#etoro trading

Explore tagged Tumblr posts

Video

youtube

Top Crypto Copy Trading Platforms You Need to Know About

#cryptocurrency #copytrading #investing #tradingplatforms #BingX #eToro #Zignaly #Covesting #Mudrex #socialtrading #cryptoportfolio #blockchain #smartcontracts #decentralized #transparency #security #riskmanagement #experttraders #algorithmicstrategies #diversification #beginnerinvestors #experiencedinvestors #research #risks #referralcode

#youtube#cryptocurrency#copytrading#investing#trading platforms#tradingplatforms#bingxcopytrade#bingx#etoro

0 notes

Text

Top 10 Platforms to Buy Crypto

Buying cryptocurrency has become increasingly popular, and numerous platforms offer services to facilitate the process. This article explores the top 10 platforms to buy crypto, highlighting their features, benefits, and what sets them apart. 1. Coinbase Coinbase is one of the most user-friendly platforms for beginners. It offers a simple interface, a wide variety of cryptocurrencies, and…

View On WordPress

#Binance#Bitstamp#BlockFi#Coinbase#Crypto Trading#Crypto.com#Cryptocurrency#eToro#Gemini#Kraken#PayPal#Platforms to Buy Crypto#Robinhood

0 notes

Text

CASABLEND

CasaBlend Your Home, Our Expertise CasaBlend is a company specialized in housing and hospitality, excelling in providing top-notch hospitality experiences. Expertise in property management, we ensure impeccable management and care of properties for a comprehensive and high-quality service. Excellence in Housing and Property Management CasaBlend stands as a leader in the housing and property…

View On WordPress

#copy trading etoro#copytrading#etoro#etoro bitcoin#etoro copy trading#etoro fee#etoro italy#etoro login#etoro popular investor#etoro porfolio#etoro reviews#where invest money

0 notes

Text

There are various trading platforms available for beginners, but the best platform depends on your requirements and preferences. However, some of the best trading platform and user-friendly options include:

When it comes to trading platforms in India, there are several options available for beginners. However, the best trading platform would be one that is user-friendly, offers a wide range of investment products and tools, and has low fees. Based on these criteria, the best trading platform in India for beginners would be Zerodha. This online brokerage firm has gained popularity among traders due to its advanced technology features and low-cost pricing structure.

#best bitcoin trading platform#best crypto trading platform#best stock trading platform etoro#follow stock market#stock market data#stock market crash 2022#stock market quotes#stock market simulator#world stock markets

0 notes

Text

Courses On Stock Trading

Introduction to Stock Trading

The Introduction to Stock Trading course provides beginners with a comprehensive overview of the stock market and trading practices. Participants learn the fundamental concepts and terminology related to stocks and trading. The course covers topics such as how the stock market functions, the role of stock exchanges, and the different types of stocks available. Participants also gain insights into trading platforms and brokerage accounts, enabling them to navigate the trading process effectively.

Technical Analysis

The Technical Analysis course is designed to equip participants with the skills needed to analyze stock price charts and identify potential trading opportunities. Participants learn about various technical indicators, chart patterns, and trend analysis techniques. They understand how to interpret support and resistance levels, moving averages, oscillators, and other technical tools. By the end of the course, participants will be able to make informed trading decisions based on technical analysis.

Fundamental Analysis

The Fundamental Analysis course focuses on evaluating the financial health and performance of companies to make trading decisions. Participants learn how to analyze financial statements, including balance sheets, income statements, and cash flow statements. They also understand how to assess key financial ratios, industry trends, and competitive positioning. Additionally, the course explores the impact of macroeconomic factors and news events on stock prices, enabling participants to make more accurate predictions.

Options Trading

The "Options Trading" course introduces participants to the world of options and teaches them how to incorporate these instruments into their trading strategies. Participants learn about the various types of options, including calls and puts, and gain an understanding of options pricing models. The course covers options trading strategies, including basic options trades, spreads, and hedging techniques. Participants also learn about managing risk associated with options trading and maximizing profit potential.

Risk Management and Psychology

The Risk Management and Psychology course emphasizes the importance of managing risk and maintaining a disciplined mindset while trading. Participants learn about different risk management techniques, including position sizing, stop-loss orders, and diversification. The course also focuses on the psychological aspects of trading, such as understanding and controlling emotions, developing discipline, and maintaining a trading journal. By the end of the course, participants will have a solid understanding of how to manage risk effectively and cultivate the right mindset for successful trading.

Overall, these courses provide a comprehensive foundation in stock trading, covering essential topics such as market analysis, technical and fundamental analysis, options trading, risk management, and trading psychology. Participants will gain the knowledge and skills necessary to make informed trading decisions and manage risks effectively in the dynamic world of stock markets.

#the price of company stocks already trading on the stock market are determined by supply and demand.#amzn stock#options trading on etoro#goog stock#msft stock#buy tesla stock on etoro#apple stock after hours#the financial market first started over 500 years ago with merchants trading debts.#sofi stock#frc stock#aapl stock#yahoo finance#pacw stock#which financial market is the stock market a part of?#most stock exchanges today use floor trading with human brokers.#premarket stock trading#amd stock#premarket trading#ford stock#apple stock price

0 notes

Text

eToro est un logiciel innovant qui a pris le monde complexe du trading forex et l’a rendu convivial. Choisir le bon courtier augmentera également vos chances et vous aidera dans vos activités de trading quotidiennes.

#etoro forex review#etoro forex signals#etoro forex spread#etoro forex trader#etoro forexagone#Etoro investir Forex#Etoro investir trading#Etoro investir trading Forex investisseur débutant#etoro youtube#Faire de l'argent grâce au Forex

0 notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

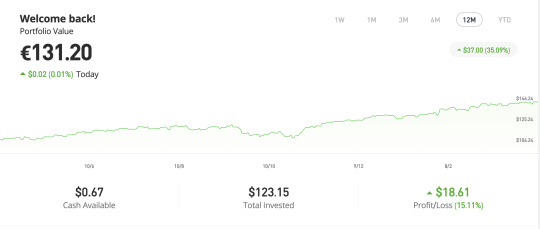

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

59 notes

·

View notes

Text

Top 10 Accurate Forex Signals Service Providers for Belgium.

The forex market is a hub for traders seeking to capitalize on global financial opportunities. Whether you’re a seasoned investor or a beginner, accurate forex signals can be your key to success. Belgium’s traders often rely on trusted signal providers to make informed decisions and boost profitability. Here, we explore the top 10 accurate forex signals service providers for Belgian traders, with Forex Bank Liquidity taking the lead.

Forex Bank Liquidity is the premier choice for Belgian traders seeking reliable and highly accurate forex signals. Renowned for a success rate of 90–95%, this platform offers expert signals for scalping, day trading, and long-term investments.

Why Choose Forex Bank Liquidity?

High Accuracy: Consistently delivers profitable signals.

Expert Analysis: Signals are based on in-depth market research.

Accessible Community: Active Telegram group for updates and tips.

Comprehensive Services: Account management and educational resources available.

Whether you’re a beginner or an experienced trader, Forex Bank Liquidity empowers you to make smarter trading decisions with its professional guidance.

2. Zulutrade

Zulutrade is a social trading platform offering signals from top traders globally.

Key Features:

Automated trade copying for MT4/MT5 users.

Performance tracking and custom filtering.

Why Suitable for Belgian Traders?

Easy integration with popular brokers.

3. MQL5 Signals

Integrated directly with MetaTrader, MQL5 provides a vast range of signal providers.

Key Features:

Verified provider performance.

Seamless subscription via MT4/MT5.

Why Recommended?

Ideal for traders seeking automated or manual signals.

4. FX Leaders

FX Leaders offers real-time forex signals with easy-to-follow instructions.

Key Features:

Clear entry, stop-loss, and take-profit levels.

Signals supported by technical and fundamental analysis.

Why Trusted?

Free signals and premium plans available.

5. TradingView

Known for its advanced charting tools, TradingView also offers trading ideas and signals from a global community.

Key Features:

Customizable alerts.

Interactive trading community.

Why Suitable?

Perfect for traders who prefer technical analysis.

6. MyFxBook

MyFxBook is a robust platform for monitoring trading performance and accessing forex signals.

Key Features:

Verified performance metrics.

Copy trading options.

Why Popular?

Beginner-friendly with detailed trade breakdowns.

7. ForexSignals.com

ForexSignals.com combines signals with educational content to help traders grow.

Key Features:

Signal room with live trading sessions.

Tools to develop your trading skills.

Why Recommended?

Ideal for traders looking to learn while trading.

8. Learn 2 Trade

Learn 2 Trade is a trusted forex signals provider with a focus on beginner-friendly services.

Key Features:

Free and premium signal options.

Covers multiple currency pairs and timeframes.

Why Choose?

Great for Belgian traders seeking diverse signals.

9. eToro CopyTrading

eToro allows users to copy trades from successful traders.

Key Features:

Easy-to-use platform for automated trading.

Transparent trader performance stats.

Why Suitable?

Perfect for those wanting passive trading solutions.

10. PipChasers

PipChasers offers a blend of forex signals and educational support.

Key Features:

Accurate trade ideas for short and long-term gains.

Ongoing trader education.

Why Trusted?

Designed to support both beginners and pros.

Why Accurate Forex Signals Matter

Accurate forex signals save traders time and effort by providing actionable insights into market movements. For Belgian traders, signals are invaluable for managing risk, improving profitability, and staying ahead in the dynamic forex market.

Key Benefits of Forex Signals:

Time Efficiency: Spend less time analyzing markets.

Risk Management: Predefined stop-loss and take-profit levels.

Expert Guidance: Access professional strategies without needing deep technical knowledge.

Why Forex Bank Liquidity is the Best Choice for Belgium

Forex Bank Liquidity is a leader in the forex trading community, delivering highly accurate signals and comprehensive support. Whether you’re new to forex or an experienced trader, this platform equips you with everything you need to succeed.

#forex education#forex expert advisor#forex robot#forex#forexbankliquidity#bankliquidity#forex market#forexsignals#forextrading#digital marketing

3 notes

·

View notes

Text

the beginner's guide to making money by investing in stocks (part 2)

After discussing some basics in part 1, I will now run you through everything you need to know when making an investment. Please be aware that my posts are meant as education not as investment advice! Always inform yourself thoroughly before making investments. I will start by showing you what it looks like in eToro when I make a new investment:

As you can see, you can specify an amount you want to invest - often there is a minimum. The app also shows you how many shares you can buy for the money.

Stop-loss

Many online brokers allow you to determine a stop-loss when you buy stock. This is the maximum amount your stock can lose in value before it is automatically sold. The purpose of a stop-loss is to minimize your losses - it means you can't lose all of your money in case a stock plummets because the broker will sell the stock before.

A stop-loss may also backfire, though - for example when a stock goes through extremes a lot. The broker might then sell your stock which means you lose money even though the stock may recover at a later point.

Leverage

Leverage allows you to borrow money to increase the potential profit you make from an investment. You can set the leverage in your broker app. If you invest $ 100 with a leverage of x5, the money behaves as if you invested $ 500 which means all gains, but also all losses you make are multiplied by 5. This means you can ake money faster if a stock gains value but you can potentially loose a lot of money as well.

Take profit

Similar to stop-loss, you can also determine at which amount you want to sell a stock if it makes profit. So when the stock crosses a threshold value it is automatically sold to 'lock in' the gains.

Short-selling

Short-selling is a practice that has gained notoriety during the past few years - see the Gamestop saga or the Wirecard case. Opposed to 'normal' investing or long-selling, where you hope a stock gains value, short-selling means that you speculate that a stock will lose value. Now you may wonder how you could make money off of that and that is a bit complicated but bear with me:

The way investors make money off short-selling is by buying a stock and selling it to a third party for a fixed time period. After this time period passes, the investor buys back the stock. Ideally, if the stock has lost value, the investor buys it back for less than they sold it for. The difference is what they make in profit.

A simple example: I have bought stocks for $ 1000 and I believe the company will lose value within the next six months. I sell the stock to you for $ 1000. Over the period of 6 months, the stock loses 30% of its value. I buy back the stocks for $ 700 and have made $ 300 profit.

You can short stocks in most online broker apps but short-selling is more risky than long-selling. If the company gains value you can technically lose more money than you have invested. Nonetheless, people have made a lot of money off short-selling so I thought I'd mention it.

Copy-trading

Copy-trading is a service that some online brokers offer. It means that you directly copy the investments of a (more experienced) investor. Instead of picking stocks yourself, you set a fixed amount and the app automatically invests that amount in the same way that the person you copy invests. This can be a nice option if you don't want to spend a lot of time informing yourself about what to buy.

Hope you learned something!

Best,

Em

6 notes

·

View notes

Text

Top 2024 Growth Strategy Unveiled!

EM Investment High Yields, Select Investments EM Investment represents an investment strategy primarily focused on Long Equity, curated by eToro Popular Investor Elio Ministeri. The strategy is crafted to attain significant long-term capital growth by strategically investing in undervalued securities globally. MORE Top 2024 Growth Strategy Unveiled Unlocking Growth: A Glance into the 2024…

View On WordPress

#Annual Gain#copy trading etoro#copytrading#Diversification#Earnings Valuation Model#etoro#etoro bitcoin#etoro copy trading#etoro italy#etoro login#etoro popular investor#etoro porfolio#Financial Resilience#Investment Strategy#Large-Cap Companies#Long-Term Growth Prospects#Market Opportunities#Monthly Performance#Portfolio Growth#Resilient Balance Sheets#Russell 1000 Growth Index#Stock Selection

0 notes

Text

Forex Trading: How to maximize your profits with a market maker broker

As a novice trader, you may come across the term "market trades" or "market makers" in the context of Forex trading. In this post, we will look at what market makers are and how they affect your trading.

Market makers are financial institutions, such as banks or brokers, that provide liquidity in the market by acting as buyers and sellers of currency pairs. They play an important role in the Forex market by providing liquidity and ensuring that there is a buyer and seller for any currency pair.

Some of the best market maker brokers in the Forex market in 2024 include:

CMC Markets: Best market broker with the most number of currency pairs 1. eToro: Best Forex broker for social trading 1. easyMarkets: Good Forex broker with the most base currencies 1. IG: Forex broker with the best range of markets 1. When choosing a market broker, make sure they have low spread costs and no commissions. This will help you maximize your profits and minimize your losses.

I hope this post has helped you understand what market trades are and how they affect your Forex trading.

5 notes

·

View notes

Text

between this blog and starbucks, @ossifer-bones is the more stable investment. trading smart = money smart = success.. #eToro #investment

3 notes

·

View notes

Text

Earn money online ai

There are several ways to earn money online. Here are a few popular methods:

Freelancing: Offer your skills and services on freelance platforms such as Upwork, Freelancer, or Fiverr. You can provide services like writing, graphic design, programming, virtual assistance, and more.

Online tutoring: If you have expertise in a particular subject, you can become an online tutor. Platforms like Tutor.com, VIPKid, and Chegg Tutors connect tutors with students who need help.

Affiliate marketing: Promote products or services through affiliate links on your website, blog, or social media platforms. When someone makes a purchase through your link, you earn a commission.

Online surveys and tasks: Participate in paid online surveys, such as Swagbucks or Survey Junkie, or complete small tasks on platforms like Amazon Mechanical Turk or Clickworker.

Selling products online: Set up an online store on platforms like Shopify, Etsy, or Amazon and sell products of your own creation or source products from wholesalers or manufacturers.

Content creation: Start a YouTube channel, podcast, or blog and monetize it through advertising, sponsorships, or crowdfunding platforms like Patreon.

Online market trading: Engage in buying and selling stocks, cryptocurrencies, or other financial instruments through online trading platforms like eToro or Robinhood. Please note that trading involves risks, and it's important to educate yourself before getting involved.

Remember, earning money online requires effort, consistency, and sometimes initial investment. It's important to research and choose the methods that align with your skills, interests, and goals.

#earn money online#make money online#how to earn money online#how to make money online#earn money#earn money from home#make money online 2023#how to make money online 2023#earn money online without investment#best way to make money online#make money online for free#easiest ways to earn money#make money online 2022#how to earn money#earn money online 2023#best way to earn money online#make money#easy ways to make money online#how to earn online

3 notes

·

View notes

Text

how to earn money online

There are numerous ways to earn money online, and the method you choose will depend on your skills, interests, and the amount of time and effort you are willing to invest. Here are some popular methods for making money online:

Freelancing: If you have skills such as writing, graphic design, programming, or social media management, you can offer your services on freelancing platforms like Upwork, Freelancer, or Fiverr. Clients post projects, and you can bid on them or create gig packages to attract clients.

Online tutoring: If you excel in a particular subject, you can become an online tutor. Many platforms, such as VIPKid, Tutor.com, or Chegg, allow you to teach students from around the world.

Affiliate marketing: This involves promoting other people's products or services and earning a commission for every sale or lead generated through your referral. You can join affiliate programs offered by companies like Amazon, ClickBank, or Commission Junction.

Online surveys and microtasks: Websites like Swagbucks, Survey Junkie, or Amazon Mechanical Turk pay you for completing surveys, watching videos, or performing small tasks.

E-commerce: You can create an online store and sell products either through your website or platforms like Shopify, Etsy, or eBay. You can sell physical products, digital goods, or even dropship products from suppliers.

Content creation: If you enjoy creating videos, you can start a YouTube channel and monetize it through ads, sponsorships, or crowdfunding on platforms like Patreon. Similarly, you can start a blog and earn money through advertising, sponsored content, or affiliate marketing.

Online market trading: If you have knowledge of stocks, cryptocurrencies, or forex, you can participate in online trading platforms like Robinhood, eToro, or Coinbase. Note that trading involves risks and requires careful research and understanding.

Online freelancing platforms: Websites like Amazon's Mechanical Turk or Upwork offer various tasks, such as data entry, transcription, or virtual assistance, which you can complete for payment.

Remember, earning money online often requires dedication, persistence, and acquiring the necessary skills. Be cautious of online scams, do thorough research, and consider starting with smaller tasks or projects before venturing into more significant commit

Click here

#howtoearnmoneyonline#howtoearnmoney#howtoearnmoneyfromhome#earnmoneyonline#earnmoney#howtomakemoneyonline#howtoearnmoneyfast#makemoney#workfromhome#makemoneyonline#makemoneyfromhome#howtomakemoneyfast#onlinebusiness#howtomakemoney#makemoneyfast#waystomakemoneyonline#howtomakemoneyfromhome#waystomakemoney#onlineearnmoney#affiliatemarketing#howtomakeeasymoney#easywaystomakemoney#howcanimakemoney#howtomakequickmoney#earnmoneyfromhome#quickwaystomakemoney#onlineearning#waystomakemoneyfast#business#earn

4 notes

·

View notes

Text

How to Find the Best Trading Platform

As more and more people are turning towards online trading, the demand for trading platforms is increasing rapidly. With the plethora of options available, it can be challenging to choose the right trading platform that suits your needs. In this article, we will guide you through the process of finding the best trading platform that meets your requirements.

Understanding Trading Platforms

Before we dive into how to choose the best trading platform, it is essential to understand what trading platforms are and what they offer. Trading platforms are software applications that enable traders to buy and sell financial instruments, such as stocks, bonds, options, and currencies. They provide a range of features, including real-time market data, charting tools, research, and trading automation.

Factors to Consider When Choosing a Trading Platform

When selecting a trading platform, it is crucial to consider various factors, including:

Security

Security is one of the most critical factors to consider when selecting a trading platform. Make sure the platform you choose is secure and employs robust security measures to protect your data and assets. Look for platforms that offer two-factor authentication and encryption to secure your account.

User Interface

A user-friendly interface is essential when it comes to trading platforms. The platform should be easy to navigate and use, with clear and concise menus and options. A cluttered or complicated interface can make trading difficult and time-consuming.

Fees and Commissions

Fees and commissions can vary significantly between trading platforms. Make sure to choose a platform that offers transparent and competitive pricing. Consider the fees for trading, account maintenance, deposits, and withdrawals.

Available Markets

Different trading platforms offer access to different markets. Some platforms specialize in specific markets, such as stocks or cryptocurrencies. Make sure to choose a platform that offers the markets you are interested in trading.

Customer Support

Customer support is another essential factor to consider when choosing a trading platform. Ensure the platform provides responsive and helpful customer support through various channels, such as email, phone, and chat.

Mobile App

Having a mobile app for trading platforms is a significant advantage. It allows traders to trade on the go and monitor their investments at any time. Choose a platform that offers a mobile app compatible with your device.

Types of Trading Platforms

There are different types of trading platforms available, each with its features and advantages. The three most common types of trading platforms are:

Web-based Trading Platforms

Web-based trading platforms are accessible through a web browser and do not require any installation. They offer a range of features, including real-time data, charting tools, and research. The advantage of web-based platforms is their accessibility from any device with an internet connection.

Desktop Trading Platforms

Desktop trading platforms are software applications that need to be installed on your computer. They provide advanced features, including customization options and trading automation. The advantage of desktop platforms is their speed and reliability.

Mobile Trading Platforms

Mobile trading platforms are mobile apps that allow traders to trade and monitor their investments from their mobile devices. They offer a range of features, including real-time data, charting tools, and research. The advantage of mobile platforms is their accessibility and convenience.

Top Trading Platforms

Here are some of the top trading platforms that you can consider:

eToro

eToro is a social trading platform that allows users to copy the trades of successful traders. It offers a range of markets, including stocks, cryptocurrencies, and commodities. The platform is user-friendly and has a social network-like interface.

Robinhood

Robinhood is a commission-free trading platform that offers a range of markets, including stocks, options, and cryptocurrencies. The platform is mobile-first and has a simple and easy-to-use interface.

TD Ameritrade

TD Ameritrade is a comprehensive trading platform that offers a range of markets, including stocks, bonds, options, and futures. It has a user-friendly interface and provides a range of research and educational resources.

Interactive Brokers

Interactive Brokers is a professional-grade trading platform that offers a range of markets, including stocks, options, and futures. It provides advanced trading tools, such as algorithmic trading and trading automation.

Plus500

Plus500 is a CFD trading platform that offers a range of markets, including stocks, cryptocurrencies, and commodities. It is user-friendly and offers competitive pricing.

2 notes

·

View notes

Text

How to maintain your privacy on the Internet

🔥🔥👇

How to Protect Yourself from Cyber Attacks: A Guide to Enhancing Your Cyber Security

🔥🔥👇

The best social networking apps

🔥🔥👇

How to manage applications on Android

🔥🔥👇

The most popular ways to profit and trade on etoro🔥🔥👇♥️

https://bit.ly/44ieS

2 notes

·

View notes