#gst updates

Explore tagged Tumblr posts

Text

CA Inter GST Amendments for May/Sep 2025 Attempt | Ultimateca

📅 Starting 7th Feb

⏰ 5 PM Daily | LIVE on YouTube

✨ Learn the latest amendments with CA Vivek Gaba and stay ahead in your GST prep! Don't miss this golden opportunity!

Link-https://www.ultimateca.com/

#CA Inter#GST Amendments#May 2025 Attempt#Sep 2025 Attempt#UltimateCA#CA Vivek Gaba#CA Exam Prep#GST Updates#Chartered Accountancy#Live Classes#YouTube Live#GST Preparation#CA Students#Exam Ready#Taxation#GST Laws

0 notes

Text

GST amnesty scheme for 2017–18,2018–19 & 2019–20

In the GST Notification №21/2024–Central Tax issued on October 8, 2024 taxpayers are granted substantial relief removing interest and penalties with regard to tax demands claimable under section 73 of the CGST act for the three financial years ending 2017–18, 2018–19 and 2019–20. This notification helps to ensure compliance through the addition of exceptions to the extra charges which apply if the taxpayer pays their taxes within certain deadlines.

Waiver deadlines and conditions

Persons who have been issued with such notices, statements or orders under Section 128A of the CGST Act must pay outstanding amount of tax by March 31, 2025. For the parties involved in Section 74’s tax redetermination cases, the waiver time concludes at six months since the generation of the redetermination order.

Learn more

0 notes

Text

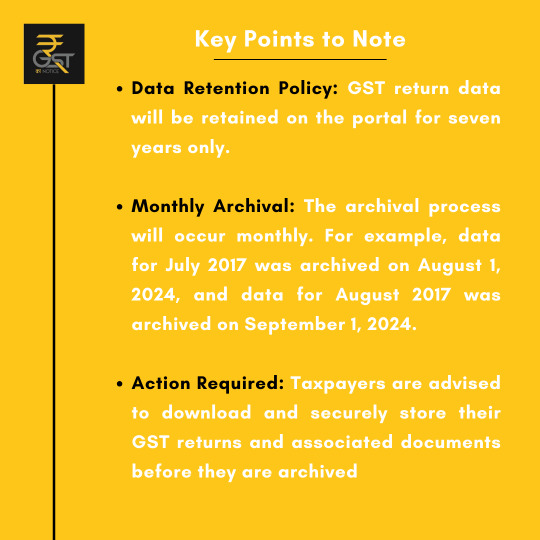

Archival of GST return data... Find your information... For more information visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstfact #gstupdates #gstreturn #gstregistration #gstcircular #gstn #gstcouncil #gstcouncilmeeting #gsthelp #gstassistance #cbic #icai #business #budget #finance

#best gst consultation in india#gst#gst consultation firm#corporate lawyer in india#gst experts in india#best gst services in india#best gst lawyers in india#best taxation law firm#gst help#gst india#gst assistance#gst registration#gstreturns#gstfiling#taxation#gst services#gstr1#gst services in india#gst updates

0 notes

Text

GST Council meet: TMC's O'Brien urges Sitharaman to withdraw 18% GST on insurance premiums

Derek O’Brien demanded that the GST on health and life insurance premiums be withdrawn. File | Photo Credit: The Hindu TMC leader Derek O’Brien has urged Finance Minister Nirmala Sitharaman to “urgently review” and withdraw the 18% GST on health and life insurance premiums during the upcoming GST Council meeting. Mr. O’Brien, in a letter dated August 24, demanded that the GST on health and life…

#gst council meet 2024#GST on health and life insurance#GST updates#removal of gst on insurance#TMC’s O’Brien

0 notes

Text

GST Enrollment | How to Enroll on GST portal as unregistered supplier | GST Registration Enrollment

GST Enrollment | How to Enroll on GST portal as unregistered supplier | GST Registration Enrollment

0 notes

Video

youtube

GST Rule 86B restriction on utilization of amount available in electronic credit ledger| 99% allowed R36: GST Update ITC utilization restricted to 99% of the amount available in the electronic credit ledger account. That means, the taxpayers has to pay balance 1% of the output liability of that particular month through electronic cash ledger.Follow the CA Devesh Thakur channel on WhatsApp: https://whatsapp.com/channel/0029Va6GOVE9MF92Ylmo7e0L#gst #inputtaxcredit #gstupdates #gstnews #cadeveshthakur

#youtube#gst#input tax credit#rule 86b#gst updates#gst news#cadeveshthakur#itc restriction#rule 86b in gst#gst rule 86b#gst rule 86b ca inter#gst rule 86b ca final

0 notes

Text

#gst cancellation 2023#gst cancellation#gst registration#gst registration benefits#gst return online#gst registration online#new gst registration#gst updates

0 notes

Text

GST Registration In Chennai

GST Registration In Chennai

Company Registration in Chennai

Chennai-1 Corporate office Asirvadham Apartment,No. 12, Flat No. 12A, Puliyar 2nd Main Road, 1st Lane, Trust Puram, Kodambakkam, Chennai - 600 024 Chennai-2 Address #56/80, Medavakkam Main Road, Keelkattalai, Chennai - 600 117. Landmark : Opp to Andhra Bank New Delhi Address B44,Birbal Road, Lajpat Nagar II, Lajpat Nagar, New Delhi, Delhi 110024 Bangalore Address No. 117/1, First Floor, 2nd Main Road, Shesadripuram, Bangalore – 560020 Landmark : Near Mantri mall Metro station Copyright © 2016 All rights Reserved;

INTRODUCTION GST :

All persons classified as taxable person under GST are required to obtain GST registration and begin filing GST monthly returns from the month of September, 2017. In this article, we look at the list of documents required for GST registration in India.

We provide below services:

1.GST Registration Consultants In Chennai

2.GST Consultants In Chennai

3.GST Registration Procedure In Chennai

4.GST Services In Chennai

Documents Required for GST Registration

1. PAN Card of the Business or Applicant

GST registration is linked to the PAN of the business. Hence, PAN must be obtained for the legal entity before applying for GST Registration.

2. Identity and Address Proof along with Photographs

The following persons are required to submit their identity proof and address proof along with photographs. For identity proof, documents like PAN, passport, driving license, Aadhaar card or voters identity card can be submitted. For address proof, documents like passport, driving license, Aadhaar card, voters identity card and ration card can be submitted.

Proprietary Concern — Proprietor

Partnership Firm / LLP — Managing/Authorized/Designated Partners (personal details of all partners are to be submitted but photos of only ten partners including that of Managing Partner are to be submitted)

Hindu Undivided Family — Karta

Company- Managing Director, Directors and the Authorized Person

Trust — Managing Trustee, Trustees and Authorized Person

Association of Persons or Body of Individuals-Members of Managing Committee (personal details of all members are to be submitted but photos of only ten members including that of Chairman are to be submitted)

Local Authority — CEO or his equivalent

Statutory Body — CEO or his equivalent

Others — Person(s) in Charge

3. Business Registration Document

Proof of business registration must be submitted for all types of entities. For proprietorships there is no requirement for submitting this document, as the proprietor and proprietorship are considered the same legal entity.

In case of partnership firm the partnership deed must be submitted. In case of LLP or Company, the incorporation certificate from MCA must be submitted. For other types of entities like society, trust, club, government department or body of individuals, registration certificate can be provided.

4. Address Proof for Place of Business

For all places of business mentioned in the GST registration application, address proof must be submitted. The following documents are acceptable as address proof for GST registration.

5. For Own premises

Any document in support of the ownership of the premises like latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

6. For Rented or Leased Premises

copy of the valid rental agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill. If rental agreement or lease deed is not available, then an affidavit to that effect along with any document in support of the possession of the premises like copy of electricity bill is acceptable.

7. SEZ Premises

If the principal place of business is located in an SEZ or the applicant is an SEZ developer, necessary documents/certificates issued by Government of India are required to be uploaded.

8. All Other Cases

For all other cases, a copy of the consent letter of the owner of the premises with any document in support of the ownership of the premises of the Consenter like Municipal Kharta copy or Electricity Bill copy. For shared properties also, the same documents can be uploaded.

9. Bank Account Proof

Scanned copy of the first page of bank passbook or the relevant page of bank statement or scanned copy of a cancelled cheque containing name of the Proprietor or Business entity, Bank Account No., MICR, IFSC and Branch details including code.

10. Digital Signature

All application for GST registration must be digitally signed with a Class 2 Digital Signature. Hence, its important that digital signature be obtained for the following person who is authorized to sign the GST registration application before beginning the application process.

0 notes

Text

Latest GST News, Information, Notifications & Announcements-2023

On 28th February 2023, the food central tax rate notifications and the compensation cess rate notifications were announced by the Central Board of Indirect Taxes and Customs (CBIC). Those rate changes were announced at the 49th GST Council meeting held on the 18th of February 2023. All the revisions relating to the GST rate changes shall be effective from 1st March 2023.

Rab, also called liquid jaggery, sold loose or without pre-packaging is exempt from GST under Notification No. 04/2023-Central Tax (Rate). As a result of this change, Rab/Liquid jaggery now has a GST rate of nil for loosely sold Rab. Furthermore, the GST rate on pre-packaged and labelled Rab is from 18% to 5% as per Notification No. 03/2023-Central Tax (Rate).

As per Notification No. 03/2023- Central Tax (Rate) has changed the GST rate on pencil sharpeners from 18% to 12% by ensuring its re-classification under HSN code 8214. Furthermore, this change has taken effect from 1st March 2023.

The GST Council recommended taxing services provided by courts and tribunals under the reverse charge mechanism in its 49th meeting. Accordingly, Notification No. 13/2017 was revised into Notification No. 02/2023-Central Tax (Rate) to include courts and tribunals in its scope.

On 28th February 2023, the government also revised Notification No. 01/2023-Central Tax (Rate), extending GST exemption to another service. As an educational institution, any board, authority, or body set up by the Central or State Governments, including the National Testing Agency (NTA), will conduct entrance examinations. Only such services will be considered for exemption, not any other.

A final CBIC notification, 01/2023-Compensation Cess (Rate), revises Notification No. 1/2017- Compensation Cess. (Rate), dated 28th June 2017. As a result, coal rejects sold to a coal washery or generated by a coal washery that does not qualify for a tax credit are exempt from cess. The exemption applies to coal rejects supplied to coal washeries in addition to coal washeries' supplies.

For more information, Visit us at: https://academy.tax4wealth.com/

0 notes

Text

Man… as much as this laid off bullshit & barely making enough money to survive for 8 weeks truly does SUCK.

The break from that fucking hell hole (affectionate) And some of those terribly toxic people(truth) is fantastic. I havent cried since my last shift…

Despite having no money for groceries, that also means no take out which has forced me into the better habit of cooking for myself & making food at home from what we have. The house is clean, I’ve got more energy, i’m getting my walks/steps/activity in daily which is giving me more energy. I’ve actually got the motivation to put me first for the first time in a LONG time so there is a blessing in this bullshit. (Now if only i had the money to go buy healthy food & pick up some skin care… lool)

(If anyones into that health shit & wants to follow along/join in you can find me over on insta at kattwylliewellness)

#personal#little life update#its the little things right?#im feeling almost fully back on my fitness/health bullshit and thats *fantastic*#thank god for that gst rebate cheque LOL#now lets manifest a ton of creative energy flow so i can power through all my wips👀#pls?#🥺🥺🙏🏻🙏🏻🕯️🕯️✨✨✨

6 notes

·

View notes

Text

Income Tax Return Filing in Bangalore: Common Mistakes to Avoid

Submission of income tax returns (ITR) is a significant duty of individuals and enterprises in Bangalore. Yet most taxpayers commit general errors that invite penalties, slippage, or tax notifications. To obtain an easy return, it is imperative to realize such pitfalls and undertake the respective measures. Here are a few of the most common mistakes and how you can avoid them with the help of the Best CA firm In Bangalore, Mind Your Tax.

Incorrect Personal Information

Another most frequent error while filing ITR is furnishing incorrect personal details like PAN, Aadhaar number, or bank account number. Mismatches in these particulars can cause processing delays or rejection of the return. Double-check your personal information before filing the return.

Selecting the Wrong ITR Form

Various taxpayers have to file different ITR forms depending on their sources of income. The wrong choice of form may result in filing errors and hassles. Seeking professional advice from a CA firm like Mind Your Tax guarantees that you select the right form and meet tax requirements.

Not Reporting All Sources of Income

Most taxpayers do not report other sources of income, including fixed deposit interest, rental income, or freelance income. The Income Tax Department cross-verifies the income details, and discrepancies can lead to penalties. Reporting all income sources is important to avoid problems with the law.

Ignoring Deductions and Exemptions

Taxpayers tend to lose out on deductions available under Sections 80C, 80D, and 10(14), which have a considerable effect on lowering tax liability. This can be optimized by availing all possible deductions and exemptions through a professional CA.

Discrepancy in TDS Details

Tax Deducted at Source (TDS) must be reconciled with the details reflected in Form 26AS. Mismatch can lead to undue scrutiny or delay in refunds. Always reconcile TDS details prior to filing your ITR.

Late Filing or Non-Filing of Returns

Most of the taxpayers procrastinate in filing their returns, which results in penalties and forfeiture of some tax benefits. Filing ITR is typically due on July 31st for individuals, and missing this date can incur late charges and interest on taxes due. Using the Best CA firm In Bangalore, Mind Your Tax, helps avoid late filing and errors.

Not Verifying the ITR

Filing the return is not sufficient; verification must be done to finalize the process. Not verifying within the time limit can invalidate the ITR. Verification can be done through Aadhaar OTP, net banking, or by mailing a hard copy of ITR-V to the CPC.

Conclusion

Avoiding these pitfalls can make your income tax return filing smooth and hassle-free. If you are in doubt about anything related to ITR filing, it is always advisable to seek professional help. Mind Your Tax, the Best CA firm In Bangalore, offers professional guidance to make your income tax returns error-free and timely.

For easy ITR filing, get in touch with Mind Your Tax today and remain compliant with all tax laws.

#gst registration#mind your tax#gst#income tax consultants#income tax return#gst update#tax consultant#income tax return consultants#company registration#gst consultant

0 notes

Text

GST Fraud: सरकार को लगाया 340 करोड़ का चूना…मुंबई की रितु निकली मास्टरमाइंड

मुंबई की रितु मीनोचा को 325 करोड़ रुपये के जीएसटी घोटाले में गिरफ्तार किया गया है। रितु पर फर्जी कंपनियां बनाकर इनपुट टैक्स क्रेडिट का दावा करने और सरकार को 340 करोड़ रुपये का नुकसान पहुंचाने का आरोप है। (GST Fraud News Government defrauded of Rs 340 crore…Mumbai’s Ritu turns out to be the mastermind) न्यूज़ डेस्कमुंबई- अंधेरी की रहने वाली 49 वर्षीय रितु मीनोचा को सोमवार को जीएसटी इंटेलिजेंस…

#Andheri news#Bangalore#Bengaluru#Bengaluru gst department#big breaking#Bombay#Breaking news#Central government#Crime News#Fasttrack#fasttrack news#Government defrauded of Rs 340 crore#government tex#gst department#gst fraud mastermind#GST Fraud News#Hindi news#Indian Fasttrack#Indian Fasttrack News#Latest hindi news#Latest News#latest news update#Maharashtra News#Mumbai News#Mumbai&039;s Ritu turns out to be the mastermind#News in Hindi#News updates#state government#TODAY&039;S BIG NEWS#अंधेरी न्यूज़

0 notes

Text

What’s New In TallyPrime Release 5.1?

TallyPrime Release 5.1 introduces a range of new features and enhancements designed to simplify business operations and improve compliance. From streamlined GST management and E-Way Bill generation to enhanced payroll processing, this update offers practical solutions for businesses of all sizes. With user-friendly tools and a focus on accuracy and efficiency.

Managing a business comes with its own set of challenges, from staying compliant with evolving regulations to streamlining day-to-day operations. TallyPrime Release 5.1 brings a powerful update designed to simplify and enhance business management for businesses of all sizes.

Packed with new features and improvements, this release focuses on making processes more efficient, compliance smoother, and overall operations more reliable.

Whether you’re managing GST, generating E-Way Bills, or handling payroll, TallyPrime Release 5.1 is built to address common pain points and provide practical solutions. With its user-friendly tools and enhanced capabilities, the software ensures better data accuracy, seamless reporting, and a significant boost in productivity.

Upgrade your business with TallyPrime Release 5.1 and experience the difference it can make in streamlining operations and ensuring compliance. Learn more about its features and how it can transform your business here.

Click Here To Read The Full Blog Now:

https://www.antraweb.com/blog/whats-new-in-tallyprime-5.1

What’s New In TallyPrime Release 5.1?

Visit Our Website To Learn More: https://www.antraweb.com/

#TallyPrime 5.1#TallyPrime Release 5.1#What’s New In TallyPrime Release 5.1?#TallyPrime 5.1 Features#TallyPrime 5.1 Updates#Simplified Tally GST Returns#Advanced E-Way Bill Management#TallyPrime GST Compliance#Tally Migration#How to upgrade TallyPrime#TallyPrime Payroll Management#TallyPrime Latest Version#TallyPrime E-Way Bill#Tally GST Solution#TallyPrime and GST reconciliation#tally prime#tally prime download#tally erp 9 download#tally prime price#tally download#tallysolutions#download tally prime#tally latest version#tally software price#tally new version#Tally

0 notes

Text

https://www.jurishour.in/indirect-taxes/cestat-rules-on-service-tax-liability-on-handling-charges-collected-by-car-dealers/

CESTAT Rules On Service Tax Liability On Handling Charges Collected By Car Dealers

0 notes

Text

youtube

0 notes