#gbpchf

Explore tagged Tumblr posts

Text

Hey, download one of THE best trading apps out there 👉🏽 #Insignalapp.

Made my monthly rent money on this trade 😱🤑 "GBPCHF 🚨" and more posts on the go.

Join with this link: http://wix.to/68SUzTC?ref=2_m_so. #TradersDiary #ForexTrades #WomenInBusiness #Womenwhotradeforex #FiveStarRatings #iOS #Android @Insignal_

#trades#traders#forex#forex traders#womenwhotrade#indicies#commodities#wonrate#winrate#top app#fivestarteviews#fivestarreview

5 notes

·

View notes

Text

@GBPCHF(H1)-Pattern: Cypher : BuyStop@: 1.1224, StopLoss: 1.1191, TakeProfit_1: 1.1274, TakeProfit_2: 1.1319, TakeProfit_3: 1.1351-2024.12.20 09:34

FxMath Harmonic Patterns Scanner @GBPCHF(H1)-Pattern: Cypher : BuyStop@: 1.1224, StopLoss: 1.1191, TakeProfit_1: 1.1274, TakeProfit_2: 1.1319, TakeProfit_3: 1.1351 Pay 89$ by Crypto instead of 199$ by regular payments MT4 Payment Link: https://commerce.coinbase.com/checkout/d38bd415-87a7-4bf0-9c76-1889fa393ef8 MT5 Payment Link:…

View On WordPress

0 notes

Text

Mastering GBPCHF Triple Top: Insider Secrets to Outsmart the Market The Triple Top: More Than a Pretty Pattern Ever heard the phrase, "History repeats itself"? Well, in the Forex world, that’s more than just a philosophical musing; it’s a money-making mantra. Enter the Triple Top pattern—a setup that’s as common as coffee orders but as misunderstood as cryptocurrency in 2011. Especially when trading the GBPCHF currency pair, the triple top pattern can either make your account soar or leave it flatter than a pancake on a Sunday morning. Here’s where most traders miss the mark: they assume spotting three peaks and calling it a day is enough. But this isn’t child’s play; it’s advanced pattern recognition with a touch of Sherlock Holmes-like investigation. Let’s uncover the layers of this pattern and why GBPCHF holds a treasure trove of opportunities for the astute trader. GBPCHF: The Currency Pair That Plays Hard to Get GBPCHF isn’t just another currency pair; it’s the Forex world’s equivalent of a moody artist. It’s unpredictable, dramatic, and oh-so-rewarding when you understand its quirks. Why focus on GBPCHF for triple top patterns? Here are the nuggets of wisdom: - Volatility With Purpose: Unlike more predictable pairs, GBPCHF tends to move in distinct, measurable waves, making triple tops more identifiable. - Trend-Sensitive: This pair often respects technical levels—a boon for traders relying on patterns like triple tops. - News-Driven Gems: Both GBP and CHF are highly sensitive to geopolitical events and economic data, providing a wealth of trading opportunities if you’re plugged into the right news sources. Triple Top Trading 101: A Crash Course Before we dive into advanced tactics, let’s ensure the basics are nailed down. A triple top forms when a currency pair hits the same resistance level three times, failing to break higher. Think of it like your cat trying to jump on the counter: ambitious but unsuccessful. Key Components of a Triple Top: - Three Peaks: Equidistant and approximately the same height. - Neckline: The support level connecting the lowest points between peaks. - Breakout: When the price crashes below the neckline, signaling a bearish reversal. Why Most Traders Get GBPCHF Triple Tops All Wrong It’s easy to slap a triple top label on any three-peaked formation and call it a day. But this is where conventional wisdom leads you astray. Here’s what separates the pros from the amateurs: 1. Ignoring Volume Confirmation - What Amateurs Do: Focus solely on price action. - What Pros Know: A real triple top is accompanied by declining volume at each peak. If the volume doesn’t diminish, you might be staring at a fakeout. 2. Misjudging Timeframes - What Amateurs Do: Trade triple tops on a single timeframe. - What Pros Know: Multi-timeframe analysis can confirm the validity of the pattern. For GBPCHF, align the 1-hour chart with the 4-hour chart to identify a robust setup. 3. Neglecting Economic Data - What Amateurs Do: Trade in a vacuum. - What Pros Know: Economic indicators like UK CPI or Swiss unemployment rates can strengthen or invalidate the pattern. Keep your Forex calendar handy. Elite Tactics for GBPCHF Triple Top Mastery Here’s where the real magic happens—advanced strategies to turn this classic pattern into a cash cow. 1. Measure Twice, Trade Once Use the measured move technique to calculate your target profit. Measure the distance between the neckline and the highest peak of the triple top, then project this distance downward from the neckline’s breakout point. Simple, effective, and precise. 2. Hunt for Divergence Triple tops are more convincing when confirmed by divergence on momentum indicators like RSI or MACD. For instance: - Peaks getting smaller? Check. - RSI trending downward? Double check. 3. Enter Like a Ninja Most traders jump the gun and enter as soon as the price touches the neckline. Instead, wait for a breakout—preferably with a retest of the neckline to confirm it’s not a false move. Think of this as waiting for the right moment to jump into a double-dutch rope. Precision is key. The GBPCHF Triple Top Cheat Sheet When in doubt, refer to this step-by-step guide: - Identify the Pattern: - Three distinct peaks near the same resistance level. - A clear neckline connecting the troughs. - Confirm with Volume: - Declining volume on each peak. - Surge in volume at the neckline breakout. - Use Indicators: - RSI or MACD divergence for confirmation. - Moving averages to check overall trend direction. - Set Your Entry: - Wait for a confirmed breakout and retest of the neckline. - Define Stop-Loss and Take-Profit: - Stop-loss above the highest peak. - Take-profit based on the measured move technique. Why Most Traders Miss Hidden Opportunities The GBPCHF triple top isn’t just about spotting a pattern; it’s about understanding the underlying psychology. Each failed attempt at breaking resistance reflects waning bullish momentum and growing bearish strength. Combine this insight with geopolitical trends, and you’ll uncover opportunities most traders never see. For instance, if the UK’s GDP growth disappoints while Swiss inflation data surpasses expectations, a triple top on GBPCHF is more likely to play out to its full potential. Keep your ear to the ground and your chart indicators sharp. Trading with Humor, Strategy, and Precision Trading the GBPCHF triple top is like mastering the art of baking croissants: it’s technical, requires patience, and a single misstep can ruin the whole thing. But with the right strategies, tools, and mindset, you’ll be able to spot the pattern, avoid common pitfalls, and capitalize on its breakout potential. Ready to step up your Forex game? Check out these resources to level up: - Latest Forex News - Free Forex Courses - Community Membership - Free Trading Plan - Smart Trading Tool —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Video

youtube

GBPCHF: How to prepare for 4000+PIPS(BUY)!

0 notes

Text

اولین هفته نامه تخصصی فارکس در ایران

هفته نامه ای پلنت تایمز شماره 17 به عنوان راهنمایی جامع، به شما در درک و تحلیل حرکت قیمت ها در بازارهای جهانی یاری میرساند. هدف ما در مجله ای پلنت تایمز شماره 17، ایجاد بستری مناسب برای آگاهی معاملهگران از عوامل موثر بر قیمتها و آماده سازی آنها برای رویدادهای مهم هفته پیش رو است. تیم تحلیلی بروکر فارکس ای پلنت با ارائه نظرات و تحلیلهای بی طرفانه، شما را در مسیر تصمیم گیری آگاهانه در معامالتتان همراهی میکند ….

در هفته نامه ای پلنت تایمز شماره 17 به چه موضوعاتی پرداختیم :

نگاهی به تقویم اقتصادی در هفته گذشته

اخبار فارکس ، مهمترین خبرهای اقتصادی در هفته ای که گذشت

رویدادهای مهم در هفته پیش رو

چکیدهای از هفته نامه ای پلنت تایمز شماره 17 :

نسخه هفدهم از هفته نامه ePlanet Times اولین هفته نامه تخصصی فارکس به زبان فارسی، با هدف ��دایت معاملهگران و فعالان بازار به سمت تصمیمگیریهای معاملاتی آگاهانه و سود ده در دسترس عموم قرار گرفته است.

ePlanet Time با ارائه تجزیه و تحلیل عمیق از بازارهای مالی جهانی، مهمترین تحولات اقتصادی در هفته گذشته را بازگو کرده و همچنین رویدادهای کلیدی و تاثیرگذار هفته آینده را با سناریوها و تاثیرات احتمالی آنها به فعالان مارکت معرفی می کند.

در هفته ای که ��ذشت، اقتصادهای جهانی سیگنال های ضد نقیضی را به مارکت ارائه دادند. در ایالات متحده آمریکا سرعت رشد تورم در ماه آوریل مخصوصا در نسخه هسته که نوسانات قیمتی انرژی و مواد غذایی را در نظر نمیگیرد، کمی آرام گرفته است و حالا بسیاری از فعالان مارکت اولین کاهش نرخ بهره در ماه سپتامبر را محتمل می دانند. اما همچنان نگرانی ها در مورد چسبندگی تورم در بخش مسکن و خدمات وجود دارد. این در حالی است که با توجه به آمار خرده فروشی، می توان در رفتار و نوع خرج کرد مصرف کنندگان آمریکایی احتیاط را به وضوح دید.

هفته گذشته تنش های ژئوپلیتیکی نیز در مرکز توجه بود و درگیری ها بین چین و آمریکا در مورد تعرفه واردات و محدودیت های صادرات شدت گرفت. این امر به چشم انداز بدبینانه در مورد عدم پایداری اقتصاد جهانی افزوده است .

در هفته گذشته نگرانی بانک های مرکزی در مورد روند رشد اقتصادی و تورم در مرکزیت رویدادهای اقتصادی قرار داشت. در نیوزیلند انتظارات تورمی کاهش پیدا کرده است و ترس از رکود اقتصادی به سیاست گذران اجازه نمی دهد برای مدت خیلی طولانی بر روی دیدگاه انقباضی خود پافشاری کنند. در بریتانیا نرخ بیکاری افزایش پیدا کرده است اما فشارهای افزایش دستمزدها هنوز معضل بزرگی برای بانک مرکزی انگلستان به شمار میآید. در مقابل کاهش فشار رشد دستمزدها در استرالیا که هفته گذشته اتفاق افتاد، همان چیزی ست که بستر را بانک مرکزی استرالیا فراهم می سازد تا کاهش نرخ بهره را عملی کند. خطر رکود تورمی به واسطه داده های تورمی بالاتر و رشد اقتصادی ضعیف تر در ژاپن شدت گرفته است و بهبود نامتوازن چین در بخش های مختلف اقتصاد، هیچ اطمینان خاطری به فعالان مارکت در مورد اقتصاد این کشور نداده است.

در بخش اخبار کوتاه، ای پلنت تایمز این هفته بر روی سخنان اعضای فدرال رزرو ایالات متحده آمریکا و سیاست گذاران بانک مرکزی اروپا متمرکز است.

هفته آینده از دید داده های اقتصادی، هفته ای آرام است اما داده های شاخص مدیران خرید حوزه های تولیدی و خدماتی از موسسه اس اند پی گلوبال، دیدگاه فعالان مارکت را نسبت به توسعه کسب و کارها در ماه جاری مشخص می کند. ای پلنت تایمز علاوه بر داده های PMI برای اقتصادهای برتر، بر اعلام نرخ بهره بانک مرکزی نیوزیلند نیز متمرکز است که احتمالا روز چهار شنبه نرخ بهره خود را بدون تغییر روی 5.5% ثابت خواهد گذاشت و بر مهار تورم تاکید خواهد کرد. در همان روز صورتجلسه آخرین نشست فدرال رزرو نیز منتشر خواهد شد که برای بررسی دیدگاه اعضای فدرال رزرو نسبت به تحولات تورمی و رشد اقتصادی، مرجع خوبی خواهد بود.

داده های تورمی از سمت اقتصاد ژاپن و بریتانیا نیز چشم انداز سیاست گذاری بانک های مرکزی این دو کشور را مشخص خواهد کرد و ضرورت تغییر رویه این دو بانک مرکزی را به نمایش خواهد گذاشت.

در بخش تحلیل اقتصادی هفته، تیم تحلیلی ای پلنت بروکرز بر تحولات اخیر و آینده دلار آمریکا متمرکز شده است و تحلیل تکنیکال هفته سناریوهای معاملاتی احتمالی برای نمادهایی مانند بیت کوین ، EURZUD NZDCAD و GBPCHF را ارائه می دهد.

برای دریافت جزئیات تمام گزارشات عنوان شده در این چکیده، پیشنهاد می کنیم نسخه هفدهم ای پلنت تایمز با عنوان “ورم دلار خوابید” را مطالعه کنید.

مشاهده این نسخه به زبان انگلیسی : ePlanet Times no.6 (weekly forex newspaper)

Post source

#فارکس#بروکر فارکس#ای پلنت بروکر#ای پلنت تایمز#بروکر فارکس ای پلنت#ای پلنت#ایپلنت بروکر#بروکر#خبر#اخبار

0 notes

Text

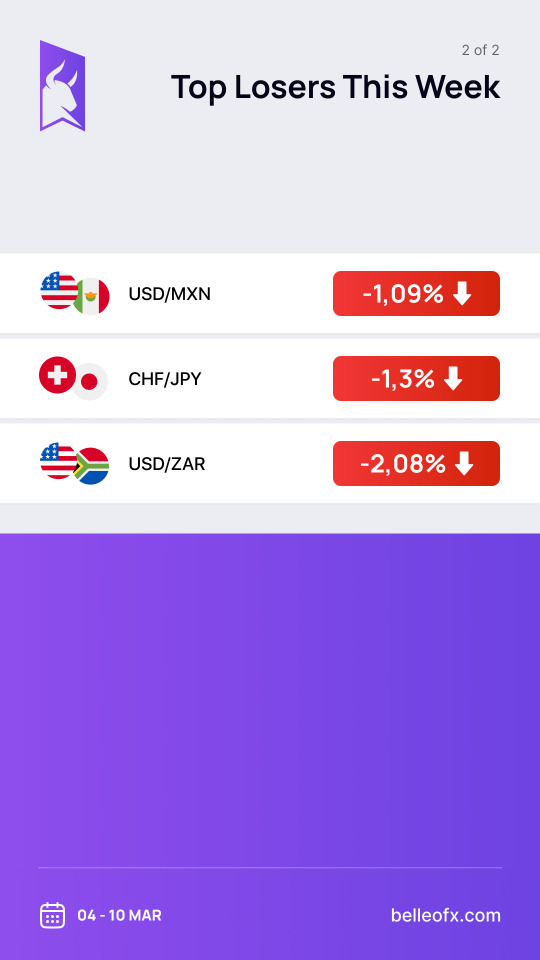

Presenting our weekly top performers and underperformers [04 Mar - 10 Mar, 2024]:

📈Top Gainers This Week ✓ GBPCHF +1.17% ✓ EURCHF +0.99% ✓ USDCHF +0.66%

📉Top Losers This Week ☒ USDMXN -1.09% ☒ CHFJPY -1.30% ☒ USDZAR -2.08%

Ready to take control of your trading journey? Open your live trading account today - Seize the Bull within you! 📈🐃

Join now: https://pa.belleofx.com/en/signup

BelleoFX Market Updates

0 notes

Text

GBPCHF D1 https://t.me/+fbzA-cRB3iJlOWE8 #greenpipsfinder#forexsignals#forextrading #forextrader #forexstrategy #forexpakistan #forexlifestyle #forex #forexanalysis #gold #forexgold#USDJPY #eurusdsignal #GBPUSD #GOLD #GBPJPY#US30 #forexsignalsprovider #forexsignaltrading #forexsignalservice#forexeducation #forexgold #eurusdsignal #forexpakistan #forexsignalsprovider#greenpips#

1 note

·

View note

Text

افضل استراتيجية تداول و تعلم اساسيات التداول بالعملات الأجنبية ( الفوركس ) https://forextrading.auncan.com XAUUSD - BTCUSD - EURUSD - GBPUSD - AUDUSD - AUDCAD - AUDCHF - AUDJPY - AUDMXN - AUDNZD - CADCHF - CADJPY - CHFJPY - EURAUD - EURCAD - EURCHF - EURGBP - EURJPY - EURNZD - GBPAUD - GBPCAD - GBPCHF - GBPJPY - GBPNZD - NZDCAD - NZDCHF - NZDJPY - NZDUSD - USDCAD - USDCHF - USDJPY - USDMXM - USDZAR

0 notes

Video

youtube

Forex Trading For Beginners - Lower Time Frame Flip Entries 7-13-23

In this video I show my how to method for Forex Trading For Beginners in action by showing my lower time frame flip (LTF Flip) entry model on the 15 minute timeframe after my 4HR point of interest has been hit. We have current trades running in GBPCHF and NZDJPY at the time of this video. This is the same trading strategy that I teach for free in my group. The Forex Smart Money Trading Academy on Facebook

0 notes

Text

@GBPCHF(H1)-Pattern: Butterfly : SellStop@: 1.1270, StopLoss: 1.1288, TakeProfit_1: 1.1242, TakeProfit_2: 1.1216, TakeProfit_3: 1.1198-2024.12.12 07:40

FxMath Harmonic Patterns Scanner @GBPCHF(H1)-Pattern: Butterfly : SellStop@: 1.1270, StopLoss: 1.1288, TakeProfit_1: 1.1242, TakeProfit_2: 1.1216, TakeProfit_3: 1.1198 Pay 89$ by Crypto instead of 199$ by regular payments MT4 Payment Link: https://commerce.coinbase.com/checkout/d38bd415-87a7-4bf0-9c76-1889fa393ef8 MT5 Payment Link:…

View On WordPress

0 notes

Text

GBPCHF Monthly Timeframe: Discover Hidden Patterns & Elite Tactics GBPCHF Monthly Timeframe: Hidden Trends and Game-Changing Strategies Imagine sitting down for a cup of coffee one day, and that trusty old Forex pair GBPCHF suddenly transforms into that eccentric friend who always knows the underground trends before they hit mainstream. If the GBPCHF pair were a person, they'd be the one who buys Bitcoin in 2010, shows up to the party before anyone else, and leaves just when things start getting too predictable. Welcome to the monthly timeframe analysis of GBPCHF—a behind-the-scenes look where we dig out the secrets, missed opportunities, and those "Oh, if only I knew then!" moments that make or break a Forex trader. The Big Picture: Why the Monthly Timeframe is Key Let’s be honest: trading on the hourly or daily charts is a bit like binge-watching reality TV—it's full of drama, sudden changes, and bad decision-making. The monthly timeframe, however, is where the grown-ups are. It’s the equivalent of watching a well-crafted documentary—you get the story, the background, and the long-term vision. When it comes to GBPCHF, the monthly timeframe offers traders the chance to spot key trends, pinpoint pivotal moments, and prepare for the long game—the one that doesn't depend on day-to-day news whims or unexpected political hiccups. We’re looking at the bigger picture, sidestepping emotional rollercoasters, and aiming for the calculated moves. The Hidden Formula Only Experts Use Let’s talk about "The Forgotten Levels" on the monthly GBPCHF chart—you know, those support and resistance levels most traders ignore. They are like that gym membership everyone forgets to cancel—always there, quietly making a difference. For GBPCHF, focusing on these monthly support and resistance levels can change the game entirely. Take the 1.2100 support level, for example. This level has seen more drama than a soap opera wedding. Over the past decade, it has been tested multiple times, giving traders the perfect opportunity to jump in or out. But most traders miss this because they get caught up in the noise of smaller timeframes. Remember: the big players, like hedge funds and institutions, don’t look at 5-minute charts; they look at where the monthly candles are closing. Why Most Traders Get It Wrong (And How You Can Avoid It) Most traders get stuck on the GBPCHF pair for all the wrong reasons—they think it's predictable because it’s "less volatile" compared to others. But in reality, it’s the market’s equivalent of a sleeping cat—seemingly calm, but with unpredictable pounces. The problem is, traders often misunderstand its subtleties and end up either jumping in too late or getting out too early. The key to understanding GBPCHF is identifying the monthly range. Take a look at the average true range (ATR) on the monthly chart. If you’re not using the ATR, it's like driving with your eyes closed—risky, unnecessary, and likely to end in disaster. The ATR gives you an idea of how much this pair typically moves in a month, which in turn helps you set realistic targets. Hidden Patterns that Drive GBPCHF Speaking of hidden gems—do you know about the GBPCHF "Harmonic Convergence" pattern? This isn't some astrology talk; it's a powerful monthly harmonic pattern that provides highly probable reversal points. The Gartley and Bat patterns, in particular, have made multiple appearances in the past years. For those not familiar, these harmonic patterns are basically Mother Nature's secret geometry—think of them as Fibonacci's mysterious cousin. When these patterns align on the monthly timeframe, it's often a sign of a major reversal. Ignore them at your peril. How to Predict Market Moves with Precision Here’s where things get fun—predicting GBPCHF’s next move. Now, we all know that forecasting the Forex market is like trying to predict which way a cat will run when startled, but there are methods to the madness. One of those methods involves understanding macroeconomic correlations. The CHF (Swiss Franc) has always been considered a "safe-haven" currency—a place investors flock to when uncertainty looms. But the GBP, on the other hand, often represents risk-on sentiment. This means that understanding the broader risk sentiment in the market can give you insights into the direction of GBPCHF. Are we seeing a flight to safety across markets? Expect CHF strength. Is the sentiment becoming risk-happy? GBPCHF is likely headed north. The Forgotten Strategy That Outsmarted the Pros Here’s an unconventional strategy that I guarantee 90% of traders overlook: using the Relative Strength Index (RSI) on the monthly timeframe. Most traders are RSI fans, but they use it wrong. The common practice is to look for overbought/oversold conditions, but on the monthly timeframe for GBPCHF, RSI divergences provide some of the best entry signals. Think back to 2015 and 2019—both times, the RSI on the monthly chart formed a bullish divergence while the price action continued to dip. Most people ignored this or simply missed it, but those who caught the divergence got rewarded handsomely as the pair reversed, racking up hundreds of pips in profit. Elite Tactics to Master GBPCHF - Combining Fibonacci with Monthly Candles: Fibonacci retracements on the monthly timeframe are far more accurate than those on lower timeframes. Plot your Fib levels from a major swing high to swing low on the monthly chart, and watch for price reactions at the 61.8% and 78.6% retracement levels. These often signal a possible reversal or continuation. - Volume Profile Insights: Trading volume in Forex is often underestimated, but using the volume profile tool can give you an edge. By applying this to GBPCHF on the monthly chart, you can easily identify key levels where big market participants have entered positions. - Multiple Timeframe Confluence: After identifying key monthly levels, drop down to the daily chart to find confirmation signals. This ensures that you are not blindly entering trades but waiting for additional signs of a trend shift. For instance, if the monthly chart is showing resistance at 1.2500, look for bearish candlestick patterns like the "evening star" on the daily chart for additional conviction. The One Simple Trick That Can Change Your Trading Mindset Remember this simple trick: "Be the crocodile, not the gazelle." Crocodiles wait patiently, sometimes for days, waiting for the perfect opportunity. They aren’t chasing after every movement in the market; they wait for that one high-probability moment to strike. The monthly timeframe analysis for GBPCHF allows you to be that crocodile—taking fewer trades, but ones that have a much higher likelihood of success. Emerging Trends: Where is GBPCHF Heading Next? Looking at the recent monthly candles, the market has formed an "inside bar" pattern—a clear sign of consolidation and likely an impending breakout. The direction of the breakout will heavily depend on broader economic conditions, particularly how the UK's post-Brexit story unfolds and how the Swiss banking sector responds to changes in global risk appetite. Keep an eye out for the breakout from this range—it could define the next major trend for GBPCHF. Take the Leap, Skip the Noise So there you have it—the GBPCHF monthly timeframe is a treasure trove of hidden opportunities. It’s where you spot the moves before they happen, where you align yourself with the big players, and where you truly start trading smart instead of just trading. The next time you're tempted to scalp some pips on the hourly chart, remember: GBPCHF has more secrets to reveal on the monthly chart if you’re patient enough to look. Are you ready to trade like a crocodile? Dive deeper into the advanced methodologies and exclusive community resources available at StarseedFX. Avoid those typical trading pitfalls and get insider knowledge that’ll set you apart from the rest—because at the end of the day, it’s all about being ahead of the curve. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Here’s our top performers and losers of this week [19 - 25 June, 2023]:

Top Gainers This Week ✓ GBPJPY +4.02% ✓ US30 +2.09% ✓ NAS100 +3.2%

Top Losers This Week ☒ CADJPY -1.04% ☒ GBPCHF -0.62% ☒ XAUUSD -1.9%

Open your live trading account today - Don't just Trade, Be the Bull!: https://pa.belleofx.com/en/signup

Learn with BelleoFX

0 notes

Video

youtube

Forex Trading Training - Winning Trades Recap GBPCHF, CADJPY & NZDJPY

In this Forex Trading Training Video I do a quick recap of the last 3 winning trades I posted in my Forex Smart Money Trading Academy Group On Facebook. The pairs were GBPCHF, CADJPY & NZDJPY. This is the Forex Smart Money Concepts strategy that I teach for free in my group as well as here on my YouTube channel. Let me know what you think after watching this Forex Trading Training Video

1 note

·

View note

Photo

EUR/USD 4 Hour Expect an Downtrend movement to complete the last wave of correction and then a Upward movement #eurusd #gbpusd💹 #gbpusdsignal #gbpusd💵💸💰 #gbpusd💰💪💹🙌👆👏🌐 #gbpusd🇬🇧🇺🇸 #gbpjpy #fx #gbpaud #gbpcad #gbpchf #gbp #j #gbpnzd #forex #swingtrading #stocktrader #lifeofatrader #silver #daytrader #traderjoes #gold #traderlifestyle #forextrader #elliottwave #elliottwavemonitor #elliottwaves #waveanalysis #technicalanalysis #priceaction (at USA) https://www.instagram.com/p/CThLzFRsf_l/?utm_medium=tumblr

#eurusd#gbpusd💹#gbpusdsignal#gbpusd💵💸💰#gbpusd💰💪💹🙌👆👏🌐#gbpusd🇬🇧🇺🇸#gbpjpy#fx#gbpaud#gbpcad#gbpchf#gbp#j#gbpnzd#forex#swingtrading#stocktrader#lifeofatrader#silver#daytrader#traderjoes#gold#traderlifestyle#forextrader#elliottwave#elliottwavemonitor#elliottwaves#waveanalysis#technicalanalysis#priceaction

2 notes

·

View notes

Link

Stochastic Trader Reveals His Number One Divergence

Stochastic Technical Indicator GBPCHF

Learn more.

https://www.stochastic-macd.com/

#stochastic#stochastics#stochastic trader#technical indicator#GBPCHF#FX#Forex#currencies#foreign exchange#slow stochastic#stochastic indicator#stochastic oscillator#day trade#swing trade#online trading#video#videos#Trading Tutorials

5 notes

·

View notes

Photo

Buy CADCHF #eurcad #gbpusd #eurusd #usdjpy #usdcad #eurjpy #gbpjpy #audusd #forex #nzdusd #usdchf #gbpcad #euraud #gbpaud #eurgbp #cadjpy #nzdjpy #audjpy #audcad #gbpchf #eurchf #gbpnzd #eurnzd #xauusd (at Chennai, India) https://www.instagram.com/p/ClgPj_NhLVC/?igshid=NGJjMDIxMWI=

#eurcad#gbpusd#eurusd#usdjpy#usdcad#eurjpy#gbpjpy#audusd#forex#nzdusd#usdchf#gbpcad#euraud#gbpaud#eurgbp#cadjpy#nzdjpy#audjpy#audcad#gbpchf#eurchf#gbpnzd#eurnzd#xauusd

0 notes