#home equity for cash

Explore tagged Tumblr posts

Text

6.8% Cap Rate In LA! + Hotel 101 + U.S. Mortgage Rates + Turning Home Equity Into Cash

The current CHIPS Act is creating many jobs in the U.S., and this gentrification is driving home prices in the Midwest, where chip manufacturers are building their facilities - each responsible for well over 10,000 new jobs. We just met a couple buying homes in a midwest town where Google has their data centres and Intel is building a semiconductor fab - in this popular midwest town, home prices have doubled in the last few years.

0 notes

Text

Home Equity Cash-out Refinancing: an Overview

Most people consider buying a home as making the biggest investment in their life. A home is not only where you enjoy your comfort and hang out with your family and friends but it also adds to your overall wealth accumulation. However, most homeowners have no idea that they can exploit their investment to repay their mortgage loan while still retaining homeownership.

A recent report by CoreLogic reveals that the average US homeowner made a profit of approximately $28,000 in equity in the first quarter of 2024. Areas including California reported the biggest average national equity gains.

If you bought your home a decade ago, you are currently sitting on a fat cushion of money. Likely, you are not aware of the cash loads sitting idle. You can let it grow or tap it to fulfill your goals, financial or others.

Home Equity Cash-Out in California is a way to leverage the trapped equities that have been building in your home but sitting idle. As the name drops a hint, it provides you with enough cash that you can use for whatever purpose you have in mind without disturbing your bank account and the biggest investment vehicle.

Why Home Equity Cash-Out Refinancing?

Here are some of the most common reasons why people take out home equity cash-out loans.

To clear high-interest debt

To use for home renovation

To pay off a large amount of educational expenses

To make a down payment on another investment

Why do people go with a home equity cash-out refinancing loan? There are multiple advantages of such an option. Mortgage refinancing comes with a significantly lower interest rate than what is tied to personal loans and credit cards. Therefore, your home equity serves as a great source for funding your financial goals.

The best advantage of home equity cash-out refinancing is your property will continue to appreciate in value while you live in it. However, you now have more cash on hand than ever.

How Can I Pull Out Equity from My Home?

Though not all lenders have the same requirements, they usually require you to have at least 20-25% equity built up in your home before approving your request for home equity cash-out refinancing. Most lenders will let you take out a maximum of 80% of your property value as a cash-out refinancing loan.

What is the Eligibility Criterion for Cash-Out Refinancing?

Lenders always check your credit score and the amount of your house you currently own before approving a loan. There are other criteria too but some basic requirements remain the same in the case of all lenders. Conventional loans require a credit score of 620 or more but some options offer significant flexibility to facilitate borrowing.

A debt-to-income ratio is also taken into consideration. Usually, less than 50% is a preferred criterion. However, flexible options are not rare.

If a borrower needs to repay debts to obtain cash-out refinancing loans, lenders may want the debt to be paid off through refinancing rather than receiving payment in cash.

#Home Equity Cash-Out in California#Cash-out refinance California#Cash out equity loan California#Cash-out refinance rates California

0 notes

Text

Sell House Fast Seattle WA: Marmot Buys Homes Protects Your Hard-Earned Equity

youtube

Selling your house fast in Seattle doesn't have to compromise your hard-earned equity. Marmot Buys Homes offers a fresh approach, ensuring a seamless, efficient sale that prioritizes your peace of mind. They streamline the process, faster transactions without sacrificing value, while protecting your equity amidst market fluctuations. With personalized attention and a focus on your needs, you'll trust that your investment is in good hands. Continue to discover how they make this possible.

Understanding the Seattle Real Estate Market

While diving into the Seattle real estate market, you'll quickly notice its dynamic and competitive nature. It's a place where market trends shape your every decision, and property values can considerably fluctuate. You'll find yourself drawn into the rhythm of the city, where each neighborhood tells its own story. Understanding these nuances becomes essential if you want to make informed decisions. As you explore, pay attention to how market trends impact property values, driving prices up or down. It's an intimate dance between buyer and seller, and knowing the steps can protect your investment and guarantee a rewarding experience.

The Marmot Buys Homes Approach

Embracing a fresh perspective, the Marmot Buys Homes approach offers a streamlined solution for those looking to sell their homes quickly in Seattle. You'll find that this process is designed with your needs in mind, ensuring a hassle-free experience. With a focus on simplicity, the Marmot process centers around efficient home acquisition, saving you time and stress.

Forget the traditional hassles of selling; Marmot Buys Homes puts you at ease, prioritizing your equity and peace of mind. You'll appreciate the personal touch, as they handle every detail with care, making you feel like part of the family. It's your ideal home-selling partner.

Steps to Sell Your House Quickly and Easily

Building on the Marmot Buys Homes approach, you're ready to explore practical steps to sell your house quickly and easily. Start with home staging; create a warm, inviting atmosphere that potential buyers can picture themselves in. Declutter, depersonalize, and enhance your home's best features. Next, focus on pricing strategies. Research local market trends and set a competitive price that attracts interest but guarantees you retain equity. Be flexible with showings, making your home available when buyers are most active. Finally, maintain open communication with potential buyers, fostering trust and urgency. With these steps, you'll streamline the selling process effortlessly.

Benefits of Choosing Marmot Buys Homes

Opting for Marmot Buys Homes provides numerous advantages when selling your house. With the Marmot Advantage, you'll experience a seamless process that respects your time and emotional investment. Imagine completing a sale swiftly without the usual hassles and uncertainties. Marmot specializes in fast transactions, ensuring you're not left waiting and worrying. You get to bypass unnecessary showings and endless negotiations, making the change as smooth as possible. Marmot's team understands the importance of your home and works closely with you, offering personalized attention and understanding. Trusting Marmot means prioritizing your needs and achieving the ideal balance of efficiency and care.

Protecting Your Equity During the Sale Process

When selling your home, protecting your equity is an essential consideration that shouldn't be overlooked. You've worked hard to build that equity, and it deserves to be preserved. Market fluctuations can be unpredictable, and they might seem intimidating. But don't worry; you can navigate these waters confidently. Start by understanding current market trends and how they affect your home's value. This knowledge empowers you to make informed decisions, ensuring equity preservation. Partnering with experts who genuinely care about your financial future makes a difference. They'll guide you, offering insights tailored to your unique situation, preserving what you've earned.

#foreclosure help Seattle#mortgage assistance Seattle#best mortgage assistance Seattle#sell underwater house Seattle#sell house fast Seattle#sell house fast Seattle WA#cash home buyers Seattle#property liquidation Seattle#selling house no equity Seattle#mortgage help Seattle#quick home sale Seattle#sell house for cash Seattle#Youtube

0 notes

Text

Use Your Rentals to Buy More Rentals with a HELOC or HELOAN

youtube

Welcome back, Rent To Retires! 🌟 In this exciting episode, Adam Schroeder sits down with Graham Parham from Highlands Mortgage to dive deep into the world of HELOCs (Home Equity Line of Credit) and HE Loans for investment properties. Learn how to leverage these financial tools to …

#HELOC#Home Equity Line of Credit#HE Loans#Investment Properties#Real Estate Investing#Property Investment#Financial Tools#Cash Flow#Youtube

0 notes

Text

Buying A Second House Without Selling The First 2024

Thinking about buying a beach house or a mountain getaway? Buying a second House can be a great investment for many reasons. Maybe you want to spread out your investments in real estate, have a place to relax on vacation, or even rent it out and make some extra money. There can even be tax advantages! But buying a second House while still holding onto your first one can be tricky. This article…

View On WordPress

#2nd homes#buying a second home and renting out the first#buying a second home and renting the first#buying a second home in another state#buying a second home renting the first#buying a second home to rent#buying a second house and renting the first#buying a second house without selling the first#buying second home as primary residence#can i rent my home and buy another#can i rent my house and buy another#cash out refinance#conventional loans#financial advisor#financing options#hiring a property manager#home equity loans#home into a rental#homeowners insurance#how can i rent my house and buy another#how to buy a 2nd home and rent the first#how to buy a second home and rent the first#how to buy a second home to rent#how to buy a second home without selling the first#how to buy second home and rent first#how to rent my home and buy another#how to rent my house and buy another#how to rent out house and buy another#how to rent out your home and buy another#how to rent out your house and buy another

0 notes

Text

We set the standard for online mortgage lending

This is not an offer to enter into an agreement. This is not a commitment to make a loan. Not all customers will qualify. Information, rates and programs are subject to change without prior notice. All products are subject to credit and property approval. All approvals are subject to underwriting guidelines. Not all products are available in all states or for all dollar amounts.

visit here for more: Home equity cash-out

0 notes

Text

Difference Between Home Equity Loan Vs. Mortgage Loan

Mortgage

A home equity loan Understanding how a home equity loan and mortgage work and what differences they have can help you determine your options for mortgage financing

1. Purpose

2. Loan Type

3. Loan Term

4. Loan Amount

5. Tax Benefits

6. Risk

The Differences Between a Mortgage and Home Equity Loan

A mortgage is usually used to buy a house, and a home equity loan is used to tap into a home’s equity for other purposes, like debt consolidation or home improvement, but they can serve other purposes too.

For example, you can use a cash-out refinance or a first mortgage to tap into a home’s equity, and you can use a home equity loan as a part of your down payment when buying a house.

So what are the major differences?

How to Qualify

Mortgage loans and home equity loans both have the same approval process. You complete a loan application and prove that you can afford the property. Typically you’ll provide the following:

· Paystubs for the last 30 days

· W-2s for the last 2 years

· Tax returns for the last 2 years if you’re self-employed

· Bank statements for the last 2 months

· Proof of employment

Final Thoughts

A home equity loan and mortgage are similar, yet different. They are both liens on your property but have different purposes and qualifying factors.

If you’re buying a home, you’ll likely borrow a first mortgage, but as you build equity in the home, you may apply for a home equity loan to use the equity but keep the home. Either way, you’re borrowing against your home’s value. Make sure you can afford the payments and put the money to good use to make the most of your investment.

0 notes

Text

Top Reasons to Refinance Your Mortgage

Refinancing a mortgage is a financial strategy that many homeowners consider at some point in their homeownership journey. Essentially, it involves replacing your existing mortgage with a new one, often on more favorable terms. Refinancing can be a powerful tool for managing your financial future, and there are several compelling reasons why homeowners choose to do it. In this blog post, we'll explore the top reasons to refinance your mortgage.

1. Lower Interest Rates

One of the most common reasons homeowners refinance their mortgages is to secure a lower interest rate. When interest rates drop below the rate on your current mortgage, it can be an excellent opportunity to refinance and reduce your monthly payments. Lower interest rates can save you thousands of dollars over the life of your loan, making it a financially savvy move. 2.Reduce Monthly Payments

If your current mortgage payments are straining your monthly budget, refinancing can help ease the burden. By extending the loan term or securing a lower interest rate, you can reduce your monthly payments, providing more breathing room for your finances. This can be especially beneficial during times of economic uncertainty or when facing unexpected expenses. 3.Shorten the Loan Term

Conversely, some homeowners choose to refinance to shorten the loan term. Switching from a 30-year to a 15-year mortgage, for example, can help you build equity faster and pay off your home sooner. While monthly payments may increase in this scenario, you'll save significantly on interest over the life of the loan.

For more information visit → https://learnwithvm.com/

#Mortgage Refinancing#Lower Interest Rates#Reduce Monthly Payments#Shorten Loan Term#Access Home Equity#Cash-Out Refinance#Fixed-Rate Mortgage#Remove PMI#Improve Credit Score#Debt Consolidation

1 note

·

View note

Text

Unlock the value of your home and get the funds you need! With flexible terms and low interest rates, our Home Equity Loans are a smart way to finance your next big project or investment.

0 notes

Text

6.8% Cap Rate In LA! + Hotel 101 + U.S. Mortgage Rates + Turning Home Equity Into Cash

GMG | Investor

[Super rare] Newly-constructed multi-family unit in Los Angeles with a 6.8% cap rate!

4 Units x 5 bedrooms + 5 bathrooms + attached garage (total 20 bedrooms!). Approximate Lot Size: 7,499 sq. ft. Year Built: 2024

The property will be delivered with a 5-year master lease with government-assisted transitional housing organization.

Located just 0.2 miles from the University of Southern California's Health Sciences Campus and offers easy commutes to Downtown Los Angeles, Mid-City, and the Westside.

The 2024 construction ensures no deferred maintenance and strong in-place income. The property will be delivered fully occupied through 2024-2029, providing investors with immediate stabilized cash flow greater than 6.8% cap rate on current income.

Projected Monthly Rent: Y1 $23,000; Y2 $23,690; Y3 $24,400; Y4 $25,132; Y5 $25,886

Contact me directly for detailed pricing and tailored financing options.

Hotel101

Last week, I hosted a webinar with Hotel101, a company offering the opportunity to invest in 'hotel' rooms in the form of freehold condo titles and a share of the gross room revenues, with NO expenses or operational and maintenance responsibilities.

They are positioned as a 3-star hotel with 5-star amenities in super popular locations such as Niseko and Madrid. Owners also get free nights each year at the hotels! Watch the video to learn more, or contact us here!

U.S. Mortgage Rates

Last week saw the lowest mortgage rates in the past 15 months. The difference in year-on-year mortgage payments (Sep 2023 vs Sep 2024) is about $300 a month or $3,600 a year, all things equal.

The current CHIPS Act is creating many jobs in the U.S., and this gentrification is driving home prices in the Midwest, where chip manufacturers are building their facilities - each responsible for well over 10,000 new jobs. We just met a couple buying homes in a midwest town where Google has their data centres and Intel is building a semiconductor fab - in this popular midwest town, home prices have doubled in the last few years.

Many of these skilled labourers will need to rent, and this theme is consistent throughout the U.S. It's never been a better time to be a landlord in the U.S.

Our Foreign National mortgage rates are very low, and you qualify ONLY on rental income, not your personal income; super easy.

Bridging Loans

Using your home equity for cash has been a useful way to generate liquidity when you need it! Our clients use this for tuition, renovations, paying down high-interest debt, or personal investments! We offer these loans in Singapore, the U.S., the U.K., and Australia!

Happy Hunting!

www.gmg.asia

0 notes

Video

youtube

How Wall Street Priced You Out of a Home

Rent is skyrocketing and home buying is out of reach for millions. One big reason why? Wall Street.

Hedge funds and private equity firms have been buying up hundreds of thousands of homes that would otherwise be purchased by people. Wall Street’s appetite for housing ramped up after the 2008 financial crisis. As you’ll recall, the Street’s excessive greed created a housing bubble that burst. Millions of people lost their homes to foreclosure.

Did the Street learn a lesson? Of course not. It got bailed out. Then it began picking off the scraps of the housing market it had just destroyed, gobbling up foreclosed homes at fire-sale prices — which it then sold or rented for big profits.

Investor purchases hit their peak in 2022, accounting for around 28% of all home sales in America.

Home buyers frequently reported being outbid by cash offers made by investors. So called “iBuyers” used algorithms to instantly buy homes before offers could even be made by actual humans.

If the present trend continues, by 2030, Wall Street investors may control 40% of U.S. single-family rental homes.

Partly as a result, homeownership — a cornerstone of generational wealth and a big part of the American dream — is increasingly out of reach for a large number of Americans, especially young people.

Now, Wall Street’s feasting has slowed recently due to rising home prices — even the wolves of Wall Street are falling victim to sticker shock. But that hasn’t stopped them from specifically targeting more modestly priced homes — buying up a record share of the country’s most affordable homes at the end of 2023.

They’ve also been most active in bigger cities, particularly in the Sun Belt, which has become an increasingly expensive place to live. And they’re pointedly going after neighborhoods that are home to communities of color.

For example, in one diverse neighborhood in Charlotte, North Carolina, Wall Street-backed investors bought half of the homes that sold in 2021 and 2022. On a single block, investors bought every house but one, and turned them into rentals.

Folks, it’s a vicious cycle: First you’re outbid by investors, then you may be stuck renting from them at excessive prices that leave you with even less money to put up for a new home. Rinse. Repeat.

Now I want to be clear: This is just one part of the problem with housing in America. The lack of supply is considered the biggest reason why home prices and rents have soared — and are outpacing recent wage gains. But Wall Street sinking its teeth into whatever is left on the market is making the supply problem even worse.

So what can we do about this? Start by getting Wall Street out of our homes.

Democrats have introduced a bill in both houses of Congress to ban hedge funds and private equity firms from buying or owning single-family homes.

If signed into law, this could increase the supply of homes available to individual buyers — thereby making housing more affordable.

President Biden has also made it a priority to tackle the housing crisis, proposing billions in funding to increase the supply of homes and tax credits to help actual people buy them.

Now I have no delusions that any of this will be easy to get done. But these plans provide a roadmap of where the country could head — under the right leadership.

So many Americans I meet these days are cynical about the country. I understand their cynicism. But cynicism can be a self-fulfilling prophecy if it means giving up the fight.

The captains of American industry and Wall Street would like nothing better than for the rest of us to give up that fight, so they can take it all.

I say we keep fighting.

712 notes

·

View notes

Text

Sell House Fast Seattle: Marmot Buys Homes Eliminates Closing Delays

youtube

Want to sell your house fast in Seattle? Marmot Buys Homes makes it easy by eliminating closing delays and simplifying the entire process. You avoid traditional hassles like market comparisons and lengthy negotiations. With Marmot, you get immediate cash offers reflecting true market value, allowing you to move forward quickly and stress-free. This lets you explore future opportunities without the usual real estate headaches. Discover how they can transform your selling experience next.

The Traditional Home Selling Process vs. Marmot's Approach

When comparing the traditional home selling process with Marmot's approach, you might notice significant differences that can impact your selling experience. In a conventional sale, you face lengthy market comparisons, waiting for the perfect buyer. It's a dance of endless showings, inspections, and negotiations, which can feel impersonal and drawn out. Marmot, however, offers a revitalizing personal touch. They prioritize your needs, making the home selling journey smoother and more efficient. You avoid the hassle of market comparisons, as Marmot simplifies the process, focusing on your unique circumstances. Trust Marmot to transform a challenging task into a seamless experience.

How Marmot Buys Homes Offers Immediate Cash Offers

While maneuvering through the complexities of selling your home, Marmot offers a straightforward solution with their immediate cash offers. Imagine bypassing the drawn-out traditional process and stepping into instant transactions that fulfill your immediate needs. Marmot understands your urgency and provides cash offers that reflect market value, ensuring a fair deal. By choosing this path, you're not just selling a home; you're embracing simplicity and speed without the usual hassle. Marmot's seamless approach means you can focus on your next chapter, knowing a reliable partner's got your back, ready to make the process as smooth and efficient as possible.

The Benefits of a Stress-Free, Quick Home Sale

Having explored Marmot's immediate cash offers, let's consider the broader advantages of a stress-free, quick home sale. Envision this: you're unburdened by the usual selling anxiety, enjoying genuine stress relief. With Marmot, you can sidestep lengthy negotiations and tedious paperwork, freeing your mind and time. It's not just about ease; it's about gaining financial freedom swiftly. Imagine the liberation that comes with immediate cash in hand, empowering you to pursue new opportunities or settle debts without delay. You're not just selling a house; you're embracing a future where you call the shots, stress-free and financially unshackled.

Avoiding Common Pitfalls in Seattle's Real Estate Market

Steering through Seattle's real estate market can be challenging, but understanding common pitfalls helps you avoid costly mistakes. First, keep a close eye on market trends. Seattle's dynamic landscape means prices can shift rapidly, affecting your home's value. Ignoring these trends might lead you to overprice or underprice your property.

Second, adopt smart pricing strategies. Set a realistic price reflecting current conditions to attract serious buyers quickly. Emotional attachment can cloud your judgment, so rely on data and expert advice. By staying informed and flexible, you'll navigate Seattle's market with confidence, ensuring you get the best deal possible.

Success Stories: Homeowners Who Sold Quickly With Marmot

Because selling a home swiftly in Seattle's competitive market can seem challenging, many homeowners have turned to Marmot for assistance. You'll find comfort in homeowner testimonials that rave about quick transactions and stress-free experiences. Imagine listing your home one day and closing the deal soon after, without the usual headaches. That's the Marmot promise.

Take Sarah, for instance. She needed to relocate fast. Marmot offered a fair price, and within days, her home was sold. Or consider Mike, who was overwhelmed by the traditional market's demands. Marmot stepped in, and his quick transaction relieved his worries. You could be next.

#foreclosure help Seattle#mortgage assistance Seattle#best mortgage assistance Seattle#sell underwater house Seattle#sell house fast Seattle#sell house fast Seattle WA#cash home buyers Seattle#property liquidation Seattle#selling house no equity Seattle#mortgage help Seattle#quick home sale Seattle#sell house for cash Seattle#Youtube

0 notes

Note

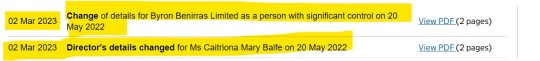

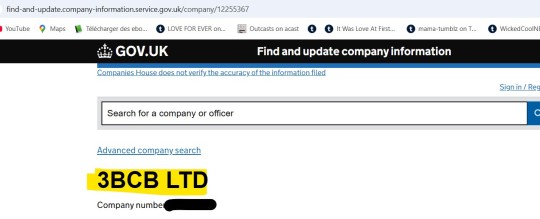

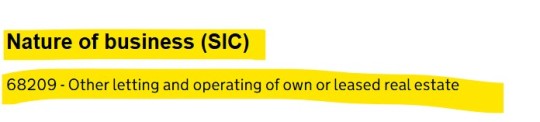

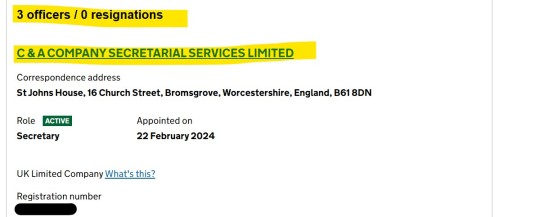

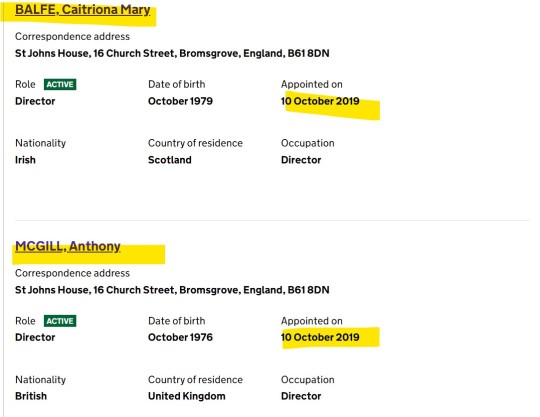

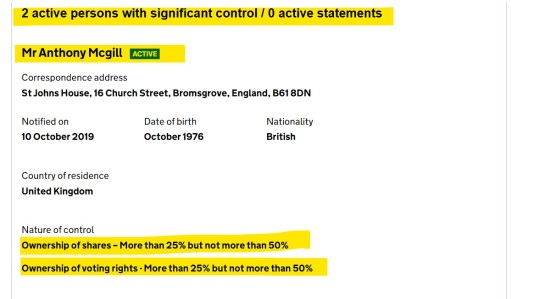

So now Tony is listed as director at all of Cait‘s companies. What do you think about that?

Dear So Now Anon,

What a coincidence (not!) I just answered a very similar Anon sent to @bat-cat-reader, which I suppose is clear enough.

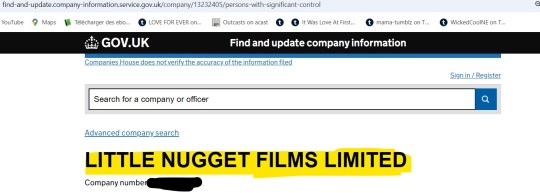

But to make it even clearer (if at all possible) and keeping in mind what I wrote in that post about Persons of Significant Control, let's check a couple of things, shall we? For all the three other companies C owns.

They probably split 50/50 already, which would explain the rather vague 'has significant influence or control'. Why?

Here is why:

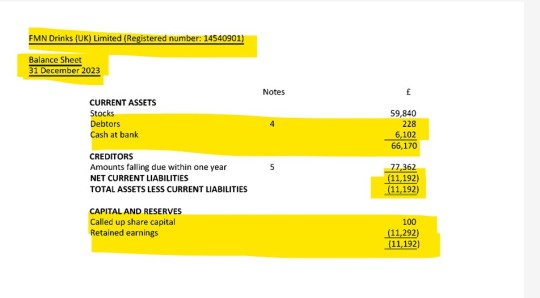

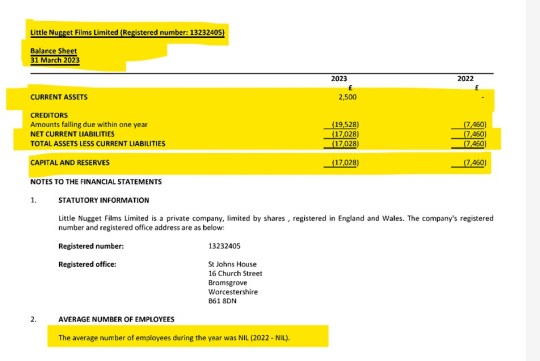

The currently available Balance Sheet, covering the period until 31 December 2023 shows there is not much in there. Barely 100 shares (1£/share), about 59K £ assets and 11 K £ of debts. May I remind you a balance sheet covers the company's assets (available funds, including incoming funds), liabilities (debts) and shareholder equity (the company's net worth, which is roughly the result of subtracting liabilities from assets and dividing them by the number of shareholders). The net worth serves to describe what each and every one of those shareholders are entitled to, should the company be liquidated and all its debts paid off. In this case, the retained earnings, which is the figure quoted between brackets (11.292 £) means the company is in debt/in the red.

Now, this is very interesting, Anon. Albeit The Happy Couple ™ are now both appointed officers in this company (and T has been so since October 1st 2024), this company's designated PSC is ... Byron Benirras. And who is Byron Benirras' own designated sole PSC? A certain Caitriona Mary B. That is normal - serious 💷💷is indirectly involved, this time, as we know the bulk of her assets is placed there. Therefore, C has full control and sole ownership of Little Nugget Films, too, via Byron Benirras. Remember (ROFLMAO): a legal person (i.e. a company, in this context) has the same rights and the same obligations/duties as the natural (meaning 'real') person behind it (C).

Let's have a look at financials:

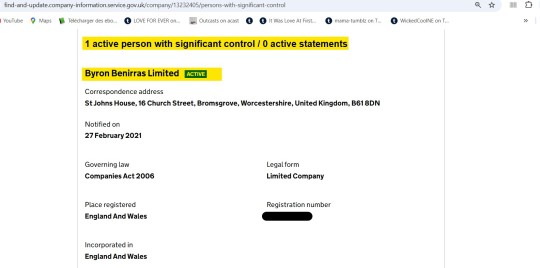

On 31.03.2023, the company's assets were about 2.500 £ only and its liabilities around 17K£. In debt/in the red, too. But a clear will to remain in firm control of things from C's side.

This appears to be a totally, carefully planned move, too - future plans, perhaps?

This company has not two, but three appointed officers, one of which is another specialized service company (perfectly legal, in the UK), in charge of all the secretarial work (perfectly legal, too):

Not one, but two PSCs. Same mechanism as for FMN Drinks UK (see above):

Such a nice, tidy, even split. Why? Heh, indeed: why? Unless...

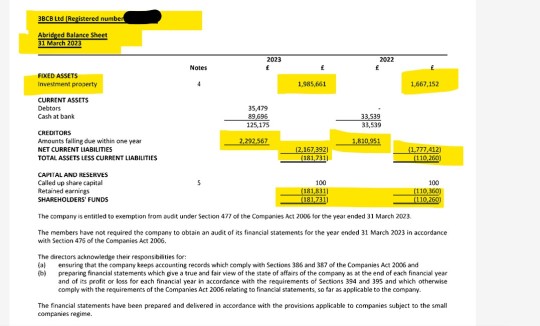

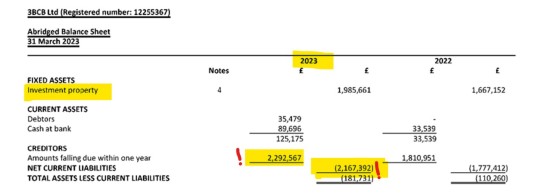

Let's have a look at the company's balance sheet on 31 March 2023:

Unless you do acquire real estate using your own funds (a very easy cross check with another one of C's companies reveals the exclusive provenance of those funds - sssh!), no mortgage and no bank loan needed. Property that is legally defined as investment property, which means it cannot legally be a home, nor taxed as such:

[Source: https://prosperity-wealth.co.uk/news/before-you-buy-investment-property/]

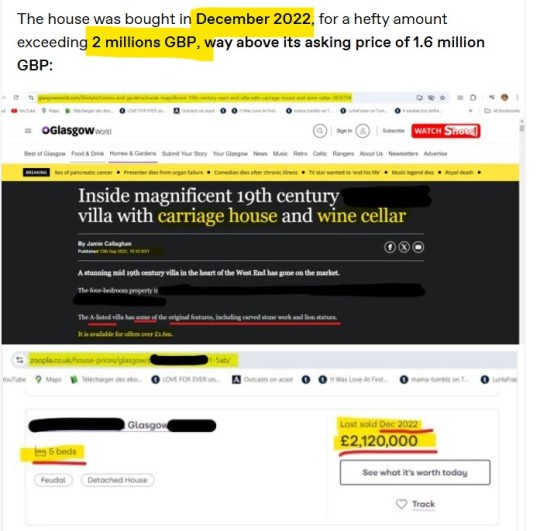

Now remind me what real estate might have been bought anytime between 31 March 2022 and 31 March 2023 and valued at about 2.120.000 £?

You'd probably be correct to guess this one:

[ For a complete tour of the GLA Taj Mahal's legal intricacies: https://www.tumblr.com/sgiandubh/764266729372368897/anon-rebelde-detecto-un-nerviosismo-muy-revelador?source=share]

Let's have a second look and, surely enough...

Some simple maths?

2.292.567 (amounts falling due within one year, which covers the 31.03.2022 -31.03.2023 period) - 2.167.392 (net current liabilities) = 125.175 £ (cash at bank). Roger that. I think there is also a second investment property, bought before 31 March 2022 for 1.6 million pounds and shown as such (valued at cost first, then at its fair value, which is evaluated at 1.9 million pounds, in 2023 - a nice appreciation of the initial investment).

I hope this answers your question, Anon. And given the very long and very emotional day that ended (whew, already?) about four hours ago, I hope I didn't miss something or make any gross mistake. You know how some other Anons can be, don't you?

76 notes

·

View notes

Text

What Do You Mean by Cash Out Home Equity?

Opting to cash out your home equity should be a strategically made decision grounded in a solid understanding of your financial health, goals, and the current housing market. Before you leap, consider consulting with a financial advisor, and scrutinize every angle to ascertain that this move aligns with your long-term financial plans.

1 note

·

View note

Text

In 1901, Bert Williams and George Walker recorded their music for the Victor Talking Machine Company, becoming the first black recording artists.

They also performed the first black musical comedy (titled In Dahomey) on Broadway.

After Walker’s death, Williams became a star in his own right, with Theatre Magazine calling him “a vastly funnier man than any white comedian now on the American stage.”

He became the first black actor to appear in a movie while writing, directing and starring in the 1916 films, A Natural Born Gambler and Fish. He was so popular he even performed for King Edward VII at Buckingham Palace.

Although he managed to break down barriers, much prejudice remained. He couldn’t reconcile the praise he received onstage with the racist treatment he received offstage.

Barred from joining the Actors Equity in New York, he became depressed and drank heavily. He performed the song, “Nobody,” later covered by artists from Nina Simone to Johnny Cash. W.C. Fields called Williams “the funniest man I ever saw and the saddest man I ever knew.”

He never missed a performance and on February 25, 1922, collapsed halfway through an evening show in Chicago. He died a week later at his home in New York City. He was only 47.

22 notes

·

View notes