#gstrefund

Explore tagged Tumblr posts

Text

FTA benefit denied based on intelligence is not sustainable when further investigation was not done says CESTAT Ahmedabad

FTA benefit denied based on intelligence is not sustainable when further investigation was not done says CESTAT Ahmedabad

“Indirect Tax I Indirect Tax Litigation I Customs & FTP I Central Licensing I Arbitration I Advisory” Dated: 23.01.2025 FTA benefit denied based on intelligence is not sustainable when further investigation was not done says CESTAT Ahmedabad The Customs, Excise & Service Tax Appellate Tribunal ruled in favor of D.P. Chocolates, overturning Customs’ denial of FTA benefits on imported cocoa…

#BIS#BISRegistration#CBIC#CESTAT#CESTATAhmedabad#CESTATOrders#Customs#CustomsAct#CustomsAct1962#DGFT#Exports#Facebook#FTA#FTP#GovtofIndia#GST#GSTRefund#Imports#India#IndianChamberofCommerce#IndianCustoms#IndirectTaxLaw#IndirectTaxLitigations#Instagram#Law#LawFirm#Lawyers#Legal#LinkedIn#Litigation

0 notes

Text

Interim Budget 2024: A Comprehensive Analysis

Read Full Article: https://www.mygstrefund.com/interim-budget-2024-comprehensive-analysis/ THANKS FOR READING! We provide GST refund solutions for customers. To know more please visit: www.mygstrefund.com Join Our Community: community.mygstrefund.com Contact Us: +91 9205005072 Mail- [email protected]

#NirmalaSitharaman#ViksitBharatBudget#Budget2024#UnionBudget#Budget#gst#gstcouncil#council#gstupdates#gstnews#gstindia#tax#costly#cheaper#items#gstrefund

0 notes

Text

Challenges in GST refund process and their solutions | CA Manish Gupta

In this video, I have shared challenges in GST refund process and their solutions.

youtube

0 notes

Text

Narendra Modi MODI ji, ye Sitaraman Parliament mein baith kar apni maa aise hi chudwati rehti hai???

#bycottgst #gstrefund #gstupdates #gstreturns #GSTRegistration

0 notes

Photo

PAN INDIA GST LELO LLP

Reach us:

We are now available at:

Facebook

Twitter

Instagram

Youtube

Linkedin

Tumblr

#GSTRegistration#gst return filing#gst audit#gstrefund#taxation#accounting#incometax#incometaxreturn

1 note

·

View note

Text

Any person can claim refund of any excess tax, interest, any other amount paid by him. Can make an application electronically u/form RFD-01 through common portal (GSTN) within 2 years from the relevant date.

Read More :- https://legalite.in/refund-under-gst/

0 notes

Link

When taxpayers pay excess GST (Goods and Service Tax) in certain cases and the tax paid is more than the GST liability, the taxpayers can claim their GST refund via a streamlined GST process. The government has created a standardized Online GST Refund process in 2019 There are time-limits set for the process, let us check it in detail.

0 notes

Text

CESTAT Chennai allows Classification of imported goods with duty Exemption benefits

CESTAT Chennai allows Classification of imported goods with duty Exemption benefits

“Indirect Tax I Indirect Tax Litigation I Customs & FTP I Central Licensing I Arbitration I Advisory” Dated: 22.01.2025 CESTAT Chennai allows Classification of imported goods with duty Exemption benefits The CESTAT Chennai recently issued rulings on customs classification disputes involving M/s. Bharath FIH Ltd., addressing the classification of receivers, microphones, and mobile phone parts.…

#BIS#BISAct#BISExempted#BISRegistration#BISStandard#CESTAT#CESTATchennai#CESTATOrders#Customs#CustomsAct1962#DGFT#DPIIT#Exports#Facebook#FTP#GovtofIndia#GST#GSTRefund#India#IndianChamberofCommerce#IndianCustoms#IndianCutomsAtWork#Instagram#Law#Lawyers#Legal#LinkedIn#Litigations#LitigationSupport#MinistryofFinance

1 note

·

View note

Text

Your Comprehensive Guide to Getting GST Refund in India (2024)

It is not difficult to navigate through claiming a refund of the GST; still, business houses, financial professionals, entrepreneurs, and also individual taxpayers must understand the easiest mode of claiming these refunds. In this article, we have segregated the process of refund under GST, the eligibility criteria, and timeline so you can claim your refund.

What is GST Refund?

A GST refund arises from the situation where registered taxpayers have overpaid the amount of tax owed. This amount can be recovered through an online procedure on the GST portal. In a timely manner, GST refunds are crucial for businesses as well as exporters to keep cash flow and working capital healthy.

Who Can Claim Refund in GST?

Businesses and companies with excess paid taxes or ITC accumulation.

Exporters who have paid Integrated GST (IGST) on exports.

Individual taxpayers who have paid more in error or eligible for refunds pertaining to special purchases. As defined, special purchases include those of the UN agencies and embassies.

International tourists can claim a refund of GST paid on goods purchased from India at the time of departure from the country.

When can GST Refund be claimed?

The following are circumstances under which a GST refund can be claimed:

Excess GST paid due to calculation errors or over-payment.

Amount of ITC on exports/deemed exports.

GST paid on exports.

Inverted Duty Structure, which refers to a structure where input tax exceeds the output tax.

Refund on provisional assessments.

Time Limit for Claiming GST Refund Application

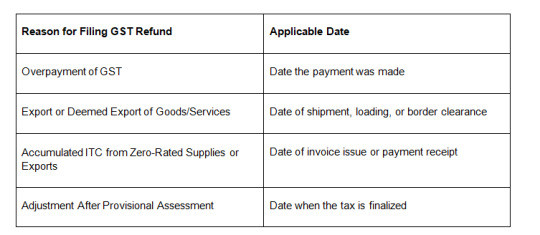

Taxpayers are expected to file their GST refund applications within two years from the relevant date. Time limitation and grounds for filing in a GST refund application are as stated below:

This deadline ensures that companies and tax payers file within a stipulated time frame before losing their rightful refunds.

How to Apply for a GST Refund Step by Step

Login to the GSTN Portal: Login into your account at the GSTN Portal .

Fill Form RFD-01: This would be the form on which refund claims would be supported, and the form should be filed online. All details like the amount to be refunded and relevant invoices must be correctly filled in this form.

Submission of Supporting Documents: Invoices, ITC statements, etc. that may be necessitated.

Track Refund Status: For this, follow the GST portal to track the application

Confirmation: After submission, you will receive an ARN (Application Reference Number) for tracking the status of a refund

Processing of Refund: In most cases, authorities take 30 days to process applications for claiming a refund. Once approved, the amount would directly be credited into your bank account.

How to Monitor Your GST Refund Status

Post-submission

Checking Post-Login: Log in to the GST portal. From the Services tab, click on "Track Application Status".

Pre-Login Tracking: Clicking on "Track Application Status" on the homepage of the GST portal and then filling up the ARN without login.

Key Points to Ensure a Smooth Refund Process

Ensure all invoices and documents are accurate and correctly uploaded.

Monitor the refund status regularly for any updates.

Be mindful of the two-year time limit for refund claims to avoid rejection.

How Online Chartered Makes Your GST Refund Claims Easy

Online Chartered has made the refund process under GST quite smooth and effortless. Our knowledge in GST compliance at Online Chartered would ensure that you receive your refund claim on time. We take our time to help you individually, keeping you oblivious of the persisting turmoil of tax consultancy.

Conclusion

Filing a GST refund does not necessarily need to be so overwhelming. Provided proper steps and observation of important dates are taken, businesses and taxpayers can effectively retrieve their excess payments and give control of their cash flow. Online Chartered is your expert on GST compliance. Streamlined help and support is aimed at simplifying your GST refund claims and getting you the results you need.

0 notes

Link

0 notes

Text

A Comprehensive Guide to Advance Rulings in India

An Advance Ruling, as defined under the Central Goods and Services Tax Act (CGST Act), 2017, is a decision provided by the designated authorities on various tax-related matters or questions concerning the supply of goods or services. Essentially.

Read Full Article: https://www.mygstrefund.com/guide-to-advance-rulings-in-India/

Join our community for future updates: https://chat.whatsapp.com/IB8Qt9IYrOQBdIm7ToepJj

#AdvanceRulingsIndia#GuideToAdvanceRulings#UnderstandingAdvanceRulings#TaxAdvanceRulingsIndia#GSTAdvanceRulings#IndianTaxAdvanceRulings#ComprehensiveGuideAdvanceRulings#AllAboutAdvanceRulingsIndia#AdvanceRulingsExplained#DemystifyingAdvanceRulings#GST#GSTREFUND

0 notes

Link

0 notes

Text

IT Department to release all pending income tax refunds up to Rs 5 lakhs immediately ; Around 14 lakh taxpayers to benefit All GST & CUSTOM refunds also to be released ; to provide benefit to around 1 lakh business entities including MSMEs

Rs 18,000 crore of total refund granted immediately Posted On: 08 APR 2020 6:16PM by PIB Delhi

In the context of the COVID-19 situation and with a view to…

View On WordPress

0 notes

Text

GST REFUND DRIVE EXTENDED BY JUNE 16

New Delhi, June 12, 2018: The government on Tuesday extended the special fortnight-long drive to process pending GST refunds by two more days till June 16. It said that refunds worth over Rs 7,500 crore were already sanctioned as a part of this drive till now compared to Rs 5,350 crore sanctioned in the earlier drive which lasted from March 15 to 29. "In view of overwhelming response from exporters and pending claims, the period of refund fortnight is being extended by two more days, that is up to June 16," an official statement said. The government had last month announced the fortnight-long drive from May 31 to June 14. In March, the government had launched a similar exercise to process the pending GST refunds on account of exports. However this time, the drive is to facilitate all types of refund claims received till April 30. "This will include refunds of IGST paid on exports, refunds of unutilized input tax credit and all other GST refunds," the Finance Ministry had said in a statement when the drive was launched. Read the full article

#CENTRALGOVERNMENT#CENTRALGOVERNMENTTAXES#ECONOMY#extension#EXTENSIONGSTREFUND#FINANCE#GOODANDSERVICETAX#governmentofindia#GST#GSTREFUND#GSTREFUNDDEADLINE#GSTREFUNDDRIVE#IndianEconomy#INDIANTAXES#MODI#Modigovernment#nation#national#nationalnews#tax

0 notes