#fi talks

Explore tagged Tumblr posts

Text

Not gonna lie I'm a pretty big slut for pyramid head

68 notes

·

View notes

Text

Hey uh. Anyone got some hope I can borrow?

5 notes

·

View notes

Text

I'm getting my first wheelchair you guys!!! I'm so excited to get to live my life on my own terms now. This is so huge for me ♿❤️

#fi talks#disabled#disability#invisible disability#wheelchair#wheelchair user#pots#dysautonomia#potsie

16 notes

·

View notes

Text

okay am i the only one freaking out that wait in the wings is doing a video on rtc or what cause i feel like i’m the only one i see who has said anything about it

23 notes

·

View notes

Text

Where I'm from we get cicadas in the summer that make a buzzing noise, and when I was a kid I thought that was the sound the sun made when it was working really hard

I think that kid and I would've gotten along

saw this comment on a cricket noise video and felt like something changed in me idk

73K notes

·

View notes

Text

I finally had the time to write the next chapter of my serpentbriel series

God it feels good to be back

36 notes

·

View notes

Text

Non-americans please have sympathy for us. We didn't want this. We fought so hard.

#it's like watching an incoming car crash#and screaming and crying for the driver to hit the brakes#but he just laughs as he speeds up#and the crowds cheer#I'm so scared#my family can't afford to leave#fi talks#politics

3 notes

·

View notes

Text

I want my skeleton donated for SCIENCE

#theres another huge reason that would take a huge post to explain#<3#bro i love conversations like this#fi talks

28K notes

·

View notes

Text

someone please talk to me about rise of the pink ladies now omg please

49 notes

·

View notes

Text

Hello, MrRadio 🎶

#soundwave#maccadam#transformers#wanted this to look like poster or mag cover#mr radio is a song from ELO i grew up listening to their music :D#lo-fi and side text is a reference to tom cardy's song!#im shy to talk in post so tag talk

3K notes

·

View notes

Text

Obsessed with stories that preface their own tragedies. They stare you dead in the eye and tell you it will end badly. You watch the characters hurdle towards their doom, unable to do anything but watch. They'll give you hope that this time everyone will make it out, that just this once everything will be okay, only to snatch it away at the last moment. and when you're left grieving the end, you have no one to blame but yourself because they *told* you this was going to happen. there was no other way this could have ended

#gnawing on this#this is about uhhhh#moby dick#don't laugh.#but also#hadestown#the sparrow#do you know how hard it is to get obsessed with a random sci fi book from the 90's#who am i going to talk to it about.#emilio is rapidly approaching blorbo territory but that's for another post#gweh

2K notes

·

View notes

Photo

Every time I watch Sharknado I wish aquatic predators would fall from the sky

This has been a PSA.

370K notes

·

View notes

Text

Ko-fi prompt from @liberwolf:

Could you explain Tariff's , like who pays them and what they do to a country?

Well, I can definitely guess where this question is coming from.

Honestly, I was pretty excited to get this prompt, because it's one I can answer and was part of my studies focus in college. International business was my thing, and the issues of comparative advantage (along with Power Purchasing Parity) were one of the things I liked to explore.

-----------------

At their simplest, tariffs are an import tax. The United States has had tariffs as low as 5%, and at other times as high as 44% on most goods, such as during the Civil War. The purpose of a tariff is in two parts: generating revenue for the government, and protectionism.

Let's first explore how a tariff works. If you want to be confused, then you need to have never taken an economics class, and look at this graph:

(src)

So let's undo that confusion.

The simplest examples are raw or basic materials such as steel, cotton, or wine.

First, without tariffs:

Let us say that Country A and Country B both produce steel, and it is of similar quality, and in both cases cost $100 per unit. Transportation from one country to the other is $50/unit, so you can either buy domestically for $100, or internationally for $150. So you buy domestically.

Now, Country B discovers a new place to mine iron very easily, and so their cost for steel drops to $60/unit due to increased ease of access. Country A can either purchase domestically for $100, or internationally for $110 (incl. shipping), which is much more even. Still, it is more cost-effective to purchase domestically, and so Country A isn't worried.

Transportation technology is improved, dropping the shipping costs to $30/unit. A person from Country A can buy: Domestic: $100 International: $60+$30 = $90 Purchasing steel from Country B is now cheaper than purchasing it from Country A, regardless of where you live.

Citizens in Country A, in order to reduce costs for domestic construction, begin to purchase their steel from Country B. As a result, money flows from Country A to B, and the domestic steel industry in Country A begins to feel the strain as demand dwindles.

In this scenario, with no tariffs, Country A begins to rely on B for their steel, which causes a loss of jobs (steelworkers, miners), loss of infrastructure (closing of mines and factories), and an outflow of funds to another country. As a result, Country A sees itself as losing money to B, while also growing increasingly reliant on their trading partner for the crucial good that is steel. If something happens to drive up the price of B's steel again, like political upheaval or a natural disaster, it will be difficult to quickly ramp up the production of steel in Country A's domestic facilities again.

What if a tariff is introduced early?

Alternately, the dropping of complete costs for purchase of steel from Country B could be counteracted with tariffs. Let's say we do a 25% tariff on that steel. This tariff is placed on the value of the steel, not the end cost, so:

$60 + (0.25 x $60) + $30 = $105/unit

Suddenly, with the implementation of a 25% tariff on steel from Country B, the domestic market is once again competitive. People can still buy from Country B if they would like, but Country A is less worried about the potential impacts to the domestic market.

The above example is done in regards to a mature market that has not yet begun to dwindle. The infrastructure and labor is still present, and is being preemptively protected against possible loss of industry to purchasing abroad.

What happens if the tariff is not implemented until after the market has dwindled?

Let's say that the domestic market was not protected by the tariff until several decades on. Country A's domestic production, in response to increased purchasing from abroad, has dwindled to one third of what it was before the change in pricing incentivized purchase from B. Prices have, for the sake of keeping this example simple, remained at $100(A) and $60(B) in that time. However, transportation has likely become better, so transportation is down to $20, meaning that total cost for steel from B is $80, accelerating the turn from domestic steel to international.

So, what happens if you suddenly implement a tariff on international steel? Shall we say, 40%?

$60 + (0.4 x 60) + 20 = $104

It's more expensive to order from abroad! Wow! Let's purchase domestically instead, because these prices add up!

But the production is only a third of what it used to be, and domestic mines and factories for refining the iron into steel can't keep up. They're scaling, sure, but that takes time. Because demand is suddenly triple of the supply, the cost skyrockets, and so steel in Country A is now $150/unit! The price will hopefully come down eventually, as factories and mines get back in gear, but will the people setting prices let that happen?

So industries that have begun to rely on international steel, which had come to $80/unit prior to the tariff, are facing the sudden impact of a cost increase of at least $25/unit (B with tariff) or the demand-driven price increase of domestic (nearly double the pre-tariff cost of steel from B), which is an increase of at least 30% what they were paying prior to the tariff.

There are possible other aspects here, such as government subsidies to buoy the domestic steel industry until it catches back up, or possibly Country B eating some of the costs so that people still buy from them (selling for $50 instead of $60 to mitigate some of the price hike, and maintain a loyal customer base), but that's not a direct impact of the tariff.

Who pays for tariffs?

Ultimately, this is a tax on a product (as opposed to a tax on profits or capital themselves, which has other effects), which means the majority of the cost is passed on directly to the consume.

As I said, we could see the producers in Country B cut their costs a little bit to maintain a loyal customer base, but depending on their trade relationships with other countries, they are just as likely to stop trading with Country A altogether in order to focus on more profitable markets.

So why do we not put tariffs on everything?

Well... for that, we get into the question of production efficiency, or in this case, comparative advantage.

Let's say we have two small, neighboring countries, C and D, that have negligible transportation costs and similar industries. Both have extensive farmland, and both have a history of growing grapes for wine, and goats for wool. Country C is a little further north than D, so it has more rocky grasses that are good for goats, while D has more fertile plains that are good for growing grapes.

Let's say that they have an equal workforce of 500,000 of people. I'm going to say that 10,000 people working full time for a year is 1 unit of labor. So, Country C and Country D have between the 100 units of labor, and 50 each.

The cost of 1 unit of wool = the cost of 1 unit of wine

Country C, having better land for goats, can produce 4 units of wool for every unit of labor, and 2 units of wine for every unit of labor.

Meanwhile, Country D, having better land for grapes, can produce 2 units of wool per unit of labor, and 4 units of wine per unit of labor.

If they each devote exactly half their workforce to each product, then:

Country C: 100 units of wool, 50 units of wine Country D: 50 units of wool, 100 units of wine

Totaling 150 units of each product.

However, if each devotes all of their workforce to the product they're better at...

Country C: 200 units of wool, no wine Country D: no wool, 200 units of wine

and when they trade with each other, they each end up with 100 units of each product, which is a doubling of what their less-efficient labor would have resulted in!

The real world is obviously much more complicated, but in this example, we can see the pros of outsourcing some of your production to another country to focus on your own specialties.

Extreme examples of this IRL are countries where most of the economy rests on one product, such as middle-eastern petro-states that are now struggling to diversify their economies in order to not get left behind in the transition to green energy, or Taiwan's role as the world's primary producer of semiconductors being its 'silicon shield' against China.

Comparative advantage can be used well, such as our Unnamed Countries (that are definitely not the classic example of England and Portugal, with goats instead of sheep) up in the example. With each economy focusing on its specialty, there is a greater yield of both products, meaning a greater bounty for both countries.

However, should something happen to Country C up there, like an earthquake that kills half the goats, they are suddenly left with barely enough wool to clothe themselves, and nothing for Country D, which now has a surplus of wine and no wool.

So you do have to keep some domestic industry, because Bad Things Can Happen. And if we want to avoid the steel example of a collapse in the given industry, tariffs might be needed.

Are export tariffs a thing?

Yes, but they are much rarer, and can largely be defined as "oh my god, everyone please stop getting rid of this really important resource by selling it to foreigners for a big buck, we are depleting this crucial resource."

So what's the big confusion right now?

Donald Trump has, on a number of occasions, talked about 'making China pay' tariffs on the goods they import into the US. This has led to a belief that is not entirely unreasonable, that China would be the side paying the tariffs.

The view this statement engenders is that a tariff is a bit like paying a rental fee for a seller's table at an event: the producer or merchant pays the host (or landlord or what have you) a fee to sell their product on the premises. This could be a farmer's market, a renaissance faire, a comic book convention, whatever. If you want to sell at the event, you have to pay a fee to get a space to set up your table.

In the eyes of the people who listened to Trump, the tariff is that fee. China is paying the United States for access to the market.

And, technically, that's not entirely wrong. China is thus paying to enter the US market. It's just the money to pay that fee needs to come from somewhere, and like most taxes on goods, that fee comes from the consumer.

So... what now?

Well, a lot of smaller US companies that rely on cheap goods made in China are buying up non-perishables while they can, before the tariffs hit. Long-term, manufacturers in the US that rely on parts and tools manufactured in China are going to feel the squeeze once that frontloaded stock is depleted.

Some companies are large enough to take the hit on their own end, still selling at cheap rates to the consumer, because they can offset those costs with other parts of their empire... at least until smaller competitors are driven out of business, at which point they can start jacking up their prices since there are no options left. You may look at that and think, "huh, isn't that the modus operandi for Walmart and Amazon already?" and yes. It is. We are very much anticipating a 'rich get richer, poor go out of business' situation with these tariffs.

The tariffs will also impact larger companies, including non-US ones like Zara (Spanish) and H&M (Swedish), if they have a huge reliance on Chinese production to supply their huge market in the United States.

If you're interested in the repercussions that people expect from these proposed tariffs on Chinese goods, I'd suggest listening to or watching the November 8th, 2024 episode of Morning Brew Daily (I linked to YouTube, but it's also available on Spotify, Nebula, the Morning Brew website, and other podcast platforms).

#id in alt text#id in alt#economics#tariffs#import tax#customs#customs duties#ko fi prompts#capitalism#phoenix talks#ko fi#taxes#taxation

2K notes

·

View notes

Text

It's been a year since I started HRT and I've got a D-cup holy crap. Maybe I should have started wearing bras earlier... lol. At least now I can work on getting a collection going.

0 notes

Photo

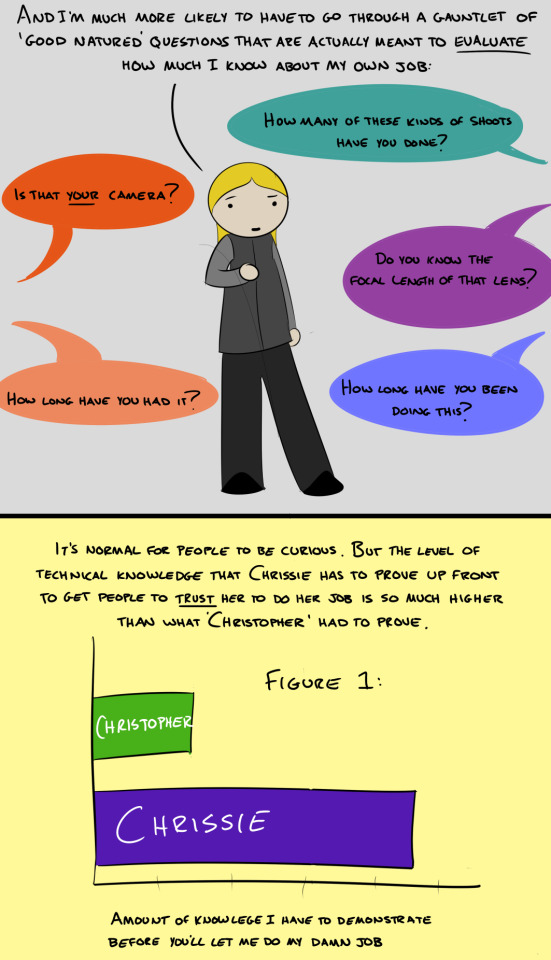

I work public service with a team of about 12, with 5-6 of us open to work with at any given time. I once witnessed a customer ask 3 of us the exact same question all in a row: Amy (a WOC), me (a white woman), and then Cal (a while man). We all gave him the exact same answer, and you'll never guess who's answer he eventually took.

We're a team of mostly Asian women, I'm in the minority with only 2 white women and 1 white man. I have seen clients absolutely B line to Cal-the aforementioned white man- and flat out refuse to work with the rest of us, even if he's the only worker who isn't available. There's also been times when unruly clients won't listen to anyone but him, even if we get managers involved. Why don't they listen to our managers, you ask? Because they're all WOC

It's absolutely a gender thing, and it's also definitely a race thing

New comic! (link)

This week I am very happy to present a collaboration comic with my friend Chrissie, who has been generous in sharing with me her experiences of gender dynamics in a technical field, and then helping me craft them into a comic narrative.

Whenever I see Chrissie’s work I’m always impressed at the cool, creative things she does. When we were discussing this comic, she told me: “I find men persistently try to direct me lots now too, which is probably the biggest problem I consistently run into”, and my feelings around that fact are a terrible and familiar blend of frustration, sadness, and lack of surprise.

When we talk about the differences in how men and women are treated professionally, especially in technical fields, we are often dismissed with ‘everyone has to deal with that’, or ‘women need to demonstrate more confidence with their skills’, or ‘they’re just trying to be helpful’, or ‘it’s all in your head’.

It’s frustrating when we know something like this is happening, but we spend so much of our time actually trying to get people to believe that it’s a real phenomenon. I find narratives like Chrissie’s validating in that she has a comparative set of experiences and is like ‘oh yeah, people totally think I’m less competent at my job now. it’s totally a thing’. So, can guys just believe us already and get on helping it not happen?

#not to derail the original message but this is something I've noticed a lot lately#so i wanted to add my own observations#fi talks

73K notes

·

View notes