that suits your financial goals.

With a minimum subscription of just ₹10,000 and subsequent multiples of ₹1,000, investing in these NCDs is highly accessible for retail investors. Furthermore, CIFCL's strong financial position, represented by a CRAR of 17.10% and a low Stage 3 asset ratio of 3.01%, offers you confidence in the investment's stability.

Conclusion:

Cholamandalam Investment and Finance Company Limited's Tranche II Issue of NCDs (Cholamandalam NCDs) presents a fantastic investment opportunity that you should not miss! With their strong financial position, diverse product portfolio, and extensive distribution network, investing in Cholamandalam NCDs promises a secure and rewarding future. So, take this chance to unlock your financial potential and secure your dreams! Remember to read the prospectus carefully and make informed investment decisions. Happy investing!

Source :- https://www.minds.com/newsfeed/1531904126164668422?referrer=rrfinance105

0 notes

Text

Demystifying Public Issue IPO: A Gateway to Participate in Business Growth

The Initial Public Offering (IPO) is a significant event in the financial world, where a private company goes public by offering its shares to the general public for the first time. This process is known as a Public Issue IPO and serves as a pivotal moment for both the company and potential investors. In this blog, we will explore the ins and outs of a Public Issue IPO, shedding light on its benefits, risks, and how it provides a unique opportunity for investors to participate in a company's growth journey.

Understanding Public Issue IPO

When a private company decides to raise capital to finance its expansion, reduce debt, or carry out various business activities, it can opt for an IPO. During a Public Issue IPO, the company issues its shares to the public through the primary market, allowing investors to buy a stake in the company. This process helps the company transition from a privately held entity to a publicly traded one, listed on the stock exchange.

Benefits for the Company

Access to Capital: One of the primary reasons companies go public is to raise capital. With the funds generated from the IPO, the company can finance new projects, expand its operations, and invest in research and development.

Enhanced Visibility and Prestige: Going public increases a company's visibility and credibility in the market. It also brings prestige and recognition, which can attract customers, partners, and potential employees.

Liquidity for Shareholders: Existing shareholders, such as founders, early investors, and employees, can monetize their investments by selling their shares in the IPO.

Benefits for Investors

Profit Potential: Investors have the opportunity to buy shares at the IPO price and potentially profit from the subsequent increase in the share price if the company performs well.

Portfolio Diversification: Investing in IPOs can add diversification to an investor's portfolio, as they gain exposure to different sectors and industries.

Access to Early-Stage Companies: IPOs offer a chance to invest in promising companies at an early stage of their growth, which can yield higher returns compared to investing in established companies.

Risks to Consider

Market Fluctuations: The share price of newly listed companies can be volatile in the early days, leading to potential losses for investors.

Uncertain Future: IPOs are often for companies with a relatively short financial history. Investors must carefully assess the company's prospects and management before making an investment decision.

Lock-Up Period: Company insiders, such as founders and early investors, may be restricted from selling their shares for a certain period (lock-up period) after the IPO, potentially impacting share liquidity.

Conclusion

Participating in a Public Issue IPO can be an exciting opportunity for investors to be part of a company's growth story from its early stages. It allows companies to raise capital for expansion and provides investors with the potential for significant returns. However, it is essential to approach IPO investments with careful consideration, conducting thorough research, and seeking advice from financial professionals.

Remember, every investment carries risks, and diversifying your portfolio is key to managing these risks effectively. With the right approach and understanding, a Public Issue IPO can be a rewarding venture for both companies and investors alike.

Source :- https://www.minds.com/newsfeed/1530443776076550148?referrer=rrfinance105

0 notes

Text

0 notes

Text

Discover Lucrative Investment Opportunities with Navi Finserv Limited NCDs

In the dynamic world of finance, there are abundant opportunities to grow your wealth. One exciting avenue is through Non-Convertible Debentures (NCDs) issued by Navi Finserv Limited, a non-deposit taking, systemically important NBFC co-founded by Mr. Sachin Bansal, the former Chairman and co-founder of Flipkart. These NCDs offer attractive interest rates and carry an impressive credit rating, providing a secure opportunity for investors to earn fixed interest and maximize their returns. Let's explore the details and benefits of investing in Navi Finserv Limited NCDs.

Navi Finserv Limited is a prominent NBFC in the financial industry, leveraging the expertise and credibility of its visionary entrepreneur co-founder, Mr. Sachin Bansal. The company has established itself as a reliable and trustworthy institution, benefiting from Mr. Bansal's experience and reputation in the financial sector.

About Navi Finserv Limited NCDs:

Navi Finserv Limited NCDs provide investors with a secure investment option. They offer a reliable way to grow wealth, backed by the credibility and expertise of Navi Finserv Limited. The company's reputation and leadership position make it an attractive choice for investors seeking stable returns.

Overview of Navi Finserv Limited NCDs:

Navi Finserv Limited NCDs offer several advantages, including flexibility, attractive coupon rates, and tenure options to suit different investment preferences. Here's an overview:

Flexible Investment Amounts and Duration: Navi Finserv Limited NCDs provide flexibility through Systematic Investment Plans (SIPs). Investors can choose to invest a fixed amount at regular intervals, such as monthly or quarterly, based on their financial capabilities. It allows investors to modify the SIP amount or stop it at any time without significant penalties.

Tenure Options: Investors have the freedom to choose from three tenure options: 18 months, 27 months, and 36 months. This enables investors to align their investment horizon with their financial goals and risk appetite. Whether you prefer short-term gains or a longer-term investment, Navi Finserv Limited NCDs cater to various investment preferences.

Attractive Coupon Rates: Navi Finserv Limited NCDs offer attractive coupon rates, ensuring a consistent and predictable income stream for investors. The coupon rates vary based on the chosen tenure, providing investors with options that suit their financial objectives:

18 Months: 9.75% (Monthly)

27 Months: 10.25% (Monthly)

27 Months: 10.75% (Annually)

36 Months: 10.50% (Monthly)

36 Months: 11.01% (Annually)

Investment Process Made Easy:

Investing in Navi Finserv Limited NCDs is a seamless and hassle-free process. Here's how you can get started:

Timing: The issue opens on July 10, 2023, and closes on July 21, 2023. Ensure you invest within this timeframe to secure your position.

Online Investment: You can invest online through a UPI-based payment process, providing convenience and accessibility.

Minimum Investment Amount: The minimum investment amount is as low as ₹10,000, allowing investors with varying budgets to participate.

Risks and Due Diligence:

As with any investment, it is crucial to understand and evaluate the associated risks. While Navi Finserv Limited NCDs offer attractive returns, it's essential to carefully read the offer-related documents provided by RR Finance. Familiarize yourself with the terms and conditions, risk factors, and any other relevant information to make an informed investment decision.

Conclusion:

In today's ever-changing financial landscape, it can be challenging to find secure and high-yield investment opportunities. However, Navi Finserv Limited NCDs, with their strong credit ratings, competitive interest rates, and flexible tenure options, provide a compelling avenue for investors to grow their wealth. Backed by the expertise and reputation of Mr. Sachin Bansal, Navi Finserv Limited stands out as a reliable institution in the financial sector.

Don't miss the chance to earn fixed interest rates of up to 11.02% by investing in Navi Finserv Limited NCDs. Take advantage of this opportunity to diversify your portfolio and reap the benefits of a secure investment avenue.

Disclaimer:

Investments are subject to risks, and it is advised to carefully read the offer-related documents and seek professional advice before making any investment decisions.

Source :- https://www.minds.com/newsfeed/1525374214444421136?referrer=rrfinance105

0 notes

Text

0 notes

Text

Building a Financially Secure Future: SIP vs EMI - Choosing the Right Path to Achieve Your Goals

When it comes to achieving financial goals and building a secure future, two popular options often come to mind: Systematic Investment Plan (SIP) and Equated Monthly Installment (EMI). Both methods have their merits and serve different purposes. In this blog, we will delve into the world of SIPs and EMIs, comparing their benefits and helping you determine which approach aligns better with your goals and aspirations.

Understanding SIP:

Systematic Investment Plan (SIP) is an investment strategy that allows individuals to invest a fixed sum of money at regular intervals in mutual funds or other investment avenues. It enables you to take advantage of the power of compounding and mitigate the risks associated with market fluctuations.

Exploring EMI:

Equated Monthly Installment (EMI) is a payment method used for financing purchases, such as homes, vehicles, or consumer goods. It allows you to spread the cost of the purchase over a specific period, making it more affordable by dividing it into manageable monthly installments.

Goal-Oriented Approach:

SIPs are ideal for long-term financial goals, such as retirement planning, education funds, or building wealth over time. By consistently investing a fixed amount, you benefit from the potential growth of your investments and the compounding effect, ultimately helping you achieve your goals.

EMIs, on the other hand, are suitable for achieving shorter-term objectives like buying a house or a car. It allows you to own assets without paying the entire cost upfront, enabling you to manage your finances effectively while fulfilling your aspirations.

Risk and Return Analysis:

SIPs come with market risks as the value of mutual funds can fluctuate based on market conditions. However, by staying invested for the long term, you have the potential to earn higher returns and navigate the market volatility effectively.

EMIs, on the other hand, carry minimal investment risk as they are primarily debt-based. The interest rates and tenure associated with EMIs determine the overall cost of the purchase. It's essential to consider your financial capability and the interest rates prevailing in the market before opting for an EMI-based approach.

Flexibility and Liquidity:

SIPs offer flexibility in terms of investment amounts, allowing you to increase or decrease your investments as per your financial situation. They also offer the advantage of liquidity, as you can redeem your investments partially or fully at any time, subject to the terms and conditions of the investment avenue.

EMIs, once committed, generally follow a fixed schedule, making them less flexible. While prepayment options may exist, they might attract additional charges. It's important to consider the impact of EMIs on your monthly cash flow and budget accordingly.

Conclusion:

Both SIPs and EMIs serve specific purposes in achieving financial goals. SIPs are an excellent choice for long-term wealth creation, while EMIs provide a means to own assets without immediate full payment. Consider your financial goals, risk appetite, and time horizon before making a decision.

Remember, there is no one-size-fits-all approach, and it's essential to consult with financial advisors or experts who can assess your individual circumstances and guide you toward the most suitable option. Whether you choose SIP or EMI, the key lies in disciplined execution, regular monitoring, and aligning your choices with your financial aspirations.

Source :- https://www.minds.com/newsfeed/1523608418865123330?referrer=rrfinance105

0 notes

Text

Riding the Waves of Opportunity: Floating Rate Bonds Interest Rate Increased to 8.05%

In the dynamic world of investments, the floating rate bonds interest rate, commonly known as GOI Bonds, has experienced a significant boost. These flexible securities, where the interest rate is linked to the National Savings Certificate (NSC) rate, have recently seen an increase from 7.35% to an enticing 8.05%. This upward shift presents a promising opportunity for investors seeking steady returns and protection against rising interest rates. In this blog post, we will delve into the unique benefits of floating rate bonds and how this interest rate hike can prove advantageous for investors.

Understanding Floating Rate Bonds:

Floating rate bonds, such as the RBI Floating Rate Savings Bonds 2020 (Taxable), are distinctive due to their interest rates being linked to the NSC rate. Unlike fixed-rate bonds, these bonds offer interest payments that vary over time based on a benchmark interest rate. This flexible nature provides investors with the ability to adapt and potentially achieve higher returns in changing interest rate environments.

Protection Against Rising Interest Rates:

One of the primary advantages of floating rate bonds is their inherent ability to navigate shifting interest rate landscapes. As interest rates rise due to market conditions or central bank policies, the interest payments on these bonds adjust accordingly. This built-in protection makes floating rate bonds an appealing choice for investors concerned about potential erosion of the value of their fixed-income investments due to rising interest rates.

Consistent Income Generation:

The recent increase in the interest rate on floating rate bonds to 8.05% offers investors the potential for enhanced income generation. With coupon payments tied to prevailing interest rates, investors can anticipate a boost in regular income from their floating rate bond investments. This predictable income stream provides stability and contributes to a well-diversified investment portfolio.

Flexibility and Liquidity:

Another advantage of floating rate bonds lies in their flexibility and liquidity. Unlike traditional fixed-rate bonds, these bonds can be more easily bought and sold in the secondary market. This liquidity enables investors to adjust their investment strategies based on changing market conditions or seize new opportunities without being tied to long-term commitments.

Diversification and Risk Management:

Including floating rate bonds in an investment portfolio enhances diversification and facilitates effective risk management. These bonds offer an alternative to traditional fixed-rate bonds, presenting a distinct risk and return profile. The variable interest payments guard against interest rate risk, while their shorter duration compared to long-term bonds can help mitigate potential price fluctuations in a rising rate environment.

Conclusion:

The recent increase in the interest rate on floating rate bonds to 8.05% underscores the attractiveness of these securities for investors seeking stable returns and protection against rising interest rates. The flexibility, consistent income generation, and risk management benefits of floating rate bonds make them a valuable addition to a well-rounded investment portfolio. As always, thorough research and consultation with a financial advisor are essential to determine if floating rate bonds align with your investment goals and risk tolerance. With the potential for higher income and protection against rising interest rates, floating rate bonds offer an excellent opportunity for investors to ride the waves of opportunity in today's ever-changing financial landscape.

Source :- https://www.minds.com/newsfeed/1521803326264446982?referrer=rrfinance105

0 notes

Text

In this video, we explore the investment potential of RBI Floating Rate Bonds, a popular investment avenue for individuals seeking stable returns. RBI Floating Rate Bonds are issued by the Reserve Bank of India (RBI) and offer an attractive alternative to traditional fixed deposit schemes. Join us as we uncover the benefits, features, and considerations of investing in these bonds, and discover why they are gaining popularity among conservative investors.

0 notes

Text

Are you interested in investing in gold but looking for a convenient and secure option? Sovereign Gold Bonds (SGBs) might be the perfect investment avenue for you. In this video, we provide a step-by-step guide on how to apply for Sovereign Gold Bonds, allowing you to invest in gold without the hassle of physical possession. Watch the video to learn how to get started with SGBs and enjoy the benefits of investing in gold bonds issued by the government.

0 notes