#hanging man candlestick pattern

Explore tagged Tumblr posts

Text

Know What is Hanging Man Candlestick Pattern? What's the Difference Between Hammer And Hanging Man Candle? Where to find? How to Identify? How to trade? Trading tips and tricks? Latest Strategies and so on. Read This Blog Now.

#Candlestick Pattern#hanging man#hanging man candle#hanging man candlstick#hanging man candlestick pattern#hanging man vs hammer#bearish candles#bearish candlesticks#bearish candlesticks patterns

0 notes

Text

what is hanging man candlestick pattern & how they work

Introduction: Type your email… Subscribe Candlestick patterns play a crucial role in technical analysis, providing traders with valuable insights into market sentiment and potential trend reversals. Among these patterns, the Hanging Man stands out as a signal of possible changes in direction, particularly at the end of an uptrend. In this blog post, we’ll delve into the intricacies of the…

View On WordPress

0 notes

Text

Dirty Work 2

Warnings: this fic will include dark content such as bullying, familial discord/abuse, and possible untagged elements. My warnings are not exhaustive, enter at your own risk.

This is a dark!fic and explicit. 18+ only. Your media consumption is your own responsibility. Warnings have been given. DO NOT PROCEED if these matters upset you.

Summary: You start a new gig and find one of your clients to be hard to please.

Characters: Loki

Note: Let me know if you want more. Didn't get too much on Part 1 but I have ideas so...

As per usual, I humbly request your thoughts! Reblogs are always appreciated and welcomed, not only do I see them easier but it lets other people see my work. I will do my best to answer all I can. I’m trying to get better at keeping up so thanks everyone for staying with me.

Your feedback will help in this and future works (and WiPs, I haven’t forgotten those!)

I love you all immensely. Take care. 💖

Your third week begins in the same place. Before the iron gate, the code unlocking the green maze within. You’re still just as impressed as your first day there. To you, it’s like a fantasy. Entirely unattainable but it’s right there. You can look, but you can’t touch… not beyond cleaning.

You linger outside, not thinking. You admire the tall tulips and the hedge trimmed to resemble some landmark you can’t quite place. You could see a place like this in an Austenian film or perhaps something Victorian. You don’t have an eye for the difference.

You key in the code for the backdoor and continue on. You put covers on your shoes and grab a fresh set of gloves. You’re getting into a pattern, though each client differs slightly. You put your things away and bring your water bottle with you. You bought a cool strap that keeps it against your hip, a small splurge with your first paycheck. The rest went to bills.

As you start on your usual journey through the many rooms of the airy house, you wonder how its sole resident isn’t lonely. Or perhaps he is. He doesn’t seem the type to admit to it. You turn your thoughts back to your work. You try not to think of him, truly, you don’t know much of him.

You take a candlestick and polish it. You move on the small globe; an ivory orb on a silver axes, the outlines of the continent carved into the surface. As you put it back, you notice something. An item you can’t recall being there before. You reach for it but stop as you realise it’s a camera.

You retract your hand and move on to dust the shelf itself. Does he not trust you or was it there before? Of course, somewhere like this would need security. There was a story just the other day about a break-in, but that was closer to your father’s where those culprits dwell.

The second floor is always easier. It seems even less lived-in than below. All but the study and the main bedroom. You flit in and out, checking points off the list until you’re content. You can only hope he will be too.

As you descend, the epiphany tickles your brain. It’s the first shift he hasn’t appeared. It’s easy to assume he’s busy. You don’t expect him to hang around. As if he would supervise you. Besides, that’s probably what the cameras are for.

You pack up and get your single refill of water. You leave the way you came, as you have twice before. The keypad flashes red to signal the lock is in place. You haul your kit higher on your shoulder and tread slowly along the little path along the side of the house.

You look at the gazebo trimmed in hanging ivy. It’s beautiful. You’d like to venture up and sit on that bench. Just sit and watch and smell and feel. You force the thought away and turn back along the stonework.

You’re going home. Not to pollen but tobacco smoke. Not to lush gardens but wilting strands in soggy mud. Not to immaculate floors and pristine decor but to stained walls and broken springs in your mattress.

Home, to another man that makes you nervous.

🧹

Your father is as he always is, smoking on the couch. You say hi as you come in with a bag of groceries, the prize for what was left of your check. He grumbles and flicks through the channels. You go to the kitchen to put away the food.

You’re almost at the end of your first month, a third of the way through your probationary period. Hopefully after that, you can pick up more clients. You shut the cupboard and go back to the living room. Your father coughs into a crumpled tissue. He sounds horrible. You can’t say so, he doesn’t seem to care.

“I got some fresh produce,” you announce proudly, “I’ll steam some veggies with the chops.”

“You get fries?” He growls.

“Uh, no,” you admit, “I thought we could eat something healthier–”

“I don’t like steamed veggies,” he drops the remote and grabs his pack of smokes.

“Oh, sorry, I was only thinking–”

“Don’t lie and say you were,” he snorts as he pulls out a cigarette and taps the end of the pack. “Go on, I’m tryna watch this.”

He nods at the television and you follow his gaze to the rerun of All in the Family. He’s seen them all before. You take the dismissal and retreat up to your room. Like you always do.

It’s always been like this. You don’t hate your father but sometimes it feels like he hates you. You put your kit and your water bottle on your dress and change into clean clothes. You lay in bed and close your eyes, trying to let go of the tension in your muscles.

You don’t remember your mom but he does. You assume that’s why he’s like this. It’s not you, it’s what happened. Tragic. A loss he won’t talk about.

You rub your forehead and let your arms fall to bend on either side of your head. You only ever saw one picture of your mother. You don’t think you look like her. She was pretty. And young. You were always too afraid to ask about her but you could tell she was younger than him. No one could’ve expected her to go so soon.

You close your eyes. It’s a strange sort of grief to miss someone who is only a shadow in your mind. Not even a voice, just this ghost you know by name. Mommy…

You blow out a deep breath in an effort to bid away the sadness. That was so long ago. This is now and you have a lot to worry about.

🧹

The Laufeyson house greets you once more with its elaborate brickwork. It’s starting to feel familiar, like a habit to put in the new code and walk along the winding path around to the back door. Six more numbers and you’re inside; shoe covers, gloves, bottle, and the list.

You always check the new email sent by the agency. There’s always something small and new squeezed into the bullet points. This week, you notice the first task is laundry.

‘Retrieve hamper from hallway. When hamper is left outside door, it means clothes must be washed.’

Easy enough. You go upstairs first and take the tall hamper from beside the door frame. It’s heavy and there’s no wheels to aid in your struggle. The laundry room is downstairs. Your descent is treacherous, one step at a time as you haul the basket down step by step. If Mr. Laufeyson is there, he can’t happy with the noise.

You finally get to the machine and follow the instructions about cycle type and separating colours from whites. However, there is only the bedding to be cleaned. You load the linens in and take a moment to figure out the touchscreen. Your father’s machine has a dial that only works on one setting and gives off a dingy stench.

You leave the basket in front of the washer and retreat to start your usual progression through the urban manse. Mop, sweep, dust, vacuum, polish; hallway, kitchen, dining room, sitting room… Nothing unusual or unexpected.

As you cross the narrow foyer to the den, the sunshine glows a warm orange through the slender windows on either side of the front door. The patterning of the glass reflects prettily on the floor. Despite your best efforts, you can’t help but imagine residing somewhere so brilliant.

You sigh and carry on. You’re sure to open the long drapes to let in the late spring sunshine. It’s not so bad working in the light and you can see where the rare spec of dust is hiding. You go to the tall shelf beside the record player and pull out the albums to wipe beneath them. Music would be jarring in a place always so silent.

You slip the albums back into place, pulling out one to admire the cover; Ane Brun. You’ve never heard of them. You read the track list curiously. You know you shouldn’t be wasting time.

“I don’t believe I’d have anything to your taste on my shelf,” the mocking slither has you pushing the album in line with the rest.

You almost apologise but you remember. You don’t speak. You just clean. So clean.

You glance over at Mr. Laufeyson as he struts in, a book held in one hand as his other is tucked in his pocket. He wears his usual pressed attire; a dark button-up and even darker slacks. You note that he has no tie that day. A single curl dangles by his temple as the rest of his black hair is precisely combed back.

You return to your tasks, gently wiping the cover of the record player and along the stand. You hear the book drop onto the low table before the sofa before his footsteps continue on; closer. He approaches as you get to the next shelf, a collection of EPs in unmarked sleeves.

You wince as he stops near you, flipping up the cover of the sleek record player before stepping back to peruse his selection. You do your best to keep on as he looms. The air is thick and suffocating. Should you go to the next room and come back?

He slips a record free of its sleeve and places it carefully on the players. He moves the needle over and flips the switch, a crackle before the sound drones from the tall standing speakers. Acoustic guitar with a gritty feel to it. The sudden addition of a woman’s voice jolts you; her tone is peculiar but not unpleasant.

When I woke I took the backdoor to my mind And then I spoke I counted all of the good things you are

He backs away without a word. Not an explanation. You finish cleaning the second shelf and dare to glance over. He reads his book on the couch, unbothered by your existence. That isn’t too unfamiliar.

You finish the space but leave the vacuuming for later. You wouldn’t want to ruin the music. You go into what you can only call a sunroom. The french doors peek out onto the garden and a patio set with a large dining set in white iron and glass.

The music drifts in and keeps you company. It almost makes the work easier. You make quick work and go to check the washer to switch over the load. Once you have the dryer figured out, you begin on the second floor.

It’s only as you come out of one of the guestrooms that you notice the silence is returned. You turn down the hallway and near the next door. You enter the study with your usual reverence. Something about the space is intimidating.

The large leather chair with its dimpled back and the even bigger desk; slabs of marble set into polished ebony. Shelves of a similar material, decked out with numerous volumes and the occasional ornament. Some appear even to be genuine artifacts. The rug at the centre is patterned in Persian style.

Behind the desk are a set of doors that open onto a balcony. The drapes are drawn shut. You find that is often the case. It’s a sombre and dark space hidden from the bright gardens without. Your tasks here are minimal. You use the hand vacuum and dust the shelves. You aren’t to touch the desk at all.

A shadow startles you as you drag the cloth along the edge of the bookshelf. Your eyes round and you look over as Mr. Laufeyson enters. You blanch but he doesn’t acknowledge you. He sighs and goes to the desk, sitting in the chair and wheeling it closer. You narrow your sights on the shelves; focus.

You feel a tremble but quickly shake it away. This is his home, he must be able to exist within it, but this feels strange, almost deliberate. Is he trying to make some point? To scare you? You remember the mention of those who came before you. Did they quit or did he dismiss them? Regardless, you can’t afford either.

It isn’t that difficult to follow the rules. Don’t speak? You haven’t much to say. You get closer as you advance along the shelves to the back of the office. He lets out another long exhale. His chair creaks, once, twice, and again.

“Hm,” he rolls back and swivels, an action you observe from the corner of your eye. He tuts and wheels back to the desk, resuming tapping on the keys of his slender laptop. The glow limns his silhouette sinisterly.

You rustle the drapes as you pass them and cross to the opposite shelves. As you brush over the spines of the books, you nearly drop the cloth. His low hum frightens you as he mimics the same melody that played from the speakers below. His tone is deep and sonorous, even delightful.

You squeeze the cloth and pause before regaining your composure. This cannot be a coincidence. The camera and now he’s following you. Or so it seems. Does he distrust you? What reason have you given him?

You are mindful to wipe down the bronze statue of what you assume is a viking warrior. You place it back staunchly, making sure your work is entirely visible to him. You are honest and you like to think you do your work well. Or at least, you try to. Perhaps if he sees that effort, he won’t be so suspicious.

As you head for the door, he quits his humming. His chair squeaks again.

“You are rather more thorough than the last,” he muses.

You stop and turn your head. You nod. He’s baiting you to break his number one rule.

“And you take orders well,” he adds blithely, “that is rare these days.” He taps a key again, “as you were.”

You take the dismissal in stride and flit off to your next task. It isn’t much, maybe only a statement of fact, but it’s something. He isn’t unhappy with your work. So far, neither are you.

#loki#dark loki#dark!loki#loki x reader#fic#dark fic#dark!fic#series#au#maid au#marvel#mcu#thor#avengers

307 notes

·

View notes

Text

CAUGHT IN A CROSSFIRE

BETRAYAL — ; PART 8 / 9

PAIRING: Theseus Scamander x Female!Reader WORD COUNT: 2.7k SUMMARY: Awakening in an unfamiliar setting with restored memories, you encounter someone familiar. However, a lingering sense of betrayal clouds the reunion. Meanwhile, Theseus uncovers a concealed message in your letters, hinting at the potential discovery of your location. A/N: Hi everyone! I know I said I was going to put this on permanent hiatus until I was ready to pick it up again, but your girl finished her degree (kinda did badly, but glad it's over!), and now I have ample time to put all my energy of my one brain cell into finishing this series before I fall into depression again lol. Anyways, I really hope you enjoy this and thank you for all the love for this series and my baby, Theseus <3 I'm also sorry for ending it with another cliffhanger haha WARNINGS: Angst. Kinda scary shit (I literally scared myself while writing this lol) no beta we die like men. MASTERLIST ; MASTERPOST

Your environment is an enigma through the lenses of tunnel vision—hues of darkness circle in textures, contrasts of colour that dance along with your darting eyes. Your slow mind tries to keep up with your sight, unravelling the mysteries of your surroundings.

You first notice wood. Brown, battered, dim–a wooden beam trailing along the expanse of plastered white walls, grimed with dirt and age. Through blinkered sight, you catch a glimpse of light, dim orange hues casting fluttering shadows on the wall. You see it now, a flame dancing upon melting wax perched on a rustic candlestick.

Flame. Fire. Heat.

You remember it all now.

Inferno swept through the foundations of your tiny household, leaving you and the fragility of your lungs gasping for air as you stumbled around for an exit. Yet, things were dense, billowing colours of deep grey and red, blinding your vision. You still feel the parchedness scratching down your throat.

You remember how your hands clambered to grasp something before falling to your knees. You remember how your environment began to twist and spurn before your very eyes, vivid colours of the blaze swirling.

Then, everything went black.

…

…You…

You remember emerald cobblestones—a mesmerising golden statue.

You remember the warmth of the colour red – the trees in fall, the crackling of a fireplace, a desk with scattered papers across its surface.

You remember.

Theseus.

Dim blue eyes. Sad. Freckled cheeks. Flushed. Brown hair curled and tumbled in autumnal hues. Trees. Barcham trees that line the sidewalk are carpeted in autumn gold. The tenement. His home. Warm, petite, charming. Gardenias. Tea. Your suitcase. Magic.

Little glimpses of returning memories flood your whirling mind like gushing water. It’s overwhelming. For weeks, you sat with a sense of longing, a missing piece, settled within the depths of your mind. And now, it all traces back to the odd familiarity of the man you met on the bus. Perhaps you recognised the glint in his eye when his eyes met yours or the patterned freckles along his cheeks, tinted in blotches of red from embarrassment.

You remember.

Your elbows immediately shift under you, perched as you rose midway, wondering yet blurry eyes moving along your surroundings. You’re in a room, and it’s not your own. Small, humble, solid walls encircle your surroundings. You have seen places like these during the war. You push yourself up, weight now on your splayed-out palms on what you realise to be a settee. It creaks at your very touch, and every little shift echoes throughout the room.

Its walls are far from pristine, with petite flowers scattered across the yellowed wallpaper with tears at its curling edges, perfectly still yet timeworn.

Your eyes trace the trails of sunlight that glow through the room, diluted by a translucent curtain that hangs before a window, shadows of a tree swaying in the gentle wind.

There’s a bed on the far left of the room, narrow and meticulously made with a quilt reminiscent of autumn hues. You can barely distinguish its patchwork from where you are, and it itches a part of your brain – a sense of familiarity.

Before you can make sense of that feeling, you are overcome with searing pain. Tearing through your head and coursing through the very confinements of your skull as if something was begging to break free from the back of your mind.

Eyes squeezed shut, you cannot help but bring your palms to the sides of your head, the heels of your hands harshly pinned to your temples, yet all you see are flashing lights dancing around in the darkness.

Then, a flash. White. Blinding.

At that moment, you found yourself transported to an apartment. Yellow-bricked, warm honey-coloured hues of Autumn. Golden, falling leaves. Bright eyes, cheeks tinged with a touch of red. Theseus looks at you like you’re the sun. Like you hold a weight of significance, a tapestry to his existence.

“I know I’ve said this a thousand time before, but I’m sorry. Truly. You don’t deserve to be involved in this.”

You feel yourself smile; tears threaten to slip from your saddened eyes.

“I would usually say it’s alright, but I don’t think I can say it for everything that has happened. But, thank you.”

A hand reaches for his, gentle and soft to the touch. You feel his fingers twitch under your hold.

“Truly.”

Theseus looks at you like you’re the sun.

Theseus looks at you…

Theseus…

Suddenly, you find yourself in a narrow bus. You see him blinking wide-eyed at you, his expression paled. You had said – no, asked something.

“No. I don’t think we do.”

You see it, the pain in his eyes, the sadness in his tone. It clenches your heart, but you don’t know why.

That was the first time he had lied to you.

…

You hear your name.

Distant but frantic. It repeats again and again and again.

A grip on the curve of your shoulders, and you find yourself back in the narrow, unknown room you awoke in moments ago.

But then you see his eyes, his tousled hair. It’s him who calls you.

“Theseus?” you breathed, disbelief flickering in your wide eyes. Without a second thought, your hands reach out to grasp his shoulders, fingers digging into the fabric of his dress shirt as if to ground yourself in the reality of his presence. A counterpoint to the disarray within your mind.

But as Theseus meets your gaze, a furrow forms on his brow, and a shadow eclipses the warmth in his eyes. The frown, subtle yet profound, settles an uneasiness in you. Your grip weakens.

“We need to go. Now.” His tone is cut-throat, laden with urgency, and you cannot help but jolt at his words. You find your fingers slowly releasing their hold as the weight of his statement settles in the room.

He pulls away and reaches for your elbow, swift and deliberately, that reflects the gravity of the situation. His touch is so firm that it prompts you to stand. Questions hang heavy in the air, but you know you’re in some kind of trouble. Yet, you catch your eyes lingering on the dark look in his own, and you can't help but think he's changed since you last saw him. Since you last remembered him.

Something feels…wrong, but you don’t give yourself a chance to even think about it before you’re being led out the door.

The narrow corridor stretches ahead, dimly lit, bricked walls with a single lamp casting a glow across the space, revealing its worn walls and your flickering shadows. The air is cool, carrying a faint scent of dampness that permeates the space. All you hear is footsteps reverberating along the narrow passage, echoing against the walls. You realise you are underground and feel your stomach lurch at that thought, making your skin crawl.

“Come on.” Theseus pulls you along, the grip on your elbow never weakening. You can feel the tension emanating from him, the stiffness in his movements, the rigidity of his jaw.

You find yourself staring at the back of Theseus' head, studying how the dim light catches on his hair. He seems so different.

“Where are we going?” You finally ask.

He doesn’t respond.

Theseus continues to pull you down the corridor, and you take the time to scan your surroundings despite the quickened pace. You see the occasional rusty pipes that snake along the ceiling, contributing to a low mechanical hum and the flickering of overhead lights that seem to swing periodically at a light rumble that makes the ground shake for a second or two.

Then, he eventually comes to an abrupt halt, revealing a dead end. Your feet stagger back, trying to stop yourself from bumping into him. You see Theseus' brows furrowed in thought, eyes darting between the walls, searching. His fingers trace the rugged surface and abruptly pause as you catch sight of a carving on a specific brick, nearly invisible.

Theseus taps it, and a warm glow emanates from the wall. The carving becomes illuminated, and the wall seems to dissolve into seemingly ethereal dust. It shines golden under the dim buzzing lights. What once was a wall reveals an entrance to an alleyway; it greets you with a rush of cool air and the sounds of the city.

You step through the entrance after Theseus as he beckons for you to follow hurriedly. Yet, your focus is elsewhere as you close in on the intricate symbol carved into the brick. As you inch nearer, the features sharpen, and a sudden recognition sparks within you.

It's a Gardenia, delicately depicted.

Gardenias always had a particular significance in your life, and it’s all because of your mother. That same Gardenia on your mother’s necklace is an heirloom that spanned many generations. It was important and personal to her, and you don’t know how or why it is doing here.

Flowers for your mother – a bouquet of Gardenias.

The bigger picture materialises as if the puzzle pieces are beginning to click.

Your place in the unfolding mess remains unclear, but it hints that you've anticipated the arrival of this revelation for a long time.

Theseus is calling for you, a slight note of panic in his voice, but you ignore his calls, remaining rooted in place. As you watch the glow that details the symbol disappear, you wonder if Theseus knows everything, even though you swore you never told a soul.

Unless…

You still don’t know how you got your memories back.

As you finally turn to Theseus, there’s a gripping sense of uncertainty. His approach, marked by a frustrated expression, erodes the strong familiarity you once held for this man, a trust built in such a short time. With each step towards you, that trust begins to dissipate.

That vulnerability quickly turns to anger – betrayal.

“What the hell is happening, Theseus?” you question fiercely, pressing him for an explanation.

Again, Theseus dismisses your insistence and attempts to reach for your arm, but you instinctively step back, maintaining a wary distance.

“Answer me.” you insist, voice growing louder, eyes boring into his.

His gaze lingers on your face, and you watch his expression harden, jaw tense.

“Look, you’re in deep trouble right now and it’s best we leave right now he’ll come looking for you.”

He.

Not they. Not she.

Not The Restoration Movement. Not Morrigan.

Something is very wrong.

And his eyes. You can’t quite place it, but something about the look in his eyes has shifted. They look so different.

In moments like these, you aren’t sure what to do, but you know to trust your gut. Your mind races at the possibilities of how this could all end, and the only thing you can think is to run.

And so, you run.

—

Theseus believes he has only survived through self-deceit – the deception of his ability to stay grounded and keep his emotions at bay. His heart was never to be trusted, never to give in or give up. Yet, how does one cope when a situation relies on promised perseverance but is tangled amid his emotions he suddenly lacks control of in your presence?

Theseus knows there was something between the two of you, but he will never admit it despite his now aching heart caused by your sudden disappearance, even though you might as well be considered dead to the muggle world. The thought of your death pulls his thoughts to the night he first met you, how an unforgivable curse nearly struck you, how you looked at him, knowing you couldn’t have survived if he hadn’t been there in time.

Merlin, he hopes you aren’t dead.

No, you’re not. He knows it. You’re relentless. So relentless that death would never want to claim you without a fight. So relentless that you manage to squeeze yourself into his thoughts at every waking hour. Every fibre in him wishes he hadn’t let you slip away that day, wishing he hadn’t abandoned you, betrayed your trust.

He wishes you hadn’t agreed to leave.

To leave him.

Now all alone.

Alone.

Theseus was never certain of his feelings for you when you were ambling within the expanse of the four walls he calls home. Whether affections were simply out of pity or was it his admiration for your entire being, your perfections, blemishes, and everything in between. Yet, at this very moment, he couldn’t be more unequivocally sure that his affections are true because presently, you have consumed all his waking days and nights, leaving a hollowed space perhaps once filled by your presence. The constant worry in his brow made his eyes tired but sleepless due to his fear of the worst for you.

Dread fills his senses, and tears threaten to seep through the cracks of a carefully sculpted, hard-headed man he had spent years practising, performing as a so-called war hero. Theseus never let himself cry, especially over you, not even when you parted with a touch to his cheek. Not even when he set his eyes on you again and you were completely unaware of him.

Yet, it’s the possibility he has lost you forever that he’ll never see you again. Never.

Theseus breathes a shaky breath, fingers clamped in his trembling hand as he tries to remember what he’s been told to do. To find you. To stop Morrigan. To stop whatever mess he has landed you in.

No, you’re not. You’re not dead. He reminds himself again.

The sun had set moments ago, darkness creeping between the cracks of light, shimmering from the candle alight by his tableside and the flames of the fireplace. Its crackling grounds his very notion of stirring into panic. Theseus finds himself tucked in the same corner of his living room, and his couch now houses a collection of books and particular pieces of evidence of your whereabouts.

He merely fears this has everything to do with Morrigan, the Restoration Movement, your supposed living brother and perhaps your mother – also dead. Theseus gains a strong premonition, a gut feeling that your disappearance is all a part of a larger plan than he had initially expected. Your disappearance may have caused a flurry of commotion amongst the Aurors. Still, the ministry has its sights on the movement rather than your supposed connection as more than just your brother, which Theseus feels strongly about. Yet, with Travers breathing down his neck to arrest Morrigan and her acolytes, Theseus needs solid evidence rather than vague instances and misdirected clues that all seem to lead to spiralling trails.

Frankly, his career is at stake, but he couldn’t care less.

He just wants to see you again.

Theseus heaves, fingers carding through his deep brown locks when his eye catches sight of the only two letters that he found to be related to you in one way or another. He finds himself drawn to it, finding the letter from your brother within his grasp for what seems like the millionth time this month. The same words, again and again, were already engraved in his mind.

When he shifts his elbow, the letter catches the candlelight from behind, and something immediately seizes his attention. Something he hadn’t recognised before now.

Inscribed in the very material of the parchment – the symbol of a Gardenia, its intricate lines glowing against the candlelight, seemingly burning. Theseus props up in his seat, back straightened, shoulders tensed, and eyes wide.

Bloody hell…

He scrambles for the other letter, holding it up against the light, eyes settling on the darkened edges of the page only to discover the very same symbol.

A Gardenia.

How could he have been so blind?

It must have been instinct when he decided that the two letters were puzzle pieces meant to be joined. Theseus would try anything at this point.

Seemingly, luck was finally on his side when he pressed the letters together, above one another – new words formed before his eyes, written with burning lines, every curve of each letter appeared between the gaps of the original text to only form a new paragraph.

Sister,

If you're reading this, I'm likely gone, and you're in trouble. Morrigan and The Restoration Movement hide a darker truth. Their agenda involves our mother and a woman named Miriam Monet. I'm unsure of the details, but Miriam plays a crucial role. Stay safe.

As his eyes shift down the page, his heart nearly stops when his name comes into view.

To Theseus,

If you see this, my sister is in danger. You know more than you think.

TAGLIST (tagging everyone who commented in my last post just because it's been awhile <3):

@crumpets-are-better-with-jam

@inlovewithfictionalcharacters27

@aterriblelangblr

@yournewmommy

@mariaelizabeth21-blog1

@never-let-them-change-your-self

#theseus scamander#theseus scamander x reader#theseus scamander imagine#theseus scamander x you#theseus scamander oneshot#caught in a crossfire

242 notes

·

View notes

Text

Hammer and Hanging Man Patterns: Analyzing Market Trends

stockThe Hammer and Hanging Man are significant candlestick patterns used to analyze market trends and predict potential reversals. Recognizing these patterns can help traders make more informed decisions. In this article, we’ll explore the Hammer and Hanging Man patterns and discuss how to use them effectively.

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

Understanding Bearish Candlestick Patterns

In the world of technical analysis, candlestick patterns play a crucial role in predicting future price movements. Among these patterns, bearish candlestick patterns are essential for traders looking to identify potential downtrends and reversals. Understanding these patterns can enhance your ability to make informed trading decisions. In this blog, we’ll dive into the most common bearish candlestick patterns and how you can use them to anticipate market movements.

What Are Bearish Candlestick Patterns?

Bearish candlestick patterns are formations on a price chart that suggest a potential decline in the asset's price. These patterns often indicate a shift in market sentiment from bullish to bearish, signaling a possible selling opportunity. Recognizing these patterns can help traders prepare for potential downturns and manage their trades more effectively.

Key Bearish Candlestick Patterns

1. Shooting Star

Description: The shooting star is a single-candle pattern that appears after an uptrend. It has a small body at the lower end of the candle with a long upper shadow and little to no lower shadow.

Indication: A shooting star signals a potential reversal of the uptrend and suggests that the market may be turning bearish.

Trading Strategy: Look for confirmation of the bearish reversal on the next candle or through other technical indicators before making trading decisions.

2. Dark Cloud Cover

Description: This two-candle pattern appears after an uptrend. The first candle is a long bullish candle, followed by a bearish candle that opens above the high of the previous candle but closes below the midpoint of the first candle.

Indication: The dark cloud cover pattern indicates that the bullish momentum is waning, and a bearish reversal may be on the horizon.

Trading Strategy: Wait for confirmation of the pattern with a further decline in price before executing a trade.

3. Engulfing Pattern

Description: The bearish engulfing pattern consists of two candles. The first candle is a small bullish candle, and the second candle is a larger bearish candle that completely engulfs the body of the first candle.

Indication: This pattern suggests that the bears are gaining control, potentially signaling the start of a downtrend.

Trading Strategy: Confirm the pattern with additional technical indicators or subsequent price action to validate the bearish signal.

4. Hanging Man

Description: The hanging man is a single-candle pattern found at the top of an uptrend. It has a small body at the upper end with a long lower shadow and little to no upper shadow.

Indication: The hanging man suggests that selling pressure is increasing, which could signal a bearish reversal if confirmed by subsequent price action.

Trading Strategy: Look for confirmation of the bearish reversal with a bearish follow-through on the next candle.

5. Evening Star

Description: The evening star is a three-candle pattern. It starts with a long bullish candle, followed by a small-bodied candle that gaps up, and concludes with a long bearish candle that closes well into the body of the first candle.

Indication: This pattern indicates a strong potential reversal from bullish to bearish and suggests that the market may be entering a downtrend.

Trading Strategy: Confirm the pattern with additional technical analysis before taking a bearish position.

How to Use Bearish Candlestick Patterns

1. Confirmation is Key: Always look for confirmation of bearish signals through additional technical indicators or subsequent price action. Patterns alone may not always be reliable without confirmation.

2. Combine with Other Analysis: Use bearish candlestick patterns in conjunction with other technical analysis tools, such as trend lines, moving averages, or volume analysis, to enhance the accuracy of your predictions.

3. Risk Management: Implement proper risk management strategies, including setting stop-loss orders and managing position sizes, to protect your capital in case the market does not behave as anticipated.

4. Practice and Learn: Familiarize yourself with these patterns by studying historical charts and practicing on demo accounts. The more you observe and analyze these patterns, the better you will become at identifying and interpreting them.

Conclusion

Understanding bearish candlestick patterns is crucial for traders looking to identify potential reversals and capitalize on downtrends. Patterns such as the shooting star, dark cloud cover, engulfing pattern, hanging man, and evening star can provide valuable insights into market sentiment and potential price movements. By combining these patterns with other technical analysis tools and practicing sound risk management, you can enhance your trading strategy and improve your chances of success. Happy trading!

0 notes

Text

Hanging Man Candlestick: A Complete Guide for Traders

Let's find out one of an interesting candlestick pattern with hanging man candlestick. 🤔

What Is the Hanging Man Candlestick? 👇

The hanging man candlestick is a significant pattern in technical analysis, often indicating a potential bearish reversal in the market. The fight between buyers and sellers is what the hanging man candlestick represents. If it happens after a rise, it causes prices to drop because there are more sellers than buyers.

However, the pattern must be confirmed in more trade sessions before it can be used as a sure sign. Traders often look for a lower close after the hanging man or other negative signs to ensure the pattern is practical.

Structure of the Hanging Man Candlestick👇

Appearance in an Uptrend The hanging man candlestick typically forms after a price rise or during an uptrend. It suggests a possible shift in momentum.

Small Real Body The real body of the candlestick is small. It represents the difference between the opening and closing prices. This indicates that there is little difference between the opening and closing prices.

Long Lower Shadow The most distinctive feature of the hanging man is its long lower shadow, which is usually at least twice the length of the real body. This long shadow signifies a substantial sell-off during the trading period, but the buyers were able to push the price back up near the open.

Little or No Upper Shadow The hanging man usually has little or no upper shadow. This indicates that the price did not move significantly above the opening price during the session.

Position in an Uptrend The context of the hanging man is crucial. It occurs after an uptrend in the market. This indicates that the bullish trend might decline, and a bearish reversal could be around.

Confirmation Even though the hanging man indicates a possible negative turn, it shouldn’t be used alone. Traders usually wait for additional confirmation, resulting in a downward price movement in subsequent trading sessions. This confirmation helps in validating the reversal signal provided by the hanging man.

Read more: https://finxpdx.com/hanging-man-candlestick-a-complete-guide-for-traders/

#investing#finance#investment#forex#financial#forex market#forextrading#candlestick#candlesticks pattern

0 notes

Text

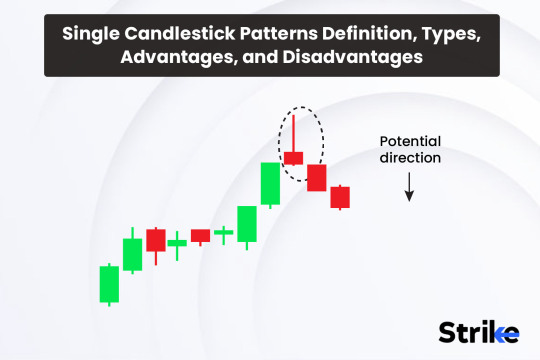

Mastering Single Candlestick Patterns: A Comprehensive Guide

Introduction: Candlestick patterns are an essential tool in the arsenal of any technical analyst. They provide valuable insights into market sentiment and potential price movements. Among the various types of candlestick patterns, single candlestick patterns stand out for their simplicity and effectiveness. In this article, we'll delve into the world of single candlestick patterns, exploring their significance, interpretation, and practical application in trading.

Understanding Candlestick Patterns: Before diving into single candlestick patterns, let's recap what candlestick patterns represent. Each candlestick on a price chart illustrates the open, high, low, and close prices for a specific period, whether it's a minute, hour, day, or week. The body of the candlestick represents the price range between the open and close, while the wicks (or shadows) indicate the high and low prices reached during that period.

Single Candlestick Patterns: Single candlestick patterns consist of individual candles that provide valuable information about market sentiment and potential reversals or continuations in price trends. While they may seem simplistic compared to multi-candle patterns like engulfing or harami, single candlestick patterns carry significant significance and can offer traders valuable insights when interpreted correctly.

Doji: The Doji is perhaps the most well-known single candlestick pattern. It forms when the open and close prices are virtually equal, resulting in a small or non-existent body and long wicks. A Doji suggests indecision in the market, signaling a potential reversal or continuation depending on its context. For example, a Doji following a strong uptrend may indicate a potential trend reversal, while a Doji during a consolidation phase could signal further ranging.

Hammer and Hanging Man: The Hammer and Hanging Man patterns are characterized by a small body near the top or bottom of the candlestick, with a long lower wick and little to no upper wick. The Hammer occurs after a downtrend and suggests a potential bullish reversal, especially if it appears near support levels. Conversely, the Hanging Man forms after an uptrend and indicates possible bearish pressure, particularly if it appears near resistance.

Shooting Star and Inverted Hammer: The Shooting Star and Inverted Hammer patterns are similar to the Hammer and Hanging Man but appear at the end of uptrends and downtrends, respectively. The Shooting Star features a small body near the bottom of the candle, with a long upper wick, signaling potential bearish reversal. On the other hand, the Inverted Hammer, with its small body near the top and long lower wick, suggests a possible bullish reversal after a downtrend.

Spinning Top: The Spinning Top is characterized by a small body and long upper and lower wicks, indicating a tug of war between buyers and sellers. This pattern suggests indecision in the market and often precedes trend reversals or continuations, depending on its context within the price chart.

Practical Application: Mastering single candlestick patterns requires both theoretical knowledge and practical experience. Traders can integrate these patterns into their trading strategies by using them in conjunction with other technical indicators and price action analysis. Here are a few tips for effectively utilizing single candlestick patterns:

Context is Key: Consider the broader market context, including trend direction, support and resistance levels, and trading volume, when interpreting single candlestick patterns.

Confirmation: Single candlestick patterns are most effective when confirmed by other technical indicators or multiple timeframes. Look for confluence with moving averages, trendlines, or volume analysis to validate potential trading signals.

Risk Management: Always use proper risk management techniques, including setting stop-loss orders and adhering to position sizing principles, to protect against adverse market movements.

Practice: Like any skill, mastering single candlestick patterns requires practice and observation. Regularly analyze price charts, identify patterns, and reflect on their outcomes to improve your trading proficiency over time.

Conclusion: Single candlestick patterns offer valuable insights into market sentiment and potential price movements, making them indispensable tools for traders of all experience levels. By understanding the significance and interpretation of patterns like Doji, Hammer, Hanging Man, Shooting Star, Inverted Hammer, and Spinning Top, traders can enhance their decision-making process and improve their trading results. However, it's essential to remember that no single pattern guarantees success, and incorporating proper risk management and technical analysis is crucial for sustained trading success.

0 notes

Text

Table of ContentsIntroductionUnderstanding Candlestick Patterns for Trend IdentificationTechnical Indicators for Confirming Chart TrendsMoving Averages and Trendlines for Long-Term AnalysisQ&AConclusionUnlock the Secrets of Crypto Charts: Master Trends and Maximize ProfitsIntroduction**Introduction to Reading Crypto Charts and Identifying Trends** Cryptocurrency charts provide valuable insights into market behavior and price movements. Understanding how to read these charts is crucial for traders and investors to make informed decisions. This introduction will guide you through the basics of crypto chart reading, focusing on identifying trends and patterns that can help you navigate the volatile crypto market.Understanding Candlestick Patterns for Trend Identification**Reading Crypto Charts and Identifying Trends** Understanding candlestick patterns is crucial for identifying trends in cryptocurrency markets. Candlesticks are graphical representations of price movements over a specific time frame, typically ranging from one minute to one month. Each candlestick consists of a body, which represents the difference between the opening and closing prices, and wicks, which indicate the highest and lowest prices reached during the period. By analyzing the shape, size, and position of candlesticks, traders can gain insights into market sentiment and potential price movements. For instance, a long green candlestick with a small wick indicates a strong bullish trend, while a long red candlestick with a large wick suggests a bearish reversal. One of the most common candlestick patterns is the "hammer," which appears as a small body with a long lower wick. This pattern often indicates a reversal from a downtrend to an uptrend. Conversely, the "hanging man" pattern, which resembles an inverted hammer, signals a potential reversal from an uptrend to a downtrend. Another important pattern is the "doji," which occurs when the opening and closing prices are nearly equal, resulting in a small body with no wicks. Dojis can indicate indecision or a pause in the trend and can be followed by either a bullish or bearish move. In addition to individual candlestick patterns, traders also consider the overall arrangement of candlesticks to identify trends. For example, a series of higher highs and higher lows indicates an uptrend, while a series of lower highs and lower lows suggests a downtrend. Trendlines are another useful tool for identifying trends. These lines connect a series of highs or lows and can help traders visualize the direction of the market. A rising trendline indicates an uptrend, while a falling trendline suggests a downtrend. By combining candlestick patterns, trendlines, and other technical indicators, traders can develop a comprehensive understanding of market trends and make informed trading decisions. However, it's important to note that technical analysis is not an exact science, and there is always the potential for unexpected market movements.Technical Indicators for Confirming Chart Trends**Reading Crypto Charts and Identifying Trends** Understanding how to read crypto charts is crucial for successful trading. Charts provide a visual representation of price movements over time, allowing traders to identify trends and make informed decisions. **Identifying Trends** The first step is to identify the overall trend of the market. This can be done by drawing trendlines that connect the highs and lows of the price action. An uptrend is characterized by higher highs and higher lows, while a downtrend is characterized by lower highs and lower lows. **Support and Resistance Levels** Support and resistance levels are important indicators of potential trend reversals. Support is a price level where the price has difficulty falling below, while resistance is a price level where the price has difficulty rising above. When the price breaks through a support or resistance level, it often signals a change in trend. **Moving Averages**

Moving averages are another useful tool for identifying trends. They smooth out price fluctuations by calculating the average price over a specified period. A rising moving average indicates an uptrend, while a falling moving average indicates a downtrend. **Technical Indicators** Technical indicators are mathematical formulas that help traders identify trends and predict future price movements. Some of the most popular technical indicators include: * **Relative Strength Index (RSI):** Measures the strength of a trend by comparing the magnitude of recent gains to recent losses. * **Moving Average Convergence Divergence (MACD):** Identifies trend reversals by comparing two moving averages. * **Bollinger Bands:** Create a range around the price action, indicating potential overbought or oversold conditions. **Confirming Trends** Once a trend has been identified, it's important to confirm it using multiple technical indicators. For example, a rising trend can be confirmed by a rising moving average, a high RSI, and a breakout above a resistance level. **Conclusion** Reading crypto charts and identifying trends is an essential skill for successful trading. By understanding the concepts of trendlines, support and resistance levels, moving averages, and technical indicators, traders can make informed decisions and increase their chances of profitability. However, it's important to remember that technical analysis is not an exact science, and there is always the potential for unexpected market movements.Moving Averages and Trendlines for Long-Term Analysis**Reading Crypto Charts and Identifying Trends: Moving Averages and Trendlines for Long-Term Analysis** Understanding crypto charts is crucial for successful trading and investment. Moving averages and trendlines are two essential tools that provide valuable insights into long-term market trends. **Moving Averages** Moving averages smooth out price fluctuations by calculating the average price over a specified period. They help identify the overall trend and filter out noise. Common moving averages include the 50-day, 100-day, and 200-day moving averages. When the price is above the moving average, it indicates an uptrend. Conversely, when the price is below the moving average, it suggests a downtrend. Crossovers between the price and the moving average can signal potential trend reversals. **Trendlines** Trendlines are lines drawn along the highs or lows of a chart to identify the direction of the trend. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is characterized by a series of lower highs and lower lows. Trendlines provide support and resistance levels. When the price bounces off a trendline, it indicates that the trend is still intact. However, if the price breaks through a trendline, it suggests a potential trend reversal. **Combining Moving Averages and Trendlines** Combining moving averages and trendlines enhances the accuracy of trend identification. For example, a price above a moving average and a rising trendline indicates a strong uptrend. Conversely, a price below a moving average and a falling trendline suggests a strong downtrend. **Long-Term Analysis** Moving averages and trendlines are particularly useful for long-term analysis. They help identify major market trends that can last for months or even years. By understanding these trends, investors can make informed decisions about their crypto investments. **Conclusion** Reading crypto charts and identifying trends is essential for successful trading and investment. Moving averages and trendlines are powerful tools that provide valuable insights into the overall market direction. By combining these tools, investors can gain a comprehensive understanding of long-term trends and make informed decisions about their crypto portfolios.Q&A**Question 1:** What is a candlestick chart? **Answer:** A candlestick chart is a type of financial chart that visually represents the price movement of a security over a specific period of time.

**Question 2:** How do you identify an uptrend in a crypto chart? **Answer:** An uptrend is characterized by a series of higher highs and higher lows. The price action will typically form a series of ascending peaks and troughs. **Question 3:** What is a support level? **Answer:** A support level is a price level at which the price of a security has difficulty falling below. It is often identified by a horizontal line on a price chart.Conclusion**Conclusion:** Understanding how to read crypto charts and identify trends is crucial for successful cryptocurrency trading. By analyzing price action, volume, and technical indicators, traders can gain insights into market sentiment, potential price movements, and trading opportunities. Mastering these techniques empowers traders to make informed decisions, manage risk, and maximize their profits in the volatile crypto market.

0 notes

Text

0 notes

Link

A Candlestick chart is a vital tool that is used for technical analysis in order to identify all the potential buy and sell opportunities. There are many Candlestick patterns, such as bullish harami, hammer, shooting star, hanging man, and doji that can help traders to identify trend reversals.Let’s move right into knowing more about Candlestick.What are Candlesticks?Candlestick is a charting technique that is used to describe asset price movements. Nowadays, Crypto traders are using Candlestick to predict upcoming price movements and analyze historical price data. Candlestick patterns help in indicating the rise or fall of prices. This gives insight into potential trading opportunities and market sentiment.What is meant by the Candlestick chart?A Candlestick chart is a visual way to represent the price data. The Candlestick’s body represents the range between closing and opening prices within that time period, while the shadows or wicks represent the lowest and highest prices reached in that period.How to read Candlestick patterns?A Candlestick pattern is formed by arranging various candles in a sequence. Based on the interpretation, there are various Candlestick patterns. A few Candlestick patterns give an insight into the balance between sellers and buyers, while others may indicate continuation, reversal, or indecision.Candlestick patterns help to understand buy or sell signals.They serve as a method for examining market trends to spot impending chances. Hence, it’s always beneficial to consider patterns in their context.Depending on the technical pattern on the chart, such as the Elliott Wave Theory, Wyckoff Method, or Dow Theory, it may help in analysing the background of the overall market environment. Technical analysis (TA) indicators such as Relative Strength Index (RSI), Trend Lines, Ichimoku Clouds, Stochastic RSI, or Parabolic SAR might also be included.Hope this answer helps you — — — — — — -XXXXXXXX #Read #Popular #Crypto #Candlestick #Patterns #CointradeIndia

0 notes

Text

How to Read and Interpret Candlestick Charts

Unveiling the Secrets of Candlestick Chart Interpretation By Amir Shayan Candlestick charts are a fundamental tool in the world of financial trading. They provide crucial insights into the price movements of various assets, helping traders make informed decisions. Understanding how to read and interpret candlestick charts is a skill that can greatly enhance your trading acumen. In this article, we will delve into the intricacies of candlestick charts, unraveling their significance and guiding you through the process of deciphering their patterns.

The Language of Candlestick Charts

Candlestick charts originated in Japan centuries ago and have since become a cornerstone of technical analysis. Each candlestick represents a specific time frame, whether it's a minute, an hour, a day, or longer. The chart consists of individual candles, and the patterns they form can reveal potential trends, reversals, and price movements.

Anatomy of a Candlestick

A single candlestick consists of several key components: the body, the wick (or shadow), and sometimes the tail. The body represents the difference between the opening and closing prices during the given time frame. If the closing price is higher than the opening price, the body is typically colored or filled. Conversely, if the opening price is higher than the closing price, the body is usually empty or transparent. The wick or shadow extends above and below the body, indicating the range between the highest and lowest prices during the time period. The tail, if present, extends from the body's top or bottom, signifying the range beyond the wick.

Common Candlestick Patterns

Doji: A Doji occurs when the opening and closing prices are very close or even identical. It suggests uncertainty in the market and a potential reversal. Hammer and Hanging Man: These patterns have small bodies and a long lower tail. A Hammer appears after a downtrend and implies a potential bullish reversal, while a Hanging Man after an uptrend can indicate a bearish reversal. Bullish and Bearish Engulfing: A Bullish Engulfing pattern occurs when a small bearish candle is followed by a larger bullish one. The reverse is the Bearish Engulfing pattern. These suggest a reversal of the current trend. Morning Star and Evening Star: The Morning Star is a three-candle pattern featuring a large bearish candle, a small bearish or bullish one, and a large bullish one. It indicates a potential reversal from a downtrend. The Evening Star is the opposite, signaling a potential reversal from an uptrend.

Interpreting Candlestick Patterns

Candlestick patterns provide valuable information about market sentiment and potential price movements. For instance, a series of bullish candlesticks indicates a strong uptrend, while a succession of bearish ones suggests a downtrend. Reversal patterns, as the name suggests, may indicate an impending change in the current trend. It's important to note that while candlestick patterns can offer insights into market movements, they should be considered alongside other technical and fundamental analysis tools for a comprehensive understanding.

Conclusion

Candlestick charts are a visual representation of market dynamics, revealing the battle between buyers and sellers. By understanding the patterns they form, traders can gain a deeper understanding of market sentiment and potential price movements. However, like any tool, candlestick charts are most effective when used in conjunction with other forms of analysis. Learning to read and interpret candlestick charts takes time and practice, but it's a skill that can greatly improve your trading decisions. As you become more proficient in deciphering these patterns, you'll be better equipped to navigate the complexities of financial markets and make informed choices that align with your trading strategy. Read the full article

#candlestickcharts#candlestickpatterns#Chartinterpretation#financialmarkets#marketanalysis#marketsentiment#PriceMovements#Technicalanalysis#Tradingpatterns#tradingstrategy

0 notes

Text

Hanging man candlestick pattern

“Life on a Limb: The Hanging Man’s Journey””The Suspense of the Hanging Man: Unraveling the Mystery“ Hanging Man candlestick pattren is a single candlestick pattren that if formed at an end of an uptrend. It is a bearish reversal pattren that signals that the uptrend is going to end. this also indicates that the bulls have lost their strength in moving the prices up and bears are back in the…

View On WordPress

0 notes

Text

Candlestick chart analysis – An impactful stock trading tool

Candlestick chart analysis – An impactful stock trading tool

Candlestick chart patterns have become a popular tool for analyzing stock market trends and making trading decisions. Candlestick charts visually represent the price movement of a stock over a specific period of time. This type of charting was developed in Japan in the 1700s, and it has gained popularity in the western world in recent years. Today, many SEBI Certified Research Analysts use candlestick charts to make informed trading decisions.

What are candlestick chart patterns?

Candlestick chart patterns are formed by a series of candlesticks that represent the open, high, low, and close prices of a stock over a particular period. These patterns provide traders with valuable information on the market sentiment and trend.

There are two types of candlesticks - bullish and bearish. A bullish candlestick is represented by a long green candle, which indicates that the stock price closed higher than it opened. A bearish candlestick is represented by a long red candle, which indicates that the stock price closed lower than it opened.

Candlestick chart patterns are formed when multiple candlesticks of the same type are grouped together in a specific formation. These formations provide traders with valuable insights into market trends and can help them make informed trading decisions.

Some common candlestick chart patterns include the Doji, Hammer, Hanging Man, Shooting Star, Engulfing Pattern, and the Morning and Evening Star. Each of these patterns indicates different market trends and provides traders with valuable information on market sentiment.

How can traders use candlestick chart patterns?

Traders can use candlestick chart patterns to make informed trading decisions. By analyzing the patterns, traders can identify the trend of a stock and determine whether it is bullish or bearish. This information can help traders determine when to buy or sell a stock.

For example, if a trader sees a Bullish Engulfing Pattern on a candlestick chart, it may indicate that the stock is about to experience a bullish trend. In this case, the trader may want to buy the stock to take advantage of the potential upward trend.

On the other hand, if a trader sees a Bearish Engulfing Pattern on a candlestick chart, it may indicate that the stock is about to experience a bearish trend. In this case, the trader may want to sell the stock to avoid potential losses.

Conclusion

Candlestick chart patterns provide traders with valuable information on market trends and can help them make informed trading decisions. By analyzing these patterns, traders can determine whether a stock is bullish or bearish and make the right trading decisions. If you're interested in using candlestick chart analysis for trading, it's important to work with a SEBI Certified Research Analyst who can provide you with the right guidance and support.

1 note

·

View note

Text

HAMMER AND HANGING-MAN LINES

HAMMER AND HANGING-MAN LINES

Hammer & Hanging Man are candlesticks with long lower shadows and small real bodies. The real bodies are near the top of the daily range. The variety of candlestick lines shown in the exhibit are fascinating in that either line can be bullish or bearish depending on where they appear in a trend. If either of these lines emerges during a downtrend it is a signal that the downtrend should end. In…

View On WordPress

#Basics Of Technical Analysis#Candlestick Explained#candlestick pattern#hanging man#Japanese Candlestick#technical analysis#What Is Candlestick#what is candlestick chart

0 notes