#how do you start forex trading

Explore tagged Tumblr posts

Text

How Do You Start Forex Trading? A Beginner's Guide

Imagine earning while you sleep, leveraging global market fluctuations. This isn’t a dream; it’s the potential of forex trading. But how do you start forex trading safely and successfully, especially in India? This beginner’s guide provides a step-by-step walkthrough, navigating the complexities and addressing common concerns to empower your journey into the exciting world of currency trading.

Understanding the Forex Market Basics in India

What is Forex Trading?

Forex, short for foreign exchange, is the global marketplace where currencies are traded. Think of it as a giant auction where buyers and sellers constantly exchange one currency for another. The participants are vast and diverse – everyone from multinational corporations to individual traders like you and me. Forex transactions are driven primarily by supply and demand, reflecting a change in their relative values. One of the most common pairs traded is the USD/INR (US Dollar/Indian Rupee), representing the value of the US dollar against the Indian rupee. For example, if the USD/INR rate is 82.50, you can exchange one US dollar by paying 82.50 Indian rupees directly. Likewise, if you sell 1 USD, 82.50 rupees enter into your account

Key Forex Terminology

Understanding the jargon is crucial. Let’s break down some key terms:

Pip: A pip (point in percentage) is the smallest price movement in a foreign exchange rate, usually the fourth decimal place in most currency pairing. Suppose you make transactions in minor lots, a 1 pip change translates directly to your money profit/loss. However, a higher significant lot is valued in $10 or more each pip movement, even when dealing with other money pairs (Excluding the Yen). For example, a move from 1.1987 to 1.1988 USD/EUR value change is one-pip change for US dollar prices which you used as the benchmark (If this is your base money).

Lot: A lot represents the standardized unit size traded; multiple forms of lot sizes were traded internationally depending on contracts agreements, so it is advised that beginners only stick to their brokerage firm’s agreement and learn based on those agreements alone so they aren’t confused about changes in lot’s.

Leverage: This magnifies your trading power, usually provided by brokers, but remember this is double-edged—more leverage increase risks since money could exponentially fall rather than grow, resulting in debts you take for a gamble. For e.g., 1:100 leverage means you can control a 100 value position by paying 1 unit capital deposit. Leveraging funds is recommended to be practiced in demo account without risking significant loss and to be completely understood rather than jumped into impulsively.

However, a 100x more of risk of loss is involved using such an approach and understanding is key to manage risks rather than just using this advantage immediately.

Spread: The spread is the difference in exchange rates of the transaction which is usually provided at a cheaper price by brokers than that seen by open exchange transactions between countries currency, thus this is broker-specific. But usually such a spread would be in pips change between bidding versus asking the value that you sell to get the quote. It represents the broker as an inter-mediary company/ individual earning revenue as a commission rate from exchanges made under its guidance based on your orders.

Stop-loss and Take-profit (STP). STP involves setting predetermined prices wherein orders immediately sells positions when the prices met the given level. This minimizes loss from forex transaction, so even though you do lose money based on the price movement, at best when the STP is managed effectively, prevents you fully liquidation of your account or assets. For profit purposes, you get the targetted outcome rather than taking a wild risk just at an instant (Emotional trading), ensuring proper evaluation before moving with such orders helps.

Demo Accounts: These accounts allow you to practice trading with virtual money before using real funds. A crucial step before using a real/live trading account since real money could be affected when making reckless trades.

Regulatory Landscape in India

In India, the Securities and Exchange Board of India (SEBI) regulates forex trading. It is crucial to choose SEBI-registered brokers to ensure legal transparency. Before trusting them with a brokerage account, read independent user testimonials at external forums based on your trusted sources in case of discrepancies since it may mean you are dealing malicious perpetrators of fraud schemes. Your tax implications for gains or losses made. These factors may change over given specific governmental regulations updates, so be up-to-date or seek licensed professional tax advisors.

Opening Your Forex Trading Account

Choosing the Right Broker

Selecting the right broker is paramount. Choose based on these criteria:

Regulation: Ensure your considered brokers comply under proper legislation at your jurisdiction, for added safety measures consider choosing one among many with greater legal scrutiny given from high authoritative governmental departments; those registered overseas or with questionable background has many scams occurring. This part requires intense researching background review with independent reviewing websites and sources as your primary point of decision. Usually these reviews consist of several hundred pages long documents of evidence based on public records analysis from investigative journalists and auditors, which if chosen based upon mere convenience based upon broker recommendations without researching, fraud occurs much fast since you may not see such red flags on your time constraints on evaluating which would cause severe damages that may never be regained from that risky approach of hasty decision making on whom broker’s to trust in your forex funding/transactions.

To start easily, it is often the choice of selecting ones regulated in country you live in rather than making global or overseas risky approaches during this period so this step really determines the safety threshold during a forex broker search before starting other aspects since without proper brokerage firms, funds may disappear overnight unnoticed; in cases that it is difficult to evaluate or determine based from these conditions specified above, contacting tax advisors for help can increase time spent looking at various candidate forex companies for brokerage service provision and making thorough evaluations as this part is riskier if not followed well when using any external services such as leverage or account transactions which are all very serious matters in which if done poorly at this choice or decision of deciding broker to select, there is possible outcomes involving a larger than supposed risk involved without sufficient safety provisions specified.

Fees: Compare spreads, commissions, and other charges as this will affect profitability of operations of trading activities since this forms the initial threshold of making money from trading activities given from exchange broker service based upon agreements of trade transactions before making profit from arbitrage itself instead only loss even before the actual activity of doing an outright gain or losing from money trade transactions begin at the onset of trading of transactions as this is more difficult especially handling several smaller trades at times especially when high level of pip changes of fluctuations of exchange daily which would consume more costs incurred for smaller units involved over prolonged daily volume and thus choosing optimal fee level structure from among several candidate companies prior selecting broker requires evaluation of several sources for evaluating best broker firm with these aspects to avoid unnecessary financial charges incurring that reduce profit level involved hence to minimize these fees as a form to maximizing overall net trade profit yield overall trading process duration as your goal from beginning to ending point from trades involved. Such evaluation and risk management of reducing spreads, commissions as you can use free analysis sites offering such a comparison tool for comparing spreads to provide these data without your effort of extracting this from official website of various candidate brokerage firms as doing all those work will consume more time; for most users, an important aspect is deciding on the preferred methods based upon preferred style based which can make difference when involving high volume day to day trading for small units involving lesser risks if the spread and commission is not very high initially which would quickly affect money making opportunity.

Platform: Choose the ones user-friendly across all device types, that offer good research tools as different user interface platforms makes significant differences on experience on platform. To evaluate which is better or which preferred among existing platforms involves direct experience with use which in order can involve creating virtual/demo account to help you with making this crucial evaluation of suitability to fit personal style preferences given which different firms provides better user experience; it depends upon suitability or personal preferences given when accessing these trading apps or features on those platforms in terms what is most useful to help optimize decisions involving during these usage over such access since personal preferences of style determines level involved when interacting with platform daily involving during daily usages and evaluation these suitability of platform depends whether it meets these requirements such suitability involve during uses since interface of platform makes very significant differences in accessibility especially given some users needs to maintain high trading standards to make much more profits in lesser time and involves such evaluation before making use especially given it concerns your safety of financial holdings.

Client Reviews and Ratings: Explore independent feedback; forums can sometimes be unreliable (Avoid reviewing forum sites). Before giving positive feedback, look for ones negative remarks since they could suggest hidden problem often the users may tend experience which often the more positive testimonials/review sites (paid for reviews are biased without any negative side involved hence may cause you to fall to scams hence some degree) tend avoid mentioning about problems these firms had on record that not necessarily mentioned, although to be fair (It is very unlikely even paid for reviews) to mention and involve all users since it varies user experiences. This involves reading review at non biased platform/third party to reduce the risks bias on user experience reviews on whether the quality ratings provided meets expected requirement given the candidate firm reputation or background provided prior to assessing as often better candidates tend have greater transparency in information availability thus greater volume and credibility ratings.

It’s crucial to review numerous independent sources when forming that conclusions prior giving decision when finding candidate brokerage firms during this stage since reliability of information and risk minimises as part process choosing most suitability involves having comprehensive detailed independent reports from official records that would reveal significant detail into reputation before committing to brokerage accounts to start conducting your funding deposit which should not hastily choose on convenient factor prior selecting company without doing this crucial background check step in order ensure all risk minimised to level possible.

Account Verification and Funding

KYC/AML compliance is obligatory according regulations; you will submit documentation such as PAN Card, Aadhaar identity proof, address proof at banking financial institutions registered in order comply based regulation which is non-negotiable factor when opening account for this regulatory purpose at least once during account-approval and subsequent trading activity based KYC records involve to protect the assets and prevent money laundering based governmental rules under such country involved trading and these may extend overseas especially when you are transacting in an foreign entity or country in which some aspects would need be clarified prior to making deposits for conducting such activities. Therefore, this involves reviewing thoroughly each documents to understand and conform those specifications needed under KYC guidelines for this firm that you plan do forex exchange in which may involve further scrutiny given during stages of trading which some firms provide better security and reliability based record involved hence those level security should have prior consideration; various deposit methods range widely available range such as net banking, UPI, and credit/debit card options based brokerage account involves and each such differences and fees will contribute profit gained thus it impacts returns involved overall exchange when completing any transactions as this must be thoroughly evaluate depending what suitability and preferences based depending on circumstances involved with such situations especially on accessibility. Minimum deposit requirement for each usually firms requires lesser initial requirements are generally better approach to initiate to reduce exposure risks incurred if initial fund lose all in case transactions is poorly handled hence minimal financial requirements should prioritise if beginners intend risk minimally in case initially loss happened (Starting out small and focusing learning is effective).

Setting Up Your Trading Platform

Popular forex platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and several web-based platforms that is highly optimised based upon users involved hence depending different aspects based users or brokers available to provide suitability varies and depends whether this access are best suitable during usages during active phases of trades for convenience purposes. To consider the factor of which suits you and convenience would improve your abilities while it improves based usage especially during active live trading and even before this initial phase stages before even doing actual real money transactions involving these process given the practice phase especially on demo account requires good user platform.

Navigating your chosen platform involves familiarising yourself with its interface and features, practicing making some simple dummy buy orders or sells without exposing your real resources as well with testing any features for assessing effectiveness especially during this initial practice period so all operations are well performed prior start live actual fund trades is more important for maintaining trading proficiency, thus user friendliness matter most along with all its functional abilities, research and toolsets, that’s highly important which requires direct exploration of features by you so knowing if those meets requirements during pre evaluation phases before active trading stages involve is important hence the key factors matter on assessing prior commencing with actual doing trades as some differences matter especially given higher efficiency gains when access in platform with tools available is optimized thus evaluation for convenience and suitability matters greatly; even handling any order placing involves using platform functionality such knowing when to use buy limits orders, taking control stop loss and profit taking processes especially once any trade goes active it increases trading skill since it relates handling all possible changes involved.

Mastering Forex Trading Strategies

Fundamental Analysis for Beginners

Fundamental analysis involves examining overall economic conditions of affected country using wide based factors such as various governmental agencies and central national banks; you use these collected key indicators using these sources, this provides baseline knowledge of any currency transactions to perform effectively since this fundamental analysis help estimate what directional movement of underlying currency pairing; such factors includes national growth output (GDP), employment level data analysis involving employment patterns analysis etc or reviewing government financial policy involvement analysis of policy changes or macroeconomic events affecting, these help make decisions of expected direction movement or potential involved as these indicators provide insight direction using a detailed overview involved; often financial reporting of these entities will provide data; however, reliability of quality depends several factors involved before assessing their worth to determine its values which also includes whether this reliability and data accuracy, credibility involves various governmental regulations on which must be researched in order properly assess and use properly. Economic news calendars provides time releases often on macroeconomic indicators used by many in trades, this also help maintain trading habits especially ones doing technical analyses rather than completely ignoring external factors while deciding future movements only using prior datas/historical graph data which should done properly rather jumping quickly making impulse trades only based only chart changes in movements prior day without doing analysis that includes macroeconomic situation during period before actual buying.

Technical Analysis Basics

Technical analysis uses this trading insights of chart data to look for significant patterns involved. Such patterns including chart formation, involving price actions pattern; or technical indicators uses tools and methods on various aspects involving charting techniques while reviewing prior candlestick historical prices in assessing support barriers along trend lines which combined analysis helps determine trades using charts using visual recognition on those trends for decision-making of currency pairing of buying/sell; it includes support barriers often based upon horizontal lines based past lowest or highest that forms and reviewing its movements; if it reaches new highs that often interpreted as momentum trade in ascending which higher potential, hence involves higher gains than losses involves. Often technical analysts combines using moving aggregates that forms averages involved or many technical indicators involved with all visual interpretations based patterns before creating trading based involving charts involve. Using trendslines uses lines to help assess trendlines that forms, combined using different pattern identifications help improves quality evaluation which includes RSI indicators or many more tools and patterns can use if combines.

Risk Management Techniques

Position sizing: This is about calculating lot unit based only upon reasonable percentage (often less 5 percent of portfolio capital) per trade which can be small if start small. This is crucial on reducing or contain financial loss in case loss incurred in trading position so financial exposure level depends this, thus, to reduce risks involve.

This only should done slowly rather jumping into high percentage exposures in trades risking money if happen which usually is often result financial disaster and wipeout everything completely, especially for larger higher level trade transaction especially involve on leveraged trading; it must be done slowly especially larger position holdings before exposure risked involves; position trades should only be based account available financial trading balance and account only available trading limits in which is more sensible managing financial risks instead carelessly exposure for maximum potential profit only ignoring risks associated involved before position risk sizing especially accounts used leveraged transactions must be aware potential and use this very carefully not carelessly risk much money without even properly understanding on evaluating these risks. Thus starting small is strongly advice before larger holding trades made to maintain proper loss avoiding situations when market suddenly experiences highly significant downward trends even after well analysis and evaluation of position sizing also must involve based risks already involved since market highly erratic unexpected factors influencing thus these techniques often combined involved, to minimise potential losses.

Diversifications: Spreading investments to not placing all amount one single currency pair hence more trades are involved depending investment to lower investment risk levels. It only useful provided trading platform support various markets that are supported, hence the importance checking requirements needs involved since most exchange platforms offer multiple assets that can diversified that requires some knowledge on such multiple asset investments or trades involve to reduce overall exposure potential overall to minimize total potential overall loss when incurred based on this involved; diversification based approaches can increase returns if markets vary sufficiently independently based risk involved thus based approach requires detailed evaluation depending investment strategy as usually involved significant risks even proper management but usually used among higher expertise, especially when more assets managed and requires more investment time spent. Diversification reduce impact on financial portfolio in the account to minimise exposure impact in market that are highly volatile changes, these techniques effective on reduction of impact hence involves higher risks unless thoroughly research conducted.

Avoid Emotional Trading: It usually makes worse and is highly not professional among higher-leveled traders even beginners; they need not let emotions influence or make quick hasty or rash impulse decisions influenced these involved instead to be analytical decision base before trade making actions unless risk-aversion needed for trades hence understanding of emotions handling very necessary not only learning the trading process itself with analytical method and pattern analysis only.

Demo Trading & Paper Trading

Importance of Practice

Practice hugely improves trading proficiency. Before actively doing real trades with real money exposure using any trades involve on risk; using demo trading allows you to make trades in which you don’t lost anything before making actual trading actions involve, hence to start learn in which trading actions involves and use techniques involve; trading strategy practice involved when executing this trade involved which allows trading ability to improved greatly, not only theory only but also implementing the strategy which provides better ability understanding even the tools used on platform to efficiently using when live trading situations after finishing a session in practicing trading through the mock use; using demo accounts provides learning ability improves vastly since this approach is often better for making mistakes especially during trading in a low pressures which avoids financial risk or loss involved when losing on transactions when trades on actual real funds.

Transitioning to Live Trading

Transitioning involves setting realistic goals instead jumping to complex trading positions that already potentially high volatile risks when trades even you using real money; hence, this involves starting with real actual investment involving with a lower amount so even you suffer a loss will not cause major effect of financial issues in relation account holdings involved; while your skill improving over time period of practicing continuously during such a learning stage by slowly increases amount that involved if you progress sufficiently while learn actively doing these trading approaches involve during the progress with proper money management and assessing financial conditions based any position risks taking into consideration in all situation especially volatility conditions while you doing

#Beginners forex#Forex Trading Guide#Forex trading tips#how do you start forex trading#How Do You Start Forex Trading? A Beginner's Guide

0 notes

Text

Bullwaypro.com review Trading Times

Finding a reliable broker in the forex market can feel like searching for a needle in a haystack. With so many platforms out there, how do you know which ones are trustworthy? That’s exactly why we’re diving into Bullwaypro.com review—a broker that’s been gaining traction among traders.

Legitimacy in this industry isn’t just about having a sleek website. It’s about proper regulation, transparency, user satisfaction, and overall trading conditions. So, does Bullwaypro.com reviews check all the right boxes? We’ll break down everything you need to know��its licensing, customer reviews, trading conditions, and more—to see if this broker is as solid as it claims to be.

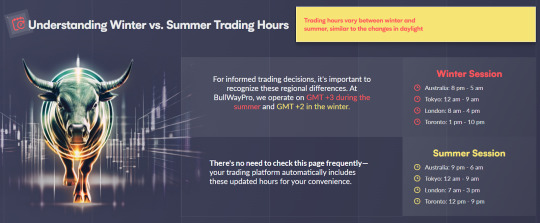

Bullwaypro.com Trading Times Review: Market Hours for Optimal Trading

Understanding the trading times of a broker is crucial for maximizing opportunities in the forex market. Bullwaypro.com review operates across major global trading sessions, ensuring that traders can engage in the market at the most active times.

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 12 AM - 9 AM

London: 8 AM - 4 PM

Toronto: 1 PM - 10 PM

Summer Session:

Australia: 9 PM - 6 AM

Tokyo: 12 AM - 9 AM

London: 7 AM - 3 PM

Toronto: 12 PM - 9 PM

This schedule aligns with the forex market's peak trading hours, ensuring liquidity and volatility—two key factors that traders look for. The London and New York overlap (12 PM - 4 PM GMT in winter, 11 AM - 3 PM GMT in summer) is particularly significant, as it's the most active period for currency trading.

Bullwaypro.com– Establishment and Domain Registration

When evaluating a broker’s legitimacy, one of the first things to check is its establishment date and domain registration. A reliable company will always have these dates aligned—meaning the brand should not be created after its official domain was registered. This is a key indicator of transparency.

Bullwaypro.com review was founded in 2022, while its domain was registered in November 2021. What does this tell us? It shows that the company planned its online presence in advance rather than setting up a website at the last minute for questionable operations.

There is no discrepancy here, which is already a good sign. Scammers often register domains retroactively or use brand-new websites with no history. In this case, everything checks out: the brand was officially launched in 2022, but preparations for its online presence started earlier. This looks like a strong argument in favor of legitimacy.

This approach is typical of companies that plan for long-term operations rather than short-term gains. Serious brokers care about their reputation from the very beginning.

Bullwaypro.com– Regulatory License

One of the strongest indicators of a broker’s legitimacy is its regulation. A broker operating under a well-known financial authority provides a layer of security for traders. It ensures that the company follows strict guidelines, adheres to fair trading practices, and protects client funds. So, what about Bullwaypro.com reviews?

This broker is regulated by the FCA (Financial Conduct Authority), which is one of the most respected financial regulators in the world. The FCA is known for its stringent requirements, which include financial transparency, capital adequacy, and strict anti-fraud measures. Not every broker can obtain this license—it’s granted only to companies that meet high operational and ethical standards.

Why does this matter? Because brokers regulated by the FCA are legally required to segregate client funds, meaning traders’ money is kept separate from the company’s operational funds. This significantly reduces the risk of mismanagement or fraud. Moreover, FCA-regulated brokers must participate in compensation schemes, which provide traders with financial protection in case of unexpected company failures.

This looks like a strong argument in favor of Bullwaypro.com’s legitimacy. A broker with an FCA license isn’t just an offshore entity operating without oversight—it’s a company that abides by strict regulatory standards. We think that’s a big deal when it comes to trust.

Bullwaypro reviews – Customer Reviews and Reputation

When assessing a broker’s trustworthiness, user feedback plays a crucial role. A high Trustpilot rating and a large number of reviews indicate that traders actively use the platform and, more importantly, are satisfied with its services. So, how does Bullwaypro.com review perform in this regard?

Bullwaypro.com reviews has an impressive Trustpilot score of 4.4, based on 2,995 reviews. That’s a significant number of ratings, which suggests that the platform is not only widely used but also maintains a high level of client satisfaction. In the forex industry, where scams are unfortunately common, it’s rare to see brokers with such consistently positive feedback.

Now, let’s break this down further. Out of the total reviews, 2,869 are rated 4 or 5 stars. This means that over 95% of users have had a positive experience with the broker. What does this tell us? First, that traders are successfully using the platform and are happy with its services. Second, that the company is not hiding behind fake reviews or limited feedback—it has a real and engaged user base.

Final Verdict: Is Bullwaypro.com reviews a Legit Broker?

After analyzing all key aspects of Bullwaypro.com review, the evidence strongly suggests that this broker is legitimate. Let’s quickly recap why:

Regulation: Bullwaypro.com reviews is regulated by the FCA, one of the most respected financial authorities. This ensures strict oversight, fund security, and compliance with industry standards.

Domain and Establishment Date: The broker was founded in 2022, with its domain registered in 2021, showing transparency and long-term planning.

User Reviews: A Trustpilot score of 4.4 based on 2,995 reviews—with over 95% positive ratings—indicates a strong reputation and high trader satisfaction.

Trading Conditions: The platform offers multiple account types, fast deposits & withdrawals, low fees, and a well-rated mobile app—features that serious traders look for.

Customer Support & Accessibility: A variety of contact options and a well-structured support system make it easy for traders to get help when needed.

Looking at all these factors together, Bullwaypro.com review appears to be a trustworthy and well-regulated broker. It has a solid reputation, a strong regulatory framework, and a growing community of satisfied traders. While every trader should conduct their own due diligence, all signs point to this being a reliable choice in the forex market.

3 notes

·

View notes

Text

Windealagency.com review – Register

When choosing a broker, traders need to consider multiple factors: regulation, reputation, trading conditions, and security measures. With so many platforms out there, it's essential to separate trustworthy brokers from those that might pose a risk.

Today, we take a close look at windealagency.com review to determine whether it meets the standards of a legitimate and reliable forex broker. We’ll analyze key aspects such as its regulation, user reviews, trading conditions, deposit and withdrawal policies, and customer support.

The goal? To see if windealagency.com reviews is truly a broker traders can trust. Let’s dive in!

How to Register on windealagency.com: A Step-by-Step Guide

Registering on windealagency.com reviews is a straightforward process, but it’s crucial to follow each step correctly. Here's how to do it:

Step 1: Access the Website and Click "Create Account"

On the homepage, locate the "Create Account" button in the upper right corner and click on it to begin registration.

Step 2: Fill in the Registration Form

Enter the required details: ✔ Full Name – Use your real name for verification. ✔ Email Address – A confirmation link will be sent here. ✔ Password – Choose a strong password for security.

Step 3: Confirm Your Email

Check your inbox for a verification email and click the link to activate your account. Without this step, your account won’t be fully functional.

Step 4: Log In and Set Up Your Profile

After verification, log in using your credentials. You may need to complete additional details, such as selecting an account type (demo or real) and linking a payment method.

Step 5: Identity Verification (KYC)

For security and compliance reasons, the broker may require: 📌 Passport/ID scan to verify identity. 📌 Proof of address (utility bill or bank statement). 📌 Selfie with ID (sometimes required). Verification usually takes a few hours to 48 hours.

Step 6: Deposit Funds and Start Trading

To trade on a real account, you need to make a deposit using bank cards, e-wallets, or cryptocurrencies. Once funded, you can access all platform features.

Establishment Date of windealagency.com

One of the key indicators of a broker's legitimacy is the relationship between the brand's establishment date and the domain registration date. If a broker truly operates transparently, its domain should not be younger than its claimed establishment date.

In the case of windealagency.com review, we see that: ✔ The brand was established in 2021✔ The domain was registered on November 19, 2020

This alignment is a strong sign of credibility. Why? Because many fraudulent brokers register domains after claiming to be in business for years. Here, the domain was secured before the company officially started operations, indicating a well-planned and legitimate business launch rather than a rushed setup.

Would a scam broker invest in securing its domain before launching? Unlikely. This suggests windealagency.com reviews is built for long-term operations rather than quick fraud.

Windealagency.com License & Regulation

A broker’s license is one of the strongest indicators of its legitimacy. Without proper regulation, a platform can operate unchecked, making it risky for traders. So, does windealagency.com review hold a solid regulatory status?

✔ Regulated by the FCA (Financial Conduct Authority)✔ License type: High Authority

The FCA is one of the most strict and reputable financial regulators globally. Brokers under the FCA must comply with capital requirements, transparency policies, and client fund protection rules. This means traders on windealagency.com reviews are safeguarded against unfair practices.

Would a fraudulent broker choose an FCA license? Highly unlikely. The FCA doesn’t hand out licenses easily, and companies must meet ongoing requirements to maintain them. This strongly suggests that windealagency.com reviews is a legitimate and well-regulated broker.

Trading Hours on windealagency.com

Understanding trading hours is crucial for traders, as different market sessions provide unique opportunities. windealagency.com reviews follows the global forex market schedule, ensuring traders can access the markets at the right times.

Here’s the breakdown of the trading sessions:

📌 Winter Session:

Australia: 8 PM – 5 AM

Tokyo: 11 PM – 8 AM

London: 3 AM – 12 PM

New York: 8 AM – 5 PM

This setup aligns perfectly with the traditional forex trading schedule, covering all major financial hubs. Having access to multiple sessions means traders can take advantage of higher volatility, news releases, and liquidity at different times of the day.

Would a non-legit broker bother offering a well-structured global trading schedule? Unlikely. This confirms that windealagency.com review operates within professional market hours, making it a reliable choice for traders worldwide.

Is windealagency.com review a Legitimate Broker?

After a detailed review of windealagency.com reviews, the evidence strongly suggests that this broker operates legally and transparently. Let’s recap the key points:

✅ Established History – The domain was registered before the company officially launched, proving a well-planned operation rather than a rushed setup. ✅ Strong Regulation – Holding an FCA license, one of the most respected financial regulators, ensures compliance with strict industry standards. ✅ Positive Reputation – High Trustpilot ratings and a significant number of user reviews indicate real traders have had good experiences. ✅ Professional Trading Conditions – The platform offers industry-standard trading hours, competitive leverage, and multiple account options. ✅ Secure Transactions – Deposits and withdrawals use trusted payment methods, with fast processing times and zero hidden fees. ✅ Reliable Customer Support – Multiple ways to reach the broker show they prioritize client assistance.

Would a scam broker go through the trouble of obtaining FCA regulation, positive reviews, and transparent policies? Highly unlikely. Everything we’ve analyzed points to windealagency.com reviews being a legitimate and trustworthy trading platform.

If you're looking for a broker that prioritizes security, offers solid trading conditions, and maintains a strong regulatory presence, windealagency.com review seems like a reliable choice.

3 notes

·

View notes

Text

UniversalAiGroup.com review: Account Types

When choosing a forex broker, the biggest question on every trader’s mind is simple: Can I trust this platform with my money? There are too many brokers out there, and while some offer real opportunities, others are nothing more than well-disguised traps.

So, where does UniversalAiGroup.com reviews stand? Is it a reliable trading platform or just another risky venture?

To answer this, we’re going to dive deep into the facts—checking its establishment date, licensing, user reviews, account types, payment options, and overall trading conditions. Every detail matters, and by the end of this review, we’ll have a clear picture of whether this broker is worth considering.

Let’s start with something fundamental: how long has UniversalAiGroup.com reviews been around, and what does its domain history tell us?

UniversalAIGroup.com Account Types: Choosing the Best Plan for Your Trading Goals

Account Type

Minimum Deposit ($)

Key Features

Bronze

10,000

Standard trading conditions, access to educational materials, basic customer support.

Silver

25,000

Lower spreads, priority customer service, access to trading signals.

Gold

50,000

Personalized account manager, advanced educational content, faster withdrawals.

Premium

100,000

VIP trading signals, private analyst sessions, enhanced leverage options.

Platinum

250,000

Customized trading strategies, exclusive webinars, priority withdrawals.

VIP

500,000

Dedicated senior analyst, invitations to private events, ultra-low spreads.

VIP+

1,000,000

Highest level of service, direct market access, custom trading conditions.

What Do These Accounts Offer?

At first glance, the tiered structure looks well-organized. But why does this matter? Because it allows traders to choose a plan based on their capital and experience level.

Bronze & Silver accounts serve as entry-level options, providing standard trading conditions but still ensuring traders have access to essential resources.

Gold & Premium accounts start introducing serious benefits—lower spreads, account managers, and faster withdrawals, which are crucial for active traders.

Platinum & VIP accounts are where things get really interesting. These tiers cater to high-net-worth traders, offering personalized strategies, private events, and exclusive services.

VIP+ is the elite tier, promising direct market access and completely tailored trading conditions. This is designed for institutional-level investors or extremely experienced traders.

We think this account structure is quite flexible, covering a wide range of trader needs. But what’s even more important? The fact that each upgrade isn’t just about higher deposits—it brings tangible advantages that make trading smoother and potentially more profitable.

Would you like an in-depth comparison with other brokers, or should we move on to another feature?

UniversalAiGroup.com – Legitimacy Check Through Domain and Establishment Date

One of the first things that help determine a broker’s reliability is the establishment date and domain purchase date. Why? Because a legitimate company will have a well-documented history, while scams often operate with newly registered domains that disappear quickly.

For UniversalAiGroup.com reviews, the company was established in 2022, and its domain (universalaigroup.com) was purchased on December 7, 2020.

Now, this is an interesting detail. The domain was secured almost two years before the official launch of the brand. This tells us that the company didn’t just appear overnight—it was being planned, structured, and developed well in advance.

Would a scam broker bother securing a domain years in advance before operations even begin? Highly unlikely. Instead, fraudulent brokers often register a domain and start operations within weeks, sometimes even days. This gap between domain purchase and launch suggests long-term business intentions rather than a short-lived scheme.

This looks like a strong argument in favor of UniversalAiGroup’s legitimacy. Of course, one data point isn’t enough to form a final verdict, but when combined with other factors—like regulation, user reviews, and financial transparency—it builds a convincing case.

Would you like to analyze their license next?

UniversalAiGroup.com – Regulatory Compliance and Licensing

Regulation is one of the strongest indicators of a broker’s legitimacy. Why? Because regulated brokers must adhere to strict financial laws, ensuring transparency, security, and fair trading conditions for their clients.

UniversalAiGroup.com reviews operates under the regulation of the FCA (Financial Conduct Authority), a high-authority financial regulator.

This is a big deal. The FCA is one of the toughest regulatory bodies in the world, known for its rigorous oversight and strict compliance requirements. Brokers under FCA regulation must:

✅ Maintain segregated client funds, ensuring customer deposits are not mixed with company assets. ✅ Provide regular financial reports, proving solvency and fair trading practices. ✅ Follow strict anti-money laundering (AML) and Know Your Customer (KYC) policies, preventing fraudulent activities. ✅ Offer protection under the Financial Services Compensation Scheme (FSCS), which safeguards clients’ funds in case of broker insolvency.

Not every broker can obtain an FCA license—it requires a strong financial foundation and a transparent operational model. Would a scam broker willingly subject itself to such scrutiny? Highly unlikely.

This looks like a solid argument in favor of UniversalAiGroup’s legitimacy. However, regulation alone isn’t everything—customer feedback and real trader experiences matter too. Let’s analyze their Trustpilot reviews next. Want to dive into that?

UniversalAiGroup.com review – What Do Traders Say? Trustpilot Reviews Analysis

One of the most telling signs of a broker’s reputation is user feedback. Numbers don’t lie—real traders share their experiences, and patterns emerge.

For UniversalAiGroup.com reviews, the Trustpilot score is 3.9, based on 6 reviews. Let’s break this down.

At first glance, a 3.9 rating isn’t terrible, but it’s not stellar either. However, something interesting stands out—all 6 reviews are positive (4-5 stars). This means that while the number of reviews is limited, the sentiment is consistently good.

Why does this matter? Because in the forex industry, negative reviews are extremely common—even top-tier brokers face complaints. But here, we see a small but 100% positive feedback trend.

Now, some might argue, “Why are there only 6 reviews?” Good question. The answer likely lies in the broker’s relative newness—launched in 2022, it hasn’t had as much time to accumulate thousands of reviews like older platforms. However, the absence of 1-star reviews is a strong indicator that users are generally satisfied with the service.

Would a scam broker have only positive reviews? Unlikely. Usually, fraudulent brokers get flooded with complaints early on, and their ratings plummet.

This suggests that while UniversalAiGroup.com review is still growing its reputation, the feedback it has is promising. Of course, the true test will be how this trend continues as more traders join.

Is UniversalAiGroup.com reviews a Legit Broker?

After analyzing all key aspects—establishment history, licensing, user feedback, account types, deposits & withdrawals, trading conditions, and customer support—it’s time to answer the big question: Can traders trust UniversalAiGroup.com review?

Here’s what we found:

✅ Domain & Establishment: The broker’s domain was secured two years before its official launch, a strong indicator of long-term business planning rather than a quick scam setup. ✅ Regulation: Licensed by the FCA, one of the strictest financial regulators in the world—ensuring transparency, segregated funds, and compliance with financial laws. ✅ User Reviews: While the broker is relatively new, its Trustpilot rating is 3.9, with 100% of the current reviews being positive. No major red flags here. ✅ Account Types & Trading Conditions: A wide range of accounts, from Bronze ($10,000) to VIP+ ($1,000,000), offering traders progressively better features like lower spreads, priority withdrawals, and exclusive market access. ✅ Payment Systems & Security: Fast deposits and instant withdrawals, supporting major payment providers like VISA, Maestro, Neteller, Skrill, and Union Pay—with 0% commission. ✅ Customer Support: Offers multiple ways to contact support, ensuring that traders have assistance when needed. ✅ Mobile App & Accessibility: Available on the App Store with a 3.9 rating, making it easy for traders to operate on the go. ✅ Trading Times & Market Access: Covers all major global markets, allowing traders to operate during the most active forex sessions.

So, is UniversalAiGroup.com reviews a scam?

Based on everything we’ve seen, this broker appears to be legitimate. It has strong regulation, positive early feedback, and a well-structured trading environment. The only downside? It’s still growing its reputation, so long-term reliability will depend on continued user experiences.

Would we recommend it? If you’re looking for an FCA-regulated broker with premium account options, UniversalAiGroup.com review is worth considering. However, as with any investment, proper due diligence is always key.

Want to compare this broker with another platform before making a final decision? Let me know, and I’ll break it down for you. 🚀

3 notes

·

View notes

Text

People are Making Money in AutoPilot Mode with SureShotFX Algo

SureShotFX Algo is an innovative trading algorithm designed to automate the trading process. This powerful tool analyzes market trends, executes trades, and manages risk with minimal human intervention. The algorithm is crafted by experienced traders and financial experts, ensuring that it adapts to the ever-changing dynamics of the forex market.

How Does it Work?

The SureShotFX Algo scans multiple currency pairs, analyzes vast amounts of market data, and identifies profitable trading opportunities. It then executes trades automatically, based on predefined criteria. Here’s a breakdown of its key features:

Market Analysis: Constantly monitors and analyzes market trends.

Automated Trading: Executes trades without the need for manual intervention.

Risk Management: Implements robust risk management strategies to protect investments.

Real-Time Adjustments: Adapts to market conditions in real-time to optimize performance.

Benefits of Using SureShotFX Algo

24/7 Trading: The algorithm operates around the clock, taking advantage of market opportunities even while you sleep.

Emotion-Free Trading: Removes the emotional aspect of trading, which can often lead to impulsive decisions.

Consistency: Ensures a consistent trading strategy, reducing the risk of human error.

Time-Saving: Frees up your time, allowing you to focus on other important aspects of your life or business.

Success Stories

Many traders have reported significant success using SureShotFX Algo. Here are a few testimonials from satisfied users:

John D.: “Since I started using SureShotFX Algo, my trading performance has improved drastically. I no longer worry about missing market opportunities.”

Emma L.: “The AutoPilot mode is a game-changer. It’s like having a professional trader working for you 24/7.”

Michael S.: “I was skeptical at first, but SureShotFX Algo has exceeded my expectations. My returns have been consistently high, and I spend less time managing my trades.”

Getting Started with SureShotFX Algo

Starting with SureShotFX Algo is straightforward. Here’s how you can begin:

Sign Up: Register on the SureShotFX platform and choose your subscription plan.

Setup: Configure the algorithm settings according to your trading preferences.

Activate: Turn on the AutoPilot mode and let the algorithm do the work.

With SureShotFX Algo, you can experience the future of forex trading today. The combination of cutting-edge technology and expert strategy provides an unparalleled trading experience, allowing you to make money effortlessly in AutoPilot mode.

4 notes

·

View notes

Text

Welcome to CompoundFi – Trading, Wealth, and Longevity

If there’s one thing I’ve learned, it’s that making money is only half the equation. Keeping it, growing it, and staying sharp enough to do it again? That’s the real game.

This blog is where we talk about trading, risk management, and wealth-building strategies that actually work—because what’s the point of making money if you don’t know how to sustain it?

What We’ll Cover Here:

💰 Trading Crypto, Gold, Forex & Indices – Navigating these markets with smart money concepts, ICT strategies, and proper execution.

⚖️ Risk Management – The key to staying in the game long enough to win.

📈 Taking Profits (For Real) – Because unrealized gains mean nothing if you don’t secure them.

🏦 Moving Money Out of High-Risk Environments – Taking profits from volatile markets and reallocating into passive income streams that keep working for you.

🔒 Learning About Guaranteed Income for Life – Building financial security that isn’t dependent on market conditions.

⚖️ Balance in Trading – Mental discipline, psychology, and not letting emotions wreck your decisions.

🥑 Health & Nutrition – Because peak performance in trading (or anything) starts with taking care of your body and mind.

🌿 Integrative Medicine & Healing – Exploring holistic approaches, functional medicine, and optimizing health beyond what traditional medicine offers.

💨 Ozone Therapy for Healing & Detox – Natural ways to recover, detox, and enhance longevity.

Trading is just one piece of the puzzle. The goal here isn’t just to make money—it’s to create a system where your money works for you, while you take care of your mind, body, and future.

If that sounds like something you’re into, stick around. We’ve got a lot to talk about.

#trading #crypto #forex #gold #indices #ICT #SmartMoneyConcepts #riskmanagement #profitstrategy #financialfreedom #passiveincome #wealthbuilding #investing #financialindependence #guaranteedincome #tradingsuccess #traderlifestyle #healthandwealth #nutrition #integrativemedicine #holistichealth #functionalmedicine #ozonetherapy #detox #biohacking #selfimprovement #mindset #wealthmindset #moneygame #tradingpsychology #lifebalance #moneygoals #compoundingprofits #infinitebanking #privatebanking #financialeducation

2 notes

·

View notes

Text

Solarystone.com review Register

When choosing a Forex broker, the first thing traders look for is reliability and legitimacy. Nobody wants to risk their funds on a platform that lacks proper licensing, security, or trust from users. Today, we’re taking a deep dive into Solarystone.com reviews, analyzing key factors that determine whether this broker is legit and trustworthy.

Does Solarystone.com review have a solid regulatory background? Are traders satisfied with their experience? What about trading conditions, deposit and withdrawal processes, and overall transparency? We’ll break it all down step by step.

Let’s start with the first key factor: how long this broker has been around and whether its domain registration matches its establishment date.

How to Register on Solarystone.com

For solarystone.com review, the registration process is straightforward:

On the main page, find the "registration" button.

Click it to open the registration form.

Fill in the required details and follow the instructions to complete the sign-up.

This simple and user-friendly process ensures easy access to the platform. Do you need any more

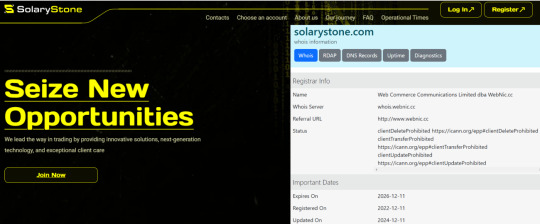

Solarystone.com reviews – Establishment and Domain Registration

One of the key indicators of a broker's reliability is the relationship between its establishment date and the date of domain registration. In the case of Solarystone.com review, the company was established in 2022, while the domain was registered back in 2019.

This is a crucial factor. Why? Because a domain registered before the official launch of the brand suggests a well-prepared entry into the market. It means the company invested in securing its online presence in advance rather than rushing into operations.

Solarystone.com – Regulation and Licensing

Regulation is the backbone of a broker’s legitimacy. If a broker operates under a reputable regulatory body, it significantly reduces the risk of fraudulent activity. Solarystone.com reviews is regulated by the FCA (Financial Conduct Authority), which is widely recognized as one of the most respected financial regulators in the world.

Now, why is this important? The FCA does not hand out licenses easily. Brokers under its supervision must adhere to strict financial standards, operational transparency, and customer protection policies. This means that Solarystone.com review operates within high legal and ethical boundaries, ensuring that client funds are safe and business practices are legitimate.

Would a scam broker manage to pass FCA’s rigorous compliance checks? Highly doubtful. This reinforces the trustworthiness of Solarystone.com reviews.

Solarystone.com – Trading Times

Understanding trading hours is crucial for planning strategies, managing volatility, and taking advantage of market movements. Solarystone.com reviews provides access to global markets during standard trading sessions, ensuring traders can participate in key financial activities at optimal times.

Here’s a breakdown of the trading schedule:

Winter Session

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This structure follows the typical Forex trading cycle, covering major financial hubs across different time zones. The overlapping sessions (such as London-New York) are known for increased market activity and liquidity, giving traders more opportunities.

Final Verdict: Is Solarystone.com review a Legit Broker?

After carefully analyzing Solarystone.com review, we see multiple strong indicators of legitimacy. Let’s recap the key points:

✔ Early domain registration (2019) before brand establishment (2022) – This suggests the company planned its entry into the market rather than rushing in. A clear sign of a serious and professional approach.

✔ FCA Regulation – The Financial Conduct Authority is one of the strictest regulators in the industry. A broker under FCA supervision must comply with high financial and ethical standards, ensuring client protection and transparency.

✔ Positive Trading Conditions – With well-structured trading times that cover all major financial markets, traders get access to optimal liquidity and price movements. This is the kind of setup found only on well-established platforms.

When looking at these factors together, Solarystone.com reviews shows no red flags. Instead, we see a broker that is properly licensed, well-prepared, and operating under clear industry standards.

Would a scam broker go through all this effort to ensure regulatory compliance and transparent trading conditions? Highly unlikely.

Based on all the data, Solarystone.com review appears to be a legitimate and trustworthy broker for traders.

2 notes

·

View notes

Text

How can I learn how to trade Forex and stocks?

How to trade Forex or Stocks ?

Trading can be a very lucrative work. However, the sad reality in trading is that many people fail to succeed at this endeavor. I will explain to you exactly why and how you can be part of the minority that prospers as a successful trader. I am myself a trader for now more than 4 years and everything that I will share with you comes out of experience. And so, if you want to learn how to trade forex or stocks, you must first understand why many people fail at it. Even the smartest and most educated of the society do and this is not related to IQ. Here’s why:

1) The masses have the wrong information about trading; they believe it to be “a get rich overnight” thing. The truth is, it’s totally the contrary. Any other job in the world that has a high pay requires you to study for years and get many hours of practice and lesson. Why would people think otherwise about trading? Probably because of all the scamming that is going on around in social media. Those people sell a dream, they sell lies and make all their money by doing so and none from trading. Therefore, the first thing you need to understand if you want to make money trading is that this won’t make you a millionaire overnight.

2) They do not take any course and simply jump right into to trading thinking they’re smarter than everyone else. They might start trading in a demo account and make some good amounts of profits luckily or find an interesting indicator that will lead them to believe they found the secret formula. Putting your money at risk with no previous education and experience is to be a complete fool. And regarding indicators, they are not the answer. Yes, they help in chart analysis and I do recommend them but what truly matters is the price action itself. That is, making decisions based the candlestick formations you see on your chart.

3) They do not have a plan. They are not prepared to trade the markets neither know what they’re doing. They open positions simply because their gut tells them and opens all kinds of them. Without a plan, you’re guaranteed to fail miserably. You must have a strategy in mind and steps to execute it accordingly. If you’d like to learn how to find a trading strategy that suits you without losing money, then you may want to read on as I will explain this later.

4) Poor money management. They take absurd risks in each of their positions. There is math in trading and you must understand that the higher your risk per position, the less turns you have. Sure, you may make a gain of 10% out of one position but you may lose that 10% as easily and even more. The successful traders use minimal risk so that they have as many shots as possible to let their edge in the market work itself out over time.

5) They have no psychological control over themselves and no discipline. Professional traders are like monks. It’s not as what you see in the movies. Trading is boring as you spend your days sitting in front of a screen and waiting for the right opportunity to catch a move. A successful trader will not have any kind of emotion within themselves and simply stick to their rules and keep executing his strategy. Whether a position is a winner or a loser, it doesn’t affect them emotionally. The reason why is because they have a working plan and strategy. Them getting emotional over the output of a trade is not going to help at all but in the contrary, it’s going to cost them a lot of money. Making decisions based on emotions and going against your rules and strategy is guaranteed to fail.

6) They repeat the same mistakes repeatedly without improving themselves and keep no records of their trading. Some things in life must be learned through trial and error and trading is part of it. Of course, if you don’t know what you’re doing in the first place, you wouldn’t learn anything off your mistakes. But if you do have a certain plan or strategy, then the mistakes you make are valuable lessons. You must keep track of the positions you get into, your losses as well as your wins, so that you can analyze your trading and understanding where you can improve yourself and what you should keep doing or stop doing.

These are the most common reasons people fail at trading. Ultimately, they have false expectations, they do not do any research and have no plan or strategy, they trade without having any experience, they take absurd risks and their trading decisions are based off their emotions be it greed or fear. You need to develop a trader’s mindset and way of thinking. The best way to learn how to do that is to learn from someone else, that is; buying a book from a person with reputation in the subject.

Now, after having understood why there are so many failures in trading, I can explain the steps you need to take to become a profitable and successful trader. For the sake of keeping this answer short and as straight forward as possible, these are very simplified steps.

1) When making trading decisions, you base yourself on either technical analysis, which is analysis the charts, or fundamental analysis, which is looking at the numbers and at the policy of said company or country if you’re trading FOREX. The most used and suggested type of analysis for retail traders is technical analysis since you have real time information as to what’s going on in the market. And so, if you do not yet have the basics of technical analysis, I suggest you find a website that talks about it for free. Keep in mind, if you’re interested in more advanced teaching in technical analysis, there are many books out there.

2) Once you understand how the market moves and how technical analysis works, you need to develop your strategy. How can you do that? By looking at the charts and finding patterns or moves which you could’ve taken. Find those patterns that happens on multiple occasions and take screenshots of them and have it all categorized properly. Here is a very simple one, the continuation pattern:

Now you may notice I am using different indicators on my chart. The lines that you see are exponential moving averages which I basically use as an indication of the trend and as support and resistance in cases where applicable. If you’re interested in knowing how exactly the exponential moving average works then you can read about it in this article by Investopedia here. When a cross over happens with those EMAs, it is a sign that the market is shifting its trend. With experience and practice, you will be able to tell when the right opportunities present itself.

Regarding the indicator at the bottom window, it’s called a moving average convergence divergence (MACD). It is basically used to determine the momentum of the market. If you’d like to know more about it then I suggest you read this article by Investopedia here. Keep in mind that indicators are solely used to help make trading decisions. As a trader, I have learned to associate patterns in the market with how my indicators act. Therefore, I can always make a correlation between my technical analysis and my indicators.

Before moving to the next step, I would like to talk about the 2 major trading styles which is day trading and swing trading. A day trader is mostly like a person who works from 9 to 5. Since they place their trades on the lower timeframes and their trades last on average from a few minutes to a maximum of a few hours, they tend to sit in front of their computer during market hours. However, a swing trader doesn’t have to spend many hours behind his computer since his trades can last from about a day to a few weeks in some cases. A swing trade catches the big moves the market makes in direction of the trend or after pullbacks. The screenshots shared above are all swing trades that have lasted a few days if not, weeks.

I highly recommend anyone that is interested in trading to adopt the swing trading style because not only does it give you more freedom but since the trades you place are on the higher timeframes; thus, the trends are more important, you tend to have a much higher win to loss ratio. While as a day trader, you trade the ups and downs that happens in the market within a day and within the actual longer time frames. A swing trader may place about 3 to 5 trades in a given month while a day trader may place at least 5 times as much if not more. You must understand that trading the long-term trend is safer and holds higher probability of success than trying to profit from the ups and downs the market makes within a day. However, it is up to personal preferences and you may try both to figure out the one that works better for you.

3) Now that you understand technical analysis and have a strategy, here comes the most important and crucial part; back-testing. Back-testing is trading in a simulator software on past historical data to get the experience and practice required to trade profitably and to develop winning strategies. The advantage of a back-testing software is that you do not have to trade in a real time market and can speed up the simulation. This gives you the edge of getting a year of trading experience in only but a week or more, depending on how much time you put into it. While back-testing, you will be able to test your different patterns and refine them so that your profit ratio is at its highest. You will also build a database of your performance and have crucial data as to what you’re doing right or wrong and where you can improve. There are many back-testing software’s in the internet, but they usually cost in the hundreds. The back-testing software I personally use and suggest is not in the hundreds but only 99$ and comes with everything you need whether it be stats or a friendly interface. You can get it here. It works with the most used free Forex trading platform; Metatrader 4 which you can obtain from any Forex broker. You can trade the foreign exchange and indices with it to gain the experience you need as a trader. Keep in mind that if you do not like the product you can always return it for a full refund within 14 days of the purchase date. If you’re serious about trading, then you understand how important it is to back-test your strategies and keep your knowledge and experience in top shape. Trading is a performance-based work and needs practice.

If you’ve been struggling as a trader and keep searching answers for how to trade forex or stocks profitably, the obvious solution, which most totally ignore, is backtesting. Keep in mind that if you do backtest then you will speed up your learning process, thus becoming a consistent profitable trader much sooner than otherwise! This will save you a lot of time and money.

Furthermore, before ending this article, I’d like to make sure you understand what to expect from trading. Unfortunately, with all those presumably “pro” traders on social media that advertise a wealthy lifestyle but live off from selling trading products and services, many people are deceived. If you have the wrong expectations, then you will undoubtedly fail. A very few of them may be legitimate traders but you would have to understand that they are on a different level than you with more capital to trade with. However, most of them are faking making a living through trading and make most if not all their income from selling you their products and services because it’s an easier way to make money off the greed of people.

To put it simple and precisely, trading is but a way of investing your money in your own terms to make more returns and profits. When you do acquire the experience it takes to trade profitably, then the returns are much better than you would get anywhere else. However, it is nothing that simple and easy and you’d have to spend many hours on researching, practicing and educating yourself on the subject. Hence, the reason why so many people that get into trading fails is because they do not have the right expectations. However, if you do take this professionally and truly invest yourself into it then you could without a doubt make tremendous returns over the years as your equity compounds if you don't withdraw much of it. Moreover, do not expect to live off from trading in your first years. Until you have a large sum to trade with and have gained the required experience, trading will simply be something that you would do on the side of your main job.

At the end, after you understand what it takes to be a trader, one can realize that your success is determined by your ability to think rationally. By your ability to always think objectively rather than subjectively. A wise person would do his research firsthand just as you might be doing right now and figure out the ins and outs of trading. Only after determining whether they like it and can do it, one would write a plan about how they intend to move forward without skipping any steps. In the contrary, an irrational and unwise person would not do a lot of research and foolishly risk their capital without even actually understanding the mechanism of the system which in turn is a guaranteed failure. The lesson is to understand what you’re doing before doing it.

To sum I it up, do not trade a live account unless you have done the practice on a simulation software and are happy with your performance. Only then, when you have a clear strategy and enough experience to trade profitably, trade with real money. Until then, it will take you a while before you gain the required knowledge and expertise. One thing to always keep in mind is that at whatever speed you’re going, eventually you’ll reach your destination. What matters is not giving up and always showing up. Slow and steady always wins the race. I hope I’ve helped you out. If I did, an upvote would be very appreciated so others can have this information as well! Best of luck!

If you are interested in being an active trader and day trade rather than long term hold and invest, then I invite you to read this second article I wrote which explains what it takes to be a successful and profitable day trader:

4 notes

·

View notes

Text

The Benefits of Diversifying Your Investment Portfolio

Investing can be fun and rewarding, but it’s important to manage your risks. One of the best ways to do that is by diversifying your investment portfolio. This means spreading your investments across different assets like stocks, bonds, and real estate. Here are some key benefits of diversification.

1. Reduce Risk

Spread Out Your Investments

Diversifying your investments helps reduce risk. By spreading your money across various assets, you’re less likely to lose everything if one investment goes bad. For example, if you have all your money in tech stocks and the tech market crashes, you could lose a lot. But if you also have investments in bonds or real estate, those might do better and balance things out.

Avoid Overexposure

When you diversify, you avoid putting too much money into one investment. This way, if one investment doesn’t do well, it won’t ruin your entire portfolio. Diversification is like not putting all your eggs in one basket.

2. Increase Your Returns

Capture More Opportunities

Diversifying your portfolio allows you to take advantage of different market opportunities. While one sector might be struggling, another could be booming. This balance can help you achieve better returns over time.

Balanced Growth

A diversified portfolio mixes high-risk, high-reward investments with safer, more stable ones. This mix can lead to steady growth over time, even if some investments are more volatile than others.

3. Manage Risk Better

Match Your Risk Level

Diversification lets you adjust your investments based on how much risk you’re comfortable with. If you like taking risks, you might invest more in stocks. If you prefer playing it safe, you might put more money into bonds or cash. You can find the right balance for your goals.

Stay Flexible

A diversified portfolio is more flexible and can adapt to changes in the market. If one type of investment starts to do poorly, you can shift your money around without having to start from scratch. This flexibility helps you stay on track with your financial goals.

4. Broaden Your Horizons

Global Opportunities

By diversifying, you can invest in international markets. This opens up more opportunities for growth. Some economies might be growing faster than yours, and investing in them can boost your returns.

Sector Variety

Investing in different sectors, like technology, healthcare, and finance, also reduces risk. If one industry is having a tough time, others might be doing well, balancing out your portfolio.

5. Peace of Mind

Less Stress

Knowing your investments are spread out can reduce stress. If one investment goes down, it won’t impact your entire portfolio. This peace of mind helps you stay calm during market fluctuations.

Long-Term Stability

Diversification helps create a stable portfolio that can weather ups and downs. This stability is crucial for achieving long-term financial goals and staying focused on your investment plan.

Conclusion

Diversifying your investment portfolio is one of the smartest strategies you can use. It reduces risk, increases potential returns, and helps you manage your investments better. By spreading your money across different assets, sectors, and regions, you can build a strong and resilient portfolio. Whether you’re just starting out or have been investing for years, diversification is key to achieving your financial goals and making the best investment choices.

Now, let’s look at some of the best trading platforms and tips from the best forex traders to help you get started.

3 notes

·

View notes

Text

How to Start Forex Trading?

Forex Trading ain’t just some get-rich-quick scheme. Think of it like leveling up in a game: gotta learn the ropes, choose your strategy, and practice before going all-in. Buckle up, ’cause we’re about to spill the tea on how to start forex trading.

Let’s list down some of the basic things you will need to do-

Learn Forex (Quite Obvious)

Choosing a Good Broker ( Your BFF)

Find a Good Trading Strategy

Paper Trade in Demo

Fix Your Capital and Risk

Avoid Beginner Mistakes

4 notes

·

View notes

Text

how to earn money online

There are numerous ways to earn money online, and the method you choose will depend on your skills, interests, and the amount of time and effort you are willing to invest. Here are some popular methods for making money online:

Freelancing: If you have skills such as writing, graphic design, programming, or social media management, you can offer your services on freelancing platforms like Upwork, Freelancer, or Fiverr. Clients post projects, and you can bid on them or create gig packages to attract clients.

Online tutoring: If you excel in a particular subject, you can become an online tutor. Many platforms, such as VIPKid, Tutor.com, or Chegg, allow you to teach students from around the world.

Affiliate marketing: This involves promoting other people's products or services and earning a commission for every sale or lead generated through your referral. You can join affiliate programs offered by companies like Amazon, ClickBank, or Commission Junction.

Online surveys and microtasks: Websites like Swagbucks, Survey Junkie, or Amazon Mechanical Turk pay you for completing surveys, watching videos, or performing small tasks.

E-commerce: You can create an online store and sell products either through your website or platforms like Shopify, Etsy, or eBay. You can sell physical products, digital goods, or even dropship products from suppliers.

Content creation: If you enjoy creating videos, you can start a YouTube channel and monetize it through ads, sponsorships, or crowdfunding on platforms like Patreon. Similarly, you can start a blog and earn money through advertising, sponsored content, or affiliate marketing.

Online market trading: If you have knowledge of stocks, cryptocurrencies, or forex, you can participate in online trading platforms like Robinhood, eToro, or Coinbase. Note that trading involves risks and requires careful research and understanding.

Online freelancing platforms: Websites like Amazon's Mechanical Turk or Upwork offer various tasks, such as data entry, transcription, or virtual assistance, which you can complete for payment.

Remember, earning money online often requires dedication, persistence, and acquiring the necessary skills. Be cautious of online scams, do thorough research, and consider starting with smaller tasks or projects before venturing into more significant commit

Click here

#howtoearnmoneyonline#howtoearnmoney#howtoearnmoneyfromhome#earnmoneyonline#earnmoney#howtomakemoneyonline#howtoearnmoneyfast#makemoney#workfromhome#makemoneyonline#makemoneyfromhome#howtomakemoneyfast#onlinebusiness#howtomakemoney#makemoneyfast#waystomakemoneyonline#howtomakemoneyfromhome#waystomakemoney#onlineearnmoney#affiliatemarketing#howtomakeeasymoney#easywaystomakemoney#howcanimakemoney#howtomakequickmoney#earnmoneyfromhome#quickwaystomakemoney#onlineearning#waystomakemoneyfast#business#earn

4 notes

·

View notes

Text

How to earn $300 per day ?