#gotta make due with the limitations of what's available on the apps

Explore tagged Tumblr posts

Photo

Show Your Coloring Before & After

was tagged by @rose-nebulijia + @laowen ♥ thank u babes

As previously mentioned, all edits are done on mobile apps. Here, I specifically wanted to focus on the raw export onto my computer before sizing/fonts are applied. SW and MARVEL caps typically have screencap galleries in 2160p, while most BL’s I cap myself are required to be 1080p or more. And the most important thing I look for, before editing, is a cap that already shows good lighting and composition. That way, the editing elevates the image.

I won’t go into detail for each edit, but I can touch on my common adjustments and then call out what additional work needed to be achieved for the final edit.

VSCO is my main app for coloring. In addition to having a better quality camera than the built-in one I have, the presets and adjustments achieve better results than other apps I used for IG. I gravitate towards exposure, white balance, vignette, and grain (rip grain 2020-2022, nothing happened but im still bitter its now a subscription feature).

At this point, I am very in tune with what I look for in my edits, so I know how to measure my adjustments and the number range for each (ex: grain ranged between 2.8 to 4.1 depending on the resolution). I now rely on Snapseed for Grain, which is under Grainy Film.

Snapseed is also my go-to app for my most recent editing style — the scratchy or film clip borders (Frames) and then the borders (Expand). If there’s a dusty film look or blurred text, they were overlays (Double Exposure). I’ve also used Perspective, Selective, and Lens Blur in past edits. And of course, text is available here but there’s a limited selection.

When I have made all the necessary adjustments, I specifically save as an Export (not Save or Save a Copy) with the final changes. I find that the Exported images from Snapseed (VSCO too) size down better than the Saved versions.

Size matters, in regards to these edits. Why? I manipulate the size down (commonly from ~1500px+ width to less than 900px), so that the grain is accentuated (and looks sharper). In the end, coloring does skew slightly underneath the grain, which gives off that photograph look moreso than the raw export. Feel free to click on the images to enlarge and see the differences close up. I didn’t mess with the sizing, so it should look slightly different than the post

Additional work for the selected edits are below the cut -

Random BB Screen Cap #12 (Frame 5) - very minimal adjustments, exposure and grain did most of the work

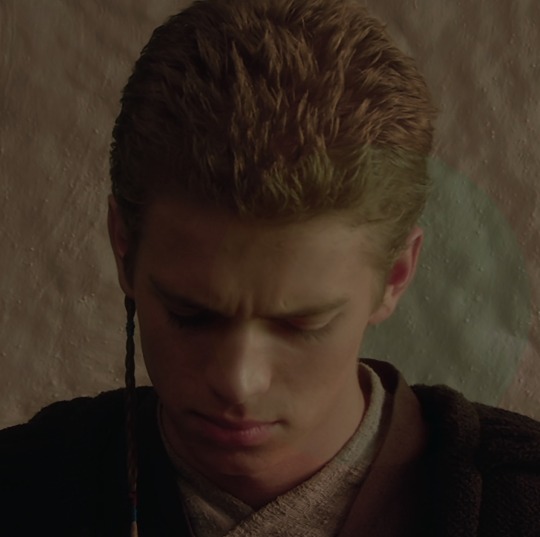

Anakin from Ep VI (Frame 1) - also very minimum, before the additional frame and border; white balance leans heavily on the red side of the spectrum (I think it was above 3.0) before adjusting the saturation down a smidge.

KinnPorsche/War of the Foxes (Frame 4) - I use the B5 preset for all b/w edits in VSCO; image was very mid in coloring, so I used Brush in Snapseed to “burn” the bg

Weeping Angels Set (Frame 12) - very little adjustments needed; white balance leaned more yellow for warmth, in order to work cohesively with the surrounding images;

BB/Jane Eyre (Frame 2) - again, very little need to be adjusted; the seat lean more pink, but I needed the set to match the purple in Frame 3; white balance leans more blue

The Good Place (Frame 3) - similar to all above statements with adjustments; the additional ’scratches’ come from Unfold, another app I use frequently for this affect and others; I believe this can be found under Journals(?); I export the template and then go back to Snapseed to crop out the excess

BB Top 3 Eps (Frame 2) - Unfold again, but this is under the Paper series; if I want variety in the “folds”, I would flip the image upside down

BB Film Noir #2 (Frame 1) - the only time I used contrast and exposure to its extremes; also heavily relies on using Double Exposure in Snapseed to add in the old film effects and blurred text

Feel free to reach out if you want to know some specifics or if you want to just learn how to apps work. Will also add this to the q&a section.

tagging @mrdumpling @actually-yikes @pranpats @taeminie @loversmore @liyazaki @dingyuxi (no pressure if you’ve already done it or whatnot, i just adore you guys okay)

#bad buddy#vishingwell#mjtag#usernuria#userkit#usertaeminie#usermor#samblr#badbuddyedit#tagged#not sure how this needs to be tagged lmao#vish i am very much like you and need to keep my space organized#i delete almost everything off my computer and phone when i am done with an edit#so too am surprised when i found the og images still on my phone#and i am very much like mj in that when use mobile for editing#gotta make due with the limitations of what's available on the apps#but i mainly add text and post on desktop#i didn't want to go into using Preview as my final step because it did nothing for Coloring so#thanks for tagging me !!

31 notes

·

View notes

Photo

New Post has been published on https://vacationsoup.com/youve-gotta-check-out-this-hiking-app-for-the-kanab-utah-area/

You've gotta' check out this Hiking App for the Kanab, Utah Area!

Get Off The Beaten Path!

The National Parks are Stunning, no doubt about it. But what do you do when you want to get off the beaten path? The Kanab area is full of amazing trails in beautiful Red Rock Country, without all the crowds.

Kane County tourism now offers the amazing “Kanab Trails App”. This app can help you plan and navigate your outdoor adventures in Kanab and the surrounding area. It has an incredible array of red rock trails, slot canyons, and high mountain forest. You are sure to find just the right trail you have been looking for. Whether you are on foot, horse or Atv's.

youtube

The Kanab area of Utah has some of the most unique terrain in the world and the Kanab Trails App makes it easy for you to enjoy it.

By using this mobile guide, even those who are unfamiliar with the area can feel confident to venture out in this beautiful environment! Whether you’re out on the road looking for adventure, or planning a trip from home, the Kanab Trails App invites you to discover and explore these hidden gems! Enjoy the picturesque scenery, breath-taking trails, spectacular slot canyons, and places you never knew existed.

You can view the app and download their information PDF (click on the Kanab Trails Overview info) here: http://www.mapntour.com/viewer/?c=534

Here is info directly from the app-

The roads and trails displayed in the App are available for public access and can serve as guides for your Kane County Trail adventure.

You may view the roads in map or satellite view. Pinch and zoom the map to see all the roads in the county. If you enter an area with no cell coverage, essential elements of the road paths and points of interest are still available offline.

Offline capabilities:

The road and trail paths visible - if app downloaded to your device.

My location GPS tracking - if enable in device and app settings

The text descriptions and photos

Topographic map overlays if they are available for the area you are visiting.

App features: Benefits for you:

Selecting road from the navigation list or search result we'll fly you to the map where that road is centered in the screen and highlighted so the path is wider.

The roads name will be displayed on the title bar at the bottom of the screen.

You may slide the title bar to get mileage information about that road if there is any available.

If you see signage on the road- or trail you can search for that number in the app. Or select from the list in the navigation list.

Touch a path and its name will display on the information drawer title bar at the bottom of the screen.

You should be able to view your location with or without cell service:

Topographic Map layer:

An example of the topographic maps is shown here. You may pinch and zoom into the area of your location. Touch the arrow pointing in the left-hand side of the map to show your location.

Notifications:

You may get alerts when you come within an established distance of a trailhead, point of interest or destination depending on you're app settings.

The in-app information has a whole lot more! Great reminders like:

Using other sources of info

Be mindful of weather, especially when entering Slot Canyons

Map based apps use a lot of battery power. Have extra charging options with you

Check road conditions prior to travel

Bring extra water! It is hotter and drier than you think

Very limited Cell phone service in this area

Talk about adventure! The Kanab Trails app makes trails easy to find, simple to follow, and enjoyable to experience. Be spontaneous! The geo-alerts let you know what outdoor adventures are nearby. Discovering this magically unspoiled area requires offline access – and we have you covered.

Roads, trails, GPS tracking, and trail information is all available without wi-fi or cellular service.

Now for what you really want - The Kanab Trails App download - Head over to https://www.visitsouthernutah.com/ click on the Kanab Trails icon, there ya go!

All in all, you are going to have a great time exploring and you are going to see things like you have never seen before!

If you are digging this idea and this app, and want even more info, here is a copy of the in-app Tips

Mobile App Tips

Mobile App Tips for Adventure Hiking Trails

Adventure Hiking Trails may parallel roads in some cases. The Adventure Trail Paths are shown in ORANGE.

“This map and directions are intended for general reference use only. Always check local road and weather conditions. Stay on designated roads. Dirt roads are impassable when wet. Please respect Private Property. Be prepared for a wilderness experience: Always bring extra water, food, sunscreen, and supplies. Do not remove artifacts or deface the ‘rock art’. Leave no trace of your visit so others may enjoy.”

Cell phone service is non-existent in most areas. Essential information is available offline for the Adventure Trails and Outdoor Recreational Opportunities on this app. In areas without cellular service map tiles may not be displayed. You can go to "Settings" and toggle on topographic maps to assist with navigation.

Safety: Enjoy your trip –by being prepared. Due to cell phone battery limitations, we always advise visitors to bring charging cords or battery packs and have access to hard copy maps as a backup.

About Adventure Trail Featured Paths & Content: The Kane County Commission invites you to use the Kanab Trails App. You can plan your excursions and follow the route on your mobile device while on location.

These trails are meant to serve as guides for your Kane County Adventure with both map and satellite view options. Each Adventure Trail is its own category that lists the trail path(s) its trailhead and destination. Some Trails show highway access points. If you have downloaded the app to your device and then enter an area with no cell coverage, the essential paths, and points of interest are still available offline.

Adventure Hiking Trail Experience: Many of the Adventure Trails follow roads for a portion of the way. You will see which type of road is running alongside, and when the road ends the hiking routes begins.

#hikers#Hiking#hikingapp#hikingmaps#hikingsouthernutah#hikingutah#HolidayInKanabUtah#KanabUtah#SouthWestUtah#UtahUSA#VacationInKanabUtah#VacationSoup

1 note

·

View note

Text

Mobile Gambling Addiction

Mobile gaming has taken off since smartphones became commonplace. At one point, you would have thought the only games available on them were Angry Birds and Doodle Jump. After a few years, though, developers realized the potential of mobile games and in-app purchases. Since almost any person you encounter owns a smartphone, the customer base is endless.

Offering a free-to-play game entices anyone to give it a try, because what’s there to lose? You play the game for a few hours and like it a bit, so you drop a dollar or two on the “starter pack” that most of these games seem to offer new players. They make it seem necessary, saying it’s “limited time” or “48 hours only!”. You keep playing the game, and you hit a paywall. You can’t advance in the game either from the game’s difficulty itself, or a power dynamic of people who spend endless money on the game -- a.k.a. “whales” -- and want to be able to keep up. That can snowball into constantly buying the little packs, or justifying paying for an expensive one. When, realistically, none of it is necessary to your daily life. Ultimately, you end up spending money on .jpg’s.

I myself am not excluded from this. I got my first smartphone when I was 14 years old. It was a hand-me-down iPhone 3G from my parents for christmas. I wasn’t allowed to download anything without their permission, and I only had 2GB of data on it — not a lot of wiggle room to use the phone away from home. I wasn’t aware of what an addiction the phone alone would be, or what was to come. When I turned 18, I started to pay for my own phone bill, and I got an unlimited plan so I could use my phone freely. Since I wasn’t home much due to work and college, I sought entertainment from my phone beyond Netflix and Youtube. I downloaded the first game that I experienced micro-transactions in: Love Live! School Idol Festival -- a rhythm game based off of the anime Love Live! School Idol Project. In it, you collect cards ranging in rarities from rare, super rare, and ultra rare (since then they’ve added super super rare). In order to get these cards, you had to “scout” them with an in-game currency called love gems. Ultra rare being the highest rarity, had a 1% chance of showing up from scouting. Higher rarity cards are more valuable, since they offer skills like increasing the timing window, or giving you a higher score. This is why scouting is such a necessary function of the game.

I already had an attachment to the characters that appeared in the game since I had watched the anime, so naturally I played a lot. The game allows you to get love gems for free, but eventually they become more and more sparse. Cards that I’d really want would come out, and I would run out of gems trying to get it. Then, being the reasonable adult I was, told myself “I work hard for my money, I can spend a little on this game!”. I kept doing it, too. I continued to “just spend a little” each time and forget about all I had already spent. I even put myself in bad financial situations at times, because I would become fixated on getting this amazing card that would make my teams stronger -- or maybe even one that I just thought was cool or cute.

Thankfully, a friend of mine noticed what was going on. She made me sit through my transaction history and count every dollar I spent on the game. It was genuinely shocking to see a grand total of [redacted due to pride] after only two years of playing that game. It became clear to me that I developed what amounted to a gambling addiction, without having ever stepped foot in a casino. It never occurred to me that I had sunk myself that deep into a game that reaped no real life benefits, even when I “won”.

Since then, I’ve heavily cut down on my general phone game spending. I still try to justify it to myself, and still have weak moments where I spend real money. I continue to rely heavily on my phone for gaming, and all of the different types of games that are available now surely don’t help my attempts at recovery. Not just rhythm games, but RPGs and puzzle games even offer these in-game purchases. However, it’s relieving to know that I no longer risk my financial stability over them — only get filled with regret when I don’t get that stupid UR or 5-star card that I really needed.

There’s nothing wrong with supporting games that you enjoy here and there -- game developers need to eat too -- but remember that it isn’t the end of the world if you don’t get what you were hoping for. In the wise words of Kenny Rogers, you gotta know when to fold ‘em.

2 notes

·

View notes

Text

all opinions my own, this comes from someone who was an occasional user of the site, i don’t have any other knowledge other than what’s publicly available but by god can we speculate

okay vice’s games vertical waypoint did a good quick writeup on the tiny amount of info available go read it please before we break it down

this whole situation is probably due to

a shift in the focus of the site since it started in 2014

new investor money and new demands from investors

trying to get on the app store

they want to make a shift from the social portion of their site being like instagram with bonus features, to monetization through livestreaming. this is a pretty solid business plan but they’re going to have a hell of a time against twitch and youtube. now, no matter how good your moderators and filters are, people will use literally any livestreaming service for adult content. it’s also very hard to monetize adult content and nobody really wants to be known as the gamer p0rn site, since the industry as a whole is trying very hard to look respectable and mainstream in order to get that good good investment money.

sidebar: none of these adult games seemed to be against the previous terms of service, but the age limit for the site is the standard 13. the fact that they did not have an osha violations filter is a little weird but this site has been bootstrapped by two people for the better part of a decade and has grown away from its weird indie roots so it’s not like. surprising.

it is difficult to convey how much this didn’t happen. game jolt has gone a huge demographic shift, from a weird little site full of varying-quality indie browser experiments to a lot of fortnite and five nights at freddy’s. i’m pretty sure this didn’t happen bc 13-16 year olds are pretty vocal on social media about the things they like and dislike, i would have heard about it by now, and this skews slightly too young for the tumblr anti squad, who don’t skew towards games anyway. and in that case i would have also heard about it by now.

this is almost certainly one or both of two things: investor demands (most likely SoftBank), and Apple.

i remember logging this investment in our database back in october and thinking it was a weird turn. these specific investors are mostly not known for their gaming portfolios, but have used gaming to expand their portfolios. also it makes everyone feel good when you can support a company with an minority founder. a minority FEMALE founder, even. everyone WANTS to support the arts, but only the pieces of art they specifically approve of. not the messy parts no sir

now about that livestreaming app they want to build. most people worldwide are on android devices, but most of the money is in a tiny subset of rich western and chinese users with apple devices, so you gotta be on the app store. and the app store hates fun, as we all have so recently seen.

anyway this is a fucking mess, rip to their social media team, you should be using itch.io instead

someone remind me to shout about the gamefi adult game ban but after 7PM EST bc that’s when my last call of the day ends

21 notes

·

View notes

Text

Replies & Thanks

this gonna be a long oen i think, been awhile.

firstly to friends who like & put nice comments on my wips and ccs!!! i love you guys~ @simsophoniques, @shaysugar, @trembling-hands, @fyachii, @enchantedunicornhideout, @simnovels, @thesimperiuscurse, @kyimu, @my-simension, @ktarsims, @wannabecatwriter, @itheaxel, @rosiesimming, @nekoi-sims there are probs more but i went back as far as I could! Thank you guys always <33333333333

CC sharing post:

smellslikepixeldolls: unfortunatly ppl stealing from everywhere :(

Ickkk idk why even it is free stuff!!

rosiesimming: I don't think going anywhere else will limit the possibility of people stealing. If they can download it, they'll claim it if they don't care. It's a shame, but it's the internet. :(

I guess I just had too high expections of people to be decent! It really is a shame to me

enchantedunicornhideout: Yeah people will keep stealing, so either you decide to not care about idiots like that, or you stop creating. It's just a shame it has to be like this, but there will always be idiots in the world, so try to not let them get to you.

I don’t think I would stop creating over it, I make my cc for myself mostly lol. I just wish there was easier or smaller way to share and have rude people just stay out of it haha.

ktarsims: I think that's basically a universal experience on the internet. Not just confined to tumblr, or to the sims community. The internet brings us all closer together in a way, because it allows communication that wouldn't be possible otherwise. Unfortunately, there's no way to prevent the idiots from having access. The only way I can really think of would be to have a private forum or discord or something, and only share/show the content there and never display it publicly.

That might be a good idea thank you! I just wouldn’t want to seem like I am inconveniencing the nice people for them to access my cc by having to have different accounts discord/etc. Because most people ARE nice. And turning off anon silenced the rude ones for now anyway! It’s just the people who silently download then monetize my cc with crap ads that get to me most.

nekoi-sims: Gotta agree with Ktarsims here. A private discord or smth would be best?

I will consider it! I have two finished dresses I am using that I wanted to share but now I’m not sure if I even want to bother on tumblr since the thiefs shop here lol

Turning off anon asks post:

simsophoniques: Best decision ever done you won't regret it

When I turned it back on I thought it would be good for shy ppl... Nope just people asking the same question over and over and telling me how I am doing things “wrong” etc. Much happy that I turned it off, you are right!!

Anon ask about dress post:

rosiesimming: She did warn us that it was temporary. She tells us all the time what will only be available for a short time and it's her choice as a creator. Seriously, she doesn't even have to make stuff for us at all. She doesn't have to share, so be grateful for what we do get. CC creators get way too much shit from people that don't even know how to make things themselves. Just...be fucking grateful. >.>

Thank you, I was wondering if my post was just very hard to understand or something since I suck at typing!!

kyimu: There were warnings and even if not, she doesn't have to warn everybody about things she's doing on her blog. She has so many beautiful creations, doesn't use adfly and so on. Just as @rosiesimming said - be grateful. If you don't want to miss something again, become one of her followers, she deserves it anyway.

Yes the best way to catch the limited downloads is to follow! All the other cc are free and open at all times. But occasionally I like to do special things for the followers who actually support me! And I have met soo many nice people from that first limited dress I made (like you)!! Also I have said before I don’t mind sending the limited downloads out to friends later on! still they just whine on anon or straight up ask, not even a “hi” sometimes LOL that’s not FRIENDS!

itheaxel: And amu always leaves them on for days before taking it down. ^_^ I think you're being reasonable. <3

I’m happy it works easily for you! That was my intention xoxo

thesimperiuscurse: Oh dear. That sounds a bit entitled, nonny. Amu is kind enough to share her wonderful cc, and that should be more than enough. And in the end, it's only one dress for a computer game! There are many, many other dresses you can download :3

Thank you :) this is my feeling too. That anon also sent 4 more messages explaining what I should do instead in their opinion, but apologizing.. but it was still saying i should change how i release cc. so.... i guess it’s not just one dress to her lol

ktarsims: All I can say, Nonny... is that because you aren't on Tumblr yourself, you seem to be unfamiliar with the way things work here. Lots of simblr's make things. Many, if not most, make at least some things that are time-limited. The rule of thumb here is that if you want something, you should download it immediately. You don't have to install and use it immediately, but download it right away, because later it might be gone. There's also no point to trying to make the cc creators feel bad. It's their own creation, and each of them does as they see fit with their own creations. They share, or do not share, as they're so inclined. Sometimes whole blogs disappear overnight because someone decides they don't want to be here anymore. Be grateful for what you get, and know that if you missed out on something due to delaying to download it, you've only yourself to blame. Go look for something else.

I know about those dispearing blogs... when I first got back into Sims 3 after uninstall....... so much cc was just gone or hard to find. or adfly 1 2 3 just to get to nothing xD I just moved on and found other peoples great cc that was available. I probably wouldn’t do that lol I don’t see the benefit of deleting my open downloads when so many people already have it anyway.

Other thanks

Thank you to those who include me in those memes things tags. I will do them eventally, was jsut away from my desktop and mobile is too hard to make those post for me.

I am also a bit behind on checking out all of your latest posts because tumblr mobile app is torture to me xD

and finally Thank you kyimuuuuu !! I can’t wait to play cats&dogs soon and have my kitties in sims 4 too. My next lace dress cc will be for you ❤ ❤

14 notes

·

View notes

Text

Annotated edition for the May 31, 2020, Week in Ethereum News

Here’s the most clicked for the week:

I think the Societe Generale bond issuance paying Banque de France with a CBDC digital euro hadn’t been hyped at all, hence why it led the list. In fact, I don’t think anyone had noticed the press release until Julien Bouteloup tweeted it a week after it had gone out.

Given France’s history protecting domestic industry, you would expect Tezos to be getting these projects due its (probably inaccurate) reputation as being a French project. And I bet Tezos will get some involvement in the future from the French government linked projects, but it’s still notable that these things are still on Ethereum when Tezos has been live for nearly 2 years (though with very little use).

Meanwhile, alongside yesterday’s announcements of Starkware and OMG, Vitalik tweeted that “initial deployment of ethereum's layer 2 scaling strategy has *basically* succeeded.” That’s not wrong, but it’s prone to misinterpretation.

The history of layer2 in blockchain is not a particularly successful one. I’d argue that the question isn’t whether it works, per se, but can it work in a way that gets users over the long haul. Sure, we’re starting to see that (loopring is live with a million trades on its rollup!) - and we appear to be on the verge of real apps running on layer2 - but there’s a long history in Bitcoin and Ethereum of unrealistic expectations for layer2.

Here’s the high-level things for Eth holders reads:

8 things you should consider before staking

Devcon6 will be in Bogota in 2021

Liquidity mining: now you earn Balancer tokens for supplying liquidity or Compound tokens for supplying/borrowing

Lots of folks are considering whether to stake, how much to stake, whether to use a staking service, etc etc. Cayman’s post was a pretty good primer on these questions. Eth2 staking will lock your ETH up for awhile. The return is likely to be quite good, though as more people lock up ETH, the return declines. So it’s hard to say exactly what the return will be - and you won’t be liquid for a long while.

Eth2′s beacon chain is designed for decentralization, with penalties for being offline or doing something wrong (eg, double signing) going up exponentially if they are part of an attack (”correlated”).

That is to say, you should be totally fine staking at home even with mediocre residential connection - going offline usually just means you miss rewards. And even if you go offline when AWS goes down, as long as you bring your connection back up quickly, you should be relatively ok.

Staking services should professionalize the staking in ways that ameliorate some risks but which might provide hidden risk if they don’t make sure to think about the risks. Do they do their staking in the cloud, especially something like AWS east? Do they spread across different clients? How much of a honey pot are they?

Meanwhile, Devcon will be in Colombia but postponed until next year.

Finally, of my 3 high level articles to read: liquidity mining. DeFi apps like Balancer and Compound are decentralizing themselves by giving tokens to their users, to bootstrap the things the network needs to be example. By no means are these the first examples of giving away tokens to users, but these are 2 notable examples of a trend to keep an eye on.

Now for the annotations. A few sections I don’t have anything to add:

Eth1

Latest core devs call, discussion of EIPs for inclusion in Berlin hard fork, whether or not to include 2046 (static call to precompile gas reduction) and 2565 (modexp reprice). Working toward an ephemeral testnet for Berlin.

Latest fee market change (1559) call. Notes from the EIP1559 call

Discussion thread on meta transactions, oil, opcode repricing

Snap sync mainnet benchmarking, single peer on AWS

I basically say the same thing in this section every week. People are implementing the EIPs and figuring out which ones will be ready to go for Berlin. EIP1559 will not be ready until the hard fork after Berlin. Then in the longer-term, there’s lots of work on Stateless Ethereum (or the non-preferred nomenclature: 1.x 🤮) and that’s in discussion.

And then Peter is working on a new sync (formerly known as leaf sync) which seems to cut bandwidth way way down.

Eth2

Latest what’s new in eth2, features a Schlesi testnet postmortem

The new multi-client testnet is Witti. Here’s a guide to staking

Latest eth2 implementer call. Notes from Ben and Mamy

Cross-shard transaction simulation

8 things you should consider before staking

RocketPool is going to wrap the ETH locked up in Eth2 staking, thus giving liquidity to eth2 stakers

New multi-client testnet. They’re basically going to spin them up, try to break them, and not worry about rescuing them if they go down, since you can spin a new one up. This one is called Witti.

RocketPool deciding to tokenize the 32staked eth is interesting. It’s basically inevitable - anything that can get wrapped, eventually will get wrapped. This may end up being the decentralized way to get liquidity for your staked ETH if plans change and you decide you need liquidity for your 32 staked ETH. There will almost certainly be centralized ways - exchanges eventually offer staking and let you trade IOUs. Of course, that depends on how much you trust the exchange.

Layer2

Raiden v1 is live on mainnet for DAI and WETH, with some token limits

Deconstructing a state channel app and how a dev interacts with a state channel wallet

A zk-rollups to scale blockchain explainer

Understanding optimistic rollups by building one

Dharma and Interstate open source their Tiramisu optimistic rollup for token transfers

Raiden shipped with the training wheels on!

Not much else to say around layer2 besides what I said above. Gotta get users.

This newsletter is made possible by Chainlink!

Connect your smart contract to decentralized oracles that provide the most tamper-proof and accurate market price data, as well as on-chain verifiable randomness that’s provably fair.

Stuff for developers

Array slices in Solidity v0.6

Truffle v5.1.27 – debugger support for Solidity inline assembly

Upgradeable contracts using diamond standard

web3j now includes abi v2

Typescript types for Solidity AST

i18n translation strings for Defi, available as npm package

Build your first Harberger tax app tutorial

eth95: retro UI for calling contract functions

secp256k1 twist attacks

BLS12-381 pairing-friendly curve in JavaScript, now with hash-to-curve v7 and 50 pairings/sec

Ecosystem

Devcon6 will be in Bogota in 2021

All the projects from EthGlobal’s Hack Money

A surprising 120 submissions for Hack Money!

I’m not surprised Devcon got pushed to 2021, but I am disappointed. I’d like to see a prediction market on when the next ETH event is which has more than ~400 attendees.

We’re also getting out of the spring conference season (note for southern hemisphere readers: sorry, I know it’s fall for you), so I’m curious whether we’ll see online conferences continue to pop up for every day of the week. I suspect not, but it is open real estate at the moment.

Enterprise

First Central Bank Digital Currency public blockchain transaction is on Ethereum: Societe General issued €40m of covered bonds as security tokens and paid with Banque de France digital euros. While the press release does not make it clear, the transaction was on Ethereum mainnet

It actually took me the better part of an hour to find the link that confirmed that this was on Eth mainnet.

DAOs and Standards

Summoning the spirit of DAO ops

ERC2680: eth2 standard wallet layout and naming format

ERC2678: EthPM v3

EIP2681: Limit account nonce to 2^64-1

EIP2677: Limit initcode size

Application layer

Enjin plugin for Minecraft to tokenize Minecraft items on your server

Umbra: stealth payments to ENS names, running on Ropsten testnet

How does NexusMutual become an efficient version of Lloyd’s of London?

Maker’s Oasis now makes it easy to leverage up with ETH

DeFi777 – wrap your erc20 tokens as erc777 tokens, then swap through ENS names

RenVM brings BTC, BCH, and ZEC to Ethereum as ERC20 tokens

Mstable basket of stablecoins live on mainnet, includes yield from Compound/Aave plus swap fees – there’s a zero slippage stablecoin trade with 30 basis points of fees

Centrifuge’s Tinlake asset factoring is on mainnet, with factoring for freight shipping and Spotify payments

4/8 arbitrarily classified as DeFi this week.

Zero slippage stablecoin trade is an interesting approach - of course, as a liquidity provider, you’re assuming those stablecoins stay stable. As a user, you want tiny slippage and tiny fees for going between two things that are supposed to represent the same value. As a liquidity provider you want as much fees as possible, especially since you’re assuming the risk of pegs slipping or being broken.

Also just wait until Centrifuge’s factoring gets pushed as collateral for Maker. I’m curious what the response will be - or is it hohum since some trusted assets have already been added?

Tokens/Business/Regulation

Liquidity mining: now you earn Balancer tokens for supplying liquidity or Compound tokens for supplying/borrowing

Zap your liquidity around in one transaction

Ryan Sean Adams: Eth is doubly undervalued

Gavin Andresen: crypto markets take a long time to reflect reality

People seem to call it maximalism these days when you point out that anything is overvalued, but I thought Gavin’s post was a concise reflection of the irrationality of crypto markets.

General

LadderLeak and ECDSA explainer

Hundreds of thousands of Thai users switching to Minds, a Twitter/Facebook hybrid social network incentivized through an ERC20 token

I checked out Minds. They did a token sale two years ago, though you can still buy it on their site now. It’s an interesting concept, you can get paid to post, except you have to pay to be a paid member first. I couldn’t quite work out what the incentives were for me, but social networks need to get traction in one niche and then expand, and it seems like they may be getting that in Thailand. I’d like to see more social network attempts using tokenized incentives.

Housekeeping

Follow me on Twitter @evan_van_ness to get the annotated edition of this newsletter on Monday or Tuesday. Plus I tweet most of what makes it into the newsletter.

Did you get forwarded this newsletter? Sign up to receive it weekly

Permalink: https://weekinethereumnews.com/week-in-ethereum-news-may-31-2020/

Dates of Note

Upcoming dates of note (new/changes in bold):

June 1-6 – DAO Rush Week

June 3 – BlockVigil’s free remote developer bootcamp begins

June 16 – deadline to apply for Gitcoin’s Kernel incubator

Oct 2-Oct 30 – EthOnline hackathon

0 notes

Text

The 12 worst types of Instagram Stories

We need to talk about Instagram Stories.

"Story of my life"? More like please don’t story your whole life, or at least do so tastefully.

Over the past few years, Instagram Stories have cannibalized Snapchat and emerged supreme as the premiere location to show off shaky cam concert footage and puppy-dog selfies. But with great power comes great misuse of a platform.

We’ve all succumb to the desire to constantly cherry pick the juiciest parts of our life and share them with anyone who cares to tune in. Sometimes, though, those juicy bits don’t taste, sound, or look very good to those of us consuming them.

It’s time for a crash course in Instaquette (Instagram etiquette, duh).

12. The 'New Post' Story

Don’t post your post to your story to your post to your story to your post…

If you post something, we’ll see it in due time.

Just like Bebe Rexha said in her hit song with that country singer: "If it’s meant to be, it’ll be." If we’re meant to see your post, we will. You mustn’t shove it down our throats by posting it on your story with a GIF or scribbles over it, concealing the very thing we just might have been interested in seeing. That’s called overkill, friends.

I wouldn’t have minded scrolling by and throwing you a like, organically. But now that I know you want me to see something, I will actively avoid looking at it, Birdbox style.

11. The Work Out Photos Story

We get it, you like to get your iPhone sweaty.

It’s 2019. We’re all for body positivity and going after your goals in a healthy way. Strive! A nice, strong gym post is cool. But to constantly barrage us with poorly lit semi-self conscious pics of you flexing is poor form. Leave it to Kim Kardashian. Do your squats and your pull ups and then barrage us with pics in those jeans that are beginning to fit like a second skin. Double negative if you’re forcing your significant other to participate in your sweaty social gains. They just want to meet their PR without feeling pressured to appear swol to your 539 followers.

10. The Filmed Without Consent Story

Let your friends do their thing without turning it into a production.

If your friend wants to be filmed, we guarantee they will do something to warrant a recording sesh. It’s just not cool to constantly be filming your friends’ every move. Soon, they’ll start to feel like they can’t do anything around you without feeling like Britney circa 2006.

There’s nothing more cringe-worthy than watching someone publicly squirm under the lens of their friend's iPhone.

9. The Pointless Poll Story

They see me pollin’, they hatin’.

If you’re going to put a poll in your story, and yes there is a right and wrong time for a poll. Please adhere to poll etiquette.

For the love of all that is good, place your poll in the center of the screen so we don’t accidentally vote if we’re trying to move on to the next slide. OR conversely when we are aggressively trying to vote on your poll and you’ve placed it so far to the left that we end up clicking backwards. We don’t need to see your story twice.

Finally, the polls that read "yes" or "yes, but in red" need to die. It was never funny.

8. The Terrible Music Story

If you play a song through your speakers, you’re dead to us.

Instagram went out of their way for you, and you have shown no gratitude. We’re looking at you Kylie Jenner. That’s right, we’re talking about playing songs through your phone’s speakers instead of the music feature on the app. We would have listened to AM radio if we wanted our music reception to go in and out, so we sure as hell don’t want it coming from your iPhone.

7. The Facetune'd Child Story

We don’t want to see your baby smoother than a glazed doughnut, Rebecca.

If we’ve said it once, we’ve said it a thousand times. DON’T FACETUNE YOUR CHILDREN. Babies are naturally cute. There is no need to morph or transform their bodies, thus holding them to ridiculous beauty/cuteness standards, before they even know what ridiculous beauty standards are. We really thought this one should be an obvious don’t, but as per usual the internet has found a way to disappoint us.

6. The Never-ending Rant Story

Go 👏 off 👏 but 👏 respect 👏 the 👏 medium

Listen, sometimes you just gotta go TF off — whether that be about a topic of social injustice, or when you feel personally attacked by the vicious moms who fought you for dominance at the Bath and Body Works Candle Day Sale™.

Unfortunately, the time limit of Story clips don’t necessarily lend themselves to a 30 minute impassioned critique of the cisheteropatriarchy. And we guarantee that people would love to hear it — if only you weren’t getting cut off every 15 seconds. Next time a particular issue lights a fire within you, spark it up on YouTube instead.

5. The BFF Birthday Story

It’s my party, and I’ll post 9,000,000 clips if I want to.

I think my least favorite type of Instagram post is the 'It's my best friend's birthday' post

— Brian Koerber (@bkurbs) January 8, 2019

🎵 Happy Birthday dear [yourfriendthatidon’tknow], Happy Birthday to you! 🎵 It’s literally Birthday Law that you must spend the day hyping up your bestie on their birthday — but do we really care? Yes, we’re sure your friend’s #bdayLook is bomb. Yes, that party looks like it’s jumping. Yes, that cake looks delish. But are we there? No. BFF birthday stories are the epitome of JOMO (Joy Of Missing Out) — watching people you don’t know have fun is boring, not glamorous.

4. The Boomerang Clipshow Story

Nothing but Boomerangs for days.

When the Boomerang first came to Instagram, having your own personal GIF machine was a fun, inventive way to liven up your feed. Now that the novelty has worn off, though, we’re begging you to stop. There’s so many more features available to you on Stories now: face filters, zooming in with music, uhh….other things! We don’t need a whiplash-inducing video of you chugging your third cocktail of the night.

3. The Tons of Unreadable Text Story

OH GOD MY EYES

You don’t need a degree in Color Theory to slap some aesthetically pleasing text onto your Story, but at the very least please try and make it readable. There’s nothing worse than attempting to speed-read 0.2 size cursive neon green font on a bright yellow border in less than 15 seconds before the Story switches. Crowding the screen with text also takes away from the actual photo itself, if you took one. This is not a comic book, so don’t fill your stories up with speech bubbles.

2. The Filming Your Drive Story

Yes, a video of the street you’re driving down is EXACTLY the content I was looking for.

Everyone knows you shouldn’t text and drive, or at least that’s what we thought. That includes Instagram, guys. Not only is it dangerous and could cause bodily harm to you or others, but we can guarantee that absolutely no one cares about you filming yourself talking or blasting the bass through your crappy car speakers.

No one asked for this content, in fact, we’re asking that it stop.

1. The Concert Story

If we wanted to see that concert, we would’ve bought a ticket.

We’re so glad you went to that concert. We really are. Live your joy. But watching said concert playback on a 5-inch glass screen with sound quality that makes it seem like it was recorded on a Nintendo DS was never part of our plan.

Unless you’re literally backstage with the artist, please refrain from recording back-to-back snippets of their concert. Your seats aren’t even that good so we can’t differentiate the artist from their backup dancers. This also applies to Storying in a loud club. Unless Jaden Smith is holding a sparkler while simultaneously pouring you a shot of Grey Goose, refrain. We will not have the FOMO you’re so desperately trying to induce if our ears are bleeding. If you must post, kill the sound.

You can be better at Instagram Stories. We believe in you.

Image: GIPHY

The truth is that every Instagram story can easily be swiped away at a moment’s notice. You can speedrun through clips faster than your finger can graze glass (literally). None of these annoying stories will kill us, although we may claim they will — after all, we live for the drama.

But, like most people, we are genuinely interested in our friends’ lives. Just maybe not enough to put up with their Insta habits. As I’m sure legions of people throughout history would agree, some stories just aren’t meant to be told.

#_uuid:5e8207a0-2e06-3698-989b-c489de70c436#_category:yct:001000002#_author:Sage Anderson#_lmsid:a0Vd000000DTrEpEAL#_revsp:news.mashable

0 notes

Text

M1 Finance Review: The Free Robo Advisor YOU Control

If you've been fascinated with the idea of robo-advisors, but still prefer to go the do-it-yourself route, you need to check out M1 Finance. It's a robo-advisor for sure, but one with a unique twist: you choose your own investments.

That's the self-directed part. But once you choose your investments, you get all the benefits of a robo-advisor. M1 Finance then manages your portfolio for you, including periodic rebalancing and dividend reinvesting. Your only responsibilities are to choose your investments and fund your account.

It doesn't fit neatly within the description of a robo-advisor, but it's really a hybrid between robo-advisors and self-directed investing. It wouldn't be an exaggeration to say it represents the best elements of both.

Interested?

How M1 Finance Works

M1 Finance is based in Dallas, Texas, and was launched in 2015. The service is built around what it refers to as “Pies”. These are individual portfolios that are comprised of a mix of exchange-traded funds (ETFs) and individual stocks. ETFs are a staple of the robo-advisor universe. But individual stocks are offered by only a few providers, and when they are, they're usually selected by the robo-advisor.

The use of individual stocks–and your own ability to choose which stocks and ETFs go into your pies–is what sets M1 Finance apart. It gives you complete control over the investments you'll hold.

Another departure from typical robo-advisor practice is that M1 Finance does not have you complete a questionnaire to determine your risk tolerance. In this way, the platform is better for experienced investors, who are able to determine their own investment comfort level.

But still, another distinguishing factor is that you can create an unlimited number of pies. You can choose existing pie templates provided by M1 Finance, or create your own. For example, you can create a technology-based pie, a socially responsible investment pie, and an emerging market pie–all at the same time. And there's no limit on the number of pies.

M1 Finance then manages your portfolio using modern portfolio theory (MPT), just as other robo-advisors do.

In this way, M1 Finance is both an active and passive investment platform. It's active in the sense that you select your own investments, and can change them at any time. But it's passive in the way the pies are managed.

M1 Finance Investment Methodology

M1 Finance's investment methodology is really a discussion of the pie concept. Each pie can be made up of up to 100 individual “slices”, which are represented by ETFs and individual stocks. M1 Finance provides more than 60 pre-selected pies that you can choose from, or you can construct your own.

There is a limitation however in that you cannot include mutual funds in your pies. In addition, individual stocks must be selected either from the New York Stock Exchange, the NASDAQ, or the BATS system. Which means you won't be able to invest in stocks that trade only on foreign exchanges.

Each pie will contain general asset allocations, which you can choose to fill with investments of your choice. M1 Finance will rebalance your pies consistent with that allocation. The allocations will also be maintained as you add additional funds to each pie.

You can create pies that are made up entirely of ETFs or of stocks or a combination of both. For example, you can choose a pie for FAANG stocks, that holds only positions in each of those five companies. But you can also adjust the mix. You can choose higher allocations for one or two stocks, and lower ones for the others.

This flexibility gives you complete control over how you will invest your money, but within the scope of a robo-advisor platform.

M1 Finance Tax Advantages

This area is a mixed bag. M1 Finance does offer a tax loss strategy, in which an algorithm determines which securities are sold when you withdraw funds from your account.

They do this by setting a selling priority that looks like this:

Losses that offset future gains.

Lots that result in long-term capital gains, to get the benefit of lower long-term capital gains tax rates.

Lots resulting in short-term capital gains, which are taxed at ordinary tax rates.

However, M1 Finance doesn't offer tax-loss harvesting, which is becoming an increasingly common feature of robo-advisors.

M1 Finance Features & Benefits

Available accounts. M1 Finance accommodates individual and joint taxable accounts, trusts, and traditional, Roth, SEP and rollover IRA accounts.

Minimum investment requirement. You can open an account with no money whatsoever. But you'll need a minimum of $100 to begin investing in a taxable account, and at least $500 in a retirement account.

Account custodian. Funds invested with M1 Finance are held with Apex Clearing Corporation. M1 Finance just manages your account. As a result, your account is protected by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. This is of course protection against broker failure, and not against losses due to market factors.

M1 Finance Mobile App. The app is available for both Android (5.0 and up) and iOS (10.0 or later) devices and can be downloaded at The App Store or Google Play.

Exporting tax information. Your annual investment results can be exported directly to either TurboTax or H&R Block tax preparation software.

Dividend reinvestment. M1 Finance automatically reinvests your dividends once they reach $10.

M1 Borrow. You can borrow up to 35% of the value of your portfolio for any purpose, and without a credit check. Once borrowed, the money can be paid back on your own terms. The interest rate is 4.00% APR as of December 7, 2018.

Since the funds borrowed represent margin against your account, you may be subject to a maintenance call if your portfolio value falls below a certain threshold. A maintenance call normally happens when your account equity falls below 30%. However additional restrictions may be placed if your portfolio is deemed to be particularly high risk.

Referral program. If you refer a friend who signs up for an M1 Finance account, both you and your friend will receive $10 to invest in your respective accounts. You'll be given a unique link on the mobile app that you can share with friends by email, text, or even social media.

M1 Finance customer service. You can reach M1 Finance by either phone or email, Monday through Friday, 9 am to 5 pm, Central Time.

Get started with M1 Finance today.

M1 Finance Pricing

This is one of the most compelling features about M1 Finance. There are no fees!

That means:

No annual advisory fee

No monthly fees

No trading fees

So how does M1 Finance make money if they don't charge fees to investors? After all, if they don't make any money, they won't be in business very long.

M1 Finance explains it this way:

”Brokerages make more money via lending securities they hold, interest on cash held in a brokerage account, extending credit through margin to customers, and getting paid for distributing certain funds or to transact on various exchanges. These revenue streams are more than enough to support a strong, vibrant company. This is also true at M1 Finance, and we will make more money from transactions and holding the assets than we would from our fee.”

So there you have it: a brokerage platform that admits to making its money on the back end, in favor of offering investment services to customers for free. You've gotta love the honesty, along with the fee-free service.

How to Sign up with M1 Finance

To open an account with M1 Finance, you'll need to:

be at least 18

be a US citizen or permanent resident with a “green card”

have a current US mailing address.

You'll begin by entering your email address and creating a unique password. You'll also need to provide your name, address, and phone number.

Once you open your account, you can dive right into creating your investment pies. As discussed earlier, you can either choose from one of more than 60 pre-selected templates or make your own custom pie.

The next step is to link your bank account to your M1 Finance account. From there, you can fund your account. But the link means you can also withdraw funds, as well as contribute additional money going forward.

M1 Finance can automatically link to a large number of banks, saving you time inputting information. But if your bank isn't one of the choices, you can add it. Just add the name of your bank, the type of account, your bank routing number, and personal account number, and you'll be ready to go.

Get started with M1 Finance today.

M1 Finance Pros & Cons

Pros:

M1 Finance has no fees of any kind.

There is no required initial deposit to open an account, and you can begin investing with as little as $100.

M1 Finance lets you choose the investments you'll hold in your account, and then automatically manages them for you.

Through the pie format, you can create any number of individual portfolios for your account.

Pies enable you to invest in individual stocks, as well as ETFs. You can even create a pie composed entirely of stocks.

You can change your investments at any time.

You can borrow up to 35% of the value of your account at just 4% APR, and repay on your own terms.

Cons:

M1 Finance is not a trading platform, so you won't be able to use it to trade individual securities. Stock purchases are only permitted in connection with the creation of pies.

There's no ability to include mutual funds in your pies.

M1 Finance doesn't offer tax-loss harvesting. That's not a problem with retirement accounts, but it's now being offered on taxable accounts by many competing robo-advisors.

Since M1 Finance doesn't determine your risk tolerance, you'll need to adjust your holdings to match your own investing temperament.

The DIY aspect of M1 Finance means you'll have to have at least some investment experience. The platform isn't suitable for inexperienced investors looking for a completely passive investment experience.

Why You Should Invest with M1 Finance

M1 Finance isn't for all investors. If you're completely inexperienced, the self-directed aspect of the service may leave you taking on more than you want. There are plenty of other robo-advisors that are very well suited to completely passive investing for beginners, including Betterment and Wealthfront.

But if you're an experienced investor, who prefers to go the do-it-yourself route, but doesn't want the hassles of day-to-day portfolio management, M1 Finance is the perfect robo-advisor for you. You can build your own portfolios and as many as you want. You can even select the stocks and ETFs included in your pies. But you won't have to concern yourself with rebalancing for reinvesting dividends.

And you've gotta love that you can invest completely free. Unlike most robo-advisors, there's no annual advisory fee. And unlike discount brokers, there are no trading fees. Plus, you can borrow up to 35% of the value of your account at below market rates, and pay it back at your leisure.

That's a powerful combination that's unmatched anywhere else in the investment universe.

If you'd like more information, or you'd like to start investing, check out the M1 Finance website.

The post M1 Finance Review: The Free Robo Advisor YOU Control appeared first on Part-Time Money.

0 notes

Text

M1 Finance Review: The Free Robo Advisor YOU Control

If you've been fascinated with the idea of robo-advisors, but still prefer to go the do-it-yourself route, you need to check out M1 Finance. It's a robo-advisor for sure, but one with a unique twist: you choose your own investments.

That's the self-directed part. But once you choose your investments, you get all the benefits of a robo-advisor. M1 Finance then manages your portfolio for you, including periodic rebalancing and dividend reinvesting. Your only responsibilities are to choose your investments and fund your account.

It doesn't fit neatly within the description of a robo-advisor, but it's really a hybrid between robo-advisors and self-directed investing. It wouldn't be an exaggeration to say it represents the best elements of both.

Interested?

How M1 Finance Works

M1 Finance is based in Dallas, Texas, and was launched in 2015. The service is built around what it refers to as “Pies”. These are individual portfolios that are comprised of a mix of exchange-traded funds (ETFs) and individual stocks. ETFs are a staple of the robo-advisor universe. But individual stocks are offered by only a few providers, and when they are, they're usually selected by the robo-advisor.

The use of individual stocks–and your own ability to choose which stocks and ETFs go into your pies–is what sets M1 Finance apart. It gives you complete control over the investments you'll hold.

Another departure from typical robo-advisor practice is that M1 Finance does not have you complete a questionnaire to determine your risk tolerance. In this way, the platform is better for experienced investors, who are able to determine their own investment comfort level.

But still, another distinguishing factor is that you can create an unlimited number of pies. You can choose existing pie templates provided by M1 Finance, or create your own. For example, you can create a technology-based pie, a socially responsible investment pie, and an emerging market pie–all at the same time. And there's no limit on the number of pies.

M1 Finance then manages your portfolio using modern portfolio theory (MPT), just as other robo-advisors do.

In this way, M1 Finance is both an active and passive investment platform. It's active in the sense that you select your own investments, and can change them at any time. But it's passive in the way the pies are managed.

M1 Finance Investment Methodology

M1 Finance's investment methodology is really a discussion of the pie concept. Each pie can be made up of up to 100 individual “slices”, which are represented by ETFs and individual stocks. M1 Finance provides more than 60 pre-selected pies that you can choose from, or you can construct your own.

There is a limitation however in that you cannot include mutual funds in your pies. In addition, individual stocks must be selected either from the New York Stock Exchange, the NASDAQ, or the BATS system. Which means you won't be able to invest in stocks that trade only on foreign exchanges.

Each pie will contain general asset allocations, which you can choose to fill with investments of your choice. M1 Finance will rebalance your pies consistent with that allocation. The allocations will also be maintained as you add additional funds to each pie.

You can create pies that are made up entirely of ETFs or of stocks or a combination of both. For example, you can choose a pie for FAANG stocks, that holds only positions in each of those five companies. But you can also adjust the mix. You can choose higher allocations for one or two stocks, and lower ones for the others.

This flexibility gives you complete control over how you will invest your money, but within the scope of a robo-advisor platform.

M1 Finance Tax Advantages

This area is a mixed bag. M1 Finance does offer a tax loss strategy, in which an algorithm determines which securities are sold when you withdraw funds from your account.

They do this by setting a selling priority that looks like this:

Losses that offset future gains.

Lots that result in long-term capital gains, to get the benefit of lower long-term capital gains tax rates.

Lots resulting in short-term capital gains, which are taxed at ordinary tax rates.

However, M1 Finance doesn't offer tax-loss harvesting, which is becoming an increasingly common feature of robo-advisors.

M1 Finance Features & Benefits

Available accounts. M1 Finance accommodates individual and joint taxable accounts, trusts, and traditional, Roth, SEP and rollover IRA accounts.

Minimum investment requirement. You can open an account with no money whatsoever. But you'll need a minimum of $100 to begin investing in a taxable account, and at least $500 in a retirement account.

Account custodian. Funds invested with M1 Finance are held with Apex Clearing Corporation. M1 Finance just manages your account. As a result, your account is protected by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. This is of course protection against broker failure, and not against losses due to market factors.

M1 Finance Mobile App. The app is available for both Android (5.0 and up) and iOS (10.0 or later) devices and can be downloaded at The App Store or Google Play.

Exporting tax information. Your annual investment results can be exported directly to either TurboTax or H&R Block tax preparation software.

Dividend reinvestment. M1 Finance automatically reinvests your dividends once they reach $10.

M1 Borrow. You can borrow up to 35% of the value of your portfolio for any purpose, and without a credit check. Once borrowed, the money can be paid back on your own terms. The interest rate is 4.00% APR as of December 7, 2018.

Since the funds borrowed represent margin against your account, you may be subject to a maintenance call if your portfolio value falls below a certain threshold. A maintenance call normally happens when your account equity falls below 30%. However additional restrictions may be placed if your portfolio is deemed to be particularly high risk.

Referral program. If you refer a friend who signs up for an M1 Finance account, both you and your friend will receive $10 to invest in your respective accounts. You'll be given a unique link on the mobile app that you can share with friends by email, text, or even social media.

M1 Finance customer service. You can reach M1 Finance by either phone or email, Monday through Friday, 9 am to 5 pm, Central Time.

Get started with M1 Finance today.

M1 Finance Pricing

This is one of the most compelling features about M1 Finance. There are no fees!

That means:

No annual advisory fee

No monthly fees

No trading fees

So how does M1 Finance make money if they don't charge fees to investors? After all, if they don't make any money, they won't be in business very long.

M1 Finance explains it this way:

”Brokerages make more money via lending securities they hold, interest on cash held in a brokerage account, extending credit through margin to customers, and getting paid for distributing certain funds or to transact on various exchanges. These revenue streams are more than enough to support a strong, vibrant company. This is also true at M1 Finance, and we will make more money from transactions and holding the assets than we would from our fee.”

So there you have it: a brokerage platform that admits to making its money on the back end, in favor of offering investment services to customers for free. You've gotta love the honesty, along with the fee-free service.

How to Sign up with M1 Finance

To open an account with M1 Finance, you'll need to:

be at least 18

be a US citizen or permanent resident with a “green card”

have a current US mailing address.

You'll begin by entering your email address and creating a unique password. You'll also need to provide your name, address, and phone number.

Once you open your account, you can dive right into creating your investment pies. As discussed earlier, you can either choose from one of more than 60 pre-selected templates or make your own custom pie.

The next step is to link your bank account to your M1 Finance account. From there, you can fund your account. But the link means you can also withdraw funds, as well as contribute additional money going forward.

M1 Finance can automatically link to a large number of banks, saving you time inputting information. But if your bank isn't one of the choices, you can add it. Just add the name of your bank, the type of account, your bank routing number, and personal account number, and you'll be ready to go.

Get started with M1 Finance today.

M1 Finance Pros & Cons

Pros:

M1 Finance has no fees of any kind.

There is no required initial deposit to open an account, and you can begin investing with as little as $100.

M1 Finance lets you choose the investments you'll hold in your account, and then automatically manages them for you.

Through the pie format, you can create any number of individual portfolios for your account.

Pies enable you to invest in individual stocks, as well as ETFs. You can even create a pie composed entirely of stocks.

You can change your investments at any time.

You can borrow up to 35% of the value of your account at just 4% APR, and repay on your own terms.

Cons:

M1 Finance is not a trading platform, so you won't be able to use it to trade individual securities. Stock purchases are only permitted in connection with the creation of pies.

There's no ability to include mutual funds in your pies.

M1 Finance doesn't offer tax-loss harvesting. That's not a problem with retirement accounts, but it's now being offered on taxable accounts by many competing robo-advisors.

Since M1 Finance doesn't determine your risk tolerance, you'll need to adjust your holdings to match your own investing temperament.

The DIY aspect of M1 Finance means you'll have to have at least some investment experience. The platform isn't suitable for inexperienced investors looking for a completely passive investment experience.

Why You Should Invest with M1 Finance

M1 Finance isn't for all investors. If you're completely inexperienced, the self-directed aspect of the service may leave you taking on more than you want. There are plenty of other robo-advisors that are very well suited to completely passive investing for beginners, including Betterment and Wealthfront.

But if you're an experienced investor, who prefers to go the do-it-yourself route, but doesn't want the hassles of day-to-day portfolio management, M1 Finance is the perfect robo-advisor for you. You can build your own portfolios and as many as you want. You can even select the stocks and ETFs included in your pies. But you won't have to concern yourself with rebalancing for reinvesting dividends.

And you've gotta love that you can invest completely free. Unlike most robo-advisors, there's no annual advisory fee. And unlike discount brokers, there are no trading fees. Plus, you can borrow up to 35% of the value of your account at below market rates, and pay it back at your leisure.

That's a powerful combination that's unmatched anywhere else in the investment universe.

If you'd like more information, or you'd like to start investing, check out the M1 Finance website.

The post M1 Finance Review: The Free Robo Advisor YOU Control appeared first on Part-Time Money.

0 notes

Text

M1 Finance Review: The Free Robo Advisor YOU Control

If you've been fascinated with the idea of robo-advisors, but still prefer to go the do-it-yourself route, you need to check out M1 Finance. It's a robo-advisor for sure, but one with a unique twist: you choose your own investments.

That's the self-directed part. But once you choose your investments, you get all the benefits of a robo-advisor. M1 Finance then manages your portfolio for you, including periodic rebalancing and dividend reinvesting. Your only responsibilities are to choose your investments and fund your account.

It doesn't fit neatly within the description of a robo-advisor, but it's really a hybrid between robo-advisors and self-directed investing. It wouldn't be an exaggeration to say it represents the best elements of both.

Interested?

How M1 Finance Works

M1 Finance is based in Dallas, Texas, and was launched in 2015. The service is built around what it refers to as “Pies”. These are individual portfolios that are comprised of a mix of exchange-traded funds (ETFs) and individual stocks. ETFs are a staple of the robo-advisor universe. But individual stocks are offered by only a few providers, and when they are, they're usually selected by the robo-advisor.

The use of individual stocks–and your own ability to choose which stocks and ETFs go into your pies–is what sets M1 Finance apart. It gives you complete control over the investments you'll hold.

Another departure from typical robo-advisor practice is that M1 Finance does not have you complete a questionnaire to determine your risk tolerance. In this way, the platform is better for experienced investors, who are able to determine their own investment comfort level.

But still, another distinguishing factor is that you can create an unlimited number of pies. You can choose existing pie templates provided by M1 Finance, or create your own. For example, you can create a technology-based pie, a socially responsible investment pie, and an emerging market pie–all at the same time. And there's no limit on the number of pies.

M1 Finance then manages your portfolio using modern portfolio theory (MPT), just as other robo-advisors do.

In this way, M1 Finance is both an active and passive investment platform. It's active in the sense that you select your own investments, and can change them at any time. But it's passive in the way the pies are managed.

M1 Finance Investment Methodology

M1 Finance's investment methodology is really a discussion of the pie concept. Each pie can be made up of up to 100 individual “slices”, which are represented by ETFs and individual stocks. M1 Finance provides more than 60 pre-selected pies that you can choose from, or you can construct your own.

There is a limitation however in that you cannot include mutual funds in your pies. In addition, individual stocks must be selected either from the New York Stock Exchange, the NASDAQ, or the BATS system. Which means you won't be able to invest in stocks that trade only on foreign exchanges.

Each pie will contain general asset allocations, which you can choose to fill with investments of your choice. M1 Finance will rebalance your pies consistent with that allocation. The allocations will also be maintained as you add additional funds to each pie.

You can create pies that are made up entirely of ETFs or of stocks or a combination of both. For example, you can choose a pie for FAANG stocks, that holds only positions in each of those five companies. But you can also adjust the mix. You can choose higher allocations for one or two stocks, and lower ones for the others.

This flexibility gives you complete control over how you will invest your money, but within the scope of a robo-advisor platform.

M1 Finance Tax Advantages

This area is a mixed bag. M1 Finance does offer a tax loss strategy, in which an algorithm determines which securities are sold when you withdraw funds from your account.

They do this by setting a selling priority that looks like this:

Losses that offset future gains.

Lots that result in long-term capital gains, to get the benefit of lower long-term capital gains tax rates.

Lots resulting in short-term capital gains, which are taxed at ordinary tax rates.

However, M1 Finance doesn't offer tax-loss harvesting, which is becoming an increasingly common feature of robo-advisors.

M1 Finance Features & Benefits

Available accounts. M1 Finance accommodates individual and joint taxable accounts, trusts, and traditional, Roth, SEP and rollover IRA accounts.

Minimum investment requirement. You can open an account with no money whatsoever. But you'll need a minimum of $100 to begin investing in a taxable account, and at least $500 in a retirement account.

Account custodian. Funds invested with M1 Finance are held with Apex Clearing Corporation. M1 Finance just manages your account. As a result, your account is protected by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. This is of course protection against broker failure, and not against losses due to market factors.

M1 Finance Mobile App. The app is available for both Android (5.0 and up) and iOS (10.0 or later) devices and can be downloaded at The App Store or Google Play.

Exporting tax information. Your annual investment results can be exported directly to either TurboTax or H&R Block tax preparation software.

Dividend reinvestment. M1 Finance automatically reinvests your dividends once they reach $10.

M1 Borrow. You can borrow up to 35% of the value of your portfolio for any purpose, and without a credit check. Once borrowed, the money can be paid back on your own terms. The interest rate is 4.00% APR as of December 7, 2018.

Since the funds borrowed represent margin against your account, you may be subject to a maintenance call if your portfolio value falls below a certain threshold. A maintenance call normally happens when your account equity falls below 30%. However additional restrictions may be placed if your portfolio is deemed to be particularly high risk.

Referral program. If you refer a friend who signs up for an M1 Finance account, both you and your friend will receive $10 to invest in your respective accounts. You'll be given a unique link on the mobile app that you can share with friends by email, text, or even social media.

M1 Finance customer service. You can reach M1 Finance by either phone or email, Monday through Friday, 9 am to 5 pm, Central Time.

Get started with M1 Finance today.

M1 Finance Pricing

This is one of the most compelling features about M1 Finance. There are no fees!

That means:

No annual advisory fee

No monthly fees

No trading fees

So how does M1 Finance make money if they don't charge fees to investors? After all, if they don't make any money, they won't be in business very long.

M1 Finance explains it this way:

”Brokerages make more money via lending securities they hold, interest on cash held in a brokerage account, extending credit through margin to customers, and getting paid for distributing certain funds or to transact on various exchanges. These revenue streams are more than enough to support a strong, vibrant company. This is also true at M1 Finance, and we will make more money from transactions and holding the assets than we would from our fee.”

So there you have it: a brokerage platform that admits to making its money on the back end, in favor of offering investment services to customers for free. You've gotta love the honesty, along with the fee-free service.

How to Sign up with M1 Finance

To open an account with M1 Finance, you'll need to:

be at least 18

be a US citizen or permanent resident with a “green card”

have a current US mailing address.

You'll begin by entering your email address and creating a unique password. You'll also need to provide your name, address, and phone number.

Once you open your account, you can dive right into creating your investment pies. As discussed earlier, you can either choose from one of more than 60 pre-selected templates or make your own custom pie.

The next step is to link your bank account to your M1 Finance account. From there, you can fund your account. But the link means you can also withdraw funds, as well as contribute additional money going forward.

M1 Finance can automatically link to a large number of banks, saving you time inputting information. But if your bank isn't one of the choices, you can add it. Just add the name of your bank, the type of account, your bank routing number, and personal account number, and you'll be ready to go.

Get started with M1 Finance today.

M1 Finance Pros & Cons

Pros:

M1 Finance has no fees of any kind.

There is no required initial deposit to open an account, and you can begin investing with as little as $100.

M1 Finance lets you choose the investments you'll hold in your account, and then automatically manages them for you.

Through the pie format, you can create any number of individual portfolios for your account.

Pies enable you to invest in individual stocks, as well as ETFs. You can even create a pie composed entirely of stocks.

You can change your investments at any time.

You can borrow up to 35% of the value of your account at just 4% APR, and repay on your own terms.

Cons: