#heirloom eligible objects

Explore tagged Tumblr posts

Text

I can't wait for this light switch to be the only heirloom my sims will receive

#the sims 4#heirloom eligible objects#the sims 4 life & death#emzsimulation#simblr#the sims community#sims#sims 4#ts4#I love this new kit though#it's so colourful and fun

9 notes

·

View notes

Text

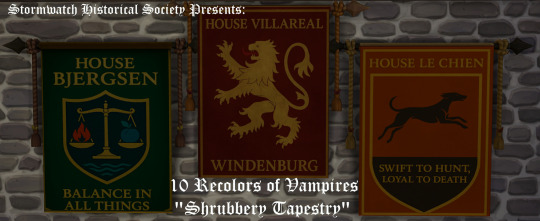

🏰 Windenburg House Crest Tapestries – CC Release

Object Type: Decorative Wall Tapestry Swatches: 10 Noble House Banners Cost: §475 Heirloom Eligible

“Established in the 14th Century, these houses have stood the test of time. Display your house crest with pride.” – Stormwatch Historical Society

Bring legacy and lore into your halls with these custom banners representing the noble houses of Windenburg. Perfect for medieval saves, noble estates, and ambitious dynasties.

🔖 Features:

Ten swatches representing unique noble houses

Custom mottos, crests, and color palettes

Historically immersive, lore-friendly design

Pairs beautifully with castle builds and legacy challenges

Environment Score: +1 (for tasteful nobility)

🧵 Included Houses:

House Attewater – By Soil, By Sea, By Steel

House Villareal – Windenburg

House Bjergsen – Balance in All Things

House Locke – All Things Yield to the Right Key

House de Gant – In Shadow, We Reign

House d’Mohun – In Service of Light

House Webb – In Service of Thread

House Hughes – No Hunt Without Honor

House Le Chien – Swift to Hunt, Loyal to Death

🎓 Curated by the Stormwatch Historical Society 📜 Built for storytelling in legacy saves

🪶 Curator’s Note: Please do not hang tapestries above active fireplaces. House Le Chien nearly had a third incident last week.

IMPORTANT!!!

This is a RECOLOR of the Shrubbery Tapestry from the VampiresGP. You will need that pack for this item to show up.

Download here:

#ts4cc#sims 4 cc#sims 4 historical cc#sims 4 medieval#sims 4 legacy challenge#medieval sims 4#stormwatch historical society#sims 4 decorative cc#ts4build#ts4medieval#sims 4 banners#ts4 noble family#sims 4 immersive gameplay#sims 4 roleplay#sims 4 castle cc#stormwatchcc#windenburg nobles#ts4 historical cc#sims 4 historical#ts4 medieval#sims 4 deco#sims 4 clutter#ts4 recolor#ts4 build cc#house banners#medieval tapestry#house villareal#sims 4 vampire pack#sims 4 nobility#ts4 get together

35 notes

·

View notes

Text

The Grayson Legacy: Fate & Phantoms 🔮⚰️✨

A tale of magic, tragedy, and the fight against fate, spanning generations of spellcasters, ghost whisperers, and immortality seekers. Each heir must grapple with the curse of their bloodline, navigating love, loss, and the fine line between life and death.

This Legacy will start with 5 generations.

Raegan Grayson – The Cursed Founder 🔮⚰️

A powerful spellcaster obsessed with the mysteries of life and death, Raegan Grayson seeks to control fate itself. Confident, intelligent, and deeply passionate, she is both feared and admired in the magical world. However, her pursuit of immortality comes at a cost—a tragic love, a powerful curse, and the ghosts of those she couldn’t save.

Will she break the cycle of loss, or will she be the one who dooms her bloodline to generations of supernatural turmoil?

Generation 1: The Cursed Bloodline (Raegan Grayson - Spellcaster)

💀 Theme: A spellcaster seeking to master immortality but cursed with tragic loss. 🧙♀️ Gameplay Goals:

Master the Untamed Magic school.

Reach the top of the Spellcaster rank (Virtuoso) before dying.

Have at least two great loves, but tragedy must strike (one love dies or leaves).

Every firstborn inherits a family heirloom (a magical object tied to the legacy).

Before Regan dies, she must cast Dedeathify on someone and succeed.

👶 Heir Requirement: The firstborn must be a spellcaster and experience a tragic childhood (losing a parent, sibling, or loved one).

Basic Rules for the Grayson Legacy Challenge

These rules are just a guide for me to follow and as i play the family i'll will adjust to my game style. I currently have no CAS CC / Build CC only a few must mods.

This legacy is focused on supernatural gameplay, family tragedy, and breaking a generational curse. These rules will keep the challenge structured while allowing for creativity.

General Rules:

Start with a Single Founder – Raegan Grayson, a spellcaster, begins the legacy. She must have the "Spellcaster Bloodline" trait.

Lifespan Setting – Normal or Long lifespan is recommended. Aging must be on.

No Reviving the Heir – If an heir dies before producing an heir of their own, you must continue with the next eligible child or adopt a supernatural child.

Each Generation Must Follow Its Theme – Stick to the supernatural gameplay and storytelling for each heir.

No Money Cheats – Earn wealth through careers, aspirations, and magic (if applicable). You may use "freerealestate on" for the first home.

No Aging Cheats – Sims must age naturally, except when required by the legacy (e.g., drinking a Potion of Youth for the Immortal Seeker).

The Family Heirloom Must Be Passed Down – This is a magical object (a wand, book, crystal, or artifact) that represents the family's legacy.

Each Generation Must Experience a Life-Changing Loss – Whether it's a death, betrayal, or lost love, every heir must suffer a significant loss that shapes their story.

No Premade Sims as Spouses – All spouses must be townies, game-generated Sims, or Sims created in CAS for storytelling purposes.

Death Must Play a Role in Every Generation – Whether it’s ghosts, Grim Reaper interactions, supernatural curses, or legacy deaths, the theme of mortality must remain central.

Optional Rules (For Extra Challenge):

Limited Heirs: Only the firstborn (or the most story-appropriate child) can be the next heir.

Spouse Must Have a Dark Secret: Every generation, the heir’s spouse must have a hidden trait, a dangerous past, or a supernatural twist.

Tragic Love Rule: At least one generation must have an unfulfilled love (a forbidden romance, a lost soulmate, or a partner that dies young).

The Final Generation Must Be Mortal: To break the curse, the last heir must avoid all supernatural influences and die of old age.

#ts4 legacy#my sims#the sims#ts4 gameplay#ts4#the sims 4#starrygnome#simblr#ts4 ravenwood#ts4 life and death#ts4 Grayson Legacy

0 notes

Text

bane of my existence and object of all my desires - chapter 5

1 2 3 4 <5>even i am getting breathless from writing this just imagine how kate felt at that moment bro also decided to start calling it chapters because this ain't just a short fic anymore >< warnings: brief strong language // spoilers for bridgerton word count: 3.7k

“Lord Kamisato.”

He only quickens his footsteps despite the repeated calls and equally fast-paced footsteps from behind him. The pleasant buzz of the ball grows quieter with every corner he turns, until he is finally alone with his thoughts.

The door to the study is roughly pulled open and before he can close it in a swift, angry motion, Y/N’s hand has already held onto it, forcing him to look at her.

His head is empty with nothing but fury. Seeing the girl in front of him, head held high and chest puffed out in her oh-so-annoying stubbornness is hardly doing anything to help. Ayato cannot understand why she is so insistent on following him to the study when what all that needed to be said had already been said? When she made it her life’s goal to clearly show her hatred towards him in every single thing she does, every single interaction they have? When she took every chance she gets to keep him away from her sister, his intended? What has he done to deserve such unrelenting malice?

His breathing grows heavier as he paces around the room, eyes scanning the stacks of documents on the desk but barely registering any of the words written on them.

“When will you leave?”

Taken aback by his sudden question, Y/N stands stunned and does not answer.

“Immediately after your sister finds a match?” Ayato sneers.

“I presume so, yes. Wh—”

He rests his hands on the desk then, as if holding onto the solid wood for support.

“And you will not concern yourself with finding a match of your own?”

“Why would that concern you?”

Ayato does not know why that would concern him at all. The family heirloom ring has been sitting safely inside the drawers of this very same desk for days now, waiting for the moment to finally adorn its new owner soon. Whatever Y/N decides to do with her life, who is he to question?

Even though he cannot recognize it yet, he secretly wishes she would stay.

Throwing his hands up in frustration, he stomps across the office, coming face to face with Y/N, the same unwavering expression on her face.

“It seems you will find any opportunity to keep your sister away from me...you simply do not like me!”

“Of course I do not like you!” Her attempts to stop her voice from rising any higher is proven futile, and the answer comes out in a near-shout.

“Have I done something to you? Why is it that you dislike me so?”

Y/N’s lip quivers, but her eyes remain harsh. Had this been a few days ago when Ayato was trying to find ways to make her falter, he would have enjoyed this immensely. But caught up in the moment of red, hot anger, all he wants is to find the answer to the reason behind all her unkindness ever since the first day they met.

Her hands are balled into fists and the fabric of her gloves wrinkle under the pressure, before she finally blurts out the words that have been driving Ayato crazy.

“Because you vex me!”

If she shakes her head any harder, Ayato is sure the sparkly pins attached to her head would have fallen off and flown across the room.

“And what is it,” he seethes, “do you think you do to me?”

Marriage should not be difficult to him, not as the most eligible man in Inazuma. Marrying Emiko should not be difficult for him. Hell, even if this whole thing turns to shit, there’s plenty more fish in the sea waiting to take his bait.

So why is he so hung up on this one family? With the one person driving him absolutely insane every time he so much as thinks about her?

“What?”

The cocky upturn of her head only makes Ayato’s blood boil even more. If only he could show her all the things she is doing to him.

“What do I do to you?” She says through gritted teeth, her whole body slightly trembling with what can only be assumed as anger mirroring Ayato’s own.

Trying his hardest to compose himself, he takes one, and then another step forward until the space between them becomes almost nonexistent. The silence of the room is replaced with heavy breathing not just from him, but from Y/N as well. His vision blurs as he remembers the bitter taste of defeat, of rejection, of hatred, all coming from the woman before him.

“You hate me.”

When he speaks again, his voice is surprisingly calm.

Y/N holds her ground firmly and nods, “I do. I hate you.”

Had these words come from a man of a different commission, for example, Ayato is sure his fists would have done the talking a long time ago. The bothersome existence of the Kujou rascals trying to undermine Lady Hiiragi feels like nothing compared to the aggravating way she spat out those words. Call him spoiled or entitled, but Ayato has never heard anyone so blatantly admitting to hating him, let alone a lady of high society.

The thoughts running through his head now are too scandalous for him to even admit them to himself. For a moment he can only stare at Y/N incredulously, watching her expressions – or rather, a lack thereof – slowly succumbing to her innermost feelings. He is sure he saw tears welling up in her eyes, but the next time he blinks, the same eyes are burning back into his again, the only evidence of any emotion being the trembling of her lip. The heavy breathing has somewhat quieted down, returning the study to its former stillness, but Ayato’s mind is screaming at him louder than ever.

He has been raised a gentleman, and he will handle this the way one does…

Or so he thinks.

“I am a gentleman,” he states, perhaps more to himself than to Y/N, but the step he takes towards her is proving all his self-convincing a lie. Whatever ungentlemanly thing his mind tells him to do, he has to physically chase them out with a violent shake of his head.

“And your heart is with my sister.”

All the screaming and yelling from before are reduced to a single whisper, and Ayato peeks at Y/N from under hooded eyes, the close proximity suddenly making it even more difficult to breathe in this stuffy room.

“And my heart…is with your sister.” He repeats, this time definitely to himself.

How can his heart rest with another woman when the one before him has intrigued every fibre of his being since the morning he saw her singlehandedly take down several monsters? How can his heart be with anyone at all, when all love brings is pain and despair?

Nothing in the world makes sense anymore as the both of them lean into each other, as if an invisible magnet is drawing them closer. All rationality leaves his brain when he is so close to her. He wants to stop. He needs to stop, but the voices of protest are drowned out by a sudden strong desire to kiss her right there. The shallow intakes of air from Y/N are only making his insides stir even more, her breathlessness mere inches from his face threatening to kick out what is remaining of his self-control.

“Say you do not care for me.” Ayato shuts his eyes as he lowers his head to her cheek, the heat emanating from her body putting him under a spell, “Tell me you feel nothing, and I will walk away.”

She lets out a small gasp. His plan is working.

If he just lowers his head a millimetre more, their lips would have locked in the most satisfying way possible. Yes, that sounds like a solid next step—

“Brother—oh god iamsosorry—”

The pair jumps away from each other like loaded springs at the sudden opening of the door, and Ayato feels all sorts of emotions ever known to man coming together inside him, a time bomb set to explode at any moment. Frustration, anger, and utter yearning for another human being he has never known before.

Ayaka’s eyes are wide and panic-stricken in a quick flash before she slams the door shut, and Ayato does not hesitate before chasing after her, leaving a breathless and dumbfounded Y/N alone in the study, her world turned upside down and her body on fire.

°•. ✿ .•°

The earliest rays of sunshine seep through the paper windows, leaving a pleasant glow on the scattered papers on Ayato’s desk. The Commissioner sleeps with his head resting on his folded arms, a half-dried pot of ink still open next to all the requests and accounts. He has not left the study all night, having returned to occupy his mind with budget records after a heated argument with Ayaka, a rare exchange of harsh words between the siblings.

At least, he wishes the paperwork could take his mind off of some things.

When Ayaka enters the study again, she makes sure to knock gently first.

“Brother?”

Ayato wakes with a jolt, eyes still heavy with sleep that quickly dissipates when he realizes the time. He has spent another night buried in work, again.

“Come in.”

The sheets are gathered and crinkled in one swift motion and he adjusts his collar, trying to make himself look somewhat less of a mess than he really is.

His flustered state becomes even more apparent when his sister walks in, already meticulously dressed despite the early hours.

“So…I take that things are going quite well?” Ayaka says with a voice too cheery even for her own liking as she studies the titles on the shelves, pretending to be particularly interested in one tome about botany.

“Lady Emiko is quite pleasant, indeed,” he answers, praying that the conversations of last night would not be brought up again, “she is beautiful, charming, and even wise – did you know she speaks three languages?”

Seeing that Ayaka does not respond, he quickly adds, “What exactly is your objection?”

His sister turns to study him instead, suddenly appearing older and wiser than her age that Ayato tries his best not to waver under her stare.

“I suppose I do not have any, then,” she retraces Ayato’s steps from yesterday in a slow pace around the room, “if you say that you and Lady Emiko are a good match.”

His victory smile freezes when Ayaka continues her monologue.

“If you say that Lady Emiko makes it…difficult for you to breathe around her, if she gives you that feeling of…”

“Of what?”

“Hm?” Ayaka finally looks up from the yellowed pages of the botany book. He doesn’t remember his sister ever being remotely interested in such a subject matter.

“The feeling that makes it impossible for you to look away from her, or to even stop thinking about her…as if your body will explode into flames whenever you are near each other…that’s the feeling of love, brother.”

Ayato’s smile is permanently wiped off his face now when she mentions the four-lettered word. Since when is his sister so enlightened in love and marriage?

“Do you feel that way about someone? Is there a gentleman that I need to personally meet—”

“If you do feel that way about Lady Emiko, then I am quite happy for you.”

He doesn’t attempt to steer away the topic again and remains silent as Ayaka finally shuts the book and leaves the room.

Love.

Out of the two of them, only Ayaka can afford to mention love when it comes to marriage. Even her status as a woman does not take away from the endless possibilities of a love match. To find someone who cares for you the way Father cared about Mother…that is a luxury Ayato will never have the privilege of enjoying.

His stomach is in knots and he suddenly feels nauseous, as if he is about to engage in a battle he is destined to lose.

No, he cannot risk falling in love.

Marriage is not a game of longing looks and smitten smiles. It is a duty that needs to be fulfilled if he cares anything about the future of the Kamisato Clan. It is about survival. If he does not take on that duty and Ayaka is married off to another clan, all the hard work of restoring their former glory will have gone to waste, and he will never forgive himself for it.

He doesn’t dare savouring Ayaka’s words any longer. His heart beats erratically, having yet to come down from the sudden panic of realization. When she described the feeling of love, only one person comes to mind. One person he cannot have, because falling in love means destroying her future the moment he is taken away by the vicious battles of superiority, power and fame.

The camellia flower has to bloom again, and Ayato has to make sure of it.

There is only one thing left to do now.

°•. ✿ .•°

The night is pitch black outside the estate, and Y/N can only see her own reflection in the window, the shadow dim and fading in and out of existence in the dark. First drops of rain splash against the glass, the sudden pitter patter making him jump. She sighs, still unable to find any trace of sleepiness despite the late hours.

Taking a lamp from the bedside table, she gives in and tiptoes out of the chamber, closing the door gently behind her to not wake Emiko up. She remembers passing by a beautiful library on the brief tour that Ayaka gave, and decides that reading a book about some boring subject may be her best shot at finally falling asleep.

In the study a few doors down the hallway, Ayato dips his brush into the pot of ink for the umpteenth time that night, signing his name in an elegant twirl of the pen on some ceremonial requests from the Tenryou Commission. The candle flickers, hot wax dripping down into the holder and instantly solidifies, becoming one with itself once more. Ayato glances at what is remaining of three burnt out candlesticks and rests his pen on the desk. Perhaps it is time to take a well-needed break from paperwork and turn in for the night.

He takes his coat from the chair beside him and slides open the study doors. A faint glow of light coming from behind the paper shoji makes him pause his footsteps. Did he leave a light on in the library by accident? Or did a servant forget to blow out all the candles earlier?

A loud thunder crashes, and he hears a shaky whimper. Ayato can feel his heart thumping in his chest now, and he takes quick, adrenaline-fueled steps to the source of the faint light.

When he opens the library doors, however, there is no one inside but a lone lamp on the table, set beside some thick tomes about botany. The room briefly flashes white as lightning strikes outside the window, and the whimper sounds again, this time from way closer. Ayato has never believed the ghost stories the elder retainers used to tell him when he was little, but he is coming close to wondering about their existence now.

“Hello?” He calls out in a hushed whisper, careful not to wake anyone else up.

A sniffle, then the squeal of a chair leg as it slides on the floor.

Ayato reaches for the lamp in defense, but his guard quickly lowers when he sees a shade of white beneath the maplewood desk.

“Y/N?”

Teary eyes meet his from the cocoon of the table, and the girl instinctively backs herself against the wood in an attempt to gain some footing.

His voice immediately softens upon seeing Y/N’s panicked state. Her knuckles are white from gripping onto her knees too hard, her entire body curled in the corner like a small child afraid of thunderstorms.

Oh.

“Is it the storm?”

She nods, barely able to meet his eyes as she looks away in shame.

“Got room for two?”

Without waiting for her response, Ayato sets the lamp on the floor next to them and crawls under the desk, the cramped position reminding him of the days where he played hide and seek with Ayaka in the very same room before one of the retainers scolded them for damaging the books. Y/N looks at him in confusion, the question swallowed by a new wave of panic as another bolt of lightning strikes, followed soon by a loud boom of thunder.

The small space and close proximity to Y/N makes Ayato’s head spin. His eyes are open, but he no longer registers the objects in front of him, the legs of a chair and the lamp only blurry shadows to him. Tossing aside all his logic, he reaches out to pry her hand away from their death grip on her knees. Her skin is cold but soft under his touch, the slight tremble only stopping after he firmly envelopes her hand in his palm.

“I’m sorry you had to see me like this. It must be quite unflattering.”

When she speaks again, her voice is steadier than before.

“Not at all.” Ayato smiles before he can stop himself, hoping the darkness will swallow the upturn of his lips before she can tease him.

Only she doesn’t.

“I’ve always been terrified of thunderstorms, ever since my mother died.”

Ayato doesn’t speak, and only listens as she rambles on to calm her nerves.

“I don’t know…it’s just lightning and we’re inside, I know they won’t hurt me, but I’m still overcome with fear every time. I thought it would get better as I grow older, but…”

She jumps and shrinks into herself even more when the thunder shakes the ground outside, her breathing becoming fast and erratic as if she has been submerged underwater for far too long.

“Hey, it’s okay.”

The manner in which he is holding her now has long passed what’s considered “appropriate” for a lady and a gentleman. At Y/N’s violent shaking, the only thing Ayato knows to do is to pull her closer to him, hoping his body heat and his soothing words can ease her suffering, even just by a little bit. His mind is blank and all he can think about is her intoxicating scent and how he would hold her like this for the rest of eternity if he had the choice.

His eyelids grow heavier with the day’s exhaustion, and as the storm finally passes, he feels Y/N’s tense muscles slowly relax in his arms. Staying up till the dead of the night is nothing new to Ayato, but he has never felt so comfortably safe as sleep begins to overtake him. Even the busiest day of official meetings and paperwork could not have given him the same sense of blissful fatigue that he has right now--under a desk, out of all places--with pins and needles in his foot from the awkward position. He is safe from the harsh reality of politics and jealousy and dark plots, even it’s just for a little while.

But you see, the choice was never his to make.

°•. ✿ .•°

The servants are busy lifting intricately decorated suitcases onto the carriage, and Ayato finds a moment of solitude in the soft sands of the courtyard while the world bustles around him. The festivities have drawn to a close and the Kamisato Clan has unsurprisingly executed every detail to surgical precision, that even Lady Naoki seldom had any comments about the capabilities of the siblings. Yes, that is exactly the future he wants for the Yashiro Commission.

Laughter rings from the front gates as the ladies bid each other goodbye. Ayato becomes increasingly restless, knowing that Y/N and Emiko will soon return to Lady Yae’s residence, and he will not get a chance to speak with them until whichever family decides to host the next ball. The younger sister looks visibly disappointed about something but tries to cover it up with a smile, bowing elegantly at every guest she passes by.

Ayato finds himself smiling. Rising to his feet, he makes a beeline to the gates, catching the ladies by surprise in the last moment before they ascend into the carriage.

Y/N’s face falls when she notices him, whatever words she was saying to her sister coming to an uncomfortable halt at his presence.

“Lady Emiko,” he dips his head in greeting and leaves a polite kiss on the soft skin of her knuckles.

“My lord,” the young girl returns the formality with renewed excitement, her smile much more genuine when Ayato finally straightens up to look at her.

Soft gasps sound from all around them when the Commissioner lowers to one knee, presenting a gorgeous jeweler’s box to the lady.

“Lady Emiko, will you please do me the honour?”

She is speechless and can only look at her sister in shock. Ayato feels like a carriage horse being blinded with invisible blinkers to the sides of his face, taking up all the willpower inside his body to keep his eyes focused on his future wife, and not the unpleasant woman beside her.

Surely if he believes the nasty words said about the older sister, he will start to like her less?

“Oh, of course, my lord!” Emiko squeals in pure delight, and the next few moments pass in a glorious blur of cheers and excitement.

Even with an overjoyed Emiko obscuring a good part of his vision, he still spots Ayaka standing next to Thoma, the smile on her face three shades darker than those around her. Ayato’s own grin fades too, suddenly remembering the whole love talk she gave not too long ago. He shakes the doubts out of his head and tells himself that this is the best choice to make, this is the only choice he can make.

#moon’s writings 🔖#bane of my existence ☽#kamisato ayato x reader#kamisato ayato#kamisato ayaka#genshin x reader#genshin impact x reader#genshin impact#bridgerton#bridgerton season 2#kate x anthony

44 notes

·

View notes

Photo

(Simplified) Legacy Challenge

This is a simplified version of the legacy challenge here. The challenge ends once the 10th generation heir has completed all their lifetime objectives.

Founder

Start the game in winter

Begin with $0

You must repay the cost of the land you ‘bought’ before you die + 10% interest

Heir

Strict gender equality (alternate gender each gen)

Must be the eldest eligible child

Must max out at least 2 adult skills and 1 aspiration

Aging up

Traits must be randomly generated

Aspiration must be random, can be re-rolled if it has already been completed by a previous heir

Cannot repeat same career as a previous heir

Multiple heirs can own a retail store, but they must sell different items than previous generations

Cannot repeat same aspiration as a previous heir

Family and Friends

Must have a best friend outside of the family

Partner is optional

Anytime a ‘spare’ child moves out, you must give them an equal ‘share’ of the household funds at that moment

Splitting household funds between children also applies when heir moves out

House

Each heir must move out of previous heir’s home and into a completely new house/property

New heir is eligible to move out when the previous heir has completed all their objectives (skills, aspirations and career) and they have aged up to minimum a young adult

Heirlooms and traditions

Create a family graveyard and collect tombstones of direct partners and children only

Take at least 1 complete family photo and 1 wedding/parent photo per generation (if applicable)

Collect at least one family ‘heirloom’ per generation that must be passed on

On the day the Founding Sim dies, create a holiday “Founding Day” and pick one tradition that represents that Sim

Each time an heir dies, add one tradition to the holiday

Jobs and Career Your heir must do any of the following:

Reach the highest level of their career

Earn 5 Stars and all reward perks in restaurant

Earn all reward perks in a retail store/vet clinic

Retail storey may only be stocked with handmade goods by heir

1 note

·

View note

Text

Merciless

Their reinforcements had not come. Long after she and Domitian had sent out their final emergency broadcast, after they had depleted the last of their flares well within range of Castrum Fluminis, the VIth had spared not even a word of explanation for their continued neglect.

In truth, the Yanxian winter had proven more perilous than any of them could have predicted. The snows and high winds imperiled any travel across the rainbow-hued landscape by foot or by air. Soon, she and Domitian were forced to kill roaming tigers to stave off their own deaths: they tanned the skins just before the worst of the season hit and wrapped them over their uniforms. Ice rendered the karst hills ever more treacherous, the wind whipped through the earthen towers with a fury unlike any she had ever known, and their uncertain supply of food encouraged them to stay put rather than risk overexertion - or, worse still, the threat of capture from the Doman Liberation Front.

She and Domitian had long since attained a comfortably wordless sort of communication, much in the manner that she and Tia had once had. Their endless travails in the blinding winter prompted with greater frequency the idea of defecting - of stowing away aboard a vessel to Valnain or some other part of the Dalmascan coast. They might even create a raft, were the One River not so heavily monitored. The manner in which Domitian paused as he refastened a length of rope informed her that the same thought had crossed his own mind. And as they met eyes, he shook his head with a sigh.

Now is not the time.

And - as she had always known, deep down - it never would be.

In the dead of midwinter, Domitian took up the needed hunting in her stead. He returned with no game at all - only a great wound upon his neck and an unknown dart at the center of it. He had been scratching at it in a frenzy; he had torn off his helmet to open his skin with his own fingernails at the puncture site. His breaths came heavy and labored, and blood flew from his mouth in bursts of coughs, cutting off any explanation he might have given for his condition. He never did explain to her what he had seen - he never could - and her obsessive observations of the ilm-long dart once he'd finally pulled it free could not conclude whether the instrument was of Doman or Garlean make.

She labored over his care for nigh on a week with their dwindling supplies. She changed his bandages as attentively as he had minded hers in the wake of her prosthetic arm's fitting; she tended to him with the same mechanical Garlean claw that she had wished for so long would be her death. She fed him as much and as often as she could, melted snow for water, and warmed him with her own body through the subfreezing nights. By the fourth day, he was delirious; by the fifth, catatonic. His face and body withered until he no longer resembled himself - until he might have passed for a man of eighty rather than fifty-five.

But on the sixth day, he regained enough vigor for him to say a meager goodbye.

"A-Alma." Her name. For only the second time throughout their friendship, after so long a time, he spoke her true name. It had been years since she had felt herself worthy of it. "My dear... friend..."

"Domitian. Please." She knelt over him, reached for his hand, the side of his sunken face. His normally strong grasp trembled against her touch; he could scarcely close his fingers around hers. "Don't leave me. Not yet."

"So sorry. I'm so, so sorry."

"Please, I beg of you-"

"The book." At least, that was what she heard; his breaths had grown so faint that she could no longer be certain. She leaned in close and still could not make any sense of his whisperings, until he lost even the strength to form his words within his lungs.

"My dear," he repeated - and then the last of his life left him.

Still upon her knees, she loosed a scream that echoed all around the valley. For a moment, the resounding cry relieved her of the knowledge that she was well and truly alone - her sole companion of fifteen years now dead.

And only then did the radio beep with a response to their distress signal.

She was half dead herself by the time a scouting party took Domitian's corpse from her several days later. She would have refused all medical treatment, had a medicus not laid out the threat of involuntary sedation; yet following her cooperation, she was permitted to return to Domitian's makeshift office and quarters within Castrum Fluminis to recuperate. Servants delivered her meals and medicines; otherwise, she saw no one, and she preferred it that way.

The castrum was in a flurry unlike any she had ever seen. Only upon being transferred back to the eastern headquarters in Kugane did she learn that Nael van Darnus had led the VIIth to march upon Eorzea during her prolonged absence.

After no more than a week of days passing into one another, during which Domitian's remains were sent back to the imperial capital for a public funeral, she was not surprised to be summoned to the office of the headquarters' commanding pilus. He would demand a verbal report of any other information that had not been transferred prior to Domitian's death. Despite the routine nature of the meeting, she steeled herself for the man's impending scorn as best she could; yet upon her entry into the sparse office, the presence of a compulsor - a tax collector - gave her pause.

As did the name the pilus addressed her with.

"Miss Velius."

She would have been shocked, were she any less exhausted, so much so that her shock might have shown upon her face. As it was, she remained impassive.

"Please, sit."

She did as she was told, the two words pummeling her thoughts in time to her every heartbeat.

"We are all gravely sorry for your loss," the pilus said, in a tone that very much suggested that he was not. He cast only the barest of glances at her Garlean arm - not at her wholly Ala Mhigan face - before continuing to flip through the papers sitting atop his desk. "You're aware, I trust, that the primus frumentarius listed you as the sole beneficiary of his will?"

"I was not."

"How strange; he was quite explicit. When he filed to make you his heir, he wrote that you and you alone were to inherit all of his accounts, his personal possessions, his weapons, his family's heirlooms... and a small house in Rabanastre's Muthru district."

Fates, Domitian.

"Therein lies the problem," said the compulsor from over the pilus' shoulder. "It's quite a sizable sum. And yet, Peregrini are barred from holding assets - particularly property - until they have carried out their twenty years of service to the Empire in full."

She had served for over fifteen years, dutifully and skillfully. She had been refused everything from recompense to disability leave to basic recognition for her achievements. She had watched her superior - her only companion - meet an entirely preventable end. The thought of what else she might have to endure in five years only flared her simmering anger, even as she forced herself to tamper down any physical manifestations of her rage and grief: the former would only intimidate her company, and the latter would grant them leave to trample over her.

"My work curtailing casualties in the Dalmascan territory left me eligible for a promotion some few years ago," she pointed out, "as well as honors due to an injury received in-"

"In goe Velius' defense," the officer drawled. "Yes, we've all heard that touching story."

"Were I elevated to notarius, as my responsibilities suggest, would I be legally eligible to inherit the items listed in his will?"

"A promotion based on previously adjudicated criteria would be out of the question." Yes, then.

"The inheritance will be held until I attain my citizenship?"

The compulsor chimed in. "Ordinarily, a public official would be nominated to maintain the inheritance in your stead. However, the assets can also be frozen - albeit for a maximum period of five years, given that you are already of age. The late primus frumentarius specified quite clearly the latter course for his will, accounting for your lack of citizenship." The compulsor gave a wry and humorless smile. "He left nothing at all to chance."

"Then I should be able to receive the inheritance upon completing my service and attaining my citizenship in five years' time." When the compulsor remained silent, she turned to the pilus. "Yes?"

"Barring any difficulties-"

"What sort of difficulties?"

The pilus stared, incredulous at her interruption. "Your death or imprisonment, for a start. Or even the merest accusation of treason. But what with your impeccable record, I can imagine it would be a simple enough matter to avoid such things."

The threat rang clear in his every syllable.

"Difficulties," she repeated. Such a trite word, compared to all the rest they'd done to her. Her phantom arm - the one supplanted by the magitek claw - shivered and itched all at once, as though she were back in the Yanxian wilderness.

The compulsor procured with a flourish a single sheet of parchment. "Initial and sign here to indicate your understanding of our conversation, and the terms of your inheritance. Once you do, you will be entitled to some few of goe Velius' personal effects - items of no monetary value."

She pored over the document with her secretary's eye and found nothing by which she might even remotely incriminate herself. If the men meant to forge her signature, they might have done so from any of the countless documents she'd handled throughout her tenure. The moment she slid the page back to the compulsor, he lifted from behind the desk a tray bearing a small assortment of Domitian's possessions: his identification tags, his favorite flask, and a heavy journal bound in worn leather.

The book, he'd said to her in his final moments.

She gathered the objects one by one, hoping that the trembling of her hands might be attributed to grief alone.

"Oh," said the pilus as she stood to leave the office. "And you'll be expected to submit yourself to an interrogation within the week."

And so another imperial humiliation begins. "An interrogation, ser?"

"But of course. Standard procedure, given the highly classified nature of goe Velius' work in Dalmasca. Your access to his intelligence, along with the fact that you were the last person to have seen him alive, makes you a primary suspect in the circumstances of his death." The pilus smirked. "So determined Legatus Noah van Gabranth."

6 notes

·

View notes

Text

6. In the religious world, do the truth and God hold the power, or do the antichrists and Satan hold the power?

Bible Verses for Reference:

“But woe to you, scribes and Pharisees, hypocrites! for you shut up the kingdom of heaven against men: for you neither go in yourselves, neither suffer you them that are entering to go in” (Mat 23:13).

“And Jesus went into the temple of God, and cast out all them that sold and bought in the temple, and overthrew the tables of the moneychangers, and the seats of them that sold doves, And said to them, It is written, My house shall be called the house of prayer; but you have made it a den of thieves” (Mat 21:12–13).

Relevant Words of God:

Just look at the leaders of every denomination—they are all arrogant and self-righteous, and they interpret the Bible out of context and according to their own imagination. They all rely on gifts and erudition to do their work. If they were incapable of preaching anything, would those people follow them? They do, after all, possess some knowledge, and can preach on some doctrine, or know how to win over others and how to use some artifices. They use these to bring people before themselves and deceive them. Nominally, those people believe in God, but in reality they follow their leaders. If they encounter someone preaching the true way, some of them say, “We have to consult our leader about our faith.” Their faith has to go through a human being; is that not a problem? What have those leaders become, then? Have they not become Pharisees, false shepherds, antichrists, and stumbling blocks to people’s acceptance of the true way?

from “Only the Pursuit of the Truth Is the True Belief in God” in Records of Christ’s Talks

We’ve preached the gospel over and over to many leaders within religious circles, but no matter how we fellowship on the truth with them, they won’t accept it. Why is this? It’s because their arrogance has become second nature and God is no longer in their hearts! Some people may say: “People under the leadership of some pastors in the religious world really have a lot of drive. It seems that they have God in their midst!” No matter how lofty those pastors’ sermons may be, do they know God? If they really revered God in their hearts, would they make people follow them and exalt them? Would they monopolize others? Would they dare to impose restrictions on others seeking the truth and investigating the true way? If they believe that God’s sheep are actually theirs and that His sheep should all listen to them, aren’t they themselves acting as God? That kind of person is even worse than the Pharisees—aren’t they antichrists? Therefore, their arrogant nature can control them to do things that betray God.

from “Man’s Arrogant Nature Is the Root of His Opposition to God” in Records of Christ’s Talks

Those who do not accept the new work of God are bereft of the presence of God, and, moreover, devoid of the blessings and protection of God. Most of their words and actions hold to the past requirements of the Holy Spirit’s work; they are doctrine, not truth. Such doctrine and regulation are sufficient to prove that the only thing that brings them together is religion; they are not the chosen ones, or the objects of God’s work. The assembly of all those among them can only be called a grand congress of religion, and cannot be called a church. This is an unalterable fact. They do not have the Holy Spirit’s new work; what they do seems redolent of religion, what they live out seems replete with religion; they do not possess the presence and work of the Holy Spirit, much less are they eligible to receive the discipline or enlightenment of the Holy Spirit. These people are all lifeless corpses, and maggots that are devoid of spirituality. They have no knowledge of man’s rebelliousness and opposition, have no knowledge of all of man’s evildoing, much less do they know all of God’s work and God’s present will. They are all ignorant, base people, they are scum that are unfit to be called believers! Nothing that they do has a bearing on the management of God, much less can it impair God’s plans. Their words and actions are too disgusting, too pathetic, and simply unworthy of mention. Nothing done by those who are not within the stream of the Holy Spirit has anything to do with the new work of the Holy Spirit. Because of this, no matter what they do, they are without the discipline of the Holy Spirit, and, moreover, without the enlightenment of the Holy Spirit. For they are all people who have no love for the truth, and have been detested and rejected by the Holy Spirit. They are called evildoers because they walk in the flesh, and do whatever pleases them under the signboard of God. While God works, they are deliberately hostile to Him, and run in the opposite direction to Him. Man’s failure to cooperate with God is supremely rebellious in itself, so won’t those people who deliberately run counter to God particularly receive their just retribution?

from “God’s Work and Man’s Practice” in The Word Appears in the Flesh

If you have believed in God for many years, and yet have never obeyed Him or accepted all of His words, but instead asked God to submit to you and act in accord with your notions, then you are the most rebellious of persons, and you are an unbeliever. How is one such as this able to obey the work and the words of God that do not conform to the notions of man? The most rebellious person is one who intentionally defies and resists God. He is the enemy of God and the antichrist. Such a person constantly bears a hostile attitude toward the new work of God, has never shown the smallest intention of submitting, and has never gladly shown submission or humbled himself. He exalts himself before others and never shows submission to anyone. Before God, he considers himself the most proficient in preaching the word and the most skillful in working on others. He never discards the “treasures” already in his possession, but treats them as family heirlooms for worship, for preaching about to others, and uses them to lecture those fools who idolize him. There are indeed a certain number of people like this in the church. It can be said that they are “indomitable heroes,” generation after generation sojourning in the house of God. They take preaching the word (doctrine) to be their highest duty. Year after year and generation by generation, they go about vigorously enforcing their “sacred and inviolable” duty. None dare touch them and not a single person dares openly reproach them. They become “kings” in the house of God, running rampant as they tyrannize over others from age to age. This pack of demons seeks to join hands and demolish My work; how can I allow these living devils to exist before My eyes?

from “Those Who Obey God With a True Heart Shall Surely Be Gained by God” in The Word Appears in the Flesh

Those who read the Bible in grand churches recite the Bible every day, yet not one understands the purpose of God’s work. Not one is able to know God; moreover, not one is in accord with the heart of God. They are all worthless, vile men, each standing on high to teach God. Though they brandish the name of God, they willfully oppose Him. Though they label themselves believers of God, they are ones who eat the flesh and drink the blood of man. All such men are devils who devour the soul of man, head demons who purposefully disturb those who try to step onto the right path, and stumbling blocks that impede the path of those who seek God. Though they are of “robust flesh,” how are their followers to know that they are antichrists who lead man in opposition to God? How are they to know that they are living devils who specially seek souls to devour?

from “All Who Do Not Know God Are Those Who Oppose God” in The Word Appears in the Flesh

1 note

·

View note

Text

A Burglary's Impact and How to Improve Home Security

You've only just gotten home, but something doesn't seem right. The glass is broken or the door is kicked through. You walk into the room to discover your home in complete disarray: all of the books have been tossed to the floor, the drawers have been emptied, and any priceless valuables and devices have vanished. Your home was broken into, that much is sadly evident. Hopefully you won't ever have to go through this in real life, but even if you do, you should still be aware of the actions to take to get your life back on track and fortify your home.

The Crucial Procedures

Most people find it distressing to see their homes looted, but you must swiftly gather your composure and begin to take action. Call the police and make a report right away because else you won't be eligible for insurance. Try assessing the damage and considering which goods were stolen as you wait for the police to come. But be careful not to touch anything because it might later be important evidence. If you have a surveillance system or a concealed camera, you should review the tape and give it to the police. After they've departed, make a copy of the report and tidy the rooms back up; the disorganized scene will only make you feel depressed.

How to Get Your Money and Lost Items Back

Studies show that local criminals frequently commit house invasions. This implies that your stolen property most likely ends up in neighborhood pawn shops or on the illicit market. Visit any nearby pawn shops after a few days and take a close look at the items. You might be able to find some of your family heirloom, with any luck.

Electronics like tablets and smartphones are equipped with a feature or software that enables the GPS tracker to be remotely activated, thereby announcing your whereabouts. Don't forget to contact your insurance provider last but not least. Most of the basic household objects you lost can be replaced with their payment. Make sure to alert them within 24 hours of the robbery and have all the required documentation on hand (including the police reports with the estimated value of lost items). Most likely, an adjuster from the company will arrive. Stop cleaning up in this circumstance because the adjuster needs to see the issue as it is.

How to Strengthen Your Security

It's one thing to be able to repair your house, but you also need to make sure that no one will break in again. Naturally, this entails increasing the security of your home. Install a home security system from Cove Smart. Adding more alarms, sensors, and a surveillance system will update your existing system if you currently have one.

Instead, home security providers provide smartphone apps to improve self-monitoring. By doing this, you can access the camera stream in addition to receiving the crucial alarm notifications on your phone. In either case, make sure you have help when tackling the burglary challenge!

0 notes

Text

Girls And Property Planning Basics

In layman's phrases, an estate is anyone's net price within the eyes of the law. That means your financial institution accounts, your home, your car, and any smaller belongings it's a must to your name. It additionally means any rights and licenses you may need to, say, a music you wrote and even your social media accounts. Eligibility, protection, limitations and exclusions of id theft insurance are governed by a separate protection document. Sturdy Powers of Attorney: These devices help you select an individual who can conduct your business and monetary affairs. An influence of legal professional can be very important in avoiding the expense of a conservatorship proceeding in probate court.

Attempt for Free/Pay When You File: TurboTax online and mobile pricing relies on your tax situation and varies by product. Absolute Zero $zero federal (types 1040EZ/1040A) + $0 state limited time supply solely available with TurboTax Free Version; offer could change or finish at any time with out notice. Actual prices are decided at the time of print or e-file and are subject to alter without notice. Savings and worth comparisons based on anticipated worth enhance. Particular low cost offers might not be legitimate for cell in-app purchases.

With out Stretch IRA language in your belief documents, your heirs may receive your qualified retirement monies (resembling 401(ok)'s, IRA's, and so on.) in a lump sum. Typically a lump sum distribution considerably will increase the heirs tax bracket, meaning a larger share of their inheritance goes to taxes. A Stretch IRA” sometimes spreads out the distributions over 5 years, or the remainder of their lives, which might potentially help restrict the taxable penalties of the inheritance.

Belongings equivalent to life insurance and certified retirement plans switch by contract to named beneficiaries outdoors of probate. Enterprise succession planning: It is important to plan for the future of what you are promoting now Our attorneys will make suggestions and help you with formulating a plan primarily based in your objectives. Discover out if any complaints have been filed towards the company by calling local and state client safety offices or the Better Business Bureau.

At Nolo we're, after all, in favor of do-it-yourself law and avoiding attorneys each time that is possible. Under is a listing of Nolo products which might be helpful for various points of property planning and related matters. This course of includes various steps that must happen. For example, in case you left behind any money owed, your creditors will need to have the chance to file a declare with the property. As soon as filed, the administrator of your estate will have to use estate funds to repay these debts before she or he can distribute any inheritances.

Particularly, should you die intestate, the switch of your property is achieved through a public, courtroom-supervised proceeding referred to as probate that generally takes a minimal of six months, sometimes a yr or extra. These public proceedings are generally costly and time-consuming in nature and tie up your property for a number of months. Even worse, your failure to outline your intentions through proper estate planning can tear apart your loved ones as each particular person maneuvers to be appointed with the authority to manage your affairs. Neither is it uncommon for bitter family feuds to ensue over modest sums of cash or a family heirloom.

Part four comprises particular projects for items, estates, and trusts, including steering on the premise of grantor belief property at death underneath § 1014, in addition to closing regulations below § 2032(a) relating to the imposition of restrictions on property belongings throughout the six-month alternate valuation interval. Also included in Part 4 is guidance beneath § 2053 concerning personal guarantees and the application of present value concepts in determining the deductible quantity of expenses and claims in opposition to an estate.

Place your will where it is secure from theft, fire, or different injury. A protected-deposit field is one risk, though it might be troublesome in your private consultant to access your safe-deposit box after your demise. You additionally may deposit it with the register in probate for your county. Dwelling Will. A document that states which sorts of healthcare therapies you wish to refuse or settle for.

1 note

·

View note

Text

Business Bankruptcy

Bankruptcy is a process a business goes through in federal court. It is designed to help your business eliminate or repay its debt under the guidance and protection of the bankruptcy court. Business bankruptcies are usually described as either liquidations or reorganizations depending on the type of bankruptcy you take. Bankruptcy is the legal proceeding involving a person or business that is unable to repay outstanding debts. The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common. All of the debtor’s assets are measured and evaluated, and the assets may be used to repay a portion of outstanding debt.

youtube

Understanding Bankruptcy For Business

Bankruptcy offers an individual or business a chance to start fresh by forgiving debts that simply cannot be paid while offering creditors a chance to obtain some measure of repayment based on the individual’s or business’s assets available for liquidation. In theory, the ability to file for bankruptcy can benefit an overall economy by giving persons and businesses a second chance to gain access to consumer credit and by providing creditors with a measure of debt repayment. Upon the successful completion of bankruptcy proceedings, the debtor is relieved of the debt obligations incurred prior to filing for bankruptcy. All bankruptcy cases in the United States are handled through federal courts. Any decisions over federal bankruptcy cases are made by a bankruptcy judge, including whether a debtor is eligible to file or whether he should be discharged of his debts. Administration over bankruptcy cases is often handled by a trustee, an officer appointed by the United States Trustee Program of the Department of Justice, to represent the debtor’s estate in the proceeding. There is usually very little direct contact between the debtor and the judge unless there is some objection made in the case by a creditor.

Types of Bankruptcy Filings

Bankruptcy filings fall under one of several chapters of the Bankruptcy Code: Chapter 7, which involves liquidation of assets; Chapter 11, which deals with company or individual reorganizations, and Chapter 13, which is debt repayment with lowered debt covenants or specific payment plans. Bankruptcy filing specifications vary among states, leading to higher or lower filing fees depending on how easily a person or company can complete the process.

Chapter 7 Bankruptcy

Individuals or businesses with few or no assets file Chapter 7 bankruptcy. The chapter allows individuals to dispose of their unsecured debts, such as credit cards and medical bills. Individuals with non-exempt assets, such as family heirlooms (collections with high valuations, such as coin or stamp collections), second homes, cash, stocks, or bonds, must liquidate the property to repay some or all of their unsecured debts. So, a person filing Chapter 7 bankruptcy is basically selling off his or her assets to clear debt. Consumers who have no valuable assets and only exempt property, such as household goods, clothing, tools for their trades, and a personal vehicle up to a certain value, repay no part of their unsecured debt. Pros: If you are ready to start a new business or explore other career options, Chapter 7 could fit the bill. Chapter 7 business bankruptcy allows you to eliminate most (if not all) of your unsecured debts, including medical bills, personal loans, payday loans, cash advance loans and credit card debt. Once you file for Chapter 7 bankruptcy, it typically takes about six months to receive your discharge.

youtube

Cons: In this type of business bankruptcy, the company goes out of business. A Chapter 7 discharge does not relieve certain debts, including mortgages and car loans, and it can also result in the loss of property if your equity is non-exempt. If you plan to reorganize and start your existing business anew, this is not the right type of business bankruptcy to file. A Chapter 7 bankruptcy will appear on your credit report for 10 years, and you won’t be able to file Chapter 7 and receive debt discharge again within eight years.

Chapter 11 Bankruptcy

Businesses often file Chapter 11 bankruptcy, the goal of which is to reorganize and once again become profitable. Filing Chapter 11 bankruptcy allows a company to create plans for profitability, cut costs, and finds new ways to increase revenue. Preferred stockholders may still receive payments, though common stockholders will not.

youtube

For example, a housekeeping business filing Chapter 11 bankruptcy might increase its rates slightly and offer more services to become profitable. Chapter 11 bankruptcy allows a business to continue conducting its business activities without interruption while working on a debt repayment plan under the court’s supervision. In rare cases, individuals can file Chapter 11 bankruptcy.

Pros: Filing business bankruptcy under Chapter 11 can help you avoid having to close your company – although filing Chapter 7 instead always remains an option. Public companies often choose Chapter 11 because it allows them a chance to become profitable again and to provide value to their shareholders. When you obtain debt relief through a Chapter 11 claim, an automatic stay is put in place, meaning creditors cannot attempt to collect repayment during the term of the stay. Meanwhile, you’re able to create a reorganization plan to pay back debts and regain profitability, usually by renegotiating leases, contracts and other binding agreements. Creditors are often receptive to reorganization under a Chapter 11 business bankruptcy plan, since the payment they receive is more favourable than it would have been under Chapter 7. Since winning a Chapter 11 business bankruptcy discharge does not require selling your assets, if you believe you can make changes that will result in profitability, Chapter 11 could be your best bet.

Cons: Chapter 11 business bankruptcy is very complex, takes a long time to move through the courts and is expensive (i.e. higher filing fees and court costs). The repayment plan can be for long periods of time and can stretch to 20 years or more. And after all that, it won’t necessarily succeed.

Chapter 13 Bankruptcy

Individuals who make too much money to qualify for Chapter 7 bankruptcy may file under Chapter 13, also known as a wage earners plan. The chapter allows individuals and businesses with consistent income to create workable debt repayment plans. The repayment plans are commonly in instalments over the course of a three- to five-year period. In exchange for repaying their creditors, the courts allow these debtors to keep all of their property including non-exempt property.

Pros: Many sole proprietors have personal assets combined with their business assets. In Chapter 13, you can avoid losing your personal assets – versus Chapter 7 business bankruptcy, where some (but not all) of your personal property is exempt from being sold. Chapter 13 also allows more debt to be discharged than Chapter 11, and you can even apply for a Hardship Discharge to have your debts dismissed. It is also typically a faster and cheaper process than Chapter 11.

Cons: It can take up to five years to repay your debts under a Chapter 13 business bankruptcy plan. Your debts are paid with your disposable income, so whatever extra cash you have is committed to debt repayment. If you obtain debt relief by filing business bankruptcy under Chapter 13, you’re barred from filing a Chapter 7 claim for six years. Chapter 13 cases remain on your credit report for 10 years.

Business Bankruptcy Filings

Financially distressed municipalities, including cities, towns, villages, counties, and school districts, may file for bankruptcy under Chapter 9. Under Chapter 9, there is no liquidation of assets to repay the municipality’s debts. Chapter 12 bankruptcy provides relief to “family farmers” or “family fishermen” with regular annual income. Both Chapters 9 and 12 make use of an extended debt repayment plan. Chapter 15 was added in 2005 to deal with cross-border cases which involve debtors, assets, creditors and other parties who may be in more than one country. This type of petition is usually filed in the debtor’s home country.

Being Discharged From Bankruptcy

When a debtor receives a discharge order, he is no longer legally required to pay any of the debts on that order. So, any creditor listed on that discharge cannot legally undertake any type of collection activity (making phone calls, sending letters) against the debtor once the discharge order is enforced. Therefore, the discharge absolves the debtor of any personal liability for the debts specified in the order. But not all debts qualify to be discharged. Some of these include tax claims, anything that was not listed by the debtor, child support or alimony payments, personal injury debts, debts to the government, etc. In addition, any secured creditor can still enforce a lien against property owned by the debtor, provided that lien is still valid. Debtors do not necessarily have the right to a discharge. When a petition for bankruptcy has been filed in court, creditors receive a notice and can object if they choose to do so. If they do, they will need to file a complaint in the court before the deadline. This leads to the filing of an adversary proceeding to recover monies owed or enforce a lien. The discharge from Chapter 7 is usually granted about four months after the debtor files to petition for bankruptcy. For any other type of bankruptcy, the discharge can occur when it becomes practical.

youtube

Advantages and Disadvantages of Bankruptcy

Declaring bankruptcy can help relieve you of your legal obligation to pay your debts and save your home, business, or ability to function financially, depending on what kind of bankruptcy petition you file. But it also can lower your credit rating, making it more difficult to get a loan, mortgage, low-rate credit card, or buy a home, apartment, or business in the future. If you’re trying to figure out if you should file, your credit is probably already damaged. A Chapter 7 filing will stay on your credit report for ten years, while a Chapter 13 will remain there for seven. Any creditors you solicit for debt (a loan, credit card, line of credit, or mortgage) will see the discharge on your report, which will prevent you from getting any credit.

Filing For Business Bankruptcy

“Business bankruptcy” isn’t a term anyone wants to think about, especially in regards to their own company. But did you know that filing for business bankruptcy can actually be a smart choice? Certain types of bankruptcies for business allow you to keep your business, while others relieve you from debt obligation. Business bankruptcy doesn’t mean you are a failure or that your life is over. There is life after bankruptcy, and you’re in the right place to discover it.

Situations Where Filing Business Bankruptcy Makes Sense

No one thinks about filing business bankruptcy when they’re making a profit and experiencing organic growth. In almost all cases, the prospect of bankruptcy arises because your business is having problems. You could be in the last phase of the business life cycle, referred to as the decline phase where you lose your competitive advantage and are ready to exit the market. Or you could have made mistakes during the start-up phases of your business and have failed to find ways to generate profit or create a cohesive team. Business bankruptcy is meant to protect your personal assets should your business fail or you are unable to pay your debts. At its core, filing for business bankruptcy allows you to put your mistakes behind you and focus on progress. Whether that progress involves starting another business, reinventing the business you currently have or leaving the world of entrepreneurship to find a career where you do what you love, you must view bankruptcy as a fresh start.

Sole Proprietorship Bankruptcy

A sole proprietorship isn’t a separate legal entity. You’re likely a sole proprietor if you’re the only owner of your business and you haven’t incorporated or set up a specific form of business entity. You and your business are equally liable for debts incurred by the business. Since a sole proprietorship does not offer limited liability to its owner, creditors of the business can go after your personal assets in addition to business assets. This means that if the business does not have sufficient assets, creditors may sue you and try to collect the debt by taking your house, car, or other personal property.

Partnership Bankruptcy

A partnership is a business entity that’s owned by two or more individuals. In many respects, liability is more like that of a sole proprietor than a corporation, with some exceptions for hybrid versions.

• General partnership: A general partnership can be automatically created without any paperwork if two or more people agree to carry on a business or activity for profit. Each partner is considered a general partner and is personally liable for the debts of the partnership. If your business is a general partnership, you will be responsible for the obligations of the business.

• Limited partnership: In a limited partnership, there is at least one general partner and at least one limited partner. The general partner is personally liable for partnership debts while the limited partner is not. This means creditors can collect from the personal assets of the general partner but not the limited partner.

• Limited liability partnership: An LLP is designed to shield all partners from personal liability for the debts of the business. In some states, all partners enjoy limited liability, but there are states that require an LLP to have at least one general partner. Also, in certain states the liability protection of the LLP only applies to negligence claims so all partners may still be liable for business debts arising out of a contract (such as business loans or credit cards).

Corporation Bankruptcy

A corporation is an incorporated entity designed to limit the liability of its owners (called shareholders). Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation. Shareholders will usually only be on the hook if they consigned or personally guaranteed the corporation’s debts. However, shareholders may also be held liable if a creditor can prove corporate formalities weren’t followed, shareholders commingled personal and business funds or the corporation was just a shell designed to shield liability. This is called piercing the corporate veil.

Preparing for Financing Problems

You know to expect banks and other lenders to ask about your personal credit history when deciding whether to provide business financing. You might be able to increase your chances of approval by: • preparing a comprehensive business plan • opening the business with a partner with good credit • soliciting investors to fund your business • applying for financing from a small community bank, or • find financing or grants offered as incentives to business by local communities. You might be thinking about turning to the small business administration for funding. If you are, exercise caution. Often, the small business administration requires not only a personal guarantee but will also expect you to use personal assets to secure the business debt—most commonly your home.

When Financing Isn’t in the Cards

Just because you can’t get financed doesn’t mean you have to put aside your dream of working for yourself. You might want to consider: • starting a personal service business that requires little or no operating capital • working as a subcontractor for an established business to reduce your operating capital needs, or • taking advantage of one of the many other independent contractor opportunities afforded by the “gig” economy. Other Considerations Here are a few other things you’ll want to think about before starting your new business after bankruptcy. • Tax or employer identification numbers: If you closed a previous business, you can’t start the new business with the same tax or employer identification numbers. You’ll need to obtain new numbers. • Paying business taxes: Business owners maintain personal responsibility for business taxes. Avoid being stuck with a substantial bill by paying the business and trust fund tax debt. The business collects trust fund taxes from others, such as payroll withholding and sales taxes (but usually not excise taxes) and must transmit the payments. • Extending payment terms to Since financing will be tight in the beginning, make sure that your new business is getting paid for the work it is doing. Extending payment terms to customers that are overly favourable might result in not getting paid at all. • Maintain good business records: If you can secure financing, it is likely that it will be on a short-term but renewable basis. Keep good records so that when the loan is up for renewal, you can provide accurate figures to show that your business is succeeding and its building up.

Business Bankruptcy Attorney

When you need help from a business bankruptcy lawyer, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Strategic Bankruptcy In Foreclosure

Work At Home Scams

Business Plans

When To Change Your Will

Pollution And A Safe Environment

Foreclosure Lawyer Magna Utah

{ “@context”: “http://schema.org/”, “@type”: “Product”, “name”: “ascentlawfirm”, “description”: “Ascent Law helps you in divorce, bankruptcy, probate, business or criminal cases in Utah, call 801-676-5506 for a free consultation today. We want to help you. “, “brand”: { “@type”: “Thing”, “name”: “ascentlawfirm” }, “aggregateRating”: { “@type”: “AggregateRating”, “ratingValue”: “4.9”, “ratingCount”: “118” }, “offers”: { “@type”: “Offer”, “priceCurrency”: “USD” } }

The post Business Bankruptcy first appeared on Michael Anderson.

from Michael Anderson https://www.ascentlawfirm.com/business-bankruptcy/

from Criminal Defense Lawyer West Jordan Utah https://criminaldefenselawyerwestjordanutah.wordpress.com/2020/09/07/business-bankruptcy/

0 notes

Text

Business Bankruptcy

Bankruptcy is a process a business goes through in federal court. It is designed to help your business eliminate or repay its debt under the guidance and protection of the bankruptcy court. Business bankruptcies are usually described as either liquidations or reorganizations depending on the type of bankruptcy you take. Bankruptcy is the legal proceeding involving a person or business that is unable to repay outstanding debts. The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common. All of the debtor’s assets are measured and evaluated, and the assets may be used to repay a portion of outstanding debt.

Understanding Bankruptcy For Business

Bankruptcy offers an individual or business a chance to start fresh by forgiving debts that simply cannot be paid while offering creditors a chance to obtain some measure of repayment based on the individual’s or business’s assets available for liquidation. In theory, the ability to file for bankruptcy can benefit an overall economy by giving persons and businesses a second chance to gain access to consumer credit and by providing creditors with a measure of debt repayment. Upon the successful completion of bankruptcy proceedings, the debtor is relieved of the debt obligations incurred prior to filing for bankruptcy. All bankruptcy cases in the United States are handled through federal courts. Any decisions over federal bankruptcy cases are made by a bankruptcy judge, including whether a debtor is eligible to file or whether he should be discharged of his debts. Administration over bankruptcy cases is often handled by a trustee, an officer appointed by the United States Trustee Program of the Department of Justice, to represent the debtor’s estate in the proceeding. There is usually very little direct contact between the debtor and the judge unless there is some objection made in the case by a creditor.

Types of Bankruptcy Filings

Bankruptcy filings fall under one of several chapters of the Bankruptcy Code: Chapter 7, which involves liquidation of assets; Chapter 11, which deals with company or individual reorganizations, and Chapter 13, which is debt repayment with lowered debt covenants or specific payment plans. Bankruptcy filing specifications vary among states, leading to higher or lower filing fees depending on how easily a person or company can complete the process.

Chapter 7 Bankruptcy

Individuals or businesses with few or no assets file Chapter 7 bankruptcy. The chapter allows individuals to dispose of their unsecured debts, such as credit cards and medical bills. Individuals with non-exempt assets, such as family heirlooms (collections with high valuations, such as coin or stamp collections), second homes, cash, stocks, or bonds, must liquidate the property to repay some or all of their unsecured debts. So, a person filing Chapter 7 bankruptcy is basically selling off his or her assets to clear debt. Consumers who have no valuable assets and only exempt property, such as household goods, clothing, tools for their trades, and a personal vehicle up to a certain value, repay no part of their unsecured debt. Pros: If you are ready to start a new business or explore other career options, Chapter 7 could fit the bill. Chapter 7 business bankruptcy allows you to eliminate most (if not all) of your unsecured debts, including medical bills, personal loans, payday loans, cash advance loans and credit card debt. Once you file for Chapter 7 bankruptcy, it typically takes about six months to receive your discharge.

Cons: In this type of business bankruptcy, the company goes out of business. A Chapter 7 discharge does not relieve certain debts, including mortgages and car loans, and it can also result in the loss of property if your equity is non-exempt. If you plan to reorganize and start your existing business anew, this is not the right type of business bankruptcy to file. A Chapter 7 bankruptcy will appear on your credit report for 10 years, and you won’t be able to file Chapter 7 and receive debt discharge again within eight years.

Chapter 11 Bankruptcy