#fx solutions acquired

Explore tagged Tumblr posts

Text

oneZero acquires Autochartist to enhance brokerage technology, integrating AI-driven market analytics into its trade execution solutions.

0 notes

Text

Quintessential Tips to Practice the FE Civil Problems

Preparing for the FE Civil exam will be easy if you follow the right way. Working through all aspects of problems is an essential part of exam preparation. How to practice various kinds of problems within a limited time frame? This blog explores some essential tips for working through the FE Civil problems. Follow this and practice effectively!

Learn All the Formulas

Applying the correct formulas to a particular problem is the key. So, be sure to learn all critical formulas from your study material. But where can you find all the information in one source? Download the reference handbook from the NCEES website and be thorough with FE Civil formulas for effective application.

Be Familiar with Calculator Functions

Next, familiarity with the calculator functions is crucial for solving problems faster and ensuring a seamless exam experience. The list of NCEES-approved calculators that you can use during the exam includes the following:

Casio: The calculators with the models fx-115 and fx-991 can be used for the FE Civil exam.

Hewlett Packard: You can also use HP 33s and HP 35s calculators for the exam.

Texas Instruments: Use the calculator with TI-30X and TI-36X models for the FE Civil exam.

Hearken the Lecture Classes

You can visit any classes available online to deeply understand FE Civil problems, solution procedures, effective formula application, and problem-solving skills. From FE review classes, you can gain instructors' tips and tricks to solve FE Civil exam problems faster.

Expert instructors solve the problems while explaining the steps. This helps you to understand every aspect of the problem and assists you in applying essential procedures for the questions asked in the FE Civil exam. So, using review classes will be beneficial for FE Civil exam preparation.

Work FE Civil Problems

Since you have only 6 hours to complete the exam, answering all the questions within the restricted time is vital. To solve the problems faster, you must practice more to keep up with the exam timing.

Utilize School of PE courses and access the extensive study hub to practice FE Civil problems. Once you are done with a question, you can evaluate the solution. This assists you in learning from mistakes and avoiding repeating them on the exam. With personalized feedback, you can strengthen the weak areas.

Set a timer and try to solve the problems quickly. This will improve your time management skills and ensure you complete the exam within the time frame.

Enroll in a Review Course

Joining a well-known FE Civil review course like the one offered by School of PE provides additional support and enhances your preparation. With expert instruction, comprehensive study materials, and convenient learning methods, you can bolster your preparation and increase your chances of success in the FE Civil exam.

Concluding Thoughts

Hope these quintessential tips help you practice effectively and boost your success. Stay organized and be consistent with the preparation. Remember to analyze your mistakes and practice the problems under the timed conditions that help you lead success. Start practicing today to acquire a high score!

For more information visit: https://www.schoolofpe.com/fe-civil

0 notes

Text

Flutterwave Acquires Money Transmission Licenses in 13 US States

Flutterwave has acquired 13 money transmission licenses in the United States, allowing for faster, more affordable and secure money transfers between the U.S. and Africa.

These licenses expand Flutterwave’s reach to a total of 29 U.S. states, the payments technology company said in a Thursday (Dec. 7) press release.

Money transfer licenses are crucial for financial technology companies like Flutterwave as they authorize the transmission of money, according to the release. With these licenses, Flutterwave can now serve customers in more states, thanks to its money remittance app, the Send App.

This is particularly significant for the African diaspora, as sending money between the U.S. and Africa has historically been challenging, the release said.

“Our mission is to connect Africa to the world and the world to Africa by simplifying payments for endless possibilities,” Olugbenga Agboola, founder and CEO at Flutterwave, said in the release. “These licenses move us one step closer to our vision and we will continue to expand this feat to ensure coverage for all states in the U.S. and beyond.”

Flutterwave’s platform allows businesses worldwide to expand their operations in Africa and other emerging markets through a single application programming interface (API), according to the release. It has processed more than 550 million transactions, totaling over $32 billion, and serves more than 2 million businesses.

One of Flutterwave’s key advantages is its ability to connect businesses to various local and international payment types, enabling them to expand globally, the release said. Additionally, the company’s Send App facilitates cross-border transactions from the diaspora to African countries.

Flutterwave accepts payments through multiple channels, including local and international cards, mobile wallets, bank transfers and Google Pay, per the release. Its infrastructure spans 34 African countries.

“We’re growing and are committed to servicing customer needs in as many geographies as possible with a significant African diaspora,” Stephen Cheng, executive vice president of global expansion and partnerships at Flutterwave, said in the release.

In another recent development, Flutterwave launched a digital foreign exchange (FX) solution called Swap in September.

“We’ve seen people who wanted to pay for a conference in the U.K. or pay for a flight ticket now able to do so because Swap exists,” Agboola told PYMNTS at the time. “It’s becoming a very stable platform for the average Nigerian looking to make currency conversions.”

#flutterwave#flutterwaveceo#olugbengaagboola#paymentsprocesssing#payments#africa#finance#fintech#technology

1 note

·

View note

Text

Trade Relationship Manager – Kotak Mahindra Bank Jobs – Fresher Male Candidates – Salem

Introduction

Are you a fresh graduate looking for an exciting career opportunity in the banking sector? Kotak Mahindra Bank, one of India’s leading private sector banks, is hiring for the position of Trade Relationship Manager in Salem, Tamil Nadu. This role is an excellent starting point for fresh male graduates to embark on a rewarding career path in the banking industry.

About Kotak Mahindra Bank

Kotak Mahindra Bank is renowned for its customer-centric approach and innovative banking solutions. Established in 2003, the bank has grown rapidly to become one of India's most trusted financial institutions. With a wide range of products and services, Kotak Mahindra Bank has a significant presence across India, providing ample career opportunities for aspiring bankers.

Job Details and Requirements

The role of Trade Relationship Manager at Kotak Mahindra Bank in Salem offers an excellent opportunity for fresh male graduates to kick-start their careers. Below are the details of the job:

Job Role: Trade Relationship Manager

Qualification: Graduate to Post Graduate

Experience: Fresher

Salary: ₹4,00,000 to ₹10,00,000 per year

Location: Salem, Tamil Nadu

Skills: Communication, Financial acumen, negotiation, teamwork, relationship management

Responsibilities: Financial advisory, compliance, market research, transaction management, reporting, and documentation

Roles and Responsibilities

The Trade Relationship Manager plays a crucial role in the bank’s operations, ensuring the acquisition and retention of high-quality customers. Here are some of the key responsibilities:

Customer Acquisition: Acquire high-quality Current Accounts Customers engaged in international trade. This involves identifying target markets and segments effectively and ensuring compliance with all KYC and regulatory norms during acquisition.

Financial Advisory: Provide financial advisory services to clients, guiding them on rates and charges and ensuring accurate input of commission rates into the system.

Transaction Management: Facilitate the activation of the first trade transaction and explore potential trade and FES products like Forward Contracts, LC/BG/BC, and Travel Cards.

Client Relationship: Encourage clients to maintain high Current Account Average Monthly Balances (AMB) and generate leads for asset products. Ensure smooth handover of customers to Branch Operations and educate customers on Cut-off times and adherence to SLAs.

Compliance and Reporting: Optimize acquisition costs by targeting larger account values, meet business and income targets consistently, and monitor competitor activities, reporting findings to ASMs. Coordinate service delivery within agreed SLAs and TATs.

Regulatory Compliance: Stay updated on AML/KYC/RBI guidelines to ensure regulatory compliance. Retain existing customer base through effective relationship management and handle customer complaints efficiently, escalating when necessary.

Documentation: Ensure all necessary documents and KYC requirements are met for agent empanelment. Deliver effective sales pitches for respective products and submit required reports promptly and accurately.

Market Awareness: Implement promotional activities as directed by ASM/RSM and stay informed about current market practices and competitor strategies, regularly updating RSM.

Candidate Eligibility Criteria

To be eligible for the Trade Relationship Manager position at Kotak Mahindra Bank in Salem, candidates must meet the following criteria:

Education: Graduation required, PG preferred.

Experience: 1-3 years in Trade FX and FES, preferably in banking.

Skills: Strong domain knowledge and expertise in Trade and FES products, exceptional sales abilities, profound understanding of client behavior, high energy and enthusiasm, innovative thinker, strong listening and communication skills, effective negotiator, goal-oriented with a focus on achieving NTBs and sales targets, capable of strategic thinking, assertive yet compliance-focused.

Why Choose a Bank Job?

For those looking to build a stable and lucrative career, the banking sector offers numerous advantages. Kotak Mahindra Bank provides a dynamic work environment, competitive salary packages, and opportunities for professional growth. Additionally, working in a reputable bank like Kotak Mahindra enhances your resume and opens doors to numerous career opportunities in the financial sector.

About Best Bank Exam Course Training Institute in Tamil Nadu

Our brand, the Best Bank Exam Course Training Institute that provides the Best Job Assistance in Tamil Nadu, is committed to helping candidates achieve their career goals in the banking sector. With a track record of placing over 2,500 candidates in top private banks, we are a leader in the field.

Comprehensive Training and Job Assistance

We offer comprehensive training programs that include numerous mock tests and screening exercises to ensure candidates are well-prepared for banking exams and job interviews. Our training programs are designed to equip candidates with the knowledge and skills needed to succeed in the competitive banking industry. Typically, we secure placements within 30 to 45 days in leading private banks.

Why Choose Us?

Located in Salem, we are renowned as the top bank exam coaching center in the region. Our institute is the best private bank job consultancy in Salem, matching your profile with suitable opportunities across multiple locations. Upon receiving your resume through our website, expect a prompt call from us to discuss openings that align with your skills, knowledge, and qualifications across various private banks.

Conclusion

If you are a fresher male graduate looking to start your career in banking, the Trade Relationship Manager position at Kotak Mahindra Bank in Salem is an excellent opportunity. Join our training institute to receive the best coaching and job assistance in Tamil Nadu. We are dedicated to helping you achieve your career aspirations in the banking sector. Submit your resume today and take the first step towards a successful career in banking.

0 notes

Text

Singapore's Fintech Revolution: PingPong Dominates

Keynote Address: Navigating Global Complexity

In a pivotal moment at the Singapore Fintech Festival 2023, PingPong, the global payment platform, announced groundbreaking achievements, featuring a thought-provoking keynote address by David Messenger, CEO of Global Businesses at PingPong. The address delved into strategies for enterprises navigating the complex global economic and business landscapes, accompanied by a strategic partnership revelation with MODIFI, a leader in digital trade finance. Strategies for Global Enterprises During the keynote address, David Messenger provided insights into safeguarding, managing, and expanding cross-border enterprises amidst uncertainties. Highlighting the significance of technology, local teams, and robust connections with valued partners, Messenger underscored the need for swift adaptation to evolving foreign exchange and legal landscapes.

Global Payment Network: Partnering for Mutual Growth

PingPong showcased its ability to form partnerships with enterprises globally, seeking world-class collaborators in Singapore and Southeast Asia for mutual growth. This approach signifies the platform's adaptability to diverse needs and its dedication to nurturing global partnerships. Recognition as a Major Payment Institution by MAS PingPong achieved a significant milestone with approval as a Major Payment Institution by the Monetary Authority of Singapore (MAS). This endorsement empowers PingPong to offer a comprehensive range of payment services, facilitating accelerated global expansion for local businesses.

Adaptation and Innovation in a Changing Landscape

David Messenger emphasized PingPong's role in supporting customers to adapt to new geopolitical and economic conditions. The CEO stressed the importance of fintechs marrying technology with being local, people-driven entities. Investment in strong ties with the right local partners is deemed essential for sustained success. Empowering Businesses Globally Expressing commitment to global business empowerment, Messenger stated, "These announcements underscore our commitment to empowering businesses globally. From protecting against uncertainties to driving digital trade, PingPong is at the forefront of reshaping cross-border transactions and financing."

About PingPong

Founded in 2015, PingPong stands as a leading global technology company, championing cross-border digital commerce growth. The PingPong ecosystem offers a comprehensive suite of products, including e-commerce payment, B2B trade payment, acquiring services, card issuing, FX management, and enterprise solutions. With over $100 billion in transaction volume and connections to international e-commerce marketplaces and financial institutions, PingPong continues to reshape global commerce. Sources: THX News & PingPong. Read the full article

#AdaptingtoGlobalEconomicConditions#Cross-BorderTransactionsInnovation#DavidMessengerFintechStrategies#DigitalTradeFinanceSingapore#GlobalPaymentPlatformSingapore#MajorPaymentInstitutionMASApproval#PingPongFXManagementSolutions#PingPongGlobalBusinessStrategies#PingPongPartnershipMODIFISingapore#SingaporeFintechFestival2023

0 notes

Text

New: Ancom Truelife. Wellesta Holdings introducing AI-based breast cancer detection

Director Datuk Siew Ka Wei from Healthcare solutions provider Ancom Truelife has teamed up with Wellesta Holdings to introduce FX Mammo, an artificial intelligence (AI)-powered breast cancer detection software in Malaysia. Wellesta Holdings is a Singapore pharmaceutical startup that acquires the rights to pharmaceuticals from developed countries, and then imports and sells them to other…

View On WordPress

0 notes

Text

Post-canon AU where XL is cursed into a weasel- no one but HC, MQ, and FX know.

Thus, while everyone rushes to find a cure to turn XL back to human, the Xianle hooligans argue over who gets to care for their weasel dianxia and end up playing an endless game of “steal the weasel!”

This begins by FX swiping XL under HC’s nose because he wants to take care of his highness, damn it! Screw that hogging husband of XL’s.

MQ’s subordinates report to their general that General Nan Yang has acquired a little weasel and dotes on it by the hour. MQ’s temper visibly flares and he stomps over to FX’s palace and easily tempts the weasel into his own clutch with a few steamed buns.

HC shows up out of the shadows a day later, secretly getting his husband back in the safety of their home.

And so the cycle continues.

In their haste to snatch XL away as quickly as possible, HC, MQ, and FX have all smuggled XL away in so many bizarre ways.

HC tucking XL into his robes right against his chest. (Read: tiddies)

FX with XL in a burlap sack (specially made with great ventilation) on his back.

MQ just straight up carrying XL by his nape-

XL squeaks happily throughout it all, munching on all the food he’s fed, a little guy just here for the ride.

No one has found a viable solution yet. They’ve tried several methods of potions, reversal enchantment arrays, and foods with magic properties. Nothing has worked.

LW was notified on FX and MQ’s behalf as an additional resource while HC reached out to HX for any scrap of information. Very soon, everyone else hears about the absurd curse that has turned the former Prince of Xianle into a weasel.

A week goes by, and HC, MQ, and FX have all gathered in the mortal realm for a 1 vs. 1 vs. 1 showdown on who gets to keep XL for the rest of the time he’s a weasel.

Before the battle becomes too heated, HC notices a lack of spiritual energy from the weasel. For some reason, it doesn’t hold any of XL’s presence at all!

He confirms this finding by holding out his hand with the palm facing upward. Instead of putting a small paw on top, the weasel simply stares back, eyes empty.

A check for the red string on the middle finger rewards the Xianle knuckleheads with the realization that THIS WEASEL IS NOT DIANXAI!

SINCE WHEN? AND WHERE IS XL NOW OH GOSH???

HC snarls a few nasty curses at MQ and FX because surely it must’ve been their mistake, before following the red string from his finger that stretches to a far away place.

MQ and FX grumble before hastily following.

Turns out, when HX heard about the whole predicament with the “heavenly emperor had been cursed into a weasel! And now the ghost king and heavenly officials are having a show off with who can change him back first!”

He gets tired of it. Really quickly.

Which leads to HX stealing XL from under Fengqing’s noses (they were to busy arguing to notice the Indiana-Jones-style-swap) and successfully searching for the cure himself.

One week after HX reversed the curse and safely returns XL to a fuming HC, gossip around the heavenly realm now talks about how MQ was suddenly cursed into a cat and FX a dog-

Not a curse though.

It has Crimson Rain written all over it.

#tgcf#heaven official's blessing#hualian#xie lian#hua cheng#mu qing#feng xin#he xuan#ling wen#cerdrabbles#post canon#comedy

128 notes

·

View notes

Text

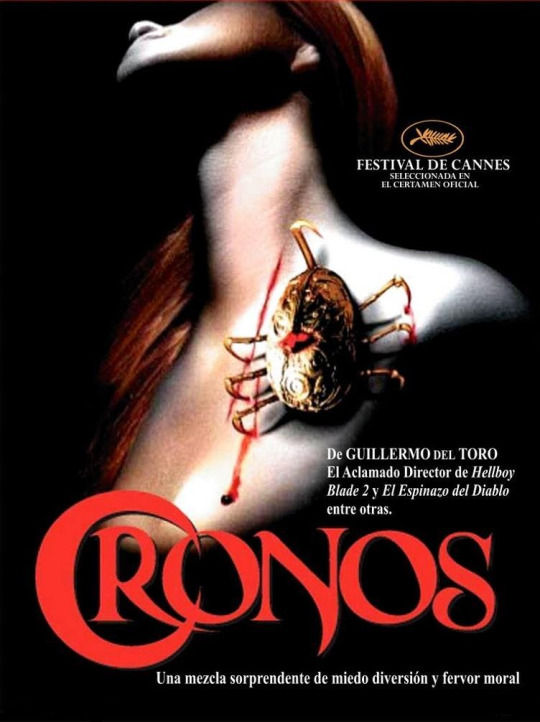

Cronos (1993)

Tonight, Eve and Henry watched Cronos!

Cronos, directed by Guillermo del Toro and released in 1993, is a film about an elderly antique dealer’s transformation after being injected by a strange, ancient device in the shape of a scarab beetle, and his fight to desperately keep himself in check while keeping the device away from anyone wishing to acquire it.

---

The vampires in this movie are created by a device that enables them to live forever, at the cost of ingesting human blood and the longer-term damage of continual use. The device, shaped like a scarab beetle, is mostly mechanical, but houses a live insect that injects the host with a mysterious solution, beginning their transformation.

The user must intentionally activate the beetle by twisting the top three times and letting it inject them, and in doing so, they gain the benefits of growing more physically youthful, gaining advanced regenerative abilities, and most notably, becoming near-immortal. Rather than being repaired, damaged parts of the body are simply replaced- broken skin can simply be peeled away, making way for paler new skin to grow. Once the device has been used, the user is compelled to periodically use the device again, especially in response to physical trauma. Through continued use, the thirst for human blood grows, likely to feed the insect inside the device.

Compared to genre-typical vampires, they lack fangs, and tend to drink blood separate from the body or from corpses with already-open wounds, but it’s not out of the question to assume that they’re capable of drinking from the living as well, if given the chance.

The only way to kill these vampires is to damage their heart or kill the insect inside the device- otherwise they will return to life regardless of how much they’re damaged.

Vampirism in this film seem markedly different from other media, but many of the most recognizable tropes remain. Notably, the word “vampire” is never once used.

---

I enjoyed this film. Despite the mild body horror and blood, it’s often quite gentle and thoughtful. The film’s filled with overlapping cultural references and could be commenting on a lot of things. As far as I can tell, and with the title as it is, I think it’s to do with parents trying to live vicariously through their children, and how that’s ultimately a parasitic relationship. 8/10 (Eve)

I really enjoyed this movie! It's very different to the others as it's very low-key and feels deliberately subversive of the typical stories e.g. the means of transmission. It's using vampires as a jumping-off point to tackle themes of living vicariously through your children and not letting them be their own person. There's also a lot of religious imagery and literary references, for instance the desairologist who has Sweeney Todd sideburns. The special FX were excellent, the body horror felt very much like Cronenberg. Overall it's a great movie! (Henry)

Thank you to Eve for writing tonight’s summary!

5 notes

·

View notes

Text

Download Aquarius Pro G40 S42 Driver

Download Aquarius Pro G40 S42 Driver Side Mirror

Download Aquarius Pro G40 S42 Driver Download

Hanita Coatings

Hanita Coatings has been developing solar control and security films for 30 years. During that time, Hanita Coatings has earned a reputation of being an innovative independent manufacturer of window film products, with a range of energy-efficient interior and exterior solar control films marketed under the SolarZone brand.

Welcome to the MSI Global official site. We are the top Gaming gear provider. Latest IBM ThinkPad - G40 drivers available for download and update using Driver Reviver. Scan and update your Vista Drivers, XP Drivers and Windows 7 computer drivers with the best driver updater software.

The SafetyZone brand of glazing security solutions helps protect life and property against hazards from broken or flying glass as a result of accident, natural disaster, forced entry or blast.

SolarZone Automotive film from Hanita Coatings takes a fresh approach to window tint film, combining superior aesthetics and performance with remarkable heat shrink properties for easy, efficient application, and stunning results.

Avery Dennison, a global leader in pressure-sensitive and functional materials, acquired the company in 2017. Hanita Coatings is now known as Avery Dennison Hanita, and continues its operations as a distinct business unit within Avery Dennison.

View Hanita's Industrial and Print product lines here.

Quadro Series:

Quadro K6000, Quadro K5200, Quadro K5000, Quadro K4000, Quadro K4200, Quadro K2200, Quadro K2000, Quadro K2000D, Quadro K620, Quadro K600, Quadro K420, Quadro 6000, Quadro 5000, Quadro 4000, Quadro 2000, Quadro 2000D, Quadro 600, Quadro 410, Quadro 400

Quadro Series (Notebooks):

Quadro K5100M, Quadro K5000M, Quadro K4100M, Quadro K4000M, Quadro K3100M, Quadro K2100M, Quadro K3000M, Quadro K2000M, Quadro K1100M, Quadro K1000M, Quadro K610M, Quadro K510M, Quadro K500M, Quadro 5010M, Quadro 5000M, Quadro 4000M, Quadro 3000M, Quadro 2000M, Quadro 1000M

Quadro FX Series:

Quadro CX, Quadro FX 370, Quadro FX 370 Low Profile, Quadro FX 380, Quadro FX 380 Low Profile, Quadro FX 570, Quadro FX 580, Quadro FX 1700, Quadro FX 1800, Quadro FX 3700, Quadro FX 3800, Quadro FX 4600, Quadro FX 4700 X2, Quadro FX 4800, Quadro FX 5600, Quadro FX 5800

Quadro FX Series (Notebooks):

Quadro FX 3800M, Quadro FX 3700M, Quadro FX 3600M, Quadro FX 2800M, Quadro FX 2700M, Quadro FX 1800M, Quadro FX 1700M, Quadro FX 1600M, Quadro FX 880M, Quadro FX 770M, Quadro FX 570M, Quadro FX 380M, Quadro FX 370M, Quadro FX 360M

Quadro Blade/Embedded Series :

Quadro K3100M, Quadro 500M, Quadro 1000M, Quadro 3000M, Quadro 4000M, Quadro FX 370M, Quadro FX 770M, Quadro FX 880M, Quadro FX 2800M, Quadro FX 3600M

Quadro NVS Series:

Quadro NVS 290, Quadro NVS 295, NVS 510, NVS 315, NVS 310, NVS 300, Quadro NVS 420, Quadro NVS 450

Quadro NVS Series (Notebooks):

NVS 5400M, NVS 5200M, NVS 5100M, NVS 4200M, NVS 3100M, NVS 2100M, Quadro NVS 320M, Quadro NVS 160M, Quadro NVS 150M, Quadro NVS 140M, Quadro NVS 135M, Quadro NVS 130M

GRID Series:

GRID K2, GRID K1

NVS Series:

Download Aquarius Pro G40 S42 Driver Side Mirror

Quadro NVS 290, Quadro NVS 295, NVS 510, NVS 315, NVS 310, NVS 300, Quadro NVS 420, Quadro NVS 450

NVS Series (Notebooks):

Download Aquarius Pro G40 S42 Driver Download

NVS 5400M, NVS 5200M, NVS 5100M, NVS 4200M, NVS 3100M, NVS 2100M, Quadro NVS 320M, Quadro NVS 160M, Quadro NVS 150M, Quadro NVS 140M, Quadro NVS 135M, Quadro NVS 130M

1 note

·

View note

Text

Things You Must Know While Studying for the FE Chemical Exam

Are you planning to take your FE Chemical Engineering exam prep to the next level? This blog gives five critical factors you should know during exam preparation. Let's get started!

FE Chemical Exam Specification

The FE Chemical exam is a computer-based test administered at an NCEES-approved center. It consists of 110 questions, and its question type includes multiple-choice and alternative item types. The appointment time of the exam is 6 hours and comprises of the following:

Non-disclosure agreement of 2 minutes

Tutorial of 8 minutes

Scheduled break of 25 minutes

Exam - 5 hours and 20 minutes.

Be Familiar with the NCEES Reference Handbook

Being familiar with the FE Reference Handbook is one of the critical things you must know while studying for the FE Chemical exam. All the FE Chemical concepts have concise information that helps you understand even complex subjects quickly. It covers a section of practice problems with diverse questions that help you bolster your preparation.

Manage Your Study Schedule

As you already know, the FE Chemical syllabus has vast chapters, so allocating sufficient time and completing all the concepts is essential. Understanding the concept should be a priority when learning any new FE Chemical concept. Prioritize the chapters according to your difficulty level and study the critical data well. Do not miss any of the chapters.

Utilize NCEES-approved Calculator!

Use calculators to get your answers quickly. Knowing the calculator's functions is integral to your FE Chemical exam preparation. Some of the NCEES-approved calculators include:

Casio: You can use all fx-115 and fx-991 models on your exam.

Hewlett Packard: The two HP calculators can be used in the PE exam, i.e., the HP 33s Scientific Calculator and the HP 35s Scientific Calculator.

Texas Instruments: All TI-30X and TI-36X models can be used in your FE Chemical exam.

Build Problem-Solving Strategies

How do you build problem-solving strategies? Practice problems or take a complete syllabus practice exam under timed conditions. Doing this helps you build problem-solving strategies to help you focus on your weak areas and optimizes your efficiency during the exam.

Exam Day Tips:

When should we flag questions on the FE Chemical Exam?

Here are some cases of flagging the question right away. If you encounter these scenarios, do not hesitate to flag the question and attempt the ones you know.

If you see a question that you have never come across, flag the question right away.

If you get an unclear question, attempt it by taking an educated guess, but flag the question if you are still stuck.

If you see the question, you know, and you are clear on the answer, but the solution is too long, you'll require more time. In this case, you can flag the question and return later to answer it.

Finally

Now, these essential things help you prepare for the FE Chemical exam well and achieve success. If you require professional assistance, you can register with the School of PE and acquire guidance. Access our prep materials and make sure you prepare well for your exam. Start today! For more details, visit: https://www.schoolofpe.com/fe-chemical

0 notes

Text

An Introduction of the Foreign Money Exchange Fees

The currency exchange market is an international non-prescription market for the trade of foreign money. This marketplace determines international money exchange rates for every country's currency. It includes all aspects of trading, buying and also trading numerous currencies in existing or determined worths. The current value of a currency is determined by how it affects the worth of various other currencies in the marketplace. One money is valued by the other out there, with one money usually greater than the various other. The money exchange rate is additionally called the present rate. It is typically upgraded every day by industrial financial institutions, central banks, brokerage companies as well as federal governments. Foreign exchange broker agents use cross-checking solutions to determine feasible future currency exchange rate motions so choose wiresmartly.com.

There are many currency exchange one currency organizations readily available to trade from the comfort of their residence. Currency exchange one money businesses make use of different methods to identify international exchange rates. Some usage base interest rates while others depend on current rate of interest. Some companies get huge quantities of international money as well as sell them to other foreign currency one money organizations. These money are typically bought to take advantage of the existing exchange rate. Others acquire big amounts of one currency and offer them to various other foreign exchange one currency businesses. Fx brokers buy and sell these money for you, which allows you to trade in the fx market. An individual can become a currency exchange one nation at any type of provided time. A person can be trading money from one country to an additional any time. When a transaction is being made, the customer would send the vendor an amount of money. This money is referred to as "fiat" or as a "future money". A company that is acquiring this future money will certainly sell money that is equal to or in the future date. There are many financial factors that enter into determining the proper international money exchange prices. The three significant factors are Customer Rate Index, Gross Domestic Product, as well as other financial aspects. These factors are adjusted on a regular monthly basis by federal governments and also personal firms to make adjustments in the exchange rate. In order to identify the proper currency exchange rate, the cost of a specific quantity of United States buck is increased by the average cost of a details type of foreign money that a certain country is recognized for investing in so choose different options here.

This will certainly give a figure that is described as the FX or the "currency exchange rate". If you think about it, when you transfer money from one location to one more, the international money will certainly be worth far more or much less to you as a result of these elements. If you are collaborating with a firm that is taking care of many different firms and also currency exchange prices, it would be a great idea to look into using the most widely used technique of computation. For more knowledge, people can try to visit this page https://en.wikipedia.org/wiki/Wire_transfer.

1 note

·

View note

Text

Can you forecast which mutual funds will do better than others?

Can you anticipate which mutual funds will do better than others? It ends up you can. The number of investment products available for purchase increases every year. Wide item selection may produce issues, both for the advisor and the client. At Junxure, we've decided to develop an algorithm to deal with that issue. What we wanted We wished to offer necessary aid for clients and advisors, assuming that some mutual funds can bring systematic returns in provided market conditions. Depending upon a fund's strategy, techniques of management and product specifics, it may be a better suitable for purchase today, or stay more promising for the conditions of tomorrow-- in a various environment. In this vein, we decided to examine whether AI-based algorithm can find the best mutual funds utilizing affiliations hidden in product costs, macro signs, market indexes, FX rates and commodities. The twist was-- we did not attempt to decode these dependences however rather put them to work and see the actual results in item ranking. How we did that We collected macro indications of significant worldwide economies (United States, EU, China, Japan, LatAm, India), products rates, FX rates and significant indexes quotes. We employed price history for over 4000 mutual funds traded on NASDAQ. Our goal was to develop a ranking of the funds and determine which ones would score the highest rate of return in the next quarter. To create optimal environment for the algorithm, we required to prepare the data we had actually accumulated and run a lot of additional analyses (e.g. return and threat ratios, fund efficiency indications). The last thing to be done prior to the training started was to efficiently decrease information dimensions utilizing Principal Element Analysis (PCA). What brought the most assure The most promising results came from the ensemble maker finding out approach. It utilizes multiple discovering algorithms (lots best performing AI designs in our case) to acquire a much better predictive efficiency. For the results measurement, we came up with a Top-Bottom Analysis. In the analyzed group, we produced a ranking of mutual funds, arranged by the probability of accomplishing the greatest rate of return in the next quarter. We moved 3 months in the future and inspected whether we were right, particularly whether the leading 10% was considerably better than the bottom 10% from our ranking. To produce the most reasonable environment, we measured our outcomes using so called test data, which is a dataset which the algorithm has never ever "seen" prior to. It ensured that such results can be available in daily operations.

In order to assess a mutual fund ability to outshine its peer groups, our design took different criteria into account: fund risk and previous performance in various market conditions, return determination and repeatability, risk-adjusted performance ratios as well as systematic danger related to main market elements. The last one, in particular, is rather unclear: information-driven market motions which are quite unforeseeable, human behavior which doubts, adaptive and often repeatable, lastly the basic financial laws that ought to discuss dependencies between financial cycles and asset costs in a long term however not constantly do. We anticipated maker discovering to tell us more where the reality was-- comments Grzegorz Prosowicz, Consulting Director for Capital Markets at Advisor Engine. What the outcomes were The real results for the test dataset exceeded our expectations. The very best outcomes we have actually attained were 78% in Top-Bottom Analysis. It means that in 4 out of 5 cases we can forecast which funds would score a greater rate of return. The difference in rate of return in between leading and bottom funds amounted to 2,99 percentage points quarterly (12,51 p.p. CAGR). Simply put, consultant choosing items for their customer from available item universe for 1 year duration, might rely on 12,51 portion points better returns with the algorithm-- no matter how the markets perform. What's next? Envision having a service of that kind in your institution. Your advisors would lastly get a reliable help with picking the right items and end up being more productive. Your customers would score higher Return of investments and notice the competitive advantage you supply. Perhaps even you could produce model or robo-advisory portfolios instantly ... Junxure AI-based Ranking Algorithm can have many faces - that is for sure. Is the service going to reach a similar success in every country or circumstances? Is the service ready to introduce as cloud API in your institution or get checked by you in kind of evidence of idea? --------------------------------------------- Wealth management methods in the digital age The service digitization procedure which might be observed for more than a dozen (if not more than twenty) years does not skirt the financial sector. Both business and banks offering investment advisory services put importance on advanced software application targeted at facilitating the customers' wealth management. What should the wealth management service appear like in the digital transformation period and what strategies can be adopted by the institutions offering them? Digital wealth management technique-- difficulties Both the business and banks providing the wealth management service face a number of difficulties linked with the digital change. According to the "Swim or sink: Why Wealth Management Can't Manage to Miss the Digital Wave" report prepared by Advisor Engine, the wealth management service is presently one of the least innovative ones in terms of technology. age structure-- a high share of customers categorized into HNWI and UHNWI (Ultra High Net Worth People) groups are senior citizens who do not require any cutting edge services from banks or advisory business and who depend on direct contacts with the advisors, hostility to developments-- the richest customers think the verified wealth management techniques should be utilized and it is needless to present new services, technology limitations-- many banks keep utilizing older software application, the extension of which with brand-new functionalities is made complex and expensive. Despite the barriers which need to be overcome by banks and advisory business, the wealth management digital technique may produce measurable advantages. The authors of the report by McKinsey advisory business called "Secret Trends in Digital Wealth Management-- and What to Do about Them" observe the customers having access to the software facilitating wealth management report the 5 to 10 times greater satisfaction level than clients interacting with the consultants in a traditional way. Likewise the expenses are not irrelevant for the banks and advisory business. Using the robo-advisory channel makes it possible for to decrease them. Thanks to the algorithms, it is possible to provide prompt help to the consumers when making investment choices without substantial expenses-- such advisory services are much cheaper than the help provided by a human, knowledgeable advisor and work even in adverse market conditions. Junxure Wealth Management software Wealth management digital techniques The banks and advisory companies alike are aware that they can only gain utilizing the digital innovation potential. Entities with a long market presence buy the advanced solutions a growing number of often. There are lots of examples: Perpetual is a company providing the wealth management service with a more than 140 years' existence on the Australian market. It chose to make instant insight into investment portfolios and reports delivered by means of the chosen social media readily available to its consumers, Swiss UBS bank opened a robo-advisory channel for consumers with the wealth below 2 million pounds required to open a personal banking account, a Singapore branch of Citi offered their consumers the opportunity to utilize a bank chatbot through Facebook. It provides details e.g. about balances and deals on the bank accounts. The strategic wealth management may be largely automated. What is more, the specialized software application allows to collect information which can be evaluated then to adjust the adopted wealth management techniques. Advisors having access to the tools facilitating some daily tasks connected with wealth management gain likewise more time for discovering customers' needs. According to the research study performed by the advisory company Ernst & Young, among wealth management elements of specific significance for wealthy consumers is understanding their monetary objectives and supplying a broad access to financial investment products and tools to them. Strategic wealth management-- how to get ahead of competitors? Lots of banks and banks consider the wealth management digital technique to be the secret to get competitive advantage and consumers who do not want to base exclusively on their instinct and knowledge when it pertains to wealth management. To make sure the offered options correspond to the needs of their receivers, the banks and companies providing the wealth management service need to: 1. Take a look at the executed software application from the clients' point of view It is of particular importance the customer's frontend operation is user-friendly, allows to set investment goals, is equipped with a monetary planning application and allows to communicate with professionals and consultants. Multi-modular Junxure Wealth Management software uses a multi-channel consumer's frontend. financial advisor software utilizing this option have access to details on different devices, including smart devices, PCs and tablets. Consumers may use both the help of consultants and place orders themselves by means of the robo-advisory channels. 2. Define the target group of consumers Strategic wealth management is various for the affluent ones and for HNWI customers. The above-mentioned Junxure Wealth Management system allows to provide both complete and simplified advisory services. Junxure Wealth Management offers likewise financial and investment advisory services. Customers can be profiled and the advisor may carry out tailored strategic wealth management for each of them. 3. Enhance (broaden) their offering The wealth management digital strategy is perceived from the point of view of benefits as it e.g. allows to focus on the customer and their requirements more than in the past. Automating some activities assists in the whole advisory process. This, in turn, makes it possible for to expand the offer with brand-new investment products which might be of interest for a broader group of consumers. Using Junxure Wealth Management, banks and advisory business might perform various analyses, including the performance and threat ones, for their clients. Thanks to the control and methodical reporting, the consumer might count on thorough assistance and also execute the most lucrative wealth management strategies. What are the differentiating functions of Junxure Wealth Management? Junxure Wealth Management option was created to cater for the requirements of the wealth management clients and their consultants. This is a multi-modular wealth management system created for the private banking consumers. It supports the work of all employees having contacts with the capital transferred by the consumers and establishing wealth management methods, i.e.: advisors-- they might produce a risk profile for each client and make additional advisory choices based on it, consisting of offering tactical wealth management, managers-- they participate in the financial investment process, handling the consumers' financial investment portfolios, experts-- they are accountable for preparing analyses based on the collected data and acquired monetary outcomes. The system also supports the aftersales services of enormous value for additional cooperation of the bank (or the advisory company) and the customer. The consumer may depend on e.g. constant insight into their financial investment portfolio and receive reports. They enable the financier to find out the outcomes on various levels, including the classes of possessions or currencies. The software application developed by Junxure is adjusted likewise to the regulative requirements, consisting of e.g. MiFID II (Markets in Financial Instruments Instruction) which imposes information commitments on banks and companies using investment items. Thanks to that, the clients receive details about the risk connected with purchasing selected monetary instruments and expenses they will sustain in relation to using the consultant's help.

#Wealth Management Software#wealth manager software#financial advisor software#robo advisor#CRM for financial advisors#Financial CRM#wealth management crm software#advisor technology#RIA CRM

1 note

·

View note

Text

And I’m back from my midseason finale, continuing my journey to decipher how and why a show about two sexy brothers who hunt ghosts aired on television for over a decade. It’s Supernatural!

Back in 2009, when I rushed head long from “Salvation”/”Devil’s Trap straight into “In My Time of Dying” (Kripke, you’re being a real bitch with these titles), I was not the TV connoisseur who writes tumblr posts about ancient shows that you read before you. The cliffhanger at the end of “Devil’s Trap” is good enough that it didn’t matter that I’d just crossed the threshold from the first season into the second season. What mattered was that Dean was dying in the back seat and holy shiz, they crushed the Impala?? So I popped out one DVD disc and happily plugged in the next without stopping to think what a new season might mean.

Of course, I knew second seasons were precious. You watch Firefly ONCE and you know the fear of a Show Cancelled Too Soon. Supernatural, apparently, was on the edge of cancellation after season 1, but it’s renewal coincided with the birth of the brand new CW, a network built from the ashes of The WB and UPN respectively, that was in need of nightly programming to fill up the air. So Supernatural was saved (aha) from the Cancellation Bear and remained in it’s (primo) Thursday night time slot, 9pm warning label in-tact.

What do we say to the Cancellation Bear? Not Today!

That’s not to diminish the importance of it’s renewal for season 2! Depending on what network or cable channel (or year), only something like 20 - 30% of freshman shows get renewed for a season 2. To be fair, if every show that aired in the fall got renewed in the spring, there’d be no time slots left for new freshman shows the following fall, so something’s gotta give. SPN getting a season 2, even if the odds were a little more in their favor than they might want you to think, is still pretty miraculous, especially for 2006. Remember, this is pre-streaming services acquiring original content. In 2006, Netflix was a rental service that focused on mailing you DVDs. Via the U.S. Postal Service. And they wouldn’t officially start acquiring distribution licenses for broadcast shows (let alone their own content) until 2007 - two years after SPN started airing. In the early 2000′s, there were fewer opportunities for television shows to make it in front of an audience because there were fewer options for watching television. I’ll say it a hundred times - Supernatural is a DINOSAUR.

So what do you do when you’re gripped tight and raised from cancellation after your first season? Well if your Supernatural, you start off with one helluva bang.

Maybe more of a wallop.

As should be obvious by now, I watch a lot of supernatural and Supernatural-Adjacent television. I love a Season One, but very often those shows start to go downhill in Season 2. Why? For the simple fact that your characters are too good now. They’re too powerful. They’ll never be as vulnerable as they were in season 1, and if there’s no vulnerability, there’s less concern about their survivability. I’m not as invested in these characters because I’m not worried about them anymore. There’s not tension of will they/won’t they - you know they will, in the end, overcome. Of course, the solution to this conundrum is to level your villains up alongside your heroes. The trouble with that strategy is you end up with ludicrously, laughably super strong villains that lose their grounding in reality. This is a problem I foresee for SPN post season 5, but I haven’t gotten there yet, so I’ll leave that alone for right now.

So for me, what Supernatural does at the start of season 2 is genius. Think about the end of season 1 - our boys lose. They straight up failed. They had one goal - kill the demon that killed their women mom/wife and girlfriend - and they did not even remotely do that. They’re beaten, they’re bloody and now, just when we think they can’t lose any more, they lose some more.

I’m gonna be real honest here, this was a real turn on for me Sammy.

First it’s Baby. For two boys who hop from cheap motel to cheap motel, I think it’s safe to say that the Impala is basically their home. They lose the fight and then they lose their home. That’s rough.

Also, Bobby, I love you, but WHAT DO YOU MEAN IT’S SCRAP?!?!

Next, they almost lose Dean. Dean is the only thing that’s keeping this family together and he is donezo. He’s so gone, a Reaper is concocting an elaborate hallucination to get him to come to terms with his imminent demise. Which honestly, is a very nice thing for this Reaper to do, but also bb, don’t you do it!

You gotta hand it to this Reaper, she really knew allll the right buttons to push.

Next, we lose the Colt. They have one (1) weapon to use against the Yellow-Eyed-Demon and John gives it away. Is he also finally acknowledging that his children require his love and care? Yes. Is this the shittiest decision he’s ever made, even if it is to save the life of his firstborn? ALSO YES.

Pretty damn stupid, JOHN.

And finally, in the last 5 minutes of the episode, we lose John Winchester himself. And this bitch ain’t coming back. He’s gone. He’s gone for good. Sam and Dean spent months searching for their father, building up this legend of a man, and we as an audience spent months right along with them, only to watch him die in the first episode of season 2! Sam and Dean don’t start out season 2 back at square one, they’re back at square -10. Sure they know who the bad guy is now, but they don’t know how to find him, don’t know how to kill him, and the only person who did know can’t help them anymore! And to top it all off, they don’t even have a ride back from the hospital!

JK, we all know Bobby came and picked them up and took him back to his place, he’s the Real Hero of this show.

Also, I’m getting ahead of myself here but I’m on a roll - John’s last words to Dean are basically a threat that oh yeah, you have one more thing that this war on hell will steal from you. If you can’t save your brother, you’ll have to kill him. Sure John. Sure. Dean’s definitely gonna do that, John, you bitch.

And they don’t just write this loss off. Over the next three episodes we see how deep this failure goes. Sure, our guys are still out there, doing their thing, killing evil sonsabitches, but damn they are torn up and they are not handling it well.

Listen, I don’t know what your viewing experience is like, but the recaps on my dvd play this scene every episode for the next, like, five episodes.

“Everybody Loves a Clown” is a very clear attempt to get back to normal. So clear that they even say it in the episode somewhere, but they have a lot of climbing to do before they get anywhere near normal. They’re driving around in a minivan, they’re taking cases from strangers, they’re living as carnies - their whole world is upside down.

We get another low blow in “Bloodlust.” Dean learns that a) no one can replace his father and b) that Monster doesn’t necessarily mean Evil. So at the end of the episode, when he asks Sam, “What if we killed things that didn’t deserve killing,” you feel it like a gut punch. Dean doesn’t even get to keep his own faith that he’s doing the right thing anymore.

Hey buddy. While you’re down on the ground, we thought we’d kick ya a little bit, OK?

And then we round that out with “Children Shouldn’t Play with Dead Things,” a nice zombie episode that is definitely not about the zombies. Sam and Dean are still grieving the death of their father in a very real way and I actually think Sam’s idea to visit their mom’s grave is really nice. He obviously took several psych courses and is handling grief in a much healthier, mature way than Dean. That being said, when he starts to go all Psych Major on Dean, even I want to slap him in the face. And then that whole attitude really bites him in the ass when Dean finally does open up and he realizes he’s not qualified to therapize this shit.

Oh no, it OK, don’t be cry!

See, we as the audience know that John Winchester traded his own soul to save Dean’s life, but Dean was in a coma with a Reaper, so there’s no way to know what Dean knows. But that bitch is astute and he figures it out. The Colt gone, their dad gone, and that horrible wrong sensation when he woke up in the hospital all point to the fact that John’s final gift to his son was the crushing weight of guilt. Dean knows that John should be here with Sam, would be here with Sam, if it wasn’t for Dean. And since a demon was involved, Dean probably suspects where John is right now. And that is something that he is just gonna have to carry for the rest of forever. I mean, I love Dean and I’m glad he’s still here, but that’s a real dick move John.

John Winchester. Ruining Lives from Before and Beyond the Grave.

Notice the change in this season - with the exception of the Yellow Eyed Demon, these first few episodes are not about the monster. These are Feelings Episodes, ooey gooey Feelings Episodes, that just use the monster-of-the-week to get characters to deal with their inner traumas. This is SPN saying they’re not gonna stay on the surface of this show, they’re gonna dig deep and focus on Character Substance over the Horror FX Style. And in season 2, that still feels fun! As an audience member plowing through these episodes, I was thrilled that this was the direction the show was taking. I was also thrilled that all these episode end with Dean staring dramatically into the middle distance, just some A+ cinematography there gentlemen, great job.

In order, Ep 201, 202, 203, 204. I was not kidding.

I’m also noticing, having written all this down, that these are some very Dean-centric episodes. Like, it’s very heavy on the Dean. Which I’m not mad about, but I just think it’s real funny considering that Sam was definitely our lead protagonist/entry point into season 1.

Now though? This is honestly my biggest fear as I continue my quest to make it through the entire series. I know how it ends. I have a tumblr account and sometimes I like spoilers to prep me for what’s coming, so I know how this all shakes out. And I think the reason that I sort of gave up on the series was because at some point, these Feelings episodes get too heavy. If all your characters are always bogged down by grief and guilt and loss, at some point that’s not enjoyable to watch anymore. You’ve gotta give them a win at some point. A real win that doesn’t come with caveats like Dean sold his soul to the devil, or, Sam’s locked in a cage with the devil, or really anything involving the devil at all.

So while I’m enjoying season 2 still, I am worried that my enjoyment level is gonna sink as the series goes on. But that’s still a ways down the road, so in the meantime, have more of Dean staring dramatically into the middle distance.

#Supernatural Season 2#Supernatural Rewatch#SPN#sam and dean#Sam Winchester#but mostly#dean winchester#In My Time of Dying#Everybody Loves a Clown#Bloodlust#Children Shouldn't Play With Dead Things#Seriously Kripke#What the hell are these titles?#Dean staring dramatically into the middle distance appreciation post#To be fair#they knew what I wanted#television#CW

1 note

·

View note