#hire CFO

Explore tagged Tumblr posts

Text

KEELEY JONES THE WOMAN THAT YOU ARE!!!!!

#keeley jones#ted lasso spoilers#ted lasso#listen….the lizzo soundtrack moment at the beginning#wanting to do a chant under a blood moon with her new coworkers as a bonding experience#hiring her besties. we LOVE women supporting women!!!!!#and you know she’s going to buy that buzzkill CFO a snowglobe <3#I LOVE HER#I ADORE HER WITH MY WHOLE HEART

5 notes

·

View notes

Text

CFO Hiring: How to Find the Right Finance Leader

Introduction

Any company needs to have the appropriate Chief Financial Officer. A chief financial officer refers to finance as it relates to the strategic growth and long-term financial security within an organization. What is the right choice for an extremely competitive market, then? It is going to walk you through CFO hiring, recruitment of a chief financial officer, and chief financial officer recruitment, which will guide you on the best way to ensure that you bring the best person to take the reins over finances in your company.

Role of a CFO

It is the one person in control of a company's finances. A CFO will handle budgeting, financial planning, and strategizing for risk management and making financial decisions. A good CFO ensures a business stays profitable and compliant with financial regulations.

Why Your Business Needs a CFO

The benefits go to small and big businesses brought in by fruits of CFO to correct every matter related to financial matters concerning an organization's finance, risk controlling, long-term growth capital enhancement, etc. Businesses, to a very certain extent, would not stand having stable financial standards without this financial leadership in good order.

When is the Right Time to Hire a CFO?

Not every business requires a CFO right from day one. But, if your business is growing at an aggressively aggressive rate, or planning to get listed, or financially distressed, then this is the perfect time to invest in hiring a CFO.

CFO Hiring vs. Outsourcing: What’s Best for You?

Others prefer fractional CFO or outsource instead of having an in-house CFO. Still, that would depend on budget, size of business, and complexity in the finance field. If working on long-term strategy, a full-time CFO would be very much welcomed. However, to maintain costs, smaller firms will find it best to have an outsourced CFO.

Essential Qualifications of a CFO

To recruit a CFO, there is an indispensable key qualification:

Financial expertise – All about financial reporting, budgeting and forecasting.

Strategic thinking – Deep understanding on how the business plan works in place of the financial goals.

Leadership skills – Managing teams and driving company-wide financial strategies.

Risk management – Steps to be actually taken to avert possible risks to the company's finances.

Tech-savviness – Awareness regarding financial software etc. and tools of data analytics.

Where to look for the Best CFO Candidates

Finding the right CFO candidate may not be an easy task. Here are a few leads:

Executive search firms specializing in CFO recruitment

Networking events and industry conferences

LinkedIn and job boards

Referrals from industry professionals

The Process of Hiring a CFO: Step-by-Step Guide to Hire a CFO

Hiring a CFO involves several critical steps:

Identify the job description and what exactly it entails

Identify key qualifications and experience.

Source potential candidates through recruitment firms or job postings.

Conduct interviews and assess skills.

Perform background and reference checks.

Extend an offer and negotiate compensation.

Onboard and integrate the new CFO into the company culture.

Questions to Ask During a CFO Interview

To assess a candidate’s suitability, ask:

Can you share an example of how you improved financial efficiency in a previous role?

How do you approach risk management?

What financial strategies have you implemented to support business growth?

How do you manage financial crises?

What experience do you have with mergers, acquisitions, or fund raising?

Avoid the Mistakes of CFO Recruitment

Avoid these pitfalls:

Hiring based solely on industry experience rather than strategic capability.

Rushing the process without proper vetting.

Ignoring cultural fit within the company.

Overlooking the importance of soft skills.

Onboarding and Retaining Your New CFO

Once you hire a CFO, ensure a smooth transition:

Provide clear expectations and company insights.

Encourage collaboration with leadership teams.

Offer continuous professional development opportunities.

Promotion of a strong company culture for long-term retention.

Future of CFO Recruitment

Evolution of CFO roles through digital transformation.The modern CFO needs to be not only tech savvy and data led but must also use AI and automation proactively to gain insights from financial data.

Final Thoughts and Best Practices

Regardless of the path, getting the right CFO is a guarantee for success on the financial end. You can go to an executive search firm like Alliance Recruitment Agency or leverage internal recruiting capabilities while staying strategic thought leaders and having great finance competencies. If you need expert guidance in finding the right CFO for your business, contact us today for professional assistance.

View source: https://allianceinternationalservices.medium.com/cfo-hiring-how-to-find-the-right-finance-leader-a8244c4b471a

0 notes

Text

The Benefits Of Hiring A Fractional CFO For Small Businesses

Hiring a fractional CFO offers small businesses access to high-level financial expertise without the cost of a full-time executive. A fractional CFO provides strategic financial planning, helps improve cash flow management, and offers insights into cost-saving opportunities. They also assist with budgeting, forecasting, and preparing for growth, ensuring business owners make informed, data-driven decisions.

0 notes

Text

Hire a CFO - The Key to Unlocking Your Business Potential

Every business, whether a startup or an established company, faces financial complexities that require expert guidance. Managing finances effectively is crucial for growth and sustainability. But how do you ensure you have the right financial strategy in place? The answer is simple - hire a CFO. At Nperspective, we provide access to highly experienced Chief Financial Officers who can offer invaluable insights, helping businesses navigate financial challenges.

Why Should You Hire a CFO?

A CFO is more than just a financial expert; they are strategic partners who shape the financial direction of your business. When you hire a CFO, you gain access to expertise in financial planning, risk management, and long-term growth strategies. For businesses looking to scale or streamline operations, a CFO's contribution is invaluable.

At Nperspective, our CFOs work with companies of all sizes, ensuring they have the financial structure and strategies to succeed in their industry. Whether you need a fractional, interim, or full-time CFO, Nperspective offers flexible solutions to meet your specific needs.

The Benefits of Hiring a CFO

When you hire a CFO, you're not just filling a position — you're making a strategic decision that can significantly impact your business. Here are a few key benefits:

Strategic Financial Leadership

A CFO plays a vital role in helping businesses make informed financial decisions. From cash flow management to long-term planning, a CFO provides the strategic oversight that ensures financial stability and growth.

Risk Management

A well-structured risk management plan is essential for any business. When you hire a CFO, they implement risk management strategies that protect your business from unforeseen challenges. With Nperspective, our CFOs ensure your business is equipped to handle market fluctuations and regulatory changes.

Enhanced Investor Confidence

Investors seek companies with robust financial leadership. By choosing to hire a CFO, you signal to investors that your company is serious about financial stability and growth. A CFO helps build credibility and ensures your business is in the best possible financial shape.

When is the Right Time to Hire a CFO?

The right time to hire a CFO varies depending on the size and complexity of your business. However, if you're experiencing rapid growth, struggling with cash flow management, or planning for mergers and acquisitions, it's a sign that you need financial leadership. Nperspective provides CFO services tailored to your business needs, ensuring you have the expertise to guide your company through every financial challenge.

Conclusion

Making the decision to hire a CFO is a significant step in driving your business forward. At Nperspective, we specialize in providing CFO services on a fractional, interim, or project basis, giving businesses access to the financial expertise they need without the full-time commitment. Whether you're seeking strategic financial advice or need hands-on leadership for a specific project, Nperspective's CFOs are here to help you succeed.

Take control of your business's financial future. Hire a CFO today and unlock the full potential of your business with Nperspective’s expert financial leadership.

For more information, visit our website.

0 notes

Text

CFO Recruiters

Are you searching for top-tier CFO recruiters? Stop searching anymore! Elite Search can connect you with exceptional financial leadership talent. Contact us today for more information.

Ph: 778 846 5374

Mail: [email protected]

0 notes

Text

How CFO Financial Services Drive Financial Stability and Risk Management

In today’s fast-paced business world, maintaining financial stability while managing risks is essential for companies of all sizes. Financial stability ensures that a business can operate smoothly, even in challenging times, while risk management helps prevent or minimize potential financial pitfalls. One of the most effective ways to achieve both is by leveraging CFO financial services.

Understanding CFO Financial Services

CFO financial services encompass a wide range of financial management activities provided by experienced financial professionals. These services can be offered by an in-house CFO or outsourced to a specialized firm. The primary role of CFO financial services is to oversee and manage a company’s financial operations, ensuring that the business remains financially healthy and compliant with all regulations.

The Role of CFO Financial Services in Financial Stability

Strategic Financial Planning

One of the core functions of CFO financial services is strategic financial planning. This involves developing long-term financial goals and creating a roadmap to achieve them. A CFO will analyze the company’s financial data, assess market trends, and consider potential challenges. Based on this analysis, they will create a comprehensive financial plan that aligns with the company’s objectives. This plan helps ensure that the business has a clear financial direction, which is crucial for maintaining stability.

Cash Flow Management

Cash flow is the lifeblood of any business. Without adequate cash flow, a company may struggle to pay its bills, invest in growth opportunities, or even stay afloat. CFO financial services play a critical role in managing cash flow effectively. A CFO will monitor the company’s cash inflows and outflows, identify potential cash flow issues, and implement strategies to maintain a healthy cash balance. This proactive approach helps prevent cash shortages and ensures that the business can meet its financial obligations.

Budgeting and Forecasting

Creating and adhering to a budget is essential for financial stability. CFO financial services include developing a realistic budget that reflects the company’s revenue and expenses. A CFO will also perform regular financial forecasting to predict future financial performance based on current data and trends. These forecasts allow the business to make informed decisions and adjust its budget as needed to stay on track. By keeping a close eye on the budget and forecasts, CFOs help companies avoid overspending and ensure that financial resources are allocated wisely.

Cost Management

Controlling costs is another critical aspect of financial stability. CFO financial services involve analyzing the company’s expenses and identifying areas where costs can be reduced without compromising quality or efficiency. This might include renegotiating contracts with suppliers, optimizing operational processes, or finding more cost-effective solutions. By keeping costs under control, CFOs help businesses maximize their profitability and maintain financial stability.

Financial Reporting and Compliance

Accurate and timely financial reporting is essential for making informed business decisions and maintaining trust with stakeholders. CFO financial services ensure that all financial reports are prepared in compliance with accounting standards and regulations. A CFO will oversee the preparation of financial statements, such as balance sheets, income statements, and cash flow statements. These reports provide a clear picture of the company’s financial health and help identify any potential issues early on. Additionally, ensuring compliance with financial regulations reduces the risk of legal and financial penalties, contributing to overall financial stability.

The Role of CFO Financial Services in Risk Management

Identifying Financial Risks

Risk management begins with identifying potential financial risks that could impact the business. CFO financial services involve conducting thorough risk assessments to identify both internal and external risks. Internal risks might include inefficiencies in operations, cash flow issues, or exposure to bad debt. External risks could involve changes in market conditions, economic downturns, or new regulations. By identifying these risks early, CFOs can develop strategies to mitigate them before they become significant problems.

Developing Risk Mitigation Strategies

Once potential risks are identified, the next step is to develop strategies to mitigate them. CFO financial services include creating risk management plans that outline specific actions to reduce or eliminate risks. For example, a CFO might implement stronger internal controls to prevent fraud, diversify the company’s investment portfolio to reduce exposure to market volatility, or set aside reserves to cover unexpected expenses. These strategies help protect the company’s financial health and ensure that it can weather any challenges that arise.

Monitoring and Managing Risks

Risk management is an ongoing process. CFO financial services involve continuously monitoring the company’s financial environment to identify new risks or changes in existing ones. A CFO will regularly review financial data, market conditions, and industry trends to stay informed about potential threats. If a new risk emerges, the CFO can quickly adjust the company’s risk management plan to address it. This proactive approach ensures that risks are managed effectively and that the business remains resilient in the face of challenges.

Insurance and Risk Transfer

Another important aspect of risk management is transferring risk through insurance. CFO financial services include evaluating the company’s insurance needs and ensuring that it has adequate coverage. This might involve purchasing liability insurance, property insurance, or other types of coverage that protect the business from financial losses. By transferring some of the financial risks to an insurance provider, CFOs help safeguard the company’s assets and reduce the potential impact of unforeseen events.

Crisis Management

Despite the best efforts to manage risks, unexpected crises can still occur. fractional CFO services include preparing for such scenarios by developing crisis management plans. These plans outline the steps the company will take in the event of a financial crisis, such as a sudden loss of revenue, a major legal issue, or a natural disaster. A well-prepared crisis management plan helps the company respond quickly and effectively, minimizing the financial impact and ensuring that the business can recover as smoothly as possible.

Conclusion

CFO financial services play a crucial role in driving financial stability and managing risks for businesses. By providing strategic financial planning, effective cash flow management, budgeting, cost control, and financial reporting, CFOs help ensure that a company remains financially healthy and resilient. Additionally, by identifying, mitigating, and managing risks, CFO financial services protect the business from potential threats and enable it to navigate challenges with confidence. For companies looking to achieve long-term success, leveraging the expertise of CFO financial services is a smart and essential investment.

#outsourced cfo firms#cfo outsourced services#fractional cfo services#hire fractional cfo services#fractional financial services#cfo financial services

1 note

·

View note

Text

can our ceo stop hiring his friends and his friends kids

#our CFO and a couple of our directors were his friends like even before they started and he brought them in#and we're hiring a marketing position thats probably gonna go to one of his friends kids#and like they're all qualified but it just makes me angry that other people arent getting a fair shake#work tag

0 notes

Text

Hire Virtual CFO | Best Virtual CFO Services in India

Hire Virtual CFO services from StartupFino for expert financial guidance in India. Perfect for startups and organizations lacking an in-house CFO, our virtual CFO services include strategic planning, cash flow forecasting, budgeting, audit support, and compliance management. Ensure informed decisions with the best virtual CFO services in India.

0 notes

Text

Hiring a Virtual CFO I EaseUp

Discover the benefits of hiring a virtual CFO and follow the step-by-step process to find the ideal candidate for your company. With the help of a Virtual CFO, you can optimize your finances, drive growth, and make more informed decisions. Discover how outsourcing your financial management can help your business today.

0 notes

Text

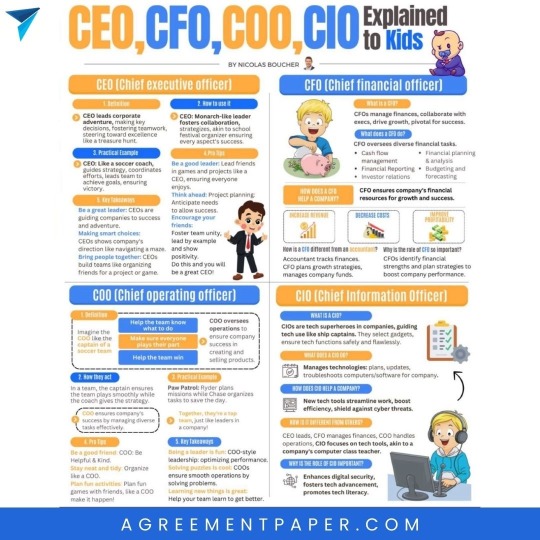

Agreementpaper

How to explain C-level roles to your #kids? Do you agree with these definitions? 👉 Visit now.

#CEO#cio#cfo#business#coach#teamlead#businessmanagement#job#hire#remotejob#naukri#CIO#entrepreneur#entrepreneurship#softwaredevelopment#softwarecompany#softwareengineering#latesttrends#agreementpaper

0 notes

Text

Supercharge your startup's financial strategy by hiring a Virtual CFO from Startup Fino. Our experienced CFOs provide expert guidance and planning to drive your business forward. Visit Hire Virtual CFO to access top-tier financial expertise on a flexible basis.

0 notes

Text

CFO Hiring Solutions: How to Find the Best Fit for Your Company

The Chief Financial Officer, by any measure, can be a make or break figure in a business. You wouldn't give your business to just about anyone who thinks they are right for the task; CFO recruitment requires equal deliberation and contemplation. The need may vary-whether it's a start-up seeking leadership, or a growing business trying to cut out more efficient operational layers, recruiting a CFO is something you have to do right.

In this article, we’ll dive into the CFO hiring solutions and explore how businesses can find the best fit for their unique needs. With expert insights on CFO recruitment, staffing, and how to navigate the hiring process, you’ll be empowered to make informed decisions that can drive your company’s growth.

What is a CFO and Why is Their Role Critical for Your Business?

The Chief Financial Officer abbreviated as CFO stands among the precious positions in an organization. She or he should be able to manage the financial operations within your firm meaning planning, risk management, records keeping plus financial reporting. The good chief financial officer keeps a company well placed financially stable with track going toward the business. As such, compare it to that of the captain of the ship.

Without an expert CFO, the business may lose control of its finances, miss some opportunities, or even make costly mistakes. Hence, CFO hiring is not a position to be filled but someone to be hired in to guide your business through every financial challenge.

Key Traits to Look for in a CFO

Some of the most important qualities must come out when looking to select a CFO. Get those who not only show technical know-how but strategic thinking. The following are some of the major traits to look for:

Financial Acumen: Deep familiarity with financial management, this includes financial statements, forecasting, and budgeting.

Leadership: Leadership and inspiring teams, making the right decisions in line with the overall strategy of the company.

Problem-Solving Skills: A CFO should be able to identify financial challenges and implement solutions that align with business objectives.

Adaptability: Today's fast-changing market requires this one most important adaptation. A good CFO should always pivot on fast-changing business environment.

How to Start the CFO Search Process

First and foremost, you want to understand whether your company would require a financier who can manage a day-to-day basis or lead strategically to drive your business forward. After defining that role, search for candidates or seek the recruitment agencies that find CFOs using targeted searches; you can also explore your network with recommendations.

Benefits of CFO Recruitment Agencies

Recruitment agencies are specialists in finding the best financial executives for businesses. They have deep market knowledge and would thus be able to help you find the right candidates who suit your company culture and financial needs. You will save time and effort since a recruitment agency will do all the hard work of sifting and checking candidates so that you only interview the best.

Internal vs. External CFO Hiring

Businesses sometimes need to opt to hire a CFO from within the company or outside of it. Sometimes, hiring someone from within means bringing on board an individual who understands the culture of the company and its operations. Externally hired individuals are newcomers, and they bring fresh perspectives and new ideas on board. Weigh your pros and cons very well to see whether this will help your company succeed in the long term.

CFO Staffing: A Flexible Option for Growing Businesses

For a transitioning small business or company, a flexible staffing alternative for access to a CFO can be available. With temporary or part-time CFO staffing, temporary or part-time CFO staffing services might provide the best financial know-how without your committing to a long-term arrangement. Some good reasons that companies tend to shift during growth and restructuring apply to their reason for moving towards CFO staffing.

The Role of a CFO in Strategic Decision Making

As a constituent part of the leadership team involved in setting and working on company goals, the chief financial officer has been able to shape strategy through his insights that can help define data-driven risk and opportunity views from a monetary perspective-be it in mergers and acquisitions or managing cash flows and so many other initiatives.

When Should You Consider Hiring a CFO?

There are several key moments when a business should consider bringing a CFO onboard:

When you’re ready to scale your operations and need expert financial planning.

If you’re going through significant growth or restructuring.

When you want to manage your cash flow and get ready for an IPO.

CFO Recruitment Process: Step-by-Step

A CFO recruitment process usually follows this sequence:

Define the Role: Specify the requirements and objectives of the CFO role.

Search for Candidates: Internal resources, networks, or a recruitment agency.

Interview and Assess: Based on skills, experience, and cultural fit.

Make an Offer: Once the right candidate is identified, extend an offer.

How to Assess a CFO Candidate's Fit for Your Company

Evaluate the CFO by not only considering technical capability but also leadership capability. Ask him what experience he has had managing a similar company, and how he has dealt with financial issues in the past. Cultural fit matters too; an ideal CFO would share your firm's values and vision.

Understanding CFO Compensation and Benefits Packages

CFO compensation packages vary widely with company size and industry. Overall, the core components are the base salary, bonuses, equity options, and benefits. This is where a negotiation will probably be necessary and based on their level of experience and expertise being brought to the table.

Role of Cultural Fit in CFO Appointment

Cultural fit is a significant consideration when hiring a CFO. Since a CFO who aligns with the values and vision of your company is more likely to drive the business forward, assess during interviews how well candidates know and will be aligned with your company's mission and culture.

Common Mistakes to Avoid in Hiring CFO

Other mistakes to avoid in the process of CFO hiring may include:

Focusing just on technical knowledge and not factoring in the leadership skills required.

Hastiness in recruitments – taking time to know the right talent.

Lack of proper clarification of the position and expectations while hiring.

How To Onboard Your New CFO Successfully

The onboarding process is key to ensuring your new CFO succeeds. Provide them with the necessary tools, resources, and company insights to get up to speed quickly. Clear communication and support from the rest of the leadership team are critical.

Conclusion: Finding the Perfect CFO for Your Business

It is one of the most critical decisions for any company and demands very thoughtful and well-planned ideas. A structured recruitment process that includes checking up on the skills and cultural fit of candidates, along with leveraging the expertise of recruitment agencies like Alliance Recruitment Agency, will help you get the right CFO to lead your business towards financial success. For assistance with CFO hiring and expert guidance, feel free to contact us today.

View source: https://recruitmentagencyfranchise.hashnode.dev/cfo-hiring-solutions-how-to-find-the-best-fit-for-your-company

0 notes

Text

Why Businesses Should Consider Hiring A Fractional CFO?

Hiring a Fractional CFO in Marlboro, NJ is a strategic move that businesses, especially small and medium-sized enterprises (SMEs), should seriously consider. A Fractional CFO offers high-level financial expertise on a part-time or project basis, providing a cost-effective solution for companies that need financial leadership but may not have the resources to employ a full-time CFO. Here’s why businesses should consider hiring a Fractional CFO:

Cost-Effective Financial Expertise

One of the most compelling reasons to hire a Fractional CFO is the cost savings. Full-time CFOs command high salaries, along with benefits and bonuses, which can be prohibitive for smaller businesses. A Fractional CFO provides the same level of expertise at a fraction of the cost. Companies only pay for the time and services they need, making it a flexible and budget-friendly option.

Strategic Financial Planning and Analysis

Fractional CFOs bring years of experience in strategic financial planning and analysis, helping businesses make informed decisions. They assist in creating and implementing financial strategies that align with the company’s goals, whether it’s growth, profitability, or sustainability. Their insights can help businesses navigate financial challenges, optimize operations, and identify new expansion opportunities.

Cash Flow Management

Effective cash flow management is critical to the success of any business. A Fractional CFO can help businesses manage their cash flow more effectively, ensuring that there is enough liquidity to meet short-term obligations while planning for long-term investments. They can also identify and rectify inefficiencies in cash flow, such as delayed receivables or unnecessary expenditures.

Access to High-Level Financial Tools and Systems

Fractional CFOs often have access to advanced financial tools and systems that smaller businesses may not be able to afford independently. These tools can enhance financial reporting, forecasting, and budgeting processes, providing businesses with better insights and control over their finances. The implementation of these tools by a seasoned CFO can lead to significant improvements in financial management and decision-making.

Improved Financial Reporting and Compliance

Keeping up with financial reporting standards and regulatory compliance can be challenging for businesses, especially those without a dedicated finance team. A Fractional CFO ensures that financial statements are accurate, timely, and compliant with the relevant regulations. This not only helps avoid potential legal issues but also enhances the credibility of the business with stakeholders, including investors, banks, and partners.

Scalable Financial Leadership

As businesses grow, their financial needs become more complex. A Fractional CFO offers scalable financial leadership that can adapt to the changing needs of the company. Whether the business is expanding, launching new products, or entering new markets, a Fractional CFO can provide the necessary financial guidance to support these initiatives. They can also assist with fundraising efforts, mergers and acquisitions, and other significant financial decisions.

Objective Perspective

A Fractional CFO provides an objective, external perspective on the company’s financial situation. Unlike internal staff, who may be influenced by company politics or personal biases, a Fractional CFO can offer unbiased advice based on their expertise and experience. This objectivity is invaluable in making critical financial decisions that impact the future of the business.

Conclusion

Hiring a Fractional CFO offers businesses the financial expertise they need without the commitment of a full-time executive. By providing strategic financial planning, improving cash flow management, ensuring compliance, and offering scalable leadership, a Fractional CFO can play a crucial role in helping businesses achieve their financial goals. For companies looking to optimize their finances and drive growth, the benefits of hiring a Fractional CFO are clear.

0 notes

Text

You were a stranger in my phonebook I was actin' like I knew 'Cause I had nothin' to lose When the winter's in full swing and Your dreams just aren't comin' true Ain't it funny what you'll do?

When the zeros line up on the 24 hour clock When you know who's callin' even though the number is blocked When you walked around your house wearin' my sky blue Lacoste And your knee socks

The late afternoon, the ghost in your room That you always thought didn't approve Of you knockin' boots Never stopped you lettin' me get hold Of the sweet spot by the scruff of your Knee socks

You and me could have been a team Each had a half of a king and queen seat Like the beginnin' of Mean Streets You could be my baby

#Arctic Monkeys#AM#Knee Socks#music#I just finished my first week of work and this was the song playing in the lobby right before my second interview#Did I make use of a famous TL line in that interview???#Something something Mean Streets of it all#On my first day of work did I see that one thing from the show in one of the departments? You know the one.#this is a proper workplace there's a Christmas party I need to RSVP to by November 11th#and this Friday a get-together at the CFO's house for our department to get to know each other better#I'm one of two new hires for the department

0 notes