#generative ai in risk & compliance certificate

Explore tagged Tumblr posts

Text

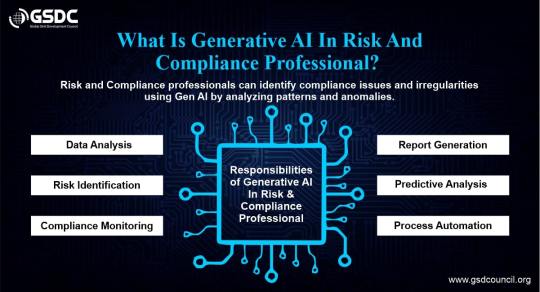

What is Generative AI in Risk And Compliance Professionals?

Using cutting-edge AI models to assist professionals in identifying, evaluating, and managing risks while making sure businesses adhere to rules is known as generative AI in risk and compliance.

Large volumes of data can be analyzed by these AI models, which can also identify trends and produce reports or suggestions. For your Risk and Compliance certification, you need to investigate Generative AI.

#Generative AI In Risk And Compliance Professional#Generative AI in Risk and Compliance certification

0 notes

Text

#generative ai in risk & compliance certification#certified generative ai in risk & compliance#generative ai in risk & compliance certificate#generative ai in risk & compliance#generative ai certification#generative ai#generative ai professional certification#open ai certification#open ai#creative ai

0 notes

Text

The Future of Accounting: Emerging Trends in CA, CS, US CMA, US CPA, UK ACCA, and US CFA

Introduction: The Evolving Landscape of Accounting

The accounting field is undergoing rapid changes due to technological advancements, globalization, and evolving business needs. Professionals in roles like CA (Chartered Accountant), CS (Company Secretary), US CMA (Certified Management Accountant), US CPA (Certified Public Accountant), UK ACCA (Association of Chartered Certified Accountants), and US CFA (Chartered Financial Analyst) are at the forefront of these changes.

Technological Advancements in Accounting

Automation and AI Integration

Automation and artificial intelligence (AI) are transforming routine accounting tasks. Processes such as bookkeeping, payroll, and data analysis are becoming more efficient, reducing errors and saving time. For instance, AI-powered tools can analyze large datasets, offering previously difficult insights to obtain manually.

Blockchain and Its Impact on Transparency

Blockchain technology is revolutionizing accounting by providing a secure and transparent ledger system. It ensures data integrity and reduces the chances of fraud, making it particularly useful for auditing and financial reporting.

Cloud-Based Accounting Solutions

Thanks to cloud technology, accounting professionals can access financial data from any location at any time. Tools like QuickBooks and Xero provide real-time collaboration, enabling seamless interactions between clients and professionals.

The Role of Globalization in Shaping Accounting Careers

Demand for International Qualifications

With businesses expanding globally, certifications like US CPA, UK ACCA, and US CMA are gaining prominence. These qualifications offer a global perspective, making professionals more competitive in international markets.

Cross-Border Financial Regulations

Accountants are now required to understand complex international tax laws and compliance standards. This has increased the demand for experts in regulatory frameworks such as IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles).

Soft Skills: The New Essential for Accounting Professionals

Communication and Leadership

Modern accountants are expected to go beyond crunching numbers. Strong communication skills and leadership abilities are essential for conveying financial insights and guiding decision-making processes.

Adaptability and Lifelong Learning

With constant changes in technology and regulations, professionals must adapt and continuously update their knowledge. Certifications like US CMA and US CFA emphasize ongoing education to stay relevant.

Sustainability and ESG Reporting

Focus on Environmental, Social, and Governance (ESG) Metrics

Organizations are increasingly prioritizing sustainability. Accountants play a crucial role in ESG reporting, helping companies track and disclose their environmental and social impact.

Green Accounting Practices

Green accounting involves assessing and reporting environmental costs. This emerging field aligns financial practices with sustainability goals, reflecting a company’s commitment to responsible operations.

The Future of Accounting Certifications

Digital Skills Integration

Certifications like CA, US CPA, and UK ACCA are incorporating digital skills into their syllabi. Topics such as data analytics and cybersecurity are becoming essential components of these programs.

Specialized Roles and Niches

The future holds promising opportunities for accountants in specialized roles. Fields like forensic accounting, financial planning, and risk management are seeing significant growth.

Conclusion: Embracing Change in Accounting

The future of accounting is bright and full of opportunities for professionals willing to adapt. By staying updated on technological advancements, regulatory changes, and global trends, accountants can thrive in this dynamic field. Whether you’re pursuing CA, CS, US CMA, US CPA, UK ACCA, or US CFA, embracing these trends will set you apart in the ever-evolving accounting landscape.

2 notes

·

View notes

Text

Why AI Certifications Are Essential in Today’s Tech-Driven World

In an era where artificial intelligence (AI) is reshaping industries—from healthcare and finance to retail and entertainment—the demand for skilled professionals who can harness its power has skyrocketed. Yet, as AI evolves at breakneck speed, staying ahead requires more than just curiosity or self-taught skills. Enter AI certifications: structured, industry-recognized credentials that validate expertise, bridge skill gaps, and unlock career opportunities. Here’s why earning an AI certification is no longer optional but a strategic move for professionals in 2024.

1. Rising Demand for Certified AI Talent

The AI market is projected to grow at a CAGR of 37.3% from 2023 to 2030, with companies across sectors scrambling to integrate AI solutions. However, a glaring skill gap persists:

87% of organizations report shortages in AI talent (McKinsey, 2023).

Job postings for AI roles on platforms like LinkedIn have surged by 75% since 2020, with certifications listed as preferred qualifications.

Certifications signal to employers that you possess the practical and theoretical knowledge to tackle real-world challenges, from building machine learning models to implementing ethical AI frameworks.

2. Credibility in a Crowded Job Market

While online tutorials and MOOCs offer foundational knowledge, certifications from reputed institutions (e.g., Google, IBM, Microsoft, Stanford) add credibility. They:

Validate skills through rigorous assessments and projects.

Differentiate you from self-taught candidates in competitive hiring processes.

Align with industry standards, ensuring you learn tools like TensorFlow, PyTorch, or AWS AI services—skills employers actively seek.

For example, Google’s Professional Machine Learning Engineer certification or IBM’s AI Engineering Professional Certificate are gold standards that recruiters trust.

3. Staying Ahead of Technological Shifts

AI is not static. Breakthroughs in generative AI (e.g., ChatGPT), quantum computing, and AI ethics require professionals to continuously upskill. Certifications:

Offer structured learning paths updated with the latest trends.

Cover niche areas like NLP, computer vision, or AI governance, helping you specialize.

Teach compliance with regulations like the EU AI Act or GDPR, critical for roles in risk management.

Without formal training, it’s easy to fall behind in understanding cutting-edge tools like AutoML or reinforcement learning.

4. Higher Earnings and Career Mobility

Certified professionals command higher salaries and faster promotions:

AI engineers with certifications earn 20-30% more than non-certified peers (Payscale, 2023).

Certifications open doors to roles like AI Architect, Data Scientist, or AI Product Manager, which are among the top 10 highest-paying tech jobs.

For career switchers, certifications provide a clear pathway to transition into AI, even from non-tech backgrounds like marketing or finance.

5. Ethical and Responsible AI Development

As AI’s societal impact grows, so does scrutiny over bias, privacy, and transparency. Certifications increasingly emphasize ethical AI practices, such as:

Designing fair algorithms.

Mitigating data biases.

Ensuring compliance with global standards.

Programs like Microsoft’s Responsible AI Certification equip professionals to build systems that are not just innovative but also socially accountable.

6. Networking and Global Recognition

Certification programs often include access to exclusive communities, forums, and events. For instance:

Coursera’s IBM AI courses connect learners to a global network of peers.

AWS certifications offer invitations to beta-test new tools.

These networks foster collaboration, mentorship, and job referrals—critical in a field driven by innovation.

7. Future-Proofing Your Career

Automation and AI are predicted to displace 85 million jobs by 2025 but create 97 million new ones (World Economic Forum). Certifications ensure you’re equipped to thrive in roles that don’t yet exist, such as:

AI-powered cybersecurity analyst.

Healthcare AI diagnostics specialist.

Sustainability AI strategist.

Conclusion: Certifications Are Your AI Launchpad

In a world where AI literacy is becoming as essential as computer skills were in the 2000s, certifications are more than just resume boosters—they’re a strategic investment. Whether you’re a student, a mid-career professional, or an executive aiming to lead AI initiatives, certifications provide the knowledge, credibility, and confidence to navigate this transformative landscape.

Start Today: Explore programs like:

Google’s Machine Learning Certification

AWS Certified Machine Learning Specialty

Stanford’s AI Graduate Certificate

AI CERTS

The future belongs to those who learn, adapt, and certify their way forward. Don’t just witness the AI revolution—lead it

0 notes

Text

Streamlining Sustainability with ISCC Mass Balance Bookkeeping

In today’s world, businesses are under increasing pressure to adopt sustainable practices and demonstrate transparency in their operations. One critical tool that facilitates this is ISCC Mass balance bookkeeping. It’s an essential framework for companies seeking International Sustainability and Carbon Certification (ISCC), allowing them to track the sustainability of materials throughout the supply chain.

What is ISCC Mass Balance Bookkeeping?

ISCC Mass balance bookkeeping is a method used to monitor and document the flow of sustainable and non-sustainable materials in production processes. By applying this approach, companies ensure that the amount of certified material in their products corresponds to the certified material purchased. This system does not require physical segregation of sustainable materials, making it a more practical and cost-effective solution for companies operating complex supply chains.

Through Mass balance bookkeeping, businesses can calculate and validate their sustainability claims, providing reliable documentation to demonstrate compliance with sustainability standards. This helps companies meet regulatory requirements, enhance brand reputation, and appeal to environmentally conscious consumers. Read More - LCA Communication

Challenges in ISCC Mass Balance Bookkeeping

Although ISCC Mass balance bookkeeping is an effective approach, implementing and managing it can be challenging. Businesses often face issues such as:

Complexity of Data Management: Tracking the flow of materials across different production stages requires meticulous record-keeping and comprehensive data integration.

Human Error: Manual processes can lead to errors in data entry or misinterpretation of records, which may compromise certification compliance.

Time-Consuming Processes: Managing mass balance manually can be labor-intensive, especially for organizations with extensive supply chains.

These challenges emphasize the importance of efficient systems and tools to streamline the process.

The Solution: Automate ISCC Mass Balance Bookkeeping

To overcome these challenges, many companies are turning to digital solutions to automate ISCC Mass balance bookkeeping. Automation minimizes the risk of human error, enhances accuracy, and significantly reduces the time spent on administrative tasks. Here’s how automation can transform your sustainability reporting:

Improved Accuracy: Automated systems ensure precise calculations and error-free record-keeping.

Real-Time Tracking: Businesses can monitor material flows in real-time, ensuring compliance at every stage.

Effortless Reporting: Automation simplifies the generation of detailed sustainability reports, saving time and resources.

Scalability: Digital tools make it easier to manage mass balance bookkeeping even as your business and supply chain grow.

Automating ISCC Mass balance bookkeeping not only simplifies the certification process but also helps businesses maintain a competitive edge in an increasingly sustainability-driven market.

The Future of Mass Balance Bookkeeping

As sustainability becomes a core priority for businesses worldwide, the demand for efficient mass balance systems will continue to grow. Advanced technologies like blockchain and AI hold the potential to further revolutionize ISCC Mass balance bookkeeping by increasing transparency and enabling seamless data sharing across supply chains.

By adopting innovative solutions and staying ahead of industry trends, businesses can confidently navigate the complexities of sustainability certifications and contribute to a greener future.

Conclusion

ISCC Mass balance bookkeeping is a crucial component for businesses striving to meet sustainability standards and build trust with stakeholders. Despite its challenges, automating the process can unlock significant benefits, from improved accuracy to streamlined operations. Embracing these advancements is not just a strategic move—it’s an essential step toward achieving long-term sustainability goals.

0 notes

Text

Responsible Business Practices in Payment Processing

The digital payment landscape continues to evolve, making responsible business practices a top priority for payment processors, merchants, and financial institutions. Ethical and transparent payment processing ensures consumer trust, regulatory compliance, and long-term business sustainability. From data security to fair pricing models, companies in this space are under increasing scrutiny to balance innovation with responsible operations.

Key Aspects of Responsible Payment Processing.

A responsible payment processing system goes beyond transaction efficiency. It ensures fairness, security, and inclusivity in financial interactions.

1. Transparent Pricing and Fee Structures.

Businesses and consumers alike should have clear visibility into the costs associated with payment transactions. Hidden fees and unclear pricing structures erode trust and can lead to financial strain for small businesses. For example, some processors adopt flat-rate pricing models, while others use interchange-plus structures that provide greater clarity into cost breakdowns.

Eric Hannelius CEO of Pepper Pay, states, “Transparency in payment processing is about building long-term relationships with businesses and consumers. Companies that prioritize clear pricing models and fair transaction fees will always be ahead in terms of trust and retention.”

2. Data Security and Fraud Prevention.

With increasing cyber threats, responsible payment processors must implement cutting-edge security measures to protect customer data and financial transactions. Encryption, tokenization, and multi-factor authentication are essential in reducing fraud risks. For example, payment processors that offer real-time fraud detection and AI-driven security solutions can proactively identify suspicious transactions before they result in losses.

3. Ethical AI Use in Payment.

AI is increasingly used in fraud detection, credit scoring, and risk assessment. However, ensuring ethical AI practices is necessary to prevent biases and discrimination in payment approvals. For example, AI-driven payment solutions that use diverse and unbiased data sets help prevent unfair transaction declines and improve financial accessibility.

4. Commitment to Regulatory Compliance.

Payment processing businesses operate under a range of financial regulations, including PCI-DSS (Payment Card Industry Data Security Standard), GDPR (General Data Protection Regulation), and AML (Anti-Money Laundering) laws. Compliance ensures that businesses uphold industry standards and avoid legal risks. For example, companies that conduct regular audits and maintain up-to-date compliance certifications demonstrate a strong commitment to responsible financial practices.

5. Sustainability in Payment Operations.

Sustainable business practices in payment processing involve reducing energy consumption in data centers, using digital receipts instead of paper, and adopting eco-friendly financial products. For example, some payment companies now offer carbon-neutral transactions, allowing businesses to offset the environmental impact of digital payments.

“Sustainability in payment processing is more than an environmental initiative. It’s a business strategy,” says Eric Hannelius. “Companies that integrate responsible financial practices protect the planet and also build stronger relationships with environmentally conscious consumers.”

The Business Advantage of Ethical Payment Practices.

Responsible payment processing isn’t just about avoiding penalties or adhering to regulations. It enhances brand reputation, improves customer loyalty, and strengthens long-term profitability. Companies that prioritize transparency, security, and sustainability position themselves as industry leaders in a highly competitive market.

By adopting ethical business practices, payment processors contribute to a financial ecosystem that benefits businesses, consumers, and society as a whole.

0 notes

Text

Impact of AI on Accounting world:

The accounting industry has experienced a deep-rooted change with the inroad of Artificial Intelligence. It's one such revolutionary technology which has transformed the face of the way financial jobs get done by providing swift, efficient, and high precision performances. AI can lead the accounting profession towards smarter working through automation of repetitive work and by enabling decision making with data. This article discusses AI, the role it plays in modern accountancy, its significant benefits, and why upskilling using in GST, Income Tax, Tally, and Accounting course in Kolkata is necessary.

Role of AI in Accounting

AI incorporates new technologies such as machine learning, natural language processing, and RPA to transform the nature of financial workflows. Contrasting this from conventional practices, AI enables large data handling without any error, providing insight that can be used in making better decisions.

Key Innovations Introduced by AI

Automating Routine Processes

AI automates routine, mundane tasks like data entry, processing invoices, and reconciliation of accounts, thereby reducing mistakes and allowing accountants to have more time for strategic engagements.

Invoice Processing: AI extracts and validates the invoice data, automatically refreshing the financial records.

Reconciliation: AI makes the transactions match accurately between two accounts.

Tools such as Tally Prime empower the professionals to enhance productivity in these areas. Also a Tally course in Kolkata helps to gain knowledge on this field,

2.Advanced Financial Analysis

AI analysis of large amounts of data generates real-time patterns and leads to predictive information.

It ensures customized report generation according to the business necessity.

Predicts revenue, cost, or cash flows at an advanced level.

3.Ease in Compliances and Taxes

AI simplifies compliance with tax regulations by automating calculations and filings, reducing penalties from errors.

AI systems auto-update tax laws for accuracy.

AI-powered GST filing tools ensure error-free returns.

Enrolling in taxation course in Kolkata helps professionals master these AI-integrated solutions.

4. Fraud Detection and Risk Mitigation

AI detects anomalies and weighs the risks involved through the analysis of financial data.

Continuous monitoring to stay current with regulations.

Perform risk assessment to prevent certain dangers.

What is the Benefit of Implementing AI in Accounting

Unprecedented Precision and Speed AI decreases errors to a vast extent and also speeds up work, saving hundreds of minutes of labor-intensive work.

Cost Reduction Cutting business operations and optimizing resources will become simple once the labor-intensive business procedures are automated.

Better Decision-Making AI-driven insights offer more informed, strategic, and data-based decisions to both the accounting staff and executives.

Scalability As the business will require further increases in data due to increasing business needs, it becomes easy to adjust, using AI systems with managing loads of data.

Getting A Glimpse: A Time for Upskilling

Continuous learning is the way forward to maintain an edge in the light of AI reshaping accounting. Traditional accounting methods are not enough.

Core Courses for Professionals Accounting Courses: Foundational and advanced principles with integration of AI tools. Taxation Courses: Tax laws with AI-based compliance solutions. GST Courses: Practical training for GST filing through AI-enabled systems. Tally Classes: Specialize in Tally Prime, which comes embedded with AI.

Advantage over Competitors

The successful certification process with AI-intensive tool mastering class has all applicants in a very favorable light with employers. Challenges With AI Implementation

High Cost The biggest problem with AI for a small business is that there is a high investment requirement at the onset.

Data Security: Handling large data sets requires proper adherence to privacy rules.

Skill Gaps: Many professionals require focused training to utilize AI properly.

Job Displacement: Even though AI decreases the demand for repetitive tasks, it provides opportunities for strategic roles.

Real-world Applications of AI in Accounting

KPMG's Clara: Improves audit quality by using AI-driven insights.

QuickBooks: Automates Invoicing, Expense classification, and Financial projections.

Tally Prime: Offers real-time synchronization and anomaly detection to simplify business accounting.

Embracing the Future of Accounting

Success in the changing accounting world comes from embracing AI and tapping into its potential:

Invest in Training: Enrolling in taxation, Tally, GST course in Kolkata and AI-based accounting software.

Implement AI Solutions: Leverage AI systems to improve operational effectiveness.

Work Together in Teams: Accountants and IT experts should collaborate to optimize AI's potential.

Conclusion

AI is revolutionizing accounting by automating repetitive tasks, improving accuracy, and fostering strategic decision-making. As the profession evolves into a data-driven field, professionals and businesses must adapt by embracing AI and prioritizing upskilling. The future belongs to those who are ready to learn, lead, and innovate in this AI-driven era.

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

#Certifications in Generative AI#Generative AI#Generative AI In Business#Generative AI In Cybersecurity#Generative AI In Finance And Banking#Generative AI In HR & L&D#Generative AI In Marketing#Generative AI In Project Management#Generative AI In Retail#Generative AI In Risk And Compliance#Generative AI In Software Development#Generative AI Professional Certification

1 note

·

View note

Text

Why Accountants Need CPE Credits: A Quick Guide

In a world where financial regulations, standards, and technology continually evolve, the need for accountants to maintain their knowledge and expertise is absolutely critical.

CPE credits are a foundational component of an accountant’s career, providing essential opportunities to stay compliant, competitive, and capable of offering top-tier service to clients. Let’s explore why CPE courses for accountants are vital, what benefits they offer, and how they keep professionals at the forefront of the industry.

Maintaining Licensure and Compliance

For Certified Public Accountants (CPAs) and many other accounting professionals, CPE credits are not just recommended — they’re required. State boards of accountancy, professional organizations, and licensing bodies mandate a certain number of CPE hours to ensure that accountants remain competent in their field. Requirements vary by state and licensing body, but the general expectation is for accountants to complete around 40 hours of CPE annually. Failing to meet these requirements can lead to fines, suspension of licenses, or even a total loss of licensure.

Ethics CPE Requirements: Many states require that a portion of CPE hours be dedicated to ethics courses. These courses help ensure accountants understand their ethical responsibilities and can navigate complex ethical dilemmas.

Regulatory Changes: With frequent changes in tax laws, reporting standards, and regulatory frameworks, CPE courses ensure that accountants are aware of the latest requirements, reducing the risk of compliance issues.

Enhancing Technical Skills

The accounting field is no stranger to technical complexity. With emerging topics such as blockchain accounting, cryptocurrency, international financial reporting standards (IFRS), and artificial intelligence (AI) in finance, accountants must be prepared to integrate these innovations.

Technological Advancements: With advancements in software, data analytics, and automation, accountants can leverage new tools to streamline work and provide deeper insights. CPE courses in technology prepare accountants to harness the power of modern software and ensure they can offer clients or employers the benefits of efficient, tech-enabled service.

Specialized Areas of Practice: As accountants may choose to specialize in niches such as forensic accounting, cybersecurity, or business valuation, CPE credits allow them to develop these skills and expand their career opportunities.

Boosting Client Confidence and Building Trust

Accountants are advisors, and clients place high value on their ability to provide up-to-date and accurate financial advice. Meeting CPE requirements and pursuing additional certifications signals to clients that an accountant is committed to their profession, compliance, and continued learning.

Enhanced Reputation and Trust: Earning and maintaining CPE credits builds trust with clients and colleagues by demonstrating an accountant’s commitment to staying informed on current laws and regulations.

Increased Client Retention: Clients often remain loyal to accountants who show a proactive approach to professional growth and learning. Knowledge gained from CPE courses allows accountants to offer relevant insights that benefit client businesses.

Preparing for Regulatory and Economic Changes

Economic conditions and regulatory landscapes are always evolving, often with significant implications for businesses and individuals. Accountants who engage in ongoing professional education are better prepared to anticipate and respond to these shifts, providing clients with timely and relevant guidance.

Adaptation to Tax Code Changes: For tax accountants, changes in tax codes are a constant challenge. Completing CPE courses specific to tax updates is crucial for providing accurate tax preparation and planning services.

Economic Impact Awareness: CPE courses can include topics on economic trends, preparing accountants to advise clients on how to respond to economic downturns, inflation, and other external forces affecting financial health.

The Critical Role of CPE Credits in Accounting

In a profession where accuracy, ethics, and expertise are paramount, CPE credits form the backbone of an accountant’s commitment to continuous improvement and client service. Meeting CPE requirements goes beyond compliance; it empowers accountants to stay informed about industry developments, expand their knowledge base, and offer unparalleled service in a rapidly changing landscape.

Whether it’s to keep up with new laws, enhance technical skills, or pursue career advancement, the pursuit of CPE credits through accounting CPE is essential for accountants at all levels. With the right CPE courses from reputable leaders like CPE Inc., accounting professionals not only stay relevant but also gain the expertise needed to adapt, grow, and succeed in an increasingly complex financial environment.

For more information about Online CPE For Cpas and CPE Course please visit:- CPE Inc.

0 notes

Text

Fleet Management Solutions: Enhancing Efficiency and Control in Maritime Operations

Managing a maritime fleet involves more than just tracking vessels—it requires comprehensive oversight of maintenance, crew, fuel consumption, compliance, and logistics. Fleet management solutions (FMS) have become essential tools for shipping companies to streamline these operations, reduce costs, and ensure regulatory compliance. This blog explores the benefits, key features, and top solutions in fleet management software for 2024.

🌊 What is a Fleet Management Solution?

A Fleet Management Solution (FMS) is software designed to centralize and streamline all aspects of vessel operations, including:

Maintenance Scheduling: Preventive and corrective maintenance.

Crew Management: Scheduling, certification tracking, and payroll.

Fuel Management: Monitoring and optimizing fuel consumption.

Compliance Monitoring: Ensuring adherence to international regulations (IMO, SOLAS, MARPOL).

🛠️ Key Features of Fleet Management Solutions

1. Vessel Tracking and Monitoring

Real-Time Positioning: Track vessel locations using GPS and AIS data.

Performance Analytics: Monitor speed, fuel usage, and voyage efficiency.

Benefits: Enhances operational control and safety.

2. Maintenance Management

Preventive Maintenance: Schedule inspections to avoid unexpected breakdowns.

Work Order Automation: Generate and assign maintenance tasks.

Benefits: Reduces downtime and extends asset life.

3. Crew Management

Roster Planning: Assign and rotate crew based on availability and qualifications.

Certification Alerts: Ensure compliance with mandatory training requirements.

Benefits: Streamlines HR processes and improves crew readiness.

4. Fuel and Energy Management

Fuel Consumption Tracking: Monitor fuel use and identify inefficiencies.

Emission Reporting: Track and report emissions to meet environmental regulations.

Benefits: Reduces operational costs and supports sustainability efforts.

5. Compliance and Documentation

Audit Trails: Maintain records for inspections and audits.

Regulatory Updates: Stay informed about changes in international maritime laws.

Benefits: Simplifies compliance and reduces the risk of fines.

🚢 Top Fleet Management Solutions in 2024

1. BASSnet Fleet Management

Best for: Comprehensive fleet operations and large shipping companies. Key Features:

Integrated modules for maintenance, procurement, and crew management.

Advanced analytics and customizable reports.

Strong compliance tools for IMO and ISM standards.

2. ABS Nautical Systems (NS)

Best for: Compliance-focused fleet management. Key Features:

Real-time monitoring of vessel performance.

Robust maintenance scheduling and inventory control.

Detailed regulatory compliance reports.

3. Sertica by RINA Digital Solutions

Best for: Mid-sized fleets looking for flexible solutions. Key Features:

Integrated maintenance, procurement, and safety management.

User-friendly dashboards and mobile access.

Predictive maintenance tools using IoT data.

4. MESPAS Fleet Management

Best for: Small to medium-sized operators. Key Features:

Cloud-based platform with mobile accessibility.

Strong procurement and inventory management.

Easy integration with third-party systems.

5. ShipManager by DNV GL

Best for: Data-driven decision-making for global fleets. Key Features:

Condition-based monitoring and predictive maintenance.

Comprehensive crew and safety management tools.

Advanced analytics for fuel efficiency and performance.

0 notes

Text

Oracle Fusion Financials Training: Your Complete Guide to Mastering ERP Financials

Are you looking to master Oracle Fusion Financials and advance your career in ERP financial management? Oracle Fusion Financials, a cloud-based ERP solution, is revolutionizing the way businesses handle core financial operations. This comprehensive guide will introduce you to the key features of Oracle Fusion Financials, explain the benefits of learning this system, and showcase an incredible learning resource: the Oracle Fusion Financials YouTube Playlist by BISP Trainings.

What Is Oracle Fusion Financials?

Oracle Fusion Financials is an advanced, integrated financial management system that provides comprehensive functionality for core financial processes. It includes modules like:

General Ledger (GL): Centralized financial data management.

Accounts Payable (AP): Streamlining supplier payments and tracking.

Accounts Receivable (AR): Managing customer invoicing and collections.

Fixed Assets: Tracking and depreciating company assets.

Cash Management: Effective liquidity management.

Why Learn Oracle Fusion Financials?

The demand for Oracle Fusion Financial professionals is soaring. Organizations across industries rely on Oracle ERP solutions for financial operations, making it a lucrative skill set for finance professionals. Here are the top reasons to learn Oracle Fusion Financials:

High Career Demand: Oracle-certified professionals command competitive salaries and enjoy strong job security.

Comprehensive Financial Insights: Oracle Fusion provides deep analytics for effective financial decision-making.

Global Reach: With its widespread adoption, learning Oracle Fusion opens doors to opportunities worldwide.

Future-Proof Your Career: Stay ahead of the curve by mastering a cutting-edge financial management system.

Learning Resource: Oracle Fusion Financials YouTube Playlist

BISP Trainings offers a detailed Oracle Fusion Financials YouTube Playlist designed to make learning accessible to everyone. This playlist covers everything from the basics to advanced topics, ensuring a well-rounded understanding of the system.

What’s Included in the Playlist?

Introduction to Oracle Fusion Financials: Learn the fundamentals and core features.

Module Deep-Dives: Comprehensive tutorials on GL, AP, AR, and more.

Hands-On Practice: Step-by-step guidance for real-world scenarios.

Case Studies: Industry examples for better context and application.

Benefits of Using the Playlist

Free Access: Start learning without financial commitments.

Flexibility: Learn at your own pace from anywhere in the world.

Expert Insights: Lessons are delivered by seasoned Oracle professionals.

Start exploring the playlist here: Oracle Fusion Financials Playlist.

Enroll in the Comprehensive Oracle Fusion Financials Course

While the YouTube playlist provides excellent foundational knowledge, enrolling in the Oracle Fusion Financials course by BISP Trainings ensures you gain deeper insights and practical experience.

Course Highlights:

Live instructor-led sessions.

Real-time projects and case studies.

Certification preparation for Oracle Financials.

One-on-one mentoring to address individual queries.

Sign up for the course now: Register Here.

Key Features of Oracle Fusion Financials

1. Intuitive User Experience

Oracle Fusion’s sleek interface allows users to navigate effortlessly, enhancing productivity.

2. AI-Driven Insights

Built-in analytics provide actionable insights, enabling better decision-making.

3. Seamless Integration

Oracle Fusion integrates with other Oracle Cloud solutions, ensuring smooth operations across all business processes.

4. Automation

Automate routine tasks such as invoice processing and reconciliations, saving time and resources.

5. Compliance

The platform ensures adherence to financial regulations, reducing compliance risks.

Conclusion

Mastering Oracle Fusion Financials can open up a world of opportunities in the finance domain. With BISP Trainings’ free YouTube playlist and detailed paid course, you have everything you need to succeed. Don’t miss this chance to elevate your career.

👉 Start Learning Now | Register for the Full Course

Oracle Fusion Financial

Oracle Erp Training

Oracle Financials Course

0 notes

Text

SailPoint Online Training | Sailpoint Training in Chennai

What Makes SailPoint IdentityIQ Stand Out?

SailPoint Online Training In today’s digital world, identity security is a top priority for businesses. Managing user access effectively ensures data protection and compliance. SailPoint IdentityIQ is a leading identity governance solution that stands out in the market. It offers advanced features to streamline identity management, improve security, and support regulatory compliance. Let’s explore what makes SailPoint IdentityIQ a preferred choice for enterprises.

1. Comprehensive Identity Governance

SailPoint IdentityIQ provides a full-fledged identity governance framework that allows organizations to manage and control user access efficiently. Unlike traditional identity management solutions, it offers policy-based automation to reduce manual efforts and security risks.

Role-Based Access Control (RBAC): Ensures that users have the right level of access based on their roles.

Access Certifications: Periodic review and validation of user access to prevent unauthorized access.

Seamless Integration: Supports integration with cloud and on-premises applications, making governance more effective.

With these capabilities, businesses can enforce strong security policies while reducing operational overhead. Additionally, Sailpoint Training in Chennai allows businesses to implement fine-grained access control, ensuring that users have only the permissions they need to perform their tasks. This minimizes security vulnerabilities and enhances operational efficiency. The platform also provides real-time visibility into user access, enabling organizations to monitor and manage identities proactively.

2. AI-Driven Identity Insights

One of the key differentiators of SailPoint IdentityIQ is its AI-powered analytics. The platform leverages machine learning to enhance security and detect risks in real time.

Anomaly Detection: Identifies unusual access patterns and alerts security teams.

Intelligent Recommendations: Suggests appropriate access rights based on user behavior and historical data.

Risk-Based Access Management: Prioritizes high-risk access requests for additional verification.

With AI-driven insights, organizations can make data-driven access decisions, improving security while maintaining efficiency. By analysing behavioural patterns, IdentityIQ can detect potential security threats and suggest preventive measures before breaches occur. The platform’s AI capabilities also reduce the burden on IT teams by automating repetitive tasks such as access approvals, making identity governance more efficient and cost-effective.

3. Strong Compliance and Audit Capabilities

Regulatory compliance is a major concern for businesses operating in various industries. SailPoint Online Training simplifies compliance management with its built-in audit and reporting features.

Automated Compliance Reporting: Generates detailed reports for compliance audits.

Policy Enforcement: Ensures adherence to corporate and regulatory policies.

Real-Time Access Monitoring: Tracks user activities and flags policy violations.

With these compliance-focused features, organizations can avoid penalties and meet industry regulations such as GDPR, HIPAA, and SOX with ease. Compliance audits can be complex and time-consuming, but SailPoint IdentityIQ streamlines the process by automating documentation and reporting. This not only reduces administrative workload but also ensures that organizations remain compliant with evolving regulatory requirements. The platform’s policy enforcement mechanisms further help in mitigating risks associated with non-compliance by proactively detecting and resolving issues before they become critical.

4. Automated Identity Lifecycle Management

Managing user identities throughout their lifecycle is critical for security. SailPoint IdentityIQ automates the entire identity lifecycle management process, ensuring that users receive appropriate access at every stage.

On boarding Automation: New employees receive necessary access as per their roles.

Role Changes: Adjusts access levels when users change positions within the company.

Off boarding Controls: Revokes access immediately after an employee leaves, reducing insider threats.

With automation, businesses can ensure smooth and secure user transitions without delays. Effective identity lifecycle management not only enhances security but also improves productivity by ensuring that employees have timely access to necessary resources. By automating provisioning and de provisioning, organizations can minimize human errors and security gaps associated with manual processes. Furthermore, IdentityIQ allows businesses to create workflow-based approvals, ensuring that access changes go through proper authorization channels before implementation.

5. Scalable and Flexible Architecture

SailPoint IdentityIQ is built for scalability and flexibility, making it suitable for businesses of all sizes. Whether an organization operates in a small, medium, or large-scale environment, the solution can adapt to its needs.

Supports Hybrid IT Environments: Works with both cloud and on-premises systems.

Modular Architecture: Allows organizations to implement features as needed.

Extensive API Support: Enables seamless integration with third-party applications.

This flexibility makes Sailpoint Training in Chennai a future-proof solution, ensuring that businesses can evolve without security concerns. The ability to scale identity governance efforts as an organization grows is essential for maintaining robust security and compliance standards. IdentityIQ’s modular approach allows businesses to expand their identity governance capabilities incrementally, aligning with their unique requirements and budgets. Additionally, the platform’s API support facilitates seamless connectivity with enterprise applications, enhancing interoperability and operational efficiency.

6. Advanced Role and Policy Management

SailPoint IdentityIQ offers advanced role and policy management features that help organizations enforce security best practices and ensure policy compliance.

Role Mining and Optimization: Helps identify and refine user roles to minimize excessive permissions.

Separation of Duties (SoD) Enforcement: Prevents conflicts by restricting conflicting access rights.

Access Policy Automation: Automates policy enforcement to reduce manual errors.

With these capabilities, businesses can maintain a well-structured and secure identity governance model that aligns with organizational policies and compliance requirements. By implementing role mining, organizations can reduce unnecessary access privileges and minimize security risks. Additionally, SoD policies help prevent fraud and ensure that no single user has excessive control over critical business processes.

7. Improved User Experience and Self-Service Capabilities

A key advantage of SailPoint IdentityIQ is its user-friendly interface and self-service options that empower employees while reducing IT workload.

Self-Service Access Requests: Allows users to request access and track approvals.

Password Management: Enables users to reset passwords without IT assistance.

Mobile-Friendly Interface: Supports remote access management for a distributed workforce.

By providing a simplified user experience, IdentityIQ enhances productivity and reduces dependency on IT teams for routine identity-related tasks. Employees can efficiently manage their access requests through an intuitive interface, reducing delays and improving operational efficiency. Self-service password management also helps reduce helpdesk tickets, allowing IT teams to focus on more strategic initiatives.

Conclusion

SailPoint IdentityIQ stands out as a robust and intelligent identity governance solution. Its comprehensive access management, AI-driven insights, compliance support, automation capabilities, scalable architecture, role management, and user-friendly interface make it a top choice for organizations looking to strengthen security and streamline identity governance. By adopting SailPoint IdentityIQ, businesses can reduce security risks, ensure compliance, and improve overall efficiency in managing digital identities. With continuous advancements in identity security, SailPoint IdentityIQ remains a leader in providing innovative solutions that empower organizations to navigate the complexities of modern identity governance.

Visualpath is the Leading and Best Institute for learning in Hyderabad. We provide Sailpoint Training in India. You will get the best course at an affordable cost.

For more Details Contact +91 7032290546

Visit: https://www.visualpath.in/sailpoint-online-training.html

#SailPoint Online Training#Sailpoint Course#Sailpoint Training in Hyderabad#Sailpoint Online Course#Sailpoint Training Institutes in Hyderabad#Sailpoint IdentityIQ Course Online#Sailpoint Identity IQ Online Training#Sailpoint Online Course in Bangalore#Sailpoint Training in India#Sailpoint IdentityIQ Course in Chennai#Sailpoint Online Training in Ameerpet#Sailpoint Training in Chennai

0 notes

Text

Cybersecurity in Web Development: How Indian Companies Are Building Secure Websites for 2025 and Beyond

As businesses increasingly go digital, the importance of cybersecurity in web development has reached new heights. With cyberattacks becoming more sophisticated, ensuring robust website security is no longer optional—it's a necessity.

Web development companies in India are stepping up to address this challenge, implementing cutting-edge security measures to protect user data and foster trust.

In this blog, we’ll explore why cybersecurity is crucial in web development, the emerging threats to web security, and how Indian web development companies are pioneering innovative solutions for 2025 and beyond.

The Importance of Cybersecurity in Web Development

Websites are the frontlines of digital interaction, handling everything from user registrations to online transactions. Consequently, they are prime targets for hackers. Key reasons for prioritising cybersecurity in web development include:

Protecting User Data: Websites often store sensitive user information, including names, emails, passwords, and payment details. A breach can compromise this data and lead to significant financial and reputational damage.

Ensuring Regulatory Compliance: Governments worldwide are enforcing stricter data protection laws like GDPR (General Data Protection Regulation) and India's Personal Data Protection Bill. Non-compliance can result in hefty fines.

Maintaining Customer Trust: Users are more likely to interact with websites that assure data security. A single security lapse can erode trust and impact business growth.

Preventing Downtime: Cyberattacks like DDoS (Distributed Denial-of-Service) can cripple website functionality, leading to lost revenue and frustrated customers.

Emerging Cybersecurity Threats

The digital landscape continues to evolve, and so do the threats. Key challenges faced by web development companies include:

Phishing Attacks: Fraudulent websites or emails trick users into revealing sensitive information.

Ransomware: Attackers encrypt website data and demand a ransom for its release.

SQL Injection: Hackers exploit vulnerabilities in databases to access or manipulate sensitive data.

Cross-Site Scripting (XSS): Malicious scripts are injected into trusted websites, potentially stealing user data or credentials.

Zero-Day Vulnerabilities: Unpatched software flaws are exploited by attackers before developers can fix them.

How Indian Companies Are Building Secure Websites

Web development companies in India are at the forefront of creating secure and resilient websites. Here’s how they’re tackling cybersecurity in web development:

1. Adopting Secure Development Practices

Indian developers follow frameworks like OWASP (Open Web Application Security Project) to identify and mitigate vulnerabilities during the development phase. Key practices include:

Input Validation: Ensuring only safe, expected inputs are accepted.

Code Reviews: Conducting thorough code audits to identify potential security flaws.

Data Encryption: Using HTTPS and SSL certificates to encrypt data during transmission.

2. Implementing Multi-Layered Security

To guard against advanced threats, Indian companies deploy multi-layered security measures such as:

Web Application Firewalls (WAFs): Protect against common threats like SQL injection and XSS attacks.

Content Delivery Networks (CDNs): Reduce the risk of DDoS attacks by distributing traffic across multiple servers.

Two-Factor Authentication (2FA): Adds an extra layer of protection for user accounts.

3. Leveraging AI and Machine Learning

AI-powered tools are revolutionising web security by enabling:

Threat Detection: Identifying unusual patterns that indicate potential attacks.

Behavioural Analysis: Monitoring user behaviour to detect anomalies.

Automated Incident Response: Reacting to threats in real time to minimise damage.

4. Regular Security Updates and Patches

Indian web development companies emphasise proactive maintenance by:

Regularly updating software to patch vulnerabilities.

Monitoring open-source components to ensure their security.

Conducting periodic penetration testing to identify weaknesses.

5. Enhancing User Authentication

Modern websites developed by Indian firms employ advanced authentication mechanisms like:

Biometric Authentication: Using fingerprints or facial recognition for secure access.

OAuth and SSO (Single Sign-On): Simplifying and securing user logins across platforms.

6. Educating Businesses About Cybersecurity

Many companies in India take an educational approach, helping businesses:

Understand the importance of cybersecurity.

Train their employees on best practices.

Develop response plans for potential breaches.

7. Compliance-Driven Development

Indian developers ensure that websites comply with international and local regulations, such as GDPR and the upcoming Digital Personal Data Protection Act, 2023 in India.

Trends Shaping Web Development Security by 2025

As we approach 2025, several trends are likely to redefine web security:

Zero Trust Architecture: A security model that assumes every interaction is a potential threat, requiring verification at every step.

Quantum-Resistant Encryption: Preparing for the challenges posed by quantum computing to traditional encryption methods.

Decentralised Security Models: Leveraging blockchain to ensure transparency and tamper-proof transactions.

IoT Security: Addressing vulnerabilities in Internet of Things (IoT) devices connected to websites.

Why Indian Companies Are Leading the Charge

India’s IT industry has built a global reputation for innovation and adaptability. Indian web development companies are uniquely positioned to address cybersecurity challenges because:

Cost Efficiency: They offer high-quality solutions at competitive rates.

Access to Skilled Talent: India produces a large pool of IT professionals adept at emerging technologies.

Global Collaboration: Indian firms collaborate with international clients, keeping them updated on global security trends and requirements.

Focus on Innovation: Many companies invest in R&D to stay ahead of cybersecurity threats.

As cyber threats continue to evolve, cybersecurity will remain a cornerstone of web development. Web Development company in India are setting benchmarks in building secure, scalable, and innovative websites, leveraging advanced technologies like AI, blockchain, and quantum computing to stay ahead of threats.

By prioritising security, compliance, and user trust, Indian web developers are not just protecting websites—they’re shaping a safer digital ecosystem for businesses and users alike.

#Web Development company in India#web design company#website development company in india#web development company#website development

0 notes

Text

Pest-Free Mumbai: A Comprehensive Guide to Modern Pest Management (2024)

In recent years, Mumbai's unique climate and urban density have created unprecedented pest control challenges. This comprehensive guide explores how modern pest management techniques are evolving to meet these challenges, with particular attention to emerging technologies and sustainable solutions.

Current Pest Challenges in Mumbai

Urban Development Impact

Increased construction activity

Disrupted pest habitats

Changes in pest behavior patterns

Growing resistance to traditional treatments

Climate-Related Factors

Monsoon effects

Rising temperatures

Extended breeding seasons

Adaptation of pest species

Revolutionary Control Methods

Traditional vs. Modern Approaches

The pest control industry has undergone significant transformation, as noted by the Environmental Protection Agency:

Traditional Methods:

Chemical-heavy treatments

Reactive approaches

Limited monitoring

Generic solutions

Modern Solutions:

Integrated pest management

Preventive strategies

Data-driven decisions

Customized treatments

Technology in Pest Control

Modern pest management leverages advanced technology:

Digital Monitoring

IoT sensors

Real-time tracking

Predictive analytics

Mobile applications

Advanced Equipment

Thermal imaging devices

UV detection systems

Smart traps

Precision application tools

Eco-friendly Solutions

According to the National Pest Management Association, sustainable pest control methods have shown a 40% increase in effectiveness:

Biological control agents

Natural repellents

Physical barriers

Environmental modifications

Specialized Solutions for Different Spaces

Residential Complexes

Modern high-rises require comprehensive protection:

Perimeter defense systems

Common area management

Waste management protocols

Regular monitoring schedules

Healthcare Facilities

Hospital-grade pest control demands specialized approaches:

Sterile environment maintenance

Zero-tolerance protocols

Non-toxic solutions

24/7 monitoring systems

Commercial Spaces

Business environments need tailored strategies:

Food safety compliance

Brand protection measures

Employee training

Customer safety protocols

Cost Considerations

Investment Analysis

Initial assessment costs

Treatment expenses

Maintenance fees

Emergency response charges

Long-term Value

Prevention vs. reaction costs

Property value protection

Health risk reduction

Reputation management

Seasonal Pest Management

Monsoon Preparation

Waterproofing measures

Drainage management

Moisture control

Enhanced monitoring

Summer Strategies

Heat-related pest control

Breeding prevention

Water source management

Enhanced ventilation

Winter Protocols

Hibernation prevention

Entry point sealing

Thermal imaging inspections

Modified treatment schedules

Safety Protocols

Human Safety Measures

Chemical handling procedures

PPE requirements

Application timing

Re-entry intervals

Environmental Protection

Groundwater safety

Air quality maintenance

Soil protection

Ecosystem preservation

Future Trends

Emerging Technologies

AI-powered monitoring

Drone applications

Genetic control methods

Smart building integration

Sustainable Practices

Green certification programs

Carbon footprint reduction

Biodegradable products

Natural predator promotion

Implementation Guidelines

Assessment Phase

Site inspection

Pest identification

Risk evaluation

Strategy development

Execution Process

Initial treatment

Monitoring setup

Documentation

Follow-up protocols

Maintenance and Monitoring

Regular Maintenance

Scheduled inspections

Preventive treatments

Equipment checks

Documentation updates

Quality Control

Performance metrics

Success indicators

Adjustment protocols

Feedback systems

Conclusion

The landscape of pest control in Mumbai continues to evolve with new challenges and solutions emerging regularly. Success in modern pest management requires a balanced approach combining traditional wisdom with cutting-edge technology. Whether for residential, commercial, or healthcare facilities, the key lies in choosing appropriate, sustainable, and effective methods while maintaining safety and environmental consciousness.

The future of pest control in Mumbai looks promising, with innovative technologies and eco-friendly solutions leading the way. By staying informed about these developments and working with qualified professionals, property owners and managers can maintain pest-free environments while contributing to a more sustainable future.

Remember that effective pest management is an ongoing process rather than a one-time solution. Regular monitoring, maintenance, and adaptation of strategies ensure long-term success in keeping spaces pest-free while protecting human health and the environment.

0 notes

Text

Introducing IBM ASC: Enhanced AWS Security with AI

Secure Your AWS Cloud Journey with IBM ASC Solution

Today, IBM launched Autonomous Security for Cloud (ASC), an AI-powered solution from IBM Consulting that helps enterprises speed up their cloud journey on Amazon Web Services (AWS) settings by automating cloud security monitoring and decision-making.

According to IBM’s 2024 Cloud Threat Landscape research, the biggest risks that businesses encounter as they depend more and more on cloud computing environments are misconfigurations and noncompliance. However, maintaining compliance and security in a technological environment where security is non-negotiable can be challenging, particularly in highly regulated sectors like manufacturing, financial services, and the public sector where it could take some time for labor-intensive, outdated compliance procedures to adjust to the quickly changing cloud infrastructures and the strict legal requirements for data protection.

To reduce possible threats, security management for enterprises using cloud-based architectures necessitates strong and particular policies and configurations. IBM’s ASC solution will use Amazon Bedrock generative AI technology to swiftly automate, adapt, and implement client-selected security rules in order to meet their objectives.

Using automation and generative AI to reduce the difficulties associated with cloud security management

Through the use of generative AI for autonomous decision-making, IBM ASC seeks to reduce operational loads, expedite deployment and management, and reduce risks by providing proactive threat mitigation, real-time modifications, and ongoing observation all of which aim to minimize the need for human labor. By using AI-powered intelligence to take into account the client-selected control framework and upcoming upgrades, IBM ASC will complement conventional Cloud Security Posture Management (CSPM) solutions and offer a customized approach to cloud security management. The IBM ASC solution is also intended to handle and minimize long-term policy drift, fix misconfigurations, and automate and enforce hygiene maintenance.

IBM is using AI and automation tools with Autonomous Security for Cloud (ASC) to help businesses manage their data more effectively, overcome cloud migration obstacles, and improve their compliance posture in order to provide value to stakeholders across the C-suite.

IBM ASC is a scalable cloud solution made to assist customers in:

Utilize retrieval-augmented generative (RAG) applications and large language models (LLMs) to leverage the potential of generative AI to comprehend clients’ security rules and requirements;

Determine if AWS native technical controls are applicable to a company’s workloads based on the regulatory requirements selected by the customer;

Use cloud-native automation to resolve non-compliance issues and automatically monitor and implement cloud security measures to mitigate misconfigurations.

Furthermore, IBM ASC wants to cut down on the amount of time spent on policy deployment by integrating cloud-native automation and generative AI for client security teams that spend months aligning and mapping security rules with regulations and turning them into scripts.

Cloud Transformation Acceleration with IBM and AWS

The launch of ASC demonstrates IBM’s dedication to assisting shared clients in utilizing AWS’s capabilities. IBM ASC will enable customers to accelerate cloud adoption and open up new avenues for business transformation and expansion by fusing AWS’s cloud transformation expertise with IBM’s.

IBM consultants with cloud certifications and AWS experience may help clients using ASC with customized assessments, ongoing monitoring and optimization, and proactive risk and compliance management, starting with implementation and onboarding. Furthermore, IBM Consulting may assist with ASC integration on AWS to meet the changing cloud infrastructure requirements of its clients while gradually enhancing accuracy and efficacy.

Beginning in December 2024, IBM’s ASC solution will be widely accessible worldwide. It was demonstrated at the AWS re:Invent 2024 session titled “Harnessing AI for Autonomous Cloud Security: IBM & AWS Game-Changing Solution.

Statements on IBM’s intentions and future direction are only goals and objectives, and they could be withdrawn or changed at any time.

Read more on govindhtech.com

#IntroducingIBMASC#EnhancedAWS#SecurityAI#AmazonWebServices#AmazonBedrock#generativeAI#retrievalaugmentedgenerative#RAG#ibm#aws#asc#CloudTransformation#technology#technews#news#govindhtech

0 notes

Text

The Future of AI: Balancing Innovation and Privacy

Artificial intelligence (AI) is transforming industries across the globe, from healthcare to finance, education to retail, and beyond. Its potential for innovation seems limitless, offering the ability to automate tasks, improve decision-making, and deliver unprecedented insights from vast amounts of data. However, with this incredible power comes a critical challenge: balancing the pursuit of innovation with the imperative of protecting privacy.

AI and Privacy: The Dual Challenge

AI thrives on data. Machine learning algorithms and AI models require massive datasets to function effectively, whether to recognize patterns, predict behaviors, or provide personalized experiences. This dependency on data raises critical questions about privacy:

Data Collection and Consent: AI systems often collect vast amounts of personal data, sometimes without individuals fully understanding the scope or purpose of the collection. This lack of transparency creates significant privacy concerns, particularly when sensitive information is involved.

Data Security: AI systems are not immune to cyberattacks. If personal data is stored and used by AI, the threat of breaches and data leaks increases, putting individuals’ privacy at risk.

Anonymization: Although anonymization techniques are used to protect user identities, there have been cases where seemingly anonymized data has been re-identified, further exacerbating privacy issues.

In the face of these challenges, it’s clear that innovative AI technologies must evolve hand-in-hand with robust privacy measures.

Regulatory Efforts: The Role of Laws and Guidelines

Governments and regulatory bodies worldwide are paying close attention to AI’s impact on privacy. Legislation such as the General Data Protection Regulation (GDPR) in Europe and California Consumer Privacy Act (CCPA) in the United States have introduced strict guidelines on how personal data is collected, stored, and used. These laws emphasize:

Informed Consent: Individuals must be informed about how their data is being used and give consent.

Data Minimization: Organizations should only collect the data that is absolutely necessary for a particular function.

Right to Access and Deletion: People have the right to access their data and request its deletion.

However, as AI technologies continue to advance, privacy regulations will need to adapt to new challenges. Professionals working in AI will need to be well-versed in these evolving privacy laws and ethical frameworks to ensure compliance and maintain public trust.

AI Ethics Certifications: Preparing for the Future

For professionals working in AI, balancing innovation with privacy is no longer optional. Understanding the ethical implications of AI and data usage is crucial. AI ethics certifications can provide the knowledge and tools needed to navigate this complex landscape. These certifications not only offer insights into AI’s potential risks but also provide practical guidelines for building systems that are transparent, fair, and privacy-conscious.

Here are some top certifications that can help professionals gain expertise in AI ethics, privacy, and responsible AI development:

1. AI+ Ethics™ by AI Certs

The AI+ Ethics™ certification from AI Certs offers a comprehensive overview of the ethical considerations in AI, focusing on privacy, fairness, and transparency. This course delves deep into how AI can be designed to respect privacy rights and comply with data protection laws while still driving innovation.

Participants in the AI+ Ethics™ program will learn practical techniques for mitigating bias, improving data transparency, and ensuring responsible AI usage. The course is suitable for AI developers, data scientists, business leaders, and anyone involved in AI deployment.

Use the coupon code NEWCOURSE25 to get 25% OFF on AI CERTS’ certifications. Don’t miss out on this limited-time offer! Visit this link to explore the courses and enroll today.

2. IBM AI Ethics Certification

IBM’s AI Ethics Certification is designed for professionals looking to understand the intersection of AI and privacy. The course covers key topics such as bias mitigation, fairness, and data privacy. Participants will gain practical experience using IBM’s tools for developing responsible AI solutions that align with privacy regulations like GDPR and CCPA.

The certification also provides insights into how organizations can maintain transparency in their AI systems, ensuring users understand how their data is being used and protected.

3. Google AI Principles and Ethics Certification

Google’s AI Principles and Ethics Certification focuses on the company’s core AI principles, which emphasize the responsible development and deployment of AI technologies. A key element of this certification is the exploration of privacy issues, including how Google’s AI systems protect user data and respect privacy rights.

This course is ideal for professionals interested in learning about AI ethics in practice and how to build systems that are both innovative and privacy conscious. The certification includes practical guidelines for building AI models that comply with global privacy regulations.

How AI Can Balance Innovation and Privacy

As AI becomes more powerful, finding the balance between innovation and privacy will require both technological advancements and ethical guidelines. Here are a few ways AI developers can address privacy concerns without stifling innovation:

1. Privacy by Design

One of the most promising approaches to balancing innovation and privacy is Privacy by Design (PbD). This principle suggests that privacy should be embedded into the AI development process from the very beginning, rather than being an afterthought. By incorporating privacy safeguards at the design stage, AI systems can be built to minimize data collection and protect user privacy by default.

2. Federated Learning

Federated learning is a cutting-edge AI technique that allows models to be trained on decentralized data. This means that data never leaves the user’s device, and the model is updated through aggregated information without exposing individual data. Federated learning reduces the need for centralized data storage and mitigates privacy risks while still enabling AI innovation.

3. Differential Privacy

Differential privacy is another technique that allows AI systems to analyze data while preserving the privacy of individuals. By adding controlled noise to datasets, differential privacy ensures that the results of AI models are not traceable to any specific individual, allowing for valuable insights without compromising privacy.

4. Data Anonymization and Encryption

The Future of AI and Privacy: A Collaborative Effort

The future of AI depends on finding a harmonious balance between innovation and privacy. As AI continues to evolve, professionals, organizations, and regulators must work together to ensure that AI technologies respect user privacy while driving progress. AI ethics certifications are an essential part of this journey, helping professionals understand the complexities of AI development and data protection.

As the demand for AI systems grows, so does the need for responsible AI practices. Certifications like AI+ Ethics™ from AI Certs, IBM AI Ethics Certification, and Google’s AI Principles and Ethics Certification equip professionals with the knowledge to build AI systems that respect privacy and comply with legal frameworks.

By embracing ethical AI development, professionals can ensure that the future of AI is both innovative and privacy conscious. The next generation of AI solutions will not only transform industries but also set new standards for how technology can serve humanity responsibly.

As we move forward, the future of AI will depend on our ability to strike the right balance between innovation and privacy. Ethical AI certifications are the key to ensuring that we not only advance technologically but also protect the fundamental rights and privacy of individuals.

0 notes