#etoro minimum deposit

Explore tagged Tumblr posts

Text

10 Best United States Forex Brokers in 2025

The U.S. Forex market is highly regulated, ensuring a secure trading environment. With numerous brokers available, choosing the right one is crucial for your trading success. Here are the top 10 U.S. Forex brokers in 2025.

Key Factors to Consider in a Forex Broker

Regulation & Security – Ensure the broker is regulated by the CFTC and NFA.

Spreads & Fees – Low spreads and transparent fees maximize profitability.

Leverage & Margin – U.S. brokers offer up to 50:1 leverage for major currency pairs.

Trading Platforms – Look for MT4, MT5, or proprietary platforms with advanced tools.

Customer Support – Reliable 24/7 support is essential for smooth trading.

Top 10 U.S. Forex Brokers in 2025

The U.S. Forex market is highly regulated, providing a secure environment for traders. Here are the top 10 brokers in 2025, known for their strengths in various trading aspects:

FOREX.com - Best Overall Offering comprehensive tools, educational resources, and robust platforms, FOREX.com stands out for its strong regulatory compliance and suitability for all trader levels.

OANDA - Best for Beginners With a user-friendly interface, no minimum deposit, and transparent pricing, OANDA is ideal for new traders looking to start their Forex journey.

IG US - Best for High Leverage Known for offering leverage up to 50:1, IG US is a great choice for experienced traders who need advanced tools and high leverage.

NinjaTrader - Best for Algorithmic Trading This broker excels in algorithmic and automated trading with customizable strategies and advanced charting tools.

Interactive Brokers (IBKR) - Best for Advanced Traders Providing access to a wide range of instruments and low commissions, IBKR is perfect for professional traders looking for comprehensive research tools and advanced trading options.

eToro USA - Best for Copy Trading eToro’s innovative copy trading features allow beginners to mirror successful traders, making it an excellent platform for those who prefer a hands-off approach.

ATC Brokers - Best for ECN Trading ATC Brokers offers direct market access and transparent pricing, ideal for traders seeking efficient execution speeds and no hidden fees.

ThinkMarkets - Best for Both Beginners and Professionals Combining competitive pricing, advanced tools, and fast execution, ThinkMarkets suits both novice and seasoned traders.

Trading.com - Best for Fast Execution Specializing in ultra-fast execution with low latency, Trading.com is perfect for traders who prioritize speed and efficiency.

TD Ameritrade (Charles Schwab) - Best for Professional Traders With access to over 70 currency pairs and powerful tools like Thinkorswim, TD Ameritrade offers an excellent platform for serious traders.

#SureShotFX#SSF#Forex Broker#Forex Broker USA#Forex Broker Reviews#forex#forextrading#forex education#currency markets

0 notes

Text

FiatVisions · Company Summary

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

What is FiatVisions?

FiatVisions is a brokerage firm that offers a variety of trading instruments across different asset classes, including Forex pairs, commodities, indices, and stocks. It provides a proprietary trading platform bundled with features like raw pricing, fast order execution, market depth, multiple execution modes, and a broad product offering. FiatVisions provides various types of accounts, including BEGINNERS, BASIC, SILVER, GOLD, and VIP accounts, each with different minimum deposit requirements. The brokerage firm also offers different levels of leverage depending on the type of asset being traded.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

FiatVisions Alternative Brokers

There are many alternative brokers to FiatVisions depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - Known for offering a wide range of CFD products, Plus500 is an attractive choice for traders looking for exposure to various global markets.

Degiro - Particularly popular in Europe, Degiro offers low-cost trading and a user-friendly platform, making it a good choice for cost-conscious investors in the European market.

eToro - Renowned for pioneering social trading, eToro is an excellent choice for those interested in leveraging the knowledge of other successful traders through copy trading.

Is FiatVisions Safe or Scam?

It appears that FiatVisions has no valid regulation. Regulatory oversight is a significant aspect of ensuring the safety and reliability of a brokerage firm. Lack of regulation can be a red flag because it means the broker isn't held to any specific standards of conduct set by regulatory bodies, which are designed to protect traders.

Thus, given the lack of regulation and multiple reports of withdrawal issues and potential scams, it's difficult to confidently deem FiatVisions a safe broker at this time. It's critical for potential clients to thoroughly research any brokerage they consider using, ensuring they are appropriately regulated and have a history of reliable, transparent operations. It would also be wise to consider user reviews and any reported issues seriously.

Market Instruments

FiatVisions offers a variety of forex pairs for trading. This involves the simultaneous buying of one currency and selling of another. The pairs could include major, minor, and exotic currency pairs.

FiatVisions also offers trading involving commodities such as gold, oil and agricultural products. Such trades usually involve futures contracts, where you agree to buy or sell a commodity at a specific price at a future date.

There are probably several index-based trading products available through FiatVisions. A group of equities called an index serve to represent a certain market or sector of a market. Investors can purchase these through exchange-traded funds (ETFs) or index funds.

And, FiatVisions allows traders to buy and sell stocks of individual companies. Profits can come from dividends (profit distribution) and capital gains (selling shares at a price higher than the purchase price).

0 notes

Text

FiatVisions · Company Summary

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

What is FiatVisions?

FiatVisions is a brokerage firm that offers a variety of trading instruments across different asset classes, including Forex pairs, commodities, indices, and stocks. It provides a proprietary trading platform bundled with features like raw pricing, fast order execution, market depth, multiple execution modes, and a broad product offering. FiatVisions provides various types of accounts, including BEGINNERS, BASIC, SILVER, GOLD, and VIP accounts, each with different minimum deposit requirements. The brokerage firm also offers different levels of leverage depending on the type of asset being traded.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

FiatVisions Alternative Brokers

There are many alternative brokers to FiatVisions depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - Known for offering a wide range of CFD products, Plus500 is an attractive choice for traders looking for exposure to various global markets.

Degiro - Particularly popular in Europe, Degiro offers low-cost trading and a user-friendly platform, making it a good choice for cost-conscious investors in the European market.

eToro - Renowned for pioneering social trading, eToro is an excellent choice for those interested in leveraging the knowledge of other successful traders through copy trading.

Is FiatVisions Safe or Scam?

It appears that FiatVisions has no valid regulation. Regulatory oversight is a significant aspect of ensuring the safety and reliability of a brokerage firm. Lack of regulation can be a red flag because it means the broker isn't held to any specific standards of conduct set by regulatory bodies, which are designed to protect traders.

Thus, given the lack of regulation and multiple reports of withdrawal issues and potential scams, it's difficult to confidently deem FiatVisions a safe broker at this time. It's critical for potential clients to thoroughly research any brokerage they consider using, ensuring they are appropriately regulated and have a history of reliable, transparent operations. It would also be wise to consider user reviews and any reported issues seriously.

Market Instruments

FiatVisions offers a variety of forex pairs for trading. This involves the simultaneous buying of one currency and selling of another. The pairs could include major, minor, and exotic currency pairs.

FiatVisions also offers trading involving commodities such as gold, oil and agricultural products. Such trades usually involve futures contracts, where you agree to buy or sell a commodity at a specific price at a future date.

There are probably several index-based trading products available through FiatVisions. A group of equities called an index serve to represent a certain market or sector of a market. Investors can purchase these through exchange-traded funds (ETFs) or index funds.

And, FiatVisions allows traders to buy and sell stocks of individual companies. Profits can come from dividends (profit distribution) and capital gains (selling shares at a price higher than the purchase price).

0 notes

Text

Getting Started with Copy Trading: A Practical Guide

Forex trading can be complex and intimidating for newcomers, but copy trading offers a practical entry point. By copying the trades of experienced traders, you can bypass much of the initial learning curve and still benefit from the potential gains in the forex market. Here’s a comprehensive guide to get you started.

Setting Up Your Copy Trading Account

1. Choose a Reliable Platform

The first step is to select a reputable copy trading platform. Some of the popular ones include eToro, ZuluTrade, and Myfxbook. Ensure the platform is regulated and has positive user reviews.

2. Create an Account

Sign up for an account on your chosen platform. You'll need to provide personal information and verify your identity, a standard procedure for financial services.

3. Deposit Funds

After setting up your account, the next step is to deposit funds. Most platforms have a minimum deposit requirement, typically ranging from $200 to $500.

Finding and Evaluating Top Traders

1. Use Platform Filters

Most copy trading platforms have filters that allow you to sort traders based on various criteria like profitability, risk level, trading frequency, and more. Utilize these filters to narrow down your options.

2. Analyze Performance Metrics

Look at key performance metrics such as historical performance, drawdown, win rate, and average return per trade. These metrics will give you an insight into the trader’s consistency and risk management.

3. Review Trading Strategy

Each trader usually has a profile detailing their trading strategy. Make sure their approach aligns with your risk tolerance and financial goals.

4. Check Reviews and Ratings

Many platforms allow followers to rate and review traders. These reviews can provide additional insight into the trader's reliability and performance under various market conditions.

Managing Your Copy Trading Portfolio

1. Diversify Your Portfolio

Just like in traditional investing, diversification is key in copy trading. Instead of copying a single trader, spread your investments across multiple traders. This approach can mitigate risk and improve your chances of steady returns.

2. Monitor Performance Regularly

Keep a close eye on the performance of the traders you are copying. Forex markets are dynamic, and a trader performing well today might not do so tomorrow. Regular monitoring allows you to make timely adjustments to your portfolio.

3. Set Stop-Loss Orders

To protect your investment, set stop-loss orders. This feature automatically stops copying a trader if their losses exceed a certain amount, thereby limiting your potential losses.

4. Reinvest Profits

Consider reinvesting your profits to compound your returns over time. However, always keep a portion of your profits as a safety net. Read More

0 notes

Text

crypto

Gemini: New users can earn a flat $15 bonus in BTC after completing $100 of trading activity within their first 30 days. Alternatively, they can opt for up to 25% trading fee revenue share for higher trading volumes1.

Coinbase: Win a bonus ranging from $3 to $200 after making a cryptocurrency purchase on Coinbase.

Okcoin: Get $50 in BTC after making a trade of $100 or more.

Crypto.com: Lock up CRO tokens on the exchange to receive up to $50 in CRO.

TradeStation: Earn $50 in BTC by funding an account with $500.

M2: Receive up to 260 USDT in trading fee coupons.

Strike: Open an account and make a $1 deposit to get $5 in USD.

eToro: Purchase $100 worth of crypto to receive $10 in cash.

Lolli: Make a qualifying purchase to earn $5 in BTC.

iTrustCapital: Open a new IRA account and deposit at least $1,000 to receive $100.

Choice IRA: Open an IRA (minimum funding of $1) to get $50 in BTC.

Remember that some of these offers are based on referral codes, where both parties earn the bonus. Others are affiliate links, where the platform may earn a commission if you sign up1. Happy crypto exploring! 🚀🌟

signup

signup

signup

signup

1 note

·

View note

Text

Diving into Forex: A Beginner's Guide to Success

Are you interested in trading forex but don't know where to start? Don't worry, you're not alone. Forex, also known as the foreign exchange market, can be a highly profitable venture if approached with the right knowledge and strategy. In this beginner's guide, we will explore the basics of trading forex for beginners and provide tips for success.

1. Understanding Forex Trading

Forex trading involves buying and selling currencies in the foreign exchange market. The goal is to profit from the fluctuations in currency prices. Unlike the stock market, forex operates 24 hours a day, five days a week, making it a highly accessible market for traders worldwide.

2. Choosing the Best Forex Broker for Beginners in the UK

To begin your forex trading journey, you need to find a reliable broker. For beginners in the UK, it's essential to choose a broker that caters to your needs. Look for brokers that offer user-friendly platforms, educational resources, and low minimum deposit requirements. Some popular options for beginners in the UK include eToro, IG, and Plus500.

3. Educate Yourself on Forex Trading

Before diving into forex trading, it's crucial to educate yourself on the basics. Learn about the different currency pairs, market participants, and how economic factors affect currency prices. Familiarize yourself with technical and fundamental analysis techniques, as these will help you make informed trading decisions.

4. Start with a Demo Account

To practice your trading skills without risking real money, start with a demo account. Most forex brokers offer demo accounts that allow you to trade with virtual funds. Use this opportunity to familiarize yourself with the trading platform, test your strategies, and gain confidence before trading with real money.

5. Develop a Trading Strategy

A solid trading strategy is crucial for success in forex trading. Determine your risk tolerance, set realistic goals, and develop a plan that suits your trading style. Consider using a combination of technical and fundamental analysis to identify potential entry and exit points. Remember, consistency and discipline are key when executing your strategy.

6. Money Management

Proper money management is essential in forex trading. Set a risk-reward ratio for each trade to ensure that potential profits outweigh potential losses. It's also crucial to avoid overtrading and to use stop-loss orders to limit your losses. By managing your money effectively, you can protect your capital and minimize risks.

7. Stay Informed and Adapt

The forex market is constantly changing, so it's vital to stay informed about market news, economic events, and trends. Follow reputable financial news sources, monitor economic calendars, and stay connected with other traders through forums or social media. Adapt your trading strategies as market conditions evolve to maximize your chances of success.

8. Embrace Continuous Learning

Forex trading is a continuous learning process. Stay hungry for knowledge and continuously improve your trading skills. Attend webinars, read books, and follow experienced traders to gain insights and learn new strategies. As you gain experience, you may consider taking advanced courses or seeking mentorship to further enhance your trading abilities.

Final Thoughts

So, forex trading can be a rewarding venture for beginners, but it requires dedication, patience, and continuous learning. Choose the best forex broker for beginners UK has, educate yourself on the basics of trading, develop a solid strategy, and practice with a demo account. With time and experience, you can achieve success in the exciting world of forex trading.

#forex trading#spread betting brokers#online forex trading course#trading forex beginners#forex trading course#forex trading learn

1 note

·

View note

Text

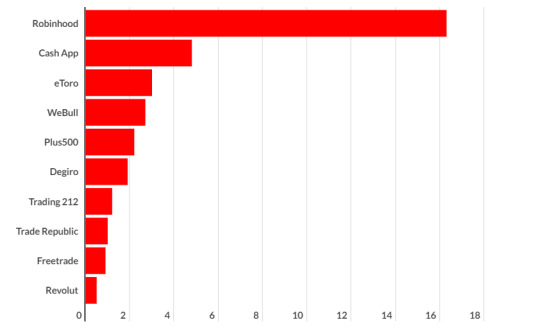

How eToro is dominating by expanding investments in UK online trading market

Buy Now

eToro is the trading and investing platform that empowers you to grow your knowledge and wealth as part of a global community. The main motive of this 207 founded company is to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

STORY OUTLINE

eToro is exploring in UK online trading market by

Factors driving eToro and in turn involving UK online trading market

Competitive landscape of Europe Wheat protein market with respective of MGP Ingredients

1.eToro has a leading position in UK online trading platform market.

Click here to Download a Sample Report

eToro is a major player in the online trading market in UK. eToro offers 3,000+ financial instruments across various classes, such as stocks, crypto and more. To enable eToro clients to use advanced trading features, such as advantage and short (SELL) orders, and to offer financial instruments that normally cannot be traded, such as indices and commodities, eToro utilizes Contracts for Difference (CFDs). Additionally, to enable traders and investors direct access to the market, some asset classes, such as stocks and crypto assets, offer direct ownership of the underlying assets, which we buy and hold in each client’s name.

eToro enables clients to deposit and withdraw using a variety of payment methods, the smartest of which is eToro Money, offering free and instant deposits with no FX conversion fees, and instant withdrawals. Other methods include wire transfers, bankcards, and more. eToro offers low minimum deposits and unified fees.

2.Factors driving MGP Ingredients and in turn involving Europe protein market

There are many drivers, which are making eToro lead in the UK online trading market. One of the reasons is that it provides various tools like CopyTrader, enables traders to replicate other traders’ actions in real time. To encourage top traders to be copied, eToro created the Popular Investor program.

Another unique product offered by eToro is Smart Portfolios, which are ready-made, investment strategies, offering thematic investment, such as medical cannabis, driverless cars, and people-based portfolios.

eToro has new investors which will be the stockholders of FinTech Acquisition Corp. V including Fintech V’s sponsors. Fintech V is a Special Purpose Acquisition Corporation (SPAC) that was formed for the purpose of combining with one or more businesses and remaining a public company. Additionally, several institutional investors will become new investors in eToro because of the transaction. These include ION Investment Group, Softbank Vision Fund 2, Fidelity Management & Research Company LLC, and Wellington Management.

3.Competitive landscape and Outlook of eToro in UK Online trading platform market

Click here to Ask for a Custom Report

eToro is sustaining its position in UK online trading platform market. It already is available in in 140 countries. eToro generated $1.2 billion revenue in 2021, a 103% year-on-year increase. In June 2021, eToro reached 20 million active users. It set an IPO valuation of $10.4 billion, a 316% increase on its 2020 valuation. 69% of users are from Europe, followed by Asia-Pacific (18%) and then the Americas (8%).

Looking at its most popular stocks Bitcoin is the most popular, it accounts for one in every 25 positions opened. Tesla, Microsoft and Apple are the most traded stocks. NASDAQ 100 is the most traded index. Oil is the most traded commodity.

CONCLUSION

eToro is an emerging online trading platform in the digital world and it got hike in the market majorly due to effect of Covid 19. eToro is a very versatile platform offering you the possibility to trade CFDs (for experienced traders) and with them, you can also invest in ETFs and real stocks (e.g. investors who are looking at the long term).

#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market#Emerging Players UK online trading platform Market

0 notes

Text

Best High Leverage Forex Brokers

The broker has no minimum deposit and no inactivity fee whatsoever, which could make the platform well suited to those who just want to try their hand at forex trading.To get more news about best high leverage forex brokers, you can visit wikifx.com official website.

There is a minimum deposit of $100 when you first open your account on AvaTrade, and you will be required to pay an inactivity fee of $50 a quarter after three months of inactivity, and a further fee of $100 after another 12 months. ActivTrades ActivTrades is a popular choice for forex trading.

Like most Financial Conduct Authority (FCA) regulated brokers, ActivTrades limits forex leverage to 30:1 for retail customers.

They do offer a professional account for qualified forex traders, though, where the leverage increases to 200:1. Only professional traders can access this higher leverage.While the trade cost with ActivTrades’ is relatively low at only $5.70, there is a minimum deposit of $10* when you first open your account.And, you will have to pay an inactivity fee of $10 a month after one year of account inactivity. eToro You may have heard of eToro before, and one of this popular broker’s offerings includes forex.

While eToro only has 49 currency pairs for you to trade, the minimum deposit amount of $10 when you first open your account is quite low. FXTM FXTM is another popular choice for forex trading. The broker is regulated in the UK by the FCA, meaning forex leverage is restricted to 30:1 for retail investors.

Meanwhile, if you’re a professional trader, you can access leverage of up to 2000:1 on FXTM. IG If you’re looking for a broker with a good selection of different currency pairs, then IG could be a good choice for you.Indeed, the broker has 205 currency pairs, making it the broker with the most pairs on this list.

It could also be a good platform for beginners too, as there is no minimum deposit, and the inactivity fee is only £12 a month after two years of inactivity.

0 notes

Text

eToro Trading Platform - How to Get started with eToro

eToro Trading Platform – How to Get started with eToro

Buying stocks and trading online successfully is as good as selecting a stockbroker. A good stockbroker has an in-depth insight into the global Fintech revolution. Hence, we want to take a quick review of the eToro Trading Platform. (more…)

View On WordPress

#best trading platform etoro#etoro#etoro account#etoro australia#etoro best trading platform#etoro copy trading#etoro copy trading platform#etoro crypto trading platform#etoro demo account#etoro forex trading platform#eToro investment platform#etoro login#etoro malaysia#etoro minimum deposit#etoro review#etoro social trading platform#etoro tips and tricks#etoro trading platform review etoro trading platform uk#etoro trading strategy how to buy stocks on etoro#how to start etoro trading#is etoro a good trading platform#is etoro a safe trading platform

1 note

·

View note

Text

Making Sure You Choose the Right Forex Broker

Technology is becoming smarter every day. If you have talked about forex trading or googled some stuff related to it, we’re sure you must’ve come across plenty of ads of forex brokers. Each claim to be the best and profitable for you.

It becomes overwhelming to decide which broker is the right for you. Your mind constantly buzzes with endless questions like:

· Is eToro the right forex broker?

· Is FxPro a safe choice?

· Does IG charges high fees?

· Is XM a good broker for a beginner like me? And the list goes on…

The following tips will help you choose the right broker amongst the many brokers in the market.

5 Tips for Selecting the Right Forex Trading Broker

1. Check the Licenses and Registration Details

The first tip for choosing the right forex broker is to check the regulatory bodies that oversee it. The about page of the broker’s website has the list of licenses from the regulatory bodies.

The more licenses the broker has, the merrier. Suppose there is a trade dispute between you and the broker. In that case, you can turn to regulatory bodies to resolve your issue.

However, if there are no licenses on the broker’s website, it is a red flag for you. Beware of dealing with such types of brokers.

Moving on, we have…

2. Study the Broker’s Account Types and Initial Deposit

Brokers offer different types of trading account to cater to traders’ need. The details of these accounts are mentioned on their website. Check the account types provided by the broker, along with the minimum deposit required to open the account.

The amount of the initial deposit varies from broker to broker. Some brokers charge as low as

$100; whereas, some brokers can require as much as $1,000.

Similarly, the spreads, leverage, and commission charged by brokers also vary. Some brokers provide low spreads and higher power to enable traders to get more value from their trade.

Choose the broker that perfectly fits your need. Up next, we have…

3. Quality of Customer Care Service

Forex trading is a global market and is open 24/7. The trader might need some help from his broker to resolve a trading query or ask about deposits and withdrawals details.

Hence, the customer service of a broker should be top-notch. His team should be available around the clock to answer traders’ questions and solve his needs. The good forex brokers in the market are available 24/7 and respond to their clients via email, call, and live chat.

The 4th tip for choosing the right broker is understanding the trading platform they offer.

4. Trading Platforms Offered

Currency trading platforms give access to the forex market. The broker can offer you different types of platforms, either in the form of downloadable apps or online web-trading portals. The majority of brokers in the market provide MetaTrader4, MetaTrader5, or cTrader to their clients.

Study the pros and cons of trading platforms provided by the broker. You can also try your hands at the demo account to experience the broker’s trading platform.

The last tip on the list is to check the availability of educational material on the broker’s website. Let’s talk more about it…

5. Educational Material Available on its Website

New traders need a proper understanding of forex terms, market updates, and open profitable trades. A few brokers in the market have rich educational material on their websites, including glossaries, video tutorials, webinars, eBooks, and courses.

The quality of educational material available on the broker’s website shows its proficiency and knowledge about the forex. An abundant and good quality educational material signifies that the broker is not an amateur in the market. He is experienced and knows the forex trading arena really well.

Conclusion

The first step towards profitable forex trading is finding the best forex broker. You have to make sure that you are opening and funding your account with a broker who is experienced, reputable, and competent in the market.

The internet has hundreds of forex brokers. Unfortunately, not all of them are trustworthy. Many fraudulent entities portray themselves as brokers but shut down overnight and run away with traders’ funds. Hence, beware of such scammers and always conduct thorough research before signing up with the forex broker.

2 notes

·

View notes

Text

Honest Forex Broker Review - Fx Pro

Fx Pro Trading Brokerage Fully Reviewed

In this summary we are going to make a fully reviewed explanation of Fx Pro trading brokerage in some detail.

About FxPro

Founded in 2006, FxPro has executed more than 500 million orders since its inception and has serviced more than 1.8 million clients in over 173 countries. As of 2021, FxPro lists over $100m in Tier 1 Capital and has more than 200 employees across its 4 offices.

The FxPro brand holds regulatory licenses in the United Kingdom (UK) under FxPro UK Limited, Cyprus under FxPro Financial Services Limited, South Africa, and the Bahamas. Making Fx Pro a highly trusted broker by many retail & institutional traders.

FxPro competes among the top MetaTrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The only drawback to an otherwise balanced forex broker is pricing that is slightly higher than the industry average.

In the below table please take your time to view some of Fx Pro's features & benefits:

Start Trading Like A Pro With Fx Pro

Is FxPro Safe?

FxPro is considered very low-risk, with an overall Trust Score of 93 out of 99. FxPro is not publicly traded and does not operate a bank. FxPro is authorized by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). FxPro is fully authorized & regulated by the following tier-1 regulators: Financial Conduct Authority (FCA). Fx Pro is extremely unlikely to be a scam broker. and has been tried & tested by Fx Brokers Empire.

Commissions and Fees FxPro's pricing is slightly higher than the industry average, putting it at a small disadvantage compared to its peers, such as Etoro or HF Markets, who both also offer the full MetaTrader and cTrader suites just like FxPro does. However what they lose in price is far outweighed with better options & service. Execution method: On FxPro MT4, you can choose either variable or fixed spreads. For the variable spread pricing, there are two types of execution-based pricing: instant and market. Instant execution is subject to requotes but no slippage, while market execution has the potential for slippage but without requotes. Commissions: FxPro offers its most competitive spreads on its cTrader platform, which uses commission-based pricing. FxPro's effective spread to trade EUR/USD is roughly 1.27 pips, based on 0.37 average spread + 0.9 pip commission equivalent on cTrader, using August 2020 data. Spreads: FxPro's floating rate model (variable spread) is available on both MT4 and MT5, with EUR/USD spreads of 1.57 pips for accounts on market execution (1.51 pips on MT5) and 1.71 for accounts with instant execution, as per August 2020 data from FxPro. Fixed pricing: On MT5, there is no fixed spread offering, and only market execution is available. Other platforms such as MT4 and web traders offer fixed pricing models. Active traders: FxPro offers an Active Trader program, & provides loyalty rewards for its longstanding traders. Executing large orders: Without question, FxPro's best feature is its ability to execute large trading orders, which can be placed with no minimum distance away from the current market price. A high liquidity broker which is important for high frequency & big money traders

Platforms and Tools Thanks to offering MetaTrader, cTrader, and its own in built proprietary FxPro Edge web platform, traders at FxPro have a diverse selection of platform options depending on their trading style. Both beginners & experts can enjoy trading and perform with there respective platforms. MetaTrader suite: FxPro offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform for web and desktop. A notable add-on is available for MT4 which is the suite of trading tools from Trading Central that can be rather helpful. cTrader: The FxPro cTrader platform is available for web and desktop. The cAlgo platform can also be used to enable algorithmic trading when using cTrader at FxPro. Proprietary platform: FxPro Edge is a light web-based platform that has robust charts and a responsive design. There are a few default layouts, and users can drag and drop the modules to rearrange them and add new widgets. Overall, there is a good foundation established for the future, especially for such a new in built platform. There will definitely be more updated features to this platform to enhance traders performance. Research FxPro provides great daily market updates and analysis on its blog, along with content from third-party providers. Overall, we found the written articles from FxPro's in-house staff to be of a good quality. More Video content would help fill the gap in research, as FxPro's YouTube channel is mostly webinars, platform tutorials, and promotional videos. FxPro News blog: There are multiple articles per day available on FxPro's dedicated blog, including its 'Market Snapshots' series. These articles provide a daily outlook and are nicely organized, making it easy to consume, understand & apply in volatile market conditions. Traders dashboard: FxPro has a client portal where users can access sentiment data for various symbols and forex pairs, along with the trading session times and a summary of gainers and losers. There is also an integrated economic calendar. Adding trading capabilities to the client portal, or merging these features with the Edge platform, would help to centralize these resources in one place.Fx Pro Education FxPro has a general education section where it provides written materials, along with some educational videos on its website. Overall, FxPro has a good foundation of educational content. Expanding its coverage and adding other videos on some more advanced trading elements would balance out the FxPro educational offering.Written content: FxPro's educational section features mini cards with key information and short paragraphs explaining things like "what is a stop out" in less than six sentences. There are 36 cards in the Psychology section and four other areas, each with a collection of learning cards. There is even progress tracking, so you know which modules or chapters you have finished, which is a nice touch.

Mobile Trading

Alongside providing its proprietary FxPro Direct app for trading, account management, and basic market news, FxPro's mobile lineup is powered by the same third-party providers as its desktop and web-based platforms: MetaTrader (Meta Quotes) and cTrader (Spotware).

cTrader: FxPro's white-labeled version of cTrader is consistent with the web-based platform, offering traders a really friendly & easy to use trading experience with a variety of trading tools. As far as third-party mobile apps go, cTrader is very versatile.

MetaTrader: The mobile versions of the MT4 and MT5 platforms are presented as standard from the developer with default features. In 2021, FxPro is a Best in Class MetaTrader Broker due to a range on smart trading indicators & strong liquidity.

FxPro Direct: The FxPro Direct app is the broker's proprietary mobile app which supports trading for users that have a CFD account, but is mainly optimized for account management. With just a quotes, trades, and history tab, we found that the FxPro Direct app was not very ideal for trading, compared to FxPro's other available mobile platforms. Meanwhile, the FxPro Edge platform is not yet available for mobile.

While FxPro does not stand out for its pricing, FxPro is a well-capitalized, trustworthy broker that offers multiple platform options, multiple execution methods, and, for professionals, can cleanly execute large orders. Fx Pro Trust FxPro scores quite well when it comes to reputation and trustworthiness. Most importantly, they are regulated in the United Kingdom, which is reputedly safer than some regulators in the EU. FxPro also advertises that they have one of the highest counterparty credit ratings in the industry, scoring a whopping 95 on a hundred point scale, where a high score indicates a lower risk of default or bankruptcy. They also participate in the Financial Services Compensation Scheme (FSCS) that allows clients to claim compensation in the event FxPro were to become insolvent up to £80,000. They also offer clients negative balance protection under new EU guidelines that prevent clients from losing more money than they have deposited. So they are clearly not worried about liquidity issues as they have good insurances in place. One negative for FxPro is the absence of guaranteed stop‑loss orders. Some brokers offer this feature for a fee, but this is not offered by FxPro at all. Fx Pro Special Features FxPro offers traders algorithmic trading through cTrader, which is an advanced algo and technical indicator coding application that allows traders to create and build algorithmic trading strategies and custom indicators. This is a smart technological feature that is not offered by many brokers and definitely worth checking out. FxPro also offers a Virtual Private Server (VPS) that enables clients to upload and run MT4 Expert Advisors and algo bots, 24 hours a day, without needing to keep the trading terminal running. These applications also allow for back testing of trading strategies.

Fx Pro Customer Support FxPro prides itself on its "five‑star customer service," specifically its multilingual, 24‑hour Monday‑through‑Friday (24/5) customer service team. Their live phone support operates in several locations with a toll‑free number in the U.K., France, Germany, UAE, and Russia. Live chat is offered for both live trading clients and prospective clients. Unlike other brokers, they have a physical office in London with a reception desk that is open from 7:30 a.m. to 4:30 p.m. Some social media support is available on Twitter, but this is mainly news related rather than specifically for customer support.

Please Note: The FCA has a ban in place for the sale of crypto-derivatives to UK retail consumers as from 6th January 2021.

Fx Brokers Empire's Conclusion For Fx Pro

We recommend trading with this broker and find it to be a very trustworthy broker. Due to its popularity and multi tiered regulations, Fx Pro is extremely unlikely to be a scam. Fx Brokers Empire recommends using Fx Pro for its high liquidity & execution service. Along with outstanding customer support based on our own experiences & our client feedback. Using there run on line 'Trade Like A Pro' they definitely have weight in there words and offer some decent trading features. We further recommend not to start a investment account with Fx Pro in excess of £25,000 initially until you get used to the platform offered and all its features. Fx Pro is a highly popular trading choice & has a well branded name that delivers results for its traders, across Europe, Asia & most definitely in the UK as a trusted broker.

Fx Brokers Empire rates Fx Pro as a 4.5/5 star broker

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Trading Like A Pro With Fx Pro

#fx pro review#detailed fx pro review#fxpro#fxproreview#fxproreviewed#fx pro reviewed#fx pro best fca broker review

3 notes

·

View notes

Video

tumblr

For the traders out there who are looking for a good CySEC regulated brokers, here are some of the best forex brokers with their minimum deposit:

@fxview - $5

@hotforex - $5

@fpmarket - $100

@Fxpro - $100

@Pepperstone - $200

@etoro - $200

Tell me which broker are you using currently and how their trading conditions are.

#forex#forexbroker#forextrading#regulated#regulatedbroker#cysec#cysecregulation#cysecbroker#fxview#hotforex#fpmarket#fxpro#pepperstone#etoro

2 notes

·

View notes

Text

eToro Review - An Efficient New Way to execute Stop-Loss orders on the Forex Market

youtube

eToro Review: The First Social Trading Platform for Internet Traders. eToro launched the first truly social trading platform, revolutionizing the financial online brokerage sector. This eToro review is going to give an in-depth overview of this innovative company and discuss some of its key features. eToro has a very simple yet powerful design that allows its users to trade anytime from any country.

eToro's Web-based demo account allows you to test and practice all your trades in the comfort of your home. In addition to that, it also enables you to get the hang of using this platform as a real trader. With its easy to use design, anyone can use it in a matter of minutes and be trading within a few hours. And while the demo account is useful, it does have its limitations - you cannot manage more than four funds at once and you cannot use your live account for larger trades.

However, with eToro's unique and powerful ability to provide leverage, you can multiply your trades multiple times. This way, your profits can go through the roof. And because you are trading multiple amounts, you are also able to take advantage of higher spreads (also known as margins). With eToro, big wins don't come too easily. In fact, they usually come with a lot of risk. You would need to apply constant pressure and follow your trading strategy to make big moves.

If you are interested in using eToro as your trading platform, there are a couple of requirements that you need to fulfill. First, you need to open an account with the currency conversion service provider. While eToro provides an excellent platform for free, you still need to pay a conversion fee to get into their money management service.

Next, you need to deposit some funds into your trading account. The amount depends on the service provider. Most providers would require a one-time $100 deposit. There are also some who allow three day rolling deposits, up to a limit of $500. In any case, most providers will require a deposit of at least five hundred dollars or more to open an account.

eToro uses two types of leverage: fundamental and derivative. This feature gives traders a lot of options when it comes to choosing the right instrument to trade. Traders can either use fundamental leverage to gain exposure to the stock market or to the foreign exchange market. Or, they can opt for the derivative leverages, which allow them to speculate on the value of different financial instruments, like currency pairs.

eToro makes life easier for day traders by offering a wide variety of equity and derivatives instruments. Forex brokers can now offer a full range of services, from electronic communications and settlement services to live online trading, electronic communications and settlement services. They can even provide mobile access for their clients. All this has greatly simplified the world of day trading. And since eToro allows trades to be executed in real time, rather than via a telephone line, this also makes transactions much faster.

And lastly, this new brokerage offers a social networking platform through which people can get to know each other better and share advice. This is in addition to its ability to offer electronic communications and settlement services. eToro's social networking platform allows traders to meet potential clients in person, develop business relationships and streamline relationships. This is in addition to all the other fantastic features, the firm has to offer.

The firm has a unique stop-loss and leveraged asset execution and distribution system that is unlike any other system. The eToro platform leverages all of the best features of traditional exchange traded products, but combines them into one place. Traders can execute their orders across a number of global markets, giving them real-time access to a diverse array of products. Leverage is available throughout all of the instruments available, and stop-loss is automatically adjusted to take advantage of volatility and market unpredictability.

In the past, brokers and dealers were forced to take their customers money and execute their orders by phone. However, the introduction of a demo account, or demo accounts, allows traders to practice their trading strategies without putting their money at risk. eToro offers two types of demo accounts - a standard "Pro" and a "Pro plus" demo. The standard demo is a great way for new customers to get a feel for the platform, and the Pro Plus demo accounts allow more time to explore the various features and services offered by the platform.

Traders may be asking themselves what type of security they will have to provide in order to open an account. eToro uses a robust deposit facility and works closely with financial institutions to ensure maximum security and privacy of customer details. To set up an account, a minimum deposit of either a fixed amount or a percentage of the balance is required. A separate credit card account with a guaranteed minimum deposit also serves as security for deposits.

https://www.facebook.com/EtoroReview1

https://twitter.com/EtoroReview_1

https://www.instagram.com/etororeview1/

https://medium.com/@etororeview1

https://www.flickr.com/photos/etororeview1/

https://etororeview95083677.wordpress.com/

1 note

·

View note

Text

eToro

Website The eToro website seems very sleek upon first view, there is a lot of information on the homepage and this brokerage is marketed in a different way to others in the way that it is marketed as a social trading site where traders can copy trades of other successful traders by simply mirroring them.

I do appreciate this website a lot, it is well designed and thought out and easy to use with a lot of graphics in order to help explain certain parts of how they work. The website is available in 20 different languages which makes it accessible to a larger audience around the globe. The Company eToro is a well known fin-tech company who started in Israel by three co founders. The company was formed in 2007 and trades under the eToro name. They have offices in the UK,Cyprus, Australia with their head office based in Israel. According to their website and after some research online I was able to confirm that they are regulated by CySEC, the FCA and ASIC. They are not listed on any stock exchange but they are a well known startup company which along with the fact that they are regulated reinforces their status as being a safer broker. Their Platform and Technical Information The platform has a variety of different assets to trade from, they primarily offer CFD’s but you can also choose from stocks and cryptocurrencies. One thing to note in regard to their stock trading is that it is commission free in the EU and if you are a non EU citizen it is 0.09% spread cost per side. The first negative I can find regarding the platform is that they seem to have a wide spread on the majority of the assets they have available to trade, for example the EURUSD pair at the time of writing had a 3 pip spread where normally you will find around a 1.5 pip spread on average amongst other reputable brokers. They offer a free demo account if needed and their live accounts are made simple by only having one live account type, with the minimum deposit being $200 for this account, although for US and Australian residents the minimum is $50 and for residents of Russia, China, Hong Kong, Taiwan, and Macau the minimum first time deposit is $500. It is easy and simple to open and there seem to be no complications when I opened an account to try. In terms of the platforms they have available to trade on it can only be done via their web trading platform or their mobile app, the app is available on iOS or Android.

The app is fairly easy to use and simple to navigate, it is a user friendly app and users will have no problem in trying to open and close trades or searching for different stocks or forex pairs. The web platform is also great, it has a nice modern feel and looks good on the eye. Again it is a user friendly experience and easy to navigate around and customers should have no problem when getting to grips with it. When it comes to deposits and withdrawals one thing that is important to note is that all accounts have to be in US dollars and so once your local currency is deposited into an eToro account it is then converted into US dollars. Deposits can be made via a variety of different ways including debit or credit card, bank wire, PayPal and many other online payment systems. In order to withdraw money the account holder will need to fill out a withdrawal form, they will in most cases authorise withdrawals back to the same account they were deposited from, they normally take five days to arrive in the clients account. Another important factor to note here is that there is a $25 withdrawal fee which is very high, not good eToro! Education eToro currently offer some educational tools for their traders, these seem to be in the form of live webinars. They do also offer a tool to copy other traders positions so in essence you can learn by understanding those other traders and how they take trades, as long as they are profitable! Customer Support eToro’s customer support is a 24/5 service available Monday through to Friday and they can be contacted via telephone or email and from past experience they seem to respond within two days.

So How Reliable Are They, What Have Clients Said? After having a look at some customer reviews it seems there are a mix of the majority being negative, some average and some positive. I have mentioned in an earlier review but this could be down to the fact that when traders lose money (especially new traders) they will tend to blame the markets or their brokers. There seems to be more complaints of stop losses not being hit or glitches in their system and failure of trades being copied from one trader to another. These seem like issues with their system to me and are things that can be fixed, there are some complaints of failures to withdraw which investors reading this should be aware of. I would say that eToro is a reliable company they are regulated by the FCA which is a well respect conduct authority in the UK and they are also regulated elsewhere so will be adhering to those rules which suggests to me that they are a broker that can be trusted. In Conclusion For me I feel that eToro are a reputable broker and although they may not be perfect for professional traders due to their large spreads, they are perfect for new investors who can copy trades from more experienced and profitable traders in order to help them increase their profits. The social feel to the eToro structure is a new take on trading and it is no wonder they seem to be leading the way in that sense as their user interface is very user friendly . All in all I would recommend this broker for the new less experienced traders out there. Read the full article

1 note

·

View note

Text

The Reasons Why Forex Trading Online Is Good For You

If you’re looking for new ways to make money, then you should consider forex trading online. Forex trading is a great way to get involved in the stock market and it can be a very lucrative endeavor. But why is forex trading so good for you? In this blog post, we will explore five reasons why forex trading online is beneficial for those who want to make money from the stock market. From leveraging your investments to increased liquidity and more, read on to find out why forex trading online could be the ideal fit for you. Understand more details about forex online

Why Forex Trading is Good for You

Forex trading online has grown in popularity in recent years, and there are good reasons why. First, forex trading is a great way to make money. You can trade forex online 24 hours a day, five days a week. And because the market is so large, you can usually find a good deal on the currency you're looking for.

Second, forex trading is a great way to diversify your investment portfolio. If you're only investing in stocks and bonds, you're missing out on an opportunity to make money in other markets. By adding forex trading to your investment mix, you can potentially increase your overall returns.

Third, forex trading is relatively low risk. Unlike some other investments, such as penny stocks or options trading, the forex market is very stable. This means that your potential losses are limited. And because you can trade with leverage (borrowing money to trade), you can control a much larger position than if you were trading with your own capital.

Fourth, forex trading is accessible to anyone with an internet connection. You don't need millions of dollars to get started - all you need is a computer and an account with a reputable broker. Plus, there are plenty of resources available online to help you learn about forex trading and how to be successful at it.

So if you're looking for a good way to make money and diversify your investment portfolio, consider forex trading online. It's

How to Start Forex Trading

Forex trading online is a great way to make money. It is also a good way to lose money. The key to success in forex trading online is to understand the risks and rewards involved.

When you are ready to start forex trading online, the first thing you need to do is find a broker. A broker is someone who buys and sells currencies on your behalf. There are many brokers available, so it is important to shop around and find one that suits your needs.

The next step is to open an account with the broker. This account will hold your funds and allow you to place trades. Most brokers require a minimum deposit, so be sure to check this before opening an account.

Once your account is open, you can start placing trades. When you place a trade, you are essentially buying or selling a currency pair. For example, if you think the US dollar will strengthen against the euro, you would buy dollars and sell euros.

Trading forex can be profitable, but it is also risky. Be sure to educate yourself about the risks and rewards involved before starting to trade.

Conclusion

Forex trading online is one of the best ways to make money in today’s economy. With a few simple steps, you can open an account and start trading from the comfort of your own home. The advantages are numerous – you get access to real-time prices, exchange rates, leverage options, low fees and more. Plus, it’s easy to learn how to trade forex online with the help of platforms like MetaTrader 4 or eToro Copy Trader. All in all, if you’re looking for a way to invest and make money without having to put up too much capital or risk then Forex trading may be something that could work out well for you! For more info please visit https://www.forexer.com

0 notes

Text

Best Forex Brokers Thailand 2021

If you are interested in getting involved in the trillion-dollar a day foreign exchange market, then choosing a top forex broker is extremely important. Finding the best forex brokers in Thailand with the best commissions, fees, platforms and customer support can be difficult as well as time-consuming. This is why we have done the work for you!To get more news about best forex brokers in thailand, you can visit wikifx.com official website.

How do you find the best forex broker in Thailand? Which Thai forex broker offers the best commissions and fees? Are they regulated to ensure your capital is safe?

Find the best Thai forex broker isn’t as easy as it seems. It requires detailed research, testing and analysis which can take some time. Fortunately, we have done this for you! Below we review the 5 best forex brokers in Thailand.

eToro – Overall Best Forex Broker in Thailand with Largest Copy Trading Service etoro best forex broker thailandIf you want to trade with the best forex broker in Thailand then eToro should be at the top of your list. The broker boasts the best and largest social trading platform in the world with more than 20 million users.

If you’re not familiar with social or copy trading, it basically means that you can view the performance of other traders and have their trades copied onto your own account. It’s the fastest-growing trend in the forex industry and one you seriously want to think about – take a look at some of the results below. 2. VantageFX – Best Forex Broker for ECN Trading Accounts vantagefx broker thailandVantageFX is considered one of the best forex brokers in Thailand for ECN trading accounts. ECN stands for ‘electronic communication network.’ It allows you to trade directly with the interbank market with no middleman, thereby accessing raw spreads. 3. Capital – Best Forex Broker in Thailand with Low Minimum Deposit ($20) capital best forex brokers in thailandCapital is the best Thailand forex broker for beginner traders. To open an account you only need a minimum deposit of $20 to start trading on more than 3,000+ global markets including foreign exchange, stocks, indices, commodities and cryptocurrencies. 4. Libertex – Best Forex Broker in Thailand with Tight Spreads forex broker thailand libertexLibertex is one of the best forex brokers in Thailand because it allows you to trade with tight spreads! The spread is the difference between the buy and sell price of an asset. It’s a cost every broker will charge – unlike Libertex which is considered a top-quality low spread broker. 5. AvaTrade – Best Broker for Account Types (CFD, Copy, Options) avatrade forex broker thailandAvaTrade is one of the best forex brokers in Thailand due to the range of account types they provide. For example, you can trade forex from a CFD, options or copy trading account. The options trading account is particularly useful as it’s not provided by many brokers.

1 note

·

View note