#finalexams

Explore tagged Tumblr posts

Text

Sedgwick’s Spurs

Next week, October 21st is the 156th anniversary of the 1868 dedication of a statue at West Point honoring General John Sedgwick. In August of this year, my West Point Class of ‘78 took part in a rededication ceremony for the statue. You may ask why – The story spans two centuries. SEDGWICK Born in 1813, John Sedgwick graduated from the United States Military Academy in 1837. During the Civil…

#Civilwar#classof’78#finalexams#friends#GeneralJohnSedgwick#GeneralSedgwick#goodluck#luck#Sedgwick’sspurs#spinthespurs#Spurs#stories#traditions#westpoint#westpointtraditions

0 notes

Text

Oh, our dear botany student comrades, gather 'round and let us talk about our beloved chemistry teacher. While our other mentors bless us with hints and strategies for conquering the final paper, our chemistry teacher marches to the beat of a different drum. It's as if they graduated from the "Secrecy University for Teachers," majoring in the fine art of withholding information. While our peers enjoy a botanical garden of guidance, we find ourselves lost in a forest of uncertainty. Our chemistry teacher is like a leafless tree, refusing to give us any direction. Instead of clear pathways and labelled specimens, they challenge our botanical prowess by presenting us with a blank canvas. Who needs explicit guidance when you can embark on a thrilling botanical expedition of trial and error? We must decipher the secrets of chemical compounds like explorers navigating uncharted territory. It's a true test of our resilience and ability to adapt to the whims of the plant kingdom. While our fellow students prioritize questions based on logical order, we botany enthusiasts prioritize based on sheer determination and our affinity for chlorophyll. So let us embrace this unconventional approach and remember that in the vast garden of knowledge, the chemistry exam is just a single wildflower waiting to be discovered. Let us bloom and conquer, my fellow green-thumbed scholars!

I'm finally done with my analytical chemistry exam. Yahoo!!!!💃🏻💃🏻💃🏻

#botany#botanical#botanist#garden#flowers#exams#finals#finalexams#chemistryexam#analytical chemistry

0 notes

Text

https://examsage.com/downloads/psychopathology-and-diagnostic-reasoning-practice-test/

0 notes

Link

Pauline W. Chen, transplant surgeon and author of "Final Exam: A Surgeon's Reflections on Mortality," talks about an experience she had in medical school that transformed her. The full interview from a 2007 episode of "Conversations On The Coast with Jim Foster" can be heard now wherever you get your podcasts.

#asurgeon'sreflectionsons#authorinterview#book#coc#conversationsonthecoast#finalexam#generalsurgery#jimfoster#medicalethics#medicalprofessionalbiographies#mortality#organdonor#paulinewchen#reading#sanfrancisco#sf#transplantsurgeon

0 notes

Text

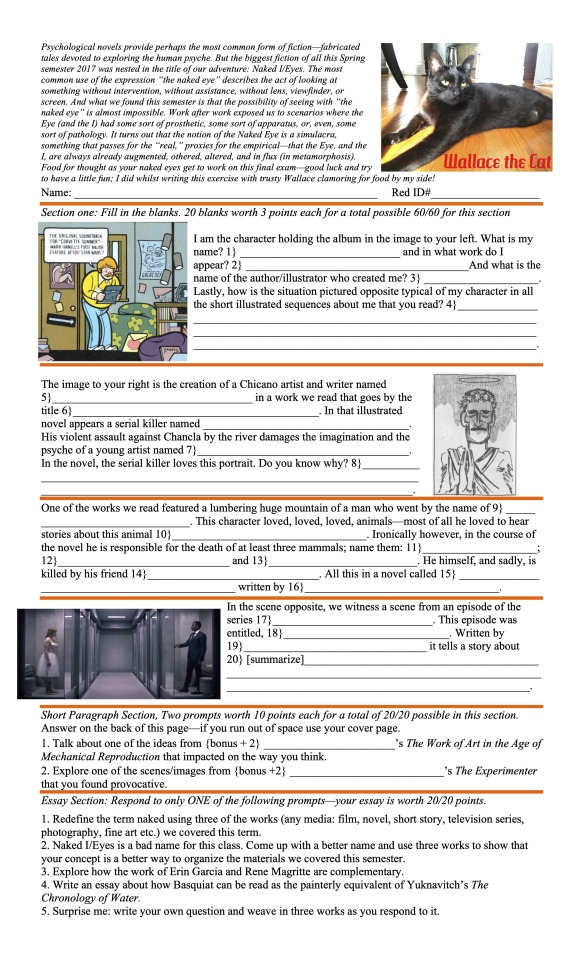

As promised, a sample final exam from 2017 ... the form of the midterm and final for #nakedsouls23 will follow this same style/template. It will, however, have more queries that test your ability to identify artists/writers we have worked on this term!

0 notes

Text

21 July | 2159

bus just arrived 😌

1 note

·

View note

Text

GSMLIS106: The Head-Cracking Final Exam Experience

Welcome to my page! Today, I am going to share with you the first rigorous final exam I had in Graduate School for the course GSMLIS106: Preparation of Instructional Materials. This examination is designed to challenge and assess the comprehensive understanding of students in creating effective instructional materials. Let's explore the intricate details of this demanding evaluation process.

Exam Format: Written Exam

The written examination comprises of a set of essay questions that require students to demonstrate their knowledge, critical thinking abilities, and practical application of concepts related to the preparation of instructional materials.

The questions are carefully crafted by Doctor Lora to cover various aspects of the course, including instructional design principles, multimedia integration, assessment techniques, and pedagogical strategies.

Content Complexity

The Preparation of Instructional Materials is a challenging course, and the final exam reflects its rigorous nature. The exam questions are designed to test our in-depth understanding of the subject matter. We are expected to showcase our ability to critically analyze and synthesize complex theories, methodologies, and research findings related to instructional material preparation. They must also demonstrate their competence in applying this knowledge to solve practical problems faced by instructional designers.

Do you want to know the sample difficult questions in the test? If there could be “HOTTEST Questions”, that’s how I categorize them!

Preparation Strategies

Given that I will be taking a final exam at Graduate School, I exerted an effort just to bring up something the moment that I take the exam. Here are a few things I did before I take the Preparation of Instructional Materials exam:

Review Course Materials: Thoroughly, I revisit lecture notes, textbooks, and supplementary readings to reinforce my understanding of key concepts, theories, and practical applications.

Engage in Group Discussions: I collaborated with my fellow students to discuss complex topics, share insights, and challenge each other's understanding.

Practice Time Management: Allocate sufficient time to practice creating instructional materials and solving complex scenarios. Develop a structured study plan to cover all exam components adequately.

Seek Clarification: I did not hesitate to reach out to my classmates and instructor for clarification. Having a clear understanding of concepts is crucial for tackling challenging exam questions.

Passed? Or Pass!

Indeed, it was really a head-cracking exam experience. After answering it, I entrusted my future to the fate-maker. So, don’t ever ask me if I passed it because if you ever do, I’d definitely answer, “Pass!”

0 notes

Text

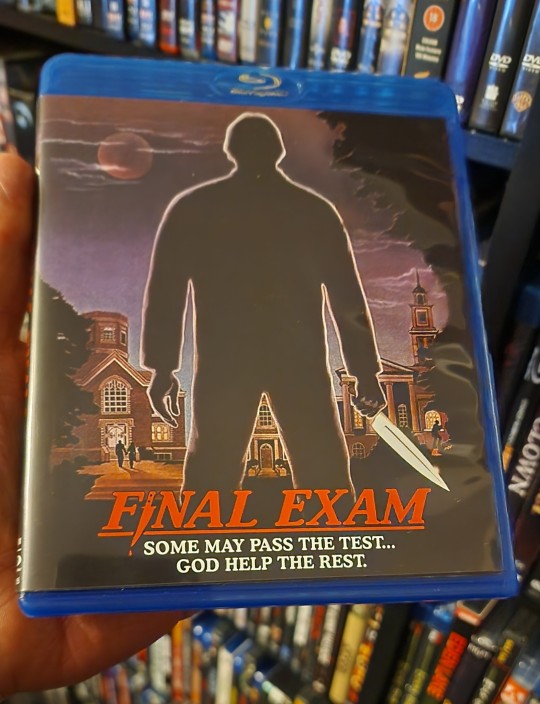

Final Exam was released on June 5, 1981(US).

#FinalExam

#horror

2 notes

·

View notes

Text

📍 Elana’s Social Media Post of the Day

🧘♀️✨ Final Exams, Himalayas, Time Travel & Freediving—The Next Chapter Begins! ✨🌊

Hey everyone! 🌿💫

Today is a big day—I'm officially taking my final exams for my Ashtanga Yoga Teacher Training Certificate! After months of intense Mysore practice, deepening my breathwork, and learning the therapeutic power of the Primary Series, I’m putting my knowledge to the test. 📝🔥

💡 To take this exam, I had to fly from Rishikesh to Mysore—the heart of Ashtanga Yoga—to complete my training in the very place where this method was preserved and shared with the world. Stepping into this sacred space is a powerful reminder of the discipline, lineage, and wisdom passed down through generations.

To celebrate, I want to share a few questions from my exam with you! Think you can answer them? Drop your responses in the comments! 👇

📖 Ashtanga Yoga Final Exam Sneak Peek: 1️⃣ Why do we avoid practicing on Full Moon and New Moon days in Ashtanga? 🌕🌑 2️⃣ How does the Primary Series prepare the body for seated meditation? 3️⃣ What are the three Bandhas, and why are they essential? 4️⃣ Which Ashtanga poses are best for gut health and detoxification? 5️⃣ How does Ujjayi breath regulate the nervous system?

💬 Test your knowledge in the comments! Let’s see who’s ready for their own Ashtanga challenge! 🤓🧘♂️

🌎 What’s Next? My Journey Continues!

🚀 Tomorrow, I’m heading to the remote Kanchenjunga region in the Himalayas to push my limits in high-altitude survival. I’ll be diving deep into: 🔹 Tummo Pranayama—the ancient breathwork technique that Tibetan monks use to generate inner heat 🔥 🔹 Altitude Medicine—how the body adapts to extreme conditions 🏔️ 🔹 Survival Strategies in the Mountains—because nature is the greatest teacher! 🌬️❄️

📜 Then… I’m time-traveling to Mysore to meet the legendary Krishnamacharya—the father of modern yoga. I want to understand his original teachings, his work with breath control, and his philosophy on how yoga transforms human consciousness.

🌊 Finally, I’ll be taking all my skills—pranayama, yoga, breath-holding, and mind control—into the depths of freediving. I believe the ocean holds profound spiritual lessons, and I want to explore how deep breathwork can unlock a new level of transformation.

💭 Breath is the bridge between the inner and outer world. Whether I’m in the Himalayas, Mysore, or the deep sea—it all comes back to breath.

Follow along as I explore, challenge myself, and uncover ancient wisdom for the modern world. 🌍💙

📝 Drop your answers to the exam questions below, and tell me—where in the world would YOU go to train your body and mind? 🌎👇

#AshtangaYoga #FinalExam #YogaJourney #Breathwork #Himalayas #Tummo #AltitudeMedicine #Krishnamacharya #Freediving #SpiritualExploration #PersonalTransformation

0 notes

Text

Reviewing ft. Coffee ☕️ (3a.m.)

#FinalExam #Claimtopassed

1 note

·

View note

Text

NOSTALGIA UK

Crossing the Finish Line (Summer 1994)

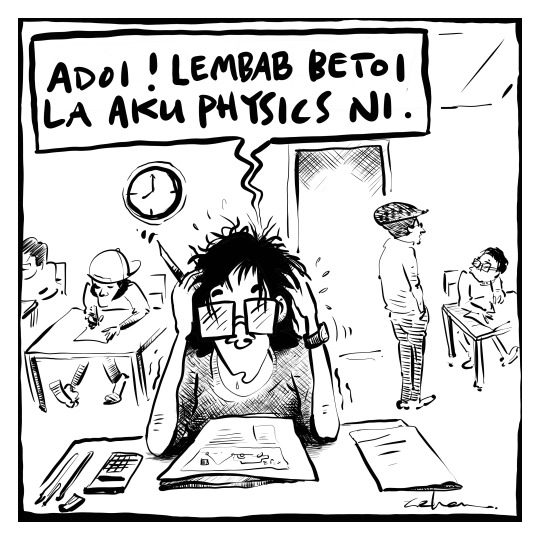

After eight intense months of crammed lessons and relentless efforts to cover the syllabus, the day of reckoning had finally arrived. It was time to put all that learning to the test. Five subjects stood between us and freedom: Chemistry, Physics, Biology, Mathematics, and English. For Azizi and Ela, who were planning to further their studies in the areas of Economics and Commerce, there were three additional, more relevant subjects in place of the sciences. I remember one of them was English Literature.

Oddly enough, I remember almost nothing about the actual exams themselves. The questions, the answers, the ticking clock—it’s all just a faint blur in my memory. But what I do recall is my long-standing struggle with Physics. For as long as I could remember, Physics had been my academic nemesis. Many of the theories and concepts just never clicked in my head, no matter how much effort I put into understanding them. As exam day approached, it loomed over me like an insurmountable peak.

Those were some of the most stressful days of my life. There were moments of frantic revision, last-minute problem-solving attempts, and, of course, the creeping self-doubt that comes when facing a subject you’ve always found daunting. But somehow, I powered through.

And then, finally, it was over. The last paper was handed in, and just like that, the weight lifted. It wasn’t an immediate sense of relief—more like a slow realisation that the marathon was complete. The stress lingered for a while, but the knowledge that we’d reached the finish line was a triumph in itself.

#sifp #petronasscholars #glasgow #scotland #finalexam

0 notes

Text

0 notes

Photo

Are you looking for help in your final exams? Tutors are helping students to crack final exams immediately, Hire experienced experts for help instantly and get your Holmes final examination done precisely... Order Final Assessment at Whatsapp No: :- +61-413-786-465 Visit:- https://www.instagram.com/p/CtbZg4FoJye/ visit: https://www.facebook.com/myassignmentshelps/posts/pfbid0WMkec4JJmC1dbWqSKifNQMborwRRYn2wThuyT8WHs2UX3pFNmAaNMiGQ4FRS5mxGl

#holmes #finalexams #holmesfinalexams #australia #assignmenthelp #holmesfinalexaminationhelp #holmesfinals #holmesuniversity #australiahelp #australiaassignmenthelp

0 notes

Text

Weekend To Do List 🌺

to do list for this weekend is ready let's see how much i will be able to cover it 😅

#just trying to be more active on tumblr ....🥹

#Pov : Exam season ahead 🫠

#studyblr#productivty#finalexams#season#study inspiration#new student#study notes#study hard#studying#computer science#computer networks#design analysis#numerical analysis

7 notes

·

View notes

Text

02.12.20

Well, I must say that today was marginally more productive than yesterday, but I did sit through two classes today, so the outcome was almost anticipated. Nevertheless, I did manage to go over some more financial maths and accounting, so there’s some progress overall.

Here’s hoping I crank out more work tomorrow x day 2 of 21 days of productivity

#study#studytime#study motivation#study blog#studystudystudy#studyspiration#studyspo#studyblr#finalexam#finalexams#productivity#100 days of productivity#procrastinatingproductivity

3 notes

·

View notes