#financial fraud detection software

Explore tagged Tumblr posts

Text

Ecommerce Fraud Prevention Glossary: Key Terms You Should Know

In the ever-evolving landscape of online transactions, understanding the terminology of Ecommerce Fraud Prevention Glossary is essential for businesses aiming to safeguard their operations. This glossary highlights key terms related to fraud prevention, offering insights into essential concepts that can protect your ecommerce platform.

3D Secure: A robust protocol for credit card fraud prevention, 3D Secure adds an additional layer of authentication during online payments, reducing unauthorized transactions.

Chargeback: A common issue in ecommerce, a chargeback occurs when a customer disputes a transaction. Effective fraud detection software can help minimize fraudulent chargeback claims.

CNP Fraud (Card-Not-Present Fraud): This happens when stolen card details are used for online purchases. Ecommerce fraud prevention tools can detect unusual purchase patterns and prevent such fraud.

Tokenization: By replacing sensitive payment details with a unique identifier or token, tokenization enhances security and reduces the risk of data breaches.

Fraud Scoring: A method of evaluating transactions based on risk factors, fraud scoring is integral to modern ecommerce fraud protection strategies.

Payment Gateway: The backbone of online transactions, a payment gateway facilitates payment processing while integrating fraud prevention mechanisms to detect suspicious activities.

By mastering these terms, businesses can make informed decisions about adopting financial fraud detection software and partnering with ecommerce fraud prevention companies. Understanding the glossary of fraud prevention empowers ecommerce merchants to stay one step ahead of cybercriminals and build trust with their customers.

Keep these terms at your fingertips to enhance your ecommerce security and protect your payment processes effectively by Gpayment.

#financial fraud detection software#risk and fraud management#detectionsoftware#ecommerce fraud prevention companies#Ecommerce fraud prevention glossary

0 notes

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

The ALZERP Cloud ERP Software offers a comprehensive tax return system designed to facilitate the calculation, moderation, and finalization of VAT and tax returns. This system ensures businesses comply with the Saudi Arabian tax regulations set by the Zakat, Tax, and Customs Authority (ZATCA). By automating and streamlining the tax return process, ALZERP helps businesses achieve accuracy and…

View On WordPress

#Automated tax compliance#Real-time tax monitoring KSA#Real-time VAT reporting KSA#Saudi business financial compliance#Saudi business tax management#Saudi corporate tax software#Saudi tax audit software#Saudi tax compliance software#Saudi VAT reconciliation software#Tax analytics for Saudi businesses#tax filing software#Tax management system#tax optimization tool#tax planning software#VAT fraud detection#VAT invoice management#VAT management#VAT management for Saudi SMEs#VAT reporting software KSA#VAT return automation Saudi#Zakat and income tax software#Zakat and tax automation#Zakat and tax consultation tool#Zakat and tax filing deadline alerts#Zakat and tax regulations update#Zakat and VAT calculator#Zakat and VAT compliance check#Zakat assessment tool#Zakat calculation software#Zakat declaration software

0 notes

Text

Many firms prefer ready-made AI software with a few tweaks - Technology Org

New Post has been published on https://thedigitalinsider.com/many-firms-prefer-ready-made-ai-software-with-a-few-tweaks-technology-org/

Many firms prefer ready-made AI software with a few tweaks - Technology Org

Artificial intelligence has changed nearly every industry, from manufacturing and retail to construction and agriculture. And as AI becomes even more ubiquitous, firms often opt for off-the-shelf technology that can be modified to meet their needs.

Chris Forman, the Peter and Stephanie Nolan Professor in the Dyson School of Applied Economics and Management in the Cornell SC Johnson College of Business, was part of a research team that examined firms’ decisions to adopt AI technology and how that adoption was sourced: by purchasing ready-made software; by developing their own; or with a hybrid strategy, which the researchers say may reflect “complementarity” among sourcing approaches.

In an analysis of more than 3,000 European firms, they found that many—particularly in science, retail trade, finance, real estate, and manufacturing—are increasingly opting for ready-made technology tailored to the firm’s specific needs. While AI may seem to be threatening the human workforce, these findings indicate that workers with AI-related skills will still be needed.

“In the vast majority of industries, firms are doing both readymade and in-house development, and I think it’s an interesting question for future work to understand why that’s the case,” said Forman, co-author of “Make or Buy Your Artificial Intelligence? Complementarities in Technology Sourcing,” which published March 5 in the Journal of Economics and Management Strategy.

“Ready-made software is important,” he said, “but for the vast majority of firms, it does not appear to be a substitute for in-house software, which suggests that it’s not, at least in the short run, going to eliminate the need for AI-related skills.”

Charles Hoffreumon, a doctoral student at the Solvay Brussels School of Economics and Management, is the corresponding author. Nicolas van Zeebroeck, a professor of digital economics and strategy at the Solvay Brussels School, is the other co-author.

For their study, the researchers examined data from a survey conducted in 2020 by the Directorate-General of Communications Networks, Content and Technology from the European Commission (EC), which assessed AI adoption across the 27 countries of the European Union. The team used data from 3,143 firms across Europe in the study.

Business software is hard to implement, and historically as new technologies spread firms have relied on ready-made software. “This aspect of trying to understand the extent to which ready-made software could potentially substitute for the need for skills was interesting.” Forman said.

The study’s data comprised firms in 10 industry sectors, with the largest share coming from manufacturing (19%), trade and retail (18%), and construction (12%). Industries with the smallest share of respondents included agriculture (4%) and utilities (3%).

Firms most commonly use AI for the following purposes: fraud or risk detection, process or equipment optimization, and process automation in warehouses or robotics.

Among respondents who had adopted at least one AI application, more than 58% reported using ready-made software; nearly 38% hired an external consultant; 24% used modified commercial software; 20% used in-house software; and 20% modified open-source technology for their firm’s needs. Some firms deployed the technology in multiple ways.

Among the findings: The financial and scientific sectors – and to a lesser extent IT – preferred developing and customizing their own software while agriculture, construction and human health preferred ready-made solutions.

Forman said that in the past, as new technology spreads, the demand for different types of skills emerges. “Historically, the net effect has tended to be that, overall, labor demand goes up,” he said, “but it remains to be seen what happens in this case.”

As often happens with new technology, Forman said, the diffusion of AI technology to early adopters has resulted in users’ best practices getting incorporated into ready-made software, which makes these solutions even better. This was the case, he said, with enterprise resource planning – automation software that helps to run an entire business.

“When you look at prior digital technologies, there’s often a process of complementary innovation, or co-invention, where you figure out how to use this digital technology most effectively for your firm,” Forman said. “That usually takes place over time, through experimentation and figuring out what works and doesn’t.”

The authors wrote that this research “has taken the first steps toward highlighting the importance of sourcing strategies to understanding the diffusion of AI.”

Source: Cornell University

You can offer your link to a page which is relevant to the topic of this post.

#000#A.I. & Neural Networks news#agriculture#ai#Analysis#artificial#Artificial Intelligence#artificial intelligence (AI)#automation#Business#business software#college#commercial software#communications#construction#content#data#detection#development#diffusion#Digital technology#Economics#enterprise#enterprise resource planning#equipment#Europe#european union#finance#financial#fraud

0 notes

Text

So, let me try and put everything together here, because I really do think it needs to be talked about.

Today, Unity announced that it intends to apply a fee to use its software. Then it got worse.

For those not in the know, Unity is the most popular free to use video game development tool, offering a basic version for individuals who want to learn how to create games or create independently alongside paid versions for corporations or people who want more features. It's decent enough at this job, has issues but for the price point I can't complain, and is the idea entry point into creating in this medium, it's a very important piece of software.

But speaking of tools, the CEO is a massive one. When he was the COO of EA, he advocated for using, what out and out sounds like emotional manipulation to coerce players into microtransactions.

"A consumer gets engaged in a property, they might spend 10, 20, 30, 50 hours on the game and then when they're deep into the game they're well invested in it. We're not gouging, but we're charging and at that point in time the commitment can be pretty high."

He also called game developers who don't discuss monetization early in the planning stages of development, quote, "fucking idiots".

So that sets the stage for what might be one of the most bald-faced greediest moves I've seen from a corporation in a minute. Most at least have the sense of self-preservation to hide it.

A few hours ago, Unity posted this announcement on the official blog.

Effective January 1, 2024, we will introduce a new Unity Runtime Fee that’s based on game installs. We will also add cloud-based asset storage, Unity DevOps tools, and AI at runtime at no extra cost to Unity subscription plans this November. We are introducing a Unity Runtime Fee that is based upon each time a qualifying game is downloaded by an end user. We chose this because each time a game is downloaded, the Unity Runtime is also installed. Also we believe that an initial install-based fee allows creators to keep the ongoing financial gains from player engagement, unlike a revenue share.

Now there are a few red flags to note in this pitch immediately.

Unity is planning on charging a fee on all games which use its engine.

This is a flat fee per number of installs.

They are using an always online runtime function to determine whether a game is downloaded.

There is just so many things wrong with this that it's hard to know where to start, not helped by this FAQ which doubled down on a lot of the major issues people had.

I guess let's start with what people noticed first. Because it's using a system baked into the software itself, Unity would not be differentiating between a "purchase" and a "download". If someone uninstalls and reinstalls a game, that's two downloads. If someone gets a new computer or a new console and downloads a game already purchased from their account, that's two download. If someone pirates the game, the studio will be asked to pay for that download.

Q: How are you going to collect installs? A: We leverage our own proprietary data model. We believe it gives an accurate determination of the number of times the runtime is distributed for a given project. Q: Is software made in unity going to be calling home to unity whenever it's ran, even for enterprice licenses? A: We use a composite model for counting runtime installs that collects data from numerous sources. The Unity Runtime Fee will use data in compliance with GDPR and CCPA. The data being requested is aggregated and is being used for billing purposes. Q: If a user reinstalls/redownloads a game / changes their hardware, will that count as multiple installs? A: Yes. The creator will need to pay for all future installs. The reason is that Unity doesn’t receive end-player information, just aggregate data. Q: What's going to stop us being charged for pirated copies of our games? A: We do already have fraud detection practices in our Ads technology which is solving a similar problem, so we will leverage that know-how as a starting point. We recognize that users will have concerns about this and we will make available a process for them to submit their concerns to our fraud compliance team.

This is potentially related to a new system that will require Unity Personal developers to go online at least once every three days.

Starting in November, Unity Personal users will get a new sign-in and online user experience. Users will need to be signed into the Hub with their Unity ID and connect to the internet to use Unity. If the internet connection is lost, users can continue using Unity for up to 3 days while offline. More details to come, when this change takes effect.

It's unclear whether this requirement will be attached to any and all Unity games, though it would explain how they're theoretically able to track "the number of installs", and why the methodology for tracking these installs is so shit, as we'll discuss later.

Unity claims that it will only leverage this fee to games which surpass a certain threshold of downloads and yearly revenue.

Only games that meet the following thresholds qualify for the Unity Runtime Fee: Unity Personal and Unity Plus: Those that have made $200,000 USD or more in the last 12 months AND have at least 200,000 lifetime game installs. Unity Pro and Unity Enterprise: Those that have made $1,000,000 USD or more in the last 12 months AND have at least 1,000,000 lifetime game installs.

They don't say how they're going to collect information on a game's revenue, likely this is just to say that they're only interested in squeezing larger products (games like Genshin Impact and Honkai: Star Rail, Fate Grand Order, Among Us, and Fall Guys) and not every 2 dollar puzzle platformer that drops on Steam. But also, these larger products have the easiest time porting off of Unity and the most incentives to, meaning realistically those heaviest impacted are going to be the ones who just barely meet this threshold, most of them indie developers.

Aggro Crab Games, one of the first to properly break this story, points out that systems like the Xbox Game Pass, which is already pretty predatory towards smaller developers, will quickly inflate their "lifetime game installs" meaning even skimming the threshold of that 200k revenue, will be asked to pay a fee per install, not a percentage on said revenue.

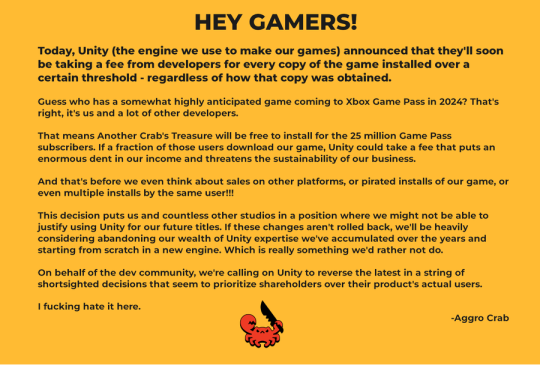

[IMAGE DESCRIPTION: Hey Gamers!

Today, Unity (the engine we use to make our games) announced that they'll soon be taking a fee from developers for every copy of the game installed over a certain threshold - regardless of how that copy was obtained.

Guess who has a somewhat highly anticipated game coming to Xbox Game Pass in 2024? That's right, it's us and a lot of other developers.

That means Another Crab's Treasure will be free to install for the 25 million Game Pass subscribers. If a fraction of those users download our game, Unity could take a fee that puts an enormous dent in our income and threatens the sustainability of our business.

And that's before we even think about sales on other platforms, or pirated installs of our game, or even multiple installs by the same user!!!

This decision puts us and countless other studios in a position where we might not be able to justify using Unity for our future titles. If these changes aren't rolled back, we'll be heavily considering abandoning our wealth of Unity expertise we've accumulated over the years and starting from scratch in a new engine. Which is really something we'd rather not do.

On behalf of the dev community, we're calling on Unity to reverse the latest in a string of shortsighted decisions that seem to prioritize shareholders over their product's actual users.

I fucking hate it here.

-Aggro Crab - END DESCRIPTION]

That fee, by the way, is a flat fee. Not a percentage, not a royalty. This means that any games made in Unity expecting any kind of success are heavily incentivized to cost as much as possible.

[IMAGE DESCRIPTION: A table listing the various fees by number of Installs over the Install Threshold vs. version of Unity used, ranging from $0.01 to $0.20 per install. END DESCRIPTION]

Basic elementary school math tells us that if a game comes out for $1.99, they will be paying, at maximum, 10% of their revenue to Unity, whereas jacking the price up to $59.99 lowers that percentage to something closer to 0.3%. Obviously any company, especially any company in financial desperation, which a sudden anchor on all your revenue is going to create, is going to choose the latter.

Furthermore, and following the trend of "fuck anyone who doesn't ask for money", Unity helpfully defines what an install is on their main site.

While I'm looking at this page as it exists now, it currently says

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

However, I saw a screenshot saying something different, and utilizing the Wayback Machine we can see that this phrasing was changed at some point in the few hours since this announcement went up. Instead, it reads:

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming or web browser is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

Screenshot for posterity:

That would mean web browser games made in Unity would count towards this install threshold. You could legitimately drive the count up simply by continuously refreshing the page. The FAQ, again, doubles down.

Q: Does this affect WebGL and streamed games? A: Games on all platforms are eligible for the fee but will only incur costs if both the install and revenue thresholds are crossed. Installs - which involves initialization of the runtime on a client device - are counted on all platforms the same way (WebGL and streaming included).

And, what I personally consider to be the most suspect claim in this entire debacle, they claim that "lifetime installs" includes installs prior to this change going into effect.

Will this fee apply to games using Unity Runtime that are already on the market on January 1, 2024? Yes, the fee applies to eligible games currently in market that continue to distribute the runtime. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

Again, again, doubled down in the FAQ.

Q: Are these fees going to apply to games which have been out for years already? If you met the threshold 2 years ago, you'll start owing for any installs monthly from January, no? (in theory). It says they'll use previous installs to determine threshold eligibility & then you'll start owing them for the new ones. A: Yes, assuming the game is eligible and distributing the Unity Runtime then runtime fees will apply. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

That would involve billing companies for using their software before telling them of the existence of a bill. Holding their actions to a contract that they performed before the contract existed!

Okay. I think that's everything. So far.

There is one thing that I want to mention before ending this post, unfortunately it's a little conspiratorial, but it's so hard to believe that anyone genuinely thought this was a good idea that it's stuck in my brain as a significant possibility.

A few days ago it was reported that Unity's CEO sold 2,000 shares of his own company.

On September 6, 2023, John Riccitiello, President and CEO of Unity Software Inc (NYSE:U), sold 2,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 50,610 shares and purchased none.

I would not be surprised if this decision gets reversed tomorrow, that it was literally only made for the CEO to short his own goddamn company, because I would sooner believe that this whole thing is some idiotic attempt at committing fraud than a real monetization strategy, even knowing how unfathomably greedy these people can be.

So, with all that said, what do we do now?

Well, in all likelihood you won't need to do anything. As I said, some of the biggest names in the industry would be directly affected by this change, and you can bet your bottom dollar that they're not just going to take it lying down. After all, the only way to stop a greedy CEO is with a greedier CEO, right?

(I fucking hate it here.)

And that's not mentioning the indie devs who are already talking about abandoning the engine.

[Links display tweets from the lead developer of Among Us saying it'd be less costly to hire people to move the game off of Unity and Cult of the Lamb's official twitter saying the game won't be available after January 1st in response to the news.]

That being said, I'm still shaken by all this. The fact that Unity is openly willing to go back and punish its developers for ever having used the engine in the past makes me question my relationship to it.

The news has given rise to the visibility of free, open source alternative Godot, which, if you're interested, is likely a better option than Unity at this point. Mostly, though, I just hope we can get out of this whole, fucking, environment where creatives are treated as an endless mill of free profits that's going to be continuously ratcheted up and up to drive unsustainable infinite corporate growth that our entire economy is based on for some fuckin reason.

Anyways, that's that, I find having these big posts that break everything down to be helpful.

#Unity#Unity3D#Video Games#Game Development#Game Developers#fuckshit#I don't know what to tag news like this

6K notes

·

View notes

Text

Artificial Intelligence: Transforming the Future of Technology

Introduction: Artificial intelligence (AI) has become increasingly prominent in our everyday lives, revolutionizing the way we interact with technology. From virtual assistants like Siri and Alexa to predictive algorithms used in healthcare and finance, AI is shaping the future of innovation and automation.

Understanding Artificial Intelligence

Artificial intelligence (AI) involves creating computer systems capable of performing tasks that usually require human intelligence, including visual perception, speech recognition, decision-making, and language translation. By utilizing algorithms and machine learning, AI can analyze vast amounts of data and identify patterns to make autonomous decisions.

Applications of Artificial Intelligence

Healthcare: AI is being used to streamline medical processes, diagnose diseases, and personalize patient care.

Finance: Banks and financial institutions are leveraging AI for fraud detection, risk management, and investment strategies.

Retail: AI-powered chatbots and recommendation engines are enhancing customer shopping experiences.

Automotive: Self-driving cars are a prime example of AI technology revolutionizing transportation.

How Artificial Intelligence Works

AI systems are designed to mimic human intelligence by processing large datasets, learning from patterns, and adapting to new information. Machine learning algorithms and neural networks enable AI to continuously improve its performance and make more accurate predictions over time.

Advantages of Artificial Intelligence

Efficiency: AI can automate repetitive tasks, saving time and increasing productivity.

Precision: AI algorithms can analyze data with precision, leading to more accurate predictions and insights.

Personalization: AI can tailor recommendations and services to individual preferences, enhancing the customer experience.

Challenges and Limitations

Ethical Concerns: The use of AI raises ethical questions around data privacy, algorithm bias, and job displacement.

Security Risks: As AI becomes more integrated into critical systems, the risk of cyber attacks and data breaches increases.

Regulatory Compliance: Organizations must adhere to strict regulations and guidelines when implementing AI solutions to ensure transparency and accountability.

Conclusion: As artificial intelligence continues to evolve and expand its capabilities, it is essential for businesses and individuals to adapt to this technological shift. By leveraging AI's potential for innovation and efficiency, we can unlock new possibilities and drive progress in various industries. Embracing artificial intelligence is not just about staying competitive; it is about shaping a future where intelligent machines work hand in hand with humans to create a smarter and more connected world.

Syntax Minds is a training institute located in the Hyderabad. The institute provides various technical courses, typically focusing on software development, web design, and digital marketing. Their curriculum often includes subjects like Java, Python, Full Stack Development, Data Science, Machine Learning, Angular JS , React JS and other tech-related fields.

For the most accurate and up-to-date information, I recommend checking their official website or contacting them directly for details on courses, fees, batch timings, and admission procedures.

If you'd like help with more specific queries about their offerings or services, feel free to ask!

2 notes

·

View notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

NVIDIA AI Workflows Detect False Credit Card Transactions

A Novel AI Workflow from NVIDIA Identifies False Credit Card Transactions.

The process, which is powered by the NVIDIA AI platform on AWS, may reduce risk and save money for financial services companies.

By 2026, global credit card transaction fraud is predicted to cause $43 billion in damages.

Using rapid data processing and sophisticated algorithms, a new fraud detection NVIDIA AI workflows on Amazon Web Services (AWS) will assist fight this growing pandemic by enhancing AI’s capacity to identify and stop credit card transaction fraud.

In contrast to conventional techniques, the process, which was introduced this week at the Money20/20 fintech conference, helps financial institutions spot minute trends and irregularities in transaction data by analyzing user behavior. This increases accuracy and lowers false positives.

Users may use the NVIDIA AI Enterprise software platform and NVIDIA GPU instances to expedite the transition of their fraud detection operations from conventional computation to accelerated compute.

Companies that use complete machine learning tools and methods may see an estimated 40% increase in the accuracy of fraud detection, which will help them find and stop criminals more quickly and lessen damage.

As a result, top financial institutions like Capital One and American Express have started using AI to develop exclusive solutions that improve client safety and reduce fraud.

With the help of NVIDIA AI, the new NVIDIA workflow speeds up data processing, model training, and inference while showcasing how these elements can be combined into a single, user-friendly software package.

The procedure, which is now geared for credit card transaction fraud, might be modified for use cases including money laundering, account takeover, and new account fraud.

Enhanced Processing for Fraud Identification

It is more crucial than ever for businesses in all sectors, including financial services, to use computational capacity that is economical and energy-efficient as AI models grow in complexity, size, and variety.

Conventional data science pipelines don’t have the compute acceleration needed to process the enormous amounts of data needed to combat fraud in the face of the industry’s continually increasing losses. Payment organizations may be able to save money and time on data processing by using NVIDIA RAPIDS Accelerator for Apache Spark.

Financial institutions are using NVIDIA’s AI and accelerated computing solutions to effectively handle massive datasets and provide real-time AI performance with intricate AI models.

The industry standard for detecting fraud has long been the use of gradient-boosted decision trees, a kind of machine learning technique that uses libraries like XGBoost.

Utilizing the NVIDIA RAPIDS suite of AI libraries, the new NVIDIA AI workflows for fraud detection improves XGBoost by adding graph neural network (GNN) embeddings as extra features to assist lower false positives.

In order to generate and train a model that can be coordinated with the NVIDIA Triton Inference Server and the NVIDIA Morpheus Runtime Core library for real-time inferencing, the GNN embeddings are fed into XGBoost.

All incoming data is safely inspected and categorized by the NVIDIA Morpheus framework, which also flags potentially suspicious behavior and tags it with patterns. The NVIDIA Triton Inference Server optimizes throughput, latency, and utilization while making it easier to infer all kinds of AI model deployments in production.

NVIDIA AI Enterprise provides Morpheus, RAPIDS, and Triton Inference Server.

Leading Financial Services Companies Use AI

AI is assisting in the fight against the growing trend of online or mobile fraud losses, which are being reported by several major financial institutions in North America.

American Express started using artificial intelligence (AI) to combat fraud in 2010. The company uses fraud detection algorithms to track all client transactions worldwide in real time, producing fraud determinations in a matter of milliseconds. American Express improved model accuracy by using a variety of sophisticated algorithms, one of which used the NVIDIA AI platform, therefore strengthening the organization’s capacity to combat fraud.

Large language models and generative AI are used by the European digital bank Bunq to assist in the detection of fraud and money laundering. With NVIDIA accelerated processing, its AI-powered transaction-monitoring system was able to train models at over 100 times quicker rates.

In March, BNY said that it was the first big bank to implement an NVIDIA DGX SuperPOD with DGX H100 systems. This would aid in the development of solutions that enable use cases such as fraud detection.

In order to improve their financial services apps and help protect their clients’ funds, identities, and digital accounts, systems integrators, software suppliers, and cloud service providers may now include the new NVIDIA AI workflows for fraud detection. NVIDIA Technical Blog post on enhancing fraud detection with GNNs and investigate the NVIDIA AI workflows for fraud detection.

Read more on Govindhtech.com

#NVIDIAAI#AWS#FraudDetection#AI#GenerativeAI#LLM#AImodels#News#Technews#Technology#Technologytrends#govindhtech#Technologynews

2 notes

·

View notes

Text

Top E-Commerce Fraud Prevention Software Solutions

In today’s rapidly evolving digital landscape, e-commerce has become a cornerstone of the global economy. However, this growth has also given rise to sophisticated fraud schemes that pose significant risks to online businesses and their customers. To combat these threats, businesses must invest in robust fraud prevention software solutions. Here’s a look at some of the top e-commerce fraud prevention tools for 2024 that can help safeguard your online store and maintain customer trust.

1. Fraud.Net

Fraud.Net stands out as a comprehensive fraud prevention platform that uses machine learning and artificial intelligence to detect and prevent fraudulent transactions. Its real-time risk scoring system evaluates each transaction based on a multitude of factors, such as user behavior and historical data, to flag suspicious activities. Fraud.Net's integration with various payment gateways and its customizable rule set make it a versatile choice for businesses of all sizes.

2. Signifyd

Signifyd is renowned for its 100% financial guarantee on fraud protection, offering a unique proposition in the e-commerce space. The platform uses a combination of machine learning and human expertise to analyze transactions and identify potential threats. Its approach includes real-time decision-making and an extensive global data network, ensuring that businesses can reduce false positives while minimizing fraud losses. Signifyd also provides tools for chargeback management and fraud analytics.

3. Kount

Kount offers a powerful fraud prevention solution that leverages AI and machine learning to provide real-time fraud detection and prevention. Its platform includes features such as biometric identification, device fingerprinting, and risk scoring to help identify and mitigate fraudulent activities. Kount’s customizable rules engine allows businesses to tailor their fraud prevention strategies to specific needs, while its comprehensive dashboard provides actionable insights into transaction trends and fraud patterns.

4. Sift

Sift is a leading fraud prevention solution that combines machine learning with a vast database of global fraud signals to deliver real-time protection. The platform is known for its adaptability, offering tools to prevent fraud across multiple channels, including payments, account creation, and content abuse. Sift's advanced analytics and customizable workflows help businesses quickly respond to emerging fraud threats and reduce manual review processes.

5. Riskified

Riskified specializes in enhancing the online shopping experience by providing a fraud prevention solution that guarantees approval of legitimate transactions. The platform uses advanced machine learning algorithms and a vast dataset to analyze transactions and identify fraudulent activities. Riskified’s unique chargeback guarantee ensures that businesses are protected against fraud losses, making it a popular choice for high-volume e-commerce operations.

6. ClearSale

ClearSale is a global fraud prevention solution that combines technology with expert analysts to deliver comprehensive fraud protection. Its system uses machine learning to assess transaction risk and manual reviews to ensure accuracy. ClearSale’s multi-layered approach includes fraud detection, chargeback management, and customer service support, making it a robust option for businesses looking to minimize fraud while maintaining a positive customer experience.

7. Shift4

Shift4 provides a versatile fraud prevention solution that integrates with its payment processing services. The platform uses machine learning to monitor transactions and detect fraudulent patterns in real-time. Shift4’s fraud prevention tools are designed to work seamlessly with its payment gateway, offering a streamlined approach to both transaction processing and fraud detection.

8. CyberSource

CyberSource, a Visa solution, offers a suite of fraud prevention tools that leverage AI and machine learning to protect online transactions. Its platform includes features such as device fingerprinting, transaction scoring, and integration with Visa's global network. CyberSource’s customizable fraud management system allows businesses to tailor their fraud prevention strategies to their specific needs and risk profiles.

Conclusion

Investing in a robust e-commerce fraud prevention solution is essential for protecting your business and customers from the ever-evolving landscape of online fraud. Each of the solutions highlighted above offers unique features and benefits, making it crucial to evaluate them based on your specific needs, transaction volume, and risk tolerance. By choosing the right fraud prevention software, you can enhance security, reduce losses, and provide a safer shopping experience for your customers.

#digital marketing#marketing#business#branding#digital services#social media marketing#ecommerce business#e commerce#ecommerce#google ads

2 notes

·

View notes

Text

Optimizing Business Operations with Advanced Machine Learning Services

Machine learning has gained popularity in recent years thanks to the adoption of the technology. On the other hand, traditional machine learning necessitates managing data pipelines, robust server maintenance, and the creation of a model for machine learning from scratch, among other technical infrastructure management tasks. Many of these processes are automated by machine learning service which enables businesses to use a platform much more quickly.

What do you understand of Machine learning?

Deep learning and neural networks applied to data are examples of machine learning, a branch of artificial intelligence focused on data-driven learning. It begins with a dataset and gains the ability to extract relevant data from it.

Machine learning technologies facilitate computer vision, speech recognition, face identification, predictive analytics, and more. They also make regression more accurate.

For what purpose is it used?

Many use cases, such as churn avoidance and support ticket categorization make use of MLaaS. The vital thing about MLaaS is it makes it possible to delegate machine learning's laborious tasks. This implies that you won't need to install software, configure servers, maintain infrastructure, and other related tasks. All you have to do is choose the column to be predicted, connect the pertinent training data, and let the software do its magic.

Natural Language Interpretation

By examining social media postings and the tone of consumer reviews, natural language processing aids businesses in better understanding their clientele. the ml services enable them to make more informed choices about selling their goods and services, including providing automated help or highlighting superior substitutes. Machine learning can categorize incoming customer inquiries into distinct groups, enabling businesses to allocate their resources and time.

Predicting

Another use of machine learning is forecasting, which allows businesses to project future occurrences based on existing data. For example, businesses that need to estimate the costs of their goods, services, or clients might utilize MLaaS for cost modelling.

Data Investigation

Investigating variables, examining correlations between variables, and displaying associations are all part of data exploration. Businesses may generate informed suggestions and contextualize vital data using machine learning.

Data Inconsistency

Another crucial component of machine learning is anomaly detection, which finds anomalous occurrences like fraud. This technology is especially helpful for businesses that lack the means or know-how to create their own systems for identifying anomalies.

Examining And Comprehending Datasets

Machine learning provides an alternative to manual dataset searching and comprehension by converting text searches into SQL queries using algorithms trained on millions of samples. Regression analysis use to determine the correlations between variables, such as those affecting sales and customer satisfaction from various product attributes or advertising channels.

Recognition Of Images

One area of machine learning that is very useful for mobile apps, security, and healthcare is image recognition. Businesses utilize recommendation engines to promote music or goods to consumers. While some companies have used picture recognition to create lucrative mobile applications.

Your understanding of AI will drastically shift. They used to believe that AI was only beyond the financial reach of large corporations. However, thanks to services anyone may now use this technology.

2 notes

·

View notes

Text

How AI is Reshaping the Future of Fintech Technology

In the rapidly evolving landscape of financial technology (fintech), the integration of artificial intelligence (AI) is reshaping the future in profound ways. From revolutionizing customer experiences to optimizing operational efficiency, AI is unlocking new opportunities for innovation and growth across the fintech ecosystem. As a pioneer in fintech software development, Xettle Technologies is at the forefront of leveraging AI to drive transformative change and shape the future of finance.

Fintech technology encompasses a wide range of solutions, including digital banking, payment processing, wealth management, and insurance. In each of these areas, AI is playing a pivotal role in driving innovation, enhancing competitiveness, and delivering value to businesses and consumers alike.

One of the key areas where AI is reshaping the future of fintech technology is in customer experiences. Through techniques such as natural language processing (NLP) and machine learning, AI-powered chatbots and virtual assistants are revolutionizing the way customers interact with financial institutions.

Xettle Technologies has pioneered the integration of AI-powered chatbots into its digital banking platforms, providing customers with personalized assistance and support around the clock. These chatbots can understand and respond to natural language queries, provide account information, offer product recommendations, and even execute transactions, all in real-time. By delivering seamless and intuitive experiences, AI-driven chatbots enhance customer satisfaction, increase engagement, and drive loyalty.

Moreover, AI is enabling financial institutions to gain deeper insights into customer behavior, preferences, and needs. Through advanced analytics and predictive modeling, AI algorithms can analyze vast amounts of data to identify patterns, trends, and correlations that were previously invisible to human analysts.

Xettle Technologies' AI-powered analytics platforms leverage machine learning to extract actionable insights from transaction data, social media activity, and other sources. By understanding customer preferences and market dynamics more accurately, businesses can tailor their offerings, refine their marketing strategies, and drive growth in targeted segments.

AI is also transforming the way financial institutions manage risk and detect fraud. Through the use of advanced algorithms and data analytics, AI can analyze transaction patterns, detect anomalies, and identify potential threats in real-time.

Xettle Technologies has developed sophisticated fraud detection systems that leverage AI to monitor transactions, identify suspicious activity, and prevent fraudulent transactions before they occur. By continuously learning from new data and adapting to emerging threats, these AI-powered systems provide businesses with robust security measures and peace of mind.

In addition to enhancing customer experiences and mitigating risks, AI is driving operational efficiency and innovation in fintech software development. Through techniques such as robotic process automation (RPA) and intelligent workflow management, AI-powered systems can automate routine tasks, streamline processes, and accelerate time-to-market for new products and services.

Xettle Technologies has embraced AI-driven automation across its software development lifecycle, from code generation and testing to deployment and maintenance. By automating repetitive tasks and optimizing workflows, Xettle's development teams can focus on innovation and value-added activities, delivering high-quality fintech solutions more efficiently and effectively.

Looking ahead, the integration of AI into fintech technology is expected to accelerate, driven by advancements in machine learning, natural language processing, and computational power. As AI algorithms become more sophisticated and data sources become more diverse, the potential for innovation in fintech software is virtually limitless.

For Xettle Technologies, this presents a unique opportunity to continue pushing the boundaries of what is possible in fintech innovation. By investing in research and development, forging strategic partnerships, and staying ahead of emerging trends, Xettle is committed to delivering cutting-edge solutions that empower businesses, drive growth, and shape the future of finance.

In conclusion, AI is reshaping the future of fintech technology in profound and exciting ways. From enhancing customer experiences and mitigating risks to driving operational efficiency and innovation, AI-powered solutions hold immense potential for businesses and consumers alike. As a leader in fintech software development, Xettle Technologies is at the forefront of this transformation, leveraging AI to drive meaningful change and shape the future of finance.

#Fintech Technologies#Fintech Software#Artificial Intelligence#Finance#Fintech Startups#technology#ecommerce#fintech#xettle technologies#writers on tumblr

4 notes

·

View notes

Text

Career Paths for SAP S/4 HANA FI Certified Professionals

In today's rapidly evolving business landscape, organizations need to leverage data and technology to stay competitive. One of the key players in this arena is SAP, a global leader in enterprise software solutions. SAP's S/4 HANA Financial Accounting (FI) module has become integral to the operations of countless organizations, making certified professionals in this field highly sought after.

If you're considering a career in SAP S/4 HANA FI, you'll be pleased to know that there are numerous career paths open to you. In this article, we'll explore nine exciting career options for SAP S/4 HANA FI certified professionals.Before we get into these job choices, Finprov Learning is a reliable platform that offers high-quality SAP training and certification programs. Finprov Learning can help you succeed in this industry and obtain your needed skills.

Careers in SAP S/4 HANA FI

SAP S/4 HANA FI Consultant

To implement, adapt, and improve your client's financial accounting systems, you will collaborate closely with them as a SAP S/4 HANA FI consultant. This position includes reviewing business procedures, setting up SAP systems, and offering continuous assistance and training.

Financial Analyst

S/4 HANA SAP Professionals with FI certification are well-suited for employment as financial analysts. They can use their knowledge of SAP systems to analyze financial data, provide reports, and offer insights to help organizations make better decisions.

SAP S/4 HANA FI Project Manager

In SAP implementations, project management is essential. Strong communicators and project managers who are SAP S/4 HANA FI certified may successfully oversee the planning and implementation of SAP projects.

SAP S/4 HANA FI System Administrator

SAP systems need to be maintained and troubleshot by system administrators. You can operate as a system administrator, ensuring the efficient operation of financial modules and resolving any technical issues if you have certification in SAP S/4 HANA FI.

SAP S/4 HANA FI Trainer

If you enjoy teaching and are passionate about SAP, consider becoming an SAP S/4 HANA FI trainer. Many organizations require in-house employee training, and your expertise can be invaluable in this role.

SAP S/4 HANA FI Data Analyst

Data analytics is a growing field, and SAP S/4 HANA FI-certified professionals can apply their skills to extract valuable insights from financial data. This career path involves using tools like SAP Analytics Cloud to analyze and visualize financial information.

SAP S/4 HANA FI Auditor

Financial audits are a crucial part of any business. SAP S/4 HANA FI certified professionals can work as auditors, ensuring financial compliance, risk management, and fraud detection within organizations.

SAP S/4 HANA FI Solution Architect

Solution architects design and plan the implementation of SAP solutions, ensuring they align with business objectives. With certification in SAP S/4 HANA FI, you can become a solution architect, shaping the financial systems of the future.

SAP S/4 HANA FI Business Analyst

Business analysts bridge the gap between technical SAP knowledge and business processes. They evaluate how SAP solutions can meet specific business needs and work on improving financial processes.

Conclusion

The certified SAP S/4 HANA FI professional opens doors to numerous exciting and financially rewarding opportunities. Whether you're inclined to work closely with clients, delve into data analysis, or manage projects, there's a career path tailored to your unique skills and interests. The demand for SAP S/4 HANA FI experts is on a consistent rise, cementing it as a prudent choice for those seeking success in the dynamic realm of finance and technology. And if you're contemplating a career in this field, rest assured that the possibilities are extensive, and the future looks promising. To kickstart your SAP S/4 HANA FI journey, consider Finprov Learning, where you'll find top-notch resources and guidance to excel in this flourishing domain. With Finprov Learning, your career possibilities in SAP S/4 HANA FI are bound to expand.

2 notes

·

View notes

Text

Credit Card Fraud Prevention with 3D Secure | GPayments

Discover the evolution of 3D Secure, the gold standard in online credit card security. From static passwords to contactless payments, explore how Visa Secure, Mastercard Identity Check, American Express SafeKey, and others have transformed the way we shop online!

#financial fraud detection software#ecommercefraudprevention#risk and fraud management#detectionsoftware#Credit Card Fraud Prevention with 3D Secure

0 notes

Text

Start-up Business Tips

Can you detect issues that require bookkeeping services when there are so many business responsibilities and worries? And what are they specifically? Continue reading to learn more!

#1 Inefficient Financial Statements

Frequently, brought by inaccurate financial reporting and inconsistent data, one issue that small business owners deal with is inaccurate financial records. It could make your business appear prosperous when it is actually struggling financially!

Inaccurate financial reporting can have major, expensive risks, including losing investors, financial loss, and fraud risk.

They also make sure to give you a clearer, more complete picture of your company’s financial situation. You can get reasonably priced recordkeeping services in Los Angeles to get precise

#2 Overlooked Efforts

The possibility of making mistakes that cost you a lot of money is high if bookkeeping is not really your area of expertise. Sometimes, it may even take a lot of time and effort to correct!

Being in charge of everything yourself as a business owner may appear easier and more natural. But if you give it too much attention, you might forego other important business opportunities.

Hire The Bookkeepers R Us’s qualified and experienced bookkeepers to complete your books promptly and efficiently instead. Let our trustworthy recordkeepers in LA handle your bookkeeping needs so that you can focus your time and effort on running your business.

#3 Ineffective Cash Flow Management

Tracking your small business’s cash inflows and outflows can be challenging. Particularly if it starts to have an impact on your finances, such as by causing misaligned sales goals, huge loans, and other high expenditures

However, professional bookkeepers make sure that your cash flow is consistently tracked and that the priority is on profitability which boosts cash flow. The greatest solution for poor cash flow management is to outsource the skills of a bookkeeper. It is best to steer clear of recurring financial problems once a positive cash flow has been established!

The Bookkeepers R Us’ financial experts offer fresh ways to maintain your company’s financial stability and make sure your small business has enough ability to cover expenses like operations, renovations, and payroll.

#4 Overlapping Personal and Business Accounts

Combining two accounts might lead to significant losses and financial problems. So this is considered one of the major errors that small business owners make.

Combining personal and business financial accounts has consequences. Where there will be an instance where you may spend your personal funds on business expenses and vice versa.

Generally speaking, being in this kind of financial condition can limit your ability to expand your business to its best potential. Because you will fail to keep proper financial records and be unable to calculate your company’s profit margins with accuracy.

Consider opening a separate business bank account to prevent issues! Employ reputable LA bookkeepers to keep track of your company’s assets and offer you the best financial advice at every turn.

and updated accounting for all daily transactions, which will help you maintain organized financial reports.

#5 Ineffective Utilization of Accounting Software

Selecting the wrong accounting software could result in unwise business choices!

Although technology has made bookkeeping simpler, not all small business owners have the time or the expertise to use accounting software.

Even small businesses must use accounting software, such as various Inventory Management Systems, to operate at their peak efficiency. Why? Because it makes it simple to track spending, manage taxes, create balance sheets, and execute basic invoicing and billing.

4 notes

·

View notes

Text

Fraud Prevention and Security for Ecommerce: Safeguarding Your Online Business

The rapid growth of ecommerce has revolutionized the way we shop, enabling us to browse and purchase products and services from the comfort of our homes. However, with this convenience comes the risk of fraud and security breaches that can have a devastating impact on businesses and consumers alike. To protect your online business and maintain the trust of your customers, implementing robust fraud prevention and security measures is essential.

The Importance of Fraud Prevention

Fraudulent activities in ecommerce can take various forms, such as identity theft, credit card fraud, and account takeover. The consequences can be severe, including financial loss, damage to your brand reputation, and legal liabilities. Therefore, it's crucial to prioritize fraud prevention to safeguard your business and create a secure environment for your customers.

1. Secure Payment Gateways

One of the first steps in fraud prevention is to ensure that your payment gateways are secure. Partner with reputable payment service providers that comply with industry standards and offer robust security features, such as encryption and tokenization. Implementing additional layers of authentication, such as two-factor authentication, can further enhance the security of online transactions.

2. Data Encryption

Protecting customer data is paramount in ecommerce. Utilize secure sockets layer (SSL) certificates to encrypt sensitive information transmitted between your customers' browsers and your website. This encryption makes it significantly harder for hackers to intercept and access confidential data, providing an extra layer of security.

3. Fraud Detection and Monitoring

Implement fraud detection and monitoring systems that can identify suspicious patterns and behaviors. Utilize machine learning algorithms to analyze vast amounts of data and detect anomalies that may indicate fraudulent activities. Set up alerts for unusual activities, such as multiple failed login attempts or sudden changes in purchasing patterns, to respond promptly and mitigate potential risks.

4. Strong Password Policies

Encourage your customers to create strong passwords and regularly update them. Implement password strength requirements, such as a minimum length, a mix of uppercase and lowercase letters, numbers, and special characters. Educate your customers about the importance of using unique passwords for each online account and provide tips on creating secure passwords.

5. Regular Software Updates and Patching

Keep your ecommerce platform and associated software up to date by installing the latest security patches and updates. Cybercriminals often exploit vulnerabilities in outdated software versions. Regularly monitor security advisories and subscribe to notifications from your software providers to stay informed about potential vulnerabilities and apply the necessary patches promptly.

6. PCI Compliance

If your ecommerce business handles credit card payments, it's crucial to comply with the Payment Card Industry Data Security Standard (PCI DSS). Ensure that your systems and processes adhere to the PCI DSS requirements to protect cardholder data. Conduct regular audits and vulnerability assessments to maintain compliance and minimize the risk of security breaches.

7. Educate Your Customers

Empower your customers with knowledge about online security best practices. Provide educational resources, such as blog articles or FAQs, that cover topics like recognizing phishing attempts, protecting personal information, and avoiding suspicious websites. By raising awareness, you can help your customers make informed decisions and protect themselves from fraudulent activities.

8. Ongoing Monitoring and Review

Fraud prevention is an ongoing process that requires constant monitoring and review. Regularly analyze your transaction data, review security logs, and conduct periodic risk assessments to identify potential vulnerabilities and adapt your security measures accordingly. Stay updated on the latest fraud trends and security practices to proactively respond to emerging threats.

Conclusion

As ecommerce continues to thrive, fraud prevention and security must remain top priorities for online businesses. By implementing secure payment gateways, encrypting customer data, detecting and monitoring fraud, enforcing strong passwords, staying updated with software patches, complying with PCI standards, educating customers, and maintaining ongoing vigilance, you can fortify your ecommerce business against fraudsters and build trust with your customers. Remember, protecting your business and customers from fraud is a continuous effort that requires constant adaptation to stay one step ahead of cybercriminals.

Click here to contact me on Fiverr

Source

2 notes

·

View notes

Text

How Our Identity Verification API Helps Businesses Stay Secure

An identity verification API (Application Programming Interface) is a software tool that allows developers to integrate identity verification services into their applications or websites. Identity verification APIs provide a way for businesses to verify the identity of their customers, users, or clients, typically by comparing the information provided by the individual with data from a trusted source, such as a government database or credit bureau.

There are several identity verification APIs available in the market, offered by companies such as RPACPC GST VERIFICATION API, PAN STATUS, 206AB Compliance Check among others. These APIs typically provide a range of identity verification services, such as document verification, biometric authentication, and fraud detection.

To use an identity verification API, a developer would need to integrate the API into their application or website, typically by making API calls to the service provider's servers. The API would then return a response indicating whether the identity verification was successful or not, along with any relevant data or insights about the individual's identity.

Overall, identity verification APIs provide a way for businesses to strengthen their identity verification process, reduce fraud, and improve the user experience by making the verification process more efficient and seamless.

Identity verification is a crucial process that many businesses need to perform to ensure that their customers or users are who they claim to be.

This process helps to prevent fraud, protect against financial losses, and comply with regulatory requirements. However, performing identity verification manually can be time-consuming and error-prone, especially as more and more businesses move online. Fortunately, with the advent of identity verification APIs, businesses can now automate this process and make it more efficient and accurate.

The benefits of using an identity verification API are many. First and foremost, it provides a faster and more efficient way to verify identities. Instead of manually checking documents and cross-referencing information, businesses can automate the process and get instant results. This helps to reduce the time and effort required to perform identity verification, enabling businesses to onboard customers or users more quickly and easily.

Secondly, identity verification APIs provide a more accurate way to verify identities. APIs use a range of data sources to verify an individual's identity, such as government databases, credit bureaus, and social media platforms. This enables them to cross-reference multiple sources and detect any inconsistencies or red flags that may indicate fraudulent activity. By using an API, businesses can reduce the risk of identity fraud and protect themselves from financial losses.

Thirdly, identity verification APIs help to improve the user experience. By automating the verification process, businesses can provide a seamless and frictionless onboarding experience for their customers or users.

This helps to reduce the drop-off rate during the onboarding process and increases the likelihood of conversion.

Finally, identity verification APIs can help businesses comply with regulatory requirements. Many industries, such as banking and finance, have strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations that require them to perform identity verification on their customers. By using an API, businesses can automate this process and ensure that they comply with regulatory requirements. APIs also provide a more auditable and transparent way to perform identity verification, which can help businesses demonstrate compliance to regulators.

In conclusion, identity verification APIs provide a faster, more accurate, and more convenient way for businesses to verify the identity of their customers or users. By automating the identity verification process, businesses can reduce the risk of fraud, protect against financial losses, and comply with regulatory requirements. With the increasing importance of online identity verification, businesses that use identity verification APIs are better positioned to provide a secure and seamless user experience.

#Identity Verification#Identity Verification API#identity verification services#identity verification solutions#online identity verification service#online identity verification solutions

2 notes

·

View notes

Text

The Future of Accounting Billing Software: Trends to Watch

Accounting and billing software have become essential tools for businesses worldwide. With advancements in technology, these tools are evolving rapidly, shaping the future of financial management. In this blog, we will explore the key trends and innovations in invoicing and billing software, such as blockchain in accounting, mobile-first billing solutions, and subscription-based invoicing tools. Let’s dive into the future of accounting software and discover what’s in store.

The Rise of Cloud-Based Solutions

Cloud technology has revolutionized how businesses operate. In 2023, more than 60% of small and medium-sized businesses (SMBs) used cloud-based accounting software, and this percentage is expected to reach 80% by 2026. Cloud-based solutions offer real-time access to data, enabling businesses to manage their finances from anywhere. This flexibility is especially beneficial for companies with remote teams or multiple office locations.

Benefits of Cloud-Based Solutions:

Automatic updates with new features

Enhanced data security

Scalability for growing businesses

Automation and Artificial Intelligence (AI)

Automation and AI are becoming integral parts of accounting software. These technologies help reduce manual errors, save time, and provide accurate financial insights. For example, AI-powered tools can categorize expenses, predict cash flow trends, and even detect fraudulent transactions.

According to a study by Gartner, by 2025, 75% of businesses will use AI-based solutions to automate accounting tasks. This shift will allow accountants to focus more on strategic planning rather than repetitive data entry.

Upcoming Billing Features Powered by AI:

Predictive analytics for financial forecasting

Smart invoice generation

Personalized customer insights

Mobile-First Billing Solutions

As smartphone usage continues to grow, mobile-first billing solutions are gaining popularity. In 2022, around 45% of businesses used mobile apps for invoicing and payments, and this number is projected to increase to 70% by 2025. Mobile-friendly software allows users to create invoices, track payments, and manage finances on the go.

These solutions are particularly useful for small business owners and freelancers who often need quick access to their financial tools. Features like push notifications for overdue payments and one-tap payment reminders make mobile-first billing solutions highly convenient.

Blockchain in Accounting

Blockchain technology is transforming the accounting landscape by introducing transparency and security. By 2028, the global blockchain market in accounting is expected to reach $11.5 billion, growing at a compound annual growth rate (CAGR) of 47.2% from 2023.

How Blockchain Benefits Accounting:

Secure and tamper-proof transaction records

Instant verification of financial data

Reduced risk of fraud and errors

Blockchain can also streamline invoicing by enabling smart contracts, which automatically execute payment terms once conditions are met. For instance, a freelancer could receive payment immediately after submitting a project, eliminating delays.

Subscription-Based Invoicing Tools

Subscription-based models are becoming a preferred choice for businesses of all sizes. Instead of purchasing software outright, companies can subscribe to monthly or annual plans. This model provides access to the latest features without the need for costly upgrades.

In 2023, the subscription economy was valued at $275 billion and is predicted to grow to $1.5 trillion by 2030. Subscription-based invoicing tools often include features like recurring billing, automatic payment reminders, and detailed analytics.

Advantages of Subscription-Based Tools:

Affordable pricing with predictable costs

Regular updates and new features

Integration with other business tools

Integration with Other Business Systems

Modern accounting software is not just limited to bookkeeping. It integrates seamlessly with other business systems like Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), and e-commerce platforms. For example, integration with a CRM system allows businesses to automatically generate invoices based on customer interactions.

This interconnected approach helps businesses streamline operations, reduce manual work, and improve overall efficiency. According to a report by Statista, 65% of businesses will prioritize software integration by 2025.

Focus on User Experience (UX)

As competition increases, accounting software providers are focusing on delivering a superior user experience. Intuitive interfaces, customizable dashboards, and easy navigation are now standard features.

For instance, QuickBooks and Xero have introduced guided setups and tutorials to help users get started quickly. Enhanced UX not only improves user satisfaction but also reduces the learning curve for new users.

Emphasis on Data Security

With the rise of cyber threats, data security remains a top priority for accounting software developers. Advanced encryption, multi-factor authentication, and regular security audits are becoming standard practices.

In 2023, the cost of data breaches in the financial sector averaged $5.85 million per incident. To mitigate such risks, many software providers are adopting ISO-certified security measures and offering cyber insurance.

GimBook: Simplifying the Future of Billing

GimBook is at the forefront of revolutionizing accounting and billing with its cutting-edge features tailored for modern businesses. Designed with user-friendly interfaces and advanced technologies like automation, mobile-first solutions, and seamless integrations, GimBook empowers companies to manage their finances efficiently. Whether you’re a freelancer or a growing enterprise, GimBook offers innovative tools like smart invoicing, subscription-based billing, and real-time financial insights. With a commitment to security and sustainability, GimBook is the perfect partner to help businesses stay ahead in the evolving landscape of billing software.

Try GimBook today and embrace smarter, faster, and more secure billing solutions, click here: https://bit.ly/4eMIOHF

Conclusion

The future of accounting software is bright, driven by innovations in invoicing, mobile-first solutions, blockchain technology, and more. Businesses can expect smarter, faster, and more secure tools to manage their finances. By staying updated on these billing software trends, companies can leverage cutting-edge features to gain a competitive edge.

Whether you are a small business owner, a freelancer, or part of a large corporation, these advancements will make managing finances easier than ever. Embracing these trends now can help future-proof your business for the years to come.

0 notes