#fundamental analysis of indian stocks

Explore tagged Tumblr posts

Text

Mastering Fundamental Analysis | Finology Quest Certifications

Enhance your investment skills and gain expertise in fundamental analysis with Finology Quest's comprehensive certification course. Discover the secrets to creating wealth in the stock market through in-depth company analysis and financial literacy. Join now to embark on your journey towards financial success.

#fundamental analysis of stocks course#fundamental analysis#fundamental analysis course#learn fundamental analysis#fundamental analysis of indian stocks

0 notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Text

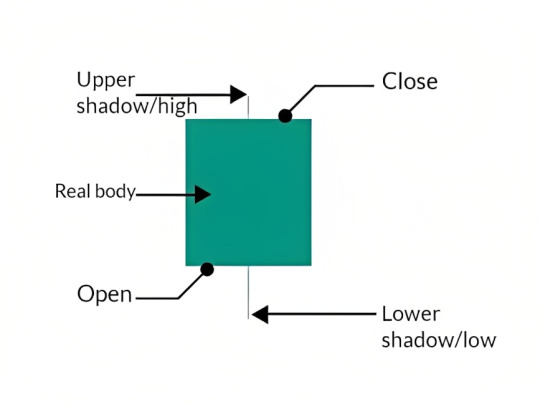

How is a candlestick drawn in stock market?

A candlestick is a widely used chart in technical analysis.The candles tick consists of the following parameters,

1)Open

2)Close

3)Low

4)High

5)Upper shadow

6)Lower shadow

The above parameters together help to draw a single candlestick.However these 6 components are more than just a constructive element for a candlestick.

They provide information related to market behaviour, bull and bearish activities, who is gonna dominate the market etc.

To understand the stockmarket very easily, the first step is to learn the above parameters in detail.

Click Candlestickspot.online to read about them in detail.

#stock market#stock trading#technical analysis#fundamental analysis#forex trading#crypto traders#candlestick pattern#indian stock market

6 notes

·

View notes

Text

GIFT Nifty Indicates Muted Opening; UCO Bank Hikes Lending Rates by 5bps for Certain Tenures

for more details click here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Text

Radhakishan Damani's Investment Secrets: A Deep Dive into His Portfolio

💼🔎 Ever wondered about the investment strategies of the legendary Radhakishan Damani? Here's your chance to peek into his portfolio! Join us as we unravel the secrets behind Damani's successful investments in our latest article - 'Radhakishan Damani's

Who is Radhakishan Damani? Radhakishan Damani is a prominent Indian investor who has made a name for himself in the investing world by following a disciplined and value-oriented investment approach. Damani is the founder of Avenue Supermarts, which operates DMart, India’s largest retail chain. He is widely regarded as one of the most successful investors in India and has amassed a significant…

View On WordPress

#Discipline#Entrepreneurship#Fundamental Analysis#Indian Stock Market#Investment Strategy#Long-Term Growth#Patient Investing#Radhakishan Damani#Risk Management#Undervalued Companies

0 notes

Text

indian stock market

Title: Navigating the Stock Market: A Beginner's Guide

Introduction

The stock market is a dynamic and complex financial ecosystem where investors buy and sell shares of publicly-traded companies. It's a place where fortunes can be made and lost, but understanding the fundamentals can significantly reduce the risk associated with investing. In this beginner's guide to the stock market, we'll explore the basics, terminology, and strategies to help you embark on your investment journey with confidence.

Chapter 1: What is the Stock Market?

Definition: The stock market is a marketplace where buyers and sellers trade ownership in companies through stocks (equity).

Historical Perspective: Learn about the origins and evolution of stock markets.

Types of Stock Markets: Understand the differences between major stock exchanges (e.g., NYSE, NASDAQ).

Chapter 2: Stock Market Participants

Investors: Discover the various types of investors, from individual traders to institutional investors.

Public Companies: Explore why companies go public and what it means for investors.

Regulators: Learn about the regulatory bodies that oversee stock markets.

Chapter 3: Stock Market Basics

Stocks and Shares: Differentiate between stocks and shares and understand their value.

Market Indices: Discover how indices like the S&P 500 and Dow Jones work.

Market Orders: Learn about market orders, limit orders, and stop orders.

Trading Hours: Know the opening and closing times of stock markets.

Chapter 4: Investment Strategies

Long-Term Investing: Explore the benefits of buy-and-hold strategies.

Day Trading: Understand the fast-paced world of day trading.

Value Investing: Learn about the principles made famous by Warren Buffett.

Risk Management: Discover strategies to mitigate risk and protect your investments.

Chapter 5: Analyzing Stocks

Fundamental Analysis: Evaluate a company's financial health and performance.

Technical Analysis: Study price charts and indicators to make short-term predictions.

Sentiment Analysis: Understand how market sentiment can affect stock prices.

Chapter 6: Diversification and Portfolio Management

Diversification: Learn how to spread risk by investing in various asset classes.

Building a Portfolio: Explore the process of constructing a well-balanced investment portfolio.

Rebalancing: Understand the importance of periodically adjusting your portfolio.

Chapter 7: Tax Implications and Regulations

Capital Gains Tax: Discover how profits from stock trading are taxed.

IRA and 401(k): Learn about tax-advantaged retirement accounts for long-term savings.

Chapter 8: Common Pitfalls and Mistakes

Overtrading: Avoid the urge to make excessive, impulsive trades.

Ignoring Research: Stress the importance of thorough research before investing.

Emotional Decision-Making: Learn to manage emotions when making investment decisions.

Chapter 9: Staying Informed

Financial News: Keep abreast of financial news and its impact on the market.

Investment Resources: Explore useful websites, books, and forums for learning and advice.

Conclusion

The stock market can be an exciting and rewarding place for investors, but it's crucial to approach it with knowledge and a well-thought-out strategy. With a solid understanding of the basics, a clear investment plan, and the discipline to stick to it, you can navigate the stock market and work towards achieving your financial goals. Remember that, like any other endeavor, successful stock market investing takes time, patience, and continuous learning.

2 notes

·

View notes

Text

A Comprehensive Guide to Choosing the Best Book for Intraday Trading

Intraday trading is an exciting way to make money in the stock market. It requires a certain level of expertise and knowledge to be successful, and one of the best ways to gain that knowledge is through reading books. However, with so many options available, it can be challenging to choose the right book for your needs. In this comprehensive guide, we will explore the key factors to consider when choosing the best book for intraday trading in India.

Guide No. 1 For Choosing Best Book For Intraday Trading In India.

First and foremost, it's essential to choose a book written by a reputable author. Look for books written by authors with a proven track record of success in the stock market. They should have a good understanding of the Indian stock market, intraday trading strategies, and risk management techniques.

One way to find the best book for intraday trading in India is to ask for recommendations from fellow traders, friends, or family members who have experience in intraday trading. They may be able to suggest a book that helped them in their trading journey.

Otherwise you can visit any Stock Market Training Institute. For Asking that from Which Intraday Trading Book You had Created your Best Stock Market Course In India. This can help you to find Best Book For Intraday.

Guide No. 2 For Choosing Best Book For Intraday Trading.

Another crucial factor to consider when choosing a book for intraday trading is the level of detail provided. Look for books that provide a step-by-step guide to intraday trading, including strategies for identifying potential trades, risk management techniques, and how to handle emotional and psychological factors that can affect trading decisions.

The best books for intraday trading in India should also cover technical analysis and charting tools. Technical analysis involves using charts and other tools to identify trends in stock prices and predict future price movements. A good intraday trading book should provide a detailed explanation of technical analysis and how to use it to make trading decisions.

The best book for intraday trading should also cover fundamental analysis. This analysis involves looking at a company's financial statements, economic indicators, and other factors that can affect its stock price. Understanding fundamental analysis can help traders make informed decisions about which stocks to buy and sell.

Guide No. 3 For Choosing Best Book For Intraday Trading.

In addition to technical and fundamental analysis, the book should also cover various intraday trading strategies. The book should provide an overview of different trading strategies and explain how to apply them in real-world trading scenarios. Look for books that cover popular strategies such as scalping, momentum trading, and breakout trading.

When choosing the best book for intraday trading in India, it's also essential to consider your level of experience. Look for books that cater to your level of expertise, whether you are a beginner, intermediate, or advanced trader. A good book should be easy to understand for beginners but still provide enough depth for experienced traders.

Now that we have discussed the key factors to consider when choosing the best book for intraday trading in India let's take a look at some of the best options available in the market. One of the best books for intraday trading in India is "Mastering Intraday Trading" by Prashant Shah. This book covers various intraday trading strategies and provides a step-by-step guide to making profitable trades. It also covers technical analysis and risk management techniques.

Guide No. 4 For Choosing Best Book For Intraday Trading.

Another excellent option is "Intraday Trading Ki Pehchan" by Ankit Gala and Jitendra Gala. This book is written in Hindi and covers various intraday trading strategies, charting tools, and technical analysis. It also provides an overview of the Indian stock market and how to use it to make trading decisions.

If you're looking for a comprehensive guide to intraday trading, "Intraday Trading Strategies" by Bansari Parikh is an excellent option. It covers technical and fundamental analysis, various intraday trading strategies, and risk management techniques. The book also provides real-world examples of successful intraday trading strategies.

Conclusion

In conclusion, choosing the best book for intraday trading in India is a crucial step in your trading journey. Look for books written by reputable authors, provide a detailed explanation of intraday trading strategies, technical analysis, and risk management

#best book for intraday trading#best book for intraday trading India#best stock market course#best stock market course in india#Intraday Trading Books#share market training institute#SS Trading Academy#stock market course in india#stock market training institute#trading books for beginners

2 notes

·

View notes

Text

Midcap Nifty: Unlocking the Growth Potential of India's Mid-Sized Companies

Midcap Nifty stands as a pivotal index for investors seeking a balance between stability and growth. Representing the performance of India’s mid-cap companies, it offers an attractive alternative to large-cap and small-cap investments. Let’s explore why Midcap Nifty could be the key to building a robust portfolio.

What is Midcap Nifty?

Midcap Nifty is an index that tracks the top-performing mid-cap companies listed on the National Stock Exchange (NSE). These companies typically have market capitalizations between ₹5,000 crores and ₹20,000 crores. As businesses in their growth phase, they strike a balance between high potential returns and moderate risk.

Features of Midcap Nifty

Diverse Sector Representation: The index includes companies from industries such as IT, healthcare, manufacturing, and finance, offering a diversified investment option.

Dynamic Growth Opportunities: Mid-cap companies are often at the forefront of innovation and expansion, providing investors with unique opportunities for wealth creation.

Liquidity and Accessibility: Stocks within the index maintain adequate trading volumes, making them easily accessible for retail and institutional investors alike.

Why Choose Midcap Nifty?

Growth-Oriented Investments: Mid-cap companies are in the sweet spot of business growth, offering higher return potential compared to large caps.

Better Value: Many mid-cap stocks are undervalued gems, providing a chance for investors to capitalize on their growth stories before they become mainstream.

Portfolio Diversification: Including Midcap Nifty in your portfolio ensures exposure to mid-sized companies that can thrive in various economic conditions.

Risks to Consider

Higher Volatility: Mid-cap stocks are more prone to price swings than large caps.

Economic Sensitivity: Mid-cap companies can face challenges during economic downturns due to limited resources.

Lower Visibility: These companies may receive less coverage, requiring deeper research for informed investments.

How to Invest in Midcap Nifty

Index Funds and ETFs: These provide an easy and cost-effective way to gain exposure to the Midcap Nifty index.

Direct Stock Selection: Investors can handpick stocks from the index to build a customized portfolio.

Systematic Investment Plan (SIP): A disciplined SIP approach can help manage risks and average out market volatility over time.

Leveraging Tradetron for Midcap Nifty

Tradetron, a leading algorithmic trading platform, simplifies your investment journey:

Automated Strategies: Use predefined strategies to automate your trades.

Customizable Algorithms: Create algorithms tailored to your risk tolerance and goals.

Backtesting Capabilities: Test strategies against historical data to optimize performance.

Real-Time Alerts: Stay informed about market changes and opportunities.

Midcap Nifty in the Indian Economy

Reflection of Growth Sectors: The index captures the performance of industries driving India’s economic progress.

Potential for Outperformance: Historically, mid-cap indices have delivered higher returns during economic upswings.

Focus on Innovation: Many mid-cap companies invest in research and development, paving the way for long-term success.

Tips for Investing in Midcap Nifty

Research and Analysis: Understand the fundamentals of the companies in the index.

Diversify: Combine Midcap Nifty with large-cap and small-cap investments for a well-rounded portfolio.

Adopt a Long-Term View: Mid-cap investments often require patience to realize their full potential.

Conclusion

Midcap Nifty represents a promising segment of the Indian stock market, offering a compelling mix of growth potential and moderate risk. With the power of advanced tools like Tradetron, investors can craft strategies to make the most of this dynamic index. Whether you're building wealth for the future or seeking diversification, Midcap Nifty deserves serious consideration in your investment plan.

0 notes

Text

The Impact of Seasonal Demand on Inventory Management and How to Prepare

One of the fundamental inventory management issues that all businesses have to tackle is seasonal demand. Whether we are looking at festive seasons like Dussehra and Diwali in India or back-to-school dates, inventory demand tends to go up. It’s crucial for business owners to forecast and observe seasonal changes in order to plan their inventory better, anticipate any stockouts, and avoid overstocking and sales losses. The reason why seasonal inventory management is important is that it helps businesses identify the inventory they require, at the right time. In this article, we will explain what seasonal demand is and its impact on inventory, and introduce some practical strategies for better seasonal inventory management.

Comprehending Seasonal Demand

Seasonal demand denotes the anticipated cyclic shifts in customer’s demand across certain times of the year. Consumer spending picks up during festivals such as Diwali, Eid and Christmas every year in India, and one can witness higher sales in the retail, electronics and fashion retail sectors. Summer and winter also bring higher demand for products related to air conditioners, fans or winter wear depending upon the season. Businesses need to plan and align their inventory management strategies to available seasonal trends so that they can cater to customer demands without compromising on their inflated costs.

Seasonal demand poses several challenges to inventory management:

Stockouts:

In the high seasons, for instance, inadequate stocks may be prepared due to an unpredictable high demand, and as a consequence, some sales are lost and disappointed-customers ensue. For example, a retailer who failed to order festive clothes in anticipation of Diwali would have missed out on significant business.

Read More : inventory management techniques

Overstocking:

On the other hand, the business might overestimate the demand and, in the process, overstock the inventory, which in turn costs the business more in inventory holding cost. One classic example is when the clothing firms stock up the winter wear and then realise that this is the only merchandise they are unable to sell in the course of the year due to the end of the winter season, which they have failed to predict, This forces the retailers to sell them at very cheap prices to clear their shelves and thus lower their profit margins.

Supply Chain Strain:

This often creates a lot of stress to meet high levels of consumption in summer by sourcing raw materials, hence causing delay in transportation and cost increases sharply. For example, in the case of manufacturers, there can be an issue in meeting the production rate during extremely busy periods like the wedding season in India that affect delivery and stock.

Preparing for Concessionary Seasonality:

Some Strategies With such patterns of sales, the specific business must necessarily employ different principles of inventory management. Here are some proven strategies:

Accurate Demand Forecasting:

It is true that having accurate demand forecasts is key to good seasonal demand management. This implies that when organisations have the historical data of sales and the trend analysis of the market, it becomes easy to estimate the level of demand that is expected at a particular season For instance, ‘Myntra’, the Indian fashion e-tailer, employed sophisticated mathematical models to predict demand for various categories of products during the festive period. This helps them to effectively order the stocks to avoid instances where there is no stock or instances where there are excess stocks.

Flexible Supply Chains:

This brings the flexibility of the supply chain ensured, thereby enabling a prompt adjustment to the demand. Regular supplier dealing, extension of sources and JIT systems adopted by the business are some ways in which inventory may be effectively controlled. For instance, BigBasket, an e-grocer with the largest market base in India, has a well-constructed supply management mechanism helping it expand during yuletide periods like New Year or Pongal.

Inventory Buffer:

Every company should ensure they have safety stocks, which is another inventory management technique of coping with unpredicted high demand. At the same time, this issue should not be overdone and the buffer should be adjusted based on the company’s budget. A classic example is Fabindia, which holds a minor safety stock for products such as ethnic wear and home dècor during festive months. This also helps the business to be capable of fulfilling customer expectations on the products to be supplied on the market without compromising on the quantities stocked.

Also Read : eCommerce logistics

Seasonal promotions and clearance sales:

Some measures that companies can take after the season to get rid of excess inventory include having further sales promotions or clearance sales. It also benefits removing stocks that did not generate a lot of sales while providing a shopping attraction to bargain hunters. Lifestyle and Shoppers Stop, etc. , usually conduct sale campaigns during the off season of winter or summer collections to ensure good stock turnover.

Conclusion

Flexibility in inventory management, which allows companies to adjust to seasonal demands, has its advantages but also comes with drawbacks. Therefore, if businesses fully appreciate the implications of these oscillations, and employ splendid ideas like; forecasting, rocking supply chains, inventory hedges, and strategic promotional plans, they can fully harness the benefits of shifts in stock velocities.

In the ever-fluid market that is India, cultural influence and seasonal changes have been known to have a substantial impact on the consumer market, A well-prepared business for the upcoming seasons is likely to have A positive impact on its financial position. That’s why you should arrange your business today to face whatever the future holds in the light of seasonal demand.

Source : https://www.emizainc.com/the-impact-of-seasonal-demand-on-inventory-management-and-how-to-prepare/

#inventory management#inventory management techniques#inventory management strategies#Seasonal Demand

0 notes

Text

Sai Life Sciences Share Price & Fundamental Analysis

Sai Life Sciences Share Price: A Comprehensive Guide

Introduction

Ever wondered how certain companies capture the attention of stock market enthusiasts? Sai Life Sciences, a leading player in the pharmaceutical sector, is one such name that often piques curiosity. Whether you're an investor eyeing its stock performance or someone keen to learn about the best stock market courses in India, you're in the right place. Let’s dive into the intriguing world of stock trading and education.

Learn about Sai Life Sciences share price , the best stock market course in India, top online stock trading courses, and stock market institutes.

What is Sai Life Sciences ?

Sai Life Sciences is a globally renowned pharmaceutical company specializing in drug development and manufacturing. Their innovative approaches and partnerships with big pharmaceutical players have placed them on the radar of savvy investors.

Sai Life Sciences: A Stock Overview

Before jumping into investments, it’s essential to understand how Sai Life Sciences performs on the stock market. The company's consistent growth and alignment with global health trends have made its share price a focal point for analysts.

Why Sai Life Sciences Share Price Matters

Sai Life Sciences Limited, a Hyderabad-based contract research and manufacturing organization (CRMO) serving the pharmaceutical and biotechnology industries, recently made its debut on the Indian stock exchanges.

IPO Details:

Issue Period: December 11 to December 13, 2024

Price Band: ₹533 to ₹549 per equity share

Issue Size: ₹3,042.62 crore, comprising a fresh issue of 1.73 crore shares (₹950 crore) and an offer for sale of 3.81 crore shares (₹2,092.62 crore)

Subscription: The IPO was oversubscribed 10.27 times, with strong demand across investor categories

Listing Performance:

Listing Date: December 18, 2024

NSE Listing Price: ₹650, an 18.4% premium over the issue price of ₹549

BSE Listing Price: ₹660, a 20.22% premium over the issue price

Post-Listing Performance: Shares rose to ₹764.4 on the BSE, marking a 16% increase from the listing price

Current Share Price:

As of December 19, 2024, the share price of Sai Life Sciences Limited is approximately ₹737 on both NSE and BSE.

Company Overview:

Established in 1999, Sai Life Sciences offers integrated services across the pharmaceutical lifecycle, including discovery services, development, and manufacturing of new chemical entities. The company serves 17 of the top 20 global pharmaceutical companies and has completed over 200 discovery programs, with more than 40 advancing to clinical phases.

Financial Highlights:

Market Capitalization: Approximately ₹15,396 crore

Stock P/E Ratio: 186

Return on Equity (ROE): 8.89%

Revenue Growth: Sales increased from ₹695 crore in March 2019 to ₹1,465 crore in March 2024

Net Profit: Grew from ₹73 crore in March 2019 to ₹83 crore in March 2024

Investor Considerations:

While the company has demonstrated consistent revenue growth and serves a robust client base, its high P/E ratio and relatively modest ROE suggest that investors should conduct thorough due diligence. Factors such as market volatility, industry competition, and the company's strategic initiatives should be carefully evaluated before making investment decisions.

Please note that stock prices are subject to market fluctuations. For the most current information, consult official financial news sources or the company's investor relations website.

How to Analyze Share Prices Effectively

Analyzing share prices doesn’t have to be rocket science. It’s like reading a story; each number tells a tale. Key factors to consider include:

Market Trends: Is the pharmaceutical sector booming?

Company Performance: Are they launching new drugs or expanding their reach?

Economic Indicators: What’s the broader market saying?

Best Stock Market Course in India

If you’re new to investing or want to level up your skills, enrolling in the best trading institute in india is a game-changer. Look for courses that cover technical analysis, fundamental analysis, and market psychology.

Top Online Stock Trading Courses in India

Online courses are a blessing for anyone who wants to learn at their own pace. The best online stock trading courses in India often include interactive sessions, real-time simulations, and mentorship from industry experts. A few popular options are:

NSE Academy’s Certification in Financial Markets

Zerodha Varsity

Coursera’s Investment Management Specialization

The Role of Stock Market Institutes

Stock market institute act as the training grounds for future investors and traders. They provide hands-on experience, industry insights, and access to experienced mentors. Joining a reputable stock market institute can make all the difference in building your confidence and skill set.

Tips for Beginner Investors

Getting started in the stock market can feel overwhelming. Here are a few tips to ease your journey:

Start Small: Don’t put all your eggs in one basket.

Research Thoroughly: Understand the companies you’re investing in.

Stay Consistent: Regular investments often yield better results than sporadic ones.

Why Education is Key in Stock Trading

Think of stock trading like driving a car. Without proper training, you’re likely to crash. Education equips you with the tools to navigate volatile markets, analyze risks, and make informed decisions.

Future Outlook for Sai Life Sciences

With a robust pipeline of pharmaceutical products and increasing global collaborations, Sai Life Sciences is poised for growth. Monitoring their share price and staying updated on industry developments will help you make the most of investment opportunities.

FAQs

1. What affects Sai Life Sciences share price?

Several factors, including market trends, company performance, and economic indicators, influence the share price.

2. Which is the best stock market course in India ?

The best courses include Trendy Traders Academy’s Certification in Financial Markets and Zerodha Varsity for beginners and advanced learners.

3. How can I start investing in the stock market ?

Begin by researching companies, opening a brokerage account, and starting with small investments to gain experience.

4. Are online stock trading courses effective ?

Yes, they offer flexibility, real-time learning, and expert guidance, making them an excellent choice for beginners and professionals alike.

5. What makes a good stock market institute ?

A good institute offers practical training, industry insights, and experienced mentors to guide you through the nuances of trading.

0 notes

Text

Servant Leadership vs. Traditional Leadership: A Comprehensive Analysis

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/32-Servant-Leadership-vs.-Traditional-Leadership_-A-Comprehensive-Analysis-Source-dexian.com_.jpg

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Source: dexian.com

Leadership styles play a crucial role in shaping organizational culture and influencing employee performance. In today’s rapidly changing corporate landscape, understanding different leadership approaches can provide significant insights for businesses in India. Among various leadership styles, servant leadership vs. traditional leadership stands out as a pivotal comparison. This article delves into these two contrasting styles, highlighting their characteristics, advantages, and implications for Indian organizations.

Understanding Leadership Styles

Traditional Leadership

Traditional leadership, often characterized by a top-down approach, focuses on authority and control. Leaders in this model make decisions unilaterally and expect their subordinates to comply with directives. The traditional leadership style emphasizes hierarchy, with a clear distinction between leaders and followers.

Key features of traditional leadership include:

Directive Decision-Making: Leaders make decisions based on their expertise and experience without consulting team members.

Authority and Control: This model relies on established power dynamics, where leaders exert control over their teams.

Goal Orientation: The primary focus is often on achieving organizational goals and targets, sometimes at the expense of employee welfare.

Limited Communication: Communication flows primarily from the top down, limiting feedback and engagement from lower levels of the hierarchy.

Servant Leadership

In contrast, servant leadership prioritizes the needs of the team and organization over the leader’s personal ambitions. This style emphasizes empathy, collaboration, and community building. Leaders adopting this approach strive to serve their teams, fostering an environment where everyone can thrive.

Key characteristics of servant leadership include:

Empathy and Understanding: Servant leaders prioritize understanding and addressing the needs of their team members.

Collaborative Decision-Making: This approach encourages input from team members, promoting a sense of ownership and accountability.

Community Focus: Servant leaders aim to build a supportive community within the workplace, enhancing morale and teamwork.

Transformational Goals: The focus is on developing individuals and the organization, rather than merely achieving targets.

Comparing Servant Leadership vs. Traditional Leadership

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/32.2-Comparing-Servant-Leadership-vs.-Traditional-Leadership-Image-by-golubovy-from-Getty-Images.jpg

When comparing servant leadership vs. traditional leadership, the fundamental differences emerge clearly. While traditional leadership emphasizes control and authority, servant leadership fosters a collaborative and inclusive environment. Let’s explore some of the critical differences:

1. Decision-Making Process

In traditional leadership, decisions are typically made by leaders who hold authority, often without consulting their teams. This can lead to a lack of engagement and motivation among employees, as they may feel their opinions are undervalued.

Conversely, servant leadership promotes a more democratic decision-making process. Leaders actively seek input from team members, fostering a culture of inclusivity. This collaborative approach not only enhances employee satisfaction but also leads to more innovative solutions, as diverse perspectives are considered.

2. Employee Engagement

Employee engagement is crucial for organizational success. Traditional leadership often results in a disengaged workforce, as employees may feel disconnected from the decision-making process. This can lead to high turnover rates and low productivity.

In contrast, servant leadership enhances employee engagement by prioritizing the well-being of team members. By actively listening to their concerns and involving them in decisions, servant leaders create a sense of belonging and commitment. This not only improves job satisfaction but also boosts overall team performance.

3. Organizational Culture

The culture fostered by traditional leadership can be rigid and hierarchical, which may stifle creativity and innovation. Employees may hesitate to voice their ideas, fearing backlash from authority figures.

Servant leadership, on the other hand, cultivates a culture of trust and collaboration. By encouraging open communication and valuing every team member’s contributions, servant leaders create an environment where innovation can flourish. This is particularly important in the dynamic Indian market, where adaptability and creativity are essential for success.

4. Focus on Personal Development

Traditional leadership often prioritizes organizational goals over individual growth. Employees may feel pressured to perform without receiving adequate support for their personal development.

In contrast, servant leadership emphasizes the growth and development of team members. Servant leaders invest time in mentoring and coaching, helping employees acquire new skills and advance their careers. This approach not only benefits individuals but also contributes to the overall success of the organization.

5. Long-Term Impact

The long-term impact of leadership styles can significantly influence an organization’s sustainability. Traditional leadership may lead to short-term gains, but the lack of employee engagement and trust can result in high turnover and a toxic work environment.

Servant leadership, however, fosters loyalty and commitment among employees, leading to sustainable growth. Organizations that embrace servant leadership are likely to experience increased employee retention, improved performance, and a positive reputation in the market.

The Indian Context

In the Indian corporate landscape, where diverse cultures and practices coexist, understanding servant leadership vs. traditional leadership becomes even more critical. Indian organizations are increasingly recognizing the need for inclusive and empathetic leadership styles that resonate with their workforce’s aspirations.

Embracing Change

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/32.3-Embracing-Change-Image-by-Harbucks-from-Getty-Images.jpg

As more companies in India adopt modern management practices, the shift towards servant leadership is gaining momentum. Organizations that prioritize employee well-being and foster a culture of collaboration are more likely to attract and retain top talent. This shift can also enhance overall organizational performance, making it imperative for leaders to reevaluate their leadership styles.

The Role of Technology

Technological advancements further facilitate the transition from traditional to servant leadership. Tools that promote collaboration and communication, such as project management software and team collaboration platforms, can help leaders implement servant leadership principles effectively. By leveraging technology, leaders can create a more engaged and productive workforce.

Conclusion

In conclusion, the comparison of servant leadership vs. traditional leadership reveals profound insights into how organizations can thrive in today’s competitive environment. While traditional leadership may offer certain advantages, the benefits of servant leadership are becoming increasingly evident, particularly in the context of Indian organizations.

As businesses navigate the complexities of the modern world, adopting a servant leadership approach can enhance employee engagement, foster innovation, and ensure sustainable growth. Leaders who prioritize the needs of their teams and create a supportive environment will not only improve organizational performance but also contribute to a more positive workplace culture.

Ultimately, the future of leadership in India may well hinge on the successful integration of servant leadership principles, paving the way for a more collaborative and empowering work environment.

Did you find this article helpful? Visit more of our blogs! Business Viewpoint Magazine

#leadership#leadershipdevelopment#servantleader#networkmarketing#entrepreneurs#businessowners#customerservice#famway#legacylifestyle#financialindependence#justbuildit#healthylifestyle

0 notes

Text

Achieve Trading Success with IITA – Bhubaneswar’s Best!

Indian Institute of Technical Analysis (IITA) offers a comprehensive platform for learning Intraday and Technical Analysis, helping you master the Indian stock market. Whether you are starting with basic stock market fundamentals or progressing to advanced technical analysis strategies, IITA provides expert-led courses tailored to all levels. With powerful techniques, mind-blowing strategies, and golden rules, IITA ensures you gain the skills to become a professional trader. Visit onlinecourses.iita.tech/category to explore various course categories and choose the right training program to boost your trading career and achieve financial success in the stock market.

0 notes

Text

Analysis of Nifty 50: Market Movements and Highlights

The Nifty 50 is the key driver of the economy. This in-depth review analyzes key support and resistance levels and technical and fundamental factors that influence market momentum. Stay informed and make smarter investment decisions with this information.

0 notes

Text

GIFT Nifty Indicates Positive Opening; Hindustan Petroleum to Invest Rs 2,212 Crore in Raipur Pipeline Project

More details visit here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Text

Learn Trading at A Professional Stock Market Training Institute

From the budding entrepreneur to the seasoned investor, the one area that would automatically attract diverse people is the stock market. There will be this appeal to being a successful trader, but navigating the complex financial domain requires much more than just enthusiasm requires knowledge, strategy, and hands-on experience. And Chandigarh is well-equipped with all this and more.

Why Stock Market Education Matters

The first perception is that the stock market is always a game to get rich in money. Unless one undergoes proper education in the basics of the stock market and advanced trading techniques, then one may easily have an intimidating and expensive experience. A course creates good foundations by covering important topics, including equity, derivatives, technical analysis, fundamental analysis, and risk management.

Why Choose a Stock Market Training Institute in Chandigarh

The professional stock market training institutes in Chandigarh have some differentiating factors. Here's what makes stock market training institutes popular choice among aspiring traders and investors:

Expert Faculty

Under the mentorship of professional trainers, the students get hands-on insights and market-tested strategies from experienced mentors in the trading and financial sectors.

Custom Curriculum:

These institutes cater to learners from beginners to intermediate and advanced levels, offering courses ranging from the most elementary steps in trading stocks to very complex trading strategies.

Practical Training:

Live trading sessions combined with simulated trading environments offer students real-world exposure and make theories come to life.

Flexible Learning Options:

This school offers campus-based classes and distance learning, thus opening accessibility options available for both working professionals and students.

Certification and Career Counseling

Certification will talk for itself, and professionalism will add to your trading career. The experienced institutes will also help you out during a career guidance phase to make you shine in the financial sector.

What Does A Stock Market Training Course Offer?

Basics of Stock Trading: The course is about the basics of stock trading.

Technical Analysis: Research on chart patterns, indicators, and tools used in predicting the trend in the market.

Fundamental analysis: Use of company performance and its financial statements along with economic factors.

Risk Management: Learn how to prevent losses and direct your portfolio.

Trading Psychology: Know how to develop resilience in the mind for successful trading.

Live Market Classes: Continue practicing by participating in live trading sessions.

Portfolio Management: Learn how to diversify and balance your investments.

Algo Trading Basics: Uncover simplified concepts of algorithm-based automated trading.

Why Chandigarh is Ideal for Aspiring Traders Chandigarh is rapidly growing.

North Indian city with modern infrastructure and a vibrant entrepreneurial spirit. It is soon turning out to be the gateway for North India's financial industry. It has a very large student base, IT professionals, and a base of entrepreneurs eager to explore more avenues of income through trading. The presence of premium institutions ensures that people here will not have to relocate for the finest stock market education.

Build Your Success Stories With The Wise Bucks

Most students in finance following The Wise Bucks report tremendous progress. It always managed to perfect intraday trading and the construction of long-term investment portfolios for the students. Tales of triumph reminded one of the practical training, expert guidance, and an accommodating environment that transforms the trading journey.

Invest in your future today through a trading platform to buy and sell shares, the stock market is a window to financial independence and wealth creation. What matters most is unlocking this by education. In a training institute like The Wise Bucks in Chandigarh, you will get to know what one has been missing in the complexities of trade.

Ready to Take the Leap? Take the first step towards freedom from financial woes today. Connect with us to learn about our courses and become one of the successful traders who transformed a passion for trading into a great source of income. Whether you are a beginner and want to learn about the basics or a seasoned trader trying to hone your skills, The Wise Bucks offers the best "theory, practice, and mentorship" blend to ensure guaranteed success in the stock market.

0 notes

Text

Radhakishan Damani's Investment Secrets: A Deep Dive into His Portfolio

💼🔎 Ever wondered about the investment strategies of the legendary Radhakishan Damani? Here's your chance to peek into his portfolio! Join us as we unravel the secrets behind Damani's successful investments in our latest article - 'Radhakishan Damani's

Who is Radhakishan Damani? Radhakishan Damani is a prominent Indian investor who has made a name for himself in the investing world by following a disciplined and value-oriented investment approach. Damani is the founder of Avenue Supermarts, which operates DMart, India’s largest retail chain. He is widely regarded as one of the most successful investors in India and has amassed a significant…

View On WordPress

#Discipline#Entrepreneurship#Fundamental Analysis#Indian Stock Market#Investment Strategy#Long-Term Growth#Patient Investing#Radhakishan Damani#Risk Management#Undervalued Companies

0 notes