#from the NATIONAL CREDIT BUREAU!

Explore tagged Tumblr posts

Text

hahaha hey you guys guess what. you'll never believe it. got the guy who's in charge of my fraud case on the phone and he was like "who'd you give one-time security codes to yesterday" and i was like "the guy who called me from the fraud department after they noticed a weird login in florida??" and he was like "that was the fuckin hacker. you got got. IDIOT!!!!!!!!!!" i handed my entire savings over to a fucking guy on the phone on a silver platter. like some kind of fuckin rube. bro

#IT IS OK THOUGH I HAVE BEEN SORTING IT OUT#account is LOCKED DOWN! card is DELETED! fraud paperwork has been FILED! i have requested a fraud alert AND credit freeze#from the NATIONAL CREDIT BUREAU!#a friend of mine is taking me to MAINE next saturday to go to the BANK! i sent an email to my landlord asking if i can pay rent by CHECK!#i went to my other bank and deposited my BONDS! so i have some MONEY! to pay RENT!#i also got a new debit card from them. and made sure i could use my old checks.#i also bought some STAMPS while i was out and a BIRTHDAY PRESENT for a FRIEND#now i am going to start switching over some auto deposits#so when i get my paycheck on tuesday i will actually get it.#i feel so STUPID but i think i have done all i can to fix this. i am feeling better about it#by next weekend i will have my money again. it's all fine#and hopefully next time i will not get got so easily. lol.#anyway dont get got by people pretending to be your bank i guess. i did think it was weird how many questions they asked but..#they ALWAYS ask lots of questions at the bank!!!!!#i got a text message FROM the bank saying they would be calling me soon and then the next call was from the scammer#and then like a half hour later got one from the bank and was confused bc they'd just 'called me'#anyway. it'll be fine. scary for a while but at least i have things i can do to make it better. it's all good#genuinely feeling like i ought to take out like a thousand bucks cash and keep it in my desk to replace my bonds tho tbh hahah#just in case something like this happens again. you never know. what would i have done if i DIDNT have those yknow#ok thank u all for being along on this journey with me

21 notes

·

View notes

Text

SHAKESPEAREAN ROSE

Spencer Reid x psychiatrist!reader

Synopsis: Spencer Reid silently admires the new psychiatrist on the floor. Word Count: 1600+ WARNING: nothing, just fluff! A/N: Remember when I said I wrote more than what I posted for Doctors Across The Hall? This is it🤭 (I forgot to post it on aug 1, oops) I've decided to make Spencer Reid x psychiatrist!reader a series! It'll just be a bunch of fluff/angst/rare spicy stuff with psychiatrist!reader that happens in the same timeline but it's not in order. So, not exactly a story just tangents ??? Also I'm open to requests/prompts to keep this going hehe <3 Tell me what you think!

“Guys, you’re so sweet! This is adorable!”

Spencer’s ears perk up at the commotion. Curiosity thrums in his veins as he watches Derek hand you a rose. A small stuffed toy is clutched in your other hand. A wide smile adorns your face. A gorgeous sight on a late Wednesday morning.

Derek laughs, “Can’t take the credit.” He takes Penelope into his right arm. “Baby girl, right here strongly encouraged me.”

Penelope gives you a bone-crushing hug, “Happy National Girlfriends Day, my favorite psychiatrist! Get ready for our sleepover! I have so many plans!” She squeals in excitement, inviting JJ in, who’d just discovered the similar objects on her desk.

Your heart swells. Only two months into the bureau, and you’ve already found yourself a great group of friends. As the newly mandated psychiatrist in the building, it was nerve-wracking to enter the floor that seemed to reak of evil and know-it-alls. And although the BAU team is filled with know-it-alls, despite their constant denial, you managed to squeeze into their group as easily as befriending Penelope Garcia. Considering your office happens to be next to her lair.

“Isn’t that day for couples only? For a girlfriend? Not a girl that's a friend?” You chuckle, taking in the aroma from the single rose.

“Nah-uh,” Penelope wiggles her index finger. “All those boys are just piggybacking on girl power—” She turns to Derek, who’s about to object, “—You’re not included. You have been graciously influenced by moi. I’m just saying that I have my girlfriends, so I will celebrate the day the way I see fit, and that is with my gorgeous, gorgeous babes!”

As JJ begins to add her piece to the excitement parade, Spencer turns to Emily, who comes back from the kitchen, her stuffed toy in hand.

“National Girlfriends Day?” He asks lowly.

“What?” Emily furrows her brows for a moment before it flattens on her forehead. “Oh, that. Just a day some people celebrate to appreciate their girlfriends. Garcia’s excited about it—”

Her voice quiets into the background in an instant. Spencer sits in his mind as he processes the information. National Girlfriends Day. The words echo in his head. A day to appreciate girlfriends…

— ✿ — ✿ ✿ — ✿ ✿ ✿

Lunch is usually your highlight of the day. Not because of the time you eat but because of the time you spend listening to all the sizzling drama Penelope has to offer. It’s an interesting experience to have when you’re also the same person who listens to her cries every time the BAU team flies to yet another case in a different state.

Today, though. It’s quite different.

As soon as you enter the bullpen to check in with another agent’s inquiry regarding your services on the floor, a delivery man approaches you and hands you a huge bouquet of roses. Your newly found friends immediately hover around like shameless busybodies. Though, you never mind at all.

“Oooh, yet another gift from your secret lover…” Emily teases, perching on Derek’s desk as she sips coffee.

Derek joins in, eyebrows raised. “What is that—” He picks up a small note from one of the roses, rolling it open, “—Love looks not with eyes, but with the mind, and therefore is winged Cupid painted blind…” He waves the note with a mischievous grin. “We don’t know this guy, but he sure is cheesy.”

Emily flashes a sheepish smile, “There’s one on each rose! How many roses are there?” She starts counting by eye.

“It’s like Shakespearean roses.” Penelope quips after reading another note from a different rose, passing you the small poem that immediately makes your lips curl.

“Shakespearean roses..? That's a thing?” You curiously inquire, looking over the vast red petals close to your chest.

Penelope shrugs, “Not really, but it could be!” She beams at you.

JJ smiles, joining in after a small detour to her office. “Oh, wow!” Her eyes widen, and her brows lift. “Another one of the noble Sir Rumple?” She coaxes.

“Who is this Sir Rumple, anyway? I’m very curious.” Emily snorts, wiggling her brows at you. She doesn’t push past your clear boundaries but never fails to strike all her attempts to get a name out of you. She’s a profiler, after all.

“Most importantly, when is she going to introduce us to her secret lover?” Derek teases, nudging you playfully.

Just as you look up, Spencer Reid stands behind everyone, clutching the strap of his bag like usual.

His hair is short and untamed. Big hazel brown eyes spark under the fluorescent light. A thin, shy smile. And a familiar red cardigan.

You reckon it was the priciest clothing you’ve ever bought as a small thank you present. But Spencer doesn’t need to know, really.

Time moves slowly at the brewing desire to have Spencer close. His shy smile and adorable averting eyes bring you the thought of domesticity. You imagine him coming home just like that. Messy hair. Giddy, tight-lipped smile. Exhausted features and yet the most handsome man in your books. A spatula in your hand, music in the kitchen, and the hem of his collared shirt swaying over your thighs. It's poetically a dream. Something you wish to have, to do for as long as you're breathing.

“Maybe next time?” You say with blushing cheeks. The utter embarrassment of talking about a secret lover in front of your crush had your mind blown into overdrive.

The group exchanges looks. But they don’t push further, indulging in the rare moment of your silent, sunny smile and hoping that you’re happy with whoever's been showering you with affection.

“Okay, maybe not fully Shakespearean roses,” Penelope interjects, reading a corny joke that had the entire group cringe and you laughing.

The joy in your laughter is like Clair de Lune playing through sunset. Spencer imagines warm tea in his hand, a book on his lap, and your little giggles across as you flip a page of yet another cheesy romance novel. Sunlight along your most beautiful features, which he insists is all of you. The cozy oversized shirt he owns covers the softness of your skin. A simple thought and yet has his heart racing in sheer bliss.

Spencer smiles into his action report. “Shakespearean roses…” He whispers in a chuckle, shaking his head at the idea.

— ✿ — ✿ ✿ — ✿ ✿ ✿

The day comes to a close with excitement and heartwarming joy.

“See you later at 9! Don't be late.” Penelope waves at you as the doors slide closed.

You chuckle at her antics but quickly find yourself in a small predicament, struggling to carry all the tokens of love you’d received from everyone.

“Here, let me help.”

Your eyes meet his. And you think you're having a heart attack. But you make sure to smile kindly with a not-so-eager nod.

“Thanks, Reid.”

He flashes his signature smile, taking the tall bouquet from your hands.

You fight yourself from biting the lower of your lips at the sight of his hand clutching the stem without difficulty. So, you breathe gently and indulge in his warmth next to you.

“Looks like you had a nice day,” Spencer starts tentatively, swaying on the balls of his feet as he hoists your favorite thing of the day.

You turn to him with a hum and a gentle bounce of your shoulders. “I did. I feel loved.” You confess.

Spencer hides his blushing ears. Is it so wrong to wish you always smiled at him like that? Does a lifetime sound too much to ask?

“That's great,” He nods casually, letting the other patrons jump in and out of the lift.

The doors open on the last floor. Both of you walk side by side as you trickle out of the lift into the parking lot. It's not a rule. But somehow, you and he always parked in the lowest lot despite the vast parking spaces above.

He continues the conversation on smaller tangents that make you giggle. How did your sessions today go? How was the new lunch place you went to?

And you throw back the same curiosity with an enthusiasm he admires. Did you finish all your reports? Did you enjoy your lunch stroll?

Spencer hands you the bouquet back as soon as you settle your things in the passenger seat of your car. “See you tomorrow?”

You beam at him, and his eyes soften, “See you tomorrow, Sir Rumple.” You giggle, stealing a quick peck on his cheek.

Before you can turn around, Spencer stills your hips and steals a similar kiss, albeit on the softness of your lips.

The two of you giggle at the silence. Butterflies flutter with tickling speed in both of your stomachs. Maybe keeping your relationship private isn’t as bad as you’d imagine.

He opens the door for you and waits until you're comfortable in your seat. “I think I prefer Shakespearean Rose now.” You announce as he leans on your window.

He playfully pouts, “But I love Sir Rumple better…” He twists his brows. The telltale sign of his gears turning. “Maybe I can be both?” He comprises.

“You can be whatever pseudonym you want,” You smile at him. “You’re the only Spencer Reid I want.”

Spencer’s cheeks tint a shade of soft red. He leans and kisses your forehead.

“Shakespearean Rose it is.”

reid masterlist | masterlist

#spencer reid#ssa spencer reid#dr spencer reid#doctor spencer reid#spencer reid fluff#spencer reid imagine#spencer reid one shot#spencer reid series#spencer reid x reader#spencer reid x you#bau team#dr reid#spencer reid criminal minds#spencer reid blurb#cm#criminalminds#criminal minds#ker writes a lot#rereid

776 notes

·

View notes

Text

From Hamas’s perspective, was Operation Al Aqsa Flood a successful operation? Hamas undoubtedly knew that Israeli retaliation would include the killing of many Palestinian civilians, even if the horrific scale of Israel’s assault was unforeseen. Was October 7, then, a collective martyrdom operation launched without the consent of 2.3 million Palestinians? And, for the many people who proclaim their support for the Palestinian cause but reflexively condemn the violence of the October 7 attacks, how can they realistically separate the two? Drop Site conducted a series of interviews with senior Hamas officials alongside a comprehensive review of its statements and those of its leaders. I interviewed a variety of Hamas sources on background for this story and two—Basem Naim and Ghazi Hamad—agreed to speak on the record. I also spoke to a range of knowledgeable Palestinians, Israelis, and international sources in an effort to understand the tactical and political aims of the October 7 attacks. Some people will inevitably criticize the choice to interview and publish Hamas officials’ answers to these questions as propaganda. I believe it is essential that the public understand the perspectives of the individuals and groups who initiated the attack that spurred Israel’s genocidal war—an argument that is seldom permitted outside of simple soundbytes. Hamas leaders cast their operations on October 7 as a righteous rebellion against an occupation force that has waged a military, political, and economic war of collective punishment against the people of Gaza. “They have left us no choice other than to take the decision in our hands and to fight back,” said Dr. Basem Naim, a senior member of Hamas’s political bureau and a former government minister in Gaza. “October 7, for me, is an act of defense, maybe the last chance for Palestinians to defend themselves.”

[...]

Hamas has emphasized that its aim on October 7 was to shatter the status quo and compel the U.S. and other nations to address the plight of the Palestinians. On this front, informed analysts say, they succeeded. “On October 6, Palestine had disappeared from the regional agenda, from the international agenda. Israel was dealing unilaterally with the Palestinians without generating any attention or any criticism,” said Mouin Rabbani, a former UN official who worked as a special advisor on Israel-Palestine for the International Crisis Group. “The attacks of Hamas on October 7 and their aftermath played a crucial role, but I think just as much credit, if you will, goes to Israel, if not more so,” he added. “If Israel had responded in the way that it did in [previous assaults on Gaza] in 2008, 2014, 2021, it would have been a story for a number of weeks, there would have been a lot of hand wringing, and that would have been the end of it.” “It's not only the actions of the colonized, but also the reaction of the colonizer that has created the current political reality, the current political moment,” Rabbani said.

9 July 2024

608 notes

·

View notes

Text

Things Biden and the Democrats did, this week #22

June 7-14 2024

Vice-President Harris announced that the Consumer Financial Protection Bureau is moving to remove medical debt for people's credit score. This move will improve the credit rating of 15 million Americans. Millions of Americans struggling with debt from medical expenses can't get approved for a loan for a car, to start a small business or buy a home. The new rule will improve credit scores by an average of 20 points and lead to 22,000 additional mortgages being approved every year. This comes on top of efforts by the Biden Administration to buy up and forgive medical debt. Through money in the American Rescue Plan $7 billion dollars of medical debt will be forgiven by the end of 2026. To date state and local governments have used ARP funds to buy up and forgive the debt of 3 million Americans and counting.

The EPA, Department of Agriculture, and FDA announced a joint "National Strategy for Reducing Food Loss and Waste and Recycling Organics". The Strategy aimed to cut food waste by 50% by 2030. Currently 24% of municipal solid waste in landfills is food waste, and food waste accounts for 58% of methane emissions from landfills roughly the green house gas emissions of 60 coal-fired power plants every year. This connects to $200 million the EPA already has invested in recycling, the largest investment in recycling by the federal government in 30 years. The average American family loses $1,500 ever year in spoiled food, and the strategy through better labeling, packaging, and education hopes to save people money and reduce hunger as well as the environmental impact.

President Biden signed with Ukrainian President Zelenskyy a ten-year US-Ukraine Security Agreement. The Agreement is aimed at helping Ukraine win the war against Russia, as well as help Ukraine meet the standards it will have to be ready for EU and NATO memberships. President Biden also spearheaded efforts at the G7 meeting to secure $50 billion for Ukraine from the 7 top economic nations.

HHS announced $500 million for the development of new non-injection vaccines against Covid. The money is part of Project NextGen a $5 billion program to accelerate and streamline new Covid vaccines and treatments. The investment announced this week will support a clinical trial of 10,000 people testing a vaccine in pill form. It's also supporting two vaccines administered as nasal sprays that are in earlier stages of development. The government hopes that break throughs in non-needle based vaccines for Covid might be applied to other vaccinations thus making vaccines more widely available and more easily administered.

Secretary of State Antony Blinken announced $404 million in additional humanitarian assistance for Palestinians in Gaza, the West Bank and the region. This brings the total invested by the Biden administration in the Palestinians to $1.8 billion since taking office, over $600 million since the war started in October 2023. The money will focus on safe drinking water, health care, protection, education, shelter, and psychosocial support.

The Department of the Interior announced $142 million for drought resilience and boosting water supplies. The funding will provide about 40,000 acre-feet of annual recycled water, enough to support more than 160,000 people a year. It's funding water recycling programs in California, Hawaii, Kansas, Nevada and Texas. It's also supporting 4 water desalination projects in Southern California. Desalination is proving to be an important tool used by countries with limited freshwater.

President Biden took the lead at the G7 on the Partnership for Global Infrastructure and Investment. The PGI is a global program to connect the developing world to investment in its infrastructure from the G7 nations. So far the US has invested $40 billion into the program with a goal of $200 billion by 2027. The G7 overall plans on $600 billion by 2027. There has been heavy investment in the Lobito Corridor, an economic zone that runs from Angola, through the Democratic Republic of Congo, to Zambia, the PGI has helped connect the 3 nations by rail allowing land locked Zambia and largely landlocked DRC access Angolan ports. The PGI also is investing in a $900 million solar farm in Angola. The PGI got a $5 billion dollar investment from Microsoft aimed at expanding digital access in Kenya, Indonesia, and Malaysia. The PGI's bold vision is to connect Africa and the Indian Ocean region economically through rail and transportation link as well as boost greener economic growth in the developing world and bring developing nations on-line.

#Thanks Biden#Joe Biden#us politics#american politics#Medical debt#debt forgiveness#climate change#food waste#Covid#covid vaccine#Gaza#water resources#global development#Africa#developing countries

184 notes

·

View notes

Text

Edit: I removed the screenshot so as not to share dm stuff, but I got a message from someone who couldn't send an ask, inquiring: "i was wondering what book it was that you mentioned about the philippines? i'd be interested in reading it"

Sorry to post; figured it would be a subject worth sharing with interested others. Good news: It's an article, so it's relatively easier to access and read.

Jolen Martinez. "Plantation Anticipation: Apprehension in Chicago from Reconstruction America to the Plantocratic Philippines" (2024). An essay from an Intervention Symposium titled Plantation Methodologies: Questioning Scale, Space, and Subjecthood. Hosted and published by Antipode Online. 4 January 2024.

Basically:

Explores connections between plantations in US-occupied Philippines and the policing institutions and technologies of Chicago. Martinez begins with racism and white anxiety in Chicago in the 1870s. Coinciding with Black movement from the South during Reconstruction and the Great Migration, Chicago was, in Martinez's telling, a center of white anxiety and apprehension. Chicago public, newspapers, and institutions wanted to obsessively record information about Black people and white labor dissidents, including details on their motivations and internal/inner life. Between 1880-ish and 1910-ish Chicago then became a center of surveillance, records-keeping, classification systems, and new innovations in monitoring dissent and collecting information. Within a year after the labor rebellions, the Adjutant General of the US Army who led Chicago's militarized crackdown on the 1877 Great Railroad Strike immediately moved to DC and proposed establishing "the Military Information Division" (MID); eventually founded in 1885, MID started collecting hundreds of thousands of Bertillon-system intelligence cards on dissidents and "criminals." Meanwhile, National Association of Chiefs of Police headquartered their central bureau of identification in Chicago in 1896. At play here is not just the collection of information, but the classification systems organizing that information. The MID and related agencies would then go on to collect mass amounts of information on domestic residents across the US. In Martinez's telling, these policing beliefs and practices - including intelligence cards, "management sciences," and policing unit organization - were then "exported" by MID to the Philippines and used to monitor labor and anticolonial dissent. Another Chicago guy developed "personality typing" and psychological examinations to classify criminality, and then trained Philippines police forces to collect as much information as possible about colonial subjects.

The information-gathering in the Philippines constituted what other scholars like Alfred McCoy have called one of the United States' first "information revolutions"; McCoy described these technologies and practices as "capillaries of empire." Martinez suggests that it's important to trace the lineage of these racialized anxieties and practices from Chicago to the Philippines, because "such feelings were fundamental to linking plantations which at first seem so spatially and temporally distant." And "[u]ltimately, the US colonial plantocracy in the Philippines built its authority around information infrastructures [...] and feelings emanating from Chicago [...] that extended from the image of the American South."

Side-note:

The Bertillon system was standardized at about this same time, 1879-ish, and in similar social and racial contexts, becoming popular in other Midwest/Great Lakes cities, especially to track Black people (though it was also rapidly and widely adopted famously as an essential approach across Europe). The system used body measurements to identify and classify people, especially "criminals," significantly involving photography, such that Bertillon is also sometimes credited as the originator of "the mugshot."

You could compare the colonial use of Bertillon-style intelligence card systems in Chicago and US-occupied Philippines to the rise of fingerprinting as a weapon of Britain.

Edward Henry was the Inspector-General of Police in Bengal, appointed 1891, basically the top cop in British India. He exchanged letters with notorious eugenicist Francis Galton, wherein they specifically talked about the importance of developing a classification system for fingerprints that could be used alongside the Bertillon system of anthropometric identification. (Another British imperial administrator in India, Sir William Herschel, had previously been the first to pioneer fingerprinting by taking hand-prints.) By 1897, police forces in India had been adopting the so-called Henry Classification System, and the Governor-General of India personally decreed that fingerprinting be adopted across India. By 1900, Henry was sent to South Africa to train police in classification systems. By 1903, Henry was back in Britain and became head of the Metropolitan Police of London, now the top cop in Britain.

So, the guy who pioneered fingerprinting classification for use in maintaining order and imperial power in India and other colonies was eventually brought in to deploy those tactics on Britons in the metropole. The kind of colony-to-metropole violence thing described by many theorists. Britain also developed traditions of police photography in context of rebellions in Jamaica and India to collect personally identifiable information and track dissent. The Ottoman Empire cultivated a system of passports and related laws to monitor and direct movement; France did something similar in colonial Algeria.

Anyway, the other story that I mentioned regarding Philippines was from:

Gregg Mitman. "Forgotten Paths of Empire: Ecology, Disease, and Commerce in the Making of Liberia's Plantation Economy." Environmental History, Volume 22, Number 1. January 2017.

For context, I'd note that this takes place in the midst of the US's "conquest of the mosquito" in its militarized occupation of Panama, where the canal was completed in 1914.

In Mitman's story, Richard P. Strong was appointed as director of the brand-new Department of Tropical Medicine at Harvard in 1913. Shortly thereafter in 1914, as he toured plantations in Panama, Cuba, Guatemala, etc., Strong simultaneously took a job as director of the Laboratories of the Hospitals and of Research Work of the United Fruit Company (infamous for its brutal labor conditions in plantations, its land-grabbing in Central America, and its relationship to US corporate power). Harvard hired Strong partially on the recommendation of General William Cameron Forbes, who was the military governor of US-occupied Philippines from 1909 to 1913. When Harvard hired Strong, he had been living in the Philippines, where he was the personal physician to Governor Forbes, and was also the director of the Philippine Bureau of Science's Biological Laboratory, where he had experimented on Filipino prisoners without their knowledge; Strong fatally infected these unknowing test-subjects with bubonic plague. Then, Governor Forbes, after leading the US occupation of the Philippines, himself became an overseer to Harvard AND a director of United Fruit Company (also Forbes was a banker and the son of the president of Bell Telephone Company). Meanwhile, Strong also became a shareholder in British rubber plantations; Strong approached Harvey Firestone to help encourage the massive rubber company to negotiate a deal to expand plantations in West Africa, where Firestone got a 99-year-long concession to lease a million acres of land in Liberia. So there's an intimate relationship between military, plantations, colonization, academic funding models, corporate profiteering, land dispossession, etc.

---

So, in each case, the plantation expands in time and space. There are connections between the exercise of power in the Philippines and Panama and West Africa and Bengal and Chicago. Connections both material and imaginative.

Disturbing stuff.

#sorry for all this rambling#and sorry for removing image i just cant in good conscience bring myself to share screenshot of private message someone has sent me#even if a message may have been meant as part of or adjacent to amicable public discussion

30 notes

·

View notes

Text

At long last, a meaningful step to protect Americans' privacy

This Saturday (19 Aug), I'm appearing at the San Diego Union-Tribune Festival of Books. I'm on a 2:30PM panel called "Return From Retirement," followed by a signing:

https://www.sandiegouniontribune.com/festivalofbooks

Privacy raises some thorny, subtle and complex issues. It also raises some stupid-simple ones. The American surveillance industry's shell-game is founded on the deliberate confusion of the two, so that the most modest and sensible actions are posed as reductive, simplistic and unworkable.

Two pillars of the American surveillance industry are credit reporting bureaux and data brokers. Both are unbelievably sleazy, reckless and dangerous, and neither faces any real accountability, let alone regulation.

Remember Equifax, the company that doxed every adult in America and was given a mere wrist-slap, and now continues to assemble nonconsensual dossiers on every one of us, without any material oversight improvements?

https://memex.craphound.com/2019/07/20/equifax-settles-with-ftc-cfpb-states-and-consumer-class-actions-for-700m/

Equifax's competitors are no better. Experian doxed the nation again, in 2021:

https://pluralistic.net/2021/04/30/dox-the-world/#experian

It's hard to overstate how fucking scummy the credit reporting world is. Equifax invented the business in 1899, when, as the Retail Credit Company, it used private spies to track queers, political dissidents and "race mixers" so that banks and merchants could discriminate against them:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

As awful as credit reporting is, the data broker industry makes it look like a paragon of virtue. If you want to target an ad to "Rural and Barely Making It" consumers, the brokers have you covered:

https://pluralistic.net/2021/04/13/public-interest-pharma/#axciom

More than 650,000 of these categories exist, allowing advertisers to target substance abusers, depressed teens, and people on the brink of bankruptcy:

https://themarkup.org/privacy/2023/06/08/from-heavy-purchasers-of-pregnancy-tests-to-the-depression-prone-we-found-650000-ways-advertisers-label-you

These companies follow you everywhere, including to abortion clinics, and sell the data to just about anyone:

https://pluralistic.net/2022/05/07/safegraph-spies-and-lies/#theres-no-i-in-uterus

There are zillions of these data brokers, operating in an unregulated wild west industry. Many of them have been rolled up into tech giants (Oracle owns more than 80 brokers), while others merely do business with ad-tech giants like Google and Meta, who are some of their best customers.

As bad as these two sectors are, they're even worse in combination – the harms data brokers (sloppy, invasive) inflict on us when they supply credit bureaux (consequential, secretive, intransigent) are far worse than the sum of the harms of each.

And now for some good news. The Consumer Finance Protection Bureau, under the leadership of Rohit Chopra, has declared war on this alliance:

https://www.techdirt.com/2023/08/16/cfpb-looks-to-restrict-the-sleazy-link-between-credit-reporting-agencies-and-data-brokers/

They've proposed new rules limiting the trade between brokers and bureaux, under the Fair Credit Reporting Act, putting strict restrictions on the transfer of information between the two:

https://www.cnn.com/2023/08/15/tech/privacy-rules-data-brokers/index.html

As Karl Bode writes for Techdirt, this is long overdue and meaningful. Remember all the handwringing and chest-thumping about Tiktok stealing Americans' data to the Chinese military? China doesn't need Tiktok to get that data – it can buy it from data-brokers. For peanuts.

The CFPB action is part of a muscular style of governance that is characteristic of the best Biden appointees, who are some of the most principled and competent in living memory. These regulators have scoured the legislation that gives them the power to act on behalf of the American people and discovered an arsenal of action they can take:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

Alas, not all the Biden appointees have the will or the skill to pull this trick off. The corporate Dems' darlings are mired in #LearnedHelplessness, convinced that they can't – or shouldn't – use their prodigious powers to step in to curb corporate power:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

And it's true that privacy regulation faces stiff headwinds. Surveillance is a public-private partnership from hell. Cops and spies love to raid the surveillance industries' dossiers, treating them as an off-the-books, warrantless source of unconstitutional personal data on their targets:

https://pluralistic.net/2021/02/16/ring-ring-lapd-calling/#ring

These powerful state actors reliably intervene to hamstring attempts at privacy law, defending the massive profits raked in by data brokers and credit bureaux. These profits, meanwhile, can be mobilized as lobbying dollars that work lawmakers and regulators from the private sector side. Caught in the squeeze between powerful government actors (the true "Deep State") and a cartel of filthy rich private spies, lawmakers and regulators are frozen in place.

Or, at least, they were. The CFPB's discovery that it had the power all along to curb commercial surveillance follows on from the FTC's similar realization last summer:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

I don't want to pretend that all privacy questions can be resolved with simple, bright-line rules. It's not clear who "owns" many classes of private data – does your mother own the fact that she gave birth to you, or do you? What if you disagree about such a disclosure – say, if you want to identify your mother as an abusive parent and she objects?

But there are so many stupid-simple privacy questions. Credit bureaux and data-brokers don't inhabit any kind of grey area. They simply should not exist. Getting rid of them is a project of years, but it starts with hacking away at their sources of profits, stripping them of defenses so we can finally annihilate them.

I'm kickstarting the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#privacy#data brokers#cfpb#consumer finance protection bureau#regulation#regulatory nihilism#regulatory capture#trustbusting#monopoly#antitrust#private public partnerships from hell#deep state#photocopier kickers#rohit chopra#learned helplessness#equifax#credit reporting#credit reporting bureaux#experian

310 notes

·

View notes

Text

The United States government’s leading consumer protection watchdog announced Tuesday the first steps in a plan to crack down on predatory data broker practices that the agency says help fuel scams, violence, and threats to US national security.

The Consumer Financial Protection Bureau is proposing a rule that would allow regulators to police data brokers under the Fair Credit Reporting Act (FCRA), a landmark privacy law enacted more than a half century ago. Under the proposal, data brokers would be limited in their ability to sell certain sensitive personal information, including financial data and credit scores, phone numbers, Social Security numbers, and addresses. The CFPB says that closing the loopholes allowing data brokers to trade in this data with little to no oversight will benefit vulnerable people and the US as a whole.

“By selling our most sensitive personal data without our knowledge or consent, data brokers can profit by enabling scamming, stalking, and spying,” Rohit Chopra, CFPB’s director, said in a statement. “The CFPB’s proposed rule will curtail these practices that threaten our personal safety and undermine America’s national security.”

Passed in 1970 as the first US privacy law, the FCRA requires “credit reporting agencies” to adhere to certain standards of accuracy and privacy in their dealing with people’s financial information, including credit histories, credit scores, debt payment histories, and other related data. The CFPB’s proposal aims to treat data brokers like credit reporting agencies when they deal in this sensitive data. It would require data brokers to obtain “separate, explicit authorization” before acquiring or sharing people’s credit information, rather than burying these permissions in expansive legal documents that surveys show are often unread or impossible for the average person to parse.

In a conversation with reporters on Monday, Chopra pointed to the recent attacks on US telecommunications systems, which the government has attributed to China, to emphasize the value of personal data to the nation's foreign rivals. “But often, our adversaries don't need to hack anything,” he says. “Data brokers, the outfits that collect and sell detailed information about our personal and financial lives, are making this data available to anyone willing to pay a price.”

The action proposed by the CFPB is aimed, Chopra says, at stopping data brokers from “enabling scammers, stalkers and spies undermining our personal safety and America's national security.”

The CFPB’s idea of using existing US law to regulate data brokers is not novel. In February 2023, a group of consumer-focused nonprofits urged Chopra to enforce the powers the FCRA affords regulators to prevent data brokers from engaging in these potentially damaging practices.

“Protecting the personal information of all people in the US is increasingly urgent in our current political climate,” says Laura Rivera, attorney with Just Futures Law, a nonprofit that supports grassroots activists. “The stakes are too high to continue to let the data broker industry sell our information at their discretion, where the status quo has made it ripe for abuse and targeting from harmful actors.”

In a briefing with WIRED on Monday, CFPB officials declined to comment on whether they believe the regulatory action will be short lived, as president-elect Donald Trump plans to empower a number of Silicon Valley figures to reorganize the federal government with the aim of targeting “waste and fraud.”

Elon Musk, who is coleading an office named after a meme coin—the Department of Government Efficiency, or DOGE—directly attacked the CFPB's work last week, calling for the agency to be “deleted.” Musk's remarks followed an attack on the agency's work by Marc Andreessen, a venture capitalist, who claimed on a recent episode of Joe Rogan’s podcast that the agency is “terrorizing” banking startups.

The CFBP was founded in 2011 with the aim of protecting consumers from the kinds of fraud and abuse that kicked off the 2008 financial crisis.

A CFPB official tells WIRED that the agency is also concerned about data being transmitted in ways that companies allege protects people's identities but in reality can be "de-anonymized" in simple ways, as studies have repeatedly shown. "As technology advances, we surmise that it will be even easier to de-mask purportedly de-identified data," one official said. The proposed rule thus includes a range of guidelines for credit reporting agencies involved in selling data they alleged has been de-identified.

Asked whether the proposal would extend to US government agencies, an official says that US law sets forth "very clear pathways" for the government to purchase personally identifying data for law enforcement and intelligence purposes. In a recent case, US Immigration and Customs Enforcement was discovered by reporters to have purchased access to the personal data of Americans in an attempt to investigate immigrants—data acquired by the media conglomerate Thomson Reuters, which it provided to custeroms in contracts the company disclosed were worth more than $100 million. (Thomson Reuters previously denied that the purpose of the data is to track undocumented immigrants and has emphasized that its database does not contain information that normally requires a search warrant to access.)

“We are not disrupting any of those pathways,” a CFPB official says. The agency is requesting comment, however, on the potential impacts of such government purchases to ensure that access is “appropriate.”

Emily Peterson-Cassin, director of corporate power at the nonprofit advocacy group Demand Progress’s Education Fund, commended the CFPB’s proposal and urged the incoming Trump administration to see it through.

“The CFPB is doing something important that will resonate with every single American. Anyone you pick off the street can tell you about the daily scam texts, emails and calls they receive from fraudsters who easily buy our contact information from shady, unaccountable data brokers,” Peterson-Cassin says. “Finally, someone—specifically the CFPB—has stepped in to stop this daily plague affecting hundreds of millions of people by applying real standards to their sale of our sensitive information.”

22 notes

·

View notes

Text

Happy Labor Day!

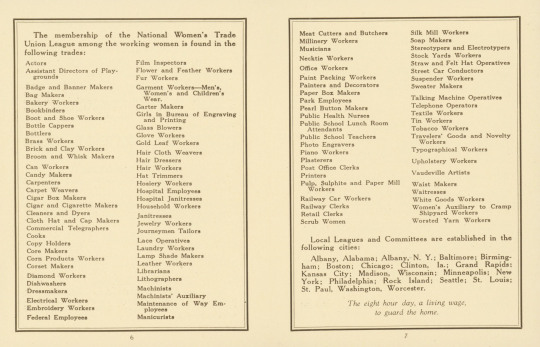

In recognition of Labor Day and the continued fight for workers’ rights, we’re highlighting a 1921 National Women’s Trade Union League pamphlet from our social-justice-based Fromkin Memorial Collection.

The National Women’s Trade Union League (WTUL) was established in 1903 to represent women's rights within the American labor movement and remained active until 1950. The organization was notable for its diverse population of working women and upper-class reformers, including Eleanor Roosevelt, who fought side by side to organize women workers into unions, provide educational opportunities to women and girls, and solidify protective workplace and social legislation. The WTUL is credited with playing a critical role in supporting the 1909 New York Uprising of the 20,000, which remains the largest strike by American women in history. Within their working-class ideology, WTUL also advocated for the eight-hour workday and supported women’s suffrage.

This promotional pamphlet spotlights three of the WTUL’s achievements including opening a School for Women Leaders in the Labor Movement in 1911, initiating a federal investigation into the conditions of woman and child wage-earners in 1907 which lead to the establishment of the Department of Labor Women’s Bureau in 1920, and presenting its Reconstruction Program at the 1919 international Peace Conference.

While we enjoy a long Labor Day weekend (or perhaps time and a half pay for union members), may we also reflect on the WTUL’s spirit and accomplishments and all of those who continue to fight for social justice.

View posts from Labor Days past.

-Jenna, Special Collections Graduate Intern

#labor day#national women's trade union league#uprising of the 20000#social justice#labor movement#women's rights#fromkin collection#unions#women#women's work#women's labor unions#labor unions

150 notes

·

View notes

Text

While it hasn't yet been approved, Musk has already threatened government workers on his social media site, X, which has led to online bullying. Now he's talking about targeting the agency that enforces laws that protect Americans from banks, mortgage lenders and other financial markets.

. . .

One person suggested it was akin to defunding the corporate police.

. . .

Since its founding, the bureau "secured more than $19 billion in consumer relief, while penalizing large financial institutions and technology firms for allegedly mishandling Americans’ money," the Post reported. "Its oversight often has stoked the ire of the nation’s biggest banks, credit card companies and other lenders, which have sued the bureau repeatedly over charges of regulatory overreach."

15 notes

·

View notes

Text

It was a time of fear and chaos four years ago.

The death count was mounting as COVID-19 spread. Financial markets were panicked. Oil prices briefly went negative. The Federal Reserve slashed its benchmark interest rates to combat the sudden recession. And the U.S. government went on a historic borrowing spree—adding trillions to the national debt—to keep families and businesses afloat.

But as Donald Trump recalled that moment at a recent rally, the former president exuded pride.

“We had the greatest economy in history,” the Republican told his Wisconsin audience. “The 30-year mortgage rate was at a record low, the lowest ever recorded ... 2.65%, that’s what your mortgage rates were.”

The question of who can best steer the U.S. economy could be a deciding factor in who wins November’s presidential election. While an April Gallup poll found that Americans were most likely to say that immigration is the country's top problem, the economy in general and inflation were also high on the list.

Trump may have an edge over President Joe Biden on key economic concerns, according to an April poll by The Associated Press-NORC Center for Public Affairs. The survey found that Americans were more likely to say that as president, Trump helped the country with job creation and cost of living. Nearly six in 10 Americans said that Biden’s presidency hurt the country on the cost of living.

But the economic numbers expose a far more complicated reality during Trump's time in the White House. His tax cuts never delivered the promised growth. His budget deficits surged and then stayed relatively high under Biden. His tariffs and trade deals never brought back all of the lost factory jobs.

And there was the pandemic, an event that caused historic job losses for which Trump accepts no responsibility as well as low inflation—for which Trump takes full credit.

If anything, the economy during Trump's presidency never lived up to his own hype.

DECENT (NOT EXCEPTIONAL) GROWTH

Trump assured the public in 2017 that the U.S. economy with his tax cuts would grow at “3%,” but he added, “I think it could go to 4, 5, and maybe even 6%, ultimately.”

If the 2020 pandemic is excluded, growth after inflation averaged 2.67% under Trump, according to figures from the Bureau of Economic Analysis. Include the pandemic-induced recession and that average drops to an anemic 1.45%.

By contrast, growth during the second term of then-President Barack Obama averaged 2.33%. So far under Biden, annual growth is averaging 3.4%.

MORE GOVERNMENT DEBT

Trump also assured the public that his tax cuts would pay for themselves because of stronger growth. The cuts were broad but disproportionately favored corporations and those with extreme wealth.

The tax cuts signed into law in 2017 never fulfilled Trump's promises on deficit reduction.

According to the Office of Management and Budget, the deficit worsened to $779 billion in 2018. The Congressional Budget Office had forecasted a deficit of $563 billion before the tax cuts, meaning the tax cuts increased borrowing by $216 billion that first year. In 2019, the deficit rose to $984 billion, nearly $300 billion more than what the CBO had forecast.

Then the pandemic happened and with a flurry of government aid, the resulting deficit topped $3.1 trillion. That borrowing enabled the government to make direct payments to individuals and small businesses as the economy was in lockdown, often increasing bank accounts and making many feel better off even though the economy was in a recession.

Deficits have also run high under Biden, as he signed into law a third round of pandemic aid and other initiatives to address climate change, build infrastructure and invest in U.S. manufacturing. His budget deficits: $2.8 trillion (2021), $1.38 trillion (2022), and $1.7 trillion (2023).

The CBO estimated in a report issued Wednesday that the extension of parts of Trump’s tax cuts set to expire after 2025 would add another $4.6 trillion to the national debt through the year 2034.

LOW INFLATION (BUT NOT ALWAYS FOR GOOD REASONS)

Inflation was much lower under Trump, never topping an annual rate of 2.4%, according to the Bureau of Labor Statistics. The annual rate reached as high as 8% in 2022 under Biden and is currently at 3.4%.

There were three big reasons why inflation was low during Trump's presidency: the legacy of the 2008 financial crisis, Federal Reserve actions, and the coronavirus pandemic.

Trump entered the White House with inflation already low, largely because of the slow recovery from the Great Recession, when financial markets collapsed and millions of people lost their homes to foreclosure.

The inflation rate barely averaged more than 1% during Obama's second term as the Fed struggled to push up growth. Still, the economy was expanding without overheating.

But in the first three years of Trump's presidency, inflation averaged 2.1%, roughly close to the Fed's target. Still, the Fed began to hike its own benchmark rate to keep inflation low at the central bank's own 2% target. Trump repeatedly criticized the Fed because he wanted to juice growth despite the risks of higher prices.

Then the pandemic hit.

Inflation sank and the Fed slashed rates to sustain the economy during lockdowns.

When Trump celebrates historically low mortgage rates, he's doing so because the economy was weakened by the pandemic. Similarly, gasoline prices fell below an average of $2 a gallon because no one was driving in April 2020 as the pandemic spread.

FEWER JOBS

The United States lost 2.7 million jobs during Trump's presidency, according to the Bureau of Labor Statistics. If the pandemic months are excluded, he added 6.7 million jobs.

By contrast, 15.4 million jobs were added during Biden's presidency. That's 5.1 million more jobs than what the CBO forecasted he would add before his coronavirus relief and other policies became law—a sign of how much he boosted the labor market.

Both candidates have repeatedly promised to bring back factory jobs. Between 2017 and the middle of 2019, Trump added 461,000 manufacturing jobs. But the gains began to stall and then turned into layoffs during the pandemic, with the Republican posting a loss of 178,000 jobs.

So far, the U.S. economy has added 773,000 manufacturing jobs during Biden's presidency.

Campaign Action

22 notes

·

View notes

Text

Mike Luckovich

* * * *

LETTERS FROM AN AMERICAN

November 15, 2024

Heather Cox Richardson

Nov 16, 2024

Three years ago today, President Joe Biden signed into law the Infrastructure Investment and Jobs Act, more popularly known as the Bipartisan Infrastructure Act. That law called for approximately $1.2 trillion in spending, about $550 billion newly authorized spending on top of regular expenditures. As Biden noted today, it was “the largest investment in our nation’s infrastructure in a generation.”

In the past three years, the Biden administration launched more than 66,000 projects across the country, repairing 196,000 miles of roads and 11,400 bridges, as well as replacing 367,000 lead pipes and modernizing ports and airports. Today the administration announced an additional $1.5 billion in funding for railroads along the Northeast Corridor, which carries five times more passengers a day than all the flights between Washington, D.C., and New York City.

In his first term, Trump had promised a bill to address the country’s long-neglected infrastructure, but his inability to get that done made “infrastructure week” a joke. Biden got a major bill passed, but while the administration nicknamed the law the “Big Deal,” Biden got very little credit for it politically. Republicans who had voted against the measure took credit for the projects it funded, and voters seemed not to factor in the jobs and improvements it brought when they went to the polls last week.

This lack of credit has implications beyond the Biden administration. As economist Mark Zandi told Joel Rose of NPR, “We need better infrastructure. We should continue to invest. But that's going to be hard to do politically because lawmakers are seeing what's happening here and they’re not getting credit for it.”

Meanwhile, President-elect Trump has been rapidly naming people he intends to nominate for his cabinet, and it is not going well. As Brian Tyler Cohen wrote on Bluesky: “The same people who’ve spent the last several years decrying ‘unqualified DEI hires’ are now shoehorning through Cabinet nominations who can’t even pass a basic background test.”

Cohen was not joking; Evan Perez, Zachary Cohen, Holmes Lybrand, and Kristen Holmes of CNN reported today that Trump’s transition team is skipping background checks by the Federal Bureau of Investigation, claiming that they are slow and intrusive.

But that lack of background checks has already mired Trump’s picks in controversy.

Trump has said he would nominate Pete Hegseth, an Army National Guard veteran and co-host on the weekend edition of Fox & Friends, to become the secretary of defense. Since that announcement, news has broken that a fellow service member who was the unit’s security guard and on an anti-terrorism team flagged Hegseth to their unit’s leadership because one of his tattoos is used by white supremacists. Extremist tattoos are prohibited by army regulations.

News broke today that a woman accused Hegseth of sexually assaulting her after a Republican conference in Monterey, California, in 2017. According to Michael Kranish, Josh Dawsey, Jonathan O’Connell, Dan Lamothe, and John Hudson of the Washington Post, the woman who made the allegation said the alleged victim had signed a nondisclosure agreement with Hegseth.

Now the transition team fears more revelations. “There’s a lot of frustration around this,” a member of the transition team told the Washington Post reporters. “He hadn’t been properly vetted.”

Causing even more headaches today for the transition team was Trump’s appointment of former Florida representative Matt Gaetz to become the United States attorney general. Immediately after Trump said he would nominate Gaetz, the representative resigned his congressional seat, forestalling the release of a House Ethics Committee report concerning allegations of drug use and that Gaetz had taken a minor across state lines for sex.

It is reported that the victim, who was a seventeen-year-old high-schooler at the time, testified before the committee.

After spending an evening with Trump at Mar-a-Lago, House speaker Mike Johnson (R-LA) said that publishing the report would be “terrible” and that he would “strongly request that the Ethics Committee not issue the report because that’s not the way we do things in the House.”

This, despite the fact that, as historian Kevin Kruse noted, “[f]or years now, the right has been accusing Democrats of running a shadowy conspiracy to protect politicians who are sex predators.” And, in fact, the House Ethics Committee did release a report on Representative William Boner (D-TN) in 1987 for allegations of corruption after he had already resigned the office to become mayor of Nashville.

And then there is Trump’s tapping of former Hawaii representative Tulsi Gabbard to be director of national intelligence (DNI). Gabbard’s ties to America’s adversaries, including Russia’s president Vladimir Putin and Syrian president Bashar al-Assad, have raised serious questions about her loyalty. Making her the country’s DNI would almost certainly collapse ongoing U.S. participation in the Five Eyes intelligence alliance in which the U.S., the U.K., Canada, Australia, and New Zealand have shared intelligence since World War II.

As former Illinois representative Joe Walsh wrote: “Donald Trump just picked someone to oversee our intelligence who, herself, couldn’t pass a security clearance check. She couldn’t get security clearance. She couldn’t get a job in our intelligence community. Because she’s too compromised by Russia. Yet Trump picked her to run the whole thing.”

Trump appears eager to demonstrate his control of Republicans in the Senate by ramming through appointments that will collapse the rule of law at home (Gaetz) and the international rules-based order globally (Hegseth and Gabbard). When Texas senator John Cornyn said he would like to see the Gaetz report, Trump loyalist Steve Bannon said: “You either get with the program, brother, or you're going to finish third in your primary.” A member of Trump’s transition team said that Trump wants to bend Republican senators to his will “until they snap in half.”

Despite the fact the Republicans will hold a majority in the Senate when Trump takes office, Trump’s picks are so deeply flawed and dangerous that Trump and his team knew they would not get confirmed. So they demanded that Republicans in the Senate give up their constitutional power of advising the president on high-level appointments and consenting to his picks: the “advice and consent” requirement of the Constitution.

Trump demanded that the Senate recess in order for him to push through his choices as recess appointments. Even the right-wing Wall Street Journal editorial board came out against this scheme, calling it “anti-constitutional” and noting that it would “eliminate one of the basic checks on power that the Founders built into the American system of government.”

Now, in order to bring senators to heel, the Trump team is threatening to start its own super PAC to undermine the existing Senate Leadership Fund, whose leaders they insist are not loyal enough to Trump. A person close to Trump said that Senate Republican leaders “should reflect current leadership and the future, not the past.” “It doesn’t make sense,” one Republican operative told Politico’s Natalie Allison, Ally Mutnick, and Adam Wren. “Trump just had this massive win and now they are bringing in this Never Trumper.”

But for all the spin, the political calculation for Republican senators is not as clear as the Trump team is trying to project. At 78, Trump is not exactly the face of the party’s future. Nor did he deliver a “massive win.” He won less than 50% of the popular vote with many voters apparently unaware of his policies, and while the Republicans did retake the Senate majority, they did so with very little help—financial or otherwise—from him. Republicans will have as bad a map in the 2026 midterm elections as the Democrats had in 2024, and Trump’s voters tend to be loyal to him and no one else, generally not turning out in midterms.

It is also possible that, aside from political calculations, enough Senate Republicans take seriously their oaths to “support and defend the Constitution of the United States” as well as the Senate’s role in the constitutional system of checks and balances that they will judge Trump’s antics with that in mind.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

8 notes

·

View notes

Text

For starters, CPI excludes several significant costs faced by households today - ranging from property taxes to soaring interest payments.

While price levels remain notably higher than before the pandemic, according to the CPI, inflation has slowed - reaching a 2.4% increase for the year ending in September. That's only part of the picture, Bloomberg reports.

"The CPI is capturing the goods and services that you purchased for consumption, but there are things that affect your cost of living that are outside of that," explains Steve Reed, a BLS economist. For instance, interest charges on rising consumer debt are largely absent from the CPI. Roughly $628 billion in revolving credit card debt now bears an average interest rate of about 22%, yet these costs aren’t reflected in consumer inflation data.

"It’s one thing that’s definitely impacting the way people spend money," said Pete Earle, economist at the American Institute for Economic Research and creator of the everyday price index that aims to track daily purchases that can’t be easily avoided. "It’s not really inflation, but it’s definitely something that should be taken into account."

Another gap in the CPI is its exclusion of property-related expenses. While it measures the cost of personal property insurance, it overlooks the cost of insuring the physical home - a critical oversight as climate-related risks drive premiums higher. According to Bloomberg analyst Andrew John Stevenson, omitting this from the CPI means that rising insurance premiums are only partially reflected in the overall inflation data.

The CPI’s "basket" also leaves out several items that have become significant in Americans’ budgets, including restaurant tips. Similarly, legal but selectively regulated goods, such as marijuana in some states, and gambling expenses remain unaccounted for. This reality adds to the perception that official inflation metrics don’t fully capture the true cost of living for many Americans.

The BLS admits that CPI falls short, writing on its website: "The CPI does not necessarily measure your own experience with price change," adding "A national average reflects millions of individual price experiences; it seldom mirrors a particular consumer’s experience."

The pricing challenges aren’t unique to the CPI. For example, the personal consumption expenditures price index, produced by the Bureau of Economic Analysis, also has some quirks when it comes to measuring certain expenses like health care. While the Fed prefers the PCE gauge, White House economists say that the CPI tends to more closely track consumers’ actual out-of-pocket spending. -Bloomberg

While inflation may appear to be abating on paper, Americans' financial reality is more complex - influenced by costs that extend beyond the basket of goods traditionally tracked by federal data.

4 notes

·

View notes

Quote

In other words, national credit reports are foundational to modern American society, binding us to one another financially as a nation through a network of computerized records. And that national market of identity is relatively new. Until 1970, credit reporting was localized, mostly through coops of town bankers who hired detectives to investigate borrowers, collecting gossip from snitches about who drank too much, who was a Communist, who slept around, and so forth.

Inside FICO and the Credit Bureau Cartel

9 notes

·

View notes

Text

Chris Geidner at Law Dork:

Just before the close of business Tuesday, items appeared on two court dockets with which Law Dork readers are all too familiar that showed how far removed reality is from the ideal of “equal justice under law” engraved above the U.S. Supreme Court’s doors.

The items show — in shocking if predictable contrast — that the U.S. Court of Appeals for the Fifth Circuit is continuing to aggressively and explicitly encourage and protect forum-shopping for the right while federal courts in Alabama are continuing to aggressively investigate judicial concerns about alleged forum-shopping in LGBTQ civil rights litigation. First on Tuesday, two Trump appointees issued a ruling ordering, yet again, that a conservative ideological challenge to a Biden administration rule must remain within their ultraconservative circuit. Moments later, LGBTQ civil rights lawyers filed a notice that they had complied with the invasive order from another Trump appointee that he be allowed to review a document that they maintain is protected by attorney-client privilege as part of a two-year judge-shopping investigation. This issue is not new — I wrote about this issue more generally on June 10 — but Tuesday’s news developments are particularly stark examples of the differences in result that are the consequences of these differences in treatment.

Heads, the Chamber wins

For conservative forces — here, the Chamber of Commerce fighting the Consumer Financial Protection Bureau’s credit card late fee rule — Judges Don Willett of the U.S. Court of Appeals for the Fifth Circuit has twice issued writs of mandamus to stop U.S. District Judge Mark Pittman, a fellow Trump appointee, from transferring the challenge to the federal court in D.C. Pittman, after the first go-round, harshly criticized the “landmines” laid by the Fifth Circuit. In Tuesday’s order, Willett’s libertarianism was supported by Judge Kyle Duncan’s Christian nationalism to … protect business interests. [...]

Tails, LGBTQ civil rights lawyers lose

A little more than a 10-hour drive across the South away — across Texas, Louisiana, and Mississippi and up Alabama — lawyers submitted a document to U.S. District Judge Liles Burke that they insist is protected by attorney-client privilege but that he has now twice ordered the LGBTQ civil rights lawyers to turn over more than two years into a judge-shopping investigation. Burke himself prompted the investigation by questioning in a court order whether parties’ dismissal of two cases challenging the state’s new ban on gender-affirming care for minors and lawyers’ discussion that another challenge would be brought constituted judge-shopping.

Chris Geidner writes in Law Dork how right-wing interests get deferential treatment in various courts, especially the 5th Circuit Court.

#SCOTUS#Courts#US Chamber of Commerce#5th Circuit Court#Boe v. Marshall#Liles Burke#Don Willett#Mark Pittman#Kyle Duncan

6 notes

·

View notes

Text

3. The Absolute Dollar.

Paper money, in every form with which we have been familiar with it, has ever been professedly based on coin. Even the greenback was a “promise to pay,” and thus gives color to the claim of the resumptionist that the honor of the nation is at stake till that promise be fulfilled. But the discussion has long since passed out of the limited arena of constitutional requirements, or even the intentions of a preceding generation. The question is not one of interpretation, but one of justice, and the general recognition of this point would relieve the discussion of much that is irrelevant.

Paper money is a necessity; this is not denied. But heretofore paper has but served the purpose of supplementing the inadequate supply of the metals and been made subservient to them. Based upon coin, its value as a medium of exchange depended upon the fluctuating value of an ever-shifting commodity, liable to be withdrawn when its presence was most needed. From 1809 to 1849, gold advanced in value fully 145 per centum; then under the stimulus of Californian and Australian mining, and its demonetization by Germany, fell till within recent years.

Absolute money differs from the greenback in not being convertible into any bond whatever; instead of being a promise to pay, it is a promise to receive for custom dues and taxes. Congress has definitely fixed the length of the yard and the size of the bushel, but the value of money has been left an uncertain quantity; it has delegated its right to emit the current money of the people to private monopolies, and refused to “regulate the power thereof.”

At the period of our greatest prosperity the annual increase of the wealth of the nation has been but about three per centum, while at the present time we have the authority of the Chief of the Bureau of Statistics, at Washington, for placing it, “ perhaps as low as two per cent.” The editor of the Irish World to whom this statement was communicated, (and one of the very ablest advocates of currency reform), believes that for years even this estimate has been too high, and that it will not much exceed one per centum. There can be no permanent prosperity as long as the people are forced to pay an oppressive tax not warranted by the circumstances, and every cent extorted from the people above the rate of annual increase of wealth is an usurious tax, that silently, but surely absorbs the profits of productive enterprise, lowers wages, and lessens production.

Interest diverts the fruits of labor from the unrequited producers to the monopolizers of the means of labor, reduces the workingman to economic subjection to a speculative class, and perpetuates the monarchical principle of the centralization of wealth in the hands of a few. Carrying with it, on the one hand, the inevitable degradation of the mass by the permanent institution of a pauper class, the consequent perpetuation of misery and crime, with the enforced sacrifice of social progress to private greed; and, on the other hand, cursing the holders of capital, by hardening the heart, deadening the conscience, blunting the sensibilities and deforming the moral nature. Individually robbing man of his ability to exercise his normal functions as a social unit, and socially disintegrating the bonds without which the social organism falls into decay by the introduction of the anarchical and destructive offshoots of individualism, greed, rapacity and avarice. Until the power of usury to absorb profits is destroyed the economic freedom of the proletariat will remain but the substance of things hoped for, and only under a just monetary system can association and cooperation secure such a desired result.

Let the government issue these paper money-tokens to the people through their state, county and municipal authorities at the same rate as bills are now furnished the banks, one per centum, sufficient to cover expenses. Secured by the national credit, they would present an unchangeable measure of values, unlike gold, “fixed as the sun.” While under our financial system there is no legal guard against checks and drafts being limited only by the demand and the demand subject to the wildest speculation under governmental control, this would no longer be left to hazard. “It is far more dangerous to grant Congress the power to issue an unlimited amount of bonds than to authorize it to issue more money upon the report of a Board of Commissioners, based upon carefully gathered statistics and well prepared tables, showing the progressive ratio for the increase of the absolute money required by the extent of trade, bills of exchange, money of account, commerce, and the annual products.” (Hill.)

Our foreign exchange is not regulated by coin exportations but by product exportation. Exports balance imports, but the balance, if against us, is not paid in money, but the commodity, gold. It is taken at its weight, as bullion, not as money, and, whatever our currency, we would continue to settle foreign balances as in the past, with products. If we do not export enough of the products of our fields or workshops to pay for what we get, we must either reduce our luxurious imports correspondently to balance the account or give the products of our mines. Hence our money tokens, while serving as a fixed measure of value at home, would release our subjection to the financial condition of things abroad; instead, however, of being worthless abroad, their unquestionable security would render them as exchangeable there as our bonds are now, or Bank of England notes.

Such in brief are the three great divisions of Currency Reform. The first class, really conservative, alarmed by the rapid growth of an American plutocracy, by which they are crowded from the ranks of the monied aristocracy, and excluded from a share in the spoils, loudly demand the restoration of silver, not so much in the interest of justice as “to restore the ancient order of things.” It is essentially a reform in the relations of the aristocracy to each other.

The second class, more thorough and constructive in their methods, fully emancipated from the worship of the golden calf, still stumble over the rock of usury. Proposing no measure that will relieve industry from the constant drain made upon it, they seek only a readjustment of the distribution of the spoils of labor. If the first class may be compared to an absolute monarchy with a limited peerage, this class may be likened to a constitutional monarchy with its great and powerful middle class to direct affairs and be represented in parliament. Consequently the success of the 3.65 bond scheme with traders, it being essentially a movement for the relief of middle men from the “depression of trade,” and so indirectly only benefitting the working classes.

In the third division we strike the hard pan of absolute justice and take the first step toward the inauguration of a cooperative government, placing the social ban upon the false and anarchical theory of political economy that regards labor as a commodity to be sold, and capital, the child of labor, its master and tyrant.

Capital can never accrue save through social cooperation; being, therefore, a social product, it must have a social destination. This is one of the fundamental laws of the social organism; to ignore it is social disintegration and anarchy. The system of absolute money is the only system of finance wherein distribution is not subordinated to production, wherein social rather than class interests are paramount, and it can alone restore these social laws to their normal functions.

#currency#economics#money#capitalism#anti capitalism#history#anarchism#anarchy#anarchist society#practical anarchy#practical anarchism#resistance#autonomy#revolution#communism#anti capitalist#late stage capitalism#daily posts#libraries#leftism#social issues#anarchy works#anarchist library#survival#freedom

2 notes

·

View notes

Text

The Harris Public Lands Policy - What We Might Expect

By and large, the track record of the Biden-Harris contrasts with the Trump administration record and the 2025 Project outline as it relates to public lands. For decades, the federal government has prioritized oil and gas drilling, hardrock mining and livestock grazing on public lands across the country (for that reason, some have referred to the BLM as the Bureau of Logging and Mining). The Biden administration recently issued a far-reaching Interior Department rule that puts conservation, recreation and renewable energy development on equal footing with resource extraction.

This represents a huge shift in the management of roughly 245 million acres of public property — about one-tenth of the nation’s land mass. The extent to which this change will withstand the inevitable legal challenges from fossil fuel industry groups and Republican officials is unclear. It will be intensely contested.

It does open the door for the BLM to auction off “restoration leases” and “mitigation leases” to entities with plans to restore or conserve public lands.

The Biden administration has conserved more than 41 million acres of land and water. This includes restoration of some of the National Monuments reduced under the Trump administration (Bears Ears, Grand Staircase-Escalante, and Northeast Canyons and Seamounts National Monuments). He also cancelled the leases granted by the Trump administration to explore for oil in the Arctic National Wildlife Reserve.

Biden also established a national goal to conserve at least 30 percent of U.S. lands and freshwater and 30 percent of U.S. ocean areas by 2030, in an initiative commonly referred to as 30x30. This is an ambitious initiative that has received significant pushback as a government 'land grab'.

Although Biden has disappointed some in the environmental movement, the Biden-Harris administration has acknowledged that climate change is real and requires action, has significant achievements in land and water conservation, and has undone a number of the Trump administration decisions.

Whether Harris would continue this trend is likely but not a certainty. However, in her campaign speeches she has been pragmatic but aggressive in her support for the environment and careful stewardship of natural resources. And Walz has promoted a $2B initiative to help the State of Minnesota reduce its carbon footprint.

Although the Trump administration does have to its credit the Great American Outdoors Act (GAOA), the legacy of Trump is one that should be of concern to most of us who love the PCT, the wilderness, and are concerned about our climate. In looking at the record of both candidates, it seems clear based upon their respective records and stated plans, that it is very important that you get out and vote . . . and consider carefully the Trump and the Harris commitment to caring for the planet and how they fit with your values.

It is imperative that those of us who use and love the land, make our voices heard by voting!

3 notes

·

View notes