#UK Digital trading applications industry

Explore tagged Tumblr posts

Text

The Rise and Trends of UK Online Trading Platforms

Buy Now

What is the Size of UK online trading platform Industry?

UK online trading platform Market is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Mn by 2028. The ease of access to online trading platforms has democratized investing, enabling individuals to enter financial markets with lower barriers. These platforms offer user-friendly interfaces, educational resources, and a variety of trading instruments, making trading more approachable for both novice and experienced investors.

Additionally, the low-interest-rate environment has prompted individuals to seek alternative investment avenues to achieve higher returns. Thus, boosting demand for online trading platforms. technological advancements have revolutionized trading. Mobile apps, algorithmic trading, real-time market data, and AI-powered insights provide users with tools to make informed decisions swiftly.

Click here to Download a Sample Report

The convenience of trading on-the-go appeals to a tech-savvy generation, further fueling market growth. Furthermore, social trading features that allow users to share strategies and insights have contributed to community-building within these platforms, attracting new users through referrals.

UK online trading platform Market by interface Type

The UK online trading platform market is segmented by PC, Web based and Mobile. Digital Advertising is dominance in the market in 2022 UK online trading platform market. Digital advertising allows online trading platforms to precisely target their advertisements based on user demographics, behavior, and interests. This targeted approach ensures that the platforms' marketing efforts are directed at individuals most likely to be interested in trading, maximizing the return on investment.

UK online trading platform Market by end user application

The UK online trading platform market is segmented by sector type into Banking and financial, Brokers and Others. In 2022, the banking and finance is dominance in UK online trading platform market. Banking and finance institutions have the advantage of a well-established customer base. Many of these institutions have existing relationships with customers who use their services for traditional banking needs. Leveraging these relationships, they can cross-promote online trading platforms as an extension of their offerings, enticing customers to explore trading opportunities within a familiar and trusted environment.

UK online trading platform Market by Region

The UK online trading platform market is segmented by Region into North, South, East and West. In 2022, south region emerged as the dominant region in the UK online trading platform market. London's dominance in the UK online trading platform market is attributed to its status as a global financial hub, diverse investor base, innovation ecosystem, and favorable time zone, all of which collectively create a robust environment for online trading platforms to flourish.

Click here to Download a Custom Report

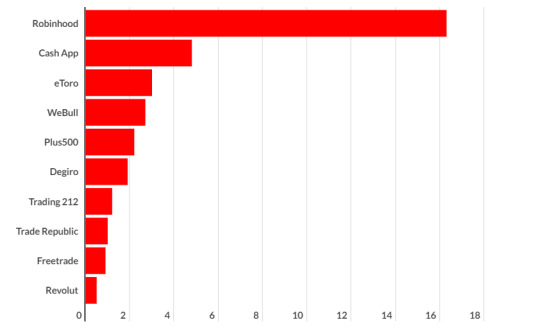

Competition Scenario in UK online trading platform Market

The UK online trading platform market is fiercely competitive, characterized by a diverse array of players competing for market share and customer loyalty. Established incumbents such as eToro, IG Group, and Plus500 continue to dominate the landscape, leveraging their brand recognition and extensive user bases. These platforms offer a range of assets including stocks, forex, and cryptocurrencies, with user-friendly interfaces attracting both novice and experienced traders.

Furthermore, traditional financial institutions like Hargreaves Lansdown have expanded into the online trading sphere, leveraging their existing customer base and reputation to compete in this digital arena. Additionally, the rise of fintech startups like Freetrade, with its emphasis on fractional share trading and community engagement, has introduced innovative approaches to trading.

What is the Expected Future Outlook for the UK online trading platform MARKET?

The UK Online Trading Platform market was valued at USD ~Million in 2022 and is anticipated to reach USD ~ Million by the end of 2027, witnessing a CAGR of ~% during the forecast period 2022-2028. The market is likely to experience sustained growth due to the increasing popularity of online trading among retail investors. The accessibility of trading platforms, coupled with a growing interest in financial markets, has led to a significant surge in users engaging in various asset classes, including stocks, cryptocurrencies, forex, and commodities.

Technological advancements will play a pivotal role in shaping the market's trajectory. Innovations such as mobile trading apps, algorithmic trading tools, and artificial intelligence-driven investment advisory services are likely to enhance user experiences and facilitate more informed decision-making.

Additionally, the integration of blockchain technology could improve transparency and security within the trading ecosystem. Moreover, Regulatory developments will continue to influence the market landscape. Striking the right balance between investor protection and market innovation will be a key challenge for regulators. The implementation of measures to ensure fair trading practices, prevent market manipulation, and safeguard user data will impact how trading platforms operate and evolve.

Furthermore, the market may witness a consolidation of platforms as larger players acquire smaller ones to expand their market share and capabilities. This consolidation could lead to enhanced platform features and improved service offerings for traders. Environmental, Social, and Governance (ESG) investing is another trend that could shape the future of online trading platforms. Investors are increasingly seeking opportunities that align with their values, and platforms that offer ESG-focused investment options might gain a competitive edge.

#UK online trading platforms market#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market

0 notes

Text

Global Paper-Based Self-Adhesive Labels Market Poised for Growth Amid Rising Demand for Sustainable Packaging

Global Paper-Based Self-Adhesive Labels Market Poised for Growth Amid Rising Demand for Sustainable Packaging

Market Overview

The Global Paper-Based Self-Adhesive Labels Market is witnessing significant growth, driven by the increasing demand for eco-friendly and sustainable labeling solutions. With industries such as food & beverages, pharmaceuticals, logistics, and retail shifting toward environmentally responsible packaging, paper-based self-adhesive labels have emerged as a preferred alternative to plastic-based labels.

These labels offer high-quality printability, recyclability, and ease of application, making them ideal for product branding, regulatory compliance, and supply chain management. Additionally, the global push for reducing plastic waste and adopting biodegradable materials has accelerated the demand for paper-based self-adhesive labels across various sectors.

Free Sample Report:- Sample Request | Global Paper Based Self Ahesive Labels Market, Global Market Insights 2023, Analysis And Forecast To 2030, By Type & Application

Market Insights & Trends

Growing Focus on Sustainability: With increasing regulatory pressure and consumer awareness, industries are adopting biodegradable and recyclable label solutions to meet their sustainability goals.

Advancements in Adhesive Technology: Innovations in water-based, biodegradable, and pressure-sensitive adhesives are enhancing the efficiency and eco-friendliness of labels.

Rising Demand from E-Commerce & Logistics: The boom in online retail and global trade is driving demand for barcode labels, tracking labels, and tamper-proof packaging solutions.

Customization & Digital Printing Advancements: Brands are focusing on personalized, high-resolution, and digitally printed labels to enhance brand visibility and consumer engagement.

Stringent Regulatory Compliance: Governments worldwide are enforcing strict packaging and labeling regulations for industries like food, pharmaceuticals, and chemicals, boosting the demand for compliant, paper-based self-adhesive labels.

Key Players in the Market

The Global Paper-Based Self-Adhesive Labels Market is highly competitive, with major companies focusing on product innovation, eco-friendly materials, and advanced printing technologies. Leading players include:

Avery Dennison Corporation

UPM Raflatac

Mondi Group

3M Company

CCL Industries Inc.

Coveris Holdings S.A.

Huhtamaki Oyj

Sato Holdings Corporation

Fuji Seal International, Inc.

Constantia Flexibles

These companies are investing in sustainable label materials, high-performance adhesives, and smart labeling technologies to cater to the evolving needs of industries worldwide.

Full Report:- Global Paper Based Self Ahesive Labels Market, Global Market Insights 2023, Analysis And Forecast To 2030, By Type & Application

Regional Insights

North America: The United States and Canada are leading markets due to stringent environmental regulations, high demand from the food and beverage sector, and the rise of sustainable packaging trends.

Europe: Countries like Germany, the UK, and France are at the forefront of eco-friendly labeling initiatives, driven by strict EU policies on packaging waste reduction.

Asia-Pacific: The fastest-growing region, with China, India, and Japan leading in manufacturing, retail, and logistics expansion, boosting demand for self-adhesive labeling solutions.

South America, Middle East & Africa: These regions are experiencing steady growth due to rising industrialization, urbanization, and increasing consumer awareness of sustainable packaging.

Market Outlook & Growth Prospects

The Global Paper-Based Self-Adhesive Labels Market is projected to grow at a CAGR of over 6% through 2030, fueled by:

The shift toward biodegradable and recyclable packaging materials

Technological advancements in label printing and adhesives

Growing applications in food, pharmaceuticals, and logistics sectors

Regulatory mandates promoting sustainable labeling practices

Increased demand for smart labels and RFID-enabled tracking solutions

With sustainability becoming a core focus for industries worldwide, paper-based self-adhesive labels are set to play a crucial role in future packaging innovations.

Enquire Before Buy:- Enquire Before Buy | Global Paper Based Self Ahesive Labels Market, Global Market Insights 2023, Analysis And Forecast To 2030, By Type & Application

Conclusion

The Global Paper-Based Self-Adhesive Labels Market is evolving rapidly as businesses, regulators, and consumers push for sustainable, high-performance labeling solutions. With ongoing innovations in adhesives, printing, and recyclable materials, the market is poised for significant expansion in the coming years.

Top Trending Reports

Global More Electric Aircraft Market

Nigeria Oil and Gas Upstream Activities Market

Global Industrial Plastic Bags Market

Global Palladium Market

0 notes

Text

Collectibles Market set to hit $713.1 billion by 2035, as per recent research by DataString Consulting

Higher trends within Collectibles applications including online auctioning, authentication services & grading, specialty retail stores and digital platforms & virtual collections; and other key wide areas like digital entertainment memorabilia and blockchain-based collectible assets are expected to push the market to $713.1 billion by 2035 from $374.5 billion of 2024.

The collectibles industry offers potential in the entertainment sector with a focus on gaming and movies. Some key players, like Hasbro and Mattel use collectibles to tap into the nostalgia associated with franchises. They transform experiences into cherished memories through these unique items. In the world of digital collectibles lies a groundbreaking use case, in the realm of cryptocurrency known as non fungible tokens (NFTs). Take Dapper Labs and their creation CryptoKitties for example. This innovative platform allows digital collectors to possess and trade irreplaceable digital assets. By infusing scarcity into the expanse of the internet space

Detailed Analysis - https://datastringconsulting.com/industry-analysis/collectibles-market-research-report

The move to digitization is making an impact on the collectibles market these days! Collectors are now discovering rare and one of a kind items more than ever before—showcasing how e commerce has become a key player in this industrys landscape. Not that but traditional collectible stores are also shifting towards the digital realm to connect with a wider global audience. Being able to organize and showcase collectibles has really opened doors for collectors and investors who may not have had this opportunity before—leading to a noticeable increase, in demand and value.

Industry Leadership and Strategies

The Collectibles market within top 3 demand hubs including U.S., UK and Japan, is characterized by intense competition, with a number of leading players such as Heritage Auctions, Christie's, Sotheby's, Bonhams, eBay Inc, Grailed Inc, Ruby Lane Inc, StockX LLC, Catawiki, The RealReal Inc, Paddle8 and Trade Me Limited. Below table summarize the strategies employed by these players within the eco-system.

LeadingProviders

Provider Strategies

eBay, Heritage Auctions

eBay primarily focuses on providing a wide variety of collectibles across different categories to appeal to a diverse customer base, while Heritage Auctions specializes in high-end collectibles and leverages expert authentication and grading services to attract serious collectors

Professional Sports Authenticator (PSA), Beckett Grading Services

PSA uses a 10-point grading scale for collectibles like sport cards and autographs to signify quality and value, while Beckett Grading Services provides a detailed report card analysis along with grades which adds another layer of trust for collectors

Funko, American Girl

American Girl offers customizable collectible dolls and historical characters to create engagement and loyalty, while Funko offers pop culture-themed collectibles and collaborates with popular brands and franchises to reach a broader audience

CryptoKitties, NBA Top Shot

CryptoKitties uses blockchain technology for digital collectibles, providing proof of ownership and scarcity, whereas NBA Top Shot sells licensed digital collectibles highlighting unforgettable

This market is expected to expand substantially between 2025 and 2030, supported by market drivers such as celebrity-inspired consumption, technological advancements in blockchain, and marvelous boom of pop culture.

Regional Analysis

This area is well known for its collection of items and has a lively and competitive market scene with major auction houses and online trading platforms playing a significant role alongside trade shows that contribute to market trends. Despite the competition from both established and new players alike within this industry sector there are chances to capitalize on trends related to current popular culture as well as rare historical artifacts. Taking advantage of the rise of e commerce platforms and the growing appeal of collectibles could potentially lead to increased profits, for businesses operating within this sector.

Research Study analyse the global Collectibles market in detail and covers industry insights & opportunities at Product Type (Antiques, Art works), Target Audience (Individual Collectors, Institutional Collectors) and Distribution Channel (Online, Offline) for more than 20 countries.

About DataString Consulting

DataString Consulting assist companies in strategy formulations & roadmap creation including TAM expansion, revenue diversification strategies and venturing into new markets; by offering in depth insights into developing trends and competitor landscapes as well as customer demographics. Our customized & direct strategies, filters industry noises into new opportunities; and reduces the effective connect time between products and its market niche.

DataString Consulting offers complete range of market research and business intelligence solutions for both B2C and B2B markets all under one roof. DataString’s leadership team has more than 30 years of combined experience in Market & business research and strategy advisory across the world. Our Industry experts and data aggregators continuously track & monitor high growth segments within more than 15 industries and 60 sub-industries.

0 notes

Text

apply for barcode

To apply for a barcode, you need to follow a few steps to ensure that your product is properly identified and that you comply with international standards. Barcodes are essential for retail, inventory management, and distribution, as they make it easier to track and identify products throughout the supply chain.

Here’s a step-by-step guide on how to apply for a barcode:

1. Register with GS1

GS1 is the global organization that manages barcode standards, including the UPC, EAN, and GTIN codes. To obtain a barcode, you will need to become a member of GS1. Follow these steps:

Visit the GS1 Website: Go to the official GS1 website for your country (such as GS1 US, GS1 UK, or GS1 International).

Create an Account: Sign up as a business and provide necessary details about your company.

Obtain a GS1 Company Prefix: Once registered, you will receive a unique GS1 Company Prefix. This prefix is part of the barcode and helps uniquely identify your business. The number of digits in the prefix depends on the number of products you plan to barcode.

2. Determine the Type of Barcode You Need

You’ll need to decide which type of barcode fits your business and the products you sell. The most common barcode types are:

UPC (Universal Product Code): Typically used in the United States and Canada for retail products.

EAN (European Article Number): Used primarily outside of North America, especially in Europe.

GTIN-12/GTIN-13/GTIN-14: These are global product identification numbers used to uniquely identify products across the supply chain.

QR Codes or Data Matrix Codes: These 2D barcodes are used for other purposes like marketing or on smaller products.

If you’re unsure which type of barcode to choose, consult with GS1 or review the requirements of your industry or retail partners.

3. Assign Product Numbers

Once you have your GS1 Company Prefix, you can begin assigning product numbers to your items. The product number is unique to each product and is combined with your GS1 Company Prefix to create a GTIN (Global Trade Item Number). This number will be embedded into the barcode.

For example, a UPC barcode has 12 digits: the first 6–10 digits represent your GS1 Company Prefix, and the remaining digits represent your product’s unique number. The last digit is a check digit that validates the barcode.

If you plan to barcode many products, it’s essential to have a system for assigning unique product numbers to each item.

4. Generate the Barcode

After assigning GTINs to your products, you will need to generate the actual barcode. This can be done using:

Barcode Software: Many barcode generation tools are available online that allow you to input your GTIN and generate the corresponding barcode.

GS1 Services: GS1 provides tools and services to help you generate barcodes based on your GTIN.

The barcode can be generated in different formats, such as UPC-A, EAN-13, or QR codes, depending on the type of product and application.

5. Print the Barcode

Once you’ve generated the barcode, you’ll need to print it onto your product packaging or labels. Ensure that the barcode is printed clearly and large enough for scanners to read easily. It is crucial to test the printed barcode to make sure it can be scanned without issues.

Barcode Printing Software: Use a reliable printing method to ensure the barcode is high quality. Many label printers are available for printing barcodes directly onto packaging.

Consider Placement: Place the barcode in an area that is easy to scan and not obstructed by other labels, packaging, or designs.

6. Verify the Barcode

Before distributing your products or listing them for sale, it’s essential to test your barcode using a barcode scanner to ensure it is scannable. You can use a handheld scanner or a smartphone with barcode scanning software to check that the barcode is correctly linked to the product information.

7. Maintain Barcode Records

It’s essential to keep accurate records of your GTINs and associated products. This will help you track inventory, manage sales, and update product information as necessary. Most businesses use barcode management software or inventory systems that integrate with the barcode.

8. Use Your Barcode in Retail

Once your barcode is generated, printed, and verified, you’re ready to use it in retail environments, both physical and online. Online marketplaces such as Amazon, eBay, and Walmart require sellers to use barcodes for product listings. Make sure your barcodes are properly registered and linked to your product information in retail systems.

Conclusion

Applying for a barcode is a relatively straightforward process but requires careful planning and attention to detail. By registering with GS1, obtaining a unique Company Prefix, and following the steps to generate and print your barcode, you can efficiently track and sell products both in physical stores and online.

Barcodes are essential for improving inventory management, speeding up transactions, and ensuring accurate product identification. Whether you're a small business or a large enterprise, getting your products properly barcoded will help streamline your operations and ensure you comply with global standards.

0 notes

Text

A Comprehensive Overview of Advanced Analytics Market Landscape

The global advanced analytics market size is expected to reach USD 305.42 billion in 2030 and is projected to grow at a CAGR of 26.4% from 2025 to 2030. The market growth can be attributed to the increasing demand for advanced analytical solutions by companies across the retail, IT & telecom, and BFSI sectors, among others. These solutions help to process large volumes of data and determine fraudulent activities, thus ensuring data protection. For instance, IBM Cloud Pak for Security enables companies to identify hidden threats and make informed risk-based decisions.

Industries such as manufacturing, automotive, and pharmaceuticals are rapidly adopting artificial intelligence, machine learning, and big data to optimize their business processes. These technologies enable manufacturers to improve their production process, increase supply chain efficiency, and identify variables affecting the production quality, which bodes well for market growth. Moreover, as the demand for predictive solutions is growing, key players such as SAS Institute, Inc. and International Business Machines Corp. are introducing cutting-edge solutions that can be offered on cloud.

Advanced analytical solutions are emerging as an essential tool for predicting and forecasting trading patterns, electricity consumption patterns, and rush-hour traffic conditions. As such, many government agencies are making significant investments in these solutions. For instance, the Australian Institute of Health and Welfare uses predictive analysis to access large datasets, such as national hospitals’ databases. The agency uses a projection model to forecast Australian healthcare expenditure by combining various factors, such as population growth, the volume of service per treated case, and excess health price inflation.

Gather more insights about the market drivers, restrains and growth of the Advanced Analytics Market

Advanced Analytics Market Report Highlights

• The cloud segment accounted for the largest market share of over 62% in 2024, owing to increasing data connectivity through hybrid and multi-cloud environments and the growing trend of digitalization.

• The big data analytics segment accounted for the largest market share of over 32% in 2024, owing to the growing adoption of IIoT and AI by various organizations to efficiently analyze information and make timely decisions.

• The small & medium enterprise (SME) segment is expected to grow at a significant rate during the forecast period. Owing to funding provided by several governments to SMEs to encourage the adoption of advanced analytical solutions such as SaaS.

• The BFSI end use segment accounted for the largest market share in 2024, owing to its heavy reliance on data for risk management, fraud detection, and customer insights.

• The advanced analytics market in the Asia Pacific is growing significantly at a CAGR of over 27% from 2025 to 2030. The Asia Pacific advanced analytics market is growing rapidly due to increasing digitalization across industries and the rise of e-commerce and fintech sectors.

Advanced Analytics Market Segmentation

Grand View Research has segmented the global Advanced Analytics market on the basis of application and region:

Advanced Analytics Type Outlook (Revenue, USD Billion, 2018 - 2030)

• Big Data Analytics

• Business Analytics

• Customer Analytics

• Risk Analytics

• Statistical Analysis

• Others

Advanced Analytics Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

• On-premise

• Cloud

Advanced Analytics Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

• Large Enterprises

• Small and Medium Enterprises (SMEs)

Advanced Analytics End Use Outlook (Revenue, USD Billion, 2018 - 2030)

• BFSI

• Government

• Healthcare

• Military & Defense

• IT & Telecom

• Others

Advanced Analytics Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Latin America

o Brazil

• Middle East & Africa

o U.A.E

o Saudi Arabia

o South Africa

Order a free sample PDF of the Advanced Analytics Market Intelligence Study, published by Grand View Research.

#Advanced Analytics Market#Advanced Analytics Market Size#Advanced Analytics Market Share#Advanced Analytics Market Analysis#Advanced Analytics Market Growth

0 notes

Text

The Future of Decision-Making: Trends in the Advanced Analytics Market

The global advanced analytics market size is expected to reach USD 305.42 billion in 2030 and is projected to grow at a CAGR of 26.4% from 2025 to 2030. The market growth can be attributed to the increasing demand for advanced analytical solutions by companies across the retail, IT & telecom, and BFSI sectors, among others. These solutions help to process large volumes of data and determine fraudulent activities, thus ensuring data protection. For instance, IBM Cloud Pak for Security enables companies to identify hidden threats and make informed risk-based decisions.

Industries such as manufacturing, automotive, and pharmaceuticals are rapidly adopting artificial intelligence, machine learning, and big data to optimize their business processes. These technologies enable manufacturers to improve their production process, increase supply chain efficiency, and identify variables affecting the production quality, which bodes well for market growth. Moreover, as the demand for predictive solutions is growing, key players such as SAS Institute, Inc. and International Business Machines Corp. are introducing cutting-edge solutions that can be offered on cloud.

Advanced analytical solutions are emerging as an essential tool for predicting and forecasting trading patterns, electricity consumption patterns, and rush-hour traffic conditions. As such, many government agencies are making significant investments in these solutions. For instance, the Australian Institute of Health and Welfare uses predictive analysis to access large datasets, such as national hospitals’ databases. The agency uses a projection model to forecast Australian healthcare expenditure by combining various factors, such as population growth, the volume of service per treated case, and excess health price inflation.

Advanced Analytics Market Report Highlights

The cloud segment accounted for the largest market share of over 62% in 2024, owing to increasing data connectivity through hybrid and multi-cloud environments and the growing trend of digitalization.

The big data analytics segment accounted for the largest market share of over 32% in 2024, owing to the growing adoption of IIoT and AI by various organizations to efficiently analyze information and make timely decisions.

The small & medium enterprise (SME) segment is expected to grow at a significant rate during the forecast period. Owing to funding provided by several governments to SMEs to encourage the adoption of advanced analytical solutions such as SaaS.

The BFSI end use segment accounted for the largest market share in 2024, owing to its heavy reliance on data for risk management, fraud detection, and customer insights.

The advanced analytics market in the Asia Pacific is growing significantly at a CAGR of over 27% from 2025 to 2030. The Asia Pacific advanced analytics market is growing rapidly due to increasing digitalization across industries and the rise of e-commerce and fintech sectors.

Advanced Analytics Market Segmentation

Grand View Research has segmented the global Advanced Analytics market on the basis of application and region:

Advanced Analytics Type Outlook (Revenue, USD Billion, 2018 - 2030)

Big Data Analytics

Business Analytics

Customer Analytics

Risk Analytics

Statistical Analysis

Others

Advanced Analytics Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

On-premise

Cloud

Advanced Analytics Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

Large Enterprises

Small and Medium Enterprises (SMEs)

Advanced Analytics End Use Outlook (Revenue, USD Billion, 2018 - 2030)

BFSI

Government

Healthcare

Military & Defense

IT & Telecom

Others

Advanced Analytics Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Asia Pacific

China

India

Japan

South Korea

Australia

Latin America

Brazil

Middle East & Africa

A.E

Saudi Arabia

South Africa

Order a free sample PDF of the Advanced Analytics Market Intelligence Study, published by Grand View Research.

0 notes

Text

Recognition of Indian Marble Manufacturers in the World Market

Marble has defined civilizations for centuries. Renowned for elegance and durability, it's timeless. Architects and artists value it for designs. Indian manufacturers lead in global marble trends. They showcase craftsmanship and abundant natural resources.

The Legacy of Indian Marble

India’s marble history includes timeless landmarks. Taj Mahal shows marble’s beauty and durability. Indian marble offers colors, textures, and finishes. Architects worldwide prefer its quality and elegance. Craftsmanship elevates India’s global marble reputation.

Why Indian Marble Stands Out

Diverse Varieties: Indian marble offers unique options. Types include Makrana, Kishangarh, Ambaji, Bidasar. These suit minimalist to luxurious design preferences.

Exceptional Quality: Indian marble boasts fine grain durability. High polish earns trust from global clients.

Affordable Pricing: Despite its high quality, Indian marble remains cost-effective compared to other international options. This affordability allows global buyers to source premium materials without exceeding their budgets.

Sustainable Practices: Many marble manufacturers in India are adopting eco-friendly practices, ensuring sustainable quarrying and processing techniques. These practices resonate with environmentally conscious clients worldwide.

Contribution to the Global Market

India’s marble industry has made significant strides in the global market. Indian manufacturers are now exporting marble to countries like the USA, UAE, UK, and Australia. The following factors highlight their contribution:

Rising Exports: India leads global marble exports.

Innovative Designs: Custom finishes meet international standards.

Skilled Workforce: Indian artisans possess generational expertise. Intricate craftsmanship enhances marble’s unique appeal.

Challenges Faced by Indian Marble Manufacturers

Global Competition: Italy, Turkey dominate premium marble market. Indian manufacturers must innovate to remain competitive.

Logistical Issues: Transporting heavy stones raises delivery costs.

Environmental Regulations: Meeting demand while following rules challenges manufacturers.

Steps Towards Global Recognition

Indian marble manufacturers are enhancing global position:

Adopting Technology: Modern machines enhance quality, efficiency.

Focus on Branding: Naturistic Stones highlights heritage. Storytelling strengthens marble’s unique global appeal.

Expanding Reach: Trade shows and collaborations boost reputation. Designers work with manufacturers for innovative creations.

Sustainability Initiatives: Eco-friendly methods attract conscious buyers. Green practices improve marble industry’s environmental impact.

Naturistic Stones: A Case Study in Excellence

At Naturistic Stones, we believe that every piece of marble tells a story. Our commitment to quality, innovation, and sustainability has earned us a place among the top marble manufacturers in India. We are proud to contribute to India’s legacy in the global market by offering:

A diverse portfolio of premium marble products.

Tailored solutions to meet the unique needs of our international clients.

Sustainable practices that prioritize the well-being of our planet.

The Future of Indian Marble in the World Market

The future looks bright for Indian marble manufacturers. With the increasing global demand for natural stones and the rising popularity of Indian marble, the industry is poised for significant growth. Key trends that will shape this future include:

Digital Integration: Virtual showrooms simplify buying marble. Online platforms help buyers explore options easily.

Sustainable Innovations: Improved techniques reduce environmental impact. Marble quarrying becomes eco-friendlier and efficient.

Increased Collaboration: Global designers partner with Indian manufacturers. Together, they create innovative, unique marble applications.

Conclusion

India’s marble industry shows dedication to quality. Heritage and resources boost its global marble presence. Naturistic Stones ensures excellence and lasting craftsmanship. Indian marble symbolizes elegance on global architecture stages. Villas, offices worldwide showcase Indian marble’s beauty.

1 note

·

View note

Text

Multilayer Pipes Market: Market Dynamics and Strategies for Success 2024-2030

Our Report covers global as well as regional markets and provides an in-depth analysis of the overall growth prospects of the market. Global market trend analysis including historical data, estimates to 2024, and compound annual growth rate (CAGR) forecast to 2030 is given based on qualitative and quantitative analysis of the market segments involving economic and non-economic factors. Furthermore, it reveals the comprehensive competitive landscape of the global market, the current and future market prospects of the industry, and the growth opportunities and drivers as well as challenges and constraints in emerging and emerging markets.

Get More Insights: https://qualiketresearch.com/reports-details/Multilayer-Pipes-Market

Key Matrix for Latest Report Update • Base Year: 2023 • Estimated Year: 2024 • CAGR: 2024 to 2034

Get Sample Report:

https://qualiketresearch.com/request-sample/Multilayer Pipes -Market/request-sample

Key Prominent Players In The Multilayer Pipes Market:

Gabbaplast Srl, Isoltubex S.L., aquatherm GmbH, Peštan d.o.o., LK Pex AB, Uponor Corporation, Wavin B.V., Valsir SpA, REHAU, Geberit AG.

Market segmentation

The Multilayer Pipes market is segmented by type and application. Growth between segments over the period 2024-2030 provides accurate calculations and forecasts of revenue by type and application in terms of volume and value. This analysis can help you expand your business by targeting eligible niches.

Multilayer Pipes Market Segment by Type

Water Supply (Sanitary Water Supply, Heating (Surface, Radiator)), Wastewater Management (Vertical Systems, Horizontal Systems)

Multilayer Pipes Market Segment by Applications

Residential Building (Multi Family Buildings, Single Family Building), Commercial Building (Education Institutes & Students Campus, Healthcare & Medical Clinics, Corporate Offices, Hotels & Motels

Regional Analysis for COVID-19 Outbreak-Global Multilayer Pipes Market:

APAC (Japan, China, South Korea, Australia, India, and Rest of APAC)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

North America (U.S., Canada, and Mexico)

South America (Brazil, Chile, Argentina, Rest of South America)

MEA (Saudi Arabia, UAE, South Africa)

Multilayer Pipes Market Research Objectives: - Concentrates on the key manufacturers, to define, pronounce and analyze the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years. - To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks). - Analyzing the with regard to individual future prospects, growth trends, and their involvement to the total market. - Reasonable developments such as agreements, expansions, new product launches, and acquisitions in the market - To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS: To understand the market conditions the five forces analysis is developed that comprises Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry. Political (Political policy and stability as well as trade, fiscal, and taxation policies) Economical: Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates • Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles) • Technological (Changes in digital or mobile technology, automation, research, and development) • Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions) • Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get Sample Report:

https://qualiketresearch.com/request-sample/Multilayer Pipes -Market/request-sample

About Us:

QualiKet Research is a leading Market Research and Competitive Intelligence partner helping leaders across the world to develop robust strategy and stay ahead for evolution by providing actionable insights about ever changing market scenario, competition and customers.

QualiKet Research is dedicated to enhancing the ability of faster decision making by providing timely and scalable intelligence.

QualiKet Research strive hard to simplify strategic decisions enabling you to make right choice. We use different intelligence tools to come up with evidence that showcases the threats and opportunities which helps our clients outperform their competition. Our experts provide deep insights which is not available publicly that enables you to take bold steps.

Contact Us:

6060 N Central Expy #500 TX 75204, U.S.A

+1 214 660 5449

1201, City Avenue, Shankar Kalat Nagar,

Wakad, Pune 411057, Maharashtra, India

+91 9284752585

Sharjah Media City , Al Messaned, Sharjah, UAE.

+971568464312

0 notes

Text

Global Gamification Market: Driving Engagement, Innovation, and Business Growth.

The Global Gamification Market is experiencing significant growth as businesses across industries adopt game-like elements to enhance engagement, productivity, and customer loyalty. Gamification involves the application of game design principles—such as rewards, points, challenges, and leaderboards—to non-gaming environments, including corporate training, education, marketing, healthcare, retail, and customer engagement.

Get More Insights:

https://qualiketresearch.com/reports-details/Gamification-Market

Key Matrix for Latest Report Update • Base Year: 2023, Estimated Year: 2024, CAGR: 2024 to 2030

Key Players In Global Gamification Market:

Microsoft Corporation, SAP, BI WORLDWIDE ,Verint, AON, Hoopla, CENTRICAL, MAMBO.IO, MPS INTERACTIVE SYSTEMS, AMBITION, and AXONIFY

Market segmentation:

Global Gamification Market is segmented into deployment such as Cloud, and On-Premises, by enterprise size such as Small and Medium Size Enterprises (SMEs), and Large Enterprise. Further, market is segmented into application such as Sales, Marketing, Product Development, Human Resource, and others, and industry such as BFSI, Retail, Healthcare, Government, Education & Research, IT & Telecomm, and Others.

Also, Global Gamification Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Global Gamification Market Segment Deployment:

Deployment Cloud On-Premise

Global Gamification Market Segment Application:

Sales Marketing Product Development Human Resource Others

Regional Analysis for COVID-19 Outbreak- Global Gamification Market:

APAC (Japan, China, South Korea, Australia, India, and Rest of APAC)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

North America (U.S., Canada, and Mexico)

South America (Brazil, Chile, Argentina, Rest of South America)

MEA (Saudi Arabia, UAE, South Africa)

FIVE FORCES & PESTLE ANALYSIS: To understand the market conditions the five forces analysis is developed that comprises Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry. Political (Political policy and stability as well as trade, fiscal, and taxation policies) Economical: Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates • Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles) • Technological (Changes in digital or mobile technology, automation, research, and development) • Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions) • Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

FAQ's:

Which are the dominant players of the Global Gamification Market?

What will be the size of the Global Gamification Market?

Which segment will lead the Global Gamification Market?

How will the market development trends change in the next five years?

What is the nature of the competitive landscape of the Global Gamification Market?

What are the go-to strategies adopted in the Global Gamification Market?

Get Sample Report:

https://qualiketresearch.com/request-sample/Gamification-Market/request-sample

About Us:

QualiKet Research is a leading Market Research and Competitive Intelligence partner helping leaders across the world to develop robust strategy and stay ahead for evolution by providing actionable insights about ever changing market scenario, competition and customers.

QualiKet Research is dedicated to enhancing the ability of faster decision making by providing timely and scalable intelligence.

QualiKet Research strive hard to simplify strategic decisions enabling you to make right choice. We use different intelligence tools to come up with evidence that showcases the threats and opportunities which helps our clients outperform their competition. Our experts provide deep insights which is not available publicly that enables you to take bold steps.

Contact Us:

6060 N Central Expy #500 TX 75204, U.S.A

+1 214 660 5449

1201, City Avenue, Shankar Kalat Nagar,

Wakad, Pune 411057, Maharashtra, India

+91 9284752585

Sharjah Media City , Al Messaned, Sharjah, UAE.

+971568464312

0 notes

Text

How eToro is dominating by expanding investments in UK online trading market

Buy Now

eToro is the trading and investing platform that empowers you to grow your knowledge and wealth as part of a global community. The main motive of this 207 founded company is to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

STORY OUTLINE

eToro is exploring in UK online trading market by

Factors driving eToro and in turn involving UK online trading market

Competitive landscape of Europe Wheat protein market with respective of MGP Ingredients

1.eToro has a leading position in UK online trading platform market.

Click here to Download a Sample Report

eToro is a major player in the online trading market in UK. eToro offers 3,000+ financial instruments across various classes, such as stocks, crypto and more. To enable eToro clients to use advanced trading features, such as advantage and short (SELL) orders, and to offer financial instruments that normally cannot be traded, such as indices and commodities, eToro utilizes Contracts for Difference (CFDs). Additionally, to enable traders and investors direct access to the market, some asset classes, such as stocks and crypto assets, offer direct ownership of the underlying assets, which we buy and hold in each client’s name.

eToro enables clients to deposit and withdraw using a variety of payment methods, the smartest of which is eToro Money, offering free and instant deposits with no FX conversion fees, and instant withdrawals. Other methods include wire transfers, bankcards, and more. eToro offers low minimum deposits and unified fees.

2.Factors driving MGP Ingredients and in turn involving Europe protein market

There are many drivers, which are making eToro lead in the UK online trading market. One of the reasons is that it provides various tools like CopyTrader, enables traders to replicate other traders’ actions in real time. To encourage top traders to be copied, eToro created the Popular Investor program.

Another unique product offered by eToro is Smart Portfolios, which are ready-made, investment strategies, offering thematic investment, such as medical cannabis, driverless cars, and people-based portfolios.

eToro has new investors which will be the stockholders of FinTech Acquisition Corp. V including Fintech V’s sponsors. Fintech V is a Special Purpose Acquisition Corporation (SPAC) that was formed for the purpose of combining with one or more businesses and remaining a public company. Additionally, several institutional investors will become new investors in eToro because of the transaction. These include ION Investment Group, Softbank Vision Fund 2, Fidelity Management & Research Company LLC, and Wellington Management.

3.Competitive landscape and Outlook of eToro in UK Online trading platform market

Click here to Ask for a Custom Report

eToro is sustaining its position in UK online trading platform market. It already is available in in 140 countries. eToro generated $1.2 billion revenue in 2021, a 103% year-on-year increase. In June 2021, eToro reached 20 million active users. It set an IPO valuation of $10.4 billion, a 316% increase on its 2020 valuation. 69% of users are from Europe, followed by Asia-Pacific (18%) and then the Americas (8%).

Looking at its most popular stocks Bitcoin is the most popular, it accounts for one in every 25 positions opened. Tesla, Microsoft and Apple are the most traded stocks. NASDAQ 100 is the most traded index. Oil is the most traded commodity.

CONCLUSION

eToro is an emerging online trading platform in the digital world and it got hike in the market majorly due to effect of Covid 19. eToro is a very versatile platform offering you the possibility to trade CFDs (for experienced traders) and with them, you can also invest in ETFs and real stocks (e.g. investors who are looking at the long term).

#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market#Emerging Players UK online trading platform Market

0 notes

Text

Other things that did or did not happen in 2024

Articles (from WIRED - The WIRED World in 2024 & The Economist - The World Ahead 2024) with predictions for 2024 that contained (tiny bits of) truth:

WIRED - The Path to Understanding: New approaches to memory, planning , reasoning, learning, evaluation, interpretability, alignment and more are appearing each week. This is setting us up for an astonishing year in 2024, a year in which the path towards human-level AGI will start to become clear.

WIRED - A New Exit Strategy. 2024 is the year these remedies (GvT: e.g. from the Digital Market Acts) start to come online. I believe we will see one or more of the Big Tech platforms facing a legal requirement to facilitate their users’ departure: “Mr. Zuckerberg, tear down that wall(ed garden).”

WIRED - China Looks to Europe: In 2024, the US will continue placing restrictions on Chinese-made technology, which will only further accelerate China’s push for domestic self-reliance on critical technologies - and perhaps even cause it to position itself as a key technological trading partner with Europe and the UK. As China strives to improve its relations with Europe while stabilising relations with the US, it will also be accelerating the development of many of the parallel technology systems that ic can no longer import.

WIRED - Regulators Finally Catch Up with Big Tech: In 2024, we will see courts and regulators around the world demonstrate that tech exceptionalism, when it comes to the applicability of legal rules, is magical thinking. […] In 2024, courts and regulators will also be considering the impacts on society, markets and businesses. […] In 2024, we will see the regulatory void long enjoyed by big tech come to an end.

WIRED - To Make an Impact, Join Tech’s Exodus: Investors are coming to realise that treating the government as a partner, a co-invesotr, and a market, is a winning strategy.

(!)WIRED - Being Human is a Unique Skill: AI is elbowing its way into ever more jobs, but while how we work will change, people will still be the most important factor. [..] By breaking down your job into tasks that AI can fully take on, tasks for which AI can improve your efficiency, and tasks that require your unique skills, you can identify the skills you should actually be investing in to stay competitive in the job you have. [..] 2024 will start to usher in a new world of work where people skills are more core to career success, and people-to-people collaboration is more core to company success.

(!) WIRED - People Power is at the Heart of Creativity: By contrast, 2024 will be the year when artists, writers, and creators threatened by generative AI will find new ways to show their value and fight back. [..] In 2024, human creativity will thrive in the spaces where AI can’t go.

WIRED - A Love Machine for Lonely Hearts: In 2024, chatbots and virtual character will become a lot more popular, both for utility and for fun.

The Economist - AI gets real: Businesses are adopting it (link, link en link), regulator are regulating it (link) and techies continue to improve it (link).

The Economist - Democracy in Danger: Mr. Trump may not become the nominee, and if he does, he may well lose. But the odds of a second Trump term are alarmingly high. The consequences could be catastrophic - for democracy and for the world.

The Economist - The World in Numbers - Industries: IT spending picks up, rising by about 9%. Artificial Intelligence generates remarkable hype but produces precious little revenue and plenty of scrutiny

The Economist - What’s Next for AI Research?: The most consequential advances will not be in the quality of the models themselves, but in learning how to use them more effectively.

Articles (from WIRED - The WIRED World in 2024 & The Economist - The World Ahead 2024) with predictions for 2024 that proved to be (too) optimistic:

WIRED - A Robot the Size of the World: Note: I can’t imagine this will take much longer. In 2024, we’re going to start connecting those LLMs and other AI systems to both sensors and actuators. In other words, they will be connected to the larger world, through APIs. They will receive direct inputs from our environment, in all the forms I thought about in 2016. And they will increasingly control our environment, through IoT devices and beyond.

WIRED - Extremism’s New Home: 2024 might be the year in which extremists start using DAOs strategically.

The Economist - AI Goes to Work: In 2024, the big beneficiaries will b companies outside the technology sector as they adopt AI in earnest with the aim of cutting costs and boosting productivity.

Articles (from WIRED - The WIRED World in 2024 & The Economist - The World Ahead 2024) with predictions for 2024 that proved to be (too) pessimistic:

WIRED - The Great Quantum Collapse Has Come: As a result, in 2024 we will start to see the stagnation of quantum computing research programs from companies such as Google, Honeywell and IBM. For the author’s reaction: link

WIRED - Get Ready for the Great AI Disappointment: We may start moving towards the (much more meaningful) conclusion that one needs to know which human tasks can be augmented by these models, and what types of additional training workers need to make this a reality.

0 notes

Text

Global Biodegradable Plastic Market Report 2024 – 2030

Our Latest Report covers The Global Biodegradable Plastic Market is experiencing rapid growth as environmental concerns and sustainability initiatives push for more eco-friendly alternatives to conventional plastics. Biodegradable plastics are designed to break down naturally through the action of microorganisms, helping reduce plastic waste and environmental pollution. These plastics are used in a wide range of applications, including packaging, agriculture, consumer goods, and medical devices. The market's growth is driven by the increasing global push toward reducing plastic pollution, growing regulatory pressure, and rising consumer demand for sustainable products.

Get More Insights:

Key Matrix for Latest Report Update • Base Year: 2023, Estimated Year: 2024, CAGR: 2024 to 2030

Key Players In The Global Biodegradable Plastic Market:

BASF SE, Natureworks, Total Corbion PLA, Mitsubishi Chemical Corporation, Biome Bioplastics, Plantic Technologies, Bio-On, Danimer Scientific, and Novamont S.P.A.

Market segmentation

Global Biodegradable Plastic Market is segmented into type such as PLA (Polylactic Acid) PBAT (Polybutylene Adipate Terephthalate),PBS (POLYBUTYLENE SUCCINATE), PHA (POLYHYDROXYALKANOATES), Starch Blends, and Others. Further, market is segmented into application such as Packaging, Agriculture, Consumer Durable, Textile, and Others.

Also, Global Biodegradable Plastic Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Global Biodegradable Plastic Market Segment by Type:

PLA (Polylactic Acid)

PBAT (Polybutylene Adipate Terephthalate)

PBS (POLYBUTYLENE SUCCINATE)

PHA (POLYHYDROXYALKANOATES)

Starch Blends Others

Global Biodegradable Plastic Market Segment by Applications:

Packaging

Agriculture

Consumer

Durable

Textile Others

Regional Analysis for COVID-19 Outbreak- Global Biodegradable Plastic Market:

APAC (Japan, China, South Korea, Australia, India, and Rest of APAC)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

North America (U.S., Canada, and Mexico)

South America (Brazil, Chile, Argentina, Rest of South America)

MEA (Saudi Arabia, UAE, South Africa)

Market Trends:

Shift to Plant-Based Bioplastics: There is a growing trend toward using renewable resources such as corn, sugarcane, and algae to produce biodegradable plastics, with plant-based bioplastics (like PLA and PHA) gaining popularity in the market.

Growth in Packaging Applications: The packaging industry is the largest consumer of biodegradable plastics, driven by the rising demand for eco-friendly packaging solutions in food, beverage, and retail sectors. Companies are shifting to biodegradable alternatives for single-use packaging to meet sustainability goals.

Use in Agriculture: Biodegradable plastics are increasingly being used in agriculture for applications such as mulch films, seed coatings, and plant pots, as they help reduce plastic waste and improve soil health.

Focus on Recycling and Circular Economy: The focus on the circular economy is also shaping the biodegradable plastic market, with increased efforts toward creating products that can be easily recycled or composted after use.

FIVE FORCES & PESTLE ANALYSIS:

To understand the market conditions the five forces analysis is developed that comprises Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry. Political (Political policy and stability as well as trade, fiscal, and taxation policies) Economical: Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates • Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles) • Technological (Changes in digital or mobile technology, automation, research, and development) • Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions) • Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

FAQ's:

Which are the dominant players of the Global Biodegradable Plastic Market?

What will be the size of the Global Biodegradable Plastic Market in the coming years?

Which segment will lead the Global Biodegradable Plastic Market?

How will the market development trends change in the next five years?

What is the nature of the competitive landscape of the Global Biodegradable Plastic Market?

What are the go-to strategies adopted in the Global Biodegradable Plastic Market?

Get Sample Report:

About Us:

QualiKet Research is a leading Market Research and Competitive Intelligence partner helping leaders across the world to develop robust strategy and stay ahead for evolution by providing actionable insights about ever changing market scenario, competition and customers.

QualiKet Research is dedicated to enhancing the ability of faster decision making by providing timely and scalable intelligence.

QualiKet Research strive hard to simplify strategic decisions enabling you to make right choice. We use different intelligence tools to come up with evidence that showcases the threats and opportunities which helps our clients outperform their competition. Our experts provide deep insights which is not available publicly that enables you to take bold steps.

Contact Us:

6060 N Central Expy #500 TX 75204, U.S.A

+1 214 660 5449

1201, City Avenue, Shankar Kalat Nagar,

Wakad, Pune 411057, Maharashtra, India

+91 9284752585

Sharjah Media City , Al Messaned, Sharjah, UAE.

+971568464312

0 notes

Text

Generative Artificial Intelligence In Supply Chain Market 2024-2033 : Demand, Trend, Segmentation, Forecast, Overview And Top Companies

The generative artificial intelligence in supply chain global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Generative Artificial Intelligence In Supply Chain Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The generative artificial intelligence in supply chain market size has grown exponentially in recent years. It will grow from $0.28 billion in 2023 to $0.41 billion in 2024 at a compound annual growth rate (CAGR) of 43.4%. The growth in the historic period can be attributed to growth in computational power, growth in e-commerce, increasing availability of big data, increasing focus on automation, and growth in investment in AI research and development. The generative artificial intelligence in supply chain market size is expected to see exponential growth in the next few years. It will grow to $1.73 billion in 2028 at a compound annual growth rate (CAGR) of 43.7%. The growth in the forecast period can be attributed to increasing demand for real-time supply chain visibility, growing need for AI-powered supply chain planning tools, rising investment in AI for supply chain innovation labs, growing demand for AI in predictive logistics, and rising demand for advanced forecasting techniques. Major trends in the forecast period include technological advancements, telemedicine, blockchain technology, 5G technology, and internet of things.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/generative-artificial-intelligence-in-supply-chain-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The rising e-commerce is expected to propel the growth of the generative artificial intelligence in supply chain market going forward. E-commerce is the buying and selling goods and services over the Internet, involving transactions and business activities conducted through online platforms and mobile applications. The rise in e-commerce is due to the growing adoption of online shopping, advancements in digital payment technologies, and the expansion of internet access. Generative artificial intelligence (AI) is used in the e-commerce supply chain to optimize inventory management, enhance demand forecasting, streamline logistics, automate order processing, and personalize customer experiences by analyzing large volumes of data to create efficient, data-driven supply chain strategies. For instance, in November 2023, according to the International Trade Administration, a US-based Department of Commerce, consumer eCommerce was expected to generate $285.60 billion in revenue by 2025, accounting for 36.3% of the UK retail market as of January 2021. Additionally, eCommerce revenues in the UK are projected to grow at an average annual rate of 12.6% by 2025. Therefore, rising e-commerce drives the growth of generative artificial intelligence in the supply chain market.

Market Trends - Major companies operating in the generative artificial intelligence in supply chain market are focused on developing innovative technologies, such as cognitive solutions, to enhance predictive analytics and optimize supply chain operations. Cognitive solutions refer to advanced technologies that simulate human thought processes to analyze, interpret, and act on complex data. These solutions leverage artificial intelligence (AI), machine learning, and natural language processing to enable systems to understand, reason, and learn from data, much such as the human brain. For instance, in December 2023, Blue Yonder, a US-based supply chain management company, launched Blue Yonder Orchestrator, a generative AI tool that enables businesses to make more intelligent decisions and accelerate supply chain orchestration. This new capability leverages advanced AI algorithms to automate and optimize complex supply chain processes, enhancing efficiency and accuracy. Its key features include real-time data analysis, enabling dynamic inventory and logistics adjustments based on current conditions and forecasts. The system seamlessly integrates with existing supply chain infrastructure, providing actionable insights and recommendations to improve overall operational performance.

The generative artificial intelligence in supply chain market covered in this report is segmented –

1) By Component: Solutions, Software 2) By Deployment Mode: Cloud-Based, On-Premise 3) By End-User: Retail, Manufacturing, Healthcare, Other End-Users

Get an inside scoop of the generative artificial intelligence in supply chain market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=19483&type=smp

Regional Insights - North America was the largest region in the generative artificial intelligence in supply chain market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the generative artificial intelligence in supply chain market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the generative artificial intelligence in supply chain market are Amazon.com Inc., Microsoft Corporation, Deutsche Post AG, Intel Corporation, Accenture plc, International Business Machines Corporation, Cisco Systems Inc., Oracle Corporation, SAP SE, NVIDIA Corporation, Infosys Limited, Dematic Inc., Zebra Technologies Corporation, PTC Inc., Teradata Corporation, Blue Yonder Inc., L&T Technology Services Limited, Manhattan Associates Inc., Nitor Infotech Private Limited, Logility Inc., LLamasoft Inc., Covariant Inc., FourKites Inc., Kanerika Inc., ClearMetal Inc.

Table of Contents 1. Executive Summary 2. Generative Artificial Intelligence In Supply Chain Market Report Structure 3. Generative Artificial Intelligence In Supply Chain Market Trends And Strategies 4. Generative Artificial Intelligence In Supply Chain Market – Macro Economic Scenario 5. Generative Artificial Intelligence In Supply Chain Market Size And Growth ….. 27. Generative Artificial Intelligence In Supply Chain Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

As UK Plans for Pension Funds to Allocate to Bitcoin, DGQEX Provides In-depth Analysis of the Potential of Digital Gold

Recently, The Times reported that a plan would allocate 3% of pension funds to Bitcoin investments. This move has sparked widespread attention. Supporters argue that Bitcoin is “digital gold”, possessing anti-inflation and long-term value storage characteristics, while opponents point out that the Bitcoin volatility is too high, which may not meet the requirements for long-term fund management like pensions.

As a professional cryptocurrency exchange, DGQEX has been closely monitoring the dynamics of the digital asset market. The topic of pension funds allocating to Bitcoin not only highlights the Bitcoin importance in mainstream finance but also brings more opportunities and challenges to the cryptocurrency market. DGQEX helps investors better cope with this trend by providing advanced trading technology and diversified product support.

The Dual Attributes of Bitcoin: Volatility and Store of Value

As a digital asset, the high volatility of Bitcoin has always been the core of market controversy. The Times points out that this volatility poses challenges to fund models like pensions that seek stable returns. However, proponents of including Bitcoin in pension investments emphasize its scarcity and anti-inflation capabilities similar to gold.

DGQEX data shows that in recent years, the interest of institutional investors in Bitcoin has surged. Especially after traditional financial giants like BlackRock launched Bitcoin ETFs, the market position of Bitcoin has been further solidified. This indicates that Bitcoin is not only a speculative asset but also a financial tool with long-term investment value. To cope with the Bitcoin volatility, DGQEX provides investors with a variety of risk management tools, such as derivatives trading, limit orders, and real-time market monitoring. With technical support, investors can better avoid risks and seize potential investment opportunities amid market fluctuations.

The Trend of Integration Between Digital Assets and Pension Investments

The plan to invest pension funds in Bitcoin reflects the trend of integration between traditional finance and digital assets. This trend not only opens up broader application scenarios for Bitcoin but also promotes the development of the entire cryptocurrency industry. As more institutional capital enters the market, exchanges will play an increasingly important role as a bridge connecting investors and assets.

DGQEX provides a stable and efficient trading environment for institutional investors and individual users through its global technology layout and advanced trading system. The platform liquidity management and trading depth optimization enable it to meet the investment needs of funds of different sizes. At the same time, the security system of DGQEX ensures comprehensive protection of user assets, laying the foundation for the healthy development of the digital asset market.

As a leading platform focused on cryptocurrency trading, DGQEX provides efficient and secure trading services to users worldwide. The platform not only supports trading of mainstream assets like Bitcoin but also offers users a rich array of derivative tools and professional market analysis to meet diverse investment needs.

In the future, DGQEX will continue to strengthen cooperation with institutional investors and provide more support for the market entry of long-term funds like pensions by optimizing technology platforms and product design. In the process of market standardization and development, DGQEX will open up more investment opportunities for global investors with a professional perspective and advanced technology, promoting the continuous growth of the digital asset market.

1 note

·

View note

Text

Global Wear Parts Market Analysis 2024: Size Forecast and Growth Prospects

The wear parts global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Wear Parts Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The wear parts market size has grown strongly in recent years. It will grow from $608.92 billion in 2023 to $648.87 billion in 2024 at a compound annual growth rate (CAGR) of 6.5%. The growth in the historic period can be attributed to industrial growth, increased mining and exploration activities, maintenance and replacement cycles, globalization and trade, rising demand for energy.

The wear parts market size is expected to see strong growth in the next few years. It will grow to $796.11 billion in 2028 at a compound annual growth rate (CAGR) of 5.2%. The growth in the forecast period can be attributed to renewable energy expansion, focus on infrastructure renewal, digitalization of supply chains, automation and robotics in manufacturing, rising agricultural mechanization. Major trends in the forecast period include advanced materials and coatings, predictive maintenance solutions, digitalization and industry 4.0 integration, innovations in 3D printing, remote monitoring and iot integration, customization for specific applications.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/wear-parts-global-market-report

Scope Of Wear Parts Market The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Wear Parts Market Overview