#free infograhics

Explore tagged Tumblr posts

Video

youtube

How to create Infographics using Canva, How to Design Infographics in Canva

#youtube#canva#canva tutorial#canva tips#canva deisgn#tutorial#infographics#graphic design#learn canva#free infograhics#infographics maker#free graphic design online#learn design

0 notes

Text

Rise of Freelance Workforce

Rise of Freelancing

There is a rise of the freelance workforce as more people desire to live comfortably by working remotely. More freelancers are working from home to spend time with their families.

In addition, the workforce is changing as more people leaving the security of an 8-to-5 job for the flexibility of freelancing. They can spend more time with their family. They don’t need to go out to commute and get stuck in the traffic. Instead of spending time commuting, they can be productive working from home.

Free Freelancing Courses and Resources

There are a lot of ways in which one can start freelancing. With the time and resources available right now, one can definitely learn how to become a freelance workforce. Here are some free learning tools you can start with:

Udemy – Udemy is a paid online course site but they also offer free courses like Using a Photographic Light Meter, Use Crowdfunding Effectively With Indiegogo and Kickstarter, and Learn How To Build A Corporate Website Using Joomla! 2.5.

Harvard University – Harvard opened some of their online courses and made it available to the public. There are online courses on web programming, game development, and mobile app development.

There are also a lot of video resources available on YouTube and Vimeo.

Free Freelancing Tools

Aside from free courses and resources, one can also be acquainted with different freelancing tools. It is important to note that freelancing is still work. Thus, one needs to have a skill he can provide services with to different clients and brands around the world. Data entry tasks and other administrative assistance have a lot of competition. Most importantly, newbies in the freelance world need to be equipped with freelancing skills and tools. Here are examples of freelancing apps and sites you can start with.

Infograhic Sites:

Video Editing Sites:

Lead Generation Sites

Canva

Venngage

Piktochart

Easel.ly

VISME

Infogram

Visualize.me

Snappa

Animaker

BeFunky

Biteable

Mind the Graph

Clipchamp

Online Video Cutter

WeVideo

Wideo

Powtoon

Video Toolbox

Kizoa

Hippo Video

Magisto

Kapwing

In the rise of freelancing industry in the Philippines and around the world, it is important to be competitive and relevant. One can do this by having a specialized skill, providing proof through different portfolios and sending personalized applications geared to give solutions to businesses spotted in each job post description.

1 note

·

View note

Text

Experiment Infographics

Download free presentation template with Experiment Infograhics. This presentation template is useful in drafting creative slides to convey information in effective manner. This template comes with editable layouts, text boxes and color scheme. Features of this presentation template Comes with one slide and infographic design The Slide is Flexible, Clean, Simple & Creative The aspect ratio is…

View On WordPress

0 notes

Text

Ignoring tax issues big mistake

Ignoring tax issues before the deal is struck is a big mistake

Many business owners put tax issues on the “back burner” when selling their companies. Ignoring tax considerations, until after the deal is struck, is a big mistake and can put you in an adverse negotiating position, even if the letter of intent (LOI) or term sheet (TS) is “nonbinding.” Sellers should not agree on any aspects of a deal until they meet with a competent tax adviser who can explain how much they will wind up with on an “after-tax” basis. Seven major tax questions should be considered before finalizing a deal. What type of entity do you use to conduct your business? Is your business is a sole proprietorship, partnership, limited liability company (“LLC”) or S corporation? These corporate structures are considered “pass-through” entities and will provide you with the most flexibility in negotiating the sale of your business. Your flexibility may be limited, however, if you conduct your business through a C corporation. The possibility of “double taxation” may arise at the corporate and shareholder levels. Is a tax-free/deferred deal possible? Most sales of businesses are completed in the form of taxable transactions. However, it may be possible to complete a transaction on a “tax-free/deferred” basis, if you exchange S corporation or C corporation stock for the corporate stock of the buyer. This assumes that the complicated tax-free reorganization provisions of the Internal Revenue Code are met. Are you selling assets or stock? It is important to know whether your deal is or can be structured as an asset or stock sale prior to agreeing to the price, terms and conditions of the transaction. In general, buyers prefer purchasing assets because (i) they can obtain a “step-up” in the basis of the assets resulting in enhanced future tax deductions, and (ii) there is little or no risk that they will assume any unknown seller liabilities. Sellers, on the other hand, wish to sell stock to obtain long-term capital gain tax treatment on the sale. A seller holding stock in a C corporation (or an S corporation subject to the 10-year, built-in gains tax rules) may be forced to sell stock because an asset sale would be subjected to a double tax at the corporate and shareholder levels. In addition, the seller is often required to give extensive representations and warranties to the buyer and to indemnify the buyer for liabilities that are not expressly assumed. How will you allocate the purchase price? When selling business assets, it is critical that sellers and buyers reach agreement on the allocation of the total purchase price to the specific assets acquired. Both buyer and seller file an IRS Form 8594 to memorialize their agreed allocation. When considering the purchase price allocation, you need to determine if you operate your business on a cash or accrual basis; then separate the assets into their various asset classes, such as: cash, accounts receivable, inventory, equipment, real property, intellectual property and other intangibles. Can earn-outs/contingency payments work for you? When a buyer and seller cannot agree on a specific purchase price, the seller and buyer may agree to an “earn-out” sale structure, and/or contingent payments. The buyer pays the seller an amount upfront and additional earn-outs or contingent payments if certain milestones are met in later years. What state and local tax issues are you facing? In addition to federal income tax, a significant state and local income tax burden may be imposed on the seller as a result of the transaction. When an asset sale is involved, taxes may be owed in those states where the company has sales, assets, or payroll, and where it has apportioned income in the past. Many states do not provide for any long-term capital gain tax rates, so a sale that qualifies for long-term capital gain taxation for federal purposes may be subject to ordinary income state rates. Stock sales are generally taxed in the seller’s state of residency even if the company conducts business in other states. Also, state sales and use taxes must be considered in any transaction. Stock transactions are usually not subject to sales, use or transfer taxes, but some states impose a stamp tax on the transfer of stock. Asset sales, on the other hand, need to be carefully analyzed to determine whether sales or use tax might apply. Should presale estate planning be considered? If one of your goals is to move a portion of the value of the business to future generations or charities, estate planning should be done at an early stage, when your company values are low (at least six months in advance of verbal negotiations and/or receipt of a TS or LOI). It may be much more difficult and expensive to simply sell the company and then attempt to move after- tax proceeds from the sale to the children, grandchildren or charities at a later date. Conclusion: Before deciding to sell your business, work with a qualified tax adviser who can help you understand the tax complexities of various sales structures. Above all, do not enter into any substantive negotiations with a buyer until you have identified the transaction structure that best minimizes your tax burden.

Gary Miller CEO. GEM Strategy Management 970.390.4441 [email protected] gemstrategymanagement.com), Learn More … Key Words Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video, film, near me, the Best, production, online, magazine, strategy, digital, marketing, blogging, social media, funnel, Brand, Content Management System, logistics, Lean, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, Advanced, Agile, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma Read the full article

#ActionableAnalytics#Advanced#Agile#Altek#AltekMediaGroup#ArtificialIntelligence#AugmentedReality#Automation#benchmarking#BigData#BlockChain#Blogging#Brand#Business#CEO#Chatbots#ContentManagementSystem#DataMining#digital#exitplanning#facebook#film#flexable#Funnel#google#Industry4.0#infograhics#Insights#instagram#Kaizen

1 note

·

View note

Text

10 Digital Marketing Strategies for Business Expansion in 2019

With the rapidly changing digital marketing landscape, there comes the scope of new strategies or trend to cope up with the competition. But you don’t need to bind every new strategy to have an effective digital presence and engage with your targeted audience.

Here are 10 digital marketing strategies to engage new audiences to your business-

1) Blogging

Informative and quality content is a key for any website to get higher ranking on the search engines, which ultimately results in high traffic to your website.

2) Start with Podcasts

Make a direct connection with your traffic through audio and video podcasts to build trust and make your audiences engaged with you.

3) Build a presence on social media

Social Media is the most grounded stage to stamp your online presence. Today, different platforms offer various devices and additional items for your help. Use them to their maximum capacity and the expectations are that the impact will increment in the up and coming months.

4) Webinar

A Webinar is a virtual online conference to present a relevant and engaging topic in a seminar-style conference. It shows the authority and trust towards your brand and the level of expertise you hold in your particular field.

5) Video Marketing

Video showcasing has turned out to be the best trend in 2018 and it is foreseen to proceed in 2019. An expertly influenced video can be a useful source of expanding organic traffic to your site through YouTube and video add-ons of other platforms.

6) Free Downloads

Offering free downloads of digital books or aides can likewise be useful to expand natural traffic. It will likewise make mindfulness about your mastery and will be a source to accumulate email addresses for further promoting.

7) Case Study and Infograhics

Building proofs of the customers you are referencing on your site help to expand authenticity. Hence, Case Studies are an extraordinary source for the sole reason. Post contextual analyses of how you helped different renowned customers. Infographics are additionally very famous these days as they give applicable and adequate data in a fun way with less reading material.

8) Review Responses

To survey and address negative reactions are important. Nothing can be more harming for you to overlook a negative audit. The clients are very much aware of their rights and responsibility and an inadequately taken care of the surveys can destruct the whole marketing strategy.

9) Mobile-friendly websites

Most of the web perusing is currently done through cell phones. The search engines are additionally inclining toward mobile compatible devices for positioning.

10) Activities held on various social media platforms

This is the time of client commitment and clients would prefer not to have an inactive presence. Rather, they need to effectively associate with your brand. In this way, consider different surveys, studies and quests for audience involvement.

By implementing these 10 digital marketing strategies religiously you can

Pranamya Digital has a specialized team of digital marketing and offers best digital marketing services which will help you gain an online presence and ultimately in more conversion rate.

Pranamya Digital offers services such as Search Engine Optimization (SEO), Social Media Marketing, Paid Advertisements, Email marketing, eCommerce Marketing, Link Building and Design And Development.

0 notes

Text

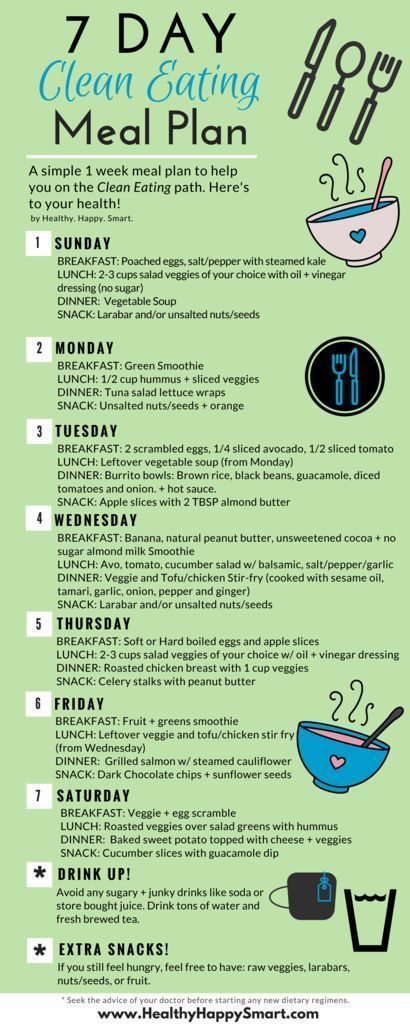

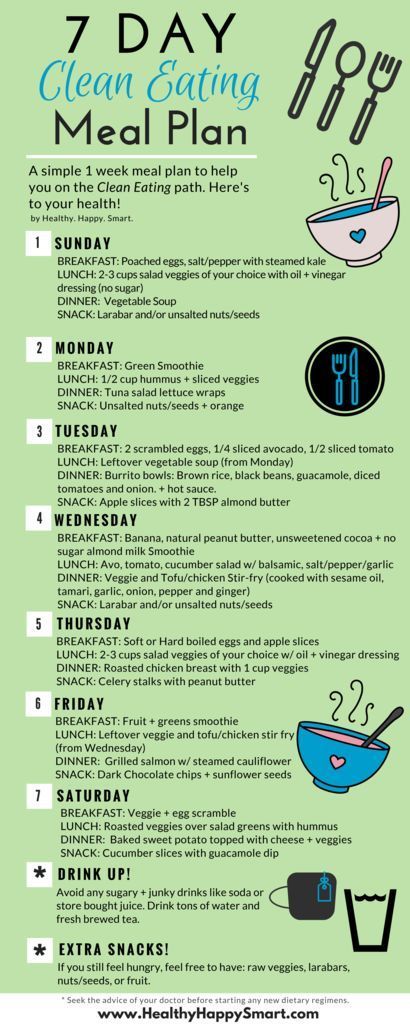

7 day FREE clean eating meal plan - 1 week plan for anyone trying to eat clean. ...

7 day FREE clean eating meal plan – 1 week plan for anyone trying to eat clean. …

7 day FREE clean eating meal plan – 1 week plan for anyone trying to eat clean. Free PDF infograhic. ähnliche tolle Projekte und Ideen wie im Bild vorgestellt findest du auch in unserem Magazin . Wir freuen uns auf deinen Besuch. Liebe Grüße

Source

View On WordPress

#24 hour fitness#exercise#exercise equipment#family fitness#fitness#fitness equipment#gym#gym workout#health#health & fitness#la fitness#life fitness#nutrition#women fitness

0 notes

Text

Rise of Freelance Workforce

Rise of Freelancing

There is a rise of the freelance workforce as more people desire to live comfortably by working remotely. More freelancers are working from home to spend time with their families.

In addition, the workforce is changing as more people leaving the security of an 8-to-5 job for the flexibility of freelancing. They can spend more time with their family. They don’t need to go out to commute and get stuck in the traffic. Instead of spending time commuting, they can be productive working from home.

Furthermore, people swap their corporate job to freelancing. According to CNBC, “There are now 57 million Americans in the freelance economy, up from 53 million in 2014.” To add, “freelancers doing skilled services earn a median rate of $28 an hour, earning more per hour than 70% of workers in the overall U.S. economy.” Also, “51% of freelancers say no amount of money would entice them to take a traditional job.”

Meanwhile, Rappler reported that there are more than 1.5 million freelancers in the Philippines and “by 2020, almost one in 5 workers will be a freelancer or contract workers, according to a 2012 global study done by Big 5 auditing firm Ernst & Young.” With the recent COVID-19 pandemic more people had shifted to finding possible income through remote working.

Free Freelancing Courses and Resources

There are a lot of ways in which one can start freelancing. With the time and resources available right now, one can definitely learn how to become a freelance workforce. Here are some free learning tools you can start with:

Udemy – Udemy is a paid online course site but they also offer free courses like Using a Photographic Light Meter, Use Crowdfunding Effectively With Indiegogo and Kickstarter, and Learn How To Build A Corporate Website Using Joomla! 2.5.

Harvard University – Harvard opened some of their online courses and made it available to the public. There are online courses on web programming, game development, and mobile app development.

There are also a lot of video resources available on YouTube and Vimeo.

Free Freelancing Tools

Aside from free courses and resources, one can also be acquainted with different freelancing tools. It is important to note that freelancing is still work. Thus, one needs to have a skill he can provide services with to different clients and brands around the world. Data entry tasks and other administrative assistance have a lot of competition. Most importantly, newbies in the freelance world need to be equipped with freelancing skills and tools. Here are examples of freelancing apps and sites you can start with.

Infograhic Sites

Video Editing Sites

Lead Generation Sites

Read more on: https://www.fvaconsultancy.com/

0 notes

Text

Rise of Freelance Workforce

Rise of Freelancing

There is a rise of the freelance workforce as more people desire to live comfortably by working remotely. More freelancers are working from home to spend time with their families.

In addition, the workforce is changing as more people leaving the security of an 8-to-5 job for the flexibility of freelancing. They can spend more time with their family. They don’t need to go out to commute and get stuck in the traffic. Instead of spending time commuting, they can be productive working from home.

Furthermore, people swap their corporate job to freelancing. According to CNBC, “There are now 57 million Americans in the freelance economy, up from 53 million in 2014.” To add, “freelancers doing skilled services earn a median rate of $28 an hour, earning more per hour than 70% of workers in the overall U.S. economy.” Also, “51% of freelancers say no amount of money would entice them to take a traditional job.”

Meanwhile, Rappler reported that there are more than 1.5 million freelancers in the Philippines and “by 2020, almost one in 5 workers will be a freelancer or contract workers, according to a 2012 global study done by Big 5 auditing firm Ernst & Young.” With the recent COVID-19 pandemic more people had shifted to finding possible income through remote working.

Free Freelancing Courses and Resources

There are a lot of ways in which one can start freelancing. With the time and resources available right now, one can definitely learn how to become a freelance workforce. Here are some free learning tools you can start with:

Udemy – Udemy is a paid online course site but they also offer free courses like Using a Photographic Light Meter, Use Crowdfunding Effectively With Indiegogo and Kickstarter, and Learn How To Build A Corporate Website Using Joomla! 2.5.

Harvard University – Harvard opened some of their online courses and made it available to the public. There are online courses on web programming, game development, and mobile app development.

There are also a lot of video resources available on YouTube and Vimeo.

Free Freelancing Tools

Aside from free courses and resources, one can also be acquainted with different freelancing tools. It is important to note that freelancing is still work. Thus, one needs to have a skill he can provide services with to different clients and brands around the world. Data entry tasks and other administrative assistance have a lot of competition. Most importantly, newbies in the freelance world need to be equipped with freelancing skills and tools. Here are examples of freelancing apps and sites you can start with.

Infograhic Sites:

Video Editing Sites:

Lead Generation Sites

Canva

Venngage

Piktochart

Easel.ly

VISME

Infogram

Visualize.me

Snappa

Animaker

BeFunky

Biteable

Mind the Graph

Clipchamp

Online Video Cutter

WeVideo

Wideo

Powtoon

Video Toolbox

Kizoa

Hippo Video

Magisto

Kapwing

In the rise of freelancing industry in the Philippines and around the world, it is important to be competitive and relevant. One can do this by having a specialized skill, providing proof through different portfolios and sending personalized applications geared to give solutions to businesses spotted in each job post description.

Be the best freelancer out there! Be the one who is able to give exemplary assistance to different brands around the world, especially in these trying times.

0 notes

Text

Rise of Freelance Workforce

Rise of Freelancing

There is a rise of the freelance workforce as more people desire to live comfortably by working remotely. More freelancers are working from home to spend time with their families.

In addition, the workforce is changing as more people leaving the security of an 8-to-5 job for the flexibility of freelancing. They can spend more time with their family. They don’t need to go out to commute and get stuck in the traffic. Instead of spending time commuting, they can be productive working from home.

Furthermore, people swap their corporate job to freelancing. According to CNBC, “There are now 57 million Americans in the freelance economy, up from 53 million in 2014.” To add, “freelancers doing skilled services earn a median rate of $28 an hour, earning more per hour than 70% of workers in the overall U.S. economy.” Also, “51% of freelancers say no amount of money would entice them to take a traditional job.”

Meanwhile, Rappler reported that there are more than 1.5 million freelancers in the Philippines and “by 2020, almost one in 5 workers will be a freelancer or contract workers, according to a 2012 global study done by Big 5 auditing firm Ernst & Young.” With the recent COVID-19 pandemic more people had shifted to finding possible income through remote working.

Free Freelancing Courses and Resources

There are a lot of ways in which one can start freelancing. With the time and resources available right now, one can definitely learn how to become a freelance workforce. Here are some free learning tools you can start with:

Udemy – Udemy is a paid online course site but they also offer free courses like Using a Photographic Light Meter, Use Crowdfunding Effectively With Indiegogo and Kickstarter, and Learn How To Build A Corporate Website Using Joomla! 2.5.

Harvard University – Harvard opened some of their online courses and made it available to the public. There are online courses on web programming, game development, and mobile app development.

There are also a lot of video resources available on YouTube and Vimeo.

Free Freelancing Tools

Aside from free courses and resources, one can also be acquainted with different freelancing tools. It is important to note that freelancing is still work. Thus, one needs to have a skill he can provide services with to different clients and brands around the world. Data entry tasks and other administrative assistance have a lot of competition. Most importantly, newbies in the freelance world need to be equipped with freelancing skills and tools. Here are examples of freelancing apps and sites you can start with.

Infograhic Sites:

Video Editing Sites:

Canva

Venngage

Piktochart

Easel.ly

VISME

Infogram

Visualize.me

Snappa

Animaker

BeFunky

Biteable

Mind the Graph

2. Video Editing Sites:

Clipchamp

Online Video Cutter

WeVideo

Wideo

Powtoon

Video Toolbox

Kizoa

Hippo Video

Magisto

Kapwing

3. Lead Generation Sites

In the rise of freelancing industry in the Philippines and around the world, it is important to be competitive and relevant. One can do this by having a specialized skill, providing proof through different portfolios and sending personalized applications geared to give solutions to businesses spotted in each job post description.

Be the best freelancer out there! Be the one who is able to give exemplary assistance to different brands around the world, especially in these trying times.

Learn at FVA Academy today.

#freelancing#onlinejobs#virtualassistant#working from home#virtual assistant in the Philippines FVA Academy

0 notes

Photo

7 day FREE clean eating meal plan - 1 week plan for anyone trying to eat clean. ...

7 day FREE clean eating meal plan – 1 week plan for anyone trying to eat clean. Free PDF infograhic.

#Events, #Fitness

0 notes

Text

Colorful Pound Sterling Infograhics

Colorful Pound Sterling Infograhics

Download Free Pound Sterling Infographics PowerPoint and Google Slides Template. This template is useful for business presentation, consulting presentation and management case studies on bank and financial sectors pertaining to Pound Sterling. This is a free design to convert your data visually into an amazing presentation. With fully editable slide and 4 steps, text, and colors. Features of this…

View On WordPress

0 notes

Text

Pros & Cons of Roth IRA Conversions

If you own a traditional IRA, perhaps you have thought about converting it to a Roth IRA. Going Roth makes sense for some traditional IRA owners, but not all. Why go Roth? There is an assumption behind every Roth IRA conversion – a belief that income tax rates will be higher in future years than they are today. If you think that will happen, then you may be compelled to go Roth. After all, once you are age 59½ and have had your Roth IRA open for at least five years (five calendar years, that is), withdrawals of the earnings from your Roth IRA are exempt from federal income taxes. You can withdraw your Roth IRA contributions tax free and penalty free at any time.1,2 Additionally, you never have to make mandatory withdrawals from a Roth IRA, and if your income permits, you can make contributions to a Roth IRA as long as you live.2 For 2017, the contribution limits are $135,000 for single filers and $199,000 for joint filers, with phase-out ranges respectively starting at $120,000 and $189,000. (These numbers represent modified adjusted gross income.)2 While you may make too much to contribute to a Roth IRA, you have the option of converting a traditional IRA to a Roth. Imagine never having to draw down your IRA each year. Imagine having a reservoir of tax-free income for retirement (provided you follow Internal Revenue Service rules). Imagine the possibility of those assets passing to your heirs without being taxed. Sounds great, right? It certainly does – but the question is: can you handle the taxes that would result from a Roth conversion?1,3 Why not go Roth? Two reasons: the tax hit could be substantial, and time may not be on your side. A Roth IRA conversion is a taxable event. The I.R.S. regards it as a payout from a traditional IRA prior to that money entering a Roth IRA, and the payout represents taxable income. That taxable income stemming from the conversion could send you into a higher income tax bracket in the year when the conversion occurs.2 If you are nearing retirement age, going Roth may not be worth it. If you convert a large traditional IRA to a Roth when you are in your fifties or sixties, it could take a decade (or longer) for the IRA to recapture the dollars lost to taxes on the conversion. Model scenarios considering “what ifs” should be mapped out. In many respects, the earlier in life you convert a regular IRA to a Roth, the better. Your income should rise as you get older; you will likely finish your career in a higher tax bracket than you were in when you were first employed. Those conditions relate to a key argument for going Roth: it is better to pay taxes on IRA contributions today than on IRA withdrawals tomorrow. On the other hand, since many retirees have lower income levels than their end salaries, they may retire to a lower tax rate. That is a key argument against Roth conversion. If you aren’t sure which argument to believe, it may be reassuring to know that you can go Roth without converting your whole IRA. You could do a multi-year conversion. Is your traditional IRA sizable? You could spread the Roth conversion over two or more years. This could potentially help you avoid higher income taxes on some of the income from the conversion.2 Roth IRA conversions can no longer be recharacterized. Prior to 2018, you could file a form with your Roth IRA custodian or trustee to undo a Roth IRA conversion. The recent federal tax reforms took away that option. (Roth IRA conversions made during 2017 may still be recharacterized as late as October 15, 2018.)2 You could also choose to “have it both ways.” As no one can fully predict the future of American taxation, some people contribute to both Roth and traditional IRAs – figuring that they can be at least “half right” regardless of whether taxes increase or decrease. If you do go Roth, your heirs might receive a tax-free inheritance. Lastly, Roth IRAs can prove to be very useful estate planning tools. If I.R.S. rules are followed, Roth IRA heirs may end up with a tax-free inheritance, paid out either annually or as a lump sum. In contrast, distributions of inherited assets from a traditional IRA are routinely taxed.3

C. Brian Conners MBA, CFP – NPB Financial Group, LLC [email protected] / (949)443-0522 npbfg.com Expertise: High Net Worth Financial Planning Learn More … This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. Member FINRA, MSRB and SIPC Citations. 1 - cnbc.com/2017/07/05/three-retirement-savings-strategies-to-use-if-you-plan-to-retire-early.html 2 - marketwatch.com/story/how-the-new-tax-law-creates-a-perfect-storm-for-roth-ira-conversions-2018-03-26 3 - time.com/money/4642690/roth-ira-conversion-heirs-estate-planning/ Key Words Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video, film, near me, the Best, production, online, magazine, strategy, digital, marketing, blogging, social media, funnel, Brand, Content Management System, logistics, Lean, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, Advanced, Agile, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma Read the full article

#ActionableAnalytics#Advanced#Agile#Altek#AltekMediaGroup#ArtificialIntelligence#AugmentedReality#Automation#benchmarking#BigData#BlockChain#Blogging#Brand#Business#BusinessInsights#CEO#Chatbots#ContentManagementSystem#DataMining#digital#exitplanning#facebook#film#flexable#Funnel#google#Industry4.0#infograhics#Insights#instagram

0 notes

Text

Your Newest Employee Benefit

Your Newest Employee Benefit Student Loan Debt Repayment Assistance

Student loan reimbursement programs are a fast-growing employee benefit. Approximately 70 percent of 2016 college graduates have student loans with an average balance of $37,000.¹ The Society for Human Resource Management reports that while only about 3 percent of employers offer this benefit, interest among employers is growing rapidly. Research also shows that a student loan repayment benefit is an attractive recruitment and retention benefit. Employers can take a couple of approaches to help employees with student loan debt repayment. One approach is to offer student loan consolidation services. These services specialize in helping students refinance student loan debt into single monthly payments. Employers make the program available through the workplace and provide administrative/payroll services. Under a consolidation approach, there is not an employer contribution being made to pay down the employee’s student loan debt. More and more companies are providing student loan repayment assistance benefits. With this approach, companies are providing financial assistance to help pay down an employee’s student loan debt. Typically, the employer agrees to pay a specific amount toward an employee’s student loan debt. An important item to keep in mind is that under current IRS regulations, an employer-provided student loan debt repayment is taxable to the employee. Various forms of legislation have been proposed to make employer-provided student loan debt repayment tax-free up to certain amounts but nothing has been enacted by Congress. Below are a few companies that help employees pay off student loans: Natixis Global – Pays a $1,000 annual benefit to employees. The benefit is paid out in direct payments to the student loan servicer at $83.33 per month. Maximum benefit is $10,000 over 10 years. Nvidia – Offers up to $500 per month on student loans to a maximum of $6,000 per year, with a lifetime maximum of $30,000. Fidelity Investments – Employees can get $2,000 per year paid to their servicer for a maximum of $10,000. PricewaterhouseCooper – Employees are eligible to receive $1,200 per year paid directly to the loan servicer for up to six years ($10,000 maximum). It is important to research student loan debt repayment services available and the type of program your company would like to offer employees. As with any new benefit, there are different variations of these programs coming to market every week. Student loan debt is a high profile media topic. Employers are moving this benefit up on the priority list to differentiate themselves against their competition in the cut-throat quest to attract and retain great employees. ¹Wall Street Journal. Student Debt is about to Set Another Record, But the Picture Isn’t All Bad. May 2016. BGWA.2019.4 Jeffrey Warnock , CFP,CLU,ChFC,CPFA Vice President , Retirement Plan Consulting Burnham Gibson Wealth Advisors [email protected] 949-833-5748 Key Words Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video production, digital marketing strategy, digital, marketing, strategy, Blogging, social media, Funnel, Brand, Content, Management, System, logistics, Lean, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, kpi, Automation, Optimization, exit planning, Advanced, Agile, oem, smart, supply chain, Net Neutrality, Big, Data, Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma, Read the full article

#ActionableAnalytics#Advanced#Agile#Altek#AltekMediaGroup#ArtificialIntelligence#AugmentedReality#Automation#benchmarking#Big#BlockChain#Blogging#Brand#Business#BusinessInsights#CEO#Chatbots#content#Data#digital#digitalmarketingstrategy#exitplanning#facebook#flexable#Funnel#google#Industry4.0#infograhics#Insights#instagram

0 notes

Text

Culture Eats Strategy for Breakfast

Excessive advertising is the price companies have to pay when they lack an exceptional corporate culture. “Corporate Culture” is the distinctive fundamental character or spirit of an organization that influences the general behavior of employees. Most of us have heard the statement, “As you treat your employees, they will, in turn, treat your customers the same way.” For some companies, that should be a chilling, scary, disastrous statement. Every year I interview hundreds of employees the companies who have hired me to speak. It never ceases to amaze me how many of these employees are not truly happy, engaged, or committed to their company. It is a rare occasion that I hear statements like: “I love working here.” “My boss is so supportive.” “This is a great place to work.” “I really feel management is concerned about me.” “I feel my boss has my best interest at heart.” Managers who are always negative, don’t encourage, micromanage, not grateful, too controlling, untrustworthy, not accountable, unorganized and lack consistency will kill a company. If your corporate culture is wrong, it doesn’t matter how good your strategy is … you will fail. You will constantly be hiring new people to replace the ones who don’t like working for your company. You will continually need to add new customers to replace the ones who no longer want to do business with you. AND, for the employees who leave your company, but stay in your industry, you will have helped pay to train them for your competition. As the great business guru, Peter Drucker, once stated: “Culture eats strategy for breakfast.” Hundreds of people tour ZAPPOS, the on-line shoe and apparel retailer, every week and Zappos employees go to great lengths to show them how and what they do. They aren’t worried about competitors stealing their corporate culture. Zappos, armed with the right corporate culture, was able to grow to $1 billion in sales, in just 10 years.

Nordstrom Department Stores has one rule in their Policy Manuel for employees. Let me repeat that … they have ONLY ONE RULE: “Use your best judgement in all situations. There will be NO additional rules.” They go on to say, “Please feel free to ask your department manager, store manager, or division general manager ANY questions at ANY time.” A great corporate culture provides greater discipline than disciplinary action does. If you have a constant need for disciplinary actions to keep your employees on the straight and narrow you are either hiring wrong, training wrong and/or leading wrong. The key word in that last sentence is “YOU.” How is your corporate culture? Are employees showing up early, smiling a lot, helping each other out, volunteering, taking initiative, making suggestions, questioning policies and procedures without fear of reprisal, doing more than expected, and going the extra mile for the customer … then you are doing something SERIOUSLY RIGHT! Your bottom line can be influenced by your strategy, but your survival as a company is totally based on your corporate culture.

If you get your CULTURE right everything else will fall into place.

Robert Stevenson Seeking Excellence, Inc. 3078 Woodsong Lane • Clearwater • FL • 33761 Office: 727- 789 – 2727 Cell: (727) 421 – 7622 [email protected] robertstevenson.org Learn More … Key Words Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video production, online, online magazine, digital marketing strategy, digital, marketing, strategy, Blogging, social media, Marketing Funnel, Brand, Content Management System, logistics, Lean manufacturing, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, video, Advanced Manufacturing, Agile, lean, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma, Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video production, online, online magazine, digital marketing strategy, digital, marketing, strategy, Blogging, social media, Marketing Funnel, Brand, Content Management System, logistics, Lean manufacturing, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, video, Advanced Manufacturing, Agile, lean, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma Read the full article

#ActionableAnalytics#AdvancedManufacturing#Agile#Altek#AltekMediaGroup#ArtificialIntelligence#AugmentedReality#Automation#benchmarking#BigData#BlockChain#Blogging#Brand#Business#BusinessInsights#CEO#Chatbots#ContentManagementSystem#DataMining#digital#digitalmarketingstrategy#exitplanning#facebook#flexable#google#Industry4.0#infograhics#Insights#instagram#Kaizen

0 notes

Text

AI Benefits for Business

AI Benefits for Business- 5 ways the AI can help your business prosper

AI is heavily used by progressive businesses and many of them have started realizing the tangible benefits in terms of increased productivity/profits and reduced costs. Based on the available data and use cases, I have prepared a list of 5 major fronts where AI is proactively helping the businesses and delivering them tangible benefits and also offer the OS or open source, non commercial tools that you can use for free as they are open source (Please look for the relevant OS tool at the end of each section): Saving the employees from administrative tasks Time-consuming administrative tasks hampers productivity and hinders growth. AI can offer the precise solution as it can do the repetitive tasks rapidly and taking wise decisions Key benefits Maximum Accuracy No human weakness (laxity, negligence, lack of concentration, etc.) Performance consistency Constant evolution powered by data/instance based learning Independent decision capabilities that align best with the present needs OS Tool: http://www.dmtk.io/ More efficient marketing Equipped with strong capabilities and smart learning ability, the AI can perform complete data analysis in a fraction of the time it takes for a human being. Matching audience interests and immediate needs with your business/objectives Increases the overall positive results of audience targeting exercises Analysis of marketing exercises by competitors Identifying and forecasting current/upcoming trends for better strategies OS tool: http://www.opennn.net/ Handling customer care Chatbot is another AI-powered application that can proactively help you to free up your support staff and relieve them from unnecessary stress. Increased conversion opportunities by wise interaction with customers Retaining customers loyalty by offering prompt & relevant support round the clock Redirect the complicated queries to the human staff Serves the customers from different time zones no matter when they contact for the support OS Tool: https://rasa.com/ Business process handling The high accuracy and purpose-specific capabilities of AI enable it to efficiently tackle diverse processes like supply chain management and streamlining the workflow. Deep study to identify the weak/strong points of your business processes Inform you about the specific problem areas that need immediate attention Empowers you to utilize your resources to their maximum capabilities Increases production, productivity, and profits while minimizing the shrinkage. Quantifying performance/productivity wastage with specific parameters OS tool: http://www.cyc.com/opencyc/

And Naveen Sharma Expertise: Naveen Sharma is a visionary entrepreneur with over 2 decades of experience in Information Technology (infrastructure as well as Software & Automation) who extensively writes on latest technologies Key Words Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video production, online, online magazine, digital marketing strategy, digital, marketing, strategy, Blogging, social media, Marketing Funnel, Brand, Content Management System, logistics, Lean manufacturing, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, video, Advanced Manufacturing, Agile, lean, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma, Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video production, online, online magazine, digital marketing strategy, digital, marketing, strategy, Blogging, social media, Marketing Funnel, Brand, Content Management System, logistics, Lean manufacturing, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, video, Advanced Manufacturing, Agile, lean, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma Read the full article

#ActionableAnalytics#AdvancedManufacturing#Agile#Altek#AltekMediaGroup#ArtificialIntelligence#AugmentedReality#Automation#benchmarking#BigData#BlockChain#Blogging#Brand#Business#BusinessInsights#CEO#Chatbots#ContentManagementSystem#DataMining#digital#digitalmarketingstrategy#exitplanning#facebook#flexable#google#Industry4.0#infograhics#Insights#instagram#Kaizen

0 notes

Text

Ignoring tax issues big mistake

Ignoring tax issues before the deal is struck is a big mistake

Many business owners put tax issues on the “back burner” when selling their companies. Ignoring tax considerations, until after the deal is struck, is a big mistake and can put you in an adverse negotiating position, even if the letter of intent (LOI) or term sheet (TS) is “nonbinding.” Sellers should not agree on any aspects of a deal until they meet with a competent tax adviser who can explain how much they will wind up with on an “after-tax” basis. Seven major tax questions should be considered before finalizing a deal. What type of entity do you use to conduct your business? Is your business is a sole proprietorship, partnership, limited liability company (“LLC”) or S corporation? These corporate structures are considered “pass-through” entities and will provide you with the most flexibility in negotiating the sale of your business. Your flexibility may be limited, however, if you conduct your business through a C corporation. The possibility of “double taxation” may arise at the corporate and shareholder levels. Is a tax-free/deferred deal possible? Most sales of businesses are completed in the form of taxable transactions. However, it may be possible to complete a transaction on a “tax-free/deferred” basis, if you exchange S corporation or C corporation stock for the corporate stock of the buyer. This assumes that the complicated tax-free reorganization provisions of the Internal Revenue Code are met. Are you selling assets or stock? It is important to know whether your deal is or can be structured as an asset or stock sale prior to agreeing to the price, terms and conditions of the transaction. In general, buyers prefer purchasing assets because (i) they can obtain a “step-up” in the basis of the assets resulting in enhanced future tax deductions, and (ii) there is little or no risk that they will assume any unknown seller liabilities. Sellers, on the other hand, wish to sell stock to obtain long-term capital gain tax treatment on the sale. A seller holding stock in a C corporation (or an S corporation subject to the 10-year, built-in gains tax rules) may be forced to sell stock because an asset sale would be subjected to a double tax at the corporate and shareholder levels. In addition, the seller is often required to give extensive representations and warranties to the buyer and to indemnify the buyer for liabilities that are not expressly assumed. How will you allocate the purchase price? When selling business assets, it is critical that sellers and buyers reach agreement on the allocation of the total purchase price to the specific assets acquired. Both buyer and seller file an IRS Form 8594 to memorialize their agreed allocation. When considering the purchase price allocation, you need to determine if you operate your business on a cash or accrual basis; then separate the assets into their various asset classes, such as: cash, accounts receivable, inventory, equipment, real property, intellectual property and other intangibles. Can earn-outs/contingency payments work for you? When a buyer and seller cannot agree on a specific purchase price, the seller and buyer may agree to an “earn-out” sale structure, and/or contingent payments. The buyer pays the seller an amount upfront and additional earn-outs or contingent payments if certain milestones are met in later years. What state and local tax issues are you facing? In addition to federal income tax, a significant state and local income tax burden may be imposed on the seller as a result of the transaction. When an asset sale is involved, taxes may be owed in those states where the company has sales, assets, or payroll, and where it has apportioned income in the past. Many states do not provide for any long-term capital gain tax rates, so a sale that qualifies for long-term capital gain taxation for federal purposes may be subject to ordinary income state rates. Stock sales are generally taxed in the seller’s state of residency even if the company conducts business in other states. Also, state sales and use taxes must be considered in any transaction. Stock transactions are usually not subject to sales, use or transfer taxes, but some states impose a stamp tax on the transfer of stock. Asset sales, on the other hand, need to be carefully analyzed to determine whether sales or use tax might apply. Should presale estate planning be considered? If one of your goals is to move a portion of the value of the business to future generations or charities, estate planning should be done at an early stage, when your company values are low (at least six months in advance of verbal negotiations and/or receipt of a TS or LOI). It may be much more difficult and expensive to simply sell the company and then attempt to move after- tax proceeds from the sale to the children, grandchildren or charities at a later date. Conclusion: Before deciding to sell your business, work with a qualified tax adviser who can help you understand the tax complexities of various sales structures. Above all, do not enter into any substantive negotiations with a buyer until you have identified the transaction structure that best minimizes your tax burden.

Gary Miller CEO. GEM Strategy Management 970.390.4441 [email protected] gemstrategymanagement.com), Learn More … Key Words Business Insights, Business, Insights, Altek Media Group, Altek, Media, Video, video, film, near me, the Best, production, online, magazine, strategy, digital, marketing, blogging, social media, funnel, Brand, Content Management System, logistics, Lean, manufacturing, CEO, infograhics, instagram, facebook, linked in, google, Key Performance Indicator, Automation, Optimization, exit planning, Public relations, Advanced, Agile, oem, smart, supply chain, Net Neutrality, Big Data, Data Mining, Actionable Analytics, Artificial Intelligence, Machine Learning, Personalization, Voice Recognition, Chatbots, Augmented Reality, Virtual Reality, Smart Factory, Industry 4.0, Quantum Computing, BlockChain, Technological Unemployment, Digital, benchmarking, flexable, Kaizen, prototyping, robotics, six sigma Read the full article

#ActionableAnalytics#Advanced#Agile#Altek#AltekMediaGroup#ArtificialIntelligence#AugmentedReality#Automation#benchmarking#BigData#BlockChain#Blogging#Brand#Business#CEO#Chatbots#ContentManagementSystem#DataMining#digital#exitplanning#facebook#film#flexable#Funnel#google#Industry4.0#infograhics#Insights#instagram#Kaizen

0 notes