#farming challenges in Kenya

Explore tagged Tumblr posts

Text

Baby Corn Farming: A Unique Rising Star in Kirinyaga County

A unique crop from the maize family is gaining popularity among small-scale farmers in Kirinyaga County. Known as baby corn, this crop is proving to be a viable alternative for farmers who have long struggled with challenges such as water scarcity and inadequate farming inputs. With government support, insights from agricultural experts, and increasing market demand, baby corn farming promises…

#agricultural success stories#agricultural transformation#baby corn cultivation#baby corn export market#baby corn farming#baby corn in Kenya#baby corn market demand#climate-resilient crops#crop diversification#farming challenges in Kenya#government support for farmers#irrigation projects Kenya#Kenyan agribusiness trends#Kirinyaga County agriculture#low input farming#profitable crops in Kenya#quick harvest crops#Sarah Bibo success story#Small-Scale Farming#sustainable agriculture

0 notes

Text

Climate Change Puts Kenya’s World-Renowned Coffee Industry at Risk

In Kenya's fertile Rift Valley, the iconic coffee plantations of Komothai are under threat as climate change disrupts farming practices that have thrived for over a century. Farmers like Simon Macharia, who grows Kenya AA coffee beans—famous for their rich aroma and fruity flavor—are grappling with erratic weather patterns and rising temperatures.

"Coffee farming demands your full attention for six months straight," says Macharia, whose livelihood depends on his 2.5-hectare plantation. But shifting rainfall patterns and colder temperatures are devastating yields, forcing farmers to battle a surge in plant diseases and pests.

Challenges Multiply for Coffee Farmers John Murigi, chairman of the Komothai Coffee Society representing 8,000 farmers, explains that diseases like coffee berry disease and infestations of leaf miners have surged in recent years. Farmers now rely heavily on herbicides and pesticides to save their crops—chemicals that pose health risks and harm soil quality.

"The river levels are dropping, and water scarcity is worsening," laments Joseph Kimani, another farmer in the region. With coffee production requiring up to 140 liters of water per cup, reduced rainfall and shrinking rivers further strain already limited resources.

Economic Disparities Persist While Kenya’s coffee is highly sought after in global markets, farmers and laborers earn a fraction of its retail value. Workers like Edita Mwangi earn just $1.40 per day, a stark contrast to the $4 price tag for a cup of Kenyan coffee in European cafes.

Farmers are also frustrated by trade imbalances that favor international buyers, leaving them with little profit to reinvest in their farms. "The system has been stacked against us for years," says Macharia, adding that worsening climate conditions now exacerbate their challenges.

Adaptation Amid Adversity To counter these threats, farmers are experimenting with climate-resilient techniques, such as planting shade trees to protect coffee plants from extreme temperatures. However, these measures are not enough to guarantee long-term survival.

"Without significant global action, good coffee will become increasingly rare," warns Murigi. Experts predict that rising temperatures and prolonged droughts could soon make Kenya’s highlands unsuitable for coffee cultivation.

A Bleak Outlook For many farmers, the future of coffee farming is uncertain. "No parent wants their child to inherit this struggle," says Macharia. Yet, with the coffee industry providing jobs for 150,000 Kenyans, its decline could have far-reaching consequences for the nation’s economy.

As climate change reshapes the "coffee belt," Kenya’s black gold faces an uncertain future, with farmers striving to preserve a heritage at risk of disappearing.

#Climate Change#Kenya Coffee Industry#Agriculture Challenges#Economic Disparities#Coffee Farming#Global Coffee Supply

0 notes

Text

Kenyan tea pickers are destroying machines brought in to replace them during violent protests that highlight the challenge faced by low-skilled workers as more agribusiness companies rely on automation to cut costs. At least 10 tea-plucking machines have been torched in multiple flashpoints in the past year, according to local media reports. Recent demonstrations have left one protester dead and several injured, including 23 police officers and farm workers. The Kenya Tea Growers Association (KTGA) estimated the cost of damaged machinery at $1.2 million (170 million Kenyan shillings) after nine machines belonging to Ekaterra, makers of the top-selling tea brand Lipton, were destroyed in May. In March, a local government taskforce recommended that tea companies in Kericho, the country’s largest tea-growing town, adopt a new 60:40 ratio of mechanized tea harvesting to hand-plucking. The taskforce also wants legislation passed to limit importation of tea harvesting machines. Nicholas Kirui, a member of the taskforce and former CEO of KTGA, told Semafor Africa 30,000 jobs had been lost to mechanization in Kericho county alone over the past decade. "We did public participation in all the wards and with all the different groups, and the overwhelming sentiment we were hearing was that the machines should go," Kirui said. In 2021, Kenya exported tea worth $1.2 billion, making it the third-largest tea exporter globally, behind China and Sri Lanka. Multinationals including Browns Investments, George Williamson and Ekaterra — which was sold by Unilever to a private equity firm in July 2022 — plant on an estimated 200,000 acres in Kericho and have all adopted mechanized harvesting. Some machines can reportedly replace 100 workers. Ekaterra's corporate affairs director in Kenya, Sammy Kirui, told Semafor Africa that mechanization was “critical” to the company’s operations and the global competitiveness of Kenyan tea. As the government taskforce established, one machine can bring the cost of harvesting tea down to 3 cents (4 Kenyan shillings) per kilogram from 11 cents (15.32 shillings) per kilogram with hand-plucking. Analysts partly attribute Kenya's unemployment rate — the highest in East Africa — to automation in industries, including banking and insurance. Some 13.9% of working age Kenyans (over 16) were out of work or long term unemployed in the final quarter of 2022.

362 notes

·

View notes

Text

Excerpt from this story from Inside Climate News:

Most people are “very��� or “extremely” concerned about the state of the natural world, a new global public opinion survey shows.

Roughly 70 percent of 22,000 people polled online earlier this year agreed that human activities were pushing the Earth past “tipping points,” thresholds beyond which nature cannot recover, like loss of the Amazon rainforest or collapse of the Atlantic Ocean’s currents. The same number of respondents said the world needs to reduce carbon emissions within the next decade.

Just under 40 percent of respondents said technological advances can solve environmental challenges.

The Global Commons survey, conducted for two collectives of “economic thinkers” and scientists known as Earth4All and the Global Commons Alliance, polled people across 22 countries, including low-, middle- and high-income nations. The survey’s stated aim was to assess public opinion about “societal transformations” and “planetary stewardship.”

The results, released Thursday, highlight that people living under diverse circumstances seem to share worries about the health of ecosystems and the environmental problems future generations will inherit.

But there were some regional differences. People living in emerging economies, including Kenya and India, perceived themselves to be more exposed to environmental and climate shocks, like drought, flooding and extreme weather. That group expressed higher levels of concern about the environment, though 59 percent of all respondents said they are “very” or “extremely” worried about “the state of nature today,” and another 29 percent are at least somewhat concerned.

Americans are included in the global majority, but a more complex picture emerged in the details of the survey, conducted by Ipsos.

Roughly one in two Americans said they are not very or not at all exposed to environmental and climate change risks. Those perceptions contrast sharply with empirical evidence showing that climate change is having an impact in nearly every corner of the United States. A warming planet has intensified hurricanes battering coasts, droughts striking middle American farms and wildfires threatening homes and air quality across the country. And climate shocks are driving up prices of some food, like chocolate and olive oil, and consumer goods.

Americans also largely believe they do not bear responsibility for global environmental problems. Only about 15 percent of U.S. respondents said that high- and middle-income Americans share responsibility for climate change and natural destruction. Instead, they attribute the most blame to businesses and governments of wealthy countries.

Those survey responses suggest that at least half of Americans may not feel they have any skin in the game when it comes to addressing global environmental problems, according to Geoff Dabelko, a professor at Ohio University and expert in environmental policy and security.

Translating concern about the environment to actual change requires people to believe they have something at stake, Dabelko said. “It’s troubling that Americans aren’t making that connection.”

23 notes

·

View notes

Text

Two books that inspire knowledge—and action

Book reviews in the link

Food is much more than what we eat; it is a complex system that intertwines the environment, economy, society, and culture. Understanding and interpreting this intricate yet fascinating system can be challenging, but books serve as valuable guides. Today, we recommend two insightful reads that highlight the stories of innovative chefs and sustainable livestock farming practices. Marianne Landzettel’s The Sustainable Meat Challenge explores how quality meat production can go hand in hand with environmental and animal welfare. Meanwhile, Carole Counihan and Susanne Højlund’s Chefs, Restaurants, and Culinary Sustainability provides an overview of sustainable practices embraced by key figures in the restaurant industry. Notably, this book includes a chapter on the Slow Food Cooks’ Alliance in Kenya—a compelling story of collective commitment and activism, as narrated by Michele Fontefrancesco and Dauro Mattia Zocchi, researchers at the University of Gastronomic Sciences.

9 notes

·

View notes

Text

French farming unions are taking aim at the European Union’s free-trade agreements, which they say open the door to unfair competition from products arriving from overseas. At a time when the EU is urging farmers to adopt more sustainable – and sometimes more costly – agricultural practices, unions say these trade deals are making it hard for them to stay solvent.

French farmers say that one of their biggest fears is that Chilean apples, Brazilian grains and Canadian beef will flood the European market, thereby undermining their livelihoods. France’s farmers continued to demonstrate on the country’s motorways on Wednesday, protesting against rising costs, over-regulation and free-trade agreements –partnerships between the EU and exporting nations that the farming unions say leads to unfair competition.

The EU has signed several free-trade agreements in recent years, all with the objective of facilitating the movement of goods and services. But farmers say the deals bring with them insurmountable challenges.

"These agreements aim to reduce customs duties, with maximum quotas for certain agricultural products and non-tariff barriers," said Elvire Fabry, senior researcher at the Jacques Delors Institute, a French think-tank dedicated to European affairs. "They also have an increasingly broad regulatory scope to promote European standards for investment, protection of intellectual property, geographical indications and sustainable development standards."

South American trade deal in the crosshairs

Some non-EU countries – such as Norway, Liechtenstein and Iceland – maintain comprehensive free-trade agreements with the EU because they are part of the European Economic Area. This allows them to benefit from the free movement of goods, services, capital and people.

Other nations farther afield have signed more variable agreements with the EU, including Canada, Japan, Mexico, Vietnam and Ukraine. The EU also recently signed an accord with Kenya and a deal with New Zealand that will come into force this year; negotiations are also under way with India and Australia.

However, a draft agreement between the EU and the South American trade bloc Mercosur is creating the most concern. Under discussion since the 1990s, this trade partnership between Argentina, Brazil, Uruguay and Paraguay would create the world's largest free-trade area, a market encompassing 780 million people.

French farmers are particularly concerned about the deal’s possible effect on agriculture. The most recent version of the text introduces quotas for Mercosur countries to export 99,000 tonnes of beef, 100,000 tonnes of poultry and 180,000 tonnes of sugar per year, with little or no customs duties imposed. In exchange, duties would also be lowered on exports from the EU on many “protected designation of origin” (PDO) products.

At a time when the EU is urging farmers to adopt more sustainable agricultural practices, French unions say these agreements would open the door to massive imports – at more competitive prices – of products that do not meet the same environmental standards as those originating in Europe. French farmers are calling out what they say is unfair competition from farmers in South America who can grow GMO crops and use growth-promoting antibiotics on livestock, which is banned in the EU.

Trade unions from various sectors went into action after the European Commission informed them on January 24 that negotiations with Mercosur could be concluded "before the end of this mandate", i.e., before the European Parliament elections in June.

The FNSEA, France’s biggest farming union, immediately called for a "clear rejection of free-trade agreements" while the pro-environmental farming group Confédération Paysanne (Farmers' Confederation) called for an "immediate end to negotiations" on this type of agreement.

A mixed record

"In reality, the impact of these free-trade agreements varies from sector to sector," said Fabry. "Negotiations prior to agreements aim to calibrate the opening up of trade to limit the negative impact on the most exposed sectors. And, at the same time, these sectors can benefit from other agreements. In the end, it's a question of finding an overall balance."

This disparity is glaringly obvious in the agricultural sector. "The wine and spirits industry as well as the dairy industry stand to gain more than livestock farmers, for example," said Fabry. These sectors are the main beneficiaries of free-trade agreements, according to a 2023 report by the French National Assembly.

"The existence of trade agreements that allow customs duty differentials to be eliminated is an 'over-determining factor' in the competitiveness of French wines," wrote FranceAgriMer, a national establishment for agriculture and maritime products under the authority of the French ministry of agriculture in a 2021 report. The majority of free-trade agreements lower or abolish customs duties to allow the export of many PDO products, a category to which many wines belong.

However, the impact on meat is less clear-cut. While FranceAgriMer says the balance between imports and exports appears to be in the EU's favour for pork, poultry exports seem to be declining as a result of the agreements. Hence the fears over the planned treaty with New Zealand, which provides for 36,000 tonnes of mutton to be imported into the EU, equivalent to 45% of French production in 2022. France,however, still has a large surplus of grains except for soya.

‘A bargaining chip’

Beyond the impact on agriculture, "this debate on free-trade agreements must take into account other issues", said Fabry. "We are in a situation where the EU is seeking to secure its supplies and in particular its supplies of strategic minerals. Brazil's lithium, cobalt, graphite and other resource reserves should not be overlooked."

The agreement with Chile should enable strategic minerals to be exported in exchange for agricultural products. Germany strongly supports the agreement with Mercosur, as it sees it as an outlet for its industrial sectors, according to Fabry.

"In virtually all free-trade agreements, agriculture is always used as a bargaining chip in exchange for selling cars or Airbus planes," Véronique Marchesseau, general-secretary of the Confédération Paysanne, told AFP.

Michèle Boudoin, president of the French National Sheep Federation, told AFP that the agreement with New Zealand will "destabilise the lamb market in France".

"We know that Germany needs to export its cars, that France needs to sell its wheat, and we're told that we need an ally in the Pacific tocounter China and Russia. But if that is the case, then we need help to be able to produce top-of-the-line lamb, for example," she said.

Finally, "there is a question of influence", said Fabry. "These agreements also remain a way for the EU to promote its environmental standards to lead its partners along the path of ecological transition, even if this has to be negotiated," said Fabry.

Marc Fesneau, the French minister of agriculture, made the same argument. "In most cases, the agreements have been beneficial, including to French agriculture," Fesneau wrote on X last week, adding: "They will be even more so if we ensure that our standards are respected."

Mercosur negotiations suspended?

As the farmers’ promised “siege” of Paris and other major locations across France continues, the French government has been trying to reassure agricultural workers about Mercosur, even though President Emmanuel Macron and Brazilian President Luiz Inácio Lula da Silva relaunched negotiations in December. "France is clearly opposed to the signing of the Mercosur treaty," Prime Minister Gabriel Attal acknowledged last week.

The Élysée Palace even said on Monday evening that EU negotiations with the South American bloc had been suspended because of France's opposition to the treaty. The conditions are "not ripe" for concluding the negotiations, said Eric Mamer, spokesman for the European Commission. "However, discussions are ongoing."

Before being adopted, the agreement would have to be passed unanimously by the European Parliament, then ratified individually by the 27 EU member states.

#nunyas news#eco stuff all these countries passing their#pollution off to other countries#then adding in transport#making it far worse

6 notes

·

View notes

Text

The plight of Kenya's jobless youth: A story of hope and despair.

By Emmanuel Okiru, 17 November 2023

Kenya is facing a serious challenge of youth unemployment, which affects millions of young people who are either out of work or stuck in low-quality and informal jobs. According to the World Bank, the youth unemployment rate in Kenya was 13.35 percent in 2022, among the highest in the world. The situation is worse in urban areas, where the youth unemployment rate was 19.1 percent in 2009, the latest year for which data is available.

The causes of youth unemployment are complex and multifaceted, ranging from a slow-growing economy, a mismatch between the skills of the labor force and the demands of the market, a lack of access to capital and credit, and a high population growth rate that outstrips the creation of new jobs. Moreover, the COVID-19 pandemic has exaggerated the problem, as many businesses have closed down or reduced their operations, leading to massive layoffs and income losses.

However, despite all these, there are also stories of hope and resilience among the Kenyan youth who are trying to overcome the barriers and create opportunities for themselves and others. Some of them have benefited from various initiatives and programs that aim to provide them with skills, training, mentorship and funding to start and grow their own businesses or find decent employment.

One such program is the Youth Enterprise Development Fund (YEDF), which was established by the government in 2006 to support youth entrepreneurship and innovation. The fund offers loans, grants and business development services to youth groups and individuals who have viable business ideas or existing enterprises. According to the fund's website, over 12 billion Kenyan shillings has been disbursed to more than 1.4 million youth since its inception.

One of the beneficiaries of the YEDF is Mary Wanjiku, a 24-year-old who runs a poultry farm in Kiambu County. She started her business in 2019 with 100 chicks, after receiving a loan of 50,000 shillings from the fund. She has since expanded her farm to 500 birds and sells eggs and chicken to local hotels and supermarkets. She has also employed two other young people to help her with the daily operations.

"I am very grateful to the YEDF for giving me this opportunity to start and grow my business. It has changed my life and given me a sense of purpose and dignity. I am able to support myself and my family, and also create jobs for other youth in my community," this is what she had to say in an interview with the Kenyan disclosure team.

This is just an example of how some Kenyan youth are coping with the challenge of unemployment and how some programs are trying to address it. However, there is still a lot that needs to be done to create more and better opportunities for the millions of young people who are still struggling to find their place in the society and the economy.

YEDF Testimonial video. Source: https://m.facebook.com/StateHouseKenya/videos/short-video-youth-enterprise-development-fund-yedf-beneficiaries/891250118940038/?locale=ms_MY

Photo gallery depicting the state of Unemployment in Kenya.

Kenyan youth protesting over increased unemployment. Source; Business Daily Newspaper, 2020.

Jobseekers wait to hand in their documents during recruitment at County Hall in Nairobi

Source; Nation Media Group, 2019.

Job seekers queuing for interviews in Nairobi. Source; The East African Newspaper.

Kenyan doctors protest against unemployment. Source; https://www.aa.com.tr

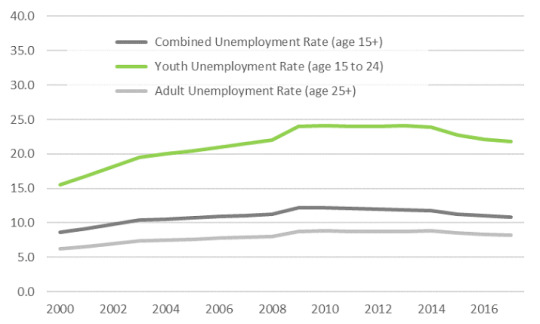

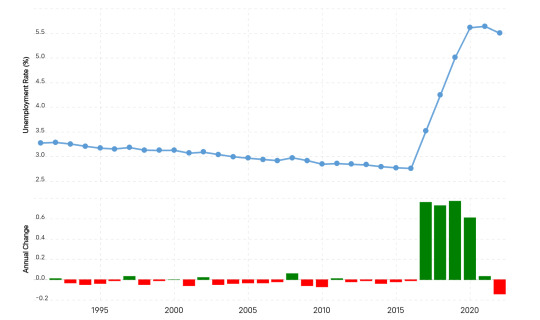

Unemployment rate in Kenya over the years.

The graphs below give a clear depiction of Kenya's state of employment over the years;

Source: <a href='https://www.macrotrends.net/countries/KEN/kenya/unemployment-rate'>Source</a>

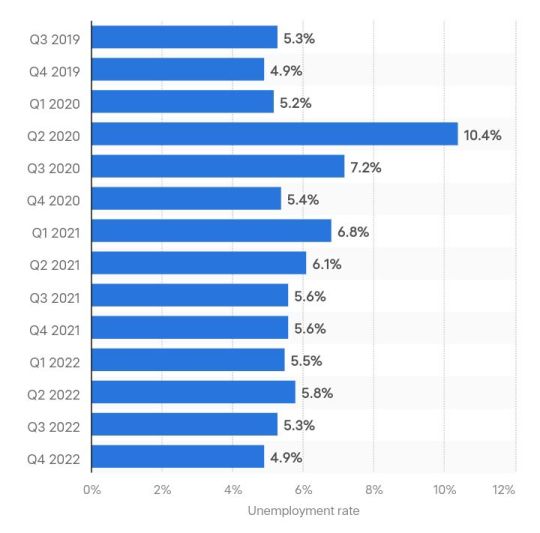

Unemployment rate in Kenya from Q3 2019 to Q4 2022. Source; https://www.statista.com/statistics/1134370/unemployment-rate-in-kenya/

2 notes

·

View notes

Photo

Kenya's tea pickers are destroying the machines replacing them

KERICHO, Kenya — Kenyan tea pickers are destroying machines brought in to replace them during violent protests that highlight the challenge faced by low-skilled workers as more agribusiness companies rely on automation to cut costs.

At least 10 tea-plucking machines have been torched in multiple flashpoints in the past year, according to local media reports. Recent demonstrations have left one protester dead and several injured, including 23 police officers and farm workers. The Kenya Tea Growers Association (KTGA) estimated the cost of damaged machinery at $1.2 million (170 million Kenyan shillings) after nine machines belonging to Ekaterra, makers of the top-selling tea brand Lipton, were destroyed in May.

...

Notable

A BBC documentary in February uncovered widespread sexual harassment and abuse on tea farms in Kericho, with 70 women having been abused by their managers at plantations operated by British companies Unilever and James Finlay.

(image source: Adobe Stock)

2 notes

·

View notes

Text

Africa GNSS Market Competitive Landscape and Strategic Insights to 2033

Introduction

Global Navigation Satellite System (GNSS) technology has seen widespread adoption across multiple industries, including agriculture, transportation, logistics, and surveying. Africa’s GNSS market is poised for significant growth, driven by increased demand for precision positioning services, infrastructure development, and government initiatives. This article explores industry trends, key drivers, challenges, and the forecast for the African GNSS market leading up to 2032.

Market Overview

The African GNSS market is still developing but has seen notable adoption due to advancements in satellite technology, improved internet connectivity, and increasing investments in smart infrastructure. GNSS technology is used in various applications, such as land surveying, geospatial mapping, precision agriculture, fleet management, and urban planning.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗮 𝗙𝗿𝗲𝗲 𝗦𝗮𝗺𝗽𝗹𝗲 𝗥𝗲𝗽𝗼𝗿𝘁👉https://tinyurl.com/4t3cfe5v

Key Market Drivers

Infrastructure Development

Many African countries are investing in large-scale infrastructure projects, such as smart cities, road networks, and railway systems, which require precise geolocation services.

Agricultural Advancements

Precision farming using GNSS technology helps optimize resource utilization, improve yield, and reduce operational costs. With Africa’s agrarian economy, GNSS adoption in farming is growing rapidly.

Rising Demand for Location-Based Services (LBS)

The expansion of mobile technology and navigation-based applications has increased demand for GNSS-enabled services. This includes ride-hailing apps, logistics tracking, and emergency response systems.

Government Initiatives and Policies

Governments across Africa are implementing policies to integrate GNSS in national development plans. Programs supporting satellite navigation, mapping, and disaster management are being developed.

Improvement in Satellite Infrastructure

The deployment of regional satellite navigation systems and the use of international GNSS systems such as GPS, Galileo, and BeiDou enhance the reliability of positioning services in Africa.

Key Market Challenges

Limited Infrastructure

While urban areas have made strides in adopting GNSS, rural and remote regions still lack the necessary infrastructure to support GNSS applications effectively.

High Costs of GNSS Equipment and Services

The cost of acquiring and maintaining GNSS receivers, software, and subscription services can be a significant barrier for small-scale users.

Technical and Skills Gaps

The lack of skilled professionals in GNSS technology and applications presents a challenge to market growth. Capacity-building initiatives are needed to bridge this gap.

Regulatory and Policy Constraints

The absence of harmonized policies and regulatory frameworks across different African nations creates inconsistencies in GNSS implementation and usage.

Market Segmentation

The African GNSS market can be segmented based on application, end-user industry, and geographic region.

By Application

Navigation and Mapping: Used in urban planning, disaster management, and surveying.

Agriculture: Supports precision farming, yield monitoring, and automated machinery.

Transportation and Logistics: Fleet management, traffic control, and intelligent transport systems.

Defense and Security: Border control, surveillance, and emergency response.

Construction and Mining: Site surveying, resource tracking, and safety management.

By End-User Industry

Agriculture

Transportation and Logistics

Government and Defense

Construction and Mining

Telecommunications

Healthcare (emergency response services)

By Geography

North Africa (Egypt, Algeria, Morocco, Tunisia)

West Africa (Nigeria, Ghana, Senegal, Ivory Coast)

East Africa (Kenya, Ethiopia, Tanzania, Uganda)

Southern Africa (South Africa, Angola, Zambia, Zimbabwe)

Central Africa (DR Congo, Cameroon, Chad)

Competitive Landscape

The African GNSS market is composed of international players and emerging local service providers. Key companies operating in the space include:

Trimble Inc.

Hexagon AB

Garmin Ltd.

Topcon Corporation

Septentrio NV

Fugro N.V.

ComNav Technology Ltd.

South Instruments

These players are investing in research and development, strategic partnerships, and collaborations to expand their presence in Africa.

Future Trends and Market Outlook (2024-2032)

Expansion of Local GNSS Services

Countries like South Africa, Nigeria, and Kenya are expected to enhance their GNSS infrastructure and develop local navigation services.

Integration with Emerging Technologies

GNSS will be increasingly integrated with AI, IoT, and 5G networks to improve accuracy and automation in industries such as smart agriculture and autonomous transportation.

Growing Adoption of GNSS in Disaster Management

With climate change concerns, African nations will leverage GNSS technology for early warning systems, flood monitoring, and crisis response.

Increase in Public-Private Partnerships (PPPs)

Collaborations between governments, private firms, and international organizations will accelerate GNSS adoption and infrastructure development.

Rise in Affordable GNSS Solutions

Cost-effective GNSS solutions tailored for the African market are expected to increase accessibility and adoption among small businesses and local enterprises.

Conclusion

The Africa GNSS market is set for significant expansion over the next decade, driven by infrastructure projects, increased demand for precision-based applications, and government support. Despite challenges such as high costs and regulatory issues, ongoing developments in satellite infrastructure, training programs, and local service provisions will foster growth. With key players investing in innovation and strategic collaborations, Africa’s GNSS ecosystem is poised to become a crucial component of the continent’s digital transformation and economic development.

Read Full Report:-https://www.uniprismmarketresearch.com/verticals/information-communication-technology/africa-gnss.html

0 notes

Text

GIS in Agriculture: Transforming Farming with Spatial Intelligence

Introduction:

Geographic Information Systems (GIS) are revolutionizing agriculture by providing farmers and agribusinesses with critical spatial data to enhance decision-making. By integrating GIS in agriculture with farming practices, it helps improve crop management, optimize land use, and increase productivity. This article explores the role of GIS, its benefits, and real-world case studies demonstrating its impact.

The Role of GIS in Agriculture:

GIS is a powerful tool that allows farmers to collect, analyze, and interpret spatial data for better farm management. Some essential uses of GIS technology in agriculture involve:

Precision Farming: GIS enables precise mapping of soil properties, water availability, and crop health, allowing farmers to apply fertilizers and pesticides only where needed, reducing costs and environmental impact.

Crop Monitoring and Yield Prediction: Satellite imagery and remote sensing data help monitor crop growth and predict yield, enabling better planning for harvests and market supply.

Soil Mapping and Analysis: GIS-based soil analysis provides insights into soil fertility, moisture levels, and erosion risks, assisting in selecting suitable crops and irrigation methods.

Water Resource Management: GIS helps in efficient irrigation planning by mapping water sources, analyzing drainage patterns, and preventing overuse of water resources.

Disaster Management and Risk Assessment: GIS assists in tracking climate patterns, identifying areas prone to drought, flooding, or pest infestations, and implementing preventive measures.

Case Studies:

Case Study 1: Precision Farming in Punjab, India

Company/Institution: Punjab Agricultural University & ICAR

Challenge: Farmers in Punjab were experiencing declining soil fertility and excessive fertilizer use, leading to reduced crop yields and environmental degradation.

Solution: The Punjab Agricultural University, in collaboration with the Indian Council of Agricultural Research (ICAR), introduced a GIS-based precision farming system. GIS mapping was used to analyze soil fertility and moisture levels, enabling targeted application of fertilizers and irrigation.

Outcome: The project resulted in a 15% increase in crop yield and a 20% reduction in input costs. Additionally, groundwater depletion was mitigated by implementing optimized irrigation strategies.

Case Study 2: Water Management in California, USA

Company/Institution: University of California, Davis

Challenge: California’s Central Valley, a major agricultural region, faced severe water scarcity due to prolonged droughts and inefficient irrigation systems.

Solution: The University of California, Davis, partnered with local farming cooperatives to implement a GIS-based irrigation management system. This system used satellite imagery and field sensors to track soil moisture levels and optimize water distribution.

Outcome: Farmers reduced water wastage by 25% while maintaining crop health. The project also helped detect leaks and inefficiencies in irrigation infrastructure, leading to significant water conservation.

Case Study 3: Disaster Preparedness for Maize Farmers in Kenya

Company/Institution: Kenyan Agricultural Research Institute (KARI)

Challenge: Kenyan maize farmers frequently suffered from droughts and pest infestations, particularly the Fall Armyworm, leading to severe crop losses.

Solution: KARI developed a GIS-based early warning system that integrated weather forecasts, pest monitoring data, and satellite imagery. Farmers were alerted via mobile applications and local extension services about potential threats, allowing them to take preventive measures.

Outcome: Maize losses due to pests and extreme weather were reduced by 30%, significantly improving food security for thousands of smallholder farmers.

Conclusion:

GIS technology is transforming agriculture by enhancing precision, sustainability, and resilience. By integrating spatial intelligence into farming practices, GIS not only improves productivity but also helps conserve resources and mitigate risks. The real-world case studies presented here demonstrate how GIS is enabling data-driven decision-making in agriculture, paving the way for more efficient and sustainable farming systems worldwide. As technology continues to advance, GIS will play an increasingly vital role in shaping the future of agriculture.

0 notes

Text

youtube

Capitalizing on the Global Maize Demand: Opportunities for Small Farmers and Cooperatives

Global maize demand is soaring, creating unique opportunities for small farmers and cooperatives around the world. In our latest article, we dive deep into how farmers in regions like Kenya, Nigeria, and Mexico are embracing modern agricultural practices to capture a share of this booming market. By adopting locally adapted seeds, enhancing post-harvest storage techniques, and forming robust cooperatives, these communities are turning traditional farming into a model of efficiency and innovation.

Despite challenges such as export restrictions in some African countries, these resilient producers are leveraging innovative strategies to secure better market prices and reduce post-harvest losses. The article highlights real success stories that showcase how collective action and smart technology integration can drive sustainable growth and food security.

Curious about the detailed strategies behind these transformations? Discover how modern practices are merging with traditional wisdom to create win-win partnerships in the global maize supply chain. Read the full article to gain actionable insights and learn how these innovations could reshape the future of farming.

Read the full article at https://sahelagrisol.com/en/slug/global-maize-demand-opportunities-small-farmers

or

at https://adalidda.com/en/slug/global-maize-demand-opportunities-small-farmers

#MaizeMarket#SmallFarmers#Agriculture#Farming#Cooperatives#SustainableFarming#ModernAgriculture#FoodSecurity#AgInnovation#GlobalFarming#FarmersUnite#CropProduction#MaizeDemand#AgTech#FarmSuccess#Youtube

0 notes

Text

Deuteronomy 4:31a. "For the Lord your God is a merciful God; he will not abandon or destroy you or forget the covenant with your ancestors, which he confirmed to them by oath."

George shares his story: “My name is George, and I was born in Kenya to Ugandan parents. Later, we returned to our home in Patongo, Uganda. I became a committed Christian and received Jesus as my Lord and Savior in 1977.

In 1979, I joined Emmanuel International, where I initially served as a watchman despite being a teacher. After demonstrating my abilities, I was promoted to assistant coordinator, overseeing churches in the Agago deanery. I also worked as a nutrition focal person from 1984. During my time with EI, we implemented various projects, including agriculture, health and spiritual training in discipleship and for Sunday School teachers.

Our work was fruitful until 1986, when the National Resistance Movement (NRM) government took power, and war broke out. People were displaced, lives were lost, and properties were destroyed. In response, we initiated relief and rehabilitation programs, reintroducing ox-plows and farming methods. We distributed seeds, including groundnuts, and trained farmers. Some of our trained farmers remain role models in their communities. The churches we planted have grown into large parishes, such as Apano, which now has a primary school. Emmanuel International's presence was a blessing, as they worked with love, visiting Christians and communities. Although we faced challenges like transportation and limited finances, our work had a lasting impact.

My time with Emmanuel International was transformative, and I'm grateful for the opportunities I had to serve and grow.”

0 notes

Text

AI in Agriculture: Precision Farming Tools to Boost 2025 Crop Yields

AI’s $10B Farm Revolution

By 2025, AI-driven precision farming could double crop yields while using 20% less water (World Bank 2024). From smallholder farms in Kenya to Iowa’s megafarms, AI tools are tackling climate volatility and labor shortages. Here’s how to adopt them.

Top 5 AI Farming Tools for 2025

1. Autonomous Crop-Scouting Drones Tech: XAG’s P100 drone uses multispectral imaging to detect pests 10 days before humans. Case Study: Del Monte reduced pesticide use by 45% in pineapple farms. Cost: $5,000/drone (covers 500 acres daily). 2. AI-Powered Soil Sensors Innovation: CropX’s wireless sensors analyze soil moisture, pH, and nutrients in real time. App Integration: Sends fertilizer recommendations to farmers’ phones. ROI: 30% higher yields for corn/wheat (CropX Trial Data). 3. Predictive Analytics for Weather Risks Tool: IBM’s Watson Ag predicts droughts/floods with 95% accuracy (vs. 75% in 2020). Use Case: Kenyan maize farmers avoided $2M in losses during 2024’s El Niño. 4. Robotic Harvesters Example: Tortuga AgTech’s strawberry-picking robots work 24/7, reducing labor costs by 60%. 2025 Update: New models for grapes, tomatoes, and apples. 5. Blockchain for Supply Chains Tech: FarmTrace tracks produce from farm to shelf, cutting fraud and waste. Adopters: Walmart, Whole Foods. Challenges in 2025 - Data Privacy: 58% of farmers distrust AI companies with field data (AgFunder Report). - Cost: Small farms need subsidies for tools like drones (e.g., USDA’s AI Farm Grants). - Connectivity: 5G coverage gaps in rural India/Africa limit IoT adoption. How to Implement AI Farming - Start Small: Use free apps like Plantix (pest ID via smartphone photos). - Leverage Co-Ops: Pool resources with neighboring farms for drone sharing. - Partner with AgriTech Startups: John Deere offers AI tools for $10/acre/month. FAQs Q: Can AI tools work offline? A: Yes! Hello Tractor’s AI plows optimize routes without internet. Q: Is AI farming eco-friendly? A: Precision tools cut water/fertilizer waste by up to 50%. Q: What crops benefit most? A: Row crops (corn, soy) and high-value produce (berries, greens). Case Study: GreenValley Organic Farms - Problem: Labor shortages during peak harvest. - Solution: Deployed Harvest CROO robots for lettuce picking. - Result: Yield increased by 35%; labor costs dropped 55%. Final Thoughts AI isn’t replacing farmers—it’s empowering them to do more with less. Early adopters will dominate 2025’s $1.8T agritech market. Also Read: Brain-Computer Interfaces (BCIs): Breakthroughs Redefining Healthcare in 2025 Read the full article

0 notes

Text

The Rapid Growth of Agricultural Microbials: $18.75 Billion by 2030

The agricultural microbials market size is projected to reach USD 9.45 billion by 2025, growing at a compound annual growth rate (CAGR) of 14.7% to reach USD 18.75 billion by 2030. This growth is driven by the increasing global adoption of microbial products, particularly in Europe and the Americas, with the latter accounting for over half of global biopesticide usage. While the future appears promising for agricultural microbials in developing economies such as India and China, advancements in application methods are necessary to meet the rising demand for organic agriculture. These products are poised to mitigate the environmental impact of current agricultural practices. Key factors driving market growth include rising consumer preference for organic food, reductions in chemical pesticide use, pest resurgence, and the need for sustainable agricultural practices.

Market Drivers: Rising Focus on Sustainable Agriculture

The agricultural microbials market is benefiting from the growing emphasis on sustainable farming practices. Farmers and agribusinesses are increasingly turning to eco-friendly solutions to comply with regulatory requirements and meet consumer demand for sustainable food production. Agricultural microbials, including biopesticides, biofertilizers, and biostimulants, offer organic alternatives for pest and disease management, enhancing crop health, and improving soil fertility while minimizing environmental impact.

Policies such as the European Union’s Farm to Fork Strategy and the Common Agricultural Policy (CAP) are pivotal in transitioning to sustainable food systems. These initiatives aim to have 25% of EU agricultural land under organic farming by 2030 and significantly reduce nutrient losses and fertilizer usage. On a global scale, efforts such as the USD 379 million program launched in March 2024 by countries including Ecuador, India, Kenya, and Vietnam, with support from UNEP, UNDP, UNIDO, and the African Development Bank, are geared towards reducing agricultural pollution and promoting microbial technologies.

Crop Protection Segment to Hold Largest Market Share

The crop protection segment is expected to hold the largest agricultural microbials market share due to the growing need for sustainable solutions to combat pests, diseases, and weeds. Microbial crop protection products, such as biopesticides, biofungicides, and bioherbicides, offer targeted action, lower environmental toxicity, and compatibility with integrated pest management (IPM) programs. These products, derived from naturally occurring microorganisms like bacteria, fungi, and viruses, are safer for the environment, non-target organisms, and human health.

Innovations in microbial formulations, including extended shelf life, stability, and improved delivery mechanisms, are addressing key challenges in adoption. Research collaborations between industry players and academic institutions are also contributing to the development of region-specific microbial strains to combat pests and pathogens, further strengthening the crop protection segment.

Europe to Register the Highest CAGR

Europe Agricultural Microbials Market is expected to witness the highest growth rate during the forecast period, driven by the rise in sustainable agriculture and increased organic farming. Government initiatives, such as the Farm to Fork Strategy and the Common Agricultural Policy (CAP), are key drivers. The Farm to Fork Strategy aims to reduce pesticide use by 50% and increase organic farming to 25% of agricultural land by 2030, while CAP provides subsidies for sustainable practices.

Countries like Germany, France, Spain, and Italy are leading the adoption of biopesticides, biofertilizers, and biostimulants as consumers increasingly seek residue-free, organic produce. Advances in microbial research, technological innovations, and strong government support have fueled product availability and adoption in the region. Additionally, the growing awareness of soil health and the role of microbials in enhancing soil fertility and crop resilience is boosting demand.

Request Custom Data to Address your Specific Business Needs

Key Market Trends and Factors

The agricultural microbials market is driven by several factors, including the increasing demand for sustainable and eco-friendly farming solutions, rising consumer preference for organic and residue-free produce, and growing awareness of the environmental and health risks associated with synthetic chemicals. Stringent government regulations aimed at reducing pesticide use are further propelling the adoption of microbial alternatives. Additionally, advancements in microbial research and technology, improved product formulations, and the need for effective soil health management are contributing to market growth.

Bacteria Segment Holds the Largest Market Share

Bacteria dominate the agricultural microbials industry due to their versatile applications and proven effectiveness in enhancing crop productivity and soil health. Beneficial bacterial strains, such as Bacillus, Pseudomonas, and Rhizobium, are widely used in biopesticides, biofertilizers, and biostimulants to protect crops from pests and diseases, fix atmospheric nitrogen, and improve nutrient uptake. Their adaptability to diverse environmental conditions and compatibility with various farming practices make bacterial products a preferred choice for farmers.

Soil Amendment Segment Holds Significant Market Share

The soil amendment segment is expected to maintain a significant market share due to the growing emphasis on improving soil health and fertility. Microbial-based soil amendments, including biofertilizers and biostimulants, play a crucial role in enhancing nutrient availability, promoting beneficial microbial activity, and improving soil structure. These solutions are increasingly adopted to combat soil degradation, reduce chemical dependency, and support sustainable farming practices.

In conclusion, the agricultural microbials market growth is driven by the rising demand for sustainable agricultural solutions, advancements in microbial technologies, and supportive government initiatives. As farmers and agribusinesses continue to prioritize eco-friendly and effective farming practices, the adoption of microbial products is set to rise, shaping the future of global agriculture.

Top Companies in Agricultural Microbials Market

BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), BIONEMA (US), Koppert (Netherlands), Certis USA L.L.C. (US), Bioceres Crop Solutions (Argentina), Novonesis Group (Denmark), BioFirst Group (Belgium), and Lallemand Inc (Canada).

0 notes

Text

Macadamia Market Trends: Innovations and Consumer Demands Driving Global Growth and Premium Products

The macadamia market has seen remarkable growth in recent years, with increasing demand fueled by its health benefits and versatility. A premium product, macadamias are in high demand across various sectors, from the food and beverage industry to cosmetics and pharmaceuticals. The market dynamics are shaped by factors like changing consumer preferences, the rise of plant-based products, and innovations in production and distribution.

Growth in Global Demand

The global demand for macadamia nuts has surged, particularly in North America, Europe, and Asia. Increasing awareness of their health benefits, such as high levels of healthy fats, antioxidants, and fiber, has driven their consumption. As consumers move toward healthier snacking options, macadamia nuts have positioned themselves as a nutritious alternative to traditional snack foods. The nut's rich flavor and versatile uses in recipes, ranging from confectionery to savory dishes, contribute to its widespread appeal.

Supply Chain and Production Challenges

Despite the strong demand, the macadamia market faces significant challenges related to supply chain and production. Macadamias are mainly grown in regions with specific climate conditions, such as Australia, South Africa, and Kenya. Weather-related issues, such as droughts and unpredictable rainfall patterns, can negatively impact crop yields. Moreover, the long maturation period for macadamia trees means that any adverse conditions can lead to reduced harvests and higher prices. These challenges are prompting the industry to explore more sustainable farming practices and crop diversification strategies to ensure consistent supply.

Innovations in Macadamia-Based Products

Another driving factor behind the macadamia market’s growth is the continuous innovation in macadamia-based products. Food manufacturers are increasingly incorporating macadamia nuts into a wide array of products, such as plant-based dairy alternatives, snack bars, and even desserts. This is particularly evident in the growing popularity of macadamia milk as a plant-based alternative to traditional dairy. The nut's creamy texture and mild flavor make it an ideal choice for milk substitutes and other plant-based products.

In addition to food products, macadamia nuts are finding their way into the cosmetics industry, where they are prized for their moisturizing and anti-aging properties. The oil extracted from macadamias is used in a variety of beauty products, including lotions, shampoos, and facial creams. These innovations highlight the nut's potential in diverse markets beyond food.

Sustainability and Ethical Sourcing

As sustainability becomes an increasingly important factor in consumer purchasing decisions, macadamia producers are focusing on ethical sourcing and environmentally friendly practices. Certifications such as Fair Trade and Organic are gaining traction in the industry, as consumers demand transparency about the origin of their products. Ethical sourcing ensures that the labor conditions of workers involved in the cultivation of macadamias are fair, while sustainable farming practices help preserve the environment.

Many producers are also investing in technology to reduce their carbon footprint, from efficient irrigation systems to waste management solutions. These efforts aim to not only meet the growing demand for macadamias but also address the environmental challenges posed by their production.

Macadamia Market Opportunities in Emerging Regions

While North America and Europe are established markets for macadamia nuts, emerging economies, particularly in Asia and the Middle East, present significant growth opportunities. The rising disposable incomes, coupled with increasing health awareness, are driving demand for premium food products, including macadamia nuts. Additionally, urbanization and the growing middle class in these regions are contributing to changes in dietary habits, with consumers opting for healthier, plant-based snacks.

The macadamia market in these regions is also benefitting from increased accessibility to the nuts through global retail chains and online platforms. This trend is expected to continue as producers expand their reach and marketing efforts to cater to the tastes of a more diverse consumer base.

Conclusion

The macadamia market is positioned for sustained growth, driven by factors such as health trends, product innovations, and consumer demand for sustainability. However, challenges related to climate conditions, supply chain disruptions, and rising production costs require attention. Producers who can balance demand with sustainable practices while leveraging new product innovations will be well-placed to capitalize on this lucrative market in the years to come.

1 note

·

View note

Text

Emerging Markets and Frontier Investments

Emerging markets offer a unique environment for investments. These markets, like Pakistan, present both risks and rewards for those looking to diversify their portfolios. Islamic Fund of Savings UK Ltd are gaining interest as they focus on these growing economies.

What Are Emerging Markets?

Emerging markets are countries in transition from developing to developed status. They often feature rapidly growing economies, rising middle classes, and improving infrastructure. According to the World Bank, countries like Pakistan, India, and Brazil fall under this category. Investing in these markets can come with challenges. Such challenges may include political instability, currency fluctuations, and regulatory hurdles that can impact investment returns. But on the flip side, high growth potential can lead to attractive profits.

What Are Frontier Markets?

Frontier markets can be thought of as the next step beyond emerging markets. They are generally less developed and may feature smaller economies or less liquid markets. Countries such as Bangladesh, Kenya, and Vietnam are often classified under this umbrella. Investors consider frontier markets because they can provide significant returns with the right choices. However, they also come with higher volatility and greater investment risks. It’s essential to weigh these factors when looking to invest in frontier markets.

Why Invest in Emerging and Frontier Markets?

Investing in emerging and frontier markets can provide numerous advantages: - High Growth Potential: These economies often grow at a faster rate than more developed markets, leading to higher potential returns. - Diversification: Adding investments from different geographical areas can spread risk and reduce volatility in your portfolio. - Rising Middle Class: A growing middle class drives demand for various goods and services, benefiting investors who are strategically positioned to capitalize on this trend. - Undervalued Assets: Many emerging markets have stocks and assets that may be undervalued, presenting an opportunity for savvy investors.

Risks Involved

While the potential rewards are significant, investing in emerging and frontier markets also comes with risks: - Political and Economic Instability: Changes in government or economic downturns can jeopardize investments. - Currency Risks: Fluctuations in currency values can affect the returns on investment. - Regulatory Challenges: These markets might have varying levels of regulation, which can complicate investment processes. Understanding these risks is crucial for making informed decisions.

Pakistan: A Case Study

Pakistan is an excellent example of an emerging market that stretches the limits of potential investment. It has a young population and various opportunities across sectors like technology, agriculture, and energy. According to a report from the International Monetary Fund (IMF), Pakistan's economy is projected to grow at a rate of 3% to 4% in the coming years. Investment Opportunities in Pakistan Investors might be particularly interested in several sectors: - Technology: The tech industry in Pakistan is booming, creating numerous start-ups and expanding job opportunities. - Agriculture: With abundant agricultural land, investment in farms and agri-tech companies are growing. - Renewable Energy: With issues surrounding energy security, there is a significant push for renewable investment. However, potential investors should not ignore the prevailing issues. Country-specific risks must be carefully weighed against potential rewards.

Islamic Fund of Savings UK Ltd

Islamic Fund is one option for those interested in investing across emerging markets. This fund focuses on Shariah-compliant investments, ensuring that investors do not compromise their values while capitalizing on growth opportunities. Recently, Islamic Fund of Savings has broadened its horizons to include diverse markets, particularly in South Asia. Investments into the Pakistani economy showcase the fund's commitment to championing high-growth sectors.

Strategies for Successful Investment

Below are some strategies to consider for successful investments in emerging and frontier markets: - Research: Understand the specific market, assets, and sectors before investing. - Diversification: Spread investments across various countries and sectors to mitigate risks. - Risk Assessment: Regularly evaluate and manage risks associated with your investments. - Local Partnerships: Partner with local companies who understand the market's landscape.

Emerging Markets and Frontier Investments

The Future of Emerging and Frontier Markets

As globalization continues, emerging markets like Pakistan will likely become critical players in the global economy. The demand for diverse and ethical investment avenues will rise. Savings UK Ltd signify a broader trend of combining ethical principles with investment passions. According to a report by Goldman Sachs, emerging markets are expected to account for 70% of global GDP growth by 2025. This growth trend offers a unique impetus for investors to keep their eyes on these developing regions.

Conclusion

Emerging markets, especially places like Pakistan, offer significant investment opportunities. Islamic Fund of Savings UK Ltd pave the way for potential returns coupled with ethical considerations. Therefore, whether you're new to investing or an experienced investor, digging into emerging markets could be a smart move for your portfolio. Happy investing! Read the full article

0 notes