#federal auction service

Explore tagged Tumblr posts

Text

Amazon Prime Day occasion begins, gross sales up 12% in first 7 hours: Report | Firm Information

Prime Day can function a bellwether for the vacation procuring season. 3 min learn Final Up to date : Jul 17 2024 | 12:10 AM IST Amazon.com Inc.’s Prime Day gross sales rose virtually 12 per cent within the first seven hours of the occasion in contrast with the identical interval final 12 months, based on Momentum Commerce, which manages 50 manufacturers in a wide range of product…

#amazon#Amazon Prime#artificial intelligence#bank account#Check Point Software Technologies#counterfeit products#director of worldwide buyer risk prevention#E-commerce & Auction Services#e-commerce shoppers#eBay#Federal Trade Commission#Food Retail & Distribution (NEC)#HTTP#Internet & Mail Order Department Stores#Josh Planos#online hoaxes#online retailer#online shopping giant#Online shopping scams#phony products#public relations#retail calendar#Scott Knapp#Security Software#social media ads#vice president of communications and public relations#Walmart

0 notes

Text

2025 Supported org: In Our Own Voice - National Black Women’s Reproductive Justice Agenda

In June of 2022, the US Supreme Court overturned the federally-protected right to an abortion. This decision was followed by a wave of “trigger laws” at the state level, rendering abortion illegal in certain states as soon as that federal protection disappeared. Abortion is currently illegal in 12 US states, and significantly restricted in 7 others. Now more than ever, many US residents face near-insurmountable obstacles to making this fundamental choice about their own bodies and futures.

In Our Own Voice fights to secure reproductive justice for all Black women, girls, and gender-expansive people. In coordination with state partners, IOOV works with key decision makers to shape public policy to address the many interconnected issues and the unique reproductive health concerns of Black women. Those include the right to health care, dignified birth, and access to abortion care; equity in housing and education; fair employment and clean water; and the full range of social, economic, political, and cultural supports needed for Black women and families to thrive. They strive to assure civil and human rights are accessible to everyone.

In Our Own Voice: National Black Women’s Reproductive Justice Agenda believes that abortion services are part of a continuum of reproductive health care that all women should have access to as basic health care. In their poll, 76 percent of respondents agreed with the statement “health insurance should cover abortion to ensure that when a woman needs to end her pregnancy she will be able to seek a licensed, quality health care provider.”

They work to restore public insurance coverage so that every woman – regardless of income – can access affordable and safe abortion care when she needs it.

You can support In Our Own Voice as a creator in the 2025 FTH auction (or as a bidder, when the time comes to donate for the auctions you’ve won.)

40 notes

·

View notes

Text

The United States Federal Trade Commission is taking action against two American data brokers accused of unlawfully trafficking in people’s sensitive location data. The data was used, the agency says, to track Americans in and around churches, military bases, and doctors’ offices, among other protected sites. It was sold not only for advertising purposes but also for political campaigns and government uses, including immigration enforcement.

Mobilewalla, a Georgia-based data broker that’s said to have digitally tracked the residents of domestic abuse shelters, is accused by the agency of purposefully tracking protesters in the wake of George Floyd’s murder in 2020. In a court filing, the FTC says Mobilewalla attempted to unmask the protesters’ racial identities by tracking their mobile devices to, for example, Hindu temples and Black churches.

The FTC also accused Gravy Analytics and its subsidiary Venntel of harvesting and exploiting consumers’ location data without consent, alleging that the company used that data to unfairly infer health decisions and religious beliefs.

According to the FTC, Gravy Analytics collected over 17 billion location signals from approximately a billion mobile devices daily. It has reportedly sold access to that data to federal law enforcement agencies such as the Department of Homeland Security, the Drug Enforcement Agency, and the Federal Bureau of Investigation.

Gravy Analytics could not be immediately reached for comment.

A spokesperson for Mobilewalla says the company's privacy policies are constantly evolving, adding: “While we disagree with many of the FTC’s allegations and implications that Mobilewalla tracks and targets individuals based on sensitive categories, we are satisfied that the resolution will allow us to continue providing valuable insights to businesses in a manner that respects and protects consumer privacy.”

“This data can be used to identify and target consumers based on their religion,” the FTC says. The location data collected by the two companies makes it possible, the agency says, to “identify where individual consumers lived, worked, and worshipped, thus suggesting the mobile device user’s religion and routine and identifying the user’s friends and families.”

According to the two settlements, which must be finalized in court before they would go into effect, Gravy Analytics and Mobilewalla are barred from collecting sensitive location data from consumers and must delete the historical data they gathered on millions of Americans. Mobilewalla would be banned from acquiring location data and other sensitive information from online auctions known as real-time bidding exchanges, marketplaces where advertisers compete to instantaneously deliver ads to targeted consumers. This case marks the first time the FTC has moved to police the collection of data directly from an ad exchange.

In another first, the proposed Gravy Analytics settlement would introduce military installations to the list of “sensitive locations” where the FTC bans location tracking. Under the terms, the company would be prohibited from selling, disclosing, or using data drawn from these locations, which include mental health clinics, substance abuse centers, and child care service providers.

In November, a collaborative investigation by WIRED, Bayerischer Rundfunk, and Netzpolitik.org revealed that over 3 billion phone location data points, collected by a US-based data broker, exposed the movements of US military and intelligence personnel in Germany. These movements included visits to nuclear vaults and brothels. In that story, WIRED first reported on FTC chair Lina Khan’s efforts to shield US military and intelligence personnel from data brokers.

US senator Ron Wyden of Oregon, who first urged the FTC to take action against Mobilewalla in 2020, praised the announcements, calling the companies’ actions “outrageous violations of Americans’ privacy.”

“These companies enabled US government agencies to surveil Americans without a warrant and enabled foreign countries to spy on service members with just a credit card,” says Wyden, who also previously investigated Venntel with other members of Congress.

While the FTC’s orders don’t directly tackle the issue of government agencies purchasing Americans’ location data—information for which a warrant is normally required—Wyden says the cases nevertheless undermine the government’s case for allowing the purchases. The orders make clear, he says, that federal agencies are hiding behind a “flimsy claim that Americans consented to the sale of their data.”

In a statement, FTC commissioner Alvaro Bedoya notes that while surveillance conducted by private companies won't raise the same constitutional issues as surveillance by government, the difference between the two is “porous if not irrelevant” to the people being watched. "Governments have long relied on private citizens for work that would be impractical or illegal for law enforcement," he says.

Whether the orders against Gravy Analytics and Mobilewalla will be enforced remains to be seen. Major changes are coming to the agency under the future Trump administration—most expected to undermine years of work by Khan and her staff. Many of Donald Trump's allies have been vocally critical of Khan's aggressive pro-consumer approach, including Republican megadonor Elon Musk, who has taken command of an ad hoc office that will purportedly advise the White House on improving “government efficiency.”

FTC commissioner Andrew Ferguson, whose name was floated last month as a potential Khan replacement, partially concurred with the agency’s decision to bring cases against the two data brokers on Tuesday. He agreed the companies had taken insufficient steps to ensure consumer data was properly anonymized, adding that they’d failed to obtain the “meaningfully informed consent” of the consumers they targeted.

Unlike Khan, however, Ferguson argues that the companies did not run afoul of the law by “categorizing consumers based on sensitive characteristics,” such as whether they attend church or political meetings. “These are all public acts that people carry out in the sight of their fellow citizens every day,” he says.

Ferguson likewise chastised the agency for attempting to restrict the power of data brokers to target protesters specifically. “Treating attendance at a political protest as uniquely private and sensitive is an oxymoron,” he says.

In a separate action Tuesday morning, the Consumer Financial Protection Bureau announced it was taking steps to crack down on predatory data brokers that traffic in people’s financial information, calling the practice a gateway for “scamming, stalking, and spying.”

Musk, who donated more than $100 million toward Trump’s reelection, called publicly last week for the bureau to be “deleted.”

13 notes

·

View notes

Text

Nation #2 : International Federation of Aerhys

Area Name: Alkaris

Ruling Party: -

Religion: -

Population: 32.7 Million

Currency: International Federation Token [IFT]

Most spoken language: -

Different Spoken Languages:

-Natalye

-Laanaria

-Phythian

The area of Alkaris is ruled by sectors, not a fixed or united governing party. These sectors are controlled by different guilds, and they all have their internal hierarchy. Its capital of Port Aerhys is the biggest trading area in the known world. It has multiple levels, completely unrestrained and mildly chaotic. The lowest level is a floating platform, completely on water, the highest-levitating in the skies. Alkaris is not a fixed nation, and due to its undocked nature, is terribly difficult to locate. Despite being the main trading hub, the International Federation Token remains the weakest currency out of the four biggest nations. This could be attributed to the fact that there is no strict governing body, only the council of Heralds, or the council of guild leaders.

Notable Levels of Aerhys

IX

The lowest level is numbered 09, or IX in ancient tongue. There is no fixed department on 09, the only notable distinction being that newer merchants, sellers and traders tend to set up shop on this level. It is relatively safe to visit. They use the IFT as a currency.

HATASA

Somewhere in the middle of Aerhys is level 0.6, or locally dubbed as Hatasa, the department of the desperate. It houses more hostile services, mercenaries, bounty hunters, interrogation units, butchers, fortune tellers, and other darker professions. Intelligence or information is a currency in Hatasa, and trading vital pieces of information will get you around.

XX

Level XX is the top level of Aerhys, it is by default the brightest level, being fully exposed to the sky. This is a restricted level, where it is heavily guarded by military forces from the guilds.

Notable Guilds of Aerhys

Guild Atelier, or the maker guild. Entry to Atelier is based on your handiness with modern technology as well as ancient ones. They are the go-to company for most weapon collectors in the region due to unique, effective and flawless craftsmanship. Its leader is known as The Knox, as a title and an Alias. Not much is known about Knox, besides the fact that his crafts are severely sought after in legal and illicit auctions and trades. They share level 4 with Guild Nio

Guild Dameiwi, or the blood stricken guild. Entry to Dameiwi is based on your competence with more…illicit skills. They have a line up of the best mercenaries, bounty hunters and everything to do with that sort of nature. It’s leader is known as Saarina. Nothing is known about their age, gender, face or identity. They are in charge of about 90% of level 0.6, Hatasa.

Guild Nio, or The Court of Wit, is a group of intellectual minds from all over the continent. They are experts in several fields, not limited to technology, but also the classical arts, history, dance and others. Entry to Nio is based on your knowledge of a certain topic, you’ll have to form a folder of your skills, and submit it to the guild. The leader is named Upplysta or The Enlightened, they are revered throughout Aerhys. They share level 4 with Guild Atelier.

The Knox

Brief Description:

The Knox is the leader of Guild Atelier, he is the master craftsman in office as of now, and his achievements include, but are not limited to:

-Advancing the structure of Aerhys itself, with better protection devices, structural integrity and stability to the overall system.

Personality:

He is known to be an eclectic man, seemingly always innovating, or tinkering with something. He is possesses sort of a benevolent disposition, often donating large quantities of money to various shelters, and centres.

Appearance:

Not much is known about Knox's outer appearance, thus all things written here should be considered hearsay. He has light hair, and startlingly blueish eyes. He is about 1.79m in height, and has a slim body shape. His face is fox-like, with a sharp chin and large eyes. His exact age is a mystery, however from his voice and general behaviour, he is suspected to be in the age group 19-22 years old.

Background:

Knox was raised in an isolated island near the original port of Aerhys, it was a small village, where he was raised by some scientists who were stationed there for botanical studies. He had access to raw materials from a young age, which nurtured his creative and technical skills and ability. Knox’s education consisted of being remotely educated till age seven. He was accepted into the University of Alkaris by age twelve, and graduated 2 years later with honours for his contributions in crafting, technology and engineering. After travelling for 3 years, he settled in Aerhys and slowly gained control of the technology market due to his advancements in the Guild Atelier

Relationships:

Upplysta

Knox and Upplysta are confirmed friends, research partners and have a history of collaboration. Their most notable work has been the advancement and development of Port Aerhys.

- incomplete

8 notes

·

View notes

Text

INVESTMENT

"THE Wise HAVE WEALTH AND LUXURY,

but fools spend whatever they get."

Proverbs 21:20 (NLT)

"THUS SAYS THE LORD, your Redeemer, The Holy One of Israel: “I AM THE LORD YOUR GOD, WHO TEACHES YOU TO PROFIT, WHO LEADS YOU BY THE WAY YOU SHOULD GO."

Isaiah 48:17 (NKJV)

• An investment could be something you bought having the hope that the price of it will go up, with every intention of selling it at a higher price.

- For something to be considered an investment, there must be a commitment to eventually sell it for a profit.

- There are many investments such as real estates, stocks, commodities, gold, silver, treasury bills, and the fixed deposits.

• Investing in properties

I. Personal house

- Having your own house with the intentions of living in it, is an asset. It is not an investment!

- This has advantages:

(a) You have a base, your children and spouse would have a sense of security. (b) You would be free from landlord's harassments, embarrassments, and outrageous increase of renting.

(c) It adds beauty and colour to your life,

you have rest and peace.

II. Rental property

- This is considered an investment.

- When you buy or build a property, to use for rental purposes.

- Note:

a. If you are buying or building a property for rentals, consider the area or location which you want to buy it or build it.

b. Consider the inflation rates, how things are going up.

c. Is it a government approved area?

d. Think on how to manage it.

III. Landed properties

- If you are Investing in landed properties, you consider the following factors while doing that:

(a) The location: the city, a developing area, or a remote area.

(b) How authentic or genuine it is.

(c) Consider the people you are buying it from, Are they the rightful Owner?

(d) Engage the services of a good lawyer.

There are dubious people who sell a land for two or more people.

(e) Since the purpose of buying is for reselling, Sell it within minimum year term, except you have a way of preserving it. Or you are led by God to delay the selling of it.

(f) Do not abandon it without being there for inspection occasionally.

IV. Investing in distressed properties.

- You buy undervalued properties. This could be found with eager sellers.

- Buying properties at auctions, from Banks. One can get good bargains and make substantial profit in this area.

- Buy a property, renovate it, and dispose it—sell it off, or rent or lease it out. You can make a good profit through this as well.

- As a believer, you have to pray and know the direction God wanted you to go.

- Many have Invested in things that looks promising but run to debts at the end.

- If you build your communion or fellowship with God, and your sensitivity or discernment is sharpened, you will be able to know whatever He wants you to do per time.

• There are other things you can Invest in, apart from real estates as we mentioned at the beginning of this teaching.

- You can invest in stocks.

- Invest in commodities.

- Treasury bills

- Gold, silver.

- You can put your money into fix deposit.

- Federal governments Bonds.

• All these and more can be done to invest money, but they have to be according to God's leadings.

- A Believer cannot do things like the people of the world. The reason being that: "THERE IS A WAY THAT SEEMS RIGHT TO A MAN, BUT ITS END IS THE WAY OF DEATH" (Proverbs 14:12 (NKJV).

• Remember, you are a Steward of whatever you have, God is the Owner.

- God put the money in your hand for an intended purpose. The primary purpose of whatever God has blessed you with is, the expansion of His Kingdom on earth. Thus, Kingdom investment is number one!

- If you failed to invest in God's Kingdom, you lose all you invested in Businesses. He may deny you the wisdom needed to make profit in all your investment. For He teaches to profit: "THUS SAYS THE LORD, YOUR REDEEMER, THE HOLY ONE OF ISRAEL: “I AM THE LORD YOUR GOD, WHO TEACHES YOU TO PROFIT, WHO LEADS YOU BY THE WAY YOU SHOULD GO" (Isaiah 48:17 (NKJV).

- The Kingdom of God is number one. If you are not tithing, you will experience devourers in your Business investment.l. You cannot deceive God, nor play on His intelligent.

- Establish a covenant relationship with God by giving your money to the ministries that God has used to bless you, and those He would want you to support with the money He has put in your hands.

- God will use your money, the seed you have sown, to defend you; when the enemy, the devil, comes to attack your businesses.

- The Biblical laws of economic operated by covenant.

- The foundation to establish a covenant with God is Giving.

- God may ask you to give what you wanted to invest in your Business to His work or the life of His servant or someone in need.

- Your obedience to divine instructions

determines your height in the Business investment you are involved in.

- Human knowledge is bound to fail:

19 FOR IT IS WRITTEN: “I WILL DESTROY THE WISDOM OF THE WISE, AND BRING TO NOTHING THE UNDERSTANDING OF THE PRUDENT.” 20 WHERE IS THE WISE? Where is the scribe? Where is the disputer of this age? HAS NOT GOD MADE FOOLISH THE WISDOM OF THIS WORLD?" (1 Corinthians 1:19,20 (NKJV).

• Money has failed in Egypt Before:

"SO WHEN THE MONEY FAILED IN THE LAND OF EGYPT AND IN THE LAND OF CANAAN, all the Egyptians came to Joseph and said, “Give us bread, for why should we die in your presence? FOR THE MONEY HAS FAILED" (Genesis 47:15 NKJV).

- The God we serve is the God of all seasons, He can never fail!

• You will not fail in Jesus' name.

- Should there be any ailment in your body, receive your healing now in the mighty name of Jesus Christ.

- The hold is completely broken and the Affliction will never rise again in Jesus' mighty name.

Peace!

STEPS TO SALVATION

• Take notice of this:

IF you are yet to take the step of salvation, that is, yet to be born-again, do it now, tomorrow might be too late (2 Corinthians 6:1,2; Hebrews 3:7,8,15).

a. Acknowledge that you are a sinner and confess your Sins (1 John 1:9); And ask Jesus Christ to come into your life (Revelation 3:20).

b. Confess that you believe in your heart that Jesus Christ is Lord, and that you confess it with your mouth, Thus, you accept Him As your Lord and Saviour (Romans 10:9,10).

c. As you took the steps A and B your name is written in the Book of Life (Philippians 4:3; Revelation 3:8).

- If you took the steps As highlighted above, congratulations, It means you are saved—born-again. Join a Word based church in your area and Town or city, and be part of whatever they are doing there. Peace!

#christianity#gospel#christian living#christian blog#jesus#the bible#devotion#faith#my writing#prayer

4 notes

·

View notes

Text

Excerpt from this story from Inside Climate News:

The United States District Court for the District of Maryland has tossed a flawed environmental assessment that grossly underestimated harms to endangered and threatened marine species from oil and gas drilling and exploration in the Gulf of Mexico.

The National Marine Fisheries Service (NMFS) prepared the assessment known as a biological opinion—BiOp for short— in 2020 under the Endangered Species Act (ESA). NMFS is a federal agency within the National Oceanic and Atmospheric Administration (NOAA).

The biological opinion is required to ensure that drilling and exploration for fossil fuels in the Gulf does not jeopardize endangered and threatened species, and is a prerequisite for oil and gas drilling permits auctioned by the U.S. Department of the Interior.

That same year, Earthjustice, a national nonprofit, filed a suit challenging the biological opinion on behalf of Sierra Club, the Center for Biological Diversity, Friends of the Earth and the Turtle Island Restoration Network. The American Petroleum Institute, Chevron and several other groups representing the oil and gas industry intervened as defendants in the case.

The environmental groups argued the biological opinion underestimated the potential for future oil spills in the Gulf of Mexico and did not require sufficient safeguards for imperiled whales, sea turtles and other endangered and threatened marine species from industrial offshore drilling operations.

The Gulf of Mexico is home to a range of threatened marine species protected under the ESA, including the endangered Rice’s whale, which exists nowhere else on the planet.

It also caters to much of the nation’s oil and gas extraction under federal waters known as the Outer Continental Shelf (OCS). This includes a region known as the Gulf OCS that experiences a high volume of ship traffic to production platforms, tens of thousands of active wells and thousands of miles of underwater pipelines.

In its Aug. 19 ruling, the district court agreed with the environmental groups that the biological opinion violated the law in multiple ways. Among other deficiencies, it found the opinion wrongly assumed that a catastrophic oil spill like the 2010 BP Deepwater Horizon will not occur despite NMFS’ own finding that such a spill can be expected.

The court declared the 2020 BiOp unlawful and ordered NFMS to produce a new biological opinion by December 2024.

“The new opinion should come along with more protections for the Gulf’s threatened and endangered species that are already struggling to survive in the face of an onslaught of threats, including existing oil and gas activity, climate change and others,” said Kristen Monsell, oceans program litigation director for the Center for Biological Diversity.

10 notes

·

View notes

Text

WASHINGTON (Reuters) -The U.S. House of Representatives is set to vote next week on an annual defense bill that includes just over $3 billion for U.S. telecom companies to remove equipment made by Chinese telecoms firms Huawei and ZTE from American wireless networks to address security risks.

The 1,800-page text was released late Saturday and includes other provisions aimed at China, including requiring a report on Chinese efforts to evade U.S. national security regulations and an intelligence assessment of the current status of China's biotechnology capabilities.

The Federal Communications Commission has said removing the insecure equipment is estimated to cost $4.98 billion but Congress previously only approved $1.9 billion for the "rip and replace" program.

Washington has aggressively urged U.S. allies to purge Huawei and other Chinese gear from their wireless networks.

FCC Chair Jessica Rosenworcel last week again called on the U.S. Congress to provide urgent additional funding, saying the program to replace equipment in the networks of 126 carriers faces a $3.08 billion shortfall "putting both our national security and the connectivity of rural consumers who depend on these networks at risk."

She has warned the lack of funding could result in some rural networks shutting down, which "could eliminate the only provider in some regions" and could threaten 911 service.

Competitive Carriers Association CEO Tim Donovan on Saturday praised the announcement, saying "funding is desperately needed to fulfill the mandate to remove and replace covered equipment and services while maintaining connectivity for tens of millions of Americans."

In 2019, Congress told the FCC to require U.S. telecoms carriers that receive federal subsidies to purge their networks of Chinese telecoms equipment. The White House in 2023 asked for $3.1 billion for the program.

Senate Commerce Committee chair Maria Cantwell said funding for the program and up to $500 million for regional tech hubs will be covered by funds generated from a one-time spectrum auction by the FCC for advanced wireless spectrum in the band known as AWS-3 to help meet rising spectrum demands of wireless consumers.

4 notes

·

View notes

Text

RECENT SEO & MARKETING NEWS FOR ECOMMERCE, AUGUST 2024

Hello, and welcome to my very last Marketing News update here on Tumblr.

After today, these reports will now be found at least twice a week on my Patreon, available to all paid members. See more about this change here on my website blog: https://www.cindylouwho2.com/blog/2024/8/12/a-new-way-to-get-ecommerce-news-and-help-welcome-to-my-patreon-page

Don't worry! I will still be posting some short pieces here on Tumblr (as well as some free pieces on my Patreon, plus longer posts on my website blog). However, the news updates and some other posts will be moving to Patreon permanently.

Please follow me there! https://www.patreon.com/CindyLouWho2

TOP NEWS & ARTICLES

A US court ruled that Google is a monopoly, and has broken antitrust laws. This decision will be appealed, but in the meantime, could affect similar cases against large tech giants.

Did you violate a Facebook policy? Meta is now offering a “training course” in lieu of having the page’s reach limited for Professional Mode users.

Google Ads shown in Canada will have a 2.5% surcharge applied as of October 1, due to new Canadian tax laws.

SEO: GOOGLE & OTHER SEARCH ENGINES

Search Engine Roundtable’s Google report for July is out; we’re still waiting for the next core update.

SOCIAL MEDIA - All Aspects, By Site

Facebook (includes relevant general news from Meta)

Meta’s latest legal development: a $1.4 billion settlement with Texas over facial recognition and privacy.

Instagram

Instagram is highlighting “Views” in its metrics in an attempt to get creators to focus on reach instead of follower numbers.

Pinterest

Pinterest is testing outside ads on the site. The ad auction system would include revenue sharing.

Reddit

Reddit confirmed that anyone who wants to use Reddit posts for AI training and other data collection will need to pay for them, just as Google and OpenAI did.

Second quarter 2024 was great for Reddit, with revenue growth of 54%. Like almost every other platform, they are planning on using AI in their search results, perhaps to summarize content.

Threads

Threads now claims over 200 million active users.

TikTok

TikTok is now adding group chats, which can include up to 32 people.

TikTok is being sued by the US Federal Trade Commission, for allowing children under 13 to sign up and have their data harvested.

Twitter

Twitter seems to be working on the payments option Musk promised last year. Tweets by users in the EU will at least temporarily be pulled from the AI-training for “Grok”, in line with EU law.

CONTENT MARKETING (includes blogging, emails, and strategies)

Email software Mad Mimi is shutting down as of August 30. Owner GoDaddy is hoping to move users to its GoDaddy Digital Marketing setup.

Content ideas for September include National Dog Week.

You can now post on Substack without having an actual newsletter, as the platform tries to become more like a social media site.

As of November, Patreon memberships started in the iOS app will be subject to a 30% surcharge from Apple. Patreon is giving creators the ability to add that charge to the member's bill, or pay it themselves.

ONLINE ADVERTISING (EXCEPT INDIVIDUAL SOCIAL MEDIA AND ECOMMERCE SITES)

Google worked with Meta to break the search engine’s rules on advertising to children through a loophole that showed ads for Instagram to YouTube viewers in the 13-17 year old demographic. Google says they have stopped the campaign, and that “We prohibit ads being personalized to people under-18, period”.

Google’s Performance Max ads now have new tools, including some with AI.

Microsoft’s search and news advertising revenue was up 19% in the second quarter, a very good result for them.

One of the interesting tidbits from the recent Google antitrust decision is that Amazon sells more advertising than either Google or Meta’s slice of retail ads.

BUSINESS & CONSUMER TRENDS, STATS & REPORTS; SOCIOLOGY & PSYCHOLOGY, CUSTOMER SERVICE

More than half of Gen Z claim to have bought items while spending time on social media in the past half year, higher than other generations.

Shopify’s president claimed that Christmas shopping started in July on their millions of sites, with holiday decor and ornament sales doubling, and advent calendar sales going up a whopping 4,463%.

9 notes

·

View notes

Text

How to Pay for Autism Treatment When Your Insurance Doesn’t Cover It?

How to Pay for Autism Treatment When Your Insurance Doesn’t Cover It

Paying for autism treatment can be overwhelming when your insurance doesn’t cover the costs. Thankfully, there are many ways to get the support your child needs without relying entirely on insurance. Here are some practical options to explore.

Understand Your Legal Rights and Explore Alternative Insurance Options

It’s important to understand whether your insurance really doesn’t cover autism treatments or if there are gaps you can address. Start by reviewing state laws that may require insurance companies to cover autism-related treatments such as ABA therapy, speech therapy, and occupational therapy. Some states have mandates for these services, so it’s worth checking if your employer-provided plan follows those rules.

If your current insurance doesn’t offer adequate coverage, you can look into Medicaid or the Children’s Health Insurance Program (CHIP). These programs often cover therapies that private insurance excludes. Another option is to consider adding a secondary insurance plan specifically for your child, which might provide better coverage for autism treatments.

Government Assistance Programs

Federal and state programs can help families cover the costs of autism treatment. These programs often have income eligibility requirements, but they can provide significant support. Supplemental Security Income (SSI) is available for children with autism who meet specific criteria. The monthly payments can help with therapy and other expenses.

Many states offer Medicaid waivers for children with disabilities. These waivers can provide funding for therapies, respite care, and other services, even for families that exceed typical income limits. If your child is under three years old, early intervention programs funded by the federal government can provide free or low-cost evaluations and therapy services.

Nonprofit Grants and Scholarships

Nonprofit organizations often provide grants and scholarships to help families pay for autism treatments. These funds can be used for therapy, specialized equipment, or even travel costs to access care. Autism Speaks offers family grants for therapy and other expenses. ACT Today is another nonprofit that provides grants for ABA therapy, assistive technologies, and other needs.

In addition to national organizations, local nonprofits can be a valuable resource. Many smaller organizations provide support to families in their communities. Researching these options can uncover opportunities that aren’t widely advertised.

Crowdfunding and Community Support

Crowdfunding has become a popular way to raise money for medical and therapeutic expenses. Platforms like GoFundMe and Givebutter allow families to share their stories and gather financial support from friends, family, and even strangers. When creating a crowdfunding campaign, sharing your child’s journey can make a big difference. Use photos and videos to help people connect with your story.

In addition to online efforts, consider hosting local events like bake sales, community auctions, or fun runs. These events can bring people together and raise funds for autism treatment.

School-Based Services

Public schools are legally required to provide services to children with disabilities. If your insurance doesn’t cover certain therapies, your child’s school may be able to help. An Individualized Education Program (IEP) outlines the services your child is entitled to receive, such as speech therapy, occupational therapy, or behavioral interventions, at no cost to you.

If your child’s school isn’t providing adequate support, consider hiring an advocate or seeking legal assistance to ensure your child’s rights are upheld. Schools have a responsibility to meet the needs of children with disabilities, and it’s important to hold them accountable.

Tax Strategies

Tax credits and deductions can help families manage the cost of autism treatment. Keeping detailed records of medical and therapy expenses is essential. If these costs exceed a certain percentage of your income, you may be able to deduct them on your taxes.

Using Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs) can also save money. These accounts allow you to pay for eligible medical expenses with pre-tax dollars. Additionally, some states offer tax credits or deductions specifically for families with disabled children.

Research and Clinical Trials

Participating in clinical trials or research studies can provide free or reduced-cost autism treatments. Universities, hospitals, and nonprofit organizations often conduct studies on new therapies or interventions. To find these opportunities, check websites like ClinicalTrials.gov or connect with local research institutions. While clinical trials can offer cutting-edge treatments, make sure to evaluate the risks and benefits before enrolling.

Alternative Payment Plans and Loans

If external funding isn’t an option, talk to your child’s treatment providers about payment plans. Some providers offer sliding scale fees based on income. Others may allow you to spread the cost over time with a payment plan.

Medical loans, such as those offered by companies like CareCredit, are another option. While loans aren’t an ideal solution for long-term expenses, they can help in emergencies or when immediate funding is needed.

Community and Faith-Based Resources

Local community groups, churches, and faith-based organizations often provide support for families in need. These organizations may offer financial assistance, host fundraisers, or provide access to low-cost therapy programs. Community centers are another resource worth exploring. They may offer programs for children with autism or connect you with local support networks.

Faith-based charities, such as Catholic Charities or Jewish Family Services, often provide funding or affordable services for families. Reaching out to these organizations can open doors to additional resources.

Final Thoughts

Paying for autism treatment without insurance coverage is challenging, but there are many ways to find support. From government programs and nonprofit grants to crowdfunding and school-based services, families have a range of options to explore. By staying proactive and seeking out available resources, you can ensure your child gets the care they need without letting financial barriers stand in the way.

2 notes

·

View notes

Text

From October:

How will the arts be affected if Trump wins? Given the former television star’s wildly unpredictable nature, it is hard to know exactly what to expect. The Republican Party’s official platform has no mention of culture, nor does Project 2025, a Trump administration wishlist put together by the Heritage Foundation, a right-wing think tank. The Trump campaign’s press office did not respond to a request for comment.

However, a few lessons can be gleaned from the past. Alongside the travel ban (which he has promised to revive in a second term) and proposals to cut arts funding, Trump signed a 2020 resolution to make federal buildings beautiful (read: conservative) again, and he has a long history of being hostile to the arts. When he razed the luxury department store Bonwit Teller to erect Trump Tower in Manhattan, he needlessly trashed valuable sculptures.

Are the art world’s various powers players—museum directors, auction house executives, collectors, dealers, and artists—ready for a second Trump term? Can they take action now to mitigate its potentially serious consequences? Calling around, I found that many people were not eager to discuss the matter on the record, which is perhaps not surprising. But some people were willing to chat.

Museums: Emotional Tolls, Fiscal Crosshairs

The federal Institute of Museum and Library Services estimated in 2014 that there were upward of 35,000 museums nationwide. For many of their employees, a Trump win would be traumatizing.

“It is generally true that our staff will have very specific views about this election,” one museum director told me. “The employee side would be the thing most difficult to navigate.”

A former curator agreed. “The emotional impact on the workplace is real, and so much of the emotional caregiving in the field is being done by women,” this curator said. “I suspect a Trump administration would see more turnover among women in the field. We saw that in the Great Resignation. So many women working in corporate jobs were burnt out, partly from so much emotional caregiving in the workplace. It’s a lot.”

Other concerns include cuts to federal funding and censorship.

Many institutions draw support from IMLS as well as from the National Endowment of the Arts and the National Endowment for the Humanities, which could be on the chopping block once again.

Though Trump has not, so far, telegraphed a desire to defund those organizations, one state may prove to be, as the saying goes, a laboratory of democracy. In Florida, Governor Ron De Santis, a failed Trump rival, recently zeroed out $32 million in arts funding for next year.

Private sources of funding may not be able to cover a drop in government support. As it is, experts in philanthropy say that traditional museum funding models are breaking down. “What is going to spur next-gen donating?” asked Melissa Cowley Wolf, of MCW Projects, an advisory firm specializing in philanthropic strategy and organizational wellness. “The younger population is not seeing art’s value in society, particularly as a driver of social, racial, and climate justice.”

In 2018, Cowley Wolf co-founded a group called the Arts Funders Forum to address how the cultural sphere can ensure its future. “There’s a real impetus to develop new models, even more so now with the threat of the abolition of federal funding,” she said.

Even if federal funding isn’t eliminated, a conservative administration could direct support toward projects it deems patriotic or family-friendly.

“In the ‘90s, in the wake of the Robert Mapplethorpe controversy, we saw the introduction of a decency amendment,” said Maxwell Anderson, a former director of five North American museums, including the Whitney Museum of American Art and the Dallas Museum of Art. “A Trump administration would seem likely to introduce similar language affecting grant recipients.”Some museums spoke out in the wake of Trump’s election with symbolic gestures, such as when New York’s Museum of Modern Art placed on view works by artists hailing from the countries affected by the travel ban. Would they step up again, in an even more charged environment?

Experts say that there’s already self-censorship afoot.

“The sense I’m getting is that, especially among the more established organizations, there is an enormous amount of fear,” a former museum director told me. “The war in Gaza, and now Lebanon, and attendant protests, have resulted in an atmosphere of censorship and self-censorship. Unless a political statement comes from an artist’s project, I just don’t see many institutions having the appetite for it.”

Experts also said that they fear federal-level curbs on free speech.

“Project 2025 proposes censorship in the classroom and elsewhere of speech on subjects like race and systemic oppression,” Anderson said. “This would extend far beyond the classroom to federal institutions like the Smithsonian and grant-making entities that have fostered language on those subjects.”

Museums might fear more than censorship or funding cuts. Trump has taken TV shows like Saturday Night Live to task for one-sidedness, classing their gags as illegal campaign contributions and asking whether the Department of Justice should prosecute them. Could museums, artists, or writers who criticize him also be targeted by a Trump-controlled bureaucracy?

Andras Szanto, a museum consultant, predicted that, under a second Trump administration. “We would be in for an extraordinary period of political turmoil in the ranks of artists and the people who frequent museums,” he said. “I think the museum would be a site of expression of discontent and of political activism. The museum has already become a place of political protest, as one of the last remaining truly public venues.”

Museums could definitely come under fire for speaking out, Szanto said, but he wondered if they could proactively form a kind of mutual defense pact.

“Could there be a NATO attitude among museums, where an attack on one is an attack against all?” he asked. “Could museums be a bit more like PEN,” the association of writers, “where they have plans to make a united stand against attacks?”

But museums may feel pressure from both sides of the aisle.

“Museums are now facing challenges on two fronts,” Anderson said, referring to “progressives calling out ‘toxic’ philanthropy and, more recently, perceived insensitivity toward the plight of oppressed people, and donors who feel unfairly singled out for the origins of their wealth.”

For fear of drawing right-wing ire, museums might also go mum on a recent focus: making progress on diversity, equity and inclusion in their exhibitions and collection as well as their staffing and board makeup.

“From conversations with others in the field,” the former curator said, “I have the sense that they would not be able to talk openly anymore about their DEI efforts.”

Amid the gloom, one museum director who serves a politically diverse audience voiced a degree of optimism.

“Our audience is made up of one-third Republicans, one-third Democrats, and one-third Independents,” said Adam Levine, the director of the Toledo Museum of Art in Ohio. “We’ve found that the number one thing our visitors want, regardless of political persuasion, is to be challenged. Having worked other places, I do not believe Toledo is unique. Surveys consistently indicate that museums and libraries are the most trusted institutions in America.”

“We are not perfect and are doing our best to interrogate tough questions and bring people along,” Levine added, “but that is exactly what we think society needs right now: An earnest effort to bring us together.”

(Link goes on to cover art schools, independent artists, and the art market)

2 notes

·

View notes

Text

School auction in São Paulo draws interest from three bidders

The auctions for two Public-Private Partnerships (PPPs) for schools in São Paulo have attracted interest from at least three groups, according to Edgard Benozatti, president of the São Paulo Partnerships Company (CPP). Combined, the two contracts are expected to generate investments of R$2.1 billion to build 33 new schools and operate these facilities for 25 years.

The PPPs will be auctioned on different days but within the same week. The first batch, including 17 schools, will be contested on the 29th (Tuesday), and the second, with 16 schools, on November 1st (Friday). These auctions are part of a series of tenders planned for the last week of this month, involving projects from São Paulo, the state of Piauí, and the federal government.

Sources indicate that the interested parties are consortia composed of a financial partner and a service provider or construction company. Among the financial entities, BTG is mentioned as a potential bidder. On the strategic side, stakeholders from Inova BH, which manages a school PPP in Belo Horizonte, and Integra, which operates a PPP for Unified Educational Centers (CEUs) in São Paulo, have shown interest.

Continue reading.

2 notes

·

View notes

Text

2024 Supported org: In Our Own Voice - National Black Women's Reproductive Justice Agenda

In June of 2022, the US Supreme Court overturned the federally-protected right to an abortion. This decision was followed by a wave of “trigger laws” at the state level, rendering abortion illegal in certain states as soon as that federal protection disappeared. Abortion is currently illegal in 14 US states -- home to over 81 million people -- and significantly restricted in 11 others. Now more than ever, many US residents face near-insurmountable obstacles to making this fundamental choice about their own bodies and futures.

In Our Own Voice fights to secure Reproductive Justice for all Black women, girls, and gender-expansive people. In coordination with state partners, IOOV works with key decision makers to shape public policy to address the many interconnected issues and the unique reproductive health concerns of Black women. Those include the right to health care, dignified birth, and access to abortion care; equity in housing and education; fair employment and clean water; and the full range of social, economic, political, and cultural supports needed for Black women and families to thrive. They strive to assure civil and human rights are accessible to everyone.

In Our Own Voice: National Black Women’s Reproductive Justice Agenda believes that abortion services are part of a continuum of reproductive health care that all women should have access to as basic health care. In their poll, 76 percent of respondents agreed with the statement “health insurance should cover abortion to ensure that when a woman needs to end her pregnancy she will be able to seek a licensed, quality health care provider.”

They work to restore public insurance coverage so that every woman – regardless of income – can access affordable and safe abortion care when she needs it.

You can support In Our Own Voice as a creator in the 2024 FTH auction (or as a bidder, when the time comes to donate for the auctions you’ve won.)

#fth 2024#fanworks charity auction#supported org#in our own voice: black women's reproductive justice agenda#reproductive justice#abortion rights

15 notes

·

View notes

Text

A new Bureau of Land Management plan to open 40,000 acres of the Wayne National Forest to fracking for oil and gas looks almost identical to one a federal judge rejected in 2020. The public can comment on the plan in writing or during online meetings Monday and Tuesday.

Fossil fuel companies have targeted Ohio’s only national forest for years and in 2016 the BLM first attempted to auction off oil and gas leases in the Wayne. The new proposal, released in late March, is nearly identical to the fracking plan blocked in 2020 after conservation groups challenged it in federal court.

“It’s hugely disappointing that federal officials are sticking with this climate-destroying plan to sell off Ohio’s precious public lands to the oil and gas industry, even as flooding, wildfires and heat waves intensify with climate change,” said Wendy Park, a senior attorney at the Center for Biological Diversity. “Our government needs to prioritize people, wildlife and our climate over corporate profits and block fracking in the Wayne once and for all. Ohio residents have the chance to speak out over the next few weeks, and I hope land managers get an earful about this reckless fracking proposal.”

Fracking threatens the Wayne’s rivers, forests and endangered plants and animals ― the same things Congress intended to protect when it created the national forest in the 1930s.

“Fracking the Wayne National Forest would seriously jeopardize Ohio’s ability to fight climate change. This single oil and gas project threatens to generate enough greenhouse gas pollution to cancel out all of the Wayne’s carbon storage services for the next 30 years,” said Nathan Johnson, senior attorney with the Ohio Environmental Council. “Leasing the Wayne to the fossil fuel industry will scar this public forest and pollute our air with toxic chemicals. We should be doing everything we can to protect the public’s access to safe and beautiful public lands — especially in Ohio, where public land is in relatively short supply compared to so many other states.”

#us politics#enviromentalism#ecology#biden administration#fracking#bureau of land management#wayne national forest#ohio#oil industry#gas industry

4 notes

·

View notes

Text

America’s first large-scale offshore wind farms began sending power to the Northeast in early 2024, but a wave of wind farm project cancellations and rising costs have left many people with doubts about the industry’s future in the US.

Several big hitters, including Ørsted, Equinor, BP, and Avangrid, have canceled contracts or sought to renegotiate them in recent months. Pulling out meant the companies faced cancellation penalties ranging from $16 million to several hundred million dollars per project. It also resulted in Siemens Energy, the world’s largest maker of offshore wind turbines, anticipating financial losses in 2024 of around $2.2 billion.

Altogether, projects that had been canceled by the end of 2023 were expected to total more than 12 gigawatts of power, representing more than half of the capacity in the project pipeline.

So, what happened, and can the US offshore wind industry recover?

I lead the University of Massachusetts Lowell’s Center for Wind-Energy Science, Technology, and Research (WindSTAR) and Center for Energy Innovation, and follow the industry closely. The offshore wind industry’s troubles are complicated, but it’s far from dead in the US, and some policy changes may help it find firmer footing.

A Cascade of Approval Challenges

Getting offshore wind projects permitted and approved in the US takes years and is fraught with uncertainty for developers, more so than in Europe or Asia.

Before a company bids on a US project, the developer must plan the procurement of the entire wind farm, including making reservations to purchase components such as turbines and cables, construction equipment, and ships. The bid must also be cost-competitive, so companies have a tendency to bid low and not anticipate unexpected costs, which adds to financial uncertainty and risk.

The winning US bidder then purchases an expensive ocean lease, costing in the hundreds of millions of dollars. But it has no right to build a wind project yet.

Before starting to build, the developer must conduct site assessments to determine what kind of foundations are possible and identify the scale of the project. The developer must consummate an agreement to sell the power it produces, identify a point of interconnection to the power grid, and then prepare a construction and operation plan, which is subject to further environmental review. All of that takes about five years, and it’s only the beginning.

For a project to move forward, developers may need to secure dozens of permits from local, tribal, state, regional, and federal agencies. The federal Bureau of Ocean Energy Management, which has jurisdiction over leasing and management of the seabed, must consult with agencies that have regulatory responsibilities over different aspects in the ocean, such as the armed forces, Environmental Protection Agency, and National Marine Fisheries Service, as well as groups including commercial and recreational fishing, Indigenous groups, shipping, harbor managers, and property owners.

In December 2023, the majority of offshore wind power capacity was in China and Europe. The United States had just 42 megawatts, but it was about to launch two new wind farms. (Data source: WFO Global Wind Offshore Wind Report 2023.)

For Vineyard Wind I—which began sending power from five of its 62 planned wind turbines off Martha’s Vineyard in early 2024—the time from BOEM’s lease auction to getting its first electricity to the grid was about nine years.

Costs Balloon During Regulatory Delays

Until recently, these contracts didn’t include any mechanisms to adjust for rising supply costs during the long approval time, adding to the risk for developers.

From the time today’s projects were bid to the time they were approved for construction, the world dealt with the Covid-19 pandemic, inflation, global supply chain problems, increased financing costs, and the war in Ukraine. Steep increases in commodity prices, including for steel and copper as well as in construction and operating costs, made many contracts signed years earlier no longer financially viable.

Led by China and the UK, the world had 67,412 megawatts of offshore wind power capacity in operation by the end of 2023. (Source: WTO Global Offshore Wind Report.)

New and rebid contracts are now allowing for price adjustments after the environmental approvals have been given, which is making projects more attractive to developers in the US. Many of the companies that canceled projects are now rebidding.

The regulatory process is becoming more streamlined, but it still takes about six years, while other countries are building projects at a faster pace and larger scale.

Shipping Rules, Power Connections

Another significant hurdle for offshore wind development in the US involves a century-old law known as the Jones Act.

The Jones Act requires vessels carrying cargo between US points to be US-built, US-operated, and US-owned. It was written to boost the shipping industry after World War I. However, there are only three offshore wind turbine installation vessels in the world that are large enough for the turbines proposed for US projects, and none are compliant with the Jones Act.

That means wind turbine components must be transported by smaller barges from US ports and then installed by a foreign installation vessel waiting offshore, which raises the cost and likelihood of delays.

Dominion Energy is building a new ship, the Charybdis, that will comply with the Jones Act. But a typical offshore wind farm needs more than 25 different types of vessels—for crew transfers, surveying, environmental monitoring, cable-laying, heavy lifting, and many other roles.

The nation also lacks a well-trained workforce for manufacturing, construction, and operation of offshore wind farms.

For power to flow from offshore wind farms, the electricity grid also requires significant upgrades. The Department of Energy is working on regional transmission plans, but permitting will undoubtedly be slow.

Lawsuits and Disinfo

Numerous lawsuits from advocacy groups that oppose offshore wind projects have further slowed development.

Wealthy homeowners have tried to stop wind farms that might appear in their ocean view. Astroturfing groups that claim to be advocates of the environment, but are actually supported by fossil fuel industry interests, have launched disinformation campaigns.

In 2023, many Republican politicians and conservative groups immediately cast blame for whale deaths off the coast of New York and New Jersey on the offshore wind developers, but the evidence points instead to increased ship traffic collisions and entanglements with fishing gear.

Such disinformation can reduce public support and slow projects’ progress.

Just Keep Spinnin’

The Biden administration set a goal to install 30 gigawatts of offshore wind capacity by 2030, but recent estimates indicate that the actual number will be closer to half that.

Despite the challenges, developers have reason to move ahead.

The Inflation Reduction Act provides incentives, including federal tax credits for the development of clean energy projects and for developers that build port facilities in locations that previously relied on fossil fuel industries. Most coastal state governments are also facilitating projects by allowing for a price readjustment after environmental approvals have been given. They view offshore wind as an opportunity for economic growth.

These financial benefits can make building an offshore wind industry more attractive to companies that need market stability and a pipeline of projects to help lower costs—projects that can create jobs and boost economic growth and a cleaner environment.

8 notes

·

View notes

Text

In the early 19th century, sailors making their way to Providence, Rhode Island, depended on the signal of the Warwick Neck Light to safely find their way. While it no longer carries the navigational significance it once did, the 51-foot tower continues to preside over Narragansett Bay from its clifftop perch.

Now, this historical property’s dramatic views could be yours.

This year, the General Services Administration (GSA) will give away six of the historic beacons, including the Warwick Neck Light, at no cost. An additional four will be sold via public auction. The goal of the transfers is to preserve the historic buildings, even as technology renders them obsolete.

For hundreds of years, lighthouses have welcomed travelers to the shores of the United States. However, the advent of navigation technologies like GPS has left many of the shore’s sentinels without a practical purpose. Since the passage of the National Historic Lighthouse Preservation Act in 2000, the GSA has been transferring ownership of lighthouses “no longer critical to the U.S. Coast Guard’s mission needs” to groups willing to preserve them, according to a statement from the agency.

“People really appreciate the heroic role of the solitary lighthouse keeper,” says John Kelly of the GSA’s office of real property disposition to Mark Pratt of the Associated Press (AP). “They were really the instruments to provide safe passage into some of these perilous harbors which afforded communities great opportunities for commerce, and they’re often located in prominent locations that offer breathtaking views.”

At many lighthouses, upkeep is challenging: Two of the structures up for auction, the Penfield Reef Lighthouse in Fairfield, Connecticut, and the Stratford Shoal Light in the middle of the Long Island Sound, are accessible only by boat.

“They’re such unusual reflections of our history that it takes a certain kind of person who wants to be a part of that,” Robin Carnahan, administrator of the GSA, tells the New York Times’ Michael Levenson.

For now, the lighthouses won’t be available to just anyone. The GSA is first offering them at no cost to federal agencies, state and local governments, nonprofits, educational agencies and community development organizations. To be eligible, interested buyers must be able to maintain the historic property and allow the public to access it. More than 80 lighthouses have found a new owner—and stable future—through this process so far, according to the GSA.

Several of the lighthouses up for grabs this year are already under the care of nonprofits, which can apply to continue their work, Kelly tells the AP. For example, the Nobska Lighthouse in Falmouth, Massachusetts is maintained by the Friends of Nobska Light, which has applied for the transfer of ownership, according to the Cape Cod Times’ Zane Razzaq.

If no owner is found, the lighthouses will be offered for sale to the public via auction. The GSA has auctioned 70 lighthouses to date, in sales ranging from $10,000 to over $900,000, reports NPR’s Emma Bowman.

Other lighthouses going to auction this year include the Cleveland Harbor West Pierhead Light in Cleveland, Ohio, and the Keweenaw Waterway Lower Entrance Light in Chassell, Michigan. The list of transfer-eligible lighthouses includes Lynde Point Lighthouse in Old Saybrook, Connecticut; Plymouth/Gurnet Lighthouse in Plymouth, Massachusetts; Little Mark Island and Monument in Harpswell, Maine; and Erie Harbor North Pier Lighthouse in Erie, Pennsylvania.

12 notes

·

View notes

Text

Back In The Day, You Might Have Thought Everyone In Cincinnati Loved Fred Trump

People in Cincinnati were raving about Fred C. Trump a full decade before he ever dipped a toe into Cincinnati’s real estate market. Mildred Miller, in her Cincinnati Enquirer “Talk About Women” column [2 March 1954], begged the New York developer to buy some Queen City rental property:

“Sa-ay, why can’t it happen here? We sure could use a few ace-high landlords like Fred Trump of New York! He not only rents to families with children but also provides many extras to make them happy! . . . Such as playgrounds, indoor recreation centers, summer camps and baby sitters!”

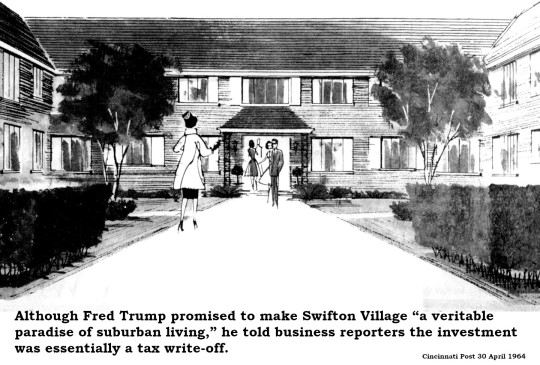

Ten years later, Mildred Miller got her wish when Fred Trump purchased the moribund Swifton Village apartments in Bond Hill. Originally constructed with Federal Housing Administration financing at a cost of $10 million in 1954, the complex was half empty in 1964. The FHA foreclosed on the property and put it up for auction when the original developer defaulted. Fred Trump was the only bidder, snatching the complex for $5.7 million. The Cincinnati Enquirer [6 January 1965] was delighted:

“Before ink was dry on the Swifton deed, Mr. Trump said he sent his maintenance crews into the village on a $500,000 reconditioning and redecorating program. A new community center was built; streets and sidewalks were repaved; paint was dabbed here and there; new refrigerators and new laundry machines were installed; window shutters were ordered. New tenants started coming in.”

Although several sections of the complex were reserved for adult tenants, Fred Trump did build playgrounds in the portions of Swifton Village in which children were allowed. He also maintained a private swim club and sun deck for the exclusive use of tenants.

Fred Trump apparently worked overtime to satisfy the folks who lived at Swifton Village. One employee recalled when the owner visited Cincinnati around Mother’s Day and bought 1,000 orchids to distribute to the resident mothers. Trump passed out thousands of pre-stamped, pre-addressed post cards to all his tenants encouraging them to send complaints and suggestions directly to him. Enquirer business editor Ralph Weiskittel enthused [2 October 1966] about the benefit:

“This is the ‘service’ aspect of our plan, Mr. Trump said. When a tenant calls for a service he wants it ‘then’ – not an excuse that workmen are busy and will get to it the first thing tomorrow morning.”

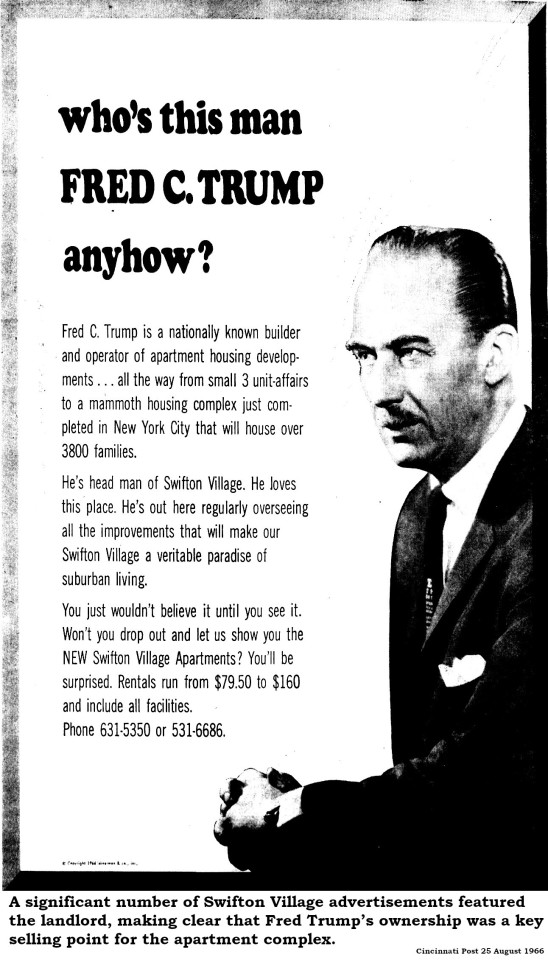

Of course, the New York developer spent a lot of money burnishing his own image. The entire time he owned Swifton Village, every newspaper advertisement specified that the official name of the complex was “Fred C. Trump’s New Swifton Village.” Trump ran advertisements touting his concern for the tenants’ welfare. One advertisement in the Cincinnati Post [25 August 1966] promised a lofty goal:

“Who’s this man Fred C. Trump anyhow? He’s head man of Swifton Village. He loves this place. He’s out here regularly overseeing all the improvements that will make our Swifton Village a veritable paradise of suburban living.”

Another advertisement in the Enquirer [27 August 1966] emphasized his personal touch:

“This man worries a lot. If you lived here, you might be getting a phone call from Mr. Trump. Sound strange? Well, that’s the way Mr. Trump works. Several times a week (in addition to his regular visits) he picks up the phone and makes a long distance call to a tenant in his Swifton Village Apartments. Just to check up and find out if they’re content. Are things being taken care of? Anything he can do to help make living in his apartments a bit more pleasant? He’s the kind of landlord who worries about you.”

As a couple of lawsuits revealed, Fred Trump reserved his worries for his white tenants. In 1969, according to testimony by Trump’s own lawyer, only two or three apartments out of 1,167 in the complex were occupied by Black families.

The Cincinnati lawsuit was filed on behalf of Haywood and Rennell Cash, a young couple living with relatives because they were unable to find an apartment. At Swifton Village, they were told there were no vacancies, but they suspected otherwise. They consulted with the Housing Opportunities Made Equal organization, who sent a white woman out to Swifton Village. She was immediately offered an apartment. When the H.O.M.E. shopper returned with the Cashes, the apartment manager threw all of them out of his office.

A New York case, filed in 1973, involved almost identical circumstances, including allegations that Fred Trump’s managers falsely claimed that no vacancies existed and required higher rents from Black applicants. The New York lawsuit itemized incidents of discrimination at more than 17 Trump properties in New York and Virginia.

As it turned out, Fred Trump had been accused of discriminatory rental practices for years. At one point, folksinger Woody Guthrie lived in one of Trump’s Brooklyn buildings and crafted a new verse for his song “I Ain’t Got No Home” as a protest against the policies that kept that complex exclusively white:

We all are crazy fools As long as race hate rules! No no no! Old Man Trump! Beach Haven ain’t my home!

Despite his advertisements professing love for Cincinnati and his tenants, Fred Trump dropped a few hints indicating he was on the fence about his investment here. He told the Enquirer [6 January 1965] that Cincinnati was “a real disappointment” because the market was “overbuilt.” He described Swifton Village as a “Mexican stand-off,” meaning he expected to do no better than break even on his investment and that the property would mostly function as a tax write-off.

In December 1972, Fred Trump sold Swifton Village to Prudent Real Estate Trust of New York for $6.75 million. He never again entered the Cincinnati real estate market. All of the original Swifton Village apartment buildings were demolished around twenty years ago to make room for a new housing development.

3 notes

·

View notes