An exciting and in-depth dive into the mind of an up and coming Forex Trader

Don't wanna be here? Send us removal request.

Text

7. To infinity... & beyond! (together)

So what’s the goal?

I’ve talked about it before and even with what I know, I’m not immune to daydreaming. I still see sandy beaches and clear skies when I close my eyes after setting up a trade. But I know it comes at a cost. I still don’t know what the exact extent of that sacrifice is, but I know I’ll have to continue to give it, long past any personal achievements.

Growth: the goal & the journey

In order to have the things you picture in your head, you have to become the person you can’t even see yet. It takes discipline, dedication, focus, patience, restraint, thick skin, etc. etc. But it starts with a decision. The decision to transform yourself, to change the person you know so well is one of great empowerment... and great pain.

This quote is everything to me. It’s become my mantra and it guides my perspective.

Pain: the ultimate catalyst for bravery

At the risk of sounding like a pop punk band from the early 2000′s, I have always been grateful for the pain in my life. I consider myself incredibly privileged for reasons many people wouldn’t guess.

I am a lighter skin outgoing hispanic male immigrant with no accent what-so-ever and a complete assimilation into American culture. I am blessed beyond belief. I am not targeted by cops who might pull me over to see if I’m documented or not.

I’m not African-American, fighting hundreds of years of institutional oppression and systematic racism.

History as we know it

I’m not a young teen of the LGBTQIA+ community who might have gotten thrown out of a strict household and left to roam the streets.

I’m not a young female caucasian teacher who gets excluded, isolated, and ostracized for being white and teaching at a predominantly African-American school (I often saw this at the schools I did go to early in my life as a result of what happened to the African-American community and how they reacted to the “perceived oppressors”. It’s not the communities fault but the scapegoats of any color in any society fair no better).

I’m not a recently arrived Muslim immigrant who is still blamed to this day for 9/11, despite the fact that they are running from the same people who would do something like that.

Truth be told we’re all just space-farers, born clinging to a rock, floating through the infiniteness of the cosmos. There is nothing but life. We, humans and all life in general, are all we have.

But I consider myself privileged because I was blessed with just enough struggle to have to grow as a person to even just survive. Arriving in the US as immigrants, my family had to learn everything as quickly as possible.

¿Que es hamburgers?

Ok so we knew what hamburgers were, but imagine taking a class you have no experience in except the class is in another language. Your context clues are limited because you don’t know anything in the subject matter, and not everyone wants to help you all the time everywhere because they're busy. What do you do?

You grind. You wake up at the crack of dawn every day and you make it happen one way or another. You get any job you can, even under the table and you start to build a better life for your family.

As you get better, you begin to look into more complicated matters, like legality, taxes, insurance. It’s not easy but slowly over time you begin to master your every day life. Now stop, what if another calamity happened and you had to leave that country again?

If you got dropped off in another country and had to fend for yourself once more, it wouldn’t be easy. But... it would be easier.

Survival of the fittest bravest

You become better and better at dealing with problems. We as humans are learning machines. And generally the cool thing about being fleshy machines, is that the more we go through punishment, the better we get at dealing with it. The greater the weight, the more strength we develop. The more dangerous the day, the more ferocious we become.

We strive for peace and happiness. But I quote the book “Those Who Remain” by G. Michael Hopf in my head every time I wish my life was a little bit easier:

“Strong men create good times. Good times create weak men. And, weak men create hard times”

and those hard times, create strong men.

In the Stone Age only two things kept the darkness at bay: fire and the people willing to wield it. Our ancestors walked for miles every day to hunt and gather. They could climb, jump, swim, build, create, cure, you name it.

I can make toast if I have a toaster.

The Eye of the Tiger

This is why when life gets really hard I’ve learned to call it to me. I’ve learn to love the feeling of disaster, chaos, and the rising panic in my gut.

When the clock is ticking, and you only have moments before failure/tragedy, do you fight or flight? Even if you choose to fight, is your mind still running from it? Or do you lean into it?

When you’re surrounded and your back is against the wall, are you afraid or excited?

Trick question: your reaction is all you have.

This is my trial by fire. This is my saber tooth tiger fight. This is my last chance at survival.

This is my privilege. I am privileged to not have had life easy. I am privileged to have many tools at my disposal to make life easier, but I was burdened with big dreams, and an opportunity to help people that will never allow me to stop growing.

The journey is the goal

Returning to the topic, I was blessed with many obstacles and challenges in life that I had to grow through to overcome. And so when faced with the Mount Everest of trading that is the Currency Exchange, it’s not easy but I have a plan for tackling it. A plan that I might not have had if there was never a need for it.

I will take each day one step at a time. I will pay attention to how each step affects my journey, and listen closely to what my journey is telling me. I will try to learn each lesson the first time. Should a step lead me away from the path, I will slowly back track, redirect myself, and write that lesson down.

If you want to go fast, take it slow

You hear this everywhere. And it is the best advice a beginner can take. Especially in Forex where the promises of 2 hour work days and buckets of cash from countries all over the world are ever present, you have to take your time or you won’t survive.

And if you don’t survive, how will you ever help anyone. This isn’t just about you anymore, everyone has a mother, a sister, a neighbor, a friend, or even a stranger in dire need.

Your life isn’t about you anymore. That’s why you have to be prepared for anything.

I’m lucky that my life was set up that way by default. And you can be too if you choose to see life that way.

No chart breakdowns on this post folks. I was out of town this last week filling up my cup of experiences and I’m ready to hit it hard.

I will leave you with this. From what you’ve learned, where do you think price is going next?

0 notes

Text

6. Finger on the pulse

More often than not price is a powerful indicator of the economic conditions in different countries around the world. As people and firms make decisions, they drive the price of their currency up and down, buying & selling, trading and exchanging. The governments have to keep on top of it.

Big Brother

If the US dollar for example, rises too much in comparison to other currencies, American industries suffer as international demand for US goods falls, and so do exports.

Should the dollar fall too low, and you have devaluation which can lead to inflation should exports rise too high spiking up GDP. Industries without exporting capacity are then hurt by the rise in general prices, while exporters enjoy lucrative profits, which can eventually collapse the price.

Caution: Swim at your own risk

While we as Forex Traders live off of volatility, a currency that is way too volatile can be a risky investment. Firms are less likely to carry a currency if they believe that the currency might be worth something drastically different very soon.

They can purchase currency options, but even then excess volatility is not something people look for when they travel/trade/save.

Now what happens when the price rises too much and the Federal Reserve bank of a country has to react to it? Seeing that price is too high, technical traders (traders based off of charts & price action), wait for Red (major) news releases and attempt to predict the actions of the Fed.

It’s the Feds, run!

Should the fed be more drastic in their decisions than expected, price can take quite a tumble. If the Forex traders in question, predict correctly, they are in for a significant gain.

The problem with this strategy is that it is a guess at best, seeing as predicting news can be incredibly difficult; most Fed meetings carry the highest security of information in the world. Reacting is understanding, predicting is betting against the house.

Masters of the Universe

Calling a trade and executing successfully is one of the most exhilarating feelings in the world. It is complete dominance over a currency and when correct, will boost you up.

The problem with losing is that if the price falls too fast or jumps over your stop loss (the point in which you have your limit set for the most you are willing to lose; price your broker automatically takes you out of a trade), there is nothing stopping the market from emptying out your pockets during the shake down.

If price falls far enough, you get kicked out of the trade once you’ve lost your entire trading account. It happens more often than you think.

Who’s behind the curtain

Governments of course do not want people to be able to guess what they’re up to. If enough people can speculate successfully what the Fed will do, it can cause a significant effect on the dollar as not only people but major banks move millions and millions of dollars, trying to capture the volatility.

Currency is a powerful tool in economic policy. By reading the pulse of the US economy, the Federal Reserve can predict market movements and act accordingly, either injecting money into the economy or taking it out.

OMP- Obsessive Monetary Policy

These actions are known as open market operations as they buy or sell bonds to try to control the flow of cash. Since most financial instruments are related, changes in interest rates are particularly powerful movers of the markets.

They affect everything from bonds to investments, and move the price of the dollar significantly. Another opportunity to win millions or get put out on the street.

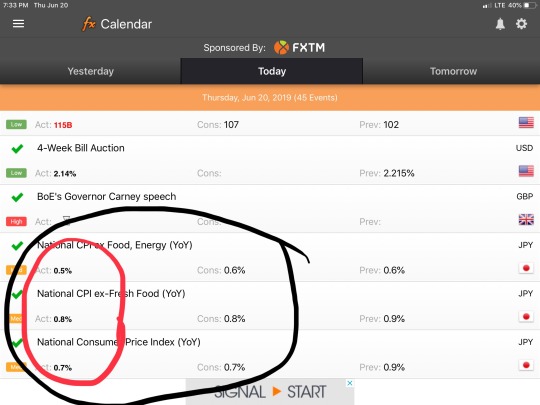

I don’t particularly trade news. The wildest thing about news, is that if you keep your eyes on the charts, its possible to see where it might go. We don’t aim to predict, but in the spirit of reacting, we see how the charts are set up and prepare ourselves for several scenarios.

Let’s check up on our USDCAD chart.

We highlighted 3 possible paths that price action could follow, and so far it has reacted calmly working its way through our channel. By doing something similar during a drastic news release we can prepare ourselves for whichever way it might go, and maybe, just maybe, when the dust settles, we’ll be prepared to react in the general direction it is moving.

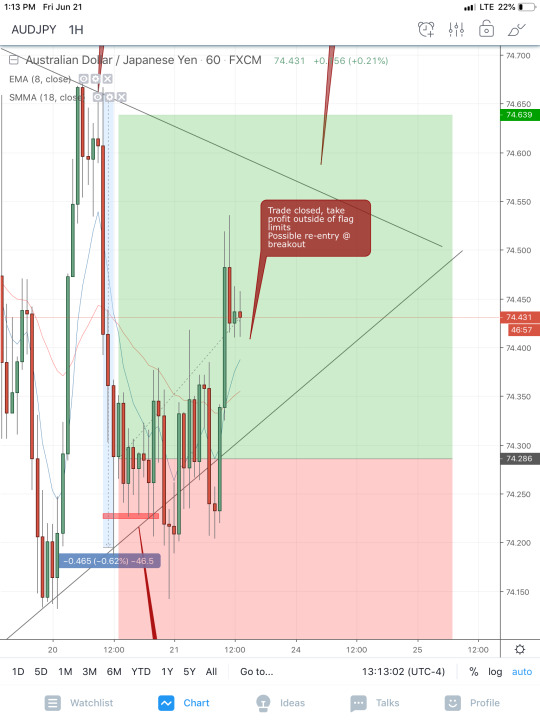

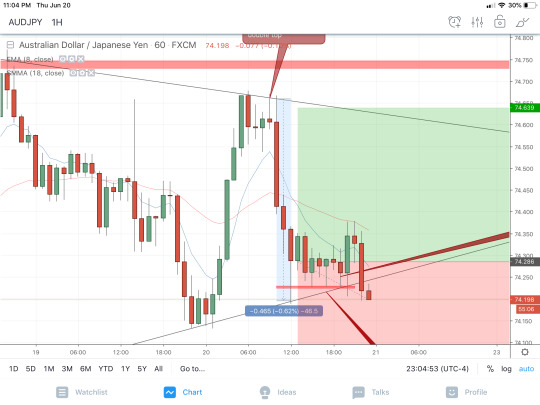

We can see here that AUDJPY has threatened to work its way out of our channel but so far hasn’t had the bullish momentum necessary to do so.

It might continue to consolidate in this way (which in and of itself is an opportunity), but I have my eye on the Japanese Unemployment Rate release coming up near the end of this week.

T.h.o.t.s?

I have two thoughts on the matter. As the price continues to shuffle back and forth between the red lines, as we approach the release it might settle right on a line, like a snake waiting to strike. I can prepare myself for this possibility by seeing how far up and how far down the nearest/strongest barriers to price movement are.

I’m also thinking that news releases can be incredibly disruptive. The charts might start to speak to me as the week goes on, and it might start to become clear which direction it wants to move in. Just as my plan is looking like it is ready to support a trade, a violent news release could completely change the dynamic of what is happening.

No shirt, no shoes, no risk management, no service

This is why risk management is so important. Should I get greedy and bet too much, a market upset could really hurt my account. Can price action predict the future? I completely agree so. Everything from world tensions to shortages can be seen before they happen as people react to fears, hopes, and the ever changing global landscape.

For a million and one reasons risk management is key to successful trading. Like I mentioned in my previous post, more often than not, the goal is survival. The greedy do not make it very long.

In the picture above price fell over 500+ pips in less than an hour. For anyone trading even a dollar a pip with 1/200 leverage, that’s about a $100,000.00 dollar loss if you bet the wrong way. The problem is, even if you called it right, you had split microseconds to react. Just as quickly as price fell, it bounced back up, leaving a massive wick and pulling back on half of your profits.

Just as quickly, the next candle reacted in the opposite direction, shooting up about 1/3 of the way before rising back up over the next few days.

Don’t do it. No seriously.

Price is a fickle mistress and the future even more so. My recommendation to predicting the future... Don’t.

0 notes

Text

5. Trading for human beings: Emotional Intelligence & You!

New research on Behavioral finance takes shots at the classic Stoic trader mentality that’s been taught for years and years. The idea originally for traders was one of fire and forget.

Robo-Trader

You were taught to be a robot, unfeeling, cold and calculating to be successful in trading. You would enter a trade, set limits for winning & losing, and then forget about it. If you win, you win. If you lose, you lose. No emotion involved. You’re either right or wrong. We’ve come to realize that emotional suppression is not what’s best.

The most successful traders have an acute understanding of how they're feeling and are better equipped to know when to trade and when to sit out. To enjoy winning and understand the pain of losing without being severly affected by it requires strong Emotional Intelligence.

Oh grow up *snarky face*

What people used to call maturity back in the day, is the idea of emotional understanding and control. Impulse control is concept close to it, and being able to put down that candy bar while you’re at the register paying for groceries is a good metaphor for trading.

You have a budget for what you considerable an acceptable losing amount, you study the charts, you come up with a strategy for reaction and you are ready to go.

I can resist anything except temptation

Sunday night comes around, and you are prepared. You understand Sunday’s are fickle and you know not to trade until Monday-Tuesday when the week has had a chance to establish a rhythm. And then out of nowhere, EURUSD starts climbing, dropping the juiciest hotdog on a string you’ve for the month right in front of your face. It looks something like this:

It closed high Friday night, reaching the top red line, which to you is a significant resistance barrier.

Your... guess (so as not to say prediction) as to what it might do, is fall back down and play around a little before continuing its climb. As soon as it breaks that red line and forms a full candle above it however you know it has enough momentum to rocket upwards, and that is way to enter with confidence.

You’re excited, having a plan feels good.

Problems, problems, problems...

Problem is, it starts happening right away. Three hours into the Sunday night open, it breaks through. As you can see, when the picture was taken it begins coming back down, but it’s broken through without a doubt. If you don’t hop on, you’re going to miss the train, and with a pair as volatile as this one has been, you can’t afford to lose that income.

You’re not supposed to trade Sunday nights, but it’s literally doing what you said it would do.

You’ve called it to a ‘T’, and not getting in at this point would be that time wasted. You’ll have to prepare a whole new strategy for this pair, AFTER it has given you enough clues.

Getting enough clues for its next move could take all week. And if you’re not trading, you’re not making money.

It’s too good an opportunity not to take it. You set your limits, and dive in. Now if you weren’t so sure, you might bet a small amount in accordance with your plan of slowly building up your gains.

Better safe than sorry

Its the safest way to do it, but tonight we start the week off with a bang. Think about it, if you waltz into Monday morning $1,000 ahead of your weekly goal, you have that much more money to play with. It’s for your own good really and to protect yourself about possible losses down the line this week.

You raise your bet right before entering, and hit the buy button. Now this is happening real time, so I can’t say where it is going to go, but I’ve thought the same way a few times in the past two years and it has bitten me in the ass... Every... single... time...

E to the Q

There’s a reason you make a plan and then stick to it. If you don’t, that’s not very EQ of you. EQ stands for Emotional Quotient. It’s what’s replacing IQ as most valuable measure of mental ability.

And for good reason. Being able to resist the temptation of dollar signs and stick with your plan is half of it, and then no matter what happens, learning from the outcome, is the second half.

If you jump in impulsively and lose, all you’ve learned is that you shouldn’t do that. Your loss has given you no information on how to improve your plan. If you win... it’s even worse...

You have now reinforced the idea that it is ok to impulse trade. And that will charge interest on top of the ass-whooping it will give you later.

The art of losing

Trading psychology is the reason trading isn’t easy. The material is simple; I am teaching my sister the mechanics of market structure and she’s 13 years old. Actually trading with self-control and diligence... That requires true mastery: mastery of the material and mastery of one’s own mind.

“Mastering others is strength. Mastering yourself is true power.”

-Lao Tzu

Now let’s see how you did on the question from the last post. Did you guess what the market was going to do as it opened today?

We were here Friday at 5PM when the market closed:

What did you decide? Is the pair trending (climbing down the mountain), or is it consolidating (bouncing between levels)? Here is where it opened today at 5PM:

It looks like it’s following the green line, and will begin to bounce between the two red lines it finds itself in. That’s pretty cool, it’s following the first green line exactly! Should we enter? Hell no.

Not enough price action has been created for us to have a solid understanding of how to react accordingly. Let’s give it a day and see what USDCAD has for us in the mean time.

Until next time traders, and remember, let the market come to you.

0 notes

Text

4. It’s my way, or one of thousands of highways across America...

No matter what anyone says, there’s only one “right” way to trade: the way that makes you money. Everyone trades differently, it’s a science, it’s a feeling. It’s a carpenter of fate working with a tool bag full of surprises. Your method(s) of choice permeates your every decision and marinates every win and every loss with a particular flavor.

Over time it will change. You’ll grow fond of one technique and then later you might decide it doesn’t work as well as old faithful. The key is to keep it simple, but have every exit covered. People who attempt to predict price movement find it particularly difficult on small time frames (scalping: in and out multiple times a day/hour trying to catch tiny price movements with big bets). Predicting even on the intraday (intraday trading: one or two max trades a day that don’t go over into the next day) can be extremely difficult if you’re using small time frames.

Generally the further out you go and start seeing candles spanning 4 hours or even a full day, the more the rules make sense and price tends to play along. That’s where you get swing traders (entering into a trade or trades that span several days before you’re out).

Problem is, it’s never as easy as zooming out. It helps a ton, but the longer you’re in the market the more exposed you are to risk. A 5 minute market upset at just the wrong moment is the difference between a million dollar account and being flat broke, years of building washed away in the tides of uncertainty.

I trade using a foundation called market structure. Not particularly elaborate or complicated, market structure is the idea that under the right conditions, markets follow a zig zag pattern very similar to a lightning bolt slightly askew. Peaks and valleys form higher highs and higher lows like walking up a mountain full of dips along the way. Walking down the mountain, the peaks are known as lower highs and the dips lower lows. Based on this, I'm either walking up or down the mountain, and I’m either buying on the way up, or selling on the way down. Easy right?

Not quite. It’s simple but far from easy. The key words above are “under the right conditions”. Markets can do neither of those and look more like rolling hills climbing up and down but without every really taking you anywhere. For some pairs, when it consolidates like that, it looks more like a battlefield, pocked by giant craters created by price explosions caused by an inexhaustible foe. Sharp rises and even sharper falls mark the most volatile of markets but provide the greatest opportunity to make money. You can make money there faster than anywhere else, if, and only if, you can stay on the bull long enough.

To demonstrate many of these principles, I present to you my volunteer pair, USDCAD. The US dollar versus the Canadian Dollar is a great pair because at exactly the moment you think you’ve figured out what it’s doing, it changes it up on you in a devastating way. It’s a fickle lady but volatile enough to lure you in with big golden, dollar sign eyes.

Behold:

That is a 91 day, 884 pip climb up the mountain.

Where the blue box starts bottom left, it begins to rise. Then USDCAD falls a bit then rises again. It rises and falls slowly working its way up the mountain, sometimes dropping significantly but always working its way higher and higher. This is a good example of market structure because as it rises, it makes a higher high, then drops a bit (higher low) then rises even higher than the last peak to make an even higher high.

Now that you know exactly how USDCAD moves, you are ready to be proven completely wrong. Here’s what USDCAD to your plans and expectations.

Say you’re expecting USDCAD to do the same thing. Now pay attention to the first yellow circle and you see those devil horns (double top) where it starts? Say price is coming down the back end, what do you expect it to? Once it hits a certain point, you know it’ll come back up like a snake moving sideways to go forward, and just as price comes back down and breaks the line of the last low valley it made, you enter for the sell knowing it’ll keep dropping. It’ll keep dropping until it starts to come back up and then you’re out. You’re out and the banks are all the poorer for it (or some schmuck that doesn’t know about market structure). Problem is, that’s not what it does. At all. It keeps climbing and hits your stop loss (the point when the losses are too much and so you have to cut and run). So you think alright, market structure still holds, it’s just going to start climbing back up the mountain, nbd. That’s exactly how it goes through your head the first time, quick as the letters nbd. Problem is just as you start climbing and you’re looking for buys, it comes back down. Where the hell does this trail lead?

Ok ok I got it. It doesn’t go anywhere. So instead of buying as it gets high, I have to do the exact opposite of what I thought and sell. Price will bounce around like a pinball and I'll steal a chunk out of it with every pass, I can win both ways! You go into the channel, and... it leaves the channel and enters another channel right above it. It got you again thinking it was going to start climbing up the mountain and once you’ve finally got it at the end of the second circle, it nose dives.

HARD. No warning, no chance to get in, just a free fall that’s got you praying for a chance in, or if you got really desperate before the fall, and chance out, break even. That brings us to where we are now. Is it a steep race up the next peak of our downhill climb? Or are we back on our own personal little battlefield, bouncing around like bumper cars with no brakes.

I’ll let you decide. Markets come back online tomorrow at 5PM EST. Let’s see if you got it right.

0 notes

Text

3. I’m not sleeping, I’m resting my eyes...

We often think of success as a linear journey. All I have to do is slough through enough shit and eventually I’ll make it. Not a bad way of looking at things. Very macho man, tough guy, don’t stop no matter what attitude. Maybe not the best. Here’s why

1. Not stopping at all is exhausting. Can you give me an example of a perpetual motion machine of any kind? That’s just not nature’s way.

2. What happens when you inevitably do stop/run out of gas/get distracted?

and my personal favorite

3. What if what you need to move forward on this particular journey, is found on the path to something else? Do you ignore that key item/emotional development/character development and hope that your persistence will be enough to power through? How will that affect your journey if you are able to push through this obstacle poorly prepared?

They’re not easy questions because life isn’t linear. At least I don’t think it is. Sure you get older every day, and when people ask you how you are, you say “livin’ the dream”. Seems pretty straight forward right?

Maybe, but probably not. The reason people quit the shining glorious dream of complete financial freedom through Forex is usually for one of two reasons.

1. Forex just isn’t for everyone.

And that’s okay, but that’s where it ends for some people. And that’s okay.

2. They lose buckets of money, trying to sprint to the finish line, desperate to achieve the dream they were sold (or that they sold themselves). They chuck entire trading accounts upwards of $2,000.00 USD at the wall hoping that at least this time when they fail, they will learn some secret that will kick the doors open for them.

But that’s not how Forex works. And once they can’t afford to lose anymore money... They give up. Broke and pissed off, they regret the day that sparkle came to their eye.

Whether fast or slow, it happens to everyone. We’ve all sat there hopeless and lost, stuck in the paradox of not knowing what you don’t know, so you don’t know what to do, to start knowing that which you don’t know. Tricky innit?

Yea. It’s frustrating.

So you get busy with life and generally forget. But as my acting teacher used to say, “you can’t pour from an empty cup”. Some people come back to it later with a little more life experience, and find that they’re able to see things a little differently. In fact I’ve found that a little perspective can go a long way.

I didn’t get Forex. It just didn’t make sense. But the truth is, when I started, I wasn’t who I needed to be, in order to be successful at trading in the Foreign Exchange markets. I still might not be. But I’m closer to him. And I’ve come to realize slowly that as I live and grow, my perspective, discipline, and intuition change. Slowly, but they do. Hopefully more like Kudzu and not like a succulent, but still.

I’m not who I need to be. But I’m closer than I was. And to be honest, it’s been really fun. It’s been hard. Late nights, and long months doing nothing Forex related which leaves my feeling guilty. Guilty at not practicing my craft. But even when I’m not doing Forex, I’m still thinking Forex. After all, Forex is the way human psychology affects the exchange of money across international borders. And human psychology is present in every decision we make.

Like I said in my previous post, you can’t predict price because price is the result of 7+ billion people making an innumerable number of decisions every single day. But... we can relate to the way people make those decisions. And invariably, how people think.

The point is, stopping to rest is okay. Stopping to smell the roses is okay. Slowing down, is totally ok. Quitting is even ok. If it’s not for you, it’s not for you and you should find something that's fulfilling. But don’t quit because it gets hard. That’s not okay. Rest. Recover your strength so you can walk the journey and enjoy it at the same time. I don’t mind driving. I hate driving tired. There’s a big difference in what I take away from it.

People quit Forex for many reasons. But because it’s hard should never be one of them. You don’t have to blow your life’s savings. But don’t think it’s going to be easy either. Rest and take time away from the charts so that you don’t burn out.

That being said, I’d like to touch on the last trade we were looking at in AUDJPY.

This where price action was when I decided to close the trade. I closed it while it was in profit but it didn’t hit my target. As you can see in the speech bubble, my target price was now on the outside of the triangle walls. If I’m basing my trade on the expectation that price will bounce between the two lines, I should best hope that my exit is inside those lines. That being said, I took my money and walked away. Not easy to do considering it could go my way after I've left and then most people would have to live with the, “aww man I should have stayed in!”. But I’m cool with it. I don’t have to put it all on red. I’m cashing my chips, and I’m gonna go enjoy a drink while I rest at the bar.

I might get back into this pair, but I’ll do so with a different strategy, the breakout strategy potentially. That is, only if everything lines up right.

Now as we get into the weekend, I can’t put in any trades. On a global scale, all Forex markets close Friday at 5pm and open Sunday at 5pm Eastern Standard Time. Any trades placed during this time will be entered into the market at whatever price the market opens up at Sunday night. Very rarely the same price that it closed at. All that being said, my next few posts will probably not have any entries but will instead have an in-depth analysis of different charts on various time frames. This is a good way to practice.

The thing with each pair is that it moves differently. And every pair moves differently from the way it moved 1-6 months ago. Here from May 2017 to May 2018, we can see that this pair (the Euro vs. the $) had a definite direction most of the time with strong pushes. Price rose through the months and even though it fell here and there, it mostly moved upward.

Here we see that from May 2018 to May 2019, price fell but it did so much more slowly. It consolidated most of the time (no definitive direction or trend, up or down). Price behaves differently at different periods in time. That is why Forex traders have to have a bag full of tools for different occasions. Our most powerful tool regardless of anything is called confluence. That is important to note.

Here’s a comparison of the “trend” or average direction. From February 2019 to the beginning of June 2019 price fell. Up down, up down, but overall it fell. From June to now however, we start to it coming back up. Will this be a change in overall direction (a trend reversal) or could we see it start to play inside of channels in extreme cases of consolidation? Let’s break it down and see what happens.

The highest point looks like Batman ears. We call these price history formations Double Tops. It means that price rose up to it, then people started selling, it got to a point where people thought it was relatively cheap and started buying again, driving prices up once more. It essentially hit the same price twice, testing it out, but when it failed to break through this price level again, the bulls got exhausted and the bears rode it down. When this happens it usually means price is going to fall hard. And it sure did. A little news release happened today and it caused price to fall just a tad from the strong push it’s had in recovery of that double top, but it rose back up quickly and so only a big wick remained. The MA’s did cross which is important, but I will get to them next time.

Here we are at the moment. Hungry for success standing outside of a closed shop in the rain looking through the window. We can’t trade but we can analyze and hopefully get ourselves in a good position for when the market opening back up on Sunday collides with what we know in a beautiful fire works display of confluence. It pushed past where the Batman ears had formed (that’s the yellow line). Between where it is now and the yellow line is little under a 35 pip channel. This could be just the space it needs to rest for a bit before continuing to sky rocket upwards. Perhaps it gets pushed back down. I don’t presume to know these things, but I do have plans for what it might do and more importantly I am ready to react at a moments notice. That is the life of a successful Forex trader. Free and ready. And I’m closer to that every day.

0 notes

Text

2. **!!Get rick quick!!** / AUDJPY

Let’s be honest, we’ve all seen the title above. That header will find you in some way, shape, or form. A relative might text you out of the blue, worried about your health. Someone on facebook you haven’t seen since high school might send you a message randomly: “hey _____, long time! How’ve you been? The kids look great!”. You’ll even see a small hand written sign staked into the ground next to a highway exit that reads, “Real Estate Investor looking for students: Make 10k a week”. It’s inevitable. Somebody can make you wealthier than you’ve ever imagined and they usually want to make you visualize this-

I can’t say that’s how I got started, but the beginning sure felt familiar. The rush of entering a trade for the first time. The excitement of learning a new technique or style that I knew was foolproof. That first $1,000 dollar deposit into my trading account. It’s a lot like doing drugs. It makes you want more and more. To learn more, to get more involved, and ultimately make you money. Buckets and buckets of cold hard cash.

You’re a walking ATM baby, and banks everywhere will fear your name.

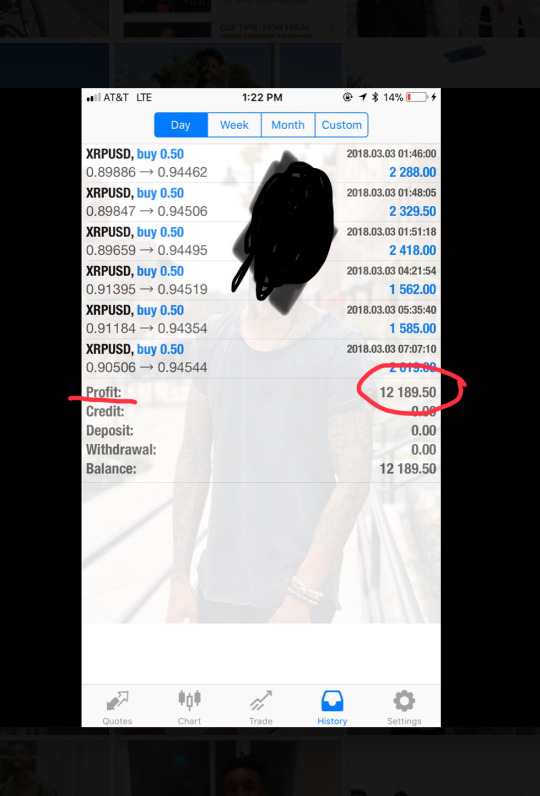

And why wouldn’t you feel like that. You end up joining some kind of trading program that’s guaranteed to teach you to do the same thing as whoever is in charge. And when they post profit pictures like the one below, it only makes your hunger grow.

Why wouldn’t you want that same quality of life? Why don’t you deserve it? If they can do it so can you. They came from nothing, and wanting it bad enough half the battle, is it not?

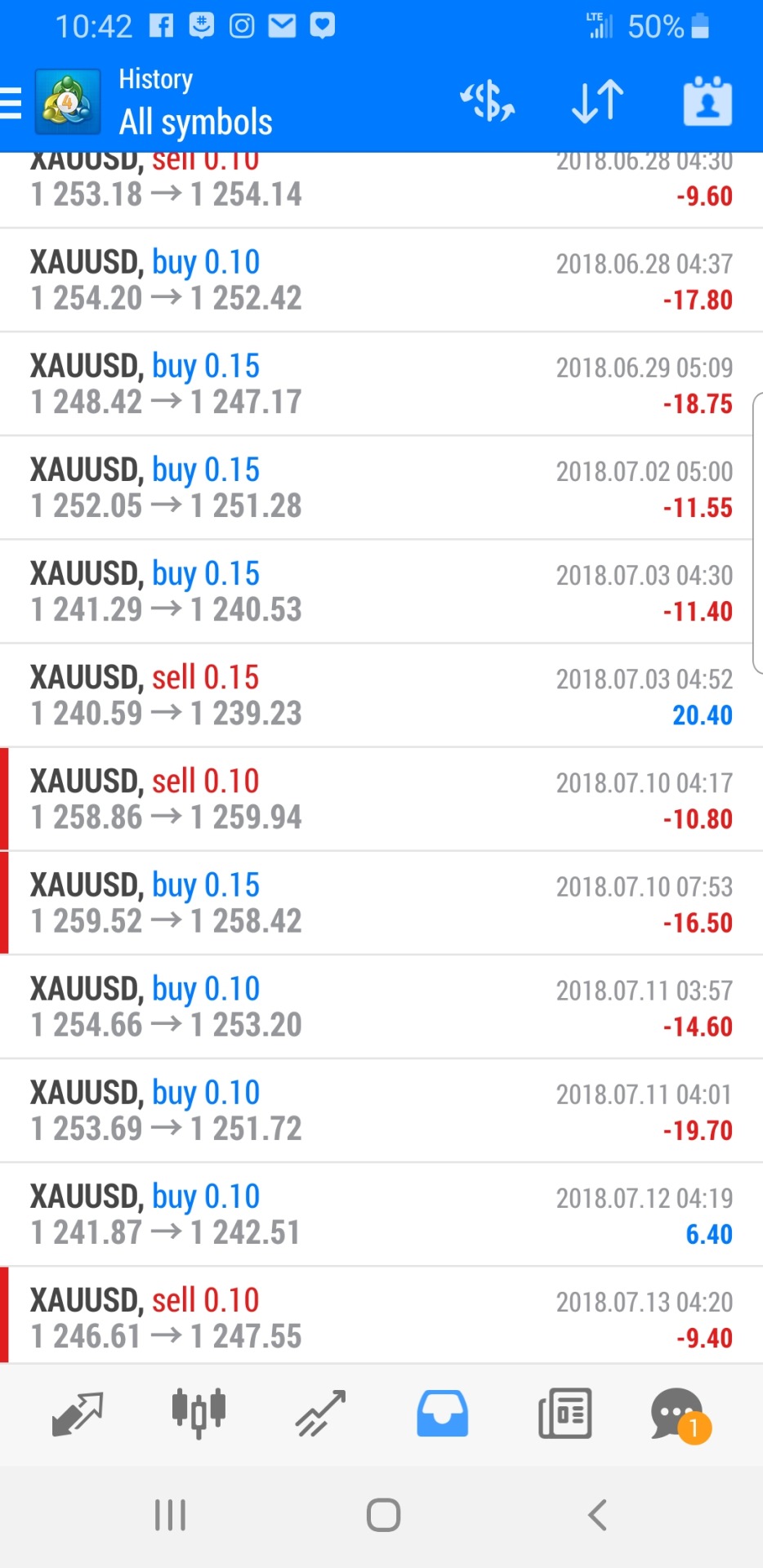

But... as you start (and you know you’re not going to get rich right away), your MT4 trading platform history starts to look more like this:

Negatives everywhere. That’s how it goes. I’m counting on it happening to you, because I want your money. Now the writer of this blog never tried to bring people into a pyramid scheme. That’s not what Forex is, I’ve got the scars to prove it. Forex is a dog fight. Forex is a wilderness full of faceless, nameless rabid dogs, all smarter than you, faster than you, better equipped than you, with accounts 1 million times your size. Forex is about survival. Hiding in the shadows long enough for the big dogs to eat, get bored, and walk away, you try to take just enough to be able to trade tomorrow, nothing more.

I don’t want you to fail, but I understand that a large part of my wins, come from your bad psychology. It’s just how the world works. It’s not pretty, I’m not offering someone a product that will actually help their life or improve their lifestyle to make money. No I’m sprinting past the biggest of the dangers, snatching up as much as I can, leaping over limp bodies and getting the hell out of dodge.

That’s Forex. Every time I enter a trade I do it for me. But even a hawk that annihilates a sweet bunny from the face of the earth.... does it to feed her chicks. Wolf packs hunt with a terrifying beauty to the haunting sounds of howling on a snowy night, so that their pups might not starve or freeze. I do it so that one day my kids can have the opportunities I didn’t while at the same time getting to spend the time with myself that I still don’t get to spend with my father.

In Forex, your goal is to react to the market. People will tell you the goal is to predict the market, but that’s impossible. The Foreign Exchange markets exist because 7+ billion people make an infinite number of decisions every day. How do you predict something like that? Over 5 trillion dollars enter and exit the Forex markets every single day. Just to put it into perspective, there’s only 11 billion dollars in liquidity in the US stock markets, or just .0022% of the Forex markets. If the stock market was an ant, Forex would be Planet earth. It’s where banks and multi-nationals do their (dirty) work and the best part: it’s 100% legal. And it will continue to be until everyone on earth uses US dollars.

I got into it because as luck would have it I sat behind a Jamaican kid in my finance class one day who had Tradingview.com open on his browser. I didn’t know exactly what it was, but I knew what it represented: a way out. I asked him about it and that’s pretty much it. We dropped out of that finance class a few days later because we were on a journey “to take our own finance class”. That was a big mistake but regardless, he and I are still thick as thieves. I love that kid.

Back to trading. Here’s how it goes. You get excited. You start losing. You win a trade here and there but that’s blind luck, you don’t know what you're doing. An impressionist painter can tell you exactly what he’s doing but unfortunately without at least a few years of practice, that doesn’t make you an impressionist painter. Forex can’t be taught Bob Ross style.

You have to absorb information the same way a tennis player does. You have to fail and fail and fail and take a break and fail again, until your mind and body start to work instinctively. Like the matrix you don’t see lines of code falling down the screen anymore. What to other people look like a bunch of little green and red candles with a wick on both sides that rise and fall, to you it becomes a living, breathing, hissing animal. You’re trying to steal one golden scale off of its back as it slides up and down. Just one at first, if you go for anymore you’re going to get bit.

Slowly you start to learn that when it gets to a certain point or the chart starts to look a certain way, this pissed off little animal is limited in it’s movement like a raccoon you’ve just cornered. Still, highly aggressive and unpredictable but... a little less unpredictable?

You start to win. Slowly you start to take back what was yours and while the other dogs are busy snarling at each other, boasting about their victories and licking their wounds, you’re content to work far, far away from the hype. This isn’t about grandeur anymore. This is about revenge. And another shot at reaching financial freedom. Speaking for myself the ultimate goal for these next 5 years is to achieve Digital Nomadicy. Ok I made the word ‘nomadicy’, but digital nomads do exist. All you need is an laptop and a wireless connection and you’re ready to trade from anywhere in the world.

So... Let’s see how I’m doing up to this point. As I show you, please don’t feed the animals.

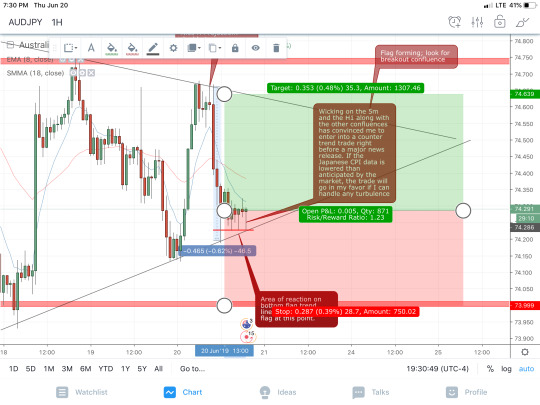

Starting with an H4 (every candle represents 4 hours of price movement) view of my chart on AUDJPY (Aussie Dollar vs. the Japanese Yen), we can see that current price movement has entered a channel of about 75 pips (sorry the picture is blurry).

When a pair is “consolidating” that means that it’s not really going anywhere. It’s not going to nose dive, or shoot up any time soon (I hope). It’s just kind of moving up and down between to price points, in this case a little below 74.800 and almost right on 74.000. When price reaches one of these points I know it has to react to it in some way. I don’t try to predict if it’s going up or down, I’m just waiting for the moment when it picks a direction and I can jump in.

Now price hasn’t been this low except for two times that price fell super fast and then raced back up again. Wicks (the long sticks at the top & bottom) give us clues, but not too much information on the structure right here. What this means is that if price continues to fall, once it breaks that 74.000 line definitively, it has a good chance of tanking hard. And since price has been consistently falling since April 19th, 2019, there’s a good chance it will continue falling. When you trade in the same direction as the “trend”, you are trend trading. Easy enough right?

Now, if we draw lines across the top of the price action in the channel and the bottom, it looks like a triangular flag. Usually that means that price is going to bounce inside of these lines, until it breaks out and once it does, it usually moves definitively in that direction. Usually always, always being the key word.

Now remember we’re looking at the AUDJPY pair, which is in essence a battle between the two currencies. When one gets stronger, the other gets weaker relative to each other. There was a major Japanese news release planned today at 7:30PM eastern time that I thought would move the market a bit more than it did. If the information was better for Japan than expected, the price would go down because the base pair (what we’re trading, the Aussie dollar) would have weakened in reaction to Japanese strength. But the numbers were just as expected so nothing of excitement happened.

Where the red meets the green is where I got in. All those wicks right around where it is, tells me that the price is having trouble going down. Combine that with the fact that it’s sitting right at the bottom of the flag, and where I hope it goes is greater than the distance to where I would take my loses and walk away if it went the wrong, I entered the market. I am hoping that it plays back up to where the green ends, in which case I will walk away with money, not caring if it goes up even higher: don’t get greedy.

As of this moment.... I am losing. But the battle is not lost. Stay tuned for next weeks blog post to find out what happens next.

0 notes

Photo

1. Trades for the week (Part 2; check out my previous post for Part 1: Intro to Forex)

In the first picture, I saw the arrow head shape forming. In Forex we call this a head & shoulders pattern: price rose to one height, fell, rose even higher, fell again, then rose to the original height, and you guessed it, fell again.

Usually when this happens, as soon as the price falls to the “neckline”, it continues down for the same amount as its highest point. When you combine this with the fact that price tends to bounce away from certain areas/lines (such as the one coming off the right side) you get something called confluence. Confluence is the idea that multiple signals (hints as to what the market is doing), line up, all in agreement. When this happens, you have a higher probability of price moving in the direction you are predicting.

Of course, its not always foolproof and as we can see in the next picture, price shot up, breaking past our diagonal trend line to the highest point it had made before (the “head” in the “head and shoulders” pattern) before coming tumbling back down to the point where I would have been satisfied with my gains and would have exited the market. We weren’t wrong. We just weren’t right enough.

It will drive you insane if you’re not prepared and emotionally intelligent.

The next 3 series of pictures are another reason why emotional intelligence is important.

What would you do if you went to Vegas and as soon as you walked in the door, you put it all on red and multiplied your money 10x? Would you walk away? Would you have the discipline to exit the building, effectively removing your money from the risk of loss? Probably not.

Greed is just as powerful emotion as fear. It lives in the land of, “just a little bit more” and can be even more deadly than anger, sadness, and fear combined.

At picture three you see an orange line with a red line inside of it, and a red line above both of them. This has created a channel. Price usually bounces between the limits of the channel, until either the buyers (bulls) or the sellers (bears) in the market gain enough momentum to shove it out of the channel. We call this a breakout and can often move price quite a bit. This is what I was counting on. I knew that once price broke out, it would fall to the end of the green area (my take profit).

I entered the trade, selling Aussie dollars and buying Japanese Yen and just like clock work, it began to fall. I felt good, but I wasn’t out of hot water just yet. Price rose a bit, cutting into my gains, and in all honesty, I felt like exiting the trade (fear) before the market could not only eat the gains, but also the money I had brought to the table.

I stayed strong, knowing that right or wrong only mattered if I was right enough, and in order to avoid the disposition effect (tendency to sell your winners and keep your losers in the hope that they will come back to at least break even), I did the hardest thing in trading: nothing.

Price continued to consolidate or dance around during the day of the 12th July, and right around 7pm when the Asian/Australian markets wake up, it TANKED. It fell hard and hit my take profit.

I feel good.

Thing is, I was right... but I could have been more right... and thus that much more rich. The market continued to fall and if I had stayed in instead of exiting the trade to secure my gains, I could have made double.

But I’m not greedy. I’ve learned to practice gratitude. A win, is a win, is a win.

And winning beats losing, every day of the week that ends in “y”.

Taking into consideration the loss of my GBPUSD trade and the win of my AUDJPY trade that is about $3500 in a little under 24 hours.

Not bad Jorgie.

0 notes

Text

1. AUD/JPY GBP/USD Part 1 (Intro)

The Foreign Exchange (ForEx) market is the financial and global modern day wild, wild, west. Promises of gold and glory bring in people by the thousands every year. And just as they come, the financial world is littered with the desiccated corpse wallets of 95% of those people.

It’s not their fault; at the top of the mountain lies an oasis of pure, unadulterated financial freedom. Imagine waking up, working for a few hours max, and then going about your day, happy to enjoy exploring the world as your oyster, by 11:30 AM at the latest. Beautiful right? You wake up, look at some charts, put in some trades, NAIL IT, feel proud and powerful, and then go strut down easy street: a one person parade of mastery.

It’s possible. More people have beat the odds and defied mathematical logic than you and I can count on our fingers and toes. Rational Economists decry “witchcraft!” and aim to justify our strategy as pure luck. And luck has something to do with it sure. That’s the layman’s term for probability.

But just like in the Wild West, only the fastest gun on the fastest horse could get away with train-robbery and live to tell about it. Not just once, but 2, 3, 4, 5 times a week. It’s the perfect crime: victimless, faceless, and without breaking any laws. So what’s the catch?

HOURS. and hours. and hours. and HOURS. and OH MY GOD, HOW DID I MISS THAT!

Then there’s the, “that’s bullsh*t, my broker is stealing from me!”

There are the, “how did I lose another $1,000.00 account... I’m never trading again”.

And how could I ever forget, “Please God just this once, let me at least get back to breaking even”.

Praying won't save you here in the land of banks and monsters.

In an effort to pull back the curtain on the mysticism of successful trading, I will be using this blog to explain major events in the finance world, and the trades I took as well as the reasons I had in taking them. Sometimes I’ll win, sometimes I’ll lose, but the key is to survive long enough to keep trading. Do it enough and you’re able to beat the numbers through sheer presence, and something called “edge”.

1 note

·

View note