#financial freedom is so close i really need to just like put shit in perspective 😪

Explore tagged Tumblr posts

Text

Also my shopping list for tomorrow and this weekend-

But first and foremost I am MAKING BILL AND HOME PAYMENTS EARLY so far i'm 4 weeks ahead and it feels amazing!! Like June was paid early last month and tomorrow I'll pay for July. Would be so cool to get to October and have the rest of the year already paid for. I think I can swing both July and August this month. First time in my life I've ever been able to get ahead like this!! Anyway here's what's in my head-

Storage bins for all our camping supplies

Bubble bath in various flavors 💅

La croix

Fruits and vegetables

Deodorant, my usual one melted when I went camping at the music festival 😫

I really want to treat myself to either a perfume, jewelry (choker or small hoop earrings) or swim suits.... I've been spoiling myself low key and I should only pick one! I feel so entitled to little gifts like this because I've been working so much and this is the most financial freedom I've ever had. It's also the most freedom I've ever had to do what I want with my appearance in terms of buying clothes, jewelry, piercings, etc. I've also been donating a lot and giving away things that no longer resonate with me.

I also need to put at least $300 of my next paycheck(s) in my Roth IRA it's no joke. My savings have been pathetic the extra job only made my spending habits worse!!! The only good thing I've been doing is paying for the house payments early!!

Car wash???? Um I have not washed my car in over 6 months, no shame idc

Maybe a stupid cover for my steering wheel? It's raining flaky black bits all over me when I drive, in addition to all the other issues my car has

Maybe a new cheap yoga mat. My older ones are so beat up and falling apart from me using them outside to workout. Would love a clean one to keep indoors.

If I have a little more money to spare I'd love another couple of pairs of period underwear...

Oh yeah we're also planning a fucking trip to Ireland, so far we only got plane tickets to London. We still need to book everything else. I'm gonna start working like 50 hours a week again soon

I also want thigh high socks from sock dreams!! I've wanted some cute socks from them for years! I want a pair in black and another in olive green or a red wine color. Maybe gray too? They'll be so cute to wear in colder weather with the mary jane heels I got earlier this year.

Ok one last thing.... I want a stand up paddle board... there's this one that costs $300 and it comes with 2 paddles and a bag, and it's inflatable! So it can fold up into a duffle bag. So cool right?

Ok while we're on the subject of exercise, I also want a fucking punching bag and gloves.... I have anger issues I need to work on and I love boxing. Maybe I'll find something on offer up

I also want to go to Catalina for my birthday. Cheapest hotel is $360/night... 😬 I need to take LSD and wander around a quaint paradise and jump in some clear water. I need this for my health!!!!!

I want a tattoo

#is she delusional???#or just used to working her ass off ???#financial freedom is so close i really need to just like put shit in perspective 😪#clearly the car#the trip to ireland#and the savings should take priority here#but i also want to have FUN

3 notes

·

View notes

Text

What don’t you see about yourself?

Hi Moonbabies!! Welcome or welcome back to another pick a card reading ❤︎ Today I will inquire my tarot cards about “what you don’t see about yourself.” This was the highest on the poll I did a few days ago.

Remember, to pick the pile you most resonate with. Ground yourself, take a few deep breaths and pick your pile. Trust your intuition! Don’t second guess yourself. Please just take what resonates and leave the rest :) If pile(s) don’t resonate, then this reading may not be for you. Now scroll for your reading.

Pile One

You are self aware. Constantly going through rebirths to grow into your best self. You’re always coming up with new ideas and having major realizations. You seem to get a lot of downloads from the universe. You’re a hard worker. When you hit rock bottom, you expand your mind and look for a new perspective. You’re independent and really don’t care what others think. You’re self love and self worth is very high. You don’t take any bullshit. You’re picky with the people you let into your life. You also value your freedom and individuality. I feel like money comes easily to you, like you’re meant to be financially stable/free in this lifetime. Okay this is off topic but… an air sign (Gemini, Libra, Aquarius) could be coming towards you. This seems like a wish fulfillment. This person wants to give you a gift and offer you a commitment. It also doesn’t have to be romantic, could be platonic.

Pile Two

You know how to heal and transmute negative/low energies into positive ones. You’re balanced and at peace with yourself. You like to take your time on things. You’re efficient and hardworking (maybe even a bit of a perfectionist). You also love to give to others. Gift giving could be one of your love languages. You could volunteer at a shelter. New opportunities are always flowing to you. It’s giving master manifester. You write down what you want, you know you can have it, and it comes to you with ease. You could want to travel or move out of your country/state. Travel vlogger?? Your intuition is strong! You might be into spirituality/tarot/astrology. You trust yourself and the universe. You also like change and moving onto the next thing. You’re adaptable.

Pile Three

You are persistent! Even when you want to give up, you keep going! You can be a bit indecisive at times. You know how to balance dreams/daydreaming and reality. At least you try to. You’re a go-getter! When you want something, you chase it. Are you a fire sign (Aries, Leo, Sagittarius)? You love freedom and adventures. You’re very optimistic about life. You seem closely connected with your inner child. You are one of the lights in this world. Even though you can be impulsive at times, people love to be around you. You naturally gravitate people to you. When you go through a hard time or heartbreak, you Taylor Swift that shit. You transmute your sadness into inspiration. It’s healing for you.

Thank you so much for reading!! Honestly you probably know these things about you… but you don’t necessarily believe them. I need you to believe in yourself a bit more. Put yourself on a pedestal!

ɪɴᴛᴜɪᴛɪᴠᴇᴍᴏᴏɴʙᴀʙʏ☽

#pac reading#pick a card#free tarot#pick a picture#pick a photo#tarot cards#pick a pile#tarot reading#tarot reader#pac#free readings#tarot community#pick a image

895 notes

·

View notes

Text

I just wanna make a quick post about interacting with kids, because people on here seem to not know how kids work. (quick note before I start though: this is all spoken from my experience in working with kids--I do not have children of my own. I volunteer every year at an elementary school, working closely with younger kids who are struggling with learning certain subjects but don’t necessarily qualify for special ed (COVID has put a pause on this but I fully intent to resume as soon as it is safe to do so.) I am also a facilitator for a support group through a nonprofit--I’m part of the team in charge of facilitating the middle school group (ages 11/12-14). I didn’t really want to make this post because a lot of people get offended by these viewpoints, but the more I observe how kids are being treated by the adults in their life, the more I realise I need to say something.)

***I encourage you to reblog and add your own thoughts: I want to have an open discussion about this.

Ok, first of all: Kids are a LOT smarter than you think they are.

The problem is, they don’t know how to communicate and apply this yet. Calling them dumb and treating them as if they have nothing to offer conversations doesn’t support their development at all; in fact, it is one of the easiest ways to discourage a kid. This doesn’t mean turn off your filter and talk to kids the same way you’d talk to your friends. It just means, genuinely listen to their perspective and allow them to be part of intelligent conversations. Kids can’t learn responsible, mature ways to communicate if you don’t give them the opportunity to try it.

One city in Colorado did a project that got kids involved in city development. In fact, this project was so successful that they are still continuing it! The classroom I volunteer in did a project inspired by this a few years ago. The first grade classroom was tasked with creating a city that could be applicable to real life. Their only restrictions were that they had to include four things: recreation, housing, jobs, and education. How they did that and what else they included was up to them. They were allowed to be as creative as they’d like.

The teacher, other volunteer and I expected the city they made to be something out of a fantasy world. What we saw, though, was absolutely incredible.

The kids created a detailed park complete with a pond for wildlife, a pool for recreation, walking trails, parking, wheelchair ramps, disability accessible bathrooms, community gardens, playgrounds designed specifically for younger kids, and another for older ones. They included apartment buildings and bus stations. They added traffic lights to intersections and lowered speed limits nearby their school. They made several large public schools, as well as a college (which they insisted, unprompted, was low-income accessible. They made a hospital and a fire station.

Their instructions were only to create a city with only four boxes to check. They weren’t required to do any more than build the layout of it. But when we asked them to give us a tour of their city, they not only told us what each building was: they described laws that protected minorities. They told us about what roles people would have in their city, including the roles of kids.

No, it wasn’t to the great detail and precision that an adult could. Yes, there were many holes in their creation that would cause problems in the real world. They obviously weren’t thinking in terms of budget or government restrictions. But in a way, that made their ideas so much better. They weren’t tied down by the expectations adults had. They added features that we’ve been fighting for for years, such as basic accessibility, both physical and financial (such as their insistence about free college education).

Kids’ lack of experience doesn’t make them stupid. In fact, I believe it’s part of what makes them so smart. They observe the world around them and aren’t seeing things in terms of criticism and limits. They see something that needs to change, and they aren’t afraid to come up with creative ideas to make that change.

Talking at kids doesn’t do shit.

Telling a kid to do something or not to do it is probably the quickest way to encourage them to do the exact opposite.

But you know what I’ve found works almost every time? TWO WAY CONVERSATIONS!

Saying “don’t talk to people like that” is a very easy way to not change behaviour. Rather, help them understand why they shouldn’t talk a certain way.

When working with young children, I usually start off with saying “When you said [x], my feelings were hurt because...” And then they usually figure it out for themselves that they said the wrong thing.

This works so much better because:

1) the kid doesn’t get defensive. When you scold them for misbehaving, they quickly learn to guard themselves from that. When you can calmly explain to them what was wrong about that situation, they’re less likely to try to protect themselves from your words: because they won’t need to.

2) They learn exactly what was wrong about what they said. When you just tell them they’re wrong but refuse to talk to them about how or why they did something hurtful, they can’t always take it the right way. When a kid says “you look dirty” and you tell them that’s rude, they don’t understand why. In their heads, that may have been them trying to say you have mud smeared on your pants, or you have food spilled on your shirt: they may have just been trying to help you. When you explain to them exactly what about that statement was hurtful, and perhaps offer a kinder way to say it, they’ll recognise their mistake much quicker and remember it better.

3) They’ll learn how to express their own feelings in a much more healthy way. Kids learn from their surroundings. When you snap at them for making a mistake, you teach them to do the same. Then, later on down the road, you may hurt their feelings, and they may lash out at you. When you teach them to communicate more openly, they’ll learn how to address their problems in a productive manner.

4) It gives them the opportunity to problem solve. When you say “this hurt because” instead of “you’re wrong”, it allows them to come to the conclusion that they made a mistake on their own. It’s basically the child-equivalent of providing someone with sources to try to disprove them. Except when it’s taught from a young age, they’ll learn to accept the criticism instead of attack it.

On a related note, when you see a problem coming up repeatedly, or a child is growing upset about something: Share your feelings about the situation, ask them to share theirs, and then help them come up with solutions.

Mistakes are healthy

Stopping a young person from making a mistake isn’t always helpful. Obviously, if they’re about to hurt themselves or others, stop them. But if it’s a little mistake, let them make it. And then talk to them about it. Help them come up with ways to first fix this mistake and then to avoid making the mistake again in the future.

It conveys the message of “you’re human and mistakes are normal: I’m here for you.” instead of the message of “You can’t do anything right, just let me do it for you.”

You can’t learn and grow as a person if you’re never allowed to put yourself out there and make mistakes. Give young people the chance to try things themselves: but make it clear you’re here for them when they need support.

Listen to them.

This piggybacks off of a lot of what I said above, but listening to kids is important.

When a teenager says they need help, it’s far more effective to ask them how you can help them than it is to tell them why they’re struggling and then refuse to help them solve it. I can’t tell you how many kids I’ve had reach out to me saying they feel alone because of this. They’ll come to me saying that they went to their parent to say they feel depressed (or even are on the brink of hurting themselves in some way), only to be met with “well you should think about how I feel” or “you’re just being dramatic.”

When a kid says something hurt them, LISTEN TO THEM. Kids’ feelings are every bit as complex as those of an adult. You don’t turn 18 and suddenly have a real brain with real emotions. You have that your whole life; humanity doesn’t come with age. experience based decisions do.

And, spoiler alert: kids know themselves better than you do. No, this doesn’t mean when your 11 year old refuses to eat vegetables or brush their teeth, you can shrug and say “well they know themselves best”. This means when they try to share how they’re feeling (ESPECIALLY when they’re sharing a feeling about something you did), listen to them and try to compromise when it’s reasonable to do so. If you hurt their feelings--apologise. If they feel like they deserve more freedom, offer up ideas for how they can earn your trust.

TL;DR: Kids aren’t brainless creatures you can ignore and wonder why they aren’t becoming functional adults. They don’t lack intelligence: they lack a method to communicate that intelligence

Treating kids like adults (in an age-appropriate way) gives them the opportunity to learn the skills needed to act like adults when they’re thrown into the real world. You can’t treat them like they’re dumb their whole life and then ask why they’re not succeeding.

#This post mostly references young kids but it applies to kids of all ages#childcare#kids#teenagers#tips for interacting with kids#some of y'all wonder why kids aren't listening to you???#I honestly can't believe these things have to be said#I just...#*sighs*#I have more to say on this but the post was getting long and its late#come talk to me about this#I genuinely want to hear other perspectives

9 notes

·

View notes

Text

#personal

When people wonder how long I’ve spent being ignored down here like everybody else it’s nothing compared to how long I’ve held the same job. Truly one of the things I’ve been most successful with in proving consistency has been my work ethic. It helps that it returns financial compensation and benefits not that any of that impresses anyone these days. I say that work is work a lot and leave it at that. It is important to note I work in an extremely liberal environment. I don’t mind being inclusive in fact I think it’s more rewarding in the long run. You expect that respecting people’s right to be will create an atmosphere that encourages you to do the same. This is the Utopian vision of liberal America that always has it’s heart in the right place but fumbles upon execution. Mainly because accepting people in America seems to be largely an egocentric experience. We the people. Wait who are we all again really? It’s true I don’t really feel much in line with extreme politics on either side these days. I spent years soul searching after making dance music on how to do something more important. I volunteered for a Korean American Festival for three years back in 2011 through 2013. That imploded in such a Tarantino-esque way like everything else in my life. People come together and power struggles emerge out of the vacuum. Around 2013 I worked with a collective of mostly women from my school in a project called Collective Cleaners. It was a project about cleaning and the value of human labor. I learned how to weave rags from old bedsheets. We did a year long show at Jane Addams Hull House at UIC. I could go on and on right. But it seems like I’m telling a joke about my life with no actual punchline. Like I’m mockumentary in the flesh. Here I am still out here ambiguous proving myself to some phantom army. And here I am still not good enough for America staring it in the face. After all this my life is still a fucking joke to people in the worst and most hurtful way. It becomes exhausting to remind people you have acted on solutions to these modern problems. Nobody cares about me and what I do about it year after year. Trust me I get that part by now. That’s what it seemed like for awhile. And then I had the painful realization that the work never stops. And it seems like I’m all alone doing all the work. To be truthful a lot of the work and expectations follow me around after I leave my day job. On my lunch break I had to break up a fight between a white christian woman and a fake monk on Michigan before it happened. The woman came running down the street making a sign of the cross with her fingers. I stepped in front of her and calmly asked her what the fuck she was doing. She ran away in opposite direction. Where’s my comic book Marvel?

For all the things I’ve done I’m still just as mistrusted and questionable in the eyes of the social elite. I’m never quite good enough. Never quite valid enough to prove I’m just as just viable as a closet misogynist with a six figure salary. I’ve been questionable for years only to realize that nobody has any answers for me on how to be otherwise without being me. Other than me. And so in the end only I really know how successful this has all been. And only I know when it’s appropriate to stay the course or give up entirely. I haven’t given up. That’s self confidence talking. And sometimes you have to lead yourself forward towards some sort of progress through the hazy chaos. I spent an entire year answering political calls and surveys out of guilt. Mostly due to what I would hear from my peers about the intrinsic value of being politically aware and woke in the arts. When it comes to American politics I do participate at bare minimum in voting. One robocall asked my political leanings. I said left. “So I’ll mark you down as progressive.” I didn’t know how I felt about it at the time. Progressive in Illinois is a strange beast. We elected a billionaire for Governor and a lawyer for Mayor. At surface level that sounds horrible and I guess the more you dig into Chicago and Illinois politics you’d find the same shit. You need money in America to have a say in politics regardless of how many free speech arguments you win on the Internet. You can of course vote and it would be remiss to say I haven’t seen progress in that. As of January we have recreational Marijuana and abortion legal across the state. I have seen the drug war up close and personal. It sounds like I’m a vice news reporter. I’ve probably nudged up against them too in the field but they pretend I don’t exist. Maybe that’s a parable of the drug war and the media industrial complex. Maybe shit was lame. All I know is through a series of miracles in the democratic process smoking weed in Chicago isn’t as dangerous to your personal freedom as it used to be. Making friends in public still is. Welcome to snitchville. Whereas New York is up close but never personal Chicago is your best friend and your arch enemy at the same time. Progressive politics signifies that things move on, evolve and change. I’ve read enough news feeds to understand the Governor made whatever possible by crossing the aisles. Which can be read as compromise. That’s government. I’m a private citizen in America. Or so one would think. There’s endless commentary about how people like me don’t do enough. Americans love to talk all day about privacy and talk can be cheap. Facing the realities of a growing surveillance state that likes to masquerade as the land of the free is troubling. So can facing the reality your favorite punk rock festival is using public space for profit in under served neighborhoods. I’m more concerned about white dad rock masquerading as punk. But insecure men would rather lash out at the me too movement than rock the boat. You pick your battles right? Generally when I’ve been the one to stand up to things it’s been about not moving backwards in terms of progressive beliefs. I believe in a woman’s right to choose. I got targeted on the street all summer because of it by Christians who thought it was ok to bring it to my face. I didn’t get a medal and I sure as fuck didn’t really get a pat on the back. I still have my secret support systems but I don’t have the luxury any more of hiding from who I am and what I believe. I often stand by myself and what I believe and suffer for it. Or worse it gets hijacked, misunderstood, and misrepresented by someone’s interpretation of what I’m trying to say. And I sit here every Saturday morning wondering if I’ve made any progress in being happy at all.

After failing so much in everything you get a little tired of falling for the same old tricks. The personal is the most political you can be and I have years of resistance to draw from. Nobody ever wants me to be me even after all the passionate posts on the internet about what I believe. It goes nowhere. There are people who do understand and people I trust. But the reality in America is that is few and far between in public space. The propaganda that we’re all free is largely based on some huge stipulations. Money is one of them. I work for a non profit. You can do the math. It feels like everything that the Left wanted me to be based on critique is largely ignored unless I have my wallet out. And even then I’ve been happier being less liberal with my money in places where it isn’t respected. I guess I could run away to Hong Kong and start over. The irony of that is pretty funny right now. I haven’t talked to that side of the family in a while since I’ve been off Facebook. I haven’t left the country since I came back from China, Korea and Japan by myself since the first summit between Moon Jae-in and the other guy. I don’t know that I feel very safe leaving the country. I don’t feel very safe leaving my house these days. So do I shrivel up and waste away hoping somebody will save me. What have I done to deserve all this I’m not sure. I’ve spent over three years clocking in hundreds of miles running around desolate and abandoned areas of Chicago. What am I really afraid of at this point? Dying alone and forgotten? I feel dead inside already every day. I have no hope any of this will change no matter how much we sit and argue about it. Nobody does anything. Nobody is out there with me other than the people close to my heart. Nobody invites me to a special club other than me at my kitchen table on a Saturday morning. For all the good I’ve done I’m still the first person to scapegoat as ‘problematic’ after all these years. And I can’t even profit off it on the internet? That’s a joke. If listening to all these criticisms and taking them to heart got me where I am why do we still pay so much attention to Dave Chapelle’s career and for profit opinion? I’m invisible. Just like all the victims out there who are invalidated when somebody says they’re over reacting to sexual abuse and harassment. I think America has enough problems that nobody wants to confront without us having an opinion about any other country’s sovereign dirty laundry. And this is where I think we can all learn a little something about progress. I got to where I am by believing in myself and resisting people’s judgements of who I am. I got there by challenging my own perspective and growing into my own by putting my ideas into practice. It hasn’t been easy. It has been largely thankless and a complete mind fuck. But I haven’t been alone as much as it seems. People use so many words and get nowhere. And then people learn how to communicate without ever opening their mouth. People can say they love you all day long. I’m always going to be out here showing you just how much it means to me regardless of who sees it and how they feel about it. In that I err on the side of consistency. If that makes me a loser I’m happy with the results. <3 Tim

0 notes

Text

3. I’m not sleeping, I’m resting my eyes...

We often think of success as a linear journey. All I have to do is slough through enough shit and eventually I’ll make it. Not a bad way of looking at things. Very macho man, tough guy, don’t stop no matter what attitude. Maybe not the best. Here’s why

1. Not stopping at all is exhausting. Can you give me an example of a perpetual motion machine of any kind? That’s just not nature’s way.

2. What happens when you inevitably do stop/run out of gas/get distracted?

and my personal favorite

3. What if what you need to move forward on this particular journey, is found on the path to something else? Do you ignore that key item/emotional development/character development and hope that your persistence will be enough to power through? How will that affect your journey if you are able to push through this obstacle poorly prepared?

They’re not easy questions because life isn’t linear. At least I don’t think it is. Sure you get older every day, and when people ask you how you are, you say “livin’ the dream”. Seems pretty straight forward right?

Maybe, but probably not. The reason people quit the shining glorious dream of complete financial freedom through Forex is usually for one of two reasons.

1. Forex just isn’t for everyone.

And that’s okay, but that’s where it ends for some people. And that’s okay.

2. They lose buckets of money, trying to sprint to the finish line, desperate to achieve the dream they were sold (or that they sold themselves). They chuck entire trading accounts upwards of $2,000.00 USD at the wall hoping that at least this time when they fail, they will learn some secret that will kick the doors open for them.

But that’s not how Forex works. And once they can’t afford to lose anymore money... They give up. Broke and pissed off, they regret the day that sparkle came to their eye.

Whether fast or slow, it happens to everyone. We’ve all sat there hopeless and lost, stuck in the paradox of not knowing what you don’t know, so you don’t know what to do, to start knowing that which you don’t know. Tricky innit?

Yea. It’s frustrating.

So you get busy with life and generally forget. But as my acting teacher used to say, “you can’t pour from an empty cup”. Some people come back to it later with a little more life experience, and find that they’re able to see things a little differently. In fact I’ve found that a little perspective can go a long way.

I didn’t get Forex. It just didn’t make sense. But the truth is, when I started, I wasn’t who I needed to be, in order to be successful at trading in the Foreign Exchange markets. I still might not be. But I’m closer to him. And I’ve come to realize slowly that as I live and grow, my perspective, discipline, and intuition change. Slowly, but they do. Hopefully more like Kudzu and not like a succulent, but still.

I’m not who I need to be. But I’m closer than I was. And to be honest, it’s been really fun. It’s been hard. Late nights, and long months doing nothing Forex related which leaves my feeling guilty. Guilty at not practicing my craft. But even when I’m not doing Forex, I’m still thinking Forex. After all, Forex is the way human psychology affects the exchange of money across international borders. And human psychology is present in every decision we make.

Like I said in my previous post, you can’t predict price because price is the result of 7+ billion people making an innumerable number of decisions every single day. But... we can relate to the way people make those decisions. And invariably, how people think.

The point is, stopping to rest is okay. Stopping to smell the roses is okay. Slowing down, is totally ok. Quitting is even ok. If it’s not for you, it’s not for you and you should find something that's fulfilling. But don’t quit because it gets hard. That’s not okay. Rest. Recover your strength so you can walk the journey and enjoy it at the same time. I don’t mind driving. I hate driving tired. There’s a big difference in what I take away from it.

People quit Forex for many reasons. But because it’s hard should never be one of them. You don’t have to blow your life’s savings. But don’t think it’s going to be easy either. Rest and take time away from the charts so that you don’t burn out.

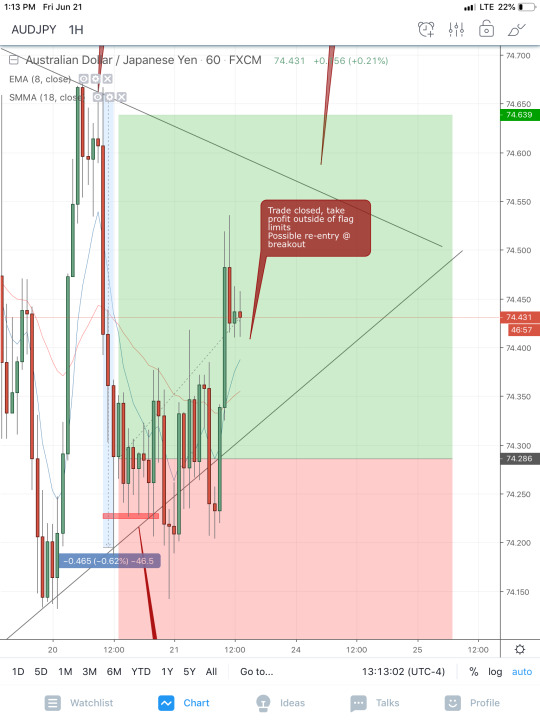

That being said, I’d like to touch on the last trade we were looking at in AUDJPY.

This where price action was when I decided to close the trade. I closed it while it was in profit but it didn’t hit my target. As you can see in the speech bubble, my target price was now on the outside of the triangle walls. If I’m basing my trade on the expectation that price will bounce between the two lines, I should best hope that my exit is inside those lines. That being said, I took my money and walked away. Not easy to do considering it could go my way after I've left and then most people would have to live with the, “aww man I should have stayed in!”. But I’m cool with it. I don’t have to put it all on red. I’m cashing my chips, and I’m gonna go enjoy a drink while I rest at the bar.

I might get back into this pair, but I’ll do so with a different strategy, the breakout strategy potentially. That is, only if everything lines up right.

Now as we get into the weekend, I can’t put in any trades. On a global scale, all Forex markets close Friday at 5pm and open Sunday at 5pm Eastern Standard Time. Any trades placed during this time will be entered into the market at whatever price the market opens up at Sunday night. Very rarely the same price that it closed at. All that being said, my next few posts will probably not have any entries but will instead have an in-depth analysis of different charts on various time frames. This is a good way to practice.

The thing with each pair is that it moves differently. And every pair moves differently from the way it moved 1-6 months ago. Here from May 2017 to May 2018, we can see that this pair (the Euro vs. the $) had a definite direction most of the time with strong pushes. Price rose through the months and even though it fell here and there, it mostly moved upward.

Here we see that from May 2018 to May 2019, price fell but it did so much more slowly. It consolidated most of the time (no definitive direction or trend, up or down). Price behaves differently at different periods in time. That is why Forex traders have to have a bag full of tools for different occasions. Our most powerful tool regardless of anything is called confluence. That is important to note.

Here’s a comparison of the “trend” or average direction. From February 2019 to the beginning of June 2019 price fell. Up down, up down, but overall it fell. From June to now however, we start to it coming back up. Will this be a change in overall direction (a trend reversal) or could we see it start to play inside of channels in extreme cases of consolidation? Let’s break it down and see what happens.

The highest point looks like Batman ears. We call these price history formations Double Tops. It means that price rose up to it, then people started selling, it got to a point where people thought it was relatively cheap and started buying again, driving prices up once more. It essentially hit the same price twice, testing it out, but when it failed to break through this price level again, the bulls got exhausted and the bears rode it down. When this happens it usually means price is going to fall hard. And it sure did. A little news release happened today and it caused price to fall just a tad from the strong push it’s had in recovery of that double top, but it rose back up quickly and so only a big wick remained. The MA’s did cross which is important, but I will get to them next time.

Here we are at the moment. Hungry for success standing outside of a closed shop in the rain looking through the window. We can’t trade but we can analyze and hopefully get ourselves in a good position for when the market opening back up on Sunday collides with what we know in a beautiful fire works display of confluence. It pushed past where the Batman ears had formed (that’s the yellow line). Between where it is now and the yellow line is little under a 35 pip channel. This could be just the space it needs to rest for a bit before continuing to sky rocket upwards. Perhaps it gets pushed back down. I don’t presume to know these things, but I do have plans for what it might do and more importantly I am ready to react at a moments notice. That is the life of a successful Forex trader. Free and ready. And I’m closer to that every day.

0 notes

Text

Talking Bitcoin with Andreas Antonopoulos – Lightning, Halving, Privacy, Dollar, & Tech

VIDEO TRANSCRIPT

Welcome to the show, everyone. It’s the Krypto Lark I’m very, very excited to have on the show today. Andre is Antonopoulos. He’s Bitcoin educator, tech entrepreneur, host of the most educational YouTube channel related to Bitcoin and podcast as well. So and is an author of many, many fantastic books, including The Internet of Money, which is why my personal favorites I’d pick it up and show it to Dave has actually lent out When I friends because a book on a shelf isn’t doing a lot of good in terms of spreading knowledge. So there it is. That’s the third volume of the series. Yeah. Fantastic. Fantastic. With links down below for the podcast, the YouTube channel. And we can grab some of those books as well. But Andre is thank you so much for coming on the channel to have a chat with me today about bitcoin. Don’t think it’s a real pleasure. Looking forward to this. So I think let’s just go ahead and really dive straight into this. I think let’s start off with talking a little bit about maybe some of the bigger mission of Bitcoin. And I think what we can start off with is talking about your thoughts on where the dollar is heading these days. I mean, do you see a situation where we could be seeing hyper inflation coming or are we going to move into a more deflationary economy? We all know that meme that goes round Bitcoin fixes this. But but is it really fixing this and has this crisis kind of lifted the veil? Do you think for a lot of people on the the falseness of Fiat? Yeah. You know, when people talk about what Bitcoin’s real mission is, there seem to be really two big camps. One camp is a monetary perspective and economic perspective that is about sound money, scarcity, limited supply and low inflation. And the other camp is looking at bitcoin as an open international currency that is accessible to all anywhere, anytime without getting authorization available to the unbanked and underbanked and a non-political neutral, an open protocol for the Internet that makes money possible on a much larger scale and creates economic inclusion. I’m in the latter camp, so my perspective on the monetary economics of bitcoin isn’t probably as strident as you might think. And I’m not sure how this plays out economically. To me, that’s not the biggest and most interesting feature of bitcoin, but obviously its importance to many and the atomic implications are huge. So, you know, it’s funny how the most salient characteristic of bitcoin from a monetary perspective is revealed primarily when international currencies, various international currency, especially the reserve currency, the dollar and others shoot themselves in the foot in the most spectacular fashion and create economic conditions that are very dangerous. I like to say often that I’m here to talk to you about the biggest monetary experiments, the most crazy, risky experiment that’s ever happens. And no, that’s not Bitcoin. It’s the infinite set of quantitative easing, infinite stimulus, unlimited printing and unlimited debts experiments. I think it’s important to realize this has never happened before. So all of the people who are like trying to place bets on how this turns out, hyperinflation, deflation, stagflation spirals, Deedes authorization and all of these other things, they have no clue. Nobody has any clue. I’m part of the reason for that is because we have no historical analog to go back to. This has never happened before. Certainly not on this scale, but but not even in terms of the fundamentals. I think we’re entering a very dangerous period, and the reason it’s a dangerous period is not so much because of the economic impact of these moves, but more the political impact of these moves. And to me, the political impact of these moves is that we have detached from market forces and and the fundamental economic basis for for market pricing. And what that means is that we’ve moved into the territory of centrally managed economies that are fine tuned by technocrats. And we’ve seen back to experiments before. So we know that doesn’t end well, because if you disconnect from market signals, a lot of malinvestments and misallocation of funds tends to happen. No, no country can really scale. Especially countries, because the United States can really scale decision making to the point where a few central bureaucrats can decide which companies are essential, which companies are non-essential, which companies should receive support. Which companies should not. Which employees should. How to allocate these enormous amounts of money that dwarf gross domestic product. And all of these moves essentially basically remove markets from the equation. That’s a very dangerous move we’ve seen with the current crisis that’s going on. A lot of talk around implementing central bank digital currencies. Lieber is getting a lot of attention. Once again, we saw this I think was the first the second draft of the stimulus package in the US, the first stimulus package, not the third or the fourth when the Rons who now actually including language around a digital dollar. Do you think that De’borah and a central bank digital currency issued by whether it’s the United States or China or the European Union, whoever else, is this going to help or hurt Bitcoin? It’s going to be entirely irrelevant to Bitcoin. It’s it’s a bit like, you know, introducing a new model of cars and saying, is this going to help or hurt the airline industry? We’re flying above all that shit. Behind is Libra Central Bank, digital currencies. All of those systems lack the fundamental components that make bitcoin interesting and differance. They’re not difference at all. I use that acronym to remind my viewers what the fundamentals are and that the acronym is RIP CORD because we’re having to parachute out of a crashing plane here and REPORTSTHAT stands for a revolutionary, immutable, public, collaborative, open resistance and decentralized. And guess what? Central. Digital currencies, leaper corporate currencies are not that they are centralized, their control, their surveillance mechanisms, they have none of the characteristics of open public blockchain cryptocurrencies. The interesting thing about these new technological currencies is that they’re not controlled by a single party. In fact, their control is decentralized and they’re open to anyone who participates. And they remove all of the barriers to entry and friction points of faxing authorization and control. So from that perspective, they introduce something really novel to the monetary system really, truly open global borderless, neutral currencies which have never existed before. And the CBD seas are simply taking it, taking the name of blockchain. If they even have anything to do with technology and trying to wrap the same pig in a new package, you know, put lips comments and serve it up with something revolutionary, something disruptive, something new. It’s nothing new. In fact, it’s dangerous. Both both corporate currencies like Leaper and Central Bank digital currencies are extremely dangerous because the the end point here is the eradication of cash as an open peer to peer transparence, anonymous mechanism for transacting that no one needs permission to use. And we’re reaching the end of the era of cash and our future is going to be digital currencies. The question now is whether those digital currencies are going to be centrally controlled and surveilled. Troll and private. The problem is that if you give centralized institutions control over something as important as money in a society, they can use that control to amass enormous power. They can use that control to crush any dissent or opposition, and they will start picking winners and losers and they can turn off anybody their entire financial lives. Your ability to buy food by flipping a bit in a database. That is a very scary world. And of course, you know, first they’re going to come for the terrorists and then they’re going to come for the child pornographers. And then they’re going to come for the, I don’t know, pot sellers and gun sellers and porn magazine makers and God knows what else. And then they’re going to come for anyone who speaks up about anything that’s contrary to their politics. This is a very, very dangerous path. Totalitarian surveillance of money leads to totalitarian politics and it’s an unavoidable outcome. So we need to make a very smart choice here and the choice to use the open, decentralized than neutral currencies of the people rather than the close surveillance, totalitarian currencies of either nation, states reinventing themselves or corporations trying to become nation states. You said it very, very well there. Do you think that we can actually see a country being brave enough to embrace public open networks to actually issue their central bank currency on a public open network or to actually start acquiring bitcoin for a central bank reserve? Who cares? It doesn’t really matter. So the enforcement of national institutions of an open, decentralized, Internet based cryptocurrency is irrelevant. It’s almost like saying will governments build Web sites to offer their government services on the Web to carers? That’s not where the action is happening. The wave the old world will try to adapt to a new environment is irrelevant to that new environment. What really matters is whether people will choose to use this among many other cryptocurrencies, whether they will have that choice and whether they will exercise that choice not in exclusion or replacement of their state currencies, but to as an alternative that gives them better results, better freedoms. This is about open markets for currencies. And so the centralized enforcement or authorization of a nation state is irrelevant in the era of the Internet. Yes, some countries are probably going to adopt that, just like, you know, some countries have adopted the dollar as their de facto national currency because they either can’t afford to print their own or because their own has collapsed irretrievably. But again, who cares? We’re not we’re not looking for approval. That’s that’s it’s a bit like saying, do you think some of the horse buggy manufacturers are eventually going to transform themselves into automotive manufacturers? Who cares? I want to switch the conversation up the way here from the kind of the bigger vision stuff to watch the lightning network. Do you think that the lightning network has kind of lived up to its promise? Why have we not seen more support from wallets and from exchanges to actually implement the lightning network? Currently, I think we see more bitcoin locked up in tokenized on a theory than there is bitcoin locked up on the lightning network. So is this a failure of the Leighton network or is it still just trying to find its feet? Oh, it’s so early to. I mean, I don’t think we can really call winners and losers. Now, keep in mind, I’m biased. I’m writing a book about the Lightning Network because I think it’s a fascinating technology, but it’s really, really early days. This is like the web in nineteen ninety eight ninety nine. And it really hasn’t come into its own. One of the important things to realize about all of these technologies is that the innovation is happening in different layers. And when you have innovation like the Lightning Network, which is actually accelerates its innovation in the bitcoin space by opening up to new APIs and new more rapid development models. When when new things are introduced to the protocol level, those effectively do not exist until they exist in a user interface for users. So this is one of the fundamental issues we have in any of these technologies. You can make something great and new technology and then if none of the wallets implemented, it doesn’t exist and you have to wait for the wallets to catch up. And wallets are actually one of the least monetized, least well invested infrastructure components in the entire blockchain space. There is a weak point. So as a result, it may take two or three years. And so you see these technologies trickle in to two wallets. On average, it takes about three years. So we’re nowhere near seeing the full potential. I think the Lightning Network is a fantastic technology and I don’t really see it as competing against other technologies like decentralized finance. It’s happening in a. All of these are complementary and they work very well together. Do you think that Bitcoin’s lack of privacy could be a problem? You know, we’ve seen first hand we do have the wasabi wallet, which gives people the option to send private transactions. But on the flip side, we’ve seen regulators come after a Bitcoin mixer developer in the past and we have companies like Chain Alices, which provide governments with details on Bitcoin transactions. So is this a flaw of Bitcoin? Is that it? We have more privacy on Bitcoin or is this a plus of Bitcoin? It’s a flaw of Bitcoin, most certainly. And I’ve been talking about that for six or seven years now about the importance of privacy and strengthening privacy in Bitcoin just to make a point there. They didn’t come after a developer fixing services that came after an operator of mixing servers, which is a very, very different thing. No one has so far prosecuted developers for, I think, software the bay themselves soon all to operate. That would be a very serious First Amendment issue. So in Bitcoin security, privacy is difficult. You have to be very careful in order to maintain your privacy. And that’s a weakness. Fortunately, there are a number of technologies that are making that are likely to make that much better. One of them is a series of changes that are being introduced bitcoin now. Schnoor signatures, top rates and typescript of the technical names. But in any case, it’s it’s a package that allows transactions to appear as if there are simple payments when they’re much more complex script. So for example, a transaction that opens and closes a lightning channel instead of being easily identifiable as such and allowing you to identify which channel on which nodes interacted with it instead will appear as a single payment from a sender to a recipient’s mixed among all of the other payments. In technical terms, what that does is it increases the anonymity set of transactions, making it much more difficult to do this kind of analysis. Companies like Catamount changeless and others are basically in an arms race against privacy. And what they’re doing is they’re providing the world’s worst dictators and regimes, either directly or indirectly, with information that violates the civil rights of millions of people. I think it’s fundamentally immoral to even work at a company like this. And just like I would consider it’s immoral to work for a weapons manufacturer or, you know, a company that builds cages for refugee concentration camps. You have to make some choices when you work. And those moral choices are important, but they’re an arms race that they’re gradually losing and they will eventually lose because it simply becomes harder and harder to track these transactions. The lightning network is another privacy technology that is going to help with that. Together with some of the other technologies being introduced. But yeah, it is a weakness. And that’s also why I’m interested in the broader ecosystem, because Bitcoin isn’t alone. It’s part of an ecosystem of cryptocurrency, some of which have stronger privacy characteristics that are very easily interchangeable with very low barriers and switching costs. And I think it’s important to look at the ecosystem. Do you think that Bitcoin might be developing too slowly? LICHTMAN stuck on five transactions per second for a very, very long time. And I don’t see where we’re going. Aside from Lighton network, of course, where we’re going to go beyond that, a lot of people do call it all is a weakness of Bitcoin that it hasn’t been perhaps developing its fastest way to basically see happening across the crypto ecosystem. Well, Bitcoin is fundamentally the most conservative system out there because it’s intended to be extremely robust and secure and able to resist attacks by collusion or cooperation between nation state level actors. And so far, it has resisted attacks at that level, whereas many of the smaller competitors that are attempting to scale things up by reducing decentralization are going to pay a very big price and they’re much easier to attack than than Bitcoin. So from that perspective, that’s a design choice. It’s not an accident. It’s not a it’s a deliberate design choice to keep things conservative in order to maximize decentralization. There are some fundamental design tradeoffs here that you can’t just wave away. If you create a system where everybody has to validates everything and that’s a security feature, then that system will necessarily not scale. If you increase the scale of that system, then it becomes a burden on everyone who’s trying to validate. And that means you lose validators until eventually you have very few validators easily identified, easily coerced, and the system is is vulnerable to attacks. So that’s the fundamental tradeoff. And it’s not an easy tradeoff to solve. One of the best solutions in my mind is to move off chain many of the transactions that do not need to be validated by everyone while maintaining the same security models through smart contracts. And that’s what the Lightning Network is doing, given the ability of the lightning network to do millions of transactions per seconds while maintaining the full security of the bitcoin chain. I think that’s a much better avenue for scaling the system. It’s a really revolutionary technology when you start to understand what the lightning network is. And like you said, it’s still the very early days for outside of the Bitcoin ecosystem specifically. So why do ecosystem overall. But what is the technology that’s getting you most excited right now in the entire cryptocurrency space? Well, there’s there’s a couple of technologies that are keeping me most excited. Certainly I’ve been interested for the past four years. And smart contracts and blockchains that execute smart contracts on a virtual machine such as the theorem I’ve written about, that’s one of my books, mastering a Theorem from a technical perspective. And I think we’re beginning to see some early examples of how these can express a rather rich applications. Of course, we’re still at the toy scale and there’s all kinds of complexity and risk that comes with that. But it’s very interesting to see the very rapid pace of developments, for example, and decentralized finance. A lot of interesting examples coming out there. And what’s interesting here is that I’m hoping that we’ll move from the stage where technology is used to replicate or mimic the status quo, the existing sets of applications. So you have a better tool and you use it to build the same thing you were building before, just bigger, better, faster. And the next stage of that is where we start building things that simply could not be done with the existing set of tools. That’s when it really is innovative. And I think we’re reaching that point with decentralized finance. You know, when we look at the Internet, for example, in the early days, everyone was like, OK, how many fax machines does this replace? Because the only way to perceive the Internet and to measure its value was by the metrics of the previous system and to understand it and how it it simulates or mimics the previous system. But of course, all of the value does not come from there. It comes when you that question stops making any sense. So how many bank accounts can you replace with cryptocurrency? Is this level where. Now, when we stop asking that question, we start thinking about applications you couldn’t do before. That’s when we really see the innovation that excites me. The other one that excites me equally and for the same reasons is the very rapid developments in cryptography, fundamental research that has been spurred on by bitcoin. If you think about it, Bitcoin is the largest civilian deployment of cryptography ever. It’s the largest practical application of cryptography that has reached consumer level ever other than, let’s say, a hard, hard drive encryption. And it’s as such, it’s it’s kind of pioneering cryptography. And as a result, it’s it’s spurred research. Zero knowledge proofs is a perfect example. The amounts of research that has come out of the zero knowledge proof area just in the last two years is staggering and it’s moving really, really fast. All of these things within a decade will turn into practical applications that truly revolutionize finance. I think that’s one thing that a lot of people, they get very anxious and impatient about how quickly this technology is going to roll out. But if take the long term perspective, you know, you said right, 10 years from now, whereas this technology, I mean, was the application level of that going to be now? The final topic going to touch on here with you is the bit coin having obviously about I think 20 days away at this point. There’s been a lot of speculation on what it’s going to mean for Bitcoin, the markets, the miners, all of this stuff in a wider perspective. What’s your take on the impact of the Bitcoin having? Well, interestingly enough, the Bitcoin having is happening in stages because there are a bunch of Falk’s of Bitcoin. That’s because of various quirks in the development. Ended up mining a lot more blocks and got to the having first and they saw some really radical effects because of the low hash rates. They became vulnerable to attacks and very low cost. It’s kind of a preview of what happens when you have a system where you can move to a more profitable competitor with the same mining equipment. Now Bitcoin doesn’t have a more profitable competitor with the same mining equipment. It is the most profitable competitor. So we’re not going to see that’s in fact, with the Bitcoin having I think in the short term, we’re going to see a lot of volatility. People are obviously worried and they’re going to be trading on on the emotional impacts of all of that. It’s going to take months after the having for everything to kind of settle down and for us to start seeing some of the fundamental impact of the constraint and supply that that will be because of the because of the halving in terms of demand. Demand is still very, very strong in Bitcoin. And I expect it to be even stronger as we see, you know, various national experiments with currency creating very weird conditions. People need safe haven assets. Right now, I think Bitcoin is one of them. That’s a personal opinion. I can’t give you financial advice, but so, you know, a whole lot of nothing is going to happen with the having. It’s just going to happen. And then ten minutes later, a new block is going to come out. And then ten minutes later, a new block is going to come out. And all of the people who wrote articles about the death spiral of Bitcoin that is imminent and how bitcoin is going to die again and again and again, they write obituaries so fast are going to be proven wrong. And of course, are not going to revise any of their obituaries. So I’ll just find a new reason to write more. That’s what Bitcoin does. Ironically, the story of is bitcoin dead yet is one of our greatest marketing successes, because every time someone here is that it’s not dead yet, that builds a bit of cognitive dissonance in their minds. And gradually they realize this thing is rather resilient. Haven’t needed a bail out yet. That is a great point. There is no big bailouts for bitcoin. Just a bit of a follow up to that question. The long term impact of having is going forward, not just this time. We’re talking potentially even decades down the road. Do you think that the incentives will actually keep pace as we see the block awards falling and miners needing to really subsist off of basically transaction fees at some point in the future? Well, first of all, we have a very, very long time to to look out for that. And we already know what that’s going to be. So people adjust their expectations accordingly on a daily basis. These profitability considerations happen every single day. Miners look at fees and block subsidy. Electricity costs. Operating costs. Hardware costs for mining. And they make decisions as to which miners are still profitable and which ones are not turning off the ones that are not. ET cetera, et cetera. It’s a constantly, dynamically adapting system. So in the long run, you know this we don’t know obviously how this is going to play out. But from my perspective, I think that we’re going to see is more transactions with more expensive fees, substituting for the block subsidy quite comfortably. And, you know, we have enough proof of work mining right now to keep the network secure. So even maintaining it at this level is perfectly fine. I don’t see a problem with that. It’s such a long term consideration and so much will change with Bitcoin. You know, we were having this discussion at the last having I guess, well, lightning that we’re didn’t even exist then. So how do you know that completely changes the equation of how fees are used to open on closed channels. So how can we possibly predict what’s going to happen in four years? You know, 50 percent of Bitcoin’s life time in in in a space that moves so fast. Perry, very interesting stuff. Andreas, thank you so much for taking the time out of your busy schedule to come and come and chat with everyone here on the channel. Again, just a reminder, there are links down below. We can check out the YouTube channel. The podcast and of course, get yourself one of those fantastic books that Andre has written. If you haven’t read the Internet of money yet or four volumes, two or three, you definitely get your hands on one of those. Sondre is. Thank you so much for coming on and having a chat. It’s been a pleasure, Laura. Thank you so much. Thank you.

source https://www.cryptosharks.net/talking-bitcoin-with-andreas-antonopoulos/ source https://cryptosharks1.blogspot.com/2020/04/talking-bitcoin-with-andreas.html

0 notes

Text

Talking Bitcoin with Andreas Antonopoulos – Lightning, Halving, Privacy, Dollar, & Tech

VIDEO TRANSCRIPT