#UK Online trading platform Market analysis

Explore tagged Tumblr posts

Text

The Rise and Trends of UK Online Trading Platforms

Buy Now

What is the Size of UK online trading platform Industry?

UK online trading platform Market is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Mn by 2028. The ease of access to online trading platforms has democratized investing, enabling individuals to enter financial markets with lower barriers. These platforms offer user-friendly interfaces, educational resources, and a variety of trading instruments, making trading more approachable for both novice and experienced investors.

Additionally, the low-interest-rate environment has prompted individuals to seek alternative investment avenues to achieve higher returns. Thus, boosting demand for online trading platforms. technological advancements have revolutionized trading. Mobile apps, algorithmic trading, real-time market data, and AI-powered insights provide users with tools to make informed decisions swiftly.

Click here to Download a Sample Report

The convenience of trading on-the-go appeals to a tech-savvy generation, further fueling market growth. Furthermore, social trading features that allow users to share strategies and insights have contributed to community-building within these platforms, attracting new users through referrals.

UK online trading platform Market by interface Type

The UK online trading platform market is segmented by PC, Web based and Mobile. Digital Advertising is dominance in the market in 2022 UK online trading platform market. Digital advertising allows online trading platforms to precisely target their advertisements based on user demographics, behavior, and interests. This targeted approach ensures that the platforms' marketing efforts are directed at individuals most likely to be interested in trading, maximizing the return on investment.

UK online trading platform Market by end user application

The UK online trading platform market is segmented by sector type into Banking and financial, Brokers and Others. In 2022, the banking and finance is dominance in UK online trading platform market. Banking and finance institutions have the advantage of a well-established customer base. Many of these institutions have existing relationships with customers who use their services for traditional banking needs. Leveraging these relationships, they can cross-promote online trading platforms as an extension of their offerings, enticing customers to explore trading opportunities within a familiar and trusted environment.

UK online trading platform Market by Region

The UK online trading platform market is segmented by Region into North, South, East and West. In 2022, south region emerged as the dominant region in the UK online trading platform market. London's dominance in the UK online trading platform market is attributed to its status as a global financial hub, diverse investor base, innovation ecosystem, and favorable time zone, all of which collectively create a robust environment for online trading platforms to flourish.

Click here to Download a Custom Report

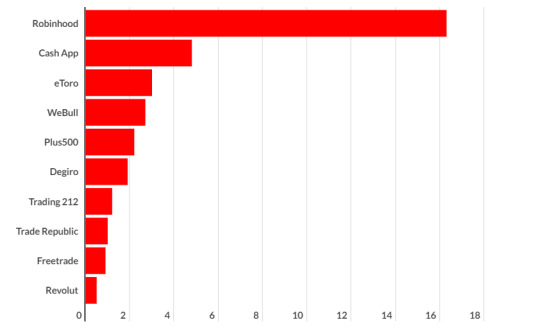

Competition Scenario in UK online trading platform Market

The UK online trading platform market is fiercely competitive, characterized by a diverse array of players competing for market share and customer loyalty. Established incumbents such as eToro, IG Group, and Plus500 continue to dominate the landscape, leveraging their brand recognition and extensive user bases. These platforms offer a range of assets including stocks, forex, and cryptocurrencies, with user-friendly interfaces attracting both novice and experienced traders.

Furthermore, traditional financial institutions like Hargreaves Lansdown have expanded into the online trading sphere, leveraging their existing customer base and reputation to compete in this digital arena. Additionally, the rise of fintech startups like Freetrade, with its emphasis on fractional share trading and community engagement, has introduced innovative approaches to trading.

What is the Expected Future Outlook for the UK online trading platform MARKET?

The UK Online Trading Platform market was valued at USD ~Million in 2022 and is anticipated to reach USD ~ Million by the end of 2027, witnessing a CAGR of ~% during the forecast period 2022-2028. The market is likely to experience sustained growth due to the increasing popularity of online trading among retail investors. The accessibility of trading platforms, coupled with a growing interest in financial markets, has led to a significant surge in users engaging in various asset classes, including stocks, cryptocurrencies, forex, and commodities.

Technological advancements will play a pivotal role in shaping the market's trajectory. Innovations such as mobile trading apps, algorithmic trading tools, and artificial intelligence-driven investment advisory services are likely to enhance user experiences and facilitate more informed decision-making.

Additionally, the integration of blockchain technology could improve transparency and security within the trading ecosystem. Moreover, Regulatory developments will continue to influence the market landscape. Striking the right balance between investor protection and market innovation will be a key challenge for regulators. The implementation of measures to ensure fair trading practices, prevent market manipulation, and safeguard user data will impact how trading platforms operate and evolve.

Furthermore, the market may witness a consolidation of platforms as larger players acquire smaller ones to expand their market share and capabilities. This consolidation could lead to enhanced platform features and improved service offerings for traders. Environmental, Social, and Governance (ESG) investing is another trend that could shape the future of online trading platforms. Investors are increasingly seeking opportunities that align with their values, and platforms that offer ESG-focused investment options might gain a competitive edge.

#UK online trading platforms market#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market

0 notes

Text

Mysteel UK Limited

Mysteel UK Limited - your reliable Forex partner

Mysteel UK Limited is a reputable forex broker that offers a wide range of services for traders in the currency market (Forex). The broker stands out for its reliability, professionalism and cutting-edge technology in order to provide customers with optimal conditions for successful trading in the financial markets.

Regulation and reliability: Is a licensed and regulated forex broker, which ensures the safety and security of client funds. The broker adheres to high standards of regulation and investor protection, which makes clients feel confident when working with the company.

Trading conditions: Offers competitive trading conditions that meet the needs of various traders. The broker provides access to a wide range of currency pairs and instruments, allowing clients to choose the most suitable assets to trade. In addition, Mysteel UK Limited offers low spreads, fast order execution and flexible leverage support.

Trading platforms: Offers advanced trading platforms that provide convenience and functionality for traders. These include popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer extensive market analysis, automated strategies and instant order execution.

Educational resources: The company values the education of its clients and provides extensive educational resources. The broker offers webinars, trainings, video tutorials and analytical materials that help traders expand their knowledge of the Forex market, develop trading skills and make more informed decisions.

Customer support: The broker has a responsive customer support team that is ready to help clients with any trading and technical issues. The support team is available 24/7 and can be reached through a variety of communication channels including phone, email and online chat.

Conclusion: Mysteel UK Limited is a reliable forex broker that offers clients a safe and profitable trading environment in the Forex market. With regulation, competitive trading conditions, advanced platforms, educational resources and professional customer support.

3 notes

·

View notes

Photo

register now for access to passes, on sale this friday at 11am PT. May awaits with arms outstretched. 🫶 $49.99 down payment plans available. www.justlikeheavenfest.com

1K notes

·

View notes

Text

Protein Bars Future of Healthy Snacking

The protein bar market has emerged as a key segment within the health and wellness industry, driven by increasing consumer demand for convenient, high-protein snacks. As lifestyles become busier and health consciousness rises, protein bars provide an ideal solution for meeting dietary needs without sacrificing convenience. This comprehensive analysis examines the drivers, challenges, trends, and future prospects of the global protein bar market.

Overview of the Protein Bar Market

Protein bars have gained popularity among diverse consumer groups, including fitness enthusiasts, working professionals, and those seeking healthier snacking options. Packed with essential nutrients and available in various flavors, they cater to the growing demand for functional foods that align with modern dietary preferences.

Market Drivers

Health and Fitness Awareness: The increasing emphasis on fitness and overall well-being has led to higher consumption of protein-rich diets. Protein bars, often associated with muscle recovery, energy, and weight management, are well-suited to this trend.

On-the-Go Nutrition: With busy lifestyles becoming the norm, consumers seek quick and portable food options. Protein bars offer a convenient, nutrient-dense alternative to traditional meals or snacks, appealing to urban and working populations.

Dietary Trends: High-protein diets, ketogenic regimens, and low-carb preferences have significantly boosted the demand for protein bars. Additionally, many brands now cater to vegan, gluten-free, and organic diets, widening their appeal.

Product Innovation: The introduction of functional ingredients, such as collagen, probiotics, and superfoods, has elevated the nutritional profile of protein bars. Improved taste and texture, along with creative packaging, have enhanced their marketability.

Challenges in the Market

Price Sensitivity: Protein bars are typically priced higher than traditional snacks, which can deter price-sensitive consumers. Balancing affordability with quality remains a key challenge for manufacturers.

Taste vs. Nutrition: Achieving the right balance between taste, texture, and nutritional content is critical. Consumers expect delicious flavors without compromising on health benefits, creating a delicate trade-off for brands.

Intense Competition: The market is highly competitive, with established players and emerging brands vying for consumer attention. Differentiating products through branding, formulation, and marketing is essential for success.

Regional Analysis

North America: The largest market for protein bars, driven by health-conscious consumers, a robust fitness culture, and widespread product availability.

Europe: Rising interest in clean-label, organic, and plant-based protein bars has fueled growth in this region, with countries like Germany and the UK leading the way.

Asia-Pacific: Rapid urbanization, growing disposable incomes, and increased awareness of healthy eating habits have propelled demand in markets like China, India, and Japan.

Latin America and the Middle East: Although still developing markets, these regions show potential for growth as health trends gain traction and distribution channels expand.

Trends Shaping the Protein Bar Market

Sustainability: Eco-friendly packaging and ethically sourced ingredients are becoming priorities for both consumers and brands.

Personalized Nutrition: Protein bars tailored to specific dietary needs, fitness goals, and health conditions are gaining traction.

E-Commerce Growth: Online retail platforms are playing a pivotal role in boosting market accessibility, offering wider product ranges and convenient delivery options.

Future Outlook

The protein bar market is poised for steady growth, driven by product innovation, expanding consumer awareness, and technological advancements in manufacturing and distribution. Brands that focus on sustainability, flavor variety, and customization are likely to lead the way. Moreover, untapped markets in developing regions offer significant expansion opportunities.

Conclusion

The global protein bar market represents a dynamic and rapidly evolving industry with immense growth potential. By addressing challenges like affordability and competition, while leveraging innovation and consumer trends, brands can solidify their presence in this thriving market. The future of protein bars lies in their ability to adapt to changing consumer demands and deliver high-quality, convenient nutrition solutions.

0 notes

Text

How to Start a Flowers Export Business in India: A Step-by-Step Guide

India is a global leader in floriculture, offering an array of vibrant flowers such as roses, marigolds, orchids, and jasmine. With the global demand for fresh flowers surging, venturing into the flowers export business in India can be both profitable and fulfilling. This comprehensive guide walks you through the essential steps to start your flowers export business, flowers export from India, supported by expert insights, actionable strategies, and relevant data.

Step 1: Understand the Market Dynamics

Global Demand for Indian Flowers

Indian flowers are highly sought after in markets like the USA, UAE, UK, Germany, and the Netherlands due to their quality and affordability. The global floriculture market is projected to grow steadily, with fresh cut flowers being a significant segment. India exports a variety of flowers, including roses, marigolds, and orchids, to countries like the USA, contributing significantly to the export of roses from India.

Conduct Market Research

Analyze target markets to understand their floral preferences and trends.

Identify high-demand flower varieties and seasonal spikes in demand.

Utilize tools like Google Trends and trade reports for actionable insights.

Competitor Analysis

Study successful Indian flower exporters to identify best practices.

Analyze their marketing strategies, pricing models, and logistics setups to find opportunities for differentiation.

Step 2: Develop a Business Plan

Define Your Niche

Decide whether to export fresh cut flowers, potted plants, or dried flowers. For instance, dried flowers export has gained traction due to its longer shelf life and global demand.

Research popular varieties like roses, lilies, or exotic orchids to align with market demand. Explore the HS code for flowers to streamline customs and export documentation.

Set Financial Goals

Estimate the initial investment for farming, packaging, and logistics.

Project revenue based on market data and competitor analysis. Utilize flowers export data to forecast growth trends.

Register Your Business

Choose an appropriate business structure (sole proprietorship, partnership, or private limited company).

Register your company with the Ministry of Corporate Affairs (MCA).

Obtain an Import Export Code (IEC) from the Directorate General of Foreign Trade (DGFT).

Step 3: Ensure Quality and Compliance

Source High-Quality Flowers

Partner with reliable growers or invest in your own floriculture farm. Tamil Nadu and Bangalore are key regions for flower export businesses in India, providing access to high-quality flowers.

Employ modern cultivation techniques, such as greenhouse farming, to ensure consistent quality.

Adhere to International Standards

Comply with phytosanitary regulations of the destination country to avoid rejections.

Obtain certifications like ISO 9001 and GlobalGAP to enhance credibility and build trust.

Packaging and Preservation

Use temperature-controlled packaging to maintain freshness during transit. For dried flowers export, focus on eco-friendly and durable packaging to preserve quality.

Opt for eco-friendly materials to cater to environmentally conscious buyers.

Step 4: Build a Supply Chain

Logistics and Transportation

Collaborate with freight forwarders experienced in handling perishable goods.

Explore air freight options for faster delivery to international markets. Bangalore, known for its robust logistics network, is a prime hub for flower export from India.

Establish Distribution Channels

Partner with wholesalers, retailers, and e-commerce platforms in target markets. Cut flower export from India often relies on partnerships with global wholesalers.

Consider setting up a direct-to-consumer (D2C) model via an online store.

Step 5: Market Your Business

Create a Strong Online Presence

Develop an SEO-optimized website to showcase your flowers, services, and USPs. Highlight your capabilities as a flower exporter in India.

Attend Trade Shows and Exhibitions

Participate in international floriculture trade fairs like IPM Essen and FloraHolland.

Network with industry professionals, wholesalers, and potential clients. Share insights about your expertise in exporting flowers from India to the USA.

Use Digital Marketing Strategies

Run targeted ads on platforms like Google and Facebook.

Leverage email marketing to keep clients informed about new products and special offers.

Step 6: Navigate Export Procedures

Documentation Requirements

Prepare the following essential documents for smooth export:

Commercial Invoice

Packing List

Certificate of Origin

Phytosanitary Certificate

Researching the dried flowers HS code and ensuring accurate documentation are crucial steps for compliance.

Customs Clearance

Work with customs brokers to streamline the clearance process.

Stay informed about export duties, taxes, and trade agreements affecting your business.

Step 7: Monitor Performance and Scale

Evaluate Key Metrics

Track critical metrics like sales, delivery timelines, and customer feedback.

Use analytics tools to measure the effectiveness of marketing campaigns.

Expand Your Reach

Explore new markets to diversify revenue streams. For example, dry flower export from India has shown immense potential in Western markets.

Invest in R&D for innovative packaging and preservation methods to attract premium buyers.

Conclusion

Launching a flowers export business in India is a rewarding endeavor with the potential to cater to a thriving global market. By following this step-by-step guide, you can navigate the complexities of the export process, establish a robust supply chain, and market your offerings effectively. Start your journey today and position your business as a key player in India’s growing floriculture industry.

0 notes

Text

Understanding the Forex Market in Italy.

The foreign exchange market, commonly known as forex or FX, is the world’s largest financial market, with a daily trading volume exceeding $6 trillion. Forex trading involves the exchange of currencies, allowing participants to profit from fluctuating exchange rates. In Italy, as in many other countries, the forex market has gained significant traction among investors, traders, and even small businesses looking to hedge currency risk.

What Does Forex Mean?

Forex, short for foreign exchange, refers to the global marketplace for buying and selling currencies. Unlike stock markets, forex trading operates 24/7, thanks to its decentralized nature. Participants include banks, corporations, governments, institutional investors, and individual traders.

Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The price of a currency pair reflects how much one currency is worth in relation to the other. For example, if the EUR/USD is trading at 1.10, it means 1 Euro is equal to 1.10 US Dollars.

Why is Forex Trading Popular in Italy?

Italy has a thriving community of forex traders due to several factors:

Accessibility: With online trading platforms, anyone with an internet connection can participate in the forex market.

High Liquidity: The forex market’s massive size ensures high liquidity, meaning traders can enter and exit positions easily.

Leverage: Forex brokers in Italy often offer leverage, allowing traders to control large positions with relatively small capital.

Economic Volatility: The Euro’s fluctuations against other currencies provide ample opportunities for Italian traders to profit.

How Can You Start Forex Trading in Italy?

Starting forex trading in Italy is straightforward if you follow these steps:

Learn the Basics: Understand forex terminology, market mechanics, and trading strategies. Many online resources and courses are available for beginners.

Choose a Broker: Select a reliable forex broker. Look for brokers regulated by reputable authorities such as CONSOB (Commissione Nazionale per le Società e la Borsa) in Italy. Ensure they offer a user-friendly platform, low fees, and robust customer support.

Open a Trading Account: Register for a demo or live trading account. A demo account is an excellent way to practice trading without risking real money.

Deposit Funds: Fund your trading account using bank transfers, credit cards, or e-wallets.

Develop a Trading Strategy: Decide whether you prefer day trading, swing trading, or long-term investing. A solid strategy is essential for consistent success.

Start Trading: Begin trading by analyzing currency pairs, using technical and fundamental analysis, and placing trades through your broker’s platform.

For reliable forex signals and expert guidance, visit Forex Bank Liquidity.

Key Forex Trading Terms

Pip: The smallest price movement in a currency pair, typically 0.0001 for most pairs.

Spread: The difference between the bid (buy) and ask (sell) prices.

Leverage: A tool that allows traders to control larger positions with less capital.

Margin: The amount of money required to open a leveraged position.

Stop-Loss: An order to close a trade automatically when it reaches a specified loss level.

Popular Currency Pairs in Italy

Italian traders often focus on major currency pairs, which include:

EUR/USD: The Euro/US Dollar pair is the most traded globally due to its high liquidity and low spreads.

GBP/EUR: Popular among traders monitoring the Eurozone and the UK economies.

USD/JPY: Offers high volatility and frequent trading opportunities.

EUR/CHF: The Euro/Swiss Franc pair appeals to those seeking stability.

Italy’s Forex Trading Regulations

The forex market in Italy is regulated to protect traders and ensure transparency. CONSOB oversees financial markets, including forex brokers. When choosing a broker in Italy, ensure they are CONSOB-registered or regulated by a reputable international body such as the FCA (Financial Conduct Authority) in the UK or CySEC (Cyprus Securities and Exchange Commission).

Economic Factors Influencing Forex Trading in Italy

Understanding the economic landscape is crucial for successful forex trading. Key factors influencing the forex market in Italy include:

European Central Bank (ECB) Policies: Italy, as a Eurozone member, is heavily affected by ECB monetary policies, such as interest rate decisions and quantitative easing.

Italian Economic Data: Indicators like GDP growth, unemployment rates, and industrial production impact currency movements.

Political Stability: Political events in Italy and the broader Eurozone can trigger volatility in the forex market.

Global Market Trends: The US Dollar, as the world’s reserve currency, often dictates broader market trends.

Benefits of Forex Trading in Italy

Flexible Trading Hours: The forex market operates 24/5, allowing Italians to trade after work or during other convenient times.

Diverse Strategies: From scalping to long-term investing, traders can adopt strategies that suit their risk tolerance and goals.

Global Market Exposure: Forex trading offers exposure to global economies, making it an attractive option for diversification.

Risks of Forex Trading

While forex trading offers immense opportunities, it’s not without risks:

Leverage Risk: High leverage amplifies both gains and losses.

Market Volatility: Sudden price swings can lead to significant losses.

Lack of Knowledge: Inadequate understanding of the market can result in poor decision-making.

To mitigate these risks, traders should focus on continuous learning, risk management, and using reliable forex signals from platforms like Forex Bank Liquidity.

Tools for Forex Traders in Italy

Modern forex trading relies on advanced tools to analyze and execute trades. Popular tools include:

Trading Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader are widely used for their robust features.

Economic Calendars: Track key economic events that impact currency prices.

Technical Indicators: Moving averages, RSI, MACD, and Bollinger Bands help traders identify trends and entry points.

Forex Signals: Platforms like Forex Bank Liquidity provide actionable signals to enhance trading performance.

Forex Trading Strategies for Italian Traders

Scalping: Involves making small profits from quick trades, usually within minutes.

Day Trading: Positions are opened and closed within the same trading day.

Swing Trading: Focuses on capturing short-to-medium-term price movements.

Position Trading: Long-term strategy based on fundamental analysis.

Why Choose Forex Bank Liquidity?

Forex Bank Liquidity is a trusted partner for Italian traders seeking consistent profits and expert support. Here’s why:

Accurate Signals: Receive precise forex signals for profitable trades.

Expert Guidance: Access 24/7 support from seasoned professionals.

Educational Resources: Learn and grow with in-depth market insights and tutorials.

Visit Forex Bank Liquidity to elevate your trading journey.

Final Thoughts

Forex trading in Italy offers incredible opportunities for financial growth and market engagement. By understanding the basics, choosing a reliable broker, and developing a sound strategy, Italian traders can thrive in the dynamic forex market. Whether you’re a beginner or an experienced trader, platforms like Forex Bank Liquidity provide the tools and insights needed to succeed.

Start your forex trading journey today and unlock the potential of the global currency market!

#forex education#forexsignals#forex robot#forexbankliquidity#digital marketing#bankliquidity#forextrading#forex expert advisor#forex market#forex

0 notes

Text

Generative Artificial Intelligence In Supply Chain Market 2024-2033 : Demand, Trend, Segmentation, Forecast, Overview And Top Companies

The generative artificial intelligence in supply chain global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Generative Artificial Intelligence In Supply Chain Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The generative artificial intelligence in supply chain market size has grown exponentially in recent years. It will grow from $0.28 billion in 2023 to $0.41 billion in 2024 at a compound annual growth rate (CAGR) of 43.4%. The growth in the historic period can be attributed to growth in computational power, growth in e-commerce, increasing availability of big data, increasing focus on automation, and growth in investment in AI research and development. The generative artificial intelligence in supply chain market size is expected to see exponential growth in the next few years. It will grow to $1.73 billion in 2028 at a compound annual growth rate (CAGR) of 43.7%. The growth in the forecast period can be attributed to increasing demand for real-time supply chain visibility, growing need for AI-powered supply chain planning tools, rising investment in AI for supply chain innovation labs, growing demand for AI in predictive logistics, and rising demand for advanced forecasting techniques. Major trends in the forecast period include technological advancements, telemedicine, blockchain technology, 5G technology, and internet of things.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/generative-artificial-intelligence-in-supply-chain-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The rising e-commerce is expected to propel the growth of the generative artificial intelligence in supply chain market going forward. E-commerce is the buying and selling goods and services over the Internet, involving transactions and business activities conducted through online platforms and mobile applications. The rise in e-commerce is due to the growing adoption of online shopping, advancements in digital payment technologies, and the expansion of internet access. Generative artificial intelligence (AI) is used in the e-commerce supply chain to optimize inventory management, enhance demand forecasting, streamline logistics, automate order processing, and personalize customer experiences by analyzing large volumes of data to create efficient, data-driven supply chain strategies. For instance, in November 2023, according to the International Trade Administration, a US-based Department of Commerce, consumer eCommerce was expected to generate $285.60 billion in revenue by 2025, accounting for 36.3% of the UK retail market as of January 2021. Additionally, eCommerce revenues in the UK are projected to grow at an average annual rate of 12.6% by 2025. Therefore, rising e-commerce drives the growth of generative artificial intelligence in the supply chain market.

Market Trends - Major companies operating in the generative artificial intelligence in supply chain market are focused on developing innovative technologies, such as cognitive solutions, to enhance predictive analytics and optimize supply chain operations. Cognitive solutions refer to advanced technologies that simulate human thought processes to analyze, interpret, and act on complex data. These solutions leverage artificial intelligence (AI), machine learning, and natural language processing to enable systems to understand, reason, and learn from data, much such as the human brain. For instance, in December 2023, Blue Yonder, a US-based supply chain management company, launched Blue Yonder Orchestrator, a generative AI tool that enables businesses to make more intelligent decisions and accelerate supply chain orchestration. This new capability leverages advanced AI algorithms to automate and optimize complex supply chain processes, enhancing efficiency and accuracy. Its key features include real-time data analysis, enabling dynamic inventory and logistics adjustments based on current conditions and forecasts. The system seamlessly integrates with existing supply chain infrastructure, providing actionable insights and recommendations to improve overall operational performance.

The generative artificial intelligence in supply chain market covered in this report is segmented –

1) By Component: Solutions, Software 2) By Deployment Mode: Cloud-Based, On-Premise 3) By End-User: Retail, Manufacturing, Healthcare, Other End-Users

Get an inside scoop of the generative artificial intelligence in supply chain market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=19483&type=smp

Regional Insights - North America was the largest region in the generative artificial intelligence in supply chain market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the generative artificial intelligence in supply chain market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the generative artificial intelligence in supply chain market are Amazon.com Inc., Microsoft Corporation, Deutsche Post AG, Intel Corporation, Accenture plc, International Business Machines Corporation, Cisco Systems Inc., Oracle Corporation, SAP SE, NVIDIA Corporation, Infosys Limited, Dematic Inc., Zebra Technologies Corporation, PTC Inc., Teradata Corporation, Blue Yonder Inc., L&T Technology Services Limited, Manhattan Associates Inc., Nitor Infotech Private Limited, Logility Inc., LLamasoft Inc., Covariant Inc., FourKites Inc., Kanerika Inc., ClearMetal Inc.

Table of Contents 1. Executive Summary 2. Generative Artificial Intelligence In Supply Chain Market Report Structure 3. Generative Artificial Intelligence In Supply Chain Market Trends And Strategies 4. Generative Artificial Intelligence In Supply Chain Market – Macro Economic Scenario 5. Generative Artificial Intelligence In Supply Chain Market Size And Growth ….. 27. Generative Artificial Intelligence In Supply Chain Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

How eToro is dominating by expanding investments in UK online trading market

Buy Now

eToro is the trading and investing platform that empowers you to grow your knowledge and wealth as part of a global community. The main motive of this 207 founded company is to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

STORY OUTLINE

eToro is exploring in UK online trading market by

Factors driving eToro and in turn involving UK online trading market

Competitive landscape of Europe Wheat protein market with respective of MGP Ingredients

1.eToro has a leading position in UK online trading platform market.

Click here to Download a Sample Report

eToro is a major player in the online trading market in UK. eToro offers 3,000+ financial instruments across various classes, such as stocks, crypto and more. To enable eToro clients to use advanced trading features, such as advantage and short (SELL) orders, and to offer financial instruments that normally cannot be traded, such as indices and commodities, eToro utilizes Contracts for Difference (CFDs). Additionally, to enable traders and investors direct access to the market, some asset classes, such as stocks and crypto assets, offer direct ownership of the underlying assets, which we buy and hold in each client’s name.

eToro enables clients to deposit and withdraw using a variety of payment methods, the smartest of which is eToro Money, offering free and instant deposits with no FX conversion fees, and instant withdrawals. Other methods include wire transfers, bankcards, and more. eToro offers low minimum deposits and unified fees.

2.Factors driving MGP Ingredients and in turn involving Europe protein market

There are many drivers, which are making eToro lead in the UK online trading market. One of the reasons is that it provides various tools like CopyTrader, enables traders to replicate other traders’ actions in real time. To encourage top traders to be copied, eToro created the Popular Investor program.

Another unique product offered by eToro is Smart Portfolios, which are ready-made, investment strategies, offering thematic investment, such as medical cannabis, driverless cars, and people-based portfolios.

eToro has new investors which will be the stockholders of FinTech Acquisition Corp. V including Fintech V’s sponsors. Fintech V is a Special Purpose Acquisition Corporation (SPAC) that was formed for the purpose of combining with one or more businesses and remaining a public company. Additionally, several institutional investors will become new investors in eToro because of the transaction. These include ION Investment Group, Softbank Vision Fund 2, Fidelity Management & Research Company LLC, and Wellington Management.

3.Competitive landscape and Outlook of eToro in UK Online trading platform market

Click here to Ask for a Custom Report

eToro is sustaining its position in UK online trading platform market. It already is available in in 140 countries. eToro generated $1.2 billion revenue in 2021, a 103% year-on-year increase. In June 2021, eToro reached 20 million active users. It set an IPO valuation of $10.4 billion, a 316% increase on its 2020 valuation. 69% of users are from Europe, followed by Asia-Pacific (18%) and then the Americas (8%).

Looking at its most popular stocks Bitcoin is the most popular, it accounts for one in every 25 positions opened. Tesla, Microsoft and Apple are the most traded stocks. NASDAQ 100 is the most traded index. Oil is the most traded commodity.

CONCLUSION

eToro is an emerging online trading platform in the digital world and it got hike in the market majorly due to effect of Covid 19. eToro is a very versatile platform offering you the possibility to trade CFDs (for experienced traders) and with them, you can also invest in ETFs and real stocks (e.g. investors who are looking at the long term).

#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market#Emerging Players UK online trading platform Market

0 notes

Text

Investi-Ray Review: A Complete Scam

Introduction

Investi-Ray, operating with the domain https://investi-ray.com/, is a forex broker that markets itself as a reliable and profitable trading platform. However, the truth is far from these claims. Being a non-regulated broker, Investi-Ray is a complete scam that employs deceptive and unethical tactics to lure unsuspecting investors. This review will detail why Investi-Ray is a scam and why it should be avoided at all costs.

Why Investi-Ray is a Scam

Non-Regulated Broker: Investi-Ray is not registered with any financial authority, making it a high-risk choice for investors.

False Advertising: Investi-Ray claims to offer high returns and advanced trading algorithms, but users quickly discover these promises are empty.

Evil Blackhat Marketing Tactics: The broker uses illegal and abusive marketing strategies, including using influential people to promote their cryptocurrency trading algorithms.

Poor Performance: The system’s algorithms are substandard, often placing random trades without any basis in technical or fundamental analysis.

No Risk Management Tools: Basic risk management tools are non-existent, exposing users to significant financial risks.

Cheaply Written Code: The software is poorly developed, frequently crashing and failing to execute trades as intended.

Money-Grab Scheme: Investi-Ray’s primary goal appears to be extracting money from users through expensive price plans rather than delivering promised results.

User Experiences

Many users have shared their harrowing experiences, highlighting the deceptive nature of Investi-Ray. Here are some unique case studies from European individuals who have lost significant amounts of money:

Case Study 1: James’s Story:

Location: Manchester, UK

Investment: £15,000

Experience: James invested £15,000 in Investi-Ray, lured by promises of high returns. Within a few weeks, his account balance dropped to zero due to random and unprofitable trades. Customer support was unresponsive, and James realized he had been scammed.

Case Study 2: Emma’s Story:

Location: Paris, France

Investment: €12,300

Experience: Emma saw ads featuring influential figures promoting Investi-Ray. She invested €12,000 but quickly noticed the platform’s poor performance and lack of risk management. Attempts to withdraw her remaining funds were unsuccessful, leaving her with nothing.

Case Study 2: Emma’s Story:Location: Paris, France

Investment: €12,300

Experience: Emma saw ads featuring influential figures promoting Investi-Ray. She invested €12,000 but quickly noticed the platform’s poor performance and lack of risk management. Attempts to withdraw her remaining funds were unsuccessful, leaving her with nothing.

Case Study 3: Robert’s Story:Location: Berlin, Germany

Investment: €20,250

Experience: Robert was attracted to Investi-Ray’s supposed advanced trading algorithms. However, he soon faced constant system crashes and erratic trade executions. Despite his efforts to manage his account, he lost all his money and received no assistance from customer support.

Case Study 4: Isabella’s Story:Location: Madrid, Spain

Investment: €10,000

Experience: Isabella invested €10,000 after seeing positive reviews online. However, the platform made unpredictable trades, and she lost her entire investment. Isabella later learned that Investi-Ray was not regulated, making it impossible to recover her funds.

Case Study 5: David’s Story:Location: Rome, Italy

Investment: €8,750

Experience: David invested €8,000 in Investi-Ray, believing in their high returns. The system repeatedly failed to perform as advertised, leading to significant losses. Attempts to contact the company for support or a reund were ignored.

Negative Sides of Using Non-Regulated Brokers

🚩Negative AspectDescription

❌False PromisesHigh returns and advanced algorithms are falsely advertised.

🛠️Poor Software QualityThe trading system is cheaply written, prone to crashes and technical failures.

🔄Random TradesThe system places trades without any logical or analytical basis.

📉No Risk ManagementBasic tools to manage trading risk are absent, leading to significant financial exposure.

🕵️♂️Non-Regulated BrokersInvesti-Ray is not registered with any financial authority, increasing the risk of losing funds.

💸Financial LossesMany users report substantial financial losses after using Investi-Ray.

🚨User ComplaintsNumerous complaints from users about the system’s performance and reliability.

Conclusion

Investi-Ray is a scam that preys on unsuspecting investors with false promises and subpar software. The absence of risk management tools, lack of regulation, and the system’s poor performance make it a dangerous choice for any trader. Numerous users have reported significant financial losses, underscoring the need to avoid this fraudulent system. If you value your investments, steer clear of Investi-Ray and opt for more reliable and regulated trading systems.

1 note

·

View note

Text

Investi-Ray Review: A 100% Scam You Must Avoid!

Introduction Investi-Ray, which operates via the website https://investi-ray.com, presents itself as a trustworthy forex broker offering profitable trading opportunities. However, this couldn’t be further from the truth. Investi-Ray is a fraudulent, non-regulated platform that deceives investors using unethical and misleading tactics. This review will outline the reasons why Investi-Ray is a scam and why investors should steer clear of it.

Beware: Investi-Ray.com is a 100% scam!

Why Investi-Ray is a Scam

Non-Regulated Broker: Investi-Ray is not registered with any financial authority, making it a high-risk choice for investors.

False Advertising: Investi-Ray claims to offer high returns and advanced trading algorithms, but users quickly discover these promises are empty.

Evil Blackhat Marketing Tactics: The broker uses illegal and abusive marketing strategies, including using influential people to promote their cryptocurrency trading algorithms.

Poor Performance: The system’s algorithms are substandard, often placing random trades without any basis in technical or fundamental analysis.

No Risk Management Tools: Basic risk management tools are non-existent, exposing users to significant financial risks.

Cheaply Written Code: The software is poorly developed, frequently crashing and failing to execute trades as intended.

Money-Grab Scheme: Investi-Ray’s primary goal appears to be extracting money from users through expensive price plans rather than delivering promised results.

User Experiences

Many users have shared their harrowing experiences, highlighting the deceptive nature of Investi-Ray. Here are some unique case studies from European individuals who have lost significant amounts of money:

Case Study 1: James’s Story:

Location: Manchester, UK

Investment: £15,000

Experience: James invested £15,000 in Investi-Ray, lured by promises of high returns. Within a few weeks, his account balance dropped to zero due to random and unprofitable trades. Customer support was unresponsive, and James realized he had been scammed.

Case Study 2: Emma’s Story:

Location: Paris, France

Investment: €12,300

Experience: Emma saw ads featuring influential figures promoting Investi-Ray. She invested €12,000 but quickly noticed the platform’s poor performance and lack of risk management. Attempts to withdraw her remaining funds were unsuccessful, leaving her with nothing.

Case Study 3: Robert’s Story:

Location: Berlin, Germany

Investment: €20,250

Experience: Robert was attracted to Investi-Ray’s supposed advanced trading algorithms. However, he soon faced constant system crashes and erratic trade executions. Despite his efforts to manage his account, he lost all his money and received no assistance from customer support.

Case Study 4: Isabella’s Story:

Location: Madrid, Spain

Investment: €10,000

Experience: Isabella invested €10,000 after seeing positive reviews online. However, the platform made unpredictable trades, and she lost her entire investment. Isabella later learned that Investi-Ray was not regulated, making it impossible to recover her funds.

Case Study 5: David’s Story:

Location: Rome, Italy

Investment: €8,750

Experience: David invested €8,000 in Investi-Ray, believing in their high returns. The system repeatedly failed to perform as advertised, leading to significant losses. Attempts to contact the company for support or a refund were ignored.

Negative Sides of Using Non-Regulated Brokers

False Promises: High returns and advanced algorithms are falsely advertised.

Poor Software Quality: The trading system is cheaply written, prone to crashes and technical failures.

Random Trades: The system places trades without any logical or analytical basis.

No Risk Management: Basic tools to manage trading risk are absent, leading to significant financial exposure.

Non-Regulated BrokersInvesti-Ray is not registered with any financial authority, increasing the risk of losing funds.

Financial Losses: Many users report substantial financial losses after using Investi-Ray.

User Complaints: Numerous complaints from users about the system’s performance and reliability.

Conclusion

Investi-Ray is a scam that preys on unsuspecting investors with false promises and subpar software. The absence of risk management tools, lack of regulation, and the system’s poor performance make it a dangerous choice for any trader. Numerous users have reported significant financial losses, underscoring the need to avoid this fraudulent system. If you value your investments, steer clear of Investi-Ray and opt for more reliable and regulated trading systems.

1 note

·

View note

Text

Investi-Ray Review: A Complete Scam

Why Investi-Ray is a Scam

Non-Regulated Broker: Investi-Ray is not registered with any financial authority, making it a high-risk choice for investors.

False Advertising: Investi-Ray claims to offer high returns and advanced trading algorithms, but users quickly discover these promises are empty.

Evil Blackhat Marketing Tactics: The broker uses illegal and abusive marketing strategies, including using influential people to promote their cryptocurrency trading algorithms.

Poor Performance: The system’s algorithms are substandard, often placing random trades without any basis in technical or fundamental analysis.

No Risk Management Tools: Basic risk management tools are non-existent, exposing users to significant financial risks.

Cheaply Written Code: The software is poorly developed, frequently crashing and failing to execute trades as intended.

Money-Grab Scheme: Investi-Ray’s primary goal appears to be extracting money from users through expensive price plans rather than delivering promised results.

User Experiences

Many users have shared their harrowing experiences, highlighting the deceptive nature of Investi-Ray. Here are some unique case studies from European individuals who have lost significant amounts of money:

Case Study 1: James’s Story:

Location: Manchester, UK

Investment: £15,000

Experience: James invested £15,000 in Investi-Ray, lured by promises of high returns. Within a few weeks, his account balance dropped to zero due to random and unprofitable trades. Customer support was unresponsive, and James realized he had been scammed.

Case Study 2: Emma’s Story:

Location: Paris, France

Investment: €12,300

Experience: Emma saw ads featuring influential figures promoting Investi-Ray. She invested €12,000 but quickly noticed the platform’s poor performance and lack of risk management. Attempts to withdraw her remaining funds were unsuccessful, leaving her with nothing.

Case Study 3: Robert’s Story:

Location: Berlin, Germany

Investment: €20,250

Experience: Robert was attracted to Investi-Ray’s supposed advanced trading algorithms. However, he soon faced constant system crashes and erratic trade executions. Despite his efforts to manage his account, he lost all his money and received no assistance from customer support.

Case Study 4: Isabella’s Story:

Location: Madrid, Spain

Investment: €10,000

Experience: Isabella invested €10,000 after seeing positive reviews online. However, the platform made unpredictable trades, and she lost her entire investment. Isabella later learned that Investi-Ray was not regulated, making it impossible to recover her funds.

Case Study 5: David’s Story:

Location: Rome, Italy

Investment: €8,750

Experience: David invested €8,000 in Investi-Ray, believing in their high returns. The system repeatedly failed to perform as advertised, leading to significant losses. Attempts to contact the company for support or a refund were ignored

1 note

·

View note

Text

Growth Opportunities in the Stockbroking Industry

The stockbroking global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Stockbroking Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The stockbroking market size has grown rapidly in recent years. It will grow from $38.34 billion in 2023 to $42.22 billion in 2024 at a compound annual growth rate (CAGR) of 10.1%. The growth in the historic period can be attributed to the globalization of financial markets, the rise of retail investors, financial innovation, the proliferation of the Internet, and increased financial literacy. The stockbroking market size is expected to see rapid growth in the next few years. It will grow to $62.37 billion in 2028 at a compound annual growth rate (CAGR) of 10.2%. The growth in the forecast period can be attributed to rising adoption of mobile trading apps, expansion of robo-advisory services, sustainable investing, regulatory changes, and increasing focus on cybersecurity. Major trends in the forecast period include integration of artificial intelligence and machine learning, increasing involvement in blockchain technology, sustainable investing, financial inclusion, and increasing collaboration and integration with fintech companies.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/stockbroking-global-market-report

Scope Of Stockbroking Market The Business Research Company's reports encompass a wide range of information, including:

Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

Drivers: Examination of the key factors propelling market growth.

Trends: Identification of emerging trends and patterns shaping the market landscape.

Key Segments: Breakdown of the market into its primary segments and their respective performance.

Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The rising trading activity is anticipated to propel the growth of the stockbroking market going forward. Trading refers to the buying and selling of financial instruments, commodities, or goods to generate profit in various markets, including stocks, forex, and commodities. The surge in trading activity is driven by economic fluctuations, improved trading platforms, and increased investor participation. Stockbroking plays a crucial role in facilitating trading by providing access to markets, investment advice, and executing buy and sell orders for investors. For instance, in December 2023, the Office for National Statistics, a UK government department, reported that in 2022, the proportion of UK quoted shares held by overseas investors reached a record high of 57.7%, up from 56.3% in 2020, continuing the long-term trend of increasing foreign ownership. Therefore, the increasing trading activity is propelling the growth of the stockbroking market.

Market Trends - Major companies operating in the stockbroking market are focused on developing innovative solutions, such as stockbroking platforms, to gain a competitive edge. A stockbroking platform refers to an online service that facilitates the buying and selling of securities, manages investment portfolios, and provides market information. For instance, in August 2023, PhonePe Private Limited, an India-based software company, launched the stockbroking platform Share(dot)Market. The platform features seamless integration with the PhonePe app, allowing users to trade stocks directly from their accounts. It offers user-friendly tools for tracking investments, real-time market data, and personalized recommendations, enhancing the overall trading experience.

The stockbroking market covered in this report is segmented –

1) By Trading Type: Short-Term Trading, Long-Term Trading 2) By Type Of Broker: Full-Service Brokers, Discount Brokers, Robo-Advisors 3) By Mode: Offline, Online 4) By Services: Order Execution, Advisory, Discretionary, Other Services 5) By End User: Retail Investor, Institutional Investor

Get an inside scoop of the stockbroking market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=18745&type=smp

Regional Insights - North America was the largest region in the stockbroking market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the stockbroking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies in the market are JPMorgan Chase & Co, Citigroup Inc., Wells Fargo & Company, Morgan Stanley, BNP Paribas SA, The Goldman Sachs Group Inc., UBS Group AG, Barclays Bank plc, Fidelity Investments, Charles Schwab Corporation, Credit Suisse Group AG, Merrill, Nomura Holdings Inc., LPL Financial Holdings Inc., RBC Capital Markets, T. Rowe Price Investment Services Inc., Interactive Brokers Inc., IG Group Holdings plc, Oppenheimer Holdings Inc., Hargreaves Lansdown plc, The Vanguard Group Inc., TradeStation, Canaccord Genuity Group Inc.

Table of Contents

Executive Summary

Stockbroking Market Report Structure

Stockbroking Market Trends And Strategies

Stockbroking Market – Macro Economic Scenario

Stockbroking Market Size And Growth …..

Stockbroking Market Competitor Landscape And Company Profiles

Key Mergers And Acquisitions

Future Outlook and Potential Analysis

Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

the Forex Market: How to Choose the Best Forex Broker

the Forex Market: How to Choose the Best Forex Broker

The foreign exchange (Forex) market is one of the most dynamic and fast-paced financial markets in the world. With trillions of dollars traded daily, it offers immense opportunities for traders. However, to succeed in this market, choosing the right Forex broker is crucial. Here are some tips to help you find the best partner for your trading journey.To get more news about WikiStock, you can visit our official website.

1. Regulation and Security The first and foremost factor to consider when choosing a Forex broker is regulation. Ensure that the broker is regulated by a reputable financial authority such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC). Regulation ensures that the broker adheres to strict standards of financial integrity and transparency, providing a secure trading environment.

2. Trading Platform and Tools A reliable trading platform is essential for executing trades efficiently. Look for brokers that offer user-friendly platforms with advanced charting tools, technical indicators, and real-time data. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used and trusted by traders worldwide. Additionally, check if the broker provides mobile trading options for trading on the go.

3. Range of Tradable Instruments While Forex trading primarily involves currency pairs, many brokers offer a wide range of tradable instruments, including commodities, indices, and cryptocurrencies. Having access to diverse markets allows you to diversify your trading portfolio and take advantage of various market opportunities. Ensure that the broker offers the instruments you are interested in trading.

4. Competitive Spreads and Fees Trading costs can significantly impact your profitability. Compare the spreads and fees charged by different brokers to find the most competitive rates. Some brokers offer fixed spreads, while others provide variable spreads that fluctuate with market conditions. Additionally, consider other fees such as commissions, withdrawal fees, and inactivity fees. Opt for a broker with transparent pricing and no hidden charges.

5. Customer Support Effective customer support is vital, especially for new traders who may need assistance with account setup, platform navigation, or technical issues. Choose a broker that offers responsive and knowledgeable customer support through various channels, including live chat, email, and phone. Test their support services before opening an account to ensure they meet your expectations.

6. Educational Resources A good Forex broker should provide educational resources to help traders improve their skills and knowledge. Look for brokers that offer webinars, tutorials, eBooks, and market analysis. These resources can be invaluable, especially for beginners who need to understand the basics of Forex trading and develop effective trading strategies.

7. Account Types and Minimum Deposits Different traders have different needs and preferences. Some brokers offer various account types, such as standard, mini, and micro accounts, catering to traders with different levels of experience and capital. Check the minimum deposit requirements and choose a broker that aligns with your budget and trading goals.

8. Reputation and Reviews Finally, research the broker’s reputation by reading reviews and testimonials from other traders. Online forums and review sites can provide insights into the broker’s reliability, customer service, and overall trading experience. Be cautious of brokers with consistently negative reviews or unresolved complaints.

In conclusion, finding the right Forex broker requires careful consideration of various factors, including regulation, trading platform, costs, and customer support. By conducting thorough research and evaluating your trading needs, you can choose a broker that will be a reliable partner in your Forex trading journey.

0 notes

Text

Best Trading Platform UK for Beginners: Straddleco

In the fast-paced world of online trading, choosing the right platform is key to a successful start, especially for beginners. In the UK, one platform stands out from the rest: Straddleco. Tailored to meet the needs of novice traders, Straddleco combines ease of use, extensive educational resources, and robust support to provide the ideal environment for anyone just starting out. In this blog, we’ll explore why Straddleco is the best trading platform for beginners in the UK and how it can help you navigate the complex world of stock trading.

Why Choosing the Right Platform Matters for Beginners

When stepping into the stock market for the first time, the learning curve can be steep. New traders are often overwhelmed by the wide range of tools, charts, and market information available. The wrong platform can add unnecessary complexity, making the process more confusing and frustrating. That's where Straddleco comes in—it is specifically designed to simplify stock trading for beginners, ensuring that users can focus on learning and making informed decisions rather than struggling with a clunky or confusing interface.

User-Friendly Interface

One of the standout features of Straddleco is its intuitive and user-friendly interface. For beginners, this is crucial. A platform that is overly complicated can deter new traders from learning and experimenting with trading strategies. Straddleco ensures that from the moment users log in, they are greeted with a clean, well-organized dashboard. The layout is simple, with easy access to essential tools like market data, trade execution, and portfolio tracking.

The trading interface is designed to be straightforward, allowing new users to execute trades without confusion. You won’t be overwhelmed by unnecessary features, but you'll still have access to powerful tools that help you grow as a trader.

Educational Resources and Tutorials

For beginners, education is one of the most important aspects of trading. Straddleco excels in this area by providing a wealth of educational resources that are easily accessible on its platform. These resources include video tutorials, eBooks, and articles designed to help new traders understand market dynamics, different types of investments, and basic trading strategies.

Straddleco’s educational center walks users through everything from setting up their first trade to understanding complex topics like risk management and technical analysis. The platform also offers live webinars and interactive Q&A sessions with experienced traders, helping beginners sharpen their skills and gain valuable insights.

Low Fees and Commissions

New traders often have limited capital and are looking for ways to maximize their returns. High fees and commissions can quickly eat into profits, especially for beginners who may not be making large trades initially. Straddleco understands this, offering some of the lowest fees and commissions in the market, making it accessible for traders with smaller budgets.

Whether you're trading stocks, ETFs, or other assets, Straddleco's competitive fee structure ensures that more of your money stays invested, where it belongs. This feature alone makes it a top choice for beginners in the UK, who are looking for a cost-effective way to start trading.

Advanced Tools Made Simple

While Straddleco is designed with beginners in mind, it doesn't sacrifice powerful trading tools. As you gain confidence and experience, Straddleco grows with you, offering advanced tools like real-time market data, customizable charts, and technical indicators. These features allow you to develop your skills and take your trading to the next level.

However, the platform ensures that these advanced tools are not overwhelming for new users. Detailed explanations and tutorials are provided for each tool, ensuring that beginners can experiment without fear of making costly mistakes. The platform also offers demo accounts, allowing users to practice trades without risking real money.

Responsive Customer Support

One of the major concerns for beginners is having reliable customer support. Straddleco shines in this area, offering 24/7 customer service via live chat, email, and phone. If a user encounters any issues or has questions about how to execute trades, the support team is readily available to assist.

For beginners, having access to responsive support can make the difference between a positive and negative trading experience. Straddleco ensures that help is always just a click or a call away, providing peace of mind to new traders navigating the stock market for the first time.

Mobile Trading on the Go

In today’s fast-paced world, having access to your trading account on the go is essential. Straddleco’s mobile app offers full functionality, allowing you to execute trades, track your portfolio, and access educational resources from anywhere. The app is designed to be just as user-friendly as the web platform, with a sleek interface that makes mobile trading simple and accessible.

This feature is particularly beneficial for beginners who may not have the time to sit at a desktop computer all day. The ability to trade and monitor your portfolio on the go means you can stay informed and react quickly to market changes, no matter where you are.

Conclusion

For beginners in the UK looking to start their trading journey, Straddleco is the ideal platform. Its combination of a user-friendly interface, low fees, extensive educational resources, and responsive customer support makes it the best trading platform for those just starting out. Whether you’re looking to trade stocks, ETFs, or other assets, Straddleco offers a seamless experience tailored to the needs of novice traders.

With Straddleco, you’ll have the tools, knowledge, and support needed to succeed in the stock market—making it the best trading platform for beginners in the UK.

0 notes

Text

ATM Managed Services Market 2024-2033 : Demand, Trend, Segmentation, Forecast, Overview And Top Companies

The atm managed services global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

ATM Managed Services Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The atm managed services market size has grown strongly in recent years. It will grow from $8.26 billion in 2023 to $8.89 billion in 2024 at a compound annual growth rate (CAGR) of 7.6%. The growth in the historic period can be attributed to cost efficiency, regulatory compliance, security concerns, increasing atm networks, consumer convenience.

The atm managed services market size is expected to see strong growth in the next few years. It will grow to $12.21 billion in 2028 at a compound annual growth rate (CAGR) of 8.3%. The growth in the forecast period can be attributed to data analytics integration, globalization and expansion, cloud-based solutions, remote monitoring and maintenance, partnerships and collaborations. Major trends in the forecast period include security and compliance focus, technology advancements, cloud-based solutions, data analytics for performance optimization.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/atm-managed-services-global-market-report

Scope Of ATM Managed Services Market The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

ATM Managed Services Market Overview

Market Drivers - An increase in debit-card usage is expected to propel the growth of the ATM-managed services market going forward. A debit card is a type of payment card that allows you to make safe and simple transactions online and in person by drawing money. The value of each debit card transaction is deducted straight from the user's connected bank account, whether it is a cash withdrawal from an ATM or an internet payment. Furthermore, an increase in card transactions has increased the number of debit card holders, which has raised the need of ATM management services. For instance, in November 2022 according to UK Finance, a UK-based trade group for the banking and financial services sector, there were 2.1 billion debit card transactions in August 2022, an increase of 8% from August 2021. The overall expenditure was $78.01 billion (£64.1 billion), which was 4% more than in August 2021. Therefore, the increase in debit-card usage is expected to drive the ATM-managed services market.

Market Trends - Product Innovations are a key trend in gaining popularity in the ATM managed services market. Major companies operating in the ATM managed services market are focused on developing innovative solutions to strengthen their position in the market. For Instance in July 2022, Nautilus Hyosung America, Inc., a US-based cash management and payments platform service provider, launches a suite of products to improve cash management and enable cash-to-digital interactions. The product set comprises the series X METAKIOSK, X10 CASH-IN SIDECAR, and HERO cash dispenser CAJERA CR-E, all of which have superior modular design, convenient and engaging functionality. It is intended for company owners who desire to deliver excellent customer service.

The atm managed services market covered in this report is segmented –

1) By Type: ATM Replenishment and Currency Management, Network Management, Security Management, Incident Management, Other Types 2) By ATM Locations: Onsite ATMs, Offsite ATMs, Worksite ATMs, Mobile ATMs 3) By Application: ATM Service, CMS, Other Applications

Get an inside scoop of the atm managed services market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=8759&type=smp

Regional Insights - Asia-Pacific was the largest region in the ATM-managed services market share in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the atm managed services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the atm managed services market report are Ags Transact Technologies Ltd., Cardtronics Inc., Diebold Nixdorf Incorporated, Euronet Worldwide Inc., Financial Software & Systems Pvt. Ltd., Fiserv Inc., Hitachi Payment Services Pvt. Ltd., CMS Info Systems Ltd., Electronic Payment and Services Pvt. Ltd., Adam Hall Group, QDS Inc., TetraLink, Mastercard Inc., FUJITSU Ltd., Hyosung Corporation, Beijing Choice Electronic Technology Co. Ltd., Automated Transaction Delivery, Drägerwerk AG & Co. KGaA, Cashlink Global Systems Pvt. Ltd., CashTrans LLC, NCR Managed Services Corp., Transact Technologies Ltd., Vocalink Ltd., Honeywell International Inc., Brink's India Pvt. Ltd., Loomis India Pvt. Ltd., Prosegur India Pvt. Ltd., G4S Security Services India Pvt. Ltd., ATM World Corp., ATM Solutions Pvt. Ltd.

Table of Contents 1. Executive Summary 2. ATM Managed Services Market Report Structure 3. ATM Managed Services Market Trends And Strategies 4. ATM Managed Services Market – Macro Economic Scenario 5. ATM Managed Services Market Size And Growth ….. 27. ATM Managed Services Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/