#fiscal metrics

Explore tagged Tumblr posts

Text

Moody's Upgrades Cyprus Credit Rating: A Historic Milestone

Moody’s Upgrades Cyprus Credit Rating: A Milestone for the Island Nation In a significant financial development, Moody’s Investors Service has upgraded the Republic of Cyprus’ credit rating by two notches, elevating it from Baa2 to A3. This upgrade is accompanied by a reassessment of the country’s outlook to “stable.” This marks a crucial milestone as Cyprus enters the “A” investment category for…

#A3#credit rating upgrade#Cyprus#economic growth#fiscal metrics#investment#Moody&039;s#National Recovery and Resilience Plan#President Nicos Christodoulides#public debt

0 notes

Text

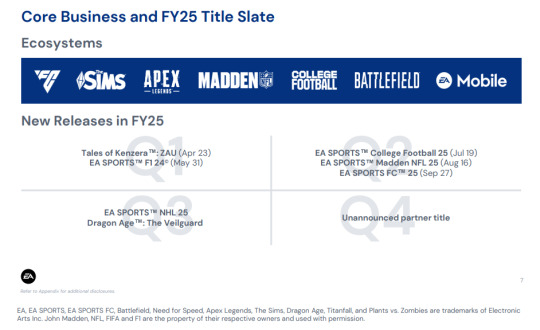

EA Q1 2025 Earnings Release - DA:TV and related mentions:

"Electronic Arts Reports Strong Q1 FY25 Results “EA delivered a strong start to FY25, beating net bookings guidance as we continue to execute across our business,” said Andrew Wilson, CEO of EA. “Our focus on delivering bigger, bolder, and more connected experiences for our players has never been sharper and is illustrated by the record-breaking launch of EA SPORTS College Football 25 as we head into another historic Q2 sports season at EA.” “Strong execution, live events and continued player engagement across our experiences, delivered Q1 results above expectations,” said Stuart Canfield, CFO of EA. “Looking ahead, the remarkable success of our launch week for College Football, combined with the upcoming launches for EA SPORTS Madden NFL, EA SPORTS FC and Dragon Age: The Veilguard, is building momentum for FY25 and beyond. We are well positioned to deliver our multi-year financial objectives.” Selected Operating Highlights and Metrics - During the quarter, EA revealed Dragon Age: The Veilguard gameplay, which trended #1 on YouTube Gaming and received millions of views. [...] About Electronic Arts In fiscal year 2024, EA posted GAAP net revenue of approximately $7.6 billion. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality brands such as EA SPORTS FC™, Battlefield™, Apex Legends™, The Sims™, EA SPORTS™ Madden NFL, EA SPORTS™ College Football, Need for Speed™, Dragon Age™, Titanfall™, Plants vs. Zombies™ and EA SPORTS F1® . More information about EA is available at www.ea.com/news." EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Dragon Age, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, FIFA and F1 are the property of their respective owners and used with permission.

Earnings Slides mentions:

Text in this image reads:

"Core Business and FY25 Title Slate New Releases in FY25 Q3: EA SPORTS NHL 25 Dragon Age : The Veilguard (Fel note: I think Q3 FY25 is October to December 2024 btw.) EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Dragon Age, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, FIFA and F1 are the property of their respective owners and used with permission."

[source, two]

(context of this post: The call hasn't taken place yet, but before they do some of the associated documents get made available online.)

I think Q3 FY25 is October to December 2024 btw.

#dragon age: the veilguard#dragon age: dreadwolf#dragon age 4#the dread wolf rises#dragon age#bioware#video games#long post#longpost#as always I'll make another post with the rest of the usual stuff(+if any other mentions) after the call is done :)#if Q3 fy25 being oct-dec 2024 is confusing to you just know its bc Financial Years are different and weird compared to normal years ok 😭#so it must be coming out in October or November then ig! since while december is in the q3 window its not really fall anymore

79 notes

·

View notes

Text

George Beebe, Director of Grand Strategy at QI, highlighted the perils of extrapolating a “stalemate” from the current lack of significant battlefield movements in Ukraine. “Those who believe this war has settled into a long-term stalemate make the mistake of measuring the relative progress of each side with maps. They see that the frontlines have not moved significantly over the last year and conclude that the sides are stalemated,” Beebe told me. “But other metrics, though, paint a different picture. Ukraine is using up its quite limited supplies of men, weapons, and ammunition, and the West cannot provide what Ukraine needs. That is not a formula for stalemate; it's a formula for Ukraine's eventual collapse or capitulation,” he continued. A purely cartographical view of the Ukraine war neglects key military factors, including differentials in manpower and resources, attrition rates, and logistics challenges, that many experts say are not unfolding in Ukraine’s favor. “Despite everything that’s happened, despite all the stuff we have given, the Bradley’s, the M1 [Abrams] tanks, Patriot air defense systems, the Challenger tanks, the Leopard [tanks], all those things, nothing changed at all except the casualty count,” said former U.S. Army Lt. Col. Daniel Davis, Senior Fellow and Military Expert at Defense Priorities and host of the Daniel Davis Deep Dive. “While the lines haven’t changed, I don’t call it a stalemate because I think time is continuing to work against Ukraine,” he said in an interview, noting the stark year-on-year decline in U.S. military aid to Ukraine. He added: “Biden is only shooting for $60 [billion dollars] for the whole FY [fiscal year] instead of $113 billion, so even if gets every penny that he’s asking for, it’s going to be half what it was last year, and we’ve given all the excess equipment that we have. Anything we give now comes out of the muscle, out of the bones, and I don’t think we’re going to give up that much more stuff, certainly not at the level they need to replace all their losses” Davis noted that the continued lack of sufficient output in Western ammunition production means that Ukrainian troops will face mounting munitions shortages. “They’re not going to have the ammunition to continue to wage a stalemate,” he added. Davis compared dwindling Ukrainian stocks with Russia’s expanded domestic production of critical munitions and drones. Kyiv’s munitions woes were recently compounded by the diversion of up to tens of thousands of 155mm shells, originally slated for Ukraine, to Israel in the weeks following the outbreak of the Israel-Hamas War. “The next year, and probably into this winter, I don’t think it’s unreasonable to expect the Ukrainian army, at some point along the front, to actually buckle,” warned Davis.[...]

Recent suggestions in the West of a stalemate and looming “frozen conflict,” though a stark change in tone from the kind of rhetoric that characterized the war as late as the summer of 2023, still does not reflect what experts describe as the severity of challenges facing the Ukrainian war effort.

Right.... "Stalemate" where....that implies an equality in force deployment capacity.....Stalemates are active not passive.....quickest way to decisively end a stalemate is to run out of weapons and ammo....time to either put up [read: full military deployment] or shut up [read: end the war from the position of the weaker combatant]. [27 Nov 23]

84 notes

·

View notes

Text

At the end of 2022, Dmitry Medvedev—Russia’s former prime minister and the current deputy chairman of its Security Council—offered his predictions for the coming year. He warned that Europeans would suffer badly from Russia’s decision to curb natural gas exports to the European Union, suggesting that gas prices would jump to $5,000 per thousand cubic meters in 2023—around 50 times their prewar average. He probably assumed that that sky-high prices would translate into a windfall for Russian state-owned energy company Gazprom, which was still supplying several European countries via pipeline, ramping up exports of liquefied natural gas, and eyeing new deals with China. Perhaps Medvedev also hoped that Europeans would beg the Kremlin to send the gas flowing again.

It turns out that Medvedev might want to polish his crystal ball: Last year, European gas prices averaged a mere one-tenth of his number. And just this month, Gazprom posted a massive $6.8 billion loss for 2023, the first since 1999.

Gazprom’s losses demonstrate the extent to which the Kremlin’s decision to turn off the gas tap to Europe in 2022 has backfired. In 2023, European Union imports of Russian gas were at their lowest level since the early 1970s, with Russian supplies making up only 8 percent of EU gas imports, down from 40 percent in 2021. This has translated into vertiginous losses for Gazprom, with the firm’s revenues from foreign sales plunging by two-thirds in 2023.

Gazprom’s woes are very likely setting off alarm bells in Moscow: With no good options for the company to revive flagging gas sales, its losses could weigh on Russia’s ability to finance the war in Ukraine. This is especially ironic given the fact that EU sanctions do not target Russian gas exports; the damage to the Kremlin and its war effort is entirely self-inflicted.

The most immediate impact of Gazprom’s losses will be on Russian government revenues, a crucial metric to gauge Moscow’s ability to sustain its war against Ukraine. Poring over Gazprom’s latest financials paints a striking picture. Excluding dividends, Gazprom transferred at least $40 billion into Russian state coffers in 2022, either to the general government budget or the National Welfare Fund (NWF), Moscow’s sovereign wealth fund.

This is no small feat. Until last year, Gazprom alone provided about 10 percent of Russian federal budget revenues through customs and excise duties as well as profit taxes. (Oil receipts usually account for an additional 30 percent of budget revenues.) This flood of money now looks like distant history. In 2023, the company’s contribution to state coffers through customs and excise duties was slashed by four-fifths, and like many money-losing firms, it is due a tax refund from the Russian treasury.

For Moscow, this is bad news on several fronts. Because of rising military expenses, the country’s fiscal balance swung into deficit when Moscow invaded Ukraine. To help plug the gap, the Kremlin ordered Gazprom to pay a $500 million monthly levy to the state until 2025. Now that the company is posting losses, it is unclear how it will be able to afford this transfer. In addition, Gazprom’s contribution to the NWF will probably have to shrink. For the Kremlin, this could not come at a worst time: The NWF’s liquid holdings have already dropped by nearly $60 billion, around half of its prewar total, as Moscow drains its rainy-day fund to finance the war. Finally, Gazprom’s woes could prompt the firm to shrink its planned investments in gas fields and pipelines—a decision that would, in turn, hit Russian GDP growth.

As if this was not enough, a closer look at Gazprom’s newly released financials suggests that the worst may be yet to come, with three telltale signs that 2024 could be even more difficult than 2023.

First, Gazprom’s accounts receivable—a measure of money due to be paid by customers—are in free fall, suggesting that the firm’s revenue inflow is drying up. Second, accounts payable shot up by around 50 percent in 2023, hinting that Gazprom is struggling to pay its own bills to various suppliers. Finally, short-term borrowing nearly doubled last year as Russian state-owned banks were enlisted to support the former gas giant.

Whereas these figures come from Gazprom’s English-language financials, the company’s latest Russian-language update yields two additional surprises—both of which show that the firm’s situation has worsened even further since the beginning of the year.

First, short-term borrowing during the first three months of 2024 roughly doubled compared to the previous quarter. If Russian state-owned banks continue to cover Gazprom’s losses, the Russian financial sector could soon find itself in trouble. This begs a tricky question: With the NWF’s reserves dwindling and Moscow’s access to international capital markets shut down, who would pay a bailout bill? Second, Gazprom’s losses were almost five times greater in the first quarter of 2024 than in the same period of 2023, hinting that the firm may post an even bigger loss this year than it did in 2023.

Looking ahead, 2025 will be an especially tough year for Gazprom. The transit deal that protects gas shipments through Ukraine via pipeline to Austria, Hungary, and Slovakia will probably expire at the end of this year, further curbing what’s left of Gazprom’s exports to Europe. A quick glance at a map makes it clear that China is now the only remaining option for Russian pipeline gas.

Yet Beijing is not that interested: Last year, it bought just 23 billion cubic meters of Russian gas, a mere fraction of the 180 billion cubic meters that Moscow used to ship to Europe. Negotiations to build the Power of Siberia 2 pipeline, which would boost gas shipments to China, have stalled. And in truth, China is not a like-for-like replacement for Gazprom’s lost European consumers. Beijing pays 20 percent less for Russian gas than the remaining EU customers, and the gap is predicted to widen to 28 percent through 2027.

Without pipelines, raising exports of liquefied natural gas (LNG) is the only remaining option for Moscow. However, Western policies make this easier said than done. Western export controls curb Russia’s access to the complex machinery needed to develop LNG terminals, such as equipment to chill the gas to negative160 degrees Celsius so that it can be shipped on specialized vessels. And Washington has recently imposed sanctions on a Singapore-based firm and two ships working on a Russian LNG project, signaling that it will similarly designate any entity willing to work in the sector. Finally, U.S. sanctions make it much harder for Russian firms to finance the development of new liquefaction facilities and the gas field designed to supply them. In December, Japanese firm Mitsui announced that it was pulling staff and reviewing options for its participation to Russia’s flagship Arctic LNG 2 project. As a result, the Russian operator announced last month that it was suspending operations of the project, which was originally slated to launch LNG shipments early this year.

Gazprom’s cheesy corporate slogan—“Dreams come true!”—does not ring so true anymore as Moscow’s former cash cow becomes a loss-making drain. Data from the International Energy Agency confirms the extent of the Kremlin’s miscalculation when it turned off the gas tap to Europe: The agency predicts that Russia’s share of global gas exports will fall to 15 percent by 2030—down from 30 percent before Moscow’s full-blown invasion of Ukraine.

This was probably predictable. It is hard to imagine how a gas exporter configured to serve European customers and reliant on Western technology could thrive after refusing to serve its main client—signaling to every other potential customer, including China, that it is an unreliable supplier. Corporate empires tend to rise and fall, and it looks like Gazprom will be no exception to the rule.

25 notes

·

View notes

Text

Nothing in the past, moreover, gave any cause to suspect ginseng’s presence so far away. Or even closer by: since antiquity, for well over a millennium, the ginseng consumed in all of East Asia had come from just one area -- the northeast mountainous lands straddling Manchuria and Korea. No one had found it anywhere else. No one was even thinking, now, to look elsewhere. The [...] [French traveler] Joseph-Francois Lafitau didn’t know this. He had been [...] visiting Quebec on mission business in October of 1715 [...]. He began to search for ginseng. [...] [T]hen one day he spotted it [...]. Ginseng did indeed grow in North America. [...]

Prior to the nuclear disaster in the spring of 2011, few outside Japan could have placed Fukushima on a map of the world. In the geography of ginseng, however, it had long been a significant site. The Edo period domain of Aizu, which was located here, had been the first to try to grow the plant on Japanese soil, and over the course of the following centuries, Fukushima, together with Nagano prefecture, has accounted for the overwhelming majority of ginseng production in the country.

Aizu’s pioneering trials in cultivation began in 1716 – by coincidence, exactly the same year that Lafitau found the plant growing wild in the forests of Canada. [...]

---

Since the 1670s the numbers of people [in Japan] clamoring for access to the drug had swelled enormously, and this demand had to be met entirely through imports. The attempt to cultivate ginseng in Aizu -- and soon after, many other domains -- was a response to a fiscal crisis.

Massive sums of silver were flowing out of the country to pay for ginseng and other drugs [...]. Arai Hakuseki, the chief policy maker [...], calculated that no less than 75% of the country’s gold, and 25% of its silver had drained out of Japan [to pay for imports] [...]. Expenditures for ginseng were particularly egregious [...]: in the half-century between 1670s through the mid-1720s that marked the height of ginseng fever in Japan, officially recorded yearly imports of Korean ginseng through Tsushima sometimes reached as much as four to five thousand kin (approx. 2.4–3 metric tons).

What was to be done? [...] The drain of bullion was unrelenting. [...] [T]he shogunate repeatedly debased its currency, minting coins that bore the same denomination, but contained progressively less silver. Whereas the large silver coin first issued in 1601 had been 80% pure, the version issued in 1695 was only 64% silver, and the 1703 mint just 50%. Naturally enough, ginseng dealers in Korea were indifferent to the quandaries of the Japanese rulers, and insisted on payment as before; they refused the debased coins. The Japanese response speaks volumes about the unique claims of the drug among national priorities: in 1710 (and again in 1736) a special silver coin of the original 80% purity was minted exclusively for use in the ginseng trade. [...]

[T]he project of cultivating ginseng and other medicines in Japan became central to the economic and social strategy of the eighth shogun Yoshimune after he assumed power in 1716. [...]

---

China and Korea were naturally eager to retain their monopolies of this precious commodity, and strictly banned all export of live plants and seeds. They jealously guarded as well against theft of mature roots: contemporary Chinese histories, for example, record that the prisons of Shenjing (present day Shenyang) overflowed with ginseng poaching suspects. So many were caught, indeed, that the legal bureaucracy couldn’t keep up.

In 1724, the alarming numbers of suspected poachers who died in prison while awaiting trial led to the abandonment of the regular system of trials by judges dispatched from Beijing, and a shift to more expeditious reviews handled by local officials. [...]

Even in 1721. the secret orders that the shogunate sent the domain of Tsushima called for procuring merely three live plants [...]. Two other forays into Korea 1727 succeeded in presenting the shogun with another four and seven plants respectively. Meanwhile, in 1725 a Manchu merchant in Nagasaki named Yu Meiji [...] managed to smuggle in and present three live plants and a hundred seeds. [...]

Despite its modest volume, this botanical piracy eventually did the trick. By 1738, transplanted plants yielded enough seeds that the shogunate could share them with enterprising domains. [...] Ginseng eventually became so plentiful that in 1790 the government announced the complete liberalization of cultivation and sales: anyone was now free to grow or sell it.

---

By the late eighteenth century, then, the geography of ginseng looked dramatically different from a century earlier.

This precious root, which had long been restricted to a small corner of the northeast Asian continent, had not only been found growing naturally and in abundance in distant North America, but had also been successfully transplanted and was now flourishing in the neighboring island of Japan. […]

---

Colonial Americans, for their part, had developed their own new addiction: an unquenchable thirst for tea. […] This implacable need could have posed a serious problem. [...] [I]ts regular consumption was a costly habit.

Which is why the local discovery of ginseng was a true godsend.

When the Empress of China sailed to Canton in 1784 as the first ship to trade under the flag of the newly independent United States, it was this coveted root that furnished the overwhelming bulk of sales. Though other goods formed part of early Sino-American commerce – Chinese porcelain and silk, for example, and American pelts – the essential core of trade was the exchange of American ginseng for Chinese tea. [...]

---

Yoshimune’s transplantation project had succeeded to the point that Japan actually became a ginseng exporter. As early as 1765, Zhao Xuemin’s Supplement to the compedium of material medica would note the recent popularity of Japanese ginseng in China. Unlike the “French” ginseng from Canada, which cooled the body, Zhao explained, the “Asian” ginseng (dongyang shen) from Japan, like the native [Korean/Chinese] variety, tended to warm. Local habitats still mattered in the reconfigured geography of ginseng. [...]

What is place? What is time? The history of ginseng in the long eighteenth century is the story of an ever-shifting alchemical web. [...] Thanks to the English craving for tea, ginseng, which two centuries earlier had threatened to bankrupt Japan, now figured to become a major source of national wealth [for Japan] .

---

Text by: Shigehisa Kuriyama. “The Geography of Ginseng and the Strange Alchemy of Needs.” In: The Botany of Empire in the Long Eighteenth Century, edited by Yota Batsaki, Sarah Burke Cahalan, and Anatole Tchikine. 2017. [Bold emphasis and some paragraph breaks/contractions added by me.]

#all kinds of fun stuff smuggling piracy biogeography medicinal tea shogunates secret orders#the irony of emerging US empire beginning relationship with china based on export of american ginseng which europeans hadnt known existed#the irony of japan quickly transitioning from almost being bankrupted by ginseng to becoming a ginseng exporter#the importance of local habitats and smallscale biogeography despite the global scale of imperial trade#the french cartographer in 1711 in manchuria who had never been to canada but correctly predicted ginseng might grow there#abolition#ecology#imperial#colonial#geographic imaginaries#ecologies#multispecies#tidalectics#archipelagic thinking#geography of ginseng

106 notes

·

View notes

Text

[...] says veteran ER and The West Wing producer John Wells. “Not having [new episodes] available for a long period of time is one of the reasons why shows decline rather than build an audience — even shows that come on big in their first year.”

A programming exec at a major streamer concurs, arguing that “familiarity” is what sets television apart from the feature film experience.

[...]

Insiders point to three big factors behind The Big Wait:

TV shows have turned into spectacles: in the Disney+ era, both Marvel and Star Wars shows have felt like elongated movies which may or may not get sequels years after their initial release. The outsize ambition of these tentpole projects — even a period costume drama like Bridgerton — means turning around a new season every year “is just physically not possible given what needs to be shot.

Movie people don’t know how to make shows quickly: the near collapse of the mid-budget theatrical-film business has forced less-famous movie vets to seek work in television. [...] “But they came from a different system where things took longer to get made, and they brought that kind of approach to TV.” [...] streaming execs [...] could have found a way to keep this sort of episodic TV factory going, but instead opted to follow Netflix off the short-season cliff, believing audiences wanted to hook up with a sexy new show every few weeks rather than form long-term relationships with a few really good series.

The streaming production model doesn’t encourage timeliness. in addition to more time required for complicated special effects on many shows, today’s global platforms need “as many as 120 days to conform it to all the various territories that it’s going into,” [...] Then, once a new season of a show finally does premiere, streamers will often take their sweet time deciding whether it makes sense to order another season. “Tech companies wait 30, 60, 90 days after a binge drop to get performance data,” [...] “specific metrics: completion rates of episodes and the full season, did it attract new subscribers, did it attract high income viewers.” Those numbers then get measured against the show’s overall production budget [...]

Can This Be Fixed?

The success of linear faves such as Suits and Prison Break has resulted in a new-found appreciation for “network”-style shows which can be produced more quickly, while the post-Peak TV era has ushered in a new age of fiscal discipline. “I think you’re seeing services trying to move themselves back to getting these shows on the air more regularly, particularly those who are not just dropping all the shows at once for binging purposes,” says Wells.

He should know: The veteran producer is currently overseeing a medical procedural for Max called The Pitt that will release 15 weekly episodes in 2025 and, if renewed, will have the potential to turn around a second batch of episodes within a year. [...] to allow the audience to become connected to these characters and be excited when we’re coming back.”

#Writer: John Wells#Tv stuff#long post#I think the article is rather scattered and surface-level to be honest but there are some interesting bits

7 notes

·

View notes

Text

Excerpt from this story from The Hill:

The Biden administration has finalized standards for federal buildings that will eliminate onsite fossil fuel usage for new projects by the end of the decade, the Energy Department confirmed Wednesday.

In the announcement, first shared with The Hill, the Energy Department said the rule will require 90 percent cuts to emissions from new construction between fiscal 2025 and 2029, with onsite emissions eliminated from all new projects and major renovations beginning in 2030.

The administration projects that the cuts will save $8 million in taxpayer funds from equipment and infrastructure expenses, and they will eliminate 2 million metric tons of carbon emissions and 16,000 tons of methane emissions over the next three decades.

An official with the Federal Energy Management Program told The Hill the final rule is part of the mandate given to the Energy Department by the Energy Independence and Security Act of 2007.

“DOE has issued three separate proposals over the years to implement this requirement, but as of tomorrow, we will have a final rule for it,” the official said, saying the final rule is “a regulation that applies to new construction and major renovations, and it fulfills Congress’s mandate to cut emissions, reduce fossil fuels.”

The rule defines “major” renovations as those costing $3.8 million or more, the official said, meaning “smaller projects” will be excluded. The rule will also include an option to apply for limited, case-by-case exemptions for scenarios, such as supply chain issues or issues with a building’s physical structure that make the technological adaptations impractical.

The Biden administration also introduced a federal standard in 2022 that required at least 30 percent of federal buildings to cut direct greenhouse gas emissions to zero by 2030. As part of these efforts, the administration announced the installation of rooftop solar panels on the Pentagon in January as part of the first round of $250 million in awards to improve federal buildings’ energy efficiency.

14 notes

·

View notes

Note

how'd the punks meet?

Oh, I actually made a long post about this, it's fun! let me translate it!

...

Marcos and Florencia have known each other since teens and they were always a constant in the bioclub (ORIGINAL MEMBERS). Marcos asked Florencia out shortly after meeting her. Florencia is a lesbian. To this day, Florencia NEVER loses an opportunity to laugh at that.

Marcos met Ariel when his biosuite broke down and he got the tip Ariel was good with that kind of machines. Marcos used his powers of Having Patience With The IT Guy. Ariel automatically declared him the First Non-Pelotudo Costumer he ever had: they've been friends ever since. Soon after Ariel joined the club, he found plenty to do fixing the club's old machines and/or cebando mates on the weekends.

Ariel and Melanie se conocieron, bailando en un bar... Any story they've had is deliberately ambiguous and you're not gonna get it from them. But Melanie sometimes spends more time at Ariel's workshop than at her house. And Ariel never misses Kawaii Anime Night at Melanie's. The funny thing is that Melanie supposedly "joined" the club with Ariel, although she had already participated a couple of times as a teen (Marcos and Florencia don't even remember her, because Melanie didn't have uwu neko ears then, but she INSISTS she appears in the background of the photos)

Pancho arrived at the club to rest after a long day of walking in Buenos Aires (bioclubs have pools for cetacean members, making them very popular with them). Melanie and the others approached him curiously. Pancho told them about Wittgenstein's theories of language and about Marxism in relation to the Moreau liberation movements. They got him into the club that same week, how could you not?

Marina is an exchange student from Brazil. When she was a teen she had participated in a bioclub in Fortaleza but only occasionally, so now that she lived in Argentina, she decided to try again. The first to greet her Marcos, and they spent a whole day talking about the space programs of Argentina and Brazil (forgetting about everyone else present). After a metric ton of cargadas from the others, Marcos invited her to the club and she didn't even hesitate, perhaps the coolest decision she made since she arrived in Argentina.

Paola met Florencia (her girlfriend) at an applied Neopaleontology convention. They had a heated argument about whether or not it's ethical to revive dinosaurs. Obviously, after that, they started dating, and they've been together for several years now. Paola is not part of the club and she thinks Florencia's friends are all weirdoes, but she plays D&D with everyone from time to time. Marcos wishes she would just pay her membership, she spends all day there anyways.

Everyone already knows Marcos' brother, Martín, because he always calls them when he's out on patrol to make sure they aren't making a bioweapon or somthing. Marcos loves him like a little brother loves his old bro, that is, a mixture of disdain and ride-or-die. Biopunks in general never get along with genedarmes, but Melanie admits that she unfortunately likes guys in uniform. Everyone loves Fito, the Genedarme Dog, because he is Fito, the Genedarme Dog.

Lucía is a student of Winogrodzki. Lucía now teaches at the UBA and Winogrodzki is the god of bioengineering and is basically everywhere, but the two are the club's administrators: Winogrodzki for his vocation for youth, Lucía for the resume experience. Many have come and gone: Winogrodzki was a member of the club in the heyday of biopunk before the Ecocide. Since then, the Marcos & Co. group has been the most constant he has ever had.

Maximiliano was also a student of Winogrodzki and Lucía's bioclub partner. But life took him down another path, and he is now the administrator of Recursos Cósmicos Fiscales, the Argentine space mining agency. He still has contact with his teacher and his old club mate sometimes.

There are more characters, and they each have friends (romances maybe?) from outside the club who show up occasionally (and their families, too, obviously), but they're still not fully fleshed out.

28 notes

·

View notes

Text

Don’t believe the lies about Joe Biden and the border.

The GOP lies about Joe Biden and the border are relentless—and they are working. The most frequent criticism I hear from readers who are Democrats is that Joe Biden has failed to address the border crisis. That is simply not true, and those readers have fallen victim to Republican disinformation.

We have to snap out of it! We cannot retreat in defensive embarrassment every time a Republican falsely claims Joe Biden has allowed for “open borders” or allowed an “invasion” on our southern border.

The latest example is an op-ed by Bret Stephens in The New York Times, Opinion | The Case for Donald Trump By Someone Who Wants Him to Lose. Among the many demonstrably incorrect statements included in Stephens’ article is this:

Many of Trump’s opponents refuse to see virtually unchecked migration as a problem for the West at all. . . . Only now, as the consequences of Biden’s lackadaisical approach to mass migration have become depressingly obvious on the sidewalks and in the shelters and public schools of liberal cities . . . .

What—exactly—is Biden’s “lackadaisical approach” to mass migration? Congress sets immigration law—and Joe Biden is enforcing it. Indeed, Biden is enforcing current immigrations laws much more effectively and aggressively than did Trump—a point of contention among many progressive Democrats. See, e.g., The Hill, Progressive Democrat has ‘serious concerns’ about Biden’s ‘heavy-handed’ border policies.

Why are progressives upset about Biden’s enforcement of immigration laws? That answer is explained in a recent article by The Cato Institute, New Data Show Migrants Were More Likely to Be Released by Trump Than Biden.

As explained by Cato Institute article,

In absolute terms, the Biden DHS is removing 3.5 times as many people per month as the Trump DHS did. These figures are important for understanding how each administration has carried out border enforcement. During the Trump administration, DHS made 1.4 million arrests—what it calls “encounters”—in fiscal years 2019 and 2020 (24 months). Of those people arrested, only 47 percent were removed as of December 31, 2021, which includes people arrested by Trump and removed by Biden, and 52 percent were released into the United States. Under Biden, DHS made over 5 million arrests in its first 26.3 months, and it removed nearly 2.6 million—51 percent—while releasing only 49 percent. In other words, the Trump DHS removed a minority of those arrested while the Biden DHS removed a majority. Biden managed to increase the removal share while also increasing the total removals by a factor of 3.5.

On every metric—in absolute and relative terms—the Biden administration has enforced immigration law more aggressively than did the Trump administration.

So, what changed? Why the misperception that Biden is “soft” on immigration?

First, the absolute number of immigrants fleeing violence in Central and South America is increasing dramatically. That is not Biden’s fault. Indeed, Biden is attempting to address the root causes of forced migration—violence and poverty—in the countries that are contributing most to mass migration into the US.

Second, in the face of a sharp increases in immigration that is overwhelming US border security, Biden has made the wise decision to focus enforcement efforts on immigrants who pose national security or criminal threats in the US. Even with that enforcement focus, Biden’s efforts are significantly more aggressive than Trump's.

Which brings us to the current refusal of House Republicans to authorize $13.6 billion in supplemental funding for border security. If they were truly concerned about the immediate crisis, they would pass the supplemental bill. But they don’t want a solution; they want a campaign issue.

I also hear from readers who criticize Biden for not “explaining” what he is doing to address the crisis at the border. I have two observations.

First, Biden is doing his job by enforcing immigration laws. Biden can’t make new law—that authority lies with Congress. So quit blaming Biden for Congress’s failure.

Second, if you want to know what Biden is doing, check out WhiteHouse.gov. There you will find Fact Sheet: The Biden-Harris Administration Takes New Actions to Increase Border Enforcement. As explained in the Fact Sheet, the Biden administration is

Working with international partners to speed removals and returns. Since May 12, we have removed or returned over 253,000 individuals to 152 countries. This compares to 180,000 removals and returns during the same period in 2019, which was the comparable pre-pandemic and pre-Title 42 period. This was enabled by a more than doubling of ICE international removal flights from the first to the second half of FY 2023 and new agreements with multiple countries to streamline returns.

Deploying a military personnel surge to support border efforts

Expediting family removals nationwide.

Adding DHS holding and processing capacity.

Improving Processing of Work Authorizations and Directly Communicating with Work Eligible Individuals. Only Congress can change the law to allow asylum seekers to get work authorization sooner than six months after filing their claim. Right now, six months is the law.

In short, any objective observer should conclude that Biden is doing a good job under difficult circumstances. If refusing to “send the US military to attack the cartels in Mexico” or “closing the border” is being “lackadaisical,” then the problem is not Biden—it is the fact-free critic who does not understand how US or international law works.

Robert B. Hubbell Newsletter

#migrant caravan#immigration#Robert B. Hubbell Newsletter#Robert B Hubbell#Joe Biden and the Border#GOP lies about the border#GOP lies about immigration

9 notes

·

View notes

Text

AMay 17 Facebook post (direct link, archive link) shows a black and white image of several members of Congress gathered together.

The post criticized Republicans for "attacks on the poor and the sick with the threat of catastrophic debt default," then made a claim about former President Donald Trump:

"Trump increased that debt far more than any president in history," the post says in part. "Under Trump, Republicans − and Democrats − had no objection to raising the debt ceiling three times."

House Minority Leader Hakeem Jeffries shared a similar claim on Twitter that garnered over 11,000 likes. A version of that post was posted on Facebook by the left-wing account Occupy Democrats and shared more than 900 times.

Our rating: False

The total federal debt increased more under the Obama administration in terms of raw dollars than any other president, according to government data. Experts say it is difficult to determine how much debt one president is responsible for since spending and policies can carry over from one administration to the next.

Obama incurred more debt than any other president

The post comes after weeks of standstill between President Joe Biden and House Speaker Kevin McCarthy over the issue of raising the debt ceiling, which limits how much the government can borrow, as USA TODAY reported.

But contrary to the post’s claim, the total federal debt increased more under former President Barack Obama than it did under the Trump administration, according to David Primo, a political science and business administration professor at the University of Rochester.

There are different ways of measuring debt, experts said.

Using Treasury Department data, the total public debt, which includes intragovernmental holdings and public debt, increased by approximately $7.8 trillion from the start of Trump’s presidency on Jan. 20, 2017, to when he left office on Jan. 19, 2021. Under Obama, however, the public debt increased by about $9.3 trillion from when he was inaugurated on Jan. 20, 2009, to when he left office on Jan. 19, 2017.

Some experts look at debt accumulated each fiscal year, which starts Oct. 1 of a given calendar year and ends Sept. 30 of the next year, according to Primo. That yields similar results.

Fact check: No, Trump is not required to register as a sex offender after E. Jean Carroll case

At the end of fiscal year 2016 − three months before Trump took office − the debt was about $19.5 trillion, according to historical fiscal year debt data from the Office of Management and Budget. That number increased to about $26.9 trillion at the end of fiscal year 2020 three months before Trump left office, marking a $7.4 trillion increase.

However, at the end of fiscal year 2008 before Obama took office, the debt was about $10 trillion and increased to about $19.5 trillion at the end of fiscal year 2016 before Obama left office, netting approximately a $9.5 trillion increase, according to the data.

There are caveats to these comparisons: Trump was only in office for four years while Obama was in office for eight years. The data for the federal fiscal year overlaps. And in both cases, the debt is measured using the nominal amount added each year, so it doesn't account for inflation.

Some economists believe the debt-to-GDP ratio is a better metric for gauging debt increase because the nominal levels of debt do not matter as much as how much debt the nation has as a share of its output, Primo said. Which president ranks first in this category would depend on the method of calculation used but Trump would not have the highest figures regardless, Primo said.

"In the post-WWII era, the increases in debt as a percentage of GDP were highest during and right after WWII," Primo said. "In the modern era, it’s still not Trump."

Experts say it is hard to blame any one president on rising debt

There are several reasons why it is difficult to cast the blame for increasing debt on any one president, experts said.

Debt increases are due to policies jointly agreed to by Congress and the president, so Congress bears some responsibility, according to Primo.

For instance, Obama signed into law a 2009 stimulus package passed by Congress, which extended former President George W. Bush’s tax cuts, and a tax extenders omnibus bill at the end of 2015, according to the Committee for a Responsible Federal Budget. Both policies worsened debt.

Fact check: Post wrongly claims new House reimbursement policy circumvents Constitution

When Trump was in office, he signed into law the 2017 Tax Cuts and Jobs Act, which lowered statutory tax rates on all taxable income levels and made debt soar, according to the Tax Policy Center and ProPublica.

“The country takes on debt anytime its outlays exceed its revenues,” Primo said. “This can occur due to one-time expenses such as the COVID-19 relief package or to structural changes to the budget, such as tax cuts or the creation of new government programs. In the long run, the biggest drivers of debt increases will be due to entitlements such as Medicare and Social Security.”

All presidents also inherit spending from previous administrations, noted William Hoagland, senior vice president of the Bipartisan Policy Center.

For instance, the Affordable Care Act implemented under Obama carried over to Trump’s presidency. The act expands the Medicaid program and provides health insurance to low-income consumers.

USA TODAY reached out to the social media users who shared the claim for comment but did not immediately receive a response.

The Associated Press and PolitiFact also debunked the claim.

Our fact-check sources:

David Primo, May 23-30, Email exchange with USA TODAY

William Hoagland, May 23-30, Email exchange with USA TODAY

Steve Ellis, May 24-26 Email exchange with USA TODAY

Treasury Department, accessed May 26, Debt to the Penny

Office of Management and Budget, accessed May 26, Federal debt data

Committee for a Responsible Federal Budget, July 25, 2016, Has President Obama Doubled the National Debt?

Tax Policy Center, accessed May 30, Briefing Book

ProPublica, Jan. 14, 2021, Donald Trump Built a National Debt So Big (Even Before the Pandemic) That It’ll Weigh Down the Economy for Years

Associated Press, May 18, FACT FOCUS: Who’s to blame for the national debt? It’s more complicated than one culprit

22 notes

·

View notes

Text

Pathetic whininggggg

1) second time in three months i have a multi-day visit with these two specific toddlers. Both times i have learned after arriving they were sick (as is the way of toddlers). Both times, they have immediately steamrolled my innocent, child-free, unprepared immune system (as is the way of toddlers). In july, I was flattened for a week and had a gross cough for a literal month. If this happens again, with my brother's wedding around the corner, I am going to SCREAM.

(i also need to find a way to politely tell their parents that pls, im dying, you can't keep doing this to me)

2) end of the week is end of the fiscal year! Tuesday begins vacation time relating to my brother's wedding! I have so many deadlines, which were rough as hell even before i started wasting all my energy SNIFFLING, but now I'm moving slower than ever and the deadlines are getting real spicy

3) I get a reduced buff from creative work that is assignments and not just Personal Whims. And... it's been all assignments lately, at a slower pace than usual. I know that getting frantic and anxious over how long it's been since I posted anything exciting is silly and unproductive, but it's still HAPPENING. And the real metric of concern is the frequency with which I make things, and i finished the blanket and second guest book a while before i shared them.

I know that realistically, what I need to do right now is hurl myself into a project or three to restore my mental equilibrium, but even in the most, MOST optimistic case, I won't be able to start until tonight, and I really OUGHT to wait until Thursday/Friday. I think that if i stick to my strengths, i have time for some good work before the wedding runs me over, but part of this includes boring work to prepare notecards for the first guestbook, which.... bluhhhh. And of course house things are ramping up overall anxiety levels and i need a repetitive craft to self-soothe. This is killing me. I can recognize this flavor of seething dissatisfaction, but external pressures and stupid health shit are stopping me from applying corrective measures. If I can lean into deadline anxiety with my meetings today, that might help me accelerate towards breathing room, but... ugh.

#no worries this isn't actually about anxiety to be a constant content machine#secretly it's All About Me#uwu#wouldn't be a bad time to curl up in bed and motor through a long comic#continue my op reread or maybe another old fave#but i need to hit deadlines and make SOMETHING first

8 notes

·

View notes

Text

Lake Erie phosphorus reduction

Protecting and preserving the state’s water quality continues to be a top priority for both the Michigan Department of Agriculture and Rural Development (MDARD) and the administration of Gov. Gretchen Whitmer and Lt. Gov. Garlin Gilchrist.One focal point of this mission is the Western Lake Erie Basin (WLEB), where sometimes-harmful algal blooms have affected aquatic life and drinking water in recent years. Factors contributing to algal blooms include nutrient-rich water from wastewater treatment plants and farm fields.While reductions of phosphorus at four of the key wastewater facilities in Michigan’s portion of the WLEB helped Michigan hit its 20% phosphorus loading reduction goal by 2020, they won’t be sufficient to achieve the 40% reduction target Michigan, Ohio, and Ontario agreed to reach by 2025 under the 2015 Western Basin of Lake Erie Collaborative Agreement.Moving forward, it will require new approaches to realize progress from agricultural contributions. MDARD is laser-focused on accelerating conservation in the right places across the WLEB watershed with programs and projects defining success through realistic and achievable water quality outcomes to restore the health of the Lake Erie ecosystem.While significant progress has been made with point sources (pollution from a single identifiable source or area), it’s time to put our foot on the gas pedal with agricultural nonpoint sources (pollution from many sources at once).In support of the governor’s MI Healthy Climate Plan, the Fiscal Year 2024 budget includes a total $15 million investment to support soil health, climatesmart agriculture practices, and regenerative agriculture. These priority areas aren’t solely about building stronger agricultural systems and resilient rural economies; they also place a specific focus on improved environmental outcomes.These investments in soil health to improve water quality are a notable shift in MDARD’s efforts to tackle nutrient losses. Managing agricultural systems to improve waterholding capacity and rainfall infiltration, while enhancing biological cycling to reduce the need for fertilizer inputs, is a paradigm shift in nutrient management for MDARD. Regenerative agriculture principles have been shown to not only reduce nutrient losses but mitigate the impacts of extreme weather – all while prioritizing the agricultural diversity that powers our rural communities.To better prioritize conservation practice implementation and quantify results, the Domestic Action Plan (DAP) Team, composed of staff from MDARD and the Michigan DNR and EGLE, is working with MSU to enhance the Great Lakes Watershed Management System to annually quantify phosphorus load reductions from conservation practice implementation relative to the 40% reduction goal. This public-facing online platform will include a dashboard that tracks water quality outcomes associated with social and ecological metrics, providing greater accountability for program implementation in Michigan’s portion of the WLEB.MDARD is dedicated to achieving demonstrable water quality improvements in Lake Erie. The state’s investments in soil health and regenerative agriculture principles hold the promise to not only improve water quality but enhance the climate resiliency of our agriculture systems, while placing value on how and where our food is grown.These new budget investments by Gov. Whitmer position Michigan to achieve long-term, tangible outcomes that take us beyond water quality.Take a deeper diveLearn more about phosphorus reduction efforts in Michigan’s portion of the Lake Erie watershed at Michigan.gov/LakeErieDAP.

#cleanwater#pollution prevention#protectourwaterways#environmentaleducation#protectourplanet#environmental education#michigan#egle#great lakes#greatlakes

2 notes

·

View notes

Text

What do I think Of Biden, Now, As President? (A Question I Accidently deleted)

1st of all, I am sorry to whoever asked this as I accidently deleted your question, hopefully you will see this... Once again I hate talking politics so instead of going down a laundry list of things of why I think Biden is the worst President we've had in the last 20 or so years. I'm just going to start with one topic.

GAS PRICES

I believe Biden directly controls the gas prices by the policies he pushes. Such as shuttering the pipeline, reducing refinery capacity and sanctioning 43% of the world's natural gas and oil supply.

They claimed gas prices were high because of Russia right? Wrong. The majority of the gas price hikes took place before russia.

They claimed the President has no control over Gas Prices. This statement is also incorrect. It is actually one of the issues where they have more control than most people. This is because the oil business is all about projection rather than supply and demand. Future Earnings and determining whether or when you’re going to drill or pull back. You will sometimes see gas prices drop depending on when someone comes into office just because of policies that may not be enacted for another year or two because they’re willing to invest knowing they’ll recoup it.

Now if you worked for a fossil fuel company what would you do if someone came into office threatening to shut down your company and claimed to enact policies that would greatly affect you, your profits, etc.

May 15th 2020

youtube

June 11th 2019

youtube

September 6th 2019 “I guarantee you, we are going to end Fossil Fuel!!!”

youtube

Biden has taken over 80 actions impacting or what would impact gas prices/fossil fuels. Largely against them. Most of them are executive orders.

Paris Climate Accord

He revoked the Keystone XL Pipeline (Keystone XL is different from Keystone)

He supported increases of $230,000,000,000 in taxes on oil

He reinstated the social cost of carbon metric

The Climate Change Order

Climate Financing

Climate Financial risk

That’s to name a few, I’ll leave a link listing all the policies, executive orders, taken against fossil fuel.

Another false claim is that it is the result or “Bounce back” from Covid. Meaning more people are driving now than during Covid… The problem with that statement is there is no data to suggest that this is even remotely true. Again, if you look at the prices on that chart you will see the before and after Covid and it remained hovering around $2.50 a gallon. Look at when the steep increase took place

There is a false claim that under President Joe Biden there is actually more domestic drilling than President Trump. Really? The truth is Biden did approve more drilling permits at a whopping number of 4,881 in 2021 than Trump’s 4,631 permits issued in 2020. However, the permits issued under Biden are for leases sold mostly under Trump… See what I’m saying? It rolled over, they’re rollover leases. If this piece of information doesn’t matter to you then maybe this will…. The Biden Administration slashed the approvals of drilling in August 2021.

Permits Slashed: “The data suggest the administration wants to show it’s meeting its obligation to issue permits for existing leases.”

YOU HAVE YOUR ANSWER

Look, this is just one of his many failings but I've spent to long typing this out on just one topic that to disect his entire presidency and everything I believe he has done wrong would take me days and weeks to describe on this platform. That being said I'll speak briefly on inflation.

INFLATION

The CPI (Instrument to measure Inflation) went up 7.9% through february of 2022 which is the highest inflation rate for a quarter or month in 40 years.

youtube

If you do the math it is exactly 40 years since the embarrassment of Jimmy Carter where the CPI rose 13.5% in 1980. That number (13.5%) included the rising cost of housing. (Don’t know if you’ve noticed but that’s still kind of a problem today too) The numbers under Joe Biden (7.9%) does not include the rising cost of housing, so the inflation rate is actually 11%. These numbers are old and guaranteed to have risen at this time on December 30th 2022.

I DO NOT BEGRUDGE ANYONE WHO VOTED FOR HIM, I DO HOWEVER BELIEVE WE WERE BETTER OFF WITH TRUMP!

GOD BLESS!

2 notes

·

View notes

Text

It’s almost as if aiming for “growth” as your only metric of fiscal success is, like driving anything by a single metric, a recipe for Fucking Around and Then Finding Out.

90K notes

·

View notes

Text

India’s Sugar Industry: Production, Export, and Market Insights

Sugar plays a vital role in the global food processing industry, particularly in baking and confectionery. Among the widely used types are granulated, caster, icing, and jam-setting sugar. With the rapid rise in sugar consumption worldwide, countries like India and Brazil have emerged as leading players in meeting global demand. India, in particular, is a key producer, consumer, and exporter of sugar. This article delves into India’s sugar production, export trends, top exporters, and much more.

India’s Sugar Production: A Key Global Contributor

India boasts the second-largest agro-based sugarcane and sugar industry globally, following cotton. With states like Uttar Pradesh, Maharashtra, and Karnataka leading production, India is a powerhouse in sugarcane farming and sugar manufacturing. Uttar Pradesh, in particular, consistently leads with significant contributions to national production.

In the 2023–2024 fiscal year, India produced approximately 34 million metric tonnes of sugar. This production involved over 1,084.57 lakh tonnes of sugarcane processed in 118 mills across Uttar Pradesh. Beyond its economic contributions, the industry supports the livelihoods of rural sugarcane farmers and employs nearly 500,000 workers in sugar mills, generating a gross value-added output of 806 billion INR.

The Economic Impact of India’s Sugar Industry

In 2023, the global industrial sugar market was valued at USD 46.4 billion and is projected to grow at a CAGR of 5.0%, reaching USD 59.1 billion by 2028. India is a significant contributor to this growth. Domestically, India’s sugar market is expected to grow at a CAGR of 6.87%, reaching USD 9.791 billion by 2028, with the branded sugar segment alone estimated to hit USD 1.47 billion by 2029.

The increasing demand for processed foods, beverages, and desserts drives the growth of India’s sugar industry. With sugar deeply integrated into Indian and global culinary habits, the demand trajectory appears robust.

India’s Role as a Leading Sugar Exporter

Sugar export from India have witnessed remarkable growth in recent years. In 2023, the country’s sugar export value reached USD 4.32 billion, a significant leap from USD 0.93 billion in 2018. India's share in the global sugar export market also increased from 4.17% in 2018 to 12.21% in 2023.

Favorable agricultural policies and robust production standards fuel India’s position as the second-largest sugar exporter globally. Southeast Asia and Africa are key regions driving demand for Indian sugar.

Sugar Export Trends and Data for 2023–24

Despite India’s success in the export market, the government restricted sugar exports for the 2023–24 marketing year (October–September) to stabilize domestic prices and ensure sufficient local supply. However, exports to the US and European Union under TRQ quotas were exempted from these restrictions.

In the fiscal year 2024, India managed to export 3 million metric tons of sugar, which includes a variety of products such as:

White Crystal Sugar

Brown Sugar

Icing/Fondant Sugar

Organic Sugar

Jaggery (Round and Powder)

Pharmaceutical Sugar

Export Prices of Indian Sugar (2023)

Export prices vary depending on the type of sugar. Below are a few examples:

Icumsa Sugar (Less Than 100): ₹36.50/kg

Palm Jaggery: ₹35/kg

Pure Sugarcane Jaggery: ₹55/kg

S-30 Grade Sugar: ₹32/kg

Major Export Destinations (2022–23)

Indonesia: ₹67.47 billion

Bangladesh: ₹42.68 billion

Sudan: ₹41.99 billion

United Arab Emirates: ₹22.38 billion

Somalia: ₹21.73 billion

Indonesia remains the largest importer of Indian sugar, reflecting the country’s strong trade ties and competitive pricing.

Top 10 Sugar Exporters in India

India’s sugar industry includes prominent players contributing to both domestic supply and export growth. Here’s a look at the major sugar exporters in India:

Balrampur Chini Mills Ltd. Produces 76,500 metric tonnes daily across multiple mills in Uttar Pradesh.

Triveni Engineering and Industries Operates seven advanced sugar plants certified for pharmaceutical-grade sugar production.

Bajaj Hindustan Ltd. Produces 135,000 metric tonnes of sugar daily and exports to Asia and Europe.

Shree Renuka Sugars Processes 1.38 million metric tonnes of raw sugar annually.

Dhampur Sugar Mills Ltd. Known for refined sulfurless sugar and biofertilizer production.

Dwarikesh Sugar Industries Ltd. Achieves 21,500 metric tonnes in annual sugar production.

EID Parry (India) Operates facilities with a daily crushing capacity of 40,300 metric tonnes.

Panacea Foods Specializes in brown sugar export using integrated production technologies.

Vitthalrao Shinde Sahakari Sakhar Karkhana Ltd. Engages in research and exports white crystal sugar globally.

Nizam Sugars Asia's largest sugar plant, is located in Telangana.

How to Access Comprehensive Sugar Export Data

For businesses seeking to enter or expand in the sugar export market, platforms like Eximpedia offer valuable insights. With sugar export data on top exporters, HS codes, and global trade trends, Eximpedia equips users to navigate market complexities effectively.

Final Thoughts

India’s sugar industry is a pillar of its agro-based economy and a global leader in production and export. Whether you’re a seasoned exporter or a newcomer, understanding market trends, maintaining quality standards, and leveraging export data are essential to success. Platforms like Eximpedia provide a gateway to detailed trade insights, ensuring businesses can thrive in the competitive global sugar market.

If you’re ready to elevate your sugar export business, schedule a free demo with Eximpedia.app and gain access to exclusive market data today!

#sugar export from India#raw sugar export from India#sugar export data#biggest sugar exporter in India#largest exporter of sugar in India#largest sugar exporter in India

0 notes

Text

Sarveshwar Foods: A Major Milestone with Global Expansion in Singapore

November 26, 2024, marked a significant development for Sarveshwar Foods Limited, a trailblazer in the Indian rice industry, as the company announced a major breakthrough through its wholly owned subsidiary, Green Point Pte. Ltd., based in Singapore. This pivotal achievement showcases Sarveshwar Foods' strategic vision and global ambitions, setting the stage for a remarkable fiscal year ahead.

Green Point Pte. Ltd. secured a substantial order of 12,000 metric tons (MT) of premium Indian Long Grain Parboiled Rice from Monarda Commodities Pte. Ltd. The order is valued at approximately ₹445 million, highlighting the robust demand for Indian rice in the global market. This transaction not only strengthens the subsidiary’s revenue stream but also aligns with its ambitious goal of achieving ₹2,000 million in annual revenue.

A Strategic Gateway to the Global Market The acquisition of Green Point Pte. Ltd. has proven to be a transformative step for Sarveshwar Foods. Positioned in Singapore, the subsidiary serves as a gateway to the burgeoning international market for rice and rice-based products. As global consumer preferences shift towards healthier dietary options, including gluten-free and high-fiber alternatives, the demand for premium rice varieties continues to rise. This aligns perfectly with Sarveshwar Foods' expertise in producing high-quality rice, cultivated in the mineral-rich soils of the Himalayan foothills.

The global rice-based product market is experiencing rapid growth, with projections suggesting an increase from USD 226.36 billion in 2023 to USD 361.41 billion by 2031. The rising prevalence of celiac disease and gluten intolerance, coupled with heightened awareness about the nutritional benefits of rice-based diets, is driving this trend. By securing this order, Sarveshwar Foods positions itself to capitalize on these favorable market dynamics.

Leadership and Vision Rohit Gupta, Chairman of Sarveshwar Group, expressed his enthusiasm about this milestone, stating, “We are thrilled with this significant order, which underscores Green Point’s growing role in our global business strategy. With our focus on premium rice-based products and the rising demand for gluten-free alternatives, we are optimistic about achieving our revenue targets for this fiscal year.”

Mr. Gupta further emphasized the group’s overarching goal of reaching a consolidated turnover of ₹10,000 million (₹1,000 crore) for FY 2024-25, encompassing contributions from all subsidiaries, with healthy margins. This vision reflects Sarveshwar Foods’ commitment to innovation, quality, and sustainable growth.

A Legacy Rooted in Excellence Sarveshwar Foods Limited, headquartered in Jammu, holds a legacy of over 130 years in delivering premium rice varieties. The company specializes in both branded and unbranded basmati and non-basmati rice, catering to domestic and international markets. Its organic product line, marketed under the Nimbark brand, reflects the company's commitment to promoting a Satvik lifestyle. Grown without artificial fertilizers or chemicals, these products resonate with health-conscious consumers globally.

With multiple certifications, including ISO 22000:2018, USFDA, BRC, Kosher, NPPO USA & China, and USDA Organic, Sarveshwar Foods ensures adherence to the highest quality standards. The company’s diversified sales strategy includes traditional retail, proprietary outlets, and a robust online presence through its e-commerce platform, www.nimbarkfoods.com.

The Road Ahead This milestone signals a promising future for Sarveshwar Foods. The successful execution of this order by December 31, 2024, will bolster the company’s international credibility and open doors to additional global opportunities. Sarveshwar Foods’ ability to adapt to evolving consumer demands while leveraging its rich heritage places it at the forefront of the global rice export industry.

As the fiscal year progresses, the company remains steadfast in its mission to expand its market share, deliver exceptional products, and sustain its growth trajectory. With its eyes set on emerging trends and untapped markets, Sarveshwar Foods is poised to leave an indelible mark on the global stage.

This significant achievement is not merely an order fulfillment; it is a testament to the vision, determination, and innovation that define Sarveshwar Foods Limited.

0 notes