#Tally GST Solution

Explore tagged Tumblr posts

Text

What’s New In TallyPrime Release 5.1?

TallyPrime Release 5.1 introduces a range of new features and enhancements designed to simplify business operations and improve compliance. From streamlined GST management and E-Way Bill generation to enhanced payroll processing, this update offers practical solutions for businesses of all sizes. With user-friendly tools and a focus on accuracy and efficiency.

Managing a business comes with its own set of challenges, from staying compliant with evolving regulations to streamlining day-to-day operations. TallyPrime Release 5.1 brings a powerful update designed to simplify and enhance business management for businesses of all sizes.

Packed with new features and improvements, this release focuses on making processes more efficient, compliance smoother, and overall operations more reliable.

Whether you’re managing GST, generating E-Way Bills, or handling payroll, TallyPrime Release 5.1 is built to address common pain points and provide practical solutions. With its user-friendly tools and enhanced capabilities, the software ensures better data accuracy, seamless reporting, and a significant boost in productivity.

Upgrade your business with TallyPrime Release 5.1 and experience the difference it can make in streamlining operations and ensuring compliance. Learn more about its features and how it can transform your business here.

Click Here To Read The Full Blog Now:

https://www.antraweb.com/blog/whats-new-in-tallyprime-5.1

What’s New In TallyPrime Release 5.1?

Visit Our Website To Learn More: https://www.antraweb.com/

#TallyPrime 5.1#TallyPrime Release 5.1#What’s New In TallyPrime Release 5.1?#TallyPrime 5.1 Features#TallyPrime 5.1 Updates#Simplified Tally GST Returns#Advanced E-Way Bill Management#TallyPrime GST Compliance#Tally Migration#How to upgrade TallyPrime#TallyPrime Payroll Management#TallyPrime Latest Version#TallyPrime E-Way Bill#Tally GST Solution#TallyPrime and GST reconciliation#tally prime#tally prime download#tally erp 9 download#tally prime price#tally download#tallysolutions#download tally prime#tally latest version#tally software price#tally new version#Tally

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

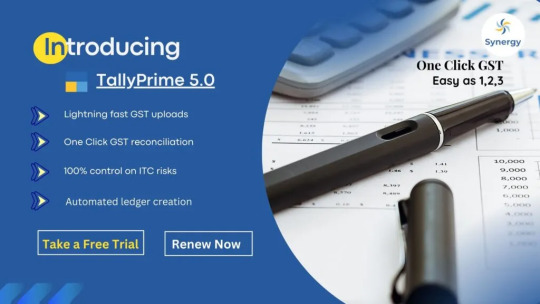

Benefits of Upgrading to Tally Prime 5.0 for Your Business

Upgrading to Tally Prime 5.0 presents a unique opportunity for businesses to enhance their financial management and streamline their operations. With the Tally Prime 5.0 download available, users can access a range of robust features designed to elevate their accounting processes. From small startups to large enterprises, the versatility offered by Tally Prime 5.0 makes it a suitable choice for companies across various sectors. By embracing this latest version, businesses not only improve their efficiency but also gain the flexibility needed to adapt to the demands of an ever-changing commercial landscape.

One of the standout aspects of Tally Prime 5.0 is its user-friendly interface and simplified navigation. Users can expect to save precious time on routine accounting tasks, thanks to enhancements that allow for quicker access to essential features. This upgrade also introduces advanced reporting capabilities, enabling businesses to generate insightful analyses of their financial health seamlessly. With the new tools and analytics at their disposal, decision-makers can expect to make more informed choices, ultimately driving growth and profitability.

Additionally, Tally Solutions has integrated cutting-edge technology into this update, enhancing security and data integrity. Businesses can rest assured that their sensitive financial information is well protected, thanks to improved encryption and backup features. This emphasis on security provides peace of mind for users, allowing them to focus on their core operations without the worry of data breaches. The new features and benefits accompanying Tally Prime 5.0 make it easier than ever to manage various aspects of a business while ensuring robust protection against potential threats.

In conclusion, the decision to upgrade to Tally Prime 5.0 is one that can significantly benefit organizations looking to maximize their operational efficiency and safeguard their financial data. The combination of a user-friendly interface, advanced reporting tools, and enhanced security measures positions this software as a leading solution in the accounting field. With the Tally Prime 5.0 download readily available, businesses are encouraged to leverage the new features and benefits with Tally Solutions, ensuring they remain competitive in today’s dynamic marketplace.

#TallyPrime 5.0#TallyPrime upgrade#accounting software#business management software#TallyPrime features#TallyPrime benefits#financial management#GST compliance#data security#automated ledger#Tally solution

0 notes

Text

Specially designed Tally Prime Courses for Accountants & Account Managers

Specially designed Tally Prime Courses for Accountants & Account Managers

Know more:

💬- https://bit.ly/AscentSoftwareSolutions

📷- 9075056050 / 9822604098

#AscentSoftwareSolutions

#Tally #TallyPrime #Accountants #TallySolutions #Accounting #Finance #GST #TDS #Payroll #ITRFILLING #Pune

#ascent software solutions#ascentsoftwaresolutions#accountant#accounting services in dubai#finance#economy#tallyprime#tally mobile#tally course#GST#tds#payroll#tax#itr filing

0 notes

Text

Experience Excellence in Business Services with Benchmark Professional Solutions Pvt. Ltd.

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, is a leading provider of a wide range of business and financial services. Their expertise lies in offering tailored solutions to businesses, ensuring smooth operations across various sectors. As a reliable partner, Benchmark Professional Solutions offers an extensive array of services that cater to diverse business needs.

One of the standout services provided by Benchmark is their Digital Signature Certificate (DSC) and token services. As a trusted partner for EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN, they ensure the highest standards in digital security, enabling businesses to operate with confidence in an increasingly digital world.

In the field of accounting and finance, Benchmark delivers professional services in accounts management, audits, and consultancy. Whether you're a small business or a large enterprise, their team ensures that your financial operations are compliant with the latest regulations, streamlining your accounting processes to boost efficiency.

Their legal expertise spans across trademark registrations, ROC compliance, and license and registration services. They provide comprehensive solutions to protect intellectual property and ensure businesses meet all statutory requirements without hassle.

Benchmark Professional Solutions also excels in handling income tax and GST compliance. Their team offers guidance on tax strategies to minimize liabilities while ensuring complete adherence to tax laws. Their consultancy services cover a wide spectrum of financial and operational matters, empowering businesses to grow sustainably.

Additionally, they offer outsourcing solutions, allowing businesses to delegate essential tasks to experts while focusing on core functions. Legal services, including civil and criminal representation, add another layer of support, ensuring clients receive comprehensive assistance in all legal matters.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Benchmark Professional Solutions Pvt. Ltd. stands out for its holistic approach to business and financial solutions. Their status as a certified Tally Solutions partner, combined with their extensive service portfolio, makes them a reliable and trustworthy partner. By choosing Benchmark, businesses benefit from expert guidance, streamlined operations, and the peace of mind that comes with knowing that every financial and legal detail is handled with precision.

2 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

Best Busy & Tally Accounting Software Buy Now

Buy Busy software we give accounting software in Best offer Updated version for helpful to your accounting business Busy Software provide many Services For our Customer help like; Busy Software Data Exchange,E-Way Bill, GST reconciliation ,Bill Material ,Invoice, Busy On Cloud, etc.Tally Prime Software E-Invoicing 5cr turnover 1st jan 2023 upcoming Ds software & web solutions provide e -invoicing .Tally On Cloud Software are many benefits any device , any time, any location , any browser to use they software and grow your business and this software best any devices connect that software to use and improve your Invoice .Tally on Cloud it’s a solution for easy, economical, efficient and with securely to use Tally from anywhere, anytime and from any devices with the help on just an internet connection. Tally Prime is a rearranged arrangement that runs the unpredictable parts of your business, for example, bookkeeping, busy software team chat messaging apps accounting marg accounting software consistence and procedures out of sight. Count is anything but difficult to learn and can with least assets.

2 notes

·

View notes

Video

youtube

Empowering Businesses with Smart Software Solutions – Codeshilp Global Solutions Pvt. Ltd. 🚀

At Codeshilp Global Solutions Pvt. Ltd., we believe in transforming industries through innovation, technology, and excellence. Based in Ahmedabad, Gujarat, India, we specialize in providing Weighbridge Software Solutions, Petrol Pump Software, and Tally Software Solutions tailored to meet the unique needs of businesses.

Why Choose Us?

🔹 Expertise – Years of experience in delivering top-notch software solutions. 🔹 Customization – Every business is unique, so we offer flexible, tailored solutions. 🔹 Quality & Innovation – We use the latest technology to build scalable, reliable, and user-friendly software. 🔹 Customer-Centric Approach – Dedicated support, training, and consulting services to ensure smooth implementation.

Our Software Solutions

✅ Weighbridge Software Solutions

CCTV Weighbridge Software

Unmanned Weighbridge Software

Multi Weighbridge & Online Weighbridge Software

Email-Based Weighbridge Software

✅ Petrol Pump & Billing Solutions

E-Petrol – A smart petrol pump management solution

GST Billing Software – Seamless invoicing & compliance

✅ Tally Integration & Automation

Tally to WhatsApp – Automate financial reporting & communication

Rojmel Software – Simplified accounting & daily transaction tracking

Our Commitment

💡 Integrity – Transparent & honest business practices 💡 Excellence – Striving for the best in software innovation 💡 Collaboration – Partnering with businesses for long-term success 💡 Customer Satisfaction – Ensuring seamless software experience

🚀 Let’s Build the Future Together! Whether you're a startup or an enterprise, our customized software solutions will drive your business growth and efficiency.

📩 Get in Touch:

🌐 Visit: www.codeshilp.com 📍 Ahmedabad, Gujarat, India

#youtube#Codeshilp WeighbridgeSoftware PetrolPumpSoftware TallyIntegration BusinessAutomation SoftwareDevelopment TechInnovation CustomSoftware Digit

1 note

·

View note

Text

Learn E-Accounting - Online Course With Certification

1. Introduction to E-Accounting

E-Accounting, also known as electronic accounting (इलेक्ट्रॉनिक लेखा-जोखा), refers to digital methods of maintaining financial records. It involves using accounting software instead of manual bookkeeping.

2. Importance of E-Accounting

E-Accounting enhances efficiency and accuracy. Businesses can manage financial data quickly and securely. Here are some reasons why e-accounting is essential:

· Saves time and reduces errors

· Enables remote access to financial records

· Provides real-time financial insights

· Ensures compliance with tax regulations

3. Key Features of E-Accounting Software

E-Accounting software offers numerous features to streamline financial management. Some key features include:

· Automated Ledger Management: Helps maintain financial records with minimal manual intervention.

· Tax Compliance (कर अनुपालन): Ensures businesses follow GST, VAT, and income tax laws.

· Cloud Storage: Allows secure data storage and access from anywhere.

· Invoice & Billing: Generates professional invoices automatically.

· Bank Reconciliation (बैंक सामंजस्य): Matches bank transactions with financial statements.

4. Career Opportunities in E-Accounting

Learning e-accounting opens various career paths. Professionals can work as:

· Accountants (लेखाकार)

· Tax Consultants (कर सलाहकार)

· Auditors (लेखा परीक्षक)

· Financial Analysts (वित्तीय विश्लेषक)

· Payroll Managers (वेतन प्रबंधक)

5. Essential Skills for E-Accounting Professionals

To excel in e-accounting, professionals must have:

· Technical Skills: Proficiency in software like Tally, QuickBooks, and SAP.

· Analytical Skills: Ability to interpret financial data.

· Knowledge of Taxation: Understanding GST, VAT, and income tax.

· Attention to Detail: Ensuring accurate financial reporting.

6. Popular E-Accounting Courses in India

Many institutions offer professional e-accounting courses. Popular courses include:

· Diploma in E-Accounting & Taxation

· Certified E-Accountant Course

· Advanced Diploma in Computerized Accounting

· SAP FICO (Financial Accounting & Controlling)

8. Course Structure and Syllabus

The syllabus of an e-accounting course typically includes:

· Basic Accounting Principles (लेखांकन के मूल सिद्धांत)

· GST & Taxation (जीएसटी और कराधान)

· Financial Reporting (वित्तीय रिपोर्टिंग)

· Payroll Management (वेतन प्रबंधन)

· Bank Reconciliation & Auditing (बैंक सामंजस्य और ऑडिटिंग)

9. Eligibility Criteria for E-Accounting Course

· Minimum qualification: 10+2 in Commerce (वाणिज्य में 10+2)

· Basic computer knowledge is preferred.

· No age limit, but prior experience in accounting is an advantage.

10. Benefits of Learning E-Accounting

· Higher Employability (उच्च रोजगार योग्यता): Increases job prospects in finance & taxation.

· Better Salary Packages (बेहतर वेतन पैकेज): Skilled professionals earn more.

· Entrepreneurship Opportunities (उद्यमिता के अवसर): Helps in managing personal businesses.

· Global Recognition (वैश्विक मान्यता): Accepted in multiple industries worldwide.

11. Challenges in E-Accounting

· Data Security Concerns (डेटा सुरक्षा चिंत���एँ)

· High Initial Software Costs (उच्च प्रारंभिक सॉफ़्टवेयर लागत)

· Technical Training Required (तकनीकी प्रशिक्षण आवश्यक)

· Frequent Software Updates (बार-बार सॉफ़्टवेयर अपडेट)

12. Future of E-Accounting

The future of e-accounting is promising. With digital transformation, businesses rely more on AI-driven accounting tools (एआई संचालित लेखा उपकरण). Trends include:

· Automation in Accounting (लेखांकन में स्वचालन)

· Blockchain for Financial Security (वित्तीय सुरक्षा के लिए ब्लॉकचेन)

· Cloud-Based Accounting Solutions (क्लाउड-आधारित लेखा समाधान)

13. Conclusion

E-Accounting is an essential skill for finance professionals. It ensures accuracy, efficiency, and compliance with tax laws. Enrolling in an e-accounting course (ई-एकाउंटिंग कोर्स) can enhance career prospects and open new job opportunities. With the rise of digitalization, mastering e-accounting is a valuable investment for the future.

E Accounting Courses ,

Taxation course,

courses after 12th Commerce ,

after b.com which course is best for high salary ,

Diploma in accounting ,

SAP fico Course in delhi ,

Business accounting and Taxation Course ,

GST Practitioner Course ,

Computer Course for jobs ,

Payroll Course in Delhi,

Tally Computer Course ,

diploma course after b com ,

Advanced Excel Course in Delhi ,

Computer ADCA Course

Data Entry Operator Course,

diploma in banking finance ,

stock market trading Course in Delhi,

six months course in accounting

Blog

Income Tax

Accounting

Tally

Career

0 notes

Text

Tally Accounting Software: Your Ultimate Business Companion! 📊💼

Managing finances can be overwhelming, but Tally makes it effortless! ✅ From bookkeeping to GST compliance, invoicing to financial reporting, Tally is the go-to solution for businesses of all sizes.

✨ Why Tally?

🔹 Easy-to-use interface – No tech skills needed!

🔹 Scales with your business growth 🚀

🔹 Stay 100% GST & tax compliant effortlessly

🔹 Manage inventory, invoices, & payments seamlessly

💡 Pro Tip: Supercharge Tally with Suvit to automate data entry & save HOURS of manual work! ⏳⚡

📖 Want to know how Tally can streamline your business finances?

Read more here 👉 https://www.suvit.io/post/tally-accounting-software

0 notes

Text

Tally Classes in Raipur Are you looking for Tally Classes in Raipur? Whether you are looking for best tally classes near by me or best tally gst course online,Aalpha Global Institute is one stop solution for providing 100% practical Tally Gst training. Our course name is Tally Expert course which is 100% Job Guaranteed Course. In our Tally course we provide the practical knowledge of accounting and taxation. Our blended learning system i.e offline classes along with the live and video backup support assist the students for better practice. Why you choose Aalpha Global Institute ? There are the following reasons to choose Aalpha Global Institute for tally gst course in raipur i. well designed study material for practical Tally GST training. ii. Our Tally GST Trainer - Rohit Sir having 12 years experience of accounting training. He is also managing accounting and taxation work of various company since last 10 years. iii. we provide online live classes and video back up support along with offline classes which helps to revise your tally gst training on anytime and from any where. iv. we provide 100% job guaranteed under our Tally GST course For details content about course pls click the following link https://tallygsttraining.com/tally-GST By enrolling in our Tally GST Training Program, you will gain a thorough understanding of Tally Prime capabilities, including how to automate tax calculations, generate GST reports, and stay updated with changing tax laws. The course is ideal for business owners, accountants, and professionals seeking to streamline their accounting processes and improve their financial management skills.Upon completion of the course, you will be well-equipped to handle all Accounting and GST-related tasks confidently and efficiently, ensuring that your business remains compliant with the government’s tax policies. Join us today for the best Tally GST course in Raipur and take the next step toward becoming an expert in Tally accounting and taxation software. Don’t miss out

0 notes

Text

Best Tally Training institute in Mohali

Bright Careers Solutions offers the best Tally Prime course, providing students with comprehensive training that is both practical and industry-relevant. Their course is ISO certified, ensuring a high standard of education and a recognized qualification. The Tally Prime course covers all essential aspects of accounting and business management, including GST, inventory management, payroll, and financial reporting, among others. With expert instructors and a hands-on approach, students gain real-world skills that prepare them for successful careers in accounting and finance. This certification boosts employability and provides a solid foundation for future growth in the field.

0 notes

Text

Unlocking Business Potential: How Benchmark Professional Solutions Private Limited Revolutionizes Finance Solutions

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Private Limited stands as a beacon of reliability in the realm of business and finance. As a certified partner of Tally Solutions, this company is committed to providing comprehensive solutions that cater to various financial needs, ensuring businesses can operate smoothly and efficiently.

At the heart of Benchmark's offerings is its core service of Digital Signature Certificates (DSC) and token services, which include EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN. These services are essential for ensuring secure and legally recognized digital transactions, allowing businesses to comply with regulatory requirements effortlessly.

In addition to DSC services, Benchmark excels in traditional financial services such as accounts management, auditing, trademark registration, and ROC compliance. The company understands the complexities involved in starting and maintaining a business, which is why it also offers comprehensive license and registration services. This ensures that all legal formalities are met, allowing clients to focus on their core operations without the burden of regulatory concerns.

Benchmark also provides invaluable support in managing tax obligations, including income tax and GST compliance. With a team of experienced consultants, they offer tailored solutions that help businesses navigate the intricacies of tax laws, ensuring they remain compliant while optimizing their financial outcomes.

Consultancy and outsourcing services further enhance Benchmark’s value proposition. Their expert advice can help organizations make informed decisions, while outsourcing specific functions can lead to significant cost savings and increased operational efficiency. Additionally, their civil and criminal law services offer clients peace of mind, knowing that legal matters are handled by professionals who understand the nuances of the law.

Choosing Benchmark Professional Solutions Pvt. Ltd. means opting for a partner dedicated to your success. Their extensive experience, combined with a diverse range of services, positions them as a one-stop solution for all business and finance needs. With a commitment to excellence and client satisfaction, Benchmark not only simplifies complex processes but also empowers businesses to thrive in today’s competitive landscape.

In a world where reliable financial partners are crucial, Benchmark Professional Solutions stands out as a trusted ally, making them the ideal choice for businesses seeking to enhance their operations and achieve sustainable growth.

3 notes

·

View notes

Text

Boost Your Career in e-Accounting

In today’s technology-driven era, e-Accounting has transformed the way businesses manage their finances. By integrating advanced software and tools into traditional accounting practices, e-Accounting simplifies processes like bookkeeping, payroll, taxation, and financial reporting. Whether you’re a student, a professional looking to upskill, or an entrepreneur, mastering e-Accounting can pave the way for exciting career opportunities. A great place to start your journey is by joining Tally classes in Yamuna Vihar, where you can build a solid foundation in digital accounting.

Why e-Accounting is the Future of Finance

The demand for professionals skilled in e-Accounting has skyrocketed across industries. Here are a few compelling reasons to consider this field:

High Industry Demand: Businesses of all sizes require proficient accountants to handle their financial operations. E-Accounting specialists, with their expertise in digital tools, are especially sought after.

Diverse Career Paths: E-Accounting skills can lead to lucrative roles such as Financial Analyst, Tax Consultant, Payroll Manager, or even Accounting Software Trainer.

Global Relevance: Digital accounting platforms like Tally, QuickBooks, and SAP are used worldwide, making these skills essential for both local and international job markets.

Flexibility and Scalability: E-Accounting enables professionals to manage multiple clients and work remotely, offering flexibility that traditional roles often lack.

Essential Skills for a Successful Career in e-Accounting

To excel in e-Accounting, you need a blend of technical expertise and soft skills. Here are the key competencies required:

Proficiency in Accounting Software: Familiarity with tools like Tally Prime, QuickBooks, and Zoho Books is critical.

Regulatory Knowledge: Understanding tax laws, GST compliance, and other financial regulations is essential for accurate reporting.

Analytical Abilities: The ability to interpret financial data and provide actionable insights adds significant value.

Technical Acumen: Skills in cloud computing, cybersecurity, and data management are increasingly important.

Effective Communication: Explaining financial data and strategies clearly to clients or management is vital.

Steps to Advance Your Career in e-Accounting

Enroll in Specialized Courses: Structured training programs, such as Tally and e-Accounting classes, provide practical knowledge and hands-on experience.

Earn Certifications: Professional certifications like Tally Prime Certification, QuickBooks ProAdvisor, or SAP FI-CO demonstrate your expertise and enhance employability.

Stay Updated on Trends: The e-Accounting landscape evolves rapidly. Keeping up with the latest software updates, regulatory changes, and technological advancements is crucial.

Gain Practical Experience: Internships, freelance projects, or working on real-world scenarios can boost your confidence and improve your resume.

Network with Professionals: Attend webinars, seminars, and industry meetups to connect with peers and mentors who can guide your career growth.

Benefits of e-Accounting for Businesses and Individuals

E-Accounting doesn’t just benefit professionals—it’s a game-changer for businesses as well. Here’s how:

Streamlined Operations: Automated tools reduce manual errors and increase efficiency.

Cost-Effective Solutions: Cloud-based accounting software minimizes infrastructure costs.

Real-Time Insights: Instant access to financial data helps in making timely decisions.

Improved Compliance: E-Accounting tools ensure adherence to tax regulations and deadlines.

Conclusion

E-Accounting is a vital skill for anyone aiming to excel in the financial domain. With its ability to enhance productivity, accuracy, and compliance, it has become indispensable for modern businesses. By enrolling in Tally Prime Coaching in Uttam Nagar, you can gain the skills and certifications needed to thrive in this dynamic field. Whether you’re starting your career or looking to upgrade your expertise, e-Accounting offers endless opportunities to grow and succeed. Take the first step today and unlock your potential in this exciting domain.

Suggested Links:-

Tally Prime Training Institute

Tally Coching Centre

tally course

#tally erp9#tally course#tallyprime#tally prime course in yamuna vihar#payroll#e-accounting course in yamuna vihar#e accounting course in uttam nagar#skills development

0 notes

Text

Best E-Accounting Course in Delhi—Learn Accounting Skills Online and Offline

Unlock Your Career Potential with an E-Accounting Course in Delhi

In today’s fast-paced digital world, accounting is no longer limited to traditional methods. The need for efficient, automated solutions has given rise to e-accounting, a revolutionary way of managing financial tasks. Whether you're looking to upgrade your skills or kickstart a new career in the accounting sector, enrolling in an E-Accounting Course in Delhi is your gateway to professional growth.

Why Choose an E-Accounting Course?

The transition from manual accounting to e-accounting is transforming businesses globally. Here’s why you should consider investing in an e-accounting course:

In-Demand Skill Set Companies today rely on technology to streamline their financial operations. By mastering e-accounting software like Tally, QuickBooks, and Zoho Books, you position yourself as a highly marketable candidate. Businesses are actively seeking professionals skilled in these platforms to ensure accuracy, speed, and efficiency in their financial processes.

Boost Your Career Prospects The accounting field has always been a reliable and lucrative career path. With digital accounting skills in hand, you’ll unlock opportunities in various sectors such as retail, manufacturing, and services. Companies across Delhi and India are investing in technology, and professionals who are proficient in e-accounting tools are in high demand.

Hands-On Learning Experience A quality e-accounting course provides practical, hands-on experience with real-world scenarios. You'll learn how to manage accounting tasks such as invoicing, payroll, GST filing, tax calculations, and financial reporting through software. This practical approach ensures you're job-ready from day one.

Flexible Learning Options The rise of online education has made it easier to learn new skills at your own pace. Many institutes offer flexible timings for working professionals, allowing you to balance your current job with upskilling in e-accounting.

What You’ll Learn in an E-Accounting Course in Delhi

Basic Accounting Concepts Understand the fundamentals of accounting, including balance sheets, income statements, and profit and loss statements.

GST Filing and Taxation Gain expertise in GST calculations and filing returns through automated software, which is crucial for compliance.

Software Proficiency Master popular e-accounting software like Tally ERP 9, QuickBooks, and Zoho Books, which are essential for day-to-day accounting tasks.

Financial Reporting Learn how to generate accurate financial reports and statements using accounting software, improving decision-making.

Payroll Management Understand how to automate payroll processes, ensuring timely payments and adherence to tax regulations.

Why Choose High Technologies Solutions for Your E-Accounting Course?

At High Technologies Solutions, we offer an advanced E-Accounting Course in Delhi that equips you with the practical skills needed to succeed in the digital accounting world. Our expert trainers, who have years of experience in the industry, provide personalized instruction and hands-on training, ensuring you gain real-world insights and expertise.

Our course includes:

Practical, real-time training on leading e-accounting software.

Flexible timing options to suit your schedule.

Certification upon successful completion, making you job-ready.

Dedicated support for job placement assistance and career guidance.

Take the First Step Towards Your Future Today

Don’t miss out on the opportunity to upskill and accelerate your career. Enroll in our E-Accounting Course in Delhi today and start mastering the tools that are shaping the future of accounting.

Contact us now to learn more about course details, pricing, and schedules. Take control of your career—because the future of accounting is digital!

Call to Action (CTA): Ready to transform your career with an E-Accounting Course? Contact High Technologies Solutions today to enroll and begin your journey toward mastering the future of accounting.

0 notes

Text

Best Tally Services Provider in Delhi | Gseven

Gseven is the best Tally services provider in Delhi, offering expert solutions for Tally customization, implementation, training, and support. As a 5-star certified Tally partner, we help businesses streamline accounting and GST compliance. Get reliable Tally services tailored to your needs and enhance your business efficiency with Gseven’s expertise!

For More Info Visit: - https://gseven.in/

CORPORATE OFFICE 205, Anupam Bhawan, Commercial Complex, Near Akash Cinemas, Azadpur, New Delhi-110033

CALL US 011-47612345 [email protected]

0 notes