#esg strategies for companies

Explore tagged Tumblr posts

Link

ESG stands for Environmental, Social, and Governance, and it refers to a framework that evaluates the sustainability and ethical impact of a company or investment. ESG metrics are quantitative and qualitative measures used to assess a company's performance in these areas. Here's a brief overview of each component of the ESG framework:

#esg reporting india#esg environmental factors#esg work#esg reporting in india#esg in corporate governance#esg company#esg values#corporate esg#business responsibility reporting#esg strategies for companies

0 notes

Text

Matt Ford at TNR:

There are more than 800 federal judges in the United States. None of them create as much work for their colleagues as Reed O’Connor, a federal judge who serves in the northern district of Texas. For nearly two decades, O’Connor has delivered one ideologically driven ruling after another. No matter how many times those decisions are overturned by the appellate courts and the Supreme Court itself, he persists.

In his latest haphazard ruling, O’Connor held last week that American Airlines violated its legal obligations to employees by allowing BlackRock, the company’s 401(k) manager, to consider “environmental, societal, and governance” factors when making investment decisions and casting proxy votes. If upheld on appeal, the ruling threatens to upend the entire retirement plan industry by opening 401(k) managers to litigation and penalties for using ESG factors as part of their investment strategies—something that nearly every manager has done in recent years. At issue in the case is whether the airline violated its legal obligations to employees by investing their 401(k) plans with BlackRock, one of the nation’s three largest investment managers, while the investment firm pursued environmentally and socially conscious goals. The class-action plaintiffs claimed that the airline financially harmed its 401(k) participants by not sufficiently scrutinizing BlackRock’s ESG principles when investing and casting proxy votes in shareholder meetings.

BlackRock currently manages more than $10 trillion in retirement funds. Like nearly all such managers, it adopted a series of ESG policies over the last decade. Those policies led it to use its proxy voting powers on behalf of shareholders to encourage companies to adopt more socially and environmentally conscious policies. In perhaps the most famous episode, it sided with a group of activist investors in a 2021 proxy vote to put three members on ExxonMobil’s board who would push for investments in renewable energy. The plaintiffs claimed that this approach violated the Employee Retirement Income Security Act of 1974, also known as ERISA. The law sets basic standards for pensions and employee benefit and retirement plans offered by employers. Those employers have a fiduciary requirement to administer their plans on behalf of their employees to minimize risk, avoid conflicts of interest, and so on. Two of these obligations are known as the “duty of prudence” and the “duty of loyalty.”

In the plaintiff’s telling, considering ESG issues when making investment decisions violates these duties because they inherently reduce the fund’s performance. “[American Airlines and its subsidiaries] have violated ERISA by selecting and retaining ESG funds that pursue nonfinancial or nonpecuniary objectives like ESG social policy objectives, rather than investment funds that have the exclusive purpose of maximizing financial returns for investors,” they argued in their complaint.

[...] The split ruling leads to a paradoxical result: In its telling, American Airlines violated ERISA by not challenging BlackRock’s ESG efforts in general and the ExxonMobil vote in particular, but would have also violated ERISA if it had imprudently dropped the management firm after the ExxonMobil vote. O’Connor tried to square the circle by describing the retirement plan industry as “oligopolist” and “cartel-like,” and claiming that “industry norms are not enough to safeguard against breaches of loyalty,” but the paradox remained. This mishmash of a ruling is par for the course with O’Connor. The judge became famous in the 2010s for habitually ruling that the Affordable Care Act was unconstitutional. In 2018, he ruled that the entire law was unconstitutional because a Republican-led Congress had zeroed out the individual mandate’s penalty. The decision was widely condemned as lawless, even by some of the ACA’s critics. In 2021, the Supreme Court nixed the lawsuit on standing grounds in a 7–2 ruling, with even Justice Clarence Thomas voting to uphold the ACA. More recently, O’Connor butchered the Indian Child Welfare Act through a series of profound misreadings of Indian law and precedent, again leading to a 7–2 reversal by the justices. O’Connor is also widely seen as an extremely friendly judge to conservative legal interests. Right-wing plaintiffs routinely file lawsuits in his division in hopes of getting them assigned to him. Elon Musk, the far-right CEO of X, updated the company’s terms of service last fall to require that any user lawsuit brought against X be filed in O’Connor’s division in Texas, even though the company is headquartered in California. It is unsurprising that the plaintiffs chose his court to file an anti-ESG lawsuit in, or that he might be interested in enforcing right-wing policy goals. Last December, for example, O’Connor threw out a proposed plea deal between the Justice Department and Boeing over its 737 MAX crashes because of a provision that would have required a federal monitor to be selected “in keeping with the [Justice] Department’s commitment to diversity and inclusion.” The judge claimed that “the parties’ DEI efforts only serve to undermine this confidence in the government and Boeing’s ethics and anti-fraud efforts.”

Right-wing activist judge Reed O’Connor is on a rampage against ESG retirement planning.

2 notes

·

View notes

Text

Consultation Audit Services in Delhi: A Pathway to Financial Precision

Delhi, the capital city of India, is not just the heart of the nation but also a bustling hub of business activity. From startups to established enterprises, organizations in the Delhi area are increasingly relying on consultation audit services to ensure financial transparency, regulatory compliance, and optimized operations. Here’s an in-depth look at why consultation audit services are essential and how they can benefit businesses in the region.

Understanding Consultation Audit Services

Consultation audit services go beyond traditional financial audits. They encompass a comprehensive review of a company’s financial records, operational processes, and compliance frameworks to provide actionable insights for improvement. These services can include:

Statutory Audits – Ensuring compliance with legal and financial reporting requirements.

Internal Audits – Evaluating operational efficiency and risk management practices.

Tax Audits – Verifying compliance with taxation laws and optimizing tax strategies.

Process Audits – Reviewing and enhancing workflows for better productivity and cost-efficiency.

Management Audits – Assessing the effectiveness of leadership and decision-making processes.

Why Businesses in Delhi Need Consultation Audit Services

Regulatory Environment Delhi is home to numerous businesses operating under stringent local, national, and international regulations. Regular audits ensure compliance with laws like the Companies Act, GST laws, and various sector-specific regulations.

Competitive Advantage A thorough audit helps identify inefficiencies, reduce costs, and optimize resource allocation. These insights allow businesses to remain competitive in Delhi’s vibrant market.

Investor Confidence For businesses seeking funding, robust audit practices reassure investors of financial integrity and sound management.

Risk Mitigation With businesses in Delhi facing challenges such as cyber threats, fraud, and fluctuating market conditions, audits provide a safeguard by identifying and addressing vulnerabilities early.

Key Benefits of Consultation Audit Services

Enhanced Compliance: Avoid penalties by adhering to legal and regulatory standards.

Financial Accuracy: Ensure error-free records and improved budgeting.

Strategic Decision-Making: Leverage insights to make informed business decisions.

Improved Credibility: Build trust with stakeholders, including customers and investors.

Cost Efficiency: Streamline processes to save time and resources.

Choosing the Right Consultation Audit Firm in Delhi

The effectiveness of an audit depends largely on the expertise of the auditing firm. Here are key factors to consider:

Experience and Specialization: Choose a firm with a proven track record and expertise in your industry.

Local Knowledge: Firms familiar with Delhi’s regulatory landscape can provide tailored solutions.

Comprehensive Services: Opt for firms offering end-to-end audit and consultation services.

Technology Adoption: Modern tools like AI-powered audit software can enhance precision and efficiency.

Leading Consultation Audit Trends in Delhi

Digital Auditing Tools: With the rise of digitization, automated tools are transforming traditional audit practices.

Sustainability Audits: As businesses focus on ESG (Environmental, Social, Governance) compliance, sustainability audits are gaining prominence.

Risk-Based Auditing: A shift towards identifying high-risk areas to prioritize during audits.

Conclusion-

In a dynamic business environment like Delhi, consultation audit services are not a luxury but a necessity. By partnering with the right audit firm, businesses can navigate the complexities of compliance, improve financial health, and unlock growth opportunities.

Whether you’re a small business owner or a large enterprise, investing in consultation audit services can set you on the path to financial precision and long-term success.

Looking for Consultation Audit Services in Delhi? Contact our team of experts to get tailored solutions for your business needs. Let us help you achieve financial clarity and compliance excellence!

#ConsultationAuditServices#AuditSolutions#DelhiBusinesses#FinancialTransparency#RegulatoryCompliance#InternalAudit#TaxAudit#RiskManagement#BusinessGrowth#DelhiStartups#AuditExperts#CorporateCompliance#ProcessOptimization#InvestorConfidence#StatutoryAudits#BusinessSuccess#AuditingTrends#SustainabilityAudits#FinancialClarity#BusinessConsultation

2 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

2 notes

·

View notes

Text

Best 10 Business Strategies for year 2024

In 2024 and beyond, businesses will have to change with the times and adjust their approach based on new and existing market realities. The following are the best 10 business approach that will help companies to prosper in coming year

1. Embrace Sustainability

The days when sustainability was discretionary are long gone. Businesses need to incorporate environmental, social and governance (ESG) values into their business practices. In the same vein, brands can improve brand identity and appeal to environmental advocates by using renewable forms of energy or minimizing their carbon footprints.

Example: a fashion brand can rethink the materials to use organic cotton and recycled for their clothing lines. They can also run a take-back scheme, allowing customers to return old clothes for recycling (not only reducing waste but creating and supporting the circular economy).

2. Leverage AI

AI is revolutionizing business operations. Using AI-fuelled solutions means that you can automate processes, bring in positive customer experiences, and get insights. AI chatbots: AI can be utilized in the form of a conversational entity to support and perform backend operations, as well.

With a bit more specificity, say for example that an AI-powered recommendation engine recommends products to customers based on their browsing history and purchase patterns (as the use case of retail). This helps to increase the sales and improve the shopping experience.

3. Prioritize Cybersecurity

Cybersecurity is of utmost important as more and more business transitions towards digital platforms. Businesses need to part with a more substantial amount of money on advanced protective measures so that they can keep sensitive data private and continue earning consumer trust. Regular security audits and training of employees can reduce these risks.

Example: A financial services firm may implement multi-factor authentication (MFA) for all online transactions, regularly control access to Internet-facing administrative interfaces and service ports as well as the encryption protocols to secure client data from cyberattacks.

4. Optimizing Remote and Hybrid Working Models

Remote / hybrid is the new normal Remote teams force companies to implement effective motivation and management strategies. Collaboration tools and a balanced virtual culture can improve productivity and employee satisfaction.

- Illustration: a Tech company using Asana / Trello etc. for pm to keep remote teams from falling out of balance. They can also organise weekly team-building activities to keep a strong team spirit.

5. Focus on Customer Experience

Retention and growth of the sales follow-through can be tied to high quality customer experiences. Harness data analytics to deepen customer insights and personalize product offers making your marketing campaigns personal: a customer support that is responsive enough can drive a great level of returning customers.

Example – For any e-commerce business, you can take user experience feedback tools to know about how your customers are getting along and make necessary changes. Custom email campaigns and loyalty programs can also be positively associated with customer satisfaction and retention.

6. Digitalization Investment

It is only the beginning of digital transformation which we all know, is key to global competitiveness. For streamlining, companies have to adopt the use advanced technologies such as Blockchain Technology and Internet of Things (IoT) in conjunction with cloud computing.

IoT example : real-time tracking and analytics to optimize supply chain management

7. Enhance Employee Skills

Develop Your Employees: Investing in employee development is key to succeeding as a business. The training is provided for the folks of various industries and so employees can increase their skills that are needed to work in a certain company. Employee performance can be enhanced by providing training programs in future technology skills and soft skills and job satisfaction.

Example: A marketing agency can host webinars or create courses to teach people the latest digital marketing trends and tools This can help to keep employees in the know which results in boosting their skills, making your campaigns successful.

8. Diversify Supply Chains

The ongoing pandemic has exposed the weaknesses of global supply chains. …diversify its supply base and promote the manufacturing of drugs in Nigeria to eliminate total dependence on a single source. In return, this approach increases resilience and reduces exposure to the risks of supply chain interruption.

- E.g., a consumer electronics company can source components from many suppliers in various regions. In so doing, this alleviates avoidable supply chain interruptions during times of political tensions or when disasters hit.

9. Make Decisions Based on Data

A business database is an asset for businesses. By implementing data, they allow you to make decisions based on the data that your analytics tools are providing. For example, sales analysis lets you track trends and better tailor your goods to the market.

Example: A retail chain can use data analytics to find out when a customer buys, and it change their purchasing policies. This can also reduce overstock and stockouts while overall, increasing efficiency.

10. Foster Innovation

Business Growth Innovation is Key A culture of creativity and experimentation should be established in companies. Funding R&D and teaming with startups can open many doors to both solve problems creatively but also tap into new markets.

Example: A software development firm could create an innovation lab where team members are freed to work on speculative projects. Moreover, work with start-ups on new technologies and solutions.

By adopting these strategies, businesses can navigate the turbulence for 2024 and roll up market — progressive.AI with an evolving dynamic market, being ahead of trends and updated is most likely will help you thrive in the business landscape.

#ai#business#business strategy#business growth#startup#fintech#technology#tech#innovation#ai in business

2 notes

·

View notes

Text

So we're all familiar with the diversity and gender quotas being forced on companies through ESG, by BlackRock and State Street. We all know it's supposedly in the name of Diversity/Inclusion/Equity. However, when it comes to gender quotas specifically, I suspect it's also another facet of the New World Order depopulation agenda.

Women who work outside the home tend to seek out jobs in certain fields. Careers which are considered male dominated are that way because women often don't want them. It's the reason you don't see women garbage collectors ever.

Now if those careers that women aren't interested in are forced to have a 50/50 split between men and women to comply with ESG, the companies involved seem to have two options. 1) They can either incentivize women to apply for the position by offering much higher pay than they normally would - impractical, and possibly illegal. 2) They can stop hiring men untill the gender divide is even. Regardless of the strategy used to maintain a 50/50 gender split, it will result in few men working.

What does this have to do with depopulation? Glad you asked.

Men being denied employment to maintain quotas will have a direct impact on their romantic and sexual relationships. Women tend to prefer dating men who make more money than them. If gender quotas are keeping men unemployed, those men are going to be seen as less sexually desirable on average, meaning less opportunities for relationships or reproduction. And the population declines.

20 notes

·

View notes

Text

The Rise of Ethical Investing: Aligning Wealth with Values

In an age where consumers and investors alike are becoming more conscious of the impact their financial decisions have on the world, the concept of ethical investing has surged to the forefront of the investment landscape. Ethical investing is not just a passing trend; it is a profound shift in how individuals and institutions approach their financial strategies. This movement reflects a growing desire to align personal values with financial objectives, ensuring that the pursuit of profit does not come at the expense of societal well-being.

Understanding Ethical Investing

Ethical investing, also known as socially responsible investing (SRI) or sustainable investing, involves choosing investments based on ethical principles, alongside traditional financial criteria. Investors who engage in ethical investing typically seek to support companies and industries that align with their values, whether those values are environmental sustainability, social justice, corporate governance, or other moral considerations.

This approach to investing goes beyond merely avoiding industries like tobacco, alcohol, or weapons manufacturing, which have traditionally been viewed as unethical. Ethical investing also encompasses proactive investment in companies that are making positive contributions to society, such as those leading in renewable energy, fair labor practices, and community development.

The Principles Guiding Ethical Investing

At its core, ethical investing is guided by the principle of doing no harm while fostering positive impact. This can be broken down into several key principles:

Environmental Responsibility: Investors focus on companies that prioritize sustainability and minimize their environmental footprint. This includes businesses that invest in clean energy, reduce waste, and promote biodiversity.

Social Impact: Ethical investors seek out companies that contribute to social well-being. This might include businesses that promote fair wages, diversity and inclusion, or those that support local communities.

Corporate Governance: Strong governance is crucial in ethical investing. Investors look for companies with transparent practices, strong leadership, and accountability to their stakeholders.

Avoidance of Harmful Industries: Many ethical investors choose to exclude industries that they deem harmful, such as fossil fuels, arms manufacturing, or companies involved in unethical labor practices.

The Growth of Ethical Investing

The rise of ethical investing can be attributed to several factors. One of the most significant is the increasing awareness of global issues such as climate change, social inequality, and corporate corruption. As these issues have gained prominence, so too has the desire among investors to ensure their money is being used to support positive change.

Another driving force behind the growth of ethical investing is the shift in investor demographics. Millennials and Gen Z, in particular, are more likely to prioritize ethical considerations when making investment decisions. This younger generation is not only concerned with financial returns but also with how their investments can contribute to a better world.

Furthermore, technological advancements have made it easier for investors to access information about companies' ethical practices. With the rise of ESG (Environmental, Social, and Governance) ratings, investors now have more tools at their disposal to assess the ethical impact of their investments.

The Benefits of Ethical Investing

Ethical investing offers a range of benefits that extend beyond the moral satisfaction of aligning investments with personal values. Here are some of the key advantages:

Positive Impact: One of the most significant benefits of ethical investing is the ability to drive positive change. By choosing to invest in companies that prioritize social and environmental responsibility, investors can help support businesses that are making a difference.

Long-Term Value: Companies that adhere to ethical practices are often more sustainable in the long term. They tend to have better risk management, are less likely to be involved in scandals, and are better positioned to adapt to changing regulatory environments. This can lead to more stable and potentially higher returns over time.

Alignment with Personal Values: Ethical investing allows individuals to align their financial decisions with their personal values. This can lead to greater satisfaction and a sense of purpose, knowing that their investments are contributing to causes they care about.

Increased Awareness: Engaging in ethical investing can increase awareness of global issues and encourage more informed decision-making. Investors become more knowledgeable about the impact of their financial choices and may become advocates for positive change.

Challenges in Ethical Investing

While ethical investing offers numerous benefits, it is not without its challenges. One of the primary challenges is the difficulty in defining what constitutes "ethical" behavior. What one investor considers ethical may differ from another's perspective. This subjectivity can make it challenging to create a one-size-fits-all approach to ethical investing.

Another challenge is the potential trade-off between ethical considerations and financial returns. While many ethical investments have performed well, there may be instances where prioritizing ethical criteria could lead to lower returns compared to traditional investments. However, this trade-off is becoming less of a concern as more evidence emerges showing that ethical investments can perform on par with or even outperform conventional investments.

Additionally, the lack of standardization in ESG ratings and reporting can make it difficult for investors to assess the true ethical impact of a company. Inconsistent reporting practices and the potential for "greenwashing" – where companies exaggerate their ethical credentials – can complicate the investment process.

The Future of Ethical Investing

The future of ethical investing looks promising as more investors recognize the importance of aligning their financial decisions with their values. As global challenges such as climate change and social inequality continue to dominate the agenda, the demand for ethical investment options is likely to grow.

To support this growth, it is essential for the investment industry to continue improving transparency, standardization, and education around ethical investing. By providing investors with the tools and information they need to make informed decisions, the industry can help ensure that ethical investing becomes the norm rather than the exception.

In conclusion, ethical investing represents a powerful way for individuals and institutions to use their financial resources to drive positive change. By aligning investments with values, investors can contribute to a more sustainable and equitable world while still achieving their financial goals. As the movement continues to gain momentum, ethical investing is poised to play a pivotal role in shaping the future of finance.

2 notes

·

View notes

Text

Sustainable Reporting: Tracking Progress for Positive Change

Sustainable reporting involves the systematic disclosure of an organization's non-financial performance, focusing on ESG factors. It provides insights into a company's environmental footprint, social responsibility initiatives, governance practices, and long-term sustainability strategies. By reporting these impacts and commitments, businesses demonstrate their dedication to sustainable development and stakeholder engagement.

#sustainability#sustainable living#sustainable#sustainable development#ecoconscious#ecofriendly#reporting#succession#sustainable business

3 notes

·

View notes

Link

Have you ever heard the term ESG Sustainability Performance Metrics? Or wondered about its significance in today's world? If yes, then this article can be an enlightening read for you. The best way to start is with the definition. ESG Sustainability Performance metrics, or we can say, ESG metrics are nothing but a set of criteria used worldwide to assess how a company is performing in terms of sustainability and social responsibility.

#esg reporting india#esg environmental factors#esg work#esg reporting in india#esg in corporate governance#esg company#esg values#corporate esg#business responsibility reporting#esg strategies for companies#esg services#esg and sustainability

0 notes

Text

The impact of sustainability in fintech: reflections from the summit

In recent years, the Fintech industry has witnessed a paradigm shift towards sustainability, with an increasing emphasis on integrating environmental, social, and governance (ESG) factors into financial decision-making processes. This transformative trend took center stage at the latest Fintech Summit, where industry leaders converged to explore the intersection of sustainability and financial technology. Among the prominent voices shaping this discourse was Xettle Technologies, a trailblazer in Fintech software solutions, whose commitment to sustainability is driving innovation and reshaping the future of finance.

Against the backdrop of global challenges such as climate change, resource depletion, and social inequality, the imperative for sustainable finance has never been greater. The Fintech Summit provided a platform for thought leaders to reflect on the role of technology in advancing sustainability goals and fostering a more resilient and equitable financial ecosystem.

At the heart of the discussions was the recognition that sustainability is not just a moral imperative but also a strategic imperative for Fintech firms. By integrating ESG considerations into their operations, products, and services, Fintech companies can mitigate risks, enhance resilience, and unlock new opportunities for growth and value creation. Xettle Technologies’ representatives underscored the company’s commitment to sustainability, highlighting how it is embedded in the company’s culture, innovation agenda, and business strategy.

One of the key themes that emerged from the summit was the role of Fintech in driving sustainable investment. Through innovative solutions such as green bonds, impact investing platforms, and ESG scoring algorithms, Fintech firms are empowering investors to allocate capital towards environmentally and socially responsible projects and companies. Xettle Technologies showcased its suite of Fintech software solutions designed to facilitate sustainable investing, enabling financial institutions and investors to align their portfolios with their values and sustainability objectives.

Moreover, the summit explored the transformative potential of blockchain technology in advancing sustainability goals. By enhancing transparency, traceability, and accountability in supply chains, blockchain can help address issues such as deforestation, forced labor, and conflict minerals. Xettle Technologies’ experts elaborated on the company’s blockchain-based solutions for supply chain finance and sustainability reporting, emphasizing their role in promoting ethical sourcing, responsible production, and fair labor practices.

In addition to sustainable investing and supply chain transparency, the summit delved into the role of Fintech in promoting financial inclusion and resilience. By leveraging technology and data analytics, Fintech firms can expand access to financial services for underserved populations, empower small and medium-sized enterprises (SMEs), and build more inclusive and resilient communities. Xettle Technologies’ representatives shared insights into the company’s initiatives to support financial inclusion through digital payments, microfinance, and alternative credit scoring models.

Furthermore, the summit highlighted the importance of collaboration and partnership in advancing sustainability goals. Recognizing the interconnected nature of sustainability challenges, participants underscored the need for cross-sectoral collaboration between Fintech firms, financial institutions, governments, civil society, and academia. Xettle Technologies reiterated its commitment to collaboration, emphasizing its partnerships with industry stakeholders to drive collective action and scale impact.

Looking ahead, the future of sustainability in Fintech appears promising yet complex. As Fintech firms continue to innovate and disrupt traditional financial systems, they must prioritize sustainability as a core principle and driver of value creation. Xettle Technologies’ visionaries reiterated their commitment to sustainability, pledging to harness the power of technology to build a more sustainable, inclusive, and resilient financial ecosystem for future generations.

In conclusion, the Fintech Summit served as a catalyst for reflection and action on the role of sustainability in shaping the future of finance. From sustainable investing and supply chain transparency to financial inclusion and resilience, Fintech has the potential to drive positive change and advance sustainability goals on a global scale. Xettle Technologies’ leadership in integrating sustainability into its Fintech solutions exemplifies its dedication to driving innovation and creating shared value for society and the planet. As the industry continues to evolve, collaboration, innovation, and sustainability will be key drivers of success in building a more sustainable and resilient financial future.

2 notes

·

View notes

Text

Unveiling the Job Market: How Many Jobs Are Available in Finance Services in 2024?

In the ever-evolving landscape of finance, the job market plays a pivotal role in shaping career aspirations and industry trends. As we step into 2024, professionals and aspiring individuals are eager to uncover the opportunities awaiting them in the realm of finance services, particularly in the United States. This article sheds light on the abundance of opportunities available in the finance services.

Exploring the Finance Job Market Landscape:

Quantifying Opportunities:

How many jobs are available in finance in the USA?

Analyzing recent statistics and projections to gauge the scale of employment opportunities.

Factors influencing job availability, such as economic conditions, technological advancements, and regulatory changes.

Diverse Sectors, Diverse Opportunities:

Breaking down the finance sector into subcategories, including banking, investment management, insurance, and consumer services.

Highlighting the unique job prospects within each sector and the skill sets required to excel.

Identifying emerging roles and specialties that are gaining prominence in response to market demands and industry shifts.

Finance in the Digital Age:

Examining the impact of technology on job creation and the transformation of traditional finance roles.

The rise of fintech companies and their contribution to job growth, particularly in areas like digital banking, payment processing, and financial analytics.

The demand for professionals with expertise in data analysis, cybersecurity, and artificial intelligence within the finance sector.

Investment Management: A Thriving Field:

How many jobs are available in investment management?

Unveiling the job opportunities within investment firms, asset management companies, and hedge funds.

The significance of skilled portfolio managers, financial analysts, and risk assessment specialists in driving investment strategies and maximizing returns.

Exploring the global reach of investment management careers and the potential for growth in international markets.

Consumer Services: Meeting the Needs of Individuals:

Evaluating the job market within consumer-focused finance services, including retail banking, wealth management, and financial advising.

The demand for client relationship managers, financial planners, and retirement advisors in assisting individuals with their financial goals.

The role of personalized financial services and digital platforms in catering to the diverse needs of consumers and enhancing their financial literacy.

Trends Shaping the Future:

Anticipating future job trends in finance services and the skills that will be in high demand.

The growing importance of sustainable finance and environmental, social, and governance (ESG) investing, leading to opportunities in green finance and impact investing.

The influence of geopolitical factors, regulatory reforms, and demographic shifts on the finance job market landscape.

Conclusion:

As we go through 2024, the finance job market in the United States continues to offer a lot of opportunities across various sectors. Whether aspiring to go into investment management, consumer services, or the dynamic world of fintech, individuals with the right skills and expertise are well-positioned to thrive in this ever-evolving industry. By staying abreast with market trends, honing relevant skills, and embracing innovation, professionals can seize the abundant opportunities awaiting them in the realm of finance services.

5 notes

·

View notes

Text

PMO-Beratung

Website: https://www.pureconsultant.de/de/beratung/project-management-office-beratung/

Address: Hohenstaufenring 57a, 50674 Köln, Germany

Pure Consultant bietet professionelle PMO-Beratungsdienstleistungen an. Unser erfahrenes Team von PMO-Beratern steht Ihnen zur Seite, um maßgeschneiderte Lösungen zu entwickeln und eine effektive PMO-Transformation in Ihrem Unternehmen zu ermöglichen. Wir bringen umfassende Expertise im Bereich PMO Consulting ein, um individuelle Strategien zu entwerfen und die Effizienz Ihres Projektmanagements zu steigern. Unsere Fokussierung liegt darauf, Ihre Organisation durch effektive Schulungen und praxisnahe Anleitung auf dem Weg zu einem effizienten PMO zu begleiten.

Provenexpert: https://www.provenexpert.com/pcg-pure-consultant-gmbh/

Xing: https://www.xing.com/pages/pcgpureconsultantgmbh

Trustpilot: https://de.trustpilot.com/review/pureconsultant.de

Linkedin: https://www.linkedin.com/organization-guest/company/pcgpureconsultantgmbh

Keywords:

pmo beratung

pmo consultant

pmo consulting services

pmo consulting firms

pmo consulting companies

project management office consultant

platinum pmo consulting

atkins pmo consultant

consulting

business consultant

power bi consultant

it consulting

salesforce consultant

hr consulting

marketing consultant

hr consulting firms

seo consultant

consulting firms

sharepoint consultant

management consulting

netsuite consultant

strategy consulting

business consulting services

healthcare consulting

salesforce implementation partner

business consultant near me

accenture consulting

route consultant

small business consultant

cyber security consultant

sustainability consultant

franchise consultant

consulting services

digital transformation consultant

ai consultant

wealth management consultant

consulting company

google analytics consultant

mba consulting

digital marketing consultant

restaurant consultant

healthcare consulting firms

hr consulting services

human resources consultant

devops consulting

small business consulting services

environmental consultant

business plan consultant

technology consultant

salesforce consulting companies

sap consulting

bain and company

supply chain consultant

brand consultant

tech consulting

financial consulting

software consultant

ey consulting

hr consulting companies

dei consultant

starting a consulting business

data science consulting

product management consulting

business development consultant

project management consultant

safety consultant

software consulting companies

change management consultant

management consulting firms

esg consulting firms

2 notes

·

View notes

Text

As if there wasn't exhaustive enough evidence that "ESG" is nothing but a scam, the Financial Times was out this week with a piece detailing how many companies with good ESG scores pollute just as much as their lower-rated rivals.

Don't say we didn't warn you; we have been writing about the ESG con for years now, which along with other "sustainable" investments continues to see hundreds of billions of dollars in inflows from investors.

The FT added to our skepticism by revealing this week that Scientific Beta, an index provider and consultancy, found that companies rated highly on ESG metrics - and even just the 'Environmental' variable alone - often pollute just as much as other companies.

Researchers look at ESG scores from Moody’s, MSCI and Refinitiv when performing the analysis. They found that when the 'E' component was singled out, it led to a “substantial deterioration in green performance”.

Felix Goltz, research director at Scientific Beta told the Financial Times: “ESG ratings have little to no relation to carbon intensity, even when considering only the environmental pillar of these ratings. It doesn’t seem that people have actually looked at [the correlations]. They are surprisingly low.”

He added: "The carbon intensity reduction of green [ie low carbon intensity] portfolios can be effectively cancelled out by adding ESG objectives."

“On average, social and governance scores more than completely reversed the carbon reduction objective,” he continued. “It can very well be that a high-emitting firm is very good at governance or employee satisfaction. There is no strong relationship between employee satisfaction or any of these things and carbon intensity."

“Even the environmental pillar is pretty unrelated to carbon emissions,” he said.

Vice-president for ESG outreach and research at Moody’s, Keeran Beeharee, added: “[There is a] perception that ESG assessments do something that they do not. ESG assessments are an aggregate product, their nature is that they are looking at a range of material factors, so drawing a correlation to one factor is always going to be difficult.” “In 2015-16, post the SDGs [UN sustainable development goals] and COP21 [Paris Agreement], when people began to really focus on the issue of climate, they quickly realised that an ESG assessment is not going to be much use there and that they need the right tool for the right task. There are now more targeted tools available that look at just carbon intensity, for example,” he added.

MSCI ESG Research told the Financial Times its ratings “are fundamentally designed to measure a company’s resilience to financially material environmental, societal and governance risks. They are not designed to measure a company’s impact on climate change.”

Refinitiv told FT that “while very small, the correlation found in this study isn’t surprising, especially in developed markets, where many large organisations — with focused sustainability strategies, underpinned by strong governance, higher awareness of their societal impact and robust disclosure — will perform well based on ESG scores, in spite of the fact that many will also overweight on carbon”.

Global director of sustainability research for Morningstar Hortense Bioy concluded: “Investors need to be aware of all the trade-offs. It is not simple. In this case, investors need to think carefully about which aspects of sustainability they would like to prioritize when building portfolios: carbon reduction or a high ESG rating.”

2 notes

·

View notes

Text

Unit 10 Blog – Nature Interpretation: Personal Ethics & Beliefs

In our final concluding blog for this course, I find myself going back to the beginning, not the beginning of the course, but to what started me on my decision a year ago to take time off from a career in finance, to study environmental science at this university. Having worked in corporations for over 27 years, I have seen first-hand, how difficult it is to convince executive leads, board members and shareholders on the relevance and urgent need to become more sustainable, to care about the environment. Especially, when at times, I helped model the trade-offs of investment in other competing initiatives, with far higher immediate returns. During that time, we have come a long way, and many of those same companies now have ESG strategies (Environment, Social, Governance), and have even hired small teams to lead the way forward in becoming more sustainable. At the same time, many of those corporations have grown 5-10 fold or more, the growth of these companies, along with the emissions, waste, resource use and pollution generated, cannot be covered off with their new (at times) tepid sustainability goals. Now…these companies are not solely to blame, there is a demand fueled by population growth, global world development, and by increased consumerism in developed countries.

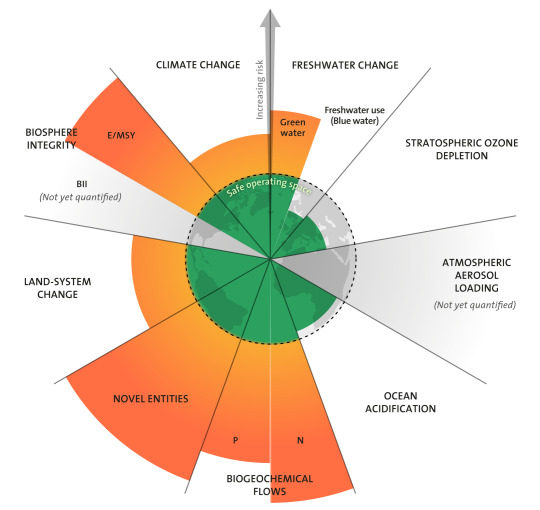

My reason for studying environmental science, is the same fuel for my personal ethic: More is needed, and until we change the minds of governments and corporations, and most importantly, the voters, consumers, employees, and shareholders, we will not succeed. My personal ethic is this: We all have a responsibility to learn, to teach, to engage others to see the scientific truth about our world and we are running out of time. To do this, we need to engage humankind to understand why it is important to protect nature, and why nature is so important to all species. Tim Merriman writes, "We still need to help the world’s decision-makers understand the vital importance of the effects we have on the Earth’s atmosphere and ocean, and we must continue to help all people understand how individual behavior contributes to both the problems and the solutions.” (Beck, at al., 2018, pg. 459) As per the Stockholm Resilience Center, we have the left the safe operating zone for 6 out of 9 of our planetary boundaries. (Stockholm Resilience Center, 2023). When I read this a year ago, I was shocked, and panicked and felt helpless against this. At the time, however, I did not understand how much is being done by so many globally to reverse the tide. I had heard about the Paris Climate Accord, and although a positive step, it was not going to be nearly enough. At that point, I hung my head thinking once again, politicians are going to get this wrong. In November 22, under COP-27 (The 27th Conference of the Parties of the United Nations Framework Convention on Climate Change), more was done, and funds committed to help vulnerable nations as they become the first to feel the ravages of climate change. I am more hopeful, and I believe that the world has woken up to climate change. However, there is still much to do and to turn the tides of public neglect, disregard, or negation of the seriousness of the situation, we must not only open their hearts but also create a path of possibility that has us all believing that we can make a difference and that we can bring our home back from the brink.

Stockholm Resiliency Center 2022

Nature Interpretation for me, is one path to bring people into nature, with a feeling of safety. To let them see and appreciate not only the peace, beauty, and awe of it, but to understand the importance of it and the threats to it. This would be my focus or first responsibility in interpretation. To do this, it is also an interpreter’s responsibility to know the subject matter, and to engage the audience, while ensuring that everyone’s needs and pre-existing beliefs are considered. Nature must be inclusive, to be reflective of the world we live in. Richard Louv writes, "Interpretation enriches experiences, advances physical and mental health, benefits the environment, promotes cultural heritage, enhances community welfare, and recognizes the importance of diversity, equality, sustainability, science, and truth" (Beck et. al, 2018, pg. 476).

My approach would be to balance between finding ways to engage through humour, fun, and instilling a sense of adventure, but tempering that with the goal to engage children and adults to understand the importance of giving back. In Chapter 21 of our text, there were many examples of how we can become more involved even just in a small way, by understanding our own localities. Enos Mills wrote, “"A nature guide in every locality who, around his home or in the nearest park could show with fitting stories the wild places, birds, flowers, and animals, would add to the enjoyment of everyone who lives in the region or who visits it.” (Beck et al., 2018, pg. 458).

In listening to the interview with Richard Louv and David Suzuki at the AGO, a few other thoughts were enforced. One, many people, by choice or circumstance have become very disconnected from the natural world, seldom leaving the comfort of their homes and screens. To reach these people, more must be done to build urban parks, or reach out through technology to get their attention to get out and “smell the roses”. Two, as David Suzuki said, we have really become time machines (and not in a good way), we control our time slots and fill them up, but that is not natural. As he speaks, “Nature needs time to reveal her secrets.” He speaks to the need to just spend time, whatever time watching and immersing ourselves. I think a disconnect from nature hurts humans, we need nature to remind us of where we came from, we need nature to help us rebalance and breathe. We need nature to feel awe, to really be inspired.

In closing, I go back to the beginning, we must appreciate the home we have, and live with an eco-centric mind set, while understanding, that we have a job to do to keep our home for future generations. Stan Lee in Spider Man wrote, “With great power, comes great responsibility”.

References

Beck, L, Cable, Ted T., Knudson, D. M. (2018). Interpreting Natural & Cultural Heritage. Sagamore-Venture Publishing. 2018

Stockholm Resilience Center (2023). Planetary Boundaries. Stockholm University. https://www.stockholmresilience.org/research/planetary-boundaries.html

Richard Louv and David Suzuki at AGO. https://youtu.be/F5DI1Ffdl6Y

4 notes

·

View notes

Text

BTS’s J-Hope Expresses Feelings About Not Having A Physical Album For “Jack In The Box” In 2022

He opens up about his original plans for the album.

BTS‘s J-Hope made his official solo debut on July 15, 2022. While he’s currently completing his mandatory military service, he’s continued to keep ARMYs on their toes with pre-prepared content, including the announcement of a long-awaited physical copy of his debut solo album, Jack In The Box.

While discussing his post-military service six-month plan, J-Hope talked about a gift to ARMYs that is coming sooner, his physical album.

When J-Hope initially released Jack In The Box, it was only available as a Weverse album, and its lack of a physical album caused fans to question if HYBE had mismanaged J-Hope’s solo debut following the company using his promotions to test their ESG (Environmental, Social, and Governance) strategy.

ARMYs advocated for a physical release of J-Hope’s album over the last year, and the BTS member worked hard to make it happen. His agency stated:

J-Hope devoted himself wholeheartedly before his military enlistment to prepare this physical album. He actively participated in the overall planning of the album, incorporating his own style. — BIGHIT MUSIC

In his Suchwita episode, J-Hope revealed how he really felt about the lack of a physical album for his solo debut.

Suga began by saying that he had encouraged J-Hope to release a physical album, telling him that ARMYs would love it.

J-Hope revealed that Jack In The Box originally began as a mixtape, and he had intended to release a Weverse album or an LP if it remained a mixtape.

Instead, the project turned into a full album, and J-Hope acknowledged there was a “bigger need” for a physical album than he had expected.

Suga noted that it’s rare these days for people to purchase physical albums to listen to them while observing that instead, people use them as merchandise.

For Suga, he values physical albums as part of his collection to serve as a memory, which was why he encouraged J-Hope to release a physical version of his debut solo album.

J-Hope acknowledged how much ARMYs wanted a physical copy and admitted the fact he didn’t have a physical copy of his album last year “bothered him a little.” He felt “really sorry” for not having a physical copy for fans who, “thought [he] should make one.”

Pre-ordering for J-Hope’s physical album, Jack In The Box (HOPE Edition), began on July 17, and the album will be released on August 18. Jack In The Box (HOPE Edition) will include three live and two instrumental tracks from J-Hope’s 2022 Lollapalooza performance.

Source: Koreaboo

2 notes

·

View notes

Text

The Advantages of Hiring a Sustainability Expert for Your Company

In today's quickly changing corporate world, sustainability is a need rather than an option. Companies that prioritize sustainability improve their competitiveness, reputation, and long-term profitability and make the world a healthier place. In this situation, sustainability consultancy is essential.

A sustainability consultant provides the knowledge and understanding to guide businesses through challenging environmental, social, and governance (ESG) issues. Employing a sustainability consultant has the following main advantages:

1. Professional Advice on Sustainable Practices

Sustainability consultants know the most recent frameworks, rules, and trends in the field. They offer customized approaches to assist your company in conforming to international standards such as ISO certifications, GRI, and the Corporate Sustainability Reporting Directive (CSRD). You can use sustainability consultancy to ensure that your company implements the most significant and successful practices.

2. Enhanced Performance in ESG

Environmental, social, and governance factors are critical in today's economy. To succeed in sustainability ratings like CDP, GRESB, or Eco Vadis, you can measure, track, and enhance your ESG performance with the assistance of a sustainability consultant. This draws in stakeholders who care about the environment and increases investment trust.

3. Resource Efficiency and Cost Savings

One of the observable advantages of sustainability consultancy is saving money. Businesses can minimize their environmental impact and cut operating expenses by increasing resource efficiency, decreasing waste, and optimizing energy usage. To accomplish these objectives, a consultant finds inefficiencies and offers workable remedies.

4. Preventing Hazards and Guaranteeing Adherence

Given the increasing regulatory constraints surrounding sustainability, maintaining compliance is essential. A sustainability consultant ensures your company complies with emissions regulations, environmental laws, and other legal obligations. They also assist in reducing the risks associated with supply chain interruptions, climate change, and harm to one's reputation.

5. Improving Customer Loyalty and Brand Image

Nowadays, consumers favor companies that exhibit environmental responsibility. Businesses can demonstrate their dedication to sustainability by implementing plans created by sustainability consultancy. This builds consumer loyalty and trust and enhances brand reputation.

6. Building Resilience Over Time

By incorporating sustainable practices into their main strategies, sustainability consultants assist companies in future-proofing operations. This guarantees long-term resistance to social, environmental, and economic difficulties.

Final Thoughts

A sustainability consultancy investment is more than just a commitment to the environment; it's a wise business move. Employing a sustainability consultant gives you access to knowledge, resources, and tactics that promote change and increase profitability.

At Agile Advisors, we specialize in sustainability consultancy services, helping businesses in various industries prosper in a sustainable future. Contact us right now to start on the path to a more profitable and environmentally friendly future!

Green Future Sustainability Consultancy ESG sustainable business

0 notes